#market outlook 2021

Explore tagged Tumblr posts

Text

Market Turbulence and Key Earnings Reports Shape Investor Sentiment Amid Global Uncertainty

#market#stock market#markets#jobs report#global market cues#stock market today#bond market performance#uncertainty#stock market research#financial markets#rbc capital markets#indian markets#investor#philippine stock market#stock market philippines#market analysis#bond market outlook#stock market outlook#global economic impact#market outlook#market rotation#stock market news#market volatility#stock market crash#market outlook 2021

0 notes

Text

Power Transmission Component Market Analysis Key Trends, Growth Opportunities, Outlook to 2032

Overview of the Power Transmission Component Market:

The power transmission component market involves the manufacturing, distribution, and sales of various components used in power transmission systems. These components are essential for the efficient and reliable transfer of electrical power from power generation sources to end-users. The market encompasses a wide range of products, including transformers, cables, and switchgear, circuit breakers, insulators, and transmission towers.

Power Transmission Component Market size exceeded USD 71 billion in 2021 and is projected to grow at over 4.4% CAGR from 2022 to 2030.

Key Factors Driving the Power Transmission Component Market:

Growing Energy Demand: The increasing global demand for electricity, driven by population growth, industrialization, and urbanization, is a key factor driving the power transmission component market. Power transmission components are crucial for the expansion and upgrade of electrical grids to meet the rising energy demand.

Renewable Energy Integration: The transition to renewable energy sources, such as solar and wind power, requires the integration of these intermittent energy sources into existing power grids. Power transmission components, such as transformers and switchgear, facilitate the efficient integration and transmission of renewable energy.

Grid Modernization and Upgrades: Aging power transmission infrastructure in many countries necessitates grid modernization and upgrades. Governments and utility companies are investing in the refurbishment and expansion of transmission networks, driving the demand for power transmission components.

Rising Investments in T&D Infrastructure: Increasing investments in transmission and distribution (T&D) infrastructure, particularly in developing economies, contribute to the growth of the power transmission component market. These investments aim to improve grid reliability, reduce transmission losses, and expand access to electricity.

Grid Resilience and Stability: Power transmission components play a critical role in ensuring the stability and resilience of electrical grids. Factors such as grid reliability, voltage control, and fault detection and mitigation are driving the demand for advanced power transmission components.

Government Regulations and Standards: Governments and regulatory bodies have implemented standards and regulations related to grid efficiency, reliability, and safety. Compliance with these regulations often requires upgrades and investments in power transmission components.

Technological Advancements: Technological advancements in power transmission components, such as the development of high-voltage direct current (HVDC) transmission systems, advanced materials, and digital monitoring and control systems, drive market growth. These advancements improve efficiency, reliability, and the ability to transmit power over longer distances.

The demand for power transmission components is driven by several factors, including growing electricity consumption, increasing investments in energy infrastructure, renewable energy integration, grid modernization initiatives, and electrification of various sectors. Here are some key aspects influencing the demand for power transmission components:

Growing Electricity Consumption: The rising global population, industrialization, and urbanization have led to increased electricity consumption. This drives the demand for power transmission components to expand and upgrade transmission networks to meet the growing electricity demand.

Infrastructure Investments: Governments and utilities worldwide are investing in the development and expansion of power transmission infrastructure to ensure reliable and efficient electricity transmission. This includes the construction of new transmission lines, substations, and associated power transmission components.

Renewable Energy Integration: The shift towards renewable energy sources, such as wind and solar, necessitates the integration of these intermittent power sources into the grid. Power transmission components, including converters, transformers, and grid interconnections, are in demand to facilitate the efficient integration of renewable energy generation into the existing transmission infrastructure.

Grid Modernization Initiatives: Many countries are focusing on modernizing their electrical grids to enhance reliability, efficiency, and flexibility. This involves the deployment of advanced power transmission components like smart grid technologies, digital control systems, and advanced sensors to monitor and manage the transmission network effectively.

Electrification of Transportation: The increasing adoption of electric vehicles (EVs) and the expansion of charging infrastructure require power transmission components capable of efficiently delivering electricity to charging stations. This includes transformers, cables, and connectors that can handle the high-power demands of EV charging.

Energy Efficiency and Grid Optimization: Energy conservation and efficiency measures drive the demand for power transmission components designed to minimize losses during electricity transmission. Upgrading and replacing aging infrastructure with high-efficiency transformers, conductors, and monitoring systems help improve overall grid efficiency.

Grid Resilience and Reliability: Power transmission components play a crucial role in ensuring grid resilience and reliability, particularly in regions prone to extreme weather events or areas with aging infrastructure. Upgrading transmission lines, substations, and associated components helps enhance the grid's resilience and minimize disruptions.

Cross-Border Interconnections: The establishment of cross-border interconnections between neighboring countries or regions enables efficient power exchange, renewable energy sharing, and grid stability. Power transmission components for interconnections, such as high-capacity transmission lines and interconnectors, experience increased demand to support cross-border electricity transmission.

Decentralized Energy Generation: The increasing adoption of distributed energy resources (DERs), including rooftop solar panels, wind turbines, and energy storage systems, drives the demand for power transmission components that enable the integration of decentralized energy generation into the grid. This involves components like inverters, grid-tie systems, and smart distribution systems.

Upgrades and Replacement of Aging Infrastructure: In many regions, existing power transmission infrastructure is aging and requires upgrades or replacement. This drives the demand for power transmission components to modernize and improve the capacity, efficiency, and reliability of the transmission network.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market. “Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/power-transmission-component-market/11353/

Market Segmentations:

Global Power Transmission Component Market: By Company

• ABB

• Toshiba

• EATON

• Siemens

• Crompton Greaves

• General Electric

• Hitachi

• Schneider Electric

• Mitsubishi

• Hyundai

• BHEL

• Emerson

Global Power Transmission Component Market: By Type

• Transformer

• Circuit Breaker

• Insulator

• Arrestor

• Transmission Line

• Transmission Tower

• Others

Global Power Transmission Component Market: By Application

• Energy

• Industrial

• Military & Defense

• Others

Global Power Transmission Component Market: Regional Analysis

The regional analysis of the global Power Transmission Component market provides insights into the market's performance across different regions of the world. The analysis is based on recent and future trends and includes market forecast for the prediction period. The countries covered in the regional analysis of the Power Transmission Component market report are as follows:

North America: The North America region includes the U.S., Canada, and Mexico. The U.S. is the largest market for Power Transmission Component in this region, followed by Canada and Mexico. The market growth in this region is primarily driven by the presence of key market players and the increasing demand for the product.

Europe: The Europe region includes Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe. Germany is the largest market for Power Transmission Component in this region, followed by the U.K. and France. The market growth in this region is driven by the increasing demand for the product in the automotive and aerospace sectors.

Asia-Pacific: The Asia-Pacific region includes Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, and Rest of Asia-Pacific. China is the largest market for Power Transmission Component in this region, followed by Japan and India. The market growth in this region is driven by the increasing adoption of the product in various end-use industries, such as automotive, aerospace, and construction.

Middle East and Africa: The Middle East and Africa region includes Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa. The market growth in this region is driven by the increasing demand for the product in the aerospace and defense sectors.

South America: The South America region includes Argentina, Brazil, and Rest of South America. Brazil is the largest market for Power Transmission Component in this region, followed by Argentina. The market growth in this region is primarily driven by the increasing demand for the product in the automotive sector.

Click Here, To Purchase Premium Report: https://stringentdatalytics.com/purchase/power-transmission-component-market/11353/?license=single

Reasons to Purchase Power Transmission Component Market Report:

• To gain insights into market trends and dynamics: this reports provide valuable insights into industry trends and dynamics, including market size, growth rates, and key drivers and challenges.

• To identify key players and competitors: this research reports can help businesses identify key players and competitors in their industry, including their market share, strategies, and strengths and weaknesses.

• To understand consumer behavior: this research reports can provide valuable insights into consumer behavior, including their preferences, purchasing habits, and demographics.

• To evaluate market opportunities: this research reports can help businesses evaluate market opportunities, including potential new products or services, new markets, and emerging trends.

• To make informed business decisions: this research reports provide businesses with data-driven insights that can help them make informed business decisions, including strategic planning, product development, and marketing and advertising strategies.

Overall, market research reports provide businesses and organizations with valuable information that can help them make informed decisions and stay competitive in their industry. They can provide a solid foundation for business planning, strategy development, and decision-making.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Power Transmission Component Market Analysis Key Trends#Growth Opportunities#Outlook to 2032#The power transmission component market involves the manufacturing#distribution#and sales of various components used in power transmission systems. These components are essential for the efficient and reliable transfer#including transformers#cables#and switchgear#circuit breakers#insulators#and transmission towers.#Power Transmission Component Market size exceeded USD 71 billion in 2021 and is projected to grow at over 4.4% CAGR from 2022 to 2030.

0 notes

Text

New 2025 Almanac Is Here! Founder’s 101st!

We lost Yale Hirsch three years ago at 98, but his legacy lives on. Santa Claus Rally, January Barometer, Best Six Months Strategy: all invented by Yale! It is fitting that the 58th Annual Edition of the Stock Trader’s Almanac, is released today, one day before what would be his 101st Birthday.

This year’s edition highlights how, “Post-election years have improved since WWII and since 1985 DJIA averages a gain of 17.2% with eight up years and two down. This is the best average gain of the four-year cycle over this period.” My outlook for 2025 expects, “the market to be up 8-12% for the year with pullbacks in Q1 and Q3.”

Past four years forecasts have been on point: “unabashedly bullish for 2021, anticipated the 2022 midterm year bear market and called the textbook October 2022 midterm bottom, expected a new bull market to emerge in 2023 with above average pre-election year gains and 2024’s bullish outlook is right on track.”

This 2025 Almanac is a testament to the original iconic work founder Yale Hirsch created in the first 1968 edition and the over five decades of behavioral finance thought leadership it has provided since. The Almanac remains the most valuable trader’s desk reference on Wall Street and this year’s Almanac is packed with seasonal and historic investing insights for the year ahead including:

My 2025 Outlook – page 10

Bulls Win When Market Hits The January Trifecta – page 20

Market Charts of Post-Presidential Election Years – page 26

Post-Election Year Performance by Party – page 28

Post-Election Years: Paying the Piper – page 32

Market Fares Better Under Democrats; Dollar Holds Up Better Under Republicans – page 34

Republican Congress & Democratic President Is Best for the Market – page 80

Traders Feast on Small Stocks Thanksgiving Through Santa Claus Rally – page 104

The Incredible January Barometer: Only 12 Significant Errors in 74 Years – page 18

“Best Six Months”: Still An Eye-Popping Strategy – page 54

MACD-Timing Triples “Best Six Months” Results – page 56

13 notes

·

View notes

Text

Slowly, but Surely (Don't Call Me Shirley)

Hello, hello.

i am slowly, but surely, recharging my creative batteries. There's less pressure now, but with good things happening. A detailed account of what's been happening. All below the cut. TLDR at the end.

Let's start with the good.

I went to the Big Gay Market in Madison, WI for the weekend. It was marvelous. There were people of all kinds of genders, an affirming and friendly environment, and so many creatives. I felt like I was in community and it's been a long time since I've felt that way. I was sad when it ended. But I bought the most beautiful wreath to hang in my room. I'll snap a picture of it when I can.

I studied the entire month of June, whenever I had a spare moment and for dedicated study sessions.

I made a total of 300 flashcards, wrote 40 pages in my notebook, used 2 test prep books, 3 learning system books, a 100 page summary of competencies, and 2 apps. I answered 2800 practice questions on those apps. I practiced and practiced until I reached at least an 80% in each competency.

And what happened?

I PASSED.

I kicked that exam in the ass! When I saw "passed" on the screen, I nearly whooped in the testing center. I cried in my car as I relayed the news to my mom, who is also an HR professional. I could not believe it. I still can't. Cal Owens, SHRM-CP. It feels SO GOOD to have letters after my name.

I'm also still on that high of completing my HR Management certificate with "high honors" and then earning my SHRM certification right after it.

Then, at the end of May, right before my birthday, I sent in an application to the Arboretum nearby. They were looking for an HR Coordinator. And they weren't requiring at least 3 years experience or a BS in HR. After the radio silence for a month and a half, I gave up on them getting back to me. I sent a follow-up email, as instructed by my mentor, and still no reply. I figured I was set aside and I moved on to apply for more jobs.

Lo and behold, the Arb emailed last week and offered me a phone interview! I spoke with their Talent Acquisition specialist way past the 30 minute time slot, which I took as a good sign. Next step was to have a virtual meeting.

But guess what? They invited me for an in-person meeting instead! My interview was at 9 AM CST yesterday. it was LOVELY. i genuinely enjoyed speaking to the Sr HR Manager. We chatted for almost 90 minutes. It went by so fast. I felt like I had answers to all her questions, however, I wonder if I was direct and clear enough? I haven't interviewed since 2021, and before that since 2016. So I know I'm rusty, I hope my enthusiasm for the role got noticed.

I should know by early next week if they will move me to the third and final round--meeting the VP of HR. The Coordinator will be responsible for managing the VP of HR's schedule in Google. I just learned how to do scheduling in Outlook, I'm sure I can do it in Google.

Anyway! I can see myself working there. The pay meets the market for that kind of job around here, and the benefits are exceptional. And the view from the admin building? Beautiful. There's just a small lane to walk through from the parking lot to the building. I felt like I was in Jane Austen novel. *Dreamy sigh.*

Fingers crossed.

Okay, so let's get the not-so-good stuff over with.

Caregiving for my father continues to be a challenge. I am the only one of his 3 kids he 100% trusts and is close to. I don't get a lot of support from my sisters because A) he prefers me to handle things and B) they don't offer. I always have to ask, and even then, most of the time I end up doing the thing anyway. Sigh.

I tried a bunch of adaptive equipment things for my dad in June. I bought him an electric tea kettle that sits in a cradle and tips over to pour so you don't have to lift it. Well, it works okay for that, but he can't see how much he's filled the kettle. So that went back. I found a pen that "talks" to you. That's been a game changer. You get special labels with bumps on them, tap the pen to the label, and you can record a sound clip! so i attached them to every medication he has in the house. he's been using the pen! Now I just need to convince him to use his white cane.

Watching my dad go through losing his vision has been very difficult. He's a completely different man than the one I knew just 5 years ago. Little by little, things are changing and that change can get overwhelming. I did manage to find him a peer to peer phone program for folks with low vision. He gets a call every month to chat with a lady name Yvies from New Jersey and just talk about what it's like being low vision. I am so grateful to her. The organization will be creating a caregiver support group in the fall and I am on the waitlist.

So, yes. I've gotten overwhelmed at some points, impatient at others, but I show up. In the future, I want to know, that without a doubt, I was there for my father. I just need to figure out how to balance this and find ways to get help.

I continue to miss Henry and my grandma.

Sometime between this past Saturday and Sunday, I fell ill. Like, nauseated, dizzy, lightheaded. [Content Warning: The GI System Going Whack] Then Sunday, I could not retain food or water. I held out for Monday and Tuesday to see if I got better with a little imodium and zofran. Wednesday morning at 7:30 AM, I called my doctor and she said, "Get thee to the ER."

So, I went. My mother was with me. In miracles of all miracles, I only had to wait an hour to be seen in the ER. I was there from 8 AM to 12:30 PM and in that period of time, I got an ultrasound, labs, an IV with a bag of saline, pain meds, and reassurance that my gallbladder and liver were doing fine. And no one misgendered me. It was a good ER trip.

The ER doctor and my PCP have no idea what knocked me out for 5 days. Could have been a virus. Could have been a side effect of mounjaro. It'll be a mystery for the ages, I suppose...

Of course, it took a huge toll on my body. Today was the first day I felt almost normal again. No bloating, no cramping, no burping, and no intense pain in my abdomen. Yay! I am supposed to be eating "light," but dammit, I deserved pasta tonight and I'm not going to regret it!

I also, in my journey through illness, reached the Medicare donut hole. I have to spend $8,000 before my advantage plan will start paying for my meds again. I have to pay 25% of the cost of all drugs. Thank goodness I was able to get on a patient assistance program for my antidepressant, because I could not afford it otherwise. I've moved all my meds, except two, to be generics. I am always trying to cut the cost down as much as I can, whether it's through GoodRx, OptumRx, or Costco. I spend most of my SSDI money on healthcare, medication, and treatments. If we had free universal healthcare, I would have been able to save up all this money, dagnabit.

The difficult things have been... well... difficult. But they are outnumbered by the good things, which makes me smile.

I am excited to be excited about working again. I am doing my best to visualize myself in that role, going into *my* office and sitting at *my* desk. I see myself growing in that department and becoming a specialist in all things HR. This is what I did as I interviewed for the 24/7 Helpline and I got that job. I saw myself getting on a train to Chicago every day until they'd let me go remote. I saw myself as a city queer again. I felt the train to the city already underneath me. I get that feeling with this role. I feel like, if I get it, I will have a Mary Tyler Moore moment.

She's gonna make it after all!

Thank you, if you've red this far. Thank you if you send good vibes for this Arb job. Thank you for just being here. Hell, thank you for being you.

One of my uncles will be visiting us from Chile in early August. I am eager for him to arrive and spend time with us. I know my mom could really use his support and sense of humor right now.

So I will be driving them (and my father, if I can convince him to join us) all around Chicago and the burbs. I hope to gather some TCV ideas from the places we will go. It's exciting to think about.

I really want to take a small trip to Cedarburg, WI. Spend a night there in a bnb, and take in all the shops and restaurants. But my car's oil needs to be changed and my brakes too, so I will have to hold off on traveling for a while.

I would like to get back to work because it's work, but I would also like to get back to contributing to my 401k, saving, paying off my medical debt and car, traveling, and actually affording medication without (too much) sacrifice. Medicare, I was told, would be cheaper than private insurance. Well, I couldn't afford a supplement, so I got stuck with an Advantage Plan. And it's not all that bad (I've met my out of pocket max), but man, do they make it hard to succeed in the system and this is a system primarily designed for seniors??? Sigh.

Anyway!

There you have it. A detailed account of things that I have been up to or coping with or working on since mid-May.

Hockey is gone. Thank goodness the Oilers didn't win the cup. Pavs retired. Wedgie was traded. Delly was traded. Faksa and Tanev were traded. We kept Dutchy, but that was about it. With a burning passion of a thousand suns, I hate Dumba and DeSmith. They will never be my Stars.

Okay. So. Where does this leave me now?

Well, I am slowly getting back "into" my work as an author. I'm hoping I can read a book or two in the next two weeks. I am inspired by the creativity of others and now that I've passed my exam, I have more free time to read and plot things out in my head.

It also helps to you know... not be extremely dehydrated.

Holy smokes, it's late. And this is long.

TLDR: Lots of caregiving, looking for jobs, studying, and recharging has happened in my break from writing. I am focused on securing a job at the Arboretum. I passed my SHRM-CP exam. I had an ER visit this week, but feel much better now.

Thank you for being here. Thank you for taking the care to read this. I appreciate y'all and the safe space y'all have made for me. I'm so glad I get to lean on this cozy, peaceful corner of fandom.

One last time--thank you.

Let's chat more.

-Cal

#compo67#authorial rambles#the tide is high and i'm holdin' on#i'm gonna be your number one#thank you#let's chat more

11 notes

·

View notes

Text

Ilana Berger at MMFA:

In a new analysis of electric vehicle-related content on Facebook, Media Matters found that negative stories made up the vast majority of content, particularly on right-leaning and politically nonaligned U.S. news and political pages, a trend which does not align with the optimistic outlook of EV adoption and technological advancements. Since 2021, the Biden administration has allocated billions of dollars toward meeting the ambitious goal of making half of all new cars sold electric or hybrid over the next few years. Provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act have provided tax credits and other incentives to jump start electric vehicle sales and infrastructure such as charging stations, domestic battery manufacturing, critical mineral acquisition, in addition to preparing the automotive industry workforce for the transition.

In March, an Environmental Protection Agency rule setting strict limits on pollution from new gas-powered cars primed automakers for success in meeting these goals. Biden’s EV push will continue to play an important role in the upcoming presidential election. Former president and current GOP candidate Donald Trump has insisted that Biden’s policies benefit China, which makes up the largest share of the global EV market. In March, while talking about the current state of the auto industry, Trump declared, “If I don’t get elected, it’s going to be a bloodbath for the whole — that’s going to be the least of it. It’s going to be a bloodbath for the country.” Economists disagree.

The comment tracks with years of outrage and opposition from Republican politicians, right-wing media, and fossil fuel industry surrogates, who have often disparaged the new technology and related policy and misleadingly framed the EV push as a threat to American jobs and national security. Constant attacks on EVs from the right have helped fuel a politically divided market, where people who identify as Democrats are now much more likely to buy them or consider buying them, while nearly 70% of Republican respondents to a recent poll said they “would not buy” an EV. So far in 2024, headline after headline announced EV sales slumps and proclaimed that “EV euphoria is dead,'' despite reports of “robust” growth. In February, CNN changed a headline about EV sales on its website from a success story to a failure. Despite the positive long term outlook for EVs based on indicators like sales and government investments, the discourse around electric vehicles is often pessimistic.

[...] Right-wing media have been driving anti-EV sentiment (with help from fossil fuel industry allies) since the start of Biden’s term. This trend was clearly reflected in Media Matters’ analysis. Out of the top 100 posts related to EVs on right-leaning pages, 95% were negative, earning over a million interactions in 2024 so far. But on Facebook, politically nonaligned pages fed into this trend as well. Nearly three quarters (74%) of EV related top posts on nonaligned pages had a negative framing. These posts generated 83% of all interactions on EV-related top posts from nonaligned pages.

On non-aligned and right-wing Facebook pages, anti-electric vehicle content-- likely fueled by a mix of climate crisis denial and culture war resentments-- draws lots of reliable engagement, in contrast to the reality of increased EV adoption in recent years.

#Electric Vehicles#Culture Wars#Automobiles#Climate Change#Facebook#CHIPS Act#Inflation Reduction Act#Infrastructure Investment and Jobs Act#Biden Administration#Joe Biden#EV Charging Stations

9 notes

·

View notes

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

4 notes

·

View notes

Text

Excerpt from this EcoWatch story:

As part of its most recent World Economic Outlook, the International Monetary Fund (IMF) has said the transition to electric vehicles will have “far-reaching” effects on production, investment, global trade and employment.

The new analysis was released in tandem with annual meetings of the World Bank and IMF this week, where efforts to finance the transition to green energy, enhance global growth and tackle debt distress were on the agenda, reported Reuters.

“The rising adoption of electric vehicles (EVs) represents a fundamental transformation of the global automotive industry,” the IMF said in the report.

The shift from fossil fuel-powered vehicles to EVs has been accelerating and is an important part of countries’ climate targets around the world.

According to the IMF, transportation was responsible for 36 percent of U.S. greenhouse gas (GHG) emissions in 2022, eight percent in China and 21 percent of those in the European Union.

Subsidies and charging stations for EVs provided by the U.S. government have helped support the rising adoption of EVs in America. The EU aims to cut auto emissions by half by 2035 compared to 2021 levels.

“[T]he shift to electric vehicles for personal transportation is a key part of the reduction of GHG emissions. To foster the adoption of EVs, both supply- and demand-side policies have been implemented across the world,” the IMF said.

In its report, the IMF made note of the global auto industry’s robust profits, large export markets, high wages and use of technology, Reuters reported.

Speeding up the global move toward EVs would change the industry, especially if China remains the export and production leader in front of European and U.S. rivals.

3 notes

·

View notes

Text

The latest look at Metro Vancouver’s rental market by Canada’s federal housing agency provided a grim outlook that’s likely no surprise to tenants across the region.

The Canada Mortgage and Housing Corporation’s new Rental Market Report showed the vacancy rate for purpose-built rentals in Greater Vancouver fell to 0.9 per cent last year, down from 1.2 in 2021 and 2.6 in 2020 at the height of the pandemic.

The figure put the Vancouver vacancy rate far below the national average of 1.9 per cent.

“In terms of rents, in the region, we’ve seen increases across the board — two bedroom market rents in Vancouver are now in the order of $2,850 per month, and that compares with $2,000 per month for units that have been occupied for longer times,” he said.

“That 43 per cent difference is very challenging for anyone whos looking to move, it’s a strong disincentive to moving since if you were looking for an identical unit across the hall or even down the street you would be facing a significant rent increase.”

The report found Toronto had the second most expensive rental market, with a two bedroom averaging at $1,770.

Victoria’s vacancy rate edged upward to 1.5 per cent on an increase in rental stock, but rents were still up about 7.7 per cent, with a two-bedroom averaging at $1,699 — good for third place nationwide.

Kelowna rounded out the top four with an average two-bedroom renting for $1,690.

Continue Reading.

Tagging: @politicsofcanada

53 notes

·

View notes

Text

Soybeans’ big players looking to a bruising year ahead

After a five-year run that featured a costly trade war and an even costlier, deadly pandemic, the biggest players in the global soybean market the United States, Brazil and China are positioning themselves for a big, bruising 2023/2024 marketing year.

Of the three, Brazil remains planted in the driver’s seat. The U.S. Department of Agriculture (USDA) forecasts that Brazil’s mostly planted 2023/24 crop will yield an export hogging 6 billion bu., 5% more than last year’s record production and an astonishing 16% larger than the 2020/2021 crop.

Two factors favor that outlook. First, after three consecutive years of dry, hot La Niña weather, this year’s El Niño should bring more moisture and less crop stress. Second, for the first time in memory, soy production costs are falling, encouraging Brazilian farmers to do what farmers anywhere would do: swap costly corn acres for cheaper bean acres.

If the projected, record 113 million soybean acres are planted and the better weather forecast comes to pass, USDA expects Brazil to export a record 103 million metric tons (mmt) of soybeans in its 2023/24 marketing year. That’s 6 mmt more than last year’s 97 mmt.

Just how many bushels are in 103 mmt of soybeans? A staggering 3.75 billion bu.

Continue reading.

8 notes

·

View notes

Text

Bitcoin Going Parabolic: A Closer Look at the Factors Driving the Surge

Bitcoin has been a subject of fascination and debate for over a decade. Recently, the buzz around its potential parabolic rise has reached new heights. With multiple presidential nominees proposing to make Bitcoin a strategic reserve asset and groundbreaking legislative efforts, the cryptocurrency is poised for a significant breakthrough. In this blog post, we will explore the factors contributing to Bitcoin's potential meteoric rise and what this could mean for the future of finance.

Current Market Overview

The Bitcoin market has seen remarkable stability and growth over the past year. Despite global economic uncertainties, Bitcoin's price has maintained an upward trajectory, driven by increased adoption and growing institutional interest. The market's resilience has only strengthened the belief that Bitcoin is here to stay.

Factors Driving Bitcoin's Potential Parabolic Rise

Institutional Adoption Institutional investment in Bitcoin has been one of the most significant drivers of its price surge. Companies like MicroStrategy, Tesla, and Square have made substantial Bitcoin purchases, demonstrating their confidence in its long-term value. Recently, MicroStrategy announced plans to raise $2 billion to buy more Bitcoin, adding to its already significant holdings of 226,500 BTC. This move exemplifies the growing trend of institutions recognizing Bitcoin as a hedge against inflation and economic instability.

Regulatory Developments Positive regulatory changes are also contributing to Bitcoin's upward momentum. Notably, several presidential nominees in the upcoming election have expressed their support for Bitcoin, proposing to make it a strategic reserve asset for the United States. Additionally, Senator Cynthia Lummis has introduced a groundbreaking bill to establish a U.S. Bitcoin reserve. This legislation aims to treat Bitcoin like gold or oil, strengthening the country's economy and positioning Bitcoin as a permanent national asset. Such initiatives could legitimize Bitcoin on a national level, potentially triggering a wave of similar actions from other countries.

Monetary Policy Shifts The Federal Reserve is expected to cut interest rates in September, a move that historically leads to Bitcoin price pumps. Lower interest rates often result in increased liquidity in the financial system, driving investors to seek alternative stores of value like Bitcoin. Moreover, the global M2 money supply is skyrocketing, indicating a significant increase in the amount of money in circulation. This surge in money supply can lead to inflation, further underscoring the appeal of Bitcoin as a deflationary asset.

Technological Advancements Bitcoin's underlying technology continues to evolve, enhancing its security, efficiency, and scalability. Innovations such as the Lightning Network and Taproot upgrade are making Bitcoin transactions faster and more cost-effective, further cementing its position as a superior financial instrument.

Historical Parabolic Trends in Bitcoin

Bitcoin's history is marked by several parabolic rises, each driven by different factors but sharing common themes of increased adoption and market maturation. The 2017 bull run, fueled by retail investor interest, and the 2020-2021 surge, driven by institutional adoption, provide valuable insights into the current trend. Studying these patterns helps us understand the potential trajectory of Bitcoin's price movement.

Expert Predictions and Analysis

Experts in the field of cryptocurrency are making bold predictions about Bitcoin's future. Influential figures like Michael Saylor, CEO of MicroStrategy, and Cathie Wood, CEO of ARK Invest, have forecasted Bitcoin reaching new all-time highs. Their analyses are based on Bitcoin's scarcity, growing adoption, and its role as digital gold.

Potential Challenges and Risks

While the outlook for Bitcoin is promising, it is essential to acknowledge the potential challenges and risks. Regulatory hurdles, market volatility, and technological vulnerabilities could impact Bitcoin's growth. Investors must remain vigilant and informed to navigate these challenges effectively.

Conclusion

Bitcoin's potential to go parabolic is underpinned by strong institutional support, favorable regulatory developments, and continuous technological advancements. As multiple presidential nominees propose to make Bitcoin a strategic reserve asset and Senator Lummis's groundbreaking bill aims to establish a U.S. Bitcoin reserve, the stage is set for a significant transformation in the financial landscape. With MicroStrategy's aggressive strategy to raise $2 billion for more Bitcoin purchases and the expected interest rate cuts by the Federal Reserve, the momentum is undeniable. Additionally, the skyrocketing global M2 money supply highlights the growing need for a deflationary asset like Bitcoin. Whether you're an investor, a crypto enthusiast, or a curious observer, staying informed about these developments is crucial as we witness the evolution of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#BTC#Blockchain#FinancialRevolution#DigitalGold#Investing#InstitutionalAdoption#Regulation#BitcoinNews#CryptoMarket#BitcoinPrice#BitcoinInvestment#FederalReserve#MonetaryPolicy#InterestRates#M2Supply#SenatorLummis#MicroStrategy#ParabolicRise#FinancialFreedom#financial experts#digitalcurrency#unplugged financial#globaleconomy#financial education#financial empowerment#finance

5 notes

·

View notes

Text

Tourism Market: Trends, Growth, and Industry Players

Introduction

The global tourism market is a dynamic sector that continually evolves in response to changing consumer preferences, technological advancements, and global events. As we delve into the current landscape, it is crucial to explore the tourism market size, growth patterns, industry trends, and key players that shape the sector's trajectory.

Tourism Market Size and Growth

The tourism market has witnessed remarkable growth over the past decade. According to the latest data the global international tourist arrivals reached 1.5 billion in 2022, marking a 4% increase from the previous year. The tourism industry's robust growth is attributed to factors such as increased disposable income, improved connectivity, and a growing middle class in emerging economies.

The COVID-19 pandemic, however, significantly impacted the industry in 2020 and 2021. International tourist arrivals plummeted by 74% in 2020, representing the largest decline in the industry's history. As the world recovers from the pandemic, tourism is experiencing a resurgence. The UNWTO estimates that international tourist arrivals will surpass pre-pandemic levels by 2023, emphasizing the sector's resilience.

Tourism and Hospitality Industry Trends

The tourism and hospitality industry is undergoing transformative changes driven by technological advancements and shifting consumer behaviors. One notable trend is the rise of sustainable tourism. Travelers are increasingly prioritizing destinations and businesses that adopt eco-friendly practices. Hotels, airlines, and tour operators are responding by implementing sustainable initiatives to meet the demands of environmentally conscious travelers.

Another trend shaping the industry is the integration of technology. From mobile apps for seamless bookings to virtual reality experiences, technology is enhancing the overall travel experience. The use of artificial intelligence and big data analytics is also becoming prevalent, enabling businesses to personalize services, predict consumer preferences, and optimize operations.

Tourism Industry Players

The tourism market is comprised of a diverse range of players, including governments, international organizations, tour operators, airlines, hotels, and online travel agencies (OTAs). Notable industry players such as Airbnb, Expedia, and Booking. com have disrupted traditional hospitality models, offering travelers a wide array of accommodation options and personalized experiences.

Governments play a crucial role in shaping the tourism landscape through policies, infrastructure development, and destination marketing. Collaborations between public and private sectors are essential to foster sustainable growth and address challenges such as over-tourism and environmental impact.

Tourism Market Analysis

A comprehensive analysis of the tourism market involves assessing key factors such as market dynamics, competitive landscape, and regulatory environments. The Asia-Pacific region has emerged as a powerhouse in the tourism sector, with countries like China, India, and Japan experiencing substantial growth. In contrast, established destinations in Europe and North America continue to attract millions of tourists annually.

The post-pandemic recovery has prompted a shift in travel preferences, with a surge in demand for domestic and outdoor experiences. Travelers are seeking off-the-beaten-path destinations, contributing to the diversification of the tourism market.

Travel and Tourism Industry Outlook

Looking ahead, the outlook for the travel and tourism industry is optimistic. The industry is expected to rebound strongly, driven by pent-up demand, increased vaccination rates, and the easing of travel restrictions. The global tourism market is projected to reach $11.38 trillion by 2027, growing at a CAGR of 6.1% from 2020 to 2027.

In conclusion, the tourism market is a vibrant and resilient sector that continues to adapt to changing circumstances. Understanding the market size, growth trends, industry players, and emerging dynamics is crucial for stakeholders navigating the evolving landscape. As the world reopens for travel, the industry's ability to innovate and embrace sustainable practices will play a pivotal role in shaping its future success.

#market research#business#ken research#market analysis#market report#market research report#travel and tourism sector#travel and tourism market#travel and tourism industry#tourism sector#tourism market trends#tourism market size#tourism market players#tourism market forecast

2 notes

·

View notes

Text

Renewable Energy M&A hits a record high of $100bn!

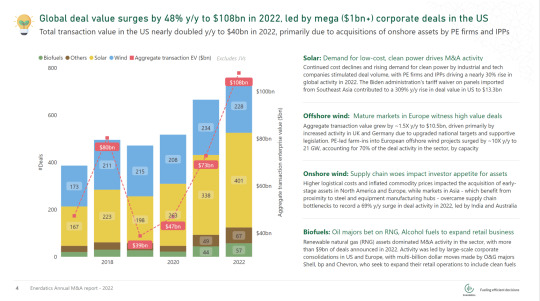

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Text

Seasonality Works! Trade the Cycles & Profit from History

Source: Super Boom (April 2011) by Jeffrey A. Hirsch, Fig. 1.3 p12, 500+ Percent Moves Follow Inflation

Earlier this month when we signed off on the final page proofs and sent the 2025 Stock Trader’s Almanac to press, I took pause to reflect upon the historic seasonal research my late father and founder of the Almanac, Yale Hirsch, accomplished and that we now continue. When Yale published the 1st edition of the iconic Stock Trader’s Almanac in 1968 who would have thought that many of the patterns and trends would still be working today? There have been changes and updates. Some trends have gone to the indicator graveyard while new patterns have emerged.

Perhaps the most quintessential Almanac pattern ever just completed for the second time in Almanac history. Remember my Super Boom forecast for Dow 38820 published in 2011

Look at this chart of the 4-Year Presidential Election Cycle! We first sent this chart to members in July 2021. It guided us through the covid bull market, called the midterm bear, pre-election year bull and current election year strength.

The market continues to follow the trends of our seasonal and 4-year cycle patterns we track and monitor. In our July Outlook, we maintained our bullish outlook for 2024, but cautioned that the market was possibly due for some mean reversion (a pullback) once NASDAQ’s 12-Day Midyear Rally ended in mid-July. NASDAQ did top out on July 10 while DJIA and S&P 500 topped about one week later.

The market has recovered in line with historical election year strength in August, but the correction is not likely over. With President Biden stepping aside our Open Field election year is back in play. This does not mean we are heading into the red for the year, but it does suggest the market may continue to struggle over the next few months during the seasonal weak period and leading up to this now more uncertain election. But remember since 1952 there have been “Only Two Losses Last 7 Months of Election Years” (page 80 STA 2024). Any potential September/October market weakness could set up a solid Q4, end-of-year rally, most likely beginning after Election Day.

For over five decades, top traders, investors and money managers have relied upon the Stock Trader’s Almanac. The 2025, 58th Annual Edition shows you the cycles, trends, and patterns you need to know in order to trade and invest with reduced risk and for maximum profit.

Limited time offer available now! Get the 2024 & 2025 Stock Trader's Almanacs for Free, while 2024 supplies last! Subscribe to my digital service, Almanac Investor, now and get the 2024 and 2025 Stock Trader’s Almanacs as free bonuses. Receive the 2024 STA now and be first to get the 2025 edition this fall hot off the press!

11 notes

·

View notes

Text

"Bitcoin's Potential Soars: Could It Reach $3 Million Per Coin?"

By George Georgiev | Nov 1, 2023

When it comes to Bitcoin (BTC) price predictions, one analyst is making waves with an eye-popping forecast. Luke Broyles, a respected crypto analyst and Bitcoin advocate, is suggesting that Bitcoin's value could skyrocket to an astounding $3 million per coin. While this may sound outrageous, Broyles presents a compelling case for this bullish outlook.

Broyles points out that despite Bitcoin's impressive market capitalization of $500 billion as of 2023, it still represents a fraction of the world's largest asset classes. To support his prediction, he emphasizes that Bitcoin's adoption rate is currently between 0.05% and 0.5%. If this adoption rate were to increase to 10%, it could drive a 100-fold increase in Bitcoin's value. Even if just 4% of the global population demanded 1 million satoshis, it could lead to Bitcoin's price soaring to astronomical heights.

Drawing parallels with the early days of the internet, Broyles argues that Bitcoin is a triple point asset, serving as a store of value, medium of exchange, and unit of account. He highlights the inherent value of groundbreaking technology, even with low initial adoption rates, as demonstrated by the internet's growth in the late '90s and early 2000s.

As of 2023, Bitcoin has shown resilience by recouping at least 50% of its all-time high from November 2021, currently trading at $34,501. However, much of the recent price action has been driven by news related to a spot exchange-traded fund (ETF), which is now fading in significance.

Achieving Bitcoin's price of $3 million per coin would require a confluence of factors, including regulatory changes, growing demand for risk assets in response to higher inflation, monetary policies enacted by central banks like the Federal Reserve, geopolitical tensions, and more. Broyles isn't the only analyst to make bold predictions about Bitcoin's future, but it's often events like chaos and social unrest that attract the most attention to this digital asset.

In conclusion, while a $3 million price target for Bitcoin may seem audacious, Luke Broyles makes a compelling argument based on Bitcoin's potential for growth and its current low adoption rates. However, realizing this milestone would depend on various influential factors coming into play. As the crypto world continues to evolve, it's clear that Bitcoin's journey is far from over.

Disclaimer:

The views and opinions expressed in this article are those of the author, Luke Broyles, and do not necessarily reflect the official stance of A-ZCRYPTOREVIEWS or its editorial team. Cryptocurrency investments are highly speculative and volatile, and readers should exercise caution and conduct their own research before making any investment decisions. It's essential to understand that cryptocurrency markets are subject to significant risks, including regulatory changes, market fluctuations, and unforeseen events that can impact the value of digital assets. A-ZCRYPTOREVIEWS provides news and information for educational purposes only and does not offer financial or investment advice. Readers are encouraged to consult with financial professionals and experts before making any investment decisions.

2 notes

·

View notes

Text

Laura K. Field for Politico:

On July 29, 2021, JD Vance appeared on Tucker Carlson’s show back when he was still a Fox News host. Like Carlson, Vance had once opposed Donald Trump, and like Carlson, he had transformed into a prominent Trump supporter and a rabid participant in the culture wars. “We are effectively run in the country, via the Democrats, via our corporate oligarchs,” he told Carlson, “by a bunch of childless cat ladies who are miserable at their own lives and the choices that they’ve made, and so they want to make the rest of the country miserable, too.” He went on to name Kamala Harris (and Pete Buttigieg, and AOC) as his prime examples of the childless leaders who should be excluded from positions of power. For years, Vance has played a key role in the elite echelons of the New Right, which can be described, loosely, as the intellectual wing of the Trumpified GOP (including many of the people in charge of Project 2025). This mixed-up group of intellectuals, activists, politicians and influencers is made up of a wide array of characters, who hold to a variety of belief systems and sometimes have divergent policy goals.

But the one instinct that Vance and the rest of the New Right share is a deep skepticism about modern feminism and gender equality — or what the New Right calls “gender ideology.” Overt chauvinism that seeks to roll back much of feminism’s gains is one of the most obvious unifying threads of this varied movement, and Trump’s choice of Vance anoints and entrenches it into the culture-war side of the MAGA movement. Vance appears to be a decent family man — someone who supports traditional conservative values, and is even willing to buck conventional GOP norms by supporting strong pro-family policies. But a quick perusal of his thoughts on women and gender reveal some unusual opinions that lie outside the American mainstream, beyond a stray comment about cat ladies.

Vance is staunchly opposed to abortion, and has suggested that it is wrong even in cases of rape and incest. He has compared the evil of abortion to that of slavery, and opposed the Ohio ballot measure ensuring the right to abortion in 2023. He also was one of only 28 members of Congress who opposed a new HIPAA rule that would limit law enforcement’s access to women’s medical records. He has promoted Viktor Orbán’s pro-natalist policies in Hungary, which offer paybacks to married couples that scale up along with the number of children (a new Hungarian Constitution that banned gay marriage went into effect in 2012, so these benefits only serve “traditional” couples). Vance opposes same-sex marriage. During his 2022 Senate campaign, he suggested the sexual revolution had made divorce too easy (people nowadays “shift spouses like they change their underwear”), arguing that people in unhappy marriages, and maybe even those in violent ones, should stay together for their children. His campaign said such an insinuation was “preposterous,” but you can watch the video yourself and be the judge.

In all of this, Vance fits squarely within (and identifies with) the faction of the American New Right that typically refers to itself as “postliberalism.” Patrick Deneen, a professor at Notre Dame, captured the basic outlook on gender and feminism among this cohort in his 2018 hit Why Liberalism Failed. Deneen’s argument is that liberal modernity is based on an irreparably individualistic view of human nature, which leads to a culture that values autonomy over community and family life. “Liberalism posits that freeing women from the household is tantamount to liberation,” he wrote, “but it effectively puts women and men alike into a far more encompassing bondage,” because work outside the home is submission to the forces of market capitalism. Somewhat bizarrely, in the postliberal mind, even gay marriage — people coming together and uniting legally into family units — becomes a form of social dissolution, because it is based on individual choice rather than traditional moral forms. Vance is an admirer of Deneen’s work and was a featured speaker at the launch of his most recent book, Regime Change, at Catholic University in May 2023. Vance spoke highly of Deneen’s book, identified personally with postliberalism and the New Right, and declared himself to be “anti-elitist” and “anti-regime.” He has picked up on the populist language used by the postliberals, who speak in all-or-nothing terms like the “ruling class,” “replacing the elites,” “using Machiavellian means to Aristotelian ends,” or “searing the liberal faith with hot irons.”

The most important figure in American postliberalism is Harvard professor Adrian Vermeule, whose 2022 book Common Good Constitutionalism describes a mode of constitutional thinking that would make it much easier for conservatives in the United States to legislate morality. Under Vermeule’s conception, judges could rule against a given law — say a law allowing marriage equality, or abortion in another state — by appealing to his “Common Good” standard. Vance is also friendly with the Claremont Institute, an election-denying “nerve center” for the broader New Right movement. He gave a speech at their newly opened “Center for the American Way of Life” in 2021 where, revealingly, he declared that the conservative movement should be about something simple: “I think that we should fight for the right of every American to live a good life in the country they call their own, to raise a family and dignity on a single middle-class job.”

The Claremont cohort is home to, or friendly with, some of the most extreme anti-feminists and misogynists in the movement, such as Scott Yenor, a professor at Boise State and a fellow with Claremont’s Center for the American Way of Life. He courted controversy in 2021 for calling career-oriented women “more medicated, meddlesome and quarrelsome than women need to be.” Or Jack Murphy, a stalwart of the Manosphere, who once declared that “feminists need rape,” and was a fellow with Claremont in 2021. Many of the leaders at the Institute, including Yenor and the president, Ryan Williams, are also part of a newly formed and pro-patriarchy fraternal organization, the Society for American Civic Renewal.

[...] National Conservatism is the big tent, umbrella organization where the New Right comes together. Vance has been a speaker at all three of the four National Conservatism conferences that have taken place in the United States since 2019 — including the meeting in D.C. earlier this month, where he gave the final keynote address at a VIP dinner on the closing day. Whereas the first big NatCon conference seemed like an upstart, fringe affair, this year, Chris DeMuth, a former American Enterprise Institute president who is one of the conference’s key leaders, opened the conference by declaring: “A revival of faith, family, and fertility are not far right, they are the new mainstream!” Vance, for his part, gave a speech titled “America is a Nation,” which touched only lightly on questions of gender, merely echoing DeMuth’s call for a renewal of the American family. Patrick Deneen was pleased.

J.D. Vance’s New Right/postliberal views on gender roles give off weirdo vibes.

See Also:

Politico: Are Republican Voters Ready for the Nerdy Radicalness of JD Vance?

#J.D. Vance#Gender Roles#Masculinity#Sexism#Antifeminism#Gender Equality#Abortion#Natalism#No Fault Divorce#Postliberalism#Claremont Institute#Patrick Deneen#Tucker Carlson#Adrian Vermeule#Chris DeMuth#Jack Murphy#Scott Yenor#Peter Thiel#Society For American Civic Renewal#National Conservatism

4 notes

·

View notes

Text

The Taming of the Songwriter

Olivia Rodrigo does it again with her sophmore album GUTS, mimicking the pop-grunge sound of the '90s and early '00s while detailing about the woes of being a young woman in the 2020s.

Although the album's audio impressed me, to no surprised, I was at first disappointed by its visuals and marketing. To me, SOUR, Rodrigo's 2021 debut didn't feel that far ago. Its soft purple pop-grunge aesthetic is still present in my memories. When the album art and marketing for GUTS was released, I was shocked to find it so similar to it's predecessor, expecting for Olivia to be entering a new "era". But then I listened to the album.

Rodrigo's maturity is evident in her song writing, but the story-telling, romanticism, and production of SOUR is present. It was after giving the record a listen-through that I realized GUTS is not a follow-up album, but more of a sister-album. An older sister album. And in the spirit of it's '90s/'00s vibe, specifically the sisters from 10 Things I Hate About You (1999): Kat and Bianca Stratford (as played by Julia Stiles and Larisa Oleynik).

Bianca is SOUR. She's youthful, naive, and romantic. Bianca Stratford is a sweet, innocent, beautiful high schooler. The "girl next door" starting her journey of love. The unoffical anthem of 2021 - Driver's License - presents a wholly teenage outlook on love. It's sweet in that many of us have or will experience the feeling of gaining that freedom to take yourself wherever you want to go. And that place could the house of your first love. The album chronicles a relationship between two young people. The innocence and passion and heartbreak that made many adults feel like a teenager again. It has more soft songs and ballads and therefore in the world of Olivia's music, is more romantic. One critique of the album is that all the songs are the same, as just one stands apart from the rest in terms of subject matter ("brutal"). This is where the album differs from her older sister.

Kat is GUTS. She's edgy, jaded, and cynical. Kat Stratford is unapoligetically outspoken. A high school feminist on her jouney of disrupting the system, but that doesn't mean she can't fall in love. GUTS is a mixed bag of experiences young women know all too well. In this album, Rodrigo includes less ballads, the ones that are present reflect on poor relationships ("logical," "teenage dream," "the grudge"). But it's more than just a recounting of her past relationships. GUTS is feminism, and maybe a little queer. "all-american bitch," "lacy," "pretty isn't pretty," all touch on subject matter regarding beauty standards and the expectations forced onto young women by the patriarchy. "bad idea right?" "ballad of a homeschooled girl," and "get him back" are upbeat, tongue-in-cheek, and range in topics. Rodrigo still gives us the bitter love songs that she's known for, but this time around, she has a lot more to say.

And come on, can't you just imagine Kat laying in bed listening to "love is embarassing" one minute and the next screaming the lyrics into a mirror?

#GUTS#olivia rodrigo#10 things i hate about you#kat stratford#biance stratford#the taming of the shrew

6 notes

·

View notes