#interest free education loan

Explore tagged Tumblr posts

Text

Top 9 Education Loan with low interest rates in India

SBI enables students to have easy and affordable loans through its competitive interest rates and adjustable repayment timings. It is therefore the first choice of students for education loans in India.IOB loans are cheap in terms of interest rates but have simplified repayment facilities for students of all classes. Therefore, it may be helpful for students from different backgrounds.

#Top 9 Education loan#Education loan interest#education loan in India#education loan interest rate#best education loan interest in India#Best education loan#interest free education loan#low interest education loan#govt educaction loan

0 notes

Text

0 notes

Link

Entregamos historias. También te damos guías, consejos y trucos sobre cómo crear el tuyo propio. Este canal está dedicado a cosas aleatorias que pasan por nu...

#us supreme court#student loan repayment plan#biden administration#gop states#legal challenge#lower courts#deepening legal fight#department of education#interest-free forbearance#white house department of justice#congress budget#8th us circuit court of appeals#emergencycket#congressional budget office#alaska#south carolina#texas#0 presidential campaign#democratic primary#majority#department of education.

0 notes

Text

Best Interest-Free Loans for Students in UK 2024

Interest-Free Loans for Students: While the idea of borrowing money for school without interest sounds amazing, it’s important to know that true interest-free loans for students in the UK are pretty rare. Most loans will have some kind of interest attached, even if it’s hidden under a fancy name. Some lenders might advertise “0% interest” to grab your attention, but this is usually a temporary…

View On WordPress

#education loan by government#education loan in india interest rate#education loan interest rate#education loan interest rate in india#education loan interest rates#education loan interest rates in india#education loan rate of interest#government education loan#government education loans#government loan for education#government loan for students#government loan student#government loans for students#government loans student#how to get education loan from government#interest free loan for students#interest free loans for students#interest free student loan#interest free student loan uk#interest free student loans#interest free student loans uk#interest rate of student loans#interest rate on student loans#interest-free loans for students#interest-free student loans uk#is a student loan interest free#student government loans#student loan from government#student loan rate of interest#student loans interest rate

0 notes

Text

What Happens If a Student Faces Difficulty in Repaying The Education Loan

What Happens If a Student Faces Difficulty in Repaying The Education Loan Education is a transformative journey that empowers individuals with knowledge, skills, and opportunities for personal and professional growth. However, for many students, financing higher education can be a substantial challenge. To bridge this gap, education loans serve as a lifeline, enabling students

#education loan#education loan in india#how to get education loan#sbi education loan#education loan interest rate#education loan kaise milta hai#education loan interest rate in india#education loan for abroad#education loans#education loan kaise le#education loan process#education loan without collateral#education#education loan process in hindi#abroad education loan#free education loan#educatio loans#sbi education loans#education loan for mba

0 notes

Text

Are education expenses tax deductible ?

Outline:

Introduction

Understanding Tax Deductions

What Are Tax Deductions?

Common Tax Deductions

Education Expenses and Tax Deductions

Eligible Education Expenses

Qualifications for Tax Deductions

The American Opportunity Credit

Who Qualifies for the American Opportunity Credit?

How Much Can You Claim?

The Lifetime Learning Credit

Who Qualifies for the Lifetime Learning Credit?

How Much Can You Claim?

Tuition and Fees Deduction

Who Qualifies for the Tuition and Fees Deduction?

How Much Can You Claim?

Student Loan Interest Deduction

Who Qualifies for the Student Loan Interest Deduction?

How Much Can You Claim?

Employer Tuition Assistance

Tax-Free Educational Assistance

Limits on Employer-Provided Education Benefits

Educational Savings Accounts

Coverdell Educational Savings Account (ESA)

529 Plans

Tax Deductibility of Work-Related Education

Qualifying Work-Related Education Expenses

Exceptions and Limitations

State Tax Deductions for Education Expenses

State-Specific Deductions and Credits

Researching State Tax Laws

Recordkeeping and Documentation

Importance of Proper Documentation

Retaining Education Expense Records

The Impact of Income on Deductibility

Phase-Out Limits for Education Expenses

Other Education-Related Tax Benefits

Student Loan Forgiveness Programs

Employer Student Loan Repayment Assistance

Tax Deductibility of Education Expenses for Self-Employed Individuals

Conclusion

Are Education Expenses Tax Deductible?

Education is a vital aspect of personal and professional growth, but it can also come with a hefty price tag. As individuals pursue higher education, the question of whether education expenses are tax-deductible becomes essential. In this article, we will explore the various tax deductions and credits available to help alleviate the financial burden of educational pursuits.

Understanding Tax Deductions

What Are Tax Deductions?

Tax deductions are specific expenses that taxpayers can subtract from their total income, ultimately reducing the amount of income that is subject to taxation. Deductions lower the overall tax liability, resulting in potential tax savings for eligible individuals.

Common Tax Deductions

Before delving into education-related deductions, it's essential to understand some common deductions available to taxpayers, such as:

Ø Home mortgage interest

Ø Charitable contributions

Ø Medical expenses

Ø State and local taxes

Ø Retirement contributions

Ø Education Expenses and Tax Deductions

Eligible Education Expenses

The Internal Revenue Service (IRS) allows taxpayers to claim certain education expenses as deductions or credits. Eligible expenses often include:

· Tuition and fees for enrollment

· Books, supplies, and required course materials

· Necessary equipment for courses

· Qualified educational software

· Qualifications for Tax Deductions

To qualify for education-related tax deductions, certain criteria must be met. Generally, the education must be for the taxpayer, their spouse, or a dependent. Additionally, the expenses should be related to enrollment in an eligible educational institution.

The American Opportunity Credit

§ Who Qualifies for the American Opportunity Credit?

The American Opportunity Credit is a tax credit that offers substantial financial assistance to eligible students pursuing higher education. To qualify, students must be pursuing a degree or other recognized educational credential and be enrolled at least half-time in their program.

§ How Much Can You Claim?

As of the time of writing, the American Opportunity Credit allows eligible taxpayers to claim up to $2,500 per student per year for the first four years of post-secondary education.

The Lifetime Learning Credit

o Who Qualifies for the Lifetime Learning Credit?

Unlike the American Opportunity Credit, the Lifetime Learning Credit is available to both undergraduate and graduate students, as well as those pursuing professional degrees or taking classes to acquire or improve job skills.

o How Much Can You Claim?

As of the time of writing, the Lifetime Learning Credit permits eligible taxpayers to claim up to 20% of the first $10,000 of qualified education expenses, resulting in a maximum credit of $2,000 per tax return.

Tuition and Fees Deduction

Ø Who Qualifies for the Tuition and Fees Deduction?

The Tuition and Fees Deduction allows eligible taxpayers to deduct qualified education expenses even if they do not itemize deductions on their tax return.

Ø How Much Can You Claim?

As of the time of writing, eligible taxpayers may deduct up to $4,000 from their taxable income.

Student Loan Interest Deduction

I. Who Qualifies for the Student Loan Interest Deduction?

Taxpayers who have taken out student loans to cover qualified education expenses may be eligible for the Student Loan Interest Deduction.

II. How Much Can You Claim?

As of the time of writing, eligible taxpayers can deduct up to $2,500 of student loan interest paid throughout the tax year.

Employer Tuition Assistance

i. Tax-Free Educational Assistance

Employers may offer tuition assistance to employees as part of their benefits package, and in some cases, this assistance may be tax-free up to a certain limit.

ii. Limits on Employer-Provided Education Benefits

While employer-provided tuition assistance can be advantageous, there are specific limitations to be aware of, such as the maximum amount of tax-free assistance allowed per year.

Educational Savings Accounts

· Coverdell Educational Savings Account (ESA)

Coverdell ESAs are tax-advantaged accounts designed to help families save for education expenses.

· 529 Plans

529 Plans are state-sponsored savings plans that offer tax benefits for qualified education expenses, including tuition, books, and room and board.

Tax Deductibility of Work-Related Education

§ Qualifying Work-Related Education Expenses

Expenses related to education undertaken to maintain or improve skills needed in one's current employment or to meet the employer's requirements may be tax-deductible.

§ Exceptions and Limitations

The IRS imposes certain exceptions and limitations on work-related education deductions, which taxpayers should be aware of.

State Tax Deductions for Education Expenses

o State-Specific Deductions and Credits

Apart from federal deductions and credits, some states offer additional tax breaks for education expenses.

o Researching State Tax Laws

It is essential to research the specific tax laws in your state to determine the available deductions and credits related to education expenses.

Recordkeeping and Documentation

ü Importance of Proper Documentation

Maintaining accurate and detailed records of education expenses is crucial when claiming tax deductions or credits.

ü Retaining Education Expense Records

Taxpayers should keep all relevant documents, including tuition statements, receipts, and enrollment records, to support their claims.

The Impact of Income on Deductibility

* Phase-Out Limits for Education Expenses

The availability of certain education-related deductions and credits may be affected by the taxpayer's income level.

Other Education-Related Tax Benefits

Ø Student Loan Forgiveness Programs

Certain federal student loan forgiveness programs may offer tax-free forgiveness of the remaining loan balance.

Ø Employer Student Loan Repayment Assistance

Some employers may provide student loan repayment assistance as an employee benefit.

Ø Tax Deductibility of Education Expenses for Self-Employed Individuals

Self-employed individuals may be eligible to deduct qualified education expenses as business expenses.

Conclusion

Education is a lifelong pursuit that comes with various costs, but the good news is that there are several tax deductions and credits available to help ease the financial burden. From the American Opportunity Credit to employer tuition assistance and state-specific benefits, exploring these options can make a significant difference in managing educational expenses.

Now, take advantage of the tax benefits and invest in your future. Maximize your potential, both personally and professionally, through the power of education.

FAQs

Can I claim tax deductions for my child's education expenses?

Yes, you may be eligible to claim certain education-related deductions or credits for your child's education expenses, depending on your circumstances.

Are student loan interest payments always tax-deductible?

No, the deductibility of student loan interest payments depends on various factors, including your income and filing status.

Can I claim education expenses if I am attending school part-time?

Yes, in some cases, you may still be eligible to claim education-related tax benefits while attending school part-time. Be sure to review the specific requirements for each credit or deduction.

What is the difference between a tax deduction and a tax credit?

Tax deductions reduce your taxable income, while tax credits directly reduce the amount of taxes you owe.

How do I know if my state offers additional education-related tax benefits?

You can visit your state's official tax website or consult with a tax professional to understand the specific education-related tax benefits available in your state.

#Are education expenses tax deductible ?#Outline:#Introduction#Understanding Tax Deductions#What Are Tax Deductions?#Common Tax Deductions#Education Expenses and Tax Deductions#Eligible Education Expenses#Qualifications for Tax Deductions#The American Opportunity Credit#Who Qualifies for the American Opportunity Credit?#How Much Can You Claim?#The Lifetime Learning Credit#Who Qualifies for the Lifetime Learning Credit?#Tuition and Fees Deduction#Who Qualifies for the Tuition and Fees Deduction?#Student Loan Interest Deduction#Who Qualifies for the Student Loan Interest Deduction?#Employer Tuition Assistance#Tax-Free Educational Assistance#Limits on Employer-Provided Education Benefits#Educational Savings Accounts#Coverdell Educational Savings Account (ESA)#529 Plans#Tax Deductibility of Work-Related Education#Qualifying Work-Related Education Expenses#Exceptions and Limitations#State Tax Deductions for Education Expenses#State-Specific Deductions and Credits#Researching State Tax Laws

0 notes

Text

Interest Free Loan Scholarship Online

Sakal India Foundation has been working to empower students with Scholarships, Interest-Free Education Loans and Career Mentoring since 1959. The idea of setting up this organisation was to encourage meritorious students from a weak financial background with grants and scholarships to pursue higher education.

SIF has granted Interest-Free Loan Scholarships to thousands of students and professionals with outstanding merit for higher studies in India and abroad irrespective of their caste, creed, and religion. Sakal India Foundation offer Interest Free Loans scholarship in India to brilliant students who are not able to meet the complete expenses of their higher education. The basic eligibility criteria are the academic excellence and achievements of the learners.

0 notes

Text

since we now know that all those "my blog is safe for Jewish people" posts are bullshit, here are some Jewish organizations you can donate to if you actually want to prove you support Jews. put up or shut up

FIGHTING HUNGER

Masbia - Kosher soup kitchens in New York

MAZON - Practices and promotes a multifaceted approach to hunger relief, recognizing the importance of responding to hungry peoples' immediate need for nutrition and sustenance while also working to advance long-term solutions

Tomchei Shabbos - Provides food and other supplies so that poor Jews can celebrate the Sabbath and the Jewish holidays

FINANCIAL AID

Ahavas Yisrael - Providing aid for low-income Jews in Baltimore

Hebrew Free Loan Society - Provides interest-free loans to low-income Jews in New York and more

GLOBAL AID

American Jewish Joint Distribution Committee - Offers aid to Jewish populations in Central and Eastern Europe as well as in the Middle East through a network of social and community assistance programs. In addition, the JDC contributes millions of dollars in disaster relief and development assistance to non-Jewish communities

American Jewish World Service - Fighting poverty and advancing human rights around the world

Hebrew Immigrant Aid Society - Providing aid to immigrants and refugees around the world

Jewish World Watch - Dedicated to fighting genocides around the world

MEDICAL AID

Sharsheret - Support for cancer patients, especially breast cancer

SOCIAL SERVICES

The Aleph Institute - Provides support and supplies for Jews in prison and their families, and helps Jewish convicts reintegrate into society

Bet Tzedek - Free legal services in LA

Bikur Cholim - Providing support including kosher food for Jews who have been hospitalized in the US, Australia, Canada, Brazil, and Israel

Blue Card Fund - Critical aid for holocaust survivors

Chai Lifeline - An org that's very close to my heart. They help families with members with disabilities in Baltimore

Chana - Support network for Jews in Baltimore facing domestic violence, sexual abuse, and elder abuse

Community Alliance for Jewish-Affiliated Cemetaries - Care of abandoned and at-risk Jewish cemetaries

Crown Heights Central Jewish Community Council - Provides services to community residents including assistance to the elderly, housing, employment and job training, youth services, and a food bank

Hands On Tzedakah - Supports essential safety-net programs addressing hunger, poverty, health care and disaster relief, as well as scholarship support to students in need

Hebrew Free Burial Association

Jewish Board of Family and Children's Services - Programs include early childhood and learning, children and adolescent services, mental health outpatient clinics for teenagers, people living with developmental disabilities, adults living with mental illness, domestic violence and preventive services, housing, Jewish community services, counseling, volunteering, and professional and leadership development

Jewish Caring Network - Providing aid for families facing serious illnesses

Jewish Family Service - Food security, housing stability, mental health counseling, aging care, employment support, refugee resettlement, chaplaincy, and disability services

Jewish Relief Agency - Serving low-income families in Philadelphia

Jewish Social Services Agency - Supporting people’s mental health, helping people with disabilities find meaningful jobs, caring for older adults so they can safely age at home, and offering dignity and comfort to hospice patients

Jewish Women's Foundation Metropolitan Chicago - Aiding Jewish women in Chicago

Metropolitan Council on Jewish Poverty - Crisis intervention and family violence services, housing development funds, food programs, career services, and home services

Misaskim - Jewish death and burial services

Our Place - Mentoring troubled Jewish adolescents and to bring awareness of substance abuse to teens and children

Tiferes Golda - Special education for Jewish girls in Baltimore

Yachad - Support for Jews with disabilities

#atlas entry#please add any more you know of an especially add fundraisers for you or people you know#if there are any fundraisers for synagogues please add those as well#jew#jewish#judaism#jumblr#punch nazis

3K notes

·

View notes

Text

Things the Biden-Harris Administration Did This Week #29

July 26-August 2 2024

President Biden announced his plan to reform the Supreme Court and make sure no President is above the law. The conservative majority on the court ruled that Trump has "absolute immunity" from any prosecution for "official acts" while he was President. In response President Biden is calling for a constitutional amendment to make it clear that Presidents aren't above the law and don't have immunity from prosecution for crimes committed while in office. In response to a wide ranging corruption scandal involving Justice Clarence Thomas, President Biden called on Congress to pass a legally binding code of ethics for the Supreme Court. The code would force Justices to disclose gifts, refrain from public political actions, and force them to recuse themselves from cases in which they or their spouses have conflicts of interest. President Biden also endorsed the idea of term limits for the Justices.

The Biden Administration sent out an email to everyone who has a federal student loan informing them of upcoming debt relief. The debt relief plan will bring the total number of a borrowers who've gotten relief from the Biden-Harris Administration to 30 million. The plan is due to be finalized this fall, and the Department of Education wanted to alert people early to allow them to be ready to quickly take advantage of it when it was in place and get relief as soon as possible.

President Biden announced that the federal government would step in and protect the pension of 600,000 Teamsters. Under the American Rescue Plan, passed by President Biden and the Democrats with no Republican votes, the government was empowered to bail out Union retirement funds which in recent years have faced devastating cut of up to 75% in some cases, leaving retired union workers in desperate situations. The Teamster union is just the latest in a number of such pension protections the President has done in office.

President Biden and Vice-President Harris oversaw the dramatic release of American hostages from Russia. Wall Street Journal reporter Evan Gershkovich, former Marine Paul Whelan held since 2018, Russian-American reporter for Radio Free Europe/Radio Liberty Alsu Kurmasheva convicted of criticizing the Russian Military, were all released from captivity and returned to the US at around midnight August 2nd. They were greeted on the tarmac by the President and Vice-President and their waiting families. The deal also secured the release of German medical worker Rico Krieger sentenced to death in Belarus, Russian-British opposition figure Vladimir Kara-Murza, and 11 Russians convicted of opposing the war against Ukraine or being involved in Alexei Navalny's anti-corruption organization. Early drafts of the hostage deal were meant to include Navalny before his death in Russian custody early this year.

A new Biden Administration rule banning discrimination against LGBT students takes effect, but faces major Republican resistance. The new rule declares that Title IX protects Queer students from discrimination in public schools and any college that takes federal funds. The new rule also expands protections for victims of sexual misconduct and pregnant or parenting students. However Republican resistance means the rule can't take effect nation wide. Lawsuits from Republican controlled states, Alabama, Alaska, Arkansas, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia and Wyoming, means the new protections won't come into effect those states till the case is ruled on likely in a Supreme Court ruling. The Biden administration crafted these Title IX rules to reflect the Supreme Court's 2020 Bostock case.

The Biden administration awarded $2 billion to black and minority farmers who were the victims of historic discrimination. Historically black farmers have been denied important loans from the USDA, or given smaller amounts than white farmers. This massive investment will grant 23,000 minority farmers between $10,000 and $500,000 each and a further 20,000 people who wanted to start farms by were improperly denied the loans they needed between $3,500-$6,000 to get started. Most payments went to farmers in Mississippi and Alabama.

The Biden Administration took an important step to stop the criminalization of poverty by changing child safety guidelines so that poverty alone isn't grounds for taking a child into foster care. Studies show that children able to stay with parents or other family have much better outcomes then those separated. Many states have already removed poverty from their guidelines when it comes to removing children from the home, and the HHS guidelines push the remaining states to do the same.

Vice-President Harris announced the Biden Administration's agreement to a plan by North Carolina to forgive the state's medical debt. The plan by Democratic Governor Roy Cooper would forgive the medical debt of 2 million people in the state. North Carolina has the 3rd highest rate of medical debt in the nation. Vice-President Harris applauded the plan, pointing out that the Biden Administration has forgiven $650 million dollars worth of medical debt so far with plans to forgive up to $7 billion by 2026. The Vice-President unveiled plans to exclude medical debt from credit scores and issued a call for states and local governments to forgive debt, like North Carolina is, last month.

The Department of Transportation put forward a new rule to bank junk fees for family air travel. The new rule forces airlines to seat parents next to their children, with no extra cost. Currently parents are forced to pay extra to assure they are seated next to their children, no matter what age, if they don't they run the risk of being separated on a long flight. Airlines would be required to seat children age 13 and under with their parent or accompanying adult at no extra charge.

The Department of Housing and Urban Development announced it is giving $3.5 billion to combat homelessness. This represents the single largest one year investment in fighting homelessness in HUD's history. The money will be distributed by grants to local organizations and programs. HUD has a special focus on survivors of domestic violence, youth homeless, and people experiencing the unique challenges of homelessness in rural areas.

The Treasury Department announced that Pennsylvania and New Mexico would be joining the IRS' direct file program for 2025. The program was tested as a pilot in a number of states in 2024, saving 140,000 tax payers $5.6 million in filing charges and getting tax returns of $90 million. The program, paid for by President Biden's Inflation Reduction Act, will be available to all 50 states, but Republicans strong object. Pennsylvania and New Mexico join Oregon and New Jersey in being new states to join.

Bonus: President Biden with the families of the released hostages calling their loved ones on the plane out of Russia

#Joe Biden#Thanks Biden#Kamala Harris#american politics#us politics#politics#Russia#Evan Gershkovich#supreme court#clarence thomas#student loans#medical debt#black farmers#racism#trans students#LGBT students#homelessness#IRS#taxes

911 notes

·

View notes

Text

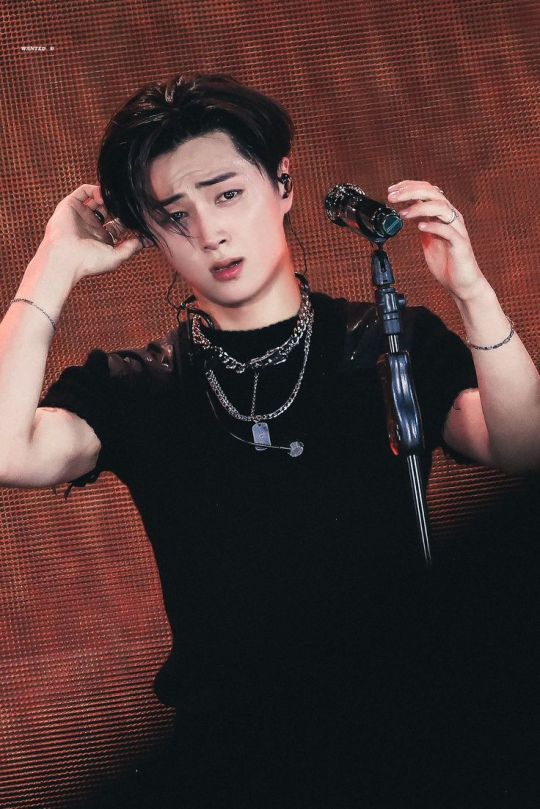

Welcome to the Dollhouse

Summary: Y/n is down on their luck making financial ends meet. When a once-in-a-lifetime opportunity forces them into a bargain that can't refuse. Now, they find themselves at a party searching for a partner but the person they get is someone they'd never expect.

Notes: Male Reader, Dubious Contracts, Financial Struggles, Idol Jay, Enhypen exists, Fake names, Kissing

Wordcount: 6.9k

It’s funny to think about how much money can buy. Many people say it can’t buy happiness, love, or fulfillment. But when push comes to shove. Money makes the world go round…

Being in college was all you wanted. A chance to get an education that was enough to get you away from the boring life that awaited you if you decided to miss out. Moving to a big city, far away from your parents wasn’t even the hard part. It was paying for college… You managed to land a decent scholarship, as long as you did your school work and did some volunteering to make the school look good then you’d be safe to coast through without any worries. Or that was the case. In your second semester of freshman year, one picture put you dead in the water.

It was your first party. No parents to worry about what time you’d be back. Friends watch you in case things get too crazy. And a cute guy who invited you. A frat boy.By the end of the night, videos of you drinking online circulated. And being a year under the drinking age wasn’t a good look either. The school tore away your scholarship, you were lucky they didn’t expel you. You didn’t have the heart to tell your parents what happened, so you had to find a way to pay for school alone. You looked for private loans, but most wouldn’t accept you without a guarantor, someone to pay them back if you couldn’t. And working odd jobs wouldn’t earn you enough money before the next semester. That’s where The Dollhouse entered the picture.

This was the sixth bank you’d visited. You were desperate. Waiting for the subway, you were approached by a man in a long black coat. He was older than you, but not by much, his early thirties max. He wore a black shirt and pants, with black hair to match. He was almost like a shadow… if shadows were handsome men. “Excuse me, you dropped this!” He exclaimed as he rushed over to you. He had your phone in his hand, ready to offer it to you.

You must’ve dropped it at the bank. “Thank you so much! I’d be dead without this.”

“You should be more careful! You never know what kind of people you’ll meet. Stranger Danger and all that.”

You giggled. He sounded like your Dad saying that. “Aren’t you a stranger?”

He tilted his head to the side, pondering your point. “I suppose so. You can call me Seo-jun.”

“I’m y/n. Sorry for making you chase me here, and thanks again for bringing me my phone.”

He shook his head. “It’s no problem. I have to go this way for work anyway.”

“What kind of job do you have?”

“I’m sorta like a manager. I help connect people looking for work with clients looking for workers.” Seo-jun smiled wryly. “But right now, business is down. Some workers quit recently, and our clients want more new faces.”

You felt a pang in your stomach. You’d been cutting out meals to save money and your job was still only paying minimum wage. Considering you had a bit of free time, you took a chance. “I could lend a hand. I could use the money, and you did help me. It’s only fair that I return the favor.”

Seo-jun’s smile faded a bit. “Um… You’re a nice kid. But I don’t think our work is good for you.”

Originally you were offering just to be nice, but now your interest was piqued. “W-Why not?”

“Don’t be like that. You look like a hard worker, but it’s not ordinary work. The paychecks are nice, but I’d hate to see such a good kid like you work there.”

“How well does it pay?”

“That’s beside the point–”

“How much does it pay!?” You demanded.

“Depending on your client. After fees from management, I’ve seen some workers make over $4,000 in less than a week of work.” Seo-jun sighed.

4k in a week could set you up for the entire semester before the end of the summer, and then some! “Take me to work with you! Please!” Seo-jun tried not to look you in the eye, but you gripped his arm and refused to let go. “Then you’ll have to walk with me there. I’ll just talk to your boss.”

“Woah, woah. I’ll take you there, just don’t make a scene. People are staring,” He whispered, trying to peel you off him.

Thankfully it wasn’t too far of a train ride. You spent it wondering what kind of work they’d had you do. You weren’t well-dressed, having sold off most of your nice clothing. Maybe if there were uniforms, then your clothes wouldn’t be much of a problem. Seo-jun was silent for most of the ride, texting someone. His face was dark, which made his face stand out more. He wasn’t just pretty, he was extremely handsome. His black hair settled on his forehead and dipped slightly past his eyebrow making him even more attractive. The type of look no one could get enough of. And a few of the girls on the train agreed with you, from how they stared.

Seo-jun guided you off the train after another five stops. You walked a few blocks, turned a corner, and approached a black building wedged between two pale ones. Before knocking, Seo-jun looked at you. “Are you sure?”

You nodded. “I think I can handle it.” You were a bit nervous. There weren’t many people on this street, and the building was tall and imposing in the quiet neighborhood.

Seo-jun knocked on the door. It cracked open, and a big man with tattoos peeked through the crack. Once he registered who was at the door, it closed again before opening completely. Seo-jun said nothing as he entered the building, and you closely followed behind him. The large man shut the door behind you. Now you saw him completely, he looked more like an NFL player. He could easily throw you around if he wanted to. Seo-jun didn’t pay the man any mind, walking forward as he passed several doors. Each had a sign on it. Most said open and a few said occupied. The doors were closed and looked pretty heavy. It was so quiet, you could only hear the sounds of your footsteps on the tile. Seo-Jun led you to an office at the end of the hallway, putting in a key from his pocket and unlocking it. He sat down behind the desk, which was covered with papers.

“Come in and take a seat, y/n.”

You sat down in the chair in front of the desk. The room had a red velvet wall, and pictures of models. Or at least, they seemed like models. All of them were men in their early twenties, each was different but handsome. You even saw one that looked like Seo-Jun.

“Is that you?” You pointed at the photo.

Seo-Jun didn’t look. “Not anymore. That was a long time ago.” You raised an eyebrow. He looked almost the same in the photo as in front of you. But maybe it wasn’t the best time to push him to spill more.

“Why are you looking for money?” Seo-Jun questioned.

“College. It’s expensive, ya know?”

He scoffed. “Yeah. I know. Don’t you have parents, or any other family who can help?”

You shook your head. “That’s not an option.” Thinking about your family left a bitter taste in your mouth. They’d be so disappointed if they knew how bad things had gotten.

He pursed his lips like he understood the feeling. “How much money do you need?”

“Ideally, enough for school.”

“Give me a number.”

“It’s about $10k a semester. More if I live on campus.”

“Okay, and when school’s not in session, do you have a place to live? Around here, specifically.” You shook your head. You caught yourself about to talk about your family home, but maybe it was best not to… Seo-Jun typed a few things on a calculator on his phone, opened a laptop, and waited for it to start. “Okay. If you start working with us, it's like this. We’ll give you the money and other necessities you need, and you have to work off that amount.”

“You’ll give me the money?”

“I’ll have you log into your student account, and I’ll pay your semester in advance now. But that’s only if you accept our offer.”

“Of course!”

Seo-Jun sighed. “Please hear me completely before you decide.” He straightened his back as he pulled the laptop closer to him. He typed a few things before turning the computer around, and showing you the screen. It was a camera feed. “This is what we do.”

You watched closely. It looked like a guy your age was in a room with another person. They were talking. You were about to look away, shrugging it off before you saw the boy kneel on the ground. He was doing something to the older man’s pants. You leaned in to see, but the camera wasn’t clear enough.

“What is this?”

“This is the job. Be a partner for your clients, whatever that means for them. Then they’ll pay you for the service.” Seo-Jun’s jaw went slack. “Like I said, this isn’t an ordinary job. But if you take it, we’ll take care of you. You’ll have a home and meals, and we’ll keep our end of the bargain and pay for school.”

You sat back in your chair as the reality of the offer landed on you. Being hired, partner… A fancy way to say, prostitute. Was this really the only way?

“I know that you don’t want to pressure your family with your financial situation. And I’ll be honest, we didn’t bump into each other by mistake.” Seo-Jun pulled your phone out of his pocket.

You didn’t even realize you’d dropped it…

“You didn’t drop it. I stole it. I needed an excuse to talk to you, and for you to trust me. I know you’ve been looking for loans, but can’t get any.” Seo-Jun leaned forward, placing his elbows on the desk. “We need workers, and you need our help. Or… does your sweet mother wanna hear about your scholarship?”

A cold sweat ran down your neck. You’d walked right into a cage and didn’t even realize it. “What scholarship?” You gulped.

“The one you lost. It’s a shame. How one mistake can ruin everything for you, isn’t it?” Seo-Jun put a video on the laptop, the same one that ruined your chances of living a normal college life. “We can make it so the video never sees the light of day again, as a bonus for signing with us. You won’t have to worry about mommy seeing it, or knowing how you lost your scholarship. You’ll have school paid for, and have time to study. All you need to do is be a worker.” Seo-Jun pulled a piece of paper from a stack on his desk, a pre-printed contract, with your name at the top. “You can read through it if you’d like. Everything I promised is in there.”

Seo-Jun placed the paper on the desk, sliding it toward you, with a pen on top.

“How can you do this to people?” You mumbled.

“It’s never easy. I did try to give you a warning, but you insisted.”

“That was before I knew this!” You wanted to throw the paper at him and storm out, but your legs were glued to the seat. This was a once-in-a-lifetime offer.

“I’ll also mention. Any extra “gifts” you get from your clients will be yours to keep. Frequently, we get high-profile clients who love to have specific partners they visit. And they bring them gifts every time they visit; from clothes and jewelry to cars and even buildings.” Seo-Jun stood from his seat, walking around the desk to lean on it close to you. “It’s a good deal. Fair and transparent. If you’re lucky, you’ll be out fast. And your identity is completely concealed within our walls. No one will ever know you worked here unless we want them to know.” He picked up your hand and the pen, placing them together. “So, what’s the call?”

Your jaw was so tight, you struggled to speak, “C-Can I sleep on this?”

“No. Once you walk out the door, the offer’s gone.” He said flatly.

The pressure was too much. You couldn’t think of anything. There was no real way out, and this was too good of an offer to pass. Even if you refused, how could you afford the new semester? You sighed heavily before moving the pen to the paper, slowly signing your name. The red ink flowed on the paper, drying into a deep crimson like you were using your blood to sign.

“Excellent. As of today, you’re a part of the Dollhouse.” Seo-Jun snatched the paper off the desk, folding it and tucking it into his back pocket. “Here’s this back,” He handed your phone back to you. “One more thing, if you violate our contract or try to run. We’ll drag your ass back here faster than you can blink. If not then your parents will have to pay off the loan.”

Your head hung. Guilt sat on your shoulder as you leaned back in the chair. This was your fate now…

Seo-Jun handed you a card. “You’ll go back to your dorm. When you do, call this number and answer whatever questions they ask. We’ll have to come by in about a week for measurements.”

“What measurements?”

“We need your body measurements to advertise you. And we’ll have to dress you, give you a nice haircut, and dress you up. Which, the Dollhouse will pay for. This will add to your debt, naturally.”

“I-I don’t want it then!”

“If you don’t look nice, no one will ask for you. If not, then you won’t make any money. If you make us no money, you’ll be stuck in our arrangement for a while.” Seo-Jun frowned. “I don’t enjoy this, so let’s make this as easy as possible. There’s an event next week where new clients can meet our workers clandestinely. It’s like a mixer, speed-dating. That’s your best way to get a high-roller on your account to support you.”

You rolled your eyes. “This is so stupid. Why would anyone pick me anyway?”

Seo-Jun glared at you. “Do not talk about yourself like that. If you start looking down on yourself, clients can tell you don’t value yourself. If you can value yourself, how can you value them?”

Seo-Jun sent you back on your way, giving you directions back home. The ride back home felt like hours. All you could do was try not to cry. You tried so hard to come to the city to be someone different than how you could’ve been back home, but it wasn’t supposed to be like this. You got back to your dorm. It was dark and quiet, just like that building. You were lucky enough not to have any roommates. No one to hear you cry yourself to sleep…

In the morning, you woke up as your phone rang. You rolled over, ignoring the call. But it rang, again and again. After the fourth phone call in a row, you looked at it. It was an unknown number.

You answered cautiously. “H-Hello?”

“Y/n? Have you lost your mind?” Seo-Jun said, with disappointment in his tone.

“How did you get this number?”

“I stole your phone. I knew I had to get your number too. Just in case you ran off.” He sighed. “I thought you did for a moment. That would’ve been a lot of trouble for the both of us… Why didn’t you call me when you got home?”

You’d completely forgotten about calling the number on the card. “Sorry. It slipped my mind.”

“Let’s get rid of that habit. Being forgetful isn’t cute. Some clients will call you at different times of the day and don’t take kindly to being ignored. You’ve got a job that’s busier than full-time. It’s 24/7.”

“Well, what do you want, Seo-Jun?”

“When we’re talking business, please call me Mr. Seo-Jun.”

You groaned but knew he wasn’t joking. “What do you want, Mr. Seo-Jun?”

“I need you to tell me your school login. I want to see your schedule for classes and pay your bill.” You told him without any fuss. You were too tired to give a damn anymore. “There’s a good boy. Now, you can go back to the rest of your week. I’ll keep in touch.”

Seo-Jun hung up before you could answer him. It was Wednesday, meaning your classes started later in the day. You took your time showering and picking out clothes. It was thirty minutes before class when you went to the bus stop. Like clockwork, your friend, Eun, waited for you to arrive.

Eun was a friend you made during the first semester of college. He was 5’9” and goofy, often laughing at his jokes like a comedy club. He probably heard a laugh track in his head when he told jokes. He usually dressed in bright-colored shirts, denim jeans, and a big smile. He was also there for you when you’d gone through the frat party fiasco. Most of your “friends” had ditched you, throwing you under the bus for drinking to save their necks. But Eun was the only one who stayed by your side.

Eun waved at you as you walked toward him. “Good morning!”

“Morning, Eun.”

He studied your face for a moment. “Yeesh, what happened? You look like you had a rough sleep.”

“Thanks, buddy. You always know just what to say…” You sighed as you looked up at the sky.

“I wasn’t trying to be funny. Seriously dude, are you okay?”

You nodded. “I’m fine.”

“If you’re sure… then, you’ll wanna hear about how Enhypen are coming to the area to perform.”

Your eyes bulged. “Enhypen’s coming here!? No fucking way, when!?”

“The news dropped this morning. They’re holding a small concert on campus around next week!”

Your stomach churned. Next week!? That’s when the mixer was supposed to be. Maybe you could ask Seo-Jun for a day off to attend the concert…

Eun saw your smile drop. “Hey, dude, seriously. What’s going on? Normally you’re super excited about this kind of stuff.”

“I am. I’ve got some stuff happening next week, so I hope they don’t overlap.” You prayed that it would be some swift joke that would pass you by…

The next few days passed, and you kept a close eye on your phone. Not a single call or text from your new boss. Or would your owner be the right word? You checked your school login a few days ago, and your school bill for the next semester was already paid in advance. It was good to know Seo-Jun was a man of his word. But it also meant that everything else he’d said would pass too. It wasn’t until Monday that you got some news.

The Enhypen concert was on a Friday. Which made sense, students would stay on campus all the time. So why not have a concert that night? However, your morning was disturbed by a call. You answered it immediately.

“Hello?”

“Good job answering the first time. You’re learning.” You could hear the smirk on his face.

“Let’s get to the part where you tell me what you want.”

“To the point it is. The date of the mixer is set to be this Friday night, it’ll be pretty late so get your homework done in time.”

You rolled your eyes. “Like you care about my schoolwork.”

“Of course I do. I’m the one paying for it.”

“What time exactly is the mixer?”

“Why?” Seo-Jun questioned.

“Well, there’s a concert happening on campus and I wanted to go–”

Seo-Jun sucked his teeth. “No. You’re expected to be here before sunset so we can get you ready. Tardiness will only put the whole team behind schedule, and some client’s time is precious.”

“But–”

“Be here. Friday. After class. Bye.” Seo-Jun hung up without another word.

You huffed a heavy sigh as you texted Eun that you wouldn’t attend the concert. Naturally, he was concerned about why and questioned you, but you lied about having a family matter to attend to. He promised to take videos for you at least. It left you feeling like a dog on a leash. Any time Seo-Jun pulled on it, you had no choice but to follow his orders. In the days before the mixer, he asked you more questions about the style of clothes you’d enjoy, strengths, weaknesses, talents, quirks, birthmarks, anything you hated, and even your allergies.

On Friday, after your last class. There was a black SUV waiting outside your dorm. Walking past the suspicious car, the window rolled down. “Just going to ignore me?” Seo-Jun’s voice whistled out. You turned to see him sitting in the back seat. “Get in. Time for fitting.”

“I just got home. Don’t I get to change or something?”

“Does it matter? You’d just be changing just to change again. You’ll have time to relax while waiting for the mixer to start.” You got in the car, tossing your backpack in. The car was nice. You didn’t recognize the driver.

Seo-Jun handed you a folder. “Does everything in here look right?”

You opened it. It was almost like a resume, all about you. From an approximate height and weight to even an ethnicity check. “How did you guess my ethnicity? I didn’t tell you that.”

He shrugged. “The internet is a scary place. If you’ve put it somewhere online before, it's on the dark web.” They closed the folder and tucked it into a briefcase. “So, let me explain the mixer a bit. Generally, it's an event for our workers to meet new clients. But also for some of our clients to show off to their rich buddies and convince them to invest in our services. Be presentable, flexible, and obedient to earn attention.” Out of the briefcase, Seo-Jun produced pictures of young men pandering to their clients. “Now, we never call our clients “clients” to their face. They’re our partners. And you’ll need a persona. Something that’s already similar to who you are so you don’t need to act too much. Some like them feisty, others like our boys a little more submissive.”

“How do I come up with one?”

“Don’t, just be you and they will. Once you’ve got one, then stick to it. The savior types might be your best bet, so maybe you’ll get them with a sort of damsel persona.”

“Savior types?”

“The ones who get off on the fact they’re helping you. Like they’re the only ones who ever could, so you need them to save you.”

There was so much nuance to this… It made your head hurt just thinking about it.

Seo-Jun studied your expression. “It’s your first one, so don’t worry about standing out. You’ll be standing with the newbies, like a puppy in an adoption bin. All the newbies are workers without a regular client, so they’re a bit cutthroat when someone gets close.”

“Anything else?” You sighed as you scrolled through your phone.

Seo-Jun leaned forward and snatched it, putting it inside his briefcase.“Also, you can't use phones. You’ll be engaged the whole time, so we can’t risk distractions. And we can’t let you take any photos of anyone.”

You grumbled as you looked out of the heavily tinted windows. The rest of the car ride was silent, even the car didn’t make much noise. After the car ride, you were escorted into the Dollhouse. Upstairs were the living quarters for all the “Dolls” as Seo-Jun called them. You were now one of the Dolls of his house. Each doll was awarded their room. Some got to move out if their clients bought them a place to stay, but they weren’t allowed to leave the city without permission. And, each doll had a name. Something they’d go by. Your new name, Minsu, means Elegant and Beautiful according to Seo-Jun.

“Okay. From now on, anytime you’re in the dollhouse or with a client, you’ll be called Minsu. Clients can pay to change their name. But it's how we can identify you without exposing your identity.” Seo-Jun elaborated, “We’ve had issues in the past of clients who get too attached to their dolls and tried to approach someone’s family to ask permission to marry their song. Which, of course, we dealt with before disaster struck.”

Minsu… You’re new name. Nothing was yours anymore. Your body, time, and now name wasn’t even yours.

“Let’s practice.” Seo-Jun cleared his throat. “Minsu, how are you?”

You hesitated for a moment before speaking. “I’m fine… Mr. Seo-Jun.”

“Good job. You even remembered Mr.” He smiled. Seo-Jun put your backpack in your room. It was a simple room, with a bed, desk, and wardrobe. It was bare. “You can decorate it with what you want, it's all yours. But if your client gives you a gift, I’d recommend making a space for it. They notice this kind of stuff.”

You looked around the room. The floor was hardwood, cold, and slightly creaky. You weren’t given much time to settle before Seo-Jun took you to the next floor. “This is the dressing room. We dress the dolls here in outfits when they have to attend events. We also have makeup available, if you don’t know how to use it we can teach you. You are expected to wear makeup, shave, and keep your body healthy while in our care.” There were two older women there. It was the first time you’d seen women in the dollhouse so far.

“This is Jill and Mary. They’re the main doll caretakers and your beauticians. They make you beautiful on the inside and out for our clients. They also help with cooking and cleaning, so please treat them kindly.”

You nodded to them shyly.

Mary cracked a smile. Her caramel brown skin had glitter around her eyes, and her smile was so white even the crayon wouldn’t be able to keep up. Her clothes were simple but chic like she was about to walk a runway. Jill was white, her most notable feature was her colorful hair. Her tattoos, where they could be seen, were amazingly detailed. She had a snake slithering up her throat, ready to bite her chin.

Seo-Jun cleared his throat. “Introduce yourself.”

“O-Oh! I’m y/n.”

Seo-Jun chuckled. “Not that name, remember?”

“I have to use my fake name with other workers too?”

Seo-Jun frowned. “It’s not fake. It’s your name. It’s just a second one to the one you’re born with. And yes, anonymity is our friend here. So use the name that you were given, please.”

You turned to the women, who were smiling expectantly. “Hi… I’m Minsu. I guess.”

Mary spoke first, “You’ll get used to it. It’s a transitory period right now so just take it slow.” Jill nodded in agreement. “Now, you’re here for fitting, right?” You could tell Mary had a slight English accent, but she was suppressing it.

“I’ll leave it to you. Minsu’s a very good boy, he won’t cause any trouble,” Seo-Jun said as he left you with the two women. Mary and Jill were thorough, each taking a side of your body and measuring you. The length of your arms, legs, waist size, and even your bust.

“So, this will be your first mixer, no?” Mary asked.

You nodded.

“Are we looking for something more cute or sexy with the concept here, Mary?” Jill asked.

“Let’s ask him.”

Mary looked at you, waiting for you to answer. “Um… I guess cute?”

Jill booed at you. “You’ve got a sexy frame already. We can crop a top, get you loose-fitting shorts, and give you something cozy yet sexy.”

“Jill, let’s respect him here. Minsu doesn’t want that. Plus, he’d look way better in leather and sheer. I already know what you’re thinking. That just won’t work.”

Jill and Mary started holding up pieces over you, arguing about what to give you. Slowly they moved away from the cute vibe you’d asked for… By the end, you had a sheer shirt, black leather pants, with a leather belt around your waist, not your pants, and a gray denim jacket. You were given some silver accessories, rings, and necklaces to try on.

You’d never worn anything so… revealing. Without your jacket or the design on the front of the shirt, you’d be shirtless. The black sheet was see-through; you could see your stomach in the mirror, and your belt only pulled attention to it. The belt was odd. It was above your pants, so make your waist smaller, so the loops used for belts were altered to move up for the belt to slide through and keep your pants up.

“Minsu, you look great!” Jill exclaimed.

Mary nodded in agreement. “Jill was right, your body suits a sexier concept anyway. Just keep the jacket on if you’re feeling modest. But if you want to get attention, take it off halfway through the party. Pretend it's warm or something!”

The pair squealed like young girls, rambling about ways to appeal to potential clients. But you were just tired and hungry. “So, when can I eat?”

“Oh, you haven’t eaten?” Jill frowned.

“We’ll get you something light. We don’t want to bloat you too much, since you have the belt on. There’s food at the mixer but remember not to stuff your face.” Mary said as she stepped away.

“Why not?”

“Well, what if a client wants to take you home? You’ll want your body to look its best if you have to perform.” Jill squealed. You hadn’t thought of that. What if someone does show an interest in you? And they want something physical from you… Would you be able to go through with it?

Mary returned with a sliced apple. “This should hold you over for now. The mixer will be soon. We still have to do your hair and makeup. So sit, It’s alright if you doze off, we’ll take good care of you.” You listened, sitting in a studio chair as they started working, one on your hair and the other on your makeup. Like magic, you passed out almost immediately in the chair. When you opened your eyes, they’d just finished their last touches.

“Welcome back, Sleeping Beauty. You look amazing!” You looked into the mirror in front of you. Your eyebrows had been brushed. Your shawling and nose had never been more prominent. And your hair had a shine that you could only really get from a hair salon.

“Thank you… This is great.” You mumbled as you looked over yourself.

The pair smiled triumphantly. “It's all a part of the job! So go knock them out! Seo-Jun will be here any minute to take you to the mixer.”

They started cleaning as you left the room, going back to your room. There was a mirror on your desk. You used it to study yourself more. Their work was impeccable, with model-quality makeup in such a short time. The alone time you’d found was spoiled quickly with a knock at the door. You answered it to see Seo-Jun waiting.

“Let’s go. Leave your backpack, you can get it later.”

You put the mirror back on your desk and followed Seo-Jun out the door. The venue for the mixer was toward the downtown area in a hotel, one of the large classy ballrooms. There were waitstaff walking with finger food. Many young men, all fashionably dressed, stood around talking to each other. It was intimidating seeing some of them. They could easily be actors and models on the front of magazines… Then there was you, the college kid who wasn’t in the same league as them.

Seo-Jun led you to an empty table. “Okay, you’ll sit here. If anyone comes to you, talk to them respectfully but in a friendly manner. You’re the only doll from our house, all these other ones won’t know you. Remember, Minsu, nothing about your personal life. Or theirs. Keep everything hidden, and tell only what you need to.”

You nodded nervously. “What are you going to do?”

“I’m going to try and point you out to a few people.” Seo-Jun turned to leave, but you grabbed his arm. He was all you’d known for the last week. And now he was leaving you alone at a table at this huge party. “If you want to be a baby, do that to clients. But with me don’t be a baby, I’ll be watching the whole time. Nothing will happen to you.” He pulled his hand away and walked off, talking to a few men in suits.

The mixer began shortly after. Men started slowly filling the room, all dressed in formal clothes, from suits or high-end outfits. Not one paid you any mind. You were relieved that no one was interested in you. You occasionally looked around the room, searching for Seo-Jun with little luck. The first hour was a panic fest, silently hoping no one would sit at your table and talk to you. In the second hour, some clients found who they liked talking to and stuck to certain areas. Some dolls had almost seven men around them at any time. In the third hour, some dolls left with their partners.

Thankfully, not one person seemed interested in you. You’d been sitting so long that your legs started to fall asleep. You’d tried your best to eat any time the servers walked past you with a plate, but the buffet at the other end of the room was almost calling you. Cautiously, looking over your shoulders, you stood and made your way over. Walking like you knew what to do, or like you belonged. The table was full of interesting foods you’d never tried. Mostly seafood and assorted fruits. You took a plate and started stacking it with whatever seemed the yummiest, which was one of everything!

It wasn’t until you reached the end that you realized how much you’d grabbed. It wouldn’t all fit on your plate. If you tried walking back to your seat, you’d drop something… You turned, slowly toward your table when you bumped into someone, keeping the damage under control. You don’t drop your food!

The person in front of you let out a heavy sigh. You looked forward, a huge spot on their shirt from where you’d bumped into them.

“Holy shit, I’m so sorry!” You exclaimed.

He shook his head. “It’s alright, you didn’t mean to.”

You put your plate down on a nearby table. You slid the sleeve of your jacket down, making it slide off your shoulder, as you rubbed the spot. It didn’t look like it was going to clean neatly. “I’m really sorry. I can take it and get it washed?” You suggested as you looked at the man’s face.

You realized he was extremely familiar–like celebrity familiar. He had a middle part with long dark hair that draped his eyes. His jawline was sharp, and his eyebrows knitted together in frustration.

“Do I know you?” You asked.

“Uh, no. We don’t know each other.” The man assured.

The spot wasn’t getting any better and some people were starting to stare. “How about you take my jacket for now?” You slid off your jacket, showing off your top completely to the room.

“Oh, I–That’s not necessary.” The man said, looking away from you. “Just put your jacket back on.”

“I insist! I ruined your shirt!” More people started staring, and whispering.

“Fine! I’ll take it, just give it!” He snatched the jacket from you, pulling it over himself as he looked down. His long hair covered his face as he looked around.

“Do you have a table? You can sit with me, and we can talk about getting your shirt cleaned.”

The man nodded again. “Fine, just take me away from here.”

You took him to your table in the corner of the room, where you’d spent the last three hours alone. Many more people were watching you this time than when you’d left. Maybe Jill was right about your shirt… It made you a little self-conscious with so much staring. You pulled out a chair for the man and sat next to him.

“I’m y-Minsu! It’s nice to meet you.” You put your hand out.

“Are things always like this?”

You shrugged. “This is my first time here, so I don’t really know.”

The man looked around the room, acknowledging the looks. “Well… That’s nice.”

You sat awkwardly as you looked at him. You noticed Seo-Jun behind him, toward the other end of the room, motioning something to you. Talk to him?

“So, Mister? What brings you here?” You asked,

“You don’t need to call me that. My name’s Jay. I… came here for something stupid and I don’t think I should’ve come.”

You smiled at him. “You sound like someone made you come here. I didn’t want to be here either. I was so worried that someone would talk to me, but it turns out that no one would even pay attention to me.”

“Why’s that?”

“I just… don’t think this is my sort of party. And I’m not very good at meeting new people. I’m only here because I have to.”

Jay nodded. “I get that. I really only came because my members teased me about not meeting any new people.”

“Members?”

Jay’s eyes flickered to you. “Y-Yeah. I’m a part of a group. I’m a performer.”

“Whoa! Do you make music? I’d love to listen to it.”

Jay smirked. “It’s not me who makes the music. But I dabble.”

“I don’t have my phone. Tell me your band, and I’ll try to remember it.”

Jay leaned close to you to whisper, “I’m a member of Enhypen.”

You blinked. The words echoed in your brain before you looked at the man again. That’s where you’d seen him! He was Jay from Enhypen, and he was talking to you. “O-Oh, yeah I’ve heard of that group before.”

“Oh? Are you a fan?” Jay smiled. “It’s always nice to meet a fan.”

“I’m not trying to be weird. I am a fan, but if you wanna forget about it or talk to someone else–”

“No. You’re funny. And I think it would be better to spend time with a fan.” Jay slipped your jacket off and placed it over your shoulders. “I think this suits you better than me, by the way.” Your heart was fluttering a mile a minute. Jay said he wanted to spend time with you and even draped a jacket over your shoulders. Eun would be foaming at the mouth at this point.

“Could I ask why you’re at an all-guy mixer?”

“You can, but then I’d ask you the same question.”

“Touche…” You chuckled awkwardly. “Well, I’m here for another hour. So we can chat… or whatever.”

Jay smirked. “Would you wanna talk somewhere else?”

You nodded. “I’m cool with that. It beats talking here, with all the staring.”

“Then let’s roll,” Jay said as he stood. You followed him as he led you out of the room. You spotted Seo-Jun who gave you a thumbs-up as you passed by. Jay took you to a room in the hotel. It had an amazing view since it was on a higher floor.

“Jay, check this out! It’s so high!” You cheered.

“So, uh. I’m kind of awkward at this since I’ve never done it. I don’t have any preferences or anything. I’d be okay to start and see how it goes.” Jay said.

You turned around to see Jay sitting on the bed in the room. “What?”

“Isn’t this the part where we… do stuff?” Jay raised an eyebrow.

Your face went warm. You hadn’t thought about the context of things until now. Jay was at a party to meet a partner to spend the night with… and he’d chosen you. And like an idiot you accepted thinking he just wanted to talk.

“I-I…”

“Is it more of a, I tell you what to do?” Jay stood, walking toward you. “I’m new to this whole thing, so I’d appreciate it if you could help me.”

You couldn’t form the words you wanted. All of the thoughts in your mind couldn’t fit the situation in front of you. “I-I’m new too,” was all that you could muster.

“Well, that works for the both of us then. We can figure it out together…” Jay approached you until the both of you were at the window. Your back against it, he leaned his arm on the glass near your head. “Let’s just go slow.”

Jay’s tone was calm and empathetic as if he were as worried as you were. He slid his free hand behind your neck and kissed you softly. Your eyes fluttered shut as you placed your hands against his chest, letting him move as he pleased. It was a peck at first. Just a touch, a test. Then Jay leaned in again for a kiss, your lips meeting for longer. His nose brushed yours as he started to move his lips experimentally to find what he liked…

#oracle of dreams#kpop x male reader#kpop x male reader smut#kpop male reader#x male reader#x reader#enhypen fanfiction#enhypen#jay enhypen#jay enha#enhypen x male reader#enhypen x reader#enhypen x y/n#enhypen jay x reader#enhypen jay x male reader#kpop male idol#kpop bg#kpop fanfic#kpop#park jongseong#enhypen jongseong

316 notes

·

View notes

Text

Real Reasons why Gaddafi was killed

1. Libya had no electricity bills, electricity came free of charge to all citizens.

2. There were no interest rates on loans, the banks were state-owned, the loan of citizens by law 0%.

3. Gaddafi promised not to buy a house for his parents until everyone in Libya owns a home.

4. All newlywed couples in Libya received 60,000 dinars from the government & because of that they bought their own apartments & started their families.

5. Education & medical treatment in Libya are free. Before Gaddafi there were only 25% readers, 83% during his reign

6. If Libyans wanted to live on a farm, they received free household appliances, seeds and livestock.

7. If they cannot receive treatment in Libya, the state would fund them $2300+ accommodation & travel for treatment abroad.

8. If you bought a car, the government finances 50% of the price.

9. The price of gasoline became $ 0.14 per liter.

10. Libya had no external debt, and reserves were $150 Billion (now frozen worldwide)

11. Since some Libyans can't find jobs after school, the government will pay the average salary when they can't find a job.

12. Part of oil sales in Libya are directly linked to the bank accounts of all citizens.

13. The mother who gave birth to the child will receive $5000

14. 40 loaves of bread cost $0.15.

15. Gaddafi has implemented the world's biggest irrigation project known as the "BIG MAN PROJECT" to ensure water availability in the desert.

Your comments on this ...

522 notes

·

View notes

Note

So I keep seeing people play the "Harris is a Cop, so I'm not voting for her because ACAB" card, and not even pointing out that she was a DA/Prosecutor rather than an actual cop seems to change their minds - as far as they're concerned, working with cops in any capacity makes you a cop. Do you happen to have anything that'd make for a good counterpoint to this argument (or, at the very least, something to make those of us who still plan on voting for her despite our dim views on Law Enforcement not feel so bad about it)?

....Not feel so bad about it?

First of all: these are laughably, incredibly unbelievably unserious people, and frankly, my first advice would be NOT to bother trying to engage with them at all, because there is nothing whatsoever they will ever accept in the way of logical proof to change their minds. First it was "you can't ask me to vote for Biden specifically because of [insert issue here.]" This changed a lot, from Roe getting overturned by the corrupt SCOTUS, to the train strike (hey anyone remember that?) to student loan forgiveness and then had settled firmly on Gaza. So now, lo and behold, they're given exactly what they asked for: a new younger candidate who is not Biden and explicitly more progressive on the Gaza issue (Harris was the first member of the administration to openly call for a ceasefire). So they turn their noses up, rush to their favorite 2020 disinformation founts that were first spouted when they were trying to sabotage her in favor of Bernie (who endorsed Biden pretty strongly before he dropped out), flirt with Jill "Actual Agent of Putin" Stein, and other equally expected and equally bullshit maneuvers. Lololololololol online leftists. Never change, or something.

That said: because their minds are so set that they will never vote for any Democrat ever, you can't really give them any logical information to separate them from this conclusion. I don't have the links on hand, but etc Google and Wikipedia are free: Harris's tenure as district attorney and California AG was progressive even by modern standards, and it was happening in the early 2000s: she refused to prosecute for low-level weed offenses, pushed for harder sentences for assault weapons, performed gay marriages LONG before it was legal even in San Freaking Francisco, refused to seek the death penalty, worked with restorative justice programs, etc. This was after she was a first-generation American child of brown immigrants who took advantage of equal-opportunity education programs to go to law school, and her parents were already high-achieving academics (one a cancer researcher from India and one an economics professor from Jamaica). Sure sure, she definitely seems exactly like Derek Chauvin to me. Critical thinking is great! #VoteJillStein! A literal puppet of Putin and unabashed Assad fangirl is definitely the pro-peace morally correct option here!*

In other words, the morons do not give a single shit about factual reflections of Kamala's record. They do not care about whether her time as a district attorney was progressive (it was) and whether she was actually a cop (she wasn't). They're so wedded at the hip to their braindead disinformation propaganda that now we're going to see the excuses change at lightspeed from why they can't vote for Biden specifically to why they can't vote for Harris specifically. None of it will be remotely tethered to reality and all of it will be in extreme and obvious bad faith. As I said, there are plenty of persuadable voters elsewhere who HAVE been energized by her elevation to candidacy. If you are indeed interested in winning voters to her side (as opposed to having to find reasons to justify yourself to the All Voting Is Evil crowd who will never listen to or believe you anyway), I suspect your time would be better spent elsewhere, and outside the echo-chamber leftist social media space in general.

Aside from that, I have gotten a few hand-wringy asks about Kamala and the election overall, and I gotta say, I am not going to waste my time and effort replying to them. We have about 100 days to win this election or become a fascist dictatorship. We are already in uncharted territory, but the replacement of Biden with Harris went UNIMAGINABLY smoothly, far, far more than anyone (including me) ever expected. It reminds me of the presto-chango that the French center, left, and center-left parties pulled off to replace candidates, IN FIVE DAYS, to better position themselves to defeat the fascists. Compared to that, three and a half months is a cakewalk, but we still absolutely do not, DO NOT, have time to sit around worrying and hand-wringing about this or that hypothetical Bad Thing. It deeply unsurprises me to hear that US Online Leftists are still throwing snits and pitching their toys out of the pram rather than getting on board, but the rest of us don't have any time to waste and need to apply our energy to where it will be best put to use. So yes.

*extreme, extreme sarcasm alert

463 notes

·

View notes

Text

#which banks offer the finest education loans for studying abroad#collateral free education loan for abroad#lowest interest rates on loans for international education#unsecured education loan for abroad

0 notes

Text

The thing that gets me so worked up about universal healthcare is how people say that it will be so expensive for the tax payer.

This is long rant warning so I added a break lol.

The TLDR is that even in a low tax state like Florida, someone making 50k a year will have an effective rate of of 32% (for taxes, healthcare, costs for an undergraduate degree).

Someone making 50k a year in a 'high tax' country like New Zealand has an effective rate of 21% (for taxes, healthcare, costs for an undergraduate degree).

For an American and a Kiwi with the same salary of $50k, if they have the same disposable income, the Kiwi will be able to save an extra $75,000 over 10 years that they can use for a downpayment on a home to further build wealth.

Low tax states just have the costs shuffled to other places, you end up paying a LOT more for the same services.

Here's a comparison of someone who makes $50,000 a year in New Zealand and Florida (I chose Florida as an extreme example because they have 0% state tax rate) and each person makes $15,000 worth of purchases that are taxable.

New Zealand

$7,658 in combined income taxes and levies

$2,250 in taxes on $15k of purchases (15% sales tax)

Total of $9,908 - an effective total rate of 19.8% paid to taxes and purchases and healthcare

Florida

$7,945 in combined taxes (federal taxes, social security, medicaid etc)

$1,050 in taxes on $15k of purchases (7% sales tax)

$1,700 average annual health insurance premium for Florida

$2,060 average annual health insurance deductible for Florida

Total of $12,755 - an effective total rate of 25.5% paid to taxes and purchases and healthcare

Even in a low tax state, you're already have less take-home income than someone with the same salary in New Zealand.

But

... in New Zealand with your taxes you're also getting public education. It's not completely free, but costs are fixed, and you get one year of your undergraduate free, so for example a Bachelor of Arts would cost a total of $13,548 (USD $8,347)

If you can't pay that upfront, you can get a 0% loan from the government, which you don't need to start paying off until you earn at least $23k per year. For someone making $50k that would be an extra 6.5% deducted from your income ($270/month) until the loan is paid off (which would be 2 years and 8 months).

In Florida the average student loan debt is 25k and if you're making the same payments as someone in NZ ($270/month) then you'll be paying that off for 11 years. [Note: I believe that some private loan interest rates go as high as 15%].

Bachelor of Arts in NZ $13,548, paid off over ~2.7 years.

Bachelor of Arts in Florida $35,539, paid off over ~11 years.

So lets look at effective payments over 11 years (for simplicity salary stays at 50k).

New Zealand works out to be 21% effective rate over 11 years (including taxes, healthcare, and undergraduate degree).

Florida works out to be 32% effective rate over 11 years (including taxes, healthcare, and an undergraduate degree) - you're paying 52% more!

That means someone with the same income will effectively be able to save an additional $5,000 per year over 11 years, if they invest that extra amount and get a 5% return, the New Zealander will have savings of about $75k which they can use for downpayment for a home etc.

In conclusion, even though it may seem like you're getting a good deal in a low tax state like Florida, you end up paying soooo much more in healthcare and education costs compared to a country where taxes are a little higher, but you get public healthcare and education.

Why is the U.S. so expensive? Well once place to look is defense, intelligence, and police. In the United States this costs on average $3,700 per person. New Zealand spends $1,600 per person (USD ~1,000).

62 notes

·

View notes

Text

Is There a Maximum Limit to The Amount I Can Borrow Through An Education Loan

Is There a Maximum Limit to The Amount I Can Borrow Through An Education Loan Is There a Maximum Limit to The Amount I Can Borrow Through An Education Loan.Pursuing higher education is a significant investment that often requires financial support beyond personal savings. Education loans have emerged as a lifeline for countless students

#education loan#education loan in india#how to get education loan#sbi education loan#education loan interest rate#education loan kaise milta hai#education loan interest rate in india#education loan for abroad#education loans#education loan kaise le#education loan process#education loan without collateral#education#education loan process in hindi#abroad education loan#free education loan#educatio loans#sbi education loans#education loan for mba

0 notes

Text

When you hear "fintech," think "unlicensed bank"

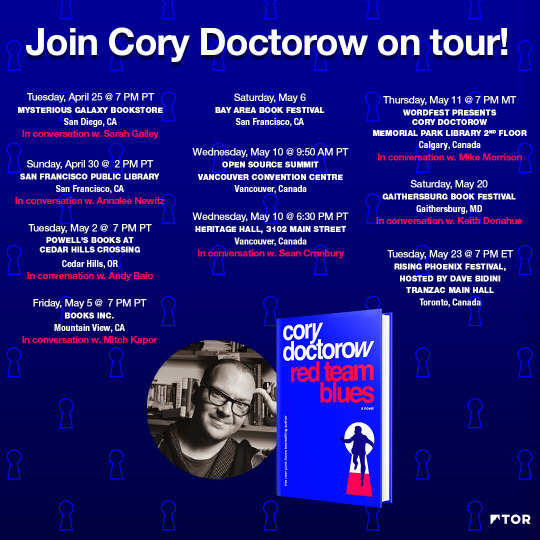

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.