#student loan rate of interest

Explore tagged Tumblr posts

Text

Best Interest-Free Loans for Students in UK 2024

Interest-Free Loans for Students: While the idea of borrowing money for school without interest sounds amazing, it’s important to know that true interest-free loans for students in the UK are pretty rare. Most loans will have some kind of interest attached, even if it’s hidden under a fancy name. Some lenders might advertise “0% interest” to grab your attention, but this is usually a temporary…

View On WordPress

#education loan by government#education loan in india interest rate#education loan interest rate#education loan interest rate in india#education loan interest rates#education loan interest rates in india#education loan rate of interest#government education loan#government education loans#government loan for education#government loan for students#government loan student#government loans for students#government loans student#how to get education loan from government#interest free loan for students#interest free loans for students#interest free student loan#interest free student loan uk#interest free student loans#interest free student loans uk#interest rate of student loans#interest rate on student loans#interest-free loans for students#interest-free student loans uk#is a student loan interest free#student government loans#student loan from government#student loan rate of interest#student loans interest rate

0 notes

Text

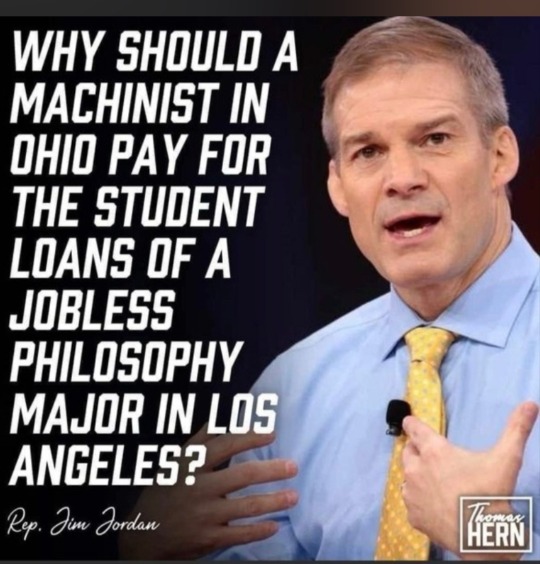

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

ya bitch is officially debt free

14 notes

·

View notes

Text

I put my private student loans on autopay, and really only pay attention to them come tax time, and while this is absolutely not my biggest student loan, this email truly came out of nowhere for me?????

May you also have your debts paid before you know it!!!

#now if we could just talk about those federal student loans (or at least the interest rates on them.....) lmao /sigh#good luck posts#ive decided!#if you asked me yesterday i wouldve guessed i had like. two years left on it???#i know i should pay better attn tbh but also! then i wouldn't get delightful surprises like this!!!!!!#student loans

19 notes

·

View notes

Text

when will neoliberalism end. i'm tired

#i want to eat fruit and play musical instruments and not be depressed#but all i got is this job that i actually like#i've been there full time for 5 years now and still the amount i owe in student loan debt is 3x all of the money i have#i did get them consolidated with a lower monthly payment and lower interest rate and i've got the public service part going bc i work#for a nonprofit. but jesus christ this sucks

10 notes

·

View notes

Text

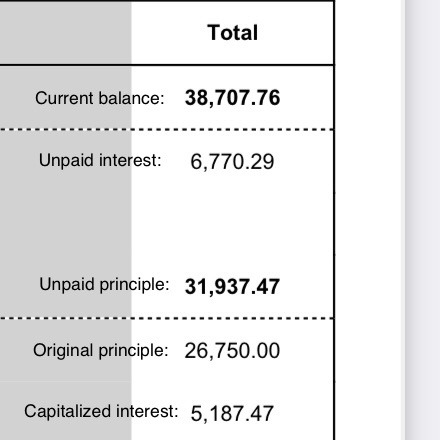

Y’all wanna see what ten years of student loan deferral looks like?

#she speaks#😬#the interest rate on my largest loan is like 6.8%#and on my smallest it’s like 3-point-something%#with this total balance you’d think I went to a private college instead of a state university lmfao#my ten year graduation anniversary from college is on the 13th#I have done nothing with my life 😂😂😂#this was actually my statement from last month#the total balance right now is *checks notes* $38803.46#that’s almost $100 interest in one month#but no we shouldn’t forgive student loan debt#setting kids up to fail is fun and cool and part of the American dream!

2 notes

·

View notes

Text

student loan debt is a bit scary actually. why didn't i know this before i went to university <- i literally knew this

#i knew but also i kind of closed my eyes to the details of it. i cant believe i was saying a few months ago to someone oh yeah in the uk#student loans aren't too bad the debt isn't as much as in the us haha it's not a big deal. GIRL THE INTEREST RATE!!!!!!!!!!!!!!!!!!!!!#oh well.

2 notes

·

View notes

Text

🫣

#just finished paying off my private student loans...!#still owe joe an arm and a log but my goodness. the RELIEF#the interest rates on those loans...sickening#:')

9 notes

·

View notes

Text

HAHA HA

#my student loans are even higher bc ofc they are#whoever decided that 10% interest rates were legal is even and should be blown up#im gonna sit here and throw up now#everytime i start coming back around to being even a little bit excited....#anyways i bought a desk and its cute bc ofc my dorm room doesnt even come with one but its fine#sstfu.txt#*EVIL THEY ARE EVIL

5 notes

·

View notes

Text

rent is 38% of my monthly income :(

#78% of this current check :((#im so tired of being broke and still working almost full-time and being a student#i'm anticipating a pretty big refund from the school from tuition assistance#it's not free money like half of it is gov loans i'll eventually have to pay back#but i'm going to use this money to pay off my credit card which is a higher interest rate. so essentially just refinancing my debt#maybe a miracle will happen and loan forgiveness will happen at some point#i think i'm at about 20k in debt right now

2 notes

·

View notes

Text

It's getting real out there ...

#cars#automotive#autos#suv#money management#money problems#old money#money making#money#debt consolidation#debt relief#debtmanagement#debt#credit cards#credit score#business loan#home loan#personal loans#student loans#loans#spending#bankers#banks#interest rates#the fed#central bank#payments#wtf#wth#huh

8 notes

·

View notes

Text

welp im too broke not to give it a go...

37K notes

·

View notes

Text

How to Improve Your Financial Situation with Personal Loans

A personal loan can be a valuable financial tool when used wisely. Whether you need funds to consolidate debt, cover emergency expenses, or make a significant purchase, a personal loan can provide the necessary financial flexibility. However, it is crucial to manage it properly to avoid unnecessary financial stress. In this guide, we will explore how you can leverage a personal loan to improve your financial situation effectively.

1. Understanding Personal Loans

A personal loan is an unsecured loan provided by banks, credit unions, or online lenders that allows borrowers to use the funds for various personal needs. Unlike home or auto loans, personal loans do not require collateral, making them a convenient option for individuals looking for quick financial assistance.

Key Features of Personal Loans:

Fixed repayment terms

Fixed or variable interest rates

No collateral required

Flexible usage

2. Consolidating High-Interest Debt

One of the most effective ways to use a personal loan is for debt consolidation. If you have multiple debts with high-interest rates, such as credit card balances, payday loans, or other unsecured loans, consolidating them into a single personal loan can help you manage your finances more efficiently.

Benefits of Debt Consolidation with a Personal Loan:

Lower interest rates compared to credit cards

Simplified monthly payments

Faster debt repayment

Improved credit score over time

By consolidating your debts, you can save money on interest and avoid the hassle of managing multiple payments each month.

3. Improving Your Credit Score

Your credit score plays a crucial role in your overall financial health. A well-managed personal loan can positively impact your credit score in several ways.

Ways a Personal Loan Can Improve Your Credit Score:

Diversifies Credit Mix: A personal loan adds installment credit to your credit report, improving your credit mix.

Establishes Payment History: Making timely payments builds a positive repayment history.

Reduces Credit Utilization: Using a personal loan to pay off credit card debt can lower your credit utilization ratio.

Responsible borrowing and on-time payments can lead to a stronger credit profile, making it easier to qualify for better loan offers in the future.

4. Handling Emergency Expenses

Life is unpredictable, and unexpected expenses can put a strain on your finances. Medical bills, home repairs, or sudden job loss can create financial stress. A personal loan can serve as a safety net to help you cover emergency expenses without depleting your savings.

Tips for Using a Personal Loan for Emergencies:

Borrow only what you need to avoid excessive debt.

Compare lenders to find the best interest rates and terms.

Create an emergency fund to reduce dependence on loans in the future.

A personal loan can provide immediate financial relief, but it's essential to borrow responsibly to prevent long-term financial challenges.

5. Investing in Education or Skill Development

Investing in education or skill development can enhance your career prospects and increase your earning potential. A personal loan can help cover tuition fees, professional courses, or certification programs that can lead to better job opportunities.

How a Personal Loan Can Help in Career Growth:

Enables access to quality education

Funds professional certifications for career advancement

Helps switch careers or start a new business

By using a personal loan to invest in self-improvement, you can create better financial opportunities for the future.

6. Financing Major Life Events

Weddings, home renovations, or starting a family often come with significant expenses. A personal loan can help you manage these costs without relying on high-interest credit cards.

When to Consider a Personal Loan for Major Events:

When you have a clear repayment plan

When other financing options are more expensive

When you need a lump sum amount for planned expenses

Using a personal loan strategically can ensure you enjoy life's major milestones without financial strain.

7. Building an Emergency Fund with a Personal Loan

While it's not advisable to take out a personal loan solely to build an emergency fund, it can help you cover necessary expenses while you set aside money for future emergencies. If you are in a temporary financial crunch, a personal loan can act as a bridge while you work on strengthening your savings.

Steps to Build an Emergency Fund Alongside a Personal Loan:

Set a goal to save at least three to six months' worth of expenses

Cut unnecessary expenses and allocate funds towards savings

Pay off your personal loan as quickly as possible to avoid interest accumulation

Once your emergency fund is built, you’ll have better financial security and reduce reliance on loans.

8. Avoiding Common Personal Loan Mistakes

While a personal loan can be beneficial, mismanaging it can lead to financial difficulties. Avoid these common mistakes to ensure you use your personal loan effectively:

Mistakes to Avoid:

Borrowing More Than You Need: Taking a loan amount higher than necessary can lead to excessive debt.

Ignoring Interest Rates and Fees: Always compare loan offers to find the most cost-effective option.

Missing Payments: Late payments can hurt your credit score and lead to penalties.

Using Loans for Unnecessary Expenses: Avoid using a personal loan for luxury purchases or non-essential spending.

By using a personal loan responsibly, you can maintain financial stability and avoid debt traps.

Final Thoughts

A personal loan can be a powerful financial tool when used wisely. Whether you're consolidating debt, handling emergencies, investing in education, or managing major expenses, a personal loan can provide the necessary financial assistance. However, it's crucial to plan your loan repayments, maintain a good credit score, and borrow only what you can afford to repay.

Before taking out a personal loan, assess your financial needs, compare lenders, and create a solid repayment plan. When managed correctly, a personal loan can help improve your financial situation and pave the way for a stable financial future.

Looking for the best personal loan options? Explore different lenders today and take control of your financial well-being!

#finance#personal loan online#bank#loan services#nbfc personal loan#personal loan#fincrif#personal loans#loan apps#personal laon#Personal loan#Debt consolidation#Improve credit score#Emergency expenses#Financial flexibility#Unsecured loans#Consolidate debt#Low interest rates#Fixed repayment terms#Credit utilization#Financial security#Borrow responsibly#Emergency fund#Loan options#Student loan assistance#Credit history#Financial tools#Borrowing tips#Financial relief#Repayment plan

0 notes

Text

That's how they think. "We predict that next year we will make $10,000,000."

Company makes $9,000,000.

Company statement: "We lost $1,000,000."

That $1,000,000 is money they never had, but sure, they "lost" it.

Growth capitalism is a deranged fantasy for lunatics.

Year 1, your business makes a million dollars in profit. Great start!

Year 2, you make another million. Oh no! Your business is failing because you didn't make more than last year!

Okay, say year 2 you make $2 mil. Now you're profitable!

Then year 3 you make $3 mil. Oh no! Your business is failing! But wait, you made more money than last year right? Sure, but you didn't make ENOUGH more than last year so actually your business is actively tanking! Time to sell off shares and dismantle it for parts! You should have made $4 mil in profit to be profitable, you fool!

If you're not making more money every year by an ever-increasing exponent, the business is failing!

Absolute degenerate LUNACY

#That's how student loans work too#Interest rates are all profit#Take away the non-existent interest rate money#Suddenly they've lost money#That they never had in the first place

52K notes

·

View notes

Text

Learn why student loan interest rates are crucial for higher studies in the USA. Understand how rates affect your repayments and choose the best loan option.

0 notes

Text

Personal Loan for Low CIBIL Score: A Comprehensive Guide

A low CIBIL score can feel like a significant obstacle when applying for a personal loan, but the reality is that it doesn’t have to stand in the way of your financial goals. Even if you have a less-than-ideal credit history, options are still available to secure a personal loan in India. In this comprehensive guide, we’ll explore how a low CIBIL score impacts personal loan applications, the steps you can take to improve your chances of approval, and how Kreditbazar can assist you in accessing funds, even with a low credit score.

What is a CIBIL Score and Why Does It Matter?

Your CIBIL score is a three-digit number ranging from 300 to 900, generated by the Credit Information Bureau (India) Limited (CIBIL), which reflects your creditworthiness. It is based on your financial history, borrowing behaviour, repayment patterns, and outstanding debts. A higher score indicates that you are a low-risk borrower, while a lower score suggests a higher risk, which can make lenders cautious about approving your loan applications.

Here’s a quick breakdown of CIBIL score ranges and what they indicate:

750 – 900: Excellent credit score, low risk, high chances of loan approval with favourable terms.

650 – 749: Good credit score, moderate risk, fairly good chance of approval.

550 – 649: Average credit score, higher risk, chances of approval reduced significantly.

300 – 549: Poor credit score, high risk, very limited loan options, if any.

For most banks and financial institutions in India, a score of 750 and above is ideal for quick and easy personal loan approvals. However, if your score falls below this, especially below 650, your loan application may either get rejected or be subject to higher interest rates and stricter terms.

But a low CIBIL score doesn’t mean you're out of options. Many alternative lenders, including Kreditbazar, offer personal loans to individuals with lower credit scores, though certain factors may influence your loan approval.

Can You Get a Personal Loan with a Low CIBIL Score?

The short answer is yes, but there are some trade-offs. Lenders may view you as a higher risk if you have a low CIBIL score, but they can still offer loans under specific circumstances. These could include charging higher interest rates, reducing the loan amount, or requiring additional guarantees like collateral or a guarantor. Some lenders, particularly NBFCs (Non-Banking Financial Companies), are more flexible with their credit requirements compared to traditional banks.

At Kreditbazar, we understand that not everyone has a perfect credit history. This is why we work with a network of lending partners, including NBFCs, to offer personal loans for low CIBIL score borrowers. While the terms may vary, our goal is to ensure that those in need of financial assistance have access to it, regardless of their credit background.

Factors That Lenders Consider Besides CIBIL Score

When evaluating a personal loan application from someone with a low CIBIL score, lenders consider several factors to assess the borrower’s repayment capacity. These include:

1. Income Stability

Lenders often look at your monthly income and job stability. If you have a steady and reliable source of income, especially from a reputed employer, this can offset the risk posed by a low CIBIL score. A higher income gives lenders the confidence that you will be able to meet your repayment obligations, even if your credit history isn’t stellar.

2. Loan Amount

Requesting a smaller loan amount may increase your chances of approval. A lower loan amount reduces the risk for the lender, making it easier for them to accommodate borrowers with low credit scores. If you don’t need a large sum immediately, opting for a smaller loan can be a smart move.

3. Existing Debt

Lenders will check your current debt load. If you are already overburdened with other loans and credit card balances, they may hesitate to extend another loan. However, if you have a manageable debt load and can demonstrate a consistent repayment history for existing obligations, it can help improve your case.

4. Collateral or Guarantor

Some lenders may ask for collateral or a guarantor if your CIBIL score is low. This provides them with extra security and reduces their risk. Offering assets like property or a fixed deposit as collateral can increase the likelihood of approval, as can having a co-applicant or guarantor with a strong credit score.

5. Relationship with the Lender

If you have an existing relationship with a lender—such as a savings account, credit card, or another financial product—they may be more willing to approve your loan despite a low CIBIL score. Having a history of responsible financial behaviour with the same lender works in your favour.

Steps to Get a Personal Loan with a Low CIBIL Score

If your CIBIL score is below the preferred threshold, here are some steps you can take to improve your chances of getting a personal loan:

1. Look for Lenders that Cater to Low CIBIL Scores

Not all lenders are focused on offering loans to high-credit-score borrowers. Some specialize in providing loans to individuals with lower scores. At Kreditbazar, we work with lending partners who understand that a low CIBIL score doesn’t necessarily reflect your current financial standing. We help connect you with loan options that match your needs, even if your credit score is less than ideal.

2. Improve Your CIBIL Score

If your loan isn’t an immediate necessity, taking a few months to improve your credit score can greatly enhance your loan prospects. Here’s how:

Timely repayments: Ensure that all your current loans, EMIs, and credit card payments are made on time.

Reduce credit utilization: Try to keep your credit utilization below 30% of your total credit limit.

Avoid applying for multiple loans/credit cards: Each application results in a hard inquiry, which can further lower your score.

Check your credit report for errors: Dispute any inaccuracies that may be negatively affecting your score.

3. Opt for a Co-Applicant or Guarantor

Adding a co-applicant or guarantor with a high CIBIL score can boost your chances of loan approval. This provides the lender with added assurance, as they have another individual to fall back on in case of default.

4. Apply for a Secured Loan

If you have assets like property, gold, or fixed deposits, consider applying for a secured loan. Secured loans often come with lower interest rates and are easier to obtain for borrowers with low CIBIL scores, as the lender has collateral to fall back on if you default.

5. Demonstrate Income Stability

Highlight your steady income and job stability in your loan application. If you have a good track record with your current employer or a strong business background (if self-employed), lenders may be more lenient regarding your low CIBIL score.

Understanding the Drawbacks: Higher Interest Rates for Low CIBIL Scores

One of the most significant drawbacks of securing a personal loan with a low CIBIL score is the higher interest rate. Lenders compensate for the increased risk by charging higher rates than they would for borrowers with good credit. This means that although you can get a loan, you may end up paying more in interest over time.

For instance, a borrower with a high CIBIL score may get a personal loan with interest rates as low as 10% to 12%, while a borrower with a low CIBIL score might be offered rates ranging from 14% to 20% or higher. It's essential to factor this into your decision and ensure that the repayment terms are manageable.

How Kreditbazar Can Help

At Kreditbazar, we understand the challenges that come with a low CIBIL score. Our mission is to ensure that financial setbacks don’t stand in the way of your future. We’ve partnered with leading NBFCs to provide personal loans for low CIBIL score borrowers, offering tailored solutions that meet your needs without adding unnecessary complexity to the process.

By applying for a personal loan through Kreditbazar, you can expect:

Quick and easy online application

Minimal documentation requirements

Personalized loan offers

Fast approvals and disbursements

Whether you're facing an emergency, planning for personal expenses, or consolidating existing debt, Kreditbazar can help you find the right loan option—even if your CIBIL score isn’t perfect.

Conclusion: Don’t Let a Low CIBIL Score Hold You Back

Having a low CIBIL score may make it more challenging to secure a personal loan, but it doesn’t mean you’re out of options. By exploring alternative lenders, improving your credit profile, and applying for manageable loan amounts, you can still access the funds you need.

Ready to apply for a personal loan despite your low CIBIL score? Explore your options with Kreditbazar today, and take the first step towards financial freedom.

#low interest personal loans#personal loans#same day loans online#loans for small business#small business funding#small business#small business loans#loans for small industry business#personal loans without car title#student loans#low cibil score#cibil score#low credit score#credit score#Low credit Score Loans#loans#lowest interest rates business loans#interest rates

0 notes