#income tax education

Explore tagged Tumblr posts

Text

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

I'll leave this 👆 here... You Decide 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do your own research#do some research#ask yourself questions#question everything#income tax#unlawful act#government corruption#theft#news#you decide

534 notes

·

View notes

Text

universities will be like “please write a 1000-word essay telling us why you value diversity equity & inclusion & how you will contribute to these core values of our institution” & then the next page is like “thanks! our application fee is $150 🥰🥰”

#like that’s not very diversity equity & inclusion of you….#also love reaching out to universities & being like hiiii i’m poor as defined by the department of education. can i get a fee waiver.#& they reply back & say no 🥰🥰#shoutout 2 the one school that actually did just let me enter my income & then said oh ok u don’t need 2 pay 😌🤘didn’t even ask for tax docs#just took my word for it….thats how it should be#anyway. killing myself november has transitioned into killing myself december. so#txt

171 notes

·

View notes

Text

Source

#eat the rich#politics#billionaires should not exist#us politics#capitalism#wealth tax#income inequality#corruption#government#current events#news#tax the rich#education#health care

4K notes

·

View notes

Text

Immigration vs Billionaires

The U.S. loses a significant amount in taxes due to undocumented immigrants, but it’s also important to note that undocumented immigrants still contribute to the economy in various ways, including through taxes.

1. Income Taxes: Many undocumented immigrants pay income taxes, often through false or borrowed Social Security numbers. According to estimates from the Institute on Taxation and Economic Policy (ITEP), undocumented immigrants contribute approximately $11.7 billion annually in state and federal income taxes.

2. Sales and Property Taxes: In addition to income taxes, undocumented immigrants contribute to state and local revenues through sales taxes when they purchase goods and services. They also pay property taxes indirectly through rent.

3. Overall Contribution: The total tax contribution from undocumented immigrants is estimated to be in the tens of billions, with studies showing that while there is a loss in terms of uncollected taxes from their wages (due to their undocumented status), they also contribute significantly to the U.S. economy in ways that offset these losses.

Overall, it’s difficult to quantify the exact "loss" in taxes due to undocumented immigrants, as the contributions through income, sales, and property taxes are considerable, even if they are not always fully captured.

The estimated cost of lost tax revenue due to undocumented immigrants is typically in the $12 to $13 billion range annually for federal income taxes, while their contributions through state and local taxes are significant, often approaching or exceeding $11 billion annually.

In 2021, Elon Musk ALONE paid approximately $11 billion in federal income taxes. This figure was reported by Forbes and other outlets. However, it's important to note that this is based on his 2021 income and does not include all of his wealth, as much of Musk’s wealth is tied to Tesla stock and other assets, which are not taxed until sold.

Despite his $11 billion tax payment, Musk’s effective tax rate as a percentage of his wealth was significantly lower. According to an investigation by ProPublica in 2021, Musk paid an effective federal income tax rate of around 3.27% on the $13.9 billion increase in his wealth from 2014 to 2018. This was much lower than the average rate for middle-income earners due to the fact that most of his wealth comes from unrealized capital gains, which are not taxed until the assets are sold.

Key Points:

The $13.9 billion refers to how much Musk’s wealth grew between 2014 and 2018 due to Tesla stock increasing in value. This increase is called unrealized capital gains (because he hasn’t sold the stock, so it’s not taxed yet).

Capital gains are the profits from selling things like stock. When Musk sells his stock, he pays taxes on the profit (capital gains).

Musk's effective tax rate was about 3.27% during that period because he paid taxes on income he actually earned (like when he sold stock), but didn’t pay taxes on the unrealized gains (the increase in the value of his unsold stock). This is why the percentage of tax he paid on his overall wealth is very low compared to regular workers who pay taxes on all their income.

In short, Musk’s $13.9 billion is how much his wealth grew from 2014 to 2018, and he paid very little tax on that growth because he hadn’t sold most of his stock during that time. He only paid taxes on what he sold in later years.

#billionaire class#political#politics#us politics#donald trump#elon musk#news#president trump#tesla#american politics#jd vance#education#america#us news#taxes#taxation#taxing#income tax#capitol#capitol gains tax#2021

20 notes

·

View notes

Text

#trump#republicans#rethuglicans#presidency#wealth inequality#income tax#elon musk#hunger#hospital#food#education#health care#philanthropy#billionaires#late stage capitalism

7 notes

·

View notes

Text

RTA Services in India

Unlock ISIN Generation & Dematerialization of Share in India. Digitization of shares, RTA outsourcing services for international markets, IPOs in India RTA Services in India | ISIN Generation | Dematerialization Shares | RTA Outsourcing India

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

2 notes

·

View notes

Text

mutual fund consultant

As a mutual fund consultant, you advise customers on how to invest in mutual funds while taking into account their goals and risk tolerance. You assess possibilities, make personalized recommendations, and remain current on market trends to make informed judgments.

#mutual fund consultant#mutual funds#gofundmecampaign#gofundmeplease#mutual#advisor#neardeathnote#money#businessplans#giveandtake#matchingfunds#mutuallikes#angeladvisor#funding#wealthmanagement#evadvisor#gofundmepage#taxcredit#invest#broker#gofundmehelp#smartinvesting#capital#income#investinyourfuture#education#grants#leadership#consultant#tax

3 notes

·

View notes

Text

17 Money Secrets to Help You Become a Millionaire

Hey there, future millionaire! Do you dream of having lots of money one day? Well, guess what? It’s not impossible! In fact, I’m here to share 17 secrets about money that can help you become a millionaire. Sounds exciting, doesn’t it? Let’s dive in!

The earlier you start saving and investing your money, the more it can grow. It’s like planting a seed that grows into a big tree over time.

#personal finance#money management#wealth building#financial goals#saving#investing#budgeting#debt repayment#multiple income streams#emergency fund#financial education#wise investments#tax planning#mindful spending#technology tools#networking#market volatility#financial advice#patience#financial success.

2 notes

·

View notes

Text

Me too. So keep voting for the incrementally better option. Not the perfect option. The option that is one minuscule, tiny baby-step away from totalitarianism and TOWARDS:

Ranked choice voting

SCOTUS reform

Bodily autonomy

Private Prison abolition

Police reform

Taxes on the wealthy

Ending for-profit healthcare

Free education

Universal basic income

This isn’t going to happen in one voting cycle, or 10. But if you refuse to participate in the current 2-party system, it only gets WORSE, NOT BETTER.

#us politics#fucking vote#vote#voting rights#voting reform#ranked choice voting#scotus#prison#13th amendment#bodily autonomy#defund the police#tax the rich#free healthcare#free education#ubi#universal basic income

42K notes

·

View notes

Text

Gain the knowledge and start the practice of income tax through the Income Tax Return E-filing Course from Tyariexamki.com with ⭐️⭐️⭐️⭐️⭐️ Star Rating Course Job Oriented course

For more information Visit us:- https://www.tyariexamki.com/CourseDetail/10/Income-Tax-Return-E-filling-Course

1 note

·

View note

Text

Are Personal Loans Tax-Deductible in India?

A personal loan provides financial flexibility for various needs, such as home renovation, business expansion, education, or medical emergencies. However, many borrowers wonder if they can claim tax benefits on personal loan interest or principal repayments.

In this article, we will explore whether personal loans are tax-deductible in India, the conditions under which tax exemptions apply, and how to maximize tax savings on loans.

🔗 Apply for a Personal Loan: Check Personal Loan Options Here

1. Are Personal Loans Eligible for Tax Deductions in India?

A personal loan itself is not tax-deductible under the Income Tax Act. However, tax benefits may apply based on the purpose of the loan. If the loan amount is used for specific tax-exempt purposes, borrowers can claim deductions under various sections of the Income Tax Act.

Key Tax Deduction Scenarios:

✔ For Home Purchase or Renovation – Tax benefits under Section 80C & Section 24(b) ✔ For Business Use – Tax deductions as a business expense ✔ For Education – Tax benefits under Section 80E ✔ For Investing in Assets – Tax benefits on capital gains

2. Tax Benefits on Personal Loans for Home-Related Expenses

2.1. Home Purchase or Construction

If a personal loan is used for buying or constructing a residential property, tax benefits apply under Section 24(b) of the Income Tax Act. Borrowers can claim: ✔ A deduction of up to ₹2 lakh per year on interest paid ✔ Tax savings apply only if the property is self-occupied or rented

2.2. Home Renovation & Repairs

Interest on personal loans taken for home improvement, repairs, or renovations is also tax-deductible under Section 24(b). There is no limit if the house is rented, but a ₹2 lakh cap applies for self-occupied homes.

🔗 Best Personal Loans for Home Renovation:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

3. Tax Deductions for Personal Loans Used in Business

If a personal loan is used for business expansion, working capital, or buying equipment, the interest paid is considered a business expense under the Income Tax Act.

✔ The entire interest amount can be deducted from business income, reducing taxable profits ✔ Principal repayment is not tax-deductible ✔ The loan must be used strictly for business-related purposes

🔗 Best Personal Loans for Business Expansion:

Tata Capital Personal Loan

Bajaj Finserv Personal Loan

4. Tax Benefits on Personal Loans for Education

If a personal loan is used to fund higher education, tax benefits apply under Section 80E of the Income Tax Act: ✔ Borrowers can claim deductions on the interest amount paid ✔ The tax benefit applies for a maximum of 8 years ✔ This deduction is available for self, spouse, or children’s education

However, personal loans for education do not qualify for the same benefits as education loans from banks.

5. Tax Benefits for Personal Loans Used for Investments

If a personal loan is used for buying assets such as property, gold, or stocks, tax benefits apply in certain cases: ✔ If the asset is later sold, interest paid on the personal loan can be deducted from capital gains ✔ This is useful when purchasing real estate or high-value investments ✔ The deduction is available only in the year of sale

🔗 Best Personal Loans for Investment Purposes:

Axis Finance Personal Loan

InCred Personal Loan

6. Tax Benefits Not Available on Personal Loans

🚫 No tax benefits are available if the personal loan is used for: ❌ Personal expenses like wedding, travel, or vacations ❌ Paying off credit card bills or other loans ❌ Unspecified or general-purpose use

To qualify for tax deductions, proof of loan usage is required, such as bank statements, invoices, or property purchase documents.

7. How to Claim Tax Benefits on Personal Loan Interest?

Follow these steps to claim tax deductions on a personal loan:

✔ Maintain Proper Documentation – Keep loan agreements, EMI payment receipts, and proof of fund usage. ✔ Ensure Loan Usage Aligns with Tax-Exempt Categories – Home purchase, business, or education expenses. ✔ Mention Interest Paid in ITR Filing – Use the correct section while filing Income Tax Returns (ITR). ✔ Consult a Tax Advisor – If unsure, seek guidance from a chartered accountant for accurate tax filing.

Are Personal Loans Tax Deductible in India?

A personal loan is not directly tax-deductible, but tax benefits apply if the loan is used for eligible purposes such as home renovation, business investment, education, or asset purchase.

Key Takeaways:

✔ Home Loans – Interest deduction up to ₹2 lakh under Section 24(b) ✔ Business Loans – Full interest deduction as a business expense ✔ Education Loans – Interest deduction under Section 80E ✔ Asset Investments – Deduction on capital gains tax if the asset is later sold

🔗 Looking for a Personal Loan with the Best Terms? Apply Here: Check Personal Loan Offers

By understanding personal loan tax benefits, borrowers can reduce tax liability and maximize financial savings!

#Are personal loans tax-deductible in India?#Personal loan tax benefits in India#Can I get tax exemption on personal loans?#Income tax benefits on personal loans#Personal loan tax deductions under Income Tax Act#Is interest on personal loans tax-free?#Tax exemption on personal loan for home renovation#Personal loan tax benefits for business use#How to claim tax deductions on personal loans?#Section 24(b) tax benefit on personal loans#finance#fincrif#personal loans#personal loan#loan services#nbfc personal loan#personal laon#bank#personal loan online#loan apps#fincrif india#Personal loan for home construction tax benefit#Business loan tax exemptions in India#Education loan tax deduction vs personal loan#Capital gains tax benefits on personal loan usage#Income tax rules for personal loans in India#Tax rebate on personal loan for property purchase#Personal loan interest deduction under IT Act#Best ways to save tax with personal loans#Eligibility for personal loan tax deduction

0 notes

Text

#law books#education#books#online bookstore#Direct Taxes Circulars 1922-2015 - Relating to the Law of Income#Wealth and Gift Tax#Black Money A#buy Direct Taxes Circulars 1922-2015 - Relating to the Law of Income

0 notes

Text

An open letter to the U.S. Congress

Pass an expanded Child Tax Credit in any end-of-year tax package!

806 so far! Help us get to 1,000 signers!

As Congress deliberates tax priorities, I am writing as your constituent to strongly urge you to prioritize reducing child poverty via an expanded Child Tax Credit (CTC) in a potential end-of-year tax package. There are currently 19 million children excluded from the full credit because of the structure of the CTC. Some do not understand that the vast majority of children whose families are left out of the full CTC are working—but their families do not make enough to get the full CTC. In fact, under current law, families with 2 children do not receive the full $2,000 CTC if they earn less than $28,000 - $35,000, denying the full credit (or any credit) to families who need it most. Ensuring that the full Child Tax Credit reaches the lowest-income children who need it most will have immeasurable benefits to families and our society for generations to come. Will you make expanding the CTC, and ensuring it reaches the lowest income families currently left out of the full benefit your top priority—not more tax breaks for large, profitable corporations? Children are our future and investing in them now means continued prosperity for generations to come. The expanded Child Tax Credit cut child poverty in the U.S. by 46%. But when Congress let it expire, child poverty more than doubled, from 5.2% to 12.4%. Just before Thanksgiving, 16% of households with children reported sometimes or often not having enough to eat in the past week, up from 10.4% in the summer of 2021 while families were getting support from a temporary expansion of the Child Tax Credit (CTC). Keeping children out of poverty means better school performance, better health outcomes, and more mentally and emotionally well-adjusted children. Research shows that most low-income families spent the expanded CTC on basic necessities like food, utilities, and rent or mortgage payments, as well as education expenses—and families need that help now. I strongly believe we should focus on tax policies to address child poverty. In contrast, if Congress makes the bonus depreciation rule permanent as some policymakers are proposing, the American public would lose out on $325 billion in revenue over the next decade. That’s money that can be used to fully fund critical programs like childcare, early childhood education, essential nutrition programs, and expand access to health care. Children and their families are our future; investing in them must be Congress’ top priority. Any tax package you consider must include the expanded Child Tax Credit, focused on directing its help to the lowest-income households. Will you voice support for expanding the Child Tax Credit to reduce child poverty with colleagues and your party’s leadership?

▶ Created on December 14, 2023 by Jess Craven

📱 Text SIGN PCNEAB to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#An open letter to the U.S. Congress#Pass an expanded Child Tax Credit in any end-of-year tax package!#As Congress deliberates tax priorities#under current law#CTC#Children are our future#child poverty#Thanksgiving#child hunger#Child Tax Credit (CTC)#better health outcomes#well-adjusted#utilities#rent#education expenses#childcare#American public#early childhood education#essential nutrition programs#healthcare#low-income households#▶ Created on December 14 2023 by Jess Craven#📱 Text SIGN PCNEAB to 50409#🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409#JESSCRAVEN101#PCNEAB#resistbot#Congress#ChildTaxCredit#Poverty

1 note

·

View note

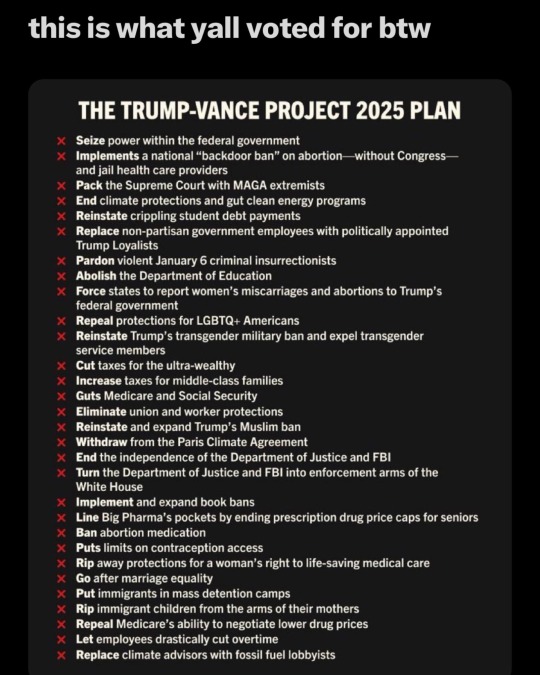

Text

#trump#vance#2024 election#republicans#rethuglicans#presidency#project 2025#abortion#health care#supreme court#SCOTUS#climate#MAGA#student debt#civil service#January 6#Department of Education#LGBTQ#LGBT#transgender#income tax#billionaires#wealthy#unions#department of justice#FBI#big pharma#medicare#marriage equality#deportation

14 notes

·

View notes

Text

Dematerialization of Shares in India – A Complete Guide by Neeraj Bhagat & Co.

In today's digital era, the Indian financial market has undergone significant transformation, with Dematerialization of shares in India emerging as a game-changer for investors. The shift from physical to electronic shares has streamlined trading, enhanced security, and improved efficiency. Neeraj Bhagat & Co. provides expert guidance on the dematerialization process to ensure seamless compliance with regulatory requirements.

What is Dematerialization of Shares?

Dematerialization of shares in India refers to the process of converting physical share certificates into electronic format, which is then stored in a Demat account. This eliminates risks associated with paper-based shares such as loss, theft, forgery, and damages.

Why is Dematerialization Important?

The Securities and Exchange Board of India (SEBI) has made it mandatory for listed companies to facilitate dematerialization, ensuring transparency and ease of trading. Here are some key benefits:

Enhanced Security: No risk of loss or forgery.

Easy Transfers: Quick and hassle-free transfer of shares.

Cost-Effective: Eliminates stamp duty and paperwork.

Increased Liquidity: Facilitates faster transactions and trading.

Regulatory Compliance: Ensures adherence to SEBI and stock exchange norms.

Process of Dematerialization in India

Neeraj Bhagat & Co. simplifies the dematerialization process by assisting investors through the following steps:

Open a Demat Account: Choose a Depository Participant (DP) registered with NSDL or CDSL.

Submit Dematerialization Request Form (DRF): Fill out the DRF and attach physical share certificates.

Verification & Processing: The DP verifies the documents and forwards them to the company’s registrar.

Electronic Credit: Upon approval, shares are credited to the investor’s Demat account.

Mandatory Dematerialization for Private Companies

The Ministry of Corporate Affairs (MCA) has mandated that all unlisted public companies must dematerialize their shares, aligning them with listed companies for better governance and transparency.

How Neeraj Bhagat & Co. Can Help

With years of experience in financial consulting, Neeraj Bhagat & Co. assists businesses and investors in:

Setting up Demat accounts.

Filing and processing dematerialization requests.

Ensuring compliance with SEBI and MCA regulations.

Providing end-to-end support for private and public company dematerialization.

Conclusion

Dematerialization of shares in India is an essential step for investors and businesses looking for secure, efficient, and transparent trading. With expert advisory from Neeraj Bhagat & Co., investors can navigate the process smoothly while ensuring compliance with regulatory norms.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

2 notes

·

View notes