#impact of global economic downturn

Explore tagged Tumblr posts

Text

0 notes

Text

The accomplishments of Joe Biden during his presidency

Joe Biden, the 46th President of the United States, assumed office at a pivotal moment in history, facing a myriad of challenges ranging from a global pandemic to economic uncertainty and social unrest.

Throughout his presidency, President Biden has pursued an ambitious agenda aimed at addressing these pressing issues and advancing key policy priorities. In this essay, we will examine some of the notable accomplishments of Joe Biden during his time in office and the impact of his leadership on the nation.

One of the most significant accomplishments of President Biden during his presidency has been his administration's response to the COVID-19 pandemic. Upon taking office, President Biden made the pandemic a top priority and swiftly implemented a national strategy to combat the spread of the virus and accelerate the vaccination campaign.

Under his leadership, the administration successfully exceeded its initial goal of administering 100 million vaccine doses within the first 100 days, ultimately surpassing 200 million doses. This aggressive vaccination effort has been instrumental in curbing the spread of the virus and has contributed to a significant reduction in COVID-19 cases and deaths across the country.

In addition to his focus on public health, President Biden has made substantial strides in revitalizing the American economy in the wake of the pandemic. The administration's American Rescue Plan, a comprehensive COVID-19 relief package, provided much-needed financial assistance to individuals, families, and businesses impacted by the economic downturn. The plan included direct stimulus payments to Americans, extended unemployment benefits, support for small businesses, and funding for vaccine distribution and testing.

President Biden's economic agenda has also centered on job creation and infrastructure investment, culminating in the passage of the Bipartisan Infrastructure Law, a historic legislation that allocates substantial funding for modernizing the nation's infrastructure, creating millions of jobs, and bolstering economic growth. Furthermore, President Biden has been a vocal advocate for advancing racial equity and social justice in the United States. His administration has taken concrete steps to address systemic inequalities and promote inclusivity, including the signing of executive orders to combat discrimination, promote fair housing, and strengthen tribal sovereignty.

Additionally, President Biden signed into law the Juneteenth National Independence Day Act, establishing Juneteenth as a federal holiday to commemorate the end of slavery in the United States. These actions underscore the administration's commitment to confronting the legacy of racism and fostering a more equitable society for all Americans.

Moreover, President Biden has demonstrated a strong commitment to combating climate change and advancing environmental sustainability.

His administration rejoined the Paris Agreement on climate change, signaling a renewed dedication to global cooperation in addressing the climate crisis. In November 2021, President Biden convened a virtual Leaders Summit on Climate, bringing together world leaders to discuss ambitious measures to reduce greenhouse gas emissions and accelerate the transition to clean energy.

Additionally, the administration has unveiled a comprehensive plan to invest in clean energy infrastructure, promote energy efficiency, and prioritize environmental justice, aiming to position the United States as a global leader in the fight against climate change.

In the realm of foreign policy, President Biden has sought to reassert American leadership on the world stage and rebuild alliances with international partners. His administration has prioritized diplomacy and multilateral engagement, working to address global challenges such as nuclear proliferation, cybersecurity threats, and human rights abuses.

President Biden has reaffirmed the United States' commitment to NATO and other key alliances, signaling a departure from the isolationist policies of the previous administration. His approach to foreign affairs has emphasized the importance of collaboration and collective action in tackling shared global concerns, fostering a more cohesive and cooperative international order. Furthermore,

President Biden has been a steadfast proponent of expanding access to affordable healthcare and strengthening the Affordable Care Act. His administration has taken steps to bolster the ACA, including increasing enrollment outreach, expanding coverage options, and lowering healthcare costs for millions of Americans.

President Biden has also championed efforts to address mental health challenges and substance abuse disorders, recognizing the critical importance of mental and behavioral health in overall well-being.

In conclusion, President Joe Biden has achieved a range of significant accomplishments during his tenure in office, from his swift and effective response to the COVID-19 pandemic to his ambitious efforts to revitalize the economy, promote racial equity, combat climate change, and reinvigorate America's role in global affairs.

His leadership has been marked by a steadfast commitment to addressing pressing domestic and international challenges and advancing a progressive policy agenda aimed at fostering a more equitable, resilient, and prosperous future for the nation. As his presidency continues to unfold, the enduring impact of his accomplishments is likely to shape the trajectory of the United States for years to come, leaving a lasting imprint on the fabric of American society and the global community.

#politics#donald trump#joe biden#potus#scotus#heritage foundation#trump#democracy#democrats#republicans#maga morons#maga cult#maga#usa#us news#white house#biden#the united states#usa politics

44 notes

·

View notes

Text

GABORONE, Botswana -- The party of Botswana's opposition candidate Duma Boko was declared the election winner Friday over incumbent President Mokgweetsi Masisi in a seismic change that ended the ruling party’s 58 years in power since independence from Britain.

Masisi conceded defeat even before final results were announced, with his Botswana Democratic Party trailing in fourth place in the parliamentary elections in what appeared to be a humbling rejection by voters and a landslide victory for the main opposition party.

Hours later, Chief Justice Terence Rannowane announced that the opposition Umbrella for Democratic Change party had won a majority of seats in the election, making its candidate, Boko, the next president of the southern African country, which is one of the world’s biggest producers of mined diamonds.

Masisi said he had called Boko to inform him he was conceding defeat.

The final results of the election were yet to be formally declared, but Rannowane said the UDC had reached the 31-seat threshold to win a majority.

“I concede the election," Masisi said in an early-morning press conference two days after the vote. "I am proud of our democratic processes. Although I wanted a second term, I will respectfully step aside and participate in a smooth transition process.”

“I look forward to attending the coming inauguration and cheering on my successor. He will enjoy my support.”

Masisi's BDP dominated politics in Botswana for nearly six decades, since independence in 1966. The nation of just 2.5 million people will now be governed by another party for the first time in its democratic history.

“We lost this election massively,” said Masisi, a 63-year-old former high school teacher and UNICEF employee. “I have not packed a shoe. I did not expect it,” he added.

Boko is a 54-year-old lawyer and Harvard Law School graduate who also ran in 2014 and 2019. He didn't immediately comment but posted on his official page on X: “Botswana First” with a picture of a UDC campaign poster with the words “Change is Here.”

Botswana has been held up as one of Africa's most stable democracies and is regarded as a post-colonial success story having built one of the highest standards of living in the region through an economy that largely relies on diamonds. Botswana is the world's second biggest natural diamond producer behind Russia and has been responsible for all the biggest diamonds found in the last decade.

But Botswana faces new challenges and the mood for change became evident as a downturn in the global demand for diamonds badly impacted the economy, becoming the central issue for the campaign.

Unemployment rose to more than 27% this year, and significantly higher for young people, as the government saw a sharp decrease in revenue from diamonds. Masisi and his party had faced criticism for not having done enough to diversify the economy and the nation has been forced to adopt recent austerity measures.

Even the BDP conceded throughout its campaign that policy change was needed and tried to convince voters it was capable of leading the country out of its economic troubles. Diamonds account for more than 80% of Botswana's exports and a quarter of its GDP, according to the World Bank.

Masisi said the country had hardly sold any diamonds since April through its Debswana company, which the government jointly owns with diamond miner De Beers.

Botswana's general elections decide the makeup of its Parliament, and lawmakers then choose the president. The party that gains a majority is in position to choose its candidate as president. All five of Botswana's post-independence presidents have been from the BDP.

The BDP was one of the longest-serving parties in Africa still in power and its sharp defeat came as a surprise after what was expected to be a tight race. It followed an equally momentous change in neighboring South Africa, where the long-ruling African National Congress lost its 30-year majority in an election in May and was forced to share power for the first time in a coalition government.

#nunyas news#like when pri lost in mexico after forever#not sure if either party is good or bad#but a change is good hopefully#good luck botswana

2 notes

·

View notes

Text

And while we were all distracted...

The financial markets around the globe are falling as Dow, Nasdaq, Nikkei and Kospi are down.

A #stockmarket crash in America could impact #health in the #Philippines in several ways:

1. **Economic Strain**: A downturn in the global economy can lead to reduced economic growth in the Philippines. This can strain government budgets, potentially leading to cuts in healthcare funding or public health programs.

2. **Job Losses**: If businesses in the Philippines are affected by the global economic downturn, there could be job losses or reduced incomes, which can affect individuals' ability to afford healthcare and healthy living conditions.

3. **Reduced Investment**: A decrease in foreign investment may lead to reduced funding for healthcare infrastructure and services, impacting the quality and accessibility of healthcare.

4. **Increased Stress**: Economic instability can increase stress and anxiety among the population, potentially leading to mental health issues. Stress can also exacerbate existing health conditions and affect overall well-being.

5. **Impact on Health Services**: If the economic downturn affects tourism or remittances, it could lead to reduced funding for private health services and charitable health initiatives, impacting the availability of healthcare services.

Overall, while the direct health impacts might not be immediate, economic challenges stemming from a stock market crash can indirectly affect health outcomes and access to care in the Philippines.

4 notes

·

View notes

Text

Six Pressing Social Issues to Consider for a Novel in 2024-25

These six social issues are indeed timely and thought-provoking themes that could shape a novel in 2024-25:

1. Mental Health Awareness

Mental health has become a critical conversation point in modern society, yet it remains stigmatized in many areas. Exploring characters grappling with anxiety, depression, PTSD, or the fallout from trauma can resonate deeply with readers. A narrative could focus on the struggle for self-acceptance or finding a support system, while challenging societal norms that misunderstand mental health struggles. It could also tackle themes like the impact of social media on self-esteem or how access to mental health resources varies across communities.

2. Racial and Social Inequality

Issues of systemic racism and social inequality remain at the forefront, from policing and justice systems to educational and employment opportunities. A story centered around these themes could explore the daily realities of those marginalized by society and the fight for justice and equality. Such a novel could delve into the emotional toll of discrimination, the intergenerational effects of inequality, or the power and pitfalls of grassroots activism, drawing attention to the deep-rooted biases that still shape much of the world.

3. Climate Change and Environmental Justice

Climate change is not only an environmental crisis but also a social one, as it disproportionately affects marginalized communities. An engaging narrative could tackle the displacement caused by rising sea levels, the struggle of communities to adapt, or the clashes between environmental activists and corporate interests. This theme can explore how the fight for a sustainable future intersects with issues of poverty, indigenous rights, and the politics of climate denial, highlighting the urgency of global action against climate disaster.

4. Technology and Privacy

As technology advances, concerns about data privacy, digital surveillance, and the ethical implications of AI continue to grow. A story set against the backdrop of a tech-dominated society could explore the loss of personal freedoms, the effects of constant surveillance, or the emotional consequences of living in a hyper-connected world. It could also delve into themes like cybercrime, misinformation, or the blurred lines between reality and virtual spaces, posing questions about what privacy means in an era where data is currency.

5. Economic Disparity and Class Struggle

Economic inequality continues to widen, fueling discussions about the distribution of wealth, the power of corporations, and the reality of working-class life. A novel could highlight the struggles of individuals in low-income communities, the impact of economic downturns, or the emotional toll of labor exploitation. It might follow characters grappling with precarious jobs, the gig economy, or the impossible balance of making ends meet. Exploring these challenges can reveal the human cost behind economic policies and bring attention to the fight for fair wages and social safety nets.

6. Gender Identity and Representation

As conversations around gender expand, exploring themes of identity, expression, and the struggles for recognition becomes increasingly important. A novel can delve into the experiences of transgender, non-binary, or gender nonconforming characters, focusing on their journeys of self-discovery and acceptance. It can also examine societal barriers like discrimination, transphobia, or the challenges of accessing healthcare. By offering authentic representation, such a story can foster empathy, challenge stereotypes, and celebrate the diversity of human identity.

Each of these themes offers rich ground for character-driven stories that reflect the complexities of modern life, allowing a writer to create a narrative that is both compelling and relevant.

Source -

#novelwriting#writing novels#writing#writers#writer#publishers#self publication#self publishing#writing tips

2 notes

·

View notes

Text

Future-Proofing Industry Insights: AI as the Key to Market Evolution

One tool that is becoming essential for this is Artificial Intelligence (AI). By integrating AI into market analysis, businesses are transforming how they understand their industries and plan for the future. But how does AI help with this, and why is it such a game-changer?

What is AI in Market Insights?

Artificial Intelligence refers to computer systems designed to mimic human intelligence. In market analysis, AI can analyze large sets of data much faster and more accurately than any human ever could. It helps businesses uncover patterns, predict future trends, and make informed decisions based on real-time data.

Instead of relying on gut feelings or traditional methods, AI can process huge amounts of information from various sources—everything from social media posts to financial reports. This makes it easier to understand customer behavior, identify new opportunities, and respond to changes in the market.

The Benefits of AI in Market Evolution

Faster Decision Making: Traditional market analysis can take weeks or even months. With AI, businesses can receive insights in real-time. For example, if a new competitor enters the market, AI can quickly analyze their impact and suggest strategies to stay competitive.

Better Accuracy: Humans are prone to errors, but AI can process data with incredible precision. It reduces the chances of missing important trends or making decisions based on inaccurate information. This level of accuracy ensures businesses make the right moves at the right time.

Predictive Power: One of AI's most powerful features is its ability to predict future trends. Using historical data, AI can forecast market shifts, customer behavior changes, or even potential economic downturns. This predictive capability allows companies to plan ahead, mitigate risks, and take advantage of emerging opportunities.

Personalized Insights: Every business is unique, and AI can deliver insights tailored to specific industries or company needs. For example, a fashion retailer might use AI to track seasonal trends, while a tech company could use it to monitor the latest innovations. AI helps businesses focus on what matters most to them.

Improved Efficiency: AI can automate routine tasks like data collection and reporting. This frees up time for employees to focus on more strategic work, such as creative problem-solving or developing new products. By enhancing efficiency, AI allows businesses to do more with less effort.

How AI is Changing Market Analysis

The impact of AI on market analysis is revolutionary. In the past, businesses relied heavily on historical data and general trends to make decisions. Today, AI provides a much deeper understanding of the market.

For instance, AI can analyze customer reviews, social media conversations, and online searches to give businesses real-time feedback on how their products are perceived. This allows companies to quickly adjust their marketing strategies or make product improvements.

In addition, AI is helping businesses identify new markets and customer segments. By analyzing global data, AI can pinpoint areas with growing demand or untapped opportunities. This gives companies a head start in entering new markets or developing products for emerging customer needs.

The Future of Market Insights with AI

As AI technology continues to evolve, its role in market analysis will only grow. Businesses that invest in AI now will be better positioned to adapt to future changes in their industries.

The future will likely see even more advanced AI systems capable of understanding complex market dynamics and providing insights that were previously unimaginable. For example, AI could help predict consumer behavior changes before they happen or identify entirely new business models.

Conclusion

In an increasingly competitive global marketplace, businesses must find ways to stay ahead. AI is proving to be a vital tool in this quest. By offering faster, more accurate, and personalized insights, AI is helping companies not only survive but thrive in evolving markets.

The key to future-proofing industry insights lies in AI's ability to transform raw data into actionable strategies. As this technology continues to develop, its impact on market evolution will only become more profound. Embracing AI today means being ready for tomorrow’s challenges—and opportunities.

Also read: b2b market research services

healthcare market research services

#data analytics#market research#data collection#datainsights#surveyprogramming#artificial intelligence

2 notes

·

View notes

Text

Anil Ambani: Navigating Success and Challenges in India's Business Arena biography and career achievements

Anil Ambani biography and career achievements is an Indian businessman and a distinguished determine in the u . S .'s company global. Born on June 4, 1959, he is the more youthful brother of Mukesh Ambani, the chairman and biggest shareholder of Reliance Industries. Anil Ambani is known for his role inside the Reliance Group, a conglomerate that spans a couple of sectors along with telecommunications, electricity, infrastructure, and monetary services. His adventure inside the commercial enterprise global is marked by using both sizable achievements and extraordinary challenges.

Early Life and Education

Impact of Anil Ambani’s leadership on Reliance Jio turned into born into a own family with a robust business background. His father, Dhirubhai Ambani, based Reliance Industries in 1966, which might develop to come to be certainly one of India's largest conglomerates. Anil Ambani pursued his education at Mumbai's well-known Kishinchand Chellaram College, where he earned his degree in Commerce. He then went on to study at the Wharton School of the University of Pennsylvania, where he acquired an MBA.

Career Beginnings and the Formation of Reliance Anil Dhirubhai Ambani Group

Anil Ambani role in transforming Indian telecommunications sector"started out his career operating in the own family enterprise, studying the intricacies of dealing with a big business enterprise. In 2002, following the death of Dhirubhai Ambani, the Reliance Group turned into divided among Anil and Mukesh Ambani. Anil Ambani obtained manage of the newly fashioned Reliance Anil Dhirubhai Ambani Group (ADAG), which turned into hooked up to handle a number of industries.

Under Anil's management, ADAG improved rapidly into numerous sectors. The institution varied into telecommunications, with the release of Reliance Infocomm (now Reliance Jio). This mission revolutionized the Indian telecom region with its aggressive pricing and vast network coverage. It is vision helped position Reliance Jio as one of the leading telecommunications groups in India, gambling a vital function in making records services greater affordable and on hand to tens of millions of Indians.

Expansion into Power and Infrastructure

In addition to telecommunications, focused on strength technology and infrastructure improvement. Reliance Power turned into hooked up to faucet into the growing energy needs of India. The business enterprise undertook numerous ambitious projects, which include the improvement of coal-based electricity flowers and different power resources. Reliance Infrastructure, another arm of ADAG, centered on infrastructure development, inclusive of roads, airports, and metro structures.

These ventures have been part of Anil Ambani’s broader imaginative and prescient of contributing to India’s monetary increase by means of addressing critical infrastructure and electricity needs. His strategy concerned making an investment in big-scale tasks and leveraging the organization’s economic energy to power improvement throughout various sectors.

Financial Challenges and Restructuring

Despite the preliminary achievement, Anil Ambani and the ADAG confronted good sized economic challenges in the later years. The organization’s formidable growth brought about high ranges of debt, and international economic downturns impacted its operations. The corporation's financial troubles have been compounded via growing hobby quotes and economic slowdowns.

By the mid-2010s, ADAG became grappling with widespread debt and financial stress. This situation led to a sequence of restructuring efforts, along with asset income and attempts to renegotiate debt phrases. The institution struggled to maintain its previous boom trajectory, and several of its projects confronted delays and value overruns.

They monetary difficulties have been in addition exacerbated by using criminal and regulatory demanding situations. The organization turned into involved in diverse legal battles, which include issues related to company governance and regulatory compliance. These challenges affected the overall belief of ADAG and its monetary balance.

Legacy and Impact

Despite the economic problems, Anil Ambani’s contributions to India's business landscape remain noteworthy. His position in transforming the telecommunications area with Reliance Jio is a massive success. The creation of lower priced information offerings has had a profound impact on India's virtual economy, contributing to accelerated internet penetration and digital inclusion.

In the infrastructure quarter, ADAG’s investments in roads, electricity, and metro systems have contributed to the improvement of crucial infrastructure in India. These tasks have had a long-lasting effect on city development and financial boom in diverse areas.

It philanthropic efforts are also really worth mentioning. The Anil Dhirubhai Ambani Foundation, hooked up via the Ambani family, has been concerned in diverse charitable sports, which include education, healthcare, and catastrophe comfort. The foundation’s initiatives purpose to cope with social problems and support underprivileged groups.

Recent Developments and Future Outlook

In current years, Anil Ambani and the ADAG have endured to awareness on restructuring and realigning their commercial enterprise operations. The organization has sought to streamline its portfolio, divesting from non-center assets and focusing on key areas of increase. Efforts to reduce debt and enhance monetary balance continue to be a concern.

Financial challenges faced by Anil Ambani’s Reliance Anil Dhirubhai Ambani Group The broader monetary and enterprise surroundings in India, such as authorities rules and marketplace traits, will play a vital function in shaping the future of ventures. As the Indian financial system continues to conform, opportunities and demanding situations will emerge, influencing the strategic path of the Reliance Anil Dhirubhai Ambani Group.

#Financial challenges faced by Anil Ambani’s Reliance Anil Dhirubhai Ambani Group#Anil Ambani biography and career achievements#Impact of Anil Ambani’s leadership on Reliance Jio#Anil Ambani role in transforming Indian telecommunications

2 notes

·

View notes

Text

FUTURE OF YANDEX SEARCH ENGINE?

PREDICTIONS FOR 2025 - SEO / AI and MACHINE LEARNING

Predicting the future of Yandex in 2025 is complex, and there is no single definitive answer. However, here are some potential developments based on current trends and expert analyses:

Potential Positive Developments:

Continued Growth in Russia and CIS: Yandex is likely to maintain its dominant position in Russia and other CIS countries due to its strong brand recognition, localized content, and understanding of the market.

Expansion into New Markets: Yandex may further expand its presence in other emerging markets, leveraging its technology and experience to compete with established players.

AI and Machine Learning Advancements: Yandex has been investing heavily in AI and machine learning, which could lead to significant improvements in search accuracy, personalization, and user experience.

Diversification of Services: Yandex's diverse portfolio of services (e-commerce, ride-hailing, cloud computing, etc.) could provide a buffer against fluctuations in the search market and contribute to overall growth.

Potential Challenges:

Increased Competition: Global players like Google and emerging AI-powered search engines could intensify competition, especially in international markets.

Regulatory Hurdles: The regulatory environment in Russia and other markets could become more restrictive, impacting Yandex's operations and growth potential.

Economic Volatility: Economic downturns in key markets could negatively affect advertising revenues, a major source of income for Yandex.

Overall Prediction:

Yandex is likely to remain a major player in the search engine market in 2025, particularly in Russia and the CIS. Its success will depend on its ability to navigate challenges, innovate, and capitalize on opportunities in a rapidly evolving landscape.

It's important to remember that these are just predictions, and the actual future of Yandex could be influenced by unforeseen events and developments.

Additional Resources:

For more information and diverse perspectives, you can search for analyst reports, news articles, and expert opinions on the future of Yandex.

It is also helpful to follow Yandex's official announcements and financial reports to stay updated on their progress and strategies.

Remember: The future is uncertain, and any predictions should be considered with caution.

SEOSHNIK: PREDRAG

#seo#seoexpert#answer engine optimization#seo yandex#yandex#yandex seo expert#realestate#design#ai yandex#yandex engine#yandex search engine#e-commerce#ride-hailing#cloud computing#SEOSHNIK#2025#optimized for 2025#2025 predictions#SEO PREDICTIONS#RECOMMENDED SEO#SEO RECOMENDED

2 notes

·

View notes

Text

Global Market Meltdown: What Caused the Panic?

Lately, there's been a lot of buzz about the significant downturn in global markets. It's hard not to notice when investors from Japan to India and the United States are losing billions. I wanted to dig deeper into what exactly caused this economic upheaval, so I watched an insightful video that breaks down the primary reasons behind this panic. Here’s a more detailed look at the key points discussed.

Global Market Downturn

The global markets have been on a rollercoaster, but lately, it's been a steep downhill ride. From Japan to India, and even the mighty United States, markets have experienced significant declines. Investors are feeling the heat, with billions of dollars seemingly evaporating overnight. The sense of unease is palpable, and everyone is asking the same question: what's causing this chaos?

Impact on India

India, with its rapidly growing economy, hasn't been immune to this downturn. In fact, the Indian markets saw a substantial loss, with approximately 17 lakh crores wiped off, equating to over $2 billion in a single day. That's an astronomical figure, and it's left many investors and analysts scratching their heads.

Weak Corporate Earnings

One of the primary reasons for this downturn in India is the disappointing first-quarter results from the country’s top 50 companies. There was minimal growth and a decline in profits, which has spooked investors. When corporate giants fail to meet expectations, the ripple effect can be severe, leading to a widespread market selloff.

Rupee Devaluation

Adding to the woes, the Indian rupee hit an all-time low against the US dollar, trading at nearly 84 rupees per dollar. A weak rupee makes imports more expensive and exacerbates inflation, which in turn can erode consumer confidence and spending. This devaluation has added another layer of complexity to an already volatile market.

Recession Fears in the US

Over in the United States, the fear of a looming recession is causing major jitters. Rising unemployment and a slowdown in the manufacturing sector are key indicators that all is not well. Recent data shows that 4.3% of Americans are unemployed, the highest rate in nearly three years. This spike in unemployment, coupled with other economic slowdowns, has investors on edge.

Manufacturing Slowdown

The US manufacturing sector, a critical component of the economy, has been experiencing a significant slowdown. This sector's health often serves as a bellwether for the broader economy. When manufacturing slows down, it not only impacts the sector itself but also sends shockwaves through supply chains, affecting various other industries.

Tensions in West Asia

The geopolitical landscape is another major factor contributing to the market instability. The worsening situation in West Asia, particularly involving Iran and its proxies targeting Israel, has escalated tensions. These geopolitical conflicts create uncertainty and risk, which markets despise. The potential for conflict in this volatile region adds to the already heavy load of negative sentiment.

Impact on Global Markets

The negative sentiment isn't confined to India and the US; it's a global phenomenon. Markets worldwide are facing headwinds. The decline in oil prices and a significant selloff in cryptocurrencies are clear indicators that investors are skittish. The interconnectedness of global markets means that turmoil in one region can quickly spread, creating a domino effect.

Decline in Oil Prices

Oil prices have been another critical factor. Traditionally, oil is seen as a barometer for global economic health. A decline in oil prices can signal weakening demand and economic slowdown. This recent drop in oil prices has only added to the growing list of concerns for investors.

Cryptocurrency Selloff

Cryptocurrencies, once the darlings of the investment world, have not been spared either. A significant selloff in cryptocurrencies has been observed, which further highlights the risk-averse sentiment prevailing among investors. The volatility of these digital assets can be both a cause and a consequence of broader market instability.

Climate Change Concerns

Interestingly, the video also touched on an often-overlooked aspect: climate change. While not directly related to the market meltdown, the mention of climate change serves as a reminder that long-term environmental issues can and will have economic repercussions. The call for action, starting with individual efforts like planting trees, underscores the need for a collective approach to combat these challenges.

Individual Efforts

It's easy to feel helpless in the face of such overwhelming economic and environmental issues. However, small actions, such as planting trees and adopting sustainable practices, can collectively make a significant impact. The idea is to start a revolution from the ground up, emphasizing that everyone has a role to play.

Conclusion

The global market meltdown is a multifaceted issue with no single cause. From weak corporate earnings and currency devaluation in India to recession fears in the US and geopolitical tensions in West Asia, several factors have converged to create the current economic turmoil. The interconnected nature of global markets means that instability in one region can quickly spread, affecting economies worldwide.

For those looking to navigate these turbulent times, staying informed is crucial. Websites like TickerInvest.com provide invaluable insights into stock market investments and the latest financial news. Their expert analysis can help you make informed decisions and stay ahead of the curve.

FAQs

What caused the global market meltdown in 2024? The meltdown was caused by a combination of factors, including weak corporate earnings in India, recession fears in the US, geopolitical tensions in West Asia, and a decline in oil prices and cryptocurrencies.

How has the downturn impacted India? India saw a significant loss, with approximately 17 lakh crores wiped off the market. Contributing factors include weak corporate earnings and the devaluation of the rupee.

Why are recession fears rising in the US? Rising unemployment and a slowdown in the manufacturing sector are key indicators of potential recession, causing concern among investors.

What role do geopolitical tensions play in market instability? Tensions in regions like West Asia create uncertainty and risk, which negatively impact market stability and investor confidence.

How are oil prices and cryptocurrencies affecting the market? A decline in oil prices and a selloff in cryptocurrencies reflect broader economic concerns and risk-averse sentiment among investors.

What can individuals do to help combat climate change? Individual efforts like planting trees and adopting sustainable practices can collectively make a significant impact in addressing climate change.

About TickerInvest.com

TickerInvest.com is a premier platform for financial news, stock market analysis, and investment strategies. Whether you're a seasoned investor or just starting out, TickerInvest.com offers a wealth of resources to help you make informed decisions. Their expert analysis, in-depth articles, and real-time market data ensure you stay ahead of the curve. For anyone looking to maximize their investment returns, TickerInvest.com is an invaluable tool. Check them out today and take your investing game to the next level!

#stock market#stock trading#finance#investing stocks#indian stock market#stock market crash#investing

2 notes

·

View notes

Text

Remote hiring builds a recession-resilient company during US recesion, it plays a huge role in understanding the market and tackling it effectively, if you are wondering what to do in a recession, this is how your company can be recession-proof with remote hiring when it comes to saving costs and battling it.

#us recession#us tech recession#tech industry downturn#impact of the global economic downturn#a recession would boost remote work

0 notes

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Video

youtube

The Power of Creative Thoughts in Shaping Reality

Creative thoughts are not just fleeting moments of inspiration; they are potent energies that shape our lives and realities. Understanding and harnessing this power read more here can lead to profound changes in personal circumstances and broader societal conditions. This article explores how thoughts manifest into reality and provides actionable steps to leverage this process effectively.

The Magnetism of Thought

Thoughts are a form of energy that functions like a magnet. When you consistently focus on positive or negative thoughts, you attract experiences that align with these thoughts. For instance, harboring a mindset centered around abundance often leads to a life filled with plentiful resources and opportunities. Conversely, a focus on lack or poverty can result in a perpetuation of these conditions.

Societal Impact of Collective Thought

The collective mindset of a society can significantly influence its overall condition. For example, a community that predominantly fears economic downturn may inadvertently contribute to such an outcome through collective behaviors driven by this fear. On the other hand, a society that embraces innovation and positivity is likely to experience growth and prosperity.

The Reflection of Life

Life mirrors our thoughts back to us. We are the architects of our reality, and it is crucial to take responsibility for the thoughts we nurture. No one else can think for us; the power and responsibility lie within each individual.

The Role of Unconscious Beliefs

Many thoughts and beliefs are unconscious, shaped by influences from our upbringing, education, and personal experiences. Recognizing and reshaping these subconscious beliefs is essential for creating a reality that aligns with our conscious desires.

The Quickening of Manifestation

Recent shifts in global consciousness have accelerated the manifestation process. What used to take years might now materialize in weeks or months. This quickening makes it more important than ever to maintain a clear and positive mindset.

2 notes

·

View notes

Text

Navigating the Path to Success: A Comprehensive Guide to a Career as a Financial Consultant

In the ever-evolving landscape of finance, the role of a financial consultant has emerged as pivotal. Balancing analytical prowess with an empathetic approach to client needs, financial consultants are the navigators in the complex world of personal and corporate finance. This comprehensive guide delves into the intricacies of pursuing a career as a financial consultant, outlining the steps to success, the skills required, and the impact one can make in this dynamic profession.

The Blueprint to Becoming a Financial Consultant

Educational Foundations

The journey begins with solid educational foundations. A bachelor's degree in finance, economics, business administration, or a related field is typically the minimum requirement. Courses in investments, taxes, estate planning, and risk management provide a strong base. Advanced degrees or certifications, such as a Master's in Business Administration (MBA) or becoming a Certified Financial Planner (CFP), can significantly enhance one's prospects and credibility.

Gaining the Right Experience

Hands-on experience is invaluable. Internships or entry-level positions in banking, insurance, or investment firms offer a practical understanding of financial products, market strategies, and client relations. Experience in customer service roles can also be beneficial, as they develop the interpersonal skills crucial for consulting.

Licensing and Certification

Depending on the services offered, financial consultants may need to obtain specific licenses. For example, selling insurance products requires a license in the relevant state, while offering investment advice might necessitate Series 7 and Series 66 licenses. Pursuing certifications like CFP or Chartered Financial Analyst (CFA) not only legitimizes expertise but also signals commitment to professional development.

Essential Skills for a Flourishing Career

Analytical Acumen

At the core of financial consulting is the ability to analyze complex financial data. Consultants must interpret market trends, evaluate investment opportunities, and understand regulatory impacts to provide sound advice.

Communication Mastery

Translating complex financial concepts into understandable advice is an art. Practical communication skills ensure that clients are informed and comfortable with their financial decisions.

Ethical Integrity

Trust is the cornerstone of a financial consultant-client relationship. Upholding high ethical standards and transparency is essential for building and maintaining this trust.

Adaptability

The financial landscape is continuously changing. Successful consultants stay abreast of new regulations, products, and market dynamics. They adapt their strategies to serve their client's evolving needs best.

The Impact of a Financial Consultant

Financial consultants make a significant impact on their client's lives and financial health. They guide individuals through life's financial milestones—be it saving for education, planning for retirement, or managing wealth. For businesses, consultants can optimize financial performance through strategic planning and risk management.

Navigating Challenges

Like any career, financial consulting comes with its challenges. Economic downturns, market volatility, and evolving financial regulations can test a consultant's resilience and adaptability. Building a client base takes time and requires consistent effort in networking and reputation management.

The Road Ahead

The demand for financial consultants is expected to grow as individuals and businesses navigate the complexities of finance in an uncertain world. Embracing technology, staying informed about global economic trends, and prioritizing continuous learning are keys to a prosperous career in financial consulting.

A career as a financial consultant offers a blend of analytical challenge and personal satisfaction. By guiding clients towards financial security and prosperity, consultants play a crucial role in the economic landscape. The path to becoming a successful financial consultant involves a commitment to education, ethical practice, and a deep understanding of financial markets. With the right skills and dedication, the journey can be both rewarding and impactful.

2 notes

·

View notes

Text

A Fruitful Investment: Analyzing Apple's Stock Price

When it comes to investing in the stock market, few companies have captured the attention of both seasoned investors and newcomers quite like Apple Inc. (NASDAQ: AAPL).

The tech giant, known for its iconic products like the iPhone, iPad, and Mac, has not only revolutionized the way we live but also how we invest.

Let's take a closer look at Apple's stock price and what makes it such an appealing investment option.

Steady Growth: Apple's stock price has demonstrated impressive resilience and growth over the years. Since its IPO in 1980, the company has weathered economic storms and market fluctuations to become one of the most valuable publicly traded companies globally.

This track record of steady growth has made Apple a favorite among long-term investors.

2. Product Innovation: One of the key factors behind Apple's stock price success is its commitment to innovation. The company's ability to consistently release groundbreaking products keeps consumers coming back for more.

Whether it's the latest iPhone model or a revolutionary new service like Apple Music or the Apple Watch, innovation drives consumer demand, which in turn positively impacts stock performance.

3. Services Revenue: Apple's shift towards a services-based business model has also contributed significantly to its stock price. The App Store, Apple Music, iCloud, and other services generate a steady stream of high-margin revenue.

This diversified income stream is seen as a stabilizing force in the stock's performance.

4. Global Presence: Apple's global reach extends far beyond its Cupertino headquarters. The company's products and services are available in nearly every corner of the world.

This global presence not only ensures a wide customer base but also helps mitigate risks associated with regional economic downturns.

5. Shareholder Returns: Apple has a long history of returning value to its shareholders through dividends and stock buybacks.

These actions not only reward long-term investors but also create demand for the stock, which can drive its price higher.

Conclusion:

While past performance is not indicative of future results, Apple's stock price history paints a picture of a company that has consistently delivered value to its shareholders.

Its combination of product innovation, service revenue, global presence, and commitment to shareholders makes it a compelling choice for investors seeking long-term growth and stability.

However, as with any investment, it's essential to conduct thorough research, consider your financial goals, and consult with a financial advisor before making any investment decisions.

Apple's stock may be sweet, but it's essential to ensure it aligns with your overall investment strategy and risk tolerance.

Hope you enjoyed this small piece of information.

3 notes

·

View notes

Text

Navigating Economic Storms: Understanding and Responding to Recession in Canada

Introduction:

In the complicated world of economics, recessions are like storms on the horizon, affecting the financial well-being of people and the stability of organizations. In this blog post, we can delve into the intricacies of recession in the context of Canada, analyzing its reasons, effects, and techniques for weathering the monetary downturn.

Defining Recession in Canada:

A recession is a considerable decline in monetary pastime that lasts for an extended period. In Canada, that is measured by the valuable resource of consecutive quarters of a bad GDP boom. This economic contraction can cause mission losses, decreased client spending, and a stylish experience of financial lack of confidence.

The Causes of Recession:

An aggregate of domestic and international elements frequently brings about recessions. In Canada, shifts in global alternate patterns, fluctuations in commodity costs, and modifications in monetary policies all play a role. For instance, the 2008 financial catastrophe was driven by an international credit rating crunch reverberating through the Canadian economy. In 2023, researchers at Deloitte are among a developing chorus of economists, which consists of those at the most significant Canadian banks, watching for the monetary gadget to be successful. This is due to a mixture of things, which include the continued COVID-19 pandemic, delivery chain disruptions, and hard work shortages.

Impacts on Various Sectors:

Different sectors revel in recessions through several strategies. While industries like manufacturing and production can also face declines in production and layoffs, company-oriented sectors like healthcare and schooling will be inclined to be more resilient. For example, at some point in the 2008 recession, the housing market in Canada experienced a significant downturn, impacting the development of the organization and associated offerings. In 2023, the tight labor market and high costs can result in a profit-inflation spiral.

Government Responses and Interventions:

In reaction to recessions, governments implement several rules to stimulate financial growth and stability. These measures can encompass modifications to hobby expenses, financial stimulus applications, and targeted investments in key industries. For example, during the COVID-19 pandemic, the Canadian authorities delivered sizeable economic resource packages to guide humans and groups. In 2023, the government may want to position comparable measures to guide the financial system.

Challenges and Opportunities for Individuals and Businesses:

For human beings, recessions can supply pastime uncertainty and monetary stress. Building a diverse capacity set and preserving a solid financial plan can help mitigate economic storms. As an alternative, businesses may additionally need to pivot their strategies, innovate, and find new markets to continue existing and thriving. In 2023, companies will also need to focus on supply chain resilience and complex paintings for improvement to stay competitive.

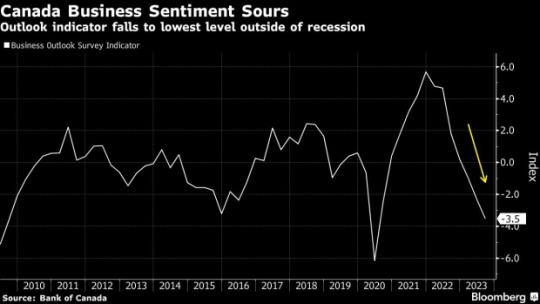

Canadian business sentiment has hit its lowest point since the 2020 Covid recession, as in line with Bank of Canada surveys. The statistics exhibits that while economic interest has slowed throughout numerous indicators, both firms and clients maintain to assume excessive inflation. Despite the slowdown, businesses are making plans greater frequent and considerable charge will increase, although hiring expectations have dipped. On the customer front, the exertions market remains considered definitely, with document-excessive expectations for salary increase. However, there's a excellent discrepancy between their perception of inflation and real figures. This standard decline in sentiment points closer to a deteriorating economic outlook, doubtlessly influencing the relevant bank's choice to maintain interest prices. The business outlook indicator fell for the 7th consecutive zone, signaling worries about slower sales increase and destiny projections. Firms also are reevaluating hiring and capital expenditure plans. The venture for policymakers lies in adjusting inflation expectations amid a cooling economy. Although corporations fear about income call for and credit, issues approximately price pressures and deliver chains are waning. Many believe that better quotes will hinder income and investments within the subsequent 12 months, and anticipate accomplishing the 2% inflation target will take longer than three years. For customers, perceptions of contemporary inflation continue to be excessive, with expectations for destiny inflation also improved. Higher fees are impacting foremost purchases, leading to a preference for discretionary spending. The Bank of Canada has maintained a consistent interest charge of five% however leaves the door open for capacity tightening inside the destiny. The next fee statement is scheduled for October twenty fifth, with September inflation information due on Tuesday.

Global Context and Interconnectedness:

Canada's monetary system is intricately related to the worldwide marketplace. Events like change tensions, geopolitical conflicts, and forex fluctuations have a proper effect on the Canadian economic machine. Recognizing those connections is essential for understanding the entire scope of a recession in Canada. In 2023, the continuing worldwide pandemic and delivery chain disruptions may also significantly impact the Canadian economy.

Conclusion:

As we navigate the complexities of a recession in Canada, staying knowledgeable and proactive is critical. By understanding the reasons, influences, and functionality techniques, individuals and groups can better prepare for financially demanding situations. Remember, even as recessions may supply turbulence, they also present model, boom, and resilience possibilities. In 2023, it's critical to stay vigilant and take proactive steps to weather the economic crisis.

2 notes

·

View notes

Text

Navigating the Storm: Bitcoin's Recent Drop and Japan's Interest Rate Hike

The cryptocurrency market has been in turmoil recently, with Bitcoin experiencing a significant drop in value. As investors scramble to understand the underlying causes, one major factor has come to light: Japan's recent decision to raise interest rates. This move has sent shockwaves through global markets, contributing to the current downturn in Bitcoin and other cryptocurrencies.

Analyzing the Causes

Japan's central bank recently raised interest rates for the first time in years, a move aimed at curbing inflation and stabilizing the economy. This decision has had a ripple effect on global financial markets, leading to increased volatility and uncertainty. Investors are reassessing their positions in riskier assets, including cryptocurrencies, leading to a sell-off that has hit Bitcoin particularly hard.

In addition to Japan's interest rate hike, other factors such as regulatory news, macroeconomic conditions, and significant events have also played a role in the market's current state. Understanding these factors can help investors navigate this challenging period.

Historical Perspective

While the current market situation may seem dire, it's important to put it into perspective. Bitcoin has experienced similar downturns in the past, often bouncing back stronger than before. Historical data shows that periods of high volatility are not uncommon and can be followed by substantial gains.

For example, in 2017, Bitcoin experienced a massive drop after reaching its then-all-time high, only to recover and reach new heights in subsequent years. This pattern of volatility followed by recovery is a hallmark of Bitcoin's market behavior.

Investor Sentiment

The current sentiment among Bitcoin investors is one of fear and uncertainty. Market downturns often lead to panic selling, further exacerbating the price drop. However, seasoned investors understand that volatility is part of the game when it comes to cryptocurrencies.

During times like these, it's crucial to remain calm and avoid making impulsive decisions based on short-term market movements. Understanding the broader market dynamics can help investors make more informed choices.

Opportunities in Adversity

As the saying goes, "When there's blood in the streets, it's the best time to buy." Downturns can present unique buying opportunities for investors. This morning, I took advantage of the lower prices and bought $200 worth of Bitcoin. Strategies like Dollar-Cost Averaging (DCA) allow investors to accumulate Bitcoin over time, reducing the impact of market volatility on their overall investment. By consistently buying at regular intervals, investors can build a position in Bitcoin without trying to time the market perfectly.

Holding through periods of volatility has historically been a successful strategy for long-term Bitcoin investors. Those who have maintained their positions during market downturns have often been rewarded when the market rebounds.

Long-Term Outlook

Despite the current downturn, the long-term potential of Bitcoin remains strong. Factors such as increasing adoption, technological advancements, and geopolitical considerations continue to support Bitcoin's growth prospects. As more institutions and individuals recognize the value of Bitcoin, its role in the global financial system is likely to expand.

Moreover, the decentralized nature of Bitcoin and its limited supply make it an attractive hedge against inflation and economic instability. These characteristics position Bitcoin as a potential store of value in the long run.

Conclusion

The recent drop in Bitcoin's value, influenced by Japan's interest rate hike and other factors, is undoubtedly concerning for investors. However, by understanding the causes and maintaining a long-term perspective, investors can navigate this challenging period more effectively. Staying informed and employing strategies like Dollar-Cost Averaging can help investors take advantage of market opportunities and build a resilient Bitcoin portfolio.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#CryptoNews#BitcoinDrop#FinancialMarket#Investment#CryptoInvesting#MarketAnalysis#JapanEconomy#InterestRates#FinancialStorm#BTC#HODL#DollarCostAveraging#CryptoOpportunities#Blockchain#EconomicTrends#DigitalCurrency#LongTermInvestment#CryptoCommunity#globaleconomy#unplugged financial#finance#financial empowerment#financial education#financial experts

3 notes

·

View notes