#how to apply for a personal loan

Explore tagged Tumblr posts

Text

How Does the Loan Application Process Differ for Government Employees?

A personal loan is a popular financial solution for individuals who need immediate funds for various expenses like medical emergencies, home renovations, weddings, education, or debt consolidation. While the loan application process remains similar for most applicants, government employees often enjoy preferential treatment due to their job stability, regular income, and lower credit risk. Banks and NBFCs (Non-Banking Financial Companies) offer special schemes and benefits exclusively for government employees, making the loan approval process smoother and more advantageous.

In this article, we will explore how the personal loan application process differs for government employees, the exclusive benefits they receive, and the key eligibility criteria lenders consider.

1. Why Do Government Employees Have an Advantage in Personal Loan Applications?

Government employees are considered low-risk borrowers due to their stable job, assured salary, and pension benefits. Financial institutions view them as trustworthy applicants, leading to faster loan approvals, lower interest rates, and higher loan amounts.

Key Advantages for Government Employees:

Job Stability: Government jobs offer lifetime employment security, reducing the risk of defaults.

Fixed Monthly Income: A guaranteed salary ensures steady repayment capacity.

Higher Loan Amounts: Due to stable earnings, government employees can qualify for larger loan amounts.

Lower Interest Rates: Banks and NBFCs provide special discounted interest rates.

Flexible Repayment Options: Some banks offer extended tenures and easy EMIs.

Pre-Approved Loan Offers: Many lenders provide pre-approved loans based on salary account history.

Due to these factors, government employees enjoy a faster and hassle-free personal loan approval process compared to private-sector employees or self-employed individuals.

2. Personal Loan Eligibility Criteria for Government Employees

Although government employees have better approval chances, they still need to meet the lender’s eligibility criteria. The general requirements include:

A. Employment Type

Banks categorize government employees into different groups, such as:

Central Government Employees (IAS, IPS, IFS officers, etc.)

State Government Employees (state-level civil servants, teachers, healthcare workers)

Public Sector Undertaking (PSU) Employees (employees of SBI, ONGC, BHEL, LIC, etc.)

Defense and Paramilitary Forces (Army, Navy, Air Force, CRPF, BSF, etc.)

Most lenders extend exclusive benefits to these categories due to higher job security and stable income.

B. Minimum Salary Requirement

Although banks offer personal loans with relaxed income criteria for government employees, they still require a minimum salary:

Metro cities: ₹25,000 - ₹30,000 per month

Non-metro cities: ₹15,000 - ₹20,000 per month

C. Age Criteria

Most lenders offer personal loans to government employees aged between 21 to 60 years. Some banks extend the upper limit to 65 years for pensionable government employees.

D. Work Experience

Minimum 1 year of continuous service in government employment.

Some lenders may require at least 6 months of salary account transactions.

E. Credit Score Requirements

A credit score of 750+ is ideal for faster loan approval and lower interest rates. However, some banks approve loans for government employees with scores as low as 650, considering their stable employment.

3. How the Loan Application Process Differs for Government Employees

The personal loan application process is similar across all applicants, but government employees enjoy certain advantages that streamline approvals.

Step 1: Choose the Right Lender Offering Special Schemes

Many banks and NBFCs have dedicated personal loan schemes for government employees with exclusive benefits such as lower interest rates and flexible repayment plans. Some top lenders offering these specialized loans include:

State Bank of India (SBI) – Xpress Credit Personal Loan

Punjab National Bank (PNB) – Personal Loan for Government Employees

HDFC Bank – Government Employee Special Loan

ICICI Bank – Instant Personal Loans for PSU Employees

Step 2: Submit Required Documents

Government employees often require fewer documents due to their verifiable salary structures. The standard documents include:

Identity Proof: Aadhaar Card, PAN Card, Voter ID

Address Proof: Utility bills, Passport, Rental Agreement

Income Proof: Latest 3-6 months’ salary slips

Employment Proof: Government-issued ID card or appointment letter

Bank Statements: Last 6 months' bank statements (for salary credit verification)

Form 16 or ITR: (Only required for higher loan amounts)

Step 3: Faster Loan Approval and Processing

Government employees often benefit from pre-approved personal loan offers, which significantly reduce processing time. Many banks process personal loan applications for government employees within 24 to 48 hours, whereas private-sector employees may have to wait longer.

Step 4: Loan Disbursal

Upon approval, the loan amount is directly credited to the borrower’s salary account. Some banks offer instant loan disbursal for government employees using digital verification methods.

4. Special Benefits for Government Employees Applying for a Personal Loan

Government employees enjoy various perks when applying for a personal loan. Here are some key benefits:

A. Lower Interest Rates

Most lenders offer discounted interest rates on personal loans for government employees, typically ranging from 8.50% to 12%, compared to 10% to 24% for private-sector employees.

B. Higher Loan Amount Eligibility

Due to a steady income, government employees can qualify for higher loan amounts, often ranging from ₹5 lakh to ₹40 lakh, depending on salary and creditworthiness.

C. Flexible Repayment Options

Some banks offer extended repayment tenures of up to 84 months, whereas private-sector employees typically get 12 to 60 months.

D. Minimal Processing Fees

Certain lenders waive off processing fees or offer discounted charges for government employees.

E. No Collateral or Guarantor Required

Government employees are generally approved for unsecured personal loans, eliminating the need for collateral or a guarantor.

5. Tips for Government Employees to Get the Best Personal Loan Offer

✅ Compare Different Banks: Check multiple lenders for the lowest interest rates and best benefits. ✅ Maintain a High Credit Score: A 750+ score can help secure the best interest rates. ✅ Opt for Digital Application: Many banks offer instant loan approval for government employees through online banking portals. ✅ Check for Pre-Approved Loan Offers: If you hold a salary account, your bank may provide special offers. ✅ Choose the Right Loan Tenure: A longer tenure reduces EMIs but increases overall interest payments. ✅ Negotiate Processing Fees: Some lenders offer discounted fees for government employees.

Conclusion

The personal loan application process is significantly easier for government employees due to their stable income, job security, and lower credit risk. Many banks and NBFCs provide exclusive benefits, such as lower interest rates, higher loan amounts, flexible tenures, and faster approvals, making government employees prime candidates for personal loans.

If you are a government employee planning to apply for a personal loan, compare different lenders, check for pre-approved offers, and choose a repayment plan that best suits your financial needs. A well-planned approach will help you secure the best loan terms while maintaining financial stability.

For more insights on personal loans and exclusive government employee benefits, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#nbfc personal loan#personal loans#loan services#finance#bank#personal loan#personal laon#personal loan for government employees#government employee loan benefits#best personal loan for govt employees#personal loan approval process#low-interest personal loan#personal loan eligibility for government employees#how to apply for a personal loan#personal loan schemes for government employees#government salary account loan offers#personal loan vs secured loan for govt employees#how government employees can get a personal loan with low interest#best banks for personal loans for government employees#personal loan eligibility criteria for PSU employees#personal loan for government teachers and defense personnel#pre-approved personal loans for government employees#does being a government employee improve personal loan approval#fastest personal loan disbursal for government workers#best loan tenure options for government employees

1 note

·

View note

Text

I'm so fucking broke. I'm on my honeymoon and I can't even buy my beloved a fucking cup of coffee or my mother a postcard. I fucking hate myself.

#into the void#i don't know what to fucking do anymore#i have applied to so many jobs and just....nothing#i just feel so useless#i wish i could afford to go back to school but i just defaulted on a school loan and i can't access my university transcript im fucked#i cant get a credit card or a loan or pay my own fucking bills#im such a pathetic burden and a dead wait#why did they marry me im feel like nothing i can ever do will make up for how much of a financial weight i am#i cant do anything right#because they do nothing but show me love and support and that im not a burden but i know it's hard for them#i know they're feeling the weight and feeling tired#i feel like ive scrambled to gain my footing for my whole life and ive never found it#personal#magpie chitters

3 notes

·

View notes

Text

“I don’t know why the op said this happened yesterday when this news is four months old”

This may shock you but it’s an election year in the US and even “the lesser evil” utilizes propaganda.

#ra speaks#personal#idk if it’s just that Time of Year already or what#but the amount of#‘WOW look what BIDEN passed !!! this is why we vote blue no matter who <3’ posts is getting nauseating#like sure vote however the fuck you want if you think it will save your own skin#but have you thought for a second. just maybe. the dems are starting ti get scared about November#and instead of idk considering NOT finding genocide they’re distracting us with shiny but impotent baubles?#‘Biden passed an executive order to have undocumented immigrants apply for citizenship in the states!’#okay why didn’t he do that four years ago. why have kids been in cages at the border for four fucking years.#use your damn braincells he’s not a saint he’s a politician trying to get enough goodwill among liberals to scrape together a win in nov.#capping inhaler and insulin prices is great! why the fuck are COVID restrictions getting more and more lax?#cracking down on industrial pollution is great! why did he start and continue pipelines in the west?#we are literally entering another lavender scare trans people are being driven out of Florida and banned in public spaces#roe v wade was overturned with little fanfare student loans remain unforgiven and oh yeah THERES A GENOCIDE TOO#by all means vote for who you want. but you’re not gonna gaslight me into believing Biden was or is a good choice.#‘lesser evil’ ‘we’ll push him left’ ‘we can’t survive trump again’#don’t talk to me about how ‘we’ won’t survive trump again while standing on the corpses of the people who didn’t survive Biden.#at least fucking acknowledge the queers and disabled and poc who died for the lesser evil you love so much.#before telling me I’m a traitor to democracy for voting for who I want to vote for (not genocider 1 or genocider 2)

4 notes

·

View notes

Text

Can’t wait for my drivers license to arrive so I can be driving legally again for the first time in 1.5 years!

#for legal reasons this is a joke#SO THIS IS WHATS UP#as a youngin#a young adult one might say#I was starting to learn that some systems are bullshit when I’d previously been a pretty big rule-follower#my mom showing me how to navigate the healthcare system a bit/showing me how student loans legit have practices to confuse and fuck us over#also im really bad at getting things in on time (this is an important fact)#so when I see that my drivers license is abt to expire. I’m like ‘Oup gotta get that done!’ then promptly forget abt it#next time I remember it’s 3 months expired.#I check the date and realize that wait! in a year imma be turning 21 and just one yr after that Real ID’s will become mandatory (im p sure)#so I decide to push off renewing my license! I think that the whole process will b annoying asf bc I’ve only dealt with the DMV in-person#and it SUCKED and took forever. I’m thinking that if I renew my drivers license right on/after my 21st birthday I can knock out two birds#with one stone: I can get it as a Real ID and I can get an updated picture that’s flipped sideways so getting age-checked is faster#little do i know: it’s v much illegal to be driving around with an expired license!#I drive around for a year (over a year? I don’t remember when I first realized it was expired) j having fun#then one month b4 my 21st birthday I get into an abroad study thing and have to get my passport. which I realize is also expired. and#realize that to renew my passport I have to have a valid drivers license. At this point I also realize how fucked I could be if I get pulled#over with my expired license. so I check out the process for DL renewal and rejoice! it’s online!#AND THANK FUCK I CHECKED THEN. bc if I had waited LITERALLY two more days I would not have been able to renew online and would’ve had to go#in-person. and there were no in-person appointments until after my 21st. and I learned in this process abt the fines my state applies when u#renew a DL late and ALSO that u have to entirely retake the test/redo all the paperwork shit if it’s expired for too long. I would’ve had to#retake the test n everything if I’d gone past my bday. I was also in another state for college. idk how incoherent these ramblings are but#basically I would’ve been Ultra Fucked. anyways! got that figured out#renewed the DL and had it sent to my home. then da house floods and crime goes up in the neighborhood and my DL ends up either being lost#Or tossed (with other flood-damaged things) or stolen.#I don’t realize this for 4 months bc I am silly. also in college out-of-state. also other reasons.#finally got around to calling DMV and telling them that my DL never arrived… 6 months after I renewed it!#and they were v sweet and are resending me my DL for free. so in the next few weeks I shall finally b driving legally again#!!!! the end#mypost

5 notes

·

View notes

Text

Look.

I have made you a chart. A very simple chart.

People say "You have to draw the line somewhere, and Biden has crossed it-" and my response is "Trump has crossed way more lines than Biden".

These categories are based off of actual policy enacted by both of these men while they were in office.

If the ONLY LINE YOU CARE ABOUT is line 12, you have an incredible amount of privilege, AND YOU DO NOT CARE ABOUT PALESTINIANS. You obviously have nothing to fear from a Trump presidency, and you do not give a fuck if a ceasefire actually occurs. You are obviously fine if your queer, disabled, and marginalized loved ones are hurt. You clearly don't care about the status of American democracy, which Trump has openly stated he plans to destroy on day 1 he is in office.

EDIT:

Ok fine, I spent 3 hours compiling sources for all of these, you can find that below the cut.

I'll give at least one link per subject area. There are of course many more sources to be read on these subject areas and no post could possibly give someone a full education on these subjects.

Biden and trans rights: https://www.hrc.org/resources/president-bidens-pro-lgbtq-timeline

Trump and trans rights: https://www.aclu.org/news/lgbtq-rights/trump-on-lgbtq-rights-rolling-back-protections-and-criminalizing-gender-nonconformity

The two sources above show how Biden has done a lot of work to promote trans rights, and how Trump did a lot of work to hurt trans rights.

Biden on abortion access: https://www.cnn.com/2022/07/08/politics/what-is-in-biden-abortion-executive-order/index.html

Trump on abortion access: https://apnews.com/article/abortion-trump-republican-presidential-election-2024-585faf025a1416d13d2fbc23da8d8637

Biden openly supports access to abortion and has taken steps to protect those rights at a federal level even after Roe v Wade was overturned. Trump, on the other hand, was the man who appointed the judges who helped overturn Roe v Wade and he openly brags about how proud he is of that decision. He also states that he believes individual states should have the final say in whether or not abortion is legal, and that he trusts them to "do the right thing", meaning he supports stronger abortion bans.

Biden on environmental reform: https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/07/fact-sheet-president-biden-restores-protections-for-three-national-monuments-and-renews-american-leadership-to-steward-lands-waters-and-cultural-resources/

Trump on environmental reform: https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks-list.html

Biden has made major steps forward for environmental reform. He has restored protections that Trump rolled back. He has enacted many executive orders and more to promote environmental protections, including rejoining the Paris Accords, which Trump withdrew the USA from. Trump is also well known for spreading conspiracy theories and lies about global climate change, calling it a "Chinese hoax".

Biden on healthcare and prescription reform: https://www.hhs.gov/about/news/2023/06/09/biden-administration-announces-savings-43-prescription-drugs-part-cost-saving-measures-president-bidens-inflation-reduction-act.html

Trump on healthcare reform: https://www.cnn.com/2024/01/07/politics/obamacare-health-insurance-ending-trump/index.html

I'm rolling healthcare and prescriptions and vaccines and public health all into one category here since they are related. Biden has lowered drug costs, expanded access to medicaid, and ACA enrollment has risen during his presidency. He has also made it so medical debt no longer applies to a person's credit score. He signed many executive orders during his first few weeks in office in order to get a handle on Trump's grievous mishandling of the COVID pandemic. Trump also wants to end the ACA. Trump is well known for refusing to wear a mask during the pandemic, encouraging the use of hydroxylchloroquine to "treat" COVID, and being openly anti-vaxx.

Biden on student loan forgiveness: https://www.ed.gov/news/press-releases/biden-harris-administration-announces-additional-77-billion-approved-student-debt-relief-160000-borrowers

Trump on student loan forgiveness: https://www.forbes.com/sites/adamminsky/2024/06/20/trump-knocks-bidens-vile-student-loan-forgiveness-plans-suggests-reversal/

Trump wants to reverse the student loan forgiveness plans Biden has enacted. Biden has already forgiven billions of dollars in loans and continues to work towards forgiving more.

Infrastructure funding:

I'm putting these links next together because they are all about infrastructure.

In general, Trump's "achievements" for infrastructure were to destroy environmental protections to speed up projects. Many of his plans were ineffective due to the fact that he did not clearly outline where the money was going to come from, and he was unwilling to raise taxes to pay for the projects. He was unable (and unwilling) to pass a bipartisan infrastructure bill during his 4 years in office. He did sign a few disaster relief bills. He did not enthusiastically promote renewable energy infrastructure. He created "Infrastructure Weeks" that the federal government then failed to fund. Trump did not do nothing for infrastructure, but his no-tax stance and his dislike for renewable energy means the contributions he made to American infrastructure were not as much as he claimed they were, nor as much as they could have been. Basically, he made a lot of promises, and delivered on very few of them. He is not "against" infrastructure, but he's certainly against funding it.

Biden was able to pass that bipartisan bill after taking office. The Bipartisan Infrastructure Plan that Trump tried to prevent from passing during Biden's term contains concrete funding sources and step by step plans to rebuild America's infrastructure. If you want to read the plan, you can find it here: https://www.whitehouse.gov/build/guidebook/. Biden has done far more for American infrastructure than Trump did, most notably by actually getting the bipartisan bill through congress.

Biden on Racial Equity: https://www.npr.org/sections/president-biden-takes-office/2021/01/26/960725707/biden-aims-to-advance-racial-equity-with-executive-actions

Trump on Racial Equity: https://www.axios.com/2024/04/01/trump-reverse-racism-civil-rights https://www.bbc.com/news/av/world-us-canada-37230916

Trump's racist policies are loud and clear for everyone to hear. We all heard him call Mexicans "Drug dealers, criminals, rapists". We all watched as he enacted travel bans on people from majority-Muslim nations. Biden, on the other hand, has done quite a lot during his term to attempt to reconcile racism in this country, including reversing Trump's "Muslim ban" the first day he was in office.

Biden on DEI: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/06/25/executive-order-on-diversity-equity-inclusion-and-accessibility-in-the-federal-workforce/

Trump on DEI: https://www.msn.com/en-us/news/politics/trump-tried-to-crush-the-dei-revolution-heres-how-he-might-finish-the-job/ar-BB1jg3gz

Biden supports DEI and has signed executive orders and passed laws that support DEI on the federal level. Trump absolutely hates DEI and wants to eradicate it.

Biden on criminal justice reform: https://time.com/6155084/biden-criminal-justice-reform/

Trump on criminal justice reform: https://www.vox.com/2020-presidential-election/21418911/donald-trump-crime-criminal-justice-policy-record https://www.theatlantic.com/politics/archive/2024/05/trumps-extreme-plans-crime/678502/

From pardons for non-violent marijuana convictions to reducing the federal government's reliance on private prisons, Biden has done a lot in four years to reform our criminal justice system on the federal level. Meanwhile, Trump has described himself as "tough on crime". He advocates for more policing, including "stop and frisk" activities. Ironically it's actually quite difficult to find sources about what Trump thinks about crime, because almost all of the search results are about his own crimes.

Biden on military support for Israel: https://www.nbcnews.com/politics/national-security/biden-obama-divide-closely-support-israel-rcna127107

Trump on military support for Israel: https://www.vox.com/politics/353037/trump-gaza-israel-protests-biden-election-2024

Biden supports Israel financially and militarily and promotes holding Israel close. So did Trump. Trump was also very pro-Israel during his time in office and even moved the embassy to Jerusalem and declared Jerusalem the capitol of Israel, a move that inflamed attitudes in the region.

Biden on a ceasefire: https://www.usatoday.com/story/news/world/2024/06/05/gaza-israel-hamas-cease-fire-plan-biden/73967659007/

Trump on a ceasefire: https://www.nbcnews.com/politics/donald-trump/trump-israel-gaza-finish-problem-rcna141905

Trump has tried to be quiet on the issue but recently said he wants Israel to "finish the problem". He of course claims he could have prevented the whole problem. Trump also openly stated after Oct 7th that he would bar immigrants who support Hamas from the country and send in officers to American protests to arrest anyone supporting Hamas.

Biden meanwhile has been quietly urging Netanyahu to accept a ceasefire deal for months, including the most recent announcement earlier in June, though it seems as though that deal has finally fallen through as well.

103K notes

·

View notes

Text

Unsecured Loan for Doctors To Support Your Practice and Dreams

As we all know, Doctors are very dedicated to caring for their patients, often putting their own needs second. Whether you're starting your own clinic, expanding medical facilities, or handling personal obligations, managing funds effectively is essential. An unsecured loan for doctors serves as an ideal financial solution to support your goals.

At Personal Loan Guru (PLG), we offer customized loan solutions customized specifically for healthcare professionals. With no collateral, fast disbursals, and flexible repayment options, doctors can now meet their financial goals without delay or stress.

What is an Unsecured Loan for Doctors?

An unsecured loan for doctors is a professional loan for doctors that does not require any collateral or security. It is specially designed to meet the financial requirements of medical professionals like general practitioners, specialists, surgeons, dentists, and others in the healthcare sector.

These doctor loans can be used for:

Setup or renovating a clinic

To Purchase advanced medical equipment

Expanding your practice or hire a new staff

Managing operational or personal expenses

Covering urgent cash flow needs

The key advantage? You don’t have to pledge any property or asset to avail funds.

Doctor Loan - Interest Rates & Benefits

Doctor Loan Interest rates are often more favorable than are lower than a regular personal loan because of a Doctor's ability to sustain repayment and their low-risk profile. At PLG, we work with multiple lending partners to offer you competitive doctor loan interest rates starting from as low as 10.5% per annum (based on your profile).

Doctor Loan Key benefits include:

Loan amounts up to ₹2 Crore (depend on your profile and CIBIL)

Repayment tenures from 12 to 96 months

Lowest ROI & Exclusive CashBack Offers

Zero collateral is required

Fast approval and disbursal within 48 hours

Minimal paperwork

Doctor Loan Eligibility Criteria

Eligibility for a professional loan for doctors is straightforward. Generally Doctor's Loan eligibility criteria include:

Nationality: Indian

Qualification: Registered medical professional (MBBS, BDS, MD, MS, BHMS, BAMS, etc.)

Experience: Minimum 1 year of post-qualification experience

Age: The Applicants age must be between 25 to 60 years

Income: Steady income and practice proof

If you meet all the above, you’re likely to qualify for a doctor loan easily.

Why Choose PLG for Your Doctor Loan?

At Personal Loan Guru, we don’t just offer loans—we offer financial solutions. Also If you'll choose a doctor loan from us you will definitely get exclusive CashBack offers and other benefits. We understand the unique challenges faced by medical professionals and ensure quick, transparent, and tailored services.

Whether you need a business loan for doctors to expand your hospital or a personal loan to meet emergency expenses, we help you choose the best option based on your income, credit score, and loan needs.

Conclusion

Managing your practice, your team, and your personal responsibilities can be overwhelming. Why let financial stress add to that? With an unsecured doctor loan, you get the freedom to fund your needs without delay or risk.So, if you're ready to manage your expenses with a doctor loan, get in touch with PLG today. Let us help you focus on what matters most—your patients—while we take care of your financing.

#doctor loan interest rates#doctor loan eligibility#professional loan for doctor#doctor loan#best loan for doctors#manage your expenses with doctor loan#personal loan for doctors interest rate#personal loans for physicians#dr loan#professional doctor loan#flexi doctor loan#Professional doctor loan in india#professional loans for doctors#professional loan for doctors#loan for doctors in india#doctor loans#doctors personal loan#special loans for doctors#loan for doctors equipment#doctors loan#loan for clinic upgrade#dr loans#how to apply for doctor loan#loan for doctor#loan for doctors#hospital loans for doctors#unsecured loan for doctors#interest rate for doctors loan#professional loan for doctors interest rate#loan doctor

0 notes

Text

Personal Loan Without Guarantor: How to Apply and Get Approved Quickly

Personal loans have become a lifeline for many individuals facing financial crunches. Whether it's for medical emergencies, home renovations, or debt consolidation, a personal loan can offer the financial relief you need. However, many people shy away from applying for a loan because they believe they need to offer collateral or a guarantor. This article will break down the process of applying for a personal loan with no guarantor or collateral, providing you with step-by-step guidance to get a Quick Approval Personal Loan without the usual requirements.

What is a Personal Loan Without a Guarantor or Collateral?

A personal loan without collateral or a guarantor is an unsecured loan. Unlike secured loans, where you need to pledge an asset (like your home or car) or get someone to co-sign, this type of loan does not require any form of security. It’s based entirely on your creditworthiness, income, and repayment capacity. For those who have limited assets or cannot rely on a guarantor, this is the perfect option.

Why Choose a Personal Loan Without Collateral or Guarantor?

No Risk to Assets: Since there’s no collateral involved, you don’t risk losing any of your valuable assets, such as your home or car.

Faster Processing: These loans typically have a quicker approval process because there’s no need for property evaluation or third-party approval.

Flexibility in Usage: Personal loans are versatile. You can use the funds for a variety of purposes, such as medical bills, travel, or home renovation.

Convenience: With the rise of digital banking, you can apply for an Online Personal Loan Application Process and get the funds disbursed to your bank account in no time.

How to Apply for a Personal Loan with No Guarantor or Collateral?

The process of applying for an unsecured personal loan is straightforward, but it’s important to understand the eligibility criteria, required documents, and the application steps.

1. Check Your Eligibility

Before applying, you need to ensure that you meet the basic eligibility criteria. Typically, lenders will check the following:

Age: Most lenders require you to be between 21 and 58 years old.

Income: A steady source of income is crucial. Lenders generally prefer individuals with a monthly income of at least ₹20,000-30,000.

Credit Score: While you don’t need collateral or a guarantor, a good credit score (750 or above) increases your chances of approval for an Instant Cash Loan Disbursal.

Employment Status: You must be either salaried or self-employed. Some lenders may have additional criteria based on your profession or employer.

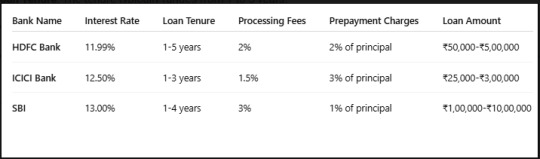

2. Compare Lenders and Loan Offers

It’s crucial to compare different personal loan offers before making a decision. Look for key features such as:

Interest Rates: Personal loans without collateral tend to have higher interest rates compared to secured loans.

Loan Tenure: The tenure typically ranges from 1 to 5 years.

Processing Fees: Some lenders charge processing fees, which could impact the total loan cost.

Prepayment Charges: In case you plan to pay off your loan early, it’s essential to check if there are any prepayment penalties.

You can use comparison tables to easily assess which lender offers the best deal for you.

3. Gather Required Documents

Though you don’t need a guarantor or collateral, you’ll still need to provide certain documents for verification:

Identity Proof: Aadhar card, passport, voter ID, or driver’s license.

Address Proof: Utility bills, Aadhar card, passport, or rental agreement.

Income Proof: Salary slips, bank statements, or IT returns (if self-employed).

Photographs: Passport-sized photos for identity verification.

4. Complete the Online Personal Loan Application Process

Many lenders now offer the ability to apply online. The Online Personal Loan Application Process is simple and quick. You’ll need to fill out an application form, upload your documents, and submit it for processing. Once your loan is processed, you’ll receive an Instant Personal Loan Approval (provided you meet the eligibility criteria).

5. Wait for Approval and Loan Disbursal

Once your application is approved, the lender will process the loan and disburse the funds into your bank account. This could take anywhere from a few hours to a couple of days, depending on the lender. With some lenders offering Fast Insta Loan Approval, you can get the money in your account within the same day or the next.

Key Factors to Consider When Applying for an Unsecured Personal Loan

Interest Rates: Be sure to understand the interest rate and how it will affect your EMIs.

Repayment Flexibility: Choose a lender that offers flexible repayment options.

Loan Limitations: Understand the maximum and minimum loan amounts.

Hidden Fees: Look for hidden fees or charges that could add up during the loan tenure.

Benefits of Taking an Instant Personal Loan with No Guarantor or Collateral

No Risk of Losing Assets: As mentioned earlier, there’s no collateral required, so you won’t risk losing valuable assets like your home or car.

Faster Access to Funds: The application process is much quicker, and many lenders offer Instant Cash Loan Disbursal, ensuring you get funds when you need them the most.

No Need for a Guarantor: You can apply independently without needing someone else to co-sign the loan, making the process more private and straightforward.

Flexible Loan Usage: Personal loans can be used for almost any purpose—medical expenses, home repairs, education fees, and more.

Quick Processing with Minimal Documentation: With minimal paperwork and quick processing times, you can have your loan approved in no time.

5 Frequently Asked Questions (FAQs)

1. Can I get a personal loan with no CIBIL score?

While having no CIBIL score may reduce your chances of approval, some lenders may still offer a personal loan without CIBIL. However, you may face higher interest rates and stricter eligibility criteria. It’s best to check with individual lenders.

2. What is the interest rate on a personal loan with no collateral?

Interest rates on unsecured personal loans are generally higher than those on secured loans. Typically, rates range from 11% to 24% depending on your credit score and the lender's policies.

3. How long does it take to get approved for an unsecured personal loan?

The approval time can vary from lender to lender, but with Fast Insta Loan Approval, you may receive approval within a few hours. Disbursement can take anywhere from a few hours to a couple of days.

4. Do I need a guarantor for a personal loan without collateral?

No, a personal loan without collateral does not require a guarantor. The loan is approved based on your creditworthiness and financial situation.

5. What if I miss a payment on my personal loan?

Missing a payment can affect your credit score negatively. Lenders may charge late payment fees, and repeated missed payments could lead to legal action or the loan being sent to collections.

In conclusion, applying for a personal loan with no guarantor or collateral is entirely possible and often a quick and convenient solution to financial challenges. By following the outlined steps, comparing lenders, and ensuring you meet eligibility requirements, you can secure the funds you need without risking your assets or involving a third party.

#Quick Approval Personal Loan#Online Personal Loan Application Process#Instant Cash Loan Disbursal#Fast Insta Loan Approval#Personal Loan with Bad Credit Score#Unsecured Personal Loan Without Income Verification#How to Apply for Personal Loan in India#Quick Online Personal Loan Approval#Fast Instant Loan Disbursement#Quick Access to Instant Loan Funds#No Income Proof Instant Loan#Unsecured Instant Loan Without CIBIL Score

0 notes

Text

Poonawalla Fincorp Launches Consumer Durables Loan Business to Strengthen Retail Expansion

In a strategic move to deepen its retail lending footprint, Poonawalla Fincorp Limited (PFL) has entered the Consumer Durables Loan segment, launching a new business vertical focused on high-frequency, point-of-sale lending. Backed by the Cyrus Poonawalla Group, the NBFC also rolled out a digital EMI card with pre-approved limits, enabling faster and more seamless financing of consumer durable…

View On WordPress

#apply for loan at Poonawalla Fincorp#EMI#finance#Fincorp#how to close Poonawalla Fincorp loan#loans#nbfc#personal loan#Poonawalla#Poonawalla Fincorp#Poonawalla Fincorp branch near me#Poonawalla Fincorp customer care#Poonawalla Fincorp EMI calculator#Poonawalla Fincorp interest rates#Poonawalla Fincorp loan eligibility#Poonawalla Fincorp loan payment online#Poonawalla Fincorp personal loan

0 notes

Text

What Are the Best Personal Loan Options for Young Professionals?

Introduction

Starting a career comes with new responsibilities and financial needs. Whether it’s relocating for a job, buying a vehicle, upgrading skills, or managing unexpected expenses, a personal loan can be a great financial tool for young professionals. With quick approvals, flexible repayment options, and competitive interest rates, personal loans help young earners manage finances without disrupting their budget.

In this guide, we will explore the best personal loan options for young professionals, eligibility criteria, application process, and smart borrowing strategies.

Why Young Professionals Need a Personal Loan?

✔️ Relocation Expenses – Moving to a new city for a job often involves rent deposits, furniture purchases, and travel expenses. ✔️ Skill Enhancement – Investing in professional certifications, online courses, and higher education boosts career growth. ✔️ Buying a Vehicle – A personal loan can help finance a bike or car for daily commuting. ✔️ Emergency Expenses – Unexpected medical bills, home repairs, or financial emergencies can arise at any time. ✔️ Debt Consolidation – Managing multiple credit card debts with a personal loan reduces financial burden and interest rates.

Top Banks & NBFCs Offering Personal Loans for Young Professionals

Young professionals can explore personal loan options from leading banks and NBFCs with competitive interest rates and minimal documentation:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

Key Features of a Personal Loan for Young Professionals

✔️ Loan Amount – Ranges from ₹50,000 to ₹25 lakhs, depending on eligibility. ✔️ Interest Rates – Competitive rates starting from 10.50% per annum. ✔️ Repayment Tenure – Flexible tenure from 12 to 60 months. ✔️ No Collateral Required – Personal loans are unsecured, meaning no assets are needed as security. ✔️ Quick Approval & Disbursal – Many lenders provide instant approval and same-day disbursal. ✔️ Minimal Documentation – Requires basic KYC documents, income proof, and employment details.

Eligibility Criteria for Young Professionals

✔️ Age – Typically 21 to 60 years. ✔️ Minimum Income – ₹15,000 to ₹25,000 per month (varies by lender). ✔️ Employment Type – Salaried employees and self-employed individuals can apply. ✔️ Credit Score – A CIBIL score of 700+ increases chances of approval. ✔️ Work Experience – Most lenders require a minimum of 6 months to 1 year of job stability.

How to Apply for a Personal Loan as a Young Professional?

Step 1: Check Your Loan Eligibility

Use an online eligibility calculator to estimate the loan amount you can avail based on your income and credit score.

Step 2: Compare Loan Offers from Multiple Lenders

Visit different lenders’ websites or loan aggregators to compare interest rates, processing fees, and EMI options.

Step 3: Gather Necessary Documents

Most banks and NBFCs require the following: ✔️ Identity Proof – Aadhaar, PAN, Passport, Voter ID ✔️ Address Proof – Utility Bill, Rental Agreement, Passport ✔️ Income Proof – Salary slips, Bank statements, ITR (for self-employed) ✔️ Employment Proof – Offer letter, Company ID card

Step 4: Submit Your Loan Application Online

Most lenders allow paperless loan applications, reducing processing time. Fill in your details, upload documents, and wait for approval.

Step 5: Receive Loan Disbursal

Once approved, the loan amount is credited to your bank account within 24-48 hours.

Smart Ways to Manage Your Personal Loan Efficiently

1. Choose the Right Loan Tenure

✔️ Shorter tenure = Higher EMI, lower total interest paid ✔️ Longer tenure = Lower EMI, higher total interest paid

2. Opt for Auto-Debit EMI Payments

✔️ Automating EMI payments prevents late fees and credit score damage.

3. Avoid Taking Multiple Loans Simultaneously

✔️ Manage your finances efficiently and prioritize essential borrowing.

4. Prepay the Loan If Possible

✔️ If you receive a bonus or salary hike, consider prepaying to reduce interest costs. ✔️ Check if your lender has zero prepayment charges.

5. Improve Your Credit Score for Better Loan Offers

✔️ Pay EMIs on time. ✔️ Avoid excessive credit utilization. ✔️ Check and correct any errors in your CIBIL report.

Common Mistakes Young Professionals Should Avoid

🚫 Borrowing More Than Needed – Stick to your financial requirements to avoid unnecessary debt. 🚫 Ignoring Loan Terms & Conditions – Always read the fine print regarding hidden fees and charges. 🚫 Missing EMI Payments – Late payments damage your credit score and attract penalties. 🚫 Choosing a Lender Without Comparison – Comparing multiple personal loan options ensures the best deal. 🚫 Not Planning for Loan Repayment – Budgeting your EMI payments prevents financial stress.

Final Thoughts: Find the Right Personal Loan for Your Needs

A personal loan is a flexible and convenient financial tool for young professionals looking to manage relocation, education, emergencies, or other expenses. Choosing the right lender, understanding loan terms, and planning EMI payments wisely can help you use a personal loan effectively without financial strain.

For the best personal loan options with low interest rates and flexible repayment plans, visit:

Apply for a Personal Loan

With the right financial decisions, young professionals can use personal loans as a stepping stone to financial stability and growth.

#personal loan#loan apps#fincrif#bank#personal loans#finance#personal loan online#nbfc personal loan#loan services#personal laon#Personal loan for young professionals#Best personal loan options#Instant personal loan approval#Low-interest personal loans#Unsecured personal loans#Personal loan for salaried employees#Best NBFC for personal loan#Personal loan without collateral#Personal loan eligibility criteria#Minimum salary for personal loan#Personal loan for job starters#How to apply for a personal loan#Top banks for personal loans#Personal loan EMI calculator#Personal loan interest rates comparison#Best personal loans for IT professionals#Quick disbursal personal loans#Flexible repayment personal loans#Personal loan tenure options#Online personal loan application

0 notes

Text

How to get a Personal Loan of 50000.

Personal loan of 50000 would be great if your need for funds could cover unexpected medical expenses, home renovations, tuition fees and debt consolidation etc. Whether you are salaried and looking for loans of up to 50000, knowing the processes and requirements are paramount in getting oneself a good deal.

What Makes You to Seek a 50000 Personal Loan?

A personal loan is considered unsecured, for which you certainly have no collateral, like your home or car. This is one reason why many people prefer such loans, given that they want access to funds without any risks. You can get 50000 personal loan for a substantial amount, which usually comes at a fixed interest rate, thus giving you the option to plan your repayments for a certain period.

Eligibility and Requirements of Loans

Most lenders consider a various of factors before granting loans up to 50000 such as creditworthiness, income, employment, and other amounts up to debts. For example, if your credit score is very good, there's a chance that your lender might even offer you even better terms, although they might deny you that great deal altogether. However, an applicant with an average credit score can also qualify for a personal loan of 50,000, albeit at a much higher rate.

Interest Rates and Loan Terms

Interest rates on 50000 personal loans vary by lender and by your creditworthiness. Generally, these loans have fixed interest rates, making monthly payments a little easier to plan. Terms for these loans are generally between 12 and 60 months, offering you several options for scheduling of repayment according to your budget.

The Procedures Linked with Applications for Personal Loans of 50000

1. Be educated about lenders: Compare the offers coming from the various banks, credit unions, and online lenders on interest rates, processing fees, and loan terms.

2. Check Credit Score: A higher credit score can help you secure a better deal on your personal loan of 50,000. If it is low, consider getting it up before applying.

3. Calculate Loan Repayment: Go to a lender's website and get a loan calculator to calculate your average monthly repayment amounts.

4. Application: After you have chosen a lender, send the documents that include proof of income, identity, and address.

5.Disbursement: Funds will be distributed into your account after approval, which usually takes a few days after applying for the 50000 personal loan.

Benefits You Will Get from 50000 Personal Loans

1. Unsecured Loan: You don't have to worry about security for loans taken, thus reducing the risk on the side of a borrower.

2. Flexibility: You will use it for medical bills, schooling, home renovations, or debt consolidation.

3. Interest Rate Fixation: Know exactly how much you will have to pay every month.

4. Quick Disbursement: Receive funds in an instant, especially when applying online.

Conclusion

A personal loan of 50000 can be a great opening to anyone needing significant financial assistance. From flexible loan terms and competitive interest rates, 50k personal loans even serve urgent financial requirements and planned expenses. By comparing options and ensuring that they meet eligibility requirements, loans up to 50000 can be an easy and effective way to achieve financial goals.

1 note

·

View note

Text

Learn How to Become LIC Agent Online and Steps to Join LIC Online!

Many individuals wonder how to Become LIC agent and what benefits they can gain from this profession. The insurance industry offers immense earning potential with commission-based income, incentives, and bonuses. If you want to become an LIC agent, taking the first step by registering and preparing for the exam can open doors to a successful career. Take action today, complete your LIC agent online registration, and step into a promising future with LIC!

To be an LIC agent, some eligibility requirements must be met. You should have passed the 12th or 10th class and be at least 18 years old, with the terms varying for rural and urban locations. Besides educational qualifications, there are some skills that can go a long way in your success as an agent. Good communication, negotiation, and interpersonal skills are the most important. Your main job as an agent will be to identify the insurance requirements of customers and provide them with suitable insurance cover.

#want to become lic agent in delhi#insuranceagent#how to join lic as an agent#how to become lic agent in delhi#agent#financial planning#insurance#how to apply for lic agent in delhi#lonas#business advisory services#business#business growth#business loan#business plan#finance#personal growth#personal loans#personal development

1 note

·

View note

Text

#Loan#Finance#Banking#Personal loan#Instant personal loan#how to get 5 lakh loan#apply for personal loan#My Mudra#Fintech company

0 notes

Text

How to Become LIC Agent | Join LIC as Agent & Apply Online Today

The job of an LIC agent is, undoubtedly, one of the finest among all occupations for those loving to associate themselves with people to help them accomplish financial goals. If you are still confused on how to become an LIC agent, this blog is a guidance to the whole process and directly speaks of major steps and advantages of this gratifying profession. How to become LIC Agent? He acts as a…

#Apply for LIC Agent#Apply Online#Become an LIC Agent#become lic agent#BecomeanLICAgent#business loans#CareerAdvice#finance#financial-planning#how to apply for lic agent#insurance#Insurance Advisor#InsuranceAgent#Join LIC as Agent#JoinLIC#lic#LIC Advisor#lic agent#lic registration online#LICAgent#LICRegistrationOnline#loans#OnlineRegistration#personal Finance

0 notes

Text

Buddy App se Loan Kaise Le | यह App 10,000 रुपये से लेकर 15 लाख रुपये तक का लोन प्रदान करता है।

Buddy App se Loan Kaise Le:आज के समय में ऑनलाइन लोन ऐप्स का चलन तेजी से बढ़ रहा है। अगर आपको अचानक पैसे की जरूरत हो और बैंकिंग प्रक्रिया लंबी हो, तो ऑनलाइन लोन ऐप्स मददगार साबित हो सकते हैं। Buddy Loan App एक ऐसी ही लोकप्रिय ऐप है, जो व्यक्तिगत लोन (Personal Loan) लेने के लिए सुविधाजनक और तेज़ विकल्प प्रदान करती है। इस लेख में, हम आपको बताएंगे कि Buddy Loan App से लोन कैसे लिया जा सकता है, इसके…

#badi app se loan kaise len#buddy app loan kaise le in hindi#buddy app se loan kaise le#buddy app se loan kaise len#buddy app se personal loan kaise le#buddy loan app se 1000 loan kaise le#buddy loan app se loan kaise le#buddy loan app se loan kaise le 2024#buddy loan app se loan kaise le 5000#buddy loan app se loan kaise le live proof#buddy loan app se personal loan kaise le#buddy loan app se student loan kaise le#happypera 2 loan review#how to apply loan in buddy loan#how to download mpokket loan app in iphone#how to get loan from buddy loan#how to get loan from buddy loan app#how to get loan from pnb one app#how to get personal loan from buddy app#how to take loan from buddy loan#instant app se loan kaise le#loan buddy app se loan kaise le

0 notes

Text

Financial needs can appear out of the blue. Having access to fast and secure financial solutions is crucial, whether it's for paying for a dream vacation, paying off debt, or covering unexpected expenses. A convenient and adaptable approach to obtain money for a variety of uses is through personal loans. We'll take you step-by-step through the loan apply online personal application process in this extensive guide, arming you with the knowledge and advice you need to proceed securely.

Understanding Personal Loans

Before diving into the application process, let's first understand what personal loans are and how they work.

What is a Personal Loan?

One kind of unsecured loan that lets people borrow money for personal use is the personal loan. Security is not needed for personal loans, unlike secured loans like financing and auto loans. Lenders, on the other hand, assess debtors according to criteria including debt-to-income ratio, income, and credit history.

How Do Personal Loans Work?

When you apply for a personal loan, the lender will assess your creditworthiness and determine the terms of the loan, including the loan amount, interest rate, and repayment period. If approved, you will receive the loan amount as a lump sum, which you must repay in fixed monthly installments over the agreed-upon term.

Steps to Apply for a Personal Loan

Now that you understand the basics of personal loans, let's explore the steps involved in applying for one.

Step 1: Assess Your Financial Situation

Spend some time evaluating your financial status prior to submitting an application for a personal loan. Calculate the monthly repayment amount that you can afford and the amount that you must borrow. Take into account elements like your income, spending, debt load, and credit score.

Step 2: Research Lenders

Once you have a clear understanding of your financial needs, research different lenders to find the best fit for your circumstances. Look for lenders that offer competitive interest rates, flexible repayment terms, and good customer service. You can compare loan options online or visit local banks and credit unions to explore your options.

Step 3: Check Your Credit Score

Your credit score plays a significant role in determining your eligibility for a personal loan and the interest rate you'll receive. Before online instant approval personal loan, check your credit score and review your credit report for any errors or inaccuracies. If your credit score is less than ideal, take steps to improve it before applying for a loan.

Step 4: Gather Required Documents

When applying for a personal loan, you'll need to provide various documents to verify your identity, income, and financial status. Commonly required documents include:

Proof of identity (such as a driver's license or passport)

Proof of income (such as pay stubs or tax returns)

Bank statements

Proof of residence

Social Security number

Gather these documents in advance to streamline the application process.

Step 5: Complete the Application

Once you have gathered all the necessary documents, you can begin the loan application process. Most lenders allow you to apply for a loan online, either through their website or mobile app. Fill out the application form with accurate and up-to-date information, including your personal details, employment information, and financial details.

Step 6: Review Loan Offers

After submitting your application, the lender will review your information and determine whether to approve your loan request. If approved, you will receive one or more loan offers outlining the terms of the loan, including the loan amount, interest rate, and repayment period. Take the time to carefully review each offer and compare them to choose the one that best fits your needs and budget.

Step 7: Accept the Loan

You must accept the loan agreement after choosing a loan offer. Make sure you understand all the terms of the loan, including the interest rate, repayment schedule, and any associated costs, by carefully reviewing the terms and conditions before signing. You consent to follow the terms and conditions specified by the lender by accepting the loan agreement.

Step 8: Receive Funds and Repay the Loan

After accepting the loan agreement, the funds will be disbursed to your bank account, usually within a few business days. Make sure to set up automatic payments or reminders to ensure you never miss a payment. Repay the loan according to the agreed-upon terms, and monitor your account regularly to track your progress.

Tips for a Successful Loan Application

Here are some additional tips to help you navigate the personal loan application process successfully:

Shop Around: Don't settle for the first loan offer you receive. Take the time to shop around and compare loan options from multiple lenders to find the best terms and interest rates.

Improve Your Credit Score: If your credit score is less than ideal, take steps to improve it before applying for a loan. Paying down debt, making timely payments, and avoiding new credit inquiries can help boost your credit score over time.

Borrow Responsibly: Only borrow what you need and can afford to repay. Avoid taking on more debt than necessary, as it can lead to financial strain in the future.

Read the Fine Print: Before accepting a loan offer, carefully review the terms and conditions, including any fees or penalties associated with the loan. Make sure you understand all the terms of the loan before signing the agreement.

Seek Assistance if Needed: If you're unsure about any aspect of the loan application process, don't hesitate to seek assistance from a financial advisor or loan officer. They can provide guidance and help you make informed decisions about borrowing.

Conclusion

If you approach the process of personal loan from online lender with beware and planning, it can be rather simple. You may improve your chances of obtaining a loan that satisfies your requirements and falls within your budget by evaluating your financial needs, researching lenders, researching your credit score, obtaining the necessary documentation, accurately filling out the application, and carefully examining loan offers. To preserve your financial stability and accomplish your objectives, always remember to borrow properly and pay your bills on time. A personal loan can be a useful instrument for reaching your financial goals and enhancing your overall financial well-being if you prepare ahead and make wise decisions.

#online instant approval personal loan#how apply personal loan#apply for online personal loan#personal loan from online lender

0 notes

Text

When applying for a personal loan, your eligibility plays a crucial role in determining whether you'll be approved and what terms you'll receive. Several factors influence your personal loan eligibility, and understanding these can help you improve your chances of getting the loan you need. In this article, we’ll explore the key factors that affect your eligibility and explain how to check personal loan eligibility effectively.

1. Credit Score

Your credit score is one of the most important factors that lenders consider when evaluating your personal loan eligibility. It reflects your creditworthiness based on your past financial behavior, including how well you've managed debts. A higher credit score generally increases your chances of loan approval and may also lead to better interest rates.

How to Improve:

Pay your bills on time to maintain a positive payment history.

Keep your credit utilization low by not maxing out your credit cards.

Regularly monitor your credit report to correct any inaccuracies.

2. Income Level

Lenders assess your income to ensure that you have the financial capacity to repay the loan. A higher income increases your personal loan eligibility because it suggests you can comfortably manage monthly payments. Additionally, lenders may require proof of stable income, such as salary slips or bank statements.

How to Improve:

Provide proof of all income sources, including any additional earnings like bonuses or freelance work.

Consider applying for a loan amount that matches your income level to avoid rejection.

3. Employment Stability

Your employment history and current job stability are significant in the personal loan eligibility check process. Lenders prefer borrowers with a stable job history, as this indicates a steady income flow. Frequent job changes or gaps in employment may lower your chances of approval.

How to Improve:

Maintain a stable job or industry for at least six months to a year before applying for a loan.

If you have recently changed jobs, provide additional documentation or a letter from your employer confirming your job security.

4. Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly income that goes towards paying existing debts. A lower DTI ratio means you have more disposable income, which positively impacts your personal loan eligibility. Lenders typically prefer a DTI ratio below 40%.

How to Improve:

Pay down existing debts before applying for a new loan.

Avoid taking on new debt until after you secure the personal loan.

Consider debt consolidation to reduce your monthly payments and lower your DTI ratio.

5. Age and Residency

Lenders may have specific age and residency requirements as part of their personal loan eligibility check. Typically, you need to be at least 21 years old and a resident of the country where you’re applying for the loan. Some lenders may also have a maximum age limit for loan applicants.

How to Improve:

Ensure you meet the age and residency criteria before applying.

Provide valid identification and proof of residence when submitting your application.

6. Loan Amount and Tenure

The loan amount and tenure you choose can also impact your personal loan eligibility. Higher loan amounts and longer tenures may require stricter eligibility criteria, as they pose more risk to the lender. Conversely, applying for a smaller loan amount with a shorter repayment period may increase your chances of approval.

How to Improve:

Assess your financial needs and apply for a loan amount that aligns with your income and repayment capacity.

Opt for a tenure that balances your ability to repay comfortably with the overall cost of the loan.

7. Existing Liabilities

If you already have outstanding loans or credit card debts, this could affect your personal loan eligibility. Lenders will consider your existing liabilities when determining your ability to take on new debt. A high level of existing debt may lead to a lower eligibility score or even rejection.

How to Improve:

Pay off some of your existing loans before applying for a new personal loan.

Consider consolidating debts to reduce your monthly financial obligations.

How to Check Personal Loan Eligibility

Before applying for a personal loan, it’s important to know how to check personal loan eligibility. Many lenders offer online tools that allow you to check your eligibility without affecting your credit score. Here’s how you can do it:

Visit the Lender’s Website: Most banks and financial institutions have an eligibility calculator on their websites.

Enter Your Details: Input your income, employment details, credit score, and desired loan amount into the calculator.

Review Your Results: The tool will provide an estimate of whether you qualify for a loan and the potential terms you might receive.

This process gives you an idea of your personal loan eligibility and helps you choose the right lender and loan product.

Conclusion

Understanding the factors that affect your personal loan eligibility can greatly improve your chances of getting approved. By maintaining a good credit score, managing your debt responsibly, and ensuring stable income and employment, you can enhance your financial profile. Don’t forget to use online tools to conduct a personal loan eligibility check before applying, so you can better prepare and increase your likelihood of approval.

#personal loan eligibility#personal loan eligibility check#how to check personal loan eligibility#apply personal loan online#quick personal loan approval

0 notes