#lic registration online

Explore tagged Tumblr posts

Text

How to Become LIC Agent | Join LIC as Agent & Apply Online Today

The job of an LIC agent is, undoubtedly, one of the finest among all occupations for those loving to associate themselves with people to help them accomplish financial goals. If you are still confused on how to become an LIC agent, this blog is a guidance to the whole process and directly speaks of major steps and advantages of this gratifying profession. How to become LIC Agent? He acts as a…

#Apply for LIC Agent#Apply Online#Become an LIC Agent#become lic agent#BecomeanLICAgent#business loans#CareerAdvice#finance#financial-planning#how to apply for lic agent#insurance#Insurance Advisor#InsuranceAgent#Join LIC as Agent#JoinLIC#lic#LIC Advisor#lic agent#lic registration online#LICAgent#LICRegistrationOnline#loans#OnlineRegistration#personal Finance

0 notes

Text

Life Insurance Corporation of India (LIC) Online Payment

https://paisainvests.com/wp-content/uploads/2024/07/lic-life-insurance-corporation-of-india-1019x573-1.webp

Understanding LIC (Life Insurance Corporation) Online Payment

The Life Insurance Corporation of India, commonly known as LIC, is one of the oldest and most trusted insurance companies in the country. Established in 1956, LIC has been offering a wide range of insurance products, including life insurance, health insurance, and pension plans. With its strong presence and extensive network, LIC continues to be a reliable choice for millions of Indians.

The Importance of Insurance

In a world full of uncertainties, having insurance is like having a safety net. It protects you and your loved ones from unexpected financial burdens due to accidents, illnesses, or even death. Insurance policies provide peace of mind, ensuring that you’re covered when life throws curveballs your way.

Why Go Online?

So, why should you consider paying your LIC premiums online? It’s all about convenience, speed, and efficiency. No more standing in long queues or dealing with paperwork. With online payments, you can pay your premiums anytime, anywhere, from the comfort of your home. Plus, it’s environmentally friendly since it reduces the need for physical receipts and documents.

LIC of India Online Payment Overview

LIC’s online payment portal is a user-friendly platform that allows policyholders to pay their premiums, check policy details, and even download premium receipts. Whether you’re tech-savvy or not, the interface is intuitive and straightforward, making it accessible for everyone.

How to Register for LIC Online Services

To start using LIC’s online services, you’ll need to register on their official website. Here’s how:

Visit the LIC India website and click on ‘New User’.

Enter your policy number, date of birth, and other required details.

Create a username and password.

Verify your details through the OTP sent to your registered mobile number.

Log in and start using the online services.

Making Your First Online Payment

Making your first online payment is a breeze. Follow these steps:

Log in to your LIC account.

Go to the ‘Premium Payment’ section.

Select the policy for which you want to make a payment.

Choose your preferred payment method and complete the transaction.

Download the receipt for your records after successful payment.

Accepted Payment Methods

LIC offers a variety of payment options to cater to different preferences. You can pay via:

Credit/Debit Cards: Visa, MasterCard, American Express, etc.

Net Banking: Most major banks are supported.

UPI: Unified Payments Interface for quick payments.

E-wallets: Popular e-wallets like Paytm, Google Pay, etc.

Benefits of Using LIC Online Payment

Opting for online payments comes with numerous benefits, such as:

Convenience: Pay from anywhere at any time.

Instant Confirmation: Immediate payment confirmation and receipt generation.

No Extra Charges: LIC doesn’t charge any extra fees for online payments.

Record Keeping: Easy access to your payment history and receipts.

Safety and Security Measures

Worried about the safety of your online transactions? LIC employs robust security measures to protect your personal and financial information. This includes secure encryption, two-factor authentication, and regular monitoring of transactions to prevent fraud.

Troubleshooting Common Issues

Sometimes, things don’t go as planned. Here are some common issues and solutions:

Payment Failure: Check your internet connection or try a different payment method.

Login Issues: Reset your password by using the ‘Forgot Password’ option.

Receipt Not Generated: Check your email or the portal’s ‘Payment History’ section.

Conclusion

LIC of India’s online payment system is a convenient and efficient way to manage your insurance policies. With its easy registration process, multiple payment options, and robust security measures, it’s a hassle-free way to stay on top of your premiums. So, why wait? Embrace the digital age and make your life easier with LIC’s online services.

By Paisainvests.com

#insurance payment online#LIC India#LIC online payment#LIC policy management#LIC registration#Life Insurance Corporation#manage LIC policies#online premium payment#pay LIC premiums online#secure payment options

0 notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below *Adhaar Address Update *Adhaar download *Adaar PVC card apply *Adhaar Update History *Adhaar Card Slot Booking *Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services * New Pan Card Apply *Pan card Corrections *Instant Pan card *Minor Pan Card *Duplicate Pan Card

4.Micro& Mini ATM Services *Cash withdrawal *Fund transfer *Cash Deposit *Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines: 1.Adhaar card photo 2.Pan Card photo 3.Phone number 4.Email Id 5.Live Location to be shared 6.2-4 Sec video Recording by holding adhaar /pan 7.Any other person reference contact number and ID proof 8.bank passbook photo 9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339 Note : Registration fees non Refundable

2 notes

·

View notes

Text

LIC Agent Online Registration & How to Join LIC of India Agent Registration

LIC agent registration is a fantastic career opportunity for those who want to build a successful career in the insurance field. LIC Agent Online Registration is a simple process by which prospective agents can start working with the Life Insurance Corporation of India. If you are looking for the process, the eligibility requirements, the skills required, and the exam process, this article will provide you with all the information about LIC agent registration.

Eligibility Criteria of LIC Agent

You must fulfill some eligibility criteria to register as LIC agent. The age limit is at least 18 years, and the candidate must have passed 10th or 12th class, depending on the location. Additionally, good communication skills, sales personality, and knowledge of financial services can be helpful to a prospective LIC agent.

Steps for LIC Agent Online Registration

Reach out to an LIC Development Officer: The first step is to reach out to an LIC development officer who will guide you through the application process.

Fill up the LIC Agent Application: You will need to complete an online application form and upload supporting documents such as proof of identity, address, and educational qualification.

Attend LIC Training: The candidates are required to undergo a mandatory training conducted by LIC. The training course covers insurance concepts, policies, salesmanship, and regulatory regulations.

Appear for the IRDAI Exam: The candidates who wish to become an LIC agent must pass the IRDAI (Insurance Regulatory and Development Authority of India) examination. The examination is a test for insurance fundamentals and regulatory policy.

Obtain LIC Agent License: After passing the exam, LIC offers an agent license so that you can begin operating as a LIC agent on a professional basis.

Skills Needed to be a Good LIC Agent

In order to be successful in this profession, one should be familiar with insurance policies and financial planning. One should be a good communicator, salesperson, and establish good relations with customers. Being self-motivated and tactfully able to win clients is also advantageous to develop your career to the next level in this industry.

Advantages of Being an LIC Agent

To become an LIC agent is a very rewarding thing with some of the benefits including flexible timings for work, there is no limit to earning, and scope to grow in terms of career. You can develop a strong customer base and good commission along with making people's financial future achievable.

Final Thoughts

The next step in your journey of LIC Agent Online Registration is the gateway to a successful and economically independent professional life. If you are willing to take a step towards this promise, proceed today and start the registration process. With proper training, knowledge, and diligence, you can develop a successful professional life as an LIC agent. Start today and establish your professional career!

#agent#want to become lic agent in delhi#career#insuranceagent#financial planning#insurance#loans#personal loans#business loans#investments#finance#home insurance#insurance policy#health insurance#insurance agent#advisor#business advisory services#lic advisor#financial advisor#how to become lic agent in delhi

0 notes

Text

Pradhan Mantri LIC Bima Sakhi Yojana 2025 | Online Registration Apply [पूरी जानकारी]

भारत सरकार द्वारा महिलाओं के सशक्तिकरण और आत्मनिर्भरता को बढ़ावा देने के लिए समय-समय पर विभिन्न योजनाओं की शुरुआत की जाती है। इसी क्रम में प्रधानमंत्री श्री नरेंद्र मोदी जी द्वारा 9 दिसंबर 2024 को LIC Bima Sakhi Yojana 2025 की शुरुआत की गई है। इस योजना के अंतर्गत ग्रामीण क्षेत्रों की महिलाओं को एलआईसी बीमा से संबंधित कार्यों में जोड़ा जाएगा, जिससे वे आर्थिक रूप से सशक्त हो सकेंगी। LIC Bima Sakhi…

0 notes

Text

SMC’s Expert Insights on LIC Login Process

SMC has thoroughly explained the LIC Login Process, helping policyholders easily navigate the LIC online portal. Whether you are a new user or an existing policyholder, their expert insights guide you through registration, login, policy management, and troubleshooting issues efficiently.

0 notes

Text

Becoming a LIC agent is the best option if you’re looking for a job that provides you with freedom, limitless earning potential, and the opportunity to truly make an impact. As an agent of LIC of India, the biggest life insurance provider in the nation, you will not only benefit from a rewarding commercial career but also contribute to the financial security of the families you provide policies to. With us, you can easily apply for LIC agent portal registration in Mumbai and successfully become LIC agent.

0 notes

Text

Get mudra loan Benefits with MSME registration

Ever wanted to get mudra loan Benefits? If you're an MSME or Micro and Small Medium Enterprises, this article is for you. With the registration process becoming more straightforward, this article will explain MSME registration with Mudra Bank.

How to get mudra loan Benefits?

Mudra loans can be used for a variety of purposes. While opting for a mudra loan, many people look forward to the benefits attached to it. With the advantages of getting a mudra loan, one can easily select their desired loan amount. Some of them are a flexible repayment schedule, quick loan processing, and an easy repayment method. If you are looking for a loan to buy your dream home or a vehicle, mudra loans are the best option. It's one of India's most popular online loan providers, working with banks to help you get rid of your financial burden and follow your dreams.

Is MSME registration required for Mudra Loan?

Were you thinking of starting a business or buying a property? Then, it is essential to ensure that you go through the registration process with msme. This way, your loan application will be processed faster, and you will easily access financing for future investments. As per the MSME registration notification, the Mudra bank gives a loan up to Rs. 10 Lakhs to the small and medium businesses within a prescribed limit of Rs. 20 million. The credit amount will be given in the form of a revolving loan, and it will be repaid with very cheap interest and principal installments.

How do I register under MSME registration?

MSMEs are required to register under msme with the Ministry of Micro, Small, and Medium Enterprises (MSME), and certain documents need to be submitted for MSME registration. The following is a rundown of what needs to be done for an MSME to be registered:-Applicant's name-Date of birth-Place of establishment-Main business activities-Authority issued by the competent authorities evidence that said the applicant would conduct the activity in question within the geographic area specified in the application.

Entrepreneurs with a vision can create a powerful brand for their company or service using the MSME platform. You can get a loan for your Business monitoring with MSME registration. MSME registration is one of the quickest and simplest ways to get a loan. You have to register yourself as an individual or company, and you are good to go!

What are the benefits of MSME registration?

Msme registration is registering a manufacturing company with the Ministry of Small and Medium Enterprise Development (MSMED). The primary benefit of MSME registration is that it can help you avail of loans from various banks such as SBI, UCO Bank, IDBI Bank, LIC, etc.

Registration with the MSME is mandatory for those who are not already registered. The benefits of MSME registration include any document issued by the ministry, a list of members, a copy of their membership card, and the opportunity to receive an MSME loan for their business startups with cheap interest, ie... a mudra loan.

Conclusion

Mudra loans are an excellent solution for everyone having a hard time getting a loan from banks. People have been searching for ways to manage their debt and spend less, which is why there has been an increase in the number of people who apply for mudra loans. Mudras are beneficial because they allow people to reduce their loan repayment amount and make payments in installments instead of all-inclusive financers. The Mudra loan is a good option for you to get the benefits of Mudra loan as a short-term loan. Moreover, you will be given a loan as per your eligibility. Finding a loan for MSME is not an easy task. There are many benefits to the loan, with low-interest rates and quick disbursement of funds.

Mudra loan Benefits : The Mudra loan is a unique loan facility offered by MSME Finance to its member MSMEs. It provides finance for the purchase or setup of capital assets/innovations, enabling the business to grow and contribute to national GDP. In addition, the facility fosters an innovative culture in industries by providing loans for projects that may not be bankable in the ordinary course.

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update

0 notes

Text

LIC Agent Benefits

LIC stands for Life Insurance Company. It is an excellent company and has its branches all over. They offer amazing remuneration and other benefits to all the people who work with them i.e. The LIC agent benefits. One such post is of a LIC Agent. LIC agent benefits are enormous. As a LIC agent, you can help people fulfil their financial goals realizing their dreams. It is one of the most rewarding careers. Now the most important question arises, what benefits will you be getting if you take the LIC policy? First of all, it’s one of the most trusted and safe companies among all the ones that are present in the market for the sole purpose of life insurance.

The benefits for you, include

Death Benefits

2. Maturity Benefits

3. Surrender Value

4. Special Surrender Value

5. Supplementary/Extra Benefits

And many more which of course are not possible for us to list here. Now that we have listed the benefits for people who take it, let’s also discuss the benefits for people who give it to us i.e., THE LIC AGENT BENEFITS.

LIC Agent Benefits include

Retirement Benefits 2. Increasing Income 3. Bonus Commission 4. Hereditary Income 5. Guaranteed Income And they too have many more other benefits. Apply for the post online through: http://www.belicagent.com The website has all the necessary things you will need to know for the LIC agent process, such as mock tests, participation registration, etc. The LIC agent application process has been made easy with this as now it can be done in the comfort of your house and just a few clicks.

OFFICAL WEBSITE : http://www.belicagent.com

PAGE WEBSITE : https://www.belicagent.com/lic-agent-benefits/

0 notes

Text

How to Join LIC Online Career & Skills for LIC Agent Registration

It is a fantastic career choice for those who want to achieve financial success and professional growth. If you are keen to learn about becoming an LIC agent online, it is easier now with the advent of the digital revolution. Becoming an LIC agent can make you earn boundless income, be your own boss, and enable people to secure their future through life insurance. To begin a career, learning about the LIC agent application procedure, educational qualifications, skills, and eligibility is crucial. If you are willing to work as an LIC agent, obtaining information regarding the online registration procedure is the foundation of a successful career.

Why Become an LIC Agent?

LIC (Life Insurance Corporation of India) is the topmost and most reliable insurance firm in India. It provides convenient working hours, good commission rates, and financial freedom. If you desire a high growth career, you can learn how to become an LIC agent online and create a lot of opportunities. LIC agent registration has become online nowadays, and it is simple to apply and begin your career without trouble.

Education & Skills Required

To be an agent in LIC, you must fulfill some minimum education and skill criteria. The applicants must have passed at least the 10th or 12th standard, depending on the region. Good communication skills, persuasion skills, and networking skills are required to excel in this career. Knowledge of insurance policies and financial planning methods will also help you build a successful career as an LIC agent.

LIC Agent Online Registration Procedure

Official Website Visit: Begin your LIC agent application procedure by visiting the official website of LIC of India and looking for the agent registration link.

Application Form Submission: Fill in the online application form with proper information, like your education and personal details.

Interview: After submitting your application, you may be contacted for an interview with an LIC Development Officer.

Complete Training: LIC offers a 25-hour training course on insurance principles, marketing, and policy details, which is compulsory to complete.

Take the IRDA Exam: IRDA exam is compulsory. You need to pass this exam in order to receive your official LIC agent license.

Begin Your Career: After clearing the exam, you will be given an LIC agent ID, and you can begin selling insurance policies and making commissions.

Benefits of Being an LIC Agent

Flexible work timings

No limit on earning potential

Reasonable rate of commission

Great appreciation and reward for superior performance

Career growth opportunities in future The procedure for registration is easy, and with the right education and training, you can build a successful career in the insurance sector. Start today by applying for your LIC agent and begin the journey towards independence!

#want to become lic agent in delhi#how to apply for lic agent in delhi#agent#insuranceagent#financial planning#insurance#career#join us#loans#personal loans#personal development#personal growth#lic advisor#insurance advisor#financial advisor#opportunities#business advisory services

0 notes

Link

1 note

·

View note

Text

अब बस मिनटों में चेक करें Online LIC Policy Status

अब बस मिनटों में चेक करें Online LIC Policy Status

Online LIC Policy Status : भारतीय जीवन बीमा निगम या LIC Policy भारत में एक लोकप्रिय कंपनी है जब बीमा और नीतियों की बात आती है तो LIC Policy के कार्यालय पूरे भारत में प्रमुख शहरों और कस्बों में स्थित है। LIC Policy ज्यादातर भारतीय घरों में बीमा का पर्याय बन गया है। LIC Policy के पास 300 मिलियन से अधिक पॉलिसीधारक होने का अनुमान है, कंपनी को धारकों से प्रीमियम के भुगतान के लिए भारत के सभी कोनों में…

View On WordPress

#best lic policy#best lic policy 2022#best policy#check lic policy#check lic policy status#check lic policy status online#e shram card self registration#how to check lic policy online#how to check lic policy status#how to check lic policy status online#how to check lic policy status online 2020#how to pay lic premium online#lic account balance kaise check kare#lic account kaise create kare#lic account phone me kaise dekhe#lic account policy#lic costumer portal registration#lic kanyadan policy#lic mobile se kaise check karte hai#lic new policy#lic new user registration#lic online pay kaise karte hai#lic online registration#lic polacy#lic policy#lic policy bonus online#lic policy check kaise kare#lic policy check kaise kare online#lic policy kaise check kare#lic policy kya hai

0 notes

Text

Welcome to the official platform for LIC Agent Portal Registration in Navi Mumbai. As a trusted LIC agent training provider in Mumbai, we help aspiring individuals become authorized life insurance advisors for LIC India. We provide assistance in LIC agent recruitment and LIC agent registration in India. We also offer IRDA-approved LIC online training programs and guidance to help you excel as an LIC agent. LIC (Life Insurance Corporation) is a pioneer in the insurance sector, recognized for its reliability and vast network of policyholders and agents. We are one of the best LIC agency in Mumbai specializing in insurance consultancy and wealth management services, covering LIC of India plans and policies such as LIC life insurance policy, Health Insurance, Pension Plans, Term Plans, and more. Whether you’re looking for a LIC agent part time job/work near me or a full-time hustle, LIC offers opportunities for everyone. Contact us to gain the skills, certification, and LIC agent licence to build a successful LIC agent career and achieve financial independence. Your journey to success starts here!

1 note

·

View note

Text

LIC Agent Kaise Bane LIC Kya Hai Ki Puri Jankari Hindi Me

LIC Agent Kaise Bane LIC Kya Hai Ki Puri Jankari Hindi Me

LIC Agent Kaise Bane LIC Agent Kaise Bane LIC Kya Ha आज हम बात करेंगे LIC Agent kya Hota हैं और LIC Agent Kaise Bane. अगर आप भी एक ऐसे जॉब की तलाश में हैं जिसे आप अपनी मर्जी से अपने समय में एक Part Time Job या Full Time Job के रूप में काम करके पैसा कमा सके तो आज हम उसी जॉब की बात करेंगे। आपने LIC का नाम जीवन म���ं कई बार सुना ही होगा खास तौर पर टेलीविजन में विज्ञापन के रूप में। इसके साथ ही आपके…

View On WordPress

#Best LIC Plans#LIC Agent Benefits#LIC Agent Eligibility#LIC Agent Kaise Bane#LIC Agent Recruitment Online Registration#LIC Agent Salary#LIC Full Form#LIC Kya Hai#Part Time Job

0 notes

Photo

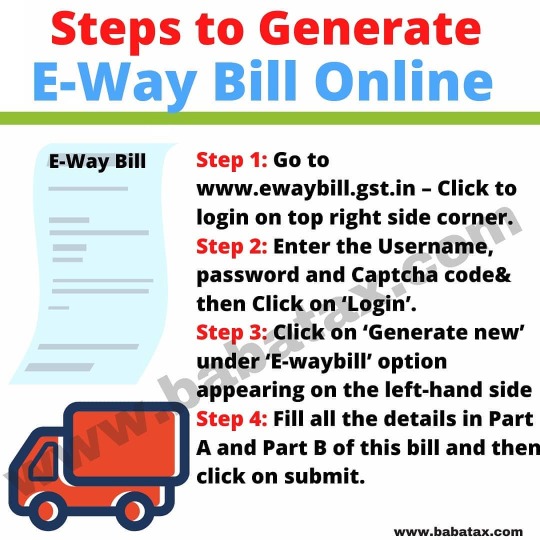

Like ❤️, Comment your Question 👇 & Share with your Friends 💯 Website Link: 👉http://www.babatax.com 👉http://www.update.babatax.com Follow 👉@baba_tax 👈 to get Full updates on GST, Income Tax and Finance🙌 Get smarter day by day!💯 ➖➖➖➖➖➖➖➖➖ ⚡@baba_tax 🔥 @baba_tax ⚡ ⚡@baba_tax 🔥 @baba_tax ⚡ 〰️〰️〰️〰️〰️〰️〰️〰️〰️ . . #gst #incometax #taxconsultant #financialfreedom #finance #lic #nse #incometips #stockmarketnews #bank #financetips #commerce #investment #government #online #income #registration #june #transport #ewaybill #eway https://www.instagram.com/p/CQigF9sL56n/?utm_medium=tumblr

#gst#incometax#taxconsultant#financialfreedom#finance#lic#nse#incometips#stockmarketnews#bank#financetips#commerce#investment#government#online#income#registration#june#transport#ewaybill#eway

0 notes

Text

പ്രധാന്മന്ത്രി ശ്രാം യോഗി മാന് ധന് യോജന

പ്രധാന്മന്ത്രി ശ്രാം യോഗി മാന് ധന് യോജന

അസംഘടിത മേഖലയിലെ തൊഴിലാളികള്ക്ക് പ്രതിമാസം 3000 രൂപ പെന്ഷന് നല്കുന്ന പദ്ധതിയാണ് പ്രധാന്മന്ത്രി ശ്രാം യോഗി മാന് ധന് യോജന. തൊഴിലാളികള്ക്ക് 60 വയസ്സാകുമ്പോഴാണ് പെന്ഷന് ലഭിച്ചുതുടങ്ങുക.പ്രതിമാസ വരുമാനം 15,000 രൂപയോ അതില് താഴെയോ ഉളളവരെയാണ് പദ്ധതിയില് ചേര്ത്തുക. 18നും 40നും ഇടയില് പ്രായമുള്ളവരുമാകണം.ആദായ നികുതി അടയ്ക്കുന്നവരോ മറ്റ് പെന്ഷന് പദ്ധതികളായ എന്പിഎസ്, ഇസ്ഐ, ഇപിഎഫ് തുടങ്ങിയ…

View On WordPress

#pm-sym pension scheme in hindi#pmkmy csccloud#pmsym card download pdf#pmsym chart#pmsym lic#pradhan mantri maan-dhan yojana online apply#pradhan mantri maan-dhan yojana registration#shram yogi mandhan yojana online registration

0 notes