#financialgoal

Explore tagged Tumblr posts

Text

Video: Things I do January 1st

his video is about some actions to help with #taxes, #financialgoal and #Budget for the #2024 and #2025 calendar years. With the #NewYear having come and gone, I thought I would share some things that I did on #January 1st of 2025, and what the state of my #finances is. I look at my #networth, budget, total #dividends, #taxbrackets, #compare my #investing prowess against the #benchmark, show my…

View On WordPress

#2024#administrative#benchmark#Budget#compare#dividends#ETFs#fees#finances#financialgoal#goals#investing#January#mutualfunds#networth#NewYear#planning#portfolio#rebalancing#SMART#taxbrackets#taxes#tfsa#yearend

0 notes

Text

youtube

#financial#millionaire#money#personal finance#wealth#WealthSecrets#MoneyTips#FinancialFreedom#Investing#insurance#MoneyManagement#finance#Wealth#Money#PassiveIncome#SmartInvesting#FinancialEducation#FinancialGoals#sidehustle#WealthCreation#Youtube

2 notes

·

View notes

Text

Financial Self-Improvement: Empower Yourself with Smart Money Habits

Step 1: Start With a Financial Assessment

Just like you would begin a fitness journey by assessing your current health, financial self-improvement starts with evaluating your financial situation. This means taking a good look at your income, expenses, debts, and savings. Ask yourself:

How much debt do I have, and what is my plan to pay it off?

Am I living within my means or relying on credit?

Do I have an emergency fund in place?

What are my long-term financial goals?

This honest assessment will give you a clear picture of where you are now and what you need to work on.

Step 2: Set Clear, Achievable Financial Goals

Without a destination, it's hard to make progress. Setting clear financial goals provides direction and motivation. Whether you want to pay off debt, save for a home, or invest in your future, defining these goals will guide your financial decisions.

Break down your goals into short-term (6 months to 1 year), medium-term (1 to 5 years), and long-term (5 years or more) objectives. For example, paying off high-interest debt might be a short-term goal, while investing for retirement could be a long-term objective.

Step 3: Budgeting—The Foundation of Financial Success

Budgeting is a key habit that separates financial success from financial stress. By creating and sticking to a budget, you ensure that your money is working for you, not the other way around. Start by listing all sources of income and tracking your expenses. Prioritize essentials, cut unnecessary spending, and allocate funds for savings and investments.

Budgeting also opens your eyes to "money leaks"—areas where you could be overspending without realizing it. Use budgeting apps or a simple spreadsheet to track your spending and hold yourself accountable.

Step 4: Build a Healthy Relationship with Money

A lot of financial self-improvement is about mindset. Cultivate a healthy relationship with money by understanding its true value. Money is a tool to provide security, freedom, and opportunity, not something to be feared or revered.

Focus on the psychology of money and work to break any negative patterns or habits, such as impulse buying or treating credit as an extension of your income. Mindful spending and saving will strengthen your financial resilience.

Step 5: Educate Yourself

The financial world is always evolving, and knowledge is power. Take time to educate yourself about personal finance, investing, and how money works. Whether you choose books, podcasts, blogs, or online courses, staying informed empowers you to make smarter decisions.

Step 6: Develop an Investment Strategy

Financial self-improvement isn’t just about saving; it’s also about growing your wealth through smart investing. Start by learning the basics of investing, including the power of compound interest, risk management, and diversification. Explore low-cost index funds, real estate, or even Bitcoin, depending on your risk tolerance and goals.

A common and effective strategy is Dollar-Cost Averaging (DCA)—investing a fixed amount of money at regular intervals, regardless of market conditions. This helps smooth out the impact of market volatility and builds wealth over time.

Step 7: Stay Consistent and Adapt

Consistency is the cornerstone of self-improvement. Whether it’s following a budget, investing regularly, or learning more about personal finance, progress takes time. Stay the course, and remember that financial improvement is a marathon, not a sprint.

At the same time, be flexible and willing to adapt. Life is unpredictable, and your financial strategy may need to change as your circumstances evolve. The key is to remain proactive and adjust your approach when necessary.

Conclusion: Financial Self-Improvement as a Lifelong Journey

Financial self-improvement is about more than just building wealth—it's about taking control of your life and creating a foundation for long-term success. By setting goals, developing smart money habits, and continually educating yourself, you can achieve the financial freedom that allows you to live life on your terms.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#FinancialSelfImprovement#PersonalFinance#MoneyManagement#Budgeting#FinancialFreedom#WealthBuilding#InvestingTips#SmartMoney#FinancialGoals#SelfImprovement#FinancialEducation#GrowYourWealth#InvestInYourself#Bitcoin#FinancialMindset#financial experts#blockchain#digitalcurrency#globaleconomy#unplugged financial#financial empowerment#cryptocurrency#financial education#finance

3 notes

·

View notes

Text

Hello Entrepreneur!

I want to share with you something that I think will be of great interest to you. I am participating in a project called Emprende World and I am getting excellent results in a very short time. The main feature is that you can earn income constantly 24 hours a day, 7 days a week. Even while you sleep!!! I am already achieving it!!! I would like you to be part of my team. The income costs only $2 dollars, which you recover almost immediately and after this you continue receiving a lot of money!

Participating in this project has the following advantages:

- 100% of the Money that Circulates is distributed among the users

- You receive payments of $2 to $120 dollars for each referral in 7 Levels

- The payments are reflected directly in your Emprende World account and you can withdraw it whenever you want!

If you are interested, please contact me and I will give you more details, or if you want to have first-hand information, copy the following link and paste it into the address bar of your browser:

https://www.emprendeworld.com/?ref=20680416

Regards,

Anilberto Villalobos

#passiveincome#onlinebusinesstips#onlinebusiness#makemoneyonline#sidehustle#financial#financialfreedom#entrepreneur#entreprenuership#entreprenuerlife#digitalmarketing#makemoneyfromhome#workfromhome#financialgoals#investing#businessopportunity

2 notes

·

View notes

Video

youtube

Avoid Money Mistakes: Learn Financial Literacy Basics

#youtube#FinancialLiteracy FinancialSuccess MoneyManagement FinancialEducation DebtFree FinancialGoals FinancialStability PersonalFinance FinancialIn

2 notes

·

View notes

Text

How to Save Money with a Tight Budget!!!

Wallet feeling lighter than a feather? Don't worry, fam! We're all about saving smart, not living like a broke student (again). Share your budgeting hacks, score deals like a pro, and ditch sneaky spending habits in the comments! Let's turn #SquadGoals into #SavingsGoals!

Saving Money Responsibly

Pay yourself first

Avoid accumulating new debt

Set reasonable savings goals

Establish a time frame for your goals

Keep a budget

Record your expenses

Double-check all payment amounts

Start saving as early as possible

Consider contributing to a retirement account

Make stock market investments cautiously

Don't get discouraged

Chopping Your Expenses

Remove luxuries from your budget

Find cheaper housing

Eat for cheap.

Reduce your energy usage.

Use cheaper forms of transportation

Have fun for cheap (or free)

Avoid expensive addictions.

Spending Money Brilliantly

Spend money on absolute essentials first

Save for an emergency fund

Pay off your debt

Put away money next

Spend on smart non-essentials

Spend on luxuries last

#finance#money#investing#business#economy#budgeting#debtfree#financialliteracy#financialfreedom#personalfinance#sidehustle#passiveincome#fintwit#financialgoals#millennialmoney

3 notes

·

View notes

Text

For Vietnamese and Chinese versions, please check out: https://ngocnga.net/positive-thinking/?utm_source=tumblr&utm_medium=social&utm_campaign=quote 💰💸🤞 If life is going to hit a wall, I hope it's a wall of money. // Rúguǒ rénshēng yào pèngbì, wǒ xīwàng shì rénmínbì.

#MoneyMatters#FinancialGoals#PositiveThinking#1quotein3languages#chineselanguage#learnchinese#learnmandarin#studychinese#chinesewords#putonghua#weibo#chinese#mandarin#pinyin#quotes#quote

2 notes

·

View notes

Text

Video: Things To Do before Year End 2023

This video is about some actions to help with #taxes, #financialgoal and #Budget for the #2024 calendar year. Visit: http://www.canadianmoneytalk.caThe Advanced Investing: Stock Analysis Course is at http://canadianmoneytalk.ca/advanced-investing-stock-analysis-course/The Investing & Personal Finance Basics course is at https://canadianmoneytalk.ca/investing-personal-finance-basics-course/

View On WordPress

0 notes

Text

Mastering Your Finances: A Step-by-Step Guide on How to Create a Budget

Creating a budget is a foundational step towards achieving financial stability and realizing your financial goals. Whether you’re aiming to save for a major purchase, pay off debt, or simply gain better control over your finances, a well-crafted budget is an invaluable tool. This comprehensive guide will take you through the essential steps on how to create a budget, empowering you to make informed financial decisions and secure a more secure financial future.

How to Create a Budget?

1. Set Clear Financial Goals

Before diving into the budgeting process, define your financial goals. Whether it’s building an emergency fund, saving for a vacation, or paying off student loans, having specific and measurable goals will guide your budgeting decisions.

2. Gather Financial Information

Collect information about your income, expenses, and debts. Compile pay stubs, bank statements, bills, and any other relevant financial documents. This step provides a comprehensive overview of your financial situation.

3. Categorize Your Expenses

Divide your expenses into fixed and variable categories. Fixed expenses, such as rent or mortgage payments and insurance, remain consistent each month. Variable expenses, like groceries and entertainment, can fluctuate. Categorizing expenses helps identify areas for potential savings.

4. Calculate Your Monthly Income

Determine your total monthly income, including salary, bonuses, freelance income, or any other sources of income. Understanding your monthly income is crucial for establishing a realistic budget.

5. List Your Fixed Expenses:

Write down all fixed expenses, such as rent or mortgage, utilities, insurance, and loan payments. These are recurring costs that remain relatively constant each month.

6. Identify Variable Expenses

Make a list of variable expenses, including groceries, dining out, entertainment, and transportation. Variable expenses can be adjusted based on your financial goals and priorities.

7. Include Savings and Debt Repayment

Prioritize saving and debt repayment in your budget. Allocate a portion of your income to an emergency fund, or retirement savings, and pay off outstanding debts. Treating savings as a non-negotiable expense ensures consistent progress toward financial goals.

8. Factor in Irregular Expenses

Account for irregular or annual expenses, such as insurance premiums, property taxes, or holiday spending. Divide these expenses by 12 to incorporate them into your monthly budget, preventing unexpected financial strain.

9. Subtract Expenses from Income

To better understand how to create a budget, subtract your total expenses from your total income. The result should ideally be a positive number, indicating that your income covers all your expenses. If the result is negative, adjustments may be needed to align your budget with your income.

10. Adjust and Prioritize

If your expenses exceed your income, revisit your budget and identify areas where you can cut back. Prioritize essential expenses and savings goals while minimizing non-essential spending. Adjusting your budget ensures financial sustainability.

11. Embrace the 50/30/20 Rule

Consider following the 50/30/20 rule, where 50% of your income goes to needs (housing, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This rule provides a simple guideline for balanced budgeting.

12. Use Budgeting Tools

Leverage technology to simplify budgeting. Numerous apps and online tools can help you track spending, set financial goals, and visualize your budget in real-time. Choose a tool that aligns with your preferences and makes budgeting more accessible.

13. Track and Review Regularly

Budgeting is an ongoing process, and the answer to “how to create a budget” might differ from person to person. Regularly track your spending against your budget, making adjustments as needed. Reviewing your budget ensures that it remains aligned with your financial goals and adapts to changes in your income or expenses.

14. Emergency Fund Planning

Prioritize building and maintaining an emergency fund within your budget. Having a financial safety net provides peace of mind and protects against unexpected expenses.

15. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. Financial advisors can offer personalized guidance to help you achieve your financial objectives.

16. Mindful Spending Habits

Cultivate mindful spending habits as a key aspect of budgeting. Regularly assess your discretionary expenses and identify areas where you can make conscious choices to reduce unnecessary spending. This might include packing lunch instead of dining out or opting for cost-effective entertainment options.

17. Cash Flow Management

Effective budgeting involves managing cash flow strategically. Ensure that you have sufficient funds available for essential expenses and prioritize payment of bills to avoid late fees. Understanding your cash flow cycle helps prevent financial stress and keeps your budget on track.

18. Automate Savings Contributions

Simplify your savings strategy by automating contributions to savings accounts. Setting up automatic transfers ensures that a portion of your income is consistently directed towards savings goals, reinforcing the habit of saving.

19. Celebrate Financial Milestones

Acknowledge and celebrate financial milestones within your budget. Whether it’s reaching a savings goal, paying off a significant portion of debt, or achieving a specific financial target, celebrating successes reinforces positive financial habits and motivates continued progress.

20. Financial Education and Literacy

Invest time in expanding your financial education. Understanding financial principles, investment options, and economic trends empowers you to make informed decisions. Numerous resources, including books, online courses, and workshops, can enhance your financial literacy and contribute to long-term financial success.

Conclusion

Knowing how to create a budget is a fundamental step toward financial empowerment and security. By following these comprehensive steps, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a dynamic process that evolves with your financial journey, so stay committed, stay flexible, and enjoy the benefits of financial well-being.

#BudgetingTips#moneymanagement#SmartSpending#financialwellness#moneymatters#financialliteracy#financialgoals#MoneySmart#wealthbuilding

2 notes

·

View notes

Text

Tax-Smart Strategies: Goviin Bookkeeping's Commitment to Your Financial Goals

Step into the dynamic realm of Goviin Bookkeeping, where financial expertise meets innovation in the heart of the UAE! Thrilled to be your financial ally, we're dedicated to offering a spectrum of cutting-edge financial services, placing a spotlight on the unparalleled Bookkeeping Services in Dubai.

We take immense pride in transcending the role of mere number crunchers. Consider us your devoted partners in navigating the intricate world of finances. Whether you're a blossoming start-up seeking establishment or a seasoned business refining its processes, rest assured, we've got your back!

Our services extend far beyond the conventional. From Specialized Bookkeeping Services in Dubai to FTA Services, Tax Preparation, and assistance with UAE Free Zone Company Formation – think of us as your comprehensive one-stop-shop for all things finance. We're not just here to balance the books; we're here to harmonize your business for unparalleled success.

In the fast-paced landscape of business, we comprehend the daily challenges you encounter. Hence, Goviin Bookkeeping is here to assist you in establishing, implementing, and tracking your financial goals. With us by your side, you can unlock your business's full potential, turning obstacles into stepping stones toward triumph.

We're not just financial experts; we're your tax-smart partners. Our mission is to tailor solutions that not only meet but surpass your expectations. Envision us as your financial strategists, skilfully minimizing tax burdens, optimizing the advantages of accessible Pro Services, and pinpointing opportunities that propel your business towards growth.

Trust is the cornerstone of our client relationships. Opting for Goviin Bookkeeping means choosing reliability and excellence. Propel your business towards greater success with our team of qualified financial experts. Your financial journey is on the verge of becoming remarkably smoother.

In the dynamic landscape of business, selecting the right financial partner is paramount. Choose Goviin Bookkeeping for the Pinnacle Bookkeeping Services in Dubai – where financial triumph takes its first step!

#GoviinBookkeeping#DubaiFinance#BusinessSuccess#BookkeepingServices#FinancialExcellence#TaxSmartPartners#UAEFreeZone#ProServices#FinancialGoals#BusinessTriumph#InnovationInFinance

5 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

6 notes

·

View notes

Text

The Importance of Budgeting Properly to Invest in Yourself: The Only Way to Get Ahead

In the intricate dance of life and finance, there is a fundamental principle that remains consistently true: the key to getting ahead lies in how well you invest in yourself. This investment, however, requires a robust foundation built on prudent budgeting. Imagine the power of taking control of your financial destiny, ensuring that every dollar you earn is a soldier in your army, marching towards a future of personal and professional fulfillment.

Understanding Budgeting

At its core, budgeting is the art and science of creating a plan to spend your money. This isn't merely about restricting your spending or living within your means—it's about having a clear, strategic vision of where your money should go to serve your greatest interests. A well-structured budget acts as both a shield and a sword; it protects you from financial pitfalls and empowers you to seize opportunities for growth and development.

Why Budgeting is Crucial for Personal Investment

Budgeting is the cornerstone of financial stability. Without a budget, it’s easy to fall into the trap of living paycheck to paycheck, never truly understanding where your money goes. This lack of awareness can stymie your ability to invest in yourself. On the other hand, a meticulously crafted budget illuminates your financial landscape, highlighting areas where you can reduce unnecessary expenses and redirect those funds towards meaningful personal investments. For instance, you might discover that by cutting back on daily coffee runs, you can afford an online course that could propel your career forward.

Steps to Create an Effective Budget

Creating an effective budget begins with an honest assessment of your current financial situation. Start by listing all sources of income and meticulously tracking every expense for a month. This exercise will provide a clear picture of your spending habits. Once you have this data, categorize your expenses into essentials (like rent, groceries, and utilities) and non-essentials (like dining out and entertainment). This categorization will help you identify potential savings.

With a clear understanding of your financial inflows and outflows, set realistic financial goals. These goals should include both short-term targets, such as saving for a professional development course, and long-term aspirations, like building a retirement fund. Tracking your expenses becomes crucial at this stage, as it ensures you stay aligned with your goals.

Allocating Funds for Personal Investment

Once you’ve identified areas to cut back on, it’s time to allocate funds towards investing in yourself. This might mean enrolling in a course to acquire new skills, investing in your health through a gym membership, or dedicating time and money to a hobby that brings you joy and fulfillment. Each of these investments contributes to your overall well-being and enhances your capacity to achieve long-term success.

Areas to Invest In Yourself

Investing in education and skills development can yield substantial returns. In our rapidly evolving world, continuous learning is indispensable. Consider the story of Jane, a software developer who, through meticulous budgeting, managed to allocate funds towards obtaining certifications in her field. These new skills not only made her more competent but also opened doors to career advancement and salary increases.

Health and wellness are equally critical areas for personal investment. Your physical and mental health form the bedrock upon which all other achievements are built. Allocating resources towards maintaining a healthy lifestyle—whether through a fitness regimen, nutritious diet, or mindfulness practices—ensures that you have the energy and resilience needed to pursue your goals.

Moreover, investing in personal hobbies and passions can be profoundly rewarding. These activities not only provide a much-needed respite from the daily grind but can also become additional streams of income or significant contributors to your personal growth.

Case Studies and Real-Life Examples

Consider Mike, an accountant who found his passion in photography. Through diligent budgeting, he was able to save enough to purchase a high-quality camera and attend photography workshops. What started as a hobby soon became a lucrative side business, bringing both financial rewards and personal satisfaction.

Then there's Sarah, who used to spend a considerable amount on non-essential items. By reassessing her spending habits and creating a budget, she was able to save money to attend leadership training seminars. These seminars equipped her with the skills needed to climb the corporate ladder, resulting in a significant promotion and pay raise.

Conclusion

In the journey towards personal and professional success, budgeting stands as an indispensable tool. It transforms your financial habits, enabling you to channel your resources into investments that yield the highest returns—investments in yourself. By taking control of your finances, you empower yourself to pursue continuous growth, achieve your goals, and ultimately, lead a fulfilling life. Begin your budgeting journey today, and watch as the seeds of your disciplined efforts blossom into the fruits of success and self-fulfillment.

By embracing the principles of prudent budgeting, you not only secure your financial future but also lay the groundwork for a lifetime of personal and professional enrichment. Remember, the path to getting ahead is paved with strategic investments in yourself—an endeavor that begins with the simple, yet powerful act of budgeting.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#PersonalFinance#Budgeting#InvestInYourself#FinancialFreedom#MoneyManagement#FinancialPlanning#SmartSpending#SelfInvestment#FinancialStability#BudgetTips#WealthBuilding#FinancialGoals#MoneyMatters#SelfImprovement#EconomicEmpowerment#bitcoin#financial education#financial experts#digitalcurrency#cryptocurrency#blockchain#finance#financial empowerment#globaleconomy#unplugged financial

5 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials" ------------------------------------------------------------------------ DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

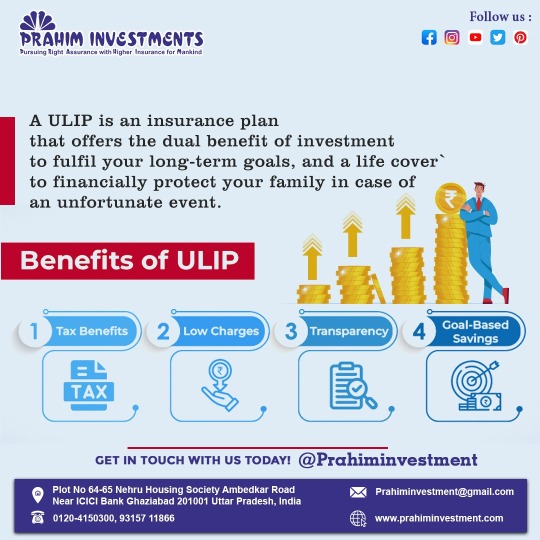

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes