#financialgrowth

Explore tagged Tumblr posts

Text

Want to earn money while you sleep? This guide shows you how to start with passive income streams, perfect for beginners looking for long-term earnings. Learn More

#PassiveIncome#IncomeStreams#financialgrowth#make money fast#make money online#make money home#make money as an affiliate#make money with chatgpt#earn money online#how to earn money#earn money fast#earnings#earn

2 notes

·

View notes

Text

Commercial real estate in Los Angeles County is one of the most lucrative and dynamic investment markets in the United States. With its diverse property types and thriving industries, Los Angeles offers exceptional opportunities for investors looking to build wealth and diversify their portfolios.

#CommercialRealEstate#LosAngeles#InvestmentAdvisor#RealEstateInvesting#PropertyManagement#MarketTrends#InvestmentOpportunities#PortfolioDiversification#RealEstateNegotiation#FinancialGrowth#CommercialProperties#RealEstateMarket#LosAngelesCounty#InvestmentStrategy#WealthBuilding#RealEstateExpertise

3 notes

·

View notes

Text

Why 2025 is the Year for Money Exchange Providers to Embrace Remittance Kiosks?

To know more about remittance kiosk solutions, please visit our website page: Panashi Technology Solutions

The financial landscape is shifting faster than ever, and 2025 is set to be a game-changer for money exchange providers ready to step up their game. One way to stay competitive? Remittance kiosks. These kiosks are revolutionizing the industry by providing customers with a seamless, 24/7 option to send money quickly and securely. Imagine offering clients a way to skip long lines, access their transactions anytime, and complete transfers within minutes—all without requiring additional staffing. Remittance kiosks aren’t just a trend; they’re the next wave in customer-centric service, allowing money exchange providers to meet growing demands for digital, self-service options. With more people embracing mobile payments and digital transactions, the market is ripe for innovation. The best part? Remittance kiosks come with integrated compliance and security features that help providers meet regulatory requirements effortlessly. And with fewer operational costs, they’re a smart financial move as well. If your goal for 2025 is to modernize, boost customer satisfaction, and improve profitability, remittance kiosks might be the missing piece. The time to invest is now—position your business at the forefront of the digital transformation in money exchange.

#kiosk#technology#software#restaurantkiosk#remittancesolutions#airportsolution#softwaredevelopment#ai#selfservice#tech#moneyexchange#digitalpayment#globalremittance#futureofbanking#financialimprovment#financialgrowth#kerala news#economicgrowth

2 notes

·

View notes

Text

Understanding the Importance of Credit Ratings for SMEs, MSMEs, and Startups in India

In the ever-evolving landscape of the Indian economy, Small and Medium Enterprises (SMEs), Micro, Small and Medium Enterprises (MSMEs), and startups play a pivotal role. These entities not only drive innovation but also create significant employment opportunities and contribute extensively to the GDP. However, one of the fundamental challenges they face is access to capital. This is where the importance of a robust credit rating comes into play.

Why is Credit Rating Crucial?

1. Access to Finance: Credit ratings determine the creditworthiness of a business. A high credit rating reassures lenders of the lower risk involved in extending credit to the business. This can lead to easier access to loans, lower interest rates, and more favorable repayment terms. For SMEs, MSMEs, and startups, which typically face higher scrutiny from financial institutions, a good credit rating can open doors to essential funding.

2. Credibility with Suppliers: A strong credit rating not only helps in securing finance but also enhances the business's credibility in the eyes of suppliers. Companies with better credit ratings can negotiate better credit terms such as longer payment durations and bulk order discounts, which can significantly improve cash flow management.

3. Competitive Advantage: In a market teeming with competition, a good credit rating can serve as a badge of reliability and sound financial health. This can be particularly beneficial in tendering processes where the financial stability of a business is a key consideration.

4. Lower Borrowing Costs: Businesses with higher credit ratings can secure loans at lower interest rates. Lower borrowing costs mean that the business can invest more in its growth and development, improving profitability and sustainability over time. This is especially critical for SMEs, MSMEs, and startups, where financial leverage can determine market positioning and long-term success.

How to Improve Your Credit Rating?

Improving and maintaining a good credit rating requires a strategic approach, including timely repayment of loans, prudent financial management, maintaining a balanced debt-to-income ratio, and regular monitoring of credit reports for any discrepancies.

Need Expert Guidance?

Understanding the nuances of credit ratings and effectively managing them can be complex. This is where expert financial advisory services, such as those offered by Finnova Advisory, come into play. Finnova Advisory specializes in providing tailored financial solutions that cater specifically to the unique needs of SMEs, MSMEs, and startups in India.

Whether you are looking to improve your credit score, secure funding, or streamline your financial strategies, connecting with the experts at Finnova Advisory can provide you with the insights and support you need to thrive in a competitive marketplace.

To learn more about how Finnova Advisory can assist your business in achieving financial excellence, visit their website or reach out directly for a personalized consultation. Remember, a robust credit rating is your gateway to not only securing finance but also establishing a strong foundation for your business's future growth and success.

5 notes

·

View notes

Text

The Importance of Dollar-Cost Averaging (DCA) in Bitcoin Investing

In the ever-evolving world of cryptocurrencies, Bitcoin stands out as a beacon of financial revolution. However, its notorious volatility can be daunting for new and seasoned investors alike. This is where the strategy of Dollar-Cost Averaging (DCA) comes into play, offering a systematic and disciplined approach to investing in Bitcoin.

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging is an investment strategy where an investor divides the total amount to be invested across periodic purchases of a target asset. By doing so, investments are made at regular intervals regardless of the asset's price. This method contrasts with lump-sum investing, where one might invest all funds at once.

How DCA Works in Bitcoin Investing

Bitcoin’s price can fluctuate wildly within short periods, influenced by market sentiment, regulatory news, technological advancements, and macroeconomic factors. DCA helps investors mitigate the risks associated with these fluctuations. Here’s how:

Consistent Investment: By investing a fixed amount regularly (e.g., weekly or monthly), investors buy more Bitcoin when prices are low and less when prices are high. This reduces the impact of market volatility.

Reducing Emotional Investment: Market timing is a challenging and often emotionally driven endeavor. DCA eliminates the need to predict market movements, thus reducing stress and emotional decision-making.

Long-Term Focus: DCA encourages a long-term investment perspective, aligning well with the general principle of Bitcoin investment—holding (HODLing) for the long haul.

Benefits of DCA in Bitcoin

Risk Mitigation: DCA spreads the investment risk over time. Instead of risking a large sum at a potentially high price, DCA ensures that the average purchase price is moderated, reducing exposure to market volatility.

Budget-Friendly: For many investors, especially those new to Bitcoin, investing a large sum upfront can be financially daunting. DCA allows for more manageable, smaller investments that can fit into a monthly budget.

Accumulation Over Time: Regular investments mean that investors are continuously accumulating Bitcoin, gradually increasing their holdings. This accumulation is beneficial in the long run, particularly if Bitcoin appreciates in value over time.

Accessibility: DCA makes Bitcoin investment accessible to more people. It lowers the barrier to entry, allowing individuals to start investing with small amounts without waiting to accumulate a large sum.

Implementing DCA in Your Bitcoin Investment Strategy

To implement DCA, follow these steps:

Determine Your Budget: Decide how much you can comfortably invest in Bitcoin each week or month. Ensure this amount fits within your financial plans without causing strain.

Choose a Platform: Select a cryptocurrency exchange or investment platform that supports automatic recurring purchases. Many platforms offer this feature, making DCA easy to implement.

Set Up Automatic Purchases: Configure your account to buy Bitcoin at regular intervals with your predetermined amount. Automation ensures consistency and removes the temptation to time the market.

Monitor and Adjust: While DCA requires less active management, it’s still important to periodically review your investment strategy. Adjust the investment amount as your financial situation changes and as you gain more confidence in your investment.

Conclusion

Dollar-Cost Averaging is a powerful tool for navigating the volatile waters of Bitcoin investment. It provides a disciplined, less stressful approach to building your Bitcoin portfolio over time. By reducing the impact of market volatility and promoting a long-term investment perspective, DCA can help investors achieve steady growth and financial stability. Whether you’re a new investor or looking to refine your strategy, DCA offers a practical path towards participating in the Bitcoin revolution.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#CryptoInvesting#DollarCostAveraging#DCA#Cryptocurrency#BitcoinInvesting#FinancialFreedom#CryptoStrategy#InvestingTips#CryptoSavings#DigitalCurrency#HODL#BitcoinStrategy#CryptoCommunity#Blockchain#FinancialGrowth#CryptoEducation#BitcoinHolder#InvestmentStrategy#SaveWithBitcoin#financial education#finance#globaleconomy#financial experts#unplugged financial#financial empowerment

4 notes

·

View notes

Text

Learn How To Build 8 Income Streams at https://www.8incomeStreams.co

Tag friends who need to see this!

#investmentplan#retirementplans#investmoney#retireyoung#investinginyourself#financialplan#financialgrowth#earlyretirement#moneymatters#retirementplanning#retirementplan#retireearly#moneymanagement#financialadvisor

4 notes

·

View notes

Text

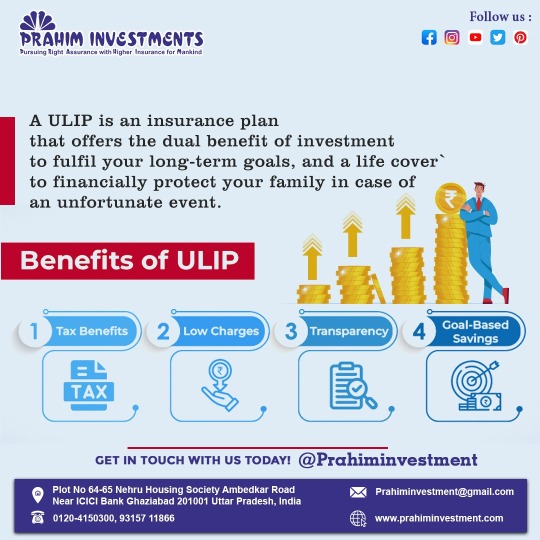

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Financial Growth

Financial growth is within your reach, and we're here to show you the way.

Explore valuable resources and actionable advice to build a secure future for yourself.

Let's embark on this journey towards financial independence together.

Start now - https://www.samratfinancialbanking.com/personal-savings

#FinancialInclusion #crypto #nfts

#FinancialGrowth#SecureFuture#WealthCreation#financial planning#samrat investments#financial freedom#make money#investing#wealth#growth

5 notes

·

View notes

Text

Facing Financial and Business Struggles

Money can't buy happiness, but financial stability shapes our future. If financial stress is holding you back, Astrologer Vijay offers powerful remedies for success & prosperity!

✅ Why Choose Astrologer Vijay? ✔️ Highly Experienced & Trusted Astrologer ✔️ Effective Remedies for Business & Financial Growth ✔️ 100% Confidential & Reliable Consultations ✔️ Available for In-Person & Online Sessions

✨ Manifest Prosperity & Success in Your Life Today! ✨

📞 Book Your Consultation Now: vijayastrology.com

#FinancialGrowth#BusinessSuccess#AstrologerVijay#WealthManifestation#BestAstrologerAustralia#MoneyMatters#SydneyAstrology#MelbourneAstrologer#ProsperityRemedies

0 notes

Text

Shaya Seidenfeld on the Benefits of Commercial Property Investment

Shaya Seidenfeld is a trusted real estate advisor committed to making the process of buying, selling, and investing in property simple and successful. With years of experience in the real estate industry, he has guided many investors toward making smart, strategic decisions. One of his key areas of expertise is commercial property investment, a sector that offers significant opportunities for financial growth. Here’s why commercial real estate might be the right choice for investors looking to build wealth and create long-term stability.

Steady Income and Higher Returns

One of the biggest advantages of commercial real estate is the potential for higher rental income compared to residential properties. Businesses typically sign long-term leases, ensuring consistent cash flow. Additionally, commercial properties often yield better returns, with rental rates that can significantly surpass those of single-family homes or apartments.

Longer Lease Terms Provide Stability

Commercial leases usually range from five to ten years or more. This stability reduces the risk of vacancies and provides landlords with predictable income over an extended period. Unlike residential tenants, who may move frequently, businesses prefer to stay in one location to maintain customer familiarity and operational efficiency.

Diversification of Investment Portfolio

Investing in commercial properties allows diversification, which helps spread risk. Rather than depending on stock market fluctuations or residential rental income alone, commercial real estate provides an additional stream of revenue that can balance an investment portfolio.

Appreciation and Value Growth

Over time, well-located commercial properties tend to appreciate. Cities grow, businesses expand, and commercial areas develop, all of which contribute to increasing property prices. Strategic upgrades, renovations, and proactive management can further enhance a property's market value.

Tax Benefits for Investors

Commercial real estate investors can take advantage of tax incentives, including depreciation deductions, mortgage interest write-offs, and property tax reductions. These benefits help lower taxable income and improve overall investment returns. Consulting with a real estate expert like Shaya Seidenfeld can ensure investors make the most of these advantages.

Lower Tenant Turnover

Unlike residential properties, where tenants may move out within a year or two, commercial tenants often sign multi-year leases. This reduces the stress and cost of frequent tenant changes, providing investors with a more stable and predictable income stream.

Professional Tenant Relationships

Commercial tenants, such as businesses and corporations, are more likely to maintain the property well. They have a vested interest in keeping the space clean and functional since their brand reputation depends on it. This means fewer maintenance issues and better overall property management.

Better Financing Opportunities

Lenders often view commercial properties as less risky than residential properties, especially if they generate strong cash flow. Investors with a solid business plan and strong financials may find it easier to secure financing for commercial properties. Additionally, the value of a commercial property is often determined by its income potential, making it easier to leverage and expand an investment portfolio.

Multiple Income Streams

Unlike residential properties, where rental income typically comes from a single tenant or family, commercial real estate can generate income from multiple sources. For example:

Office buildings can have several tenants paying rent.

Retail centers can earn revenue from leasing spaces to different businesses.

Industrial properties may have long-term contracts with manufacturers or logistics companies.

These diversified income sources reduce financial risk and provide greater financial security.

Protection Against Inflation

Commercial property investments are a great hedge against inflation. As the cost of living rises, so do rental prices, allowing investors to adjust lease agreements accordingly. This ensures property owners maintain their purchasing power and continue generating strong income even in fluctuating economic conditions.

How to Get Started in Commercial Property Investment

If you’re considering commercial real estate investment, it’s essential to follow a strategic approach. Here are a few tips to get started:

Do Your Research – Understand the local market, property demand, and growth potential.

Seek Professional Guidance – Work with an experienced real estate advisor like Shaya Seidenfeld to find the best opportunities.

Assess Financial Readiness – Ensure you have a clear investment plan, financing options, and risk management strategies in place.

Choose the Right Property Type – Office spaces, retail centers, warehouses, and mixed-use buildings all have different benefits and risks.

Understand Lease Agreements – Commercial leases are complex; having professional review terms can protect your investment.

Conclusion

Commercial property investment is a powerful way to generate wealth, secure long-term financial stability, and enjoy numerous advantages that residential real estate may not offer. With proper planning and expert guidance from trusted advisors like Shaya Seidenfeld, investors can maximize their potential and build a profitable property portfolio. Whether you’re a first-time investor or an experienced real estate professional, commercial real estate offers opportunities that can lead to long-term success.

#ShayaSeidenfeld#RealEstateInvestment#CommercialRealEstate#PropertyInvestment#WealthBuilding#FinancialGrowth

0 notes

Text

Maximize your wealth with 1 Finance’s expert finance planners. Our unique MoneySign® assessment helps understand your financial behavior, ensuring investment, savings, and debt strategies align with your goals. Unlike commission-based advisors, we offer unbiased advice designed solely for your benefit. Experience a new way of financial planning—tailored, transparent, and effective. Join 1 Finance today and gain financial clarity!

0 notes

Text

Navigating the complexities of a 1031 exchange can be daunting for real estate investors. This powerful tax-deferral tool, named after Section 1031 of the Internal Revenue Code, allows property owners to defer capital gains taxes by reinvesting proceeds from a property sale into a like-kind property.

#1031Exchange#RealEstateInvesting#EvelynBaez#ExpertGuidance#InvestmentStrategies#1031ExchangeHelp#LosAngelesRealEstate#PropertyInvestment#WealthBuilding#TaxDeferral#RealEstateAdvisor#InvestmentOpportunities#FinancialGrowth#InvestmentProperty

3 notes

·

View notes

Text

📈 Stay Focused on the Long-Term! 🚀

The market may rise & fall, but long-term mutual fund investments will always stand tall! 🌱💰

📊 Volatility is temporary, growth is permanent! 🔹 Stay invested, stay patient 🔹 Let compounding work its magic 🔹 Secure your financial future with smart investments

Build wealth the right way with Dream Funds! ✅

📞 Call Now: +91 7276518999 🌐 Visit Us: www.dreamfunds.in

0 notes

Text

KICK Advisory Services offers top-tier financial advisory consulting to help businesses navigate complex financial landscapes with confidence. Our expert team provides tailored strategies, risk management solutions, and investment insights to drive sustainable growth and long-term success. Partner with us for data-driven financial guidance that ensures stability and profitability.

#investmentadvisory#financialadvisory#registeredinvestmentadvisor#mauritiusfinance#kickadvisory#wealthmanagement#financialgrowth#smartinvesting#riskmanagement#businesssuccess

0 notes

Text

How do you empower your POSP agents to sell more policies efficiently while staying compliant with regulations?

Empowering POSP agents requires a smart, digital platform that simplifies policy selling, automates compliance, and enhances customer engagement. With Mzapp Retail POSP, agents get an easy-to-use interface, real-time policy updates, automated commission tracking, and seamless onboarding, ensuring faster sales and 100% regulatory compliance. 🚀 Upgrade today and scale your POSP network effortlessly!

#POSP#RetailInsurance#InsuranceSales#POSPAgents#DigitalInsurance#OnlineInsurance#POSPPlatform#InsuranceDistribution#POSPTraining#POSPCommission#PolicySelling#InsurTech#POSPManagement#FinancialGrowth#InsuranceTech#CustomerEngagement#InsuranceBusiness#PointOfSalesPerson#InsuranceLeads#RetailPOSP#SmartInsurance#POSPOpportunities#SalesAutomation#InsuranceSolutions#PolicyManagement#RegulatoryCompliance#POSPOnline#POSPSuccess#POSPGrowth#InsuranceEcosystem

0 notes

Text

Smart Financial Investment Strategies | Lee Ekholm

Secure your financial future with expert investment strategies from Lee Ekholm. Whether you're looking to grow wealth, plan for retirement, or diversify your portfolio, we provide personalized financial investment solutions tailored to your goals. Our approach focuses on risk management, market insights, and sustainable growth to help you make informed decisions. Trust Lee Ekholm for strategic wealth planning, asset management, and long-term financial success.

#FinancialInvestment#LeeEkholm#WealthManagement#SmartInvesting#RetirementPlanning#InvestmentStrategies#AssetManagement#FinancialGrowth#SecureFuture

0 notes