#finance providing

Explore tagged Tumblr posts

Text

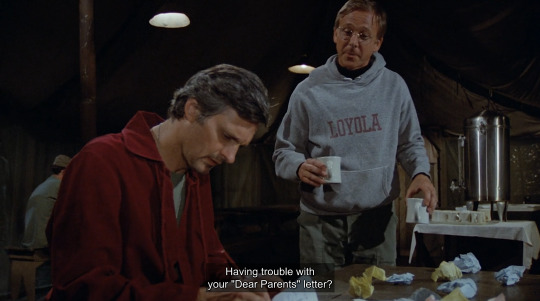

The frequency with which they seek to comfort each other gives me extremely large emotions btw

#they so often can feel when the other is aching and they literally go out of their way to provide care#i'm unwell about them#hawkeye pierce#father mulcahy#francis mulcahy#mashposting#mashblogging#m*a*s*h#s8e8#private finance#hawkahy

745 notes

·

View notes

Note

Okay but like,, do you think rb gojo would ask reader to marry him at some point??

for sure for sure i think they’d get married not long after graduating tbh

#like they strike me as a#‘get married young’ type of couple#plus finances isn’t rly an …. issue if u will#not that gojo would be the sole provider#well he can be#if ur imagination would like that

68 notes

·

View notes

Text

mothers. oof.

#she just told my sister that she doesn't wanna ask my dad for anything so they're gonna have to make sacrifices#and it's like. well no my dad is legally obligated to provide for his kids and if he wont do it unfortunately youre gonna have to remind him#it's not like my dad is violent or dangerous in any way they just don't get along as exes tend to do#but i think it's my mum's job to put aside her own feelings of discomfort around my dad#to tell him that my sister needs x y and z#my dad pays for things when he's asked he just won't inquire about finances of his own accord#he needs to be asked#and idk i think saying that my sister needs to sacrifice their needs because my mum doesn't wanna communicate with my dad#is selfish#and yeah sure my dad sucks like he literally doesn't try at all#it would be nice if he just did his job as a parent#but he doesn't. and as the parent who's more present in my sister's life i think my mum should be the one to contact him#idk#i know it's tough and far from ideal#ideally my dad wouldn't need to be asked anything he'd just provide#but he's kind of a piece of shit#so yeah#i don't think my sister should be the one to bear the consequences of my parents' lack of communication#rain.stuff

8 notes

·

View notes

Text

Woke up from my little power outage nap and couldn’t even manage to eat a full box of macked cheese, grad school will fuck you up for life kids, do it at your own risk.

#my stuff#i don’t like to admit it but i’ve developed a complicated relationship with food#i’m a rational person i know food is important and i feel hunger and when i do i want to eat#but due to the hassle of meal prep and my tight finances i basically only eat one meal a day at the end and use coffee to power through#often until like 6pm#which i know is not good in a general or transition sense#and when i was first starting to fall into this pattern i would eat A TON at night to make up for it#but sometime during my grief in march n april i developed#a psychological difficulty with finishing food. like executive dysfunction and insecurity hoarding combined#and also i sometimes get nauseous midway through eating#or rapidly feel full after being doubled over from hunger cramps and then hungry again an hour later#and above all else it’s annoying bc its subconscious or physiological and it makes it hard to overcome#and even if i was provided 3 meals a day i’d probably struggle to stomach eating that freq in any significant amount#i feel like when my stomach is empty it tries to quasi hibernate until last minute and then goes ravenous#much like me emotionally but that’s a different tag rant#anyways another complication is ‘sleep for dinner’ right when i get home which fucks up my eating AND sleep schedule#all this bullshit when i’m a scientist who has taken metabolism classes and knows my body is getting wrecked from this#so i’m guilty as fuck abt it🙂↕️

15 notes

·

View notes

Text

I woke up extremely anxious for no real reason so of course my brain made up reasons to be scared lol. Just randomly reminded me of responsibilities I should look into that I don’t have an exact answer for right this minute so now I’m worrying about something I haven’t even thought about till right now and ik I’ll be better once I can go on my morning walk and actually look into it calmly but instead I’m in bed scrolling and my brain just won’t let me get up

#I blame the fact that I had a friend staying over for more than a week so now that she’s gone after I had a routine while she was here my#brain has decided to provide ‘something to do’ and mind you the thing I’m worrying about is NOT that serious it’s a subscription that I#can’t remember if I payed yet… I still have the thing and have received no email so I should be fine??? yet my brain is like heyyyyyyy what#if you just get overcharged? what if you owe people money? what about your finances? loans? bills? GIRL (my brain) let me live!#NOTHING IS HAPPENING CAN YOU NOT MAKE ME NAUSEOUS FIRST THING IN THE MORNING

4 notes

·

View notes

Text

How to Protect Yourself from Personal Loan Phishing Scams

In today’s digital world, personal loans have become more accessible, allowing borrowers to apply online and receive funds quickly. However, this convenience has also led to a rise in phishing scams, where fraudsters attempt to steal your personal and financial information by posing as legitimate lenders. These scams can result in identity theft, financial loss, and fraudulent loan applications in your name.

If you’re planning to apply for a personal loan, it is essential to understand how phishing scams work, the warning signs to look for, and the best ways to protect yourself.

1. What Are Personal Loan Phishing Scams?

A phishing scam is a fraudulent attempt to trick individuals into providing sensitive information such as bank details, Aadhaar number, PAN card, OTPs, or login credentials. Scammers typically impersonate banks, NBFCs, or online lending platforms and contact borrowers via emails, phone calls, SMS, or fake websites.

Once they obtain your information, they can:

Steal money from your bank account

Take a loan in your name

Misuse your identity for financial fraud

Access and sell your personal data on the dark web

2. Common Types of Personal Loan Phishing Scams

2.1 Fake Loan Approval Emails & SMS

Fraudsters send emails or SMS messages claiming that your loan has been pre-approved or that you qualify for a low-interest personal loan. These messages often contain links leading to fake lender websites designed to steal your personal information.

2.2 Fake Loan Websites & Apps

Scammers create websites and mobile apps that look like real financial institutions. They trick users into entering personal and banking details, which are then used for fraudulent activities.

2.3 Fraudulent Customer Service Calls

You may receive a phone call from a scammer pretending to be a bank representative. They claim you must provide your OTP, Aadhaar, PAN, or bank details to complete your loan application. Once you share these details, scammers can withdraw money or take loans in your name.

2.4 Loan Processing Fee Scams

Fraudsters promise quick loan disbursal with no documentation but demand advance processing fees or a loan insurance fee. Once the fee is paid, the scammer disappears, and no loan is disbursed.

2.5 Social Media Loan Scams

Some scammers advertise fake loans on Facebook, Instagram, or WhatsApp and ask potential borrowers to contact them privately. Once engaged, they request confidential details, leading to identity theft.

3. Red Flags to Identify Loan Phishing Scams

3.1 Offers That Sound Too Good to Be True

If you receive an offer promising guaranteed loan approval with no credit check, zero documentation, or extremely low-interest rates, it’s likely a scam.

3.2 Unsolicited Loan Messages

Legitimate lenders do not send random SMS, WhatsApp messages, or emails offering personal loans. Be cautious if you receive messages from unknown numbers or email addresses.

3.3 Fake Loan Websites

Before applying for a loan online, always verify the website’s domain name. Scammers often create fake websites with slightly modified spellings of real lenders to trick borrowers.

3.4 Requests for Upfront Payments

No genuine lender will ask for advance processing fees before loan approval. If a lender insists on upfront payments via UPI, Paytm, or Google Pay, it’s a scam.

3.5 Pressure to Act Immediately

Scammers create urgency by saying things like, "Limited offer – Apply now!" or "Your loan will be canceled if you don’t act fast." A real lender will give you time to review the terms.

3.6 Request for Personal Information Over the Phone

A legitimate bank or NBFC will never ask you for OTPs, passwords, or CVVs over the phone. If someone does, hang up immediately.

4. How to Protect Yourself from Loan Phishing Scams

4.1 Apply for Loans Only from Trusted Lenders

Always apply for a personal loan through registered banks, NBFCs, or reputed online lenders. Here are some safe options:

🔗 IDFC First Bank Personal Loan 🔗 Bajaj Finserv Personal Loan 🔗 Tata Capital Personal Loan 🔗 Axis Finance Personal Loan 🔗 Axis Bank Personal Loan 🔗 InCred Personal Loan

4.2 Verify the Lender’s Website

Check if the website URL starts with "https://" (secure site).

Look for official lender details on the RBI website or lender’s official website.

Avoid websites with poor design, spelling errors, or unusual domain names (e.g., "axisbankloans.xyz" instead of "axisbank.com").

4.3 Never Click on Suspicious Links

Do not click on links in unsolicited emails or messages claiming to be from a bank or NBFC. Instead, visit the official website by typing the URL manually.

4.4 Avoid Sharing Personal Information Online

Scammers may ask for your Aadhaar, PAN, or bank details via email, phone, or WhatsApp. Never share sensitive information with unknown sources.

4.5 Enable Two-Factor Authentication (2FA)

Use 2FA on your banking and email accounts to protect against unauthorized access. This adds an extra layer of security if your password is compromised.

4.6 Check Reviews & Ratings Before Downloading Loan Apps

Before installing a loan app, check:

App permissions (Avoid apps that ask for access to contacts, photos, and messages).

Reviews and ratings on Google Play or App Store.

If the app is registered with an RBI-approved lender.

4.7 Monitor Your Bank & Credit Report Regularly

Check your credit report and bank statements for unauthorized loan applications or suspicious transactions. If you spot any fraudulent activity, report it immediately.

5. What to Do If You Are a Victim of Loan Phishing?

If you have fallen victim to a loan phishing scam, take these steps:

1️⃣ Contact Your Bank Immediately – Report any unauthorized transactions and request to block your account if necessary. 2️⃣ Change Your Passwords – Update your internet banking, email, and loan account passwords immediately. 3️⃣ File a Cyber Crime Complaint – Report the fraud to the Cyber Crime Portal (www.cybercrime.gov.in) or call the National Cyber Crime Helpline (1930). 4️⃣ Report to RBI & Consumer Forum – If you have been tricked into a fake loan scheme, report it to the RBI and National Consumer Helpline (1800-11-4000). 5️⃣ Monitor Your Credit Report – Check for unauthorized loans taken in your name and dispute them with credit bureaus like CIBIL and Experian.

Stay Alert & Borrow Safely

Personal loan phishing scams are on the rise, but you can stay protected by being vigilant. Always verify loan offers, apply only through trusted lenders, and avoid clicking on suspicious links.

For safe and secure personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By staying cautious and informed, you can protect yourself from loan fraud and ensure a safe borrowing experience.

#nbfc personal loan#bank#loan services#personal loans#fincrif#personal loan#personal laon#loan apps#personal loan online#finance#fincrif india#Personal loan phishing scams#Loan fraud protection#How to avoid loan scams#Safe personal loan application#Phishing scams in personal loans#Fake loan offers#Online loan scams#Fraudulent loan websites#Personal loan safety tips#How to identify loan scams#Signs of a loan scam#Avoiding personal loan fraud#Phishing emails from loan providers#Loan application fraud prevention#How scammers trick loan applicants#Secure loan application process#Fake personal loan SMS and calls#Online loan phishing protection#Tips to protect against loan fraud

3 notes

·

View notes

Text

The other thing about the Boston area (including Camberville etc) is that it’s a great example of medium density urban planning with mixed use neighborhoods and access to yards and green space, BUT it’s nearly impossible to find a one bedroom apartment for less than 2.5k/month, so you turn 30, and your options are basically to find a partner to move in with, or to be a 30 year old professional with a reasonably well paying job and 3 roommates, which is why the city has such a bad retention problem despite being so young overall. Or you move to Rhode Island

#25% of people in their 20s plan on leaving!#if you’re not overly committed to the charm of living in an old house#apartment buildings are really quite lovely#also the arts scene has a lot of local support#but isn’t exactly connected#like you can find a studio in like Newton or Belmont or Malden or whatever#but at that point you might as well just move to Providence#your three options for being a 30 something in Boston:#1. married 2. lgbt communist housing coop 3. work in finance

4 notes

·

View notes

Text

.

#oh hey i just caught myself harboring Unnecessary Nightmare Scenarios#that last post made me think about how the only thing stopping me from getting another dog is money#like i could afford having a friend for savu. it would be no problem#BUT in a situation where i lost my partner and had to provide for the dogs by myself and they'd both get sick i'd be in deep trouble#which has sounded like a completely rational thing to be aware of. a completely valid reason for not getting another dog#except that is quite a few things that need to go wrong before the deep trouble would actually hit#and is that really the way i want to live my life? waiting for this relationship to end? accepting that eventually i will be left alone?#that my current life is nothing but a brief respite from a continuous struggle with both finances and illness? a glitch that will soon pass#it actually doesn't sound valid at all when i write it out like this#i have a partner who brings another stable paycheck into this household. i have no reason to believe this would change anytime soon#i have a wonderful dog that would probably benefit from having a friend#shelties are not super prone to any major lifelong diseases or such so it's unlikely the new dog would need constant expensive treatments#i think this thought pattern got a hold of me when savu got sick last spring#it was scary and unpleasant and i still feel raw around the edges after experiencing all of it#(the dog is fine by the way! definitely better these days and i'm super happy we got the surgery. we have many good years ahead of us still#but like. i'd like if my brain accepted 'this summer was scary and i'm not sure if i'm ready to possibly experience it with another dog'#instead of feeding me lies about a future where i'm all alone and desperately poor#but hey i've never caught this one before! now i know this thought pattern exists and can do something about it#sussitalk

3 notes

·

View notes

Text

idk about y'all but that whole "I'm looking for a man in finance, 6'5", blue eyes, trust fund" thing is just so INSANE to me cause like... I know that my taste in men may not be Traditional but that is literally every red flag I can think of for a man in like. one guy. could not be less appealing. like FINANCE? BLUE EYES????????????????

#i get wanting a rich man to provide for you too but like.#finance...#6'5"#blue EYES???????????????????

4 notes

·

View notes

Text

Learn effective SEO for finance companies to improve digital presence, boost credibility, and double sales. Discover tips for keyword research, on-page, and technical SEO.

#SEO for Finance Companies#SEO service provider#SEO Company#Digital Marketing#digital marketing company#SEO Services#Search engine optimization

2 notes

·

View notes

Text

Shopping for bedding rn, as I'm finally getting a queen mattress, and frankly losing it over seemingly materially identical duvet inserts costing like, $59, or $179. What's up. Also, did the same people who named Banana Republic also name Company Store? Because those are both. Bad.

#been on a twin for 8 years that started causing me back pain several years ago. due less to finances than to executive dysfunction#and using the same frame i've had since i was what#3? 4? which lost its legs 2 moves ago due to stripped bolts and was just kind of legless on the floor. because i couldn't be fucked. so it'#and mom came last weekend and we got a frame and im getting a mattress delivered#incredibly funny the kind of disability help parents will provide as long as you frame it as a gift and not an accommodation#anyways christ this is agonizing.#also yes. chronically single person posting. what of ittttt#txt

9 notes

·

View notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals. Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support. Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere. Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels. Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

Best loan provider in Rudrapur - Divine Loan Hub

🌟 Divine Loan Hub: Your Financial Ally in Rudrapur 🌟

Welcome to Divine Loan Hub, the go-to destination for seamless and reliable financial solutions in Rudrapur, Uttarakhand. As your trusted financial partner, Divine Loan Hub stands out with a proven track record, a plethora of loan options, and a customer-centric approach.

Why Divine Loan Hub?

1. Proven Track Record: With a proud history of assisting 15,000 satisfied customers and disbursing an impressive 500 crores, Divine Loan Hub has become synonymous with success in meeting diverse financial needs.

2. Extensive Loan Options: Collaborating with 17 trusted partners, Divine Loan Hub offers a comprehensive range of loan options, including personal, education, business, home, and car loans. Specialized services such as school loans, loans against property, and commercial vehicle loans are also available.

3. Customer-Centric Approach: What truly sets Divine Loan Hub apart is its commitment to finding the best deals for customers. Meticulously comparing offerings from various banks ensures clients secure loans with the lowest interest rates and potential additional benefits, making it the best loan provider in Rudrapur.

Tailored Loans for You: Understanding that everyone has different financial needs, Divine Loan Hub provides a diverse portfolio, including school loans, loans against property, commercial vehicle loans, cash credit, overdrafts, mutual funds, health insurance, and term insurance.

Trusted Partners: Divine Loan Hub collaborates with 17 trusted partners, offering customers a plethora of choices to find the perfect financial solution that suits their needs.

Making Dreams Come True: Having assisted 15,000 individuals with their financial requirements, Divine Loan Hub is dedicated to making dreams come true. The commitment to providing 500 crores in loans showcases their expertise in navigating the world of finance.

Lowest Interest Rates and Beyond: What makes Divine Loan Hub exceptional is its dedication to securing the best deals. When you approach them for a loan, they diligently compare offerings from various banks to ensure you receive the loan with the lowest interest rates and possibly additional benefits.

Quick & Easy Approval, No Hidden Charges, Less Documents, Competitive Rates: Experience a hassle-free loan approval process with Divine Loan Hub. Benefit from transparent dealings, no hidden charges, minimal documentation, and competitive rates.

Contact Divine Loan Hub: If you're ready to embark on a journey of financial empowerment, contact Divine Loan Hub today. Call +91 8006731732 or email [email protected]. Explore more about their offerings on their website: Divine Loan Hub.

With Divine Loan Hub, you're not just getting a loan – you're gaining a trusted friend on your financial journey. Get ready to make your dreams come true in the enchanting landscapes of Uttarakhand! 🚀

2 notes

·

View notes

Text

braved the horrors of german bureaucracy and won for once.

#lily talks#massive w for lily#getting ~500€ back from the state#fuck yeah#also no more Rundfunkbeitrag for me#(meaning I’ll save like 20€ every month from now on)#(which for my finances is HUGE)#I’m just gonna ignore how tedious and long winded getting this approved was#(despite me providing all the necessary documents right from the start and the legal situation being unambiguous)

2 notes

·

View notes

Text

KYC Provider UK

KYC Verification is essential to onboard a new client in UK businesses to authenticate the identity of a person associated with the business and even to check involvement in money laundering. We are one of the leading KYC providers in the UK and assist with KYC API for financial and non-financial businesses.

#KYC UK#KYC Provider UK#KYC Solutions UK#KYC Solutions Provider UK#banking#finance#fintech#gaming#kyc api#kyc software#kyc companies#banks

4 notes

·

View notes

Text

Financial Service Provider For Bank Guarantee and Sblc

Elro Vision Ltd provides Cash backed BG Bank Guarantee and SBLC Standby Letter of Credit financial instruments issued with Top Rated Banks.

#sblc#bank guarantee#sblc monetization#bank guarantee provider#lease sblc#sblc discounting#financial instruments#trade finance companies#sblc provider#standby letter of credit

4 notes

·

View notes