#finance planner

Explore tagged Tumblr posts

Video

youtube

Ultimate Finance Tracker Notion Template | Finance Dashboard | Notion Personal & Business Finance Tracker for 2023 | Debt and Bill Tracker | Subscription Tracker | Digital Finance Planner | Finance Tracker This dashboard will help you manage all your finances in one place. Register expenses, and income & make transfers on multiple accounts. Track your debt, set expense categories, and income; manage subscriptions, wishlist & more. ▷ WHAT IS NOTION? ◉ Notion is an all-in-one workspace where you plan, write, organize, and collaborate. It provides its users the building blocks to create customized layouts to get work done. Notion is free for a personal plan and is accessible through any device connected to the Internet - be it a smartphone, tablet, laptop, or computer. ▷ WHAT'S INCLUDED? ➜ Accounts ✵ Banks ✵ Cash ✵ Credit Cards ✵ Investment ➜ Transactions ✵ Expenses ✵ Income ✵ Transfer ➜ Categories ✵ Income Categories ✵ Expenses Categories ➜ Debt & Bill Tracker ➜ Subscription Tracker ✵ Upcoming Reminder ✵ Next Month Reminder ➜ Wishlist ➜ Months at a Glance ➜ Reports ➜ Database

#notion#notion template#finance#financetracker#debt tracker#subscription#expense#income#wishlist#notion finance#bill tracker#finance planner#digital planner#business#personal#finance dashboard#dashboard#notion dashboard#monthly report#investment#upcoming reminder#transactions

11 notes

·

View notes

Text

hi friends, short on rent due this weekend so i'm gonna be plugging some art for sale as well as stickie inventory and commissions

if there's anyone you're looking for things of in particular feel free to message me and i'll look through my things!

#trashy yells#my finances will be less fucked after this month#it's my own doing#i'm getting a planner to be better about things#pay off things and whatnot#but yee i have a shelf full of books to go through hmu

7 notes

·

View notes

Text

Certified financial manager

Certified Financial Manager: Empowering Financial Success

In today’s fast-paced world, managing personal and professional finances effectively is not just a skill; it’s a necessity. A Certified Financial Manager (CFM) plays a pivotal role in helping individuals and businesses achieve their financial goals, ensuring financial stability, and fostering growth. Platforms like WealthMunshi.com are at the forefront of delivering expert financial guidance, making wealth management accessible to everyone.

Who is a Certified Financial Manager?

A Certified Financial Manager is a financial professional with specialized training and certification to provide expert advice on managing finances, investments, and wealth-building strategies. They are well-versed in budgeting, tax planning, investment strategies, risk assessment, and retirement planning, ensuring clients make informed financial decisions.

Why Choose a Certified Financial Manager?

Expert Financial Guidance: CFMs offer deep insights into financial markets, helping clients optimize their investment portfolios.

Customized Wealth Plans: They provide tailored financial plans based on individual goals, risk tolerance, and time horizons.

Comprehensive Support: From estate planning to debt management, CFMs address a wide range of financial needs.

Risk Mitigation: With a clear understanding of market risks, CFMs help clients safeguard their wealth while pursuing growth opportunities.

The WealthMunshi Difference

At WealthMunshi.com, financial management is not just a service; it’s a mission to empower individuals and families to take control of their financial future. Here’s how WealthMunshi.com stands out:

1. Certified Expertise

WealthMunshi.com collaborates with highly qualified CFMs who bring years of experience in wealth management and financial planning. Their in-depth knowledge ensures clients receive actionable and effective strategies.

2. Holistic Financial Planning

The platform offers end-to-end financial solutions, covering investment planning, retirement strategies, tax optimization, and more. Whether you're starting your financial journey or looking to diversify your portfolio, WealthMunshi.com has you covered.

3. Client-Centric Approach

WealthMunshi.com believes in personalized solutions. Every client is unique, and their financial strategy should reflect their goals, lifestyle, and aspirations.

4. Cutting-Edge Tools and Resources

The platform integrates advanced financial tools and analytics to provide real-time insights, empowering clients to make data-driven decisions.

5. Educational Resources

Financial literacy is at the heart of WealthMunshi’s philosophy. The platform provides educational content, webinars, and one-on-one consultations to help clients understand and navigate their financial options.

Benefits of Working with WealthMunshi.com

Clarity and Confidence: Simplifying complex financial concepts.

Long-Term Security: Building a robust financial foundation for the future.

Maximized Wealth Potential: Identifying and leveraging growth opportunities.

Stress-Free Financial Management: Delegating the complexities to seasoned professionals.

Key Services at WealthMunshi.com

Investment Planning: Strategic advice to grow your wealth.

Retirement Solutions: Secure your golden years with tailored plans.

Tax Planning: Optimize your finances with effective tax strategies.

Debt Management: Create a roadmap to achieve a debt-free lifestyle.

Estate Planning: Ensure your legacy is preserved for future generations.

Steps to Financial Freedom with WealthMunshi.com

Initial Consultation: Discuss your financial goals and challenges.

Financial Assessment: Analyze your current financial situation.

Strategy Development: Create a customized plan to meet your objectives.

Implementation: Execute the plan with expert guidance.

Ongoing Support: Monitor and adapt strategies to evolving financial needs.

Conclusion

A Certified Financial Manager is a trusted partner in achieving financial success, and WealthMunshi.com is a reliable platform to connect with these experts. Whether you're looking to save for the future, grow your investments, or achieve financial independence, the right guidance can make all the difference.

Take the first step towards a secure and prosperous financial future with WealthMunshi.com, where expertise meets commitment to help you turn your dreams into reality.

Visit WealthMunshi.com today and embark on your journey to financial excellence!

#certified financial manager#financial planning planner#certified financial planner#financial planner#financial advisors#wealth management#wealth management companies#personal financial advisor near me#personal financial planner#financial advisors near me#financial planner near me#wealth management co#company wealth management#certified financial planner certification#best retirement planners#need financial planning#financial planning personal finance#need for financial planning#certified financial planner cfp certification#best financial planners#financial planners in hyderabad#registered investment advisor near me#best financial advisors near me#best financial advisor in hyderabad#nri wealth management#financial advisor for nri in india#nri financial advisor#nri financial planning#online investment advisor india#certified financial planner in hyderabad

2 notes

·

View notes

Text

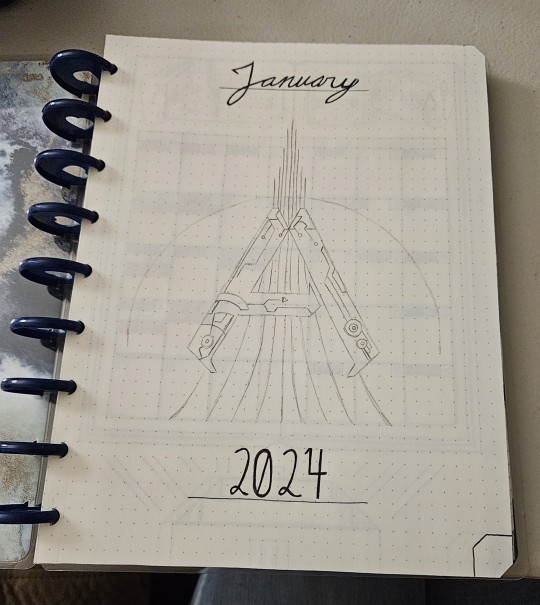

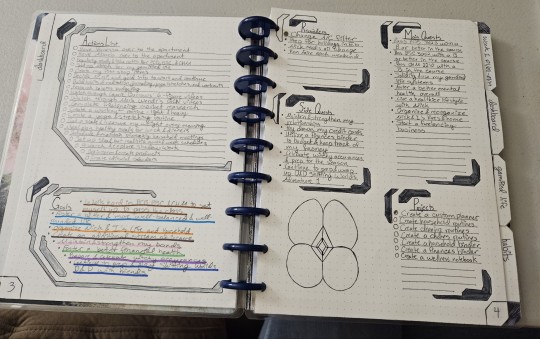

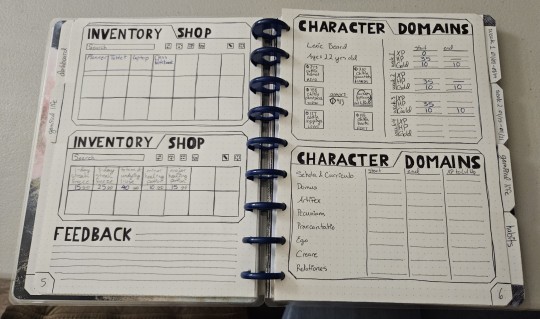

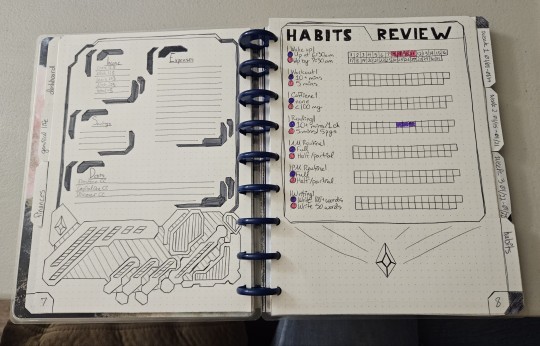

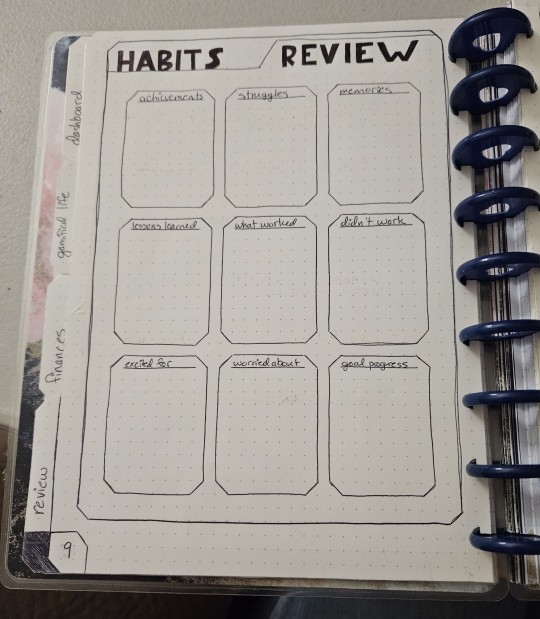

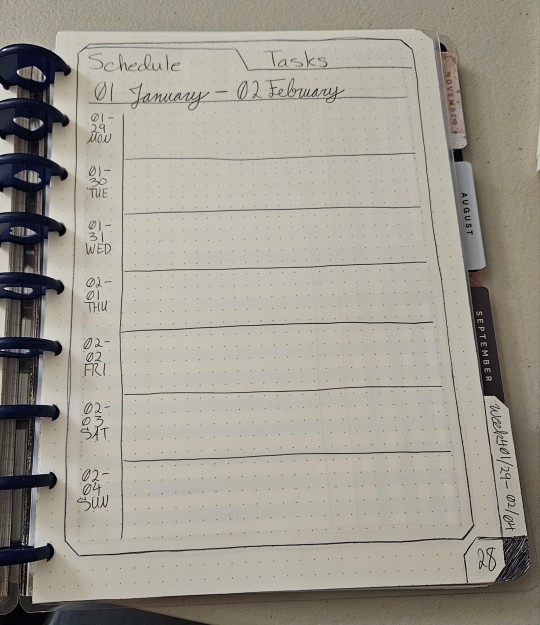

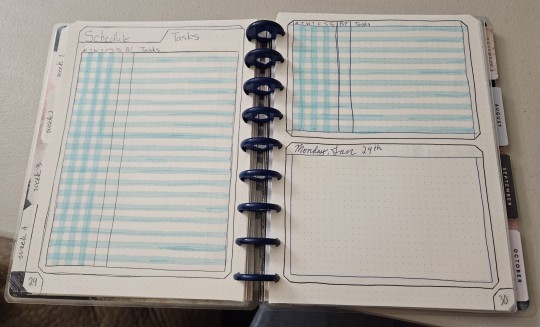

Sorry for the late update, but here's an update post on my January spreads that I've been using in my planner! All hand drawn by me and inspired by one of my favorite video games, Ark Survival Ascended.

Though I didn't do super well on my habits this month so far, there's always room for improvement (including actually filling in the boxes when I do them). January has been a curve ball so far with my uni courses changing and my work schedules changing as well so I've been struggling a bit ��😅

But, I've learned what I need to tweak (my habits are #1) and to actually create routines that are sustainable for me and a chaoticly busy life. I have a D&D campaign that is currently wrapping up Adventure 1 of 3 in the next two months, starting my husband's homebrew D&D adventure afterwards, and gearing up to finish my Bachelors this year while starting to apply for Masters Grad programs! Yay me!

My asks are open if anyone wants to ask away! Any and all comments are appreciated!

#bujo#bullet journal#goals#journal#planner#planning#goalsetting#finances#gamifiedlife#gamification#creativity#crafts#craftblr#studyblr#hand drawn#handmade#school#university#ark survival ascended#ark survival evolved

19 notes

·

View notes

Text

Maximize Your Savings Goals with Personal Financial Planning

Personal financial planning is essential for anyone looking to maximize savings and secure their financial future. By setting clear savings goals, you can build a strong financial cushion for emergencies, retirement, and other long-term needs. A personal financial plan allows you to align your spending habits with savings targets, making it easier to reach key milestones such as homeownership, education, and travel without sacrificing financial security. This plan provides a structured approach to building wealth and achieving greater financial freedom.

2 notes

·

View notes

Text

#finace#finance tracker#expense tracker#expenses#productivity#100 days of productivity#notion dashboard#notion template#notion#budget#2024 planner#financial planner#money

5 notes

·

View notes

Text

Financial Planning Worth $1-2 Million US Dollars. I would request you all to go through this guide and share it with everyone you know, so that they can secure their financial future.

#finance planning#finance management#financial freedom#finance#financial security#financial management#retirement planning#how to earn money#financial goals#cashflow#debt management#risk management#investment planner#passive income#passive investing#estate planning#retire early#financial advice#money management#money manifestation#money#cash management

6 notes

·

View notes

Text

if i was to make taylor themed daily planners and habit trackers and printables like that would anyone buy? i'd probably post them on buy me a coffee or something like that

#taylor swift#the eras tour#planner#printables#the tortured poets department#i need to make money to finance my eras tour trip lol

2 notes

·

View notes

Text

www.slaeme.com PERSONAL FINANCE TRACKER - FINANCIAL PLANNER DASHBOARD#Excel Templates #Project Tracker #spreadsheet template #Annual Budget #Financial Planner #Yearly Budget #Digital Savings #Savings Planner#Savings Planner #Excel Spreadsheet #spreadsheet habit #template habit #template business

#www.slaeme.com#PERSONAL FINANCE TRACKER - FINANCIAL PLANNER DASHBOARD#Excel Templates#Project Tracker#spreadsheet template#Annual Budget#Financial Planner#Yearly Budget#Digital Savings#Savings Planner#Excel Spreadsheet#spreadsheet habit#template habit#template business

4 notes

·

View notes

Text

The Role of Personal Finance Advisory in Retirement Planning

Planning for retirement requires strategic asset allocation, risk management, and tax-efficient savings, all of which are covered under personal finance advisory. A personal finance advisory helps ensure your retirement corpus is sufficient, well-diversified, and aligned with your post-retirement lifestyle goals. From choosing the right National Pension Scheme (NPS), Employee Provident Fund (EPF), or mutual fund SIPs, to structuring your withdrawals in a tax-efficient manner, an advisor provides end-to-end planning. They also help with contingency planning, healthcare costs, and passive income strategies, ensuring a stress-free retirement.

0 notes

Text

#bohemian rhapsody#college#celebrities#fashion#bollywood#education#3d#electronics#finance#furniture#digital product ideas#sell digital products online#business card nfc#dac digital#etsy digital products#digital wall calendar#digital dropshipping#digital products to sell#digital asset manager#measuring tape digital#digital planner#digital calendar#digital product

1 note

·

View note

Text

How the Best Investment Planners Help You Achieve Financial Goals

Building wealth requires more than saving—it demands smart investment strategies. The best investment planners help you identify high-potential opportunities, diversify your assets, and optimize your portfolio for long-term growth.

By leveraging expert advice, you can avoid pitfalls, manage risks, and achieve financial freedom faster.

Build wealth the smart way! Download our app for expert investment planning.

0 notes

Text

Certified Financial Planner in Hyderabad

Certified Financial Planner in Hyderabad: Wealth Munshi

In today's dynamic financial landscape, effective planning and management of finances are crucial to achieving long-term financial goals. Among the growing list of trusted financial planners in Hyderabad, Wealth Munshi stands out as a premier destination for individuals and families seeking expert guidance on their financial journeys. As a certified financial planner, Wealth Munshi provides customized solutions tailored to the unique needs of its clients.

What is a Certified Financial Planner?

A Certified Financial Planner (CFP) is a highly trained professional recognized for their expertise in financial planning, investment strategies, tax planning, retirement savings, and estate planning. The CFP certification is globally acknowledged, ensuring that the professional adheres to rigorous ethical standards and possesses comprehensive knowledge in financial advisory services. With a focus on helping clients meet their financial objectives, CFPs serve as trusted advisors in navigating complex financial decisions.

Why Choose a Certified Financial Planner?

Opting for a certified financial planner like Wealth Munshi ensures that you receive professional, reliable, and objective advice. A CFP understands the intricacies of financial markets and helps clients with:

Goal Setting: Identifying short-term and long-term financial goals.

Strategic Planning: Designing a roadmap to achieve financial milestones.

Risk Management: Assessing potential risks and crafting strategies to mitigate them.

Investment Management: Offering insights into building a diversified portfolio.

Wealth Creation: Focusing on sustainable growth of assets over time.

Wealth Munshi: Empowering Financial Freedom

Wealth Munshi has carved a niche for itself in Hyderabad’s financial planning landscape by providing holistic financial solutions. Their services go beyond mere numbers, focusing on empowering individuals and families with the knowledge and tools they need to make informed financial decisions. The firm’s core philosophy revolves around understanding the client's unique needs and offering personalized strategies to help them achieve financial independence.

Key Features of Wealth Munshi's Services

Personalized Approach: Wealth Munshi takes a deep dive into each client’s financial situation to develop tailored plans that align with their lifestyle and aspirations.

Expert Guidance: Backed by certified professionals, the firm offers expert advice across a range of services including retirement planning, tax strategies, investment management, and estate planning.

Ethical Practices: Adhering to the highest ethical standards, Wealth Munshi ensures transparency and integrity in all its dealings.

Educational Resources: The firm believes in educating its clients, empowering them with financial literacy to make confident decisions.

Who Can Benefit?

Wealth Munshi’s services cater to diverse clientele, from young professionals looking to save and invest, to families planning their children’s education, and retirees seeking a secure post-retirement lifestyle. The firm’s expertise also extends to small business owners aiming to optimize their financial frameworks.

Why Hyderabad Chooses Wealth Munshi

Hyderabad, known for its vibrant economy and growing professional community, demands reliable financial planning services. Wealth Munshi has established itself as a go-to financial planner in the city by consistently delivering value and earning the trust of its clients.

In conclusion, if you’re seeking a certified financial planner in Hyderabad, Wealth Munshi is an excellent choice. With their client-centric approach, ethical practices, and unwavering commitment to excellence, they are well-equipped to help you navigate the complexities of financial planning and achieve your dreams. Visit wealthmunshi.com to learn more and take the first step toward financial freedom.

#certified financial manager#financial planning planner#certified financial planner#financial planner#financial advisors#wealth management#wealth management companies#personal financial advisor near me#personal financial planner#financial advisors near me#financial planner near me#wealth management co#company wealth management#certified financial planner certification#best retirement planners#need financial planning#financial planning personal finance#need for financial planning#certified financial planner cfp certification#best financial planners#financial planners in hyderabad#registered investment advisor near me#best financial advisors near me#best financial advisor in hyderabad#nri wealth management#financial advisor for nri in india#nri financial advisor#nri financial planning#online investment advisor india#certified financial planner in hyderabad

2 notes

·

View notes

Text

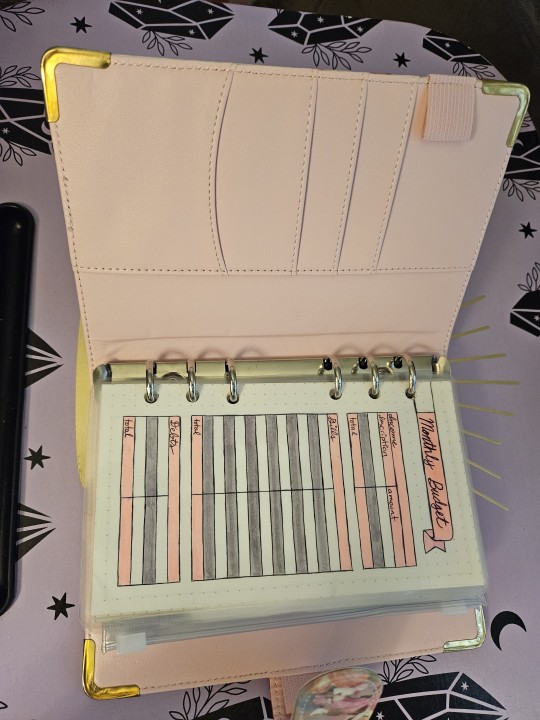

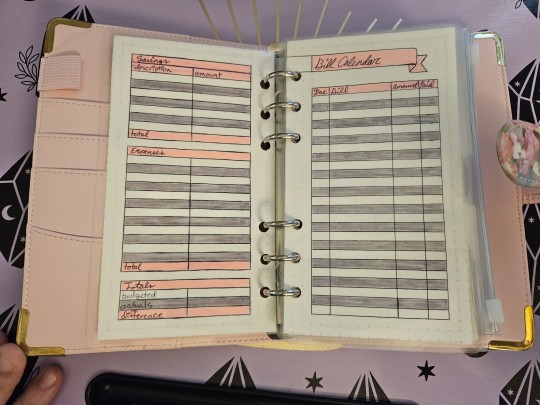

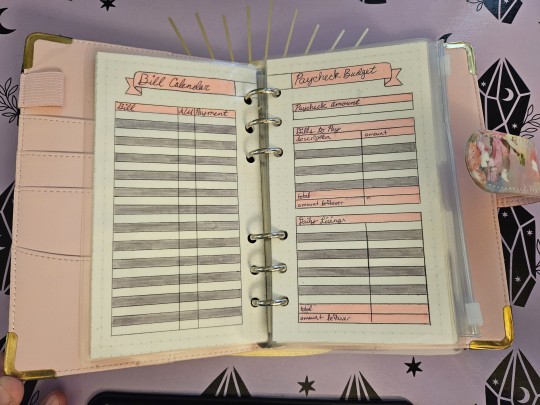

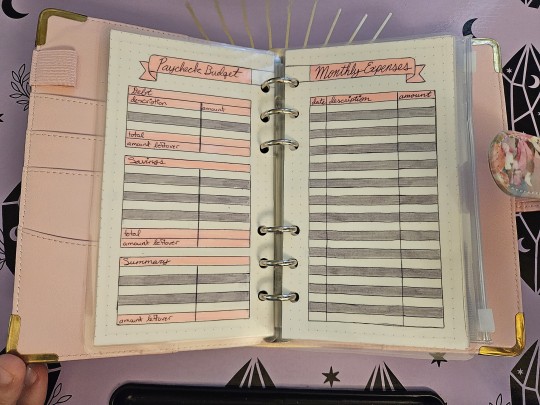

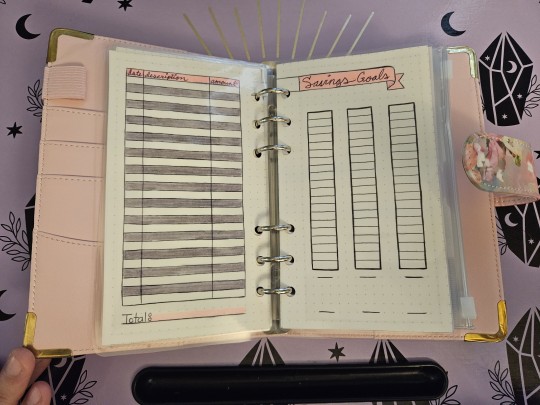

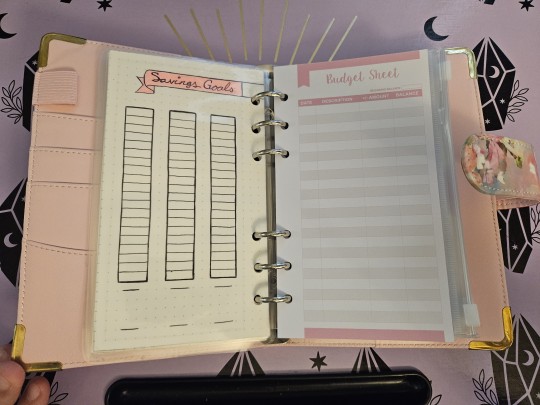

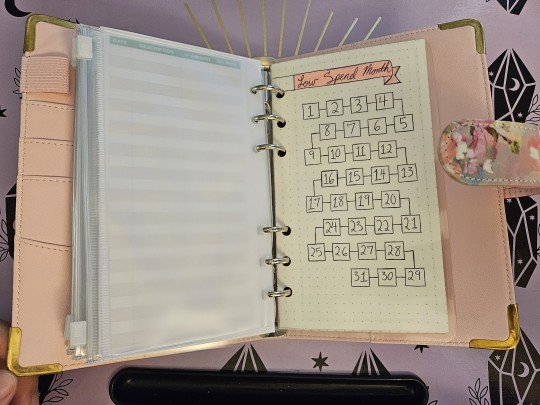

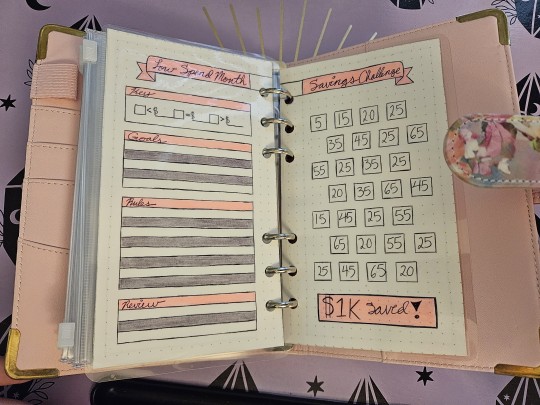

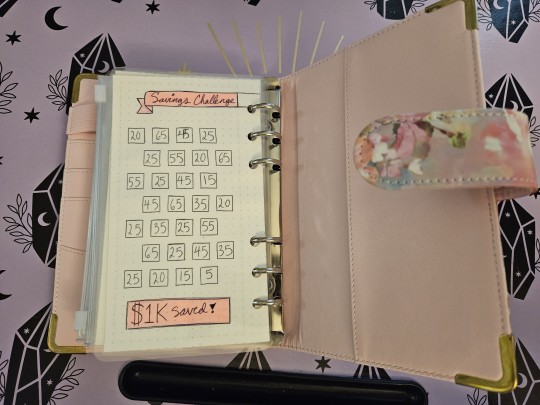

The final product for my friend's Financial Planner, her Christmas present from me going into the new year!

I hand drew and colored each of her spreads, front and back, then laminated the pages before hole punching them. Most of it is for budgeting, but the last two pages are for monthly challenges to help her save more money!

#bullet journal#bujo#goals#journal#planner#finances binder#handmade#hand drawn#crafts#finances#planning

11 notes

·

View notes

Text

Top Financial Planner Services for Holistic Financial Wellness

Financial wellness goes beyond managing money—it’s about peace of mind knowing your financial health is secure. A top financial planner offers comprehensive services, helping you manage everything from budgeting and savings to investments and risk management. Their holistic approach ensures every aspect of your finances is well-managed, allowing you to navigate life’s uncertainties confidently. With a top financial planner, you’re not just growing wealth but cultivating a financially secure lifestyle.

2 notes

·

View notes

Text

How to Choose the Best Finance Management App for Your Family?

In the era of inflation, planning, controlling, and organizing your finances has become more crucial than ever before. However, managing your money isn’t as simple as it appears to be. That is why getting the best family finance management app is the need of the hour. These apps can enable you to monitor your expenses, set budgets, and save more in the long run.

For enhanced outcomes, selecting the right finance manager app is crucial. Are you wondering how to pick the best one? Read on to explore the steps you need to follow!

#1 Define Your Goals

Before you start looking for an app to track budget spending, you must have an idea of your unique needs and financial objectives. Determine whether you want to track your spending habits and create a budget or are willing to save more money for a vacation and other long-term aspirations. Having clarity of your goals can enable you to list down the essential features of the desired app and help proceed in the right direction.

#2 Invest Time in Research

Once you have penned down all your specific requirements, it is time to look for the top-rated and reliable finance management apps. To choose the best family finance management app, you must read the reviews and ratings of the applications. The reviews of real customers can provide you with genuine information about the features and functionalities of the app. As a result, it will become easier to shortlist the options and select the right one.

#3 Explore the Features

The main goal of a budget calculator app is to make money management easier for you. That is why understanding its features matters a lot to make the perfect choice. Look for apps that allow you to sync all financial data in one place, automate the categorization of expenses, facilitate budget creation, and ensure more savings. Apart from these features, the app must also be able to provide you with insightful reports for a better understanding of your financial standing.

#4 Evaluate the Accessibility and Usability

When deciding on a financial tool for your family, it is wise to test how accessible it is and evaluate its complexity. Make sure that the app you choose has a simple user interface, is easy to use, and is readily accessible on all devices. Such an app can save you valuable time and simplify finance management.

#5 Test the App

Several finance management apps come with free trial versions. So, before you finalize your options, it is worth giving the apps a try. It can enable you to get a better idea about the functionalities and features and make your choice easier.

Conclusion

In recent times, the reliance on money management apps has been on the rise. Are you looking for the best app to save money? Kashify can be the right choice for all your needs. Get the app, evaluate its features and functionalities, and ensure better budget management for your family.

Blog Source: https://kashify.app/how-to-choose-the-best-finance-management-app-for-your-family/

#best family finance management app#finance manager app#app to track budget spending#best budget planner apps#management

0 notes