#decentralized payments

Explore tagged Tumblr posts

Video

youtube

11 New Tech Breakthroughs Straight From Sci-Fi Movies!

#youtube#decentralized network#decentralized payments#ai technology#crypto currencies#alternative banking#automated financial processes#new tech breakthroughs#immersive universes

0 notes

Text

Blockchain Payments: The Game Changer in the Finance Industry

The finance industry has experienced a remarkable transformation over the past few years, with blockchain payments emerging as one of the most groundbreaking innovations. As businesses and individuals increasingly seek secure, transparent, and efficient transaction methods, blockchain technology has positioned itself as a powerful solution that challenges traditional payment systems.

Understanding Blockchain Payments

At its core, blockchain payments utilize decentralized ledger technology (DLT) to facilitate transactions without intermediaries such as banks. Unlike conventional payment systems, which rely on centralized institutions, blockchain operates through a distributed network of nodes that validate and record transactions in an immutable ledger. This decentralized approach ensures greater transparency, security, and efficiency in financial transactions.

Key Benefits of Blockchain Payments

1. Security and Transparency

Blockchain transactions are encrypted and recorded on an immutable ledger, making them highly secure and tamper-proof. The decentralized nature of blockchain ensures that no single entity can alter transaction records, increasing transparency and reducing the risk of fraud.

2. Lower Transaction Costs

Traditional payment methods often involve intermediaries such as banks and payment processors, which charge significant fees for transaction processing. Blockchain payments eliminate the need for intermediaries, resulting in lower transaction costs for businesses and consumers.

3. Faster Cross-Border Transactions

International transactions using traditional banking systems can take days to settle due to multiple intermediaries and regulatory approvals. Blockchain payments, on the other hand, enable near-instant cross-border transactions, enhancing financial inclusivity and reducing delays.

4. Enhanced Accessibility

Blockchain payments provide financial services to individuals and businesses without requiring a traditional bank account. This feature is particularly beneficial for underbanked populations, allowing them to participate in the global economy.

Real-World Applications of Blockchain Payments

E-Commerce and Retail: Merchants are integrating blockchain payment systems to accept cryptocurrencies, offering customers an alternative and secure payment method.

Remittances: Migrant workers can send money to their families without high remittance fees, ensuring more money reaches the recipients.

Supply Chain Management: Blockchain ensures secure and transparent payments between suppliers, manufacturers, and distributors.

Decentralized Finance (DeFi): DeFi platforms leverage blockchain payments for lending, borrowing, and yield farming, providing users with financial services without traditional banks.

How Resmic is Revolutionizing Blockchain Payments?

Resmic is at the forefront of enabling seamless cryptocurrency transactions, empowering businesses to embrace blockchain payments effortlessly. The platform provides a secure and user-friendly payment infrastructure, allowing businesses to accept multiple cryptocurrencies while ensuring compliance with regulatory requirements.

Key Features of Resmic:

Multi-Currency Support: Accepts various cryptocurrencies, enhancing customer flexibility.

Fast Settlements: Near-instant transactions for efficient cash flow management.

Secure Transactions: Robust encryption and decentralized validation for enhanced security.

Seamless Integration: Easy API integration with existing payment systems and e-commerce platforms.

Embracing the Future of Finance

Blockchain payments are reshaping the financial landscape, offering businesses and individuals a more efficient and secure way to transfer value globally. As adoption continues to grow, platforms like Resmic play a crucial role in facilitating this transition. By leveraging blockchain technology, businesses can stay ahead of the curve and unlock new opportunities in the digital economy.

3 notes

·

View notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

1 note

·

View note

Text

The Rise of Decentralized Crypto Payments: Transforming Financial Transactions

The landscape of financial transactions has been undergoing a profound transformation, thanks to the advent of decentralized cryptocurrencies. Unlike traditional financial systems, which rely on centralized institutions like banks and payment processors, decentralized crypto payments leverage blockchain technology to facilitate peer-to-peer transactions. This shift promises not only greater efficiency but also a reimagining of how we handle money in a digital age.

Understanding Decentralized Crypto Payments

Decentralized crypto payments are transactions conducted using cryptocurrencies over blockchain networks without the need for intermediaries. In contrast to traditional systems, which depend on centralized authorities to process and validate transactions, decentralized systems rely on distributed ledger technology. This technology ensures that transactions are recorded across a network of computers, making them immutable and transparent.

At the heart of decentralized crypto payments is the blockchain—a public ledger that records all transactions made with a particular cryptocurrency. This ledger is maintained by a network of nodes (computers) that validate and confirm transactions through consensus mechanisms. Popular cryptocurrencies like Bitcoin and Ethereum utilize these mechanisms to ensure the integrity and security of their networks.

Advantages of Decentralized Crypto Payments

Reduced Transaction Costs: Traditional payment systems often involve various intermediaries, each of whom takes a cut of the transaction fees. Decentralized crypto payments eliminate many of these intermediaries, significantly reducing transaction costs. For instance, international transfers, which traditionally involve hefty fees and conversion rates, can be executed with minimal costs using cryptocurrencies.

Increased Financial Inclusion: Decentralized systems have the potential to bring financial services to the unbanked and underbanked populations. In regions where traditional banking infrastructure is scarce, cryptocurrencies provide an accessible alternative. All that is needed is a smartphone and internet access to participate in the global financial system.

Enhanced Security and Privacy: The decentralized nature of cryptocurrencies means that transactions are less susceptible to hacking and fraud. Blockchain technology employs advanced cryptographic techniques to secure data, making it difficult for malicious actors to alter transaction records. Moreover, cryptocurrencies often provide users with greater control over their financial privacy compared to traditional systems.

Global Accessibility: Cryptocurrencies operate on a global scale, enabling instant cross-border transactions. This global accessibility is particularly beneficial for businesses and individuals engaged in international trade or with family members living abroad. It eliminates the need for currency conversion and the associated delays.

Transparency and Immutability: The blockchain's transparent nature allows all participants to view transaction records, fostering accountability. Once a transaction is recorded, it cannot be altered, ensuring a reliable and tamper-proof history of all financial activities.

Challenges and Considerations

Despite the promising advantages, decentralized crypto payments face several challenges that need to be addressed for widespread adoption.

Regulatory Uncertainty: Cryptocurrencies operate in a regulatory gray area in many countries. Governments are still grappling with how to regulate and integrate these digital assets into the existing financial framework. The evolving regulatory landscape can create uncertainty and hinder the adoption of decentralized payments.

Scalability Issues: Many blockchain networks, particularly those based on proof-of-work mechanisms like Bitcoin, face scalability issues. As the number of transactions increases, the network can become congested, leading to slower processing times and higher fees. Solutions such as layer-two protocols and improvements to consensus mechanisms are being developed to address these challenges.

Volatility: Cryptocurrencies are known for their price volatility. The value of digital assets can fluctuate significantly within short periods, which can be a concern for both consumers and businesses. Stablecoins, which are pegged to traditional assets like fiat currencies, are being introduced to mitigate this issue, but the stability of these coins is still under scrutiny.

Technical Barriers: While the underlying technology of cryptocurrencies is sophisticated, it can be challenging for the average user to understand and utilize effectively. Issues such as the secure storage of private keys and the management of digital wallets require a certain level of technical knowledge.

Adoption and Integration: For decentralized crypto payments to become mainstream, more merchants and service providers need to accept cryptocurrencies. The integration of crypto payment systems into existing financial infrastructure and point-of-sale systems is crucial for broader adoption.

The Future of Decentralized Payments

Looking ahead, the future of decentralized crypto payments appears promising but will depend on overcoming the current challenges. Continued advancements in blockchain technology, regulatory clarity, and increased adoption by businesses and consumers will play critical roles in shaping this future.

Innovations like decentralized finance (DeFi) platforms are already expanding the capabilities of cryptocurrencies beyond simple payments, enabling more complex financial transactions such as lending, borrowing, and earning interest. As these technologies mature and become more integrated into everyday financial activities, decentralized crypto payments may become a cornerstone of the global financial system.

In conclusion, decentralized crypto payments represent a revolutionary shift in how we think about and conduct financial transactions. With their potential to lower costs, increase accessibility, and enhance security, cryptocurrencies have the capacity to redefine our economic landscape. While challenges remain, ongoing developments and growing acceptance suggest that decentralized payments could play a significant role in the future of finance.

#Decentralized crypto payments#best crypto to buy today#inceptcoinicc#inceptcoins#cryptocurrency#blockchain#finance#crypto#bitcoin

0 notes

Text

IEEE Trans. on Services Computing Vol. 16 Iss. 3, 16 Sept. 2022, DOI: 10.1109/TSC.2022.3207224

Blockchain-based payment system with auditable cryptocurrency; consortium blockchain; PoA consensus; dynamic DIDs. Fund recovery protocol for key loss risks.

https://ieeexplore.ieee.org/document/9894089

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Bitcoin, Next Stop 69k: Will The Entire Crypto Market Rise With It? | Bitcoin, Ethereum, Cardano, Uniswap, XRP, Helium, Arweave, Filecoin, Polkadot, Stellar Lumens

New Post has been published on https://www.ultragamerz.com/bitcoin-next-stop-69k-will-the-entire-crypto-market-rise-with-it-bitcoin-ethereum-cardano-uniswap-xrp-helium-arweave-filecoin-polkadot-stellar-lumens/

Bitcoin, Next Stop 69k: Will The Entire Crypto Market Rise With It? | Bitcoin, Ethereum, Cardano, Uniswap, XRP, Helium, Arweave, Filecoin, Polkadot, Stellar Lumens

Bitcoin, Next Stop 69k: Will The Entire Crypto Market Rise With It?

Bitcoin, Ethereum, Cardano, Uniswap, XRP, Helium, Arweave, Filecoin, Polkadot, Stellar Lumens

The recent surge of Bitcoin past the $50,000 mark has sent shockwaves through the crypto community, igniting hopes of a broader market recovery. While Bitcoin often sets the tone for the rest of the cryptocurrency space, is its ascent enough to guarantee a sunny outlook for other digital assets? Let’s explore the implications and delve into some promising contenders poised to benefit from this potential upswing.

Bitcoin’s Bullish Breakout: A Rising Tide Lifting All Boats?

Historically, Bitcoin’s price movements have had a significant influence on the broader crypto market. Its recent rally could signal renewed investor confidence and increased risk appetite, potentially leading to positive spillover effects for other cryptocurrencies. This optimism stems from several factors:

Increased mainstream adoption: Growing institutional interest and regulatory frameworks are paving the way for wider acceptance of Bitcoin, potentially driving further price appreciation.

Limited supply: Bitcoin’s capped supply of 21 million coins creates scarcity, making it a potential hedge against inflation and attracting investors seeking long-term value.

Technological advancements: Ongoing developments in the Lightning Network and other scaling solutions aim to address transaction speed and scalability concerns, enhancing Bitcoin’s utility.

Hot on Bitcoin’s Heels: Promising Crypto Assets to Watch

While Bitcoin may be the bellwether, several other projects hold immense potential:

Ethereum (ETH): The leading smart contract platform, facilitating decentralized applications (dApps) across various industries like finance, gaming, and NFTs. ETH 2.0, its upcoming upgrade, promises improved scalability and sustainability.

Cardano (ADA): Focused on security and scalability through a proof-of-stake consensus mechanism, Cardano aims to become a global financial system for everyone. Its rigorous peer-reviewed development process adds to its appeal.

Uniswap (UNI): A pioneering decentralized exchange (DEX) enabling peer-to-peer cryptocurrency trading without intermediaries. UNI governance tokens allow users to participate in platform decisions.

XRP (XRP): Designed for facilitating fast and cost-effective cross-border payments, XRP is popular among financial institutions. Its ongoing legal battle with the SEC adds an element of uncertainty.

Helium (HNT): Powering the decentralized Helium Network for internet-of-things (IoT) devices, HNT rewards individuals for hosting hotspots, creating a unique incentive model.

Arweave (AR): A decentralized storage solution offering permanent and verifiable data storage, Arweave caters to long-term data preservation needs.

Filecoin (FIL): Another decentralized storage project, Filecoin incentivizes network participants to store data securely and efficiently.

Polkadot (DOT): Aiming to connect different blockchains, Polkadot facilitates interoperability between diverse ecosystems, potentially unlocking the full potential of blockchain technology.

Stellar Lumens (XLM): Similar to XRP, XLM focuses on fast and low-cost cross-border payments, targeting remittance corridors and financial inclusion.

Remember: While Bitcoin’s momentum is encouraging, the crypto market remains volatile. Thorough research and understanding of individual projects’ fundamentals are crucial before making any investment decisions. Past performance is not indicative of future results.

This list highlights just a few of the many exciting projects in the crypto space. With Bitcoin breaking barriers, the coming months could see a revitalized market, but always approach every investment with caution and do your own research.

Keywords:

Bitcoin, Ethereum, Cardano, Uniswap, XRP, Helium, Arweave, Filecoin, Polkadot, Stellar Lumens, cryptocurrency, crypto market, Bitcoin price, crypto recovery, altcoins, blockchain, DeFi, smart contracts, dApps, decentralized finance, internet of things, data storage, cross-border payments, investment, technology, future of finance, space, moon, fantasy, nebula, rocket, spaceship, mascot, emblem, celestial body, pixel art, anime, constellation, panorama.

#Altcoins#Anime#Arweave#bitcoin#bitcoin price#blockchain#cardano#celestial body#constellation#cross-border payments#crypto market#crypto recovery#Cryptocurrency#dApps#data storage#decentralized finance#DeFi#emblem#ethereum#Fantasy#Filecoin#future of finance#Helium#internet of things#investment#mascot#moon#nebula#panorama.#pixel art

0 notes

Text

Embracing Cryptocurrency Compensation: Employees Opt for Bitcoin Salaries Amidst Economic Volatility

Amid economic turbulence, a growing trend has emerged where employees are actively selecting cryptocurrency as their preferred form of compensation. Bitcoin, the pioneering digital currency, has gained traction as a viable alternative to traditional paychecks. Here we explore the rising popularity of Bitcoin salaries among employees seeking stability and flexibility amidst economic…

View On WordPress

#Adoption#Bitcoin#Bitcoin payments#Bitcoin salaries#crypto#crypto payments#Cryptocurrency#decentralization

0 notes

Text

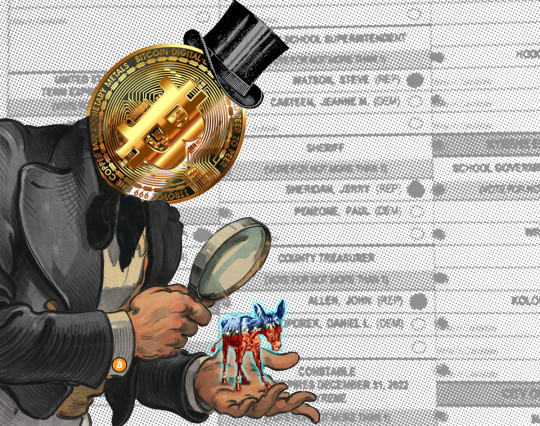

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

433 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

278 notes

·

View notes

Text

Updated Personal Infosec Post

Been awhile since I've had one of these posts part deus: but I figure with all that's going on in the world it's time to make another one and get some stuff out there for people. A lot of the information I'm going to go over you can find here:

https://www.privacyguides.org/en/tools/

So if you'd like to just click the link and ignore the rest of the post that's fine, I strongly recommend checking out the Privacy Guides. Browsers: There's a number to go with but for this post going forward I'm going to recommend Firefox. I know that the Privacy Guides lists Brave and Safari as possible options but Brave is Chrome based now and Safari has ties to Apple. Mullvad is also an option but that's for your more experienced users so I'll leave that up to them to work out. Browser Extensions:

uBlock Origin: content blocker that blocks ads, trackers, and fingerprinting scripts. Notable for being the only ad blocker that still works on Youtube.

Privacy Badger: Content blocker that specifically blocks trackers and fingerprinting scripts. This one will catch things that uBlock doesn't catch but does not work for ads.

Facebook Container: "but I don't have facebook" you might say. Doesn't matter, Meta/Facebook still has trackers out there in EVERYTHING and this containerizes them off away from everything else.

Bitwarden: Password vaulting software, don't trust the password saving features of your browsers, this has multiple layers of security to prevent your passwords from being stolen.

ClearURLs: Allows you to copy and paste URL's without any trackers attached to them.

VPN: Note: VPN software doesn't make you anonymous, no matter what your favorite youtuber tells you, but it does make it harder for your data to be tracked and it makes it less open for whatever public network you're presently connected to.

Mozilla VPN: If you get the annual subscription it's ~$60/year and it comes with an extension that you can install into Firefox.

Mullvad VPN: Is a fast and inexpensive VPN with a serious focus on transparency and security. They have been in operation since 2009. Mullvad is based in Sweden and offers a 30-day money-back guarantee for payment methods that allow it.

Email Provider: Note: By now you've probably realized that Gmail, Outlook, and basically all of the major "free" e-mail service providers are scraping your e-mail data to use for ad data. There are more secure services that can get you away from that but if you'd like the same storage levels you have on Gmail/Ol utlook.com you'll need to pay.

Tuta: Secure, end-to-end encrypted, been around a very long time, and offers a free option up to 1gb.

Mailbox.org: Is an email service with a focus on being secure, ad-free, and privately powered by 100% eco-friendly energy. They have been in operation since 2014. Mailbox.org is based in Berlin, Germany. Accounts start with up to 2GB storage, which can be upgraded as needed.

Email Client:

Thunderbird: a free, open-source, cross-platform email, newsgroup, news feed, and chat (XMPP, IRC, Matrix) client developed by the Thunderbird community, and previously by the Mozilla Foundation.

FairMail (Android Only): minimal, open-source email app which uses open standards (IMAP, SMTP, OpenPGP), has several out of the box privacy features, and minimizes data and battery usage.

Cloud Storage:

Tresorit: Encrypted cloud storage owned by the national postal service of Switzerland. Received MULTIPLE awards for their security stats.

Peergos: decentralized and open-source, allows for you to set up your own cloud storage, but will require a certain level of expertise.

Microsoft Office Replacements:

LibreOffice: free and open-source, updates regularly, and has the majority of the same functions as base level Microsoft Office.

OnlyOffice: cloud-based, free

FreeOffice: Personal licenses are free, probably the closest to a fully office suite replacement.

Chat Clients: Note: As you've heard SMS and even WhatsApp and some other popular chat clients are basically open season right now. These are a couple of options to replace those. Note2: Signal has had some reports of security flaws, the service it was built on was originally built for the US Government, and it is based within the CONUS thus is susceptible to US subpoenas. Take that as you will.

Signal: Provides IM and calling securely and encrypted, has multiple layers of data hardening to prevent intrusion and exfil of data.

Molly (Android OS only): Alternative client to Signal. Routes communications through the TOR Network.

Briar: Encrypted IM client that connects to other clients through the TOR Network, can also chat via wifi or bluetooth.

SimpleX: Truly anonymous account creation, fully encrypted end to end, available for Android and iOS.

Now for the last bit, I know that the majority of people are on Windows or macOS, but if you can get on Linux I would strongly recommend it. pop_OS, Ubuntu, and Mint are super easy distros to use and install. They all have very easy to follow instructions on how to install them on your PC and if you'd like to just test them out all you need is a thumb drive to boot off of to run in demo mode. For more secure distributions for the more advanced users the options are: Whonix, Tails (Live USB only), and Qubes OS.

On a personal note I use Arch Linux, but I WOULD NOT recommend this be anyone's first distro as it requires at least a base level understanding of Linux and liberal use of the Arch Linux Wiki. If you game through Steam their Proton emulator in compatibility mode works wonders, I'm presently playing a major studio game that released in 2024 with no Linux support on it and once I got my drivers installed it's looked great. There are some learning curves to get around, but the benefit of the Linux community is that there's always people out there willing to help. I hope some of this information helps you and look out for yourself, it's starting to look scarier than normal out there.

#infosec#personal information#personal infosec#info sec#firefox#mullvad#vpn#vpn service#linux#linux tails#pop_os#ubuntu#linux mint#long post#whonix#qubes os#arch linux

39 notes

·

View notes

Text

HeroFX: Key Concerns and Issues

HeroFX is an online trading platform established in 2021, offering various trading instruments like forex, indices, shares, futures, crypto, metals, and energies. However, several serious concerns make it a risky choice for traders.

🚨 Regulatory Concerns

No Regulation: HeroFX is not licensed by any major financial authority.

High Risk: Without regulation, there's no guarantee of fund safety or fair trading practices.

📉 User Feedback

Withdrawal Issues: Many users report problems withdrawing their funds.

Security Breaches: There are reports of security issues and possible fraud.

Poor Support: Customer support is often unhelpful and slow to respond.

💵 Minimum Deposit and Trading Conditions

Low Deposit: HeroFX advertises a low minimum deposit of $20.

High Leverage: Leverage up to 1:500.

Hidden Fees: Users report unexpected fees and unclear terms.

Crypto Payments: Reliance on cryptocurrency payments raises transparency and security concerns.

🖥️ Platform Reliability

MT5 Platform: HeroFX uses the popular MetaTrader 5 platform.

Technical Issues: Users report frequent technical problems and platform downtimes.

Unreliable: Lack of regulation undermines trust in the platform’s reliability and security.

🛑 Conclusion

HeroFX's lack of regulation, numerous user complaints, and unclear trading conditions make it a high-risk choice for traders. It's advised to be extremely cautious with HeroFX and consider safer, regulated alternatives.

If you would like a thorough analysis, please visit the full review on ForexJudge.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

64 notes

·

View notes

Text

Elon Musk and Vivek Ramaswamy have discussed the possibility of dismantling the Federal Deposit Insurance Corporation (FDIC). As co-leaders of the Department of Government Efficiency (DOGE), an advisory board established by President Donald Trump, they explored significant changes to federal financial regulatory agencies. Their discussions included the potential elimination of the FDIC, with proposals to transfer its deposit insurance responsibilities to the Treasury Department. Such actions would require congressional approval.

However, the relationship between Musk and Ramaswamy within DOGE became strained. Reports indicate that Musk advocated for Ramaswamy’s removal from the advisory board, leading to Ramaswamy’s departure.

These developments have sparked discussions about the future of federal financial regulation and the potential impacts of such significant structural changes.

Whether Elon Musk could end or significantly impact the FDIC, the short answer is no—at least not directly. The FDIC (Federal Deposit Insurance Corporation) is an independent U.S. government agency, and its operations, including insuring bank deposits, are controlled by federal law, not private individuals.

However, Musk—or any billionaire—could indirectly influence the financial system in ways that might challenge traditional banking structures. For example:

1. Encouraging Alternative Banking Systems – Musk has shown interest in decentralized finance (DeFi) and cryptocurrencies. If large-scale adoption of non-bank financial systems (like crypto or peer-to-peer banking) occurred, it could weaken the traditional banking sector that the FDIC protects.

2. Buying or Influencing Banks – While Musk cannot “end” the FDIC, he could buy a bank or invest in financial institutions, potentially reshaping banking policies or lobbying for deregulation.

3. Political Influence – If Musk heavily funded politicians or advocacy groups that push for major changes in banking regulations, he might contribute to policies that could alter the FDIC’s role or reduce government intervention in banking.

4. Disrupting Payments & Banking Infrastructure – If Musk’s companies (like X (formerly Twitter) or Tesla) introduced financial services that bypass traditional banks (such as an X “everything app” with built-in payments), it could gradually shift public reliance away from FDIC-backed institutions.

That said, the FDIC is deeply embedded in the U.S. financial system, and any major change would require congressional action, not just the efforts of a single billionaire. While Musk has disrupted many industries (cars, space, AI), taking down or replacing the entire U.S. deposit insurance system would be a far more difficult challenge.

#fdic#politics#us politics#political#donald trump#news#president trump#elon musk#american politics#jd vance#law#republicans#republican#lawmakers

29 notes

·

View notes

Text

Niche fandom happenings to take your mind after whatever stuffs happening in your fandom:

So as you can probably deduce, the model horse collecting hobby is made up mostly of older people. The hobby has been well established since the dawn of the Internet and I've talked a few times about how it's difficult to find some older resources about it/its history because of how every other link you click on which used to lead to a hobbyist artist's angelfire blog now is just a dead link or worse, bought out by some ad company sitting on the URL. Up until recently, a huge portion of hobby talk still relied on now-defunct Yahoo groups; now most have moved to either forums like Model Horse Blab or private Facebook groups. Individually most of these are pretty decentralized, but since model collecting by nature is a hobby that requires a significant amount of financial interaction (buying, trading, selling, commissioning, etc.), there has to be some kind of centralized marketplace for people to pitch their goods to as many corners of the hobby as possible.

Enter Model Horse Sales Pages (MH$P), a, well, site where people can post sales pages for model horses and accessories. It's an old fashioned sales pages site from the 2000s with a somewhat shitty layout but unparalleled detailed search functions-- to order things from a seller, you'd have to personally email them to negotiate for their listing. Though this seems somewhat inconvenient to our modern senses used to one click payments and speedy delivery, MH$P is undoubtedly a pillar of the model horse community.

... So that's why people are scrambling as it's allegedly been hacked and taken down for the foreseeable future. Worrying about personal information aside, now fans are left to wonder: what's the alternative? Well, the first one is of course eBay, which many hobbyists already use. However, eBay is obviously less catered to model horse hobbyists and is therefore a bit harder to search if you're deep in the hobby and can't be assed to look through 4000 "plastic horse" titled listings to find the 2008 SR glossy xX Devilish Girlfriend++ Thoroughbred you want. MH$P occupied a specific niche for long time fans looking for grails.

So what are our alternatives for people in the hobby looking to buy from others in the hobby? Well, there's a few decentralized official dealers like Chelsea's Model Horses or Triple Mountain who you can consign older models to, but going through a middleman takes time and you have much less freedom in your personal listings. Alternatively, you could go grassroots and post listings in Facebook groups and on forums, but those have reaches limited to the members of those specific, often small, groups, and it can be hard to move stock that way. So now people are looking for a backup marketplace platform, both for the current situation and longtime health of the hobby. But imagine my surprise when I went on Model Horse Blab and saw people suggesting an alternative site kickstarted by

STAR STABLE ONLINE YOUTUBER DENIS/DENISE WISESTORM. Denis has been a controversial figure in the SSO fandom (though there's pretty much no uncontroversial ssotubers especially on ssoblr because clickbaiting and weird reactionary takes are like the bread and butter of that side of the fandom) who's been called out for having some alt-right homophobic views in the past, as well as for his abject and unproductive negativity towards improvements made on the game. He's a lps customizer and pretty prolific breyer collector, though, so his drive to create a model trading and selling platform makes sense at least. But still! Why him!!!!!!

53 notes

·

View notes

Text

Sassanid silver plate 7th C. CE. Decorated with a figure seated on a couch in a crescent moon and a figure standing in an archway. Found in Klimova, Russia in 1907. The base of the vessel appears to have runic script scratched into it. This item is sometimes referred to as The ‘Clock of Khosrow’ or The ‘Throne of Khosrow’ Plate. Diameter: 21.6cm.

I'm just going to do a brief summary of what caused Persia to fall to Islam.

The Islamic invasion of Persia began sometime between 628-632 CE. From 541 CE to this time Persia had been exhausted by an almost constant state of war. Most of the fighting was with the Byzantine Empire in the west: The Lazic War (541-562), Byzantine–Sasanian War of 572–591, Byzantine–Sasanian War of 602–628.

However, there were also wars with the Turks to the north and the east: Perso-Turkic war of 588–589, Perso-Turkic war of 606–608, Perso-Turkic war of 627–629. In this final war the Byzantines and Turks were allies. This alliance took time to come into being but had been sought out by the Turks almost immediately after they destroyed the Hephthalites, indicating they planned to do to the Persians what they had done to the Huns. The medieval historian Movses Kaghankatvatsi described the war of 627-629:

"At the arrival of the all-powerful scourge (universal wrath) confronting us, the invaders [Turks], like billowing waves of the sea, crashed against the walls and demolished them to their foundations. [In Partaw], seeing the terrible danger from the multitude of hideously ugly, vile, broad-faced, without eyelashes, and with long flowing hair like women, which descended upon them, a great terror (trembling) seized the inhabitants. They were even more horrified when they saw the accurate and strong [Khazar] archers, whose arrows rained down upon them like heavy hailstones, and how they [Khazars], like ravenous wolves that had lost all shame, fell upon them and mercilessly slaughtered them on the streets and squares of the city. Their eyes had no mercy for neither the beautiful, nor handsome, nor the young men or women; they did not spare even the unfit, harmless, lame, nor old; they had no pity (compassion, regrets), and their hearts did not shrink at the sight of the babies embracing their murdered mothers; to the contrary, they suckled blood from their breasts like milk."

Ironically, the Sassanid ruler Khosrow I had married a Turkic princess to win an alliance with them so the two could destroy the Huns together in 560 CE at the Battle of Gol-Zarriun. Khosrow I chose his Turkic progeny, Hormizd IV, as ruler over his Persian children. From Iranica Online:

"Hormozd’s character displeased everyone. He antagonized the Zoroastrian clergy, allegedly killing many of them, even the chief mowbed, and alienated the nobility by killing thousands of them (Ṭabari, I, p. 991; tr., V, pp. 297-98; Balʿami, ed. Bahār, pp. 1072-73; Masʿudi, Moruj, ed. Pellat, sec. 632; Šāh-nāma, Moscow, VIII, pp. 319 ff.). In diplomacy he showed inflexibility, even poor judgement. He disrupted the peace negotiations with the Byzantines and made demands (payment of “tribute”) that the Romans could not accept (Menander, frag., 23.9-24-12529). His contemporary, Menander Protector, lamented that “the Romans and the Persians would have made peace, had not Ḵosrow left this life and his son, Hormisdas [Hormizd IV], a truly wicked man, assumed the crown” (tr., pp. 207-9)."

Finally the Sassanid Empire went into a civil war from 628-632 CE where it had become politically decentralized. The Plague of Sheroe also occurred in 627-628 CE, most heavily devastating the populations in the western provinces with some areas experiencing a 50% mortality rate. Afterward, the Arab Muslims flooded into an already ravaged Persia like bacteria infesting an open wound.

106 notes

·

View notes

Note

WRT social media platforms doing the legally mandated minimum (which you’ve convinced me on), how does sex work factor into this? Selling nude photos or videos is totally legal, but, from my understanding, social media platforms tend to ban it because of pressure from credit card companies. What does and doesn’t count as “sex work” is something that’s ultimately going to be left to a moderation team, which is going to wind up with the asymmetrical enforcement problem.

Obviously, the long term solution is legal protections for sex workers, but given where we are now, how do you think social media companies should go about handling sex work?

Short answer is it depends on the social network

If you're a behemoth like twitter that can't be bullied easily, just don't do anything (in terms of moderation, that is - an opt-in mature tagging system is nice for individual filtering). There's tons of sex workers and porn on twitter and it hasn't really come under fire yet.

For a decentralized fediverse style thing you can probably either fly under the radar or find some less restrictive payment processor - you're not going to be able to move huge amounts of money but you're not getting much either.

Sites like tumblr - too big to be unnoticed, too small to be untouchable - suffer the most. I recommend malicious compliance when possible (which feels kinda like what tumblr has done lately) but you gotta be careful not to fly too close to the sun. Goodhart as much as possible against the specific complaints you're given.

36 notes

·

View notes