#credit score report

Text

Check Credit Score Report Online | CIBIL Score | Paytm

Get your credit score report for free in just a few seconds at Paytm. Managing and maintaining a good CIBIL score is crucial for achieving financial goals and securing favorable lending terms. It is important to make your credit score intact and make sure that there is no delay in your payments. Also, learn more about credit history, factors affecting your credit score, and tips to manage your finances wisely. For more information, visit the site.

0 notes

Text

Insurance policy As Well As Your Credit Score Report (Part II)

Insurance policy As Well As Your Credit Score Report (Part II)

If I do not know my rating, and my score varies from company to business and day to day, exactly how will I know if my credit history is influencing my insurance purchases? The FCRA calls for an insurance company to inform you if they have taken an “adverse action” versus you, in whole or partially, due to your credit record info.

If your firm informs you that you have actually been detrimentally…

View On WordPress

#bureau#credit history#credit history bureau#credit rating#credit score report#customer.#errors#firm#improve#info#insurance#insurance policy#report#score

0 notes

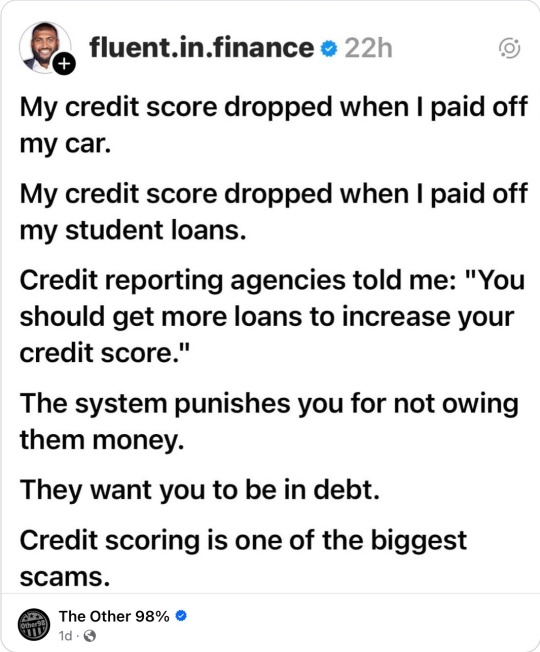

Text

#credit scores#credit reporting#corporate greed#oligarch assholes#tax the rich#the system is rigged for the rich

411 notes

·

View notes

Text

Tried to call and change my name with a credit card. I couldn't do it online, so I called and I was somehow unprepared for her to ask, "What is the reason for the change?"

I stared into space and said, "Uh... gender."

There was a very long pause before she went, "Alrighty."

#ramblies#They make me send in documents and I'm legit like#maybe I should just close this account rather than deal with that#I use the card so rarely and I only got it to help bump up my credit score#cause cards through stores report positively all year long even if you only used it once#but my credit is nice now and the hassle of mailing stuff is just not worth it#like I'd have to photocopy my license and then mail it in and they have no alternative

179 notes

·

View notes

Text

☝️

105 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

Understanding credit

Dafuq Is Credit and How Do You Bend It to Your Will?

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Ask the Bitches: What’s the Difference Between Credit Checks and Credit Monitoring?

When (And How) To Try Refinancing or Consolidating Student Loans

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Using credit

How to Instantly Increase Your Credit Score…For Free

How to Build Good Credit Without Going Into Debt

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Season 1, Episode 3: “My Parents Have Bad Credit. Should I Help by Co-signing Their Mortgage?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

Credit cards

A Hand-holding Guide To Getting Your First Credit Card

63% of Millennials Are Making a Big Mistake With Credit Cards

Let’s End This Damaging Misconception About Credit Cards

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

We’ll periodically update this masterpost as we continue to write tutorials and answer questions on credit. So if there’s anything you’re confused about, keep the questions coming!

And if we’ve helped you increase your credit score or pay off your credit card debt, consider tossing a coin to your Bitches through our PayPal. It ensures we can pay our lovely assistant and keep bringing you free articles and episodes like those above.

Toss a coin to your Bitches on PayPal

#credit#credit score#credit history#credit report#credit card#credit card debt#good credit#personal finance#money tips#debt management#debt consolidation#debt

102 notes

·

View notes

Text

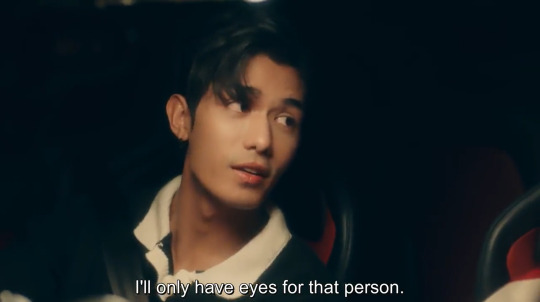

Bed Friend is such a good example of why even though I hate the miscommunication trope, I lowkey love the misunderstanding trope.

Because the truth is that Uea and King are actually pretty good at talking to each other and saying what they mean. The problem is that they are working from different frames of reference and neither, especially King, has the context to understand the other person's motives and how they will take what they've said.

So King is giving his best Tracy Chapman,

"Give me one reason to stay here and I'll turn right back around."

at the moment, and trying to make it clear he wants nothing to do with this arranged marriage, but needs to know Uea cares about losing him - needs to be in a relationship before he can use his relationship as an excuse to get out of this obligation.

But what he actually told Uea at the start of this, when Uea was up front about not believing he could actually commit, was:

If I'm serious about someone, I only care about them. And the only way you'll be convinced is if you give me a chance to prove it to you.

So Uea gives him that chance, and most importantly says:

If we meet someone else we want to be with, this is over.

The conflict of episode 6 isn't that they're not communicating properly, but that this shouldn't be a conflict at all based on what they've already said. We know throughout the whole episode that Uea isn't going to be the one to tell King he wants to stay together, because he already said he wants to be exclusive and gave King the terms of them staying together. We know Uea isn't going to ask King to take their relationship more seriously, because King already said that if he's serious, no one else matters to him.

Uea has no reason not to believe that if King wanted him as a partner, he would have already walked away from the arrangement. It seems an awful lot like King is trying to skirt a very clear hard-line rule.

And King has no reason not to believe that if Uea wanted to make their relationship official, he would have done so. Maybe after any of the times King had no problem calling himself Uea's boyfriend, or explained how he really doesn't want Uea to meet anyone else.

"If you want me, you need to ask me to stay." vs. "If you wanted me, I wouldn't have to ask you to stay."

As honest and vulnerable with each other as they've already been, they just don't know what they don't know.

#bed friend#bed friend the series#bed friend spoilers#bed friend episode 6#it's not like Uea is asking King to read his mind#King read the TOS and clicked I accept#he wanna upgrade his plan but he's supposed to be working on his credit score#canceling your vacation to go on a date with someone else does not look good on your report bud

197 notes

·

View notes

Text

"...the proposed rule...would reduce the number of people in the U.S. with medical debt listed on their credit reports to zero, down from 46 million in 2020." [emphasis added]

5 notes

·

View notes

Text

Just got a voicemail from a debt collector wtf. I dont owe any debts. Well I'm not calling them back. They want anything from me they can send it in writing

#crap#i never answer my phone lmao#if youre not on my contact list get fucked#even my hospital bill from october is paid like damn#got me all paranoid now i want to check my credit score#yeah nothing new on my credit report#so what the fuck#whatever im not calling them back i looked their name up and the one review of the closest match says theyre scammers and frauds lol

5 notes

·

View notes

Text

Every google search tonight has tried to autocomplete with pregnancy related searches after I’ve typed just one word

And yes, I know that google knows I’m a cis woman in my 30s but Jesus fucking Christ even women who want kids or are currently pregnant need to search things unrelated to pregnancy why does literally everything have to be reduced to pregnancy and babies

#I wanted to search ‘why are TransUnion and Equifax reporting 2 different credit scores’#and I got as far as ‘why’ and the top 3 autocompletes were about pregnancy#then I was looking up early 2000s fashion trends and the top autocomplete was ‘early signs of pregnancy’#maybe the more important question is why does google even bother trying to autocomplete with just one word? at least wait for a subject

1 note

·

View note

Text

How to Get the Best Personal Loan Offers in India

Introduction

In today’s fast-paced world, financial needs often arise unexpectedly. Whether it’s a medical emergency, a home renovation project, or a dream vacation, personal loans can provide the financial flexibility you need to make your aspirations a reality.

Pricemint, an Indian fintech platform, is dedicated to helping individuals unlock their financial potential by offering a straightforward and user-friendly process for obtaining personal loans.

Benefits:

Loan Comparison: Easily compare personal loan offers from multiple banks and financial institutions.

Competitive Interest Rates: Access low-interest rates and potentially save money over the loan tenure.

Convenient Digital Process: Apply for personal loans conveniently online, from anywhere.

Customized Loan Offers: Get loan offers tailored to your unique financial situation.

Flexible Loan Amounts: Choose from a wide range of loan amounts to suit your needs.

Varied Tenure Options: Select a repayment period that matches your financial circumstances.

Regional Considerations: Loan terms are adjusted to regional factors that may affect your eligibility.

Transparent Process: Clear information about interest rates, fees, and terms is provided.

Personalized Assistance: Receive guidance and support throughout the loan application process.

Privacy and Security: Your personal information is protected in accordance with their Privacy Policy.

How to Get the Best Personal Loan in a Minute –

Step 1: Select Your Employment Type

The first step in securing a personal loan through Pricemint is to define your employment status. Pricemint recognizes that different employment types may have distinct loan eligibility criteria. You can choose from the following options:

Salaried: Select this option if you are employed by a company and receive a regular salary.

Self-Employed Professional: If you work independently as a professional, this is the choice for you.

Business Owner: If you own a business, you can choose this option.

This initial step helps Pricemint tailor your loan options to your specific employment situation, ensuring that you receive the most relevant loan offers.

Step 2: Your Monthly Salary

Your monthly income plays a crucial role in determining your eligibility and the loan terms available to you. In this step, you will be asked to provide your monthly in-hand income. It’s essential to provide an accurate representation of your earnings to receive loan offers that align with your financial capacity.

Alternatively, you can simply type in your monthly income to expedite the process.

Step 3: Choose Your Primary Bank Account

Selecting the bank account for loan disbursement and repayments is the next step in the process. Your primary account should be the one you actively use for your financial transactions. Pricemint offers a list of popular banks to choose from, including HDFC BANK, SBI BANK, ICICI BANK, KOTAK BANK, AXIS BANK, BOB BANK, YES BANK, and an option for OTHER BANK. This choice ensures seamless loan disbursements and repayments.

Step 4: Provide Your Employment/Company Name

To gain deeper insights into your employment details, Pricemint requests the name of your employer or company. This information helps in assessing your financial stability and eligibility for personal loans.

Step 5: What’s Your Residence Type?

Understanding your living situation is crucial for evaluating your lifestyle and its financial implications. You will be asked to choose from various residence types:

Owned by You/Spouse

Owned by Parents

Rented with Family

Rented and Stay Alone

Company Provided

By selecting the option that best represents your current residence type, you help Pricemint tailor loan offers to your specific circumstances.

Step 6: Enter Your Current Residence City or Town

To consider regional factors that may affect your loan terms and eligibility, Pricemint requests the city or location where you currently reside. This information ensures that the loan offers you receive are in line with the conditions in your area.

Step 7: All Set! What’s Your Desired Loan Amount?

Finally, it’s time to specify the loan amount you wish to borrow. Pricemint offers a flexible range, catering to various financial needs. You can choose from the following options:

Under 1 Lakh

2/4 Lakh

5/9 Lakh

10 Lakh And Above

This wide range provides the

flexibility to select the loan amount that best suits your unique financial requirements.

Final Step – Enter Your Personal Details

In the last step, you will be required to enter your personal details, including:

Your Name

Your Email Address

Your Phone Number

This information is necessary to complete the application process and to contact you with personalized loan offers.

By clicking the “Get Offers/Apply Now/Continue” button, you indicate your acceptance of the Privacy Policy, ensuring the security of your personal information.

Conclusion

Pricemint makes obtaining personal loans in India a hassle-free process. By following the step-by-step guide outlined in this article, you can seamlessly navigate the application process, receive personalized loan offers tailored to your unique circumstances, and secure the financial support you need to achieve your goals and secure your future.

With a wide range of loan amounts, flexible tenure options ranging from 3 months to 8 years, and the ability to compare multiple offers with different interest rates, Pricemint empowers you to make informed financial decisions and choose the best loan deal for your needs.

Don’t let financial constraints hold you back from pursuing your dreams and addressing your urgent financial needs. Unlock your financial potential with Pricemint’s user-friendly personal loan application process and take control of your financial future. Get started today and embark on your journey toward financial stability and prosperity.

2 notes

·

View notes

Text

AI and Identity Theft Protection: Safeguarding Your Credit

Introduction

In a digital age fraught with cyber threats, Daniel Reitberg delves into how AI is reshaping the landscape of identity theft protection, offering individuals robust defenses against this increasingly sophisticated menace. With an eye on the critical importance of credit safety, this article explores the pivotal role that AI plays in safeguarding your financial well-being.

The Evolving Face of Identity Theft

Identity theft has taken on new forms and complexities, with criminals constantly adapting to exploit vulnerabilities. From phishing scams to data breaches, the techniques are as diverse as they are cunning.

AI-Powered Security Solutions

Artificial Intelligence (AI) has emerged as a potent weapon against these evolving threats. AI-driven identity theft protection services leverage machine learning to detect unusual patterns and behaviors in your financial activities. This capability is a game-changer in the fight against identity theft.

Real-time Threat Detection

One of the striking features of AI in this context is its real-time threat detection. AI algorithms continuously monitor your financial transactions, searching for signs of suspicious activity. Whether it's an unfamiliar credit card charge or an application for a new loan in your name, AI is vigilant.

Predictive Analysis

AI doesn't just react to known threats; it also predicts potential risks. By analyzing your past financial behavior, AI can detect when something doesn't align with your typical patterns. This predictive analysis is invaluable for stopping identity theft before it wreaks havoc.

Mitigation and Response

In case of a threat, AI doesn't just alert you; it also assists in the mitigation and response. It can, for instance, guide you through the process of freezing your credit, reporting fraud to the relevant authorities, and even recovering your identity.

Educational Resources

AI-powered identity theft protection isn't just about security; it's also about empowering users with knowledge. These services often offer resources and guidance on how to protect your personal information online and enhance your overall digital security.

The Ethical Dimension

As AI becomes a central player in safeguarding our identities, ethical considerations come into play. The responsible use of data and transparency in how AI analyzes personal information is critical for maintaining public trust.

The Future of Identity Theft Protection

The synergy between AI and identity theft protection holds immense promise. As AI algorithms become more sophisticated, users can expect even more robust security and seamless experiences.

Daniel Reitberg: A Voice for AI in Identity Protection

Daniel Reitberg is a staunch advocate for the intersection of AI and identity theft protection. His deep understanding of technology's potential in ensuring financial security underscores the transformative role of AI in safeguarding individuals' credit. In a world where digital threats loom large, the partnership between AI and identity theft protection offers a beacon of hope.

#artificial intelligence#machine learning#deep learning#technology#robotics#credit restoration#credit rating#credit report#credit repair#credit risk#credit score#identity theft

4 notes

·

View notes

Text

👏👏👏

#vote Biden Harris#medical debt#credit score#credit report#democrats help the people#Republicans help corporations and the rich#republican assholes#maga morons#convicted felon trump

124 notes

·

View notes

Text

if experian ever manifested as a human being i would FIGHT THEM omg. i am trying to reach through my screen and strangle them.

#sent in my name change documents a couple months ago. they changed my name but only for like. automated emails#and have not changed my name for my CREDIT SCORE which was the POINT#have gone back and forth multiple times with customer support in which they were completely unhelpful#only for one of them to be like ‘oh you actually need to call a different department.’ HELLO?????#why didn’t you say that the first time#why on earth would i want to change my name for only my online profile and not my ACTUAL CREDIT REPORT????#you have all the info and my documents and now i need to do it all AGAIN with a different department??????#i’ll kick your ass.#river talks

5 notes

·

View notes

Text

if my life wasn’t too hectic and exhausting enough, my social security number is listed on a child support case

for whose baby?

GREAT QUESTION

#I was just trying to claim some left over money from my old bank from before I moved#but I get a letter saying it’s being held because *I* owe over 2k#my mom tried to call to get it fixed for me today but I have to go in person#I’ve been keeping an eye on my credit report and score though and it looks like possibly *hopefully*#a case of mistaken not stolen identity#gotta love typos

4 notes

·

View notes

Text

Credit Scoring Is a Racist, Classist System that Has Us All Trapped

52 notes

·

View notes