#cost of financing

Explore tagged Tumblr posts

Text

Shifting $677m from the banks to the people, every year, forever

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

"Switching costs" are one of the great underappreciated evils in our world: the more it costs you to change from one product or service to another, the worse the vendor, provider, or service you're using today can treat you without risking your business.

Businesses set out to keep switching costs as high as possible. Literally. Mark Zuckerberg's capos send him memos chortling about how Facebook's new photos feature will punish anyone who leaves for a rival service with the loss of all their family photos – meaning Zuck can torment those users for profit and they'll still stick around so long as the abuse is less bad than the loss of all their cherished memories:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

It's often hard to quantify switching costs. We can tell when they're high, say, if your landlord ties your internet service to your lease (splitting the profits with a shitty ISP that overcharges and underdelivers), the switching cost of getting a new internet provider is the cost of moving house. We can tell when they're low, too: you can switch from one podcatcher program to another just by exporting your list of subscriptions from the old one and importing it into the new one:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

But sometimes, economists can get a rough idea of the dollar value of high switching costs. For example, a group of economists working for the Consumer Finance Protection Bureau calculated that the hassle of changing banks is costing Americans at least $677m per year (see page 526):

https://files.consumerfinance.gov/f/documents/cfpb_personal-financial-data-rights-final-rule_2024-10.pdf

The CFPB economists used a very conservative methodology, so the number is likely higher, but let's stick with that figure for now. The switching costs of changing banks – determining which bank has the best deal for you, then transfering over your account histories, cards, payees, and automated bill payments – are costing everyday Americans more than half a billion dollars, every year.

Now, the CFPB wasn't gathering this data just to make you mad. They wanted to do something about all this money – to find a way to lower switching costs, and, in so doing, transfer all that money from bank shareholders and executives to the American public.

And that's just what they did. A newly finalized Personal Financial Data Rights rule will allow you to authorize third parties – other banks, comparison shopping sites, brokers, anyone who offers you a better deal, or help you find one – to request your account data from your bank. Your bank will be required to provide that data.

I loved this rule when they first proposed it:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

And I like the final rule even better. They've really nailed this one, even down to the fine-grained details where interop wonks like me get very deep into the weeds. For example, a thorny problem with interop rules like this one is "who gets to decide how the interoperability works?" Where will the data-formats come from? How will we know they're fit for purpose?

This is a super-hard problem. If we put the monopolies whose power we're trying to undermine in charge of this, they can easily cheat by delivering data in uselessly obfuscated formats. For example, when I used California's privacy law to force Mailchimp to provide list of all the mailing lists I've been signed up for without my permission, they sent me thousands of folders containing more than 5,900 spreadsheets listing their internal serial numbers for the lists I'm on, with no way to find out what these lists are called or how to get off of them:

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

So if we're not going to let the companies decide on data formats, who should be in charge of this? One possibility is to require the use of a standard, but again, which standard? We can ask a standards body to make a new standard, which they're often very good at, but not when the stakes are high like this. Standards bodies are very weak institutions that large companies are very good at capturing:

https://pluralistic.net/2023/04/30/weak-institutions/

Here's how the CFPB solved this: they listed out the characteristics of a good standards body, listed out the data types that the standard would have to encompass, and then told banks that so long as they used a standard from a good standards body that covered all the data-types, they'd be in the clear.

Once the rule is in effect, you'll be able to go to a comparison shopping site and authorize it to go to your bank for your transaction history, and then tell you which bank – out of all the banks in America – will pay you the most for your deposits and charge you the least for your debts. Then, after you open a new account, you can authorize the new bank to go back to your old bank and get all your data: payees, scheduled payments, payment history, all of it. Switching banks will be as easy as switching mobile phone carriers – just a few clicks and a few minutes' work to get your old number working on a phone with a new provider.

This will save Americans at least $677 million, every year. Which is to say, it will cost the banks at least $670 million every year.

Naturally, America's largest banks are suing to block the rule:

https://www.americanbanker.com/news/cfpbs-open-banking-rule-faces-suit-from-bank-policy-institute

Of course, the banks claim that they're only suing to protect you, and the $677m annual transfer from their investors to the public has nothing to do with it. The banks claim to be worried about bank-fraud, which is a real thing that we should be worried about. They say that an interoperability rule could make it easier for scammers to get at your data and even transfer your account to a sleazy fly-by-night operation without your consent. This is also true!

It is obviously true that a bad interop rule would be bad. But it doesn't follow that every interop rule is bad, or that it's impossible to make a good one. The CFPB has made a very good one.

For starters, you can't just authorize anyone to get your data. Eligible third parties have to meet stringent criteria and vetting. These third parties are only allowed to ask for the narrowest slice of your data needed to perform the task you've set for them. They aren't allowed to use that data for anything else, and as soon as they've finished, they must delete your data. You can also revoke their access to your data at any time, for any reason, with one click – none of this "call a customer service rep and wait on hold" nonsense.

What's more, if your bank has any doubts about a request for your data, they are empowered to (temporarily) refuse to provide it, until they confirm with you that everything is on the up-and-up.

I wrote about the lawsuit this week for @[email protected]'s Deeplinks blog:

https://www.eff.org/deeplinks/2024/10/no-matter-what-bank-says-its-your-money-your-data-and-your-choice

In that article, I point out the tedious, obvious ruses of securitywashing and privacywashing, where a company insists that its most abusive, exploitative, invasive conduct can't be challenged because that would expose their customers to security and privacy risks. This is such bullshit.

It's bullshit when printer companies say they can't let you use third party ink – for your own good:

https://arstechnica.com/gadgets/2024/01/hp-ceo-blocking-third-party-ink-from-printers-fights-viruses/

It's bullshit when car companies say they can't let you use third party mechanics – for your own good:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

It's bullshit when Apple says they can't let you use third party app stores – for your own good:

https://www.eff.org/document/letter-bruce-schneier-senate-judiciary-regarding-app-store-security

It's bullshit when Facebook says you can't independently monitor the paid disinformation in your feed – for your own good:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#quis-custodiet-ipsos-zuck

And it's bullshit when the banks say you can't change to a bank that charges you less, and pays you more – for your own good.

CFPB boss Rohit Chopra is part of a cohort of Biden enforcers who've hit upon a devastatingly effective tactic for fighting corporate power: they read the law and found out what they're allowed to do, and then did it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

The CFPB was created in 2010 with the passage of the Consumer Financial Protection Act, which specifically empowers the CFPB to make this kind of data-sharing rule. Back when the CFPA was in Congress, the banks howled about this rule, whining that they were being forced to share their data with their competitors.

But your account data isn't your bank's data. It's your data. And the CFPB is gonna let you have it, and they're gonna save you and your fellow Americans at least $677m/year – forever.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/11/01/bankshot/#personal-financial-data-rights

#pluralistic#Consumer Financial Protection Act#cfpa#Personal Financial Data Rights#rohit chopra#finance#banking#personal finance#interop#interoperability#mandated interoperability#standards development organizations#sdos#standards#switching costs#competition#cfpb#consumer finance protection bureau#click to cancel#securitywashing#oligarchy#guillotine watch

466 notes

·

View notes

Text

here's the cost of living breakdown for Alabama, one of the least expensive states in the country to live it. annual income requirement to achieve "barely not struggling" (that's what "living wage" means, it means "how much money you have to earn to not be struggling financially") by the standards of MIT are the bottom row.

the website SmartAsset applied the 50/30/20 budget rule to this data from MIT to calculate how much it would take for someone to live comfortably (ie, above bare minimum "living wage") in each state and concluded it takes a minimum of 78k for a single adult in West Virginia, the cheapest state in the country.

standard disclaimer that I have personally never made anything near a living wage in my life, much less a comfortable wage, and am deeply in medical debt and so disabled I can't stand for more than a few hours a day. i just think it's important that other Americans are fully aware of just how poor they really are, and what "wealth" actually means in vast regions of the country. inflation and housing price increases have been so rapid, and the percentage of young adults managing their own households has dropped so significantly in the past twenty years (these things are related), that 90% of this website userbase is just completely unaware of what anything costs, and this isn't good for your financial literacy or ability to take care of yourselves.

if you disagree with these numbers please email MIT directly, I did not gather or compile this data. and cannot respond to your feedback about it.

#money#reminder: the average emergency costs $2000-3000 per person#if you are constantly worried about what will happen to your finances if you have to repair your car or go to the ER#you are definitionally not making a living wage#if you cannot save any money due to spending all of it on necessities you are not making a living wage#if you are juggling medical debt or living expenses on credit cards you are not making a living wage

624 notes

·

View notes

Text

Answer for yourself individually, not as a household/not counting partners' income.

This is specified to people who live in the US because cost of living and pay scales vary greatly in other countries.

–

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#money#finances#income#wages#salary#cost of living

383 notes

·

View notes

Text

To all my fellow Canadians:

If you have been putting off making any purchases, may I encourage you to do that RIGHT THE FUCK NOW.

Trump's tariffs against Canadian goods have give into effect, and Canada's retaliatory tariffs are going into effect on Tuesday. This will affect:

Pretty much any food product

Furniture of all kinds

Clothing, fabric, yarn, wool, linen, cotton...

Technology: LEDs, household appliances, phones, computers, etc.

Video games and game consoles

Board games! I wish I was joking!

Lumber and wooden items.

Paper and paper products, including books, notebooks, binders, folders...

Office supplies

Alcohol

And so much more! All this will increase in price by 25% in the very near future. So, brace for impact, stock up on necessary items, and hope for the fucking best.

ETA: well, Trump seems to have backed down for the time being. We'll see what happens in the meanwhile, but keep your eyes peeled.

#Canada#Canadian politics#tariffs#us politics#Donald Trump#cost of living#i don't mean to encourage impulse purchases but like if you're running low on printer paper maybe now is the time to run to Staples#go to the grocery store and buy some produce and freeze it#get some orange juice concentrate#I'm so glad i decided to start gardening this year#United States#finances

57 notes

·

View notes

Text

Garet is literally so friend shaped. I can't believe how friend shaped this boy is. (top pic is actual dialogue)

#golden sun#garet#ivan#guys im sorry i spent all day on this and also a smidge of oc art#im in pain and im not going to die but wow#my sister was like do you want me to drive you to the hospital and i told her i do not have the finances for that so no#and then she texted me fifteen minutes later to say#if its only the money issue i will help cover the costs#and i wont say what she googled that made her so concerned as an end result but uh lets hope it aint that ???#hopefully i can sleep tonight cause i have almost zero sleep in my system#bc i started to hurt a lil after midnight ?? like then i postponed sleep to take pain meds#and then woke up constantly and couldnt stay asleep#so i really just wanna go to bed

173 notes

·

View notes

Text

one thing I have learned about being poor is that you cannot for a moment stop thinking about it

#theres no peace#every little thing reminds me we are poor#seeing friends having electricity wifi heat food gas. it all costs money. and bills and fees and charges happen all the damn time#im constantly worried that i am measing up somehow or im not keeping track of my finances properly#the person handling our disability assistance application keeps coming back with question after question about my job#and i have so much doubt and fear that ive made some mistake in my answers that will disqualify us from support#and theres this sick backwards stupid thing where applying for and being on disability support is discouraging me from trying to make money#because the more i make the less likely we'll get support but i need to make money to live#its just fucked. and once we're on support i have to make monthly reports of my income so ill feel like im explaining myself all the fuckin#time#cus the system isnt built in a way that makes sense for self employed ppl who have business expenses to account for#sorry for the ranting i cant sleep#truly truly i think poverty is making me a worse persin#more anxious more resentful more jealous more miserable more spiteful#i have so little and there is so little i can do to help it#i want things in a more desparate and even childish way than i used to eant things#spend a lot more time fantasizing about magically having expendable income#not to mention the constant exponential guilt that comes from asking for help or recieving help. its guilt i need to unlearn but i feel it

139 notes

·

View notes

Text

#columbo#season 1#short fuse#columbimbo pretending to not be able to understand profit=revenue-cost#i do believe his wife does the home finances. he aint got time for that shit#mrs c is like ''frank i need your gas receipts so i can deduct them'' and he's like ''I Thignk I Left My Waulet At McDonald''

166 notes

·

View notes

Text

There's something interesting I've realized about the concept of a "living wage" in the US that has only really occurred to me since I got a better job that.. you know, pays a living wage. (Just for the sake of what I mean, I earn over $20 USD/hr, I work full time, and I live in Nebraska. My partner is the same as far as wages.)

This fall, my partner and I got our first house. It's 3 bedrooms, 2 bath, small but finished basement. It took a lot of negotiation and stress but with the help of an A+ realtor and loan expert, we got it. Yay!

Now, we were used to paying rent, but paying a mortgage was going to be almost double. This was fine, we could afford it. While we recover financially from some things we had to do (replace a deck, fix a cracked pipe, you know the usual) we have been a little more careful about our spending. Even with that though, we're still able to get groceries and eat at a restaurant once a week and buy holiday gifts for our friends and families. It might be a couple years until we can shell out for a little vacation, but that's okay.

My point here though is that... this is what it should be like for everyone. A two-income household should be able to get a decent little house and have a few fun luxuries and still have enough in savings if you need an emergency car or home repair or veterinarian bill or the like. A living wage needs to be more than just a roof over your head and food on your table. You should be able to invest in things that make you happy (like a nice bike or video game console) and things that make life easier (like a toaster oven or snowblower).

We both work desk jobs. It's stressful but we can work from home and that also saves money. But for everyone in every kind of job, or even if you can't work, you should still be able to live. And that's why it's important to support higher wages, better disability support, and universal basic income. Everyone deserves the opportunity to be happy and feel safe and secure.

So when you see local petitions out to raise the minimum wage, when you see workers striking for an income they can actually live on, and when you see measures that will help people on the ballot, remember that when you support them, things DO change for the better.

#personal ish#honestly what made all the difference was when my job bumped everyone to a starting wage of 20/hr#they did it to be more competitive with the rest of the field#and that's when i was able to save up enough for my half of the closing costs on our house#us politics#finance

121 notes

·

View notes

Text

Been hemming and hawing over upgrading my phone for months now. After this mornings crushing news I feel like perhaps I should treat myself. I like the Google Pixel 9 (comes in pink), but I hate Google. So I think I am gonna try to degoogle it and install a different OS. I have been doing some research and it seems easy enough to do.

#personal#it would hardly cost me more per month than i already pay and i am already on the absolute cheapest plan i can be on rn#so i think its fine finances wise#rogers tends to have good deals#i dont NEED a new phone#but i would like to try something new

19 notes

·

View notes

Note

while youre wheelchair posting i wanted to say that you talking about why you decided to continue using one really changed my own perspective on my disability! i get awful chronic join pains usually triggered by standing, and although im taking the physical therapy route (im hypermobile, so thats the first option,) ive recently considered that using something like a wheelchair or a cane wouldnt be so wrong of me if i feel i need it

I tell people that I just want to be able to do the things that other people do. I want to shop in a store for as long as I want, without hurting. I want to walk around the mall and look at things. I want to go somewhere without having to plan ahead where I will sit down and how long we'll be waiting in line. I want to work a full day in my store, walking from the back room to the front, guiding customers to the different areas, and I want to do that without being in pain.

My wheelchair lets me do that. My body does not let me do that.

My advice to literally everyone who thinks they might need it is, "just get the damn cane." Canes are among the cheapest mobility aids out there. They come in insanely cool colors and styles. There are ones that fold up when you don't need them. You can get one for $10 and you can just go into Walgreens and buy one. Worst case, which is also best case, you just spent the cost of a trip to McDonald's on something you don't use. Worst case, which is also best case, you find something that lets you be yourself doing the things you want to do for longer and with less pain. Worst case, which is also best case, you see that it helps you and it is the gateway into getting a more supportive mobility aid that lets you live a better life. Literally every worst case scenario you can think of is also your best case scenario. Get the cane.

I went to Goodwill on my lunch break just now and they had a rollator for $8, so we're going to experiment with Pink+Rollator in the upcoming days. Currently I'm okay with walking short distances but I really can't stand for more than a couple of minutes, so bringing a device that's also a chair with me seems like it'd be a good step in my mobility.

But yeah, to everyone who is going "hey, I think I could benefit from a mobility aid," this is me, a disabled person, telling you to go for it. You didn't need my permission, but you have it anyway. Get the mobility aid!

A wheelchair is just a chair with wheels, and you didn't need anyone's permission to sit down at a rolling desk chair. You were able to look at the options given to you by the world and choose that, in that context, sitting down on a chair with wheels was going to be the best for your body and your personal convenience. You can look at your body and your environment and make statements like, "I should not be standing for 55 minutes in this line. I can only stand for x minutes," and that's normal. Abled people make decisions like "I'm not going to stand for this long" or "I'm not going to walk this far," all the time. But when you add, "so I'm going to bring a special chair with me, so that I can wait 55 minutes in this line, like all the other people in the line," suddenly it feels different. But abled people are allowed to always be making judgements for when they're pushing their body too hard, and they make decisions all the time about when they're going to take advantage of an aid or take a break, so the only thing that changes when you're disabled is when you have to decide to use it, not at all that you have to use it. People get to pick what shoes they want based on where they're going, and that's just picking a device to aid your mobility as needed for a certain environment. Using a mobility aid is a totally normal thing, except that we've artificially labeled them as "normal person accommodations" and "ask for this and you're disabled."

Disclaimer: obviously bring it up with your care team if you are interested in using a mobility aid (and you have a care team). A LOT of doctors are hesitant to tell young people that they should be trying a mobility aid, but will say you'll benefit from it if you bring it up. If you have a PT then they're likely to have input about what are the best options and how to set them up. Also some doctors can get you mobility aids for free. Even if the cane you get from your doctor is black and boring and doesn't fold, you can still go to the store and get a cane that's fun and cool and then use the one the doctor gave you as a size reference to know how to set the one you just got. Hey, free cane.

#i'm in usa so a care team and a luxury car financed at a shitty interest rate cost the same amount of money#20dollarlolita on wheels#i'm in california so I can't get a cane with a SWORD in it and i'm very upset by that#if anyone here has ever wanted to get into illegal smuggling of fashion/weapon based medical supplies then

60 notes

·

View notes

Text

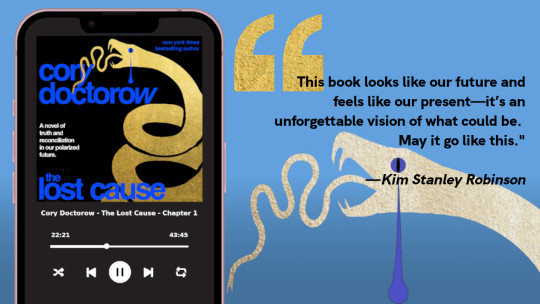

An interoperability rule for your money

This is the final weekend to back the Kickstarter campaign for the audiobook of my next novel, The Lost Cause. These kickstarters are how I pay my bills, which lets me publish my free essays nearly every day. If you enjoy my work, please consider backing!

"If you don't like it, why don't you take your business elsewhere?" It's the motto of the corporate apologist, someone so Hayek-pilled that they see every purchase as a ballot cast in the only election that matters – the one where you vote with your wallet.

Voting with your wallet is a pretty undignified way to go through life. For one thing, the people with the thickest wallets get the most votes, and for another, no matter who you vote for in that election, the Monopoly Party always wins, because that's the part of the thick-wallet set.

Contrary to the just-so fantasies of Milton-Friedman-poisoned bootlickers, there are plenty of reasons that one might stick with a business that one dislikes – even one that actively harms you.

The biggest reason for staying with a bad company is if they've figured out a way to punish you for leaving. Businesses are keenly attuned to ways to impose switching costs on disloyal customers. "Switching costs" are all the things you have to give up when you take your business elsewhere.

Businesses love high switching costs – think of your gym forcing you to pay to cancel your subscription or Apple turning off your groupchat checkmark when you switch to Android. The more it costs you to move to a rival vendor, the worse your existing vendor can treat you without worrying about losing your business.

Capitalists genuinely hate capitalism. As the FBI informant Peter Thiel says, "competition is for losers." The ideal 21st century "market" is something like Amazon, a platform that gets 45-51 cents out of every dollar earned by its sellers. Sure, those sellers all compete with one another, but no matter who wins, Amazon gets a cut:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Think of how Facebook keeps users glued to its platform by making the price of leaving cutting of contact with your friends, family, communities and customers. Facebook tells its customers – advertisers – that people who hate the platform stick around because Facebook is so good at manipulating its users (this is a good sales pitch for a company that sells ads!). But there's a far simpler explanation for peoples' continued willingness to let Mark Zuckerberg spy on them: they hate Zuck, but they love their friends, so they stay:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

One of the most important ways that regulators can help the public is by reducing switching costs. The easier it is for you to leave a company, the more likely it is they'll treat you well, and if they don't, you can walk away from them. That's just what the Consumer Finance Protection Bureau wants to do with its new Personal Financial Data Rights rule:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-proposes-rule-to-jumpstart-competition-and-accelerate-shift-to-open-banking/

The new rule is aimed at banks, some of the rottenest businesses around. Remember when Wells Fargo ripped off millions of its customers by ordering its tellers to open fake accounts in their name, firing and blacklisting tellers who refused to break the law?

https://www.npr.org/sections/money/2016/10/07/497084491/episode-728-the-wells-fargo-hustle

While there are alternatives to banks – local credit unions are great – a lot of us end up with a bank by default and then struggle to switch, even though the banks give us progressively worse service, collectively rip us off for billions in junk fees, and even defraud us. But because the banks keep our data locked up, it can be hard to shop for better alternatives. And if we do go elsewhere, we're stuck with hours of tedious clerical work to replicate all our account data, payees, digital wallets, etc.

That's where the new CFPB order comes in: the Bureau will force banks to "share data at the person’s direction with other companies offering better products." So if you tell your bank to give your data to a competitor – or a comparison shopping site – it will have to do so…or else.

Banks often claim that they block account migration and comparison shopping sites because they want to protect their customers from ripoff artists. There are certainly plenty of ripoff artists (notwithstanding that some of them run banks). But banks have an irreconcilable conflict of interest here: they might want to stop (other) con-artists from robbing you, but they also want to make leaving as painful as possible.

Instead of letting shareholder-accountable bank execs in back rooms decide what the people you share your financial data are allowed to do with it, the CFPB is shouldering that responsibility, shifting those deliberations to the public activities of a democratically accountable agency. Under the new rule, the businesses you connect to your account data will be "prohibited from misusing or wrongfully monetizing the sensitive personal financial data."

This is an approach that my EFF colleague Bennett Cyphers and I first laid our in our 2021 paper, "Privacy Without Monopoly," where we describe how and why we should shift determinations about who is and isn't allowed to get your data from giant, monopolistic tech companies to democratic institutions, based on privacy law, not corporate whim:

https://www.eff.org/wp/interoperability-and-privacy

The new CFPB rule is aimed squarely at reducing switching costs. As CFPB Director Rohit Chopra says, "Today, we are proposing a rule to give consumers the power to walk away from bad service and choose the financial institutions that offer the best products and prices."

The rule bans banks from charging their customers junk fees to access their data, and bans businesses you give that data to from "collecting, using, or retaining data to advance their own commercial interests through actions like targeted or behavioral advertising." It also guarantees you the unrestricted right to revoke access to your data.

The rule is intended to replace the current state-of-the-art for data sharing, which is giving your banking password to third parties who go and scrape that data on your behalf. This is a tactic that comparison sites and financial dashboards have used since 2006, when Mint pioneered it:

https://www.eff.org/deeplinks/2019/12/mint-late-stage-adversarial-interoperability-demonstrates-what-we-had-and-what-we

A lot's happened since 2006. It's past time for American bank customers to have the right to access and share their data, so they can leave rotten banks and go to better ones.

The new rule is made possible by Section 1033 of the Consumer Financial Protection Act, which was passed in 2010. Chopra is one of the many Biden administrative appointees who have acquainted themselves with all the powers they already have, and then used those powers to help the American people:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

It's pretty wild that the first digital interoperability mandate is going to come from the CFPB, but it's also really cool. As Tim Wu demonstrated in 2021 when he wrote Biden's Executive Order on Promoting Competition in the American Economy, the administrative agencies have sweeping, grossly underutilized powers that can make a huge difference to everyday Americans' lives:

https://www.eff.org/de/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

Image: Steve Morgan (modified) https://commons.wikimedia.org/wiki/File:U.S._National_Bank_Building_-_Portland,_Oregon.jpg

Stefan Kühn (modified) https://commons.wikimedia.org/wiki/File:Abrissbirne.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

-

Rhys A. (modified) https://www.flickr.com/photos/rhysasplundh/5201859761/in/photostream/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#cfpb#interoperability mandates#mint#scraping#apis#privacy#privacy without monopoly#consumer finance protection bureau#Personal Financial Data Rights#interop#data hoarding#junk fees#switching costs#section 1033#interoperability

159 notes

·

View notes

Text

I bought a car! I’m so glad to not have to think about this again for at least 5 years 🤞

But almost more exciting is that I had a near perfect credit score, 895 out of 900, which apparently is the range used by car dealers. The guy told me to frame the paper lol.

#i ended up financing even though i could have almost paid cash#but I plan to pay it off by the end of the year at the latest#but even if I don’t it’s only $1000 in interest over 4 years#so my money might be better used elsewhere since I have that low rate#also my teeth are costing me another 2k this month#yeesh

8 notes

·

View notes

Text

Not surprised at all.

10 notes

·

View notes

Text

i know i already posted about this but im genuinely so mad that my car died like i expected it but also buying a new one makes me wanna claw my eyes out

#i also can't be normal about anything and i will obsess over this until the problem is solved bc that's who i am#what i need to do is take a break because it's almost 10 pm and that's bedtime!#i will find something and my parents are offering to help it will be okay#plus i already found one i kinda wanna test drive#it's dirt cheap but looks decent maybe ??#my dad also suggested getting a cheap new one and financing it but the idea of paying $10000+ for a car does make me feel slightly ill#like i know they cost that but christ (well. more than that. but saying an actual realistic number would make me fully pass out)#bri babbles

8 notes

·

View notes

Note

I live in a very liberal, and expensive, state. I don't know if I can afford to stay, but I don't know if I can afford to leave either because of the ~political hellscape~ outside. How do I choose where I live?

My darling child, this is a SUPER valid question. We've thought about it a lot! Most of our thoughts and advice are in this episode of our podcast (scroll down the link for the transcript if you'd rather read than listen):

Season 4, Episode 8: "I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?"

If this helped you out, give us a tip!

39 notes

·

View notes

Text

sorry i just went on an deep dive. it would cost like. 5 or so billion dollar for the octonauts to function. either inkling has pockets as deep as the ocean or there’s some highly illegal behind the scenes nonsense goin on here

#octonauts#suddenly remembers the mafia au. ah yes this solves everyth- WRONG#rare hershel octonauts post that isnt about The Curse ?? yeah we in the finance era#(the finance era ends 2 minutes after this post is posted)#i dont think we really think about it enough. how much it would cost to have literally Anything about them#unless the economy is so bad (or good??) that money isn’t an issue……. hmm#you knkw wbaat I AM BRINGING MY AU INTO THIS. but not long enough for me to have to tag it#*cracks knuckles*#assuming humans are extinct and have been for a while. the evolved animals prolly saw their economy#and was like. ‘hey this was pretty stupid!’ because lets face it. it is. its very stupid#so option A: animals knew what NOT to do and didnt do it#or option B: they learned SOME THINGS but Don’T Have Money wasnt one of them#or option C: learned absolutely nothing. the world is pretty much exactly the same#personally i really hopin for option A but we cant have nice things now can we. anyways

42 notes

·

View notes