#interoperability mandates

Explore tagged Tumblr posts

Text

An interoperability rule for your money

This is the final weekend to back the Kickstarter campaign for the audiobook of my next novel, The Lost Cause. These kickstarters are how I pay my bills, which lets me publish my free essays nearly every day. If you enjoy my work, please consider backing!

"If you don't like it, why don't you take your business elsewhere?" It's the motto of the corporate apologist, someone so Hayek-pilled that they see every purchase as a ballot cast in the only election that matters – the one where you vote with your wallet.

Voting with your wallet is a pretty undignified way to go through life. For one thing, the people with the thickest wallets get the most votes, and for another, no matter who you vote for in that election, the Monopoly Party always wins, because that's the part of the thick-wallet set.

Contrary to the just-so fantasies of Milton-Friedman-poisoned bootlickers, there are plenty of reasons that one might stick with a business that one dislikes – even one that actively harms you.

The biggest reason for staying with a bad company is if they've figured out a way to punish you for leaving. Businesses are keenly attuned to ways to impose switching costs on disloyal customers. "Switching costs" are all the things you have to give up when you take your business elsewhere.

Businesses love high switching costs – think of your gym forcing you to pay to cancel your subscription or Apple turning off your groupchat checkmark when you switch to Android. The more it costs you to move to a rival vendor, the worse your existing vendor can treat you without worrying about losing your business.

Capitalists genuinely hate capitalism. As the FBI informant Peter Thiel says, "competition is for losers." The ideal 21st century "market" is something like Amazon, a platform that gets 45-51 cents out of every dollar earned by its sellers. Sure, those sellers all compete with one another, but no matter who wins, Amazon gets a cut:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Think of how Facebook keeps users glued to its platform by making the price of leaving cutting of contact with your friends, family, communities and customers. Facebook tells its customers – advertisers – that people who hate the platform stick around because Facebook is so good at manipulating its users (this is a good sales pitch for a company that sells ads!). But there's a far simpler explanation for peoples' continued willingness to let Mark Zuckerberg spy on them: they hate Zuck, but they love their friends, so they stay:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

One of the most important ways that regulators can help the public is by reducing switching costs. The easier it is for you to leave a company, the more likely it is they'll treat you well, and if they don't, you can walk away from them. That's just what the Consumer Finance Protection Bureau wants to do with its new Personal Financial Data Rights rule:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-proposes-rule-to-jumpstart-competition-and-accelerate-shift-to-open-banking/

The new rule is aimed at banks, some of the rottenest businesses around. Remember when Wells Fargo ripped off millions of its customers by ordering its tellers to open fake accounts in their name, firing and blacklisting tellers who refused to break the law?

https://www.npr.org/sections/money/2016/10/07/497084491/episode-728-the-wells-fargo-hustle

While there are alternatives to banks – local credit unions are great – a lot of us end up with a bank by default and then struggle to switch, even though the banks give us progressively worse service, collectively rip us off for billions in junk fees, and even defraud us. But because the banks keep our data locked up, it can be hard to shop for better alternatives. And if we do go elsewhere, we're stuck with hours of tedious clerical work to replicate all our account data, payees, digital wallets, etc.

That's where the new CFPB order comes in: the Bureau will force banks to "share data at the person’s direction with other companies offering better products." So if you tell your bank to give your data to a competitor – or a comparison shopping site – it will have to do so…or else.

Banks often claim that they block account migration and comparison shopping sites because they want to protect their customers from ripoff artists. There are certainly plenty of ripoff artists (notwithstanding that some of them run banks). But banks have an irreconcilable conflict of interest here: they might want to stop (other) con-artists from robbing you, but they also want to make leaving as painful as possible.

Instead of letting shareholder-accountable bank execs in back rooms decide what the people you share your financial data are allowed to do with it, the CFPB is shouldering that responsibility, shifting those deliberations to the public activities of a democratically accountable agency. Under the new rule, the businesses you connect to your account data will be "prohibited from misusing or wrongfully monetizing the sensitive personal financial data."

This is an approach that my EFF colleague Bennett Cyphers and I first laid our in our 2021 paper, "Privacy Without Monopoly," where we describe how and why we should shift determinations about who is and isn't allowed to get your data from giant, monopolistic tech companies to democratic institutions, based on privacy law, not corporate whim:

https://www.eff.org/wp/interoperability-and-privacy

The new CFPB rule is aimed squarely at reducing switching costs. As CFPB Director Rohit Chopra says, "Today, we are proposing a rule to give consumers the power to walk away from bad service and choose the financial institutions that offer the best products and prices."

The rule bans banks from charging their customers junk fees to access their data, and bans businesses you give that data to from "collecting, using, or retaining data to advance their own commercial interests through actions like targeted or behavioral advertising." It also guarantees you the unrestricted right to revoke access to your data.

The rule is intended to replace the current state-of-the-art for data sharing, which is giving your banking password to third parties who go and scrape that data on your behalf. This is a tactic that comparison sites and financial dashboards have used since 2006, when Mint pioneered it:

https://www.eff.org/deeplinks/2019/12/mint-late-stage-adversarial-interoperability-demonstrates-what-we-had-and-what-we

A lot's happened since 2006. It's past time for American bank customers to have the right to access and share their data, so they can leave rotten banks and go to better ones.

The new rule is made possible by Section 1033 of the Consumer Financial Protection Act, which was passed in 2010. Chopra is one of the many Biden administrative appointees who have acquainted themselves with all the powers they already have, and then used those powers to help the American people:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

It's pretty wild that the first digital interoperability mandate is going to come from the CFPB, but it's also really cool. As Tim Wu demonstrated in 2021 when he wrote Biden's Executive Order on Promoting Competition in the American Economy, the administrative agencies have sweeping, grossly underutilized powers that can make a huge difference to everyday Americans' lives:

https://www.eff.org/de/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

Image: Steve Morgan (modified) https://commons.wikimedia.org/wiki/File:U.S._National_Bank_Building_-_Portland,_Oregon.jpg

Stefan Kühn (modified) https://commons.wikimedia.org/wiki/File:Abrissbirne.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

-

Rhys A. (modified) https://www.flickr.com/photos/rhysasplundh/5201859761/in/photostream/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#cfpb#interoperability mandates#mint#scraping#apis#privacy#privacy without monopoly#consumer finance protection bureau#Personal Financial Data Rights#interop#data hoarding#junk fees#switching costs#section 1033#interoperability

159 notes

·

View notes

Text

The “everything app” already exists.

It is called “the internet.”

And it is in crisis.

We really could get so much more out of computers and our massive digital footprints if there were any incentive for software developers to make programs that work together. But everyone just wants to capture the market, be the “everything app” not realizing that the real “everything app” is open source, open protocol and a probably government mandated requirement to foster interoperability. We get little glimpses of the future when some of these things align but greed keeps every dev shackled.

If you want to make money off of people using software you are a part of the public “everything app” that is called “the internet” for the privilege of using this lucrative public space you must follow basic rules. Mostly: either make your application compatible w/ similar applications, or pay an isolation tax. The unregulated public digital commons has been enclosed! it’s time to roll it back! There is no natural market incentive to solve these problems except monopoly and do we want that? no!

22 notes

·

View notes

Text

IMAGES: B-2s land in Iceland for the first Bomber Task Force in months

Fernando Valduga By Fernando Valduga 08/14/2023 - 19:31 in Military

Three B-2 bombers from the 509ª Bomber Wing at Whiteman Air Base, Missouri, landed in Keflavik, Iceland, on August 13 to begin the first outward deployment of the stealth bomber since the B-2 fleet's six-month security pause ended in May.

More than 150 aviators along with the three B-2 Spirit aircraft arrived at Keflavik Air Base with the aim of participating in Bomber Task Force (BTF) missions, a vital component of the U.S. European Command (USEUCOM) collaborative training efforts with U.S. Allies, partners and joint forces.

The B-2 is the only operational stealth bomber of the Air Force, with a global range, and the continuous rotations of the Bomber Task Force in Europe are seen as an element of NATO's high alert level since the Russian invasion of Ukraine in early 2022. The planned duration of the recent deployment has not been disclosed, but BTFs usually last from 2 to 6 weeks.

youtube

Around the world, the U.S. Strategic Command routinely orchestrates BTF operations not only to show the United States' commitment to collective defense, but also to integrate seamlessly with the operations conducted by the Geographic Combat Commands of America. This BTF initiative is designed to strengthen USEUCOM's comprehensive security mandates across the European continent, while offering crews the opportunity to acclimatize to the complexities of joint and coalition operations in foreign locations.

"Each mission of the bomber task force highlights the feat of our armed forces in navigating today's intricate and unpredictable terrain of global security, focusing on promoting stability, security and freedom throughout Europe," said General James Hecker, commander of the U.S. Air Forces in Europe; U.S. Air Forces in Africa and NATO Allied Command. "In resolute unity, the U.S. maintains our nation's commitment to promoting peace and stability in Europe, collaborating unwaveringly with allies and partners to prevent challenges against the sovereignty of nations throughout the region."

Leading the crew of the expeditionary bomber in its deployment is Lieutenant Colonel Andrew Kousgaard, commander of the 393º Bombing Squadron. He emphasized the essence of the dynamic use of the force, describing it as a strategy that combines strategic unpredictability with operational adaptability. Lieutenant Colonel Kousgaard said: “The B-2 bomber is arguably the most strategically significant aircraft in the world, but that does not mean it is unftably; dynamically deploying bombers is a unique and important capability.”

The presence of the B-2 at Keflavik Air Base serves as a tangible link between U.S. Air Force personnel and their colleagues in the theater of operations. This connection facilitates collaborative training, increasing interoperability and highlighting the unwavering dedication of the United States to the region.

It has not been disclosed whether B-2s will operate from any advanced area in Europe, but BTFs usually include unannounced secondary deployments.

Elaborating on the importance of joint training exercises with the Allies, Lieutenant Colonel Kousgaard highlighted the role of his unit in improving collective military capabilities and increasing the likelihood of successfully achieving the shared goals. He emphasized: "There is simply no substitute for practical integration with our allies and partners that we can carry out during a BTF deployment like this."

In addition to strengthening combat readiness, the BTF initiative allows aviators to engage in a wide spectrum of military operations, covering everything from combat missions to humanitarian aid and disaster relief efforts.

The Bomber Task Force Europe offers U.S. and NATO leaders strategic options to secure, stop and defend against opposing aggression against the Alliance, throughout Europe and around the world. Regular and routine deployments of U.S. strategic bombers provide our critical touchpoints to train and operate alongside our allies and partners, reinforcing our collective response to any global conflict.

Tags: Military AviationB-2 SpiritBTFUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work around the world of aviation.

Related news

MILITARY

Marshall Aerospace receives contract for modification, support and maintenance in South Africa's C-130 fleet

15/08/2023 - 16:00

MILITARY

France concludes software update tests for Reaper drones

15/08/2023 - 14:00

MILITARY

Slovenia authorizes purchase of second transport aircraft C-27J Spartan

15/08/2023 - 13:00

One of the F-117 arriving in Duluth to participate in the Northern Lightning. (Photo: Zach P. Nipper Photography)

MILITARY

IMAGES: F-117A Nighthawk stealth aircraft participate in the Northern Lightning 2023 exercise

15/08/2023 - 08:42

Midnight, an all-electric aircraft from Archer Aviation, is seen at Salinas Municipal Airport in Salinas, California, USA, on August 2, 2023. (Photo: REUTERS/Carlos Barria)

EVTOL

U.S. Marine Corps approaches Archer's eVTOL Midnight aircraft

15/08/2023 - 08:12

MILITARY

Billionaire wants to take a captive orca to freedom in a Hercules aircraft

14/08/2023 - 21:56

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

23 notes

·

View notes

Text

The Heart of Boiler Systems: Exploring the Role of IBR Fitting and Flanges

Boiler systems serve as the backbone of numerous industrial processes, powering everything from heating and hot water supply to steam generation in various manufacturing operations. Within these systems, ensuring safety, efficiency, and reliability is paramount, and this is where IBR (Indian Boiler Regulations) fitting and flanges play a pivotal role. As a trusted distributor in Vadodara and a leading dealer in Gujarat, Tubetrading is dedicated to providing top-quality IBR fitting and flanges to industries across the region. In this blog post, we'll delve into the significance of IBR fitting and flanges in boiler systems, explore their crucial functions, and highlight the expertise of Tubetrading in supplying these essential components.

Understanding IBR Fitting and Flanges

IBR fitting and flanges are integral components of boiler systems that ensure seamless operation and compliance with safety standards mandated by the Indian Boiler Regulations. These regulations are designed to safeguard the integrity of boiler components, prevent accidents, and promote efficient energy utilization. IBR fitting and flanges are manufactured according to stringent specifications outlined by the IBR to guarantee durability, reliability, and performance in demanding industrial environments.

The Role of IBR Fitting and Flanges in Boiler Systems

1. Pressure Regulation: IBR fitting and flanges are designed to withstand high-pressure environments commonly found in boiler systems. They play a crucial role in regulating and controlling the flow of fluids, gases, and steam within the system, ensuring optimal pressure levels for efficient operation.

2. Sealing and Joint Integrity: Proper sealing and joint integrity are essential to prevent leaks and maintain the integrity of boiler systems. IBR fitting and flanges are equipped with robust sealing mechanisms, such as gaskets and O-rings, to create a tight seal between interconnected components, minimizing the risk of leaks and ensuring system integrity.

3. Connection and Interoperability: IBR fitting and flanges serve as connection points between various components of boiler systems, including pipes, valves, and vessels. Their standardized dimensions and configurations enable seamless interoperability, facilitating efficient assembly, maintenance, and repair of boiler systems.

4. Compliance and Certification: Compliance with IBR regulations is mandatory for all boiler components used in India. IBR fitting and flanges undergo rigorous testing and certification processes to ensure compliance with safety standards and regulatory requirements, providing peace of mind to industries reliant on boiler systems.

Tubetrading: Your Trusted Supplier of IBR Fitting and Flanges in Gujarat

As a reputable distributor and dealer of IBR fitting and flanges in Vadodara and Gujarat, Tubetrading prides itself on delivering superior-quality products and exceptional service to its customers. Here's why industries trust Tubetrading for their IBR fitting and flanges needs:

1. Extensive Product Range: Tubetrading offers an extensive range of IBR fitting and flanges, including elbows, tees, reducers, bends, and flanges in various sizes, materials, and specifications. Whether you need standard or customized components, we have the expertise and resources to meet your requirements.

2. Quality Assurance: At Tubetrading, quality is our top priority. We partner with reputable manufacturers who adhere to strict quality control measures and comply with IBR regulations. Our products undergo thorough inspection and testing to ensure they meet the highest standards of performance, reliability, and safety.

3. Expert Guidance: With years of experience in the industry, the team at Tubetrading possesses in-depth knowledge of IBR fitting and flanges and their applications in boiler systems. We provide expert guidance and technical support to help our customers select the right components for their specific needs, ensuring optimal performance and efficiency.

4. Timely Delivery: We understand the importance of timely delivery to our customers' operations. With our efficient logistics network and inventory management systems, we strive to fulfill orders promptly and ensure on-time delivery of IBR fitting and flanges to our customers across Gujarat.

Conclusion

In conclusion, IBR fitting and flanges are the heart of boiler systems, playing a critical role in ensuring safety, efficiency, and compliance with regulatory standards. As a trusted distributor and dealer in Vadodara and Gujarat, Tubetrading is committed to supplying top-quality IBR fitting and flanges to industries across the region. With our extensive product range, quality assurance, expert guidance, and timely delivery, we are your reliable partner for all your IBR fitting and flanges needs. Contact Tubetrading today to learn more about our products and services and discover how we can support your boiler system requirements.

#IBR Fitting and Flanges distributor in Gujarat#IBR fitting and flanges distributor in Vadodara#IBR fitting and flanges dealer in Gujarat#IBR fitting and flanges#Gujarat#Maharashtra#Rajasthan#Madhya Pradesh#Daman#Uttar Pradesh

7 notes

·

View notes

Text

The Fragmented Future of AI Regulation: A World Divided

The Battle for Global AI Governance

In November 2023, China, the United States, and the European Union surprised the world by signing a joint communiqué, pledging strong international cooperation in addressing the challenges posed by artificial intelligence (AI). The document highlighted the risks of "frontier" AI, exemplified by advanced generative models like ChatGPT, including the potential for disinformation and serious cybersecurity and biotechnology risks. This signaled a growing consensus among major powers on the need for regulation.

However, despite the rhetoric, the reality on the ground suggests a future of fragmentation and competition rather than cooperation.

As multinational communiqués and bilateral talks take place, an international framework for regulating AI seems to be taking shape. But a closer look at recent executive orders, legislation, and regulations in the United States, China, and the EU reveals divergent approaches and conflicting interests. This divergence in legal regimes will hinder cooperation on critical aspects such as access to semiconductors, technical standards, and the regulation of data and algorithms.

The result is a fragmented landscape of warring regulatory blocs, undermining the lofty goal of harnessing AI for the common good.

youtube

Cold Reality vs. Ambitious Plans

While optimists propose closer international management of AI through the creation of an international panel similar to the UN's Intergovernmental Panel on Climate Change, the reality is far from ideal. The great powers may publicly express their desire for cooperation, but their actions tell a different story. The emergence of divergent legal regimes and conflicting interests points to a future of fragmentation and competition rather than unified global governance.

The Chip War: A High-Stakes Battle

The ongoing duel between China and the United States over global semiconductor markets is a prime example of conflict in the AI landscape. Export controls on advanced chips and chip-making technology have become a battleground, with both countries imposing restrictions. This competition erodes free trade, sets destabilizing precedents in international trade law, and fuels geopolitical tensions.

The chip war is just one aspect of the broader contest over AI's necessary components, which extends to technical standards and data regulation.

Technical Standards: A Divided Landscape

Technical standards play a crucial role in enabling the use and interoperability of major technologies. The proliferation of AI has heightened the importance of standards to ensure compatibility and market access. Currently, bodies such as the International Telecommunication Union and the International Organization for Standardization negotiate these standards.

However, China's growing influence in these bodies, coupled with its efforts to promote its own standards through initiatives like the Belt and Road Initiative, is challenging the dominance of the United States and Europe. This divergence in standards will impede the diffusion of new AI tools and hinder global solutions to shared challenges.

Data: The Currency of AI

Data is the lifeblood of AI, and access to different types of data has become a competitive battleground. Conflict over data flows and data localization is shaping how data moves across national borders. The United States, once a proponent of free data flows, is now moving in the opposite direction, while China and India have enacted domestic legislation mandating data localization.

This divergence in data regulation will impede the development of global solutions and exacerbate geopolitical tensions.

Algorithmic Transparency: A Contested Terrain

The disclosure of algorithms that underlie AI systems is another area of contention. Different countries have varying approaches to regulating algorithmic transparency, with the EU's proposed AI Act requiring firms to provide government agencies access to certain models, while the United States has a more complex and inconsistent approach. As countries seek to regulate algorithms, they are likely to prohibit firms from sharing this information with other governments, further fragmenting the regulatory landscape.

The vision of a unified global governance regime for AI is being undermined by geopolitical realities. The emerging legal order is characterized by fragmentation, competition, and suspicion among major powers. This fragmentation poses risks, allowing dangerous AI models to be developed and disseminated as instruments of geopolitical conflict.

It also hampers the ability to gather information, assess risks, and develop global solutions. Without a collective effort to regulate AI, the world risks losing the potential benefits of this transformative technology and succumbing to the pitfalls of a divided landscape.

2 notes

·

View notes

Text

Ensuring Regulatory Compliance for Wireless Devices

Regulatory Framework

Regulatory compliance for wireless devices is governed by various national and international authorities. In the United States, the Federal Communications Commission (FCC) plays a pivotal role in setting and enforcing regulations related to wireless devices. The FCC establishes guidelines for electromagnetic compatibility, radio frequency emissions, and more, to prevent interference and protect consumers.

Wireless Standards

Compliance with established wireless standards is fundamental to ensuring device interoperability and safety. Two widely recognized standards organizations are the Institute of Electrical and Electronics Engineers (IEEE) and the Wi-Fi Alliance. Devices must meet these standards to ensure that they can effectively connect to wireless networks and function correctly.

Radio Frequency (RF) Emissions

One of the primary concerns in wireless device compliance is the emission of radio frequency signals. Wireless devices must not emit harmful interference that can disrupt other wireless networks or devices. Manufacturers are required to conduct extensive testing to ensure their products conform to permissible RF emissions limits.

Electromagnetic Compatibility (EMC)

EMC compliance is crucial to prevent electromagnetic interference between wireless devices and other electronic equipment. Compliance ensures that wireless devices can coexist harmoniously with other electronic devices, enhancing user experience and preventing conflicts.

SAR (Specific Absorption Rate)

SAR measures the amount of radio frequency energy absorbed by the human body when using a wireless device. To protect users from excessive exposure to radio waves, regulatory bodies establish maximum SAR limits. Manufacturers must test and disclose the SAR levels of their products, enabling consumers to make informed choices.

Product Labeling and Certification

Regulatory compliance often requires manufacturers to obtain certification for their wireless devices. These certifications, such as FCC, CE (for European markets), or other regional certifications, demonstrate that a product meets all relevant safety and performance standards. Labeling on the device indicates its compliance status, ANATEL Certification for Brazil allowing consumers to identify certified products easily.

Security and Privacy Compliance

As wireless devices collect and transmit sensitive data, ensuring data security and privacy is a critical aspect of regulatory compliance. Regulations such as the General Data Protection Regulation (GDPR) in Europe and various data protection laws worldwide mandate that manufacturers take appropriate measures to safeguard user data.

Over-the-Air (OTA) Updates

OTA updates are crucial for maintaining the security and functionality of wireless devices. Manufacturers must design their devices to facilitate secure and regular updates, ensuring that vulnerabilities are promptly addressed.

User Education

Compliance isn't solely the responsibility of manufacturers and regulators; consumers play a vital role. Users should stay informed about the regulatory requirements for their wireless devices, including firmware updates and proper usage. Understanding the potential risks and best practices can enhance the overall safety and performance of these devices.

2 notes

·

View notes

Text

Fun fact: did you know that American insurance and healthcare companies still HEAVILY use faxes in 2023?

Yup. Faxes.

If you’re old enough to drink, your parents might have one in a closet. If you’re a little older than that, you might have seen it on a Mr. Rogers rerun, or if you’re a bit older than that, when that episode first aired. Weird oversized desk phones with paper reels in them? Sometimes office-capacity ones that double as printers? Ring a bell?

Well, you see, twenty-first century American capitalism tends to form duopolies or triopolies, explicit monopolies being illegal since the previous century. And how do these companies hold onto users, how do they create dependency and up the cost to switch? They deliberately avoid interoperability. Apple vs Android vs Microsoft. Google Drive vs OneDrive (plus, in the corporate world, AWS). Epic Systems vs …there are others, but all the medical systems I’ve interacted with since college use Epic. Which is only ever pronounced ironically. Anyway, all these different insurance and healthcare companies are keeping all their very important info and documents in individualized and often proprietary databases that they can’t mutually access. Sometimes you can’t even open the native filetypes on different software, like how Mac word processing had to be exported as .doc so you could open it on the Windows school computers to print it off your 2-gig flash drive.

Here’s the magic of fax. The US telephone system is a public utility. While the provision of service to your phone and my phone may be handled by different entities—again, courtesy of twentieth-century monopoly breakups—it is illegal for one service provider to not be interoperable with another service provider. It is standardized like railroad gauges or 0.7 mm pencil lead. You can have a T-mobile phone plan and call someone who has Verizon and be able to hear what they say, and it won’t be distorted, pitch inverted, or translated into Swahili simply because of the difference in cell carriers.

This means that fax is the ONLY universal document format in the United States. You can use it to transform a paper form into a stream of fax data, which can then be turned into another paper form or into a PDF file on someone’s computer via conversion software (which, this being America, there are multiple proprietary programs for, none of which can talk to each other except by fax). You can also convert a PDF into a fax, and then print it or convert it back to a PDF at its destination. Yes, it’s possible to send a fax that has never, at any point in its life cycle, been a physical piece of paper!

So yeah, the US healthcare system and also property insurance runs on faxes, literal grandpa technology, because capitalism hates interoperability so much that it’s sabotaging an industry, insurance, that only exists because of capitalism. Also interoperability should be mandated on the same international level as the Geneva Convention and if tech companies position themselves as digital infrastructure, we should nationalize them.

But yeah, that’s why I have fax machine duty on Wednesdays at work.

2 notes

·

View notes

Text

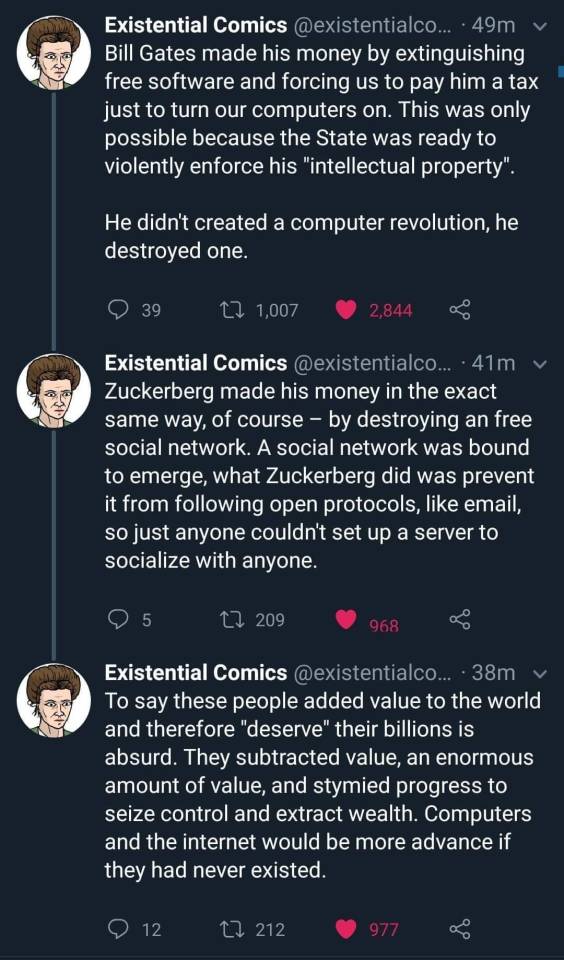

The word "extinguish" here is pulled from the phrase Microsoft used internally to describe their strategy, "Embrace, Extend, Extinguish", of entering markets with widely supported standards then introducing proprietary extensions to break compatibility. Microsoft's abuse of monopoly power was the subject of a Department of Justice lawsuit, whose proceedings lasted almost a decade before being settled (dropped) by the George W Bush administration. People paid for their software because Linux was released in 1991; Until then DOS's only major competitor was UNIX, which was at the time also a locked down and proprietary OS. Thanks to the 1998 DMCA, it's actually now a felony to do much of the reverse engineering that allowed many of these open source products to be created, essentially locking off anything that touches "content". As a different platform example, it's illegal to create a competing app that can support Audible's audiobooks, for instance, because doing so requires circumventing Audible-mandated DRM controls.

Facebook is a bit more speculative, but he's drawing a comparison to the network effects of email, USENET, the internet, etc. Because it's speculative I can't really comment as much here, but the cycle of "use network effects to become enormous, then enshittify" is the same - The data you give to Facebook is locked into a proprietary service that can't be modified, and Facebook actively works to break interoperability with open source tools that would allow competitive compatibility. Apple vs Beeper is an example of an ongoing fight to prevent network interoperability, fought on much the same terms.

My gut feeling is that he's right, without Facebook we would have a more advanced internet, but here we are in this timeline, so who knows.

26K notes

·

View notes

Text

EU to introduce shared health data space

The European Council approved the European Health Data Space regulation after a ten-month delay, Euractiv reported.

The document will allow EU citizens to access their health data anywhere across the bloc and control how it is used. Only some data, such as diagnoses and prescriptions, will be mandatory.

However, adoption was delayed due to the heavy workload of legal linguists at the end of the previous mandate and the beginning of the current one. The regulation will now enter into force in mid-March, with implementation to be gradual.

Once the data space is adopted, EU member states will be required to ensure that electronic health records comply with the European format for the exchange of electronic health records to ensure interoperability of systems.

To improve collaboration, the EU will also engage platforms for data reuse in research, public policy and medical innovation, such as France’s Health Data Hub, Germany’s Gesundheitsdatenhub and the Dutch Health Data Coalition.

The European Health Data Space implementation conference is scheduled for 18 March by the Polish Presidency of the European Council.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#health#healthcare#health and wellness#healthylifestyle#physical health#health data space

0 notes

Text

TikTok Faces A Ban — Here’s What Users Can Do If The App Is Removed From The U.S.

As the January 19, 2025, deadline approaches, TikTok faces a potential ban in the United States unless its parent company, ByteDance, divests its ownership. This situation has sparked significant concern among users, creators, and policymakers.

Background and Legal Developments

In April 2024, the U.S. government enacted the Protecting Americans from Foreign Adversary Controlled Applications Act, citing national security concerns over data privacy and potential foreign influence. The law mandates that apps owned by foreign adversaries, like TikTok, must be sold to U.S. entities or face a ban. ByteDance has resisted selling its stake, leading to legal challenges that have reached the Supreme Court. The Court heard arguments on January 10, 2025, and a decision is anticipated before the enforcement date.

Them

Read more in Google news

Political Perspectives

Senator Mark Kelly of Arizona expressed support for the ban, emphasizing the need to protect national security and remove foreign cyber software from U.S. infrastructure. He acknowledged the challenges in eliminating such threats but underscored the importance of decisive action.

Implications for Users and Creators

A ban would lead to TikTok’s removal from app stores, preventing new downloads and updates, which could degrade app performance and security. Users might attempt workarounds like using VPNs or sideloading, but these methods carry risks and potential legal implications.

AP News

Content creators, many of whom have built substantial followings and income streams on TikTok, face significant disruptions. Lexi Larson, a lifestyle influencer, and Priscilla Lopez, a financial mentor, have expressed concerns about losing their primary platform and the communities they’ve cultivated. They are exploring alternative platforms, though none offer the same monetization opportunities as TikTok.

People.com

Potential Business Solutions

In response to the impending ban, investors like Kevin O’Leary and Frank McCourt have proposed acquiring TikTok’s U.S. assets. Their plan focuses on enhancing user privacy, offering monetary incentives for data sharing, and improving interoperability with other platforms to regain user trust. However, this acquisition depends on the Supreme Court’s ruling and ByteDance’s willingness to sell.

New York Post

Conclusion

The future of TikTok in the U.S. remains uncertain, hinging on legal decisions and potential business negotiations in the coming days. Users and creators are advised to stay informed and consider alternative platforms to mitigate potential disruptions.

Financial Times

TikTok’s last dance in the US

AP News

TikTok could be banned this month. Here’s what users can do to prepare

Them

Will TikTok Be Banned in the United States? Everything to Know About the SCOTUS Case

TikTok Ban Looms: What Users and Creators Need to Know

As the January 19, 2025, deadline approaches, the future of TikTok in the United States hangs by a thread. The U.S. government’s demand that TikTok’s parent company, ByteDance, divest its ownership has sparked widespread concern, particularly among the app’s 150 million American users and the millions of content creators who rely on the platform for their livelihoods. This situation raises pressing questions about national security, free speech, and the survival of a digital community that has become central to modern culture.

Read more in Google news

Background and Legal Developments

The roots of this issue date back to 2020, when concerns over TikTok’s data privacy practices first emerged. Critics allege that ByteDance’s ties to the Chinese government pose a risk of user data being accessed for espionage. While TikTok has denied these allegations and implemented measures to store U.S. data domestically, the U.S. government remains unconvinced.

In April 2024, Congress passed the Protecting Americans from Foreign Adversary Controlled Applications Act. This legislation mandates that applications owned by companies from “foreign adversaries” must either sell their U.S. operations to a domestic entity or face a ban. TikTok’s refusal to comply with these terms led to a legal battle that reached the Supreme Court. On January 10, 2025, the Court heard arguments on both sides and is expected to issue a ruling before the enforcement deadline.

National Security Concerns

Proponents of the ban, including prominent lawmakers like Senator Mark Kelly of Arizona, argue that TikTok poses a significant national security threat. “We need to protect Americans from foreign cyber intrusions,” Kelly stated in a recent interview. He emphasized the risk of sensitive user data falling into the hands of a foreign government and the potential for TikTok to influence public opinion through algorithmic manipulation. These concerns have led to bipartisan support for the ban, despite fierce opposition from civil liberties groups and digital rights advocates.

Implications for Users and Creators

If TikTok is banned, it would be removed from app stores, preventing new downloads and updates. While existing users might still access the app for a time, its functionality would likely degrade due to lack of updates and security patches. Some users may turn to workarounds like VPNs to access the platform, but these methods carry risks, including potential legal repercussions and exposure to malware.

For content creators, the implications are dire. Many influencers, such as lifestyle blogger Lexi Larson and financial mentor Priscilla Lopez, have built entire careers on TikTok. They rely on the platform for brand partnerships, sponsorships, and direct monetization through TikTok’s Creator Fund. The loss of TikTok would force these creators to pivot to other platforms like Instagram Reels, YouTube Shorts, or emerging competitors. However, none of these alternatives offer the same level of user engagement or monetization potential as TikTok, leaving creators in a precarious position.

Economic and Cultural Impact

The economic fallout of a TikTok ban extends beyond individual creators. Small businesses that use TikTok for marketing and customer engagement could face significant challenges. TikTok’s algorithm, known for its ability to drive viral trends, has been a game-changer for businesses aiming to reach younger audiences. A ban would disrupt this ecosystem, forcing companies to invest in alternative marketing strategies, which may be less effective and more costly.

Culturally, TikTok has become a hub for creativity, social activism, and community building. From viral dance challenges to educational content and political discourse, the platform has democratized content creation and provided a voice for marginalized communities. A ban would not only silence these voices but also fragment the digital communities that have thrived on TikTok’s unique format.

Potential Business Solutions

In response to the impending ban, several investors and tech entrepreneurs have proposed acquiring TikTok’s U.S. assets. Among them is Kevin O’Leary, who has outlined a plan to enhance user privacy while providing monetary incentives for data sharing. Another proposal comes from tech investor Frank McCourt, who suggests implementing blockchain technology to improve data transparency and security. However, these solutions hinge on ByteDance’s willingness to sell and the Supreme Court’s upcoming decision.

Alternatives and Next Steps

While the fate of TikTok remains uncertain, users and creators are advised to prepare for potential disruptions. Exploring alternative platforms and diversifying digital presence can help mitigate the impact of a ban. Instagram Reels, YouTube Shorts, and Snapchat Spotlight are viable options, each offering unique features and audiences. Additionally, creators should consider building their own websites and email lists to maintain direct communication with their followers.

For now, all eyes are on the Supreme Court, which holds the power to shape the future of one of the world’s most influential social media platforms. Whether TikTok will survive in the U.S. or be relegated to the annals of digital history remains to be seen.

TikTok’s Future in the U.S.: A Battle of Security, Freedom, and Business Interests

In recent months, TikTok has found itself at the center of a heated debate in the United States, as the popular social media platform faces the prospect of an outright ban. This situation has sparked widespread concern among its vast user base, content creators, and policymakers, and it raises important questions about data privacy, freedom of expression, and economic implications.

Background and the Legal Framework

The U.S. government’s concerns about TikTok stem from its parent company, ByteDance, which is headquartered in China. Critics argue that the app poses a national security threat, as its data collection practices could potentially allow the Chinese government to access sensitive user information. These allegations led to the enactment of the Protecting Americans from Foreign Adversary Controlled Applications Act in April 2024. Under this law, foreign-owned apps deemed a security risk must either be divested to U.S. entities or face removal from the U.S. market.

The situation escalated when ByteDance resisted calls to sell its U.S. assets. The legal battle eventually reached the Supreme Court, which heard arguments on January 10, 2025. A decision is expected shortly, as the deadline for TikTok’s compliance looms on January 19.

Political and Public Reactions

The potential ban has become a highly politicized issue. Arizona Senator Mark Kelly voiced his strong support for the move, emphasizing that safeguarding national security should take precedence over individual app preferences. He pointed out that while removing foreign cyber threats entirely is challenging, decisive action against platforms like TikTok is a critical step.

Other lawmakers and public figures have offered more cautious views, highlighting the complexities of balancing security concerns with the app’s cultural and economic significance. Many see TikTok as an integral part of modern digital culture, particularly among younger demographics, which makes the prospect of its removal deeply controversial.

Impact on Users and Creators

If the ban goes into effect, TikTok will no longer be available for download in U.S. app stores, and existing users will be unable to receive updates. Over time, this will lead to a degradation of the app’s functionality and security. Some users might attempt to circumvent the ban through methods like using virtual private networks (VPNs) or sideloading the app. However, these workarounds pose security risks and could violate the terms of the ban, potentially resulting in legal consequences.

For content creators, the implications are even more severe. Many influencers have built their careers and livelihoods on TikTok, leveraging its algorithm to reach massive audiences. Lexi Larson, a lifestyle influencer, and Priscilla Lopez, a financial mentor, are among the many creators who have expressed concern over losing not only their primary source of income but also the vibrant communities they’ve built. These creators are now scrambling to explore alternative platforms like Instagram Reels, YouTube Shorts, and emerging apps, though none offer the same level of engagement or monetization opportunities.

Read more in Google news

Business and Economic Considerations

From a business perspective, the TikTok ban could have far-reaching consequences. Investors like Kevin O’Leary and Frank McCourt have proposed acquiring TikTok’s U.S. operations as a solution to the impasse. Their plans include bolstering user privacy measures, offering financial incentives for data sharing, and fostering greater interoperability with other platforms. While these proposals offer potential pathways to address security concerns, they hinge on the outcome of ongoing legal proceedings and ByteDance’s willingness to negotiate.

For the broader economy, a TikTok ban could result in a ripple effect. The platform has become a crucial marketing tool for brands, small businesses, and entrepreneurs. Its removal could disrupt advertising strategies and stifle innovation in digital marketing, forcing businesses to pivot to less effective platforms.

Broader Implications for Social Media and Security

The TikTok case has reignited debates about the role of government in regulating technology and protecting national security. It also raises questions about the precedent such a ban would set for other foreign-owned tech companies operating in the U.S. Critics argue that targeting TikTok could lead to retaliatory measures from China, further escalating tensions between the two global superpowers.

Moreover, the ban has sparked discussions about data privacy and whether similar scrutiny should be applied to all tech platforms, regardless of their country of origin. Many experts point out that companies like Facebook, Google, and Amazon also collect vast amounts of user data, yet they face fewer restrictions despite their potential to misuse information.

What Lies Ahead?

As the January 19 deadline approaches, the future of TikTok in the U.S. hangs in the balance. A Supreme Court ruling, potential divestment negotiations, and evolving public opinion will play pivotal roles in determining the app’s fate. In the meantime, users and creators are advised to stay informed and prepare for the possibility of transitioning to other platforms.

For now, TikTok’s situation serves as a reminder of the complex interplay between technology, politics, and society — a dynamic that will undoubtedly shape the digital landscape for years to come.

0 notes

Text

Shifting $677m from the banks to the people, every year, forever

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

"Switching costs" are one of the great underappreciated evils in our world: the more it costs you to change from one product or service to another, the worse the vendor, provider, or service you're using today can treat you without risking your business.

Businesses set out to keep switching costs as high as possible. Literally. Mark Zuckerberg's capos send him memos chortling about how Facebook's new photos feature will punish anyone who leaves for a rival service with the loss of all their family photos – meaning Zuck can torment those users for profit and they'll still stick around so long as the abuse is less bad than the loss of all their cherished memories:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

It's often hard to quantify switching costs. We can tell when they're high, say, if your landlord ties your internet service to your lease (splitting the profits with a shitty ISP that overcharges and underdelivers), the switching cost of getting a new internet provider is the cost of moving house. We can tell when they're low, too: you can switch from one podcatcher program to another just by exporting your list of subscriptions from the old one and importing it into the new one:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

But sometimes, economists can get a rough idea of the dollar value of high switching costs. For example, a group of economists working for the Consumer Finance Protection Bureau calculated that the hassle of changing banks is costing Americans at least $677m per year (see page 526):

https://files.consumerfinance.gov/f/documents/cfpb_personal-financial-data-rights-final-rule_2024-10.pdf

The CFPB economists used a very conservative methodology, so the number is likely higher, but let's stick with that figure for now. The switching costs of changing banks – determining which bank has the best deal for you, then transfering over your account histories, cards, payees, and automated bill payments – are costing everyday Americans more than half a billion dollars, every year.

Now, the CFPB wasn't gathering this data just to make you mad. They wanted to do something about all this money – to find a way to lower switching costs, and, in so doing, transfer all that money from bank shareholders and executives to the American public.

And that's just what they did. A newly finalized Personal Financial Data Rights rule will allow you to authorize third parties – other banks, comparison shopping sites, brokers, anyone who offers you a better deal, or help you find one – to request your account data from your bank. Your bank will be required to provide that data.

I loved this rule when they first proposed it:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

And I like the final rule even better. They've really nailed this one, even down to the fine-grained details where interop wonks like me get very deep into the weeds. For example, a thorny problem with interop rules like this one is "who gets to decide how the interoperability works?" Where will the data-formats come from? How will we know they're fit for purpose?

This is a super-hard problem. If we put the monopolies whose power we're trying to undermine in charge of this, they can easily cheat by delivering data in uselessly obfuscated formats. For example, when I used California's privacy law to force Mailchimp to provide list of all the mailing lists I've been signed up for without my permission, they sent me thousands of folders containing more than 5,900 spreadsheets listing their internal serial numbers for the lists I'm on, with no way to find out what these lists are called or how to get off of them:

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

So if we're not going to let the companies decide on data formats, who should be in charge of this? One possibility is to require the use of a standard, but again, which standard? We can ask a standards body to make a new standard, which they're often very good at, but not when the stakes are high like this. Standards bodies are very weak institutions that large companies are very good at capturing:

https://pluralistic.net/2023/04/30/weak-institutions/

Here's how the CFPB solved this: they listed out the characteristics of a good standards body, listed out the data types that the standard would have to encompass, and then told banks that so long as they used a standard from a good standards body that covered all the data-types, they'd be in the clear.

Once the rule is in effect, you'll be able to go to a comparison shopping site and authorize it to go to your bank for your transaction history, and then tell you which bank – out of all the banks in America – will pay you the most for your deposits and charge you the least for your debts. Then, after you open a new account, you can authorize the new bank to go back to your old bank and get all your data: payees, scheduled payments, payment history, all of it. Switching banks will be as easy as switching mobile phone carriers – just a few clicks and a few minutes' work to get your old number working on a phone with a new provider.

This will save Americans at least $677 million, every year. Which is to say, it will cost the banks at least $670 million every year.

Naturally, America's largest banks are suing to block the rule:

https://www.americanbanker.com/news/cfpbs-open-banking-rule-faces-suit-from-bank-policy-institute

Of course, the banks claim that they're only suing to protect you, and the $677m annual transfer from their investors to the public has nothing to do with it. The banks claim to be worried about bank-fraud, which is a real thing that we should be worried about. They say that an interoperability rule could make it easier for scammers to get at your data and even transfer your account to a sleazy fly-by-night operation without your consent. This is also true!

It is obviously true that a bad interop rule would be bad. But it doesn't follow that every interop rule is bad, or that it's impossible to make a good one. The CFPB has made a very good one.

For starters, you can't just authorize anyone to get your data. Eligible third parties have to meet stringent criteria and vetting. These third parties are only allowed to ask for the narrowest slice of your data needed to perform the task you've set for them. They aren't allowed to use that data for anything else, and as soon as they've finished, they must delete your data. You can also revoke their access to your data at any time, for any reason, with one click – none of this "call a customer service rep and wait on hold" nonsense.

What's more, if your bank has any doubts about a request for your data, they are empowered to (temporarily) refuse to provide it, until they confirm with you that everything is on the up-and-up.

I wrote about the lawsuit this week for @[email protected]'s Deeplinks blog:

https://www.eff.org/deeplinks/2024/10/no-matter-what-bank-says-its-your-money-your-data-and-your-choice

In that article, I point out the tedious, obvious ruses of securitywashing and privacywashing, where a company insists that its most abusive, exploitative, invasive conduct can't be challenged because that would expose their customers to security and privacy risks. This is such bullshit.

It's bullshit when printer companies say they can't let you use third party ink – for your own good:

https://arstechnica.com/gadgets/2024/01/hp-ceo-blocking-third-party-ink-from-printers-fights-viruses/

It's bullshit when car companies say they can't let you use third party mechanics – for your own good:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

It's bullshit when Apple says they can't let you use third party app stores – for your own good:

https://www.eff.org/document/letter-bruce-schneier-senate-judiciary-regarding-app-store-security

It's bullshit when Facebook says you can't independently monitor the paid disinformation in your feed – for your own good:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#quis-custodiet-ipsos-zuck

And it's bullshit when the banks say you can't change to a bank that charges you less, and pays you more – for your own good.

CFPB boss Rohit Chopra is part of a cohort of Biden enforcers who've hit upon a devastatingly effective tactic for fighting corporate power: they read the law and found out what they're allowed to do, and then did it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

The CFPB was created in 2010 with the passage of the Consumer Financial Protection Act, which specifically empowers the CFPB to make this kind of data-sharing rule. Back when the CFPA was in Congress, the banks howled about this rule, whining that they were being forced to share their data with their competitors.

But your account data isn't your bank's data. It's your data. And the CFPB is gonna let you have it, and they're gonna save you and your fellow Americans at least $677m/year – forever.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/11/01/bankshot/#personal-financial-data-rights

#pluralistic#Consumer Financial Protection Act#cfpa#Personal Financial Data Rights#rohit chopra#finance#banking#personal finance#interop#interoperability#mandated interoperability#standards development organizations#sdos#standards#switching costs#competition#cfpb#consumer finance protection bureau#click to cancel#securitywashing#oligarchy#guillotine watch

466 notes

·

View notes

Text

Advancing Inclusive Transit: The Role of Paratransit Software and Microtransit Solutions

The world of public transportation is undergoing a transformative shift, driven by the need for inclusivity and technological advancements. Paratransit software and microtransit software are pivotal in this evolution, addressing the unique mobility challenges faced by individuals with disabilities and other underserved populations. These cutting-edge solutions not only ensure compliance with the Americans with Disabilities Act (ADA) but also enhance operational efficiency for non-emergency medical transportation (NEMT) fleet providers.

Understanding Paratransit Software and Its Importance

Paratransit software serves as a cornerstone for agencies that provide transportation for individuals unable to use fixed-route systems due to physical, cognitive, or sensory impairments. These platforms streamline operations, ensuring that transit agencies comply with ADA mandates to provide equitable access.

Key functionalities of paratransit scheduling software include:

Automated Scheduling: Allows for efficient trip planning by optimizing routes and schedules based on rider demand and vehicle availability.

Real-Time Tracking: Enables dispatchers and riders to monitor vehicles, ensuring timely service.

Rider Communication: Facilitates notifications and updates to enhance the rider experience.

Data Analytics: Provides insights into service usage, helping agencies improve operations and allocate resources effectively.

By leveraging these features, public transportation providers can minimize operational costs while enhancing the quality of service, making mobility accessible for all.

The Role of Microtransit Software in Modern Transit Systems

While paratransit focuses on individuals with specific needs, microtransit software addresses broader challenges in the transportation ecosystem. These on-demand solutions bridge gaps in traditional transit systems, offering flexible and efficient services that adapt to real-time demand. For public transportation agencies, integrating microtransit solutions can:

Reduce Operational Costs: Shared rides and optimized routes minimize fuel consumption and labor expenses.

Improve Coverage: Provide services in areas where fixed-route systems are not feasible.

Enhance Accessibility: Offer first-mile and last-mile connectivity, making it easier for riders to access main transit hubs.

The dynamic nature of microtransit software makes it an invaluable tool for transit agencies and NEMT fleet providers aiming to deliver timely and reliable services.

Core Features of Paratransit and Microtransit Solutions

To understand the transformative potential of these platforms, it’s essential to examine their core functionalities. Both paratransit software and microtransit software share several key features that address the unique demands of their users:

Dynamic Scheduling and Routing

Algorithms optimize routes in real-time, accommodating cancellations, delays, and new bookings.

Enhanced resource utilization ensures cost-effective operations.

Integration with Public Transportation Software

Seamless interoperability allows users to plan multi-modal trips involving buses, trains, and on-demand services.

This creates a unified mobility ecosystem.

Accessibility Features

Platforms are designed to accommodate individuals with disabilities, including wheelchair accessibility and assistive technologies.

Compliance with ADA guidelines is built into the software.

Scalability

Solutions can scale to meet the demands of both small communities and large metropolitan areas.

This makes them suitable for diverse transit agencies and NEMT fleet providers.

User-Friendly Interfaces

Mobile apps and web portals enable riders to book trips, receive updates, and communicate with transit providers.

These interfaces prioritize ease of use, ensuring accessibility for all.

How Paratransit Scheduling Software Benefits NEMT Fleet Providers

Non-emergency medical transportation is a critical service that ensures patients can access healthcare facilities on time. For NEMT fleet providers, adopting advanced paratransit scheduling software is a game-changer. Here’s how:

Efficiency: Automated scheduling reduces administrative overhead and streamlines operations.

Timeliness: Real-time tracking and updates ensure patients are picked up and dropped off punctually.

Cost-Effectiveness: Optimized routes lower fuel consumption and operational expenses.

Regulatory Compliance: ADA-compliant software ensures providers meet federal and state guidelines.

By improving service quality and reliability, NEMT fleet providers can enhance patient satisfaction and outcomes.

Overcoming Barriers to Adoption

Despite the benefits, transit agencies and NEMT fleet providers often face challenges in adopting new technologies. These include:

Budget Constraints: The initial investment for software implementation can be significant, especially for smaller agencies.

Training Requirements: Staff need to be adequately trained to use new systems effectively.

Integration Issues: Ensuring compatibility with existing public transportation software may require additional resources.

To address these challenges, software providers must offer scalable, customizable solutions and robust support services. Additionally, government grants and subsidies can help smaller agencies adopt these critical technologies.

The Future of Public Transportation Software

As the transportation industry continues to evolve, the integration of paratransit software and microtransit software will play a pivotal role in shaping the future of mobility. Emerging trends include:

Artificial Intelligence (AI): Advanced AI algorithms will further optimize scheduling, routing, and resource allocation.

Autonomous Vehicles: Self-driving technology could revolutionize paratransit and microtransit services, offering safer and more efficient transportation options.

Sustainability: Green technologies, such as electric and hybrid vehicles, will align transit goals with environmental priorities.

Data-Driven Decision Making: Enhanced analytics will enable transit agencies to make informed decisions, improving service delivery and efficiency.

The Path Forward

The adoption of paratransit software, microtransit software, and integrated public transportation software is no longer a luxury but a necessity. For transit agencies and NEMT fleet providers, these tools offer a pathway to more inclusive, efficient, and sustainable mobility solutions. By addressing the unique needs of individuals with disabilities and underserved populations, these innovations help create a transportation system that truly serves everyone.

In the end, investing in advanced technologies is about more than just operational efficiency. It’s about building a world where mobility is not a privilege but a right—a world where everyone, regardless of their abilities or circumstances, can move freely and independently. With the continued evolution of paratransit scheduling software and microtransit software, the possibilities for innovation and inclusivity are boundless.

#Paratransit software#microtransit software#Americans with Disabilities Act (ADA)#paratransit scheduling software

0 notes

Text

Regulatory Scenario for ESG Rating Providers

Introduction

The regulatory landscape for sustainable finance is rapidly evolving to address investors’ growing concerns around transparency, reliability, and quality of ESG ratings. ESG Rating Providers (ERPs) are at the forefront of this shift, with their ratings influencing market transparency and affecting investment decisions. This blog gives an overview of what regional regulations are expecting of rating providers, with a particular focus on the EU and the UK and gives insight into how investors can expect the landscape of ESG ratings to shift as a result of these regulations.

Overview of the ESG Ratings Landscape

ERPs, which play a critical role in shaping investment decisions and market transparency, are increasingly coming under regulatory purview. Globally, several jurisdictions are moving forward with regulations for ERPs. The International Organization of Securities Commissions (IOSCO) is a global association of securities regulators. Its recommendations on ESG ratings and data products serve as a foundational framework for various jurisdictions, including the EU and the UK, in developing their regulatory frameworks for ERPs.

In the EU, the European Securities and Markets Authority (ESMA) has introduced a regulation to enhance transparency and integrity of ESG rating activities.

Meanwhile, in the UK, the International Capital Market Association (ICMA) and the International Regulatory Strategy Group (IRSG) have introduced a Code of Conduct for ESG ratings or data products providers.

In India, the Securities and Exchange Board of India (SEBI) has introduced a framework for ERPs.

Japan’s Financial Services Agency (FSA) has also issued a ‘Code of Conduct for ESG Evaluation and Data Providers’.

Various jurisdictions present slight variations in their regulatory requirements, all of which are equally important; however, the regulatory developments in the EU and the UK hold primary significance due to Inrate’s geographical focus.

Read more: ESG Risk Ratings vs ESG Impact Ratings

1 Regional Regulatory Developments — A Focus on the EU and the UK

1.1 Regulatory frameworks in the EU and the UK

EU: Transparency and Integrity of ESG Rating Activities ESMA has taken the lead in regulating ERPs within the EU. It has introduced a regulatory framework that aims to enhance the transparency, reliability, and comparability of ESG ratings. This framework includes several key aspects, such as registration requirements, which mandate ERPs operating in the EU to register with ESMA and adhere to specific registration requirements. Additionally, providers are required to disclose information related to key areas, including transparency, conflict of interest, processes & procedures, and quality. Furthermore, ESMA monitors the performance of ERPs and may take enforcement action when deemed necessary.

UK: Code of Conduct for ESG Ratings and Data Products Providers In the UK, ICMA and IRSG outlined a voluntary Code of Conduct, comprising six principles, emphasizing good governance, quality, conflicts of interest, transparency, confidentiality, and engagement. Upon signing the Code of Conduct through ICMA, ESG ratings and data providers are required to implement their provisions. After implementation, they must publish a ‘Statement of Application’ on their website, notifying ICMA with the pertinent details. The Code is designed to be closely aligned with IOSCO’s recommendations, aiming for international interoperability.

1.2 Focus area of the regulations

Although both the EU and the UK regulations are largely aligned, there are some differences in their scope, particularly regarding governance, applicability to data products, and other related areas. While these regulations directly target ERPs, they are designed to enhance the overall credibility and integrity of the ESG ratings market, ensuring that investors can rely on high-quality, transparent assessments.

1.3 Deep dive into the EU’s regulation and how it impacts investors

With the recent publishing of the EU’s regulation on the transparency and integrity of ESG rating activities, it is important to deep dive into how the regulation is expected to change the ESG ratings landscape for investors:

1) Transparent disclosure of rating methodologies: Investors and companies will have access to clear information on how ratings are calculated including the assumptions used, data sources, and the weightage of E, S, and G factors. You can read more about Inrate’s rating methodology here.

2) Clearly defined assessment approach: Investors will have a clear indication on whether the rating focuses on financial risks, societal impacts, or both (i.e., distinguish between ESG risk ratings, ESG impact ratings, and ESG ratings that focus on double materiality).

3) Increased confidence in conflict-of-interest management: The regulation requires rating providers to separate rating activities from consulting, auditing, or credit rating services. This helps reduce investor concerns around conflicts of interest, impacting the reliability of the ratings.

4) Supervision by ESMA: The ESMA will authorize, enforce, and monitor compliance and will impose penalties for non-adherence. This will help increase accountability among rating providers and improve reliability of ratings.

5) Greenwashing prevention: The regulation’s focus on transparency across the board supports investors to avoid any misleading sustainability claims.

6) Trickle-down effect on data quality from ESG Data Providers: The investors purchasing ESG data solutions from rating providers can expect an improvement in the data transparency and quality of the data solutions that they are currently receiving.

2 Inrate’s Approach to Transparency, Accuracy, and Quality

Inrate understands the implications of the new regulatory requirements for ERPs and is naturally positioned to be fully compliant. Our ratings have always been underpinned by a focus on transparency, recency, and quality, which aligns seamlessly with the expectations laid out by regional regulations. Some actions that underpin our preparedness include:

• Transparency: Inrate currently offers separate aspect scores and grades. We have already published a preliminary outline of our methodology, available here, which is to update in line with the expectations of the regulations.

• Conflict-of-Interest Management: Inrate has procedures for employee independence and does not participate in any consulting, auditing, or credit rating services.

• Quality: Inrate has always assessed alignment with international agreements, and will continue to do so, as recommended by the EU’s regulation.

• Governance: Inrate has clear governance structures in place and will be ensuring documentation aligns with the principles in the Code of Conduct.

As an active participant and member of the European Association of Sustainability Rating Agencies (EASRA), Inrate gains insights into emerging regulations for ERPs in the European region and Swiss jurisdiction, while continuously monitoring updates to align its practices with evolving compliance requirements.

Read more: Role of Climate Data in Assessing Portfolio Risk

0 notes

Text

Railway Signaling System Market Report: Industry Growth, Trends, and Insights

Railway Signaling System Market Report: Industry Growth, Trends, and Insights

Introduction to the Railway Signaling System Market

The global railway signaling system market plays a crucial role in enhancing rail safety, efficiency, and operational performance. In 2023, the market was valued at USD 22.0 billion and is projected to grow significantly to USD 49.1 billion by 2032, at a CAGR of 9.3% from 2024 to 2032. This growth reflects the increasing need for advanced rail management solutions worldwide.

Download Free Sample Report: https://straitsresearch.com/report/railway-signaling-system-market/request-sample

Key Industry Dimensions and Market Value

The railway signaling system ensures the safety of rail networks by managing train movements, preventing collisions, and optimizing rail traffic flow. As the demand for efficient and secure transportation systems increases, the signaling market continues to evolve with technological advancements and automation.

Industry Key Trends

Increasing adoption of automated and communication-based train control systems.

Rapid urbanization driving the expansion of metro and high-speed rail projects.

Government investments in rail infrastructure modernization.

Rising concerns about passenger safety and operational efficiency.

Integration of IoT and AI technologies for predictive maintenance and real-time monitoring.

Railway Signaling System Market Size and Share

The railway signaling market is expanding rapidly due to its critical role in improving transportation systems globally. The market's estimated size of USD 24.1 billion in 2024 highlights its robust growth trajectory. Key factors driving market share include the adoption of advanced systems like communication-based train control (CBTC) and automatic train protection (ATP) systems.

Railway Signaling System Market Statistics

2023 Market Value: USD 22.0 billion

2024 Market Value: USD 24.1 billion

Projected 2032 Market Value: USD 49.1 billion

CAGR (2024–2032): 9.3%

Regional Trends in the Railway Signaling System Market

North America

North America holds a significant share due to investments in upgrading rail infrastructure. The United States and Canada are at the forefront, focusing on adopting Positive Train Control (PTC) systems for enhanced safety compliance.

Asia-Pacific (APAC)

APAC leads the market with extensive railway network expansions in countries like China, India, and Japan. High-speed rail projects and urban transit systems contribute to this region's dominance.

Europe

Europe emphasizes technological innovations like the European Train Control System (ETCS). Nations such as Germany, France, and the UK are upgrading their rail systems for efficiency and sustainability.

LAMEA (Latin America, Middle East, and Africa)

The LAMEA region is emerging as a promising market, with Brazil, South Africa, and GCC countries investing in rail infrastructure development to boost regional connectivity.

Market Segmentations

By Technology

Automatic Train Protection (ATP) System: Ensures train safety by preventing accidents through automated interventions.

Automatic Train Operation (ATO) System: Optimizes train operations, including speed control and scheduling.

Communication-Based Train Control (CBTC) System: Enhances train control through wireless communication.

European Train Control System (ETCS): A standardized system ensuring interoperability across European railways.