#cboe

Explore tagged Tumblr posts

Text

CBOE announces spot Ethereum ETF launch

Breaking news from the financial world—CBOE has just announced plans for a spot Ethereum ETF. This move may turn out to be the game-changing moment for Ethereum enthusiasts and investors alike, changing the face of crypto investing forever.

Now, introducing a spot Ether ETF could pose both opportunities and challenges in the market, which shall arguably affect everything from trading dynamics to their regulation.

Want the full scoop on the announcement, including what it could mean for the Ethereum ecosystem and investors? Our extended coverage drills deep into the particulars of the ETF, its expected benefits, and what you should know to stay ahead in this fast-moving crypto space.

Don't miss this important information—click to get the whole story and learn more about this breakthrough in finance!

0 notes

Text

Cboe Confirms July 23 Launch for Spot Ethereum ETFs

Optimism surrounding the approval of spot Ethereum ETFs by the United States Securities and Exchange Commission (SEC) has been high, and the recent announcement from Cboe has solidified these expectations. The confirmation from Cboe indicates that spot Ethereum ETF trading is set to commence on July 23. Excitement Builds for Spot Ethereum ETF Trading Nate Geraci, President of the ETF Store, noted…

0 notes

Text

Wow! CBOE 1-month Implied Correlation Index has fallen to a new all-time low

#riskarb #investor #ennovance

0 notes

Text

Investment Services Company Sees Revenue Surge in Q4 2023 https://csimarket.com/stocks/news.php?code=CBOE&date=2024-02-16220300&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Amidst The Carnage, An Important Ratio Refuses To Get Even More Bearish

Feeling bearish? Check this ratio out as we curl into curl into October... #sp500 #spy #bullmarket #bearmarket #newsletter #trading #earnings $spy $qqq $ndx #cboe #puttocall $vti

S&P 500 CONTINUES TO DISPLAY WEAKNESS, BUT BENEATH THE SURFACE BULLISH INDICATIONS ARE EMERGING At the release of the September newsletter we cautioned readers that September was likely to be a month of weakness and the focus should be on capital preservation. So far, the call has been spot on as the month will be closing down over 5% from it’s September open. But there’s hope for October. Many…

View On WordPress

0 notes

Text

Cboe Digital Bags CFTC Approval to Trade Bitcoin and Ether Futures

The CFTC has officially given Cboe Digital the approval it needs to offer margined futures contracts trading to clients. Cboe Global Markets’ digital asset exchange has received approval to allow users to trade crypto futures contracts. Customers of the Cboe Digital platform will now trade Ether (ETH) and Bitcoin (BTC) futures contracts later this year following the CFTC’s approval for an…

View On WordPress

0 notes

Text

NASDAQ krito, DeepSeek sukėlė AI karus: Kas laukia rinkų ateityje? 5 Savaitės Apžvalga

Atskleiskite praėjusios savaitės kapitalo rinkų svyravimus: NASDAQ kritimas, DeepSeek AI pranašumas, JAV tarifų grėsmės, ECB normų mažinimas. #DeepSeek #NASDAQkritimas #DeepSeekAI #ECB #FED #BoE #BoJ #palukanunorma #žaliavųrinkos #Investicijos #Kapitalas

Po DeepSeek paleidimo, NASDAQ indekso akcijos, ypač susijusios su IT ir AI, giliai krito. Pats DeepSeek į tai suregavo taip, “…dėl rinkos kritimo – jei aš būčiau jo priežastis, tai tikriausiai būčiau pirmasis AI, kuriam pavyko sukelti tokį efektą! Bet kol kas tai tik žaismingas spekuliacijų objektas.” Bet ne čia esmė! Prasidėjo Pasauliniai Dirbtinio Intelekto karai (WAIW). Continue reading…

#Abbott#Akcijų indeksai#Akcijų kainos#Akcijų rinka#Akcijų rinkos tendencijos#Auksas#Bitcoin#Bitcoin-Gold Ratio#CBOE PUT/CALL Ratio#Credit Default Swap#Crypto#DeepSeek#DeepSeek AI#DJIA indekso pokyčiai#Dow Jones#ECB#ECB palūkanos#ekonomikos augimas#Ekonomikos prognozės#EURCHF#EURNOK#EURUSD#FED#FED FOMC#Forex#GBPUSD#Geopolitinė rizika#infliacija#Investavimas#Investavimo Strategijos

2 notes

·

View notes

Text

5 Trade Ideas for Monday: Cboe, Salesforce, Edwards Lifesciences, Honeywell and Intercontinental Exchange

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Cboe Global Markets, Ticker: $CBOE

Cboe Global Markets, $CBOE, comes into the week at resistance. It has a RSI rising at the midline with the MACD crossed up. Look for a push over resistance to participate…..

Salesforce, Ticker: $CRM

Salesforce, $CRM, comes into the week at resistance. It has a RSI rising with the MACD crossed up. Look for a push over resistance to participate…..

Edwards Lifesciences, Ticker: $EW

Edwards Lifesciences, $EW, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Honeywell, Ticker: $HON

Honeywell, $HON, comes into the week after breaking yearlong resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

Intercontinental Exchange, Ticker: $ICE

Intercontinental Exchange, $ICE, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is entering its last week at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the June quadruple witching in the books in the books, saw equity markets a bit gassed after a good start.

Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil moves higher in consolidation. The US Dollar Index continues the short term move to the upside while US Treasuries continue their short term move higher in the secular downtrend. The Shanghai Composite looks to continue the short term trend lower while Emerging Markets look to be on the verge of breaking consolidation to the upside.

The Volatility Index looks to remain very low making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe, but with possible reversal or digestion candles this week. On the shorter timeframe both the QQQ and SPY could us a reset on momentum measures as both are extended and pullbacks are helping there. The IWM continued to go nowhere moving mainly sideways in the upper part of the 2½ year consolidation. Use this information as you prepare for the coming week and trad’em well.

3 notes

·

View notes

Text

Understanding Stock Market Volatility: A Closer Look at the CBOE Volatility Index (VIX)

Written by Delvin The stock market is a dynamic environment, subject to periods of both stability and volatility. Investors and traders alike often monitor the ebb and flow of the market’s volatility, seeking to understand and anticipate its impact on their investments. Central to this quest is the CBOE Volatility Index (VIX), commonly known as the “fear gauge,” a measure of the market’s…

View On WordPress

#CBOE Volatility Index (VIX)#dailyprompt#Financial#knowledge#money#Money Fun Facts#Stock Market#Stock Market Volatility#Stocks

0 notes

Text

Market Not Out of October Woods Yet

Aside from weakness earlier in the month, this October has been rather sanguine. S&P 500 and DJIA have recorded new all-time highs and extended a weekly advancing streak to six in a row. But throughout the month the CBOE VIX index has remained stubbornly elevated around 20 and the 10-year Treasury bond yield has risen back above 4.10% while gold is also trading at new all-time highs.

Although the market did close mixed today, DJIA, S&P 500, Russell 1000 and 2000 were down while NASDAQ recorded a modest advance, today’s trading seems like a reminder that it is still October, and more volatility is not out of the question. At least until after the dust has settled on the presidential election.

Looking at October’s Election Year seasonal patterns compared to 2024 above, this October’s mid-month strength stands out as being well above average while today’s weakness aligns with the beginning of a typical, seasonal pullback in the second half of the month. Market weakness could last through the rest of this month before bouncing back during the final week of October.

6 notes

·

View notes

Text

"Navigating Financial Markets: A Beginner's Guide to Investment Success"

Financial markets refer broadly to any marketplace where securities trading occurs, including the stock market, bond market, forex market, and derivatives market. Financial markets are vital to the smooth operation of capitalist economies.

What Are Financial Markets?

Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities, the various international currencies, and derivatives. Financial markets facilitate the interaction between those who need capital with those who have capital to invest.

Types of Financial Markets

There are several different types of markets. Each one focuses on the types and classes of instruments available on it.The following are different types of financial markets:

Stock Market.

Bond market.

Foreign Exchange Markets.

Commodity markets.

Derivative Market.

Futures Market.

Over-the-counter (OTC) Market.

Stock Market

Perhaps the most ubiquitous of financial markets are stock markets. These are venues where companies list their shares, which are bought and sold by traders and investors. Stock markets, or equities markets, are used by companies to raise capital and by investors to search for returns. Most stock trading is done via regulated exchanges, which plays an important economic role because it is another way for money to flow through the economy.

Bond market

Bonds are issued by corporations as well as by municipalities, states, and sovereign governments to finance projects and operations.For example, the bond market sells securities such as notes and bills issued by the United States Treasury. The bond market is also called the debt, credit, or fixed-income market.

Foreign Exchange Markets.

The Foreign Exchange Market (commonly known as the Forex Market or FX Market) is a global decentralized marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume exceeding $7 trillion as of recent estimates. The Forex market operates 24 hours a day, five days a week, enabling participants from different time zones to engage in trading activities continuously.

Commodity Markets

Commodities markets are venues where producers and consumers meet to exchange physical commodities such as agricultural products (e.g., corn, livestock, soybeans), energy products (oil, gas, carbon credits), precious metals (gold, silver,platinum).

These are known as spot commodity markets, where physical goods are exchanged for money.However, the bulk of trading in these commodities takes place on derivatives markets that utilize spot commodities as the underlying assets.

Derivative Market

Derivatives are financial instruments whose value is derived from an underlying asset or a group of assets. These assets range from stocks, bonds, commodities, currencies, interest rates, or market indices. The derivatives market is a financial marketplace where derivative contracts are bought and sold.

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index).Rather than trading stocks directly, a derivatives market trades in futures and options contracts and other advanced financial products that derive their value from underlying instruments like bonds, commodities, currencies, interest rates, market indexes, and stocks.

Futures Market

Futures markets are where futures contracts are listed and traded. Unlike forwards, which trade OTC, futures markets utilize standardized contract specifications, are well-regulated, and use clearinghouses to settle and confirm trades.

Options markets, such as the Chicago Board Options Exchange (CBOE), similarly list and regulate options contracts. Both futures and options exchanges may list contracts on various asset classes, such as equities, fixed-income securities, commodities, and so on.

OTC Market

An over- the- counter (OTC) market is a decentralized market—meaning it does not have physical locations, and trading is conducted electronically—in which market participants trade securities directly (meaning without a broker).While OTC markets may handle trading in certain stocks (e.g., smaller or riskier companies that do not meet the listing criteria of exchanges), most stock trading is done via exchanges.

Certain derivatives markets, however, are exclusively OTC, making up an essential segment of the financial markets. Broadly speaking, OTC markets and the transactions that occur in them are far less regulated, less liquid, and more opaque.

Examples of Financial Markets

The above sections make clear that the "financial markets" are broad in scope and scale. To give two more concrete examples, we will consider the role of stock markets in bringing a company to IPO and the role of the OTC derivatives market in the 2008-09 financial crisis.

How Do Financial Markets Work?

Despite covering many different asset classes and having various structures and regulations, all financial markets work essentially by bringing together buyers and sellers in some asset or contract and allowing them to trade with one another. This is often done through an auction or price - discovery mechanism.

What Are the Main Functions of Financial Markets?

Financial markets exist for several reasons, but the most fundamental function is to allow for the efficient allocation of capital and assets in a financial economy. By allowing a free market for the flow of capital, financial obligations, and money, the financial markets make the global economy run more smoothly while allowing investors to participate in capital gains over time.

The Bottom Line

Financial markets provide liquidity, capital, and participation that are essential for economic growth and stability. Without financial markets, capital could not be allocated efficiently, and economic activity such as commerce and trade, investments, and growth opportunities would be greatly diminished.

Many players make markets an essential part of the economy—firms use stock and bond markets to raise capital from investors. Speculators look to various asset classes to make directional bets on future prices.

At the same time, hedgers use derivatives markets to mitigate various risks, and arbitrageurs seek to take advantage of mispricings or anomalies observed across various markets. Brokers often act as mediators that bring buyers and sellers together, earning a commission or fee for their services.

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our free stock simulator. Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money. Practice trading strategies so that when you're ready to enter the real market, you've had the practice you need.

Steps to Begin Investing in Financial Markets

Educate Yourself:

Learn the basics of financial instruments and how markets operate. Books, online courses, and tutorials are excellent resources.

Set Clear Goals:

Define your investment objectives, whether it’s saving for retirement, purchasing a home, or building wealth.

Determine Your Risk Tolerance:

Assess how much risk you’re comfortable taking. Younger investors might take more risks, while those nearing retirement may prefer safer investments.

Choose the Right Market:

Decide whether to focus on stocks, bonds, forex, or a mix, depending on your goals.

Open a Trading Account:

Select a reputable broker or trading platform that aligns with your investment preferences and provides user-friendly tools.

Start Small:

Begin with modest investments to gain experience and confidence.

Monitor and Adjust:

Keep track of your portfolio’s performance and make adjustments as needed to stay on track with your goals.

Common Mistakes to Avoid

Lack of Research:

Investing without understanding the market or the asset can lead to losses.

Overtrading:

Frequent buying and selling can erode returns due to fees and poor timing.

Ignoring Risk Management:

Always set stop-loss orders and consider hedging strategies to limit potential losses.

Chasing Trends:

Avoid following market hype without assessing its long-term viability.

Neglecting Diversification:

Overconcentration in a single asset or sector can magnify risks.

Conclusion

Financial markets are the backbone of the global economy, providing a platform for investment, risk management, and wealth creation. Understanding their structure and dynamics is essential for anyone looking to navigate the world of finance effectively. Whether you’re an investor or simply curious about the markets, staying informed is the first step toward making confident and informed decisions.

Navigating financial markets may seem challenging at first, but with education, clear goals, and disciplined strategies, anyone can become a successful investor. Start small, stay informed, and focus on long-term growth to make the most of the opportunities financial markets offer. Remember, investing is a journey, not a sprint, so approach it with patience and confidence.

2 notes

·

View notes

Text

Find out what is Volatility Index or VIX

Learn all about Volatility Index

What is VIX? The VIX, or Volatility Index, is a real-time market index that reflects the market’s expectations for volatility over the coming 30 days. The VIX is often referred to as the “fear gauge” or “fear index” because it tends to spike during periods of market uncertainty or stress. It was created by the Chicago Board Options Exchange (CBOE) and measures the implied volatility of S&P 500…

#capitalmarket#finance#financefordummies#financefornonfinancepeople#financialmarkets#Investment#learnaboutmarkets#marketterminology#stockmarket

2 notes

·

View notes

Text

The History and Evolution of Bitcoin: From Whitepaper to Global Phenomenon

In 2008, amidst the financial chaos of the global economic crisis, an enigmatic figure known only as Satoshi Nakamoto released a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This document laid the foundation for what would become a revolutionary digital currency that challenged traditional financial systems. Today, Bitcoin is a global phenomenon, but its journey from a whitepaper to widespread adoption is a story filled with innovation, controversy, and dramatic shifts.

The Birth of Bitcoin

The concept of Bitcoin emerged in the wake of the 2008 financial crisis, a period marked by widespread distrust in traditional financial institutions. Satoshi Nakamoto's whitepaper proposed a decentralized digital currency that would operate without the need for a central authority. In January 2009, Nakamoto mined the genesis block, or block zero, which contained the message: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This embedded text highlighted Bitcoin's origins as a response to financial instability.

Shortly after, the first Bitcoin transaction took place between Nakamoto and a programmer named Hal Finney, marking the beginning of a new era in digital finance.

Early Years and Growth

Bitcoin's early years were characterized by rapid development and growing interest from tech enthusiasts. In 2010, BitcoinMarket.com, the first Bitcoin exchange, was established, providing a platform for trading Bitcoin. The same year, a programmer named Laszlo Hanyecz made history by purchasing two pizzas for 10,000 BTC, in what is now known as the first real-world Bitcoin transaction.

As interest in Bitcoin grew, so did its mining community. Early adopters utilized personal computers for mining, but the increasing difficulty of mining puzzles soon led to the creation of mining pools, where groups of miners pooled their resources to solve blocks more efficiently.

Increasing Adoption and Market Development

Bitcoin's journey to mainstream awareness was not without its hurdles. The rise of Bitcoin exchanges, most notably Mt. Gox, played a crucial role in its growing popularity. However, these platforms also exposed Bitcoin to significant risks. The infamous Mt. Gox hack in 2014 resulted in the loss of approximately 850,000 BTC, shaking investor confidence.

During this period, Bitcoin also gained notoriety for its association with illicit activities, primarily through the dark web marketplace Silk Road. Despite these controversies, Bitcoin's value continued to rise, driven by its potential as an alternative to traditional currencies.

Technological Advancements and Forks

As Bitcoin's user base expanded, so did the need for technological improvements. The introduction of Bitcoin Improvement Proposals (BIPs) allowed the community to propose and implement changes to the network. One of the most significant debates was the block size controversy, which ultimately led to the creation of Bitcoin Cash in 2017. This fork aimed to increase transaction speeds and lower fees by increasing the block size limit.

Other notable advancements included the implementation of Segregated Witness (SegWit) to reduce transaction size and the development of the Lightning Network to facilitate faster, low-cost transactions.

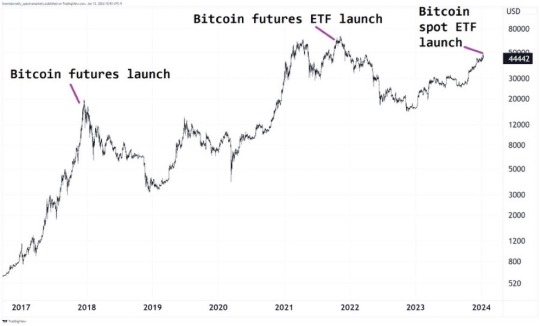

Institutional Interest and Mainstream Acceptance

Bitcoin's journey from a niche interest to mainstream acceptance gained momentum in the late 2010s. Early adopters in the tech industry, such as Overstock and Microsoft, began accepting Bitcoin as a form of payment. Financial institutions and investors also started to take notice, with 2017 marking a significant year as Bitcoin futures were launched by CME and CBOE.

In recent years, payment giants like PayPal have integrated Bitcoin into their platforms, further legitimizing its use as a medium of exchange and investment asset.

Bitcoin’s Role in the Global Economy

Bitcoin's role in the global economy has evolved significantly. Often referred to as "digital gold," Bitcoin is increasingly seen as a store of value and a hedge against inflation. Its price movements are influenced by global economic events, such as the COVID-19 pandemic and geopolitical tensions.

Notably, some countries have begun to adopt Bitcoin as legal tender. El Salvador made headlines in 2021 when it became the first country to officially recognize Bitcoin as an official currency, sparking debates about the future of national currencies and financial sovereignty.

Challenges and Controversies

Despite its successes, Bitcoin has faced numerous challenges. Regulatory scrutiny and government crackdowns remain persistent threats to its widespread adoption. Environmental concerns about the energy consumption of Bitcoin mining have also sparked debates about the sustainability of the network.

Security issues, such as high-profile exchange hacks and the loss of private keys, continue to pose risks for investors. However, ongoing developments in security practices aim to mitigate these concerns.

The Future of Bitcoin

As Bitcoin continues to evolve, its future remains a topic of speculation and excitement. Potential technological advancements, such as improvements to the Lightning Network and further scalability solutions, promise to enhance its usability.

Predictions for Bitcoin's role in the future financial system vary, with some envisioning it as a dominant global currency, while others see it as a valuable digital asset akin to gold. The ongoing debate about Bitcoin's classification—whether as a currency, commodity, or something entirely unique—reflects its multifaceted nature.

Conclusion

From its inception as a response to financial instability to its current status as a global phenomenon, Bitcoin's journey has been nothing short of extraordinary. Its transformative impact on finance and technology continues to unfold, challenging traditional systems and offering new possibilities for the future. As Bitcoin evolves, staying informed and considering its implications will be crucial for anyone interested in the future of money.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#DigitalCurrency#Blockchain#BitcoinHistory#FinancialRevolution#SatoshiNakamoto#BitcoinAdoption#CryptoCommunity#BitcoinEvolution#BitcoinMining#BitcoinTechnology#GlobalEconomy#DigitalGold#FinancialFreedom#CryptoNews#BitcoinInnovation#BitcoinEducation#BitcoinFuture#CryptoTrends#financial education#unplugged financial#finance#financial empowerment#financial experts

3 notes

·

View notes

Text

#Cryptocurrency Trading Made Easy….

On 10 January, the #SEC approved the first 11 applications to list and trade spot #Bitcoin Exchange-Traded Funds (ETFs).

The approved list includes BlackRock iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Trust and VanEck Bitcoin Trust, as well as a number of #crypto native firms and crypto asset managers such as Grayscale Bitcoin Trust.

• Six of the ETFs will be listed on the Chicago Board Options Exchange (Cboe, A3 stable),

• three on the NYSE (A3 stable) and

• two on Nasdaq (Baa2 stable).

-MCO

3 notes

·

View notes

Text

Crypto and Ai Recap

SEC approved 9 #BitcoinETF

Michigan university to let #AI participate in classes, choose major, earn degree

CoinGecko’s X accounts compromised in phishing attack

Cboe approves listing of spot Bitcoin ETFs ahead of potential SEC approval

UK crypto traders could face £900 fine for tax fraud

#OpenAI launches the GPT Store

#OpenAI launches ChatGPT Team Read more at nosisnews.com

2 notes

·

View notes

Text

Nice historical volatility chart

This is a helpful annotated chart of yearly S&P 500 volatility. I bookmarked it back in 2014, so it only covers the years from 1929 to 2014.

S&P 500 calendar year realized volatility from 1929-2014 $SPY $SPX $VIX

— via Ro_Patel on StockTwits, October 09, 2014

The y-axis is S&P Calendar Year Realized Volatility as a percentage. The x-axis is time in years. I hope it is possible to enlarge the image by clicking on it! The red bars represent the 10 years with highest volatility. The green bars represent the 10 years with the lowest volatility. I am guessing that the blue bars are all other years.

I wondered why the chart was tagged with $SPY $SPX and $VIX. Both StockTwits and Twitter used to denote stock symbols with a dollar sign instead of a hash tag.

The first two were easy. SPY is an ETF that is backed by actual shares of stock in the companies that are included in Standard & Poor's 500 index. SPX is driven by the price of the S&P 500 Index itself. SPX isn't tradeable per se, but there are SPX futures and various SPX options.

Volatility and the fear indicator

Volatility is the standard deviation of a stock, stock index, or other security's annualized returns over a time period; essentially, the rate at which the security or index price increases or decreases. ‘Actual’ (historical) volatility measures the variability of known prices.

What is $VIX

VIX is called the fear indicator because it is used to infer a quantitative metric of market risk, fear, and stress. It is defined as the 30-day expected volatility of the S&P 500 stock index, using Chicago Board Options Exchange (CBOE) listed S&P 500 options data. VIX is a measure of implied volatility (forward-looking) not historical. Values over 30 are considered high, while 20 is more typical. There's no upper bound on VIX.

The VIX isn't tradeable, which is why I am amused that its CBOE landing page (URL above) has "tradeable" in the URL! Instead, there are VIX futures, call and put options for trading.

The VIX was introduced by CBOE in 1993. I think that's why this chart doesn't have VIX on the y-axis (only alluding to it with $VIX) as an historical time series. It wouldn't be possible to impute historical values, especially not to 1929 but not even prior to 1993, because VIX is calculated by aggregating weighted prices of a constantly changing portfolio of S&P 500 calls and puts over a range of strike prices.

StockTwits

StockTwits seems mostly moribund to me, since about 2015. The name is a little strange, but it is a great idea: A social network for investor/speculators. The realtime, Twitter-like functionality, and user interface, are well-designed and fun. I think StockTwits was founded by Howard Lindzon who is nice, and maybe Fred Wilson the AVC guy ("A Venture Capitalist"?). EDIT: I just checked. It is still active but not exactly a huge startup venture.

Now that Amazon.com has retired Alexa, I can't find website metrics as easily. I'm mildly curious about StockTwits. I wish I could average unique annual page views per year, and then do a 3-line time series graph of unique daily views during 2012 (when it was really active), 2015, and last year.

5 notes

·

View notes