#cashflow management software

Explore tagged Tumblr posts

Text

Get on the Right Track with this Bank Reconciliation Solution

Reclaim your weekends and free up your weekday hours as you effortlessly sync your bank accounts through AI-powered software. SME Cashbook’s bank reconciliation solution seamlessly integrates bank feeds, categorises transactions, and reconciles accounts so you can feel confident and in control of your financials. Streamline bookkeeping with automated accuracy and insightful analytics. Put an end to manual data entry and error-prone records and experience a smooth bank reconciliation that helps your business thrive.

#cashbook software#cashbook solution#sme accounting software#trust accounting#cloud accounting software australia#trust accounting software australia#trust accounting software#accounting software#fee from refund service#cashflow management software

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

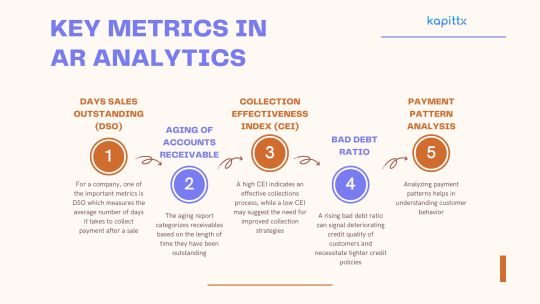

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

Case Study: AR Analytics in Action

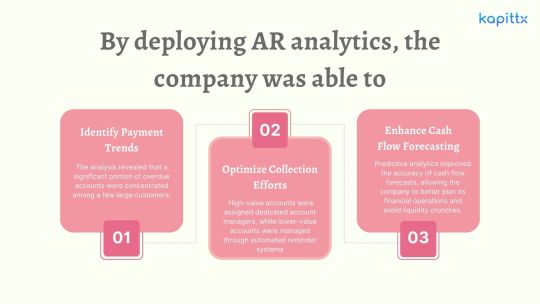

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Maximising Profitability: Leveraging Moolamore for Your Business

Excellent news! You can finally put all of your worries to rest. Intrigued? Excited? There's a revolutionary solution designed to streamline your financial processes and boost your company's profits!

In this blog, we'll look at how using the simple but cutting-edge Moolamore can boost your earnings, protect your cash flow, and ensure that your SMEs not only survive but thrive in today's competitive and ever-changing environment. Please read the entire post for all the details!

#cashflow management tool#cashflow optimization#cashflow forecasting tool#cashflow analysis software#business profitability tool#financial management software#cash flow planning tool

0 notes

Text

Why You Need Cash Flow Forecasting to Save Your Business in 2023

You may believe that sayings like "cash is king" or "cash flow is the lifeblood of your business" are overused, but they're cliches and well-worn reminders for a reason: they're true and essential. As a result, forecasting your cash flow with a trusted tool like Moolahmore is critical to understanding where your SME company stands financially and ensuring you have enough funds to stay in business.

Moolahmore, a cash flow management and forecasting tool, has a professional but simple dashboard that allows you to build salient financial data (e.g., CFS or cash flow statement)—no need for cumbersome spreadsheets that are susceptible to interference and human error.

0 notes

Text

Optimal Capital Structure: Debt vs. Equity

This rate is used to discount the future cash flows expected to help estimate the present value (PV) of earnings on the investment of capital. Ultimately, a lower cost of capital means a higher present value (PV) of the business’s future free cash flows.

#cash flow management software#cash flow management#cash flow#cash flow statement#cash flow forecast#cashflow statement

0 notes

Text

Future of Financial Reporting- NetSuite for Real-Time Data Interpretation for FinTech.

India's FinTech revolution appears impossible to stop. The growth of digital payment and lending platforms, in addition to investment Tech firms is insane and yet simple. But, with every step taken, things become more and more complicated. Financial reporting is becoming complicated to manage when the need is speed coupled with accuracy. Obsolete enterprise resource planning systems make businesses operationally slow. Luckily, the Oracle has shifted the way of modern-day business owners. With the use of college ERP, the finer details are taken care of. In addition, manual reconciliations are history. Everything is now automated at ERP software systems level. This guarantees compliance and an Oracle's outweigh around the globe and makes financial deadlines more efficient.

Financial Reports That Are Real Time Allows for Better Decision-making:

Delays in data almost always guarantee unfavorable decisions. Operationally, the business needs to keep up with the time while change is being integrated. In addition, to every finance-controlled area, the cloud ERP systems is the perfect sidekick to every CFO. Cashflow, operations, instant MVMT, and strategy step up for report visibility simultaneously.

Automating Financial Reconciliation & Compliance:

To reconcile manually is to squander precious time. Mistakes make you lose money. Oracle enterprise resource planning helps in automating reconciliation across accounts. FinTech businesses stay ready for audits. Compliance with RBI, SEBI and taxation is made easy with ERP implementation. Every transaction is ensured to be compliant with the law by NetSuite cloud ERP. No more worry about fines and penalties.

AI-Powered Predictive Analytics for Financial Planning:

Financial forecasting is revolutionized by AI. ERP global analytics lets FinTech firms anticipate patterns, adjust their prices, and make future projections. Financial health is guaranteed with the use of AI insights – no more speculation.

Multi-Currency & Cross-Border Transactions Made Easy:

FinTech firms in India have a global presence. Having to deal with different currencies is a problem. Oracle NetSuite ERP allows for currency conversion, tax without the need for user intervention, and external payments. With enterprise resource planning software, completing transactions across borders can be done with a single click. Financial reports become clearer with automatic currency conversion based on the latest rates.

Fraud Detection & Financial Risk Management:

Fraud prevention is critical to almost any business in Fintech. Suspicious activity is monitored and flagged by the AI security tools of Oracle NetSuite. Fraud is a real problem that can now be solved with the help of ERP system solutions. It doesn't need to be a reactionary strategy anymore.

Reports Can Now Be Generated Anytime, anywhere:

Unlike the standard practice of financial reporting that ties companies to office-based infrastructures, Oracle NetSuite Cloud ERP enables work to be done from any location. With cloud ERP, collaboration happens at once. The data is protected, and cloud storage improves the business’s agility.

The asset management reporting comes with a condition of speed, and depth Oracle NetSuite Cloud ERP solutions provides Indian FinTech businesses. In enterprise resource planning software, investments are made with greater security and satisfaction.

NetSuite Cloud ERP has always been a must-have resource for every business looking to stay relevant due to the market's rapid evolution.

SoftCore Solutions proudly has the title of being one of the top Oracle NetSuite partners in India.

A reliable NetSuite partner in India facilitates the smooth ERP implementation, helping FinTech organizations achieve precision, efficiency, and compliance. The next generation of financial reporting systems is already available. Are you geared up to adopt Oracle NetSuite ERP?

FAQs:

In what ways can Oracle NetSuite Cloud ERP help FinTech companies improve financial reporting?

NetSuite automates reconciliations, provides real-time insights, and ensures compliance with financial regulations.

Is it possible to use NetSuite Cloud ERP to manage financial transactions with multiple currencies?

Absolutely! Oracle cloud ERP handles currency exchange, tax compliance, and global transactions automatically.

Can expanding FinTech startups use NetSuite ERP?

Yes! The NetSuite enterprise resource planning solution works seamlessly with FinTech companies as they grow.

For what reasons does NetSuite Cloud ERP enable better fraud detection?

With NetSuite, fraudulent transactions are detected and blocked immediately through its AI-based protection tools.

#netsuite#erpsoftware#netsuite implementation#oracle#netsuite implementation partner#oracle netsuite cloud erp

0 notes

Text

Best Expense Tracking Software: Top Tools for Managing Your Finances

Best Expense Tracking Software: Top Tools for Managing Your Finances #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #BudgetTracker #SmartSpending #FinancialTools #TrackYourExpenses #MoneyMatters #FinancialWellness #ExpenseReports #SavingsGoals #InvestSmart #FinancialFreedom #DebtManagement #CashFlow #FinanceTips #MoneySaving #FinancialLiteracy #ExpenseTracker #Budgeting101 #WealthBuilding #FinancialSuccess #ExpenseSoftware #FinanceGoals #SmartFinance #MoneyMindset #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #TrackYourExpenses #BestFinanceSoftware #FinancialTools #SmartBudgeting #ExpenseTracker #MoneySaver #FinancialFreedom #BudgetingApp #FinanceTips #ExpenseReport #FinancialWellness #MoneyMatters #InvestInYourself #FinancialLiteracy #SaveMoney #WealthBuilding #FinancialGoals #ExpenseControl #CashFlowManagement #DebtFreeJourney #FinanceForAll #MoneyMindset #SmartSpending

Table of Contents Introduction Why Use Expense Tracking Software? Top Expense Tracking Software for 2024 QuickBooks Online – Best for Small Businesses Key Features: Expensify – Best for Automated Expense Reporting Key Features: Mint – Best Free Personal Expense Tracker Key Features: Zoho Expense – Best for Businesses with Global Teams Key Features: FreshBooks – Best for Freelancers &…

#best expense tracking software#expense tracker#expense tracking software#manage expenses#track expenses

0 notes

Text

ANZ Car and Equipment Finance For Small Businesses

From dental equipment for a private practice to dump trucks and earthmoving machinery for construction, having the right assets is vital for business success. However, specialised equipment is expensive and can put a dent in cash reserves.

ANZ’s flexible finance solutions can help with this. They provide a full funding solution to acquire asset purchases, with repayments structured around periods of higher cash flow to help manage cyclical cashflow.

ANZ’s Rapid Replacement process

ANZ’s Rapid Replacement process lets clients borrow to purchase equipment and vehicles for their business. This is a great option for businesses that need to upgrade or replace their equipment but don’t have the cash on hand. This product offers a competitive interest rate and allows businesses to pay off their loan with a flexible payment schedule.

This process is available for secured and unsecured loans. It also includes a streamlined application process that simplifies the approval process. This saves businesses time and effort, while reducing stress. ANZ also offers an online calculator that helps to calculate loan repayments.

ANZ’s simplified application process makes it easier for small business owners to apply for a business loan. It allows businesses to provide a minimum of 12 months of business bank statements and self-declare their financial position. ANZ can then assess the client’s ability to repay the loan and approve it quickly. This is in contrast to other lenders who require detailed personal information and BAS statements.

ANZ’s Business Banking Specialists

ANZ Business Banking Specialists proactively build and grow relationships with small businesses and provide solutions to meet their needs. They offer a range of products and services, including ANZ E*Trade, online banking, international transactions, credit cards, and loans. These specialists also collaborate with colleagues to help clients.

Whether you need a new car or equipment for your company, there are many benefits of investing in asset finance. With low interest rates and a flexible repayment structure, you can afford to pay for your asset over a term that suits your budget. You can also use this form of financing to buy a boat or caravan for your personal use.

ANZ is an award-winning bank in Australia and New Zealand. Its branch network and call centres are extensive. It is a leading provider of financial and banking services for consumers, small businesses, corporates, and governments. It has earned Canstar’s Bank of the Year | Small Business award for five consecutive years.

ANZ’s Online Application

ANZ’s online application is easy to use. It lets you manage your finances at any time, including setting up direct debits, making payments to suppliers and employees, and importing transaction files from most accounting software packages. You can also access detailed domestic, foreign currency and credit card account information. It also features payee templates and bulk payment options, as well as built in audit history.

ANZ has been around for more than half a century, and it is one of Australia’s most established financial services companies. Its core values include showing care for everyone, exploring innovative work styles, using data to improve, and actively welcoming feedback.

ANZ offers personal and business banking solutions, as well as insurance products. The company also provides corporate finance and investment management, and operates a network of over 400 branches across Australia and New Zealand. ANZ also has a presence in Asia through investments in Malaysia’s AMMB Holdings, China’s Shanghai Rural Commercial Bank and Vietnam’s Saigon Securities Incorporation.

ANZ’s Mobile App

ANZ offers a wide range of personal banking and financial services including bank accounts, home loans, credit cards, wealth management services, insurance, and more. In addition to ANZ’s traditional banking products, it also offers mobile applications for its customers.

The ANZ App includes a number of useful features, such as the ability to make payments using PayID and to schedule future or recurring payments. It can also be used to view account statements and personalised insights. Customers can also use the ANZ App to track their spending with ‘Money Tiles’ and to save money with multiple savings goals.

The ANZ App is designed to be accessible for people with disabilities. For example, it can be downloaded to an iPad and customised to include larger text and voice-activated ‘OK to pay’ functionality. The ANZ App is available for download from the Apple App Store and Google Play. It is free to download but terms and conditions apply.

0 notes

Text

Expert Bookkeeping Software to Act as a Game Changer for Your Business

Wondering who can provide you with expert bookkeeping software services? SME Cashbook has got you covered! We offer comprehensive bookkeeping services that helps managing BAS compliance and provide valuable insights and reports for better decision making. With SME Cashbook’s bookkeeping software, it’s never been easier to stay on top of your finances.

#accounting software#cashbook software#sme accounting software#cashbook solution#trust accounting#trust accounting software#trust accounting software australia#cashflow management software#cloud accounting software australia

0 notes

Text

Accounts Receivable Challenges in Distribution Industry and to Address Them

In the distribution industry, companies are navigating a complex landscape that directly impacts their cash flow management, accounts receivable, and bottom-line performance. Distribution channels, whether serving consumer goods or industrial products, play a critical role in bringing products from manufacturers to consumers, which involves warehousing, transportation, inventory management, and other logistical tasks. Industries such as grocery, convenience, and pharmacy rely on these channels for market reach and customer satisfaction.

Despite the steady demand for goods, factors like seasonal fluctuations, intense market competition, and intricate cash flow management processes have emerged as key challenges. Cash flow management is essential, especially as distribution companies often operate with extended credit terms, impacting the cash conversion cycle. Late payments from clients can significantly disrupt cash flow, leading to operational delays and missed growth opportunities. Additionally, seasonal peaks often require companies to carefully balance inventory levels and operational costs.

Achieving Scale and Enhancing Market Share

For distribution companies, achieving scale—first locally, then nationally—is vital for operational efficiency, customer insights, and investment in new capabilities. Reaching scale can also allow for reinforcing market share through key measures such as:

Digital Self-Service Tools: Investing in self-service technology for customers and resellers allows distributors to streamline transactions, enhance the customer experience, and reduce operational costs.

Pricing and Accounts Receivable Management for Distribution: Improved margins through effective pricing strategies and efficient accounts receivable management for distribution can have a positive impact on cash flow management and financial sustainability. Efficient cash application and proactive collection efforts help distributors reduce Days Sales Outstanding (DSO) and strengthen liquidity.

Private-Label Products and Value-Added Services: Offering private-label products and value-added services, such as customized delivery options or specialized product packaging, enables distributors to differentiate themselves in a competitive market and strengthen client relationships.

Key Success Factors for Distribution Companies

Effective Stock Control: Seasonal fluctuations mean that most revenue is generated in a few peak months. Accurate forecasting and stock control are essential for optimizing stock levels and maximizing sales.

Customer-Centric Workforce: Distributors who serve retail stores should emphasize customer service, as friendly, knowledgeable sales staff improve client relationships and loyalty.

Flexibility in Operations: Adapting to demand is key. During high-sales periods, distributors should expand their workforce and inventory, while scaling back in slower seasons to minimize costs.

Strong Logistics and Distribution Backbone: Controlling margins is essential in distribution. Investing in efficient logistics and distribution systems helps distributors manage transportation costs, inventory flow, and stock availability across locations.

5. Attractive Product Presentation: The product’s appearance, shelf management, and environment also influence sales. This goes beyond physical retail stores and includes online presentations and prompt service delivery, which can make a substantial difference.

Accounts Receivable Challenges in the Distribution Sector

Cash Flow and Accounts Receivable Management for Distribution companies

Cash flow remains a top priority for distributors who often deal with extended credit terms for B2B clients. This brings the importance of accounts receivable automation for distribution companies. Distributors commonly extend 30- to 60-day payment terms to retailers, impacting the cash conversion cycle. Given that most retail distributors have high expenses tied to warehousing, transportation, and workforce, any delay in payment can have a cascading effect on operations.

Extended Days Sales Outstanding (DSO) increases the risk of cash flow disruptions, creating operational delays and potentially causing missed opportunities. In the U.S., the average DSO for retail distribution companies is approximately 57 days; however, high-performing companies aim to reduce this metric to 40 days or less.

2. Seasonal Goods and Inventory Control

For many distributors, peak sales months from October to December make up a substantial part of their annual revenue. This heavy reliance on a single season places pressure on their inventory management, requiring them to balance stock levels meticulously. A miscalculation in inventory can lead to stockouts, missed sales, or excess stock, all of which affect cash flow. Companies need a firm grip on demand forecasting, especially for seasonal products, to control stock on hand and minimize waste.

Current B2B Payment Modes and Their Benefits

Adopting efficient payment modes can significantly enhance cash flow and streamline the reconciliation process for distributors. As part of the accounts receivable automation for distribution companies, by offering multiple payment options to retailers distributors can not only offer convenient options to pay, one can also improve relationships with the retailers.

Here are several payment modes and their potential benefits:

Automated Clearing House (ACH): ACH transfers reduce payment processing time and lower transaction fees compared to traditional checks. They also minimize manual reconciliation, reducing human error and time spent on cash application.

Electronic Funds Transfer (EFT): EFT enables real-time transfers, which can be crucial for high-turnover distributors who need prompt cash flow. EFTs also simplify record-keeping and reduce the need for physical checks.

Virtual Credit Cards: Virtual credit cards provide secure and quick payment methods, especially useful for repeat transactions with trusted clients. These are particularly advantageous for transactions requiring an extra layer of security.

Credit Card Payments: While these may involve processing fees, they can improve cash flow as distributors receive funds faster. This payment mode is ideal for smaller, high-frequency orders common in retail distribution.

Digital Wallets and Mobile Payments: Although less common in B2B, digital wallets like Apple Pay or Google Wallet are gaining traction. These options are secure and convenient, and as acceptance grows, they may become a more mainstream payment option in the distribution space.

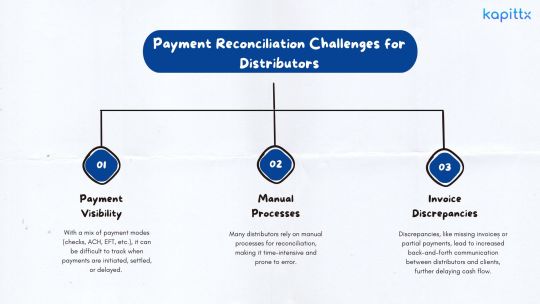

Payment Reconciliation Challenges for Distributors

One of the key components of accounts receivable for distribution companies is the obstacles you face with payment reconciliation, particularly when dealing with high transaction volumes across multiple clients. Major challenges include:

Payment Visibility: With a mix of payment modes (checks, ACH, EFT, etc.), it can be difficult to track when payments are initiated, settled, or delayed. The lack of real-time visibility results in a higher volume of unallocated cash.

Manual Processes: Many distributors rely on manual processes for reconciliation, making it time-intensive and prone to error. Nearly 30% of financial team time in some companies is spent on manual reconciliation, leaving less time for strategic activities.

Invoice Discrepancies: Discrepancies, like missing invoices or partial payments, lead to increased back-and-forth communication between distributors and clients, further delaying cash flow.

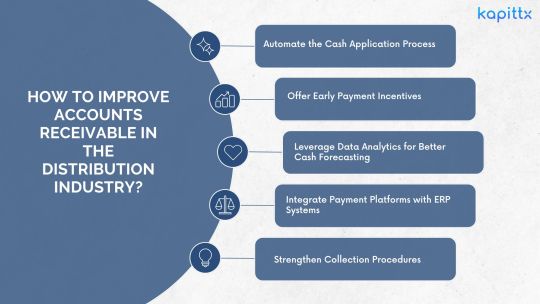

How to Improve Accounts Receivable in the Distribution Industry?

Automate the Cash Application Process: Accounts receivable automation for distribution companies will help in the automation of cash applications and can drastically reduce the time it takes to match payments to invoices, cutting down on manual processing and reducing the risk of errors. Automated systems also improve tracking and enable the finance team to focus on more strategic tasks.

Offer Early Payment Incentives: Providing discounts for early payments encourages clients to pay faster, reducing DSO and enhancing cash flow. The use of digital invoicing and payment reminders can further improve collection efficiency.

Leverage Data Analytics for Better Cash Forecasting: Advanced data analytics can provide insights into client payment patterns and predict cash flow trends. This helps finance teams forecast cash flow accurately, plan for operational expenses, and set credit policies effectively.

Integrate Payment Platforms with ERP Systems: Linking payment processing systems directly with ERP platforms ensures seamless transaction flow and real-time visibility into receivables. This integration minimizes discrepancies and improves reconciliation speed.

Strengthen Collection Procedures: A streamlined collection strategy, including regular follow-ups, automated reminders, and personalized communication, can reduce overdue receivables and maintain steady cash flow.

Conclusion

The distribution space is a dynamic sector with unique accounts receivable challenges in the distribution industry are related to cash flow, payment reconciliation, and accounts receivable management. By adopting modern payment methods, leveraging automation, and optimizing inventory, distributors can navigate these complexities more effectively. Companies that excel at managing inventory, developing a customer-focused workforce, and utilizing efficient logistics will be better positioned to succeed in this competitive market, ultimately achieving better profitability and long-term growth.

Distribution companies that prioritize efficient cash flow management, scale strategically, and invest in technology can gain a competitive advantage in the retail distribution space. By achieving these improvements, they can reduce DSO, optimize operations, and better serve their clients, positioning themselves for sustainable growth in a rapidly evolving industry.

#cashflow management#accounts receivable in distribution#accounts receivable management in distribution#cash application process#payment reconciliation software

0 notes

Text

8 Best Technology Solutions to Streamline Your Business Process

In this highly competitive business environment, small businesses to large enterprises are required to adopt innovative software solutions. These technology solutions automate processes, improve communication, and make data-driven decisions, streamlining operations and enhancing efficiency.

However, choosing the right technology as per the need is essential for businesses to leverage its benefits effectively.

In this blog, we will explore the 8 innovative software solutions for different business processes, helping you build tech infrastructure for your organizations suiting your business’s specific needs.

Best Technology Solutions for Different Business Needs

1. Prime Procurement for Better Procurement Strategy

Prime Procurement is a comprehensive procurement management software that helps your business optimize and automate the purchasing processes. The prominent solution helps you save costs, improve supplier relationships, and ensure compliance with procurement policies, ultimately leading to better procurement strategies.

2. Telelyzer to Optimize Telecom Services

One of the top technology solutions is the Telelyzer, an advanced call analysis tool. The tool simplifies the process by converting hours of call recordings into instantly actionable insights. This tool helps teams focus on improving performance, enhancing customer experience, and identifying training needs with pinpoint accuracy.

3. Choice Drive Assure to Streamline Motor Insurance

If your organization is required to deal with motor insurance, Choice Drive is one of the best digital transformation solutions to streamline the entire motor insurance issuance process with an easy KYC process, effortless quote generation, and auto-calculated commissions.

4. Greetly for Visitor Management

Greetly is a visitor management system that streamlines the check-in process for businesses. This software solution enhances security and efficiency by automating visitor registration and providing real-time notifications to hosts. With Greetly's software solution, you can improve your organization’s desk operations with the tailored check-in process.

5. Choice Touch for Field Staff Management

Manually managing field staff and their sales efficiency is a time-consuming process. Choice Touch is a software solution that eases the process of field staff management by automating several tasks including performance tracking, task allocation, and planning.

6. Cashflow Management Software to Optimize Expense Management

An effective cash flow management system is crucial for any business's success. Cashflow Management Software is a powerful tool designed to optimize expense management and invoicing for businesses of all sizes. With its automated workflows and customizable templates, PrimeCashflow management is among the technology solutions for a timely billing experience, enhancing your business financial management.

7. Prime Employee Benefits, Taking Care of the Employees

Prime Employee Benefits is one of the most useful digital transformation solutions for businesses. This software solution allows organizations to manage employee expenses, ensure on-time reimbursements, and analyze performance. Prime employee benefits also help in wealth creation for employees with the choice financial services suite.

8. Trans Track for Logistic Process

If your business is highly dependent on the transportation of goods, Trans Track is a go-to transport management software solution. The digital software is a consolidated solution for managing, procuring, distributing, and tracking vehicles. The digital transformation solutions for logistic processes address every aspect of the transportation cycle and automate the transport operations in real-time including pricing, routing, billing and invoice generation, scheduling, auditing, and status updates.

How to Choose the Best Technology Solutions for Your Business?

Since there are several technology solutions available, it’s important to find the right software solution for your business. To identify which technology solutions are good for your business, you can consider the following factors.

Your Requirements

Different businesses need different technology solutions. You can identify which technology solutions you need as the priority by learning the requirements of the automation in particular tasks.

Your Budget

Based on the capability of software solutions, the prices for them vary. You can look through your expenses and figure out how much money you want to invest in the technology solutions.

Software Solutions Features

Now that you know your needs and budget, identify the best software solutions in your range. Do extensive research to learn about their features and match them with your requirements.

Compare Technology Solutions

You can compare the different technology solutions, their key features, annual or monthly charges, and how proficiently, the tool can help you in executing your tasks.

You can also take demos of different technology solutions to find the best digital transformation solutions for your business.

Conclusion

Adapting technology solutions for business processes has become a necessity for staying ahead of the competition. The right set of software solutions automates various tasks saving time and enhancing the processes. Prime Procurement to automate the procurement process, Greetly to manage visitors, Cash flow management for optimizing expenses, and other mentioned tools are some of the best tools you can integrate into your business operations.

However, before choosing technology solutions for subscription, ensure that you identify the needs, features, and benefits for your business at ground level.

0 notes

Text

Financial Planning for MID Market Companies Tips and Tools

Effective financial planning is a cornerstone for success in the MID Market, which includes companies that are larger than small-to-medium businesses (SMBs) but not as large as enterprises. These companies face unique financial challenges and opportunities that require tailored strategies and tools.

This article will provide comprehensive insights into financial planning for MID Market companies, highlighting key tips and essential tools to ensure financial stability and growth.

Understanding the Difference Between Mid-Market SMB and Enterprise AES is crucial for grasping the unique financial dynamics of MID Market companies. This differentiation sets the context for exploring the specific financial planning strategies that these companies should adopt.

Key Financial Planning Tips for MID Market Companies

Develop a Comprehensive Budget: A well-structured budget is essential for managing resources effectively. MID Market companies should create detailed budgets that outline expected revenues, fixed and variable costs, and capital expenditures. Regularly reviewing and adjusting the budget helps ensure alignment with business goals and market conditions.

Optimize Cash Flow Management: Maintaining a healthy cash flow is critical for MID Market companies. Implementing strategies such as prompt invoicing, efficient accounts receivable management, and negotiating favorable payment terms with suppliers can enhance cash flow. Utilizing cash flow forecasting tools can help anticipate and manage liquidity needs.

Diversify Revenue Streams: Relying on a single revenue stream can be risky. MID Market companies should explore opportunities to diversify their income sources. This could include expanding product lines, entering new markets, or developing strategic partnerships. Diversification helps mitigate risks and provides a buffer against market fluctuations.

Leverage Financial Technology: Financial technology (fintech) solutions can streamline financial operations and improve decision-making. MID Market companies should invest in robust accounting software, financial management systems, and data analytics tools. These technologies provide real-time financial insights, enhance accuracy, and reduce manual workload.

Focus on Cost Control: Effective cost control measures are vital for maintaining profitability. MID Market companies should regularly review expenses and identify areas for cost reduction. Implementing cost-saving initiatives, such as renegotiating supplier contracts, optimizing supply chain operations, and reducing waste, can significantly impact the bottom line.

Plan for Growth and Expansion: Financial planning should include strategies for growth and expansion. MID Market companies need to allocate resources for research and development, marketing, and talent acquisition. Creating a scalable financial plan that supports growth initiatives ensures the company can seize new opportunities without compromising financial stability.

Essential Financial Tools for MID Market Companies

Accounting Software: Robust accounting software is the backbone of financial management. Tools like QuickBooks, Xero, and Sage Intacct offer features such as invoicing, payroll management, expense tracking, and financial reporting. These solutions streamline accounting processes and provide accurate financial data.

Cash Flow Management Tools: Tools like Float, Pulse, and Cashflow Manager help businesses monitor and forecast cash flow. These tools provide visual representations of cash inflows and outflows, helping MID Market companies anticipate cash shortages and make informed financial decisions.

Budgeting and Forecasting Software: Budgeting tools like Adaptive Insights, PlanGuru, and Prophix assist in creating and managing budgets. These tools offer advanced forecasting capabilities, scenario planning, and performance tracking, enabling businesses to adjust their financial plans in response to changing conditions.

Financial Dashboards: Financial dashboards, such as those provided by Microsoft Power BI and Tableau, offer real-time visibility into key financial metrics. These dashboards integrate data from various sources, providing a comprehensive view of the company's financial health and performance.

Expense Management Solutions: Tools like Expensify, Concur, and Zoho Expense automate expense reporting and reimbursement processes. These solutions help MID Market companies control spending, enforce policies, and ensure compliance.

For businesses seeking to enhance their technological capabilities and streamline their financial operations, partnering with an IT Solutions Company can provide the necessary expertise and resources to support their growth journey.

Conclusion

Effective financial planning is indispensable for MID Market companies aiming to achieve sustainable growth and stability. By developing comprehensive budgets, optimizing cash flow management, diversifying revenue streams, leveraging financial technology, controlling costs, and planning for growth, MID Market businesses can navigate the complexities of their financial landscape successfully. Utilizing the right financial tools further enhances their ability to make informed decisions and drive long-term success.

0 notes

Text

Optimieren Sie Ihr Studio mit einer Tanzschulverwaltungssoftware

Die Leitung einer Tanzschule umfasst eine Vielzahl von Aufgaben, von der Planung von Kursen über die Bearbeitung von Anmeldungen und Zahlungen bis hin zur Kommunikation mit Schülern und Eltern. Der Verwaltungsaufwand kann oft überwältigend werden und vom Hauptziel ablenken, eine qualitativ hochwertige Tanzausbildung anzubieten. Hier kommt die Dance School Management Software (DSMS) ins Spiel, die eine umfassende Lösung zur Rationalisierung der Abläufe und Verbesserung der Gesamteffizienz von Tanzschulverwaltungssoftware.

Zentrale Planung und Anmeldung Eine der wichtigsten Funktionen von DSMS ist die Möglichkeit, Planungs- und Anmeldeprozesse zu zentralisieren. Herkömmliche Methoden zur Verwaltung von Stundenplänen und Schüleranmeldungen über Tabellenkalkulationen oder Papierunterlagen sind nicht nur zeitaufwändig, sondern auch fehleranfällig. Mit DSMS können Tanzschulen Stundenpläne in Echtzeit erstellen, aktualisieren und freigeben. Diese Software ermöglicht es Schülern und Eltern, sich online für Kurse anzumelden, wodurch die manuelle Dateneingabe entfällt und das Risiko von Überbuchungen oder Terminkonflikten verringert wird.

Effiziente Zahlungsabwicklung Die Zahlungsabwicklung ist ein weiterer wichtiger Aspekt beim Betrieb einer Tanzschule. DSMS vereinfacht diesen Prozess durch die Integration sicherer Zahlungsgateways, sodass Schulen Online-Zahlungen für Unterricht, Kostüme und andere Gebühren akzeptieren können. Automatisierte Rechnungs- und Abrechnungsfunktionen sorgen dafür, dass Rechnungen pünktlich verschickt und Mahnungen für überfällige Zahlungen verschickt werden. Dies verbessert nicht nur den Cashflow, sondern reduziert auch den Verwaltungsaufwand, sodass sich das Schulpersonal mehr auf pädagogische und kreative Aufgaben konzentrieren kann.

Verbesserte Kommunikation Eine effektive Kommunikation zwischen Lehrern, Schülern und Eltern ist für den reibungslosen Betrieb einer Tanzschule unerlässlich. DSMS bietet integrierte Kommunikationstools wie E-Mail, SMS und Push-Benachrichtigungen, die eine zeitnahe und organisierte Kommunikation ermöglichen. Ob es sich um das Versenden von Unterrichtserinnerungen, Updates zu Schulveranstaltungen oder Notfallbenachrichtigungen handelt, diese Tools sorgen dafür, dass alle informiert und engagiert bleiben. Darüber hinaus bieten einige Softwarelösungen Elternportale, bei denen sich Eltern anmelden können, um die Anwesenheit, den Fortschritt und die bevorstehenden Kurse ihres Kindes zu überprüfen.

Anwesenheitsverfolgung und Schülerfortschritt Die Verfolgung der Anwesenheit und des Fortschritts der Schüler ist sowohl für Lehrer als auch für Schüler von entscheidender Bedeutung. DSMS bietet eine digitale Anwesenheitsverfolgung und ersetzt manuelle Anwesenheitslisten durch ein effizienteres und genaueres System. Lehrer können die Anwesenheit mit einem Tablet oder Smartphone markieren und die Daten werden automatisch gespeichert und sind für die Berichterstattung zugänglich. Darüber hinaus kann die Software den Lernfortschritt der Schüler verfolgen, sodass die Lehrer Verbesserungen feststellen, Ziele festlegen und personalisiertes Feedback geben können. Diese Funktion hilft nicht nur dabei, hohe Bildungsstandards aufrechtzuerhalten, sondern steigert auch die Motivation und das Engagement der Schüler.

Ressourcenverwaltung Tanzschulverwaltungssoftware Preise müssen häufig verschiedene Ressourcen wie Studioräume, Kostüme und Ausrüstung verwalten. DSMS enthält Ressourcenverwaltungstools, die bei der effizienten Zuweisung und Nutzung dieser Ressourcen helfen. Schulen können die Studionutzung planen, den Kostümbestand verfolgen und die Wartung der Ausrüstung verwalten, um sicherzustellen, dass alle Ressourcen optimal genutzt werden und bei Bedarf verfügbar sind.

Marketing und Wachstum Im heutigen Wettbewerbsumfeld ist effektives Marketing unerlässlich, um neue Schüler zu gewinnen und bestehende zu halten. DSMS verfügt häufig über integrierte Marketingtools, die Schulen bei der Erstellung und Verwaltung von Werbekampagnen unterstützen. Funktionen wie automatisiertes E-Mail-Marketing, Social-Media-Integration und Online-Werbung können Schulen dabei helfen, ein breiteres Publikum zu erreichen und ihre Einschreibungszahlen zu steigern. Darüber hinaus bieten Analyse- und Berichtstools Einblicke in die Wirksamkeit von Marketingbemühungen, sodass Schulen datengesteuerte Entscheidungen treffen können.

0 notes

Text

Accounting Services in Edmonton – Help You with Your Accounting and Tax Needs

ATS Accounting Inc. is your local accounting firm in Edmonton who remain always ready to help clients with a wide range of services. We take extra care in providing headache-free, accounting and tax services for businesses and individuals. Out wide ranging services include tracking of all business transactions, bookkeeping, record keeping, maintenance accurate and up-to-date accounts payable/receivable, payroll management, providing and implementing software programs, financial, cashflow and tax planning and many more. Please visit: https://www.issuewire.com/accounting-services-in-edmonton-help-you-with-your-accounting-and-tax-needs-1804622779489123

0 notes

Text

Strategic Growth: Leveraging Private Debt Solutions for Financial Success

Are you striving to enhance your financial portfolio and drive growth? Private debt solutions could be the game-changer you need. These advanced tools offer numerous benefits, including efficient debt management, risk mitigation, and improved portfolio performance. Let’s explore how Private Debt Solutions can significantly impact your financial success.

Managing Debt Instruments

Private debt solutions offer sophisticated software that streamlines the management of debt instruments. This software covers various aspects of private debt investment management, such as the creation of Repayment schedules, management of Cashflows, tracking of Valuations, and measurement of performance metrics like IRR and MoC. Automating these processes saves time & reduces the potential for human error, ensuring that every step of the investment lifecycle is handled efficiently.

Investment managers can utilize the software’s portfolio monitoring features to closely monitor their investments. Real-time data and analytics provide insights into the performance of different debt instruments, enabling managers to make swift, informed decisions. This level of oversight is crucial for maintaining a robust and profitable portfolio.

Mitigating Risks

Effective risk management is vital for any investment strategy, and private debt solutions excel in this area. The software includes extensive tracking and analysis tools that help identify potential risks. By providing a comprehensive view of the investment landscape, managers can proactively address issues before they escalate, thus protecting their investments.

The ability to generate detailed reports & conduct statistical analyses further enhances risk mitigation. These tools allow managers to evaluate the impact of various factors on their portfolios and adjust their strategies accordingly. With private debt solutions, managing risks becomes a streamlined and effective process, giving investors greater confidence in their investment decisions.

Enhancing Portfolio Performance

A key goal of any investment strategy is to enhance portfolio performance, and private debt solutions are designed to achieve just that. By offering real-time reporting and advanced analytics, these solutions provide valuable insights that help optimize investment strategies. Managers can track performance metrics, identify trends, and make data-driven decisions to improve overall portfolio returns.

Integrating various front and middle office operations into a single platform ensures that all aspects of the investment process are aligned and working towards the same objectives. This holistic approach improves efficiency and enhances the ability to achieve strategic growth.

Streamlining Operations

Private debt solutions are designed to streamline the entire investment process, from deal sourcing to investor reporting. The software integrates various functions into a cohesive platform, enabling seamless team communication and coordination. This integration helps eliminate redundancies and ensures that all operations are aligned with the firm’s overall strategy.

The software’s fund management capabilities allow for efficient tracking of investment cash flows, fund costs, drawdown, distribution, and performance metrics. Managers can quickly generate detailed reports and analytics, providing a clear picture of the fund’s health and performance. This level of transparency is crucial for maintaining investor confidence and attracting new investments.

Conclusion

Private debt solutions offer a comprehensive suite of tools that can drive financial success through effective debt management, risk mitigation, and portfolio performance enhancement. By leveraging these solutions, investment managers can streamline operations, make informed decisions, and achieve strategic growth. Incorporating private debt solutions into your investment strategy is a smart move towards financial stability and growth. Your portfolio will stay strong and lucrative with the help of these effective tools, which offer the efficiency and insights required to manage the intricacies of the investment landscape. Embrace private debt solutions today and take the first step towards a more successful financial future.

0 notes