#cashflow management tool

Explore tagged Tumblr posts

Text

Maximising Profitability: Leveraging Moolamore for Your Business

Excellent news! You can finally put all of your worries to rest. Intrigued? Excited? There's a revolutionary solution designed to streamline your financial processes and boost your company's profits!

In this blog, we'll look at how using the simple but cutting-edge Moolamore can boost your earnings, protect your cash flow, and ensure that your SMEs not only survive but thrive in today's competitive and ever-changing environment. Please read the entire post for all the details!

#cashflow management tool#cashflow optimization#cashflow forecasting tool#cashflow analysis software#business profitability tool#financial management software#cash flow planning tool

0 notes

Text

Why You Need Cash Flow Forecasting to Save Your Business in 2023

You may believe that sayings like "cash is king" or "cash flow is the lifeblood of your business" are overused, but they're cliches and well-worn reminders for a reason: they're true and essential. As a result, forecasting your cash flow with a trusted tool like Moolahmore is critical to understanding where your SME company stands financially and ensuring you have enough funds to stay in business.

Moolahmore, a cash flow management and forecasting tool, has a professional but simple dashboard that allows you to build salient financial data (e.g., CFS or cash flow statement)—no need for cumbersome spreadsheets that are susceptible to interference and human error.

0 notes

Text

How Accounts Receivable Automation Can Improve Customer Relationships and Satisfaction

Growing companies and finance professionals always ask – which strategies can your company use to improve cash flow? Or how to improve cash flow management process?

Accounts Receivable (AR) is an essential process that enables businesses to manage their cash flow effectively. However, traditional AR processes can be time-consuming, error-prone, and frustrating for customers. This is where accounts receivable automation comes in. By embracing AR process automation, businesses can streamline their operations, reduce errors, and improve customer satisfaction.

The Challenges of Traditional Accounts Receivable Processes

Traditional AR processes often involve manual data entry, paper invoices, and extensive back-and-forth communication between the business and its customers. These methods are people heavy and lead to human errors. Mistakes in invoicing, payment tracking, and data management can lead to delayed payments, disputes, and strained customer relationships. Moreover, the manual nature of these processes can result in longer processing times, causing cash flow issues and reducing the overall efficiency of the business. The answer to questions like – Which strategies can your company use to improve cash flow? Or, how to improve cash flow management process? is baked into understanding your problem statement and then leveraging an accounts receivable software solution.

1. Labor-Intensive Manual Data Entry

One of the biggest challenges of traditional AR processes is the reliance on manual data entry. This involves entering invoice details, payment records, and customer information by hand which demands significant human resources. Employees spend considerable time on repetitive tasks, diverting their attention from more strategic and value-added activities. The manual entry process can also be monotonous, leading to fatigue and, consequently, an increased likelihood of errors.

2. Paper Invoices and Physical Documentation

Despite the rise of digital technologies, many businesses still rely on sending paper invoices and physical documentation for their AR processes. This approach comes with several drawbacks. First, paper invoices can easily be lost, damaged, or misplaced, leading to delays in payment processing. Second, the storage and retrieval of physical documents require substantial space and can be cumbersome.

Additionally, paper-based systems are not environmentally friendly and can contribute to unnecessary waste. This can be costly, as it involves expenses related to printing, mailing, and storage.

3. Error-Prone Processes

Human error is an inherent risk in any manual process, and traditional AR systems are no exception. Errors in data entry, such as incorrect invoice amounts, misapplied payments, or inaccurate customer information, can create significant problems. These mistakes can result in billing disputes, delayed payments, and strained customer relationships. When errors occur, additional time and effort are required to identify and rectify them, further slowing down the AR process and increasing operational costs.

4. Extensive Back-and-Forth Communication

Traditional AR processes often necessitate extensive communication between the business and its customers. This back-and-forth exchange can involve clarifying invoice details, addressing discrepancies, and following up on overdue payments. While communication is essential for resolving issues, the manual handling of these interactions can be inefficient and time-consuming. Frequent follow-ups and reminders can also annoy customers, leading to frustration and potentially damaging the business relationship. Moreover, inconsistent or delayed communication can result in misunderstandings and further complications.

5. Longer Processing Times

The manual nature of traditional AR processes inherently leads to longer processing times. Generating, sending, and tracking invoices, as well as processing payments, can take significantly longer when done manually. Delays in invoicing can lead to delays in receiving payments, which negatively impacts the business’s cash flow. Extended processing times can also affect the company’s ability to meet its financial obligations, such as paying suppliers and employees. In some cases, the inefficiency of manual processes may even require businesses to extend their credit terms, further straining their financial position.

6. Cash Flow Issues

Effective cash flow management is vital for business’s financial health. Traditional AR processes can create challenges in maintaining a steady cash flow due to delays in invoicing and payment collection. Inaccurate or delayed invoices can lead to late payments, which disrupt the cash flow cycle and can result in a cash crunch. Businesses may struggle to meet their own payment obligations, potentially damaging relationships with suppliers and creditors. Poor cash flow management can also hinder a company’s ability to invest in growth opportunities and may lead to increased reliance on external financing, which can be costly.

7. Reduced Overall Efficiency

The inefficiencies associated with traditional AR processes can significantly reduce the overall efficiency of a business. Allocating time and resources to manual data entry, error correction, and communication could be more effectively utilized elsewhere in the business. The operational bottlenecks created by these inefficiencies can hinder the company’s ability to scale and adapt to changing market conditions. In a competitive business environment, the lack of efficiency can put a company at a disadvantage compared to its more streamlined and technologically advanced competitors.

The Benefits of Accounts Receivable Automation

https://www.kapittx.com/wp-content/uploads/2023/03/The-Benefits-of-Accounts-Receivable-Automation.jpg

1. Improved Accuracy and Reduced Errors: Accounts receivable automation minimizes the risk of human error by giving quality insights while processing invoices, tracking payments, and updating records. This ensures that the data is accurate and up-to-date, reducing the likelihood of disputes and improving the overall reliability of the AR process.

2. Faster Processing Times: The best accounts receivable tracking software can help you with the AR process automation, and speed up the AR process by eliminating the need for manual data entry and paper-based workflows. With automated payment collection reminders integrated with payment flows payments can be tracked in real-time. This not only improves cash flow but also enhances the customer experience by providing timely and accurate billing information.

3. Enhanced Customer Communication: Accounts receivable software solution can be integrated with customer relationship management (CRM) tools to provide a seamless communication channel between the business and its customers. This enables businesses to send automated payment collection reminders for upcoming payments, notify customers of overdue invoices, and provide detailed statements and reports. Improved communication helps build trust and transparency, leading to better customer relationships.

4. Increased Efficiency and Productivity: With AR process automation you can free up your team’s bandwidth from repetitive and time-consuming tasks and have them focus on more strategic activities. This increases overall productivity and allows employees to dedicate more time to customer service and other value-added tasks.

5. Better Cash Flow Management: Accounts receivable automaton provides real-time visibility into the status of invoices and payments, allowing businesses to monitor their cash flow more effectively. This helps in identifying potential issues early on and taking proactive measures to ensure timely payments. Improved cash flow management contributes to the financial stability and growth of the business.

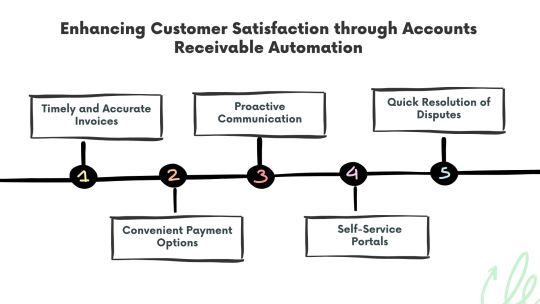

Enhancing Customer Satisfaction through Accounts Receivable Automation

1. Timely and Accurate Invoices: Customers appreciate receiving invoices that are accurate and easy to understand. Accounts receivable software solution will ensure that invoices are generated correctly and delivered promptly, reducing the chances of disputes and delays.

2. Convenient Payment Options: AR process automation can offer customers a variety of payment options, such as online payments, credit card payments, and electronic funds transfers. This flexibility makes it easier for customers to pay their invoices on time, improving their overall experience.

3. Proactive Communication: Automated payment collection reminders and notifications help keep customers informed about their payment status, upcoming due dates, and any issues that may arise. Proactive communication fosters a positive relationship and demonstrates the business’s commitment to customer service.

4. Self-Service Portals: The best accounts receivable tracking provides customers with access to self-service portals where they can view their account information, download invoices, make payments, and track their payment history. This empowers customers to manage their accounts at their convenience, enhancing their satisfaction and loyalty.

5. Quick Resolution of Disputes: In the event of any discrepancies or disputes, AR process automation enables businesses to quickly access and review all relevant information. This facilitates faster resolution of issues, ensuring that customers’ concerns are addressed promptly and efficiently.

Conclusion

In today’s competitive business environment, maintaining strong customer relationships and ensuring high levels of customer satisfaction are crucial for success. Automating the accounts receivable process is a powerful way to achieve these goals. By improving accuracy, speeding up processing times, enhancing communication, and providing better cash flow management, automation can transform the AR process into a seamless and efficient operation. Ultimately, this leads to happier customers, stronger relationships, and a more prosperous business.

Click here to see a case study from Kapittx.

Request a demo today.

Check out Kapittx’s LinkedIn here.

#ai in accounts receivable#ai powered accounts receivable#cashflow management#accounts receivable automation software#ai based accounts receivable#ar automation solution#ar collection#ar management#ar tool#payment reminder#automate payment follower

0 notes

Text

Future of Financial Reporting- NetSuite for Real-Time Data Interpretation for FinTech.

India's FinTech revolution appears impossible to stop. The growth of digital payment and lending platforms, in addition to investment Tech firms is insane and yet simple. But, with every step taken, things become more and more complicated. Financial reporting is becoming complicated to manage when the need is speed coupled with accuracy. Obsolete enterprise resource planning systems make businesses operationally slow. Luckily, the Oracle has shifted the way of modern-day business owners. With the use of college ERP, the finer details are taken care of. In addition, manual reconciliations are history. Everything is now automated at ERP software systems level. This guarantees compliance and an Oracle's outweigh around the globe and makes financial deadlines more efficient.

Financial Reports That Are Real Time Allows for Better Decision-making:

Delays in data almost always guarantee unfavorable decisions. Operationally, the business needs to keep up with the time while change is being integrated. In addition, to every finance-controlled area, the cloud ERP systems is the perfect sidekick to every CFO. Cashflow, operations, instant MVMT, and strategy step up for report visibility simultaneously.

Automating Financial Reconciliation & Compliance:

To reconcile manually is to squander precious time. Mistakes make you lose money. Oracle enterprise resource planning helps in automating reconciliation across accounts. FinTech businesses stay ready for audits. Compliance with RBI, SEBI and taxation is made easy with ERP implementation. Every transaction is ensured to be compliant with the law by NetSuite cloud ERP. No more worry about fines and penalties.

AI-Powered Predictive Analytics for Financial Planning:

Financial forecasting is revolutionized by AI. ERP global analytics lets FinTech firms anticipate patterns, adjust their prices, and make future projections. Financial health is guaranteed with the use of AI insights – no more speculation.

Multi-Currency & Cross-Border Transactions Made Easy:

FinTech firms in India have a global presence. Having to deal with different currencies is a problem. Oracle NetSuite ERP allows for currency conversion, tax without the need for user intervention, and external payments. With enterprise resource planning software, completing transactions across borders can be done with a single click. Financial reports become clearer with automatic currency conversion based on the latest rates.

Fraud Detection & Financial Risk Management:

Fraud prevention is critical to almost any business in Fintech. Suspicious activity is monitored and flagged by the AI security tools of Oracle NetSuite. Fraud is a real problem that can now be solved with the help of ERP system solutions. It doesn't need to be a reactionary strategy anymore.

Reports Can Now Be Generated Anytime, anywhere:

Unlike the standard practice of financial reporting that ties companies to office-based infrastructures, Oracle NetSuite Cloud ERP enables work to be done from any location. With cloud ERP, collaboration happens at once. The data is protected, and cloud storage improves the business’s agility.

The asset management reporting comes with a condition of speed, and depth Oracle NetSuite Cloud ERP solutions provides Indian FinTech businesses. In enterprise resource planning software, investments are made with greater security and satisfaction.

NetSuite Cloud ERP has always been a must-have resource for every business looking to stay relevant due to the market's rapid evolution.

SoftCore Solutions proudly has the title of being one of the top Oracle NetSuite partners in India.

A reliable NetSuite partner in India facilitates the smooth ERP implementation, helping FinTech organizations achieve precision, efficiency, and compliance. The next generation of financial reporting systems is already available. Are you geared up to adopt Oracle NetSuite ERP?

FAQs:

In what ways can Oracle NetSuite Cloud ERP help FinTech companies improve financial reporting?

NetSuite automates reconciliations, provides real-time insights, and ensures compliance with financial regulations.

Is it possible to use NetSuite Cloud ERP to manage financial transactions with multiple currencies?

Absolutely! Oracle cloud ERP handles currency exchange, tax compliance, and global transactions automatically.

Can expanding FinTech startups use NetSuite ERP?

Yes! The NetSuite enterprise resource planning solution works seamlessly with FinTech companies as they grow.

For what reasons does NetSuite Cloud ERP enable better fraud detection?

With NetSuite, fraudulent transactions are detected and blocked immediately through its AI-based protection tools.

#netsuite#erpsoftware#netsuite implementation#oracle#netsuite implementation partner#oracle netsuite cloud erp

0 notes

Link

#AffiliateMarketing#Arbeitsabläufe#Automatisierung#Bildgalerien#BloomCRM#Business-Optimierung#CustomerRelationshipManagement#DigitaleTransformation#Effizienzsteigerung#Freelancer#KreativeUnternehmer#Kundenbindung#LeadManagement#Produktivitäts-Tool#Projektmanagement#Rechnungsstellung#Terminplanung#Vertragsunterzeichnung#Website-Portfolios#Zeitmanagement

0 notes

Text

Best Expense Tracking Software: Top Tools for Managing Your Finances

Best Expense Tracking Software: Top Tools for Managing Your Finances #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #BudgetTracker #SmartSpending #FinancialTools #TrackYourExpenses #MoneyMatters #FinancialWellness #ExpenseReports #SavingsGoals #InvestSmart #FinancialFreedom #DebtManagement #CashFlow #FinanceTips #MoneySaving #FinancialLiteracy #ExpenseTracker #Budgeting101 #WealthBuilding #FinancialSuccess #ExpenseSoftware #FinanceGoals #SmartFinance #MoneyMindset #ExpenseTracking #FinanceManagement #BudgetingTools #PersonalFinance #FinancialPlanning #ExpenseManagement #MoneyManagement #FinanceApps #TrackYourExpenses #BestFinanceSoftware #FinancialTools #SmartBudgeting #ExpenseTracker #MoneySaver #FinancialFreedom #BudgetingApp #FinanceTips #ExpenseReport #FinancialWellness #MoneyMatters #InvestInYourself #FinancialLiteracy #SaveMoney #WealthBuilding #FinancialGoals #ExpenseControl #CashFlowManagement #DebtFreeJourney #FinanceForAll #MoneyMindset #SmartSpending

Table of Contents Introduction Why Use Expense Tracking Software? Top Expense Tracking Software for 2024 QuickBooks Online – Best for Small Businesses Key Features: Expensify – Best for Automated Expense Reporting Key Features: Mint – Best Free Personal Expense Tracker Key Features: Zoho Expense – Best for Businesses with Global Teams Key Features: FreshBooks – Best for Freelancers &…

#best expense tracking software#expense tracker#expense tracking software#manage expenses#track expenses

0 notes

Text

Master the Megaphone Pattern: Advanced Range Trading Secrets Mastering the Market: The Secrets of Range Trading with the Megaphone Pattern Forex traders often find themselves trapped in the noise of indicators, chasing elusive breakouts or fumbling over misinterpreted signals. But what if I told you there’s a strategy hiding in plain sight, capable of generating consistent profits while others scramble? Enter range trading paired with the megaphone pattern—a game-changer for those willing to embrace advanced tactics. Why Most Traders Miss the Mark Let’s be honest: most traders fail because they complicate their strategies. They stack their charts with so many indicators that it looks like a disco party gone wrong. This clutter often leads to analysis paralysis. In contrast, range trading with the megaphone pattern focuses on simplicity—leveraging price action within well-defined levels. Think of it as decluttering your closet; you don’t need 20 coats, just the right one for the season. Understanding the Megaphone Pattern: Your Secret Weapon The megaphone pattern (also known as the broadening formation) is like that friend who’s an over-sharer on social media—it broadcasts its moves loudly. Characterized by widening price swings, this pattern signals increasing volatility and potential reversal points. Key Features: - Diverging Trendlines: Price highs and lows expand outward, creating a cone-like shape. - Volatility Increase: Each swing grows larger, hinting at market indecision. - Reversal Opportunities: A break from the pattern’s boundary often triggers significant moves. Range Trading Meets the Megaphone: A Match Made in Forex Heaven Combining range trading principles with the megaphone pattern unlocks a treasure trove of opportunities. Here’s how: - Identify the Range: Look for well-defined support and resistance zones within the megaphone. - Pro Tip: Use tools like the Average True Range (ATR) to confirm volatility within acceptable limits. - Trade the Bounce: Buy near support and sell near resistance. Simple, right? But here’s the ninja tactic: anticipate false breakouts by waiting for confirmation. - Ride the Momentum: When the pattern breaks, jump on the trend train. Ensure you’re strapped in with stop-losses just below the breakout point. The Art of Spotting Hidden Opportunities Most traders overlook the megaphone pattern because they’re glued to traditional setups like head-and-shoulders or double tops. However, those patterns often rely on static market conditions. The megaphone thrives on volatility, offering opportunities even in chaotic environments. Proven Techniques to Spot the Megaphone: - Use trendlines to connect price highs and lows. - Apply volume analysis to gauge market sentiment. - Monitor for divergence using RSI or MACD indicators. Avoiding Common Pitfalls Trading the megaphone pattern isn’t without its challenges. Here are the most common mistakes and how to sidestep them: - Jumping the Gun: Impatient traders often enter positions prematurely. Wait for candle closes beyond trendlines. - Ignoring Risk Management: Treat your account like it’s a fragile antique. Position sizing and stop-losses aren’t negotiable. - Overtrading: Not every bounce is worth trading. Be selective and focus on high-probability setups. Real-World Case Study: From Chaos to Cashflow Imagine this: EUR/USD was experiencing erratic price swings last summer, leaving traders scratching their heads. By applying the megaphone pattern, seasoned trader Mia identified clear divergence in trendlines and entered near support. She exited just shy of resistance, bagging a 200-pip profit. What’s more, she reinvested in the breakout move, doubling her gains. Elite Tactics to Elevate Your Game - Leverage Multiple Timeframes: Analyze the megaphone on a daily chart but refine entries on a 1-hour chart for precision. - Combine with Fundamental Analysis: Pair technical insights with economic news to predict breakout directions. - Utilize Smart Trading Tools: Tools like those at StarseedFX simplify order management and risk calculation, ensuring efficiency. Your Path to Mastery Range trading with the megaphone pattern isn’t just a strategy; it’s a mindset shift. By focusing on clean, actionable insights, you’re already leagues ahead of the average trader. Remember, it’s not about catching every move—it’s about catching the right ones. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Year-End Financial Planning Made Simple: Tools for Business Efficiency and Growth

Businesses are at a turning point in their financial planning process as the year comes to an end. Good financial planning involves not just evaluating previous year’s performance but adopting the right strategies that will the set business on the path to success in the upcoming year. The significance of precise budgeting cannot be emphasized enough. Proper budgeting ensures that an organization has enough resources to achieve its objectives. By planning finances ahead of time, you can identify which area needs additional resources and properly identify areas where you can cut expenses. Using right tools such as wire transfer to simplify financial tasks is essential for businesses of any scale for both immediate as well as future success.

What is Financial Planning?

It involves evaluating a business’s current financial status, their short-term and long-term goals and methods to achieve them. The right financial plan acts as a guide for company’s financial advancement. It assists in organizing a company’s income and expenses, reduce debts and achieve a stable growth. Budget is one among the integral aspect of financial plan, other areas include company’s assests, expenses, cashflow and revenue. A thorough financial planning helps to uncover missed opportunities and emphasize possible risks that could affect the growth strategy.

Why Year- End Planning is Crucial for Businesses?

Before exploring how the platform can assist businesses in improving the financial strategies, it is crucial to understand why year-end planning holds such significance.

As the year comes to a close, businesses should pay attention to balance sheets, income statements and cashflow statements. Analyzing these documents reveals what requires attention. With the information business can devise strategies to improve their finances.

Setting clear goals for upcoming year is another aspect of successful financial preparation. These objectives might encompass broadening operations, boosting income, lowering debt.

Another important area is risk management which includes evaluating possible risks, market variations, funding problems and other operational difficulties. Financial planning involves creating strategies to lessen these risks and protect your business.

Liquidity management means keeping track of company’s cash flow to make sure that financial responsibilities are fulfilled timely. Good liquidity management helps avoid financial constraints and keep your operations running smoothly.

Fast Payments, Smooth Year-End

As the year wraps up, companies frequently encounter the challenge of unsettled payments to vendors. This is particularly common in sectors that need quick delivery of products and services. In such a situation, wire transfers can assist businesses in executing swift payments without the delays that can happen while resorting to traditional methods.

Zil.US enables companies to perform both domestic and international wire transfers with ease. Wire transfers are beneficial for businesses that operate on a global scale, as they remove complications of intricate international payment processes, currency exchange and prolonged waiting periods associated with other methods. Additionally wire transfer through the platform is more affordable, compared to other methods which involve high fees and extra costs. By taking advantage of the platforms competitive pricing, businesses can lessen the financial strain of both international and domestic payments, making year-end expense management easier.

Direct Deposits, Done Right

Managing employee payments is a crucial aspect of year-end preparations. As the year comes to an end, organizations must ensure that employees receive their bonuses, payments and other incentives on time. Using ACH is a smart way to handle payments, ACH transfers let businesses deposit money directly into employees' bank accounts. With Zil.US, American companies can quickly and securely make ACH transfers, guaranteeing that employees are paid punctually. Moreover, the platform supports recurring ACH payments, which is useful for businesses that provide regular bonuses or commissions at year-end.

Financial Freedom Without the Fees

A key aspect of financial planning is making sure that your business runs smoothly and stays profitable. Zil.US assists businesses in minimizing expenses by providing fee-free checking accounts and affordable transaction costs. Various financial institutions charge high fees for wire transfers, ACH and account maintenance. The platform allows to open checking account and conduct transactions without the concern of hidden fees or extra charges. Additionally, the platform lets you open multiple checking accounts, which is useful for businesses that want to keep their accounts payable and receivable separate.

Digital Gifts, Real Appreciation

Many companies search for methods to recognize employees and clients for their efforts over the years. Sending visa gift cards to employees or business partners as a gesture of thanks is simple with Zil.US. Businesses can quickly offer rewards without the need for physical cards or complex procedures as the platform provides the option to send cards via email.

This capability is especially beneficial for companies aiming to boost employee morale or express thanks to clients. By distributing digital gift cards, companies can simplify the gifting process and prevent hold-ups linked to conventional physical gift cards.

Year-end financial planning is an essential responsibility for American companies, and having the right tools can significantly impact the outcome. It helps businesses to assess their financial status, improve tax approaches, and guarantee compliance with regulatory obligations. Utilizing effective financial tools can aid in simplifying tasks like expense management, invoicing, and payroll oversight.

0 notes

Text

ClaimApp: Revolutionizing Contract Management Systems for Efficient Project Execution

In the world of construction and project management, managing claims, progress updates, and financial reconciliation can often be complex and prone to human error. However, with the introduction of ClaimApp, a cutting-edge Contract Management System, these processes have become significantly more streamlined and efficient.

Efficient Progress Claims Management

ClaimApp’s Contract Claim Management System is designed to make the submission, evaluation, and certification of progress claims a hassle-free experience. Traditionally, progress claims required extensive paperwork and manual oversight. With ClaimApp, main contractors can easily submit their progress claims online, drastically reducing administrative workload and human errors. This system allows for the seamless online certification of progress claims after they undergo thorough evaluation, verification, and approval processes.

The claim and certification forms in ClaimApp are designed to be clear and easy to understand, ensuring that users at every level of the project are on the same page. Main contractors can choose to fill out either the percentage of work completed or the value against the work done, allowing for flexibility and accuracy. This level of simplicity not only speeds up the approval process but also reduces the chances of disputes between contractors and stakeholders.

Streamlining Sub-Contractor and Material Procurement Claims

ClaimApp doesn’t just cater to main contractors; it also provides comprehensive Sub-Contract Claims Management. This feature ensures that subcontractors can submit their claims for work completed on time, improving transparency and accountability across all parties involved. Additionally, the system includes modules for Material Procurement management, making it easier to track materials from order to delivery, while maintaining full control over project costs.

Improved Accountability and Cash Flow Management

Cash flow management is one of the most critical aspects of project success, and ClaimApp ensures that all financial activities are accounted for. The system’s Cashflow Analysis tool provides a detailed, real-time overview of the financial health of the project. This tool allows project managers and higher management to keep track of the inflow and outflow of funds, ensuring that project budgets are adhered to without surprises. The system also tracks every activity performed, providing a clear audit trail and enhancing accountability.

Going Green with Paperless Transactions

One of the most significant advantages of using ClaimApp is its paperless functionality. With ClaimApp, all transaction records and documentation are stored electronically, eliminating the need for manual filing systems. This "Go Green" initiative not only helps reduce the environmental impact of paper waste but also ensures that all documents are securely stored in a safe, easily accessible digital environment. Stakeholders can retrieve files and claims at any time without the hassle of sifting through piles of paperwork, offering peace of mind regarding the integrity and security of project records.

Boosting Productivity and Security

The Contract Management System in ClaimApp is designed to significantly enhance overall productivity and performance in all areas of project management. By automating routine tasks, reducing paperwork, and streamlining communication, the system ensures that key personnel can focus on higher-level project goals and decision-making. The added security of digitally stored records further ensures that vital project data remains protected and accessible only to authorized users.

Stay Connected with Real-Time Updates

ClaimApp keeps all stakeholders in the loop with email notifications sent directly to higher management. This ensures that project managers, senior staff, and clients are always up-to-date with the latest developments. Whether it’s a progress claim awaiting certification or an update on cash flow analysis, everyone involved in the project remains informed in real-time.

Conclusion ClaimApp’s Contract Management System is a powerful tool for improving the efficiency, accuracy, and transparency of construction projects. With features designed to reduce human error, improve accountability, enhance cash flow management, and provide seamless document storage, ClaimApp is the ideal solution for modern construction project management. Its secure, paperless environment ensures that your team stays connected, productive, and on track to meet project goals.

1 note

·

View note

Text

5 Helpful Resources When Getting Started In Business

Starting a business can seem daunting, but with the right tools, it doesn’t have to be. Provided you do the research, have a solid plan, and are motivated, you can be a success story.

You’re certainly not alone. According to the latest figures, over 60,000 new businesses were created in Canada during 2024. Impressively, 78.5% of small businesses survived their first year.

The following five helpful resources can help you be one of the successful ones.

1. Business Listings

Most people think of starting a business as starting from scratch. However, it’s often challenging to come up with a new idea. It can be particularly frustrating when you look through business listings and find someone is already doing what you want to do.

That’s why, before you start your business, you should consider purchasing an existing business. Whether you’re interested in Edmonton or Vancouver, Find Businesses 4 Sale has something to offer you.

Taking on an existing business requires the same skills and commitment as starting a new one. The big difference is that you should start seeing a profit sooner.

Business listings will show you what businesses are available. This is useful if you’re looking to buy a business or if you want to see the current level of competition. Knowing what you’re competing against will help you produce a better product or service.

2. Template Designs

Starting and running a new business is time-consuming. You must create and chase leads, record customer details, arrange supplier contracts, and even log and pay invoices. That’s just a fraction of the work involved.

If you don’t get help, you’ll quickly find yourself bogged down in the daily grind. This will prevent you from moving the business forward, which is essential for success.

Fortunately, you can get templates that effectively automate many of these tasks. Whether you’re looking to start and grow an email list or simply want to make invoicing easy, you’ll find a template that can help.

This is an effective way of freeing up your time to focus on driving your business forward.

3. Education/Mentoring

Starting a business doesn’t mean stopping your education. The better your knowledge of business and your industry, the easier it is for you to succeed.

You don’t need to go back to traditional school. However, taking a class at a business school is a great way to improve your entrepreneurial skills. There are courses available in leadership, management, and even problem-solving!

An online course is usually the most flexible option which is beneficial when you’re running your own business.

Alongside this, make sure you maintain the education of any new staff members. This will help them feel valued and provide you with the best possible work ethic.

Where possible, set up a mentoring system where each member of your team helps another to grow in their role.

4. Industry Specific Publications

Running a business means constantly being on top of the latest industry news. You never know when something the government’s change will affect your industry.

By subscribing to and reading all the industry-specific publications, physical and online, you’ll be able to keep your company at the forefront of development. It will also keep your business legal.

It’s not just about legislation. Monitoring industry publications helps you keep your finger on the pulse of the industry. It will help you understand what your competitors are doing and how you can do it better.

5. Finance Firms

All businesses, whether new or well-established, experience cashflow difficulties. This is when you need to turn to finance firms.

New businesses often seek venture capitalists to get their businesses off the ground. Established businesses may need a cash injection when they experience a slowdown or want to expand.

Don’t wait until you need the money to contact finance firms. Speak to them today and cultivate a relationship. When you need them you’ll have already laid the groundwork. That makes the whole process much smoother.

Bonus Tip

One of the biggest issues that business startups face is a lack of willingness to ask for help. It doesn’t have to be financial. A new business owner may be struggling to understand the industry legislation or some other piece of information.

If that’s you, the best thing you can do is ask for help. Other business owners will be happy to advise you. There are also a variety of institutions which can help you navigate the pitfalls of starting a business and come out on top.

Summing Up

Choosing to start your own business is an exciting and scary proposition. It doesn’t have to be. You simply need to prepare yourself and use as many resources as you can to improve your knowledge and managerial style. Your customers and employees will thank you for this. In return, you’re likely to create a thriving business.

Share in the comments below: Questions go here

#startup business#helpful resources#business listings#template designs#templates#business education#online course#finance firms#venture capitalists

0 notes

Text

8 Best Technology Solutions to Streamline Your Business Process

In this highly competitive business environment, small businesses to large enterprises are required to adopt innovative software solutions. These technology solutions automate processes, improve communication, and make data-driven decisions, streamlining operations and enhancing efficiency.

However, choosing the right technology as per the need is essential for businesses to leverage its benefits effectively.

In this blog, we will explore the 8 innovative software solutions for different business processes, helping you build tech infrastructure for your organizations suiting your business’s specific needs.

Best Technology Solutions for Different Business Needs

1. Prime Procurement for Better Procurement Strategy

Prime Procurement is a comprehensive procurement management software that helps your business optimize and automate the purchasing processes. The prominent solution helps you save costs, improve supplier relationships, and ensure compliance with procurement policies, ultimately leading to better procurement strategies.

2. Telelyzer to Optimize Telecom Services

One of the top technology solutions is the Telelyzer, an advanced call analysis tool. The tool simplifies the process by converting hours of call recordings into instantly actionable insights. This tool helps teams focus on improving performance, enhancing customer experience, and identifying training needs with pinpoint accuracy.

3. Choice Drive Assure to Streamline Motor Insurance

If your organization is required to deal with motor insurance, Choice Drive is one of the best digital transformation solutions to streamline the entire motor insurance issuance process with an easy KYC process, effortless quote generation, and auto-calculated commissions.

4. Greetly for Visitor Management

Greetly is a visitor management system that streamlines the check-in process for businesses. This software solution enhances security and efficiency by automating visitor registration and providing real-time notifications to hosts. With Greetly's software solution, you can improve your organization’s desk operations with the tailored check-in process.

5. Choice Touch for Field Staff Management

Manually managing field staff and their sales efficiency is a time-consuming process. Choice Touch is a software solution that eases the process of field staff management by automating several tasks including performance tracking, task allocation, and planning.

6. Cashflow Management Software to Optimize Expense Management

An effective cash flow management system is crucial for any business's success. Cashflow Management Software is a powerful tool designed to optimize expense management and invoicing for businesses of all sizes. With its automated workflows and customizable templates, PrimeCashflow management is among the technology solutions for a timely billing experience, enhancing your business financial management.

7. Prime Employee Benefits, Taking Care of the Employees

Prime Employee Benefits is one of the most useful digital transformation solutions for businesses. This software solution allows organizations to manage employee expenses, ensure on-time reimbursements, and analyze performance. Prime employee benefits also help in wealth creation for employees with the choice financial services suite.

8. Trans Track for Logistic Process

If your business is highly dependent on the transportation of goods, Trans Track is a go-to transport management software solution. The digital software is a consolidated solution for managing, procuring, distributing, and tracking vehicles. The digital transformation solutions for logistic processes address every aspect of the transportation cycle and automate the transport operations in real-time including pricing, routing, billing and invoice generation, scheduling, auditing, and status updates.

How to Choose the Best Technology Solutions for Your Business?

Since there are several technology solutions available, it’s important to find the right software solution for your business. To identify which technology solutions are good for your business, you can consider the following factors.

Your Requirements

Different businesses need different technology solutions. You can identify which technology solutions you need as the priority by learning the requirements of the automation in particular tasks.

Your Budget

Based on the capability of software solutions, the prices for them vary. You can look through your expenses and figure out how much money you want to invest in the technology solutions.

Software Solutions Features

Now that you know your needs and budget, identify the best software solutions in your range. Do extensive research to learn about their features and match them with your requirements.

Compare Technology Solutions

You can compare the different technology solutions, their key features, annual or monthly charges, and how proficiently, the tool can help you in executing your tasks.

You can also take demos of different technology solutions to find the best digital transformation solutions for your business.

Conclusion

Adapting technology solutions for business processes has become a necessity for staying ahead of the competition. The right set of software solutions automates various tasks saving time and enhancing the processes. Prime Procurement to automate the procurement process, Greetly to manage visitors, Cash flow management for optimizing expenses, and other mentioned tools are some of the best tools you can integrate into your business operations.

However, before choosing technology solutions for subscription, ensure that you identify the needs, features, and benefits for your business at ground level.

0 notes

Text

Securing B2B Enterprise SaaS Subscription Payments On Time

The global B2B SaaS market is projected to experience significant growth from 2024 to 2032. This expansion is driven by the rising demand for cloud-based software solutions that enhance business efficiency and cost-effectiveness.

The B2B SaaS industry offers a variety of solutions, including Customer Relationship Management (CRM), Human Resources (HR), Enterprise Resource Planning (ERP), and project management software. These tools are designed to automate and streamline business operations, foster collaboration, and boost productivity.

Based on the size of the target customers, broad-level go-to-market (GTM) segmentation for B2B SaaS subscription management includes:

Small and Medium Enterprises (SMEs)

Mid-Market

Large Enterprises

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

For SaaS subscription payments, SMEs are typically willing to use credit cards to access B2B SaaS products. However, Mid-Market and Large Enterprises often prefer to operate on credit terms, which necessitates managing accounts receivable.

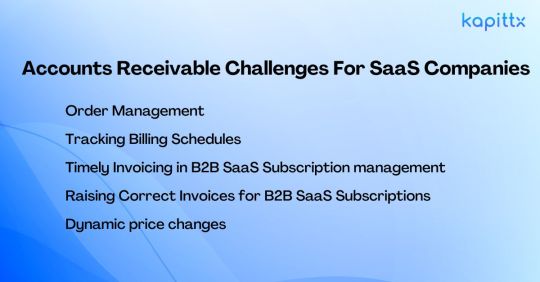

Accounts Receivable Challenges for SaaS Companies

Running a B2B SaaS Subscription management business is incredibly challenging. In today’s hyper-competitive market, in your SaaS subscription business, you must manage multiple aspects such as onboarding, adoption, upselling, customer success, retention, and churn.

The last thing you want to worry about is accounts receivable management.

This is particularly true for enterprise SaaS companies, where users often do not provide credit card details for auto-debit transactions. Consequently, you are compelled to offer ‘invoice payment’ terms. This means, similar to traditional businesses, you invoice clients and typically collect payment 30 days later, hoping the customer pays on time.

1. Order Management

Enterprise customers typically issue a Purchase Order (PO) for any product or service, and B2B SaaS subscriptions are no exception. These POs capture deliverables and commercial terms that should be thoroughly examined before acceptance.

Payment terms may include milestone payments for integration and onboarding, the start of the go-live subscription, and usage-based rates. It’s important to note that customers rely on their internal documents for commercial and payment terms, not just your published plan.

As your business grows and the number of orders increases, tracking SaaS subscription milestone payments can become overwhelming and time-consuming. Implementing an order-to-cash and subscription management tool like Kapittx can significantly streamline this process and support your growth.

2. B2B SaaS Subscription Billing Challenges: Tracking Billing Schedules:

Managing B2B SaaS subscription billing schedules requires attention to detail, clear communication with customers, and the right tools. By leveraging subscription billing tracking solutions like Kapittx, companies can streamline their processes, reduce errors, and ensure timely payments.

A. Diverse Billing Plans:

B2B SaaS subscription companies offer various billing plans to accommodate different customer needs. These plans can include monthly, quarterly, bi-annually, or yearly billing cycles. Each billing plan has its own set of terms and conditions, affecting the frequency and timing of payments.

B. Go-Live Dates vs. Billing Dates:

Some SaaS companies tie billing dates to the go-live dates of their services. For example, if a customer’s software implementation goes live on the 15th of the month, their billing cycle might start from that date. However, other companies have a policy of billing for the entire month, regardless of the go-live date. This can lead to confusion and misalignment between service usage and billing periods.

C. Customer-Specific Billing Dates:

Different customers may have unique billing dates based on their contract terms or historical preferences. Managing multiple billing schedules simultaneously can become complex, especially when dealing with a large customer base.

D. Subscription Billing Tracking Tools:

Implementing a robust subscription billing tracking tool can streamline the entire process. Such tools can:

Centralize Billing Information: Store billing details for each customer, including billing frequency, due dates, and payment history.

Automate Reminders: Send automated reminders to customers before their payment due dates.

Generate Invoices: Create accurate invoices based on the billing plan and customer-specific terms.

Handle Prorated Charges: Manage mid-cycle changes (e.g., upgrades, downgrades) and calculate prorated charges accordingly.

3. The Importance of Timely Invoicing in B2B SaaS Subscription management:

Timely invoicing not only ensures smoother financial operations but also fosters positive relationships with your customers. Enterprises follow specific payment processing cycles, often with a credit period that extends a certain number of days after the invoice date. If you issue the invoice late, it directly impacts the payment processing timeline. Late invoices lead to delayed payments.

For SaaS subscription companies, maintaining healthy cash flow is essential. Timely payments from customers contribute significantly to this. Late payments can disrupt financial planning, hinder growth, and strain operational resources.

Avoiding Payment Delays – When you bill on time, you increase the chances of receiving payments promptly. Late invoices may result in delayed approvals, additional processing time, and potential disputes.

Monthly billing cycles can be particularly tricky. Missing a billing cycle means you might end up submitting two months’ worth of invoices simultaneously. This situation can confuse customers and create administrative challenges.

With Kapittx a b2b SaaS subscription management proactively monitor SaaS subscription billing due dates closely. You can maintain a billing calendar that tracks all customer invoices that Include billing dates, due dates, and follow-up actions.

4. Raising Correct Invoices for B2B SaaS Subscriptions

Accurate and transparent invoicing contributes to a smoother billing process and fosters positive relationships with your customers.

Many SaaS subscription plans are based on usage metrics. These metrics could include the number of users, data consumed, or other measurable factors. For example, a company might pay based on the number of active users or the volume of data processed through the SaaS platform.

Differential user rates add complexity to billing. Some users may be on a basic plan, while others might have access to premium features. Managing these variations accurately is crucial to avoid disputes and ensure fair billing.

Transparency about user counts and consumption is vital. Customers should easily verify the details on their platform. Providing clear usage reports or dashboards helps build trust and minimizes billing discrepancies. When generating invoices, ensure that they reflect the actual usage and user rates.

Consequences of Ineffective arm accounts receivable management leading to accounts receivable challenges can be due to an inadequate AR process which can trigger a cascade of issues:

5. Dynamic price changes

Enterprise SaaS subscription plans may have a base plan for X users and a pre-agreed rate for additional users. Further some deals which are long-term could have pre-agreed price escalation clauses. All these complexities need a sophisticated SaaS Subscription Management system.

Challenges in SaaS Subscription Receivables Management

High Days Sales Outstanding (DSO):

DSO measures the average number of days it takes to collect payment from customers after a sale. Slow payment from customers can strain a company’s cash flow and profitability.

Management Time and Efficiency:

Managing accounts receivable can be time-consuming, especially when processes are inefficient or manual.

Delays in Invoice Submission:

Timely invoice submission is essential for prompt payment. Identifying bottlenecks that impact invoice submission is critical.

Streamlining SaaS Subscription Payments with Kapittx

Kapittx offers innovative solutions to address these challenges:

Automation: Kapittx replaces manual processes with automation, reducing the time spent on routine tasks. It streamlines invoice submission, payment reconciliation, and alerts.

Integration: By integrating Kapittx with your ERP Billing platform, you create a seamless flow of information. Alerts for delays, risks, and other critical events are delivered in real time.

Complete Control: Kapittx provides end-to-end visibility into the invoice-to-cash lifecycle. You gain control over receivables, ensuring timely collections and minimizing financial risks2.

In summary, Kapittx not only helps manage SaaS subscriptions efficiently but also empowers you with better control over your accounts receivable processes. Feel free to explore Kapittx further to optimize your financial stability

Click here to see a case study from Kapittx.

Request a demo today.

Check out Kapittx’s LinkedIn here.

#ai in accounts receivable#ai powered accounts receivable#ar management#cashflow management#accounts receivable automation software#ai based accounts receivable#ar collection#ar automation solution#ar tool

1 note

·

View note

Text

How to Use CMA Reports to Monitor & Improve Your Business’s Financial Health

A Credit Monitoring Arrangement (CMA) report isn’t just a tool for securing loans—it’s a vital document that can help monitor and improve your business’s financial health! 🌱📊

Here’s how to leverage it for more than just credit approvals:

🔍 1. Track Financial Performance Over Time

Your CMA report provides a historical and projected snapshot of your finances. By regularly comparing past data with future projections, you can spot trends, like shrinking margins or rising costs. Use this info to catch problems early and make adjustments!

💸 2. Assess Liquidity & Cash Flow

Cash flow is king! 👑 Your CMA report breaks down inflows and outflows, giving you a clear view of your liquidity. Need to improve cash flow? Optimize inventory management and tighten up on accounts receivable to boost your financial stability.

📊 3. Evaluate Debt Levels & Repayment Capacity

Your CMA’s debt-equity ratio can help you decide if you’re carrying too much debt. Too high? Time to reduce your debt load or negotiate better loan terms. Keeping debt manageable keeps your business on solid ground.

💼 4. Identify Working Capital Needs

Struggling with daily operations? 🏃♂️ Your CMA report highlights your working capital requirements, so you’ll know if you need to raise funds or adjust your receivables/payables cycles to keep things moving smoothly.

📈 5. Improve Profitability

Analyzing the profit & loss account in your CMA lets you see where profitability can be enhanced. Whether through cost-cutting, better pricing, or efficiency improvements, it’s a roadmap to better margins!

📅 6. Strengthen Financial Planning

Use the projections in your credit monitoring report to plan for growth and manage risks! Thinking ahead ensures you’re always prepared for future challenges and opportunities.

Whether you're trying to secure a loan or just keep your business in peak financial shape, your CMA report is a powerful tool! ✨ Remember, staying proactive with financial monitoring sets your business up for long-term success. 📈💪

#BusinessFinance #CMAReport #FinancialHealth #SmallBusiness #CashFlow #DebtManagement #Profitability #BusinessGrowth #WorkingCapital

0 notes

Text

Enhancing Financial Health For Businesses With Cashflow Management Services.

Effective cashflow management is the lifeblood of any successful business. Whether you're a small startup or a large corporation, maintaining a steady flow of cash is essential for daily operations, growth, and long-term sustainability. Cashflow Management Services Abu Dhabi play a crucial role in helping businesses achieve financial stability, manage risks, and capitalize on opportunities. Here’s how these services can benefit your business.

Understanding Cashflow Management

Cashflow management involves tracking, analyzing, and optimizing the flow of cash in and out of your business. It’s not just about ensuring you have enough money to pay your bills; it’s about strategically managing your finances to maximize profitability and minimize risk. Cashflow Management Services provide businesses with the tools, insights, and strategies needed to maintain a healthy cashflow, forecast future cash needs, and make informed financial decisions.

Key Benefits of Cashflow Management Services

1- Improved Financial Planning and Forecasting

Cashflow management services offer advanced tools for financial forecasting, helping businesses predict their future cash needs. By understanding the inflows and outflows of cash, businesses can plan for potential shortfalls and avoid surprises. This level of foresight allows for better decision-making, whether it’s investing in new opportunities, expanding operations, or managing debt.

2- Enhanced Liquidity Management

Liquidity is the ability of a business to meet its short-term obligations. Effective cashflow management ensures that a company has enough liquid assets to cover its day-to-day expenses. Cashflow management services help businesses optimize their liquidity by streamlining accounts receivable and payable, managing inventory levels, and identifying opportunities to improve cash conversion cycles.

3- Risk Mitigation

Financial risks are an inherent part of running a business, but poor cashflow management can exacerbate these risks. Cashflow management services help businesses identify potential cashflow gaps and implement strategies to mitigate risks, such as securing lines of credit, optimizing payment terms with suppliers, and managing customer payment behaviors. This proactive approach can prevent financial crises and ensure business continuity.

4- Better Cost Control

By closely monitoring cashflow, businesses can identify areas where they may be overspending or not utilizing resources efficiently. Cashflow management services help businesses analyze their expenses, negotiate better terms with vendors, and implement cost-saving measures. This not only improves profitability but also frees up cash for reinvestment in growth initiatives.

5- Access to Real-time Financial Data

Cashflow management services often provide businesses with real-time access to their financial data. This allows business owners and managers to make informed decisions quickly and respond to changes in the market or within the company. Having up-to-date financial information is crucial for staying competitive and seizing opportunities as they arise.

6- Support for Growth and Expansion

Growth requires investment, and investment requires capital. Cashflow management services can help businesses plan for expansion by ensuring they have the necessary funds available when needed. Whether it’s opening a new location, launching a new product, or investing in new technology, having a solid cashflow plan in place makes growth initiatives more achievable and less risky.

Why Partner with Cashflow Management Experts?

While many business owners and financial managers understand the importance of cashflow, managing it effectively can be challenging. Cashflow management services offer specialized expertise and technology that can make a significant difference. By partnering with experts, businesses can leverage best practices, advanced analytics, and tailored strategies to optimize their cashflow and drive long-term success.

Moreover, cashflow management services can save businesses time and resources by automating routine tasks, providing actionable insights, and offering ongoing support. This allows business owners to focus on what they do best – running their business – while ensuring their finances are in capable hands.

Conclusion

In today’s fast-paced and ever-changing business environment, effective cashflow management is more important than ever. By utilizing Cashflow Management Services Abu Dhabi, businesses can gain greater control over their finances, reduce risks, and position themselves for sustainable growth. Whether you're looking to improve liquidity, plan for the future, or navigate financial challenges, cashflow management services are an essential tool for achieving your business goals.

0 notes

Text

Three White Soldiers & Grid Trading: Your Secret Forex Tactic for Success The Three White Soldiers and Grid Trading: Mastering the Art of Strategic Forex Tactics When it comes to trading, there are days when the charts look as unfathomable as an art gallery at a modern art museum. You're staring at what seems to be an army of candlesticks, wondering if they're trying to tell you something significant, or if they're simply plotting to confuse you. Enter the unsung hero of pattern recognition—the Three White Soldiers. Now, pair that with the powerful arsenal of Grid Trading, and you've got a dynamic duo that can take your Forex trading strategy to the next level. In this article, we'll dig into three white soldiers and grid trading, two powerful tools that, when combined, can help you sharpen your edge in the Forex market. If you've ever found yourself hesitating to pull the trigger on a trade or wished you could better understand market momentum, then buckle up (okay, I said I wouldn't use that cliché, but this one fits) because you're about to discover how to unleash an expert-level combination that might just give you an advantage. Marching Toward Success The Three White Soldiers is a bullish reversal pattern, commonly used to identify a change in trend—a bright light at the end of the tunnel for traders. It’s made up of three long green candles that consistently close higher than the previous one, signaling a steady momentum shift towards the buyers. Imagine you're at an auction, and the bids keep climbing higher. Each bid represents buyers with more and more confidence that this price will keep rising. Similarly, when you see those three bullish candles forming back-to-back, you know the market's got its mojo back. The Three White Soldiers pattern emerges, telling you, "Hop on board—the bulls are leading the charge." But beware, because like all too-perfect setups in life—such as buying those ultra-flashy running shoes you'll probably only use to fetch the morning paper—the Three White Soldiers can come with false promises. This is why understanding how to use this pattern with additional strategies, like grid trading, is essential to maximize your success and minimize those unnecessary trips down 'Regret Avenue.' Not Your Average Sidekick Think of Grid Trading like a fishing net. Instead of casting a single line and hoping for the best, you're setting multiple hooks across different levels of the water—in this case, price points in the market. A grid system is a versatile strategy that allows you to place trades at equal intervals above and below the current market price. This way, you’re not putting all your hopes and dreams on one level—you’re hedging your bets and letting the market do the work. Unlike the Three White Soldiers, grid trading is not about trend confirmation. It's about coverage—having orders at levels where the price is likely to fluctuate and making sure you have an opportunity to capitalize on movement no matter which way it swings. It’s like trying to catch a basketball bouncing unpredictably in a room. Set enough traps and you're bound to catch that rebound eventually. But—and here's where the professionals differ from the hopefuls—your grid strategy requires clear boundaries. Risk management in grid trading is crucial, because an unchecked grid is about as safe as letting your friend who 'sort of' knows how to drive handle a race car. From Candlesticks to Cashflow Now, you might be thinking, "Alright, Botley, but how do these two even work together?" Well, here’s where the real magic happens (I said I'd include the subtle transition!). The Three White Soldiers serve as your reliable signal that the market has strong bullish momentum. You’ve got your marching orders—now, you execute a grid trade plan around that pattern. Imagine the market breaks a key resistance level, and the Three White Soldiers pattern emerges—this is your time to grid the heavens out of it. Place a buy grid, using orders that climb alongside the soldiers, riding the wave of enthusiasm in the market. The grid acts as your net, allowing you to take advantage of fluctuations, while the Three White Soldiers validate the underlying direction. The strategy here is part timing, part coverage, and a sprinkle of knowing when to bail before things hit the fan. Because—let's be honest—sometimes those soldiers are marching you straight into a reversal. Understanding the Traps The biggest trap with the Three White Soldiers pattern is that traders sometimes mistake a short-term market anomaly for long-term trend reversal. Just like that overconfident guy at a party who insists he knows everything about wine, it might look convincing at first but quickly runs out of credibility. To prevent this mistake, validate the Three White Soldiers with a couple of additional indicators—such as volume data and trend strength. Look out for signs of exhaustion (overbought RSI) and consider what’s going on from a fundamental perspective. No pattern is bulletproof, but with enough supporting data, you can feel confident enough to take on even more trades. With Grid Trading, one common pitfall is getting overzealous—it's tempting to set grids all over the place, like a kid who just discovered how to use a sticker book. But beware: when the market suddenly dips and those grids activate at once, what you initially envisioned as an army of small, profitable trades can become a full-scale losing battleground. To avoid getting caught in a disastrous chain reaction, always control how many orders activate simultaneously, set stop losses, and determine boundaries before placing those trades. Why Most Traders Get It Wrong (And How You Can Avoid It) Most traders overcomplicate things. They go after every trend, every indicator, as if more means better. It’s like piling on toppings at an all-you-can-eat pizza buffet—sure, it looks glorious, but halfway through you realize you’ve made a terrible mistake. Three White Soldiers and Grid Trading require patience and discipline. Respect the patterns, and respect the grid. You’re not trying to control the market; you're positioning yourself to move in harmony with it. Remember that trading isn’t about predicting the future—it’s about preparing yourself to respond to it. Trade with discipline, manage risks like you would manage those extra toppings, and stay focused on improving—one soldier, one grid at a time. The Game-Changing Nuggets - Three White Soldiers represent a bullish reversal and help validate a buying opportunity. - Grid Trading helps set up multiple trades at various intervals to capture market volatility and price fluctuations. - Combine these strategies by utilizing Three White Soldiers as your market signal and executing a grid to maximize profit capture. - Always employ risk management to ensure that even if trades don’t go your way, you keep losses under control. - Use additional indicators (e.g., RSI) and keep an eye on volume to validate price patterns and reduce false signals. If this sounds like something you want to learn more about, StarseedFX has some great tools to guide you. You can join the community, access the latest economic indicators, and check out the free trading journal to improve your results, all with a few clicks. Visit our website to explore more exclusive insights and find strategies that suit your trading goals. Reflect, Apply, and Conquer Now that you've learned how to combine Three White Soldiers with Grid Trading, it’s time to put these tools to good use. Set clear goals, manage your risks, and keep refining your strategy. And don't forget to leave your thoughts or questions in the comments below—we’d love to hear how you're marching forward in the Forex battlefield. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Financial Planning for MID Market Companies Tips and Tools

Effective financial planning is a cornerstone for success in the MID Market, which includes companies that are larger than small-to-medium businesses (SMBs) but not as large as enterprises. These companies face unique financial challenges and opportunities that require tailored strategies and tools.

This article will provide comprehensive insights into financial planning for MID Market companies, highlighting key tips and essential tools to ensure financial stability and growth.

Understanding the Difference Between Mid-Market SMB and Enterprise AES is crucial for grasping the unique financial dynamics of MID Market companies. This differentiation sets the context for exploring the specific financial planning strategies that these companies should adopt.

Key Financial Planning Tips for MID Market Companies

Develop a Comprehensive Budget: A well-structured budget is essential for managing resources effectively. MID Market companies should create detailed budgets that outline expected revenues, fixed and variable costs, and capital expenditures. Regularly reviewing and adjusting the budget helps ensure alignment with business goals and market conditions.

Optimize Cash Flow Management: Maintaining a healthy cash flow is critical for MID Market companies. Implementing strategies such as prompt invoicing, efficient accounts receivable management, and negotiating favorable payment terms with suppliers can enhance cash flow. Utilizing cash flow forecasting tools can help anticipate and manage liquidity needs.

Diversify Revenue Streams: Relying on a single revenue stream can be risky. MID Market companies should explore opportunities to diversify their income sources. This could include expanding product lines, entering new markets, or developing strategic partnerships. Diversification helps mitigate risks and provides a buffer against market fluctuations.

Leverage Financial Technology: Financial technology (fintech) solutions can streamline financial operations and improve decision-making. MID Market companies should invest in robust accounting software, financial management systems, and data analytics tools. These technologies provide real-time financial insights, enhance accuracy, and reduce manual workload.

Focus on Cost Control: Effective cost control measures are vital for maintaining profitability. MID Market companies should regularly review expenses and identify areas for cost reduction. Implementing cost-saving initiatives, such as renegotiating supplier contracts, optimizing supply chain operations, and reducing waste, can significantly impact the bottom line.

Plan for Growth and Expansion: Financial planning should include strategies for growth and expansion. MID Market companies need to allocate resources for research and development, marketing, and talent acquisition. Creating a scalable financial plan that supports growth initiatives ensures the company can seize new opportunities without compromising financial stability.

Essential Financial Tools for MID Market Companies

Accounting Software: Robust accounting software is the backbone of financial management. Tools like QuickBooks, Xero, and Sage Intacct offer features such as invoicing, payroll management, expense tracking, and financial reporting. These solutions streamline accounting processes and provide accurate financial data.

Cash Flow Management Tools: Tools like Float, Pulse, and Cashflow Manager help businesses monitor and forecast cash flow. These tools provide visual representations of cash inflows and outflows, helping MID Market companies anticipate cash shortages and make informed financial decisions.

Budgeting and Forecasting Software: Budgeting tools like Adaptive Insights, PlanGuru, and Prophix assist in creating and managing budgets. These tools offer advanced forecasting capabilities, scenario planning, and performance tracking, enabling businesses to adjust their financial plans in response to changing conditions.

Financial Dashboards: Financial dashboards, such as those provided by Microsoft Power BI and Tableau, offer real-time visibility into key financial metrics. These dashboards integrate data from various sources, providing a comprehensive view of the company's financial health and performance.

Expense Management Solutions: Tools like Expensify, Concur, and Zoho Expense automate expense reporting and reimbursement processes. These solutions help MID Market companies control spending, enforce policies, and ensure compliance.

For businesses seeking to enhance their technological capabilities and streamline their financial operations, partnering with an IT Solutions Company can provide the necessary expertise and resources to support their growth journey.

Conclusion

Effective financial planning is indispensable for MID Market companies aiming to achieve sustainable growth and stability. By developing comprehensive budgets, optimizing cash flow management, diversifying revenue streams, leveraging financial technology, controlling costs, and planning for growth, MID Market businesses can navigate the complexities of their financial landscape successfully. Utilizing the right financial tools further enhances their ability to make informed decisions and drive long-term success.

0 notes