#payment reconciliation software

Explore tagged Tumblr posts

Text

Accounts Receivable Challenges in Distribution Industry and to Address Them

In the distribution industry, companies are navigating a complex landscape that directly impacts their cash flow management, accounts receivable, and bottom-line performance. Distribution channels, whether serving consumer goods or industrial products, play a critical role in bringing products from manufacturers to consumers, which involves warehousing, transportation, inventory management, and other logistical tasks. Industries such as grocery, convenience, and pharmacy rely on these channels for market reach and customer satisfaction.

Despite the steady demand for goods, factors like seasonal fluctuations, intense market competition, and intricate cash flow management processes have emerged as key challenges. Cash flow management is essential, especially as distribution companies often operate with extended credit terms, impacting the cash conversion cycle. Late payments from clients can significantly disrupt cash flow, leading to operational delays and missed growth opportunities. Additionally, seasonal peaks often require companies to carefully balance inventory levels and operational costs.

Achieving Scale and Enhancing Market Share

For distribution companies, achieving scale—first locally, then nationally—is vital for operational efficiency, customer insights, and investment in new capabilities. Reaching scale can also allow for reinforcing market share through key measures such as:

Digital Self-Service Tools: Investing in self-service technology for customers and resellers allows distributors to streamline transactions, enhance the customer experience, and reduce operational costs.

Pricing and Accounts Receivable Management for Distribution: Improved margins through effective pricing strategies and efficient accounts receivable management for distribution can have a positive impact on cash flow management and financial sustainability. Efficient cash application and proactive collection efforts help distributors reduce Days Sales Outstanding (DSO) and strengthen liquidity.

Private-Label Products and Value-Added Services: Offering private-label products and value-added services, such as customized delivery options or specialized product packaging, enables distributors to differentiate themselves in a competitive market and strengthen client relationships.

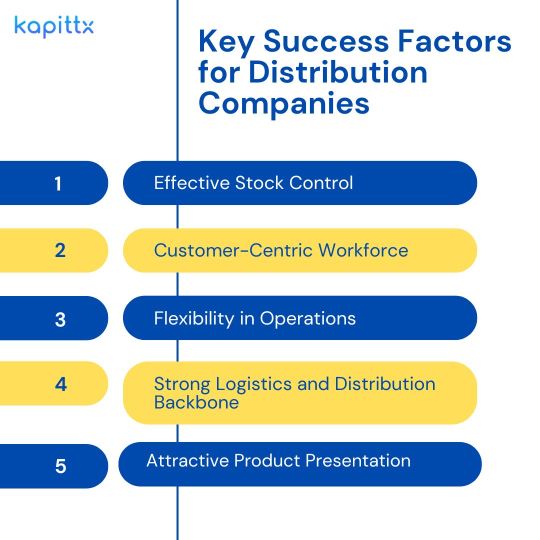

Key Success Factors for Distribution Companies

Effective Stock Control: Seasonal fluctuations mean that most revenue is generated in a few peak months. Accurate forecasting and stock control are essential for optimizing stock levels and maximizing sales.

Customer-Centric Workforce: Distributors who serve retail stores should emphasize customer service, as friendly, knowledgeable sales staff improve client relationships and loyalty.

Flexibility in Operations: Adapting to demand is key. During high-sales periods, distributors should expand their workforce and inventory, while scaling back in slower seasons to minimize costs.

Strong Logistics and Distribution Backbone: Controlling margins is essential in distribution. Investing in efficient logistics and distribution systems helps distributors manage transportation costs, inventory flow, and stock availability across locations.

5. Attractive Product Presentation: The product’s appearance, shelf management, and environment also influence sales. This goes beyond physical retail stores and includes online presentations and prompt service delivery, which can make a substantial difference.

Accounts Receivable Challenges in the Distribution Sector

Cash Flow and Accounts Receivable Management for Distribution companies

Cash flow remains a top priority for distributors who often deal with extended credit terms for B2B clients. This brings the importance of accounts receivable automation for distribution companies. Distributors commonly extend 30- to 60-day payment terms to retailers, impacting the cash conversion cycle. Given that most retail distributors have high expenses tied to warehousing, transportation, and workforce, any delay in payment can have a cascading effect on operations.

Extended Days Sales Outstanding (DSO) increases the risk of cash flow disruptions, creating operational delays and potentially causing missed opportunities. In the U.S., the average DSO for retail distribution companies is approximately 57 days; however, high-performing companies aim to reduce this metric to 40 days or less.

2. Seasonal Goods and Inventory Control

For many distributors, peak sales months from October to December make up a substantial part of their annual revenue. This heavy reliance on a single season places pressure on their inventory management, requiring them to balance stock levels meticulously. A miscalculation in inventory can lead to stockouts, missed sales, or excess stock, all of which affect cash flow. Companies need a firm grip on demand forecasting, especially for seasonal products, to control stock on hand and minimize waste.

Current B2B Payment Modes and Their Benefits

Adopting efficient payment modes can significantly enhance cash flow and streamline the reconciliation process for distributors. As part of the accounts receivable automation for distribution companies, by offering multiple payment options to retailers distributors can not only offer convenient options to pay, one can also improve relationships with the retailers.

Here are several payment modes and their potential benefits:

Automated Clearing House (ACH): ACH transfers reduce payment processing time and lower transaction fees compared to traditional checks. They also minimize manual reconciliation, reducing human error and time spent on cash application.

Electronic Funds Transfer (EFT): EFT enables real-time transfers, which can be crucial for high-turnover distributors who need prompt cash flow. EFTs also simplify record-keeping and reduce the need for physical checks.

Virtual Credit Cards: Virtual credit cards provide secure and quick payment methods, especially useful for repeat transactions with trusted clients. These are particularly advantageous for transactions requiring an extra layer of security.

Credit Card Payments: While these may involve processing fees, they can improve cash flow as distributors receive funds faster. This payment mode is ideal for smaller, high-frequency orders common in retail distribution.

Digital Wallets and Mobile Payments: Although less common in B2B, digital wallets like Apple Pay or Google Wallet are gaining traction. These options are secure and convenient, and as acceptance grows, they may become a more mainstream payment option in the distribution space.

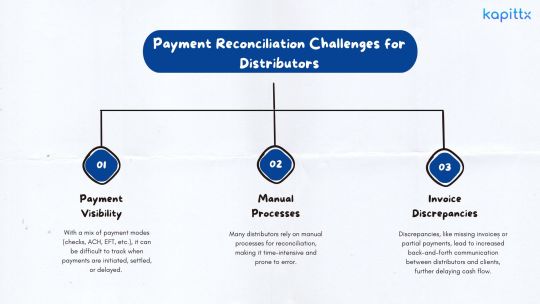

Payment Reconciliation Challenges for Distributors

One of the key components of accounts receivable for distribution companies is the obstacles you face with payment reconciliation, particularly when dealing with high transaction volumes across multiple clients. Major challenges include:

Payment Visibility: With a mix of payment modes (checks, ACH, EFT, etc.), it can be difficult to track when payments are initiated, settled, or delayed. The lack of real-time visibility results in a higher volume of unallocated cash.

Manual Processes: Many distributors rely on manual processes for reconciliation, making it time-intensive and prone to error. Nearly 30% of financial team time in some companies is spent on manual reconciliation, leaving less time for strategic activities.

Invoice Discrepancies: Discrepancies, like missing invoices or partial payments, lead to increased back-and-forth communication between distributors and clients, further delaying cash flow.

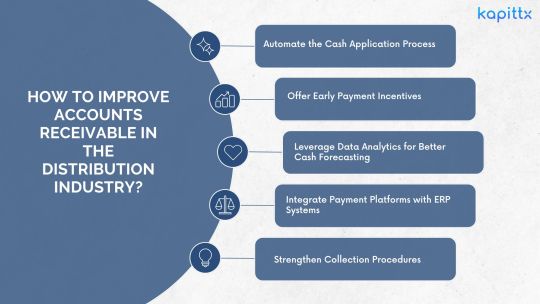

How to Improve Accounts Receivable in the Distribution Industry?

Automate the Cash Application Process: Accounts receivable automation for distribution companies will help in the automation of cash applications and can drastically reduce the time it takes to match payments to invoices, cutting down on manual processing and reducing the risk of errors. Automated systems also improve tracking and enable the finance team to focus on more strategic tasks.

Offer Early Payment Incentives: Providing discounts for early payments encourages clients to pay faster, reducing DSO and enhancing cash flow. The use of digital invoicing and payment reminders can further improve collection efficiency.

Leverage Data Analytics for Better Cash Forecasting: Advanced data analytics can provide insights into client payment patterns and predict cash flow trends. This helps finance teams forecast cash flow accurately, plan for operational expenses, and set credit policies effectively.

Integrate Payment Platforms with ERP Systems: Linking payment processing systems directly with ERP platforms ensures seamless transaction flow and real-time visibility into receivables. This integration minimizes discrepancies and improves reconciliation speed.

Strengthen Collection Procedures: A streamlined collection strategy, including regular follow-ups, automated reminders, and personalized communication, can reduce overdue receivables and maintain steady cash flow.

Conclusion

The distribution space is a dynamic sector with unique accounts receivable challenges in the distribution industry are related to cash flow, payment reconciliation, and accounts receivable management. By adopting modern payment methods, leveraging automation, and optimizing inventory, distributors can navigate these complexities more effectively. Companies that excel at managing inventory, developing a customer-focused workforce, and utilizing efficient logistics will be better positioned to succeed in this competitive market, ultimately achieving better profitability and long-term growth.

Distribution companies that prioritize efficient cash flow management, scale strategically, and invest in technology can gain a competitive advantage in the retail distribution space. By achieving these improvements, they can reduce DSO, optimize operations, and better serve their clients, positioning themselves for sustainable growth in a rapidly evolving industry.

#cashflow management#accounts receivable in distribution#accounts receivable management in distribution#cash application process#payment reconciliation software

0 notes

Text

OpenTeQ NetSuite Consulting Services: Your Partner in Success

NetSuite Consulting Services play a pivotal role in helping businesses implement and optimize NetSuite's cloud-based ERP solutions. A professional NetSuite consulting team provides expertise in customizing the platform to meet the unique requirements of any organization. Whether you're a small business or a large enterprise, NetSuite Consulting Services ensure that the transition to this powerful ERP system is smooth, efficient, and tailored to your specific needs. By offering strategic guidance on ERP implementation, customization, and optimization, consultants enable businesses to streamline operations, reduce costs, and improve decision-making.

NetSuite consultants assist with the integration of various business processes, such as accounting, inventory management, CRM, and supply chain management, providing a unified platform that improves efficiency. They also provide training and support, ensuring that teams are fully equipped to leverage NetSuite's full capabilities. The right consulting services help organizations maximize ROI from their ERP investment, reducing the risks associated with system implementation and enabling faster business growth.

NetSuite Financial Software: A Powerful Tool for Financial Management

NetSuite Financial Software is a comprehensive suite of financial management tools designed to streamline accounting, financial planning, and compliance processes for businesses of all sizes. As part of the broader NetSuite ERP system, this software delivers real-time financial visibility and flexibility, allowing businesses to make data-driven decisions. With its cloud-based infrastructure, NetSuite Financial Software automates key tasks such as accounts payable, accounts receivable, and general ledger management, which enhances accuracy and efficiency.

One of the standout features of NetSuite Financial Software is its ability to manage multi-currency transactions, tax calculations, and compliance with international accounting standards, making it an ideal solution for global enterprises. It also integrates seamlessly with other NetSuite modules, including CRM and eCommerce, providing a holistic approach to financial and business management. This comprehensive financial suite is essential for businesses aiming to achieve operational excellence, improve cash flow management, and maintain regulatory compliance.

NetSuite Support Services: Ensuring Optimal Performance

NetSuite Support Services are crucial for businesses that rely on the NetSuite ERP platform to manage their operations. These services provide ongoing technical support, troubleshooting, and guidance to ensure that the system is running smoothly and efficiently. Whether it's resolving technical issues, offering system updates, or helping users with platform navigation, NetSuite Support Services offer businesses the confidence to rely on the platform for their daily operations.

Support services come in various levels, ranging from basic helpdesk support to more advanced services, including system optimization, performance monitoring, and security management. A good NetSuite Support Services team ensures that your ERP system is always up-to-date, secure, and capable of meeting the demands of your business. These services are particularly important for businesses undergoing rapid growth or complex system customizations, where technical support is needed to avoid disruptions.

NetSuite Consultation: Partnering for Growth

NetSuite Consultation is a strategic service that helps businesses assess their needs and determine how to best leverage NetSuite’s ERP capabilities. Through consultation, businesses gain insights into which modules of the NetSuite platform can address their specific pain points, whether it’s financial management, supply chain automation, or customer relationship management. This consultative process is essential for organizations looking to implement or optimize their ERP systems to align with their business goals.

During a NetSuite Consultation, experts analyze the current state of a company’s operations and provide recommendations for improvement by NetSuite's tools and technologies. They also offer advice on best practices for system customization, data migration, and integration with existing software. By partnering with an experienced NetSuite consultant, businesses can ensure they are maximizing the value of their ERP solution, leading to improved efficiency, cost savings, and competitive advantage.

Conclusion

OpenTeQ provides comprehensive NetSuite Consulting Services that help businesses implement and optimize NetSuite solutions, ensuring seamless integration across all business processes. With expertise in NetSuite Financial Software, OpenTeQ enables companies to streamline their financial management, offering real-time insights and automation for enhanced decision-making.

Their dedicated NetSuite Support Services ensure that businesses have the technical assistance they need to maintain efficient operations and address any issues that arise. Through tailored NetSuite Consultation, OpenTeQ guides businesses in selecting the right modules and customizing the platform to meet specific needs, ultimately driving growth and efficiency.

#CPA On-Demand#Fractional CFO Services#NetSuite Mobile Apps#NetSuite Mobile App Development#NetSuite Mobile App Services#NetSuite Application Development#NetSuite Mobile Applications#NetSuite Advanced Dunning Solution#Advanced NetSuite Dunning Module#NetSuite Bulk Upload#Payment Orchestration for NetSuite#NetSuite Connectors#NetSuite Revision Management#NetSuite Advanced MRO#NetSuite Advanced Reconciliation#NetSuite RECONATOR#NetSuite for Small Business#Best NetSuite Consultants#NetSuite Managed Services#NetSuite Consulting Services#NetSuite Financial Software#NetSuite Support Services#NetSuite Consultation

0 notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health. Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing. Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations. Budgeting: It provides accurate data for future budgeting, reducing financial risks. Benefits of Outsourcing Bookkeeping Services Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources. Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records. Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books. Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties. SC Bhagat & Co. – Your Reliable Bookkeeping Partner SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services. Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices. Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management. Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected. Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts. Bank Reconciliation: Ensuring that your bank statements match your business's financial records. Expense Tracking: Managing all expenses to help reduce overheads and increase profits. Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements. Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings. Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi? SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports Comprehensive Bookkeeping Solutions Cost-effective Services Compliance with Latest Financial Regulations Final Thoughts Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

The Ultimate Comparison of Zoho Books and QuickBooks for Small Business Owners

Introduction

Running a small business is no easy feat. From managing finances to handling client relationships, the responsibilities can be overwhelming. However, with the right tools in hand, you can streamline your operations and simplify your workload significantly. Two of the most popular accounting software options for small businesses are Zoho Books and QuickBooks. But which one should you choose?

In this ultimate comparison guide of Zoho Books vs QuickBooks, we'll take a deep dive into both platforms' pros and cons so that you can make an informed decision on what's best for your business needs!

What is Zoho Books?

Zoho Books is an easy-to-use cloud-based accounting software designed specifically for small business owners. It offers a range of features to help manage finances, including invoicing, expense tracking, inventory management and time-tracking.

One of the best things about Zoho Books is its user-friendly interface. Even if you have no prior experience with accounting software, you can easily navigate through the platform and get started in no time.

Another noteworthy feature of Zoho Books is its automation capabilities. You can set up recurring invoices or automatic payment reminders to save yourself time on manual tasks. Additionally, Zoho Books integrates seamlessly with other apps within the Zoho suite and third-party applications like Stripe and PayPal.

Zoho Books provides a cost-effective solution for small businesses looking to streamline their financial operations without sacrificing functionality or ease-of-use.

What is QuickBooks?

QuickBooks is an accounting software that targets small and medium-sized businesses. It was developed by Intuit, a well-known financial software company based in Mountain View, California. QuickBooks offers a range of features such as bookkeeping, invoicing, payroll management, and inventory tracking.

One of the key features of QuickBooks is its user-friendly interface which makes it easy for non-accountants to use. The software also integrates with various third-party applications like PayPal and Shopify to provide users with more functionality.

Moreover, QuickBooks comes in both desktop and online versions meaning you can choose the one that suits your business needs. Desktop version requires installation on your computer while the online version allows you to access the app from anywhere provided you have internet connection.

QuickBooks is ideal for small business owners who need basic accounting tools without spending too much time learning complex financial jargon.

The Pros and Cons of Zoho Books

Zoho Books is a cloud-based accounting software designed for small businesses. It offers many features that can help business owners manage their finances effectively.

One of the pros of Zoho Books is its affordability. The pricing plans are reasonable and offer great value for money, especially when compared to other accounting software on the market.

Another advantage of Zoho Books is its user-friendly interface. Even if you're not an accounting expert, you can easily navigate through the software with ease.

Furthermore, Zoho Books also allows users to customize invoices and reports which can be helpful in branding your business identity as well as presenting financial data more professionally.

On the downside, some users have reported glitches with certain features like inventory management and bank reconciliation. Also, customer support may take longer than usual to respond sometimes leaving users waiting for hours or days before getting assistance.

Zoho books offer a wide range of benefits at an affordable price point but it’s important to consider the potential drawbacks too before making a final decision about whether this solution will meet your needs and expectations.

The Pros and Cons of QuickBooks

QuickBooks is a popular accounting software that has been around for decades. It offers a variety of features to help small business owners manage their finances effectively. Here are some pros and cons of using QuickBooks.

Pros:

One of the biggest advantages of QuickBooks is its user-friendly interface, which makes it easy to navigate and use even for non-accountants. The software also offers a wide range of features such as invoicing, expense tracking, inventory management, and payroll processing.

Another benefit of using QuickBooks is its integration with other applications like Microsoft Excel, TurboTax, and Salesforce. This allows you to import data from other sources into QuickBooks seamlessly.

Moreover, QuickBooks provides excellent customer support through phone or chat services and has an extensive knowledge base that can answer most common questions.

Cons:

One major drawback of using QuickBooks is its high cost compared to other accounting solutions in the market. Additionally, some users have reported glitches or difficulties when attempting to run certain functions within the software.

Furthermore, while it does offer many features that are helpful for small businesses operations; however this may be overwhelming for some users who only require basic functionalities but still need to pay the full price for all options provided by the software.

Which One is Right for You?

Choosing between Zoho Books and QuickBooks can be a tough decision, as both offer unique features to small business owners. To determine which one is right for you, there are a few factors to consider.

Firstly, the size of your business plays an important role in choosing between the two platforms. If you're running a smaller operation with fewer employees and transactions, then Zoho Books might be the way to go due to its affordability and ease of use. However, if your business has more complex accounting needs or multiple users that need access to financial information, QuickBooks may be better suited for you.

Another factor to consider is what type of industry your business operates in. QuickBooks offers more specialized versions geared towards specific industries such as construction or nonprofit organizations. On the other hand, Zoho Books caters more towards service-based businesses like consulting firms or marketing agencies.

It's worth considering whether integration with other software programs is important for your business operations. QuickBooks has been around longer and therefore may have stronger integrations with other common software systems like Microsoft Office Suite or Salesforce.

Ultimately, choosing between Zoho Books vs QuickBooks comes down to individual needs and preferences based on these various factors mentioned above - ensuring that you pick an accounting platform tailored specifically for your unique requirements will make all the difference in managing finances effectively!

Conclusion

After comparing Zoho Books vs QuickBooks, it's clear that both accounting software packages have their strengths and weaknesses. Ultimately, the decision on which one to use will depend on your specific business needs.

If you're a small business owner who is looking for an affordable solution with excellent invoicing capabilities, then Zoho Books may be the right choice for you. However, if you require more advanced accounting features or a system that integrates with other applications seamlessly, then QuickBooks may be the better option.

Regardless of which platform you choose, make sure to do your research thoroughly before committing to any particular accounting software. By taking the time to carefully evaluate each package's pros and cons in light of your company's unique requirements, you'll ensure that you end up with an ideal solution that helps streamline your operations while providing accurate financial data at all times.

3 notes

·

View notes

Text

What is Cash Application and How AI is Revolutionizing Cash Application Management?

What is Cash Application and How AI is Revolutionizing Cash Application Management?

Managing cash flow efficiently is the lifeblood of any business, especially for companies dealing with high volumes of transactions. Cash application has emerged as one of the most critical functions for businesses, as it directly impacts both cash flow and customer relationships. But what is cash application process, and how is AI transforming this fundamental process to enhance speed, accuracy, and efficiency?

Why Cash Application is Crucial for Companies

Cash application, while often overshadowed by other financial processes, is an essential part of accounts receivable (AR) management. It entails matching incoming customer payments to open invoices, and keeping accounts current and precise. When cash application management is done efficiently, it ensures that businesses maintain healthy cash flow, avoid disruptions, and provide superior customer service. Conversely, poor cash application management can lead to customer dissatisfaction, increased operational costs, and strained cash flow.

In mature as well as fast-growing markets, medium to large-scale businesses operate with complex payment systems, and the stakes are even higher. Delayed or inaccurate cash application management can result in collection inefficiencies, with businesses wasting time chasing already settled invoices. Moreover, mismanagement of the cash application process can tarnish a company’s reputation, as frustrated customers deal with errors like duplicated collection efforts or unapplied payments.

What is Cash Application Process?

Cash application is the process of matching incoming customer payments with the respective invoices. In a typical B2B setup, customers pay their bills or invoices via various payment methods, including checks, ACH (Automated Clearing House) transfers, and online payments. Each payment must be reconciled with the correct invoice to ensure the customer’s account is updated accurately.

Data Collection: Data is pulled from multiple sources like ERPs (Enterprise Resource Planning), billing systems, bank statements, and customer payment advices. Payments may also arrive through various channels such as check payments, wire transfers, and online transactions.

Matching Payments to Invoices: Payments are matched to open invoices based on the remittance advice from customers. This requires close attention to discrepancies like deductions, credit notes, and partial payments.

Reconciliation: Once matched, payments are reconciled against the company’s bank statements to ensure accuracy.

4. Handling Discrepancies: Issues such as short payments, overpayments, deductions, and disputed amounts must be resolved to maintain accurate records.

Common Challenges in Manual Cash Application

“Manual cash application processes are time-consuming and prone to human error. This process can be broken down into two main categories: Payment Reconciliation and Cash Posting.“

Payment Reconciliation

The most time-consuming part of the cash application process is payment reconciliation. This involves matching invoice amounts with remittance information and bank statements. For cash application specialists, visibility into accounts receivable and expected payments is crucial. This information is typically available in the accounts ERP. Keeping track of these payments ensures they are received in a timely manner and properly allocated to the appropriate accounts.

Depending on the payment mode and channel, these formats will vary. For instance, lockbox formats differ from ACH payment reports, and online payment information differs from wire transfers. Additionally, if the payments involve multiple currencies, FX conversion rates can further complicate the process. While bank formats are generally standard, the data still needs to be retrieved for payment reconciliation from either PDFs or Excel sheets.

During the payment reconciliation process, it’s key to segregate mismatched transactions from matched transactions by taking inputs from ERP data, customer remittance information, and bank statements.

Common types of mismatches are due to following:

1. Deductions: Deductions occur when customers reduce the payment amount due to various reasons like returns, discounts, or allowances. Reconciling these requires matching the deduction details with the corresponding invoice and ensuring the justification for the deduction is valid.

2. Short Payments: Short payments happen when customers pay less than the invoiced amount. These discrepancies need to be investigated to understand the cause—whether it’s an error, a dispute, or an approved discount.

3. FX Differences: When dealing with international transactions, FX (foreign exchange) differences arise due to fluctuations in currency exchange rates. Accurate reconciliation involves converting payments to the base currency and accounting for any exchange rate discrepancies.

4. Tax Holds: Tax holds can occur if there’s an issue with the tax calculations on an invoice. These need to be reviewed to ensure compliance with tax regulations and to adjust the accounts accordingly.

5. Refunds & Chargebacks: Refunds and chargebacks require meticulous tracking. Refunds are payments returned to the customer, while chargebacks are transactions disputed by the customer and reversed by the bank. Proper documentation and validation are essential for reconciling these entries.

6. Payment Processing Charges: When using payment gateways or ACH processing services, fees are often deducted from the payment amount before it reaches the company’s account. Reconciling these charges involves matching the net payment with the gross amount and the associated fees.

Once these mismatches are identified and addressed, the transaction-level payment reconciliation provides a clear picture, enabling accurate cash posting entries into the ERP system. This clarity ensures that all payments are correctly allocated, improving cash flow management and financial reporting accuracy.

What is Cash Posting :

Cash posting is a critical step in the cash application process where payments are recorded in the ERP system to reflect accurate account balances.

What are Cash Posting Challenges

Some of the main challenges businesses face include:

Unapplied Payments: Payments that remain unapplied for days or weeks after receipt cause significant delays. These unapplied payments can create redundancy in collection efforts, as the finance team might continue to contact customers for payments that have already been made but not yet matched and applied.

Misapplied Payments: Incorrectly posting payments to the wrong account or invoice can lead to extensive rework. This mistake requires manual corrections, consumes valuable time, and frustrates customers, potentially leading to disputes and delayed future payments.

Payment Without Remittance Advice: When customers do not provide clear instructions on how their payments should be applied, businesses may struggle to identify the correct account or invoice. This often results in unapplied or misapplied payments, further complicating the reconciliation process.

Multiple Payment Channels: Companies dealing with various payment gateways (e.g., Stripe, PayPal, and Dwolla) or handling both online and traditional check payments face the challenge of reconciling payments in different formats. The diverse formats increase the risk of mismatched data and complicate the reconciliation process.

These challenges create inefficiencies, directly affecting cash flow and customer satisfaction. Research shows that companies with poor cash application processes can experience a 20-30% delay in receiving payments due to manual errors and system inefficiencies. Streamlining and automating the cash posting process can significantly improve the accuracy and speed of payment reconciliation, leading to better financial management and enhanced customer relationships.

The Role of AI in Cash Application Process

Enter AI: artificial intelligence is now revolutionizing cash application process by automating much of the manual work and improving accuracy. Let’s understand how AI powered cash application process will create an impact on your cash flow management:

Automated Matching: AI powered cash application process can process vast amounts of payment data from multiple sources and automatically match payments to open invoices, eliminating the need for human intervention. This drastically reduces the time it takes to apply cash and ensures accuracy.

Error Reduction: AI powered cash application automation software reduces the risk of human error, particularly with misapplied or unapplied payments. By leveraging machine learning, AI systems can learn from past applications and improve their matching algorithms over time.

Handling Payment Discrepancies: AI powered cash application process can flag discrepancies such as short payments, overpayments, or missing remittance advices, and automatically suggest resolutions. For instance, if a payment doesn’t match the invoice amount, the system can identify potential deductions or adjustments based on past transactions.

4. Faster Reconciliation: AI powered cash application automation software accelerates the reconciliation process by matching payments with bank statements in real-time, minimizing delays and ensuring accurate financial records.

5. Handling Complex Payment Structures: AI powered cash application process systems can manage various payment types (check payments, ACH, online payments) and integrate with multiple payment gateways (like PayPal, Stripe, and Aydan), providing a seamless cash application process regardless of the payment method used.

Benefits of AI-Powered Cash Application Process

The introduction of AI into cash application automation software offers numerous benefits:

Speed: What once took days or even weeks can now be accomplished in minutes. AI significantly reduces processing times by automating the matching and reconciliation process.

Accuracy: AI systems are highly accurate, meaning fewer errors, less rework, and improved cash flow.

Scalability: AI can easily scale to accommodate growing transaction volumes, making it ideal for large businesses with high payment frequencies.

Cost Reduction: By automating processes, AI reduces the need for large accounts receivable teams, saving on labor costs.

Should Cash Application Be Outsourced?

While outsourcing cash application to third-party providers is an option, businesses must weigh the pros and cons. Outsourcing can reduce the need for in-house expertise and can be a more affordable option in the short term. However, it may introduce delays and limit control over sensitive financial processes.

On the other hand, AI-driven cash application solutions can offer a middle ground by automating processes while keeping them in-house. This provides greater control and ensures that the company maintains direct oversight of payment processing, while still reaping the benefits of automation.

Conclusion

The adoption of AI powered cash application automation software is transforming how businesses handle one of their most critical functions. By eliminating manual errors, speeding up payment processing, and ensuring accurate application of payments, AI offers a robust solution that allows businesses to streamline their operations and improve cash flow. As AI continues to evolve, it is poised to become an indispensable tool for finance departments looking to stay competitive in the fast-paced world of business.

Investing in AI powered cash application automation software can lead to improved customer relationships, faster cash cycles, and enhanced operational efficiency, positioning companies for long-term success in an increasingly digital economy.

#ai based accounts receivable#cashflow management#payment reminder#Cash application process#accounts receivable automation software#ai in accounts receivable#payment reconciliation#ar management

0 notes

Text

Introducing NVOCC Software: Revolutionizing Your Logistics Operations