#capitalist failure

Explore tagged Tumblr posts

Text

#pro choice#responsibility#purpose#failure#choices#focus#culture#class war#class warfare#anti capitalism#eat the rich#fuck landlords#class struggle#anti capitalist love notes#anti capitalists be like#fuck capitalism#late stage capitalism#capitalism#socialism

2K notes

·

View notes

Text

I'm really sick of how people dehumanize mentally ill people who take medication to improve their mental health.

So many assholes say that anti-depressants turn you into a zombie. Or how anti-psychotics make you an idiot. How about you fuck off and mind your own business?

I know that medication doesn't work for everyone, and it doesn't solve every single problem. But it really can save someone's life, and people need to understand how deadly untreated mental illnesses can be.

#rant#personal#i really don't know what it is about mental health#people act like you're a failure for taking medication#it's like this bs capitalist idea that you're less than if you don't have the “willpower” to handle mental illness on your own#the idea that people are weak if they seek help

228 notes

·

View notes

Text

Been watching The Spectacular Failure of the Star Wars Hotel and hats off to Jenny Nicholson, you have a new forever fan. I am in awe you are a filmmaker like no other

#jenny nicholson#the spectacular failure of the Star Wars hotel#an emphatic eff you to Disney#if you’re not using that access to give an honest review#what’s the point of being there at all#HAVE YOU NO SENSE OF INTEGRITY#burned into my brain#a true light in this capitalist hellscape#Jenny I mean#NOT Disney#star wars

27 notes

·

View notes

Text

for at least three decades vox and val were fully aware valentino naturally produces an infinite amount of Unknown Powerful Aphrodisiac and as soon as vel comes around she's like "hey ever thought about bottling and selling that stuff?" .AND THEY NEVER HAD

#hazbin hotel velvette#hazbin velvette#the vees#vette my vette#vox you failure of a capitalist how did you miss that

21 notes

·

View notes

Text

I hope this piece of shit chain goes out of business holy fucking shit

#failures of capitalism#anti capitalist#capitalism sucks ass#panera#panera bread should go out of business#holy fucking shit how is this allowed

24 notes

·

View notes

Text

Not a failure, just normal!

#Not a failure#just normal!#40 hour work week#slave wages#wage slavery#slaves#slavery#slave#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#employers#employees#employment#eat the rich#eat the fucking rich#class war#capitalism#anti capitalist#capitalist hell#capitalist bullshit#capitalist dystopia#capitalist society

8 notes

·

View notes

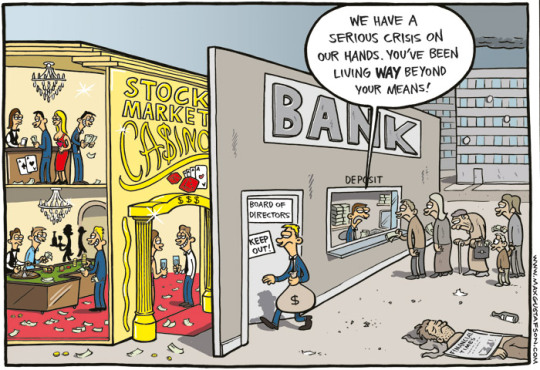

Photo

Max Gustafson

* * * *

LETTERS FROM AN AMERICAN

March 12, 2023

Heather Cox Richardson

At 6:15 this evening, Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman Martin J. Gruenberg announced that Secretary Yellen has signed off on measures to enable the FDIC to fully protect everyone who had money in Silicon Valley Bank, Santa Clara, California, and Signature Bank, New York. They will have access to all of their money starting Monday, March 13. None of the losses associated with this resolution, the statement said, “will be borne by the taxpayer.”

But, it continued, “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The statement ended by assuring Americans that “the U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.”

It’s been quite a weekend.

On Friday, Silicon Valley Bank (SVB) failed in the largest bank failure since 2008. At the end of December 2022, SVB appears to have had about $209 billion in total assets and about $175 billion in deposits. This made SVB the sixteenth largest bank in the U.S., big in its sector but small compared with the more than $3 trillion JPMorgan Chase. This is the first bank failure of the Biden presidency (while Donald Trump Jr. tweeted that he had not heard of any bank failures during his father’s presidency, there were sixteen, eight of which happened before the pandemic). In fact, generally, a few banks fail every year; it is an oddity that none failed in 2021 or 2022.

The failure of SVB created shock waves for three reasons. First, SVB was the major bank for technology start-ups, so it involved much of a single sector of the economy. Second, only about $8 billion of the $173 billion worth of deposits in SVB were less than the $250,000 that the FDIC insures, meaning that the companies who had made those deposits might not get their money back quickly and thus might not be able to make payrolls, sparking a larger crisis. Third, there was concern that the problems that plagued SVB might cause other banks to fail, as well.

What seems to have happened, though, appears to be specific to SVB. Bloomberg’s Matt Levine explained it most clearly:

As the bank for start-ups, which have a lot of cash from investors and the initial public offering of stock, SVB had lots of deposits. But start-up companies don’t need much in the way of loans because they’ve just gotten so much cash and they don’t yet have fixed assets. So, rather than balancing deposits with loans that fluctuate with interest rates and thus keep a bank on an even keel, SVB’s directors took a gamble that the Federal Reserve would not raise interest rates. They invested in long-term Treasury bonds that paid better interest rates than short-term securities. But when, in fact, interest rates went up, the value of those long-term bonds sank.

For most banks, higher interest rates are good news because they can charge more for loans. But for SVB, they hurt.

Then, because SVB concentrated on start-ups, they had another problem. Start-ups are also hurt by rising interest rates because they tend to promise to deliver returns in the long term, which is fine so long as interest rates stay steadily low, as they have been now for years. But as interest rates go up, investors tend to like faster returns than most start-ups can deliver. They take their money to places that are going to see returns sooner. For SVB, that meant their depositors began to need some of that money they had dumped into the bank and started to withdraw their deposits.

So SVB sold securities at a loss to cover those deposits. Other investors panicked as they saw SVB selling at a loss and losing deposits, and they, too, started yanking their money out of the bank, collapsing it. Banks that have a more diverse client base are less likely to lose everyone all at once.

The FDIC took control of the bank on Friday. On Sunday, regulators also shut down Signature Bank, based in New York, which was a major bank for the cryptocurrency industry. Another crypto-friendly bank, Silvergate, failed last week.

Congress created the FDIC under the Banking Act of 1933 to restore trust in the American banking system after more than a third of U.S. banks failed after the Great Crash of 1929, sparking runs on banks as depositors rushed to take out their money whenever rumors suggested a bank was in trouble, thus causing more failures. The FDIC is an independent agency that insures deposits, examines and supervises banks to make sure they’re healthy, and manages the fallout when they’re not. The FDIC is backed by the full faith and credit of the government, but it is not funded by the government. Member banks pay insurance dues to cover bank failures, and when that isn’t enough money, the FDIC can borrow from the federal government or issue debt.

Over the weekend, the crisis at SVB became a larger argument over the role of government in the protection of the economy. Tech leaders took to social media to insist that the government must cover all the deposits in the failed bank, not just the ones covered under FDIC. They warned that the companies whose deposits were uninsured would fail, taking down the rest of the economy with them.

Others noted that the very men who were arguing the government should protect all the depositors’ money, not just that protected under the FDIC, have been vocal in opposing both government regulation of their industry and government relief for student loan debt, suggesting that they hate government action…except for themselves. They also pointed out that in 2018, under Trump, Congress weakened government regulations for banks like SVB and that SVB’s president had been a leading advocate for weakening those regulations. Had those regulations been in place, they argue, SVB would have remained solvent.

It appears that Yellen, Powell, and Gruenberg, in consultation with the president (as required), concluded that the collapse of SVB and Signature Bank was a systemic threat to the nation’s whole financial system, or perhaps they concluded that the panic over that collapse—which is a different thing than the collapse itself—was a threat to the nation’s financial system. They apparently decided to backstop the banks to prevent more damage. But they are eager to remind people that they are not using taxpayer money to shore up a poorly managed bank.

Right now, this appears to leave us with two takeaways. The Biden administration had been considering tightening the banking regulations that were loosened under Trump, and it seems likely that the need for the federal government to step in to protect the depositors at SVB and Signature Bank will make it much harder for those opposed to regulation to keep that from happening. There will likely be increased pressure on the Biden administration to guard against helping out the wealthy and corporations rather than ordinary Americans.

And, perhaps even more important, the weekend of panic and fear over the collapse of just one major bank should make it clear that the Republicans’ threat to default on the U.S. debt, thus pulling the rug out from under the entire U.S. economy unless they get their way, is simply unthinkable.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Finance#the economy#Heather Cox Richardson#Letters From An American#Banking regulation#bank collapse#bank failure#Max Gustafson#debt#student loan debt#venture capitalists

81 notes

·

View notes

Text

Girl help I'm trying to balance the crushing existential dread of late-stage capitalism, autistic burnout, the atrocities happening both in and out of my own country, the high suicide rate among trans youth caused in part by incredibly powerful people telling them their lives are worthless, and the spiraling environmental impact of anthropogenic climate change against the ideology of hope-punk

#screaming#all around me are familiar faces#hope punk#existential crisis#existential dread#suicide tw#anti capitalist#trans lives are human lives#climate change#im so tired#late stage capitalism#girl help#vent post#tw vent#actually autistic#autistic burnout#i feel like a failure for not having hope for our species#but i do think life is still worth living#even if it's the end#i hope I'm wrong but#that's how I'm coping with it#I'll find joy and advocate for finding happiness in your life but#i don't have it in me to hope for our longevity

23 notes

·

View notes

Text

Really wish I could focus on doing my job and feel anything at all besides crushing helplessness and overwhelming existential despair

#Time's moving too fast#I feel like it should still be july what the fuck do you mean september's almost over#I've just been stuck in this haze of exhaustion and fear#fear of life fear of existence#fear of fate#and failure#I feel clouded and my memory feels like it's worse than it usually is#I don't know what I'm doing anymore and I've been in the break room for too long#I wish I could have one day where I don't feel equally stagnant and paralyzed by anxiety#like I'm tied to a chair and rotting in the forest#with hungry roots and vines snaking ever closer to my motionless form#I wish I had any agency or control in my life#love living in this capitalist hell lol#pun's text posts

3 notes

·

View notes

Text

I shouldn’t have to go to work every day I should get lots and lots of time to chill and rock in my rocking chair and read good books and ride my bike around town early in the quiet morning and pick sunflowers and bake honey and oat cookies and crochet giant fish for my friends and actually have time to paint and draw like I used to before I grew up and had to work all the goddam time just to have enough money to pay my bills .

#personal#antiwork#I am so tired#also ppl won’t stop emailing and messaging me#I feel bad for taking days or sometimes over a week to respond but like?!!!!? this world moves too fast.#I am so tired of feeling harried and stressed and like I’m a bad person for struggling to keep up with it all#I’m NOT!! it’s NOT a personal failure!! it’s this horrible capitalist system hurtling towards the future at breakneck speed#we have not evolved to keep up with that grind!! nor should we!!! we’re large predators we’re meant to chill out and relax#anyways. I am once again feeling like that pheasant in Bambi iykyk

9 notes

·

View notes

Text

failure and laziness are literally human invented concepts. they are not inherently real. our concept of failure, at least in the western world, is entirely based on capitalism. you've "failed" if you don't meet productivity standards. you're "lazy" if you are not productive enough. success is a similarly invented concept.

trust me, you have not failed in life. no matter what anyone says. you are not a failure, nor are you lazy. you have many valid reasons to be relaxing. this world makes us tired. succeeding is not what society says it is. success is what you make it. if you work every day to be your best and do your best, you have not failed, you are not lazy, and, damn, I'd call that success! and if you haven't what you think is your best, that's ok too. it's ok to be tired.

this world is tiring, and it's ok.

#failure#failing#laziness#success#mental health#self care#love yourself#self love#its okay#its ok to not be ok#its ok to be sad#its ok to be tired#relaxation#i love you#mental wellness#mental wellbeing#anti capitalism#anti capitalist#societal standards

18 notes

·

View notes

Text

if elon musk ever tried to put a chip in my brain i'd end up killing either him or myself. one of us has to die for that.

#i don't need a computer chip in my head girl wtf!! and ESPECIALLY not from the guy who is terminally bad at managing major projects!!!!#like.. the public failure of the modern entrepreneurial spirit!! hello!!!#sorry i just saw another article about elon musk's bullshit computer chip plans and im... AAA#like here's the thing!! cybernetics are really fucking cool and are literally lifechanging for so many people#i have a friend who has a new insulin pump thats basically ''smart tech'' and it has completely changed her life and made her type 1#so much more manageable and i wish everyone who wanted that sort of tech could get it without having any worries#but its the fact that this tech is in the hands of corporations who are so so focused on abusing their power for profit that worries me#and ESPECIALLY when we circle back to the elon musk bs i start to gnaw the bars of my cage bc like#talk about THE WORST PERSON IN THE FUCKING WORLD. TO TRUST WITH PATENTS FOR LIFE CHANGING TECHNOLOGY..#not to mention programmer bias on top of the capitalist hellscape we live in and like. the inherent biases of so much ''smart tech.''#im on the ground.#cricket.chatterbox

11 notes

·

View notes

Text

.

#I held out as long as I could but I finally had to resign today#my boss is just too nice to lay me off even though my work produces almost no business value 😭#like they just did a reorg of the teams that means QA will be stretched too thin over devs#and he’s not allowed to hire any more manual testers#this is not the same situation I was hired into!#I’m a ‘nice to have’ type of employee and they managed without my role for a while#I COULD have made myself indispensable in the last year but I couldn’t be bothered#I was busy writing fanfic and having a baby#not to mention the health shit like my wife getting covid and stranding us at my sister’s house across the country#or my older kid being hospitalized twice for respiratory failure!#so I just did the bare minimum IF THAT#and now a year later it’s all THE YEAR OF EFFICIENCY and all that bullshit#just like the rest of tech right now. bunch of dumbass capitalist copycats…#if my manager weren’t such a good dude he’d have offered my role in exchange for the manual testing hire(s) he CLEARLY needs#I really hope that my resignation helps him either get the new hire he wants or protect the rest of the department from layoffs!!!#I’m so glad I finally got it over with 😭#I start my new job in May so I’ll have a couple weeks to chill!!!

7 notes

·

View notes

Text

on the one hand i could go get a stupid corporate job and actually make enough money to live. then i could close my commission tiers on patreon and just worry about finishing my queue forever. but then also i wouldn't be able to go see my friends and family out of state because corporate jobs don't like to give you time off. aauuggghhh i wish my arm would just Magically Heal so i could just be good at my stupid art job

#prof.pdf#negative#i'm so tired of being fucking broke all the time and barely being able to pay bills and buy groceries#i can't even afford to go do anything fun this month because i'm just fucking scraping by as per usual#i'm going to spend my favourite holiday doing nothing because i'm a fucking failure in the capitalist hellhole#i'm so sick of this!!! i'm so sick of it!!!#i wish i wasn't a stupid cripple so i could work a labour job or something!!!!#i wish my stupid body wasn't so shitty that i can't even sell my blood!!!!#i hate being alive!!!! i hate this country!!!!! i hate money!!!!!!!!!!!!#i hate feeling pathetic and having to grovel for help constantly!!!!!!!!!!!!!#i wish i was dead!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!#okay sorry i'm going back to my vent blog now.

6 notes

·

View notes

Text

2nd top comment, we failed as a society

#community#society#humans#dystopian society#earth#failure#failed#class war#eat the rich#eat the fucking rich#capitalism#fascism#oppression#repression#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#oppressor#free all oppressed peoples

4 notes

·

View notes

Text

Why did Shiv become her mother and be the unhappy wife of a CEO I was under the impression that she was going to kill all these men with hammers

#I don’t even go to succession#but shiv I grieve for you my girl failure#yes you may be a capitalist girlboss but the cycle is evil

6 notes

·

View notes