#book cover salt

Explore tagged Tumblr posts

Text

It's been a year since I redrew that one Snorkmimi render...

So yeah I did it again ofc I would, why oh why wouldn't I? Tee hee silly meee

Attaching the 2023 redraw and og cause- uh- I donno, because yes, why not!!!

#This also means updated banner HECK YEAH 🔥🔥🔥#These redraws of mine are so different style-wise it's funny lmao#shoutout to Snorkmaiden one of my fav characters ever she's so perfect in every way my little baby#oh and update : since last year I still have NOT tasted “Snorkmaiden's dreamy chocolate” moomin coffee maybe one day I will or I'll do the#smart thing of making choco coffee myself without buying the maybe overpriced thing that just happens to have Snorkmay on it (I don't even#like sweet coffee 😭) buuut... you know... I could always just get it once and keep the package as a treasure! Cause I'm a hoarder. It might#or might not be a problem but I don't have time to think about that and work on it I have 100 possible uses for this old straw what if I#reeeaaallly need an old straw one day and I DON'T have it because I threw it away? Yeah! END OF THE WORLD!!!#Tbh hate to admit it but Snufkin's hazelnut coffee sounds the most inviting from all of the moomin flavoured choices to me I LOVE hazelnuts#I don't even know what licorice tastes like and I am NOT eating anything that is advertised with Stinky on the cover (jk Stinky's great)#I'm already sick of everything salted caramel flavoured it's just sugar n' salt with a different ribbon and blueberry... I'll pass. And like#I said before - I'm not a fan of sweet coffee. Sorry Snorkmaiden :[#okay enough of it no one reads allat time for real tags#snorkmaiden#snorkfröken#niiskuneiti#moomin#moomins#moomin books#Snork mimimimimimi Snork mimimimimimi

52 notes

·

View notes

Text

Singing Hills Cycle by Nghi Vo

Cover art by Alyssa Winans

Tor, 2020-2024

The Empress of Salt and Fortune (2020)

A young royal from the far north, is sent south for a political marriage in an empire reminiscent of imperial China. Her brothers are dead, her armies and their war mammoths long defeated and caged behind their borders. Alone and sometimes reviled, she must choose her allies carefully.

Rabbit, a handmaiden, sold by her parents to the palace for the lack of five baskets of dye, befriends the emperor's lonely new wife and gets more than she bargained for.

At once feminist high fantasy and an indictment of monarchy, this evocative debut follows the rise of the empress In-yo, who has few resources and fewer friends. She's a northern daughter in a mage-made summer exile, but she will bend history to her will and bring down her enemies, piece by piece.

When the Tiger Came Down the Mountain (2020)

The cleric Chih finds themself and their companions at the mercy of a band of fierce tigers who ache with hunger. To stay alive until the mammoths can save them, Chih must unwind the intricate, layered story of the tiger and her scholar lover―a woman of courage, intelligence, and beauty―and discover how truth can survive becoming history.

Into the Riverlands (2022)

Wandering cleric Chih of the Singing Hills travels to the riverlands to record tales of the notorious near-immortal martial artists who haunt the region. On the road to Betony Docks, they fall in with a pair of young women far from home, and an older couple who are more than they seem. As Chih runs headlong into an ancient feud, they find themself far more entangled in the history of the riverlands than they ever expected to be.

Accompanied by Almost Brilliant, a talking bird with an indelible memory, Chih confronts old legends and new dangers alike as they learn that every story—beautiful, ugly, kind, or cruel—bears more than one face.

Mammoths at the Gates (2023)

The wandering Cleric Chih returns home to the Singing Hills Abbey for the first time in almost three years, to be met with both joy and sorrow. Their mentor, Cleric Thien, has died, and rests among the archivists and storytellers of the storied abbey. But not everyone is prepared to leave them to their rest.

Because Cleric Thien was once the patriarch of Coh clan of Northern Bell Pass--and now their granddaughters have arrived on the backs of royal mammoths, demanding their grandfather’s body for burial. Chih must somehow balance honoring their mentor’s chosen life while keeping the sisters from the north from storming the gates and destroying the history the clerics have worked so hard to preserve.

But as Chih and their neixin Almost Brilliant navigate the looming crisis, Myriad Virtues, Cleric Thien’s own beloved hoopoe companion, grieves her loss as only a being with perfect memory can, and her sorrow may be more powerful than anyone could anticipate...

The Brides of High Hill (2024)

The Cleric Chih accompanies a beautiful young bride to her wedding to the aging ruler of a crumbling estate situated at the crossroads of dead empires. The bride's party is welcomed with elaborate courtesies and extravagant banquets, but between the frightened servants and the cryptic warnings of the lord's mad son, they quickly realize that something is haunting the shadowed halls.

As Chih and the bride-to-be explore empty rooms and desolate courtyards, they are drawn into the mystery of what became of Lord Guo's previous wives and the dark history of Doi Cao itself. But as the wedding night draws to its close, Chih will learn at their peril that not all monsters are to be found in the shadows; some monsters hide in plain sight.

#book cover art#cover illustration#cover art#Alyssa Winans#singing hills cycle#the Empress of Salt and Fortune#When the Tiger Came Down the Mountain#Into the Riverlands#Mammoths at the Gates#The Brides of High Hill#digital art#apparently i really like Alyssa Winans's style#i keep picking up books with her cover art

11 notes

·

View notes

Text

2024 reads / storygraph

The Salt Grows Heavy

dark fairy tale novella

a deep sea mermaid and her children devoured her husband and destroyed his kingdom

now she and a mysterious plague doctor travel together, and come across a strange cult-like village of ageless children and dangerous saints

#The Salt Grows Heavy#aroaessidhe 2024 reads#interesting vibes; definitely weird; I enjoyed it#I could definitely do with more tho#its funny all the reviews are like ‘theres so many pretentious big words’ bro just listen to the audiobook let it wash over you.#shh. embrace it.#queer books#OH ALSO i'm very obsessed with this cover

37 notes

·

View notes

Text

See, making timelines for your entire storyworld is fun (like actually, it's a blast, I love it), but then it also makes me a little crazy because what do you mean those utterly unconnected characters were born a year apart

#i also have historical events#and a few cultural events as well#plus maybe things from other stories that i wanted to be secretly canonical here too#it's insane#not to mention the fact that it stretches from the Book of Genesis all the way to 2029#(with a little in the 2170s but i haven't mapped out the future stories that well)#and it covers both Big Events and super mundane things#like what Ruth got for her fourth birthday or that one specific time the Lanes went to the movies#but yeah anyway#salt and light#writing#weird writer things#timelines

4 notes

·

View notes

Text

Michael Kreiser

#Michael Kreiser#salt n pepa#comic art#comics#comic covers#comic books#arte#artist#art#artwork#hiphop#hip hop#hip-hop#female rappers#female rap#female hip hop#female rapper#90s bands#90s music#90s nostalgia#90s aesthetic#90s#vintage 90s#90s hip hop#graphisme#graphic design#graphic art#graphic

13 notes

·

View notes

Note

Is it time to break out the conspiracy board?

my natural behavior

#you jest you jest but my Da books are covered with colored notes#on my lore book it's colored by specific type of lore#in the plot books it's like. politics/History/secret lore colored#except for TN that is just legit covered with papers highlights with notes taken on sticky notes#and i have mused about getting a map of thedas to be able to pin things on#in fact salt joked about making sure i get a board for my pin madness#and i do have my notebooks covered with pages of 'ok but this connects to this and to this and--'#and then the rest is just my unhinged rambling with a friend i dragged into da with me who is just as unhinged as me#so the pinboard is barely even a joke in those circumstances#or at least i think my general behavior is already worse--#ichareply#anonymous#ichafantalks da

2 notes

·

View notes

Text

Salt Kiss

By Sierra Simone.

3 notes

·

View notes

Text

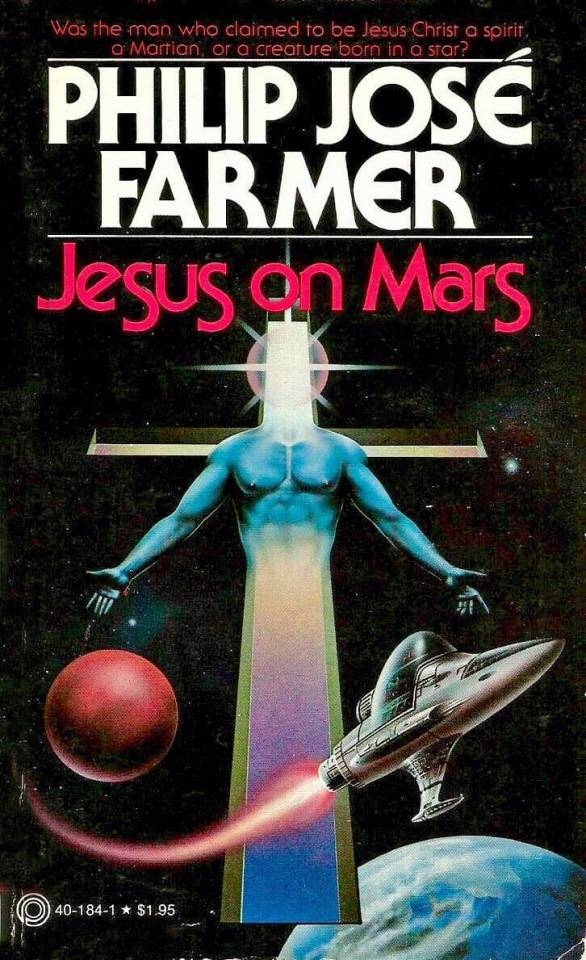

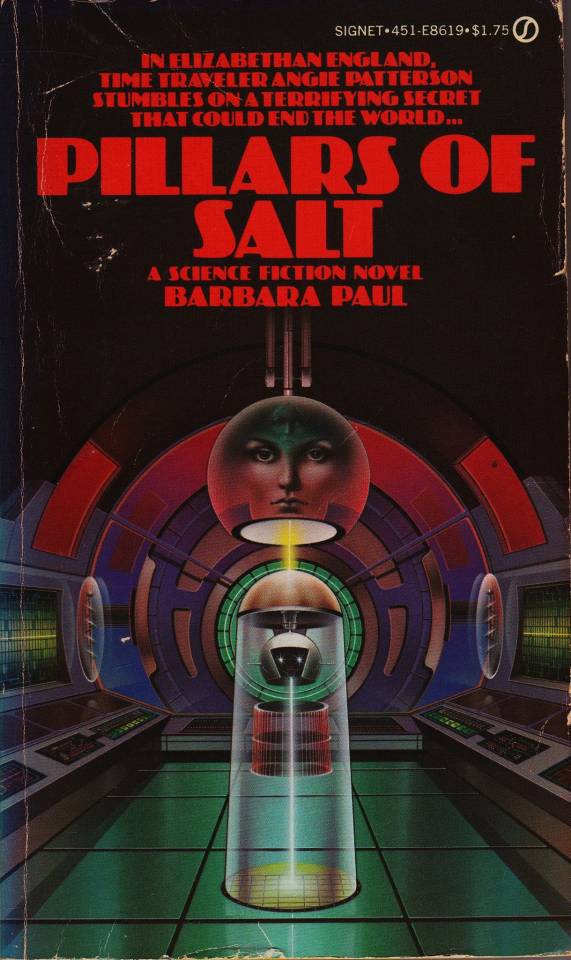

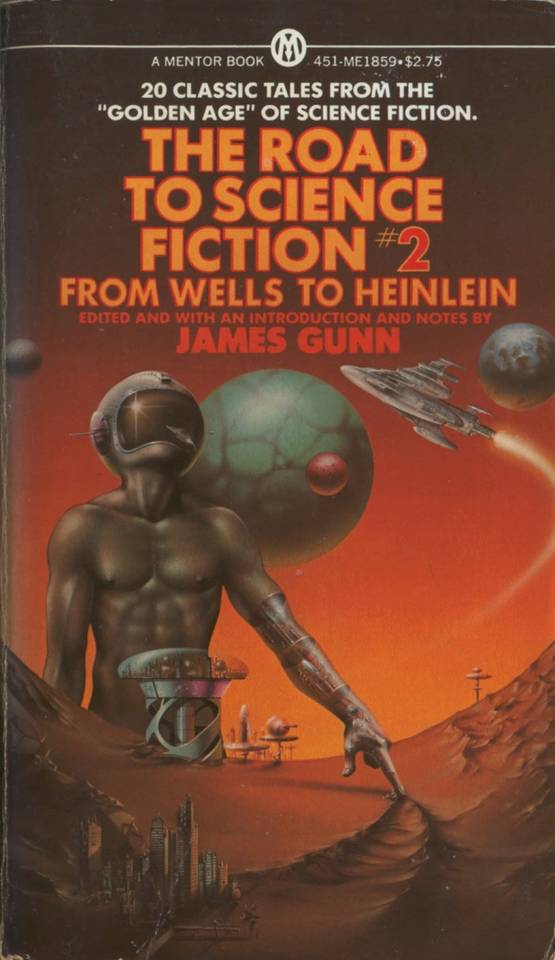

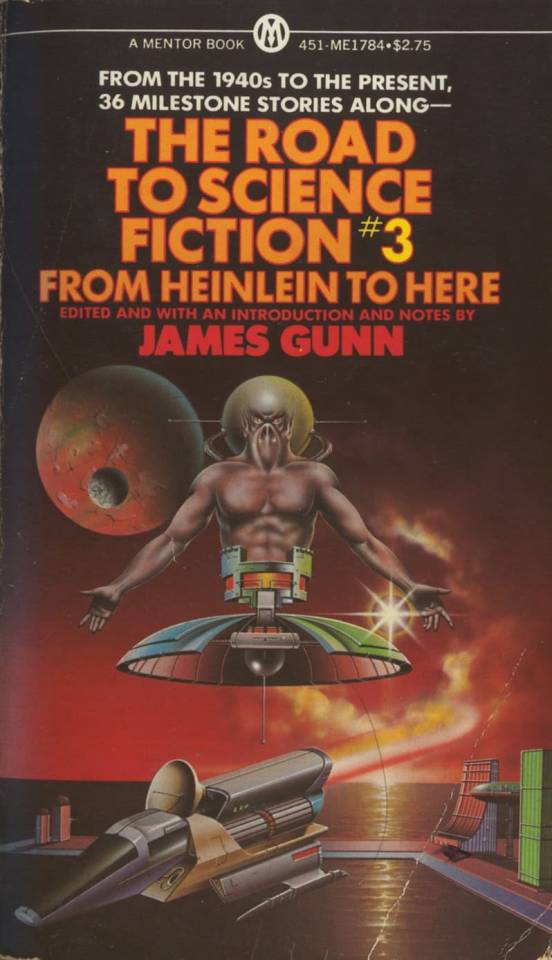

Paul Stinson cover art for: Philip Jose Farmer - Jesus on Mars Barbara Paul - Pillars Of Salt

The Road To Science Fiction #2 & #3 - From Wells to Heinlein Edited with an introduction and notes by James Gunn

#philip jose farmer#jesus on mars#sci fi books#sci fi book covers#sci fi book illustrations#barbara paul#pillars of salt#h g wells#robert heinlein#james gun

14 notes

·

View notes

Text

Movie Poster Prompt for a short story!

#my art#illustration#class art#food#cuisine de mémoires#nk jemisin#movie poster#book cover#people#forks#fork#spoon#spoons#knife#knives#salt#pepper#salt and pepper#bread#loaf#wine#alcohol#plate#plates

4 notes

·

View notes

Text

Read The Salt Grows Heavy by Cassandra Khaw if you love mermaids, plague doctors, surgeons, fairy tales, retellings, mistellings, monsters, body horror, cults, motherhood, viscera, tenderness, revenge, snow, the horrors of existence, palimpsests & flesh.

#The Salt Grows Heavy#Cassandra Khaw#book#books#book review#book reviewer#book reviews#book reccomendation#book recommendations#book rec#bookreccs#readersoftumblr#readers on tumblr#read this if#readmore#bookish#bibliophile#book cover#book covers#mermaid#mermaids#plague doctor

2 notes

·

View notes

Text

i finished the silence of the lambs and who the fuck is will graham. i just keep re reading the last paragraph i’m gonna puke

#personal#and oh oh oh oh#so i have a first edition of red dragon from etsy for like. 13 bucks. killed that#and my partners got me the first edition of silence of the lambs for christmas and ohhh this is so cool#i love the weird font size at every chapter i like how big it feels#i love the cover i love the title so much more after reading#i love clarice and ardelia i loved how fucking werid hannibal was#just a weird fucking dude#and my friend and i have been having the MOST interesting conversation during this#cause she’s been getting into video’s dissecting the trans misogyny in the movie#and i’m comparing how it is in the books it’s been cool#especially bc a ton of the gender stuff explicitly saying gumb wasn’t transsexual#and the length the text went to emphasize how usually trans people were like more likely to have violence committed onto them vs into other#vs onto others#etc etc and then i just feel like how in the mr gumb chapters the way it’s explicitly clear that at every level he doesn’t view women as#people and clarice points this out as just another form of misogyny#i mean i have seen the argument of like you think youre trans you’re trans/ im taking ways of identifying ur gender in the 80s with a grain#of salt/ gumb showing eurphoria changing appearance#but i don’t know and maybe this is bc i read the first half last year#and the second half like in the last week or so#but i feel like the text was pretty heavy on emphasizing transsexuals as not violent with the character at john hopkins#FIGHTING to keep them out of the press with gumb and blocking off the fbi#that whole thing where lecter was either lying about the name or the theory and then the name being the lie#and some other in the text evidence but also some of the points im thinking of from the gumb chapters#could definitely be argued angle wise of just being like scary trans women uses other women for their own attempt of beauty while not#understanding what a real women is#i mean either way of intentions WHAT; a bad fucking impact even to today#also insane i finished like the last 80 pages at work and i got interrupted at the LAST two pages#also my heart was fucking pounding during the confrontation im not even kidding 😭

3 notes

·

View notes

Photo

COVER REVEAL

SALT KISS (Lyonesse Trilogy 1) by Sierra Simone

Release Date: September 12, 2023

Amazon paper: https://amzn.to/3N5UAmt

From TikTok sensation Sierra Simone comes the first in the Lyonesse series, a spin-off of her bestselling New Camelot books.

Tristan Thomas is lost. After leaving the army, the young former soldier is in limbo. Until, that is, he's hired by Mark Trevena, the owner of Lyonesse—DC's ultra-secret club—to be Mark's new bodyguard. He's drawn into Mark's dark, seductive world of power and desire, and slowly drawn to Mark himself, even though Mark is everything Tristan knows he shouldn't want: cruel and wicked and shamelessly amoral.

But protecting Mark isn't Tristan's only duty: soon, Mark asks him to guard his soon-to-be bride as she travels home from Ireland on Mark's yacht. Tristan is jealous—and hurt to learn that the object of his obsession is engaged—but the former soldier in him is made to obey orders, and he goes to fetch Mark's bride for him.

Isolde Laurence is nothing like Tristan expected, however. Young, quiet, and sharp, she's being pushed into this marriage by her family, and as the two travel back to America, Tristan finds himself fascinated with Isolde and the glimpses he gets of the lonely but determined woman behind her reserve. And the fascination is mutual: one night, while sailing under the cold stars, they share a searing kiss. From there, it's a fast fall into the forbidden for all three of them.

2 notes

·

View notes

Text

TOP TEN TUESDAY – JULY 2ND

Top Ten Tuesday is a weekly meme hosted by Jana @ That Artsy Reader Girl, every week features a different book related theme to take part in.. and this week’s is.. 10 books with my favourite colour on the cover! Settling on a single colour is actually rather difficult. My favourite specific colour since childhood is teal but I am admittedly partial to khaki green, maroon red and a deep purple.…

View On WordPress

#a curse of salt#adult fantasy#aesthetic#aesthetic book#blog#blue#book blogger#book meme#book review#bookish#books#cover lover#even the darkest stars#fantasy#fiction#good reads#house of pounding hearts#meme#one dark window#pretty cover#reading meme#rebel of the sands#review#royal bastards#silver in the bone#sorcery of thorns#the girl who fell beneath the sea#the wicked king#top 10#top 10 books

0 notes

Text

my brain is combusting did y'all know that Carol is based on the book"The Price of Salt" ????

Like THIS the price of salt

I like never connected this iconic cover to like THE lesbian movie

#carol#the price of salt#mylife#like the pride center that i've started going to has a book club thing and they are reading this book this month and like i was like#omg iconic!!!#and then I found out that it like actually is like Iconic Iconic and not just in a silly meme kind of way#pride#like this is definitely a i'm dumb thing but i never realized the connection#in my defense i've never seen carol either LMAO#my only knowledge of the price of salt was the cover and that it was an older work about lesbians so that also contributes

1 note

·

View note

Text

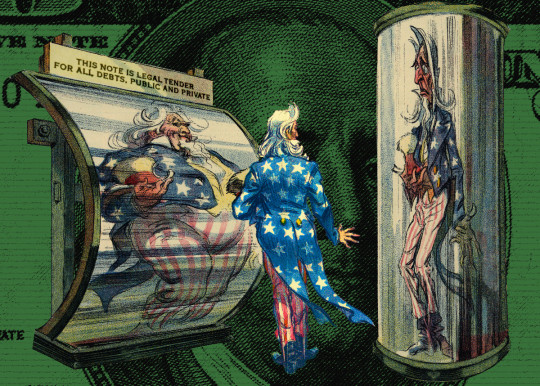

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Photo

Above the Salt: A Novel

By Katherine Vaz.

1 note

·

View note