#best etf for long term in US

Explore tagged Tumblr posts

Text

Top 5 Best ETFs to Buy in 2023 for Your Investment Portfolio

Top 5 Best ETFs to Buy in 2023 for Your Investment Portfolio Best ETFs to Buy in 2023 (Invest in These ETFs in 2023) In this post, we will be discussing the Top 5 Best ETFs to Buy in 2023 (Exchange Traded Funds) that you can consider for your investment portfolio. Now, let’s dive into the topic at hand. ETFs, also known as exchange-traded funds, are a type of investment that allows you to own a…

View On WordPress

#5 Best ETFS To Buy For 2023#best etf for long term in US#best etf to invest in 2023 USA#best etfs for 2023#best etfs to buy and hold#Best etfs to buy in 2023 for long term#Best etfs to buy in 2023 for short term#Best etfs to buy in 2023 in US#Best etfs to buy in 2023 vanguard#Best ETFs to Invest in USA#ETFs for 2023#What is the most successful ETF?#Which ETF gives best returns?#Which ETF has the highest 10 year return?

0 notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

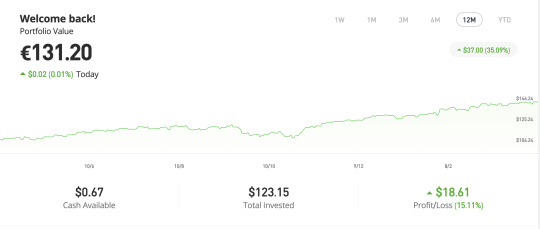

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

59 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions. 1. Stocks Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader. 2. Bonds Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns. 3. Forex (Foreign Exchange Market) The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader. 4. Commodities Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors. 5. Mutual Funds Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach. 6. ETFs (Exchange-Traded Funds) ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities. 7. Options Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks. Conclusion Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Video

How to Select the Gold Fund

Gold funds are fund of funds scheme that invest in gold exchange traded funds. Their hidden scheme invests in gold ETFs and depend on investments straightforwardly connected to gold costs. Putting resources into an asset without click here purchasing it in its physical form is useful. As the fundamental asset is held as physical gold, its worth is straightforwardly dependent on the cost of gold.

Gold shared funds are unconditional investments; the units offered depend on the units offered by the gold Exchange Traded Fund.

In India, the basic role of gold funds is to diversification of portfolio and assist in reducing with marketing risk.

To select the best gold funds, an investor ought to consider the accompanying:

Taxability:

Investments in gold common funds for over 3 years are viewed as long-term. The LTCG on gold is charged at a 20% rate with indexation benefit (plus overcharge, if any, and cess), while momentary capital increases (STCG) are charged at the proper the section rate relevant to the investor.

Adaptable investment sum: In India, Gold funds offer greater convenience than physical gold as it permits investors to purchase any sum according to their necessity. An investor can invest either through a singular amount sum or through a Taste according to her/his convenience. Consequently, consider your investment goals before making the investment.

Comparison with comparative funds: To invest in the best gold fund, an investor ought to look at the profits that the gold shared fund has offered as compared to physical gold.

Additionally, one ought to compare the typical returns and cost proportions of other gold common funds because the low cost proportion will get you more significant yields. Survey the consistency of fund execution to select a gold fund in 2021.

Liquidity: Gold ETFs in India appreciate high liquidity and can be effortlessly traded in the stock exchange at the overarching cost.

Diversify investment portfolio: Starting around 2021, Gold shared funds in India are a wise investment choice to diversify one's investment portfolio and reduce generally speaking market risk.

14 notes

·

View notes

Text

A Beginner's Guide to the Stock Market: Demystifying the Basics

Introduction:

Welcome to the exciting world of the stock market! Investing in stocks can be a rewarding venture, but for beginners, it can also be overwhelming. This blog post aims to provide you with a solid foundation and demystify the basics of the stock market, so you can embark on your investment journey with confidence.

What is the Stock Market?

The stock market is a platform where individuals and institutions buy and sell shares of publicly traded companies. It serves as a marketplace for investors to trade stocks and other securities.

Understanding Stocks:

Stocks represent ownership in a company. When you purchase shares of a company's stock, you become a partial owner of that company and may have the right to vote on certain matters and receive dividends.

Types of Stocks:

There are different types of stocks, including common stocks and preferred stocks. Common stocks offer voting rights and the potential for capital appreciation, while preferred stocks provide fixed dividends but limited voting rights.

Setting Investment Goals:

Before diving into the stock market, it's crucial to establish your investment goals. Determine your risk tolerance, time horizon, and financial objectives. This will help shape your investment strategy.

Conducting Research:

Thorough research is essential before investing in stocks. Analyze company financials, industry trends, and market conditions. Utilize fundamental analysis to assess a company's performance and technical analysis to study price patterns.

Diversification:

Diversification is a key principle to mitigate risk. Spread your investments across various sectors, industries, and even geographic locations. This helps reduce the impact of individual stock volatility on your overall portfolio.

Investment Vehicles:

There are different ways to invest in stocks, such as individual stock picking, mutual funds, and exchange-traded funds (ETFs). Mutual funds pool money from multiple investors to invest in a diversified portfolio, while ETFs are passively managed funds that track specific indices.

Risk Management:

Understand that investing in the stock market involves risks. Educate yourself on risk management techniques such as setting stop-loss orders, understanding market volatility, and staying informed about your investments.

Long-Term Approach:

Stock market investing is best suited for the long term. Avoid making hasty decisions based on short-term market fluctuations. Adopt a patient approach and focus on the underlying fundamentals of the companies you invest in.

Learn from Mistakes:

Investing is a continuous learning process. Embrace the fact that mistakes may happen, but use them as opportunities to learn and refine your investment strategy. Seek knowledge from experienced investors and financial resources.

Conclusion:

As a beginner in the stock market, remember that education and patience are your allies. By understanding the fundamentals, conducting research, diversifying your portfolio, and managing risks, you can embark on a successful investment journey. Stay disciplined, stay informed, and enjoy the rewards of long-term investing in the dynamic world of the stock market.

#beginners#stock management#stockmarket#passiveseinkommen#income#financial markets and investing#investment#maximum#bitcoin news#bitcoin

3 notes

·

View notes

Text

How to Plan Your Finances for Major Life Events: A Step-by-Step Guide

Life is full of unexpected twists and turns, but some events are certain to happen—like getting married, buying a house, or planning for retirement. These major milestones require careful financial planning to ensure you're prepared for the future. In this guide, we will be discussing how to plan your finances for big life events and how financial planning in India can help you achieve your goals. We will also talk about the need to take professional advice from the best financial advisor in India.

Why Financial Planning is Important for Big Life Events

Wedding and home buying to having children- big life events come with large costs and long-term financial consequences. These may be costly in more ways than one without a plan in place. One must prepare with a strategy that makes sense with one's goals, but also allows for flexibility to account for unexpected situations.

How to Plan Your Finances for Major Life Events

Planning for major life events involves thoughtful budgeting, setting realistic goals, and making smart investments. For this reason, here are some of the main steps to get started:

1. Set Clear Financial Goals

Outline your particular objectives before you go into the specifics of your financial plan. For example, if you're getting married, outline how much within what range you're comfortable spending. If you're looking to buy a house, figure out the down payment, options for loans, and your monthly costs. This will give you a clear view so you can track how well you are doing or focus on getting there.

2. Create an Emergency Fund

Emergencies are inevitable during any life transition. Be it a new job, city migration, or bills from medical bills, an emergency fund can take you through financially without jeopardizing your financial security. The guideline is to put aside at least 3-6 months worth of living expense.

3. Debt and Loan Planning

Big life events often come with an increase in debt, such as a mortgage for a new home or student loans for further education. Be proactive in managing and repaying debt to avoid financial burden. Make a plan to pay off high-interest debts as soon as possible and try to avoid taking on new debt unless necessary.

4. Invest for the Future

Investing is a long-term strategy that can help you build wealth for retirement, education, or other big life events. Explore different investment options, such as mutual funds, stocks, and real estate, based on your risk tolerance and financial goals. The earlier you start, the better you can use the compounding returns to your advantage.

Financial Planning in India: Customized for Your Future

Financial planning is becoming increasingly popular in India, as people aim to achieve financial independence. However, the Indian financial landscape is unique, with diverse investment options and taxation policies. To make the most of your financial journey, it's essential to understand the best strategies for managing your money.

1. Use Tax-Advantaged Accounts

Invest in various tax-saving instruments that are available such as Public Provident Fund, National Pension Scheme, and tax-saving fixed deposits. This helps in reducing your taxable income, and simultaneously saving for the long-term goals.

2. Invest in a variety of assets.

Whether you are planning a wedding or preparing for retirement, diversification is the way to go. The Indian market has both traditional investment options such as fixed deposits and modern tools such as mutual funds and ETFs. Seek professional advice to balance your portfolio with the view of attaining your financial goals.

3. Be Mindful of Inflation and Currency Risks

Inflation is one of the major factors that eats away purchasing power over time. Plan for inflation by investing in assets that offer higher returns, such as equities or real estate. Currency risks are also a concern for those planning to move abroad. Ensure your financial plan accounts for these potential risks.

How the Best Financial Advisor in India Can Help You

When it comes to major life events, the right professional advice can be just what you need. The complexity of financial planning in India becomes much more navigable when aided by a good financial advisor - whether one seeks tax-saving solutions, investment strategies, or even retirement planning assistance.

1. Expertise and Knowledge

The best financial advisor in India brings with him a lot of knowledge and experience. He can tailor a plan based on your specific needs, guiding you through investment options, tax-saving instruments, and insurance requirements.

2. Holistic Financial Planning

A professional advisor considers your financial situation as a whole and creates a roadmap for you. They will ensure that every aspect of your financial life-from short-term goals to long-term ambitions-is aligned and well managed.

3. Mitigating Financial Risks

Having the right advisor on your side means having tools and strategies that can help mitigate risks associated with market fluctuations, health emergencies, and unexpected events. They also keep you updated with any changes in tax laws or investment opportunities.

Conclusion Financial planning in India is very important in navigating the major life events that shape your future. By setting clear goals, building an emergency fund, managing debt, and investing wisely, you can ensure that you're prepared for any milestone. In India, with the right financial planning tools and professional guidance, you can achieve your dreams and build long-term wealth. Seek the expertise of the best financial advisor in India to help you achieve your financial objectives and secure your financial future.

0 notes

Text

Mutual Funds Unlocked

Investing in mutual funds is like joining a financial carpool — your money teams up with other investors to reach financial destinations faster and more efficiently. Whether you’re a complete beginner or someone looking to diversify your investments, this guide will walk you through everything you need to know about mutual funds in a simple and engaging way.

What Is a Mutual Fund?

A mutual fund is a professionally managed investment that pools money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. Think of it as a basket where each fruit represents a different stock or bond. Instead of buying individual stocks, you get a mix, reducing risks while enjoying potential returns.

Why Choose Mutual Funds?

Diversification — You don’t put all your eggs in one basket! Your money is spread across multiple assets, reducing risks.

Professional Management — Experts manage your funds, so you don’t need to analyze every stock.

Liquidity — You can redeem your investments anytime (except for some lock-in funds).

Convenience — Invest with as little as ₹500 per month through SIPs (Systematic Investment Plans).

Types of Mutual Funds

Understanding different types of mutual funds helps you pick the right one for your goals:

1. Equity Mutual Funds (For Growth)

Invests in company stocks.

Best for long-term wealth creation.

High risk, high return potential.

2. Debt Mutual Funds (For Stability)

Invests in government and corporate bonds.

Lower risk compared to equities.

Suitable for conservative investors.

3. Hybrid Mutual Funds (For Balance)

A mix of equity and debt.

Medium risk, balanced growth.

4. Index Funds & ETFs (For Passive Investors)

Mirrors stock indices like NIFTY 50 or SENSEX.

Low-cost investment option.

5. Tax-Saving Funds (ELSS)

Equity Linked Savings Scheme (ELSS) provides tax benefits under Section 80C.

3-year lock-in period, high return potential.

How to Invest in Mutual Funds?

Investing in mutual funds is easy and hassle-free. Follow these simple steps:

Step 1: Define Your Goal

Are you investing for retirement, a dream home, or short-term gains? Your goal determines the type of mutual fund to choose.

Step 2: Choose a Mutual Fund

Compare funds based on past performance, expense ratio, and risk level.

Step 3: Select SIP or Lump Sum

SIP (Systematic Investment Plan): Invest small amounts monthly.

Lump Sum: Invest a large amount at once.

Step 4: Start Investing Online

Use apps like Groww, Zerodha, or Paytm Money to invest directly.

Step 5: Monitor & Stay Invested

Markets fluctuate, but patience is key. Long-term investments yield the best results.

0 notes

Text

Understanding Market Segments: Exploring the Growth Potential of Small Cap and Broad Market Indices

Investors often look at market segments to identify growth opportunities and diversify their portfolios. Among these, small-cap stocks represent companies with relatively smaller market capitalisations, often associated with high growth potential. These stocks, tracked by indices such as the BSE Small Cap Index, are known for their ability to deliver significant returns, although they can be more volatile compared to their large-cap counterparts. At the same time, broad market indices, which aggregate the performance of large-cap and blue-chip companies, provide a comprehensive view of the overall market trend.

The small-cap segment is appealing because it includes emerging companies that are in their growth phase. These companies often operate in niche markets or develop innovative products and services, offering significant upside for investors. Meanwhile, broad market indices, such as Nifty, represent the largest and most stable companies. These indices are widely considered reliable indicators of economic health, as they capture the performance of key sectors driving the economy. Investors often use them as benchmarks for market performance and as a foundation for their investment strategies.

Growth Potential in Small Cap Stocks

Small-cap stocks are typically characterised by higher risk and higher reward. These companies may not yet have established a strong market presence but show great promise due to their innovative business models or focus on underdeveloped markets. For instance, sectors like technology, green energy, and specialised manufacturing often have a significant share of small-cap companies that could potentially outperform the market.

The potential for high returns comes with challenges. Small-cap stocks are more sensitive to market conditions, economic changes, and company-specific risks. Therefore, investors need to adopt a long-term approach and carefully evaluate the financial health, leadership quality, and growth potential of these companies.

The Role of Broad Market Indices

Stock market direction is best understood using broad market indices. These indices reflect market sentiment by tracking leading companies across sectors. Mutual funds, ETFs, and individual investment portfolios are benchmarked against indices like Nifty, making them crucial.

Conservative investors prefer broad market indices because they are less volatile than small-cap indices. Companies with proven track records, solid fundamentals, and loyal customers are included. These features make them a safer investment, especially for long-term returns.

Striking the Right Balance

Maintaining a balanced portfolio with small-cap stocks and broad market index funds maximises returns. Broad market indices offer stability and long-term reliability, while small caps offer growth. Investors can adapt to economic growth, policy changes, and global trends by monitoring these segments.

Investors can navigate market segments by understanding small-cap stock and broad market indice dynamics. This Small Cap Index shows emerging company growth, while Nifty shows established player strength. These segments give a complete market view and enable informed investment decisions.

0 notes

Text

Wealth Management Tips for Entrepreneurs in Rapid City

Wealth Management Tips for Entrepreneurs in Rapid City

Entrepreneurs in Rapid City face unique financial challenges and opportunities. Running a business while managing personal finances can be complex, but partnering with an experienced accounting consulting firm in Rapid City can make a significant difference. Strategic wealth management, guided by professionals, helps you grow and protect your assets for long-term success. By following proven financial strategies and working with experts, such as a CPA financial advisor or an accounting consulting firm in Rapid City, you can navigate these challenges effectively. Here are some wealth management tips tailored specifically for entrepreneurs.

1. Separate Business and Personal Finances

One of the most critical steps for entrepreneurs is keeping personal and business finances separate. Open a dedicated business bank account and use it exclusively for business transactions. This not only simplifies bookkeeping but also protects personal assets from business liabilities.

By separating these finances, you can better track business performance and avoid confusion when preparing taxes. Consulting with a CPA financial advisor in Rapid City can ensure your accounts are structured to optimize tax benefits and compliance.

2. Create a Financial Plan

A comprehensive financial plan is essential for managing both personal and business wealth. This plan should include:

Short-term goals, such as managing cash flow and reducing debt.

Long-term goals, like retirement savings and business succession planning.

Wealth management advisors can help you outline these objectives and create actionable steps to achieve them. A solid financial plan serves as a roadmap, guiding your decisions and ensuring financial stability.

3. Prioritize Tax Efficiency

Taxes can be a significant expense for entrepreneurs, making tax efficiency a key component of wealth management. Consider strategies such as:

Leveraging deductions for business expenses.

Structuring your business as an LLC, S-Corp, or C-Corp to optimize tax liabilities.

Taking advantage of retirement accounts like a SEP IRA or Solo 401(k).

Working with a CPA financial advisor in Rapid City can help you identify tax-saving opportunities and ensure compliance with state and federal regulations.

4. Diversify Investments

Entrepreneurs often have a large portion of their wealth tied up in their businesses. While this demonstrates confidence in your venture, it’s important to diversify your investments to mitigate risk. Consider allocating funds to:

Stocks and bonds

Real estate

Mutual funds or ETFs

Wealth management advisors can guide you in building a diversified portfolio that aligns with your financial goals and risk tolerance.

5. Build an Emergency Fund

Uncertainty is a constant in the entrepreneurial journey. Having an emergency fund can provide a financial safety net during challenging times. Aim to save at least three to six months’ worth of personal and business expenses. This cushion allows you to weather unexpected setbacks without jeopardizing your financial stability.

6. Plan for Retirement

Retirement planning often takes a backseat for entrepreneurs focused on growing their businesses. However, failing to plan for retirement can lead to financial strain in the future. Options such as SEP IRAs, Solo 401(k)s, and Roth IRAs are tailored for self-employed individuals.

Engaging wealth management advisors can help you choose the best retirement plan for your needs and ensure consistent contributions.

7. Protect Your Assets

Protecting your assets is essential for long-term wealth management. Consider the following:

Insurance: Invest in comprehensive coverage for your business, health, and personal assets.

Estate Planning: Develop a will, set up trusts, and designate beneficiaries to secure your legacy.

Liability Protection: If your business structure doesn’t offer personal liability protection, consider restructuring.

Collaborating with professionals, such as a CPA financial advisor in Rapid City, ensures you’re adequately protected.

8. Leverage Professional Guidance

Managing wealth can be overwhelming, especially when balancing the demands of entrepreneurship. Partnering with experienced wealth management advisors can provide invaluable insights and strategies. These professionals can help you:

Create tailored financial plans.

Optimize investment strategies.

Navigate tax complexities.

A local CPA financial advisor in Rapid City understands the unique financial landscape of the area and can offer personalized advice.

9. Monitor and Adjust Your Plan

Wealth management is not a one-time task but an ongoing process. Regularly review your financial plan to ensure it aligns with your goals and current circumstances. Market conditions, tax laws, and personal situations can change, requiring adjustments to your strategy.

Set up periodic meetings with wealth management advisors to assess your progress and make necessary updates.

10. Invest in Your Knowledge

As an entrepreneur, staying informed about financial trends and strategies is crucial. Attend seminars, read books, and engage with local business networks in Rapid City to expand your knowledge. The more you understand about wealth management, the better equipped you’ll be to make informed decisions.

Conclusion

Wealth management is a vital aspect of entrepreneurial success, enabling you to secure your financial future while growing your business. By separating finances, creating a plan, prioritizing tax efficiency, and seeking professional guidance from wealth management advisors, you can navigate the complexities of entrepreneurship with confidence. Whether it’s planning for retirement, protecting your assets, or diversifying investments, taking a proactive approach ensures long-term financial stability.

If you’re looking for expert advice, a CPA financial advisor in Rapid City can provide the tailored support you need. Don’t wait to start building a solid financial foundation—the time to act is now.

0 notes

Text

Durable and Reliable PFA Cables Solutions

PFA cables have superior performance capabilities in severe environmental conditions. PFA-Perfluoroalkoxy-based cables exhibit a higher degree of thermal and chemical resistance; hence they are extensively in use for high reliability. Tanya Enterprises specialize in offering quality PFA cables suitable to various industrial needs.

Some of the key features of PFA cables

PFA cables are highly resistant and operate in extreme temperatures ranging from -200°C to 260°C. They also resist severe chemicals, which ensures safety and performance in tough conditions. These cables provide excellent insulation, making them suitable for electrical, industrial, and automotive applications. Furthermore, PFA cables are lightweight, flexible, and have long-lasting performance.

Applications of PFA Cables

Due to their excellent characteristics, PFA cables find applications in aerospace, electronic, chemical processing, and medical equipment industries. They are particularly suitable for high-temperature operations, corrosive conditions, and applications where very precise and stable performance is required.

Why Choose Tanya Enterprises for PFA Cables?

At Tanya Enterprises, we understand how important reliable and high-quality products are. Our PFA cables are made from the best materials for strength and quality performance. Whatever your conditions or needs might be in terms of cable requirements, we are experienced enough to provide solutions.

Trust Tanya Enterprises for Your Cable Needs

There exists a name you can call for PFA cables by the name of Tanya Enterprises. Our commitment toward quality and customer satisfaction along with a great deal of experience from the industry ensures that we deliver the best products to you. Contact us now and seek information about our PFA cable, which will further uplift your projects.

Let's choose Tanya Enterprises for reliable PFA cable, designed to work with any condition!

Visit: -https://www.insulatedwires.com/assignment/9/fep-wires-manufacturers-etfe-wires-pfa-wires-insulated-wires-and-cables-manufacturer-supplier Address: Factory 46-Vedvyaspuri Industrial Area, Sector-8 Meerut Pin-250103, INDIA

0 notes

Text

The Best Strategies for Early Retirement

Imagine achieving financial freedom by 45, traveling the world, or pursuing your passions without worrying about money. With over 60% of millennials expressing interest in early retirement, the dream is more achievable than ever.

Thesis Statement: Early retirement involves meticulous financial planning, disciplined savings, and strategic lifestyle adjustments. This guide explores the best strategies to help you retire early and live the life you’ve always envisioned.

Financial Foundations

A. Savings and Investment

High-Yield Savings Accounts: Build an emergency fund with a high-yield savings account to ensure financial security and cover unexpected expenses.

Investing in the Stock Market: Leverage long-term growth opportunities through index funds, ETFs, and diversified portfolios. Consistent contributions and compound interest are your allies.

Retirement Accounts: Maximize contributions to tax-advantaged accounts like 401(k)s, Traditional IRAs, and Roth IRAs. Take full advantage of employer matching programs.

Real Estate Investing: Explore rental properties for passive income, REITs for diversified real estate exposure, or flipping houses for higher returns.Tip: Seeking guidance from a financial advisor in Kolkata can help you navigate these investment options effectively and tailor them to your retirement goals.

B. Budgeting and Expense Reduction

Creating a Detailed Budget: Use tools like apps or spreadsheets to track income and expenses, identifying areas for savings.

Reducing Unnecessary Expenses: Cut back on discretionary spending, such as dining out, streaming subscriptions, and impulse purchases.

Negotiating Lower Bills: Contact service providers to negotiate lower rates on insurance, utilities, and internet plans.

Downsizing or Simplifying Lifestyle: Move to a smaller home, reduce car ownership, or adopt minimalism to significantly lower living costs.

Career Strategies

A. Increasing Earning Potential

Negotiating Higher Salaries: Research industry standards and confidently negotiate raises during performance reviews.

Seeking Promotions and Career Advancement: Acquire new skills, take on leadership roles, and pursue certifications to climb the corporate ladder.

Starting a Side Hustle or Business: Generate additional income streams by freelancing, consulting, or starting a small business aligned with your expertise.

B. Career Flexibility

Remote Work: Reduce commuting costs and increase work-life balance by transitioning to remote roles.

Part-Time Employment: Gradually reduce work hours while maintaining income through part-time roles.

Consulting or Freelancing: Transition into a flexible career path with potentially higher pay and autonomy.

Lifestyle Considerations

A. Healthcare

Exploring Healthcare Options: Understand options like COBRA, Medicare, or health insurance marketplaces to ensure coverage post-retirement.

Maintaining a Healthy Lifestyle: Reduce long-term healthcare costs by prioritizing physical fitness, mental well-being, and preventive care.

B. Debt Management

Creating a Debt Repayment Plan: Focus on high-interest debt first, using strategies like the snowball or avalanche method.

Consolidating Debt: Simplify repayments with balance transfers or consolidation loans, potentially lowering interest rates.

C. Estate Planning

Creating a Will: Ensure your assets are distributed according to your wishes, avoiding legal complications for your heirs.

Establishing a Trust: Protect assets and minimize estate taxes by setting up a trust tailored to your financial situation.

Conclusion

Early retirement requires dedication, strategic planning, and a willingness to make sacrifices today for a better tomorrow. By building a strong financial foundation, maximizing career opportunities, and adopting a sustainable lifestyle, you can achieve financial independence and retire on your terms.

Call to Action: Start planning for your early retirement today. Whether it’s creating a budget, attending financial workshops, or exploring investment options, every step counts. Remember, consulting with a financial advisor in Kolkata can provide personalized strategies to help you achieve your early retirement goals. Your dream of early retirement is within reach—take the first step now!

1 note

·

View note

Text

Financial Advice for British Expats: Investments in Singapore

Singapore’s position as a vibrant financial hub with diverse investment opportunities makes it a favored destination for British expats seeking financial growth. Here’s a concise guide to navigating Singapore’s investment landscape effectively.

Key Takeaways

• Diverse Investment Opportunities:

Explore real estate, stocks, ETFs, and insurance-linked investments for stability and growth in Singapore.

• Currency and Tax Planning:

Diversify currency holdings to hedge against potential exchange rate risks. Use Singapore's tax-favorable regime while maintaining UK tax compliance.

• Retirement Savings Optimisation

Transfer UK pensions to a QROPS to optimise retirement planning from a tax perspective.

• Financial Advisors are Indispensable

Work with accredited advisors who understand international investments, Singapore tax policies, and UK financial systems.

1. Understanding Singapore's Investment Landscape

Singapore's stable economy and tax-friendly policies make it a perfect place for expat investors. Some of the most popular investment options are:

•Real Estate: Invest in high-value properties or Real Estate Investment Trusts (REITs) to enjoy rental income and potential capital growth.

•Stocks and ETFs: The Singapore Exchange (SGX) offers robust platforms for regional and global investments. ETFs are a low-cost, diversified choice for beginners.

•Insurance-Linked Investments: Tying together insurance protection with investment returns for long-term financial security.

2. Financial Planning Fundamentals for British Expats

You can have your investments in tune with your goals with smart financial planning. These include:

•Currency Diversification: Protect yourself from fluctuations of GBP to SGD by having a diversified portfolio.

•Retirement Savings: Transferring your UK pension to a Qualifying Recognised Overseas Pension Scheme (QROPS) is a good option to have it tax efficient in Singapore.

•Emergency Funds: Keep liquid savings equivalent to 3–6 months of living expenses readily available.

3. Working with a Financial Advisor

A right investment for expats in Singapore will be pivotal to tailored advice. Your best bet is an advisor having expertise in:

•International investments.

•Singapore's taxation of expats.

•Familiarity with the UK financial systems so that integration with your assets will come in handy.

4. Issues for New Expatriates

Knowing the local rules and the taxation policies will enable you to optimize the benefits:

•Tax Planning: Singapore does not tax capital gains and dividends, but a taxpayer must comply with taxes in the UK so no double taxation occurs.

•Regulations: A couple of investment options, for instance property purchase, is restrained to foreigners.

5. Balance Goals and Lifestyle

Ensure that financial growth happens without sacrificing your current lifestyle through diversification between low-risk and high-yield investments. Balanced portfolios ensure both stability and profitability.

Conclusion

A British expat navigating Singapore's financial landscape must understand the local markets, utilize tax benefits, and work with trusted advisors. With proper planning, expats can ensure a healthy and balanced financial future.

Start your journey today by consulting a financial advice for British expats and creating a strategy tailored to your needs!

1 note

·

View note

Text

Gold Rate Adyar

https://www.thejasgold.com/blog-post/gold-rate-adyar/

Explore Gold Rate in Adyar - Your Ultimate Investment Guide!

Looking to buy or invest in gold in Adyar? 💰 Stay updated on the current gold rates and discover trusted jewelers like Khazana, Joyalukkas, and GRT for the best deals. Whether it's for personal use or investment, gold is a secure asset.

Smart Buying Tips ✔️ Always check the latest gold rates ✔️ Verify purity with BIS certification ✔️ Compare prices and making charges ✔️ Choose reputable sellers

Invest in Gold with Confidence Gold remains a stable investment option. You can invest in physical gold, gold ETFs, or Sovereign Gold Bonds for long-term security. Stay ahead in your investment journey!

#GoldRateAdyar #GoldInvestment #GoldBuyingTips #AdyarGold #ChennaiJewelers #InvestmentSmart #FinancialSecurity #GoldForYou

0 notes

Text

Master CAD/CHF Delta Hedging: Ninja Tactics to Maximize Profit The Secret to Mastering CAD/CHF Delta Hedging: Ninja Tactics for Maximum Profits There you are, sipping your morning coffee, gazing at CAD/CHF charts, trying to decipher the financial equivalent of a jigsaw puzzle—except someone tossed a couple of the pieces under the couch. The good news? You're about to find those missing pieces. CAD/CHF delta hedging might sound intimidating, but once you get the hang of it, you’ll feel like you've got a crystal ball that whispers "calm down, I've got your back." Welcome to an inside look at strategies that will help you make the best out of the CAD/CHF pair—delta hedging like a pro. But here’s where the real magic happens—this isn't just any run-of-the-mill Forex guide. Today, we’re diving deep into ninja-level techniques that professional traders are using to hedge their CAD/CHF positions while keeping things funny, light, and downright profitable. Get ready to discover the hidden patterns, lesser-known secrets, and the “I can’t believe it’s not mainstream” approaches that will make you a hedging wizard. Oh, and expect some trading puns—because learning should make you smile, too. Why Delta Hedging CAD/CHF Could Save You from Major Headaches (and Sleepless Nights) If you think Forex trading is like crossing a busy street while juggling flaming torches, delta hedging is your fireproof safety net. In layman’s terms, delta hedging is a strategy that aims to protect your CAD/CHF investments against adverse market movements. It's like buying a weatherproof jacket before embarking on a hike—when the weather changes, you’re covered. Unlike using stop losses that might kick you out of a trade prematurely, delta hedging provides a method to keep risk in check while keeping you in the game. Let’s imagine you took a CAD/CHF long position. Suddenly, some unforeseeable economic event comes knocking—let’s say the Bank of Canada decides it’s time for a surprise interest rate cut (a real mood killer). Your long position starts dropping, but if you were delta hedging properly, you’d have taken a calculated short on another instrument to offset some of that risk. It's like buying ice cream after a breakup—not a full fix, but it takes the sting off. How to Delta Hedge Your CAD/CHF Position and Look Like You’ve Got a PhD in Forex Let’s face it—delta hedging can be about as fun as reading terms and conditions. But no worries, I’m about to make it easy for you. Here’s a step-by-step guide that will get you started: - Determine Your Position Delta: First things first, figure out the delta of your CAD/CHF position. The delta measures how much your portfolio value changes with a 1% move in CAD/CHF. If you have a delta of 1, it means you are fully exposed to the CAD/CHF movement—good or bad. - Calculate the Hedge Amount: Next, you want to neutralize that exposure by finding a counterbalance, just like weighing two people to balance a see-saw—except one person might be CAD, the other CHF. Calculate how much of a short position you’ll need on a correlated asset, for example, a CAD-related ETF or another currency pair like CAD/JPY, to bring your delta closer to zero. - Execute the Hedge: You can hedge by using options, futures, or simply shorting another instrument—whatever suits your trading preferences. Here’s the key: Delta-neutral means the effects of CAD/CHF movements are minimized. You can sleep easy knowing that the 3 AM rate announcement probably won't give you an ulcer. - Maintain the Hedge: Delta isn’t static, and neither are market conditions. If CAD/CHF starts dancing around like it's had too much caffeine, you'll need to adjust. This process is called “rebalancing”—yes, it’s work, but it beats the alternative of nursing a losing position without recourse. Underground Trends That Make Delta Hedging Worth Your Time Here’s the deal—delta hedging isn’t for the lazy trader, but it’s increasingly necessary in today’s volatile market conditions. Here are some secret sauces you probably haven’t heard of: - Utilizing Options for Dynamic Hedging: When most people think of delta hedging, they forget about options. A lot of traders shy away from options because they’re like the vegetables of trading—good for you but not always fun. Buying a CAD put option is a neat little ninja trick that can save your profits in case of major downturns without incurring ongoing capital commitments. - Reverse Engineering Correlations: The CAD is correlated with oil prices, which means when oil prices tank, your CAD/CHF positions might do the same. You can delta hedge effectively by shorting oil futures, indirectly covering your exposure to the CAD—this sort of cross-asset hedging is like playing 4D chess while the rest play checkers. It's complex, sure, but wildly effective when done right. - Algorithmic Delta Adjustments: Here's a tip most retail traders miss: use automated scripts to keep your delta within range. Trust me, it’s better than manually recalculating every two minutes, especially if you’re serious about retaining your sanity. There are trading platforms where you can input parameters for delta adjustment and let your computer do the work—think of it like a trading Roomba that quietly tidies up your risk. Common Pitfalls When Delta Hedging CAD/CHF (And How You Can Totally Dodge Them) - Over-Hedging Is a Thing: You might think, "If some hedging is good, more is better." Wrong! Over-hedging is like overwatering a plant—it’ll kill you with kindness. Keep it balanced. - Ignoring Transaction Costs: Every time you hedge, you’re entering into a new position, and that means transaction fees. If you’re trading a small account, those costs add up and can eat into any potential profit. Think of transaction costs as the hidden “admin fee” that turns good hedges into bad headaches. - Getting Emotional: Forex can make you feel like a hero or a zero depending on which way the market blows. With delta hedging, keep emotions in check. Remember, it’s all about balancing exposure, not making big directional bets. You want your risk to be boring—like a low-budget Sunday afternoon movie. The Contrarian Approach: Delta Hedging When Everyone’s Yelling, 'The Sky Is Falling!' When market panic sets in, everyone else runs in one direction—that’s when contrarians quietly clean up. If CAD/CHF is on a rollercoaster, delta hedging enables you to be the one sipping a mojito while others are getting margin-called. Panic is an opportunity if you’re hedged right. The trick is to diversify the assets you're using for delta adjustments. For example, instead of simply shorting CAD/CHF to hedge, add a gold contract to counterbalance CAD risk during crisis times. How to Keep Your CAD/CHF Trading Ninja-Level Sharp Remember, delta hedging isn't a one-time trick—it’s an ongoing strategy, much like sharpening a katana. You can’t expect to hedge once and ride off into the sunset. Markets change, deltas change, and if you don’t adjust, you may find yourself hedging the past rather than the present. Monitor your trades, keep tweaking those hedge ratios, and, more importantly, keep learning. Speaking of keeping sharp, want an edge? Check out the exclusive resources offered at StarseedFX—from community membership that gives daily alerts and live trading insights to a free trading plan designed to up your game. Because let’s be honest—every ninja needs a dojo. Don’t Just Survive, Thrive with CAD/CHF Delta Hedging Delta hedging is one of those things that separates a “Hey, I’m learning Forex!” trader from the battle-hardened “You should’ve seen me in 2019 when the markets lost their minds” pros. It’s not just about staying alive in a volatile market; it's about becoming untouchable. It’s knowing that regardless of which way CAD/CHF moves, you’re good. It's like being in a war where everyone has a bow and arrow, but you have a bulletproof vest. You don’t need to dodge—you’re just chillin’. So, are you ready to step up your game? Are you ready to go from “heart-in-your-mouth” trades to cool, calculated, delta-hedged brilliance? Then put on that risk-neutral hat, hedge like a ninja, and go show the market who’s boss. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Warren Buffetts Best Investment Advice For Building Wealth Over Time Achieve Financial Freedom

https://www.youtube.com/watch?v=4W5MnAm9198 Warren Buffett’s Advice for Stress-Free Investing and Building Wealth #investing Learn Warren Buffett’s top tips for long-term investing and achieving financial freedom with a stress-free approach. In this video, Buffett shares the key moments that shaped his journey, his value investing strategies, and why long-term thinking is essential for building wealth. From the stock market strategies that helped him navigate downturns, including the anticipated stock market crash 2024, to identifying stocks to buy now, this video is a must-watch for anyone interested in financial education. Discover insights into Buffett's investment philosophy that has stood the test of time, and learn how concepts like intrinsic value, dividend investing, and the teachings of Benjamin Graham and Charlie Munger can empower your investment decisions. Whether you're considering stocks like Apple or Nvidia or looking into ETFs and the S&P 500, Warren Buffett's wisdom can guide you in making informed choices. Join us as we explore the principles of investing that can lead to financial freedom and stability, especially during recessions. With motivation and practical advice, this video will inspire you to take charge of your financial future and navigate the complexities of the share market with confidence. Take advantage of this opportunity to learn from one of the greatest investors of all time! Timestamps: 00:00:00 Transition from Stock Picking to Business Ownership 00:01:08 Understanding Stock Investment Mindset 00:02:19 Investing in American Business: A Lifetime Commitment 00:03:28 Why I Prefer Buying Stocks When Markets Are Down 00:04:35 Wealth Increase in America 00:05:48 Technological Progress and the American Dream 00:07:05 Future Predictions in 1789: Imagining Modern Society 00:08:13 The Evolution of Capitalism and Government Collaboration 00:09:19 Historical Resilience and Progress Perfect for beginners and experienced investors alike, these insights reveal why patience pays off. Don’t forget to subscribe for more investing tips, and share your thoughts on Buffett’s approach in the comments! This video is about Warren Buffett’s Best Investment Advice For Building Wealth Over Time – Achieve Financial Freedom. But It also covers the following topics: Warren Buffett’s Financial Freedom Tips Building Wealth With Stocks Investment Advice For Beginners 🔔 Want to master your finances and live worry-free? Subscribe for proven tips, expert advice, and powerful tools to build wealth and invest smartly! https://www.youtube.com/@FinancialDignity/?sub_confirmation=1 🔗 Stay Connected With Us. 👉 Facebook: https://ift.tt/hwpr9PG 👉 Instagram: https://ift.tt/wKP2rGh 📩 For Business Inquiries: [email protected] ============================= 🎬 WATCH OUR OTHER VIDEOS: 👉 Why Investing Early Is Key To Beating Inflation – Protect Your Money Now! | Money Management https://youtu.be/U3akPi9tYq0 👉 No More Financial Anxiety – Say Goodbye To Money Stress And Worry | Financial Freedom https://youtu.be/xQM7aqsZtG4 👉 Can AI Help You Build Wealth? The Role Of AI In Financial Freedom https://youtu.be/6sA37l612sk ============================= #investing #warrenbuffett #financialfreedom #stockmarket #wealthbuilding #valueinvesting via Contrarian Perspectives https://www.youtube.com/channel/UC8j1vtxBoUVRmJ-G2at4-bA November 13, 2024 at 02:00AM

0 notes