#Best etfs to buy in 2023 in US

Explore tagged Tumblr posts

Text

Top 5 Best ETFs to Buy in 2023 for Your Investment Portfolio

Top 5 Best ETFs to Buy in 2023 for Your Investment Portfolio Best ETFs to Buy in 2023 (Invest in These ETFs in 2023) In this post, we will be discussing the Top 5 Best ETFs to Buy in 2023 (Exchange Traded Funds) that you can consider for your investment portfolio. Now, let’s dive into the topic at hand. ETFs, also known as exchange-traded funds, are a type of investment that allows you to own a…

View On WordPress

#5 Best ETFS To Buy For 2023#best etf for long term in US#best etf to invest in 2023 USA#best etfs for 2023#best etfs to buy and hold#Best etfs to buy in 2023 for long term#Best etfs to buy in 2023 for short term#Best etfs to buy in 2023 in US#Best etfs to buy in 2023 vanguard#Best ETFs to Invest in USA#ETFs for 2023#What is the most successful ETF?#Which ETF gives best returns?#Which ETF has the highest 10 year return?

0 notes

Text

Best Crypto to Buy in 2024

Best Crypto to Buy in 2024

2024 seems to be a good time to invest in cryptocurrency. The global economy is expected to remain unstable, which means investors should diversify their portfolios. But what is the best crypto to buy in 2024? In this article, we’ll turn your attention to noteworthy crypto assets that have the potential to become more expensive in the foreseeable future. Plus, we’ll share our traders’ insights and inform our readers about the handy ECOS instruments that you might want to rely on as an investor.

Bitcoin

For 15 years of its existence, Bitcoin BTC remains the most obvious investment choice. It boasts a huge audience and record-breaking market adoption. It introduced blockchain technology and the proof of work consensus concept that other crypto projects later adopted. In 2023, its price significantly recovered after a lengthy decline – and it’s projected to noticeably increase after April 2024 when the halving will take place. Another important point is that recently, the SEC approved Bitcoin ETF transactions, which paves the way for multi-billion investments in cryptocurrency markets.

Ethereum

A large ecosystem of dApps is thriving on the Ethereum blockchain. These include marketplaces for non-fungible tokens, publishing platforms, lending services and many more. Users can benefit from smart contracts and release their own tokens that will circulate within the whole blockchain. In 2024, the Dencun upgrade is planned for Ethereum ETH. The advantages that it will bring include upgraded staking, an advanced concept of sharding, decreased gas costs for complex transfers and the potential for price growth. The reasons for buying ETH sound solid enough, don’t they?

Solana

The price of the SOL token plummeted in 2022 but is quickly recovering and people are actively trading it – so why don’t you join them? This coin has showcased good potential for overcoming crises. Investors love it for its powerful technological advantage. It managed to solve the problem that most of its competitors failed to cope with – to couple extremely cheap transactions with the outstanding speed of their execution. This blockchain enables users to build smart contracts, which is another important brick in the foundation of its positive perspectives.

Binance Coin BNB

It’s the native token of one of the major crypto exchanges. Its holders can enjoy various benefits on this trading platform, such as paying cheaper fees. Plus, it enables developers to launch dApps in the BNB blockchain. One of the optimal variants of using this token is through the Launchpad and Launchpool programs at Binance. Their conditions and offers can change rapidly, so we’ll draw just one example here. If you stake BNB in Launchpool, it will let you earn the assets from the new blockchain projects that this pool helps to launch. Compared to other coins, BNB is likely to deliver a better yield in this case. You’ll be allowed to unstake it whenever you wish, which means your risks will be low. In the near future, Binance can announce some more exciting projects – and this news will drive up the price of its asset.

Celestia

This one was conceived to build new blockchains, using a modular approach. This method simplifies the development process, enhances collaboration, allows parallel consensus across networks and supports sovereign rollups. It becomes easier to prove data availability and detect fraud. You may consider purchasing the Celestia’s TIA token because of its decent staking yield, planned airdrops and the exciting technological concept that will keep attracting numerous developers.

Arbitrum

This blockchain was built on the layer of the ETH network, which grants exceptional security to it. Compared to its predecessor, Arbitrum offers faster and more affordable transfers. Networks that run on its blockchain have the opportunity to release custom gas tokens. Some projects that were initially launched on the ETH infrastructure moved to this advanced alternative – such as SushiSwap or Aave. The amount of total value locked in Arbitrum is among the highest in the whole DeFi segment. This project distributes grants among developers who built apps of various types, be it social media, NFT or games. Summing up all these facts, we can state that the ARB token seems to be a promising investment.

Uniswap

It’s a decentralized trading platform whose own token, which is used for governance, is called UNI. This cryptocurrency exchange gained prominence thanks to pioneering the automated market-making concept. It lists new coins earlier than its centralized counterparts, which expands its audience and ensures a steadily large trading volume. Many entities in the industry rely on Uniswap services, so it’s deeply integrated into the sector. The platform has proved its ability to process enormous amounts of money in spite of chaos in the market. Soon, it hopes to deliver a non-custodial wallet for smartphones. The project is rapidly evolving and might open great perspectives for its token holders.

Mina Protocol

Mina became famous for being a remarkably lightweight blockchain. It’s perfectly compatible with smartphones, even if they’re not too powerful. The dApps built on this platform were dubbed zkApps because they’re developed on the zero-knowledge principle. It means an individual can confirm that the data belongs to them without revealing any meaningful details about themselves to third parties. Experts predict that this principle will generate a high demand in the industry, that is why it would be wise to invest in the Mina token right now.

Cosmos

This project was launched to facilitate interoperability between different blockchains. If you stake its native token ATOM, you’ll be able to participate in governance, earn your fractions of the transaction fees and reap staking rewards. Apart from the appeal of its initial concept and the gained popularity, this project has one more advantage. Its community is voting to decrease the ATOM inflation rate – and one of the possible options is reducing it to zero. The results of this decision can make the project more appealing for investors from multiple viewpoints – for instance, they won’t have to pay more than the minimum necessary limit for blockchain security.

XRP

Its vital merits are quick and affordable transfers as well as a custom consensus protocol. XRP is an element of the On-Demand Liquidity product that enables exchanges to carry out cross-border transactions. People’s interest in this coin has been recently backed up by several meaningful events. For instance, the SEC used to have claims to the top executives of this cryptocurrency – but they’re not relevant anymore. The Dubai International Financial Centre approved this coin to use. The team behind XRP helps Georgia to launch the digital analog of its national currency. If renowned organizations and governments support a coin, investors should keep an eye on it.

Litecoin

It’s a BTC-based asset that has been around nearly just as long as its prototype. Compared to BTC, LTC features faster data transfers. SEC seems to have nothing against this asset and hasn’t mentioned it recently when talking about suspicious cryptocurrencies. The next halving is scheduled for August 2024, after which LTC is forecasted to become more expensive. If you manage to buy it earlier, you can expect to make a nice income on it.

Shiba Inu

It’s the second-largest meme coin by market capitalization. It operates on the ERC-20 standard and has been around for approximately four years. Its popularity is unlikely to decline soon because its team has very serious intentions. They want to acquire the .shib top-level domain to use it for websites, emails and personalized usernames. This domain will ensure cross-compatibility of various services, which was previously unprecedented for the industry. It can take the team up to 5 years to get the approval for .shib and even more time to put their ambitious plans into practice – so consider it as a mid-term investment.

Cardano

This blockchain was launched as an alternative to the existing ones, with an emphasis on efficiency, sustainability, scalability and interoperability. To put it simply, its founders strive to make it more user-friendly, high-performing and environmentally safe than its competitors. Cardano ADA is traded not as actively as many other cryptocurrencies from our list but its market capitalization is high. It makes sense to invest in it because its team specializes in profound research instead of craving immediate profits.

Our Traders’ Opinion

Above, we listed some of the most in-demand coins on the crypto market. However, selected lesser-known digital assets showcased excellent performance in 2023. For instance, BONK grew by +4850%, INJ by +2780% and TRB by +1450%.

Our experts continuously monitor the market for timely signals. They constantly create indexes for our clients to reveal coins with the highest probability of earning money and the highest possible risk. Throughout the last year and especially since midsummer, our indexes have become very popular among our audience. For example, XmasFortune, Fast Move and Yesterday Low are our favorites among the indexes. Of the coins that made up the indexes, our audience particularly appreciated SOL, SUI, ARB, SEI, LTC, TIA, WLD, LINK and DOT. Our team is already working on several new products for investors and will be ready to offer them to you soon.

0 notes

Text

So when interest rates go up, the tax shield increases for corporations. The value of the increase depends on the corporations tax rate. The higher the tax bracket, the more valuable the tax shield for the corporation. But this reduces the cost of interest rate increases.

Now the second thing they can do is one of these twelve ways to hedge interest rates. They can use a combination of these hedges as well......

According to Vinovest, short-duration stocks are a good way to hedge against rising interest rates. Other ways to hedge interest rates include:

Treasury Inflation-Protected Securities (TIPS): US Treasury bonds that increase in value when interest rates rise

Exchange-Traded Funds (ETFs): Can help offset the effects of lower or higher interest rates

Interest rate swaps: An agreement between two parties to exchange interest payments

Interest rate futures: Contracts that allow buyers and sellers to lock in rates on an interest-bearing asset

Real estate: Real estate prices tend to rise with interest rates

Short-term and floating-rate bonds: Can reduce portfolio volatility

Inflation-proof investments: Can help hedge against rising rates

Credit-based yields: Can help hedge against rising rates

Commodities: Can help hedge against rising rates

REITs: Real estate investment trusts that own and manage real estate, and are known for paying out substantial dividends

Investopedia

How to Invest for Rising Interest Rates

investopedia.com

What Is an Interest Rate Future? Definition and How to Calculate

Interest rate futures are contracts that allow buyers and sellers to lock in rates on an interest-bearing asset like a government bond or interbank lending rate.

Vinovest

12 Effective Ways to Hedge Against Interest Rates in 2024 ...

Visit the Vinovest website to know more! ... Invest in Short Duration Stocks. Investing in short-duration stocks is a brilliant way to hedge against rising rates. ... Buy Hedged Bond Funds. Some assets from the fixed income market also make it easy for you to hedge against rising rates. ... Buy TIPS. Treasury Inflation-Protected Securities (TIPS) are US Treasury bonds that rise in value during an interest rate hike. ... Buy ETFs. Exchange-Traded Funds (ETFs) can also help investors offset the effects of a lower or higher interest rate. ... Use an Interest Rate Cap. ... Use Forward Rate Agreements. ... Buy or Sell Interest Rate Futures. ... Use an Interest Rate Swap.

bankrate.com

8 Ways To Beat Low Savings Account Interest Rates

Apr 5, 2024 — Real estate investment trusts, or REITs, are a kind of company that owns and manages real estate, and they are well-known for paying out substantial dividends. Many REIT stocks trade on a stock exchange like a publicly traded company. The risk: Potential loss of principal. Like any stock, a REIT ...

linkedin.com

Hedging Your Interest Cost at the Time of Borrowing

Sep 4, 2023 — Interest Rate Swaps: Interest rate swaps involve an agreement between two parties to exchange interest payments. This can be especially beneficial for businesses with unique financing needs. For instance, a company with a variable-rate loan can enter into a swap arrangement to ...

Other hedging strategies include options and forward rate agreements (FRAs).

This is for informational purposes only. For financial advice, consult a professional.

How Do I Hedge Against Interest Rates? (12 Best Options to Explore)

Invest in Collectibles Such as Fine Wine. ...

Invest in Short Duration Stocks. ...

Buy Hedged Bond Funds. ...

Buy TIPS. ...

Buy ETFs. ...

Explore Embedded Options. ...

Use an Interest Rate Cap. ...

Use Interest Rate Floors.

More items...

https://www.vinovest.co › blog › h...

12 Effective Ways to Hedge Against Interest Rates in 2024 ...

Now learning how to blend different forms of hedges.

Investopedia

https://www.investopedia.com › ask

How Do Traders Combine a Short Put With Other Positions to Hedge?

A trader can use put options in a number of different ways, depending on the positions he is hedging and the options strategies he is using to

I'm watching Bloomberg as I put this together.

1 note

·

View note

Text

Best Crypto to Buy in 2024

Best Crypto to Buy in 2024

2024 seems to be a good time to invest in cryptocurrency. The global economy is expected to remain unstable, which means investors should diversify their portfolios. But what is the best crypto to buy in 2024? In this article, we’ll turn your attention to noteworthy crypto assets that have the potential to become more expensive in the foreseeable future. Plus, we’ll share our traders’ insights and inform our readers about the handy ECOS instruments that you might want to rely on as an investor.

Bitcoin

For 15 years of its existence, Bitcoin BTC remains the most obvious investment choice. It boasts a huge audience and record-breaking market adoption. It introduced blockchain technology and the proof of work consensus concept that other crypto projects later adopted. In 2023, its price significantly recovered after a lengthy decline – and it’s projected to noticeably increase after April 2024 when the halving will take place. Another important point is that recently, the SEC approved Bitcoin ETF transactions, which paves the way for multi-billion investments in cryptocurrency markets.

Ethereum

A large ecosystem of dApps is thriving on the Ethereum blockchain. These include marketplaces for non-fungible tokens, publishing platforms, lending services and many more. Users can benefit from smart contracts and release their own tokens that will circulate within the whole blockchain. In 2024, the Dencun upgrade is planned for Ethereum ETH. The advantages that it will bring include upgraded staking, an advanced concept of sharding, decreased gas costs for complex transfers and the potential for price growth. The reasons for buying ETH sound solid enough, don’t they?

Solana

The price of the SOL token plummeted in 2022 but is quickly recovering and people are actively trading it – so why don’t you join them? This coin has showcased good potential for overcoming crises. Investors love it for its powerful technological advantage. It managed to solve the problem that most of its competitors failed to cope with – to couple extremely cheap transactions with the outstanding speed of their execution. This blockchain enables users to build smart contracts, which is another important brick in the foundation of its positive perspectives.

Binance Coin BNB

It’s the native token of one of the major crypto exchanges. Its holders can enjoy various benefits on this trading platform, such as paying cheaper fees. Plus, it enables developers to launch dApps in the BNB blockchain. One of the optimal variants of using this token is through the Launchpad and Launchpool programs at Binance. Their conditions and offers can change rapidly, so we’ll draw just one example here. If you stake BNB in Launchpool, it will let you earn the assets from the new blockchain projects that this pool helps to launch. Compared to other coins, BNB is likely to deliver a better yield in this case. You’ll be allowed to unstake it whenever you wish, which means your risks will be low. In the near future, Binance can announce some more exciting projects – and this news will drive up the price of its asset.

Celestia

This one was conceived to build new blockchains, using a modular approach. This method simplifies the development process, enhances collaboration, allows parallel consensus across networks and supports sovereign rollups. It becomes easier to prove data availability and detect fraud. You may consider purchasing the Celestia’s TIA token because of its decent staking yield, planned airdrops and the exciting technological concept that will keep attracting numerous developers.

Arbitrum

This blockchain was built on the layer of the ETH network, which grants exceptional security to it. Compared to its predecessor, Arbitrum offers faster and more affordable transfers. Networks that run on its blockchain have the opportunity to release custom gas tokens. Some projects that were initially launched on the ETH infrastructure moved to this advanced alternative – such as SushiSwap or Aave. The amount of total value locked in Arbitrum is among the highest in the whole DeFi segment. This project distributes grants among developers who built apps of various types, be it social media, NFT or games. Summing up all these facts, we can state that the ARB token seems to be a promising investment.

Uniswap

It’s a decentralized trading platform whose own token, which is used for governance, is called UNI. This cryptocurrency exchange gained prominence thanks to pioneering the automated market-making concept. It lists new coins earlier than its centralized counterparts, which expands its audience and ensures a steadily large trading volume. Many entities in the industry rely on Uniswap services, so it’s deeply integrated into the sector. The platform has proved its ability to process enormous amounts of money in spite of chaos in the market. Soon, it hopes to deliver a non-custodial wallet for smartphones. The project is rapidly evolving and might open great perspectives for its token holders.

Mina Protocol

Mina became famous for being a remarkably lightweight blockchain. It’s perfectly compatible with smartphones, even if they’re not too powerful. The dApps built on this platform were dubbed zkApps because they’re developed on the zero-knowledge principle. It means an individual can confirm that the data belongs to them without revealing any meaningful details about themselves to third parties. Experts predict that this principle will generate a high demand in the industry, that is why it would be wise to invest in the Mina token right now.

Cosmos

This project was launched to facilitate interoperability between different blockchains. If you stake its native token ATOM, you’ll be able to participate in governance, earn your fractions of the transaction fees and reap staking rewards. Apart from the appeal of its initial concept and the gained popularity, this project has one more advantage. Its community is voting to decrease the ATOM inflation rate – and one of the possible options is reducing it to zero. The results of this decision can make the project more appealing for investors from multiple viewpoints – for instance, they won’t have to pay more than the minimum necessary limit for blockchain security.

XRP

Its vital merits are quick and affordable transfers as well as a custom consensus protocol. XRP is an element of the On-Demand Liquidity product that enables exchanges to carry out cross-border transactions. People’s interest in this coin has been recently backed up by several meaningful events. For instance, the SEC used to have claims to the top executives of this cryptocurrency – but they’re not relevant anymore. The Dubai International Financial Centre approved this coin to use. The team behind XRP helps Georgia to launch the digital analog of its national currency. If renowned organizations and governments support a coin, investors should keep an eye on it.

Litecoin

It’s a BTC-based asset that has been around nearly just as long as its prototype. Compared to BTC, LTC features faster data transfers. SEC seems to have nothing against this asset and hasn’t mentioned it recently when talking about suspicious cryptocurrencies. The next halving is scheduled for August 2024, after which LTC is forecasted to become more expensive. If you manage to buy it earlier, you can expect to make a nice income on it.

Shiba Inu

It’s the second-largest meme coin by market capitalization. It operates on the ERC-20 standard and has been around for approximately four years. Its popularity is unlikely to decline soon because its team has very serious intentions. They want to acquire the .shib top-level domain to use it for websites, emails and personalized usernames. This domain will ensure cross-compatibility of various services, which was previously unprecedented for the industry. It can take the team up to 5 years to get the approval for .shib and even more time to put their ambitious plans into practice – so consider it as a mid-term investment.

Cardano

This blockchain was launched as an alternative to the existing ones, with an emphasis on efficiency, sustainability, scalability and interoperability. To put it simply, its founders strive to make it more user-friendly, high-performing and environmentally safe than its competitors. Cardano ADA is traded not as actively as many other cryptocurrencies from our list but its market capitalization is high. It makes sense to invest in it because its team specializes in profound research instead of craving immediate profits.

Our Traders’ Opinion

Above, we listed some of the most in-demand coins on the crypto market. However, selected lesser-known digital assets showcased excellent performance in 2023. For instance, BONK grew by +4850%, INJ by +2780% and TRB by +1450%.

Our experts continuously monitor the market for timely signals. They constantly create indexes for our clients to reveal coins with the highest probability of earning money and the highest possible risk. Throughout the last year and especially since midsummer, our indexes have become very popular among our audience. For example, XmasFortune, Fast Move and Yesterday Low are our favorites among the indexes. Of the coins that made up the indexes, our audience particularly appreciated SOL, SUI, ARB, SEI, LTC, TIA, WLD, LINK and DOT. Our team is already working on several new products for investors and will be ready to offer them to you soon.

0 notes

Text

2023年9月に1セント未満で今すぐ購入すべき安価な仮想通貨ベスト5(The 5 Best Cheap Crypto to Purchase Now for Less Than One Cent in September 2023)

2023.11.12

2023年9月に1セント未満で今すぐ購入すべき安価な仮想通貨ベスト5(The 5 Best Cheap Crypto to Purchase Now for Less Than One Cent in September 2023)

テーマ:英語のお勉強日記(7700)

カテゴリ:仮想通貨

----Blo-katsu AD----

----Blo-katsu AD----

Shogun Saski ショウグン サスケ

Sep 6, 2023 2023年9月6日

There is a universe of promise beyond Bitcoin (BTC), despite the fact that it frequently steals the cryptocurrency spotlight. (You can also read about the upcoming altcoins to erupt in our most recent roundup of the top altcoins to buy in.) 暗号通貨のスポットライトを頻繁に盗むという事実にもかかわらず、ビットコイン (BTC) を超えて有望な宇宙があります。 (また、今後のアルトコインについては、購入すべき上位のアルトコインの最新のまとめで読むことができます。

The cryptocurrency market as a whole is currently going through a consolidation phase, largely due to Bitcoin, which has been failing to surpass the $30,000 barrier. 暗号通貨市場全体は現在、主に30,000ドルの壁を超えることができなかったビットコインのために、統合段階を迎えています。

It’s crucial to remember that the market has experienced brief gains, notably in response to good news regarding an exchange-traded fund (ETF) for spot Bitcoin. Nevertheless, experts concur that the sector may experience a recovery in the upcoming months despite the general market slowdown. 市場は、特にスポットのビットコインの上場投資信託 (ETF)に関する良いニュースに対応して、短期間の上昇を経験したことを覚えておくことが重要です。それにもかかわらず、専門家は、市場全般の減速にもかかわらず、このセクターが今後数か月で回復する可能性があることに同意しています。

A report from Yahoo Finance claims that the use of cryptocurrencies has significantly increased in Turkey. The ratio of cryptocurrency users in the nation has increased from 40% to 52% during the previous 18 months. Yahoo Finance のレポートによると、トルコでは暗号通貨の使用が大幅に増加しています。国内の暗号通貨ユーザーの比率は、過去18か月間で40%から52%に増加しました。

While you’re here, Join our Telegram Channel where you can find FREE reliable crypto signals! あなたがここにいる間に、あなたが無料で信頼できる暗号シグナルを見つけることができる私たちのテレグラムチャンネルに参加してください!

5 Best Cheap Cryptocurrencies to Buy Now for Less Than One Cent in September 2023 2023年9月に1セント未満で今購入すべき安価な暗号通貨ベスト5

Given this, a number of cryptocurrencies are available that are reasonably priced, giving investors a chance to benefit when the market turns around. Here are five cryptocurrencies that you should think about including in your portfolio the following week that are all under $0.10. このため、手ごろな価格の暗号通貨が多数用意されており、市場が好転したときに投資家に利益を得る機会を与えています。ここでは、次週にはポートフォリオに含めることを検討すべき、すべて0.10ドル未満の5つの暗号通貨は下記の通りです。

VeChain (VET) ヴィーチェーン(VET)

According to the latest market report, VeChain (VET) is currently trading at $0.015, with a $21M 24-hour trading volume. VET’s price has increased little over the last day, by 1.03%, while its performance over the past week indicates a slight fall, by -0.43%. VeChain’s overall market capitalization is $1,136,056,339, and there are 73 billion VET tokens in circulation. 最新の市場レポートによると、VeChain(VET)は現在$0.015で取引されており、24時間の取引量は$21Mです。VETの価格は前日比で1.03%とほとんど上昇していませんが、過去1週間のパフォーマンスは-0.43%とわずかに下落しています。VeChainの全体的な時価総額は1,136,056,339ドルで、730億のVETトークンが流通しています。

VeChain is on a mission to address data difficulties in a number of international businesses, including sustainability, food and beverage, healthcare, energy, and SDGs. It attempts to accomplish this by utilizing distributed governance and Internet of Things (IoT) technologies to build a strong ecosystem for trustless data exchange, which is essential for the real-time data requirements of the fourth industrial revolution. ヴィーチェーンは、持続可能性、食品・飲料、ヘルスケア、エネルギー、SDGなど、多くの国際ビジネスにおけるデータの問題に対処することを使命としています。分散型ガバナンスとモノのインターネット (IoT)技術を活用して、第4次産業革命のリアルタイムデータ要件に不可欠な信用不要なデータ交換のための強力なエコシステムを構築することで、これを達成しようとしています。

Ve Chain ヴィーチェーン

VeChain utilizes the VET and VTHO tokens in order to carry out its objectives. While VTHO is utilized to pay for GAS charges, VET is not required for data transactions because it serves as both a value storage and a mechanism of transferring value. By permitting modifications to variables like the amount of VTHO required for transactions by community votes involving all stakeholders, this solution not only streamlines operations but also maintains consistent network usage prices.

ヴィーチェーンは、その目的を遂行するためにVETおよびVTHOトークンを利用します。VTHOはGAS料金の支払いに利用されますが、VETは価値の保存と価値の移転メカニズムの両方として機能するため、データ取引には必要ありません。このソリューションでは、すべての利害関係者が関与するコミュニティの投票によって、トランザクションに必要なVTHOの量などの変数の変更を許可することで、運用を合理化するだけでなく、一貫したネットワーク使用価格を維持します。 ――――――――――――――――――続く―――――――――――――――――― 下記URLから続きを読むことができます。また、図付きの元のレイアウトで読める原文ファイルも入手可能。今月1か月分のファイルは100円で取り寄せられますが、次の月からは300円に値上げします。

https://note.com/tongansunmi/n/ne454de8d3b11===============================

インターネット・コンピュータランキング ===============================

ネットサービスランキング ==============================

【送料無料】【10/13(金)全国発売】【2023 ホリデーコレクション】エスティ ローダー メークアップ コレクション 2023【 クリスマスコフレ 2023 ホリディコレクション コフレ 】 / ギフト 価格:18,700円(税込、送料無料) (2023/11/1時点)

楽天で購入

【ふるさと納税】コカ・コーラ 爽健美茶 2L×6本【2ケース】 計12本 | コカコーラ 茶 お茶 おちゃ ペットボトル PET 飲料 飲み物 ドリンク 人気 おすすめ 送料無料 2リットル お取り寄せ そうけんびちゃ 和歌山県 海南市 価格:8,000円(税込、送料無料) (2023/11/1時点)

楽天で購入

【総合ランキング1位】アルティム8∞ クレンジング オイル ベストセラーキット / メイク落とし 化粧落とし リムーバー しっとり ダブル洗顔不要 / shu uemura シュウウエムラ 正規品 送料無料 / シュウ 公式 公式ショップ 価格:14,850円(税込、送料別) (2023/11/1時点)

楽天で購入

【11/1限定!!最大100%ポイントバック】福袋おせち 【12,345円】高級おせちを含む48種のおせちのいずれかをお届け【送料無料】2024年 お正月 お節料理 予約 冷蔵おせち 冷蔵 価格:12,345円(税込、送料無料) (2023/11/1時点)

楽天で購入

【楽天ベストコスメ2023 上半期 総合大賞 1位】角質美容集中ケア タカミスキンピール2本セット |角質美容水|30mL|TAKAMI スキンピール 角質 スキンケア 美容液 角質ケア 保湿 黒ずみ 肌荒れ くすみ ザラつき 敏感肌 乾燥肌 毛穴 ニキビケア シミ 保湿 化粧品 【タカミ公式】 価格:11,000円(税込、送料別) (2023/11/1時点)

楽天で購入

数量限定★スキンケアサンプル5点付き!トーンアップUV 3種お試し&スキンケアケアキット / 30mL / ローズ / ホワイト / クリア / 無香料 / 日焼け止め / UVケア / SPF 50+ / 洗顔 / 化粧水 / クリーム / 保湿 / 正規品 価格:3,960円(税込、送料無料) (2023/11/1時点)

楽天で購入

【P10倍】 ルンバ i3+ アイロボット 公式 ロボット掃除機 お掃除ロボット 掃除ロボット 全自動 家電 ゴミ収集 強力吸引 自動充電 機能 搭載 結婚祝い 出産祝い ルンバi3+ 掃除機 コードレス irobot roomba 日本 国内 正規品 メーカー保証 延長保証 送料無料 価格:89,800円(税込、送料無料) (2023/11/1時点)

楽天で購入

0 notes

Text

5 Gold Investment Options to Look Out for This Diwali 2023

Want to buy gold jewellery for Diwali but need help figuring out how to start your investment journey?

Diwali is often associated with buying gold, lights, rangoli, and exotic sweets. This auspicious Hindu festival is celebrated all over the world. Its history is linked to the epic poem of the Ramayana. It is believed that when Lord Rama returned from his exile to Ayodhya, his people lit the kingdom with earthen lamps.

They wanted to dispel the darkness and light up the night to welcome their beloved king. Moreover, it is deeply ingrained in our culture. We celebrate Diwali every year on Amavasya night after Rama Navami.

It celebrates the triumph of good over evil and light over darkness. Diya is marked by the lighting of earthen lamps, festivals, eating sweets, etc.

Importance of gold for celebrating Diwali

You all have heard about Dhanteras. Separating the word, "Dhan" means wealth, and "Teras" means the 13th day of the Hindu lunar calendar.

It is celebrated on the first day of the five-day Diwali cycle. Goddess Lakshmi is believed to come to earth during Diwali and bless everyone.

Due to their devotion to the goddess of wealth and prosperity, people buy gold for themselves and sometimes use it as a gift on Dhanteras.

With Diwali 2023 knocking on the door, it is time to start preparing, and the first step is to get the best gifts for your loved ones.

While chocolates, candies, clothes, and other items are often chosen for gifts, gold dominates everything. They are often bought to show purity and wealth. But with the skyrocketing price of this red precious metal, many people can't afford it, even for a small gold coin, let alone a decent piece of jewelry.

So, it is time to start investing to get enough money to buy gold for this upcoming auspicious season that brings prosperity, happiness, and light to everyone's life.

5 things to keep in mind while investing in gold during Diwali 2023

Diwali, the festival of lights, is a time of celebration and ideal for investments that can brighten your financial future. One of the most popular ways to invest during Diwali is gold.

1. Gold Coins: The Precious Tokens of Prosperity

Gold has been an integral part of Diwali celebrations for generations. Gifting and receiving gold coins symbolizes wealth and financial security. This Diwali, consider investing in gold coins, which come in different weights, including the popular 8-gram gold coins. They are an excellent investment and a favorite gift for your loved ones.

2. Buy Gold Coins Online: Convenience at Your Fingertips

Buying gold coins online has become incredibly easy in today's digital age. You can explore options, compare prices, and shop from your home. When you buy gold online, you can get various options, including polished coins like the Burj Khalifa Gold.

3. Gold Bars: Larger Investments for Bigger Returns

Gold bars are an excellent option for those looking to invest more significantly in gold. These bars come in various sizes, making them suitable for novice and seasoned investors. They are highly liquid, making buying and selling them in the market easy.

4. Gold ETFs: Investing in Paper Gold

Gold exchange-traded funds (ETFs) provide a convenient way to invest in gold without physical assets. These financial instruments track the price of gold and can be traded on exchanges. Gold ETFs offer investors flexibility and the ability to buy and sell gold in small amounts.

5. Gold Mutual Funds: Diversify Your Portfolio

Gold funds invest in a mix of gold-related assets, such as gold ETFs, mining companies, and gold itself. This diversification reduces risk and can provide better returns over the long term. Gold mutual funds are good for investors looking for professionals to manage their gold investments.

Conclusion

As you gear up for Diwali in 2023, consider these five golden investment strategies to indulge in a favorite tradition and secure your financial future. Whether you pick gold coins, buy gold coins online, invest in gold bars, find gold ETFs, or use gold mutual funds, the bottom line is this: you will make informed decisions that align with your financial goals. May the light of your gold reserves light the way to your economic prosperity and security this Diwali. Embrace the tradition of giving gifts and investing in gold to make this celebration memorable. Remember that gold prices can fluctuate, so consult a financial advisor before making an investment decision. Happy Diwali and Happy Investing!

#online gold shopping#gold jewellery store online#gold jewellery store#Gold Traders in Dubai#online jewellery shopping#online#gold shop Dubai#gold bullion#gold rate Dubai#online gold bar purchase in Dubai#gold coin price in Dubai#gold dealers in Dubai#gold jewellery gold souq

0 notes

Text

October Historically A Good Time To Buy

“Buy in October and get your portfolio sober.”

Octoberphobia strikes again but fear not. Our Tactical Seasonal MACD Buy signal has triggered. Market seasonality has turned bullish, and October has historically been a good time to buy. Our bullish outlook for Q4 remains intact. The market’s pullback/correction has most likely run its course, the seasonal low is likely in, and the market is poised to begin a new trend higher. Weakness can be considered an opportunity to accumulate new long positions for the “Best Months.”

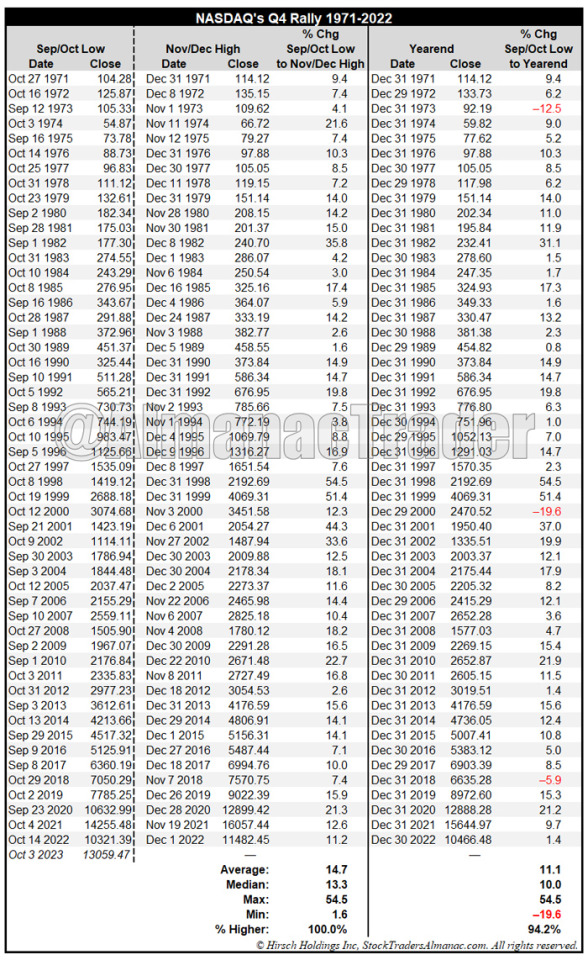

NASDAQ’s Yearend Rally

Since 1971, there has always been a NASDAQ Yearend Rally and its average advance has been 14.7%. We define the Yearend Rally as the gain from NASDAQ’s September or October closing low through its high in November or December. NASDAQ’s best Yearend rally was an amazing 54.5% in 1998. And even when we review NASDAQ’s performance from the same September or October low through the last day of the year, NASDAQ has been nearly as strong, advancing 94.2% of the time with an average gain of 11.1%. And none of the three losses occurred in a pre-election year like 2023!

Sign up today to get all of our Index ETF buys, Sector ETF buys and brand new hand-picked stock basket. Plus, as a Free Bonus you get the 2024 Stock Trader’s Almanac hot-off-the press.

Sign Up Today at StockTradersAlmanac.com!

Two ways to save:

1-Year @ $179 – over 45% Off vs. Quarterly - Use promo code 1YRTWXG24

2-Years @ $299 – BEST DEAL, over 54% Off - Use promo code 2YRTWXG24

Stock Trader’s Almanac Investor Member Benefits:

Annual Stock Trader’s Almanac included FREE each year

Targeted Strategies For Growth And Dividend/Income

Frequent Updates, Analysis, Trading & Investing Ideas

Tactical Switching Strategy & Sector Rotation ETF Portfolios

NEW Best Six Months Stock Basket!

Specific Buy & Sell Price Limits & Stops

Market-At-A-Glance, Monthly Outlook, Monthly Almanac, Monthly Strategy Calendar, Opportune ETF & Stock Picks

Best Six Months Buy and Sell Signals

Stock Portfolio 599.6% Gain Vs. 281.5% for S&P 500!

All of this and more is delivered weekly to your inbox via Email Issue and monthly member webinar!

Subscribe, Renew or Extend Now – this is a limited-time offer.

Some fine print:

Hirsch Holdings offers a pro-rated refund on all cancelled annual subscriptions. Annual subscriptions cancelled within the first three (3) months may have their refund reduced by up to $75 if an annual Stock Trader’s Almanac has been shipped. Quarterly subscriptions are non-refundable. Quarterly subscribers may cancel at any time.

Kind regards,

Jeffrey A. Hirsch CEO, Editor and Publisher

0 notes

Text

Bitcoin has been named the best performer among asset classes in 2023, but the cryptocurrency is still struggling to break new levels in its price. Despite the current bearish sentiment, many analysts have hinted and predicted a bull run in the coming months, especially as the market awaits the approval of a spot Bitcoin ETF. This has probably prompted many investors to hold on to their coins, as on-chain metrics have shown that the amount of Bitcoin supply idling recently reached a new all-time high. Unmoved Bitcoin Supply Reaches Record High The industry expects the SEC’s approval of spot Bitcoin ETFs to ignite the next bullish run for the price of Bitcoin. Although the SEC has so far rejected a number of requests for Bitcoin ETFs, many analysts believe it will not be long until one is accepted. Considering Bitcoin’s dominance of the entire crypto market capitalization, a spike in Bitcoin’s price is expected to flow into all other cryptocurrencies. As a result, investors have been keeping their holdings in expectation of a future price increase. Recent data has shown that 94.8% of the total Bitcoin supply has not moved in the past month, indicating a new all-time high for the metric. JUST IN: 94.8% of the #Bitcoin supply has not moved in the past month, a NEW ALL TIME HIGH 🚀 pic.twitter.com/bNa4MdFbKW — Bitcoin Magazine (@BitcoinMagazine) October 10, 2023 Similarly, a recent post by on-chain intelligence platform Glassnode alerts revealed that the amount of HODLed or lost Bitcoin reached a 5-year high of 7,906,288.227 BTC. 📈 #Bitcoin $BTC Amount of HODLed or Lost Coins just reached a 5-year high of 7,906,288.227 BTC View metric: pic.twitter.com/6OxLnd611f — glassnode alerts (@glassnodealerts) October 6, 2023 The overall Bitcoin net flow into exchanges has decreased by 862.42 BTC ($23.27 million) in the past 24 hours, according to chart insights provided by IntoTheBlock. While this is relatively small compared to Bitcoin’s market cap, it shows investor mood might be changing into a bullish sentiment. Source: IntoTheBlock Time For Reversal? Bitcoin’s price just rebounded up to $27,100 after failing to gain traction above the $27,800 resistance in the midst of escalating Israel-Hamas tensions in the Middle East. Despite this, BTC still remains the best-performing investment asset this year, outperforming stocks and bonds with its year-to-date (YTD) return of 63.3%. Some investors view unmoved Bitcoin as a sign of solid faith in the network and adoption of a long-term mindset. Whatever the reason, Bitcoin’s unmoved supply metric is worth watching as an indicator of holder sentiment and potential future price pressure. Recent happenings, particularly the tension of an oncoming recession in the US, have prompted billionaire hedge fund manager Paul Tudor Jones to assert that this is the best time to buy Bitcoin. BTC still holding above $27,000 | Source: BTCUSD on Tradingview.com

0 notes

Text

11 Best Crypto Exchanges of 2023

Cryptocurrency exchanges have evolved into critical trading platforms for digital currencies such as Bitcoin and Ethereum. They provide a variety of services in addition to buying and selling, such as lending and earning rewards on your investments. There are various types of exchanges to choose from in the expanding crypto world, each with its own set of benefits and drawbacks in terms of security, liquidity, fees, and user-friendliness. To assist you in making an informed decision, let's take a closer look at the top 11 crypto exchanges in 2023.

Cash App

Cash App emerges as the best cryptocurrency exchange in 2023. It's well-known for its user-friendly platform, quick withdrawals, and mobile payment support. However, it is only available in the United States and the United Kingdom. One distinguishing feature is its use of the Bitcoin Lightning Network, which ensures quick and low-cost Bitcoin transfers. Aside from cryptocurrency trading, Cash App allows commission-free stock and ETF investments.

Bisq: The Open-Source Treasure

Bisq is the exchange to use if you value privacy and decentralization. It is an open-source, decentralized platform that allows for anonymous trades without the need for Know Your Customer (KYC) procedures. Bisq is a haven for privacy-conscious users, even if it is not suitable for high-volume trading.

The Social Trading Pioneer, eToro

eToro provides a one-of-a-kind social trading experience in which you can follow and replicate the strategies of experienced traders. While it may have fewer cryptocurrencies than other exchanges, its combination of learning and investing opportunities makes it an appealing option.

Coinbase Is Your Best Friend As A Beginner

Coinbase, which was founded in 2012, is an excellent place to begin for cryptocurrency newcomers. Its user-friendly interface looks like a traditional banking app, making it simple to buy your first digital assets. Coinbase Pro has additional features for advanced users. It's worth noting, however, that Coinbase lacks control over private keys and has been chastised for poor customer service.

Gemini - The Active Trader's Choice

Gemini, a US-based exchange, is well-known for its security and compliance efforts. Its user-friendly interface and wide selection of cryptocurrencies appeal to active traders. Despite its limited payment options, Gemini is a safe bet for those looking for liquidity.

Crypto.com: A Mobile Trader's Paradise

Crypto.com stands out due to its mobile trading app and low fees, making it an excellent choice for mobile traders. The platform supports a wide range of cryptocurrencies, and its integrated auto-trading bots are ideal for those interested in automated trading.

Kraken - The Haven of the Seasoned Trader

Kraken appeals to experienced traders because of its reputation for dependability and advanced trading options. Its low fees, high security standards, and wide range of digital assets make it an excellent choice for those who value security and diversity.

Commission-Free Simplicity at Public.com

Public.com is a great option for beginners because it provides commission-free trading and a focus on financial literacy. Its openness in disclosing potential risks and rewards associated with investing enables users to make informed decisions.

Robinhood is a user-friendly, commission-free investment platform.

Robinhood is well-known for its simple, no-commission trading interface. While it lacks in-depth educational content and does not support mutual funds, it is an excellent choice for those who are just starting out in the world of investing.

TradeStation - Countless Professional Trading Tools

With a plethora of research resources and advanced tools, TradeStation caters to active traders. It provides the resources necessary for making informed decisions, particularly for those who take trading seriously.

KuCoin - Benefits and Rewards Await

KuCoin distinguishes itself by offering low trading fees and a diverse range of cryptocurrencies. It provides features such as earning interest on cryptocurrency holdings as well as margin and futures trading. However, it only supports fiat currencies to a limited extent, and regulatory uncertainty may be a concern.

The Importance of Crypto Trading Courses

Crypto trading courses are essential in the ever-changing world of cryptocurrency trading. As more people become aware of the profit potential in this sector, it becomes increasingly important to learn cryptocurrency trading from reputable sources.

These courses provide traders with crucial skills for navigating the crypto landscape by providing invaluable insights into the market dynamics of top cryptocurrencies. They simplify complex concepts into easy-to-understand lessons, making them accessible to even novices.

However, the significance of these courses goes beyond simply making profitable trades. They place a strong emphasis on cryptocurrency cybersecurity, teaching traders how to protect their digital assets in an environment rife with cyber threats. This information is invaluable in a world where your digital wealth is at stake.

Furthermore, in a regulatory environment that is constantly adapting to new regulations, crypto regulation and compliance training have become essential. Understanding and adhering to legal requirements is not only responsible, but it is also necessary to avoid legal pitfalls that can result in financial losses and legal problems.

Furthermore, these courses can introduce students to the services of a crypto advisor, who can provide expert insights and advice to help them make informed trading decisions. A mentor who has successfully navigated the crypto waters can be a source of information and support.

To summarize, the cryptocurrency landscape is rapidly evolving, and the right exchange can have a significant impact on your crypto journey. The best exchange for you is determined by your needs and level of experience, so make an informed decision. Remember that, while these exchanges are among the best in 2023, the crypto world is full of surprises, so staying informed and adapting to the changing landscape is essential. Remember that investing in your education through crypto trading courses can be a wise decision because it will provide you with the tools and knowledge you need to navigate this exciting and ever-changing space.

Blockchain Council is an authoritative group of subject experts and enthusiasts for those seeking crypto trading courses and certifications. The Blockchain Council is at the forefront of advocating for blockchain research and development, investigating diverse use cases and innovative products, and encouraging knowledge dissemination for a better world. It is a trustworthy platform that provides a wealth of resources to help people stay informed and competitive in the industry. Blockchain Council provides learners with the knowledge and skills needed to successfully navigate this transformative landscape. Blockchain Council is your trusted partner in the journey to mastering crypto trading and blockchain technology, with a commitment to educating both professionals and enthusiasts.

0 notes

Text

Biggest Crypto Gainers Today on DEXTools – TELE, SBONK, XRP

Biggest Crypto Gainers Today on DEXTools – TELE, SBONK, XRP

DEXTools Logo / Source: DEXTools Twitter

Major cryptocurrencies have been in free fall on Friday, with Bitcoin (BTC) last down around 8% in the last 24 hours and Ether (ETH) last down around 5.0% in the $25,700s and $1,650 areas respectively.

That takes losses on the week for Bitcoin and Ether to over 11% and 9% respectively, marking one of the worst weeks so far this year.

The broader crypto market’s total capitalization has dropped around $110 billion this week to only slightly above $1 trillion.

In terms of what’s causing the crash, a combination of factors have been weighing on broad crypto sentiment.

Firstly, macro is a headwind– US long-dated bond yields are back near multi-year highs as traders bet the strong US economy means higher interest rates for longer, while US stocks (correlated to crypto in recent years) have been pulling back.

Thinner than usual August liquidity conditions, which mean the month is often volatile and bearish (in the stock market, at least), have also been cited.

Finally, the fact that Bitcoin and Ether both broke below major support levels, calling their 2023 uptrends into question, has also weighed heavily on sentiment.

News that the SEC is poised to approve a raft of new Ethereum Futures ETFs has failed to lift the mood.

With major cryptocurrencies under pressure, traders looking for a better possibility of near-term gains continue to turn to the shitcoin/meme coin markets.

Here are some of the best-performing low cap coins on Friday.

Tele (TELE)

TELE, the token that powers a web3 protocol that claims to be able to allow its users to send crypto with just their phone numbers.

Last trading around $0.26, Tele is up an incredible more than 24,000% in the last 24 hours and last had a market cap of around $2.5 million, as per DEXTools.

24-hour trading volumes was last around $4.1 million, with TELE having now accumulated over 1,400 holders.

$220,000 worth of liquidity is locked for at least six months, reducing rug pull risk.

Its worth noting, however, that DEXTools’ GoPlus security audit identified 4 alerts regarding the token’s smart contract – a 3% buy and sell tax, plus an anti-whale mechanism and the potential to implement a trading cooldown.

Shib Bonk (SBONK)

A newly launched shitcoin called Shib Bonk (SBONK) is surging higher on Friday.

SBONK just hit all-time highs around $0.0000066, giving it a market cap of around $280,000.

SBONK has seen 24 hour trading volumes of around $590,000 and has nearly $230,000 in liquidity, though this isn’t locked, meaning the chance of a rug pull remains.

DEXTools’ GoPlus security audit has not identified any concerning aspects to the token contract, however, which should ease fears about the token being a scam.

XRP HarryPotterObamaPacMan9Inu (XRP)

A shitcoin called XRP HarryPotterObamaPacMan9Inu (XRP) that was launched a few days ago just hit fresh all-time highs and, as per DEXTools, was last up around 70% in the last 24 hours, making it one of the best performers.

XRP last had an impressive market cap of around $65 million, with over $850,000 in locked liquidity and over 2,600 holders.

The shitcoin has clocked up nearly $4 million in trading volumes in just the last 24 hours.

The DEXTools’ GoPlus security audit highlights two concerning aspects of the token’s contract, an anti-whale mechanism and a possible trading cooldown, as well as a 2% buy and sell tax.

Alternatives to Consider

For crypto investors looking to diversify, an alternative high-risk-high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of up-start crypto projects to help fund their development.

These tokens are nearly always sold very cheap and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

See the 15 Cryptocurrencies

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/biggest-crypto-gainers-today-dextools-tele-sbonk-xrp-htm/

0 notes

Text

How to Invest in Silver

Like gold, silver can provide a safe haven during times of stock market turmoil and a hedge against inflation. The metal also remains a highly sought-after commodity with a long history of use as hard currency and for industrial production. Below, we explore the best ways to invest in silver as well as the benefits and risks to consider. Table of contents The best ways to invest in silver The benefits of investing in silver The drawbacks of investing in silver Is silver a good investment in 2023? Investing in silver FAQs Summary of how to invest in silver The best ways to invest in silver There are many different ways you can add silver to your investment portfolio. But if you decide to invest in this precious metal, make sure to consider your broader financial goals, timeline and risk tolerance. These factors will help you determine the most financially advantageous way for you to invest in silver. If you’re still unsure about whether or not the investment is a good choice for you after studying this guide, talk to a financial advisor. Your best bet is to consult with a fiduciary, who is required to recommend what is in your best interest. Silver bullion Buying silver bullion — that is, silver bars or coins — or collectible minted silver coins is the most straightforward way to buy silver. You may want to buy silver coins and bars to supplement a portfolio of paper assets like stocks and bonds. However, be aware that investing in physical assets creates some unique conditions for investors. How to invest in physical silver Investment-grade silver is at least 99.9% pure. You can buy fine silver bullion from online precious metals brokers — like JM Bullion, where you can buy gold and silver — as well as from storefront dealers, pawn shops, some jewelry stores and specialty retailers. If you want to buy silver bullion coins or bars, acquaint yourself beforehand with the spot price — that is, the current trading value — of silver. While coins are marked-up to reflect their rarity and condition, the price of pure silver bullion is based on the value of the metal itself. Each type of silver purveyor has pros and cons. You can get silver of guaranteed purity from online brokers, but they tend to mark up the silver they sell. Some broker premiums, especially those for limited-edition collectible coins, can be steep, and you have no guarantee of making your money back even if you plan to own silver for a long time. You might be able to save money by purchasing silver in person from a numismatic dealer or jeweler. However, the trade-off could be compromising quality or purity, either of which could hurt you when it comes time to sell your silver. Pros and cons of physical silver Buying silver bullion yourself cuts out the middleman that other investments may have, but there are still associated costs you need to consider: sales tax, dealer markups and the cost of storing and insuring your silver to protect it from loss or theft. You may choose to store it at home or in a bank safe deposit box. Although silver is a highly sought-after commodity in financial and industrial markets, the metal itself might not be as liquid as silver futures or silver exchange-traded funds (ETFs), which are still backed by actual silver but can be quickly and easily sold via a broker or online trading platform. Silver mining stocks If having to store bulky silver bars or coins doesn’t sound appealing, investing in stocks of silver mining companies may be a better fit for your investment style. Companies that mine silver generally do so either as an adjunct to gold mining, or they mine silver along with other industrial commodity metals, like aluminum and copper. Investing in silver companies provides you with the benefits of investing in this precious metal without having to own the physical metal yourself. How to invest in silver stocks Finding silver company stock to buy isn’t quite as straightforward as picking gold company stocks. Companies that mine silver might not exclusively, or even predominantly, focus on that metal. If your goal is to invest in silver, research mining companies’ holdings and operations in order to determine how much of their business is actually in silver as opposed to other metals. Investing in silver stocks is done the same way you would invest in other stocks. You can use an online trading platform or stockbroker. You can also buy stocks in precious metals streaming companies, which are firms that provide financing to the companies that actually perform the mining operations. Pros and cons of silver stocks Owning stock in silver companies gives you exposure to investor demand for this safe-haven asset during times of market volatility, but doesn’t burden you with the expense and hassle of buying and storing physical silver. Silver mining stocks are easy to buy and are more liquid than silver bullion, with transparent pricing and a highly efficient market. Although silver is a sought-after commodity by precious metals investors as well as buyers for industrial and manufacturing usage, tracking down the best silver stocks takes a bit of legwork because most precious metals miners focus on extracting gold. Companies that mine other types of metals and minerals, such as lead and zinc, may also not place as much focus on silver production. Silver ETFs ETFs are buckets of securities, like stocks or commodities, you can trade throughout the day with an ordinary brokerage account. Silver exchange-traded funds hold silver-backed assets. Some ETFs, such as iShares Silver Trust, hold physical silver bullion, while others, such as Global X Silver Miners ETF, hold stocks of silver mining companies. According to ETF.com, there are a total of nine silver ETFs that trade on U.S. markets. How to invest in silver ETFs You can buy and sell silver ETFs with an ordinary brokerage account. These trading platforms and apps have resources available to help you research the composition and performance of an individual silver ETF before making a purchase. Pros and cons of silver ETFs ETFs are a low-cost and popular way to hold positions in multiple companies across an index like the S&P 500 or within an industry sector. There are gold ETFs as well as silver ETFs, in addition to other commodity-focused ones that hold assets backed by products, such as oil or copper. That said, silver ETFs are narrowly focused investments. While they can be part of a well-diversified portfolio, most financial advisors recommend keeping precious metals investments between 5% and 10% of your total nest egg to avoid over-concentration that can heighten your risk. Because of their specialized nature, silver ETFs have higher expense ratios, which is the cost of managing the fund. The average silver ETF expense ratio is 0.73%, compared to just 0.16% for the average broad-based equity ETF, according to ETF.com. Silver ETFs backed with actual pure silver can also be subject to less favorable tax treatment because they’re classified as commodities rather than paper assets, like stocks or bonds. This categorization means they can be taxed at a higher maximum capital gains tax threshold. Silver futures Another way to invest in silver is with silver futures. These financial instruments are contracts in which the buyer agrees to purchase silver at a predetermined price on a specific date at some point in the future. While silver futures are convenient because they can be easily traded with an ordinary brokerage account, they’re not recommended for beginners. That’s because trading silver futures requires a fair amount of familiarity with trading in general and with how the futures market operates in particular. How to invest in silver futures If you want to trade silver futures, many brokerage firms and trading apps have the functionality to do so. However, you may have to fulfill additional requirements on account of the greater complexity and increased risk of loss. The primary commercial function of futures markets is to allow investors to reduce their risk by hedging against unexpected price movements. Investors can take long positions — betting that the underlying asset’s price will rise — or short positions, which entails predicting a drop in value. Pros and cons of silver futures Trading in silver futures contracts instead of buying silver can give you more flexibility as well as the opportunity for greater leverage on your investment. But there’s risk. Keep in mind that futures contracts are financial instruments only intended for sophisticated investors who understand the mechanics and risks of futures trading. Futures trading takes place on centralized futures exchanges, which provides consistency and transparency. Unlike ETFs and mutual funds, you won’t pay management fees if you buy silver futures, and taxes are divided between the short- and long-term capital gains rates. Make sure you’re familiar with how the futures market operates broadly and how silver futures are priced and traded. Educating yourself about how these contracts are structured and your obligations should you enter into this type of trade is crucial. If you don’t have the time or inclination to become proficient with this segment of the market, another type of silver investment might be a better fit for you. The benefits of investing in silver Investors seeking out alternative assets might find attributes of silver appealing. Like other precious metals — including gold, platinum and palladium — silver can serve as a hedge against inflation and rising interest rates. It can help protect your portfolio from market volatility. Wealth preservation One of the key benefits of silver is that it’s a store of value. It’s also a sought-after commodity across multiple sectors of industrial supply chains. Investors often seek out precious metals because they likely won’t lose value when inflation rises. Some silver-backed assets can even be bought and held in a silver and gold IRA, potentially helping to preserve the value of your retirement nest egg. It’s a safe haven Like other precious metals, the value of silver tends to move inversely to the stock market. During times of market turmoil — such as a pandemic or recession — when stocks tumble, silver may hold or even grow its value as investors flock to these kinds of assets. Portfolio diversification Silver is used in a wide range of goods, from medical supplies to car parts to solar panels. You can buy physical silver or stocks in silver companies or invest in funds that hold silver-backed assets. Adding silver investments to your portfolio will help diversify your investment spread. Diversification is important because it helps reduce your risk of losing money on your entire portfolio when one area takes a hit. The drawbacks of investing in silver No income generation Silver doesn’t generate income in the form of interest or dividends, so even if you plan to buy and hold silver long-term, the only increase in value you’ll realize is when you sell it. Investors who buy stocks and bonds benefit from the value appreciation that comes from compounding over time, but silver, like other precious metals, also can’t add value to your portfolio via compound interest. Price volatility While investors use precious metals such as gold and silver to counterbalance stock volatility, the price of silver in the short term can be volatile and may even lose value. If you plan to buy silver, you likely want to approach it as a long-term investment so you won’t be forced to sell it at a loss. Storage and insurance costs Unlike a stock portfolio, silver bullion is bulky and can be at risk of theft. If you plan to invest in physical silver, you must factor in how much you’ll need to pay to store and insure that metal, whether you keep it at home or in a safe deposit box. Is silver a good investment in 2023? If you’re trying to determine if investing in silver is the right move for you, you must consider your long-term personal finance goals, risk tolerance and timeline. Make sure to do your own research and seek information from well-regarded, unbiased sources — don’t depend on guidance from companies that make their money from selling silver. If you need investment advice, consult a financial advisor who is a fiduciary and is obligated to put your best interests first when giving you investment recommendations. Investing in silver FAQs Is it better to invest in silver than in gold? Gold and silver -- along with platinum and palladium -- are considered part of the same asset class, so if you plan to only invest in one, you'll want to consider your overall investing style. While investors usually consider gold a store of value, silver is more like other metal commodities in that its value is driven less by speculation and more by industrial demand from manufacturers of goods in sectors like healthcare, energy and transportation. How much money should I invest in silver? The amount of money you choose to invest in silver should be driven primarily by your portfolio's value and existing composition. Most financial advisors recommend that no more than 5% to 10% of your portfolio be devoted to precious metals. It's important to prioritize diversity: If your investments are overweight in silver, you could find your nest egg threatened by risk concentration. What is the minimum amount I can invest in silver? If you choose to buy physical silver, either as silver bullion bars or collectibles like silver coins or jewelry, your minimum investment will be determined by the spot price -- the real-time market price -- for one ounce of silver at the time you make your purchase. If you plan to buy silver stocks or invest in silver ETFs, the barrier to entry is much lower: Most brokerage apps let you buy fractional stock shares for as little as $1, and you can invest in an ETF by buying as little as one share. (The prices of those shares will depend on current market valuations and conditions.) When is the best time to invest in silver? Generally, investing experts recommend against trying to time the market when it comes to buying or selling silver. Instead, if you plan to buy silver over a period of time, you can use a technique like dollar-cost averaging to mitigate price fluctuations in the silver market to which you would otherwise be exposed. Like other precious metals, silver should not be considered a short-term investment, particularly if you plan to buy physical silver coins or bars. Precious metals are less liquid than stocks, bonds or funds, and precious metals dealers tend to mark up the silver they sell. That means the value of silver will likely have to rise before you can even break even, let alone earn a return on your investment. Summary of how to invest in silver Silver is a popular precious metal for investors seeking portfolio diversification, a hedge against inflation and wealth preservation. Investment-grade silver is defined as having a silver content of at least 99.9% purity. You can buy physical silver bullion coins or silver bars from online dealers, jewelry stores or pawn shops, but make sure to factor in the expense of storing and insuring your precious metal. If you want exposure to silver but don’t want to buy the physical metal, you can invest in silver company stocks, silver ETFs or silver futures contracts. Many online trading platforms offer silver stocks and ETFs, and some may be available to buy and hold in an IRA. Silver ETFs that hold the stock of silver mining companies offer more diversified exposure than just buying stock in a single mining company, which can help mitigate risk. Silver ETFs backed by pure silver have less favorable tax treatment. Some brokerages also permit silver futures trading, although there may be additional requirements due to the greater complexity and risk involved. Silver futures are sophisticated financial instruments that aren’t suitable for beginners because the ability to increase leverage — and potential gains — also means losses can be magnified if the value of your investment falls. Before investing in silver, conduct your due diligence, seek unbiased advice and consider your personal finance situation and retirement goals. Read the full article

0 notes

Text

Warren Buffett 3 Simple Rules On How To Invest For Beginners.

Warren Buffett 3 Simple Rules On How To Invest For Beginners. https://www.youtube.com/watch?v=B2_Z8z1a8AE Warren Buffett shares 3 core principles for stock market investing. They’re all very simple yet so important! Buffett generously explains each one in detail, hope you guys enjoy it and learn a great lesson. Warren E. Buffett is an American long-term investor, philanthropist, business tycoon, and the chairman & CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth of over 100 billion dollars. Buffett was born in Omaha, Nebraska. He developed an interest in business and investing in his youth and made truly incredible stock market returns over his career. Share this video with a friend if you found it useful! Consider subscribing to the channel for videos about investing, business, stock market, managing money, building wealth, passive income, and other finance-related content! 🔔 Subscribe to our channel for expert guidance on managing finances, investments, and assets: https://www.youtube.com/@asset_informant ✅ For Business Enquiries: [email protected] ============================== ✅Recommended Playlists: 👉 Dividend Stocks: https://www.youtube.com/watch?v=zUP2FbiCNTE&list=PLNzc5UwzOZTxaGvhFj8shTcxlvc1eM7gj 👉 Stock Picks: https://www.youtube.com/watch?v=7vhIxh92Fzk&list=PLNzc5UwzOZTwmVwoZzI7KkbwKe0Z0uhIC 👉 Investing for Beginners: https://www.youtube.com/watch?v=HZ9HbObdyP8&list=PLNzc5UwzOZTx5aw-XhntekItyGTfR1lMi ✅ Other Videos You Might Be Interested In Watching: 👉 Smart Ways To Invest Your First $1000 | Investing For Beginners https://www.youtube.com/watch?v=HZ9HbObdyP8 👉 Ray Dalio's Top 5 Stocks for 2023 https://www.youtube.com/watch?v=Mx6Orudsz5k 👉 Top 3 Dividend ETFs to Invest In and Boost Your Portfolio https://www.youtube.com/watch?v=zUP2FbiCNTE 👉 Warren Buffet's Top 5 stocks for 2023 https://www.youtube.com/watch?v=zjNoDknxbVE 👉 Best undervalued dividend stock to buy in 2023 https://www.youtube.com/watch?v=_K20Su_Xyc4 ============================= ✅ About Asset Informant: We're Asset Informant, When managing finances and investments, Asset Informant is the leading source of expert-driven, actionable content on optimizing your finances and investments. With our help, you can easily and confidently navigate the complex world of finance and investments. We also provide content and information on asset allocation, tax strategies, retirement planning, debt management, insurance, and estate planning. Asset informants will also provide content that can help you with your short-term and long-term goals, such as saving for college or retirement. Our mission is to elevate the financial well-being of humanity. For Collaboration and Business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Subscribe to our channel for expert guidance on managing finances, investments, and assets: https://www.youtube.com/@asset_informant ===================== #dividendinvesting #passiveincome #investmentstrategy #wealthbuilding #stockmarket #financialfreedom Disclaimer: We do not accept any liability for any loss or damage which is incurred by you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. Do your own research. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use © Asset informant via Asset informant https://www.youtube.com/channel/UCj1XPhaWjBUMRAgy-EOko0w July 05, 2023 at 10:51PM

#personalfinance#Assetinformant#dividendinvesting#passiveincome#investmentstrategy#wealthbuilding#stockmarket#financialfreedom#aiinvesting

0 notes

Text

Financial Advice for Getting into the Stocks Market

Most major stock indexes racked up some serious losses in 2022. We don’t have a crystal ball on whether that trend will continue in 2023, but investing in financial markets has proven over the years to be a key ingredient to building wealth and retirement planning.

For most newbie investors, the biggest hurdle is the age-old question “what if stocks go down? The answer is they do, and yours may too, but there are ways to mitigate that risk. Whether you win or lose depends greatly on which stocks or funds you are holding, but also on your investing timeline. You have to ask yourself, are you investing for the next 10 minutes or the next 10 years? Historical market returns show that you usually do quite well over a ten-year period.

If you are on the outside wondering how to get started in stocks, here are three of the most common questions we get from would-be investors.

Do I need a financial advisor or stockbroker?

Traditionally, a stockbroker was the only option to facilitate the purchase of shares. Nowadays, there are plenty of online brokerages that anyone can use to set up a trading account and easily purchase individual shares and many types of index funds. Whether you need a stockbroker or some other kind of advisor (we recommend a financial coach) to help you depends on whether you want to take the time an effort to learn how to handle it yourself. Check out this great blog from our Financial Coach Matt Dewey to learn all about your options for getting started with self-directed investing.

Lots of Canadians successfully manage their own investments through online brokerages and save themselves a ton of money in fees and charges. Automated investment platforms (robo-advisors) and all-in-one ETFs are popular options because they don’t require much financial knowledge, allow for easy risk management, and are simple to use with relatively low fees.

How do I pick stocks?

The short answer is you don’t have to (and probably shouldn't) rely on picking stocks! Even if you had the time and knowledge to investigate and evaluate potential companies to invest in, your chances of picking winners with any sort of consistency is very low. Holding a limited number of individual stocks is also a risky strategy. A more sensible approach is to choose a diversified bundle of stocks made up of companies across many industries which will help to lower your overall risk.

The great news is that there are thousands of these bundles of stocks already pre-picked for you by teams of financial experts using all sorts of advanced analysis and inputs that an individual investor could never replicate. These bundles are called index funds and there are a number of variations - some try to emulate the return of an entire market like the Toronto Stock Exchange, while others focus on a specific industry or geographic sector.

Nothing will completely eliminate risk, but in general, broad-based index funds are less volatile and a great option if you want to keep your money management simple.

When is a good time to buy stocks?

If you had nerves of steel and a crystal ball and loaded up your TFSA and RRSP with stocks back in March of 2020, chances are you would be doing extremely well these days! Most stocks are up by 80% or more since their bottom at the start of the pandemic. The problem is that fluctuations like that don’t happen often and choosing the right time is always going to be hit and miss. Rather than focus on trying to nail the timing of your entry (or exit) from the market, you should be looking at your investment horizon.

The longer you leave your money in the market, the higher the chance that you will come out ahead of the game. You can always ramp up the risk of your holdings if you have a longer investment time frame and are aiming for higher returns, but trying to capitalize on short-term market fluctuations by jumping in and out of the market is a difficult strategy at best.

If you still have questions or need more information, check out our upcoming free webinars for reliable, practical information on stock investing as well as plenty of other personal finance topics.

0 notes

Text

2023年9月に1セント未満で今、購入すべき最善の安い仮想通貨5つ The 5 Best Cheap Crypto to Purchase Now for Less Than One Cent in Septe

2023.09.10

2023年9月に1セント未満で今、購入すべき最善の安い仮想通貨5つ The 5 Best Cheap Crypto to Purchase Now for Less Than One Cent in September 2023

テーマ:英語のお勉強日記

カテ��リ:仮想通貨The 5 Best Cheap Crypto to Purchase Now for Less Than One Cent in September 2023 2023年9月に1セント未満で今、購入すべき最善の安い仮想通貨5つ

Shogun Saski ショウグン・サスケ

Sept.10, 2023 2023年9月10日Introduction��じめに

There is a universe of promise beyond Bitcoin (BTC), despite the fact that it frequently steals the cryptocurrency spotlight. (You can also read about the upcoming altcoins to erupt in our most recent roundup of the top altcoins to buy in.) 暗号通貨のスポットライトを頻繁に盗むという事実にもかかわらず、ビットコイン (BTC) を超えた有望な世界があります。(また、購入すべきトップアルトコインの最新のまとめで噴火する今後のアルトコインについても読むことができます。)

The cryptocurrency market as a whole is currently going through a consolidation phase, largely due to Bitcoin, which has been failing to surpass the $30,000 barrier. 暗号通貨市場全体は現在、主にビットコインのおかげで地固めの段階にあり、30,000ドルの壁を超えることに失敗してきています。