#banking & financial software development

Explore tagged Tumblr posts

Text

Fintech built smarter. 🤓💻

SDH integrates cutting-edge technologies with your vision. Digital banking, blockchain, personal finance apps—done right. Explore:

#financial software development#custom app solutions#fintech#SDH#digital banking#blockchain#personal finance apps

0 notes

Text

The Role of Financial Services Technology and Banking Software

In today's rapidly evolving digital landscape, the financial services sector is undergoing a significant transformation. The world has witnessed transformation of traditional banking practices by the integration of updated financial services technology and innovative banking software. This paradigm shift is not only uplifting the efficiency and security of banking operations but also reshaping the manner financial institutions interact with their customers. Well, this article discusses how financial services technology and banking software are changing the landscape of the financial industry and the advantages they offer to banks and their customers.

The Rise of Financial Services Technology

Financial services technology, or FinTech, encompasses a wide range of technological innovations aimed at improving and automating the delivery of financial services. From mobile banking apps to blockchain technology, FinTech solutions are making banking more accessible, secure, and user-friendly. The rise of FinTech has been driven by several factors, including the increasing demand for digital banking services, advancements in technology, and the need for financial institutions to remain competitive in a digital-first world.

The Evolution of Banking Software

Banking software plays a critical role in the modernization of the financial services sector. It provides the infrastructure needed to support digital banking services, streamline operations, and enhance the overall customer experience. Modern banking software solutions are designed to be flexible, scalable, and secure, allowing financial institutions to adapt to changing market conditions and regulatory requirements.

One of the key features of modern banking software is its ability to integrate with various digital channels, such as mobile apps, websites, and ATMs. This integration enables banks to offer a seamless omnichannel experience, where customers can access their accounts and conduct transactions from any device, at any time. Moreover, advanced banking software includes robust analytics and reporting tools that help banks gain insights into customer behavior, identify trends, and make data-driven decisions.

Benefits of Financial Services Technology and Banking Software

The integration of financial services technology and banking software offers numerous benefits to both banks and their customers. For financial institutions, these technologies help reduce operational costs, improve efficiency, and enhance customer satisfaction. Automated processes, such as digital onboarding and transaction processing, reduce the need for manual intervention, freeing up staff to focus on more value-added tasks. Additionally, real-time data analytics enable banks to proactively address customer needs and offer personalized services.

The Future of Financial Services Technology and Banking Software

As technology continues to advance, the financial services sector will likely see even more innovation and disruption. Artificial intelligence (AI) and machine learning (ML) are poised to play a significant role in the future of banking, enabling institutions to offer more personalized and proactive services. For instance, AI-powered chatbots can provide instant customer support, while ML algorithms can analyze customer data to predict future financial needs and offer tailored product recommendations.

Conclusion

To sum up, financial services technology and banking software are revolutionizing the banking industry, offering numerous benefits to both financial institutions and their customers. As these technologies continue to evolve, they will undoubtedly play a crucial role in shaping the future of finance, making banking more accessible, efficient, and customer-centric than ever before. Financial institutions that embrace these innovations will be well-positioned to thrive in the digital age and deliver exceptional value to their customers.

1 note

·

View note

Text

A Comprehensive Guide to Integrating Fintech in Corporate Banking Strategies

In the ever-evolving realm of corporate banking, the integration of fintech solutions has become not just a choice but a necessity for institutions striving to stay competitive and relevant in the digital age. As fintech continues to disrupt traditional banking models, corporate banks must embrace innovation to streamline processes, enhance efficiency, and deliver superior customer experiences. This comprehensive guide outlines key strategies for integrating fintech into corporate banking operations, with a focus on leveraging Xettle Technologies' cutting-edge solutions to drive sustainable growth and success.

Understanding the Fintech Landscape: Before embarking on the journey of fintech integration, it is essential for corporate banks to gain a comprehensive understanding of the fintech landscape. Fintech encompasses a broad spectrum of technologies and solutions, including artificial intelligence, blockchain, data analytics, and digital payment systems. By staying abreast of emerging trends and innovations, corporate banks can identify opportunities to leverage fintech to their advantage. Xettle Technologies, with its diverse portfolio of fintech solutions, offers a one-stop-shop for corporate banks seeking to integrate cutting-edge technologies into their operations.

Aligning Fintech with Strategic Objectives: Successful fintech integration begins with aligning fintech initiatives with corporate banking's strategic objectives. Whether the goal is to enhance operational efficiency, improve risk management, or elevate customer experiences, fintech solutions must be integrated in a manner that supports these overarching goals. Xettle Technologies works closely with corporate banking partners to tailor solutions that align with their unique strategic priorities, ensuring maximum impact and return on investment.

Identifying Key Areas for Fintech Integration: Corporate banks must identify key areas within their operations where fintech integration can drive the most significant value. This may include areas such as payments and transaction processing, risk management and compliance, customer relationship management, and data analytics. Xettle Technologies offers a wide range of fintech solutions spanning these areas, enabling corporate banks to address their most pressing challenges and capitalize on new opportunities.

Building Collaborative Ecosystems: Collaboration is key to successful fintech integration in corporate banking. Corporate banks can leverage partnerships with fintech startups, technology vendors, regulatory bodies, and industry associations to access expertise, share knowledge, and drive innovation. Xettle Technologies fosters a collaborative ecosystem, partnering with leading financial institutions and fintech firms to co-create solutions that meet the evolving needs of corporate banking clients.

Embracing Agile Development Practices: In the fast-paced world of fintech, agility is paramount. Corporate banks must adopt agile development practices to rapidly prototype, test, and iterate fintech solutions. Xettle Technologies' agile development methodology enables rapid deployment and iteration of fintech solutions, ensuring that corporate banks can adapt to changing market dynamics and customer preferences with ease.

Prioritizing Security and Compliance: Security and compliance are non-negotiables in corporate banking. When integrating fintech solutions, corporate banks must prioritize data security, privacy, and regulatory compliance. Xettle Technologies adheres to the highest standards of security and compliance, implementing robust encryption protocols, multi-factor authentication, and comprehensive risk management frameworks to safeguard sensitive financial data and mitigate cybersecurity risks.

Measuring and Monitoring Performance: Finally, corporate banks must establish metrics and KPIs to measure the performance and impact of fintech integration initiatives. By tracking key performance indicators such as cost savings, revenue growth, customer satisfaction, and operational efficiency, corporate banks can assess the effectiveness of fintech solutions and make data-driven decisions to optimize their integration efforts. Xettle Technologies provides advanced analytics and reporting capabilities, enabling corporate banks to gain actionable insights into the performance of their fintech initiatives.

In conclusion, integrating fintech corporate banking into corporate banking strategies is no longer a choice but a strategic imperative in today's digital-first landscape. By following the comprehensive guide outlined above and leveraging Xettle Technologies' innovative solutions, corporate banks can unlock new opportunities for growth, differentiation, and success in the era of fintech disruption.

#Fintech Corporate Banking#Finance#Financial Planning#Fintech#Corporate#development#fintech software#programming#technology#keywords fintech development#marketing

1 note

·

View note

Text

https://www.betabyte.in/services/nidhi-software

Powering Your Financial Success With Our Nidhi Software

Power Up your financial business success with Beta Byte Technologies, your trusted partner in cutting-edge software development. Explore our advanced Nidhi Software solutions to enhance efficiency, streamline processes, and ensure seamless compliance. Transform your Nidhi business with us – Explore the future today!

#software development#custom erp software#custom software development company#nidhi software#nidhi software development#banking software#online nidhi software#best nidhi software#nidhi bank software#Financial Software

0 notes

Text

https://eitpl.in/finance

Eitpl is a leading Banking & financial Software Development Company in Kolkata provides bank software development services at best price.

#banking software development company#banking software development services#bank software development#banking & financial software development#software developer in banking sector#financial software development company#best financial consolidation software

0 notes

Link

The financial services industry is undergoing a digital revolution, driven by advancements in technology. Fintech (financial technology) has emerged as a disruptor, transforming the way we manage money, make payments, invest, and access financial services. Behind the scenes, fintech software development plays a crucial role in enabling these innovations. In this article, we will explore the top technologies for fintech software development that are shaping the future of financial services...

#fintech#fintech news#fintech technology#banking software#fintech software development#custom software development#financial institutions#top technologies#top tech#top tech news#custom software#custom software design#software developers#software development#software devs

0 notes

Text

By the authority vested in me as President by the Constitution and the laws of the United States of America, and in order to promote United States leadership in digital assets and financial technology while protecting economic liberty, it is hereby ordered as follows:

Section 1. Purpose and Policies. (a) The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation’s international leadership. It is therefore the policy of my Administration to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy, including by:

(i) protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution, including the ability to develop and deploy software, to participate in mining and validating, to transact with other persons without unlawful censorship, and to maintain self-custody of digital assets;

(ii) promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide;

15 notes

·

View notes

Text

Exploring Career and Job Opportunities in Davao City Philippines

Davao City, recognized as one of the Philippines' most progressive cities, continues to experience remarkable economic growth, creating a vibrant job market that attracts professionals from across the country. The city's diverse economy offers numerous employment opportunities, from entry-level positions to executive roles, making it an attractive destination for job seekers at all career stages.

The Business Process Outsourcing (BPO) sector stands as one of the largest employers in Davao City, providing thousands of jobs across various specializations. Companies in this sector actively recruit customer service representatives, technical support specialists, and quality assurance analysts, offering competitive salaries and comprehensive benefits packages. The industry's continued expansion has created numerous opportunities for career advancement, with many organizations promoting from within and providing extensive training programs.

Part-time employment opportunities have also flourished in Davao City, catering to students, professionals seeking additional income, and individuals preferring flexible work arrangements. The retail sector, food service industry, and education field offer numerous part-time positions with varying schedules and responsibilities. These roles often provide valuable work experience and can serve as stepping stones to full-time careers.

The Information Technology sector in Davao has seen significant growth, with many companies seeking software developers, web designers, and IT support specialists. This growth has been fueled by the city's improving technological infrastructure and the increasing number of tech-focused businesses establishing operations in the region. Tech professionals can find opportunities in both established companies and startups, with many positions offering competitive compensation and the possibility of remote work arrangements.

Davao's hospitality and tourism industry continues to expand, creating jobs in hotels, restaurants, travel agencies, and tour operations. The sector offers positions ranging from entry-level service roles to management positions, with many employers providing training and development opportunities. The industry's growth has also sparked demand for professionals in events management and tourism marketing.

The education sector presents numerous opportunities for both full-time and part-time employment. Educational institutions regularly seek teachers, tutors, and administrative staff. The rise of online learning has created additional opportunities for English language teachers and academic consultants who can work flexible hours from home or teaching centers.

Job hiring in Davao, the digital economy has opened new avenues for employment. E-commerce specialists, digital content creators, and social media managers are in high demand as businesses increasingly establish their online presence. These positions often offer the flexibility of remote work while providing competitive compensation packages.

Professional development resources are readily available in Davao City, with numerous institutions offering skills training programs and industry certifications. Job seekers can access career counseling services, resume writing assistance, and interview coaching through various employment support organizations. These resources prove invaluable in helping candidates prepare for and secure desired positions.

The financial services sector in Davao has also experienced substantial growth, creating opportunities for banking professionals, insurance specialists, and investment consultants. These positions typically offer attractive compensation packages, including performance bonuses and health benefits, making them highly sought after by experienced professionals.

Davao's agricultural sector continues to evolve, combining traditional farming with modern agribusiness practices. This has created opportunities for agricultural technologists, food processing specialists, and supply chain professionals. The sector offers both technical and management positions, with many companies providing specialized training and development programs.

For those entering Davao's job market, proper preparation is essential. Successful job seekers typically maintain updated resumes, prepare comprehensive portfolios, and stay informed about industry developments. Professional networking, both online and offline, plays a crucial role in discovering opportunities and advancing careers in the city.

The future of Davao's job market looks promising, with emerging industries creating new employment opportunities. The city's commitment to economic development, coupled with its strategic location and robust infrastructure, continues to attract businesses and investors, ensuring a steady stream of job opportunities for qualified candidates.

Whether seeking full-time employment or part-time job in Davao City offers a diverse range of opportunities across multiple industries. Success in this dynamic job market often comes to those who combine proper preparation with continuous skill development and effective networking. As the city continues to grow and evolve, its job market remains a beacon of opportunity for professionals seeking to build meaningful careers in Mindanao's premier business hub.

#Davao City#recognized as one of the Philippines' most progressive cities#continues to experience remarkable economic growth#creating a vibrant job market that attracts professionals from across the country. The city's diverse economy offers numerous employment op#from entry-level positions to executive roles#making it an attractive destination for job seekers at all career stages.#The Business Process Outsourcing (BPO) sector stands as one of the largest employers in Davao City#providing thousands of jobs across various specializations. Companies in this sector actively recruit customer service representatives#technical support specialists#and quality assurance analysts#offering competitive salaries and comprehensive benefits packages. The industry's continued expansion has created numerous opportunities fo#with many organizations promoting from within and providing extensive training programs.#Part-time employment opportunities have also flourished in Davao City#catering to students#professionals seeking additional income#and individuals preferring flexible work arrangements. The retail sector#food service industry#and education field offer numerous part-time positions with varying schedules and responsibilities. These roles often provide valuable work#The Information Technology sector in Davao has seen significant growth#with many companies seeking software developers#web designers#and IT support specialists. This growth has been fueled by the city's improving technological infrastructure and the increasing number of t#with many positions offering competitive compensation and the possibility of remote work arrangements.#Davao's hospitality and tourism industry continues to expand#creating jobs in hotels#restaurants#travel agencies#and tour operations. The sector offers positions ranging from entry-level service roles to management positions#with many employers providing training and development opportunities. The industry's growth has also sparked demand for professionals in ev#The education sector presents numerous opportunities for both full-time and part-time employment. Educational institutions regularly seek t

4 notes

·

View notes

Text

American R&B singer Aliaune Thiam, professionally known as Akon, has long wanted to help Senegal, the country he grew up in. He started Akon Lighting Africa in 2014 to install cheap Chinese solar-powered lighting systems across the continent. He hoped to do something more significant for Senegal. But how to fund it?

The answer turned out to be the same one adopted by a growing number of governments and entrepreneurs: a mixture of cryptocurrency and urban planning. It’s a combination that offers the promise of development without any of the tricky details—and which tends to turn out to be little more than vaporware. There was Bitcoin City in El Salvador, but also Painted Rock in Nevada, Satoshi Island in Vanuatu, Cryptoland in Fiji, or the Crypto-Kingdom of Bitcointopia in Utah.

In 2018, Akon announced a new cryptocurrency, to be called “akoin.” Akoin would enable Africans to, as the singer put it at a launch event, “advance themselves independent of the government”—in some manner. Most importantly, akoin would fund the creation of Akon City, an advanced planned city to be built in Senegal. Akon announced akoin and Akon City at the Cannes Lions Festival in June 2018. Akon said in November of that year that he had “everything planned out” for the city. But both Akon City and the akoin token remained only ideas for many months.

Akon was interested by the promises of cryptocurrency—specifically, free money by some unclear mechanism—but he was not up on the details of its technical or financial issues: “I come with the concepts and let the geeks figure it out,” he said. The akoin team featured initial coin offering (ICO) entrepreneurs such as Lynn Liss of ICO Impact and Crystal Rose Pierce.

The akoin cryptocurrency was pre-sold in a 2019 crypto token offering called “token of appreciation.” Each dollar “donation” would give you up to four tokens which would convert to akoin.

Akoin had not launched in Senegal at the time, despite billboards across the country. The West African CFA franc is the only legal currency in Senegal; BCEAO, the central bank, warned that akoin could not be used as a currency in the country.

Akoin promised all manner of functionality—special akoin wallet software, direct exchange with other cryptocurrencies or with cellphone minutes, an application marketplace, various “building blocks for entrepreneurship.” None of this was ever implemented.

Akoin finally started trading on a crypto exchange in November 2020. The akoin token didn’t do anything or have any particular utility; it was just a crypto token that you could trade. Pre-sale buyers dumped their akoin immediately and the price crashed. That’s not unusual: As of 2022, 24 percent of new cryptos fell 90 percent or more in their first week.

Akon posted on social media in January 2020 that he had “finalized the agreement for AKON CITY in Senegal”—though he had previously claimed that construction had already started in March 2019. The new city would be built near the small town of Mbodiène, about 100 kilometers south of the capital, Dakar.

Akon City would be a “smart city” inspired by the futuristic African nation of Wakanda from the 2018 movie Black Panther. The city would feature boldly curved skyscrapers, shopping malls, music and movie studios, “eco-friendly” tourist resorts, and a parking garage for flying cars.

Akon claimed in August 2020 that $2 billion of the $6 billion needed to build Akon City had been secured. He laid the foundation stone for the city on Aug. 31, 2020, and said that construction would start “next year,” in 2021.

Construction did not start in 2021, to the disappointment of locals. It was not clear where the $6 billion needed to build Akon City would come from. A representative for KE International, the United States-based contractor for Akon City, told AFP that more than $4 billion had been secured, with Kenyan entrepreneur Julius Mwale as lead investor, and that construction would start in October 2021—but it did not.

By 2022, Akon told the BBC that construction was “100,000 percent moving.” He said the COVID-19 pandemic was partly to blame for the delays. Akon was surprised at the “thousands of studies” that had to be done before work could even commence.

Senegal’s Society for the Development and Promotion of Coasts and Tourist Zones (SAPCO) had claimed the land by eminent domain in 2009 before offering it to Akon City in 2020. By 2023, no building work had been done at the Akon City site—though Axiome Construction insisted that geotechnical studies and environmental assessments were still under way. By this time, according to the Guardian, the only construction was a youth center nearby in Mbodiène, paid for personally by Akon—and built upon the foundation stone that he had laid in 2020.

Senegal finally lost patience with the project. Akon had missed several payments to SAPCO, and in June of this year, SAPCO sent a formal notice to Akon warning that work had to start by the end of July or SAPCO might take back almost all of the land grant.

Akon had already been looking for other opportunities to place akoin. In April 2021, he started talking to Uganda about setting up an Akon City there as well. In January 2022, the Ugandan government allocated him one square mile in Mpunge, in the Mukono district—despite objections from the National Unity Platform party and protests from Mpunge residents wanting compensation, which could not be paid before 2025.

Akon said that Akon City, Uganda, might be completed by 2036. At a 2021 news conference, he evaded questions on what the new city would cost or how it would be funded. The Forum for Democratic Change party said that the Ugandan Akon City would never happen and accused the government of granting “sweetheart deals” to developers.

Akon City was tech solutionism that leveraged the political power of celebrity. Akon wanted to launch a large project and thought that cryptocurrency, the buzzword of 2018, might fund his dream. He thought that this one weird trick would do the job.

In this case, the miracle technology was crypto. These days, such pushes by celebrities or entrepreneurs of new projects will typically use artificial intelligence—whatever that might mean in a particular case—as the marketing hook for a “smart city.

In his 2023 book Let Them Eat Crypto, Peter Howson of Northumbria University detailed how to head off solutionism-inspired blockchain projects that were heavy on publicity but light on the necessary bureaucratic work on the ground. His approach is broadly applicable to tech solutionism in general: Pay attention to the men behind the curtain. Howson has written recently on “smart city” plans as marketing for crypto tokens.

The Akon City plan was a worked example of speculative urbanization. A project is proposed with science-fiction concept drawings and a pitch aimed at tourists rather than locals; land is allocated; something might eventually be built, but it will bear little resemblance to the brochures. Christopher Marcinkoski of the University of Pennsylvania described Akon City as just one of many such initiatives, particularly in Africa, calling it “very much a real estate play.” The important output from such projects is local political capital—even as they never work out as advertised.

Cryptocurrency was an application of speculative urbanization to money—a high concept, a pitch to financial tourists, and the only end result being a token to speculate on and a tremendous amount of fraud. The Akon City project, however good Akon’s own intentions, seems functionally to have been merely the pitch for a crypto offering that failed—leaving an empty site, disappointed locals, and an embarrassed figurehead.

By 2024, akoin had been removed from the few crypto exchanges it had been listed on; it was effectively worthless. Akon sold short videos on Cameo—but he would not do requests related to cryptocurrency.

The speculative urbanization pitch rolls on. Actor Idris Elba has recently floated plans for an “environmentally friendly smart city” on Sherbro Island off Sierra Leone.

6 notes

·

View notes

Note

what are some "rich people" jobs that you don't see as much?

damn … gonna open up the floor to suggestions but let’s see

- software engineer (app or game developer, computer programmer)

- mechanical engineer - tbh ANY engineer

- orthodontist / specialist in the medical field (radiologist, neurologist, technician , anaesthesiologists make a shit ton of money )

- songwriter (these guys make bank im pretty sure ? )

- producer (movies , tv show, music - again behind the scenes but makes the whole thing go round)

- director (a24 movie director where? but also a director of a company)

- nepo baby (we know they’re out there)

- plastic surgeon

- financial dealer (taking care of the big dog billionaires and making sure those pigs stay rich)

this is all i can rlly think of rn ?? i hope it helps tho !

3 notes

·

View notes

Text

Choosing The Right MBA In Information Technology College For A Successful Career

In today’s digital-driven world, businesses rely on technology for innovation, efficiency and competitive advantage. This has led to a growing demand for professionals who can bridge the gap between business and technology. Pursuing an MBA in Information Technology College can provide aspiring leaders with the right blend of management expertise and technical skills to thrive in the industry.

Why Choose An MBA In Information Technology?

An MBA in IT equips students with a strong foundation in both business administration and technology. The curriculum typically includes courses in data analytics, IT infrastructure management, software process management, and emerging digital trends. Graduates from reputed MBA IT Colleges are well-prepared to take on leadership roles in various industries, including banking, finance, e-commerce, healthcare, and consulting.

Key Benefits Of An MBA In IT

Enhanced Career Opportunities: Graduates can explore roles such as IT Manager, Business Analyst, Product Manager, and IT Consultant.

Integration of Business & Technology: The program helps students develop problem-solving skills, critical thinking, and decision-making abilities for technology-driven businesses.

Industry-Relevant Curriculum: Courses are designed to align with the latest industry trends, ensuring that students stay ahead in the competitive market.

Networking & Industry Exposure: Many colleges offer internships, industry projects, and guest lectures by top professionals to provide hands-on experience.

What To Look For In The Best MBA IT Colleges

Choosing the right MBA IT College is crucial for career success. Here are some factors to consider:

Accreditation & Reputation: Ensure the college is recognized by national or international bodies.

Curriculum & Specialisations: Look for programmes offering diverse specializations like Data Analytics, Cloud Computing and IT Management.

Placement Support: Check past placement records and top recruiters associated with the college.

Faculty & Infrastructure: Experienced faculty and modern infrastructure enhance the learning experience.

Industry Collaborations: Colleges with strong industry ties provide better internship and job opportunities.

SICSR – A Leading MBA In IT College

Symbiosis Institute of Computer Studies and Research (SICSR) is a pioneer in offering a cutting-edge MBA in Information Technology College program. Located in Pune, SICSR provides students with a dynamic learning environment that integrates business management with the latest technological advancements. The programme offers specialisations in Banking & Financial Markets, Data Analytics, IT Infrastructure Management and Software Process Management.

With an industry-oriented curriculum, expert faculty, and strong placement support, SICSR stands out as one of the top MBA IT Colleges in India. Students benefit from experiential learning through case studies, hackathons, live projects, and industry interactions. The institute’s emphasis on continuous learning through MOOCs and research-driven education makes it a preferred choice for IT management aspirants.

2 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

Strengthening American Leadership in Digital Financial Technology

Issued January 23, 2025.

By the authority vested in me as President by the Constitution and the laws of the United States of America, and in order to promote United States leadership in digital assets and financial technology while protecting economic liberty, it is hereby ordered as follows:

Section 1. Purpose and Policies. (a) The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation's international leadership. It is therefore the policy of my Administration to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy, including by:

(i) protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution, including the ability to develop and deploy software, to participate in mining and validating, to transact with other persons without unlawful censorship, and to maintain self-custody of digital assets;

(ii) promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide;

(iii) protecting and promoting fair and open access to banking services for all law-abiding individual citizens and private-sector entities alike;

(iv) providing regulatory clarity and certainty built on technology-neutral regulations, frameworks that account for emerging technologies, transparent decision making, and well-defined jurisdictional regulatory boundaries, all of which are essential to supporting a vibrant and inclusive digital economy and innovation in digital assets, permissionless blockchains, and distributed ledger technologies; and

(v) taking measures to protect Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.

Sec. 2. Definitions. (a) For the purpose of this order, the term "digital asset" refers to any digital representation of value that is recorded on a distributed ledger, including cryptocurrencies, digital tokens, and stablecoins.

(b) The term "blockchain" means any technology where data is:

(i) shared across a network to create a public ledger of verified transactions or information among network participants;

(ii) linked using cryptography to maintain the integrity of the public ledger and to execute other functions;

(iii) distributed among network participants in an automated fashion to concurrently update network participants on the state of the public ledger and any other functions; and

(iv) composed of source code that is publicly available.

(c) "Central Bank Digital Currency" means a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.

Sec. 3. Revocation of Executive Order 14067 and Department of the Treasury Framework of July 7, 2022. (a) Executive Order 14067 of March 9, 2022 (Ensuring Responsible Development of Digital Assets) is hereby revoked.

(b) The Secretary of the Treasury is directed to immediately revoke the Department of the Treasury's "Framework for International Engagement on Digital Assets," issued on July 7, 2022.

(c) All policies, directives, and guidance issued pursuant to Executive Order 14067 and the Department of the Treasury's Framework for International Engagement on Digital Assets are hereby rescinded or shall be rescinded by the Secretary of the Treasury, as appropriate, to the extent they are inconsistent with the provisions of this order.

(d) The Secretary of the Treasury shall take all appropriate measures to ensure compliance with the policies set forth in this order.

Sec. 4. Establishment of the President's Working Group on Digital Asset Markets. (a) There is hereby established within the National Economic Council the President's Working Group on Digital Asset Markets (Working Group). The Working Group shall be chaired by the Special Advisor for AI and Crypto (Chair). In addition to the Chair, the Working Group shall include the following officials, or their designees:

(i) the Secretary of the Treasury;

(ii) the Attorney General;

(iii) the Secretary of Commerce;

(iv) the Secretary of Homeland Security;

(v) the Director of the Office of Management and Budget;

(vi) the Assistant to the President for National Security Affairs:

(vii) the Assistant to the President for National Economic Policy (APEP);

(viii) the Assistant to the President for Science and Technology;

(ix) the Homeland Security Advisor;

(x) the Chairman of the Securities and Exchange Commission; and

(xi) the Chairman of the Commodity Futures Trading Commission.

(xii) As appropriate and consistent with applicable law, the Chair may invite the heads of other executive departments and agencies (agencies) or other senior officials within the Executive Office of the President, to attend meetings of the Working Group, based on the relevance of their expertise and responsibilities.

(b) Within 30 days of the date of this order, the Department of the Treasury, the Department of Justice, the Securities and Exchange Commission, and other relevant agencies, the heads of which are included in the Working Group, shall identify all regulations, guidance documents, orders, or other items that affect the digital asset sector. Within 60 days of the date of this order, each agency shall submit to the Chair recommendations with respect to whether each identified regulation, guidance document, order, or other item should be rescinded or modified, or, for items other than regulations, adopted in a regulation.

(c) Within 180 days of the date of this order, the Working Group shall submit a report to the President, through the APEP, which shall recommend regulatory and legislative proposals that advance the policies established in this order. In particular, the report shall focus on the following:

(i) The Working Group shall propose a Federal regulatory framework governing the issuance and operation of digital assets, including stablecoins, in the United States. The Working Group's report shall consider provisions for market structure, oversight, consumer protection, and risk management.

(ii) The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.

(d) The Chair shall designate an Executive Director of the Working Group, who shall be responsible for coordinating its day-to-day functions. On issues affecting the national security, the Working Group shall consult with the National Security Council.

(e) As appropriate and consistent with law, the Working Group shall hold public hearings and receive individual expertise from leaders in digital assets and digital markets.

Sec. 5. Prohibition of Central Bank Digital Currencies

(a) Except to the extent required by law, agencies are hereby prohibited from undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad.

(b) Except to the extent required by law, any ongoing plans or initiatives at any agency related to the creation of a CBDC within the jurisdiction of the United States shall be immediately terminated, and no further actions may be taken to develop or implement such plans or initiatives.

Sec. 6. Severability. (a) If any provision of this order, or the application of any provision to any person or circumstance, is held to be invalid, the remainder of this order and the application of its provisions to any other persons or circumstances shall not be affected thereby.

Sec. 7. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

2 notes

·

View notes

Text

The Year of Bitcoin: Why 2025 Could Be a Turning Point

The start of 2025 has set the stage for what may be Bitcoin’s most transformative year yet. The events of 2024, from significant corporate acquisitions to milestones in adoption, have positioned Bitcoin as a central player in the evolving financial landscape. With growing economic instability, technological advancements, and shifting narratives, Bitcoin is poised to reach new heights in both relevance and adoption.

Setting the Stage

In 2024, Bitcoin witnessed several pivotal moments. Institutional interest soared, adoption among individuals continued to grow, and countries started exploring Bitcoin as a hedge against economic uncertainty. As we enter 2025, the momentum is unmistakable. Bitcoin is no longer merely a speculative asset—it is becoming a cornerstone of financial innovation and security.

The Macro Environment

The global economy is in a state of flux. Rising inflation and growing distrust in fiat currencies have left governments and central banks scrambling for solutions. In this environment, Bitcoin’s fixed supply and decentralized nature offer a stark contrast to the instability of traditional systems. As more people recognize its value as a store of wealth, Bitcoin’s role in the global financial system is expanding.

Adoption Trends: A Billion-Dollar Vote of Confidence

December 2024 was a monumental month for corporate Bitcoin adoption. In just the first 10 days, U.S. companies invested a staggering $3.26 billion into Bitcoin.

MicroStrategy, the largest corporate holder of Bitcoin, acquired 21,550 BTC worth $2.1 billion, bringing its total holdings to 423,650 BTC valued at $25.6 billion.

Marathon Digital, a leading Bitcoin mining firm, added 11,774 BTC for around $1.1 billion, boosting its total to 40,435 BTC worth $3.9 billion.

Riot Platforms, a Bitcoin infrastructure company, acquired 705 BTC worth $68.45 million.

These investments underscore the confidence U.S. companies have in Bitcoin as a long-term store of value. They also signal a broader shift in institutional attitudes toward Bitcoin as an essential financial asset.

A Historic Milestone: Bitcoin Enters the Nasdaq-100

In another major development, MicroStrategy joined the Nasdaq-100 Index on December 23, 2024, standing alongside titans like Apple, Microsoft, and Tesla. This milestone not only highlights MicroStrategy’s success but also validates Bitcoin’s integration into traditional financial systems.

Founded over 30 years ago as an enterprise software company, MicroStrategy transitioned into a Bitcoin powerhouse under the leadership of Executive Chairman Michael Saylor. Since 2020, the company has amassed over 423,000 BTC worth $42 billion, becoming the largest corporate holder of the scarce digital asset. Its inclusion in the Nasdaq-100 symbolizes Bitcoin’s growing credibility and mainstream acceptance.

The Strategic Bitcoin Reserve

In a groundbreaking move, the incoming Trump administration has announced plans to create a strategic Bitcoin reserve. This initiative aims to position the United States as a leader in the digital asset space while safeguarding its financial future. By holding Bitcoin as a reserve asset, the government signals its confidence in Bitcoin’s long-term value and utility. Such a policy could set a precedent for other nations, accelerating global adoption and further solidifying Bitcoin’s status as a global store of value.

Technological Advancements

Bitcoin’s infrastructure continues to evolve. The Lightning Network, which facilitates instant and low-cost Bitcoin transactions, is gaining widespread adoption, enabling new use cases like micropayments and decentralized financial services. Upgrades like Taproot and innovations in Ordinals have also enhanced Bitcoin’s privacy, scalability, and functionality. These advancements are transforming Bitcoin from a simple store of value to a versatile tool for global commerce.

The Narrative Shift

Bitcoin’s narrative is evolving. Once seen primarily as a speculative investment, it is now recognized as a tool for financial sovereignty and inclusion. Younger generations, who grew up in an era of financial crises and technological disruption, are driving this shift. For them, Bitcoin represents not just an asset but a movement—a way to opt out of traditional systems and build a fairer, more transparent financial future.

Challenges to Watch

Despite its progress, Bitcoin faces significant challenges. Regulatory uncertainty remains a critical hurdle, with governments worldwide grappling with how to classify and regulate Bitcoin. Competing narratives, such as the rise of central bank digital currencies (CBDCs), also pose a threat. Additionally, the debate over Bitcoin’s energy consumption continues, though proponents argue that it’s driving innovation in renewable energy.

Why 2025 Could Be the Year of Bitcoin

As we look ahead, it’s clear that 2025 holds immense potential for Bitcoin. With institutional adoption accelerating, technological innovations reshaping its utility, and the macroeconomic landscape driving demand, Bitcoin is on the brink of a new era.

For individuals and institutions alike, the message is clear: stay informed, get involved, and embrace Bitcoin as a cornerstone of the future financial system. The revolution is underway, and 2025 could be the year Bitcoin proves it is here to stay.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#Blockchain#FinancialRevolution#DigitalAssets#CryptoAdoption#Bitcoin2025#MacroEconomics#BitcoinMining#CryptoNews#Nasdaq100#BitcoinReserve#DigitalGold#Decentralization#CryptoInnovation#BitcoinMilestones#CryptoFuture#MoneyRevolution#HODL#LightningNetwork#financial empowerment#globaleconomy#finance#financial experts#digitalcurrency#financial education#unplugged financial

2 notes

·

View notes

Text

Artificial Intelligence: Transforming the Future of Technology

Introduction: Artificial intelligence (AI) has become increasingly prominent in our everyday lives, revolutionizing the way we interact with technology. From virtual assistants like Siri and Alexa to predictive algorithms used in healthcare and finance, AI is shaping the future of innovation and automation.

Understanding Artificial Intelligence

Artificial intelligence (AI) involves creating computer systems capable of performing tasks that usually require human intelligence, including visual perception, speech recognition, decision-making, and language translation. By utilizing algorithms and machine learning, AI can analyze vast amounts of data and identify patterns to make autonomous decisions.

Applications of Artificial Intelligence

Healthcare: AI is being used to streamline medical processes, diagnose diseases, and personalize patient care.

Finance: Banks and financial institutions are leveraging AI for fraud detection, risk management, and investment strategies.

Retail: AI-powered chatbots and recommendation engines are enhancing customer shopping experiences.

Automotive: Self-driving cars are a prime example of AI technology revolutionizing transportation.

How Artificial Intelligence Works

AI systems are designed to mimic human intelligence by processing large datasets, learning from patterns, and adapting to new information. Machine learning algorithms and neural networks enable AI to continuously improve its performance and make more accurate predictions over time.

Advantages of Artificial Intelligence

Efficiency: AI can automate repetitive tasks, saving time and increasing productivity.

Precision: AI algorithms can analyze data with precision, leading to more accurate predictions and insights.

Personalization: AI can tailor recommendations and services to individual preferences, enhancing the customer experience.

Challenges and Limitations

Ethical Concerns: The use of AI raises ethical questions around data privacy, algorithm bias, and job displacement.

Security Risks: As AI becomes more integrated into critical systems, the risk of cyber attacks and data breaches increases.

Regulatory Compliance: Organizations must adhere to strict regulations and guidelines when implementing AI solutions to ensure transparency and accountability.

Conclusion: As artificial intelligence continues to evolve and expand its capabilities, it is essential for businesses and individuals to adapt to this technological shift. By leveraging AI's potential for innovation and efficiency, we can unlock new possibilities and drive progress in various industries. Embracing artificial intelligence is not just about staying competitive; it is about shaping a future where intelligent machines work hand in hand with humans to create a smarter and more connected world.

Syntax Minds is a training institute located in the Hyderabad. The institute provides various technical courses, typically focusing on software development, web design, and digital marketing. Their curriculum often includes subjects like Java, Python, Full Stack Development, Data Science, Machine Learning, Angular JS , React JS and other tech-related fields.

For the most accurate and up-to-date information, I recommend checking their official website or contacting them directly for details on courses, fees, batch timings, and admission procedures.

If you'd like help with more specific queries about their offerings or services, feel free to ask!

2 notes

·

View notes

Text

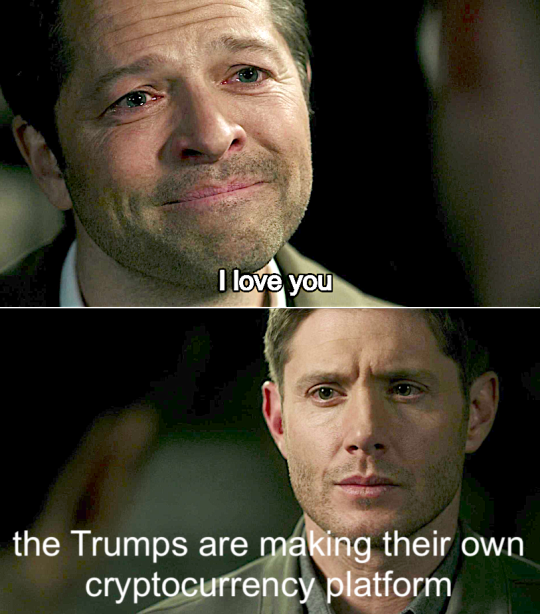

From La Stampa (translated from Italian):

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

4 notes

·

View notes