#bank bailouts

Explore tagged Tumblr posts

Text

Three, four years ago I could have told you, and did tell people, that inflation would start steadily going up, and I said even then that it would likely be stubborn, meaning it wasn't going to be an easy fix.

I knew this back then because it was obvious, even years ago, that the BRICS countries, along with many African and South Asian countries and elsewhere were looking for ways to get around using the US Dollar for trade.

They were making moves to expand trade relations outside US dollar transactions and were for many years planning and building the infrastructure for a future Multipolar world.

And that process began rapidly picking up pace three or four years ago.

I began to say then, what I'm still saying now, as that process goes on and trade outside the US Dollar system grows exponentially year-on-year, that's going to begin to have an effect on inflation.

Why? Well, Imperialism really. Because the US for decades has depended on the steady demand for US Dollars to hold down inflation, allowing the US to use debt spending to finance wars, military bases and imperialistic ventures like Syria.

Remember, it was the US in its massively dominant position after WWII that built the Bretton Woods System that made the US Dollar the world reserve currency pegged to gold, and it was the US that unilaterally abandoned Bretton Woods 1 and took the dollar off Gold, allowing for the US to finance wars through debt spending, and created the Petro-Dollar with Saudi Arabia in the 1970's.

This debt spending is essentially the surplus value from the Global South and other poorer countries that must buy US Dollars to fund infrastructure projects, energy consumption, food and medicine imports, etc since it's the world reserve currency and if you wish to use the US Financial System at all, such as the World Bank, or SWIFT messaging system, well you have to use US Dollars.

Basically, it's the sucking of the wealth out of poorer countries to finance their own economic oppression.

But as these countries catch on and with new rising global powers like Russia, China and Iran building the infrastructure for an alternative system, the US Dollar is being abandoned faster than ever.

In 2000, more than 70% of Foreign Exchange Reserves were held in US Dollars. By 2020, that figure had dropped considerably to 59%. And the rate at which it's dropping is only increasing.

Knowing this, I said back in 2019 and 2020 that inflation was likely to become a problem. And if it did become a problem, then we knew exactly what the Fed would do as a result: dramatically increase benchmark Interest rates.

This didn't take any particularly specialized or secretive sources to figure out. It's been obvious for years to anyone seriously interested in economics and geopolitics.

And what happens when interest rates go up? The value of the bonds bought under lower interest rates suddenly go way down, while debts become more expensive. It's like gravity in economics.

So with all that being said, why then did all these banks (Signature Bank, First Republic Bank, and Silicon Valley Bank) continue buying troubled assets and Treasury bonds if they're so smart and educated and knew all this?

I mean, these guys are supposed to be the best of the best corporate bankers, right? On the cutting edge of investment banking, right? That's what everyone said even just months before Silicon Valley Bank failed. (CNBC host and moron of the year Jim Cramer literally praised Silicon Valley Bank less than a month before its failure)

So one of two things must be true here and neither one is good for YOU the average worker.

Either these bankers are idiots; complete morons who have little to no understanding of basic economics, geopolitics, and monetary policy, something that should be of concern to all of us.

I mean, I'm just a dude working for a small retailer in New Orleans and even I knew this inflation and higher interest rates were coming.

So why exactly are these people paid such exorbitant salaries? If I can understand the basics of their job better than they can, why am I a retailer, and he, a millionaire banker???

So that's one possibility, one I'm virtually certain is actually true, that our ruling Elite isn't particularly smart or well educated in reality, anymore than ordinary people I meet everyday, and any one of us could easily do their jobs just as well or better than they do given the opportunities afforded to them.

But even if in this case, that's not what happened. That these weren't idiots. Well then the alternative is something that should also be deeply disturbing to you: that these bankers knew they would be facing this situation, that they were well aware of the coming inflationary pressures and equally aware what the Feds response would be, interest rate hikes.

And instead of using the last couple of years to shed possibly dangerous assets and shore up the money the banks kept on hand, they continued to do what was personally making them so much profit, at the expense of tax payers, because they were absolutely certain that the government these bankers spend so much money on campaigns for, would swoop in regardless of the recklessness of their behavior, and bail them out no matter what.

These are not the signs of a healthy political, economic or banking system.

#bailout#bank bailout#bank bailouts#us corruption#economic corruption#political corruption#us imperialism#us hegemony#wall street#bankers and bailouts#fuck capitalism#neoliberal capitalism#neoliberalism#fuck neoliberalism#socialism#communism#marxism leninism#socialist politics#socialist worker#socialist news#socialist#communist#marxism#marxist leninist#progressive politics#politics#us banking crisis#us banking system#recession#economics

189 notes

·

View notes

Text

Throwback to the 2008 financial crisis

#jerktrillionaires#jerkmillionaires#jerkbillionaires#neoliberal capitalism#capitalism#bank of america#merrilllynch#bank bailouts#bailout#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#anthony albanese#albanese government#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#class war#classwar#fuck the gop#fuck the police#fuck the supreme court#fuck the patriarchy

0 notes

Text

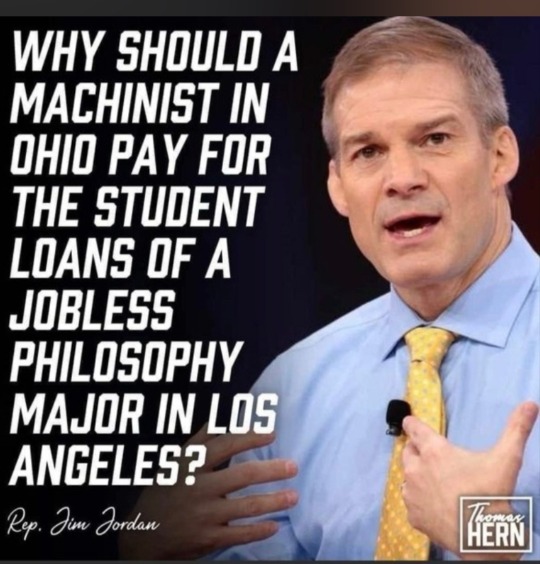

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

270 notes

·

View notes

Text

SVB bailouts for everyone - except affordable housing projects

For the apologists, the SVB bailout was merely prudent: a bunch of innocent bystanders stood in harm’s way — from the rank-and-file employees at startups to the scholarship kids at elite private schools that trusted their endowment to Silicon Valley Bank — and so the government made an exception, improvising measures that made everyone whole without costing the public a dime. What’s not to like?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/15/socialism-for-the-rich/#rugged-individualism-for-the-poor

But that account doesn’t hold up to even the most cursory scrutiny. Everything about it is untrue. Take the idea that this wasn’t a “bailout” because it was the depositors who got rescued, not the shareholders. That’s just factually untrue: guess where the shareholders kept their money? That’s right, SVB. The shareholders of SVB will get billions in public money thanks to the bailout. Billions:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

But is it really public money? After all, the FDIC payouts come from a pool of funds raised from all of America’s banks. The billions the public put into SVB will be recouped through hikes on the premiums paid by every bank. Well, sure — but who do you think the banks are going to gouge to cover those additional expenses? Hint: it’s not going to be the millionaires who get white-glove treatment and below-cost loans. It’ll be the working people whom the banks steal billions from every year in overdraft fees — 78% of these are paid by 9.2% of customers, the very poorest, and they amortize to a 3,500% loan:

https://pluralistic.net/2021/04/22/ihor-kolomoisky/#usurers

As Adam Levitin put it on Credit Slips:

They will pass those premiums through to customers because the market for banking services is less competitive than the market for capital. In particular, the higher costs for increased insurance premiums are likely to flow to the least price-sensitive and most “sticky” customers: less wealthy individuals. So average Joes are going to be facing things like higher account fees or lower APYs, without gaining any benefit. Instead, the benefit of removing the cap would flow entirely to wealthy individuals and businesses. This is one massive, regressive cross-subsidy. It’s not determinative of whether raising the cap is the right policy move in the end, but this is something that should be considered.

https://www.creditslips.org/creditslips/2023/03/the-regressive-cross-subsidy-of-uncapping-deposit-insurance.html

The SVB apologists display the most curious and bizarre imaginative leaps…and imaginative failings. For them, imagining that regulators will just wing it to the tune of hundreds of billions in public money is simplicity itself. Meanwhile, imagining that those same regulators would say, “Not one penny unless every shareholder agrees to sign away their deposits” is literally impossible.

This bizarrely inconstant imagination carries over into all of the claims used to justify the SVB bailout — like, say, the claim that if SVB wasn’t bailed out, everyone would pile into too big to fail banks like Jpmorgan. This is undoubtably true — unless (and hear me out here!), regulators were to use this failure as a launchpad for public banks, and breakups of Jpmorgan, Wells Fargo, Citi, et al.

This is a very weird imaginative failure. America operated public banks. It had broken up too big to fail banks. These weren’t the deeds of a fallen civilization whose techniques were lost to the mists of time. There are literally people alive today who were around when America operated nationwide public banks — a practice that only ended in 1966! We’re not talking about recovering the lost praxis of the druids who built Stonehenge without power-tools, here.

The most telling imaginative failure of SVB apologists, though, is this: they think that people are angry that the government saved the janitors at startups and the scholarship kids at private schools, and can’t imagine that people are angry that America didn’t save anyone else. If you’re a low-income student at an elite private school, there’s billions on hand to save you — but not because the government gives a damn about you — saving you is a side effect of saving all the rich kids you go to school with.

Likewise, the startup janitors aren’t the target of the bailout — they’re overspill from the billions mobilized to rescue the personal fortunes of tech billionaires who supply VCs’ investment capital. If there was a way to bail out the startups without bailing out the janitors, that’s exactly what would happen.

How do I know this? Well, first of all, the “investors” who demanded — and received — a bailout are on record as hating workers and wanting to fire as many of them as possible. As one of the loudest voices for the bailout said of Twitter employees, in a private message to Elon Musk following the takeover: “Day zero: Sharpen your blades boys ��”:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

But there’s even better evidence that the bailout’s intended target was wealthy, powerful people, and every chance to carve out working people was seized upon. When regulators engineered the sale of SVB to First Citizens Bank, they did not require First Citizens to honor SVB’s community development obligations, killing thousands of affordable housing units that had been previously greenlit:

https://calreinvest.org/wp-content/uploads/2021/05/Community-Benefits-Plan-SVB-CRC-GLI.pdf

Tens of thousands of people wrote to regulators, urging them to transfer SVB’s Community Benefits Plan obligation to First Citizens:

https://www.dailykos.com/campaigns/petitions/sign-the-petition-save-affordable-housing-keep-the-promises-silicon-valley-bank-made

As did Rep Maxine Waters, the ranking member of the House Financial Services Committee:

https://democrats-financialservices.house.gov/uploadedfiles/318_cwm_ltr_fdic.pdf

But First Citizens — a bank whose slot in America’s top-20 banks was secured through a string of exceptions, exemptions and waivers — was not required to take on SVB’s obligations to carry out loans to build thousands of affordable housing units in the Bay Area and Boston, including a 112-unit building for people with disabilities planned for a plum spot across from San Francisco City Hall:

https://www.levernews.com/regulators-stiffed-low-income-communities-in-silicon-valley-bank-bailout/

All those people who wanted SVB’s community development obligations to carry forward vastly outnumbered the people calling for billionaires portfolio companies to be saved — but they merely spoke on behalf of people who sought the most basic of human rights — shelter. No one listened to them. Instead, it was the hyperventilating all-caps “investors” who spent SVB’s no-good weekend shouting on Twitter about the fall of civilization who got what they wanted, with a bow on top, and a glass of publicly funded warm milk before bed.

The US finance sector is reckless to the point of being criminally negligent. It constitutes an existential risk to the nation. And yet, every time it gets into trouble, regulators are able to imagine anything and everything to shift their risks to the public’s shoulders.

Meanwhile, everyday people are frozen out. School lunches? Unaffordable. Student debt cancellation? Inconceivable. Help for the hundreds of thousands of NYC schoolchildren whose schools are facing a $469m hack-and-slash attack? That’s clearly impossible:

https://council.nyc.gov/joseph-borelli/2022/09/06/nyc-council-calls-for-mayor-adams-doe-to-fully-restore-469m-in-school-funding/

When it comes to helping everyday people, American elites and their captured champions in the US government have minds that are so rigid and inflexible that it’s a wonder they can even dress themselves. But when the fortunes and wellbeing of the wealthy and powerful are on the line, their minds are so open that some of their brains actually leak out of their ears and nostrils:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

Every bank merger is supposed to come with a “public interest analysis.” But these analyses are “perfunctory.” They needn’t be:

https://openyls.law.yale.edu/bitstream/handle/20.500.13051/8305/Kress_Article._Publication__1_.pdf

First Citizens got a hell of a bargain: it paid zero dollars for SVB’s assets, its deposits and its loans. Any losses it incurs from its commercial loans over the next five years will be paid by the FDIC, no questions asked. The inability of regulators to convince First Citizens to assume SVB’s community obligations along with those billions in public largesse speaks volumes.

Meanwhile, SVB’s shareholders continue to claim that their headquarters are a relatively unimportant office in Manhattan, and not their glittering, massive corporate offices in San Jose, as part of their bid to shift their bankruptcy proceeding to the Southern District of New York, where corporate criminals like the Sackler opioid family have found such a warm reception that they were able to escape “bankruptcy” with billions in the bank, while their victims were left in the cold:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

Contrary to what SVB’s apologists think, the case against them isn’t driven by spite — it’s driven by fury. America’s “socialism for the rich, rugged individualism for the poor” has been with us for generations, but rarely is it so plain as it is in this case.

There’s only two days left in the Kickstarter campaign for the audiobook of my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

[Image ID: A glass-and-steel, high-tech office building. Atop it is a cartoon figure of Humpty Dumpty, whose fall has been arrested by masses of top-hatted financiers, who hold fast to a rope that keeps him in place. At the foot of the office tower is heaped rubble. On top of the rubble is another Humpty Dumpty figure, this one shattered and dripping yolk. Protruding from the rubble are modest multi-family housing units.]

Image:

Lydia (modified) https://commons.wikimedia.org/wiki/File:Vicroft_Court_Starley_Housing_Co-operative_%282996695836%29.jpg

Oatsy40 (modified) https://www.flickr.com/photos/oatsy40/21647688003

Håkan Dahlström (modified) https://www.flickr.com/photos/93755244@N00/4140459965

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#housing crisis#svb#silicon valley bank#plutocracy#bailouts#affording housing#socialism for the rich#rugged individualism for the poor#regional banking#community development banks#housing

89 notes

·

View notes

Text

If you ever feel embarrassed about living paycheck to paycheck, just remember there are banks living bailout to bailout.

— Pat Mandziy (TikTok, 20 Dec 2024)

#late stage capitalism#bailouts#big banks#too big to fail#quotes#government bailouts#economics#cost of living crisis

4 notes

·

View notes

Text

love how so far every time Nate ends up in a hospital it's like the ghost of Sam follows him around to haunt him and he just reenters parent mode. love that kind of angst for us

#tv: leverage#leverage#leverage s2#the beantown bailout job#local gay watches Leverage (or their first American series in fucking years and gets a shiny new OT3 to show for it).txt#this post brought to you by him about to leave to get Detective Bonnano for the daughter of the bank worker to talk to#and then she grabs his wrist and his eyes go super soft and you have that little 'oh.' moment. once again f*ck Hutton but Nate Ford#contains multitudes

1 note

·

View note

Text

Time for some changes

here's a random word generator--whatever word it gives you is now the thing you are the deity of

#4-day workweek/4 hours a day with the same pay as 5 days/8 hours is mandatory now#free medicalaid#free university#public transit is going to get funded to hell and back#it's also going to create jobs#more parks and green areas#more walkable places#no bailouts for banks and other huge ass companies anymore#more funding for schools and kindergarden#livelong learning gets fully supported and encouraged by offering schools/universities for adults that just want to learn shit and meet peo#people#good suggestions are going to be encouraged#more greenery added to buildings - less concrete wastelands

299K notes

·

View notes

Text

Credit Suisse: A Brief History of Scandal and Collapse

Credit Suisse, one of the world’s largest and most prestigious banks, has been in the headlines for all the wrong reasons lately. The Swiss bank has been rocked by a series of scandals and losses that have tarnished its reputation and eroded its capital base. How did Credit Suisse go from being a leading global financial institution to a troubled and struggling one? Early history of Credit…

View On WordPress

0 notes

Text

So because they made things SO bad, they are gonna make them worse?

Prices/inflation (does it really matter the term?) are at an all time high, but, theft* is at a historic high, YET profits are at a 30 year high.

So even tho people are stealing more than ever (mostly DUE to prices), profits continue to rise (they wouldn't stay in business if it wasn't profitable). BUT because we are cutting into their MAXIMUM profits....

there's rumors they will use these thefts (again-the thefts are due to them AND they are still profiting) to implement (force) a government mandated digital currency.

If you think about it, that IS the way to stop thefts but...

I don't think they realize that the corna lockdown turned more people against the government than for it.

(Biden sure as fuck didn't help anything after either).

So I am gonna say it: I FUCKING DARE YOU TO TRY!

You thought theft was bad before? Wait till they plan it in large coordinated groups, you stupid greedy fucks; you will have more stolen than the last decade combined mother fuckers. We are learning from France...

You make it too costly to live, we will CHOKE out your air supply.

We don't work, we don't buy; you die. Simple as that.

Do you even know how to cook your own food? Seriously. Rich people....when shit hits the fan, poor people are used to doing whatever it takes, scraping by, and still coming out breathing. I don't think you even have the knowledge, let alone genetics, to fend for yourself. You need armies; we just need each other.

*btw, 2008 bailout and so many other years the 1% stealing ALWAYS beats what the 99% stole. Sorry, but if 1 million people stole 100 dollars, that's 100 million. But if 10 people stole a billion dollars....it's just math people. The biggest thefts, rapes, murders etc are ALWAYS from the 1%! NEVER FORGET!

#we do all the work#work#working#job#capitalism#nightmare#usa#profit#bailout#2008 bailout#banks#banking#federal reserve

0 notes

Photo

(via "Bend Over America" Graphic T-Shirt for Sale by genieroze)

Creating a tee with the impactful message "Bankster Bailout Bend Over America" in text art resembling the American flag will catch attention. To enhance the symbolism, an illustration of an eagle's head will reinforce the idea of vigilance and freedom. Behind the text, a depiction of the Statue of Liberty bent over with an American flag overlay will emphasize the sentiment of banks taking advantage, drawing a visual parallel to the notion of manipulation. This tee aims to spark conversations about economic integrity and government accountability.

#findyourthing#redbubble#bankster#banks#bailout#crooks#illuminati#deep state#lets go brandon#biden administration

0 notes

Text

What the SVB Failure Teaches us About Investment Banking (Encore)

SVB sign in front of Silicon Valley Bank headquarters in Santa Clara, California. (Minh Nguyen, via Wikimedia Commons, licensed under CC BY-SA 4.0) The Silicon Valley Bank collapse brings with it memories of the wider 2008 economic crisis. Jeet Heer and John Nichols from The Nation join us to discuss the 2018 bank deregulations that set the stage for this moment and the risky investment strategy…

View On WordPress

#bailout#bank deregulation#Bernie Sanders#bonds#collapse#Congress#depositors#deregulation#Elizabeth Warren#FDIC#financial crisis#insurance#investment#investment capital#long term bonds#Silicon valley#Silicon Valley Bank#SVB#taxpayer

0 notes

Text

Banking Nerves And Dodd-Frank

The Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in response to the 2008 financial crisis, with the aim of promoting stability and accountability in the banking industry. The law introduced a wide range of regulations intended to prevent another financial crisis, including measures to increase transparency, reduce risk-taking, and protect consumers.

One of the key ways that Dodd-Frank affects banking stability is by requiring banks to hold more capital as a cushion against potential losses. The law introduced new capital requirements for banks, including a minimum leverage ratio and a requirement for banks to hold a higher proportion of their assets in high-quality, easily liquidated assets. These measures help to ensure that banks have sufficient resources to absorb losses in the event of a financial downturn, thereby promoting stability in the banking system.

Dodd-Frank also established the Financial Stability Oversight Council (FSOC), which is charged with identifying and addressing systemic risks to the financial system. The FSOC monitors financial markets and institutions, and has the authority to designate certain companies as "systemically important," which subjects them to increased regulatory oversight.

Another way that Dodd-Frank affects banking stability is by providing for greater regulatory oversight and enforcement. The law created new regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), which is tasked with protecting consumers from abusive financial practices. Dodd-Frank also gave regulatory agencies greater authority to supervise and enforce regulations, and introduced new measures to promote accountability and transparency in the banking industry.

Yes, Dodd-Frank has been weakened to some extent in the years since it was enacted. While the law was intended to promote stability and accountability in the banking industry, some of its provisions have been rolled back or scaled back in the years since its passage.

One of the most significant changes to Dodd-Frank came in 2018, when Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act. This law rolled back several provisions of Dodd-Frank, particularly those that applied to smaller banks and credit unions. The law raised the threshold for banks that are subject to enhanced regulatory oversight, exempting many smaller institutions from certain requirements. It also eased some of the restrictions on banks' ability to engage in certain types of trading and investing activities.

In addition to legislative changes, the Trump administration also took steps to weaken Dodd-Frank through regulatory actions. For example, the administration appointed new leaders to regulatory agencies who were more sympathetic to the banking industry, and these leaders rolled back or delayed several Dodd-Frank regulations. The administration also sought to limit the power of the Consumer Financial Protection Bureau, which was created by Dodd-Frank to protect consumers from abusive financial practices.

Although Dodd-Frank has been weakened in some respects, many of its key provisions remain in place. Banks are still required to hold more capital as a cushion against potential losses, and regulatory agencies still have the authority to monitor and enforce regulations. Nevertheless, the changes to Dodd-Frank have been significant, and some critics argue that they have increased the risk of another financial crisis by reducing regulatory oversight and accountability in the banking industry.

0 notes

Text

Democrats do it again!

The more we look the more is discovered about the deceitful, traitor behavior of the Democrats and the Biden anti American administration. Now it has been discovered that the Silicon Valley Bank was established with a partnership with Shanghai Pudong Development Bank created a partnership called the SPD Silicon Valley Bank. No wonder Biden is FULLY replacing money lost in this bank fiasco well beyond the $250,000 per account, Looks like it is because this bank and SSVB played a role in putting up the4 money to finance Chinese development in tech industries and providing information to Chinese regulators. As well as helping Chinese get funding from this US Bank.

Just when are the American people going to stop these out of control domestic terrorists called DEMOCRATS

1 note

·

View note

Note

"He's remembering the realization he had when Eliot was shot and for that half a minute Nate was convinced that infecting these people with morals had killed one of them."

When was Eliot shot and Nate was briefly convinced that he'd gotten him killed? The show is a bit of a blur since I saw it all way too fast and I lost track of the timeline 😅

Lol, I'm not surprised! Leverage is an easy show to binge and I'm referencing an earlier post I made here which references a second or two blip of time in The Beantown Bailout Job. In the final confrontation in that episode, Eliot gets caught eavesdropping (after they've found out that the banker is the one running the operation, not the mob) and hauled in in front of the boss and Nate, who's trying hard not to blow his own cover. In order to flip the con and frame the mob guy for working with the cops instead of the bank manager, Nate offers to "search" Eliot and pretends to find a Marshal badge in Eliot's pocket. The bank manager demands someone just kill Eliot and while they're arguing over killing him and who's gonna do it, suddenly there's a bang and Eliot has a red spot and he just kind of stares blankly at Nate for a second in his chair and the camera cuts to Nate and you can see just raw panic on his face (in Nate fashion, which means he's frozen with slightly buggy eyes.) (And to make the emotions worse, when Nate was searching him, Eliot whispered that he hoped Nate knew what he was doing.) Then there's two more "shots", Eliot falls out of his chair, and Nate turns around to see Sophie there holding the gun. And since Sophie's in on it and would never hurt anyone, especially on the team, it must be okay, but Nate has to just ... Take that on faith for a minute.

And yeah I kind of extrapolated that that was the moment Nate realized that truly, if anything happened to these guys, it's Nate's fault for introducing them to helping people. So that's what I was referencing in my other post :D

Thanks for the ask! Remind me to do a post on The Beantown Bailout Job and how The Maltese Falcon Job mirrors it in the same way that The Long Goodbye Job mirrors The Nigerian Job ;)

#leverage#eliot spencer#nate ford#sophie devereaux#the beantown bailout job#the maltese falcon job#cookie crumbs#cookie convo

150 notes

·

View notes