#accounts receivable platform

Explore tagged Tumblr posts

Text

Ough I wanna talk about the little gremlins in my head (ocs) again. Gonna make an oc blog so I can have a designated place for them

#i heard a website called toybox(?) was a thing but i think you need to receive an invite link from someone to get an account...#so ill settle for tumblr#i tried posting my ocs on twt a long time ago? but with how toxic the platform is#i felt anxious#tumblr my beloved

2 notes

·

View notes

Text

this is honestly so real like i always appreciate it dearly whenever someone shares their thoughts on my works and goes on a full on yapping session on either my reblogs or comment sections because it’s what motivates me to keep writing and always make sure everything i post is of the best quality i can manage with so that it’ll make reading my fics worth your time :’D it may just be a reblog or a comment to you guys but for me it actually means the whole world like i’m not even exaggerating 😭

#౨ৎ﹒ノ﹒notes#if it weren’t for the constant support i receive from people here this account wouldn’t have even existed in the first place#please never stop sharing your thoughts with me <3 i always make sure to read and reply to every single comment i receive on this platform

0 notes

Text

Smart Contracts in Action: Automating Compliance in Supply Chain Finance

In the world of global commerce, supply chain finance stands as a critical pillar. It ensures the smooth flow of capital across various stages of the supply chain. As businesses strive for increased efficiency and reduced risk, the advent of blockchain technology has introduced a transformative element: smart contracts.

These digital agreements automate the execution of contracts based on pre-set rules, offering an unprecedented opportunity to enhance transactional security and operational efficiency in supply chain operations. In this blog, we shall explore the specifics of smart contracts and their application in supply chain finance. With this, we aim to provide you with a better understanding of how these technologies can automate compliance and optimize financial workflows within complex supply chains.

Foundations of Smart Contracts in Supply Chain Finance

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They operate on blockchain technology, which provides a decentralized ledger. This ledger executes and records transactions in a transparent, secure, and immutable manner. Here’s how they integrate into SCF:

Contractual Logic for Automated Execution

Smart contracts encode complex supply chain finance agreements as programmable constructs that automatically enforce contractual obligations.

This includes conditional payments, lien enforcement, and adherence to service level agreements (SLAs), all executed through predefined rules and triggers.

Decentralized Autonomous Organizations (DAOs) for Governance

In a more advanced setup, smart contracts can facilitate the creation of DAOs.

They govern supply chain finance operations.

DAOs operate on a set of programmed rules and execute financial transactions and governance decisions autonomously, without the need for human intervention.

They reduce administrative overhead and enhance execution speed.

Integration with External Oracles

Smart contracts inherently cannot access external data.

This is a limitation in supply chain finance where external market data (like currency exchange rates) and performance data (like delivery confirmations from logistics providers) are crucial.

Oracles serve as data feeds that bring external information to the blockchain in a secure manner, enabling smart contracts to execute based on real-time data.

Automating Compliance in Supply Chain Finance with Smart Contracts

Smart contracts introduce a level of automation in compliance that is transformative for supply chain finance, particularly in the following technical domains:

Dynamic Discounting and Payment Terms: Smart contracts can dynamically adjust payment terms based on real-time performance metrics and market conditions. For instance, they can automatically provide early payment discounts to suppliers based on the buyer’s cash flow status, calculated via algorithms that predict cash availability.

Regulatory Compliance and Anti-Money Laundering (AML): By embedding regulatory and compliance checks directly into the transaction process, smart contracts ensure that all supply chain finance activities adhere to relevant laws and regulations. They can automate the generation of audit trails, perform real-time AML checks, and enforce compliance with international trade sanctions.

Synthetic Securitization of Receivables: Smart contracts enable the pooling of various receivables and the issuance of covered bonds or asset-backed securities. This process, known as synthetic securitization, can be fully automated, enhancing liquidity and spreading credit risk among a broader set of investors.

Counterparty Risk Algorithms: Through the use of bespoke algorithms, smart contracts can assess counterparty risk in real time by analyzing transaction history, market conditions, and credit data. This risk assessment can trigger automated adjustments to credit terms instantaneously, a critical capability in the fluid landscape of global trade.

Future Developments and Advanced Implementations

As blockchain technology evolves, the future of smart contracts in supply chain finance is poised for the following advancements:

Machine Learning Integration

By integrating machine learning models, smart contracts can enhance their predictive capabilities regarding payment behaviors, market fluctuations, and compliance risks.

This will allow more nuanced and anticipatory finance strategies.

Interchain Operability

Future developments may allow for seamless interactions between different blockchain platforms

This will enable more robust supply chain smart solutions that can operate across various blockchains.

This enhances scalability and efficiency.

Automated Dispute Resolution

Advanced smart contracts could incorporate automated dispute resolution mechanisms.

They use AI to interpret contract terms.

They also use blockchain-recorded actions to adjudicate disputes without human intervention.

Conclusion

Smart contracts are poised to revolutionize the field of supply chain finance by providing mechanisms for greater automation, enhanced security, and meticulous compliance.

As we learnt, these contracts facilitate more than just automated transactions; they embed the very framework of financial governance into the blockchain, offering a robust solution for managing the multifaceted aspects of trade finance. The convergence of blockchain technology with traditional financial processes promises to foster a more transparent, efficient, and secure environment for businesses worldwide.

As industry leaders and financial experts continue to explore and invest in these technologies, the future of supply chain finance looks increasingly promising. Smart contracts will undoubtedly play a pivotal role in shaping this future, turning complex financial interactions into streamlined, trustworthy operations that propel global trade forward.

#supply chain finance#supply chain#trade finance#trade and supply chain finance#supply chain platform resources#digital trade finance#accounts receivable#receivables financing

0 notes

Text

it’s disheartening to see an overwhelming majority of white queer people fail to recognize that the communities they build so closely imitate the structures of oppression they have claimed to leave behind, while loudly proclaiming allyship for people of color.

i’ve been on a ton of different platforms now and even though i interact with a lot of trans people, i’ve noticed that i often find myself othered by trans fem communities. the exclusion is subtle because i am east asian, pretty, and passing. and because i am pretty and passing, i often receive recognition and admiration from other trans fems. and because i am east asian as opposed to someone with black or brown skin, i am often accepted into white circles.

but i am not white. and the subtle exclusion comes from my distaste of jokes that fail to account for privilege, from speaking up when white creators speak over other people of color, from simply having a different perspective

because i am not white. and i have never been.

i’ve lived my entire life being nearly accepted by the white people around me. and the subtle exclusion that has been a staple of my life hasn’t gone away because racism still exists within queer communities.

it’s not enough to be loud about fighting oppression.

you also have to fucking do it.

11K notes

·

View notes

Text

Hello, dear friends, how are you?

I’m writing this post while facing certain death.

I want to ask you, why have you stopped helping us? Is it because we’ve reached this point? Is it because we’ve reached €49,000?

I want to tell you all that I am deeply grateful, but as of this moment and date, we have not received a single euro from these funds. Even though we are in desperate need of it, I want to clarify that we won’t even receive half of it due to the percentage taken by the GoFundMe platform, the bank, and the state.

I also want to explain that the currency exchange fees here in Gaza exceed 30%.

We are currently in dire need of assistance. Prices have skyrocketed to unimaginable levels. The price of a bag of flour now exceeds €300, and the cost of vegetables has risen to insane, unbelievable levels. As for meat and fish, they’ve become like a dream to us. We haven’t had a proper, healthy meal since the war began.

We are now forced to survive on just one meal a day.

Let me ask you, how would you feel if you hadn’t had a proper meal for two days? Or if you were unable to have your lunch today?

We are now facing famine. Please, we beg you to help us. Please donate. Please share this post so it can reach someone capable of donating.

Let’s aim to reach €60,000 by the end of next week. I can’t do this alone, but with your support for me and my family, we can achieve it.

Please, don’t leave us alone. If you’re interested in helping, follow my account. @abdalsalam1990

Once again, I’m pleading with you to donate and share this post with your friends.

@tamamita @serial-unaliver @vampiricvenus @punkitt-is-here @2spirit-0spoons @paper-mario-wiki @omegaversereloaded @nyancrimew @90-ghost @beserkerjewel @ot3 @killy @prisonhannibal @aimasup @anneemay @dirhwangdaseul @neechees @memingursa @b0nkcreat @certifiedsexed @afro-elf @11thsense @sawasawako @vamprisms @girlinafairytale @spacebeyonce @skipppppy @beetledrink @schoolhater @3000s @annevbonny @fools-and-perverts2 @dailyquests @evillesbianvillain @wolfertinger666 @taffybuns @valtsv @postanagramgenerator

Please all my friends share it, write a comment and tag your friends so they can share it too.

#free palestine#gaza#free gaza#gaza genocide#gaza strip#save palestine#i stand with palestine#all eyes on palestine#gazaunderattack#palestine gfm#gaza ask#gaza aid#gaza under siege#the gaza strip#gaza gofundme#gaza gfm#palestinian authority#palestinian art#all eyes on gaza#gaza action#palestin#viva palestina#palestinian#palestine fundraiser#fundraiser#palestinian gofundme#GoFundMe#palestine news#palestinian genocide#gaza fundraiser

6K notes

·

View notes

Text

i want to bring everyone's attention to a campaign i happened to find while searching through the vetted gaza evacuation fundraiser sheet made by el-shab-hussein and nabulsi, specifically, #250 - "support my uncle's family to survive the war"

while legitimate, even though it was created in march it has received very little attention - at this time of writing, it only has 1.7% out of a goal of €97k

i really hope to bring some attention to this family who needs a lot of money - hasan's uncle amjad was even injured recently in early july, and i really hope this can help to bring some attention to their campaign

you can find amjad's twitter account here, if you have a twitter platform as well

let's match?

€1,665 / €97,000 goal

3K notes

·

View notes

Text

EYES ON VENEZUELA

VENEZUELA NEEDS YOUR HELP. READ. REBLOG. EDUCATE. HELP. A lot of things are happening in the world right now. But one thing I don't see receiving enough attention right now is the situation in Venezuela. Nicolás Maduro has just won the Venezuelan election with 51.21% of votes compared with 44.2% going towards his rival Edmundo González Urrutia. Except THIS IS NOT THE CASE. Undeniable election fraud has taken place - anyone within Venezuela knows that Maduro is a ruthless dictator and he was an extremely unpopular candidate. Maduro's victory does not reflect the will of Venezuelan voters. Venezuelan people are getting kidnapped and killed by the military on the streets. And this is just the beginning of Maduro's rule. I am not from Venezuela, but read the messages of friends that are as the situation unfolded.

Venezuela are on the brink of civil war, being cut off from the world, and are being killed on the streets. One of the people you just read messages from urged me to send this message:

WHAT YOU CAN DO: - Spread the word. Educate others. Reblog this post. Do research. If anyone can provide additional context and stories, please share. Talk about this on any social media platform you have. I am primarily a Sonic fandom account - I urge that if anyone with a sizeable following in this fandom reads this post, that they please share this in front of their followers. Please ensure this post spreads through the fandom ecosystems. Below is a link to a Twitter post that has artists in the replies that are from Venezuela, if you wish to give any of them financial support:

Thank you.

3K notes

·

View notes

Text

🥛🍔

#really getting fucking tired of tumblr not compressing my file itself. like it ruins the quality but it wont#automatically resize my massive fucking files!? gotta do it myself?? ugh. the lack of usability across all social media platforms is just#getting so hard to stomach anymore. nothing is functional. people get their accounts removed for no logical reason. im exhausted.#and yet i still want all my shit in a collective place -_-#ugh.do you ever look at something and are like. holy shit i painted this.damn. unfortunately it doesnt happen very often but when it does?#almost always my vent boy. why. why is that?why cant i paint anything half decent except this emo boy with a mullet?whatever. also. kinda#random but.not actually random. related actually.idk if this is just me but like. sometimes there are Articles in ur living space that just#exist. like u just accept they exist even tho u have no recollection of attaining them. im talkin clothes specifically rn. like i have this#aqua-green robe with blue trim that ive had as far back as i can recall...except i cant for the life of me remember where it came from! its#almost like it spawned in my closet one day.i just. accept it.like. dont get me wrong. it cozy. its quite physically held up for decades.#i wear it all the damn time. but ive no mortal clue how it got here. ive no memory of receiving it.also ngl i had way too much fun renderin#his beard.like u cant tell bc i apply about a million overlay layers and filters respectively to my finished works. ultimately covering up#hours + hours worth of finely rendered details each drawn individually by hand. deeming my efforts useless in the end bc i cover it up but.#trust me. i took some time with that beard.beard gang beard gang.mullet beard gang.dirty smelly mullet beard man. hello yes my name is#80 y/o who is 32/33 years old. how are you today? im personally doing terrible.good talk. WHAT CAN I SAY i just think the emo grown ass man#with boatloads of physical AND emotional trauma is neat. MY HANDS LOOK LIKE THIS SO HIS DONT HAVE TO *camera pans to a fucked up little set#of discolored claws skin translucent as alll hell. no muscle.atrophied beyond repair. also a bit of dirt is caked under the brittle + ridge#unhealthy nails. cuts and scraped take approx 3 months to heal bc the nerve functioning is That Bad*.#botdbs#fk#on a final note. I drew these about a week ago. I was literally only listening to cheeseburger in paradise the whole time. Then I learned#today that Jimmy Buffett passed away yesterday. broke my heart a little. i was just drinking my coffee from my margaritaville mug too.#Rest in peace legend. I hope heaven has so many cheeseburgers.#so many cheeseburgers in literal paradise.#Makin' the best of every virtue and vice. Worth every damn bit of sacrifice. to get a. cheeseburger in paradise.

0 notes

Text

Some quick tips to spotting accounts that are pretending to be a Palestinian needing mutual aid. Please keep in mind that not all of them are scam accounts, and that some may legitimate blogs who just aren’t too knowledgeable on how tumblr works. This guide is based around what I go by when checking certain blogs and usually it’s a quick giveaway the blog is a scam.

Please read this post too from my other blog before you tell people don’t donate to gfms:

1. You was sent the ask as someone who regularly shares Palestine related content such as regular news updates of posts by other Palestinians who are regularly giving updates. You may also get these asks from sharing a popular post that is from the Palestine tag. If you post often about Palestine, you will always start getting these asks. These askers don’t care if you state don’t send the asks. They will anyway. Unfortunately minors also get sent asks.

2. The ask has odd formatting such as having odd quotation marks in it or unusual formatting that may indicate it’s been edited and copied from somewhere else. Often the ask is the same thing as the post itself minus a link to a donation site. These asks rarely change so searching it should pull up if it’s been sent to other bloggers and sometimes the asks are edited only to add new phrases to them in time.

3. The account is almost always a few days old or a week old or long depending on how often they have sent asks. Usually some may even be an hour old and reusing a familiar pfp/ask.

4. The blog has a few Palestine related posts or posts from random tags reblogged to pad out length and then no more. They will have no original posts besides the pinned post while occasionally answering asks that they may have received but otherwise nothing else and no further updates given either.

5. They may have a Linktree link that is called “GoFundMe” as if indicating they have a GoFundMe there. However, they don’t. When clicked on, the Linktree actually goes to a PayPal account whose name may not even match the one their supposed name is. They’ll say it’s a friend, but it’s just the same person not someone else. You’ll see this same name across multiple accounts after a while usually giving away it’s not legitimate even under a different theme.

6. The text used by the blogs are often real stories stolen from legitimate fundraisers and searching parts of it in your preferred search engine should pull up the sources. These sources make no mention of a tumblr account either or don’t have the PayPal account associated with them in the info. Scammers often impersonate a real person in need and will ignore you if you show them the source they copied from.

7. Legitimate Palestinians often link to their own GoFundMe posts that their friends have set up or post links to other social platforms they are found on. They will regularly post updates when possible, post sources to support them when necessary, and also generally have some method of verifying their legitimacy. They may often share links to support others as well or give links to charities that have been shown as reliable. They will have more original posts than just a single pinned one and regularly speak to other tumblr accounts beyond just an ask. Please don’t bother them with asks about possible scam accounts. There are many guides out there that can do that for you if you search. You may find verified fundraisers too.

8. Scammers don’t know anything about Palestine and will often have trouble once you ask them anything beyond the mutual aid post. They don’t know the languages decently and you can tell it pretty easily if you’re one who uses it regularly. Whatever the scammers use is often just copied off the site they got the post from. Sometimes the text is just reused from past scams such as asking for insulin that doesn’t last long.

9. These scammers can and will use names stolen off real Palestinians to look more legitimate and trustworthy. They change names constantly once one of their PayPal accounts is shut down.

10. If you do see a GoFundMe link on a blog, don’t immediately assume it’s a scam just because it’s a relatively new account. Check the post notes to see if anyone’s verified the account yet or wait a bit as it takes time. You likely can search around to see if anyone’s posted anything where the blog has been vetted by others. You may also see if the GoFundMe is referred to on other socials or on lists that compile verified and vetted fundraisers.

Please don’t let these scams deter you from sending support where it needs to go. Even if you can’t donate personally, there are other ways to help. If you are sending money, please make sure that it’s going to where it’s needed and the place it’s sent has been verified accordingly. If you find a blog is a scammer, and have been able to prove it, please make sure to alert anyone sharing the post and report the account.

5K notes

·

View notes

Text

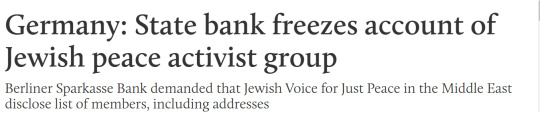

A state-owned bank in Germany has frozen the account of a Jewish anti-Zionist organisation and demanded the group disclose a list of all its members. Judische Stimme für gerechten Frieden in Nahost, or Jewish Voice for Just Peace in the Middle East, announced on Tuesday that its account with Berliner Sparkasse was frozen on 26 March with immediate effect. "In 2024, Jewish money is once again being confiscated by a German bank: Berliner Sparkasse freezes Jewish Voice account," Jewish Voice said in a statement on its social media platforms. The group received a letter from the bank informing it that a full list of all members, including adresses, tax documentation, income statements and other internal documents, needed to be submitted to Berliner Sparkasse by 5 April to "update customer data".

. . . continues on MEE (28 Mar 2024)

4K notes

·

View notes

Text

FUNDRAISERS FOR PALESTINIANS THAT ARE LOW ON FUNDS

Here are some fundraisers of Palestinians in/from Gaza who've reached out to me and that are very low on funds. If you're able to donate, I encourage you to (even if it's a small quantity, it can make a huge difference); and if not, share this post as much as you can.

DISCLAIMER: These fundraisers mostly aren’t vetted by any reliable bloggers or organizations, or I haven’t been able to find proof of vetting for them. That being said, I feel confident including them in this list since everything about them points to them being legit (for example, there’s wide picture and video documentation, and the GFM’s receiver is located in one of the countries where you’re able to receive money through the platform). Whether you decide to donate or not, it’s up to you. If one of these fundraisers is indeed a scam, please reach out to me with evidence of it so I can remove it from this list.

Rebuilding Hope: A Gaza Family in Need of Your Help (@majedgaza1) - $1243/$70000 - Majed and his family were able to escape to safety in Egypt. However, they're in need of funds to get safe housing and to pay for the education of his children so they can keep studying.

Help Whadi get cancer treatment and evacuate his family - £1739/£100000 - Whadi is a 17-year-old teenager with stomach cancer who needs urgent funds to continue his treatment and afford his medication. This campaign was vetted by the volunteer collective beesandwatermelons on Instagram, and can be found in their spreadsheet at #11.

Help me get my family out of Gaza (@karim-rasha) - 1530€/50000€ - Rasha needs help evacuating his family, which includes his elderly parents and young siblings (10 and 12 years old), from Gaza. The Tumblr account is managed by Karim, the eldest sibling.

Help us to survive from this war (@moneerraed) - 100€/35000€ - Monir, his parents, and four siblings need funds in order to evacuate Gaza after losing their shop and home.

Help Ahmed and his family get out of Gaza (@save-ahmed-family1) - 1203€/20000€ - Ahmed lost his mother when she was unable to access medical treatment after the ongoing Israeli aggression started. He now needs help to evacuate to safety alongside his wife and young daughter.

Save my family in Gaza Strip.. Help my family's children (@sara-97a) - 672€/50000€ - Ahmed and his family need urgent help evacuating Gaza, as well as affording food and medicine for his elderly mother who's a stroke survivor with diabetes and can't currently access treatment. He's got three young children as well.

Regardless of how small it is, any donation is incredibly helpful. Your five or ten bucks can be the difference and help any of the people here afford food, medicine, evacuation, and be able to survive the ongoing genocide. If not, please reblog so these fundraisers can get more eyes on them and be able to reach their goal.

1K notes

·

View notes

Text

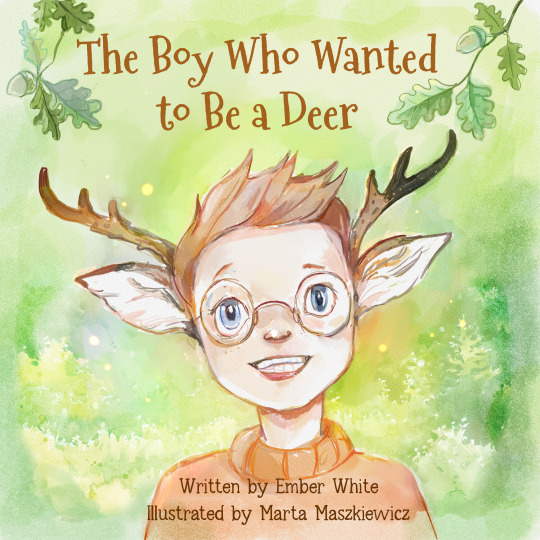

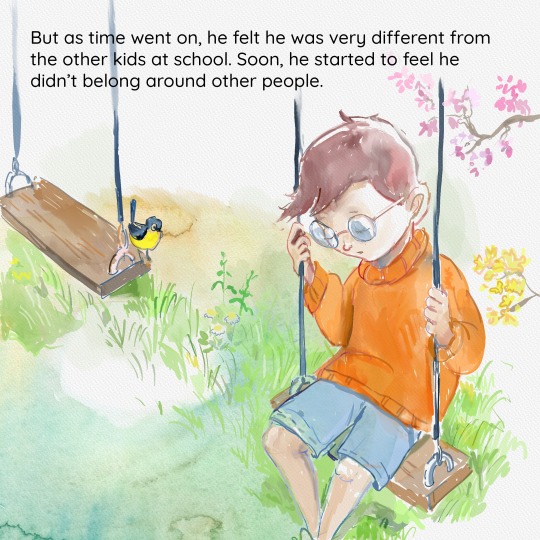

I spent the last 11 months working with my illustrator, Marta, to make the children's book of my dreams. We were able to get every detail just the way I wanted, and I'm very happy with the final result. She is the best person I have ever worked with, and I mean, just look at those colors!

I wanted to tell that story of anyone's who ever felt that they didn't belong anywhere. Whether you are a nerd, autistic, queer, trans, a furry, or some combination of the above, it makes for a sad and difficult life. This isn't just my story. This is our story.

I also want to say the month following the book's launch has been very stressful. I have never done this kind of book before, and I didn't know how to get the word out about it. I do have a small publishing business and a full-time job, so I figured let's put my some money into advertising this time. Indie writers will tell you great success stories they've had using Facebook ads, so I started a page and boosting my posts.

Within a first few days, I got a lot of likes and shares and even a few people who requested the book and left great reviews for me. There were also people memeing on how the boy turns into a delicious venison steak at the end of the book. It was all in good fun, though. It honestly made made laugh. Things were great, so I made more posts and increased spending.

But somehow, someway these new posts ended up on the wrong side of the platform. Soon, we saw claims of how the book was perpetuating mental illness, of how this book goes against all of basic biology and logic, and how the lgbtq agenda was corrupting our kids.

This brought out even more people to support the book, so I just let them at it and enjoyed my time reading comments after work. A few days later, then conversation moved from politics to encouraging bullying, accusing others of abusing children, and a competition to who could post the most cruel image. They were just comments, however, and after all, people were still supporting the book.

But then the trolls started organizing. Over night, I got hit with 3 one-star reviews on Amazon. My heart stopped. If your book ever falls below a certain rating, it can be removed, and blocked, and you can receive a strike on your publishing account. All that hard work was about to be deleted, and it was all my fault for posting it in the wrong place.

I panicked, pulled all my posts, and went into hiding, hoping things would die down. I reported the reviews and so did many others, but here's the thing you might have noticed across platforms like Google and Amazon. There are community guidelines that I referenced in my email, but unless people are doing something highly illegal, things are rarely ever taken down on these massive platforms. So those reviews are still there to this day. Once again, it's my fault, and I should have seen it coming.

Luckily, the harassment stopped, and the book is doing better now, at least in the US. The overall rating is still rickety in Europe, Canada, and Australia, so any reviews there help me out quite a lot. I'm currently looking for a new home to post about the book and talk about everything that went into it. I also love to talk about all things books if you ever want to chat. Maybe I'll post a selfie one day, too. Otherwise, the book is still on Amazon, and the full story and illustrations are on YouTube as well if you want to read it for free.

#books#reading#childrens books#lgbtq#lgbtqia#autism#transgender#furry#therian#art#deer#queer#artists on tumblr#creativity#illustration

3K notes

·

View notes

Text

Cash Flow Management Software

Tally on Mobile | Are you a Tally user? Get BFM - the best business intelligence platform and access Tally data on mobile. Automate payment reminders and collect payments 20% faster.

https://www.zikzuk.com/contact-us

#vendor invoice management software#Best Business Intelligence Platform#accounts receivable management

0 notes

Text

In the age of digital trade and supply chain finance, businesses are constantly seeking innovative solutions to streamline their operations and stay ahead of the competition. One such transformative force reshaping the landscape is the strategic implementation of artificial intelligence (AI) in supply chain finance technology platforms.

#supply chain finance#trade finance#supply chain#trade and supply chain finance#supply chain platform resources#receivables financing#accounts receivable

1 note

·

View note

Text

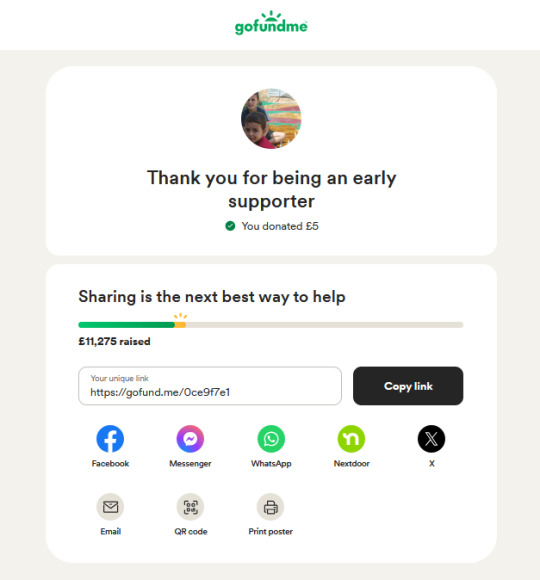

I got my first salary in my new part-time job today and after paying my debts I had a small amount left so I donated £5 to @mohamedmoner1994 and Rewaa's gofundme. Please consider matching my donation.

I haven't been able to boost and push Mohamed's and @yousefmoner's fundraiser because I've been sick for a few days and took a break from tumblr. I'll try to send out messages again to look for people who can match even just my £5 donation.

Please don't be mad or annoyed if you receive my asks; my goal will be to look for people with the ability to donate a minimum of £5 because both Mohamed's and Yousef's fundraisers are still so far from their goal nearly 5 months since they started their gofundme.

Please be assured that this is a vetted fundraiser. Mohamed's is number #66, line 70 and Yousef's is #65, line 69 in the vetted Gaza fundraisers spreadsheet. I also have countless of posts with updates from their family on my blog, tagged with their tumblr urls. Mohamed, Yousef, and Rewaa are also on instagram - pls consider following them, interacting with their posts, and sharing and collabing with their reels because the family have been struggling to promote their content on the platform. They've been asking people to help them reach a wider audience and they can really use everyone's help:

Mohamed's insta: mohamed_moner1994

Yousef's: you2.ef_

Rewaa's: rewaaamohamed

Layla, their gfm organizer: only_one_lulu

Mohamed has also started an account on tiktok, please do follow him there as well: mohamedmoner79

Mohamed is still only at £11,275 / £45,000 with only 2 donations so far today:

Yousef is at £7,794 / £50,000 with only 1 donation 1 day ago:

They have another brother, Karam, with a different fundraiser for himself, his wife, and their newborn son. I haven't been posting about him a lot because I tried to focus on Mohamed and Yousef's fundraisers first, but they also badly need donations. Their fundraiser is very new and is still only at £1,461 / £25,000 with the last donation being 3 days ago:

The last update I read from Layla was that their sister Sahar and mother Nadia went and joined Mohamed and Rewaa in Deir al-Balah, along with Karam's wife, Maram and their son, leaving behind Yousef, Karam, and father Munir in Azdaa, where there were intensified clashes and shelling that reached their encampment. Yousef, Karam, and their dad had to flee from their tent several times and sleep on the streets. When they got back to their tent, most of their belongings had been stolen.

Please help match my donation to any one of these fundraisers. If you can donate to all three, please do so. I can only afford to give £5 because of the high exchange rate here in my country, but if you have the ability to give more, your donation would go a long way to help these people and their family.

941 notes

·

View notes

Text

Pairing: Nanami Kento x Black Fem Reader

CW: Profanity, Fluff, Explicit Sexual Content, Missionary, Doggystyle, Fingering, Oral (m! receiving)…

WC: ~10k (grab your snacks)

Summary:

Nanami runs into a problem that every man dreads.

Now, you find yourself navigating the treacherous waters of his bruised ego and growing hysteria, armed with nothing but your unwavering love and a seemingly endless supply of patience, as you try to help him overcome this unexpected hurdle.

Notes: Hello! Trying to get back into the swing of writing again after so many weeks on a break and naturally Nanami is who I gravitate towards. I thought this one shot would be a funny idea, and as someone once told me, I wrote this with “my c*it on the keyboard.”

Please do not ask me for more related to this story. This is just a one-shot of a random idea, please enjoy it for what it is lol. Thank you all for understanding!

Reblogs, likes, or comments are always appreciated! Happy reading!

Dividers: @cafekitsune | Header: made by myself

Masterlist | Ao3 | Twitter |

©mysteria157, all rights reserved. DO NOT copy, plagiarize, reupload, modify, or translate (without permission) my work to other accounts and platforms.

“Fuck, Kento,” you breathe, fingers digging into the satin of the pillow case beneath your head.

The soft, warm glow of the bedside lamp bathes your intertwined bodies in a honeyed light, casting shadows that dance across your rich brown skin. Nanami’s lips, hot and insistent, trail a path of fire down your neck, pausing to lavish attention on the sensitive hollow of your throat. He drags his teeth along your clavicle, brushes his lips between the skin of your breasts. A breathy moan escapes you as his tongue traces lazy, deliberate circles around an already-sensitive nipple, sending sparks of pleasure racing through your veins.

His hands, strong and sure, yet infinitely gentle, knead the soft flesh behind your knees, coaxing your legs to open wider, allowing him to sink deeper into the welcoming heat of your body. The blunt head of his cock grazes that sweet spot inside you with each measured thrust, and you can’t help but arch your back, silently begging for more.

Your hair, messy from his fingers, frames your face in a splatter of curls, some clinging to the sheen of sweat on your cheeks. The sight of you like this—open, wanting, completely his—nearly steals the breath from his lungs and makes him double down his efforts.

It’s been weeks since you’ve had this. Weeks of Kento stumbling home late from working overtime, collapsing into bed still fully clothed. Weeks of missed connections, family obligations, and movie nights cut short with you both passing out on the couch. But tonight, finally, you have each other, free from the demands of the world outside.

As Nanami moves within you, his honey-wheat hair, usually so perfectly styled, falls in soft, tousled waves across his forehead, clinging to the perspiration that glistens on his brow. The strong line of his jaw is taut with concentration, a muscle jumping beneath the skin in a way that makes your fingers itch to trace its contours. His eyes, normally a cool, observant umber, now burn with a fierce intensity, a volatile mix of desire and something else, something harder to define.

But even as you lose yourself in the rhythm of your lovemaking, in the exquisite slide of skin against skin, you can’t help but notice the weariness etched into the lines of Nanami’s face, the slight tremor in his hands as they map the contours of your body. He’s been working himself to the bone, pushing himself to the brink of exhaustion, and it shows in the tension of his shoulders, the tightness around his eyes. You had tried to get him to sleep when he sagged through the front door, but he was insistent, clawing at your too-big t-shirt, silent and too stubborn to listen to his body as he licked into your hot mouth.

He’s so tired. Mind still running through quarterly reports and half-completed project plans. But he won’t let that deter him. He’s determined to focus—to savor this moment, to lose himself in the intoxicating scent of your skin, to surrender to the tremors that course through him as your fingers ghost up his back. You marvel at the play of muscles beneath his skin, at the flex and release of his broad shoulders with each movement—a reminder of the strength he usually keeps so carefully controlled.

But as he leans in to capture your lips, that traitorous whisper of doubt in his mind grows in volume. That exhaustion that melted away from your touch has retreated to within him, to course through the blood in his veins and manifest again in its own, evil way at the apex of his thighs. Nanami’s movements falter, his rhythm turning erratic, unsure. You feel a change in him, a hesitation that wasn’t there before, and your heart clenches with concern. His brow furrows, his lips pressing into a thin line as he tries to hold onto the moment, to keep the passion burning between you. The confidence that usually radiates from him when you are both between the sheets seems to waver, leaving in its wake a man grappling with an unfamiliar sense of inadequacy.

He doesn’t want to believe it. He refuses to acknowledge the treacherous thought creeping into his mind. His cock, moments ago hard as a rock and pulsing within you, is betraying him. He digs one hand into the pillow beneath your head, fingers tangling in your curls, savoring the sharp gasp you shake out, desperately willing himself to focus on your heat, on your breath ghosting across his face—anything but the waning firmness of his erection.

With a low grunt, he thrusts deeper so there’s no room for his cock to leave you. The movement is sharper than usual, a force that has no trace of his care behind it and it immediately makes you blink through the fog of pleasure in your mind. You notice the change, concern filling you as you take in the tumultuous emotions on his face. His blonde hair falls in thick tufts over his forehead, brushing against the deepening crease between his eyebrows.

“Ken?” Your voice is soft, a gentle caress. You bring a hand to his cheek, and he leans into your touch as if your soft skin might anchor and keep him focused. “Is everything alright?”

Everything is far from alright.

It’s a nightmare scenario that Nanami can’t bring himself to voice. But he knows you feel it. Instead, he buries his face in the crook of your neck, his breath coming in harsh, ragged pants against your vanilla skin, his fingers digging almost painfully into the flesh of your hips. He drives his hips deeper, angling upwards, trying desperately to lose himself in your pliant body.

But with his next thrust, the cruel truth becomes undeniable. What was once hard steel is now unbearably soft, slipping out of you as his hips collide with yours. Your gasp mirrors his shock as he jerks his head up to meet your gaze. The mortification in his eyes is palpable, a stark contrast to the passion that burned there mere moments ago.

“Ken, it’s okay—” you begin, but he’s already retreating, both physically and emotionally, his walls slamming back into place, shutting you out. You can practically see him retreating into himself, his shoulders hunching, his jaw clenching with a stubbornness of wounded pride.

“Hey, no, we aren’t doing this,” you insist, voice firm and laced with quiet determination.

You reach for him, your fingers wrapping around a thick wrist, anchoring him to you. You’ve spent years chipping away at his defenses, learning every facet of his being, and you refuse to let him shut you out now over something like this. This isn’t just embarrassment—it’s a fundamental shaking of his self-image, a crack in the foundation of who Nanami believes himself to be. An affliction that every man prays to the gods never finds them.

Limp dick.

You gently pull Nanami back to rest between your thighs, his weight a comforting shield against the cool air of your shared bedroom. Your fingers weave through his hair, feeling the tension thrumming through his body as he settles against you.

“Kento,” you murmur, your voice a low, soothing melody in the quiet room. “Look at me.”

He stills for a heartbeat, two, before raising his head, his eyes meeting yours. In their depths, you see a swirling maelstrom of emotions—frustration, embarrassment, shame. He’s tousled hair and flushed cheeks, an overwhelming exhaustion and stress etched beneath his eyes.

“It’s okay,” you breathe, cradling his face in your hands. Your thumbs trace the high arch of his cheekbones, feeling the heat of his skin. “This happens. It doesn’t change a thing—not how I feel, not how much I love you, none of it.”

Nanami’s jaw clenches under your palms, the muscle pulsing, a physical manifestation of the turmoil brewing within him. His gaze falls, unable to hold yours, as if the weight of his perceived failure is too much to bear. “I should be able to—”

“To what?” you interject, your voice gentle but firm. “To be some infallible sex god?” A soft laugh escapes you, your lips curving into a tender smile. “To never have limp dick?”

Those warm eyes glare at you, not at all amused by your light-hearted but poignantly accurate joke. “Now is not the time for a joke,” he grits out, his voice tight, strained.

“Now is exactly the time for a joke,” you counter, your thumb tracing the slight cracks of his bottom lip. You can sense his next moves, your body attuned to his very soul, feeling his inclination to withdraw, to roll over and brood, to let this momentary setback fester into something more. You tighten your thighs around his waist, refusing to let him drift away. “How long have we been together, Kento?”

“Three years.” His answer is immediate, automatic, a testament to the depth of your bond.

“And in that time, has this ever happened before?”

Your eyes lock—a silent battle of wills, logic against stubborn pride. He understands your point, recognizes the truth in your words, but his stubbornness matches your own. “No,” he admits, the word a reluctant concession.

“You’re human, Kento. Wonderfully, beautifully human, and the sexiest man I’ve ever known. Performance issues or not.”

He scoffs, but you feel his shoulders slacken, his body melting into yours as he exhales, the tension slowly bleeding from his muscles. His arms tighten around you, calloused hands splaying across the small of your back, pulling you flush against him, as if your touch alone could chase away the demons of self-doubt. Those beautiful golden strands tickle your cheeks as he nuzzles closer, his breath warm against your neck.

“Is that so?” he finally murmurs, and you can hear the small smile in his voice, a welcome change from the earlier tension. For as reserved as he is, Nanami preens under any sort of compliments you give him, a chink in his armor of cool composure.

“Mmhmm,” you hum, your hands sliding down to appreciate the firm planes of his back. “It’s a shame, really. You attract too much attention. I’ve been too generous with how long I let you out of the house.”

You feel more than hear his soft chuckle, the vibration rumbling through his chest and into yours. Nanami pulls back slightly, his dark eyes meeting yours. The vulnerability from before hasn’t completely faded, but it’s tempered by a familiar spark of determination kindling in their depths. You don’t know if the subject has completely dropped. But for now, he doesn’t seem to dwell on it, content to focus on you instead.

“Well,” he begins, his voice dropping to that deep, velvety tone that never fails to send shivers cascading down your spine, “I should ensure your satisfaction. Maybe then you’ll extend my hours outside.”

Before you can respond, he’s moving. He sits up on his knees, hot hands wrapping around your waist before yanking your hips closer to him, a delicious show of strength that has your breath catching in your throat. Your giggle of surprise quickly morphs into a gasp as his lips find that sensitive spot just below your ear, tongue sliding against the skin before it trails down the rest of your body, leaving a path of desire that makes you shudder against him.

You expected a period of adjustment, a gradual return to the easy intimacy you and Nanami had always shared. But as time passed, you began to notice a shift, subtle at first, but growing more pronounced with each passing day.

That first sign of something odd presents itself on day three since that night, a quiet Saturday morning that dawns with a gentle golden light filtering through your bedroom curtains. You wake up to find Nanami’s side of the bed empty, the sheets cool to the touch. Puzzled, you pad into the living room, your bare feet silent on the cool hardwood floor, your eyes roaming the space for any sign of him.

Nanami sits at the dining table, surrounded by a veritable fortress of books, their spines forming a colorful barricade around his hunched form. His laptop glows in the morning light, casting his features in a pale blue hue, multiple tabs visible on the screen. He’s hunched over and shirtless, his bare back a canvas of dark moles, constellations you’ve traced countless times with reverent fingers, your lips mapping a path between each celestial point.

As you circle the table, drawing closer to his absorbed form, you’re struck by the intensity of his concentration, the furrow of his brow, the set of his jaw. His fingers fly over the keyboard with a single-minded purpose, a man on a mission, lost in a world of his own making.

“What are you doing up so early?” you ask, running a hand through the short, silky hair at his nape.

He glances up, and the determined glint in his eye catches you off guard. “Research,” he replies simply, as if that single word explains everything.

Curiosity getting the better of you, you lean in to examine the book titles scattered across the table, your brow rising with each passing second:

Male Sexual Health

Nutrition and Libido

Stress Management for Peak Performance

What the—?

A mix of emotions bubbles up inside you—amusement at his determination, concern for his state of mind, a touch of exasperation at his stubbornness. Part of you wants to tease him mercilessly, to watch that adorable flush creep up his neck, to see him squirm under your playful attention. But you bite your tongue, sensing the fragility of the moment, the rawness of his exposed insecurities.

“Ken,” you begin, your voice a delicate balance of understanding and concern, “is this about what happened the other night? I thought we talked about this, baby.”

“We did,” he nods, not looking up from his screen. “And I appreciate your understanding. But I can’t let it happen again. I’m going to fix this.”

There’s so much you want to say, so many reassurances you want to offer. You want to tell him how normal this is, how surprised you are that it hasn’t happened more often given his grueling work schedule. But you bite your tongue, sensing that this is something Nanami needs to process on his own.

“Don’t you think this might be…a bit much?” you try one last time, your fingers tracing soothing patterns on his bare shoulder, careful not to make him feel defensive and push him further into his own head.

“Nothing is too much when it comes to satisfying you.”

And with those words, spoken with such conviction, such raw honesty, your heart swells, a tidal wave of love and affection crashing over you. He won’t be swayed, and there’s no point in trying to argue with him when he’s set on something. You can’t help but sigh fondly, running your fingers through his hair again, your nails gently scratching his scalp in the way you know he loves. He leans into your touch, his eyes fluttering closed for a brief moment, a low groan of appreciation rumbling from his chest as he guides your fingers to just the right spot.

As Nanami launches into an explanation of the benefits of Ashwagandha root, his fingers running along a line of text in one of the magazines, you can’t help but shake your head affectionately. You love this man, even (or perhaps especially) when he’s being ridiculously over-the-top, his determination to be the best partner he can be, even if it means diving headfirst into a world of herbal remedies and performance-enhancing techniques.

The days slip by, each one blurring into the next, a haze of normalcy tinged with an undercurrent of unease. It’s not until the morning of day ten that the true extent of Nanami’s newfound obsession becomes impossible to ignore.

The soft schick of his razor fills the bathroom, a rhythmic counterpoint to the rush of running water. He stands before the mirror, shirtless, a towel draped over his broad shoulders to catch stray flecks of shaving cream. You watch, transfixed, as he meticulously glides the razor along the sharp line of his jaw, each stroke precise, measured.

You stand beside him, your own morning ritual underway, massaging a rich, creamy lotion into your melanin-kissed skin. Your favorite scent of vanilla fills the air, mingling with the crisp, clean aroma of Nanami’s shaving cream. It’s a familiar dance, this shared moment of grooming, of preparation for the day ahead.

But as you reach for your leave-in, your eyes catch on something new, something that sends a jolt of surprise through your system. There, amidst the clutter of skincare products and toiletries, sits a new addition to the growing collection of bottles on the counter. The mustard-yellow label boldly proclaims: “Maca Root: For Vitality and Stamina”.

“Ken?” you murmur, plucking the bottle from the counter, your eyebrows dipping in confusion. “What’s this?”

Nanami’s eyes flick to yours in the mirror, his hand pausing mid-stroke, the razor hovering just above his skin. “Just a supplement,” he evades, his voice carefully neutral, a forced casualness he uses to avoid arguments he won’t win that always sets your teeth on edge. “For…overall health.”

You turn the bottle in your hands, eyebrow arching higher in disbelief with each word you read as you take in the bold, almost aggressive labeling. Your gaze darts to the other bottles littering the counter, a growing sense of unease settling in the pit of your stomach as you take them in for the first time.

“Uh-huh. And the Zinc? The Ginseng? The…” you squint at another label, your voice dripping with skepticism, “L-arginine? All for ‘overall health’ too?”

He clears his throat, his gaze darting away from yours, focusing intently on his reflection as he studiously avoids your probing stare. “That’s right.”

“Baby—” you begin, but he cuts you off, setting down his razor with a definitive clink and shutting the water off, turning to face you fully.

The sight of him, bare-chested and gleaming under the harsh fluorescent light, sends a bolt of desire through you, a hunger that’s been left unsatiated for far too long. The thick cords of muscle that stretch across his chest and arms, the taut planes of his abdomen, the trail of dark blonde hair that disappears beneath the low-slung waistband of his sweatpants—it’s exquisite torture, a feast for your senses after days of famine.

But there’s a tension in the set of his shoulders, a skittishness in his gaze that sets off warning bells in your head.

“It’s the research I’ve been doing,” he admits, almost apologetic as he pulls the towel from his shoulders, wiping away the last traces of shaving cream from his jaw. “From what I’ve read, these have proven benefits for…various aspects of wellbeing.”

He seems almost afraid, as if he’s bracing himself for your reaction, steeling himself against the inevitability of your displeasure. Fortunately for him, the words are like a match to kindling, a spark that ignites a flame of mischief in your belly. You step closer, your hands coming up to rest on his chest, the supplement bottle forgotten on the counter behind you.

“Various aspects, huh?” you tease, your voice dropping to a sultry whisper. This moment—when he smells of fresh soap, shaving cream, and mint toothpaste before cologne masks his natural scent—is one of many favorites. It’s one of the most arousing forms of Nanami Kento before he slides on his work clothes and gives the world a straight face and measured words. “Care to demonstrate some of these benefits?”

Your fingertips trace the muscles of his chest, slide along his skin with more purpose, your nails dragging lightly over his nipples, a teasing hint of pain that you know drives him wild. He inhales sharply, his muscles tensing beneath your hands, his jaw clenched tight, a reaction that’s as familiar to you as your own heartbeat.

For a moment, you think you have him, that he’ll give in to the desire that darkens his eyes, that he’ll roughly bunch your skirt up around your waist, hike your legs up and around him and make the bathroom mirror knock against your back until you’re gasping out his name as you tighten around his cock.

But then he’s stepping back, his hands coming up to gently catch your wrists, pulling your hands away from his skin.

“We’ll be late for work,” voice strained, conveying his own battling desire. He brings your hands to his lips, pressing a chaste kiss to the delicate skin of your wrists, your forehead, your mouth.“Let me make you breakfast instead.”

And then he’s gone, slipping past you and out of the bathroom, leaving you standing alone, frustration and disappointment warring in your chest. Your gaze falls on the supplement bottles, a physical manifestation of his growing hysteria, and for a moment, you’re seized by the urge to sweep them all into the trash, to rid your home of these unwelcome interlopers.

But you resist, drawing in a deep, steadying breath, your fingers pinching the bridge of your nose as you silently repeat the mantra that’s become your lifeline in recent days: I love him. I love him. I love him.

But as you square your shoulders and stalk out of the bathroom to start your day, you can’t shake the feeling that something’s got to give, that this tenuous balance can’t hold forever.

Day seventeen. It feels like an eternity, a cruel and unusual punishment for a crime you didn’t commit. You’re a prisoner in your own home, trapped in a world where the man you love is just out of reach, tantalizingly close but impossibly distant.

Seventeen days too long when you live with a man as loving, kind, and attentive as Nanami Kento. Seventeen excruciating days since the concept of getting dicked down was a given, a pleasure you could indulge in whenever the mood struck. Now, you’re reduced to grasping at sloppy seconds, thirds, fourths—anything for a crumb of cock, a fleeting taste of the intimacy you crave.

You’ve become a connoisseur of stolen moments, of fleeting glances and brushing touches that once held the promise of so much more. A shared look in the bathroom mirror that used to lead to soapy sex in the shower. The brush of his hand against the small of your back as you pass in the hallway, a touch that used to lead to him pulling you flush against his body, his lips claiming yours in a searing kiss. Now, you’re like an addict, desperately chasing the ghost of a high, sucking at nicotine-stained fingers for the essence of a hit.

In a last-ditch effort to reignite the spark to show him just how much he’s overreacting, you’ve taken to wearing his shirts around the house. You leave the top buttons undone, a tantalizing glimpse of cleavage on display, the hem riding high on your thighs to reveal the faint marks that he likes to lick against. But each night when you reach for him, Nanami simply presses a tender kiss to your forehead, his lips trailing a path down your body in a reverent exploration, worshiping you with his mouth and fingers until you’re trembling and spent.

But never with his cock. Never with the part of him you crave most, the part that once made you feel so deliciously full, so utterly claimed.

You feel dramatic when you think about it because it always brings tears to your eyes, hot and stinging with frustration and despair. Like you’re a petulant toddler wanting a cookie that’s been sitting on the counter all morning.

You’ve never been one to let a man dictate your life, to let his whims and insecurities hold sway over your own desires. But Nanami has always been a man to put you above and beyond anything before himself. If the women of the world knew what they were missing, if they could experience even a fraction of the pleasure Nanami Kento can provide, they’d be falling to their knees in supplication, just like you.

How far you’ve fallen.

And how little you care.

Tonight, you vow, will be different. You slip into the silk nightgown he loves, the one that clings to your every curve like a second skin, the baby blue fabric whispering against your heated flesh as you step out of the bathroom. Your heart races with anticipation, your body thrumming with need as you picture his reaction, the way his eyes will darken with desire, the way he’ll pull you into his arms and finally, finally give you what you both so desperately need.

But the bedroom is empty, the sheets still neatly made, mocking you with their pristine perfection. You frown, a sense of unease settling in the pit of your stomach as you pad down the hallway, your bare feet whispering against the cool hardwood. As you approach the kitchen, a pungent, almost medicinal smell hits your senses, growing stronger with each step, mingling with the whir of a blender.

You round the corner and freeze, taking in the scene before you. Nanami stands at the kitchen counter, surrounded by an alchemist’s array of strange-looking roots and powders. The blender in front of him churns away, filled with a murky-greenish-brown liquid that looks more like something out of a horror movie than anything fit for human consumption.

“What are you doing?” you ask, your voice thin and strained, confusion and exasperation warring for dominance in your tone.

He looks up, startled, nearly knocking over a jar of what looks like dried herbs. “It’s…a health shake.”

You want to argue, to shake his shoulders and scream that this has gone too far, that he’s lost sight of what really matters in his quest for some unattainable ideal. But the determination in his eyes, the set of his jaw, the way he grimaces as he chokes down a sip of the vile concoction—it all speaks to a desperation that breaks your heart even as it fuels your frustration.

As he takes another sip, nose twisted to the side to avoid the foul smell, his eyes catch your frame. They roam over you, taking in the nightgown, giving you the exact reaction you pictured before coming out here.

For a moment, you see that flicker of desire in his eyes that you’ve been craving.

But then it’s gone, replaced by something that looks suspiciously like guilt.

“I’ll come to bed soon,” he promises, grimacing through another sip of his vile brew. “Get some rest. I know today was rough at work.”

His words are like a knife to your gut, a reminder of the distance that’s grown between you, the way his obsession has consumed him so completely that he can’t even see the pain it’s causing you both.

All of this, because of one night.

You press your toes into the hardwood, your fingers twisting in the hem of your nightgown as you fight back the tears that burn the corners of your eyes.

“You…you don’t want to come to bed with me?” you whisper, hating the way your voice breaks, the way the hope that once buoyed your words has been replaced by a hollow, aching despair and annoyance.

“I want to finish this and catch up on a few things for work before I come to bed.” His gaze slides away from yours, unable to meet the hurt and frustration in your eyes. Unable to see just how in his head he has become with all of this. “It’ll be a little while. Sleep for me? Please?”

The rejection, however gentle, leaves you feeling exposed and bereft, a physical blow to your gut. You nod, not trusting yourself to speak anymore, and turn to head back to the bedroom, your vision blurring.

There’s so much more to this than just you wanting to have sex. You want to be supportive, to give him time and space to work through whatever this is. But you hate just how disillusioned he has become. His gaze and his touch are tainted now—held back by shame and fear of disappointing you. And you can’t help but feel like this is getting more out of control instead of getting better.

You love him, more than anything. But right now, listening to the distant sounds of him choking down that awful-smelling shake, you’ve never felt further apart.

It all comes to a head on day twenty-five. The day dawns like any other, the sun’s warm rays filtering through the windows of your shared apartment, casting a soft glow on the well-worn furniture and the mementos of your life together. It’s your day off, a rare respite from the chaos of the work week, and you find yourself moving through the space with a sense of purpose, straightening and cleaning, trying to bring order to the disarray that seems to mirror the state of certain parts of your relationship.

As you work, your mind wanders, replaying the events of the past month like a melancholy film reel. The distance, the tension, the way Nanami has been pulling away from you, retreating into himself in a desperate attempt to fix what he perceives as a fundamental flaw in his being. Insisting that he won’t let this happen again even though he won’t actually fuck you.

It’s a weight that’s been bearing down on you both, a shadow that’s slowly suffocating the light and love that once filled every corner of your lives.

Your feet carry you to the bedroom, to the closet you share. As you reach for Nanami’s side, intent on straightening his crisp dress shirts, your hand brushes against something unfamiliar, tucked away in the shadows. Curiosity piqued, you pull it out, revealing a plain, unmarked brown box.

For a moment, your heart stutters in your chest, a cold fear gripping your insides as you lift the lid, praying that it’s nothing that would point your partner in the direction of infidelity. But no, you shake your head, banishing the thought before it can fully form. Nanami would never betray you, never seek solace in the arms of another because there’s only has and ever been you.

It makes complete sense in your head, but lately—

You yank open the lid and gape.

Inside, nestled among crumpled tissue paper, are items you never expected to find in Nanami’s possession. Your fingers tremble slightly as you examine them—a cylindrical pump, clear save for the rubber base, and an orange prescription bottle, its label stark against the translucent plastic.

You stare at the objects, your mind whirling with a chaotic storm of emotions. Shock, disbelief, a rising tide of frustration and despair. This isn’t just Nanami being health-conscious anymore, not just a passing phase or a well-intentioned attempt at self-improvement. This is something deeper, something more desperate, a manifestation of the fear and inadequacy that’s been eating away at him since that fateful night.

Carefully, you replace the items, your movements mechanical, your thoughts a jumbled mess. A part of you wants to laugh, to find the absurdity in the situation, to release the tension that’s been building in your chest like a pressure cooker. But you can’t bring yourself to even stifle a giggle, the weight of your worry too heavy.

You sink down onto the bed, the cool sheets soothing the heat of your legs, and draw in a deep, shuddering breath. The weeks of distance, avoidance, the way Nanami has been retreating further and further into himself, straying more and more from reason. There’s so much more to your relationship than just sex, but it’s a big part, a well-practiced part that you both can be your rawest selves during.

But all of this is a spiral that’s slowly dragging you both down, a vortex of unspoken fears and mounting frustrations on both ends.

And in that moment, surrounded by the remnants of your shared life in your apartment, the photos and trinkets that chronicle your love story, you know that something has to give. And it looks like you’ll have to take matters into your own hands. This ends today.

Tonight, when Nanami gets home, you’ll address this head-on. No more dancing around the issue, no more swallowing your grievances in the name of patience and nonexistent understanding. It’s time to remind him of who he is, of the man you fell in love with, the man who’s always been more than enough for you.

The sound of the front door opening pulls you from your thoughts, the soft shuffle of Nanami’s footsteps echoing down the hallway. “Love, I’m home,” he calls out, his voice weary but warm, a balm to your frayed nerves.

He appears in the doorway, his tie loosened, speckled black on yellow draped over his shoulders, the top buttons of his blue shirt undone. His glasses are gone, discarded in his haste to shed the trappings of the office, to leave the stresses of the day behind. “Look at you,” he murmurs, his eyes softening as they land on you, a reverent smile playing at the corners of his lips. “So beautiful.”

Your heart flutters in your chest at his words, at the love and adoration that shines in his gaze, even though you’re in a ratty t-shirt and shorts, your curls thrown into a careless and messy bun.

“You always speak as if it’s the first time you’ve ever seen me,” you tease, tilting your head back to accept his kiss, a chaste press of his lips that nonetheless ignites a spark of longing in your core.

“Because it’s true,” he replies simply, his fingers brushing a stray curl behind your ear. “I’m going to shower.” He sounds despondent, unbelievably ragged with the weight of the day clinging to him like a second skin.

“Rough day?”

“A very rough day, my love,” he sighs, running a hand through his hair, disrupting the sharp part that he makes every morning. He reaches a hand out to you, an invitation, a plea for your company. “Join me?”

The bathroom is a sanctuary of steam and heat, the air thick with the mingled scents of your body washes—cucumber melon and sandalwood. You perch on the counter, a fluffy towel wrapped around your body, watching as Nanami goes through his post-shower routine, his movements methodical, almost meditative.

Water droplets cling to his skin, tracing tantalizing paths down the planes of his chest, the ridges of his abs. Your mouth goes dry at the sight, your fingers itching to follow those rivulets, to map the contours of his body with your lips and tongue.

“Let me,” you murmur, your voice husky with repressed longing. Your legs spread, the open lapels of your towel exposing a creamy brown thigh that Nanami’s eyes flicker to before he meets your gaze. You reach for him, pulling closer until he’s standing between your parted thighs, the heat of his waist seeping through the thin barrier of your towel.

With gentle fingers, you work through the rest of his skincare routine—toner, serum, smoothing eye cream over the delicate skin beneath his lashes. The domesticity of the moment, the intimacy of caring for him like this in whatever way you can, it’s a way to show him that you’re here—that you’re not going anywhere, no matter how lost he may feel.

Your fingertips glide over his skin, applying the last of the face cream with gentle circular motions. As you finish, your hands move to his damp hair, brushing the strands away from his forehead. The strong line of his jaw, the curve of his lips, the subtle crinkles at the corners of his eyes that crease faintly when he smiles.

Wrapping your arms around his neck, you pull him closer, a soft smile playing on your lips. Nanami’s hands come to rest on your waist, his thumbs tracing small circles on your towel-covered skin.

“Thank you,” he murmurs, thickly. His eyes, those warm pools of mahogany, are soft with gratitude and affection.

“Always,” you whisper back, your heart swelling with love for this man.

Nanami leans in, pressing his lips to yours in a gentle kiss. It’s meant to be a simple gesture of gratitude, but something shifts in the air around you. Whether it’s the intimacy of you both so close or the heat on your skin—the kiss deepens, slow and exploratory, as if you’re rediscovering each other after a long absence.

Your fingers thread through his damp hair, tangling in the strands as his hands tighten on your waist. Your tongue slides along his bottom lip, tasting the coffee he must have had on the way home, the hint of want that he wants to crumble into. He returns with equal fervor, pressing closer to you, sliding his tongue against yours, shivering from the soft moan that shakes from your wet lips when you both finally break apart. A gossamer thread of saliva connects you before he pecks your lips one last time. Nanami’s chest rises and falls deeply, coiled masculinity oozing from his pores, tangling with the downy hairs on his chest.

“Kento,” you breathe, your voice barely above a whisper, “we…we need to talk about what’s been going on.”

Your hands train down his chest as you speak, mapping the familiar terrain of his body. Beneath your fingertips, his heart thunders like a trapped bird, betraying the melting calm facade he’s trying to maintain. The defined muscles of his abdomen twitch under your touch, a visceral reaction he can’t control.

“The magazines, the supplements, the smoothies,” you continue, gentle but firm. “This has gone too far. One off night, Kento. That’s all it was. Yet here you are, acting like you’re broken, like every moment we’ve shared before was somehow lacking.”

Nanami tenses, his body coiling like a spring beneath your hands. But you’re not letting him retreat—not like that night—and certainly not right now. Your legs wrap around his waist, the gap of your towel widening as you yank him closer, anchoring him to you, skin to skin.

“You think that I would look at you differently?” you murmur, catching his distressed eyes every time they try to evade your gaze, willing him to understand. “Think I would think of you as a failure? You like logic, Kento and I’m telling you the facts. You were tired, case closed.”

“But I—” he starts, his voice rough with emotion, eyes narrowing in frustration as he tries to defend himself. You silence him with a thumb to the plump skin of his bottom lip, tracing the divots of soft, pink flesh.

“You’re the healthiest man I know, Ken.” Your other hand drifts lower, brushing through the trail of dark golden hair that disappears beneath his towel. “You take such good care of us. And you never, ever fail to satisfy me.”

His breath catches as your fingers ghost over his hipbones, alternating between soft cotton and the sharp cut of his skin. “One night doesn’t change that,” you whisper, the hand on his face sliding to card through his hair, you lean in to press your lips to the strong line of his jaw. His fingers dig into your waist from your touch, Adams apple bobbing against your gliding lips as he swallows the burning desire that’s slowly searing him from the inside out. “It doesn’t make you any less amazing, any less desirable.”

You pull back, meeting his eyes. In their warm depths, you see a swirling mix of vulnerability that makes your heartache.

“I just…I don’t want to disappoint you again. While I know that you don’t care, being unable to provide for you fully is something that I never wanted to experience.” The confession is thick in the air, sloshing with what remains of the steam from the shower, coating your skin.

“Oh, Kento,” you sigh, pressing your forehead to his. The scent of his skin—clean soap and something uniquely him—envelops you, offers that blanket of protection that you couldn’t imagine going away. “The only thing disappointing me is how you’ve been pulling away. I’m tired of you feeling inadequate when you’re anything but.”

You pause, weighing the options in your head before you take a bounding leap, throwing care to the wind. Slowly, deliberately, you slide off the counter, your body brushing against his as you descend. The cool tile of the bathroom floor contrasts sharply with the heat radiating from your skin.

Kneeling before him, you look up, your gaze never leaving his. Hands slide up thick thighs, the hair on his legs brushing against your fingertips as you travel further toward the rigid heat of where you need him most. The hitch in his breath is faint, almost nonexistent when your fingers toy with the towel’s edge around his waist. You only wait a moment, three seconds too many as your hand undoes the tight knot and the towel pools at his feet and your knees on the floor.

He’s just as he always is—thick and heavy from your proximity alone, hard and filled with the blood that pumps wildly in his veins. When you wrap your hand around him, the heft of his cock makes your cunt squeeze. You know exactly what it feels like to have the most intimate part of him carving out your insides, and god do you need it right now.

You give only one stroke and the effect is instant; Nanami hisses, fingers flexing at his sides, extending and then curling in a fist as a means to keep his hands to himself, the head of his mushroom tip red and prickles with a thick gathering of precum. Just the sight makes your mouth water.

“I found those things in your closet, you know,” you purr softly, stroking him at an excruciating pace. “You actually think you need something like that, baby?”

A flush creeps up Nanami’s neck, blooming across his cheeks in rushing embarrassment even though his pupils are dilated from the sight of you on your knees. He opens his mouth to speak, fumbling for words that choke around another hitch with your next stroke.

“You don’t feel like you would need something like that.” And you don’t wait a second longer, opening your mouth, dragging the flat of your tongue up the backside of his cock. Each taste bud slides against rigid bumps of veins, gathering with more spit as he groans from your attention. You offer a gentle kiss to his tip, licking the salty taste of his precum from your lips. “You sure don’t taste like you would need something like that.”

The rise and fall of his chest is quickly leaving the pace of steady, his eyes locked on you and jaw flexing with growing desperation. You squeeze his cock on an upward stroke, your own body beginning to heat up just from watching him fall apart.

“Look at you now,” you tease, widening the gap between your knees, the heat between your legs radiating against your ankles. “You don’t look like you need help. Responding so beautifully to me. Not a hint of hesitation.”

The velvety hardness of him in your palm twitches from your words, hard steel that’s blazing hot, and just the sight of him above you is more than enough for a whine to build in your belly, an innate urge to have any part of him inside of you.

Nanami’s eyes flutter, long lashes casting shadows on his cheekbones as you lean in. When you finally take him into your mouth, your name falls from his lips like a prayer, brown eyes rolling halfway to the back of his head, eyebrows furrowing in equal confusion and pleasure.

You’re too eager to give him time to adjust—tongue swirling around the crown of his head and softening underneath him before building a nice, slobbery rhythm. In and out, in and out. Every stroke of your mouth around his cock makes your mouth water even more and your body relax, the dig of the tile on your knees forgotten.

“Fuck,” he pants, the rare curse slipping from his lips as one hand comes to rest gently on the back of your head. You hum in appreciation—in encouragement—building his confidence to squeeze the curly strands. The vibration of your hum of attention causes Nanami’s hips to buck involuntarily and you let your throat relax without thinking, let him hit the back before you swallow around him. “I-” he bites his lip, groaning from deep in his chest.

The heat of the bathroom is suffocating, your neck covered in curls prickling with sweat, sliding down your clavicle and onto the towel around your breasts that’s quickly loosening. Or maybe it’s your own body burning from the inside out, your blood pounding and surging to your core, swelling with arousal that leaks from you without even touching yourself.

And you’re dripping. The hand not at the base of him—stroking what you can’t swallow—reaches between your thighs, rubbing a clit that’s sopping wet with slick that drips between your fingers and onto the tile floor.

It doesn’t take long for that familiar ache to build in your jaw, a growing reminder of the thick cock between your mouth. But his throaty moans keep you going, keep your cunt pulsing and squeezing around the two fingers that quickly slide inside of you.

Nanami’s eyes, dark with desire, take you in—your messy hand twisting at the base of his cock, the hint of saliva on your chin, the prickle of tears at the corners of your eyes from the way he keeps hitting the back of your throat. Only he gets to see you like this. Only he gets to be with someone who will stop at nothing to make him feel supported and loved over something as trivial as a night of bad luck.

“I…you’re…” he gasps, unable to complete his thoughts when you moan around him. “Please just—just keep…don’t stop…don’t—”