#Virtual card

Explore tagged Tumblr posts

Video

youtube

طلب بطاقة Grey الافتراضية للشراء والدفع عبر الانترنت بديل وايز

0 notes

Text

How Can a Foreign Citizen Apply for a Prepaid or Virtual Card in Argentine Pesos Without Being a Resident?

In today’s globalized world, access to financial tools such as prepaid and virtual cards has become a necessity, especially for foreign citizens. These cards offer an array of benefits, including online payments, international transactions, and easy access to local currencies. If you are a foreign citizen looking to apply for a prepaid or virtual card in Argentine Pesos (ARS) but do not reside in Argentina, you may face some challenges due to the country's specific regulations and requirements. This guide will provide step-by-step instructions on how you can obtain such a card and what options are available to you.

Buy Prepaid or Virtual Card in Argentine Pesos

Understanding Prepaid and Virtual Cards in Argentina

Before diving into the application process, let’s first define what prepaid and virtual cards are and how they can be beneficial:

Prepaid Cards: These are physical or digital cards that you load with a specific amount of money. Prepaid cards can be used for online and in-store purchases, bill payments, and ATM withdrawals. They are not linked to any bank account, making them a safer option for those who don’t want to carry large sums of money or link their primary bank accounts to third-party services.

Virtual Cards: Virtual cards are similar to prepaid cards but exist only in digital form. They are ideal for online transactions, providing an extra layer of security. Virtual cards often come with temporary numbers that can be used for a set period or a specific transaction amount.

For foreign citizens, especially those who plan to make payments in Argentine Pesos, these cards can offer a practical solution, especially for tourists, expatriates, or digital nomads. However, Argentina has specific rules for non-residents wanting to obtain such cards.

Steps to Apply for a Prepaid or Virtual Card in Argentine Pesos as a Non-Resident

While being a resident is not a strict requirement for applying for prepaid or virtual cards in Argentina, the process can still be complex. Here are the essential steps you need to follow to increase your chances of approval.

1. Research Financial Institutions That Offer International Services

The first step in applying for a prepaid or virtual card is to identify financial institutions in Argentina that provide such services to non-residents. While local banks and fintech companies are the most common providers, many international financial institutions also offer cards in Argentine Pesos. Some popular options include:

MercadoPago: This is a fintech company owned by MercadoLibre, one of the largest e-commerce platforms in Latin America. MercadoPago allows foreign citizens to apply for prepaid cards in Argentine Pesos, even if they don’t reside in the country.

Ualá: Ualá is another fintech platform that offers virtual cards. Though primarily aimed at residents, Ualá sometimes offers services to foreigners if certain conditions are met.

Rebel: Rebel is a digital banking solution that offers prepaid cards. It’s an international service that allows non-residents to open accounts and obtain Argentine Pesos virtual cards through their platform.

Cryptocurrency Platforms: Some cryptocurrency platforms offer virtual cards that can be loaded with Argentine Pesos, making it easier for foreign citizens to apply for cards without needing a local address.

2. Understand the Requirements for Foreign Applicants

Once you’ve identified potential service providers, it’s crucial to understand the requirements for applying as a foreign citizen. While each financial institution will have different criteria, most will require the following:

Proof of Identity: Most providers will need a valid passport or another form of government-issued identification to verify your identity.

Proof of Address: While this is typically a requirement for residents, some providers may accept proof of address from your home country, such as a utility bill or a bank statement.

Tax Identification Number (CUIT): If you're planning to apply for a prepaid card in Argentina, you may be asked to provide a tax identification number. This is not always required for foreign citizens, but some platforms will request this if you're engaging in larger transactions.

Income or Financial Statement: For higher-limit prepaid or virtual cards, providers may request proof of income or a financial statement. This helps them assess your eligibility for the card.

3. Choose the Right Type of Card

After understanding the requirements, the next step is choosing the type of prepaid or virtual card that fits your needs. As a foreign citizen, your options may be limited to virtual cards or specific prepaid cards linked to international payment networks like Visa or Mastercard. The key benefits of these cards are:

No Local Bank Account Needed: You don’t need an Argentine bank account, which can be difficult to open as a non-resident.

Multicurrency Support: Some providers allow you to load your prepaid or virtual card with foreign currency (such as USD or EUR), which can then be converted into Argentine Pesos for local transactions.

Global Acceptance: Cards that are part of global networks like Visa or Mastercard will be accepted internationally, making them convenient for travel or online purchases.

4. Submit Your Application

After choosing your card type and ensuring you meet the necessary criteria, it’s time to submit your application. Many Argentine providers have online applications, making it easier for non-residents to apply. Depending on the provider, you may be able to submit your application through their website or a dedicated mobile app.

5. Top-Up Your Card

Once your application is approved, you can top up your prepaid or virtual card. The most common ways to add funds include:

Bank Transfer: Depending on the provider, you may be able to use an international bank transfer to load funds onto your card.

Cryptocurrency: If you're using a crypto-backed prepaid card, you can convert your cryptocurrency holdings into Argentine Pesos and load the card.

Third-Party Payment Platforms: Some services may allow you to load your card via platforms like PayPal or local payment systems.

6. Start Using Your Card

Once the funds are loaded, you can start using your prepaid or virtual card for purchases, either online or in physical stores that accept card payments. Be sure to keep track of your balance and transaction limits, as some cards may have restrictions on foreign transactions or ATM withdrawals.

Tips for Using Prepaid or Virtual Cards as a Foreign Citizen in Argentina

Look for Low Fees: International transactions can often come with high fees. Make sure to choose a card with low transaction fees, especially if you're using it for frequent purchases or international money transfers.

Consider Currency Conversion Fees: If you're loading your card in a currency other than Argentine Pesos, be mindful of the currency conversion fees.

Check Card Expiry and Limits: Some prepaid or virtual cards have expiration dates and transaction limits, so it’s important to stay updated on your card’s terms.

Conclusion: How to Apply for a Prepaid or Virtual Card in Argentine Pesos as a Non-Resident

For foreign citizens, applying for a prepaid or virtual card in Argentine Pesos can be an excellent solution for managing finances while traveling or living abroad. By researching suitable providers, understanding the application requirements, and choosing the right card, you can quickly gain access to the financial tools you need in Argentina. Whether you are a tourist or an expatriate, prepaid and virtual cards in Argentine Pesos offer flexibility and security for managing your money without needing to be a resident.

By following these steps and selecting a reputable provider, you can enjoy the benefits of a local financial system, even as a non-resident.

1 note

·

View note

Text

15 Best Virtual Dollar Card To Use For Online Payment & Shopping in Nigeria

Learn about the Best Virtual Dollar Card To Use For Online Payment & Shopping in Nigeria, best virtual dollar card to use for online payment and shopping on any international and local websites. With the rise in online shopping and payments in Nigeria, there is a notable need to have a working Virtual dollar card to use for online payment and shopping. These cards allow users from Nigeria to…

0 notes

Text

شرح مُفصل لخطوات استخراج بطاقة RedotPay الافتراضية التي تقبل الشراء والدفع عبر الإنترنت بالدولار الأمريكي، وطريقة شحنها من بينانس بأي عملة محلية.

1 note

·

View note

Text

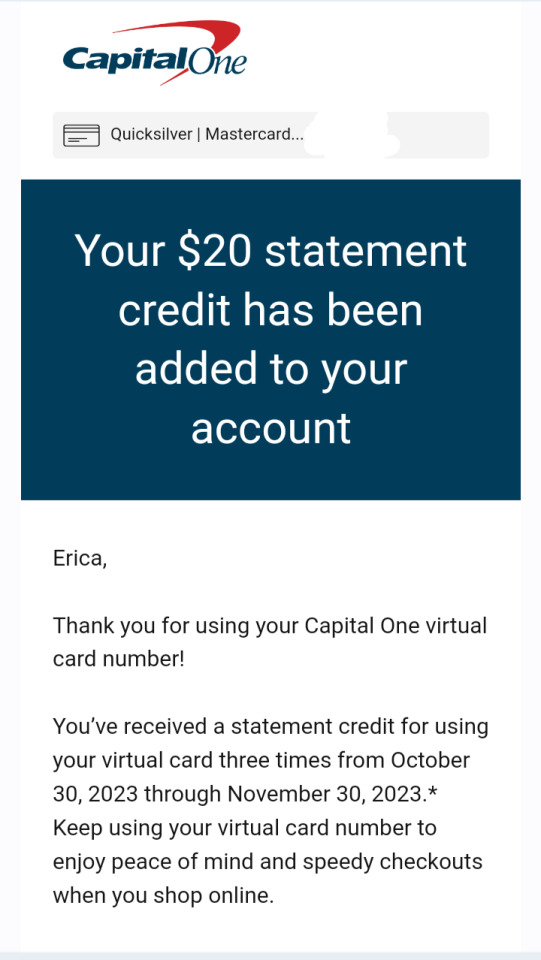

Benefits of Capital One's Eno Virtual Card Numbers

Introduction to Eno Virtual Card Numbers

Capital One's Eno virtual card numbers offer a smart way to shop online. It’s a free service, easy to use, and provides an extra layer of security. With Eno, you don’t need to share your actual card number. Instead, it creates a virtual one just for each purchase. This keeps your real card details safe. Plus, if a virtual card number is compromised, it can be quickly replaced without affecting your main account. This feature makes it easy to manage online purchases and protect your financial information.

Enhanced Security for Online Shopping

Using virtual card numbers reduces the risk of fraud. Hackers often target online shoppers, looking for credit card details. Eno acts as a barrier, shielding your actual card number from potential threats. For example, if you shop at a website and the site gets hacked, the thieves only get the virtual card number, not your real one. And if you notice something suspicious, you can disable the virtual number without cancelling your main card. This makes Eno a practical tool for secure online transactions.

Convenience in Managing Payments

Eno also simplifies managing online subscriptions and payments. If you sign up for a service, Eno creates a unique card number. This number links only to that specific service. If you decide to cancel, you simply deactivate the number. No need to update all your payment details. Also, Eno keeps track of where each virtual card is used. This is helpful when managing multiple subscriptions or online accounts. It saves time and reduces the hassle of managing your finances online.

Discover RealSettle: Your Comprehensive Source for USA Contact Information

For in-depth access to extensive USA contact details, explore the RealSettle directory. Offering a wide array of listings, this resource ensures you can find specific contacts across various industries and regions within the United States. Whether you're searching for business contacts, customer service numbers, or professional connections, RealSettle is a dependable platform to streamline your search. Utilize its user-friendly interface and vast database to access the most relevant and current contact information tailored to your needs. Efficiently uncover detailed American business contact information with the RealSettle directory today.

0 notes

Text

Unlocking the Power of Virtual Cards: Noupia Leading the Way in Cameroon and Beyond

In today's digital era, financial transactions have become increasingly convenient and secure, thanks to innovative solutions like virtual cards. These electronic counterparts to physical debit or credit cards have revolutionized online payments, offering users a safer and more versatile means of conducting transactions in an ever-expanding digital marketplace.

What are Virtual Cards?

Virtual cards, also referred to as e-cards or digital cards, are essentially online payment cards that exist solely in electronic form. Unlike traditional plastic cards, virtual cards are generated digitally and can be used for online transactions without the need for a physical presence. Each African virtual card is typically associated with a specific account and can be used to make purchases or payments online, offering a convenient alternative to traditional payment methods.

The Rise of Virtual Cards in Africa

As the global economy increasingly shifts towards digital transactions, the adoption of virtual cards in Africa has been on the rise. This trend is driven by the continent's growing tech-savvy population and the increasing demand for secure and convenient payment solutions. With traditional banking services often facing limitations in accessibility and convenience, virtual cards offer a viable alternative for individuals and businesses alike.

Noupia: Pioneering Virtual Cards in Africa

Noupia emerges as a pioneering platform in Africa, offering virtual cards tailored to the specific needs and preferences of African users. The platform's user-friendly interface and robust security measures make it a trusted choice for individuals and businesses seeking reliable digital payment solutions. By prioritizing accessibility and convenience, Noupia.com is democratizing access to virtual cards across the continent.

Accessibility and Convenience

One of the primary advantages of virtual cards is their accessibility. Unlike traditional banking services that may require extensive paperwork and documentation, virtual cards can be obtained quickly and conveniently through platforms like Noupia. With just a few clicks, users can generate Cameroon virtual card numbers linked to their existing bank accounts or digital wallets, enabling them to make secure online payments without hassle.

Security and Reliability

In addition to accessibility, Noupia prioritizes security and reliability in its African virtual card offerings. With advanced encryption technology and stringent authentication measures, Noupia ensures that every transaction is protected against fraud and unauthorized access. This commitment to security provides users with peace of mind, knowing that their financial information is safeguarded throughout the payment process.

Driving Financial Inclusion

Noupia's presence in countries like Cameroon, Congo Republic (Brazzaville), and Benin Republic underscores its commitment to driving financial inclusion across Africa. By partnering with local banks and payment providers, Noupia is able to offer virtual cards that cater to the unique needs and preferences of African users. Whether users prefer to top up their Cameroon virtual cards using mobile money, bank transfers, or cash, Noupia provides flexible solutions that empower individuals and businesses to participate in the digital economy.

Conclusion In conclusion, virtual cards represent a powerful tool for financial inclusion and empowerment in Africa. With platforms like noupia.com leading the way, accessing and managing virtual cards has never been easier or more secure. By embracing virtual cards, individuals and businesses across Cameroon, Congo Republic (Brazzaville), Benin Republic, and beyond can unlock new opportunities in the digital economy. As Africa continues to embrace the digital revolution, virtual cards are poised to play a central role in driving economic growth and prosperity across the continent.

0 notes

Text

virtual card buy with bitcoin buy virtual card,online payment and all cryptocurrency payment and solution

0 notes

Text

virtual card buy with bitcoin buy virtual card,online payment and all cryptocurrency payment and solution

0 notes

Text

Payaraa makes it easy to manage your finances across borders. 💼 Experience the freedom of global transactions with just a click! Visit: https://payaraa.com/

0 notes

Text

Go Cashless with Apple Pay: Add Your Virtual Card Today

Embrace a cashless lifestyle with Apple Pay. Learn how to add your virtual card to Apple Pay and enjoy seamless and secure transactions on the go! #ApplePay #CashlessPayments

#ApplePay#VirtualCard#CashlessPayments#bitcoin#virtual card provide with bitcoin#credit cards#crypto#virtual card

1 note

·

View note

Text

Unveiling the Benefits of Virtual Credit Cards

Introduction: In the rapidly evolving digital landscape, virtual credit cards have emerged as a secure and convenient payment solution. These digital alternatives to physical credit cards offer a plethora of benefits for individuals and businesses alike. In this blog, we will explore the advantages of virtual credit cards and how they are transforming the way we make online transactions.

Enhanced Security: Virtual credit cards provide an extra layer of security compared to traditional physical cards. They are designed to be used for a single transaction or limited period, reducing the risk of fraudulent activity. Since virtual cards do not carry the user's personal information, such as the card number or CVV, they offer protection against data breaches and unauthorized access. This heightened security helps to instill confidence in online shoppers and businesses alike.

Fraud Prevention: Virtual credit cards offer robust fraud prevention measures. With features like dynamic card numbers, expiration dates, and CVV codes, these cards ensure that each transaction is unique and cannot be used for unauthorized purposes. If a virtual card is compromised or compromised, it can be easily deactivated or closed, minimizing the potential damage.

Easy Accessibility: Virtual credit cards are incredibly convenient, as they can be accessed and managed through mobile apps or online platforms. Users can generate virtual card numbers in real-time, making them instantly available for use in online purchases. This eliminates the need to carry physical cards or manually input card details, saving time and effort for users.

Budget Control: Virtual credit cards are an excellent tool for budget control and expense management. Users can set spending limits and expiration dates for virtual cards, ensuring that they align with their financial goals. This feature is particularly beneficial for businesses, allowing them to allocate specific budgets to different departments or projects.

Seamless Online Shopping: Virtual credit cards make online shopping a breeze. They can be linked to specific online merchants or used for one-time transactions, reducing the risk of unauthorized charges or subscriptions. Virtual cards also simplify the refund process, as refunds can be directly credited back to the virtual card without any hassle.

International Payments: For individuals and businesses involved in global transactions, virtual credit cards offer significant advantages. They eliminate the need for currency conversion and reduce foreign transaction fees, making cross-border payments more cost-effective. Additionally, virtual cards can be easily used for online purchases from international merchants without any limitations.

Conclusion: Virtual credit cards have revolutionized the way we make online transactions, offering enhanced security, fraud prevention, convenience, and budget control. As the digital landscape continues to evolve, virtual credit cards are becoming increasingly popular due to their numerous benefits. Whether you're concerned about online security or looking for seamless payment options, virtual credit cards are a smart choice for the modern era of digital transactions.

#Anonymous Prepaid Card#Virtual Card#Best Crypto Card#Anonymous Loadable Card#Loadable Debit Cards#Loadable Visa Cards#Physical Card#Payroll Cards#Payoneer#Payoneer Card#Payoneer Credit Card#Best Rewards Card#card#bank#money#transactions

1 note

·

View note

Text

Simplify Your Payments with a Virtual Card

Looking for a secure and convenient way to make online purchases? A virtual card could be the solution you need. With its unique, one-time use number, a virtual card offers enhanced security and fraud protection. Plus, since it's not tied to your physical credit card, you can use it for online purchases without worrying about your credit card information being compromised. Whether you're buying goods or services, a virtual card can simplify your payments and give you peace of mind.

0 notes

Text

I'm a steady player of the MARVEL SNAP game, and thought of a support card that EVERY MCU fan might love!

So here's my concept! :)

It's not a real SNAP card, but maybe it COULD be. Still, it's a fun bit of fan-created Photoshoppery, if nothing else!

#Marvel#marvel snap#MCU#game#mobile gaming app#mobile games#photoshoppery#virtual card#card#shawarma#avengers

0 notes

Text

Want to know everything that's ever happened in Project Sekai but don't have time to read all those stories? Guess what! For the low, low price of "it seems fun", I'll be summarizing every single event!

Feel free to request any summaries or card stories you'd like to see summarized. You may also submit your own summaries, if you'd like! Use the forms found in this post to do so :)

You can also join our Discord, where we can collaborate on writing summaries and manage requests! (or just come say hi :) )

If you have a question about any of the stories as well, feel free to ask and I will do my best to answer! (Or just come and say hi :3)

If you'd like to use any of these summaries as part of a project (i.e. video essay, character analysis, etc.), you are more than welcome to! Just please credit this blog when you do so, since I do put a lot of work into each.

I try my best to get 1-2 summaries out a week, but i’m a busy college student doing this in my spare time, so things might be slow!

Masterpost links below the cut. All summaries will be tagged by unit, character appearances, and special type, if applicable.

THE ULTIMATE MASTERPOST SPREADSHEET

(Spreadsheet contains organized, filterable lists of all events and cards! I've tried making it as accessible as possible, but if you're unfamiliar with Google Sheets, just ask and I'll show you how to navigate it!)

Old Masterposts below! (Out of date, no longer maintained)

Key Stories

Leo/need

MORE! MORE! JUMP!

Vivid BAD SQUAD

Wonderlands x Showtime

Nightcord at 25:00

Mixed Events

Year 1 (Run! Sports Festival Committee Rush! - Scramble Fan Festa)

Year 2 (Time to Hang Out - At this Festival Bathed in Twilight)

Year 3 (Screaming!? Welcome to the Forest of Wolves! - Hello • Good • Day)

Year 4 (The Best Picture Wrap! -Wedding Live ♡ With Everyone!)

Card Stories

Any event card stories will be linked next to their respective events, as well as within the summary itself. (Initial 3* cards are part of the Main Stories)

Initial 1*/2* (Including 3rd Anniversary)

Birthday Cards

Fes Cards / Bloom Cards

Collaboration Cards

Card stories for events yet to be summarized

Miscellaneous

April Fools

#pinned post#project sekai#prsk#leo/need#more more jump#vivid bad squad#wonderlands x showtime#nightcord at 25:00#characters are tagged as [last name] [first name]#virtual singers are tagged as [unit abbreviation] [first name]#side characters with no last name are tagged as [unit abbreviation] [name]#main story#unit event#mixed event#world link#card story#new years#anniversary#wedding#valentine's#white day#fes card#bloom card#miscellaneous#april fools#<- special event types#not a summary#<- for anything else i may say on here!#masterpost

406 notes

·

View notes