#CashlessPayments

Explore tagged Tumblr posts

Text

Smart Vending Machine Market - Forecast(2025 - 2031)

Smart Vending Machine Market Overview:

Smart Vending Machine Market Size is forecast to reach $ 55534.2 Million by 2030, at a CAGR of 14.10% during forecast period 2024–2030.

According to the International Trade Centre, the automatic goods vending machines including those for cigarettes, food items, and beverages registered a global trade value of $1.77m in 2023. Smart vending machines are self-contained onsite product dispensing machines, and offer features such as automated payment and date recognition which enable the machines to discard expired products automatically. The real-time update feature on these machines ensure streamlined supply. The global smart vending machine market size was valued at $4.27m in 2023, and the market is estimated to witness growth at a CAGR of 16.74% through the forecast period of 2024 to 2030.

Request sample :

North America dominated the global smart vending machines market, by accounting for 37% of the share in 2023. This is owing to the presence of nations such as the U.S., which is a very lucrative region for the smart vending machines market. According to the National Automatic Merchandising Association, vending machines made an economic impact of nearly $25 billion on the U.S. convenience service industry.Additionally, the industry generates jobs worth $7.21 billion and pays $3.5 billion in taxes to the government. With such a fruitful base, the demand in the smart vending machines market is projected to grow in the near future.

Smart Vending Machine Market Outlook:

Beverage vending machines are witnessing the highest demand as compared to other types of smart vending machine, and this segment is projected to grow at a CAGR of 15.06% during the forecast period. Increased consumption of beverages such as cold drinks, alcohol, energy drinks, and juices are responsible for the growing application of beverage vending machines. These machines are used in numerous end-user industrial applications such as retail, public transport, entertainment and hospitality, and in the medical sector. According to the American Academy of Pediatrics Journal, beverages such as soda and diet soda are the most popular drinks offered for sale by vending machines. In the medical industry, 28% of the vending machines are used for storing soda, while 12% are used for storing diet soda. Beverage vending machines are also being installed in public transportation such as trains and buses to enhance the travel experience for commuters. Increasing tourism and commuting options owing to public transport is creating opportunities for the smart vending machines market.

Inquiry Before Buying:

Smart Vending Machine Market Growth Drivers

·Corporate Culture: The corporate sectors is employing advanced and innovative strategies to optimize the office environment for employees. More popularly known as office coffee service (OCS), these machines are majorly preferred by corporate consumers for providing fresh, healthy, and light refreshments during office hours. Integrating smart technology in these machines will help the offices to track individual orders and the employees consuming the products. Globally, growing demand from corporate consumers is driving the smart vending machine market.

Smart Vending Machine Market Trends

·Energy Efficient Solutions: Smart Vending Machine manufacturers are developing energy efficient solutions to reduce the carbon footprint of these machines. Popular beverage brand Coca-Cola is developing recycled and eco-friendly smart vending machines with sustainable technology which can balance the environmental impact.

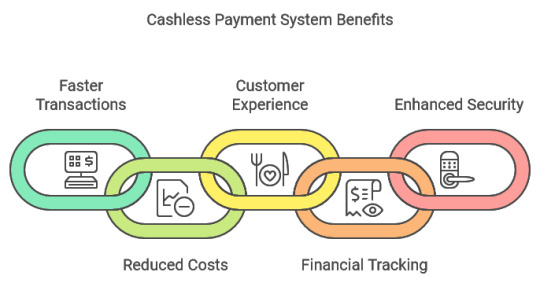

·Cashless Payment Solution: Manufacturers are trying to incorporate a cashless payment solution within the smart vending machines. They are integrating connected solutions within the vending machines to gain real-time consumer and transactional data. Foreseeing the robust digitalization, the cashless payment technology in smart vending machines will certainly increase revenues in the global smart vending machine market.

Schedule A Call:

Smart Vending Machine Market Key Players Perspective –

Companies are expanding geographically and innovating rapidly to gain ground over their competitors. The key players involved in the smart vending machine market are Azkoyen, S.A.; Bianchi Vending Group S.p.A.; Evoca Group; Fuji Electric Co., Ltd.; FAS INTERNATIONAL S.P.A.; Hunan TCN Vending Machine Co., Ltd; Sanden Holdings Corporation; and American Vending Machines.

Buy Now :

Smart Vending Machine Market Research Scope:

The base year of the study is 2023, with forecast done up to 2030. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the smart vending machine market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The smart vending machine market research report also analyses the application of smart vending machine in various sectors such as real estate, small and medium-sized business, and others.

Key Market Players:

The Top 5 companies in the Smart Vending Machine Market are:

Fuji Electric Co., Ltd.

Sanden Corporation

Seaga Manufacturing, Inc.

Azkoyen Group

Crane Merchandising Systems

For more Food and Beverage Market reports, please click here

0 notes

Text

Revolutionize Your Business with fusionmybusiness Self-Service Kiosks

In today’s fast-paced world, customer expectations are higher than ever. Businesses that offer seamless and efficient service gain a competitive edge. fusionmybusiness Self-Service Kiosks are designed to transform the way businesses operate, providing customers with an intuitive and hassle-free ordering experience.

Why Choose fusionmybusiness Kiosks?

Enhanced Customer Experience – Minimize wait times and provide a seamless self-service option, allowing customers to browse the menu, customize orders, and make payments effortlessly.

Increased Order Accuracy – Reduce human errors and ensure customers get exactly what they ordered, enhancing satisfaction and boosting repeat business.

Operational Efficiency – Free up staff from taking orders manually, allowing them to focus on food preparation and customer service.

Higher Revenue Potential – Self-service kiosks encourage upselling and cross-selling by suggesting add-ons, helping businesses increase their average order value.

Fast and Secure Transactions – Integrated with multiple payment options, including contactless payments, fusionmybusiness Kiosks make transactions quick and secure.

Perfect for Various Business Sectors

fusionmybusiness Kiosks are ideal for restaurants, cafes, quick-service outlets, food courts, convenience stores, and more. Whether you run a busy fast-food chain or a specialty café, these kiosks enhance efficiency while keeping customers happy.

Seamless Integration with fusionmybusiness

fusionmybusiness Kiosks work seamlessly with the fusionmybusiness ecosystem, ensuring real-time synchronization of orders, inventory, and sales data. Business owners get full control and insights through an easy-to-use management system.

Future-Proof Your Business

As consumer preferences evolve, staying ahead with self-service technology is key. fusionmybusiness Self-Service Kiosks provide an innovative solution that enhances efficiency, customer satisfaction, and overall business growth.

Ready to upgrade your business? Discover the power of fusionmybusiness Self-Service Kiosks today! Visit fusionmybusiness Kiosks to learn more.

#SelfServiceKiosk#fusionmybusiness#RestaurantTech#POSSystem#BusinessAutomation#SmartOrdering#CustomerExperience#FastOrdering#CashlessPayments#DigitalTransformation#RetailInnovation#FoodServiceSolutions

0 notes

Text

Dubai Currency Guide: Dirham and Payment Methods Explained

The Dubai Currency Guide explains everything you need to know about the UAE's official currency, the Dirham (AED), and various payment methods. Learn about cash, credit cards, and digital payment options widely accepted across Dubai. Understanding local currency and payment practices ensures a smooth and convenient travel experience.

#dubaitourvisa#dubaicurrency#dirham#uaecurrency#dubaitravel#traveltips#paymentmethods#cashlesspayments#dubaishopping#uaetravel#currencyguide#travelindubai#digitalpayments#travelsmart#moneymatters#travelcurrency#dubaiguide#cashorcard#uaevisit#currencyexchange#paymentoptions#dubaiexperience

0 notes

Text

instagram

#CashlessHealthcare#WinterWellness#ShivamHospital#DombivliCare#StayHealthyStayWarm#MumbaiHealth#QualityCare#CGHS#Cashless#cashless#cashlesspayment#cashlesspayments#cashlesshospital#cashlesshospitals#cashlesshospitalization#Instagram

0 notes

Text

UPI Transection incresed from January to November more then 15,500 thousand crore rupees

UPI transactions surged by over ₹15,500 thousand crores from January to November! 📈 Discover the remarkable growth of digital payments.

Visit : https://thevirtualupdate.com/upi-transection-incresed-from-january-to-november-more-then-15500-thousand-crore-rupees/

#UPIRevolution#DigitalIndia#CashlessIndia#FintechGrowth#DigitalTransaction#UPIGrowth#IndianEconomy#CashlessPayments#DigitalWallet#PaymentSolutions#UPIAdoption#FinancialInclusion#UPIStatistics#TechInIndia#IndiaFintech#TheVirtualUpdate

0 notes

Text

Food Court Management Made Easy: The Benefits of Prepaid Card-Based POS Software

In the fast-paced world of food courts, managing multiple vendors, high volumes of customers, and efficient payment systems can be a challenging endeavor. Traditional cash-based transactions and manual POS systems can slow down operations, lead to accounting errors, and cause frustration for both customers and staff. Fortunately, advances in point-of-sale (POS) technology, particularly prepaid card-based POS systems, have revolutionized food court management. This innovative approach streamlines operations, improves the customer experience, and offers unparalleled benefits in terms of reporting, security, and loyalty management.

In this article, we’ll explore how prepaid card-based POS software can make food court management easier and more efficient, covering the key benefits, use cases, and real-world impacts of this technology.

1. How Prepaid Card-Based POS Systems Work in Food Courts

Prepaid card-based POS systems replace traditional payment methods like cash or credit cards with reloadable prepaid cards. Here’s a quick look at how these systems operate in a food court setting:

Issuance of Prepaid Cards: Customers purchase a prepaid card from a central kiosk or vending machine within the food court. They can load money onto these cards in advance using cash, credit, or debit.

Integrated POS Terminals: Each vendor in the food court has a POS terminal that accepts these prepaid cards as payment. Customers simply swipe or tap their card to complete transactions.

Balance Management: Customers can top up their cards as needed, and their remaining balance is tracked automatically across transactions. This feature eliminates the need for cash handling at individual vendor stations, reducing wait times and improving transaction speed.

2. Benefits of Prepaid Card-Based POS Systems for Food Court Management

Implementing a prepaid card-based POS system offers numerous advantages for both food court operators and customers alike. Below are some of the most impactful benefits.

a. Streamlined Transactions and Reduced Queues

One of the biggest challenges in food courts is managing high volumes of transactions, especially during peak hours. With prepaid cards, customers avoid fumbling for cash or waiting for credit card approvals. Each transaction is swift, taking only a few seconds as customers tap or swipe their prepaid card. This reduction in transaction time results in shorter lines, increased efficiency, and a smoother flow of customers, improving overall satisfaction.

b. Enhanced Security and Reduced Cash Handling

Handling large amounts of cash introduces a range of security concerns, from potential theft to cash discrepancies and human error. Prepaid card systems eliminate the need for individual vendors to handle cash. Instead, all cash is deposited at a central kiosk, which reduces the risk of theft, loss, and errors at vendor stations. Additionally, it streamlines cash management and helps track all transactions, ensuring accountability and accuracy.

c. Simplified Accounting and Reporting

Traditional POS systems can complicate financial tracking, especially when multiple vendors are involved. Prepaid card-based systems consolidate all transactions digitally, providing real-time sales data and transaction histories. Centralized reporting enables food court managers to quickly assess daily sales, vendor performance, and other key metrics, simplifying end-of-day reconciliation and financial reporting. Many systems also offer automated sales reporting for tax purposes, eliminating much of the manual labor associated with accounting.

d. Improved Customer Experience

Today’s customers expect fast, convenient, and seamless service. Prepaid card systems provide a modern, cashless experience that aligns with customer expectations. With reloadable cards, customers can enjoy their food without worrying about carrying or handling cash. They can also share cards with family members, making it an ideal option for group dining. By creating a cashless, efficient environment, food courts can attract and retain more customers, ultimately boosting revenue.

e. Loyalty and Promotional Opportunities

A prepaid card-based POS system allows food court managers to implement loyalty programs directly through the card. By offering rewards such as discounts, cashback, or points accumulation, food courts can incentivize repeat visits and build customer loyalty. Promotions can be tailored for specific vendors, peak times, or menu items, giving managers flexibility to target and engage their audience. Additionally, food courts can use these programs to gather data on customer preferences, allowing them to refine offerings based on actual usage patterns.

3. Real-World Applications of Prepaid Card-Based POS Software in Food Courts

Many food courts, especially in high-traffic areas such as malls, airports, and stadiums, have embraced prepaid card-based POS systems due to their efficiency and effectiveness. Let’s look at a few examples of how these systems improve daily operations:

Shopping Mall Food Courts: In bustling mall environments, food courts can face huge surges in traffic during lunch hours or weekends. Prepaid card-based POS systems help reduce wait times, minimize cash handling, and enhance reporting for a diverse array of vendors. As a result, mall operators enjoy more satisfied customers and streamlined financial management.

University Food Courts: In colleges and universities, where students often eat together or buy food between classes, prepaid card systems simplify transactions and allow students to budget their dining expenses easily. These cards can also double as student ID cards, creating a multi-functional tool that’s easy to manage and offers universities robust control over on-campus dining.

Corporate Campus Food Courts: Many corporate campuses have large food courts to serve employees. Prepaid card-based POS systems allow companies to offer employee benefits like subsidized meals, discounts, or specific meal allowances. For employers, the system provides an efficient way to track employee dining expenses and offer targeted incentives, creating a more engaging employee experience.

4. Implementing a Prepaid Card-Based POS System: Key Considerations

While prepaid card-based POS systems offer a wealth of benefits, implementing them effectively requires thoughtful planning and management. Here are some essential considerations for successful deployment:

a. Vendor Coordination

To make the system seamless, it’s important to coordinate with each vendor to ensure they have compatible POS terminals and understand the system. This includes training staff on how to process transactions with the prepaid cards and manage any issues, such as card balance checks or reloads.

b. Centralized Card Management

Managing the central kiosk for issuing and reloading prepaid cards requires a dedicated team and clear procedures. This team should handle customer inquiries, card reloading, and troubleshooting. Additionally, food court management should regularly monitor and maintain kiosk equipment to avoid any technical disruptions.

c. Regular Data Analysis and Reporting

With access to real-time sales and transaction data, food court managers can continuously refine operations based on accurate insights. Regular reporting enables managers to identify peak times, track high-performing vendors, and even predict future trends. This data can also inform targeted promotions or loyalty incentives that align with customer preferences and behavior.

5. Future of Food Court Management with Advanced POS Systems

As technology evolves, the potential for prepaid card-based POS systems will only grow. Integrations with mobile wallets and apps, such as allowing customers to load funds onto prepaid cards digitally, will add convenience and flexibility. Additionally, advancements in artificial intelligence and analytics can help food courts further personalize promotions, track inventory levels in real time, and optimize staffing based on predictive traffic patterns.

Food court managers should also look forward to contactless solutions that enhance the customer experience even more, making transactions faster, safer, and more convenient. These innovations will likely be accompanied by further reductions in cash handling, a continued focus on data-driven decision-making, and an increasing emphasis on customer loyalty.

Conclusion: The Future of Food Court Management Is Here

Prepaid card-based POS systems offer a powerful, efficient solution for food court management, addressing the pain points of traditional systems by enhancing speed, security, reporting, and customer satisfaction. By simplifying transaction processes and reducing cash handling, food courts can create a modern, customer-centric experience that stands out in today’s competitive market.

From streamlined accounting to enhanced promotional capabilities, the benefits of adopting a prepaid card-based POS system are numerous. As food courts continue to seek ways to improve operations and attract more customers, prepaid card technology stands out as a key investment in the future of seamless, efficient, and customer-friendly food service management.

Adopting a prepaid card-based POS system could be the strategic shift that takes food court management to the next level. For food court operators, it represents not just a technology upgrade but a foundational transformation in customer service, operational efficiency, and overall profitability.

We hope you enjoyed reading our blog posts about food court and canteen prepaid card billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#cashless#FoodCourtManagement#PrepaidPOS#POSSoftware#CustomerExperience#CashlessPayments#FoodCourtSolutions#POSSystem#RetailTech#EfficientTransactions#FoodServiceTech#VendorManagement#CustomerLoyalty#FastTransactions#FoodCourtInnovation#DigitalPayments

0 notes

Text

Simplify Your Sales with Smart POS Solutions!

Take your business to the next level with fast, secure, and user-friendly POS systems. Manage sales, inventory, and customer data seamlessly. Transform the way you work!

CALL NOW: +971 50 852 9609 VISIT US: www.quicknet.me

#POSSystem#PointOfSale#RetailSolutions#BusinessEfficiency#SeamlessTransactions#SmartPOS#RetailTechnology#InventoryManagement#SalesSolutions#CustomerExperience#SmallBusinessTech#CashlessPayments#BusinessGrowth#EfficientCheckout#POSSolutions#BoostYourBusiness#POSInnovation#ModernRetail#SalesTracking#posforretail

0 notes

Text

youtube

Razorpay Payment Links is the easiest way to accept payments without a website or an app.

A Payment Link can be created from the Razorpay Dashboard and shared instantly via SMS, email, WhatsApp, or chatbots.

Customers can use this Payment Link to make payments using different payment modes like debit cards, credit cards, wallets, UPI, and net banking.

#Razorpay#PaymentLinks#OnlinePayments#DigitalPayments#AcceptPayments#NoWebsiteNeeded#BusinessPayments#PaymentGateway#Ecommerce#CashlessPayments#Fintech#PaymentSolutions#PaymentAutomation#UPIPayments#CreditCardPayments#Youtube

1 note

·

View note

Text

From Cash to Cards: The Evolution of Food Court Payments and the Rise of Prepaid

Food courts have always been bustling hubs of activity, where people gather to enjoy a variety of cuisines in a communal setting. Over the years, the way we pay for our food has dramatically changed. From the clinking of coins to the swiping of cards, and now the tapping of prepaid cards, the evolution of food court payments reflects broader trends in technology and consumer behavior. Let's take a journey through this fascinating transition.

The Early Days: Cash is King

Back in the day, cash was the undisputed ruler of food court transactions. The sound of cash registers and the sight of bills and coins changing hands were omnipresent. Cash was simple and universally accepted, but it came with its own set of challenges. Handling large volumes of cash could be cumbersome and posed security risks for both customers and vendors. Making change was a hassle, and cash management required rigorous processes to avoid discrepancies and theft.

The Advent of Credit and Debit Cards

Enter the age of plastic. Credit and debit cards began to revolutionize the way we paid for everything, including our meals at food courts. These cards offered a convenient alternative to cash, eliminating the need to carry large amounts of money. They provided an additional layer of security and simplified record-keeping for businesses. With cards, transactions became faster, and the problem of making exact change became a thing of the past.

Transition Period: Cash to Cards

The transition from cash to cards wasn't instantaneous. Consumers and businesses alike had to adapt to this new mode of payment. Initially, there was some resistance, especially from those who were comfortable with cash. However, as card payment systems became more reliable and ubiquitous, the convenience they offered led to widespread acceptance. Businesses invested in card terminals, and consumers grew accustomed to the ease of swiping their cards.

The Role of Technology in Payment Evolution

Technology has played a pivotal role in the evolution of payment systems. The development of secure payment gateways and encryption technologies enhanced the safety of card transactions. Innovations like contactless payments further sped up the transaction process, making it even more convenient for customers in a hurry. The advent of mobile payment solutions and digital wallets also contributed to the decline of cash usage in food courts.

Emergence of Prepaid Cards

Prepaid cards entered the scene as a novel payment method designed to offer the benefits of cards without some of their drawbacks. Unlike credit and debit cards, prepaid cards are not linked to a bank account or credit line. Instead, they are pre-loaded with a specific amount of money. This innovation appealed to those who wanted to manage their spending more effectively and avoid the risks associated with carrying cash or using credit.

Benefits of Prepaid Cards

Prepaid cards offer several advantages:

Budget Management: Users can load a specific amount onto the card, making it easier to stick to a budget.

Security and Fraud Prevention: Since prepaid cards are not linked to personal bank accounts, the risk of fraud is minimized.

Convenience and Accessibility: These cards are easy to obtain and use, even for those without access to traditional banking services.

How Prepaid Cards Work in Food Courts

Using prepaid cards in food courts is straightforward. Customers can purchase or reload their cards at designated kiosks or online. Once loaded, the cards can be used at any participating vendor within the food court. The transaction process is quick and seamless, often involving a simple tap or swipe. The integration of prepaid card systems with food court POS (point of sale) systems ensures smooth and efficient transactions.

Case Studies: Successful Implementation

Example 1: A Major Food Court Chain

A large, well-known food court chain implemented a prepaid card system to streamline operations and enhance customer experience. The chain reported increased transaction speeds, reduced cash handling issues, and improved customer satisfaction. The data collected from prepaid card usage also provided valuable insights into consumer preferences and spending patterns.

Example 2: Small Independent Food Courts

Even smaller, independent food courts have successfully adopted prepaid cards. For instance, a local food market in a busy metropolitan area introduced prepaid cards to cater to the tech-savvy younger crowd. The initiative was well-received, leading to higher sales and a more efficient checkout process.

Consumer Perspectives on Prepaid Cards

Feedback from consumers about prepaid cards has generally been positive. Many appreciate the control over spending and the reduced risk of overspending. Surveys indicate that users find prepaid cards to be convenient, especially for regular visits to food courts. Personal stories highlight how these cards have made quick meals more efficient and less stressful.

Business Perspectives on Prepaid Cards

From a business standpoint, prepaid cards offer several advantages. They help reduce the costs associated with cash handling and processing fees. The prepaid model also ensures that businesses receive payment upfront, improving cash flow. Moreover, the data collected from prepaid card transactions can be used to tailor offerings and promotions to meet customer demands more effectively.

Challenges and Criticisms

Despite their benefits, prepaid cards are not without criticism. Some consumers feel that the need to preload funds can be inconvenient. There are also concerns about the fees associated with certain prepaid cards, which can add up over time. However, many of these issues are being addressed as the market for prepaid cards evolves, with more consumer-friendly options becoming available.

Future Trends in Food Court Payments

Looking ahead, the future of food court payments is poised to be even more dynamic. Emerging technologies such as biometric payments, blockchain, and AI-driven payment systems are likely to further transform the landscape. These advancements promise to make transactions even faster, more secure, and more personalized. The continued rise of mobile payments and digital wallets also suggests a future where physical cards might become obsolete.

Comparing Payment Methods: Cash, Cards, and Prepaid

Each payment method has its pros and cons:

Cash: Universally accepted but cumbersome and less secure.

Credit/Debit Cards: Convenient and secure but require bank accounts and can incur fees.

Prepaid Cards: Great for budgeting and security but may have preloading inconvenience and associated fees.

The best payment method depends on individual preferences and specific scenarios.

Conclusion

The evolution of food court payments from cash to cards and the rise of prepaid cards reflects broader technological advancements and changing consumer behaviors. Prepaid cards, in particular, have carved out a significant niche by offering a blend of convenience, security, and budget control. As we look to the future, the continuous innovation in payment technologies promises to make our dining experiences even more seamless and enjoyable.

FAQs

What are prepaid cards? Prepaid cards are payment cards loaded with a specific amount of money in advance, used for transactions until the balance is depleted.

How do prepaid cards differ from credit/debit cards? Unlike credit or debit cards, prepaid cards are not linked to a bank account or credit line. They are pre-funded and can be used until the pre-loaded amount is spent.

Are prepaid cards secure? Yes, prepaid cards are generally secure as they are not connected to personal bank accounts, reducing the risk of fraud.

Can prepaid cards be used everywhere? Prepaid cards can be used at any vendor that accepts them, which typically includes a wide range of retailers and food courts.

What happens if a prepaid card is lost? If a prepaid card is lost, the user should report it immediately to the issuer. Most issuers

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#FoodCourtPayments#PaymentEvolution#FromCashToCards#PrepaidCards#FoodCourtTechnology#CashlessPayments#DigitalPayments#PrepaidBenefits#ConvenientPayments#SecureTransactions#BudgetFriendly#PaymentInnovation#CustomerExperience#BusinessEfficiency#FutureOfPayments#TechInFoodCourts#DiningExperience#TransactionSecurity#ConsumerTrends#FoodCourtEvolution

0 notes

Text

India's Cashless Boom: How Digital Transactions are Transforming Payments #cashlesspayments #digitaltransactions

0 notes

Text

Go Cashless with Apple Pay: Add Your Virtual Card Today

Embrace a cashless lifestyle with Apple Pay. Learn how to add your virtual card to Apple Pay and enjoy seamless and secure transactions on the go! #ApplePay #CashlessPayments

#ApplePay#VirtualCard#CashlessPayments#bitcoin#virtual card provide with bitcoin#credit cards#crypto#virtual card

1 note

·

View note

Link

With the increasing popularity of digital payments, Venmo has emerged as a convenient and secure option for paying for goods and services. Whether you’re buying groceries, ordering takeout, or shopping online, Venmo offers a seamless payment experience right from your smartphone.

#VenmoPayments#DigitalPayments#SecureTransactions#ConvenientPayments#VenmoNerd#VenmoGuide#MobilePayments#DigitalWallet#EasyTransactions#SecurePayments#PaymentSolutions#OnlineShopping#CashlessPayments#PayWithVenmo#PayingGoodsAndServices#PaymentApp#FinancialTechnology#VenmoTips#PaymentSecurity#FraudPrevention#UserExperience#SeamlessTransactions

0 notes

Text

About VishwasPe- A easy Payment gateway

In the world that is becoming digitalize we all want to follow trends and go digital that does our work easier and quicker. At the present times, paying bills and recharge can be a major task. by using digital payments method this task can be simplify. if you are looking for something simple and easy vishwaspe is here to modify all your payments practices and providing a very safe and trusted platform for all your budgetary needs.

Simpliefied bill Payments:

Standing in long ques is draining for paying your electric bills, water bills, recharge or any other necessary payments. Then what are you all waiting for use vishwaspe which is going to help you for everything in your one click at your comfort. Stay worry free because vishwaspe helps you overcome all your worries in one app.

Secure Transaction:

When it comes to digital payment everyones top priority is security. At vishwaspe your priorty is ours we use strong encryption and best security measures to protect all your dates and transactions. We ensure to give you what you expect and we ask you your trust for us.

Cashless Payments:

in this modern world lets modernize ourselves with cashless payment methods by using vishwaspe. This payment method supports multiple payments methods that includes your credit cards, debit cards and digital wallets. this means you will have to not worry about your cash because you have vishwaspe that does everything easy for you in few seconds making your transaction smooth and easy.

Easy Payments:

Looking for a payment app that works in just few click? vishwaspe app gives you the easiest way to pay your payments we give you no complicated process or confusing UI. vishwaspe makes transactions easy and uncomplicated.

Discount Offers:

We all love discounts and vishwaspe delivers you all that you want. by using our platform we give you discounts and freebee offers and save money on your bill payments. we aim to give you value and easy transaction. Enjoy offers that we provide you on your flight bookings that is rupees 300. rupees 200 on your bus bookings and avail discounts from rupees 50 to 100 on hotels booking.

vishwaspe is designed to manage high-volume transactions. We offer repetitive data entry to accelerate the payment processes and add a layer of convenience.

Download our app:

2 notes

·

View notes

Text

Welcome to a new era in retail – welcome to AFEN Intelligent Micro Market with robotic arm!😋😋

Our explosion-proof, vandal-resistant tempered glass full-view window and a 22-inch high-resolution touchscreen offer a seamless shopping experience, all while being advertising-friendly.

#micro#market#vendingmachine#afenvendingmachine#mexico#cashlesspayment#vendingmachinebusiness#SnackVendingMachine#italy#germany#spain#belgium#drinkvendingmachine#elevator#foodvendingmachine#coffeevendingmachine#singapore#vendingbusiness#vendingopportunity#india#malaysia#distributeurautomatique#automat#自動販売機#outdoor#vendingmachinelove#vendingnews#europe#ai#minivending

2 notes

·

View notes

Text

Boost Efficiency in Cafeterias with Prepaid Cards: A Comprehensive Guide

Introduction

In today's fast-paced world, efficiency is key, especially in high-traffic places like cafeterias. One innovative solution that has gained significant traction is the use of prepaid cards. These cards streamline transactions, reduce wait times, and enhance overall customer experience. In this article, we'll delve into the various ways prepaid cards can boost efficiency in cafeterias, making operations smoother and more customer-friendly.

The Benefits of Prepaid Cards

Enhancing Transaction Speed

Prepaid cards significantly speed up the transaction process. With a simple swipe or tap, customers can pay for their meals swiftly, reducing long queues and wait times at the cashier.

Streamlining Operations

From the cafeteria's perspective, prepaid cards streamline operations by minimizing the need for handling cash. This not only reduces the risk of errors but also frees up staff to focus on providing excellent service.

Encouraging Repeat Business

Prepaid cards can be integrated with loyalty programs, offering incentives for repeat customers. This encourages loyalty and increases the likelihood of customers returning to the cafeteria.

Implementing Prepaid Card Systems

Choosing the Right Provider

When implementing a prepaid card system, it's crucial to choose the right provider. Look for a provider that offers robust security features, seamless integration with existing systems, and excellent customer support.

Customizing Card Options

Offering a variety of prepaid card options allows customers to choose what works best for them. Whether it's a reloadable card or a one-time use card, providing flexibility enhances customer satisfaction.

Overcoming Challenges

Educating Customers

One challenge in implementing prepaid card systems is educating customers about their benefits and usage. Clear signage, informational materials, and friendly staff can help overcome this hurdle.

Handling Technical Issues

Like any technology, prepaid card systems may encounter technical glitches from time to time. It's essential to have a contingency plan in place and a responsive support team to address issues promptly.

Boost Efficiency in Cafeterias with Prepaid Cards: FAQs

How do prepaid cards benefit cafeteria operations? Prepaid cards enhance efficiency by speeding up transactions, streamlining operations, and encouraging repeat business.

Can prepaid cards be customized for different needs? Yes, prepaid cards can be customized to offer various features such as re-loadable options, loyalty programs, and special promotions.

Are prepaid card transactions secure? Most prepaid card systems come with robust security features to protect both customers and cafeteria operators from fraud and data breaches.

What happens if a prepaid card is lost or stolen? Many prepaid card providers offer options to freeze or deactivate lost or stolen cards to prevent unauthorized use. Customers can typically request a replacement card with the remaining balance transferred.

Can prepaid cards be integrated with existing cafeteria systems? Yes, many prepaid card systems are designed to integrate seamlessly with existing point-of-sale (POS) systems, making implementation smooth and hassle-free.

Are there any fees associated with prepaid cards? Some prepaid card programs may have fees associated with initial purchase, reloads, or account maintenance. However, these fees are often outweighed by the benefits of using prepaid cards.

Conclusion

In conclusion, prepaid cards offer a myriad of benefits for boosting efficiency in cafeterias. From speeding up transactions to streamlining operations and fostering customer loyalty, prepaid cards are a valuable tool for modernizing cafeteria management. By overcoming challenges and implementing best practices, cafeterias can harness the power of prepaid cards to enhance the overall dining experience for both customers and staff.

We hope you enjoyed reading our blog posts about canteen and cafeterias billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#Efficiency#Cafeteria#PrepaidCards#CustomerExperience#LoyaltyPrograms#StreamliningOperations#TransactionSpeed#CashlessPayment#Technology#DiningExperience#Convenience#CustomerService#DigitalPayments#Innovation#FoodService#Modernization#Sustainability#DigitalTransformation#PointOfSale#CashlessSociety

0 notes

Text

Digital payment is any payment or transaction made digitally. In this method, the payer as well as the payee both use the electronic mode for sending and receiving money, no hard cash is used between them. Sometimes it is not mandatory in some cases for the payee to participate digitally for the transaction to be fulfilled.

#digital_payment_market#digital_payment_market_size#digital_payment_market_growth#digital_payment_market_trends#digital_payment_market_forecast#digital_payment#cashlesspayment

0 notes