#Taxation consultancy company

Explore tagged Tumblr posts

Text

What to Expect from Taxation Consultancy Services

Taxation consultancy services involve analyzing your financial situation to provide actionable insights for tax efficiency. At Felix Advisory, our team of tax consultants offers tailored solutions to address your specific needs, ensuring you stay compliant while maximizing tax benefits. Learn more about how our expert services can make a difference for your business.

0 notes

Text

Tax consultant services in UK

We offer tax consultant services in UK, tax filing services in US, UK, Canada, Australia and Singapore. Internation taxation services.

Tax consultant services in UK | Tax consultant services in USA | Tax services in USA

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#Tax consultant services in UK

3 notes

·

View notes

Text

#CA#Chartered Accountants#Accountants#Online Accounting Services#GST Accountants#Accounting Consultants#Balance Sheet Preparation#Accounting Services for Shares#GST Returns#ITR#Income Tax returns#Audit#Taxation#Service Tax#ROC Filing#Corporate Accounting#Company Compliance#Payroll Accounting Services#Online International Accounting Services#Financial Accounting Services#Online CA Services

1 note

·

View note

Text

#outsourcing consultancy#finance and accounting#taxation services#intellectual property#enterprise compliance solutions#finance accounting services#taxation#trademark and copyright#Registration of company#FEMA compliance#Valuation services#Corporate legal advisory services

1 note

·

View note

Text

taxation consultancy services

taxation consultancy services

1 note

·

View note

Text

With more than a decade of experience in business and tax advisory offers the verified professionals like chartered Accountants, company secretaries and tax consultant in India who assures for fastest possible delivery and excellent delivery of all ca services.

#taxation consultancy services#labour law compliance rules#company registration consultants#Accounting services in delhi#secretarial audit applicability

0 notes

Text

Simplifying Company Formation in India with Blockchain Consulting Services and International Taxation

Entrepreneurs and investors are always looking for effective and transparent ways to start and run businesses in the quickly expanding business sector. A crucial part of starting a business is forming a corporation, which involves careful consideration of tax, legal, and regulatory issues. The importance of company formation in India will be discussed in this blog post, along with how LEGALLANDS LLP, a renowned law firm with offices in New Delhi, can help business owners by offering blockchain consulting services and knowledge of international taxation.

Company Formation in India

India has grown to be a desirable location for both domestic and foreign investors thanks to its strong economic growth and market potential. India is a great place to start a business because it has a vast consumer base, a trained workforce, and government programmes to make doing business easier. It can be challenging to manoeuvre through the legal and regulatory framework, though.

LEGALLANDS LLP is an expert in company formation services in India, assisting business owners at every step. They offer thorough support, which includes choosing the right business structure, creating legal documents, securing required approvals, and assuring adherence to Indian regulations. With their in-depth understanding of the legal environment, LEGALLANDS LLP guarantees their clients a simple and stress-free business formation process.

Blockchain Consulting Services

It is impossible to exaggerate the potential of blockchain technology to revolutionise business formation procedures given its emergence as a revolutionary force across industries. Blockchain is important, and LEGALLANDS LLP provides advisory services to help Indian businesses establish themselves using this technology.

LEGALLANDS LLP ensures the immutability and openness of business formation documents by using blockchain technology. By enabling secure and immutable record-keeping, blockchain lowers the possibility of fraud and manipulation. The ability to track document changes in real-time ensures that all interested parties have access to the most recent data.

International Taxation

Understanding and following international tax rules is necessary for operating a firm in the global market. In addition to guiding clients through the difficulties of cross-border transactions, LEGALLANDS LLP excels at offering knowledgeable guidance on international taxation.

Their staff of knowledgeable tax experts helps companies comprehend the tax repercussions of extending their operations abroad. They offer advice on how to structure transactions, maximise tax advantages, and guarantee adherence to international tax rules and treaties. Clients can reduce tax risks and improve their worldwide company strategy by utilising their experience.

It takes extensive knowledge of the legal, regulatory, and taxes frameworks to start a business in India. With its experience in business formation, blockchain consulting, and international taxation, LEGALLANDS LLP provides business owners and investors with a comprehensive answer.

LEGALLANDS LLP ensures openness and security in the company formation process through their blockchain consulting services. Their expertise in international taxation enables businesses to grow internationally while abiding with tax regulations.

Entrepreneurs may confidently manage the challenges of company registration in India, tap into the possibilities of blockchain technology, and streamline their global business operations with LEGALLANDS LLP as a reliable partner.

0 notes

Text

Tax Disputes: Competent and efficient management

Tax disputes can be a major headache for individuals and businesses alike. From managing tax litigations to resolving income tax disputes, navigating the complex and often-changing landscape of tax law can be challenging. It is where the expertise and efficiency of tax professionals can make all the difference. Read More: Tax Disputes: Competent and efficient management

#best income tax consultants#income tax advisor#income tax consultant in Delhi#income tax on consultancy services in India#international taxation consultant#non resident tax consultant#private limited company registration in Delhi#Tax advisor in Delhi#tax consultancy companies in India#tax consultancy firms#tax consultancy firms in India#Tax Consultancy Services#tax consultancy services India

0 notes

Note

you keep mentioning making money off of games like hsr but how? im dying to know

All right I'll make a proper post about this lmfao. May I present

The Invalid's Guide to Making Money Off Mobile Games

(Please note I'm using my affiliate links, so if you click through and join up I will get rewarded at no cost to you.)

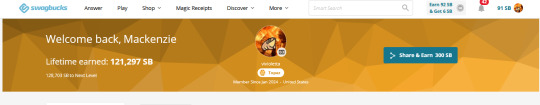

The primary way that I make money is through Swagbucks. (I also use Inbox Dollars, but I tend to use Swagbucks more for different deals. They're both owned by the same parent company.) Swagbucks is a survey website, but they also offer affiliate deals with mobile games. For proof that I'm not grifting, here is my profile.

Each swagbuck (SB) is a penny, so 100 is a dollar, 1000 is 10 dollars. As you can see as of posting this, I've earned 121, 297 SB or $1,212.97 since I started in January. I play various mobile games for a few hours every day, but I took a break for about a month and a half since I was getting burned out. I cash out to Paypal usually, but you can get a bunch of different gift cards, it's nice to be able to directly get people gift cards for their birthdays through the website.

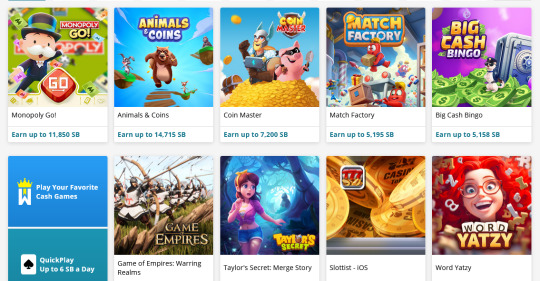

There are a ton of different offers to choose from, from various sponsors of varying levels of credibility. They'll offer to complete different checkpoints within the game for SB within a certain amount of time.

When I'm looking for an offer to start, I'm looking for a few things in particular. The amount on offer has to be worth my time. Usually, I'm looking for offers in the $40-$150 range. Anything above that is likely to have a catch, require massive amounts of in-app purchases to complete, or is downright impossible. I always consult the swagbucks reddit to check out offers beforehand, so I don't waste my time. I also consider the time investment I'm putting in. Usually 1000 levels of a puzzle game for $35 is the minimum I'm looking for. For idle games, I'm looking more in the $50 minimum range.

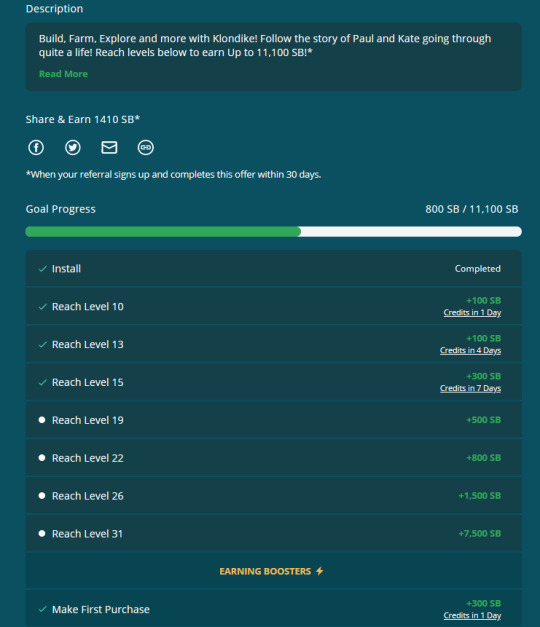

This is one of the offers I'm currently working on. (the game is Klondike, for $110 total offer)

Typically with an offer in this range, I know I'm going to make a few purchases. I always try to go for stamina boosters on the cheap. I've spent about $5 so far and I'm only a week into this and already about 1/3 of the way done. I log in multiple times a day since I am, as I've stated, disabled, so I have the freedom to do so. If you do not have the ability to be so on top of things, I recommend looking at the second to last goal point, and making that your target.

Other offers are like this

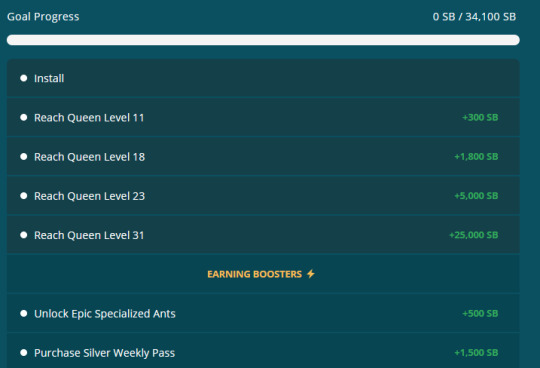

(This is Ant Legion, a game I've played before). As you can see the amount on offer is significantly higher. $340 to be exact, though keep an eye out for things like "purchase X"--typically those are 1:1 rebates, so you get a boost for free. With these types of games, you're going to be making substantially more in-app purchases. When I try this offer, I'm going to budget about $40-$50 so that I'm still making a profit of about $285. Understand that there is risk involved--if I spend that money and I *don't* make it all the way to 31 in time, I'm SOL.

Swagbucks also offers gambling games. Just stay away from those. I did one and spent about $70 to make a profit of about $150, but none of it was from the app itself. They're predatory and meant to funnel in-app purchases, though again, check the reddit. There might be a couple that are legit.

Typically with Swagbucks, I like to be doing 3 offers at a time--two idle games, and one puzzle game. I'll check my idle games throughout the day to make progress, and sit and binge the puzzle games to get to the level checkpoints (Usually about 1000 levels, which isn't as bad as it sounds.)

Before I get into the next section, this is very important, please listen to me.

If you cash out for more than the minimum threshold for taxation in your country, you will owe taxes on the money you make.

You'll need to do research for your individual situation. For USAmericans, the threshold is $600. I budget about 10% of that to go into taxes, and I have a spreadsheet with receipts for in-app purchases which qualify as business expenses in this case. Here is the SB page for more info.

Next, I've just started using Mistplay after being bombarded with ads about it. generally, I like it. I'm also not saying that it's possible to double-dip SB and Mistplay rewards, because I would not do that because it's against terms and conditions, but it might be possible (though I definitely don't recommend it).

Mistplay works differently in that it offers 'units' for playing games for a certain amount of time. I've earned about 500 units in a day playing mobile games for a few hours, and minimum cash out starts at $5 for 1800 units. Overall it's a nice system that allows me to make money on more "fun" games that I'd otherwise be playing anyway without making money, such as for instance, Honkai: Star Rail which I'm planning on starting tonight. And if you do join Mistplay, this is my recruit link ;).

Overall tips:

be prepared to watch ads. I have my shit set up on multiple devices, I have a phone and a tablet with different games on each and I usually have ads going on on one screen while I'm playing merge what the fuck ever on the other. That's how they're making the money to give to you, pussy up etc.

It does take some dedication to rack up big numbers. I consider myself on a fairly relaxed grind and usually play mobile games for about four hours a day. You can try out your limits and whatnot

RESEARCH. you can download a game and test it outside of the SB tracking to try it out, or check out the subreddit. Mucho helpful information.

IF YOU DO AN OFFER and it DOES NOT TRACK CORRECTLY do not panic. Complete the offer to the best of your ability, take screenshots, and use the SB help center to request your missing SB credit. They usually get back to me within a business day with my shit in pending.

It's a slow crawl to victory. You'll be like "i am not making fucking ANYTHING." and then the next week you'll be like. pending for $100. Be patient.

Check out the other shit on the SB and Inbox Dollars websites. I occasionally do surveys for over a dollar (though I use Forthright for surveys because overall it pays better for my time.)

Good luck gamers!

And. Please don't like. blow me up about this being a scam or whatever? I see people press x to doubt but the proof is in my bank account. Or well. My medical provider's bank account now because I've been using the money to slowly pay off bills.

12 notes

·

View notes

Text

Setting Up a Business in India: A Comprehensive Guide by Masllp

India has become a preferred destination for both local and international entrepreneurs, thanks to its growing economy, favorable government initiatives, and emerging consumer market. Whether you're a small startup or an established company looking to expand, setting up a business in India can offer remarkable opportunities. Masllp, a trusted consulting partner, specializes in helping businesses navigate the complex procedures of registration, compliance, and scaling in India.

Why Set Up a Business in India? India’s business landscape is evolving rapidly, making it an attractive destination for a wide range of industries. Here are a few key reasons to consider setting up a business in India:

Growing Consumer Market: With a large and young population, India offers a vast market for consumer goods, services, and technology. Ease of Doing Business: Government initiatives like Make in India and Startup India have simplified regulatory processes, reduced barriers, and encouraged foreign investment. Supportive Economic Policies: India's government has introduced tax incentives and simplified tax structures that foster a business-friendly environment. Skilled Workforce: India is home to a skilled and diverse workforce, making it easier to find qualified employees in virtually any industry. Steps to Setting Up a Business in India with Masllp Masllp offers end-to-end support in setting up a business in India, from choosing the right business structure to managing compliance. Here’s a step-by-step guide:

Choosing the Right Business Structure India offers several business structures, including Private Limited Company, Limited Liability Partnership (LLP), and Sole Proprietorship. Each has its advantages and requirements:

Private Limited Company: Ideal for businesses seeking to raise funds or expand quickly. LLP: Offers flexibility with limited liability and is easier to manage. Sole Proprietorship: Suitable for small businesses looking to test the market before expanding. Masllp assists clients in selecting a structure that aligns with their business objectives, ensuring compliance with local laws and regulations.

Registration and Legal Formalities Once the business structure is chosen, Masllp handles the complete registration process, including obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and Certificate of Incorporation. These are crucial for:

Establishing the company’s legal identity in India. Allowing the business to operate under its registered name. Providing a smooth setup process without regulatory hiccups.

Securing Necessary Licenses and Permits Depending on the nature of the business, specific licenses and permits might be required. Industries like food, pharmaceuticals, and manufacturing often need approvals from regulatory bodies. Masllp guides businesses through this process, ensuring that all permits are acquired for seamless operation.

Setting Up Bank Accounts and Financial Structuring Setting up a local bank account is essential for conducting business in India. Additionally, understanding India's taxation system is crucial for compliance. Masllp assists in setting up business bank accounts, as well as in understanding the Goods and Services Tax (GST), Income Tax, and other fiscal regulations, ensuring compliance and optimizing tax efficiency.

Hiring and Staffing Solutions India offers a large talent pool across diverse industries. Masllp provides HR solutions, including assistance with recruitment, payroll management, and employee benefits, to help businesses find the right team and establish efficient HR practices.

Ongoing Compliance and Reporting India has specific reporting and compliance requirements, such as annual returns, GST filings, and income tax submissions. Masllp offers ongoing compliance management, ensuring that businesses meet regulatory deadlines and avoid penalties.

Benefits of Partnering with Masllp When setting up a business in India, having an experienced partner like Masllp can streamline processes, reduce delays, and enhance operational efficiency. Masllp’s services include:

Expert Guidance: With in-depth knowledge of India’s business laws and market trends, Masllp offers strategic insights for a successful setup. Personalized Solutions: Each business is unique, and Masllp provides customized solutions to meet specific requirements. End-to-End Support: From registration to compliance, Masllp offers comprehensive support throughout the business setup journey. Common Challenges in Setting Up a Business in India While India’s business landscape is promising, challenges such as regulatory compliance, tax structures, and complex documentation can arise. Masllp has a deep understanding of these potential obstacles and employs a proactive approach to address them, ensuring smooth business initiation and growth.

Start Your Business Journey with Masllp Today! Setting up a business in India can be a transformative decision for entrepreneurs and companies alike. With Masllp by your side, you’ll have a trusted partner who understands the intricacies of the Indian market and regulatory environment. From initial planning to full-scale operations, Masllp ensures a smooth, compliant, and successful business setup experience in India.

#accounting & bookkeeping services in india#audit#businessregistration#foreign companies registration in india#chartered accountant#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Navigating Success with YKG Global: Simplicity in Business Advisory and Legal Services.

YKG Global is the premier Tax Advisory (NRI) and legal services provider with over 40 years of experience. Headquartered in Delhi and Noida, YKG Global serves clients across the globe through more than 20+ countries where it has its offices. Followed by more than 200 professionals, the most traditional values are combined with tech-driven solutions, providing business registration and regulatory compliance, and supporting litigation matters. Specializing in setting up an international company and doing all legal compliance work, we help any-sized businesses achieve sustainable growth. YKG Global is your business partner who will navigate you through the treacherous waters of complex business landscapes inside India and beyond.

Our Service-

Seamless global business registration

Not to mention, enjoy hassle-free company incorporation in over 20 countries including the US, Japan, Hongkong Singapore, and much more. Now, make the process of business registration of a foreign company easy. So you can concentrate on how to increase your business.

NRI Desk-

Access cutting-edge global management at our NRI Desk: from tax consultation and will Guidance of business setup and DTAA and certification. It will make you capable of operating your foreign business from your chosen place.

Global Reach and Competency They are very experienced in the cross-border rules of international taxation that enable compliance across jurisdictions. This is ideal for companies having operations across borders.

YKG Global is one portfolio of expatriate tax solutions that helps clients navigate through the jungle of expat taxes by achieving compliance with home and host country tax obligations while refining the tax strategy.

Mission and Objective: Business Growth: The taxation service of YKG Corp is in line with the vision of YKG Global. That is the feature whereby the company aids in business growth through detailed and reliable strategic support.

This is what YKG Global's mission does-build a better future by streamlining the complex procedures of tax compliance, registration, and business expansion to enhance growth further.

Here's how we deliver top-notch service and tailored advice to elevate your business.

Step 1 - Collection: Where every conversation counts Your journey with YKG Global starts with an introduction, designed to suit your business and financial goals. We lay a basis for a trusted partnership- at that level where two people can shake hands. Your journey with YKG GLOBAL starts with a personal introduction to your Expert team member. Understand the business of your company, what you aim to achieve financially, and the growth potential. Begin by setting the stage for a trusted partnership in that first meeting.

Step 2 - Discussion:

Your Needs, Our Priority

We listen carefully to the challenges and ambitions around your business. That enables us to find the most accurate vision for your targets and acts also as a professional convergence basis for planning and building up strategies based on your business.

Step 3 - Solutions: Our finance experts will make each solution unique in every case. We work on minute details and help you grow your business while keeping yourself in compliance in your locality or globally.

Our History- YKG Global was founded by Mr. YK Gupta in the year 1981 as a dedicated advisory firm. Over 40 years, it has grown into a global entity operating in more than 20+ countries worldwide. Our expert team of CA and Auditors team that provides services for businesses ranging from start-ups to multinational companies. With these basic values of trust, integrity, and expertise, YKG Global continues to grow with continuous evolution under the legacy characterized by our legacy.

YKG GLOBAL has maintained good GOODWILL in the market since 1981 and provided Hassle-free and fast services to its clients. We have successfully registered 2000+ companies and businesses worldwide.

Source- https://www.ykgglobal.com/blog/about-ykg-global

0 notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Benchmark Professional Solutions Private Limited : Your One-Stop Destination for Business and Financial Solutions

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Private Limited stands as a beacon of expertise in the realm of business and finance, recognized as a certified partner of Tally Solutions. With a mission to provide comprehensive solutions tailored to the diverse needs of businesses, Benchmark has established itself as a reliable ally for entrepreneurs and enterprises alike.

At the core of Benchmark’s offerings is its extensive range of services designed to streamline business operations. The company specializes in Digital Signature Certificates (DSC) and token services, partnering with reputable providers like EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN. These digital solutions not only enhance the security of online transactions but also ensure compliance with various regulatory requirements.

In addition to DSC services, Benchmark excels in traditional business services such as accounts and audits, trademark registration, and ROC (Registrar of Companies) compliance. The company’s expertise extends to licensing and registration, ensuring that businesses are set up efficiently and in accordance with local laws. With a deep understanding of taxation, Benchmark provides tailored assistance with income tax and GST compliance, enabling businesses to navigate the complexities of tax regulations confidently.

Consultancy and outsourcing services are also pivotal aspects of Benchmark’s offerings. By leveraging its extensive knowledge and experience, the company provides strategic guidance to help businesses optimize their operations and achieve sustainable growth. Furthermore, Benchmark’s legal team specializes in civil and criminal law, offering invaluable support to clients facing legal challenges.

Choosing Benchmark Professional Solutions Pvt. Ltd. means partnering with a company that prioritizes customer satisfaction and delivers results. Their commitment to excellence is reflected in their personalized approach, ensuring that each client receives solutions tailored to their specific needs. With a team of seasoned professionals dedicated to staying abreast of the latest industry trends and regulations, Benchmark provides the expertise necessary to navigate the evolving business landscape.

In conclusion, Benchmark Professional Solutions Pvt. Ltd. stands out as a premier choice for businesses seeking comprehensive support in financial and legal matters. Their diverse range of services, coupled with a commitment to quality and client success, makes them an indispensable partner in your business journey. Choose Benchmark for a brighter, more secure future in business.

2 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Exemptions from Personal Income Tax in Cameroon

Learn about the various exemptions from personal income tax in Cameroon as detailed in Section 43.

Learn about the various exemptions from personal income tax in Cameroon as detailed in Section 43. Understand which incomes are exempt to better manage your tax obligations. For comprehensive tax and business services, visit OpenHub Consulting, specializing in company registration, tax services, marketing, and bookkeeping. In our previous post, we covered the taxation of income from digital…

2 notes

·

View notes