#income tax on consultancy services in India

Explore tagged Tumblr posts

Text

Tax Disputes: Competent and efficient management

Tax disputes can be a major headache for individuals and businesses alike. From managing tax litigations to resolving income tax disputes, navigating the complex and often-changing landscape of tax law can be challenging. It is where the expertise and efficiency of tax professionals can make all the difference. Read More: Tax Disputes: Competent and efficient management

#best income tax consultants#income tax advisor#income tax consultant in Delhi#income tax on consultancy services in India#international taxation consultant#non resident tax consultant#private limited company registration in Delhi#Tax advisor in Delhi#tax consultancy companies in India#tax consultancy firms#tax consultancy firms in India#Tax Consultancy Services#tax consultancy services India

0 notes

Text

Tax consultant services in UK

We offer tax consultant services in UK, tax filing services in US, UK, Canada, Australia and Singapore. Internation taxation services.

Tax consultant services in UK | Tax consultant services in USA | Tax services in USA

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#Tax consultant services in UK

3 notes

·

View notes

Text

Company Formation Process in India

The company formation process in India might seem complicated, but by adhering to the legal steps and utilizing government-provided tools like SPICe+, it becomes more straightforward. With thorough planning and proper documentation, you can establish your business efficiently and reap the advantages of a formal corporate structure.

company formation process in india

online company registration in india

private limited company registration in india

free company registration in india

#income tax consultant in india#best tax consultants in india#best chartered accountants in india#company formation in india#goods and services tax consultant in delhi#best chartered accountant firm#goods and services tax consultant in india#chartered accountant in india#auditor in india#auditorinindia

0 notes

Text

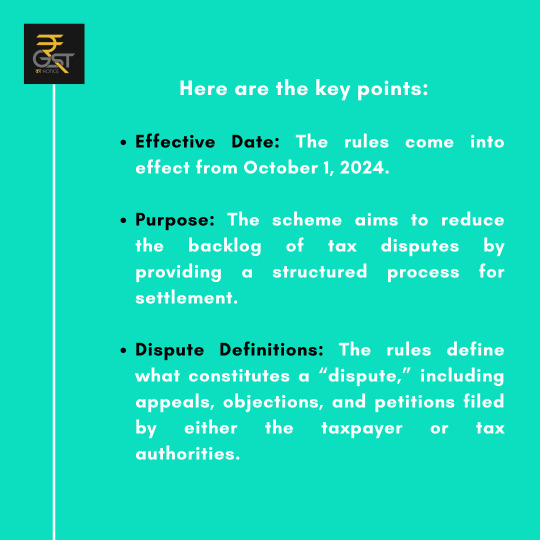

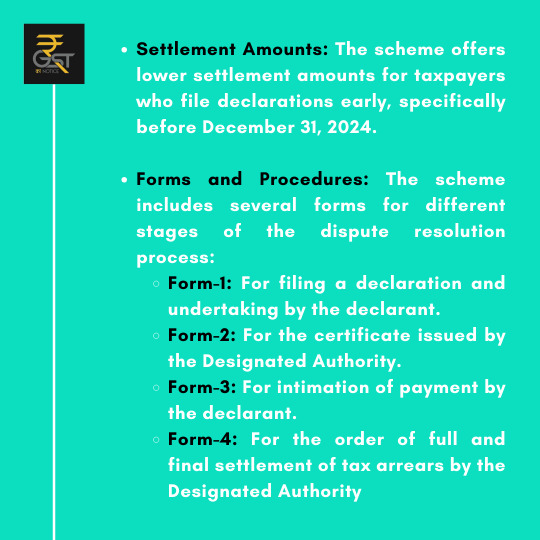

The Direct Tax Vivad se Vishwas Rules, 2024... Find your information...

For any assistance visit gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gsthelp #gstassistance #directtax #indirecttax #tax #ca #taxlaw #incometax #dggi #cbic #business #finance #budget #profit #gstreturns #gstregistration

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#gst#corporate lawyer in india#gst consultation firm#gst experts in india#gst help#gst india#gstkanotice#gst registration#gstreturns#gstfiling#taxation#gst notice reply#gst services#income tax

0 notes

Text

Income tax Consultant India | Secure Online Tax Filing

Paper Tax is a renowned income tax consultant in Indore, providing all possible solutions in the area of taxation with its experienced professionals. Call: 0731 4629991 https://bit.ly/3SL12kJ

#accounting#finance#Online Income Tax Return Filing#Income Tax Consultant Online#Income Tax Consultant India#Income Tax Return Filing Service#File Income Tax Return Online

0 notes

Text

Food License Registration in India with The Tax Planet

Ensure your food business complies with legal standards by obtaining a food license registration in India with The Tax Planet. Our expert team simplifies the process, guiding you through every step to secure your FSSAI license swiftly and efficiently. Whether you are starting a restaurant, food truck, catering service, or packaged food business, we provide comprehensive support, from document preparation to application submission. Trust The Tax Planet for hassle-free food license registration, ensuring your business meets all regulatory requirements and operates smoothly. Protect your brand and build consumer trust with our reliable licensing services.

#roc filing services in india#gst services in india#company formation in india#income tax services in india#income tax consultants in india#income tax solutions in india#gst registration in india#roc filing in india#roc compliance in india#income tax returns for nri

0 notes

Text

GST Return Filing services in India

GST return filing services in Indiawill assist you with the complicated procedure that is considered vital in order to establish yourself as a businessman. A GST return is essentially a record that contains all of the facts of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). After filing GST returns, you must pay the resultant tax liability (money that you owe the government). This whole thing makes GST return filing in India one of the important things to look after.

#Income Tax efiling Services India#Online TDS returns filing India#Tax consultation services in India#Online GST registration India

0 notes

Text

Tax Auditors in Delhi: Expert Services by SC Bhagat & Co.

Navigating the complexities of tax regulations is crucial for businesses and individuals alike, especially in a dynamic financial landscape like Delhi. Choosing a reliable tax auditor ensures your financial compliance, reduces audit risks, and enhances your financial credibility. SC Bhagat & Co., a leading tax auditing firm in Delhi, provides expert services designed to meet the unique needs of businesses and individuals, from tax compliance to advanced auditing solutions.

Why Tax Auditing Matters Tax auditing is essential for ensuring that financial records are accurate and compliant with current tax laws. Regular audits help businesses identify financial discrepancies, optimize their tax liabilities, and avoid costly penalties. For individuals, tax audits can validate their tax filings and enhance financial transparency. Whether you're a business owner or an individual taxpayer, tax audits play a vital role in:

Ensuring Compliance: By following regulatory requirements, tax audits help organizations and individuals avoid penalties. Detecting Errors and Fraud: An audit reveals inconsistencies in financial records, helping to prevent fraud or accidental errors. Improving Financial Accuracy: A professional audit provides a detailed review of financial data, ensuring accurate tax calculations. Building Credibility with Stakeholders: Regular audits reflect a commitment to transparency, boosting stakeholder confidence. SC Bhagat & Co.: Trusted Tax Auditors in Delhi SC Bhagat & Co. has earned its reputation as a trusted provider of tax auditing services in Delhi, thanks to its dedicated team of qualified professionals, extensive industry knowledge, and commitment to client success. Their expert tax auditors help clients stay compliant, reduce tax risks, and optimize their financial health through strategic auditing and consulting.

Key Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a range of tax auditing and related services designed to meet the unique needs of both individuals and businesses in Delhi:

Statutory Tax Audits SC Bhagat & Co. conducts thorough statutory tax audits to ensure clients meet legal requirements and minimize tax liabilities. Their expertise in Indian tax laws ensures every client is fully compliant with government regulations.

Internal Audits For businesses seeking to improve internal processes, SC Bhagat & Co. offers internal auditing services that identify areas of risk, improve financial accuracy, and enhance operational efficiency.

GST Audits GST compliance is critical for businesses in India, and SC Bhagat & Co. specializes in GST audits to ensure accurate filing and adherence to GST regulations. This minimizes the risk of penalties and provides peace of mind.

Income Tax Audits SC Bhagat & Co. offers comprehensive income tax audits for individuals and businesses, ensuring accurate filings and preventing potential issues with tax authorities.

Forensic Audits For clients requiring deeper analysis, SC Bhagat & Co. provides forensic audits to detect and address financial discrepancies, fraud, or irregularities within an organization.

Benefits of Working with SC Bhagat & Co. When you choose SC Bhagat & Co. as your tax auditor in Delhi, you gain access to a team that brings professionalism, in-depth knowledge, and dedication to every audit. Here are some reasons clients prefer SC Bhagat & Co.:

Industry Expertise: With years of experience in tax auditing and consulting, SC Bhagat & Co. provides services across various industries. Client-Centric Approach: The team at SC Bhagat & Co. takes time to understand each client's specific requirements, offering tailored solutions that best meet their needs. Timely and Efficient Services: Understanding the importance of meeting deadlines, SC Bhagat & Co. ensures timely audits and reporting. Confidentiality and Trust: They prioritize client confidentiality, ensuring all information is handled securely and professionally. Why Delhi Businesses and Individuals Choose SC Bhagat & Co. Delhi’s competitive business environment demands precision and reliability in tax matters. SC Bhagat & Co.’s commitment to excellence, coupled with their local expertise, makes them a preferred choice for tax audits in Delhi. Their clients range from small businesses to large corporations, as well as individuals seeking precise and trustworthy tax audit solutions.

Testimonials from Satisfied Clients Many of SC Bhagat & Co.'s clients have shared positive experiences, appreciating their professionalism and thorough approach. Here are a few testimonials:

“SC Bhagat & Co. has transformed our financial process. Their tax auditors identified several areas where we could reduce tax liabilities, helping us save significantly.”

“We’ve been working with SC Bhagat & Co. for years, and their expertise in GST audits has been invaluable. Highly recommended for any business in Delhi!”

Contact SC Bhagat & Co. for Expert Tax Auditing in Delhi If you're in need of reliable and professional tax auditing services in Delhi, SC Bhagat & Co. is here to help. Their team is ready to assist you with all your tax auditing needs, ensuring you meet compliance requirements and optimize your financial standing.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

3 notes

·

View notes

Text

Guide to the Company Formation Process in India

Starting a business in India involves a well-defined process to ensure compliance with legal regulations. Whether you’re planning to set up a private limited company, LLP, or any other business structure, understanding the steps involved is crucial for a smooth incorporation process.

1. Choosing the Right Business Structure

Selecting the appropriate business entity is the first step in the company formation process in India. Popular structures include:

Private Limited Company (ideal for startups and small businesses)

Limited Liability Partnership (LLP)

Sole Proprietorship

One Person Company (OPC)

Each structure has its own advantages and limitations, such as tax benefits, liability protection, and funding opportunities.

2. Reserving the Company Name

To incorporate a company in India, it’s essential to choose a unique name that complies with the naming guidelines under the Companies Act, 2013. The RUN (Reserve Unique Name) service on the Ministry of Corporate Affairs (MCA) portal helps you reserve your desired name.

3. Obtaining Digital Signature (DSC) and DIN

Digital Signature Certificate (DSC): All directors must have a DSC to sign electronic documents.

Director Identification Number (DIN): Apply for DIN through the SPICe+ form, which streamlines the incorporation process.

4. Filing the Incorporation Application

The incorporation process is simplified using the SPICe+ (Simplified Proforma for Incorporating a Company Electronically) form on the MCA portal. The SPICe+ form integrates services like:

PAN and TAN application

GST registration

EPFO and ESIC registration

Bank account opening

Essential documents include:

Memorandum of Association (MoA)

Articles of Association (AoA)

Proof of registered office address

ID and address proof of directors and shareholders

5. Issuance of Certificate of Incorporation

Once approved, the Registrar of Companies (RoC) issues a Certificate of Incorporation (COI), which includes a unique Corporate Identification Number (CIN). This marks the official formation of your company.

6. Post-Incorporation Compliance

After incorporation, several steps are necessary to begin operations legally:

Apply for GST registration.

Open a company bank account.

Maintain compliance with labor laws, such as EPFO and ESIC.

File annual returns with the RoC.

Benefits of Registering a Company in India

Legal recognition and credibility.

Limited liability protection for directors.

Easier access to funding and bank loans.

Tax benefits and exemptions for startups.

Conclusion

The company formation process in India may seem complex, but by following the legal steps and using government-provided services like SPICe+, the process becomes streamlined. With proper planning and documentation, you can successfully establish your business and enjoy the benefits of a formal corporate structure.

Auditor in India best tax consultants in india Company Formation in India free company registration in india online company registration in india Startup Services in India Statutory Auditor in India

#company formation in india#auditor in india#goods and services tax consultant in india#best chartered accountants in india#income tax consultant in india#best chartered accountant firm#auditorinindia#best tax consultants in india#chartered accountant in india#goods and services tax consultant in delhi

0 notes

Text

#Corporate tax rate in India#income tax#union budget 2024#corporate tax services in uae#tax plannning#corporate tax planing#corporate tax rate in india ay 2024-25#income tax slab for ay 2024-25#corporate tax rate#corporate tax rate in India 2024#income tax department#Corporate tax rate in india ay 2024 25 pdf#income tax rate for pvt ltd company for ay 2024-25#Corporate tax rate in India for last 10 years#Current corporate tax slab rates for companies in India 2024#Understanding income tax obligations for Indian companies#How GST impacts corporate tax liabilities in India#List of corporate tax exemptions available for Indian businesses#Tax rates for foreign companies operating in India#tax advisor#online ca consultation service#professional tax consultant service

0 notes

Text

Setting Up a Business in India: A Comprehensive Guide by Masllp

India has become a preferred destination for both local and international entrepreneurs, thanks to its growing economy, favorable government initiatives, and emerging consumer market. Whether you're a small startup or an established company looking to expand, setting up a business in India can offer remarkable opportunities. Masllp, a trusted consulting partner, specializes in helping businesses navigate the complex procedures of registration, compliance, and scaling in India.

Why Set Up a Business in India? India’s business landscape is evolving rapidly, making it an attractive destination for a wide range of industries. Here are a few key reasons to consider setting up a business in India:

Growing Consumer Market: With a large and young population, India offers a vast market for consumer goods, services, and technology. Ease of Doing Business: Government initiatives like Make in India and Startup India have simplified regulatory processes, reduced barriers, and encouraged foreign investment. Supportive Economic Policies: India's government has introduced tax incentives and simplified tax structures that foster a business-friendly environment. Skilled Workforce: India is home to a skilled and diverse workforce, making it easier to find qualified employees in virtually any industry. Steps to Setting Up a Business in India with Masllp Masllp offers end-to-end support in setting up a business in India, from choosing the right business structure to managing compliance. Here’s a step-by-step guide:

Choosing the Right Business Structure India offers several business structures, including Private Limited Company, Limited Liability Partnership (LLP), and Sole Proprietorship. Each has its advantages and requirements:

Private Limited Company: Ideal for businesses seeking to raise funds or expand quickly. LLP: Offers flexibility with limited liability and is easier to manage. Sole Proprietorship: Suitable for small businesses looking to test the market before expanding. Masllp assists clients in selecting a structure that aligns with their business objectives, ensuring compliance with local laws and regulations.

Registration and Legal Formalities Once the business structure is chosen, Masllp handles the complete registration process, including obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and Certificate of Incorporation. These are crucial for:

Establishing the company’s legal identity in India. Allowing the business to operate under its registered name. Providing a smooth setup process without regulatory hiccups.

Securing Necessary Licenses and Permits Depending on the nature of the business, specific licenses and permits might be required. Industries like food, pharmaceuticals, and manufacturing often need approvals from regulatory bodies. Masllp guides businesses through this process, ensuring that all permits are acquired for seamless operation.

Setting Up Bank Accounts and Financial Structuring Setting up a local bank account is essential for conducting business in India. Additionally, understanding India's taxation system is crucial for compliance. Masllp assists in setting up business bank accounts, as well as in understanding the Goods and Services Tax (GST), Income Tax, and other fiscal regulations, ensuring compliance and optimizing tax efficiency.

Hiring and Staffing Solutions India offers a large talent pool across diverse industries. Masllp provides HR solutions, including assistance with recruitment, payroll management, and employee benefits, to help businesses find the right team and establish efficient HR practices.

Ongoing Compliance and Reporting India has specific reporting and compliance requirements, such as annual returns, GST filings, and income tax submissions. Masllp offers ongoing compliance management, ensuring that businesses meet regulatory deadlines and avoid penalties.

Benefits of Partnering with Masllp When setting up a business in India, having an experienced partner like Masllp can streamline processes, reduce delays, and enhance operational efficiency. Masllp’s services include:

Expert Guidance: With in-depth knowledge of India’s business laws and market trends, Masllp offers strategic insights for a successful setup. Personalized Solutions: Each business is unique, and Masllp provides customized solutions to meet specific requirements. End-to-End Support: From registration to compliance, Masllp offers comprehensive support throughout the business setup journey. Common Challenges in Setting Up a Business in India While India’s business landscape is promising, challenges such as regulatory compliance, tax structures, and complex documentation can arise. Masllp has a deep understanding of these potential obstacles and employs a proactive approach to address them, ensuring smooth business initiation and growth.

Start Your Business Journey with Masllp Today! Setting up a business in India can be a transformative decision for entrepreneurs and companies alike. With Masllp by your side, you’ll have a trusted partner who understands the intricacies of the Indian market and regulatory environment. From initial planning to full-scale operations, Masllp ensures a smooth, compliant, and successful business setup experience in India.

#accounting & bookkeeping services in india#audit#businessregistration#foreign companies registration in india#chartered accountant#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Feeling Lost? Here’s Your Roadmap to How to find a good tax consultant in India?

Are you searching for the best online tax consultant India? There’s nowhere else to look! Our team of tax experts specializes in offering knowledgeable solutions catered to your particular financial circumstances. We ensure everyone, individual or business, can easily manage the complicated tax environment.

Navigating the world of taxes can feel overwhelming, especially with the complexity of income tax laws in India. Finding the right tax consultant is key to ensuring your financial health stays in check. If you’re confused about where to start, don’t worry. We’re here to help guide you on the path to finding a good tax consultant in India. And if you want to skip the search, look no further than TaxDunia — recognized as one of the best income tax consultant in India.

Why You Need a Tax Consultant

Handling taxes involves a lot of details, deadlines, and paperwork. Even a small mistake can lead to penalties or lost money. A qualified tax consultant ensures that your tax filings are done correctly and on time, while also helping you save as much money as possible. Best Income Tax Advisors can also guide you through complex tax laws, so you’re always on the right side of the law. We are registered with recognized as qualified professionals, best accounting tax and advisory services in India.

Steps to Find a Good Tax Consultant

Look for Experience and Expertise The first step in finding the right tax consultant is to check their experience. An expert who has been in the field for years will know how to handle various tax situations, from income tax filings to audits. Our Company, for example, brings years of experience and a strong reputation for helping clients with a wide range of tax needs.

Check for Certification Your tax consultant should be certified by recognized authorities. Look for Chartered Accountants (CAs) or Certified Public Accountants (CPAs) in India. This ensures that the person you hire is fully trained and knowledgeable about the latest tax laws and regulations.

Ask for Recommendations Getting recommendations from friends, family, or business associates is a great way to start. If a consultant comes highly recommended, they are likely to provide good service. Our company has earned positive reviews from clients all over India, thanks to its transparent and reliable service.

TaxDunia is widely recognized as the Top 10 best income tax consultant in India. The company stands out with its team of skilled professionals who provide comprehensive tax solutions tailored to both individuals and businesses. From income tax filings and strategic tax planning to managing complex tax laws, we offer expertise that you can trust.

Our Complete Services: -

At TaxDunia, we offer a range of professional services designed to meet your needs. This blog provides an overview of our offerings and how we can assist you with various business and tax requirements in India.

Private Limited Company Registration Service in India

Starting a business in India involves several steps, with one of the most crucial being Private Limited Company Registration Service in India. This process ensures that your business is legally recognized and offers you the benefits of limited liability, credibility, and easier access to capital. At our company, we streamline this process for you, handling all necessary paperwork and compliance requirements to set up your pvt ltd company registration service seamlessly.

Online Company Registration in India

For those who prefer convenience, our Online Company Registration in India service is an ideal choice. We understand that time is valuable, so we offer a user-friendly online platform to simplify your Company Registration Service in India. Our team ensures that your registration process is quick and efficient, allowing you to focus on growing your business while we take care of the formalities.

One Person Company (OPC) and Public Limited Company Registration

If you’re considering starting a business on your own, our One Person Company Registration Service in India is tailored for solo entrepreneurs. This structure offers limited liability while allowing you to retain full control. Our OPC Registration Service simplifies ensuring compliance and a smooth process.

Public Limited Company Registration

Alternatively, if you’re looking to form a larger corporation, our Public Limited Company Registration Service is designed to help you meet the requirements for public trading and raising capital.

Firm Registration Services

For those in need of Firm Registration Services, we provide comprehensive solutions to get your partnership or LLP firm officially recognized. Our services include handling all necessary documentation and compliance requirements, ensuring that your firm is legally established and ready to operate.

Income Tax Return Filing Service in India

Managing taxes can be daunting, but with our Income Tax Return Filing Service in India, you can ease your worries. We offer expert assistance in ITR Return Filing Service, ensuring that your income tax returns are filed accurately and on time. Our consultants are skilled in handling various tax scenarios, from individual to corporate tax returns.

NRI Tax Consultancy and Filing Services

If you’re an NRI, navigating Indian tax regulations can be particularly challenging. Our NRI Tax Consultancy Service is designed to provide you with expert advice on handling your Indian income and tax obligations. We also offer NRI ITR Filing Service in India to ensure that your returns are filed correctly, complying with all relevant tax laws.

GST Return Filing Services

Managing GST compliance can be complex, but with our GST Return Filing Services in India, you get expert support for all your GST needs. From GST Registration Service to Online GST Return Filing, we cover all aspects of goods and services tax filing. Our team ensures that you remain compliant with GST regulations and avoid any potential penalties.

Trademark Registration Services

Protecting your intellectual property is crucial. Our Trademark Registration Consultants offer comprehensive best Trademark Registration Service in India, including trade mark online registration. We guide you through the entire process to ensure your brand is legally protected.

Copyright Registration Services

Similarly, for those needing best Copyright Registration service in India, our Best Copyright Consultant services help you safeguard your creative works with ease.

Patent Registration Services

Innovation is a key driver of business success. With our Patent Registration Service in India, you can protect your inventions and ideas. Our team of Best Patent Consultants in India provides expert guidance throughout the online Patent Registration Services in India process, helping you secure your intellectual property rights.

Sole Proprietorship Firm Registration

For solo entrepreneurs and small business owners, we offer Sole Proprietorship Registration Service. Our services ensure that your business is properly registered and compliant with all relevant regulation.

Proprietorship Firm Registration

Setting up a proprietorship firm is a straightforward way for solo entrepreneurs to start a business. We offer comprehensive Proprietorship Firm Registration services to help you establish your business efficiently. You can also register proprietorship firm online with our user-friendly platform, ensuring a quick and hassle-free registration process. We handle all the necessary paperwork and compliance, allowing you to focus on your business.

TDS Return Filing Service & Top Consultants

Managing TDS (Tax Deducted at Source) can be complex. Our TDS Return Filing Service in India ensures accurate and timely submission of your TDS returns. We are recognized as Top TDS Return Consultants in India, offering expert guidance to ensure compliance with tax regulations and avoid penalties. Trust us to simplify your TDS management and keep your finances in order.

Foreign Company Registration in India

Expanding into the Indian market requires understanding local regulations. Our Foreign Company Registration in India service assists international businesses in setting up operations in India. We handle all the paperwork and compliance requirements, helping you establish your presence in the Indian market smoothly.

Conclusion

At TaxDunia, we are dedicated to offering comprehensive solutions for all your business and tax needs. From Private Limited Company Registration to GST Return Filing Services, our expert team supports you at every step. If you’re searching for online tax consultant services near me, look no further. Visit our website www.taxdunia.com to explore how we can assist you in achieving your business and tax goals. With our expertise, you can concentrate on your core activities while we handle the complexities of registration and compliance efficiently.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Best online tax consultant India#online Tax consultant services near me#Top 10 best income tax consultant in india#tax consultants#finance#itr filing#gst filling#itr filling#taxdunia#income tax#gst return

0 notes

Text

Chartered Accountant for Tax Filing Service in India.

Looking for a chartered accountant for tax filing Service Provider? Our expert GST tax consultants offer top-notch services for income tax return filing and more. https://bit.ly/3zwPefd

#finance#accounting#investing#Chartered Accountant Consultancy#Chartered Accountant Firm in India#Chartered Accountant for Tax Filing#Income Tax File Return India#Tax Filing Service Provider in India

0 notes

Text

Maximizing Your Income with Taxes Using The Tax Planet

Tax season can be a stressful time for many, but with the right strategies and guidance, you can turn it into an opportunity to maximize your income. At The Tax Planet, we specialize in helping individuals and businesses navigate the complexities of the tax system to ensure they keep more of what they earn. Here’s how The Tax Planet can assist you in maximizing your income through effective tax planning:

#gst registration in india#gst services in india#income tax consultants in india#roc filing services in india#income tax services in india#roc compliance in india#company formation in india#income tax returns for nri#income tax solutions in india#roc filing in india

0 notes

Text

NRI Real Estate in India: 6 Crucial Considerations Before Investing

For NRIs considering **real estate in India**Making informed decisions is essential for a successful investment journey. As the **growth of real estate in India** continues, understanding the landscape can unlock lucrative opportunities. Here are six critical factors to consider before making your investment.

1. Financial Regulations

Before diving into **NRI investment in India**, familiarize yourself with the financial regulations governing property purchases. NRIs can buy residential properties, but it's crucial to understand restrictions on agricultural land and commercial properties.

2. Tax Implications

Tax laws can significantly impact your returns on investment. NRIs must be aware of income tax, capital gains tax, and property tax obligations. Consulting a tax advisor can help clarify these aspects and optimize your financial strategy.

3. Repatriation of Funds

Understanding how to repatriate funds is vital for NRIs. The Reserve Bank of India (RBI) allows repatriation of up to $1 million annually, but certain conditions must be met. Ensure you are aware of these rules to facilitate smooth fund transfers.

4. Property Valuation

Engaging with reputable services like FutureProperty can help ensure you make sound investments. Their expertise in **real estate in India** includes thorough property valuations and insights into market trends, which are crucial for informed decision-making.

5. Location and Growth Potential

The location of your investment can significantly influence its value. Look for areas with high growth potential, as the **growth of real estate in India** is often concentrated in developing urban centers. Research local infrastructure projects and amenities that may boost property values.

6. Legal Compliance

Lastly, ensure all legal aspects are covered. Verify property titles, ownership documents, and any pending dues. FutureProperty offers valuable services to guide you through the legal processes involved in **NRI investment in India**, ensuring a hassle-free experience.

Conclusion

Investing in **real estate in India** as an NRI can be a rewarding venture if approached with the right knowledge and support. By considering these crucial factors and leveraging services from FutureProperty, you can navigate the complexities of the Indian property market effectively. For more insights, feel free to reach out to us.

**Contact Information:**

Address: HIG-35, KPHB, Road No. 1, Behind Karur Vysya Bank, Phase 1, Hyderabad - 500072, Telangana State, INDIA

Email: [email protected]

Phone: +91 7337555121

For additional information, visit our blog at [FutureProperty](https://www.futureproperty.in/blog/nri-real-estate-in-india).

For an NRI seeking to invest in real estate in India, understanding the financial landscape is critical. Follow our blog for insights and guidance.

2 notes

·

View notes

Text

Online TDS returns filing India

Online India tax filing offers an online TDS return filing service in India to meet all of your TDS needs and requirements. TDS, or tax deducted at source, is the tax collected by the Government of India at the time of a transaction. From TDS tax challan to TDS tax filing Online India tax filings offers all types of TDS assistance and services. Online India tax filings are a one-stop solution for all of your tax issues.

#Tax consultation services in India#Online GST registration India#GST Return Filing services in India#Income Tax efiling Services India

0 notes