#tax consultancy firms in India

Explore tagged Tumblr posts

Text

Tax Disputes: Competent and efficient management

Tax disputes can be a major headache for individuals and businesses alike. From managing tax litigations to resolving income tax disputes, navigating the complex and often-changing landscape of tax law can be challenging. It is where the expertise and efficiency of tax professionals can make all the difference. Read More: Tax Disputes: Competent and efficient management

#best income tax consultants#income tax advisor#income tax consultant in Delhi#income tax on consultancy services in India#international taxation consultant#non resident tax consultant#private limited company registration in Delhi#Tax advisor in Delhi#tax consultancy companies in India#tax consultancy firms#tax consultancy firms in India#Tax Consultancy Services#tax consultancy services India

0 notes

Text

Navigate GST notices with ease. GST Ka Notice offers expert services for responding to all types of GST notices. Get professional help today!

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

2 notes

·

View notes

Text

Expert Chartered Accountants in India | G.K. Kedia & Co.

Discover trusted Chartered Accountants in India with G.K. Kedia & Co. We specialize in audits, taxation, assurance, and business advisory services, helping you achieve financial success with confidence and precision.

#chartered accountants delhi#chartered accountant in india#income tax consultant in india#best chartered accountant firm#Best chartered accountant in india

0 notes

Text

Chartered Accountant for Tax Filing Service in India.

Looking for a chartered accountant for tax filing Service Provider? Our expert GST tax consultants offer top-notch services for income tax return filing and more. https://bit.ly/3zwPefd

#finance#accounting#investing#Chartered Accountant Consultancy#Chartered Accountant Firm in India#Chartered Accountant for Tax Filing#Income Tax File Return India#Tax Filing Service Provider in India

0 notes

Text

Tax Law Firms for NRI in India | Law Consultant for NRI in India Tax | Whizlegal

Looking for expert tax law firms for NRI in India? Whizlegal offers top-notch law Consultant for NRI in India Tax. Get professional legal advice and support from our experienced team of tax consultants. Secure your financial interests and navigate the complexities of Indian tax laws with ease. Trust Whizlegal for all your NRI tax law needs.

For More Information Chek Our Website:- www.whizlegal.com

#whizlegal#best legal firm for nri in india#tax law consultants for nri in india#divorce law consultants for nri in india#law consultant for nri in india

0 notes

Text

Exploring HCO & Co. - Your Premier Statutory Audit Company

In the labyrinth of financial regulations and compliance standards, navigating successfully requires not just expertise but also a steadfast commitment to excellence. Enter HCO & Co., a beacon of proficiency and reliability in the realm of statutory audit company.

Understanding Statutory Audit

Before delving into the prowess of HCO & Co., let's grasp the essence of statutory audit company. It's not just about meeting legal obligations; it's about ensuring transparency, accountability, and trust in financial reporting. A statutory audit is mandated by law and is conducted to validate the accuracy and fairness of a company's financial statements.

Meet HCO & Co.: The Pioneers of Statutory Audit

Established with a vision to redefine excellence in audit services, HCO & Co. has emerged as a trailblazer in the industry. With a team comprising seasoned professionals and domain experts, the company stands at the forefront of delivering meticulous statutory audit solutions.

Key Attributes That Set HCO & Co. Apart

Expertise: HCO & Co. boasts a team of auditors with profound expertise in diverse industries and regulatory frameworks. Their deep understanding of statutory requirements ensures thorough compliance and risk mitigation.

Precision: In the realm of statutory audit company, precision is paramount. HCO & Co. leaves no stone unturned in meticulously examining financial records, ensuring accuracy, and uncovering potential irregularities.

Client-Centric Approach: Every client is unique, and so are their audit needs. HCO & Co. takes a tailored approach, understanding the nuances of each client's business to deliver customized audit solutions.

Technology Integration: Keeping pace with the digital age, HCO & Co. leverages cutting-edge audit tools and technologies to enhance efficiency, accuracy, and transparency in the audit process.

Why Choose HCO & Co. for Your Statutory Audit Needs?

Reliability: Entrust your statutory audit requirements to HCO & Co. and experience the assurance of reliability and integrity in every audit engagement.

Compliance Assurance: With HCO & Co., rest assured that your organization remains fully compliant with statutory regulations, mitigating risks and enhancing stakeholder trust.

Insightful Reporting: Beyond mere compliance, HCO & Co. delivers insights gleaned from the audit process, empowering clients to make informed strategic decisions.

Client-Centric Approach:

What sets HCO & Co. apart is its unwavering commitment to client satisfaction. The firm believes in forging long-term partnerships built on trust, transparency, and mutual respect. From multinational corporations to emerging startups, each client receives personalized attention and bespoke solutions tailored to their unique needs. With a client-centric approach, HCO & Co. not only meets expectations but exceeds them, earning accolades and fostering enduring relationships.

Embracing Innovation for Future Readiness:

In an era of rapid digital transformation, staying ahead of the curve is imperative. HCO & Co. embraces innovation and invests in technology to enhance audit quality, efficiency, and relevance. From data analytics and artificial intelligence to blockchain and machine learning, the firm leverages the latest tools and techniques to deliver audits of the future. By embracing innovation, HCO & Co. ensures that clients are well-equipped to navigate the evolving landscape of finance and regulation.

Frequently Asked Questions

Qus. 1. What industries does HCO & Co. serve?

Ans. HCO & Co. caters to a diverse range of industries, including but not limited to finance, healthcare, manufacturing, and technology.

Qus. 2. How often should a statutory audit be conducted?

Ans. The frequency of statutory audits varies depending on regulatory requirements and organizational needs. However, most companies undergo annual audits to ensure ongoing compliance.

Qus. 3. How long does the audit process typically take?

Ans. The duration of the audit process depends on various factors, such as the size and complexity of the organization's operations. HCO & Co. strives to conduct audits efficiently without compromising thoroughness.

Qus. 4. What sets HCO & Co. apart from other audit firms?

Ans. HCO & Co. distinguishes itself through its commitment to excellence, client-centric approach, and utilization of advanced audit technologies.

Qus. 5. Can HCO & Co. assist with regulatory compliance beyond statutory audits?

Ans. Yes, in addition to statutory audits, HCO & Co. offers a range of compliance services to help organizations navigate complex regulatory landscapes.

Qus. 6. How can I schedule an audit consultation with HCO & Co.?

Ans. To schedule a consultation or learn more about our audit services, simply reach out to our team via our website or contact information provided.

Conclusion:

In the realm of statutory audit company, HCO & Co. stands as a beacon of excellence, guiding organizations towards financial integrity and success. With a steadfast commitment to professionalism, innovation, and client satisfaction, the firm continues to redefine the standards of audit excellence. As businesses strive to adapt to changing environments and navigate through uncertainties, HCO & Co. remains a trusted ally, empowering clients to thrive in a complex world.

Click here for more information: https://www.hcoca.com/statutory-audit-company-india.aspx

0 notes

Text

Law consultant for NRI in India | Whizlegal

Introduction:

Are you an Non-Resident Indian (NRI) seeking legal assistance in India? Whether it's property matters, estate planning, or any legal concerns, navigating the Indian legal landscape from abroad can be challenging. But fear not! Whizlegal is here to be your trusted ally in ensuring your legal affairs in India are handled with expertise and precision. In this comprehensive guide, we'll explore how Whizlegal serves as your dedicated law consultant for NRIs in India, providing tailored solutions to meet your unique needs.

Understanding the Need: As an NRI, you may face various legal complexities related to property management, inheritance, taxation, and more in India. These matters often require timely and informed decisions, which can be daunting when you're miles away. Whizlegal recognizes these challenges and offers Law consultant for NRI in india to bridge the gap between you and the Indian legal system.

Expertise at Your Fingertips: At Whizlegal, we boast a team of seasoned legal professionals with extensive experience in handling diverse issues concerning NRIs. Our experts possess in-depth knowledge of Indian laws and regulations, enabling them to offer law consultant for NRI in india, sound advice and effective solutions tailored to your specific circumstances.

Services Offered:

Property Consultation: Whether you're buying, selling, or managing property in India, our experts provide comprehensive guidance to ensure a smooth transaction process. From title verification to documentation assistance, we've got you covered.

Estate Planning: Planning your estate requires careful consideration of legal formalities and tax implications. Whizlegal offers personalized estate planning services to help you safeguard your assets and ensure your wishes are upheld.

Legal Representation: In case of legal disputes or litigation matters, our proficient lawyers represent your interests in Indian courts, striving for favorable outcomes while keeping you informed at every step.

Taxation Assistance: Understanding and complying with Indian tax laws can be complex. Our tax experts provide clarity on your tax obligations, helping you optimize your financial affairs while staying compliant with regulatory requirements.

Client-Centric Approach: At Whizlegal, client satisfaction is our top priority. We understand that each client's situation is unique, and we strive to deliver bespoke solutions that align with your objectives and preferences. Our proactive communication ensures you're always kept informed and empowered to make informed decisions.

Why Choose Whizlegal?

Expertise: Benefit from the knowledge and experience of seasoned legal professionals specialized in NRI matters.

Personalized Solutions: Receive customized legal solutions tailored to your specific needs and goals.

Transparency: We believe in transparent communication, providing clarity on processes, timelines, and costs from the outset.

Convenience: Access our services conveniently from anywhere in the world, with seamless communication channels and digital documentation facilities.

Conclusion:

Navigating the intricacies of Indian law as an NRI doesn't have to be overwhelming. With Whizlegal as your trusted law consultant, you can have peace of mind knowing that your legal affairs in India are in capable hands. Whether you're planning your estate, managing property, or facing legal challenges, we're here to support you every step of the way. Contact Whizlegal today to unlock expert legal guidance tailored to your needs.

For more information visit our website: www.whizlegal.com

#best legal firm for nri in india#best legal services#tax law consultants for nri in india#whizlegal

0 notes

Text

Best company Incorporation Consultants in India

Starting a business in India is an exciting yet challenging journey. One of the critical steps in this process is company incorporation, which involves navigating legal, regulatory, and compliance requirements. To make this process seamless, businesses often seek the assistance of expert consultants. Among the best company incorporation consultants in India, SC Bhagat & Co. stands out for its unmatched expertise and client-centric approach.

Why Company Incorporation is Crucial Incorporating your company is the first official step in establishing a legal business entity. It provides several benefits, including:

Legal Recognition: Establishes your business as a separate legal entity. Limited Liability: Protects personal assets of the business owners. Enhanced Credibility: Builds trust with customers, suppliers, and investors. Tax Benefits: Opens doors to specific tax advantages for incorporated entities. Ease of Raising Capital: Simplifies securing investments from banks and venture capitalists. However, the incorporation process can be complex due to the various regulations, documentation requirements, and procedural formalities involved. This is where SC Bhagat & Co. comes in to simplify the process.

About SC Bhagat & Co. SC Bhagat & Co. is a leading consultancy firm in India, renowned for its expertise in company incorporation services. With decades of experience, they have assisted startups, SMEs, and large enterprises in setting up their businesses efficiently and compliantly.

Their team of highly skilled professionals ensures that the entire process is smooth and stress-free, allowing entrepreneurs to focus on their business goals.

Services Offered by SC Bhagat & Co.

Company Incorporation Services SC Bhagat & Co. specializes in incorporating all types of entities, including:

Private Limited Companies Limited Liability Partnerships (LLPs) One Person Companies (OPCs) Public Limited Companies Section 8 Companies (Non-Profits)

Document Preparation and Filing They handle all necessary documentation, such as drafting Memorandum of Association (MoA) and Articles of Association (AoA), obtaining Director Identification Numbers (DIN), and registering for GST and PAN.

Regulatory Compliance SC Bhagat & Co. ensures your business complies with all regulatory frameworks, including the Companies Act, 2013.

Post-Incorporation Support Their services don’t end with incorporation. They offer continued support with statutory filings, annual returns, and compliance audits.

Custom Business Advisory The team provides personalized guidance to ensure your business structure aligns with your objectives and market demands.

Why Choose SC Bhagat & Co. for Company Incorporation?

Expertise and Experience SC Bhagat & Co. has years of experience in handling company incorporations across various industries. Their expertise ensures a hassle-free process for clients.

Tailored Solutions Every business is unique, and SC Bhagat & Co. takes a personalized approach to meet your specific requirements.

Time and Cost Efficiency Their streamlined processes save you time and money, allowing you to focus on growing your business.

100% Compliance They ensure your business adheres to all legal and regulatory norms, minimizing risks of non-compliance.

Customer-Centric Approach SC Bhagat & Co. is known for its responsive and supportive team, providing end-to-end guidance throughout the incorporation process.

The Process of Company Incorporation with SC Bhagat & Co. Initial Consultation: Understanding your business needs and goals. Business Structure Selection: Advising on the most suitable entity type. Document Preparation: Drafting and compiling all required documents. Registration and Filing: Submitting applications with the Ministry of Corporate Affairs (MCA). Certificate of Incorporation: Assisting in obtaining the official Certificate of Incorporation. Post-Incorporation Setup: Helping with bank account setup, GST registration, and other requirements. Contact SC Bhagat & Co. If you’re looking for the best company incorporation consultants in India, SC Bhagat & Co. is your trusted partner.

Conclusion Choosing the right consultant for your company incorporation is critical to ensuring a smooth and compliant process. With their vast experience, tailored solutions, and dedication to excellence, SC Bhagat & Co. has earned its reputation as one of the best in the industry. Set your business up for success by partnering with SC Bhagat & Co. today!

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

Company Setup in India by Masllp: Simplifying Business Formation

India is emerging as one of the world’s fastest-growing economies, making it a hotspot for entrepreneurs and businesses looking to expand. Setting up a company in India can be incredibly rewarding, but navigating the legal, regulatory, and procedural complexities can be daunting. This is where Masllp, a trusted name in business consultancy, comes into play.

Masllp specializes in company setup in India, offering end-to-end solutions that simplify the process, save time, and ensure compliance with all legal requirements.

Why Choose India for Your Business? Before diving into the details of setting up a company, let’s explore why India is an attractive destination for businesses:

Growing Economy: India’s economy is projected to grow rapidly, providing numerous opportunities for businesses in various sectors. Large Market: With a population of over 1.4 billion, India offers access to a vast consumer base. Favorable Policies: The Indian government has implemented pro-business policies, including tax incentives, ease of doing business reforms, and support for startups. Skilled Workforce: India boasts a highly skilled and cost-effective workforce, making it ideal for businesses in technology, manufacturing, and services. Masllp: Your Trusted Partner for Company Setup in India Masllp is a leading consultancy firm that assists businesses in establishing their presence in India. From startups to multinational corporations, Masllp offers tailored solutions to meet your specific needs.

Services Offered by Masllp Business Structure Advisory Masllp helps you choose the most suitable business structure, such as:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Branch Office, Liaison Office, or Subsidiary Company Registration Masllp handles the entire registration process, ensuring compliance with the Ministry of Corporate Affairs (MCA). Key services include:

Obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) Name approval and filing of incorporation documents Issuance of Certificate of Incorporation Legal and Regulatory Compliance Setting up a company in India requires adherence to various legal requirements. Masllp ensures your business complies with:

Companies Act, 2013 Taxation laws (GST, Income Tax) Labor and employment laws Taxation and Accounting Support Masllp provides ongoing support with:

GST registration and filing Income tax filings Accounting and bookkeeping services Banking and Licensing Assistance Masllp assists in opening corporate bank accounts and obtaining necessary licenses or approvals for your business operations.

Post-Incorporation Support From drafting agreements to HR policies, Masllp provides all the support you need to ensure smooth operations after incorporation.

Benefits of Partnering with Masllp Expert Guidance: Masllp’s team of experts ensures a hassle-free setup, handling every aspect with precision. Time-Saving: With Masllp, you can focus on your core business while they take care of the formalities. Cost-Effective Solutions: Their services are designed to deliver maximum value without unnecessary expenses. Compliance Assurance: Avoid legal hassles with Masllp’s thorough knowledge of Indian laws and regulations. Steps to Set Up a Company in India with Masllp Initial Consultation: Discuss your business goals and requirements with the Masllp team. Business Structure Selection: Choose the appropriate business entity based on your objectives. Document Preparation: Masllp collects and prepares all necessary documents for registration. Company Registration: The team handles the incorporation process with the Ministry of Corporate Affairs. Compliance Setup: Get your tax registrations, bank accounts, and licenses in place. Operational Support: Start your operations with confidence, supported by Masllp’s expertise. Why Masllp is the Best Choice for Company Setup in India With a proven track record of assisting businesses across various industries, Masllp has earned its reputation as a trusted partner for company setup in India. Their personalized approach, industry knowledge, and commitment to excellence make them the ideal choice for entrepreneurs and established firms alike.

Ready to Start Your Business in India?

Let Masllp make your company setup journey seamless and efficient. From registration to compliance, their expert team ensures every detail is handled with care.

Contact Masllp today to kickstart your business in India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

Balancing global commerce for equitable growth

In a world of increasing globalization, international trade has become a cornerstone of the global economy. With companies operating in multiple jurisdictions, there has been a growing concern regarding the fairness of the profits and taxes companies pay. This concern has given rise to transfer pricing, which seeks to ensure that related-party transactions are conducted at arm’s length prices to achieve a balance in global commerce for equitable growth. Read More: Balancing global commerce for equitable growth

#Domestic transfer pricing consultant#international taxation consultant#International transfer pricing consultant#tax consultancy firms#tax consultancy firms in India#tax firms in Delhi#top tax consultancy firms in india#TP study preparation consultant in Delhi#Transfer pricing consultant in Delhi

0 notes

Text

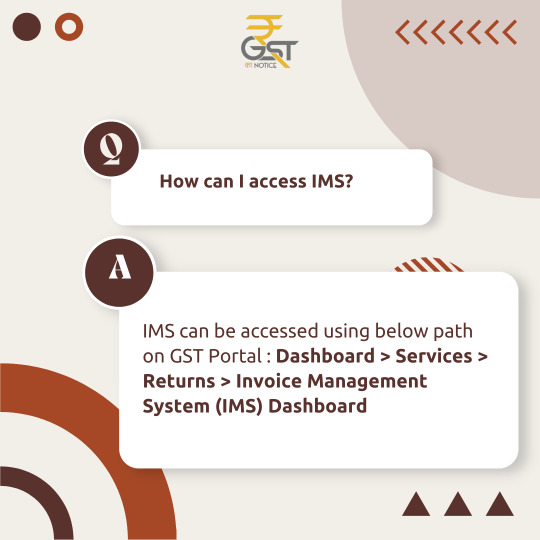

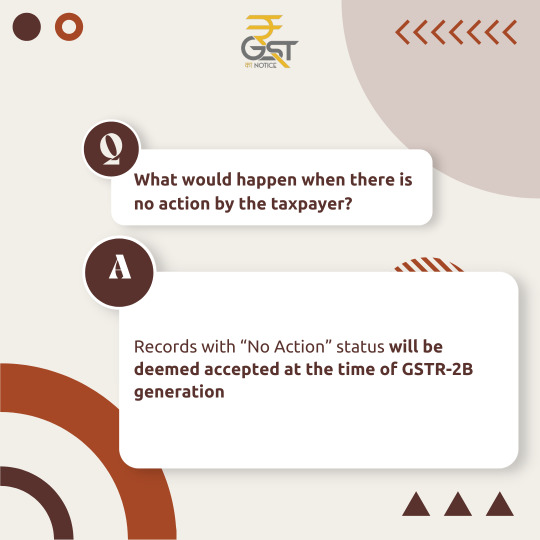

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

Chartered Accountants and Trusted Tax Advisors in India

G. K. Kedia & Co. is your go-to Chartered Accountant in India, renowned as the best tax advisor in India, providing expert tax audits and financial services for seamless compliance improvement.

#income tax consultant in india#auditor in india#chartered accountant in india#goods and services tax consultant in delhi#goods and services tax consultant in india#best chartered accountants in india#best tax consultants in india#auditorinindia#company formation in india#best chartered accountant firm

0 notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes

Text

Law consultant for NRI in India | Tax law consultants for NRI in India | Whizlegal

Navigating the legal landscape can be daunting for anyone, but for Non-Resident Indians (NRIs), the complexities multiply. The intersection of Indian and international laws, combined with evolving regulations, makes it imperative for NRIs to seek specialized legal advice. This is where Whizlegal steps in, offering unparalleled expertise as a law consultant for NRI in India. Whether it’s handling property disputes, inheritance issues, or tax obligations, Whizlegal stands as a beacon of trust and efficiency.

Why NRIs Need Specialized Legal Consultants

Complex Legal Framework

India’s legal framework can be intricate, especially when dealing with property laws, inheritance laws, and tax regulations that affect NRIs. Differences in legal practices and the added layer of international law can lead to confusion and potential legal missteps.

Property Management

Owning property in India while living abroad presents unique challenges. From property disputes and tenant issues to ensuring compliance with local property laws, having a reliable legal consultant ensures your interests are safeguarded.

Taxation Matters

NRIs face distinct tax obligations in India, including income tax, wealth tax, and property tax. Understanding the nuances of Double Taxation Avoidance Agreements (DTAA) and staying compliant with both Indian and foreign tax laws necessitates expert advice.

Whizlegal: Your Trusted Law Consultant for NRI in India

Comprehensive Legal Services

Whizlegal offers a full spectrum of Law consultant for NRI in India. Our team of seasoned lawyers is adept at handling:

Property Disputes: We provide robust legal support for resolving disputes related to property ownership, tenant issues, and illegal possession.

Inheritance Laws: Our experts guide you through the complexities of succession and inheritance laws, ensuring a smooth transfer of assets.

Family Laws: Handling matters of marriage, divorce, and child custody with sensitivity and legal precision.

Commercial Laws: Assisting NRIs with business formation, compliance, and contractual disputes in India.

Expertise in Tax Laws

Navigating tax laws is crucial for NRIs to avoid hefty penalties and ensure compliance. Whizlegal’s tax law consultants specialize in:

Tax Planning: Strategic advice to minimize tax liabilities while staying compliant with Indian laws.

Filing Tax Returns: Assistance with filing accurate and timely tax returns in India.

DTAA Guidance: Expertise in leveraging Double Taxation Avoidance Agreements to prevent being taxed twice on the same income.

Wealth Management: Advising on tax-efficient investment strategies and asset management.

Why Choose Whizlegal?

Experienced Professionals

Our team comprises highly qualified and experienced lawyers who understand the unique challenges faced by NRIs. We stay abreast of the latest legal developments to provide informed and effective advice.

Personalized Service

We offer personalized legal solutions tailored to your specific needs. Our consultants take the time to understand your situation and craft strategies that align with your objectives.

Transparent Process

At Whizlegal, transparency is key. We ensure you are kept informed at every step of the legal process, with clear communication and detailed explanations of our actions and recommendations.

Client-Centric Approach

Our clients are our top priority. We are committed to providing responsive and reliable legal services, ensuring your concerns are addressed promptly and effectively.

Conclusion

As an NRI, navigating the legal and Law consultant for NRI in India requires specialized knowledge and expertise. Whizlegal is your trusted partner, offering comprehensive legal and tax consulting services to safeguard your interests and ensure compliance. Whether you need assistance with property disputes, inheritance issues, or tax planning, our team of experienced professionals is here to help.

For expert legal consultation, contact Whizlegal today and let us help you navigate the complexities of Indian law with confidence.

#whizlegal#best legal firm for nri in india#tax law consultants for nri in india#law consultant for nri in india

0 notes

Text

HCO & Co. is Trusted Name in Accounting Company in India

The Rise of Accounting Firms in India:

Over the years, India has witnessed a surge in the number of accounting firms, reflecting the growing importance of financial management and compliance. As businesses expand and regulations become more stringent, the demand for reliable and efficient accounting services has soared. HCO & Co. stands out among the myriad of accounting firms, establishing itself as a trusted partner for businesses seeking comprehensive financial solutions.

HCO & Co.: A Glimpse into Excellence:

HCO & Co. is a leading accounting company in India, renowned for its commitment to delivering high-quality services tailored to the unique needs of its clients. Let’s explore some key aspects that set HCO & Co. apart in the realm of accounting:

Expertise and Experience: HCO & Co. boasts a team of seasoned professionals with extensive expertise in accounting, taxation, and financial advisory services. The firm’s rich experience spans across various industries, enabling them to provide insightful solutions to their diverse clientele.

Comprehensive Services: From bookkeeping and auditing to tax planning and compliance, HCO & Co. offers a comprehensive suite of services. This holistic approach ensures that clients receive end-to-end financial support, allowing them to focus on their core business activities.

Technology Integration: Keeping pace with the digital era, HCO & Co. leverages cutting-edge accounting technologies to enhance efficiency and accuracy. The firm embraces automation and cloud-based solutions to streamline processes, providing clients with real-time financial insights.

Client-Centric Approach: HCO & Co. places a strong emphasis on building lasting relationships with its clients. The firm adopts a client-centric approach, understanding the unique challenges each business faces and tailoring solutions that align with their goals.

Ethical Standards: Upholding the highest ethical standards, HCO & Co. ensures transparency and integrity in all its dealings. This commitment to ethical practices has earned the firm the trust and respect of its clients and the industry at large.

FAQs about HCO & Co.

Qus. What sets HCO & Co. apart from other accounting firms?

Ans. HCO & Co. distinguishes itself through a combination of expertise, personalized service, and a commitment to client success. With a rich history and a team of seasoned professionals, HCO & Co. stands as a reliable partner for all accounting needs.

Qus. How can I engage HCO & Co.’s services?

Ans. Engaging with HCO & Co. is a seamless process. Simply reach out to their team via their website or contact details, and they will guide you through the necessary steps to tailor their services to your requirements.

Qus. Are HCO & Co.’s services limited to specific industries?

Ans. No, HCO & Co. caters to a diverse range of industries. Their expertise spans across sectors, ensuring that businesses from various fields can benefit from their tailored accounting and advisory solutions.

Qus. What kind of support does HCO & Co. offer for startups?

Ans. HCO & Co. understands the unique challenges faced by startups and offers specialized support, including financial planning, tax assistance, and strategic guidance, setting the foundation for sustainable growth.

Qus. Is HCO & Co. only based in India?

Ans. While HCO & Co. is headquartered in India, they have a global reach, serving clients worldwide. Their international presence showcases their adaptability and ability to navigate the complexities of the global business landscape.

Qus. Can HCO & Co. assist with tax compliance?

Ans. Absolutely. HCO & Co. excels in providing comprehensive tax compliance services, ensuring that businesses adhere to regulations while optimizing their tax positions.

Conclusion:

In the vast landscape of accounting company in India, HCO & Co. shines as a beacon of excellence. Through its unwavering commitment to quality, expertise, and client satisfaction, the firm has established itself as a reliable partner for businesses navigating the complex financial terrain. As India’s economy continues to evolve, HCO & Co. stands ready to play a crucial role in shaping the financial success of businesses across the nation.

0 notes

Text

Adani conglomerate plans independent audit of group companies

One of the biggest conglomerates in India, Adani Group, has declared plans to audit its group companies independently. Concerns about the group's corporate governance policies have been voiced by a variety of stakeholders, including investors and environmental organizations.

All Adani Group entities, including Adani Ports and Special Economic Zone, Adani Power, Adani Enterprises, and Adani Transmission, will be subject to the audit, which will be carried out by an outside consulting firm. The audit will pay particular attention to a number of things, including financial reporting, risk management, and sustainability practices.

The organization has been charged with environmental infractions, tax evasion, and shady business practices recently. Investors and environmental organizations have expressed worry about the group's corporate governance processes in response to these allegations.

The Adani Group wants to allay these worries and show that it is committed to openness and good corporate governance by undertaking an independent audit. The audit is anticipated to shed more light on the group's financial and operational performance and assist in regaining investor faith in the group's operations.

Overall, the decision to conduct an independent audit is a step in the right direction towards enhancing corporate governance procedures in India and encouraging larger companies to be more transparent and accountable.

4 notes

·

View notes