#Best GST Lawyers in India

Explore tagged Tumblr posts

Text

Navigate GST notices with ease. GST Ka Notice offers expert services for responding to all types of GST notices. Get professional help today!

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

2 notes

·

View notes

Text

How GSTMEN Associates Helps Businesses with Expert GST Planning

In today’s economic world, corporations’ tax issues are manifold due to the delicate structure of the GST regime. Startups, SMEs, and large businesses alike must remain compliant and work for effective tax minimization at the same time. This is where GSTMEN Associates, the best GST advisory firm in India, comes with the best help needed.

Why GST Planning is Essential

GST planning is not all about conformance; GST planning is all about how to minimize tax outgoes, how to improve cash balances, and how to increase the efficiency of the business. Due to the continuously changing tax laws, firms require the legal services of accomplished GST consultants in India to dodge fines, handle input tax credit, and optimize processes.

How GSTMEN Associates Simplifies GST for Businesses

1. Comprehensive GST Advisory in India

Having GSTMEN Associates, you will get one-stop, end-to-end GST solutions for your business. Our weekly Tax Facts help you from understanding your tax structure to identifying potential savings to help you stay ahead of the competition.

2.Expert GST Advocacy

The team of GST advocates in India possesses rich experience in representation in audits, appeals, & litigations of the organization. Moreover, more than three decades of our lawyers’ experience guarantee timely and efficient solutions of intricate tax cases.

3.Custom-Tailored GST Solutions in India

All businesses have different informal relationships, and thus they have different taxes too. At GSTMEN Associates we develop the right solutions according to your business needs while making the compliance process as smooth as possible.

4.Reliable GST Services in India

Our GST services are GST registration, GST reconciliation, and support for GST audits. When you outsource your GST requirements to us, you can expect all the emotional work to be done in the background while you concentrate on the expansion of your business.

5.Proactive GST Firm in India

We are one of the best GST firms for businesses and provide more than just solutions to help them follow the new regulation. From our end, our team keeps track of legislative changes and assists you in the change process to avoid possible risks.

Why Choose GSTMEN Associates?

Experienced Team: Being in the market for several decades, successful experiments have been conducted with a variety of companies of various forms of incorporation across various industries.

Client-Centric Approach: Our solutions are defined by your business objectives and needs.

Timely Support: Deadlines are non-negotiable. We also make sure all GST filings and compliances are done in their respective time horizons.

Proven Track Record: Relied on by organizations for efficient and ROI-paced GST services.

Let’s Plan Your GST Strategy Today!

It has become mandatory for organizations to plan GST; it is no more a luxury but a compulsion for players in India to remain relevant and meet regulatory requirements. Choose GSTMEN Associates, the premier GST advisory company in India, to work on GST optimization to the maximum extent.

Contact Us

0 notes

Text

Licit360: Reliable & Affordable Legal Services in Indore & Bhopal

In today's fast-paced world, having access to reliable and professional legal services is crucial for individuals and businesses alike. Licit360 is one of the top law firms in Indore, providing comprehensive legal solutions tailored to meet the diverse needs of our clients. Whether you need assistance with corporate legal services, partnership deed registration, private limited company registration, trademark registration, or GST compliance, our expert team in Indore ensures seamless legal support.

Why Choose Licit360?

• Expert Legal Guidance – Our team includes some of the best lawyers in Indore and Bhopal, specializing in different areas of law.

• Comprehensive Legal Solutions – From criminal lawyers in Indore to corporate lawyers in Indore, we cover all legal aspects.

• Online Legal Consultation – Get expert legal advice from the comfort of your home.

• Efficient Legal Drafting – Our legal drafting services in Indore ensure precise documentation for all legal processes.

• Seamless Registration Services – Hassle-free registration for companies, partnerships, and LLPs.

Our Legal Services

1. Business & Corporate Legal Services

Private Limited Company Registration

Setting up a private limited company in Indore is a crucial step for any entrepreneur. Our services include:

• Company registration in India

• GST registration for private limited companies

• MSME registration for private limited companies

• Annual compliance for private limited companies

• PF and ESIC registration for private limited companies

LLP Registration

A Limited Liability Partnership (LLP) is an ideal business structure for many entrepreneurs. We offer:

• LLP registration in Indore

• GST registration for LLPs

• Annual compliance for LLPs

Section 8 Company Registration

For NGOs and non-profits, section 8 company registration in Indore is essential. Our services cover:

• Online registration of Section 8 companies

• GST registration for Section 8 companies

• Legal compliance for Section 8 companies

2. Legal Drafting and Documentation

Legal drafting is one of the most critical aspects of any business. The legal drafting services in Indore include:

• Online and offline partnership deed registration

• LLP partnership deed

• Registration of firms in India

• Deed for dissolution of partnership

• Address amendment in GST registration

• Appointment of directors in private companies

• Adding a partner to an LLP or company

3. Trademark & Intellectual Property Services

Your brand is one of the most crucial things you own in today's competitive market. We help you with:

• Trademark registration in India

• Logo and brand name registration

• Trademark filing and legal consultation

4. Import-Export Licensing & Compliance

For businesses involved in international trade, we provide:

• Import Export License (IEC Registration)

• Icegate registration and AD Code registration

5. MSME & Tax Compliance Services

Our taxation experts handle:

• MSME registration in India

• Professional tax registration in Indore

• GST registration and compliance

Why Businesses and Individuals Trust Licit360?

• Experienced legal professionals with expertise in various legal domains.

• End-to-end legal solutions, from company registration to litigation support.

• Trusted by businesses in Indore, Bhopal, and across India.

• Seamless online legal consultation for clients across locations.

#top law firms in Indore#top legal consultant in Indore#online legal consultation#best legal services in Indore#best legal advisor in Indore

0 notes

Text

Best Taxation Lawyers in India | Direct & Indirect Taxes Lawyers in India

Taxation laws in India are complex, dynamic, and essential for individuals, businesses, and corporations alike. Navigating these laws effectively requires the expertise of skilled taxation lawyers who specialize in both direct and indirect taxes. Whether it's understanding intricate tax provisions, ensuring compliance, or resolving disputes, the best taxation lawyers in India can provide comprehensive legal solutions tailored to your needs.

Understanding Direct and Indirect Taxes in India

Taxation in India is broadly categorized into direct taxes and indirect taxes:

Direct Taxes: These are taxes levied directly on an individual's or entity's income or wealth. Examples include income tax, corporate tax, and wealth tax. Direct taxes are progressive in nature, meaning higher income attracts higher tax rates.

Indirect Taxes: These are taxes levied on goods and services and are ultimately borne by the end consumer. Examples include GST (Goods and Services Tax), customs duty, and excise duty. Indirect taxes are regressive, as they are applied uniformly, regardless of the consumer's financial status.

Why Hire a Taxation Lawyer in India?

Taxation lawyers play a pivotal role in ensuring that individuals and businesses comply with tax regulations while minimizing liabilities. Here are some key reasons to hire a taxation lawyer:

Expert Guidance: Taxation laws are intricate and frequently amended. A seasoned lawyer keeps up with the latest changes, ensuring you remain compliant.

Tax Planning: Effective tax planning can reduce your tax burden legally. Taxation lawyers devise strategies to maximize benefits and minimize liabilities.

Dispute Resolution: If you face tax-related disputes, whether with the Income Tax Department or GST authorities, a lawyer can represent you effectively.

Compliance: Filing returns, adhering to deadlines, and maintaining accurate documentation are essential for avoiding penalties. Tax lawyers help streamline these processes.

Services Offered by Taxation Lawyer in India

The best taxation lawyers in India offer a wide range of services, including:

Assistance with filing income tax returns and GST returns

Legal advice on tax-saving investments

Representation in tax tribunals and courts

Handling tax audits and assessments

Resolving disputes with tax authorities

Guidance on international taxation and transfer pricing

Key Qualities of the Best Taxation Lawyer in India

When choosing a taxation lawyer, look for the following qualities:

Expertise in Tax Law: The lawyer should have a deep understanding of both direct and indirect tax laws.

Experience: Years of practice handling complex tax cases is a significant advantage.

Strong Analytical Skills: Tax cases often require interpreting intricate laws and financial data.

Proactive Approach: A good lawyer anticipates potential issues and provides solutions before problems arise.

Why VMathur Associates?

VMathur Associates is one of the leading law firms in India, known for its exceptional expertise in taxation law. With a team of highly skilled lawyers, we specialize in providing personalized legal solutions for all your taxation needs. Our services include:

Advising on income tax and GST compliance

Handling disputes and litigation in tax tribunals

Structuring tax-efficient business models

Assisting with international taxation and double taxation treaties

0 notes

Text

Leading Tax Law Firms in Delhi: Trusted Legal Advisors

Introduction to Leading Tax Law Firms in Delhi

Delhi, being the capital city of India, is home to a number of reputed tax law firms in delhi. These firms provide expert legal services to individuals, businesses, and organizations dealing with tax-related matters. Leading tax law firms in Delhi specialize in helping clients navigate the complexities of tax laws, ensure compliance with local regulations, and resolve disputes with tax authorities efficiently. Whether it’s corporate taxation or individual tax issues, the expertise of top firms can make a significant difference.

What Makes a Tax Law Firm Stand Out in Delhi?

To be recognized as a leading tax law firm in delhi, a firm must offer more than just legal representation. The top firms distinguish themselves through:

Expertise and Experience: A leading tax law firm has a team of lawyers who specialize in tax laws, with years of experience in dealing with complex issues such as tax planning, tax litigation, and regulatory compliance.

Track Record of Success: Leading firms have a proven history of successfully representing clients in high-profile tax cases, resolving disputes efficiently, and minimizing clients’ tax liabilities.

Comprehensive Services: A top tax law firm in delhi offers a broad range of services, from legal advice on tax planning to helping with corporate tax matters and resolving disputes.

Client-Centric Approach: The best firms always prioritize their clients’ needs, ensuring personalized and effective legal solutions.

Services Offered by Leading Tax Law Firms in Delhi

Leading tax law firms in delhi offer a variety of services to both individuals and businesses, ensuring they can address all their tax-related issues effectively. These services include:

Tax Dispute Resolution: Top firms provide legal representation in case of audits, disputes with tax authorities, and legal challenges to tax assessments.

Corporate Tax Services: Firms assist businesses in navigating complex corporate tax laws, including mergers, acquisitions, and compliance with tax regulations.

Tax Planning and Strategy: Expert lawyers help clients develop strategies to minimize tax liabilities, optimize tax benefits, and ensure legal compliance.

Indirect Taxes (GST, etc.): Leading tax law firms advise clients on indirect taxes, including Goods and Services Tax (GST), customs duties, and other indirect taxes.

International Taxation: They offer guidance on cross-border taxation issues, ensuring compliance with international tax laws for businesses operating globally.

By offering these comprehensive services, top tax law firms play a crucial role in managing and resolving tax matters for clients.

Why Aayati Legal is One of the Leading Tax Law Firms in Delhi

Aayati Legal is recognized as one of the leading tax law firms in delhi due to its exceptional service and client-first approach. The firm’s team of experienced tax lawyers brings a wealth of knowledge and expertise in all areas of tax law, from dispute resolution to tax planning. Aayati Legal is known for its tailored solutions and transparent legal advice, ensuring that clients receive the best possible outcomes. Whether it’s corporate taxation, individual tax planning, or resolving tax disputes, Aayati Legal has established itself as a trusted partner for legal matters.

How to Choose the Best Tax Law Firm in Delhi

When choosing a tax law firm in delhi, consider the following:

Experience and Specialization: Opt for firms that specialize in tax law with a strong track record of handling complex tax issues.

Reputation and Reviews: Look for firms with positive reviews and a solid reputation for delivering results in tax cases.

Range of Services: Choose a firm that offers a comprehensive suite of tax-related services, from tax planning to dispute resolution.

Personalized Solutions: Ensure the firm provides personalized legal services based on your unique needs.

By carefully evaluating these factors, you can find the right tax law firm in delhi to meet your legal needs.

#TaxLawFirm#TaxLawFirmInDelhi#LeadingTaxLawFirms#TaxPlanning#AayatiLegal#CorporateTaxation#TaxDisputes#GST#LegalExperts

1 note

·

View note

Text

How to Choose the Right Tax Lawyer for Your Business in India

Running a business in India is not only a process of making expert decisions but also involves legal and tax-related complexities. If you are looking for a tax lawyer to handle all this, it is essential that he is qualified and experienced. In this blog, we will guide you to choose the right Tax Lawyer in India, so that you can fulfill your business needs.

1. Check Their Experience

Using a tax lawyer who has extensive experience in modern tax laws and regulations makes your job easier. It is important to see that they have a prior understanding of the types of issues that are relevant to your industry.

2. Check Graduation for Legal Services

A specialized law degree is required to become a tax lawyer in India. Check the details about their license and their performance before deciding. The right educational background of the lawyer helps them handle your work in the best possible way.

3. Need to be an expert in a specific field

Tax laws are of different types, such as GST, income tax or international taxation. Choose a lawyer who specializes in the field in which your business is most proven.

4. Check the legal capacity and network

A tax lawyer needs to have a strong network with financial experts, chartered accountants and other lawyers. This network helps them to handle every latest tax issue quickly and effectively.

5. Check their credibility and track record

Before choosing a tax lawyer, study the feedback and success rate of their clients. You can learn more about their service by contacting previous clients.

6. Check the ability to provide regular updates

Tax laws in India change frequently. A tax lawyer should have the capacity to inform you about the latest legal changes and give advice tailored to your business.

7. Tax Dispute Skills Required

When tax disputes arise, a good tax lawyer helps you make the right decisions at the right time. They should have the skills to handle legal disputes or complaints.

8. Communication Skills Are Important

Your communication with your lawyer should be easy and clear. The main job of a lawyer is to explain your case easily and perform as required.

9. Understand the cost

Understand the lawyer's fees and the cost of their services before proceeding. It is also important to have financial integrity while choosing the right tax lawyer.

10. Trustworthy and Customized Service

A tax lawyer will be dealing with confidential information of your business, so it is important to be trustworthy. The service provided by them should be customized and tailored to your specific needs.

Find the best tax lawyer for you today!

It is now easy to stay away from legal problems while running a business in India. Our experts at Crypto Legal offer cutting-edge solutions for your every need. From compliance to contracts, we are with you! Contact us now!

Disclaimer: The content on this blog is for informational purposes only and does not constitute legal advice. For advice specific to your situation, consult a qualified legal professional.

0 notes

Text

Key Factors to Consider When Choosing the Best Tax Law Firms in India

Navigating the complex world of tax law in India can be challenging for both individuals and businesses. Whether you're dealing with tax planning, compliance, or disputes, having the right legal support is crucial. Choosing the best tax law firm in India can make all the difference in ensuring your tax matters are handled efficiently and effectively. But, with so many businesses to select from, how do you know which one is best for you? Here are some important elements to consider while making a decision.

1. Expertise in Tax Law

The first and most important factor to consider is the firm's expertise in tax law. Tax law is a specialized field that requires deep knowledge of the legal and regulatory framework governing taxation in India. Look for a firm with a proven track record in handling various aspects of tax law, including income tax, corporate tax, GST, and international taxation. A firm with experienced tax lawyers who stay updated on the latest changes in tax laws and regulations will be better equipped to provide accurate and reliable advice.

2. Reputation and Track Record

A law firm’s reputation can give you a good indication of its reliability and effectiveness. Research the firm’s history, read client testimonials, and look for reviews online. The best tax law firms in India will have a solid reputation built on years of successful case outcomes and satisfied clients. You may also want to check if the firm has received any awards or recognition in the field of tax law, which can be a sign of excellence.

3. Range of Services

Tax law involves a wide variety of services, including tax planning, compliance, and representation in tax disputes. It's important to choose a firm that offers comprehensive services to meet all your tax-related needs. Whether you need assistance with filing returns, structuring transactions to minimise tax liability, or resolving disputes with tax authorities, the firm should be able to handle it all. A full-service tax law firm can save you time and provide continuity in managing your tax matters.

4. Industry-Specific Knowledge

Different industries have unique tax challenges, so it's beneficial to choose a law firm with experience in your specific sector. Whether you're in real estate, manufacturing, finance, or any other industry, a firm that understands the particular tax issues faced by businesses like yours will be better positioned to offer tailored advice. Industry-specific knowledge can also help in identifying potential tax-saving opportunities and avoiding common pitfalls.

5. Personalized Attention

When dealing with complex tax issues, personalized attention from your legal team can make a significant difference. Choose a firm that takes the time to understand your specific situation and offers customized solutions rather than a one-size-fits-all approach. The best tax law firms in India are those that build strong client relationships, providing clear communication and regular updates on the progress of your case.

6. Cost-Effectiveness

Legal services can be expensive, so it's important to consider the cost when choosing a tax law firm. However, the cheapest option is not always the best. Look for a firm that offers transparent pricing and delivers value for money. Consider the firm's charging structure whether they charge a flat cost, an hourly rate, or a contingency fee and select the option that best suits your budget and needs. Remember, investing in a top-tier tax law firm can save you money in the long run by avoiding costly mistakes and ensuring compliance with tax laws.

7. Availability and Responsiveness

Tax issues often require timely action, so it's essential to choose a firm that is available and responsive. Consider how quickly the firm responds to your inquiries and whether they can meet your deadlines. A firm with a dedicated team that is accessible when you need them can provide peace of mind and ensure that your tax matters are handled promptly.

Conclusion

Choosing the best tax law firm in India is a critical decision that can impact your financial health and legal standing. By considering factors such as expertise, reputation, range of services, industry-specific knowledge, personalized attention, cost-effectiveness, and responsiveness, you can find a firm that meets your needs and helps you navigate the complexities of tax law with confidence. Take your time to research and consult with potential firms to ensure you make the best choice for your tax-related legal matters.

0 notes

Text

Legal Requirements and Compliance for OPCs

Starting a One Person Company (OPC) in India can be a smart move for solo entrepreneurs looking to combine the advantages of a corporate structure with the simplicity of sole proprietorship. However, it's crucial to understand the legal requirements and compliance obligations that come with forming and operating an OPC. This guide will cover the essential aspects to ensure you are well-informed and compliant.

Understanding OPC: An Overview

A One Person Company (OPC) is a unique type of business entity introduced under the Companies Act, 2013. It allows a single individual to incorporate a company with limited liability and enjoy the benefits of a corporate structure without the complexities associated with managing multiple shareholders.

Legal Requirements for Forming an OPC

1. Eligibility Criteria

To form an OPC, the individual must meet the following criteria:

Must be an Indian citizen and resident.

Cannot incorporate more than one OPC or be a nominee in more than one OPC.

2. Director and Nominee

Single Director: An OPC must have at least one director. The same person can be both the sole member and the director.

Nominee Director: The member must appoint a nominee who will take over the company's management in case of the member’s death or incapacitation. The nominee must consent in writing.

3. Documentation

The following documents are required for OPC registration:

PAN Card of the member and nominee

Aadhaar Card or Voter ID for proof of identity

Latest utility bill or bank statement for proof of residence

Passport-size photographs

Director Identification Number (DIN) and Digital Signature Certificate (DSC) for the member

Example: Entrepreneurs aiming for One Person Company Registration in Delhi should ensure all documentation is in order and can seek professional assistance to streamline the process.

Compliance Requirements for OPCs

1. Annual Compliance

Annual Return: An OPC must file its annual return with the Registrar of Companies (RoC) within 60 days from the end of the financial year.

Financial Statements: The financial statements must be signed by the director and submitted to the RoC.

2. Board Meetings

An OPC must conduct at least one board meeting every six months, and the gap between two meetings should not be less than 90 days.

3. Income Tax Compliance

An OPC is required to file its income tax returns annually. Tax audits are mandatory if the turnover exceeds the specified threshold.

4. Other Compliance

GST Registration: If the OPC’s turnover exceeds the threshold limit for GST registration.

Professional Tax: If applicable in the state where the OPC operates.

Employee Provident Fund (EPF) and ESI: If the OPC employs more than the specified number of employees.

Example: For One Person Company registration in Noida, it's essential to adhere to both central and state-specific compliance requirements to avoid penalties.

Benefits of Consulting a Lawyer for OPC Formation

Given the complexities involved in forming and maintaining compliance for an OPC, it is advisable to consult a lawyer for the formation of OPC. A legal expert can provide guidance on:

Drafting and filing the necessary documents

Ensuring compliance with all legal and regulatory requirements

Advising on the best practices for corporate governance

Example: Lawyers for One Person Company (OPC) in Delhi can offer specialized services to help you navigate the legal landscape efficiently.

Conclusion

Forming an OPC offers numerous advantages, including limited liability, perpetual succession, and ease of management. However, understanding and adhering to the legal requirements and compliance obligations is crucial for the smooth operation of your business.

Consult LawChef for Expert Guidance

At LawChef, our experienced team of lawyers for One Person Company (OPC) is dedicated to assisting you with every aspect of forming and maintaining your OPC. Whether you need help with One Person Company Registration in Delhi or Noida, our legal experts are here to ensure that you meet all compliance requirements and operate your business seamlessly. Contact us today for professional and reliable legal consultation services tailored to your needs.

0 notes

Text

Why Company Registration is Essential for Small Businesses: Benefits Unveiled

The Registration Process for Small Businesses

Small businesses in India can be either a one-person company, a limited liability partnership, a private limited company, or a Public limited company. The registration process includes many steps, like choosing the type of business entity, obtaining a digital signature certificate, obtaining a director identification number, registering on the MCA portal, Registering for GST, and obtaining a certificate of incorporation.

The Following are the key Benefits of Registration for Small businesses

Legal Recognition and Protection — Upon registration, a small business receives significant legal recognition and protection. The business requires all of these for growth, sustainability, and operation. Once a small business registers its company, it becomes a separate legal entity distinct from its owners and shareholders. This means that under its own name, the company has the authority to own property, incur debts, and initiate and defend legal actions.

The Ministry of Corporate Affairs provides a unique corporate identity number to identify a registered company, and this increases the company’s credibility in terms of customers, suppliers, and investors. Company registration prevents other businesses from using the same or a similar name, protecting the brand’s identity and reputation in the market. This helps with brand protection. Registered companies can more easily apply for trademarks, patents, and copyrights, protecting their intellectual property from infringement and unauthorized use.

Access to Funding and Loans

Registering a small business opens up ways to obtain funding and loans, which are important for its growth and business expansion. Financial institutions consider registered businesses as more credible, which makes it easier to qualify for loans and credit facilities. Registered businesses can apply for various types of business loans, including term loans, working capital loans, equipment financing, and lines of credit. Small businesses can use these funds for a variety of purposes. To facilitate international trade transactions, registered businesses can avail themselves of trade finance facilities such as letters of credit, bank guarantees, and export-import financing.

Continuity and Perpetual Succession

Continuity and perpetual succession are important benefits that small businesses gain upon registration, especially when they opt for certain legal structures like private limited companies or limited liability partnerships. Continuity and perpetual succession are valuable benefits for registered small businesses. These benefits ensure stability, longevity, and trustworthiness, enabling the business to thrive over the long term and providing peace of mind to owners, stakeholders, and investors.

Tax Benefits

Registering as a small company can bring various tax benefits and incentives, including lower corporate tax rates, deductions for business expenses, relief from capital gains tax, tax credits for investments and employment, and opportunities for tax deferral and loss offset. These tax benefits can significantly reduce the tax burden on small companies, improve cash flow, and stimulate investment and growth, ultimately contributing to their success and sustainability.

Global Jurix today is one of the Best law firms in India that is playing an important role in providing solutions to domestic and international clients and legally preparing them for their representation in the global marketplace. Our firm is also known for its critical legal solution and advice. We have acquired a desirable recognition for our sophisticated legal works in India. The highly experienced lawyers, attorneys, solicitors, patient agents, etc. of our firm are well-equipped to cater to the needs of global business requirements and the environment.

Original Post content Here: Why Company Registration is Essential for Small Businesses

0 notes

Text

How to Start a Microbrewery Business in India: Your Guide to Craft Beer Glory

The craft beer industry in India is experiencing rapid growth, with emerging brewers stepping into the spotlight. If you’re enthusiastic about brewing and have an entrepreneurial mindset, launching a microbrewery might be the realization of your dreams. However, before raising a toast to success, it’s essential to lay the groundwork. Here’s your guide to navigating the dynamic yet complex realm of microbrewery business in India.

1. Planning and Research: Craft Your Vision

Market Analysis: Understanding your target audience is crucial. Research popular beer styles, identify any gaps in the market, and determine a competitive price range.

Business Plan: Outline your brewery’s concept, financial projections, marketing strategy, and legal structure (sole proprietorship, partnership, etc.).

Location: Scout for a suitable space with good access to utilities, proper zoning for breweries, and potential for foot traffic (if you plan an on-site bar).

2. Licensing and Compliance: Navigate the Regulatory Maze

Obtaining the necessary licenses is a crucial step. The specific requirements can vary by state, so consulting a lawyer specializing in liquor laws is recommended. Generally, expect to acquire:

Excise License: Issued by the state excise department, this permits brewing and selling beer.

Restaurant Liquor License (if applicable): Allows on-site consumption of your brews.

Other Permits: These may include a GST number, a wastewater disposal certificate, and a commercial electricity line.

3. Gear Up Brewing the Perfect Batch

Investing in high-quality brewing equipment is essential. You’ll need a brewhouse system (including tanks for mashing, lautering, boiling, and fermentation), kegs, bottling equipment (if applicable), and a quality control lab for testing your beer. Partner with reputable brewing equipment suppliers in India for the best options.

4. Brew a Winning Recipe: Hire the Right Talent

A skilled head brewer is the heart of your operation. Look for someone with experience in brewing a variety of styles and a passion for experimentation. Additionally, consider hiring staff for operations, marketing, and sales, depending on your needs.

5. Let the World Know Your Beer!

Craft a strong brand identity that reflects your brewery’s personality and target market. Utilize social media platforms and local events to spread the word about your unique brews. Partner with restaurants and pubs to distribute your beer and establish a strong presence in the market.

Opening a microbrewery in India requires dedication, planning, and a love for exceptional beer. Prodebbrewery, a trusted partner for aspiring brewers, offers top-notch brewing equipment and expert consultation to help you navigate this exciting journey. Get in touch with Prodebbrewery today and turn your dream of a microbrewery into a hoppy reality!

0 notes

Text

company registration

Overview

Legalwindow.in is a company that gives you holistic services regarding every field that requires a chartered accountant, chartered secretary, and lawyers. there are many jurisdictions

that they cover such as company registration, NGO registration, and many more. LegalWindow.in is a platform that provides you with a professional technology-driven performance by multiple experts in their respective fields such as CA/CS/Lawyers to provide a concrete solution to individuals, start-ups, and other business organizations by maximizing their growth at an affordable cost.

Our team offers expertise emulsion in various fields, including Corporate Laws, Direct Taxations, GST Matters, IP Registrations, and other Legal Affairs. Our committed team provides personalized solutions to entrepreneurs in guiding them to the best possible business structure considering their individual requirements and their fiscal situations.

Company services

The company is dedicated to providing multiple services from company registration to legal drafting and many more. Company registration is when a company needs registration to commence a business which requires several legal documents and a ton load of work and can be handled by professionals which is provided by legalwindow.in.

Where do you need us?

Company registration:- For starting a business in India Private Limited Company is the most popular and effective medium for higher growth aspirants. It is incorporated under the Companies Act, 2013, and has various benefits as it ensures limited liability and a separate legal entity which means safeguarding personal property. This type of entity is mainly preferred by start-ups and growing entities.

GST registration:-Goods and Services Tax is an indirect tax imposed by the government on Indian Goods and Services It is a value-added tax levied on most goods and services sold for domestic and commercial consumption. The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services. The taxes under GST are bifurcated into three parts i.e. CGST, SGST, and IGST.

Income tax return filing for Individuals:- An individual earning an income above the minimum exempted amount is liable to pay income tax. The income can be earned from any source like salary, rental income, interest income from savings, income from mutual funds, agriculture income, sale of property or business, or professional income.

Income Tax Return is a form required to be filed with the Income Tax Department. The format and applicability of these forms are defined by the Income Tax Department. All forms have separate disclosure requirements according to the Incomes Reported As per The Income Tax Act 1961, eligible individuals need to file their income tax returns once a year. Filing of Income Tax Returns legitimates your earnings and investments whereas in the case of non-filing of Income Tax Returns if the income is required to be disclosed becomes BLACK MONEY. If you file your Income Tax Return on time you can get an income tax refund as well, if you have paid excessive taxes to the government.

There are many more services that we provide do visit:- https://www.legalwindow.in

0 notes

Text

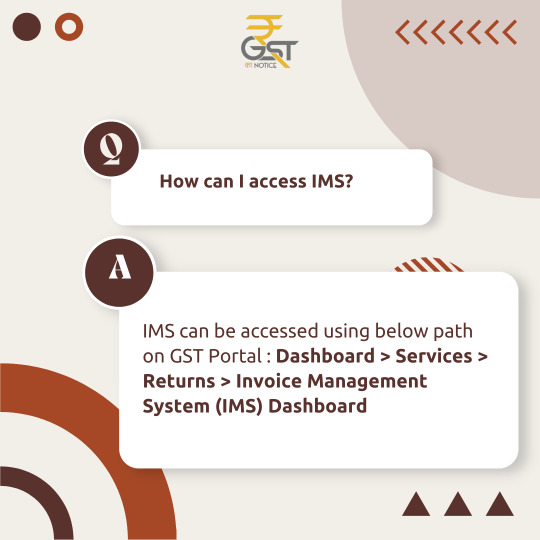

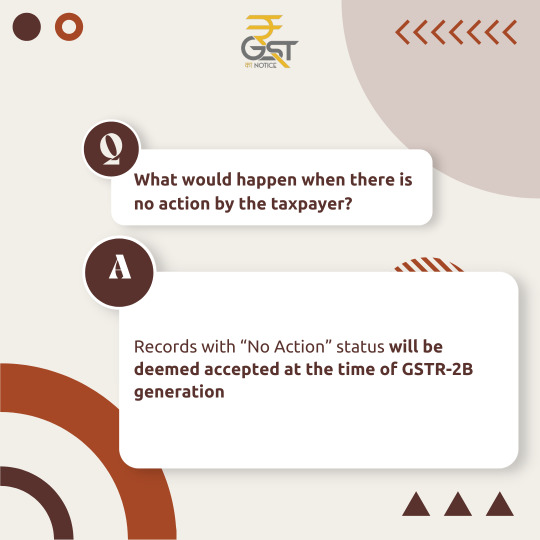

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

GST Registration - Learn step by step GST registration process in India. Know the documents required for online GST Registration. Global Jurix provides online GST registration services in India. Our well-informed lawyers perform adroitly all tasks during the entire GST registration procedure.

0 notes

Text

Legal and Business Registration Services in Indore – Licit360

Navigating the legal landscape for business registration and compliance in Indore can be challenging. At Licit360, we simplify the process by offering expert legal solutions tailored to your needs. Whether you are a startup, an established business, or an individual seeking legal assistance, or searching for top law firms in Indore, Licit 360 is the first choice having a team of experienced professionals ensures smooth, hassle-free services.

Top Law Firms in Indore – Your Trusted Legal Partner

Licit360 is one of the best law firms in Indore, providing comprehensive legal solutions, from partnership deed registration to private limited company registration. Our team ensures that businesses remain legally compliant with services like GST registration, LLP registration, and section 8 company registration.

Business Registration Services in Indore

1. Partnership Deed Registration

A partnership deed is crucial for businesses operating under a partnership model. We assist in partnership deed registration online, ensuring legal compliance with the registrar of firms. Our services include:

LLP partnership deed drafting

Online registration of partnership firm

Firm registration in India

MSME registration for partnership firms

2. Private Limited Company Registration

Starting a private limited company in Indore? We provide end-to-end assistance for private limited company registration in India, including:

GST registration for private limited company

MSME registration online for private limited companies

PF registration for private limited companies

Company name registration and online company registration in India

3. Section 8 Company Registration

For NGOs and non-profits, we offer Section 8 company registration in Indore and across India. Our services cover:

Online registration of section 8 companies

GST registration for section 8 company

Company registration under section 8

4. LLP Registration

For businesses opting for a Limited Liability Partnership (LLP) structure, we facilitate LLP registration in Indore, including:

Online LLP registration in India

Limited liability partnership firm registration

GST registration for LLP firms

5. OPC Company Registration

One Person Company (OPC) registration is ideal for solo entrepreneurs. We assist in OPC company registration in Indore, covering:

Online OPC registration

Registering a company in India under OPC format

Annual Compliance Services in Indore

Annual compliance for LLP and Pvt. Ltd. companies

ROC compliance for private limited companies

LLP annual filing and tax returns

Legal Consultation and Additional Services

Licit360 also offers online lawyer consultation and specialized legal services, including:

Trademark registration online

Import-export license (IEC registration)

ESIC and professional tax registration

Gumasta license registration in Indore

Why Choose Licit360?

Expert Legal Assistance: One of the top law firms in Indore with extensive experience.

Hassle-Free Online Registration: We provide legal services in Indore with seamless online registration processes.

Affordable Pricing: Cost-effective solutions for all legal and business registration needs.

Get in Touch!

If you're looking for firm registration, legal drafting, or business compliance services in Indore, contact Licit360 today! Our legal offices in Indore are ready to assist you with expert guidance.

#top law firms in indore#best legal advisor in indore#top legal consultant in indore#best legal services provider in indore#online legal consultant

0 notes

Text

Gst Advocate In Noida | Lead India | Law Firm

Lead India is Best Law Firm In Delhi. These lawyers are the leading authority on all legal and technical GST-related matters. We have business experts and certified public accountants on staff to help you with any accounting or tax issues.

For More Info:-

Contact Us: 8800788535 Email Us: [email protected] Website: https://www.leadindia.law/legal-services/registration/gst-registration

0 notes

Text

Importing goods into India involves various regulatory compliances to ensure the legality, safety, and smooth flow of goods across borders. Importers should pay the relevant GST on imported goods, which is determined on the exchange esteem, including customs obligations and different charges. By approving inflexible documentation, quality control, and customs systems, these compliances add to useful store network the board and buyer protection.

#BEST EXPORT IMPORT LEGAL ADVICE IN NOIDA#BEST EXPORT IMPORT LEGAL SOLUTIONS IN NOIDA#BEST EXPORT IMPORT LEGAL REMEDIES IN DELHI NCR#BEST EXPORT IMPORT LEGAL REMEDIES IN GURUGRAM#BEST EXPORT IMPORT LEGAL REMEDIES IN NOIDA#BEST EXPORT IMPORT LEGAL SERVICES IN DELHI NCR

0 notes