#Best Tax Lawyers in India

Explore tagged Tumblr posts

Text

How to Choose the Right Tax Lawyer for Your Business in India

Running a business in India is not only a process of making expert decisions but also involves legal and tax-related complexities. If you are looking for a tax lawyer to handle all this, it is essential that he is qualified and experienced. In this blog, we will guide you to choose the right Tax Lawyer in India, so that you can fulfill your business needs.

1. Check Their Experience

Using a tax lawyer who has extensive experience in modern tax laws and regulations makes your job easier. It is important to see that they have a prior understanding of the types of issues that are relevant to your industry.

2. Check Graduation for Legal Services

A specialized law degree is required to become a tax lawyer in India. Check the details about their license and their performance before deciding. The right educational background of the lawyer helps them handle your work in the best possible way.

3. Need to be an expert in a specific field

Tax laws are of different types, such as GST, income tax or international taxation. Choose a lawyer who specializes in the field in which your business is most proven.

4. Check the legal capacity and network

A tax lawyer needs to have a strong network with financial experts, chartered accountants and other lawyers. This network helps them to handle every latest tax issue quickly and effectively.

5. Check their credibility and track record

Before choosing a tax lawyer, study the feedback and success rate of their clients. You can learn more about their service by contacting previous clients.

6. Check the ability to provide regular updates

Tax laws in India change frequently. A tax lawyer should have the capacity to inform you about the latest legal changes and give advice tailored to your business.

7. Tax Dispute Skills Required

When tax disputes arise, a good tax lawyer helps you make the right decisions at the right time. They should have the skills to handle legal disputes or complaints.

8. Communication Skills Are Important

Your communication with your lawyer should be easy and clear. The main job of a lawyer is to explain your case easily and perform as required.

9. Understand the cost

Understand the lawyer's fees and the cost of their services before proceeding. It is also important to have financial integrity while choosing the right tax lawyer.

10. Trustworthy and Customized Service

A tax lawyer will be dealing with confidential information of your business, so it is important to be trustworthy. The service provided by them should be customized and tailored to your specific needs.

Find the best tax lawyer for you today!

It is now easy to stay away from legal problems while running a business in India. Our experts at Crypto Legal offer cutting-edge solutions for your every need. From compliance to contracts, we are with you! Contact us now!

0 notes

Text

Navigate GST notices with ease. GST Ka Notice offers expert services for responding to all types of GST notices. Get professional help today!

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

2 notes

·

View notes

Text

Key Factors to Consider When Choosing the Best Tax Law Firms in India

Navigating the complex world of tax law in India can be challenging for both individuals and businesses. Whether you're dealing with tax planning, compliance, or disputes, having the right legal support is crucial. Choosing the best tax law firm in India can make all the difference in ensuring your tax matters are handled efficiently and effectively. But, with so many businesses to select from, how do you know which one is best for you? Here are some important elements to consider while making a decision.

1. Expertise in Tax Law

The first and most important factor to consider is the firm's expertise in tax law. Tax law is a specialized field that requires deep knowledge of the legal and regulatory framework governing taxation in India. Look for a firm with a proven track record in handling various aspects of tax law, including income tax, corporate tax, GST, and international taxation. A firm with experienced tax lawyers who stay updated on the latest changes in tax laws and regulations will be better equipped to provide accurate and reliable advice.

2. Reputation and Track Record

A law firm’s reputation can give you a good indication of its reliability and effectiveness. Research the firm’s history, read client testimonials, and look for reviews online. The best tax law firms in India will have a solid reputation built on years of successful case outcomes and satisfied clients. You may also want to check if the firm has received any awards or recognition in the field of tax law, which can be a sign of excellence.

3. Range of Services

Tax law involves a wide variety of services, including tax planning, compliance, and representation in tax disputes. It's important to choose a firm that offers comprehensive services to meet all your tax-related needs. Whether you need assistance with filing returns, structuring transactions to minimise tax liability, or resolving disputes with tax authorities, the firm should be able to handle it all. A full-service tax law firm can save you time and provide continuity in managing your tax matters.

4. Industry-Specific Knowledge

Different industries have unique tax challenges, so it's beneficial to choose a law firm with experience in your specific sector. Whether you're in real estate, manufacturing, finance, or any other industry, a firm that understands the particular tax issues faced by businesses like yours will be better positioned to offer tailored advice. Industry-specific knowledge can also help in identifying potential tax-saving opportunities and avoiding common pitfalls.

5. Personalized Attention

When dealing with complex tax issues, personalized attention from your legal team can make a significant difference. Choose a firm that takes the time to understand your specific situation and offers customized solutions rather than a one-size-fits-all approach. The best tax law firms in India are those that build strong client relationships, providing clear communication and regular updates on the progress of your case.

6. Cost-Effectiveness

Legal services can be expensive, so it's important to consider the cost when choosing a tax law firm. However, the cheapest option is not always the best. Look for a firm that offers transparent pricing and delivers value for money. Consider the firm's charging structure whether they charge a flat cost, an hourly rate, or a contingency fee and select the option that best suits your budget and needs. Remember, investing in a top-tier tax law firm can save you money in the long run by avoiding costly mistakes and ensuring compliance with tax laws.

7. Availability and Responsiveness

Tax issues often require timely action, so it's essential to choose a firm that is available and responsive. Consider how quickly the firm responds to your inquiries and whether they can meet your deadlines. A firm with a dedicated team that is accessible when you need them can provide peace of mind and ensure that your tax matters are handled promptly.

Conclusion

Choosing the best tax law firm in India is a critical decision that can impact your financial health and legal standing. By considering factors such as expertise, reputation, range of services, industry-specific knowledge, personalized attention, cost-effectiveness, and responsiveness, you can find a firm that meets your needs and helps you navigate the complexities of tax law with confidence. Take your time to research and consult with potential firms to ensure you make the best choice for your tax-related legal matters.

0 notes

Text

Expert Coporate Law Firm in Delhi

In today’s fast-paced and ever-evolving business world, companies face various legal challenges that require expert guidance and strategic advice. This is especially true in a bustling metropolis like Delhi, where businesses, both domestic and international, are constantly navigating complex regulatory landscapes, business transactions, disputes, and compliance requirements. In such a scenario, having an experienced and trusted corporate law firm is crucial to ensuring that a company’s legal needs are effectively addressed.

Among the top corporate law firms in Delhi, VishvasLaw stands out as a leader in providing comprehensive legal services tailored to the needs of businesses. With its in-depth expertise and commitment to delivering results, VishvasLaw has earned a reputation as an Expert Corporate Law Firm in Delhi.

expert corporate law firm in Delhi

Why Choose Vishvas Law?

There are several reasons why businesses, both small and large, turn to VishvasLaw for their corporate legal needs. Here are some key aspects that set them apart from other law firms:

1. Unparalleled Expertise in Corporate Law

Corporate law is a broad and intricate field, encompassing everything from mergers and acquisitions to intellectual property, regulatory compliance, labor laws, and more. VishvasLaw offers specialized legal services across various corporate law domains, ensuring that businesses receive holistic solutions to their legal challenges.

Whether it’s negotiating and drafting complex contracts, providing counsel on corporate governance, assisting in tax planning, or advising on the legal aspects of business expansion, VishvasLaw’s team of expert lawyers is equipped with the knowledge and experience to handle all corporate legal matters. Their extensive expertise in corporate law allows them to navigate the nuances of the legal system with precision, ensuring that their clients’ interests are always protected.

2. Tailored Legal Solutions for Every Business

At VishvasLaw, there is a deep understanding that every business is unique, with its own set of challenges, goals, and legal requirements. This is why the firm takes a personalized approach to legal representation. They work closely with clients to understand their business model, industry-specific needs, and long-term objectives, enabling them to craft customized legal solutions that best address the client’s needs.

Whether it’s assisting a startup with its initial funding rounds, supporting a multinational corporation with cross-border transactions, or guiding a family business through succession planning, VishvasLaw provides expert legal advice that aligns with the client’s goals and priorities.

3. Proven Track Record of Success

The success of any law firm can be measured by the outcomes it achieves for its clients. VishvasLaw has an impressive track record of success, having represented numerous businesses across a wide range of industries, including technology, manufacturing, healthcare, retail, and more. Their ability to deliver favorable outcomes in complex corporate matters is a testament to their legal expertise and client-focused approach.

Whether it’s resolving a corporate dispute, facilitating a merger or acquisition, or navigating regulatory challenges, VishvasLaw’s attorneys consistently demonstrate a high level of competence and dedication. Their attention to detail, strategic thinking, and commitment to client satisfaction have earned them the trust of some of the biggest names in the corporate world.

4. Expertise in Regulatory Compliance

Navigating the regulatory environment in India can be daunting for businesses. With frequent changes to laws, regulations, and policies, companies must ensure they remain compliant to avoid penalties or legal issues. VishvasLaw’s team of corporate lawyers has a deep understanding of the Indian legal and regulatory framework, making them the perfect partner for ensuring compliance in all aspects of business operations.

From corporate governance and financial reporting to intellectual property rights and labor laws, VishvasLaw provides clients with the advice and guidance necessary to stay on top of regulatory requirements. Their ability to anticipate and address potential compliance risks helps businesses avoid legal pitfalls and focus on growth and innovation.

5. Strong Litigation Capabilities

In addition to providing corporate legal advisory services, VishvasLaw also offers strong litigation support. Corporate disputes are an unfortunate reality for many businesses, whether they relate to breaches of contract, shareholder disputes, intellectual property infringements, or regulatory issues. When these disputes arise, having a skilled litigator on your side is critical.

VishvasLaw’s litigation team is highly experienced in representing clients in corporate disputes, both in court and through alternative dispute resolution methods such as arbitration and mediation. Their in-depth understanding of corporate law, coupled with a strategic and practical approach to litigation, ensures that clients have the best possible representation in the event of a legal dispute.

6. International Reach and Cross-Border Expertise

In a globalized world, many businesses are involved in international operations, whether through exports, imports, joint ventures, or subsidiaries abroad. VishvasLaw has extensive experience in handling cross-border legal matters, including international contracts, trade regulations, foreign investments, and dispute resolution.

With a network of international partners and a keen understanding of global legal frameworks, VishvasLaw provides businesses with the legal support they need to operate smoothly across borders. Their international expertise ensures that clients comply with foreign regulations while protecting their interests in foreign markets.

Services Offered by VishvasLaw

VishvasLaw provides a wide range of corporate legal services, including but not limited to:

Mergers and Acquisitions (M&A): Legal assistance with the buying, selling, and merging of businesses.

Corporate Governance: Advising on the structures and processes for managing and controlling a corporation.

Intellectual Property: Protection of trademarks, patents, copyrights, and other intellectual property rights.

Corporate Finance and Taxation: Structuring corporate financing, tax planning, and compliance with tax regulations.

Labor and Employment Law: Counsel on labor-related matters, including employee contracts, disputes, and regulatory compliance.

Regulatory Compliance: Assistance with compliance on various business regulations, including environmental, antitrust, and securities laws.

Dispute Resolution: Litigating and resolving disputes through courts, arbitration, and mediation.

Conclusion

For businesses in Delhi seeking expert legal guidance, VishvasLaw stands as a premier choice. With its team of experienced corporate lawyers, comprehensive services, and personalized approach, VishvasLaw ensures that clients receive the best legal support for their business needs. Whether navigating complex corporate transactions, handling regulatory compliance, or resolving legal disputes, businesses can trust VishvasLaw to provide strategic, reliable, and results-driven legal counsel.

If you're looking for an expert corporate law firm in Delhi to help your business thrive, look no further than VishvasLaw. Their proven track record, client-focused approach, and in-depth knowledge of corporate law make them an indispensable partner for any business in today’s dynamic and challenging business environment.

Contact Us-

+91-9311177703

0 notes

Text

How Tax Lawyer Help Resolve IRS Disputes and Audits

Introduction

IRS disputes and audits are challenging and stressful to navigate. The process is complicated, from the understanding of tax regulations to negotiating with authorities, where the stakes are high and the consequences of a misstep can be quite severe. Here is where tax lawyer come into play. They are experts in tax law and have experience handling intricate cases, thus becoming valuable allies for individuals and businesses facing IRS challenges.

What Is an IRS Audit?

An IRS audit is a check of an individual's or a business's records to ensure adherence to tax law. Audits can be motivated by discrepancies, inconsistencies, or red flags that appear in the tax returns of an individual or business. However, audits themselves are not punishment; errors and unresolved issues lead to penalties, fines, and even lawsuits.

How Tax Lawyers Assist in Resolving IRS Disputes and Audits

Expert Analysis of Your Tax Situation : Tax lawyers have the in-depth knowledge of tax laws and regulations. They can scan your financial records and tax filings to determine the reasons for the audit. Their expertise helps them anticipate what may concern the IRS and come up with a plan to handle them appropriately.

Representation during IRS Audits : Facing the IRS alone is a daunting experience. Tax attorneys serve as your representatives, writing on your behalf to the IRS. They will make sure all your documentation and response are correct, timely, and in compliance with the legal system.

Negotiating Settlements : If any differences are discovered, tax lawyers may negotiate with the IRS to favorably settle it. This might involve reducing the penalties, planning for a payment plan, or securing an offer in compromise in which the liability for taxes would be settled for less than what is owed.

Protecting Your Rights : Tax attorneys know the taxpayer's rights and see to it that the IRS observes them at all times during the audit process. They prevent overreaching, guard sensitive financial information, and make sure they receive fair treatment.

Resolving Tax Disputes : Other than audit tax lawyers represent in disputes that arise from mistaken assessments of tax, claims for refunds, and abatement of penalties. They may file an appeal, represent in tax court, and file litigation if need be.

Prevention of Future Problems : A good tax lawyer doesn't only solve the current issues but also assists clients in the implementation of better tax practices that will help them avoid future disputes. This may include tax planning, compliance, and record-keeping.

Benefits of Hiring a Tax Lawyer

Specialized knowledge: Tax attorneys have extensive experience with tax codes, IRS procedure, and other legal nuances.

Strategic approach: They tailor strategies based on your individual situation to obtain the best outcome.

Stress reduction: You're free to do what you like because the burden of dealing with the complexities lies with the attorney.

Risk reduction: Their experience reduces the possibility of further penalties or escalations.

Partnering with Professionals for Tax Compliance

For those people and businesses under IRS audit or dispute, the first step toward resolution is to hire a tax lawyer. GTS Consultant India has professional, experienced experts to provide solutions tailored to your needs in solving tax challenges. They have proven their track record in tax compliance and dispute resolution and can be trusted to guide through even the most complex cases.

Conclusion

IRS disputes and audits can be very overwhelming, but they don't have to be if the right support is there. Tax lawyers bring in invaluable expertise in acting as defenders and advisors for guiding you through the process. Whether it's representation during an audit, negotiating settlements, or ensuring future compliance, tax lawyers are the allies you need in safeguarding your financial well-being. For more information on professional tax compliance services, visit GTS Consultant India.

0 notes

Text

Best Citizenship by Investment Consultants for Global Residency & U.S. Green Card Solutions

Experienced EB-5 Consultants in India for U.S. Immigration Solutions

Get personalized advice from top EB5 consultants India to navigate the U.S. EB-5 Immigrant Investor Program. We assist Indian investors in securing a U.S. Green Card through investment, project selection, and visa processing. Trust our expert team for a seamless immigration experience. Contact us for more details.

Leading EB-5 Visa Consultants in India for U.S. Residency

Discover reliable EB5 visa consultants in India who specialize in guiding you through the EB-5 visa process. From investment guidance to paperwork and USCIS procedures, our experts ensure your application is smooth and successful. Start your U.S. residency journey today with trusted professionals.

Professional EB-5 Consultant for U.S. Green Card Assistance

Understanding EB-5 Processing Time in 2024: What You Need to Know

Keep up-to-date with EB-5 processing time 2024. Our experts provide insights on the factors influencing processing times, how to manage expectations, and strategies for expediting your EB-5 visa application. Get all the information you need for a smoother process.

Expert EB-5 Consultants for Seamless U.S. Immigration

Our experienced EB5 consultants help you secure a U.S. Green Card through the Immigrant Investor Program. We provide expert advice on project selection, filing I-526 petitions, and navigating the visa process. Let us guide you through your journey to U.S. residency.

Trusted Citizenship Investment Consultants for Global Residency Options

Get the best advice on citizenship by investment from our Citizenship Investment Consultants. Whether you want a second passport or better global mobility, our team provides customized solutions to suit your needs. Explore residency and tax benefits with our expert services today.

Leading EB-5 Visa Consultants for a Smooth U.S. Green Card Process

Premier EB-5 Visa Consultants in India for U.S. Residency by Investment

Our EB-5 visa consultants in India provide expert advice to secure your U.S. Green Card. From understanding the visa process to investment options and paperwork, we guide Indian investors step by step. Achieve your American Dream today with our professional assistance.

EB-5 Visa Processing Time for India: What You Should Know

Learn about the EB5 visa processing time India with our detailed insights. We cover timelines, factors affecting processing, and steps to expedite your application. Let our experts guide you through the process for faster and smoother approval.

US Citizenship by Investment for Indian Investors: A Pathway to Global Opportunities

Discover how US citizenship by investment for Indian nationals can open doors to better opportunities. Our consultants provide end-to-end support for EB-5 visa applications, including investment selection, paperwork, and processing. Start your journey to U.S. residency today.

Everything You Need to Know About EB-5 Visa Processing Time in 2024

Stay informed on the latest EB-5 visa processing time 2024 with our comprehensive guide. Our team helps you understand the factors influencing processing durations and provides strategies to ensure your EB-5 petition progresses smoothly. Get expert advice today.

Secure Your EB-5 Visa from India: Expert Guidance and Support

Apply for the EB-5 visa India with the help of our experienced consultants. We guide you through every step of the process, from choosing the right investment to managing your I-526E petition. Trust our experts to help you achieve U.S. residency with ease.

Best EB-5 Immigration Lawyers for Investment-Based U.S. Green Cards

Work with the best EB-5 immigration lawyers to navigate the complex U.S. immigration process. We offer expert legal support for EB-5 investors, from visa petitions to residency approvals. Ensure your U.S. Green Card application is handled with care and professionalism.

Detailed Insights into EB-5 Visa Processing Time and Timeline

Understand EB-5 visa processing time with our expert insights. We break down the stages, timelines, and factors influencing approval to help you manage expectations. Get detailed guidance from our consultants to ensure a smooth process.

Secure Your EB-5 Visa for Indian Nationals with Expert Support

The EB5 visa for Indian nationals is a popular route to U.S. residency. Our consultants specialize in guiding Indian investors through the EB-5 visa process, helping you choose the right projects and expedite your application. Start your Green Card journey with trusted experts today.

Comprehensive Guide to EB-5 Visa Processing Time and Factors

Discover all the details about EB-5 visa processing time and the factors that affect it. From application submission to final approval, our team of experts provides tips and strategies to ensure your application is processed efficiently. Get in touch with us today for more information.

EB-5 Processing Time in India: What to Expect and How to Plan

Learn about EB-5 processing time India and get expert tips on managing your application. Our consultants offer up-to-date information on visa timelines and help you navigate through the process with ease. Secure your U.S. Green Card today.

How to Get U.S. Citizenship Through Investment: A Step-by-Step Guide

Getting US citizenship through investment is possible with the EB-5 Immigrant Investor Program. Our team helps you understand the investment requirements, legal steps, and processing times involved. Start your journey to U.S. residency today.

Understanding the EB-5 Visa Timeline: Key Stages and Updates

Get familiar with the EB 5 visa timeline from petition filing to approval. Our experts guide you through each step and provide information on how to streamline the process for faster results. Let us help you achieve your U.S. residency goals.

What is the Cost of an EB-5 Green Card? A Complete Breakdown

The EB5 green card cost includes various factors, from investment amounts to legal fees. Our consultants provide a detailed breakdown of all expenses associated with the EB-5 process, helping you plan your investment and application accordingly. Get expert advice on costs today.

Conclusion

Unlock global opportunities with our expert Citizenship by Investment Consultants. We specialize in offering tailored solutions for individuals seeking second citizenship, a second passport, and global residency through investment. Get professional guidance on securing U.S. citizenship by investment via the EB-5 visa program. Our consultants provide in-depth assistance, from project selection to visa-free travel benefits. Start your journey toward global mobility and U.S. residency with trusted experts today!

0 notes

Text

Best Taxation Lawyers in India | Direct & Indirect Taxes Lawyers in India

Taxation laws in India are complex, dynamic, and essential for individuals, businesses, and corporations alike. Navigating these laws effectively requires the expertise of skilled taxation lawyers who specialize in both direct and indirect taxes. Whether it's understanding intricate tax provisions, ensuring compliance, or resolving disputes, the best taxation lawyers in India can provide comprehensive legal solutions tailored to your needs.

Understanding Direct and Indirect Taxes in India

Taxation in India is broadly categorized into direct taxes and indirect taxes:

Direct Taxes: These are taxes levied directly on an individual's or entity's income or wealth. Examples include income tax, corporate tax, and wealth tax. Direct taxes are progressive in nature, meaning higher income attracts higher tax rates.

Indirect Taxes: These are taxes levied on goods and services and are ultimately borne by the end consumer. Examples include GST (Goods and Services Tax), customs duty, and excise duty. Indirect taxes are regressive, as they are applied uniformly, regardless of the consumer's financial status.

Why Hire a Taxation Lawyer in India?

Taxation lawyers play a pivotal role in ensuring that individuals and businesses comply with tax regulations while minimizing liabilities. Here are some key reasons to hire a taxation lawyer:

Expert Guidance: Taxation laws are intricate and frequently amended. A seasoned lawyer keeps up with the latest changes, ensuring you remain compliant.

Tax Planning: Effective tax planning can reduce your tax burden legally. Taxation lawyers devise strategies to maximize benefits and minimize liabilities.

Dispute Resolution: If you face tax-related disputes, whether with the Income Tax Department or GST authorities, a lawyer can represent you effectively.

Compliance: Filing returns, adhering to deadlines, and maintaining accurate documentation are essential for avoiding penalties. Tax lawyers help streamline these processes.

Services Offered by Taxation Lawyer in India

The best taxation lawyers in India offer a wide range of services, including:

Assistance with filing income tax returns and GST returns

Legal advice on tax-saving investments

Representation in tax tribunals and courts

Handling tax audits and assessments

Resolving disputes with tax authorities

Guidance on international taxation and transfer pricing

Key Qualities of the Best Taxation Lawyer in India

When choosing a taxation lawyer, look for the following qualities:

Expertise in Tax Law: The lawyer should have a deep understanding of both direct and indirect tax laws.

Experience: Years of practice handling complex tax cases is a significant advantage.

Strong Analytical Skills: Tax cases often require interpreting intricate laws and financial data.

Proactive Approach: A good lawyer anticipates potential issues and provides solutions before problems arise.

Why VMathur Associates?

VMathur Associates is one of the leading law firms in India, known for its exceptional expertise in taxation law. With a team of highly skilled lawyers, we specialize in providing personalized legal solutions for all your taxation needs. Our services include:

Advising on income tax and GST compliance

Handling disputes and litigation in tax tribunals

Structuring tax-efficient business models

Assisting with international taxation and double taxation treaties

0 notes

Text

Probono legal Consultant Law Firm is a Leading Law firm in Ameerpet, Miyapur, Hyderabad, Telangana, India. Our Law firm specialize in Top Civil, Criminal, Divorce, Corporate, disputes, corporate cases, Income tax cases, property, Cyber-Crime, Cheque Bounce, Family cases, Consumer Laws, Real Estate, and Property matters Lawyers/Advocates in Hyderabad. Our Top/Best Lawyers in Ameerpet, Hyderabad are licensed to practice in courts all over India, including the High Court Lawyers/Advocates in Hyderabad and the Supreme Court. We have a proven track record of success in helping our clients achieve their legal goals. Contact us today to learn more about how we can help you with our professional & experienced team of Best/Top Lawyers/Advocates in Ameerpet, Hyderabad.

#Best Law Firms and Advocates in Ameerpet#Hyderabad#Top Law Firm in Ameerpet-Hyderabad | Probono legal Consultant#Corporate law firms in Hyderabad#Best Law Firms and Advocates in Miyapur#Best Arbitration Lawyer in Ameerpet-Hyderabad#Consult Top Banking / Finance-lawyers-in-Hyderabad#Banking and Finance Lawyers in Hyderabad#Best Lawyers in Ameerpet

0 notes

Text

Comprehensive Legal Support for Gold Smuggling Investigations at Delhi International Airport: Legal Advice from Best Customs Lawyer for Gold Smuggling Cases in Delhi

Airports serve as a platform for illegal transportation of goods. Delhi International Airport is a major entry point in India. It has become an important location for gold smuggling and investigations. These illegal operations, which involve avoiding taxes and customs duties, not only threaten national security but also weaken India’s economy. while on the other hand some individual might falsely accused in the investigation and stuck in the prolong legal proceeding. therefore, Legal assistance is important to handle the complex nature of gold smuggling cases, which also guarantee appropriate law enforcement, and facilitate a prompt settlement. In order to prevent the illegal export of goods, maintain the integrity of the nation’s customs processes, and protect the rights of individuals to an impartial trial, a clear understanding of the legal framework and swift strategy is important. Moreover an experienced lawyer plays vital role in this process.

#top lawyers for forgery cases in delhi#top criminal lawyers in delhi high court#legal remedies for banking fraud in noida#top property lawyer in delhi#supreme court best criminal lawyer#top criminal lawyers in gurgaon#navigating banking fraud allegations in delhi ncr

0 notes

Text

What is the process for getting a divorce with a family lawyer near me?

The process for getting a divorce in India involves several legal steps, and hiring an experienced advocate for divorce cases ensures that the procedure is handled efficiently. Here's an outline of the typical process:

Consultation with a Family Lawyer: Start by consulting a family lawyer near you to discuss your case. The lawyer will help determine the grounds for divorce and explain the best course of action, whether mutual consent or contested divorce.

Filing the Divorce Petition: The petition is filed in the appropriate family court. For mutual consent, both spouses agree on terms, while for a contested divorce, one party files based on specific legal grounds like cruelty, desertion, or adultery.

Serving the Notice: The court issues a notice to the other spouse to inform them about the divorce proceedings.

Response from the Opposing Party: The spouse receiving the notice has the opportunity to respond, either agreeing to or contesting the petition.

Mediation and Counseling: Many courts encourage reconciliation through mediation or counseling. If both parties agree to reconcile, the case is withdrawn.

Evidence and Hearings: In a contested divorce, both parties present evidence, witness statements, and arguments before the court.

Final Decision and Decree: Based on the evidence and legal arguments, the court passes a judgment. If the divorce is granted, the decree officially dissolves the marriage.

An advocate for divorce cases is indispensable throughout this process to handle legal documentation, represent your interests in court, and ensure that your rights are protected. Consulting a skilled family lawyer near you can significantly simplify the complex and emotionally taxing divorce process.

If you are looking for a lawyer in Thane click on the link.

#divorce#lawyer#legal insights#legalhelp#maharashtra#advocate for divorce cases#legal advice#mumbai#thane

0 notes

Text

What are the requirements for the UK Spouse Visa?

To apply for a UK Spouse Visa, you and your spouse must be at least eighteen years old. Your partner must be a British or Irish citizen, have a certain type of visa, or have made the UK their home.

To apply as a spouse, your relationship must be legally recognized in the UK. You need to provide a marriage certificate. If you're not married but have lived together in a relationship similar to marriage for at least two years, you can apply for an Unmarried Partner Visa.

You’ll need to demonstrate that you meet the following requirements:

Financial:

The sponsoring partner must prove they can support you both without relying on public funds. The minimum income requirement is currently £29,000. You can meet the financial requirement with income from various sources, including employment, savings over £16,000, or pensions. Income from employment before tax and National Insurance, self-employment, serving as a director of a limited company in the UK, dividends, and rent are all acceptable income sources.

Accommodation:

If you and your partner want to live together in the UK, you must show proof of appropriate housing. It will be your responsibility to demonstrate that the lodging is fit for living, safe, and not overcrowded.

English Language:

You’ll need to prove your knowledge of English, usually by passing an approved English language test at CEFR level A1. You have to show that you can communicate well in English. If you are over 65, from a nation where English is the primary language, or have a degree that was taught in English, you may be excluded from this requirement.

You may show that you are proficient in the English language by completing tests like the IELTS UKVI Life Skills exam. The necessary English proficiency level for individuals asking for an extension who are already in the UK is CEFR A2.

For settlement, it's CEFR B1.

Suitability and Other:

You also need to meet suitability requirements regarding your character and immigration history. You may also need to provide a tuberculosis test certificate, depending on your country of origin.

If you are unable to pay the application cost because of a variety of circumstances, the UK government offers fee exemptions. You can apply to get your visa extended before it expires. Extending your family visa allows you to stay in the UK for an additional two years and six months.

After five years on a spouse visa, you can apply for indefinite leave to remain, sometimes known as settlement. This would allow you to live in the UK permanently.

You must apply for the Spouse Visa online. Those applying from outside the UK will usually get a decision within 12 weeks. For those applying from inside the UK, if you meet the financial requirements and English language requirements, you’ll usually get a decision within 8 weeks.

However, if you don’t meet these requirements, it can take about 12 months to make a decision. There is a faster decision option available for an additional fee.

It is strongly recommended to consult with an immigration lawyer, such as The Smartmove2UK, for expert guidance on your specific situation.

They can streamline the application procedure, assist you in obtaining the required paperwork, and clarify what is needed. Even though immigration processes are complicated, knowledgeable immigration advisers can help you understand the financial, language, and other criteria as well as help you avoid frequent mistakes made throughout the application process.

Questions in your mind for UK Spouse Visa Like below, then Read: Everything About UK Spouse Visa

Best UK Qualified Spouse Visa Expert in India.

Who Can Apply for a UK Spouse Visa

UK Spouse Visa Requirements

Required Documents for a UK Spouse Visa Application

Financial Requirements for a UK Spouse Visa

English Language Requirements for UK Spouse Visa

How to Apply for a UK Spouse Visa

Time Required for UK Spouse Visa

Trusted Immigration Support for Your Spouse Visa UK Application

UK Spouse Visa Fees and Associated Costs

What Happens If Your UK Spouse Visa Application Is Refused

Life After Obtaining a UK Spouse Visa

Your Path to a Successful UK Spouse Visa

How long does a UK Spouse Visa last

What if I don’t meet the financial requirements

Can I extend my UK Spouse Visa

Is the UK spouse visa a settlement visa?

What if I extend my stay on a UK Spouse visa?

How can my wife on a UK spouse visa become a British citizen?

What is the fee for an extension of a UK Spouse visa?

Entry Clearance Application for the UK Spouse visa?

Meeting the minimum income requirement for Spouse visa UK

Can dependants enter the UK on a spouse visa?

UK Spouse Visa refused? What next? When to re-apply?

Can I apply to switch to a UK Spouse Visa?

Can I work in the UK on my UK Spousal Visa?

UK immigration rules are subject to change. If you require advice specific to your UK Spouse Visa circumstances, reach out to our UK Spouse Visa Consultant.

#uk spouse visa#uk spouse visa processing time#uk spouse visa requirements#uk visa#smartmove2uk#uk immigration#uk immigration solicitors#uk immigration lawyer

0 notes

Text

Key Questions to Ask When Hiring a Tax Lawyer in India

Hiring a tax lawyer in India is an important decision that can have long-reaching implications for Your future financial well-being. The right tax lawyer can help you solve your problem But in order to choose a good lawyer, you should ask some Important questions. Today, let's see what Step-By-Step asks to consider when thinking about hiring a tax lawyer :

What is your expertise?

Are lawyers trained in tax legislation? It is essential to understand whether the lawyer's specialisations meet your present needs; for instance,, if you have issues with international taxation, then you would want an experienced attorney in this area.

What is your experience?

The lawyer's level of practical experience is a major pointer to his quality. You should ask the lawyer how many years he has been active in the field of tax law and how many similar cases he has handled successfully. An experienced lawyer is more competent in handling your case.

How are the fees for your services determined?

You should understand the fee structure. Ask the lawyer how his fees are assessed: Is it on a fixed amount, hourly, or other basis? It is also important to know whether there might be miscellaneous or outlays.

What types of services do you provide?

Each tax lawyer does different things. It should benefit you to find out what these are. Do they handle: tax planning and structuring TDS compliance GST advice project finance structures or other areas whose regulations are slightly off the beaten path?

Can you prepare a strategy for my case?

If you hire a tax attorney, he can easily give a clear, rational strategy to the case. Ask what kind of plan the lawyer will draw up and what measures they will take to solve your problems.

Have you handled my case before?

It's important to know that the lawyer has handled similar cases before. This ensures that you experience all the complexities and requirements of your case.

Will you be in regular contact with me?

A good lawyer will be in regular contact with you, keeping you informed about the progress of your case. You need to know what the way of contacting the lawyer will be and whether they respond promptly to your questions.

What do your client reviews and references say?

Good lawyers usually have good client reviews and references. You can look at these reviews and references to know the qualifications and professional capability of a lawyer.

Can you present the case in court?

If your case requires court involvement, it is very important that the lawyer can present the case in court. Make sure the lawyer has the ability to appear and represent in court.

How is your working style and client service?

The working style and customer service of an attorney can influence how you feel about working with them. You should make sure that the way the lawyer works is suitable for you and that they treat you in a professional and helpful manner.

During the search for a reliable tax attorney with years of experience providing advice on how to utilize cryptocurrency laws, we hope that you find Crypto Legal suited to your needs best. We are a professional taxation service provider in Bangalore, Karnataka, India, leading the way in many areas. Our services include tax planning and structuring, project review and tax optimisation, TDS compliance, GST advice and more.

Contact us now, let get you your bills settled right away!

#tax lawyer in india#tax lawyer#Best Tax Lawyers in India#Best Tax Law Firms in India#Taxation Services in Bangalore#Best Tax Lawyers in Bangalore#Best Tax Law Firms in Bangalore

0 notes

Text

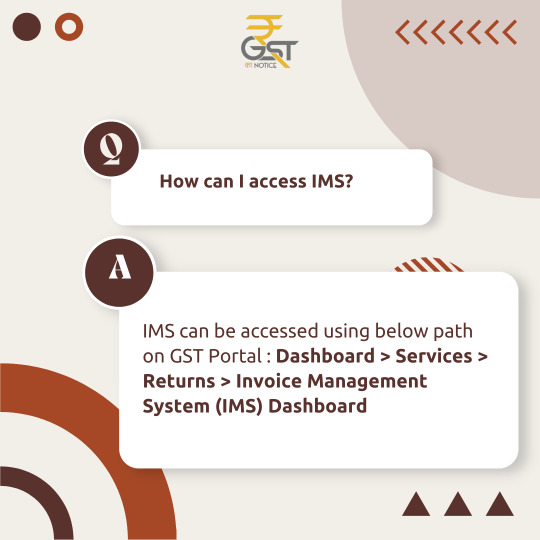

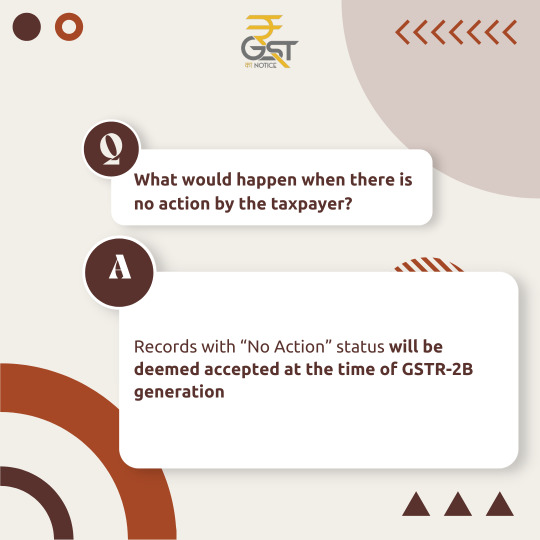

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

Why You Need a Tax Law Firm in Mumbai for Income Tax Disputes

Income tax disputes can be stressful, time-consuming, and financially draining for individuals and businesses alike. Navigating the complexities of tax laws, responding to notices, and ensuring compliance require specialized legal expertise. This is where tax law firms in Mumbai play a critical role. With their in-depth understanding of India’s tax laws and the local regulatory environment, these firms provide comprehensive support to resolve disputes effectively and minimize legal and financial risks.

In this article, we’ll explore why hiring a tax law firm in Mumbai is essential for successfully managing income tax disputes.

1. Expertise in Complex Tax Laws

Indian tax laws are constantly evolving, with amendments, new regulations, and legal interpretations emerging regularly. For a layperson, it can be challenging to understand these complexities. Tax law firms in Mumbai specialize in tax regulations and legal compliance, ensuring that clients stay updated with the latest changes in the law.

Whether it’s interpreting the Income Tax Act, dealing with Section 143(3) assessments, or responding to income tax notices, tax lawyers possess the technical expertise to navigate these complexities efficiently. Their deep knowledge of the law helps build a strong case during tax assessments or disputes.

2. Skilled Representation During Tax Litigation

Income tax disputes often escalate to litigation when disagreements arise between taxpayers and tax authorities. This could involve:

Assessments and reassessments.

Tax demand notices.

Tax penalties and interest charges.

Appeals before tribunals, High Courts, or even the Supreme Court.

Tax law firms in Mumbai provide skilled representation during litigation, ensuring that clients’ interests are protected at every stage. Their lawyers prepare comprehensive arguments, collect necessary evidence, and present the case convincingly before appellate authorities and courts.

Hiring experienced tax lawyers increases the chances of a favorable resolution, as they are well-versed in court procedures, legal precedents, and dispute resolution strategies.

3. Efficient Handling of Tax Notices and Audits

Receiving an income tax notice can be a daunting experience for both individuals and businesses. These notices could be issued for reasons such as discrepancies in tax returns, demands for additional tax, or under-reported income.

Tax law firms in Mumbai provide prompt and efficient support in handling tax notices. They:

Analyze the notice carefully to determine the underlying issue.

Assist in drafting accurate and legally sound replies to tax authorities.

Represent clients during income tax audits and ensure that all queries are addressed effectively.

By addressing issues proactively, tax law firms help clients avoid unnecessary penalties and legal escalations.

4. Personalized and Strategic Tax Advisory

Every income tax dispute is unique and requires a tailored approach. Tax law firms offer personalized strategies to resolve disputes based on the specifics of each case. Their services include:

Reviewing tax returns and documents to identify inconsistencies.

Offering strategic advice to minimize tax liabilities within the legal framework.

Planning the best course of action for filing appeals and defending claims.

Whether you are an individual taxpayer, a business owner, or a high-net-worth individual (HNI), tax lawyers ensure your tax strategy aligns with legal requirements and your financial goals.

5. Avoiding Costly Penalties and Financial Loss

Non-compliance with tax laws, missed deadlines, or incorrect filing of returns can result in severe financial consequences, including heavy penalties and interest. Tax law firms in Mumbai mitigate these risks by:

Ensuring timely compliance with all filing requirements.

Resolving disputes efficiently to avoid prolonged legal battles and additional penalties.

Negotiating with tax authorities for settlement or reduced tax demands when applicable.

Their expertise can save individuals and businesses significant financial losses in the long run.

6. Experience with Local and National Tax Authorities

Mumbai is India’s financial hub, housing some of the country’s largest businesses and financial institutions. Tax law firms in Mumbai have extensive experience dealing with local and national tax authorities, giving them a unique edge in handling disputes. Their familiarity with the workings of the Income Tax Department, tribunals, and appellate authorities ensures smooth navigation of legal processes.

This experience helps expedite dispute resolution, allowing clients to focus on their core business operations or personal goals without distraction.

7. Holistic Support for Businesses and Individuals

Tax law firms not only resolve disputes but also offer holistic support to ensure long-term compliance and tax efficiency. Their services include:

Regular tax audits and risk assessments.

Advisory on tax-saving strategies and deductions.

Legal support during business mergers, acquisitions, or restructuring.

For individuals and businesses alike, working with a tax law firm is an investment in financial stability and peace of mind.

Conclusion

Income tax disputes can be overwhelming, but they don’t have to be. By partnering with tax law firms in Mumbai, individuals and businesses gain access to specialized legal expertise, strategic advisory, and skilled representation. These firms offer comprehensive solutions to handle disputes, minimize financial liabilities, and ensure legal compliance. Whether you are facing tax litigation, responding to income tax notices, or navigating complex audits, a trusted tax law firm in Mumbai is your best ally in protecting your rights and achieving a favorable outcome. Investing in professional tax support not only resolves immediate disputes but also paves the way for a stress-free financial future.

0 notes

Text

The Best Litigation Lawyers in Delhi: Top Firm Insights

Delhi, the bustling capital of India, is not just the political hub but also a prominent legal center. Home to the Supreme Court of India, the Delhi High Court, and various tribunals, the city attracts top legal minds from across the country. For individuals and businesses seeking legal recourse, finding the right litigation lawyer is paramount. This article delves into the best litigation lawyers and firms in Delhi, offering insights into their expertise, services, and accolades.

What Makes a Great Litigation Lawyer?

Before exploring specific Top law firm in Delhi, it's essential to understand what sets a great litigation lawyer apart:

Expertise and Knowledge: Proficiency in procedural and substantive law is critical. Lawyers must have a thorough understanding of legal precedents and case laws.

Courtroom Experience: The ability to argue effectively, handle judges' queries, and navigate courtroom dynamics is invaluable.

Client-Centric Approach: A good lawyer prioritizes the client’s needs, communicates clearly, and provides realistic expectations.

Reputation: Accolades, landmark case victories, and peer recognition enhance a lawyer’s standing.

Top Litigation Lawyers and Firms in Delhi

Here is a curated list of some of the best Litigation firm in Delhi:

1. K.K. Venugopal

K.K. Venugopal is a renowned name in the legal fraternity, having served as the Attorney General for India. Known for his incisive arguments and vast legal knowledge, he has represented clients in some of the most high-profile cases in the Supreme Court and Delhi High Court. His specialization includes constitutional law, arbitration, and corporate litigation.

2. Gopal Subramanium

A former Solicitor General of India, Gopal Subramanium is an exceptional litigation lawyer known for his eloquence and legal acumen. With a career spanning decades, he has represented clients in landmark constitutional and commercial disputes.

3. Zia Mody

While Zia Mody is primarily known for her corporate law expertise, her firm, AZB & Partners, has a robust litigation practice in Delhi. They handle high-stakes commercial disputes, arbitration, and white-collar crime cases.

4. Shardul Amarchand Mangaldas & Co.

One of India’s leading law firms, Shardul Amarchand Mangaldas & Co., has a stellar litigation team in Delhi. The firm handles diverse cases, including mergers and acquisitions, competition law disputes, and insolvency matters. Their litigation lawyers are known for their strategic thinking and courtroom prowess.

5. Khaitan & Co.

With a legacy dating back to 1911, Khaitan & Co. is one of India’s oldest law firms. The firm’s litigation practice in Delhi is extensive, covering corporate disputes, regulatory matters, and tax litigation. Their lawyers are respected for their meticulous preparation and client-centric approach.

6. Cyril Amarchand Mangaldas

Cyril Amarchand Mangaldas boasts a strong presence in Delhi with a dedicated litigation team. They specialize in commercial disputes, arbitration, intellectual property cases, and more. The firm’s lawyers are known for their innovative legal strategies and persuasive arguments.

7. Senior Advocate Harish Salve

Harish Salve is a name that resonates with excellence in litigation. Known for his expertise in constitutional law, commercial law, and international arbitration, Salve has been involved in several high-profile cases in India and abroad. His meticulous approach and compelling advocacy make him one of the most sought-after litigators in Delhi.

8. Arvind Datar

Arvind Datar is a senior advocate with an outstanding reputation in tax law and constitutional litigation. Based out of multiple cities, including Delhi, his expertise and ability to handle complex cases have earned him significant acclaim.

9. L&L Partners

Formerly known as Luthra & Luthra, L&L Partners is a full-service law firm with a strong litigation practice in Delhi. Their lawyers are well-versed in handling disputes related to corporate law, real estate, and intellectual property.

10. Phoenix Legal

Phoenix Legal is a boutique law firm with a growing reputation in litigation. They specialize in corporate litigation, arbitration, and white-collar crime cases. The firm’s lawyers are known for their pragmatic and result-oriented approach.

Navigating the Legal Landscape in Delhi

For those seeking litigation lawyers in Delhi, the following tips can help streamline the process:

Identify Your Needs: Determine the nature of your legal issue—whether it’s corporate, criminal, civil, or family law. This helps narrow down your search.

Research Credentials: Look for lawyers with relevant experience and a proven track record in similar cases.

Schedule Consultations: Most top lawyers and firms offer initial consultations. Use this opportunity to assess their expertise, communication style, and approach.

Understand Fee Structures: Litigation costs can vary widely. Ensure you discuss the fee structure upfront to avoid surprises later.

Conclusion

Delhi’s legal landscape is dynamic, with top-notch litigation lawyers and firms catering to a diverse clientele. From constitutional experts like Harish Salve to full-service firms like Shardul Amarchand Mangaldas & Co., the city offers unparalleled legal talent. When selecting a litigation lawyer, prioritize expertise, courtroom experience, and client reviews to make an informed decision. With the right representation, navigating legal challenges in Delhi becomes a manageable and rewarding endeavor.

0 notes

Text

Leading Tax Law Firms in Delhi: Trusted Legal Advisors

Introduction to Leading Tax Law Firms in Delhi

Delhi, being the capital city of India, is home to a number of reputed tax law firms in delhi. These firms provide expert legal services to individuals, businesses, and organizations dealing with tax-related matters. Leading tax law firms in Delhi specialize in helping clients navigate the complexities of tax laws, ensure compliance with local regulations, and resolve disputes with tax authorities efficiently. Whether it’s corporate taxation or individual tax issues, the expertise of top firms can make a significant difference.

What Makes a Tax Law Firm Stand Out in Delhi?

To be recognized as a leading tax law firm in delhi, a firm must offer more than just legal representation. The top firms distinguish themselves through:

Expertise and Experience: A leading tax law firm has a team of lawyers who specialize in tax laws, with years of experience in dealing with complex issues such as tax planning, tax litigation, and regulatory compliance.

Track Record of Success: Leading firms have a proven history of successfully representing clients in high-profile tax cases, resolving disputes efficiently, and minimizing clients’ tax liabilities.

Comprehensive Services: A top tax law firm in delhi offers a broad range of services, from legal advice on tax planning to helping with corporate tax matters and resolving disputes.

Client-Centric Approach: The best firms always prioritize their clients’ needs, ensuring personalized and effective legal solutions.

Services Offered by Leading Tax Law Firms in Delhi

Leading tax law firms in delhi offer a variety of services to both individuals and businesses, ensuring they can address all their tax-related issues effectively. These services include:

Tax Dispute Resolution: Top firms provide legal representation in case of audits, disputes with tax authorities, and legal challenges to tax assessments.

Corporate Tax Services: Firms assist businesses in navigating complex corporate tax laws, including mergers, acquisitions, and compliance with tax regulations.

Tax Planning and Strategy: Expert lawyers help clients develop strategies to minimize tax liabilities, optimize tax benefits, and ensure legal compliance.

Indirect Taxes (GST, etc.): Leading tax law firms advise clients on indirect taxes, including Goods and Services Tax (GST), customs duties, and other indirect taxes.

International Taxation: They offer guidance on cross-border taxation issues, ensuring compliance with international tax laws for businesses operating globally.

By offering these comprehensive services, top tax law firms play a crucial role in managing and resolving tax matters for clients.

Why Aayati Legal is One of the Leading Tax Law Firms in Delhi

Aayati Legal is recognized as one of the leading tax law firms in delhi due to its exceptional service and client-first approach. The firm’s team of experienced tax lawyers brings a wealth of knowledge and expertise in all areas of tax law, from dispute resolution to tax planning. Aayati Legal is known for its tailored solutions and transparent legal advice, ensuring that clients receive the best possible outcomes. Whether it’s corporate taxation, individual tax planning, or resolving tax disputes, Aayati Legal has established itself as a trusted partner for legal matters.

How to Choose the Best Tax Law Firm in Delhi

When choosing a tax law firm in delhi, consider the following:

Experience and Specialization: Opt for firms that specialize in tax law with a strong track record of handling complex tax issues.

Reputation and Reviews: Look for firms with positive reviews and a solid reputation for delivering results in tax cases.

Range of Services: Choose a firm that offers a comprehensive suite of tax-related services, from tax planning to dispute resolution.

Personalized Solutions: Ensure the firm provides personalized legal services based on your unique needs.

By carefully evaluating these factors, you can find the right tax law firm in delhi to meet your legal needs.

#TaxLawFirm#TaxLawFirmInDelhi#LeadingTaxLawFirms#TaxPlanning#AayatiLegal#CorporateTaxation#TaxDisputes#GST#LegalExperts

1 note

·

View note