#TAX REFORM

Explore tagged Tumblr posts

Text

Things the Biden-Harris Administration Did This Week #28

July 19-26 2024

The EPA announced the award of $4.3 billion in Climate Pollution Reduction Grants. The grants support community-driven solutions to fight climate change, and accelerate America’s clean energy transition. The grants will go to 25 projects across 30 states, and one tribal community. When combined the projects will reduce greenhouse gas pollution by as much as 971 million metric tons of CO2, roughly the output of 5 million American homes over 25 years. Major projects include $396 million for Pennsylvania’s Department of Environmental Protection as it tries to curb greenhouse gas emissions from industrial production, and $500 million for transportation and freight decarbonization at the ports of Los Angeles and Long Beach.

The Biden-Harris Administration announced a plan to phase out the federal government's use of single use plastics. The plan calls for the federal government to stop using single use plastics in food service operations, events, and packaging by 2027, and from all federal operations by 2035. The US government is the single largest employer in the country and the world’s largest purchaser of goods and services. Its move away from plastics will redefine the global market.

The White House hosted a summit on super pollutants with the goals of better measuring them and dramatically reducing them. Roughly half of today's climate change is caused by so called super pollutants, methane, hydrofluorocarbons (HFCs), and nitrous oxide (N2O). Public-private partnerships between NOAA and United Airlines, The State Department and NASA, and the non-profit Carbon Mapper Coalition will all help collect important data on these pollutants. While private firms announced with the White House plans that by early next year will reduce overall U.S. industrial emissions of nitrous oxide by over 50% from 2020 numbers. The summit also highlighted the EPA's new rule to reduce methane from oil and gas by 80%.

The EPA announced $325 million in grants for climate justice. The Community Change Grants Program, powered by President Biden's Inflation Reduction Act will ultimately bring $2 billion dollars to disadvantaged communities and help them combat climate change. Some of the projects funded in this first round of grant were: $20 million for Midwest Tribal Energy Resources Association, which will help weatherize and energy efficiency upgrade homes for 35 tribes in Michigan, Minnesota, and Wisconsin, $14 million to install onsite wastewater treatment systems throughout 17 Black Belt counties in Alabama, and $14 million to urban forestry, expanding tree canopy in Philadelphia and Pittsburgh.

The Department of Interior approved 3 new solar projects on public land. The 3 projects, two in Nevada and one in Arizona, once finished could generate enough to power 2 million homes. This comes on top of DoI already having beaten its goal of 25 gigawatts of clean energy projects by the end of 2025, in April 2024. This is all part of President Biden’s goal of creating a carbon pollution-free power sector by 2035.

Treasury Secretary Janet Yellen pledged $667 million to global Pandemic Fund. The fund set up in 2022 seeks to support Pandemic prevention, and readiness in low income nations who can't do it on their own. At the G20 meeting Yellen pushed other nations of the 20 largest economies to double their pledges to the $2 billion dollar fund. Yellen highlighted the importance of the fund by saying "President Biden and I believe that a fully-resourced Pandemic Fund will enable us to better prevent, prepare for, and respond to pandemics – protecting Americans and people around the world from the devastating human and economic costs of infectious disease threats,"

The Departments of the Interior and Commerce today announced a $240 million investment in tribal fisheries in the Pacific Northwest. This is in line with an Executive Order President Biden signed in 2023 during the White House Tribal Nations Summit to mpower Tribal sovereignty and self-determination. An initial $54 million for hatchery maintenance and modernization will be made available for 27 tribes in Alaska, Washington, Oregon, and Idaho. The rest will be invested in longer term fishery projects in the coming years.

The IRS announced that thanks to funding from President Biden's Inflation Reduction Act, it'll be able to digitize much of its operations. This means tax payers will be able to retrieve all their tax related information from one source, including Wage & Income, Account, Record of Account, and Return transcripts, using on-line Individual Online Account.

The IRS also announced that New Jersey will be joining the direct file program in 2025. The direct file program ran as a pilot in 12 states in 2024, allowing tax-payers in those states to file simple tax returns using a free online filing tool directly with the IRS. In 2024 140,000 Americans were able to file this way, they collectively saved $5.6 million in tax preparation fees, claiming $90 million in returns. The average American spends $270 and 13 hours filing their taxes. More than a million people in New Jersey alone will qualify for direct file next year. Oregon opted to join last month. Republicans in Congress lead by Congressmen Adrian Smith of Nebraska and Chuck Edwards of North Carolina have put forward legislation to do away with direct file.

Bonus: American law enforcement arrested co-founder of the Sinaloa Cartel, Ismael "El Mayo" Zambada. El Mayo co-founded the cartel in the 1980s along side Joaquín "El Chapo" Guzmán. Since El Chapo's incarceration in the United States in 2019, El Mayo has been sole head of the Sinaloa Cartel. Authorities also arrested El Chapo's son, Joaquin Guzman Lopez. The Sinaloa Cartel has been a major player in the cross border drug trade, and has often used extreme violence to further their aims.

#Joe Biden#Thanks Biden#kamala harris#us politics#american politics#politics#climate change#climate crisis#climate action#tribal rights#IRS#taxes#tax reform#El Chapo

773 notes

·

View notes

Text

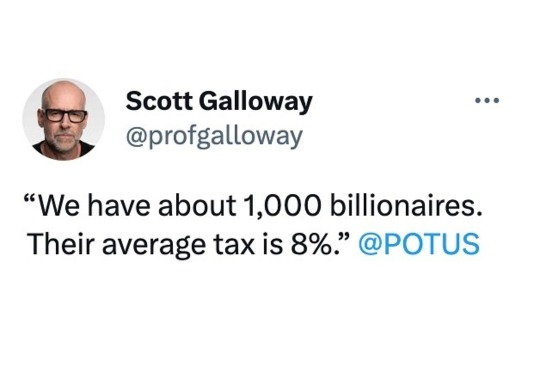

Some pay 0%.

The system is rigged. Low tax rates on the uber- wealthy created our debts and deficits.

Billionaire welfare is the most inefficient use of tax dollars. It's morally disgraceful.

The only solution is raising their tax rates and eliminating their legislated advantages.

293 notes

·

View notes

Text

An open letter to the U.S. Congress

Co-sponsor the American Stability Act to end income inequality!

624 so far! Help us get to 1,000 signers!

As your constituent, I am urging you to co-sponsor the American Stability Act (ASA). The American Stability Act is a bold, elegant solution to the threat posed by destabilizing levels of inequality.

The American Stability Act does the following:

-ELIMINATES FEDERAL TAXES for any taxpayer making less than the median cost of living for a single adult with no children (slightly above $40,000 a year);

-SHIFTS the responsibility for these revenues onto taxpayers making more than $1 million a year;

-REPLACES the ‘minimum’ wage with a new “Stability Wage,” which is set to the median cost of living in the US for a single adult with no children, and then indexes it to make that principle permanent.

We need bold, innovative reform. Lawmakers like you must structure a more stable, prosperous economy that will deliver the results we need for a strong nation.

▶ Created on October 28 by Jess Craven · 623 signers in the past 7 days

📱 Text SIGN PVBLPU to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PVBLPU#tax the rich#income inequality#American Stability Act#economic reform#fair taxation#progressive tax policy#Congress#social justice#eliminate poverty#median cost of living#tax reform#federal taxes#stability wage#minimum wage#living wage#wealth inequality#end income inequality#economic stability#prosperity#economic justice#wealth redistribution#economic fairness#bold reform#innovative policies#working-class rights#fiscal policy#sign the petition#constituent action

2 notes

·

View notes

Text

Speech Governor Walz gave at the PA State Capitol!

~BR~

#josh shapiro#kamala harris#tim walz#harris walz 2024 campaigning#policy#2024 presidential election#legislation#united states#hq#politics#democracy#national convention#democratic party#pennsylvania#harrisburg#gettysburg#Tax policy#education#affordability#middle class#tax reform#Tax and Jobs Act

2 notes

·

View notes

Text

Tax code idea.

Abolish 100% of current code.

Replace it with:

20% transaction tax at point of sale for all goods and services.

A tax exemption will be created for transactions using a government issued benefits card to pay for goods or services. For example a purchase is tax exempt if made using a card containing government issued benefits such as food stamps, SSI, SSDI, Social Security, cash assistance for families with dependant children, and/or any other spendable government assistance or entitlement. This does not include government paychecks or salaries issued via a debit card.

Make a second tax category for luxury goods and services. Define luxury goods and services as any good or service that is priced at 3x the average price for the majority of similar goods and prices of the same type. For example if the average price for a wrist watch is $30 before tax a wrist watch costing $100 before tax would also be subjected to a 20% luxury item tax in addition to the original 20% transaction tax. It would cost $140 at the register/checkout.

A third tax category for super luxury items would also be created. A super luxury tax of 40% would be assessed to any good or service that cost 6x or more what the average price of a similar good or service of the same type. If wrist watches have an average price of $30 and you buy a wrist watch that costs $200 or more you'll pay an extra 40% tax in addition to the 20% transaction tax. So a $200 before tax wrist watch would cost $320 at the register/checkout.

These would be the only taxes a non business owning citizen will ever pay. No recurring taxes on items like land, homes, and cars can ever be implemented. Taxes on items themselves, like cigarettes, gasoline, and alcohol, can never be implemented. Citizens who do not own a busniess will never pay any tax except the transaction tax of 20% plus any luxury or super luxury tax applicable.

Business taxes.

Businesses must collect a 20% transaction tax for every transaction, that is not made with a benefits card, in which they are participating as the recipient of currency from a customer or client.

Transaction, luxury, and super luxury taxes must be remitted every quarter by the 15th day of the quarter following the quarter in which they are collected.

Micro businesses will be exempt from paying a business tax.

A micro business is any business that does not profit at least 5x the average annual income of a family of four.

Independent contractors and the self employed must obtain a business license and pay taxes according to their business classification based on the amount profit they generate.

A small business tax of 20% will be created for businesses that profit an amount equal to or greater than 5 times the average income of a family of four.

A large business tax of 30% will also be created for businesses that profit 100 times or more the average income for a family of four.

A commercial business tax of 40% will be created for businesses that profit 500x or more the average income of a family of four.

A super business tax of 60% will be created for businesses that profit 1000x or more the average income of a family of four.

A mega business tax of 75% will be created for businesses that profit 10000x the average income for a family of four.

Business taxes must be remitted at the same time as transaction taxes and must be based on the transactions for which those taxes are being submitted.

Profit is defined as all money generated through the sale of goods or services minus the cost of people employed by the hour and the typical costs of doing business such as utilities, rent for a brick and mortar location, raw materials necessary to manufacture, perform or create a good or service, or the cost of goods intended to be resold as is.

The earnings of investors, salaried employees, and executives do not count as cost of doing business and must be paid from a business's profit.

A tax refund will only be issued to businesses and only in the case of an overpayment of transaction, luxury, or super luxury taxes because of accidental faulty math or customer returns of purchased goods.

This is how to reset the economy and make it BOOM again. This is how you reduce poverty. This is how you reduce crime. This is how you increase wages. This is how you reduce prices. This is how you win.

#taxplan #taxreform #replacethetaxcode #economy #poverty #crime

2 notes

·

View notes

Text

Britain’s great tax con

“Labour will soon face an inescapable choice. In order to spend money in government, the party will need to raise it. There is a very good way to do that. It is to shift the tax burden away from labour and on to capital, away from work and on to wealth ...

“Starmer and Reeves are following an electoral script written for a different era. Britain has been transformed since Labour won in 1997. One part of the country has lived through an asset boom. The other is living on wages that have not risen in real terms for 15 years, since before the 2008 financial crash. For those with assets, the crash is a distant memory. London house prices have risen inexorably since 2010, by 31 per cent after inflation. The FTSE 100 is 58 per cent higher after dividends. Real average weekly pay is, meanwhile, no higher today than in July 2006. Those who live in Asset Britain have no idea what Austerity Britain is like.

“Labour is ignoring wealth at its peril. Reeves is rejecting the most consequential tax reforms open to her, despite polling that suggests each reform she has ruled out would be highly popular. They are also vital. Britain’s growth rate is in a multi-decade decline, while wealth inequality has become entrenched. It hasn’t fallen in the 17 years the Office for National Statistics has recorded it. Every year you can expect £4 in every £10 of new wealth to go to the wealthiest 10 per cent, while £1 in £10 is shared by the bottom half. In stagnant societies, capital reigns ...

“There is one more major reform Labour is refusing to adopt: a tax on the very richest ... The only way to raise money from the very richest is to charge a wealth tax, as Labour once won an election promising to do. A tax of 1 per cent on wealth over £10m would fall on around 20,000 people – the 0.1 per cent. In the 1970s Healey thought the revenues on offer didn’t justify the cost. Advani’s research has, however, shown that a one-off version of the tax could today raise £11bn. He estimates capital flight would be rare, as it was for non-doms. And evasion is less possible than people think. The wealth of the very richest is boundless yet bound in by Britain. Land may be leased out but it cannot be moved. Estates can always be taxed. It is a political choice.

“Labour has never fought against capitalism. It once sought to alleviate its inequities through control of the commanding heights of industry. Now it risks governing without a creed. Yet one is on offer. In Britain the rules of the tax game have been stacked against working people. The question for Labour is simple and deafening: are you going to fix that or not?”

#tax reform#wealth tax#inheritance tax#capital gains tax#taxes#assets#income#keir starmer#rachel reeves#labour party#labour#conservative party#conservatives#inequality#asset taxes#capitalism#economy#politics#uk

2 notes

·

View notes

Text

I wish the release of the former president's tax returns had triggered a conversation about the need for tax reform. Our tax code is inefficient—no matter how you define this term—because it is complicated. It is conducive to cheating, unfairness, and economic distortions because it is complicated. Making all these issues go away means simplifying the tax code.

For that, legislators will have to acknowledge that there are too many loopholes, deductions, and exemptions. That issue is due in part to the fact that Uncle Sam often taxes the wrong income, which is an even bigger problem. These discussions won't happen if all partisans are focusing on is whether a particular deduction should be allowed while another shouldn't, or whether people they don't like should be taxed even though they made no money.

2 notes

·

View notes

Text

Trickle-down onto the slag heap of history!

#robber barons#anti-trust act#tax reform#progressive taxation#vote blue no matter who#roe roe roe your vote#vote democratic#vote democrat#vote blue#please vote#go vote#get out the vote#register to vote#vote 2024#corporatism#oligarchy

68K notes

·

View notes

Text

#Tags:Capital Gains Tax#Corporate Tax Loopholes#Criminal Justice Reform#Economic Fairness#Estate Taxes#facts#Family Separation#Free Speech#Gun Rights#Healthcare Laws#Immigration Reform#Legal Reform#life#Mass Incarceration#Pathways to Citizenship#Podcast#Second Amendment#serious#Social Media Censorship#straight forward#Tax Reform#Three-Strikes Laws#truth#upfront#Wealth Inequality#website

0 notes

Text

Speech Governor Walz gave at the Illinois State Capitol!

~BR~

#kamala harris#tim walz#harris walz 2024#campaigning#policy#2024 presidential election#legislation#united states#hq#politics#democracy#Illinois#springfield#peoria#chasten buttigieg#liz cheney#down ballot races#ballot initiatives#property tax#tax reform#poll workers#fertility#ivf treatment#modern family#Eric Sorensen#canvasing#door knocking

1 note

·

View note

Text

Honduras' Tax Reform: A Progressive Model for the Global South

In a significant endorsement, 85 progressive economists recently expressed their support for a proposed tax reform in Honduras. They argue that this reform could serve as a blueprint for other countries in the Global South aiming to address economic inequality and prevent tax evasion. The reform’s primary focus is on tightening tax laws for the wealthy and large corporations, thereby curbing the…

0 notes

Text

Understanding Dividend Distribution Tax (DDT): How Its Abolition Revolutionizes the Indian Economy: Budget 2024

Introduction The concept of dividends and the Dividend Distribution Tax (DDT) underwent significant changes in India with the abolition of DDT in the 2020-21 Budget. Dividends are payments made by companies to shareholders from their profits. DDT, introduced in the Finance Act of 1997, was a tax levied on these dividends distributed by domestic companies, irrespective of their income tax…

View On WordPress

#investor sentiment#global taxation norms#Dividend Distribution Tax#DDT abolition#foreign direct investment#FDI#tax policy#corporate profits#tax reform#Finance Act 1997#tax simplification#dividend policies#government revenue#reinvestment#Budget 2020-21#market competitiveness#shareholder taxation#Nirmala Sitharaman#Indian Economy#economic growth#tax compliance#tax administration

0 notes

Text

US Tax Day & The IRS - Myth vs Fact

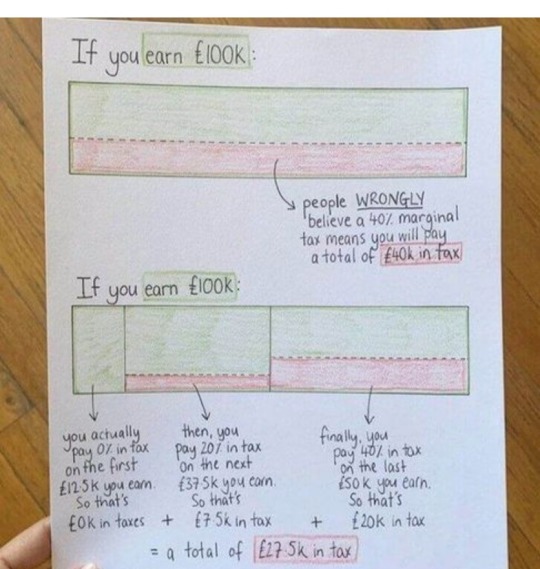

1) Myth - "If you get a small raise that bumps you into a new tax bracket, you'll end up taking home less money."

Fact - We have marginal tax rates, which means you only pay the new higher tax rate on the new part of salary.

2) Myth - "If I make a mistake on my taxes, I'll go to jail."

Fact - If you make a mistake on your taxes, the IRS will likely contact you with a bill to pay the remaining balance, and possibly a fee.

(I know someone who last year had 3 W-2s and only reported 2 of them. The IRS noticed, my friend said oops my bad and paid the remainder. There was no legal consequence, even for a 5 figure mistake.)

3) Myth - "The IRS is out to get ordinary Americans, and funding them more means more annoyance and harassment for me."

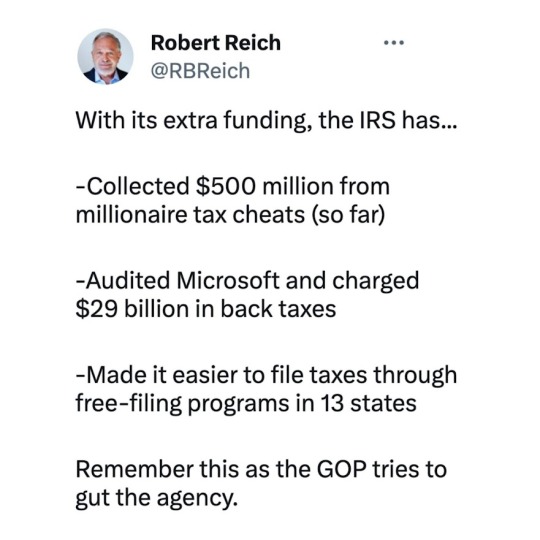

Fact - With the IRS' latest increase in funding, they are:

--improving customer experience, from offering a free filing website to reducing phone wait times

--sending refunds and other communications faster, as staff and modern-day computers are added to their operation

--catching unpaid taxes from millionaires and businesses, so that everyone pays their fair share

4) Myth - "Tax season is just one of those things that modern-day developed nations have to deal with."

Fact - Requiring each citizen to file their own taxes is a uniquely American / late-stage capitalism hurdle. The government already knows how much we owe, but TurboTax and others heavily lobby to keep their business as the middle man. In other countries, you just receive a statement from the government that is your tax owed or your refund, and that's all you have to do.

#taxes#us taxes#tax the rich#tax day#april 15#irs#tax season#irs free file#internal revenue service#tax refund#tax reform#turbotax#fuck turbotax#tax rates

0 notes

Text

The Impact of Tax Reform on Small Businesses: What Owners Need to Know

In the ever-evolving landscape of business, small enterprises are often at the forefront of economic shifts, and tax reforms are no exception. The recent changes in tax regulations have left many small business owners seeking clarity on how these adjustments will affect their operations. In this article, we delve into the impact of tax reform on small businesses, providing essential insights for owners to navigate these changes successfully.

Overview of Tax Reform: The Tax Cuts and Jobs Act (TCJA) brought about significant changes in the tax code, impacting businesses of all sizes. However, the implications for small businesses can be particularly nuanced. Understanding the key provisions of the tax reform is essential for owners looking to stay compliant and optimize their financial strategies.

Changes in Business Structure: One of the critical considerations for small business owners is the impact of tax reform on the choice of business structure. The new tax laws have altered the landscape, making it crucial to reassess whether a sole proprietorship, partnership, S corporation, or C corporation is the most advantageous for your business.

Qualified Business Income Deduction: The TCJA introduced the Qualified Business Income (QBI) deduction, providing eligible businesses with a significant tax break. Small business owners should explore whether they qualify for this deduction, as it can have a substantial impact on taxable income.

Depreciation Rules: Tax reform also brought changes to the rules governing depreciation, allowing businesses to recover the cost of certain capital investments more quickly. Small businesses can take advantage of these changes to improve cash flow and reinvest in their operations.

Employee Benefits and Credits: The tax reform has modified several employee-related provisions, including changes to retirement plan contributions and family leave credits. Small business owners should familiarize themselves with these adjustments to maximize benefits for both the business and its employees.

State-level Implications: While federal tax reform garners significant attention, small business owners must not overlook state-level implications. State tax codes may vary, and understanding how these changes interact with federal regulations is crucial for accurate financial planning.

Keeping Pace with Updates: Tax laws are subject to change, and staying informed is key to successfully navigating the evolving landscape. Small business owners should establish a reliable system for tracking updates, consult with tax professionals regularly, and adjust their strategies accordingly.

Conclusion:

Adapting to the impact of tax reform is a crucial aspect of running a successful small business. By staying informed on changes in tax laws, reassessing business structures, and leveraging available deductions, owners can navigate these reforms strategically. Seeking professional advice and staying proactive will position small businesses to thrive in the dynamic environment shaped by ongoing tax developments. With the right guidance, small business tax solutions can be tailored to ensure not only compliance but also optimal financial outcomes for sustained success.

0 notes

Text

Saturday, October 12, 2024 - Tim Walz

Today the Governor joined by Former US Rep Liz Cheney and Chasten Buttigieg—all rocking Cedar Rapid's Kennedy High School gear—hit the ground running with a door knocking event in the capitol of Illinois.

Springfield, IL (Event #1) Event Location: Iles Park and Harvard Park Neighborhoods Event Type: Door Knocking Event Time: 8:00 - 11:00 CT *The campaign knocked on doors throughout the morning and left pamphlets in doors that were unanswered. The conversations that were being had were about the Harris-Walz ticket and the ballot initiatives.

Springfield, IL (Event #2) Event Location: Illinois State Capitol Event Type: Campaign Announcement Event Time: 12:30 - 14:00 CT *Full-text of this speech will be released shortly.

Peoria, IL Event Location: Sugar Wood-Fired Bistro Event Type: Meet and Greet Event Time: 17:00 - 20:00 CT *The campaign invited registered democrats and republicans from the city of Peoria who did not vote in 2020 or 2022 to come join us for a meet and greet event where they could get to know the candidate as well as mingle with campaign surrogates. Candidate for Illinois Congressional District 17, Eric Sorensen also joined us for this event.

~BR~

#kamala harris#tim walz#harris walz 2024#campaigning#policy#2024 presidential election#legislation#united states#hq#politics#democracy#Illinois#springfield#peoria#chasten buttigieg#liz cheney#down ballot races#ballot initiatives#property tax#tax reform#poll workers#fertility#ivf treatment#modern family#Eric Sorensen#canvasing#door knocking

0 notes