#Standby LC

Explore tagged Tumblr posts

Text

Letter of credit (LC) & Standby Letter of credit (SBLC) are both the most popular, & reliable trade finance instruments used by global importers & exporters in international trade to reduce the risk of payment failure & to ensure financial stability.

A Letter of credit is a primary method of payment, while Standby LC is used when there’s a risk of buyer’s non-performance during a transaction. So, what is the difference between an LC and SBLC? Let’s check out:

Letter of Credit Vs Standby Letter of Credit

Both the letter of credit (LC), and the Standby letter of credit (SBLC) are payment guarantee instruments used in international trade. In this article, we’ve discussed the key differences and usage between LC and SBLC. Take a look:

What is a Letter of Credit?

Under a letter of credit service, the issuing bank guarantees an on-time & full-fledged payment to an exporter on behalf of its client ie. importer for the ordered goods or services. But in the event, if the importer defaults in payment or is unable to fulfill the terms & conditions of the LC contract, then, the issuing bank will compensate the beneficiary ie. the exporter.

Read more: https://www.axioscreditbank.com/blogs/key-differences-between-a-letter-of-credit-standby-lc

#letter of credit service#Standby LC#letter of credit#Differences#trade finance instruments#Standby LC agreement

2 notes

·

View notes

Text

Secure Your International Trade _ Letters of Credit_ Express Trade Finance _ Dubai

#finance#letters of credit#sblc monetization#standby letters of credit#lc issuers#financial instruments

1 note

·

View note

Text

AIO Business and Startup Support- Companies Formation & Flag Registration and Securing Fund

AIO Legal Services is currently offering financial support and offshore registration assessments for businesses and startups around the world. AIO Legal Services as a Qualified Intermediary (QI) at the Marshall Islands Registry, has the ability to provide your business with a range of services, including: • Company formation; • Flag registration; • Due diligence preparation and…

View On WordPress

#AIO LawPartners#AIO Legal Services#Asset protection#Business law#Company formation#compliance#Due diligence preparation and documentation#Finance#Flag registration#insurance#Letters of Credits (LC)#maritime law#Marshall Islands registry#Offshore Banking Services#Performance bonds#risk management#Shipping#Standby Letters of Credits (SBLC)#Tax planning

0 notes

Text

Cancelled Missions: Skylab Rescue Mission (SL-R)

Mission patch for rescue mission for SL-3

Spacecraft: CSM-119

Launch Vehicle: Saturn IB AS-208, later AS-209

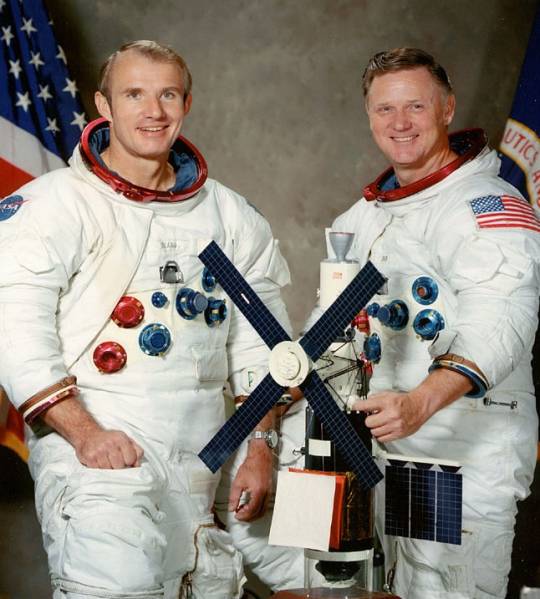

Commander: Vance D. Brand

Command Module Pilot: Don L. Lind

Intended launch date: September 1973, (on standby from August 1973 - February 1974)

Skylab rescue mission crewmen Vance Brand (left) and Don Lind.

"Influenced by the stranded Skylab crew portrayed in the book and movie 'Marooned', NASA provided a crew rescue capability for the only time in its history." Prepared for launch during Skylab 3."

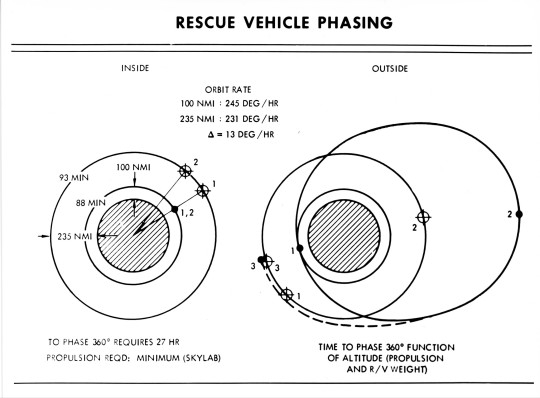

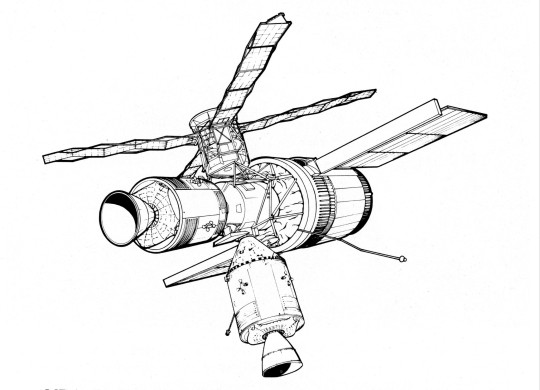

"Skylab rescue vehicle phasing - NAR Space Division drawing illustrates phasing of 5-seater Skylab rescue vehicle for a Skylab mission."

Date: April 5, 1971

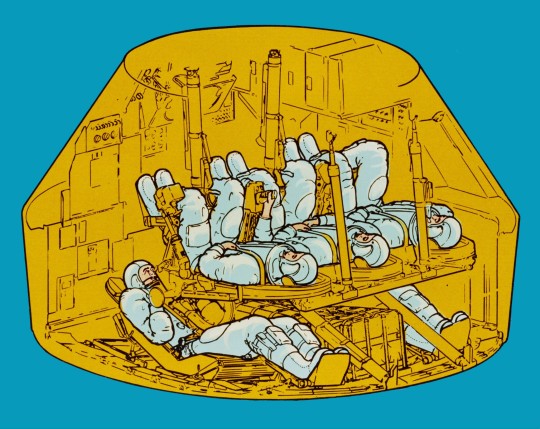

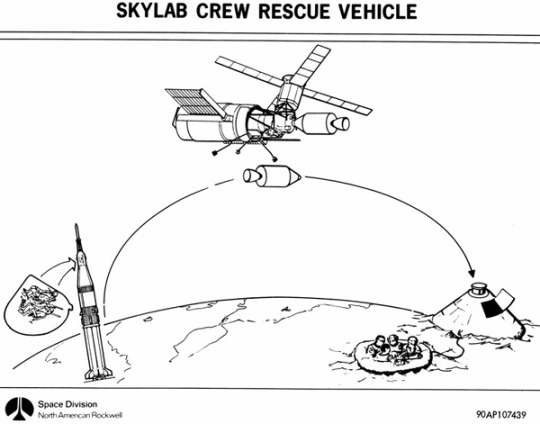

"A kit was developed to fit out an Apollo command module with a total of five crew couches. In the event a Skylab crew developed trouble with its Apollo CSM return craft, a rescue CSM would be prepared and launched to rendezvous with the station. It would dock with the spare second side docking port of the Skylab docking module."

- information from Astronautix.com: link

"The Apollo Command Module as modified to rescue stranded crews for the Skylab program. Two crew + three rescuees packed like sardines...."

"Skylab 3 astronauts Alan Bean and Jack Lousma helped design the "field modification kit" to use a standard CSM for rescue, and would have flown the CSM for their mission to rescue Skylab 2 if necessary. The standard Skylab Command Module accommodated a crew of three with storage lockers on the aft bulkhead for resupply of experiment film and other equipment, as well as the return of exposed film, data tapes and experiment samples. To convert the standard CSM to a rescue vehicle, the storage lockers were removed and replaced with two crew couches to seat a total of five crewmen."

Posted on Flickr by Mike Acs. NASA ID: 108-KSC-70P-69

"Soon after Skylab 3's launch the crew's CSM developed a problem with Quad B, one of its four reaction control system thrusters. On August 2, 1973, six days later, a snowstorm-like effect outside the station startled the crew during breakfast. What appeared to be 'a real blizzard' was fuel leaking from Quad D, opposite from Quad B. The malfunctions left two available quads, and while the spacecraft could operate with just one, the leaks posed a possible risk to other systems. The fuel for all quads and the main service propulsion system (SPS) engine were from the same batch; if the SPS fuel was contaminated, the CSM might not be able to deorbit.

source

NASA considered bringing the crew home immediately, but because the astronauts were safe on the station with ample supplies and because plans for a rescue flight existed, the mission continued while the Saturn IB rocket AS-208 with CSM-119 was assembled in the Vehicle Assembly Building at Launch Complex 39 for possible use. It was at one point rolled out to LC-39B.

Illustration of the rescue Apollo spacecraft preparing to dock at Skylab’s lateral port. source

NASA announced on August 4 that Skylab 3 and Skylab 4 backup crewmen Vance Brand and Don Lind would fly any rescue mission; they had immediately begun training for the flight once the second quad had failed on August 2. After engineers found that the leaks would not disable the spacecraft, the two men used simulators to test reentry using two quads. If ground personnel worked 24 hours a day and skipped some tests, the mission could launch on September 10, and would last no more than five days. The astronauts would attempt to prepare Skylab for further use but returning experimental data and diagnosing the cause of the problem were more important, with Lind choosing what would be brought back. Human urine and feces samples and Apollo Telescope Mount and other film were the priorities. Although Skylab had two docking ports the primary one would be used if possible, jettisoning the Skylab crew's CSM if necessary.

Posted on Flickr by Drew Granston: link

While many within NASA believed that the rescue mission would occur, within hours of the failure of the second quad the agency canceled the rescue mission. Beyond NASA's conclusion that the failed quads would not disable the Skylab 3 CSM and the SPS fuel was uncontaminated, Brand and Lind had already shown during their training as backup Skylab crewmen that a reentry with failed quads was safe. They also devised a method to deorbit with the command module's attitude control system. Later joking that they were 'very efficient but perfectly stupid, because we have literally worked ourselves out of the mission', Brand and Lind continued to train for a rescue mission, as well as for their backup roles, but the Skylab 3 crew was able to complete its full 59-day mission on the station and safely return to Earth using the two functional RCS thruster quads, using the SPS engine once instead of twice as precaution."

- Information from Wikipedia: link

Posted on Flickr by Ed Dempsey: link

Saturn IB SA-208 was used for Skylab 4 and SA-209 was assigned to the standby rescue mission. At one point, CSM-119/SA-209 was slated for the Skylab 5 mission but it was cancelled when SL-4 was extended and completed all of it objectives.

Mission patch for rescue mission for SL-4

Later, CSM-119/SA-209 was the backup launch vehicle for Apollo-Soyuz Test Project mission and standby rescue vehicle. After the Apollo program ended, the surplus rocket and spacecraft were displayed at the Kennedy Space Center, Florida.

NASA ID: 71-H-662, S73-31922

source, source

#Skylab Rescue#SL-R#Apollo CSM Block II#CSM-119#Saturn IB#SA-208#SA-209#Rocket#NASA#Apollo Program#Apollo Applications Program#Cancelled#Cancelled Mission#September#1973#my post

91 notes

·

View notes

Text

Thinking of Noctis is Tenebrae.

Specially, when he was in Tenebrae.

Noctis was born on August 30th, and was eight years old during his time in Tenebrae.

Lunafreya, who was born on September 4th, was twelve.

Considering the main game generally takes place over the course of a year (I think? Don’t quote me on this, all I know canonically is that it starts May), in the year of M.E 756 and he visited twelve years prior:

M.E 744.

I’d guess very late winter, early spring. Possibly late January through February - maybe to early or mid March, at the latest.

Why so early in the year?

In the Kingsglaive movie, the prologue when we see the fall of Tenebrae and Queen Sylva’s murder, several characters are wearing clothes that seem suited to chilly weather - namely Ravus, Lunafreya, and Noctis.

Ravus and Noctis are, respectively, wearing a padded jacket or padded vest. The puffy sort you wear when it’s getting cold out, but not big-puffy full blown winter coats.

Also, Lunafreya is wearing a shawl or capelet with a hood, and it looks like it has a fur collar(?). Her dress looks, at least to me, like a thick fabric - wool, maybe. She’s not wearing stocking or leggings (or maybe she is and I didn’t notice), so again, it’s not winter-levels of cold.

There’s no snow either, which means either it’s before winter has fallen or afterwards - and I am inclined to believe the latter.

(That’s dependent on the general climate of Tenebrae, though)

We don’t know when Noctis was attacked, except that it was after he turned eight years old - in other words, some point after august. Possibly early September 743 at the earliest, and March - July 744 at the latest, since he was out catching fireflies, which usually appear most often in spring and summer.

We know he was comatose for a period of time following the attack, but not how long.

He possibly had been afflicted by the starscourge in canon (I don’t know if this was ever confirmed).

We also know he was paralyzed, or his body was still recovering from his injuries to the point where he was still wheelchair bound in Tenebrae.

My idea is this:

Noctis is attacked some time in late M.E 743. He is rushed into emergency surgery in an attempt to save his life, no doubt after Regis had used his magic to keep the Prince alive on the way to the nearest hospital (he’d probably be transferred to the Citadel later? He woke up in the citadel in Brotherhood, at least).

Noctis is possibly comatose for a month, maybe two. As a result of lack of movement, his muscles - on top of the damage done to back and legs - begin to atrophy.

(The symptoms of starscourge infection are stymied, because starscourge adapts differently to the body of a Lucis Caelum, and makes Noct effectively asymptomatic for a time).

When he wakes up, and probably even before that, immediate therapy begins. When possible, rehabilitation in regards to spinal cord injuries begin as soon as possible, I believed.

For a time, I think it would be…not okay, not happy, but workable. Regis would be there every step of the way, and if not him - a team of nurses and doctors ever on standby.

But at some point during his rehabilitation, from the Acute and Sub-Acute phases which will stretch over into the new year, which can generally (and I mean this broadly, every spinal injury and situation is different) take around six to eight months, he begins to show signs of the starscourge.

Regis can’t do anything to help with the appearance of the scourge, and then the realization that it must have been there for a while, that this was why Noctis’ healing was so slow - even, and especially, compared to a normal person.

The crystal, the LC magic, would have been straining to heal him - but it was almost sluggish, unfocused, as it coursed through Noctis’ body.

Regis could feed Noctis magic, take the burden of how it pulled at one’s lifeforce so that his son already so close to death did not have to.

He couldn’t take away the scourge which corrupted his son’s magic, which was just as much as the family’s magic eating away at his son’s life. The doctor’s could give estimations and exams and exercises on how to help Noctis walk again, if he ever could, and even an inability to do so was not an impossible fact - not in the long history of the bloodline -

But the starscourge?

Sooner or later, it was fatal. Regis knew of no known member in the bloodline who had gotten it - most who died to daemons died outright in battle, or as a result of injuries, long before the scourge could set in and take them - but no one had ever survived the scourge.

And only one bloodline could do anything against it.

The House of Fleuret, The Oracle.

And that meant heading to Tenebrae. Even if it was an autonomous ‘kingdom’, Tenebrae had long since been annexed by Niflheim - just like Accordo.

To bring Noctis there would be like to deliver all of Lucis into the jaws of a snarling best.

If it had simply been Noctis’ back and legs maybe, maybe Regis wouldn’t have done it. It’s a big maybe, considering how much he loves his son, but maybe.

Starscourge, though?

Hell no, it’s off to Tenebrae. They have to fucking go. It doesn’t matter how dangerous it is, to go through imperial Territory. Noctis might die either way.

A route to reach Tenebrae has to be made, means for the two of them to leave the wall unknown, then travel to Tenebrae still unknown, also having Lucis ruled well - all the while, trying to keep Noctis as stable as possible? Things like that take time.

So, they arrive in Tenebrae some point in early 744. My personal headcanon is that the two are there for maybe a few months, around March, and then Niflheim strikes and everything subsequently goes to hell. It has to be before his ninth birthday.

2 notes

·

View notes

Text

i have 2 relics on standby for my blade and i just need to wait for his rerun to get his lc to bring his crit rate back up to 70% 😩

#theyre hp% boots & rope#boots have crit dmg 24.6%#and rope only has crit% 5.5% but also 4 spd#I JUST NEED HIS LIGHT CONE AND HIS CRIT% WILL BE BACK UP TO 77% AUGHHHH#and THEN he'll be done for real#all i do om this account is complain abt my blade build#im never forgiving that hp rope with crit subs that didnt roll crit subs once#that was so fucked up

2 notes

·

View notes

Text

Green Food Cabbage Vegetables Testing

The detection methods of green food cabbage vegetables mainly include the following aspects:

1. Heavy metal content detection

Heavy metal detection is one of the important items for green food cabbage vegetable detection, mainly covering lead, cadmium, mercury, and other components to ensure that vegetables meet health standards. Common detection methods include:

Atomic absorption spectrometry: quantitative element analysis is performed by using the absorption of the characteristic spectral lines of the ground state atomic vapor of the element being tested. This method has the advantages of high sensitivity, good selectivity, and simple operation.

Inductively coupled plasma mass spectrometry: Using an inductively coupled plasma torch as the excitation light source, the spectrum emitted by the excited plasma is used for quantitative element analysis. This method can detect multiple elements at the same time, with low detection limits and high accuracy.

2. Pesticide residue detection

Pesticide residue detection is the key to ensuring that cabbage vegetables are not used in excessive or illegal pesticides during cultivation. Common detection methods include:

Gas chromatography: Separation is performed by using the different adsorption or solubility of different substances in the gas phase and the difference in their distribution coefficients between the stationary phase and the mobile phase. This method is suitable for detecting organophosphorus, organochlorine, and other pesticide residues.

Liquid chromatography: Separation is carried out by using the different distribution capabilities of each component in the mixture between two phases. This method is suitable for detecting pesticide residues such as carbamates, carbendazim, and avermectin. In addition, liquid chromatography-mass spectrometry (LC-MSMS) can also be used for the detection of pesticide residues, with higher sensitivity and selectivity.

III. Microbial index detection

Microbial index detection is an important link in ensuring the sanitation and safety of green food cabbage vegetables. Common detection methods include:

Culture identification method: The sample is inoculated on a specific culture medium and the growth of microorganisms is observed by cultivation for identification. This method can intuitively reflect the microbial contamination of the sample.

PCR technology: Detection is carried out by amplifying specific gene fragments of microorganisms. This method has the advantages of rapidity, accuracy, and high sensitivity, and is suitable for detecting harmful microorganisms such as Escherichia coli and Salmonella.

IV. Nutritional component detection

Nutrient component detection is the key to ensuring the nutritional value of green food cabbage vegetables. Common detection methods include:

High performance liquid chromatography: used to analyze nutrients such as vitamins and minerals. This method has the advantages of high separation efficiency, fast analysis speed, high sensitivity, and automated operation.

Other methods: such as drying method for moisture determination, Kjeldahl nitrogen determination method for protein content determination, Soxhlet extraction method for fat determination, etc. These methods can comprehensively and accurately reflect the nutritional content of cabbage vegetables.

V. Sample collection and preparation

Before conducting the above tests, sample collection and preparation are also required. Cabbage vegetable samples should be randomly selected from suppliers and transported to the laboratory at low temperature. Samples need to be cut, crushed and stored for standby during preparation. These steps are essential to ensure the accuracy and reliability of the test results.

In summary, the detection methods of green food cabbage vegetables cover multiple aspects such as heavy metal content, pesticide residues, microbial indicators and nutritional components. These detection methods together constitute a complete system for quality control of green food cabbage vegetables, providing strong protection for consumer health and market regulations.

0 notes

Text

A Comprehensive Overview on Types of Letters of Credit

Introduction: A Letter of Credit (LC) is an essential financial instrument used to secure payment and ensure that transactions are carried out smoothly. Understanding the different types of Letters of Credit and their specific applications can help businesses choose the most suitable type for their transactions. This in-depth article explores the various types of Letters of Credit, their characteristics, uses, and benefits.

What is a Letter of Credit?

A letter of credit is a document that a bank or other financial organisation issues that assures a seller (beneficiary) that they will be paid when certain requirements are met. It functions as a guarantee that payment will be made, subject to the seller adhering to the conditions outlined in the LC, from the buyer's bank to the seller's bank.

Types of Letters of Credit

1. Revocable Letter of Credit

Characteristics:

The issuing bank reserves the right to amend or cancel this without prior notice to the beneficiary.

Less secure compared to irrevocable LCs.

Uses:

Suitable for transactions where the buyer and seller have an established and trusted relationship.

Often used in domestic transactions rather than international trade.

Benefits:

This allows the issuing bank to make changes to the terms as necessary.

Drawbacks:

Offers less security for the beneficiary as the terms can be changed unilaterally by the issuing bank.

2. Irrevocable Letter of Credit

Characteristics:

Cannot be amended or canceled without the consent of all parties involved (issuer, beneficiary, and any confirming bank).

Provides higher security compared to revocable LCs.

Uses:

Commonly used in international trade where the parties do not know each other well.

Provides a guarantee that the terms agreed upon are fixed and binding.

Benefits:

Ensures that the terms and conditions are set and cannot be changed without mutual agreement.

Drawbacks:

Less flexibility compared to revocable LCs.

3. Confirmed Letter of Credit

Characteristics:

Involves a confirming bank that adds its own guarantee to the LC issued by the original bank.

Enhances the security for the beneficiary.

Uses:

Suitable for transactions where the beneficiary is concerned about the creditworthiness of the issuing bank.

Often used in high-risk or unfamiliar trading environments.

Benefits:

Gives the beneficiary more certainty that the payment will be made.

Drawbacks:

May involve additional fees for the confirming bank’s services.

4. Standby Letter of Credit

Characteristics:

Acts as a backup payment method, ensuring payment if the buyer fails to fulfill their contractual obligations.

Serves as a guarantee rather than a primary payment method.

Uses:

Commonly used as a security measure in contracts or agreements.

Suitable for situations where a performance or payment guarantee is required.

Benefits:

Provides reassurance to the seller that payment will be made if the buyer defaults.

Drawbacks:

Typically used in conjunction with other forms of payment rather than as the primary payment method.

5. Revolving Letter of Credit

Characteristics:

Covers multiple transactions over a specified period.

Can be used for ongoing trade relationships and multiple shipments or invoices.

Uses:

Ideal for businesses with regular or repeated transactions.

Provides convenience for ongoing trade agreements.

Benefits:

Reduces the need to issue new LCs for each transaction.

Streamlines the payment process for continuous trade relationships.

Drawbacks:

May involve a more complex arrangement and higher administrative costs.

6. Sight Letter of Credit

Characteristics:

Payment is required upon presentation and verification of the necessary documents.

Offers immediate payment upon document presentation.

Uses:

Suitable for transactions where quick payment is essential.

Commonly used when the seller needs immediate cash flow.

Benefits:

Ensures prompt payment upon compliance with the terms.

Drawbacks:

May not provide as much time for the buyer to make payment arrangements.

7. Usance Letter of Credit

Characteristics:

Allows for payment to be made at a future date, typically after a specified period.

Provides extended credit terms to the buyer.

Uses:

Suitable for transactions where the buyer needs time to arrange payment.

Common in transactions where payment flexibility is required.

Benefits:

Provides the buyer with additional time to fulfill payment obligations.

Drawbacks:

Payment is delayed compared to sight LCs.

8. Red Clause Letter of Credit

Characteristics:

The beneficiary has the option to receive an advance payment prior to the shipment of the goods.

Facilitates financing for production or procurement of goods.

Uses:

Ideal for sellers who need upfront funds to produce or procure goods.

Common in industries where production financing is necessary.

Benefits:

Provides the seller with working capital before shipment.

Drawbacks:

Requires careful management of advance payments.

How to Choose the Right Type of Letter of Credit

Choosing the appropriate type of LC depends on several factors, including:

Nature of the Transaction: Consider the type of trade, whether it is one-time or ongoing, and the relationship between the buyer and seller.

Risk Level: Assess the level of risk involved in the transaction and choose a type of LC that provides adequate security.

Payment Terms: Determine whether immediate payment or extended credit terms are required.

Documentation Requirements: Ensure that the chosen LC type aligns with the documentation needs of the transaction.

Conclusion

Letters of Credit are vital instruments in international trade, offering various types to suit different needs and risk levels. Understanding the characteristics, uses, and benefits of each type of LC enables businesses to choose the most suitable option for their transactions. By leveraging Letters of Credit effectively, companies can secure payments, build trust with trading partners, and facilitate smooth and secure global trade operations.

http://oxfordinternationalbank.com

0 notes

Text

We offer bank instrument loans without upfront fee

#BankInstrument

#FinancialInstruments

#MTN (Medium Term Note)

#BG (Bank Guarantee)

#SBLC (Standby Letter of Credit)

#LC (Letter of Credit)

#Monetization

#TradeFinance

#Banking

#FinanceInstrument

#bank instrument#sblc monetization#business loan#financial services#avaition#construction#loans#personal loans#government#realestate#self care

0 notes

Text

TRADE FINANCE ESSENTIALS: WHAT EVERY BUSINESS NEEDS TO KNOW FOR SUCCESS

In today’s busy world of international trade, it’s crucial for businesses to know about trade finance to scale. This guide will help you understand the essentials, strategies, and tips to succeed in the exciting world of trade.

Trade Finance Essentials

Understanding Trade Finance:

Trade finance is like the backbone of worldwide buying and selling. It includes different ways to handle money and products to make international trade easier. This ensures that people who sell things get paid, and those who buy things do their part, making global trade safe.

Key Players in Trade Finance:

Many different groups play important roles in trade finance, like banks, buyers, sellers, insurers, and shipping companies. They work together to make sure everything moves smoothly, from goods to payments, across countries.

Common Trade Finance Solutions:

Several solutions help with international trade. Letters of Credit (LCs), Standby Letters of Credit (SBLCs), Bank Guarantees, and Documentary Collections are commonly used. Each helps in different ways to make sure trade happens securely.

Trade Finance Providers:

If your business needs help with international deals, you’ll need trade finance services. You can get these services from banks or trade finance providers. These providers differ in what they offer and how good they are globally. Understanding this helps businesses find the right solutions.

To read more visit our website https://www.pacificcorp.co.uk/trade-finance-essentials-what-every-business-needs-to-know-for-success/

0 notes

Text

HSR 3-11-24

No questions with the food fest today, this pizza is the most sensibly made food in this whole event so far.

I did a D5 run on the Path of Abundance and just a bullet list of nonsense that happened with this:

Every single domain I entered in the first plane was either a Double Occurrence or a Double Reward space.

I ran into the Trotter event three times in the first plane and all of them got full-cleared without even trying.

By the middle of the second plane I had 5 cheat chances available.

Kafka almost hit 2 million damage at one point. Thanks Remembrance!

Huohuo got to add Searing Prowler to her kill list after Guinaifen almost solo'd the thing.

Huohuo hit 10K HP by the final bosses.

18 Gold Blessings by the end of the run.

One of the best runs I've ever had, frankly. This also means I've officially cleared G&G on every Path! I still have to do conundrum levels, but that's a hassle for another day.

After that it was back to dailies:

2x Cavern runs. Found a really nice helmet in the Diver set today! It's the third I have on standby now, while I've still got the one chestpiece to fall back on.

8x Erudition Calyx runs. I'm just gonna save today's haul so I can max out her Talent tomorrow.

8x Nihility Calyx runs.

Last part of the day was another tenner on the Jing Yuan LC banner since I hit 190 limited tickets after the SU was done. Got Planetary Rendezvous and Under the Blue Sky, which is really nice since both of those are useful to my roster right now! Yukong's got a S4 copy of PR now, and my yet-to-be-built Misha is still sitting in reserves with a UtBS, now at S2!

Five-Star Fund: 180/180 (50 Character Pity; 35 LC Pity) Days to v2.1: 15

0 notes

Link

Applying for a letter of credit (LC) with a bank for overseas transactions can be a complex process, but with careful planning and attention to detail, it can be a smooth and successful experience. An LC is a payment guarantee letter issued by a bank that guarantees payment to the seller for goods or services delivered to the buyer. Here are the steps to apply for an LC with a bank for overseas transactions.

Identify the Need for an LC: The first step is to determine whether an LC is needed for the overseas transaction. An LC provides a guarantee to the seller that they will receive payment, which can help to mitigate the risk of non-payment and secure the transaction.

Choose a Bank: The next step is to choose a bank that will offer a letter of credit service. Look for a bank that has experience with international trade and a good reputation in the global trade community.

Submit an Application: Submit an application to the bank for an LC. The application will typically require detailed information about the transaction, including the amount, currency, and terms of the LC.

Provide Required Documentation: The bank will require documentation to support the LC application, such as the purchase agreement, invoices, and shipping documents. Ensure that all documentation is accurate and complies with the terms of the LC.

Read more: https://www.axioscreditbank.com/blogs/how-to-get-a-letter-of-credit-from-a-bank-to-import-goods-from-overseas

#letter of credit#international trade#payment guarantee letter#revocable LC#bank guarantees#standby LC

0 notes

Text

1 note

·

View note

Text

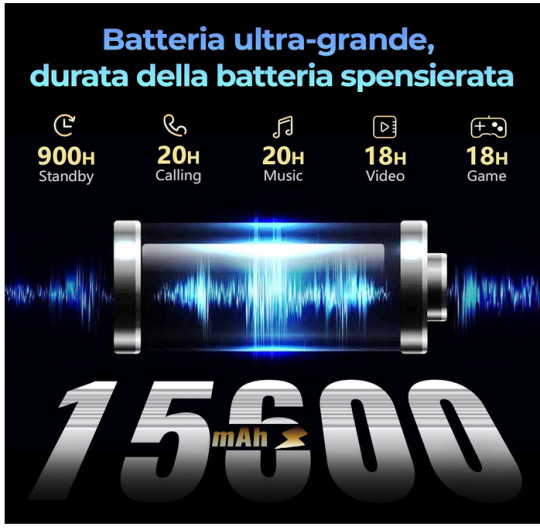

Tablet Android 13 per Lavoro: Scopri il Robusto HOTWAV R7

Tablet con Android 13 per Lavoro: Il Robusto HOTWAV R7

Se stai cercando un tablet che possa resistere alle sfide più impegnative sul campo lavorativo, il HOTWAV R7 potrebbe essere esattamente ciò di cui hai bisogno.

Con le sue caratteristiche robuste e il sistema operativo Android 13, questo dispositivo è progettato per affrontare gli ambienti più ostili e le attività più intense.

Caratteristiche Principali:

Batteria Duratura: La batteria da 15600 mAh del HOTWAV R7 offre fino a 37 giorni in standby, 20 ore di ascolto musicale, 18 ore di gioco o videochiamate. Inoltre, supporta la ricarica inversa OTG, trasformandosi così anche in un power bank mobile.

Robustezza Certificata: Con le certificazioni IP68 e IP69K e lo standard militare MIL-STD-810H, questo tablet è progettato per resistere a condizioni estreme. È impermeabile fino a 1,5 metri, protetto dalle cadute e dalla polvere, garantendo un'affidabilità eccezionale in situazioni difficili.

Display di Qualità: Lo schermo HD+ da 10,1 pollici con Corning Gorilla Glass offre una luminosità elevata, un forte contrasto e colori vivaci, garantendo un'esperienza visiva impeccabile anche sotto la luce diretta del sole.

Ampia Memoria: Con 12GB di RAM (6GB virtuali) e 256GB di spazio di archiviazione, espandibile fino a 1TB tramite scheda SD, il HOTWAV R7 offre ampio spazio per applicazioni, file e dati, garantendo prestazioni fluide anche con multitasking intensivo.

Connettività Globale: Dotato di connettività 4G Dual SIM e Wi-Fi 5G, questo tablet copre tutti i principali operatori di rete in Europa, Asia e America, offrendo velocità Internet elevate ovunque tu vada. Inoltre, può operare in un'ampia gamma di temperature, da -40°C a 70°C, rendendolo adatto a una vasta gamma di ambienti esterni.

Se sei alla ricerca di un tablet resistente, potente e affidabile per il lavoro, il HOTWAV R7 è sicuramente una scelta da prendere in considerazione.

Con la sua combinazione di prestazioni elevate, durata della batteria eccezionale e robustezza certificata, questo dispositivo è progettato per affrontare le sfide più impegnative con facilità e affidabilità.

Acquista il tablet attraverso il nostro link di affiliazione amazon

Articoli recenti

Sea of Thieves: Aggiornamento DirectX 12 garantisce miglioramenti delle prestazioni, ma richiede un download di 90 GB

Frost Giant Studios cerca investitori tra i fan per finanziare lo sviluppo di Stormgate

Attenzione: Bagnare l’iPhone e metterlo nel riso è una cattiva combinazione, avverte Apple

Come Disattivare il Nuovo Pulsante della Barra Laterale in Microsoft Edge: Guida Passo-Passo

Microsoft Aggiorna Automaticamente Windows 11 a Versione 23H2: Ecco Cosa Sapere

Microsoft aggiunge nuove funzioni e caratteristiche a Copilot per gli utenti del canale Canary di Windows 11

realme Smartphone C67 5000mAh 8GB+256GB 6.72” 90Hz: Recensione Completa e Opinioni

LC-Power LC-M29-UW-UXGA-75: Monitor Ultrawide da 29 Pollici per Gaming e Lavoro

0 notes

Text

STS-400: The planned (if needed) rescue of STS-125

Unofficial crew patch *

On LC-39A STS-125 Atlantis (left) and on LC-39B is STS-400 Endeavour (right).

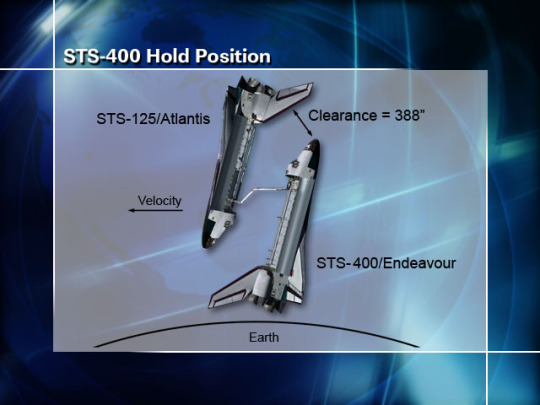

In the wake of the Columbia Tragedy, NASA prepared several contingency missions in the event a shuttle could not return safely. Most of the shuttle missions post STS-107, involved the construction/support of the International Space Station. If there were any instances where the shuttle was deemed unfit to return safely, the crew would stay on the ISS until a relief shuttle could be sent. However, STS-125 Atlantis was to service the Hubble Space Telescope and was not on the same orbital plane as the ISS. The Atlantis wouldn't have enough fuel to reach the station, so another Shuttle (Endeavour) was kept on standby on LC-39B. STS-400 would have been crewed by Christopher Ferguson, Eric A. Boe, Robert S. Kimbrough and Stephen G. Bowen.

On the first day, the crew of Atlantis would use the Canadarm to inspect the bottom of the shuttle for damage to the Thermal Protection System. Had there been any damage deemed unrepairable, the plan was to launch Endeavour 5 days later. Atlantis would be put into powered-down mode to conserve power and consumables.

Endeavour will have Altitude Control with Atlantis serving as a Micro-Meteoroid Orbiting Debris shield.

"On flight day two, Endeavour would have performed the rendezvous and grapple with Atlantis."

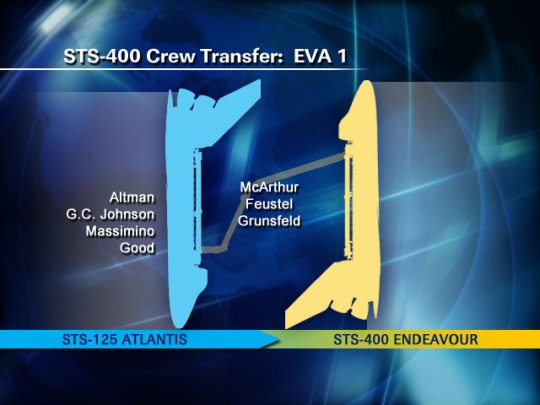

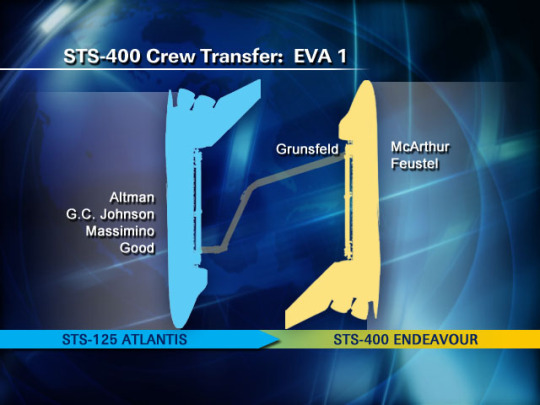

Crew locations during EVA-1

"On flight day three, the first EVA would have been performed. During the first EVA, Megan McArthur, Andrew Feustel and John Grunsfeld would have set up a tether between the airlocks. They would have also transferred a large size Extravehicular Mobility Unit (EMU) and, after McArthur had repressurized, transferred McArthur's EMU back to Atlantis. Afterwards they would have repressurized on Endeavour, ending flight day two activities."

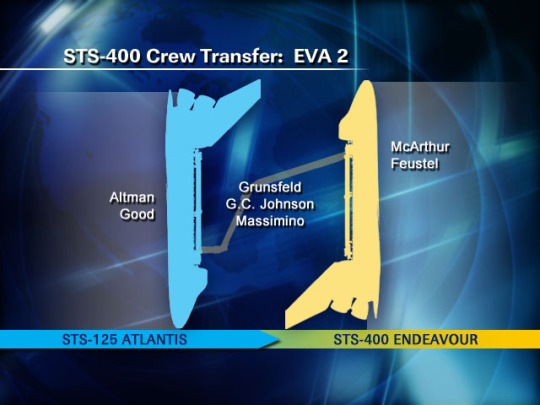

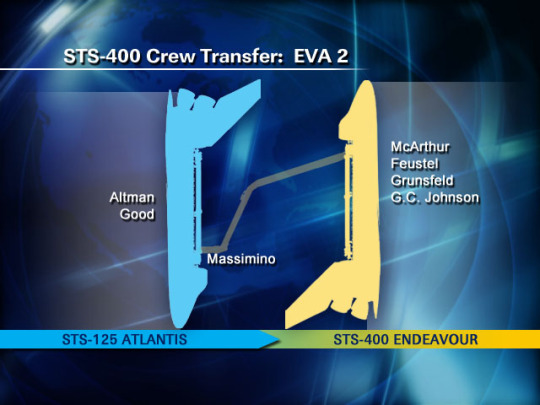

Crew locations during EVA-2

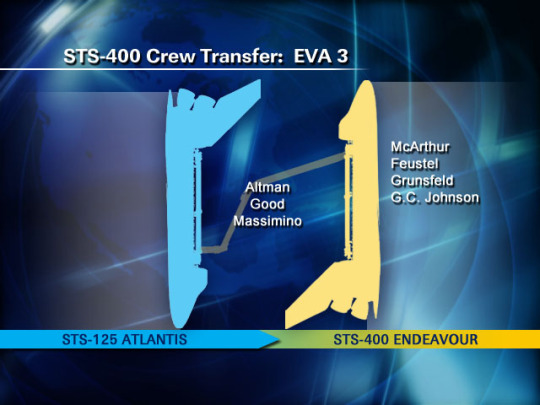

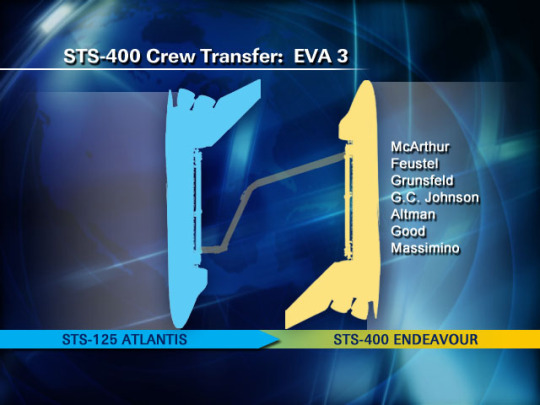

Crew locations during EVA-3

"The final two EVA were planned for flight day three. During the first, Grunsfeld would have depressurized on Endeavour in order to assist Gregory Johnson and Michael Massimino in transferring an EMU to Atlantis. He and Johnson would then repressurize on Endeavour, and Massimino would have gone back to Atlantis. He, along with Scott Altman and Michael Good would have taken the rest of the equipment and themselves to Endeavour during the final EVA. They would have been standing by in case the RMS system should malfunction. The damaged orbiter would have been commanded by the ground to deorbit and go through landing procedures over the Pacific, with the impact area being north of Hawaii. On flight day five, Endeavour would have had a full heat shield inspection, and land on flight day eight."

Information from Wikipedia link

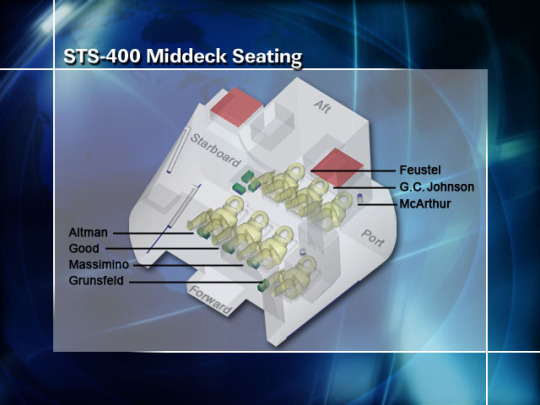

STS-400 Middeck Seating

The additional crew members on Endeavour would have been accommodated via additional seats installed on the middeck. The autopilot onboard Atlantis would be used to de-orbit the orbiter tail first, to destroy it over a region north of Hawaii, in the Pacific Ocean.

Another unofficial crew patch.

View from LC-39B of the launch of STS-125 Atlantis on May 11, 2009. This was the fifth and final Space Shuttle mission to the Hubble Space Telescope.

Fortunately, STS-400 was not needed and Endeavour was returned to the VAB from LC-39B for STS-127.

* "As a contingency mission, STS-400 was not given official support by NASA for the production of a crew patch or emblem. However this artwork was created for use by the mission team as an unofficial emblem by Mike Okuda [the same person who worked on Star Trek and most of the LCARS], who also illustrated the official patch of STS-125, the flight to be rescued by STS-400."

Date: September 9, 2008

source, source, source, source, source, source, source, source, source, source, source, source, source , source

#STS-400#STS-125#Space Shuttle Atlantis#Atlantis#OV-104#Space Shuttle#Space Shuttle Endeavour#Endeavour#OV-105#Orbiter#NASA#Space Shuttle Program#September#2008#rescue#my post

175 notes

·

View notes

Text

Optical fiber end face detector KIP-600V

● 400x magnification, stains are clearly visible ● Support SC/FC/ST/LC/SC female/LC female ● Supports TF card, can record and playback video, convenient for archiving detection data ● 4000mAH large capacity lithium battery, 20 hours standby ● Rotatable metal bracket, stable and convenient ● 3.5-inch high-definition LCD display ● 1/3-inch sensor, 300,000 effective pixels ● Removable silicone cover, anti-fall and shock-proof ● Small size, can be held with one hand, convenient and fast

0 notes