#Worldwide trade Finance banks

Explore tagged Tumblr posts

Text

https://merchantinternationalbank.com/

Title: Global Trade Finance Solutions | Merchant International Bank

Description: Comprehensive trade finance services, letters of credit, and bank guarantees. Trusted solutions for importers and exporters worldwide. Explore TradePAY today.

1 note

·

View note

Text

#FINANCIALBRANCH. Money makes the world go round, and the same saying was true for Spectre, and its' successor, Quantum. The finance branch was born the same day as Spectre itself, along with other ever-present branches like Counter-Intelligence and Tactical Operations [ known as Soldiery until the 70s ]. Despite those antique roots, the financial branch evolved constantly to remain at the vanguard of their trade, often being ahead of the competition.

The branch's primary reason to be was to manage Spectre's financial assets and keep those well invested, as well as making sure those funds were ready for use. As time passed it evolved to offering similar financial services for organizations that were, for one reason or another, restricted from accessing legitimate banking systems. Any organization was welcome to their services, as long as they could find it and afford it.

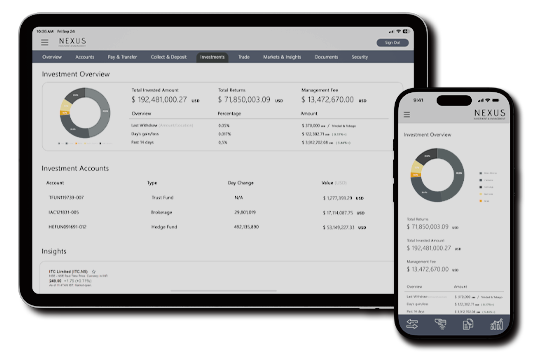

Like all other branches, the Finance Branch operates behind the mask of multiple other front companies, all in order to hide the true name and nature of their organization. There are five major companies that act as pillars to the branch: Nexus Investment & Management, Suisse de L'Industrie, Eisenband, CX Worldwide and Qoya Capital. All of those fronts operate in legal means, providing clean profit and a way to clean their own illegal funds.

The branch holds headquarters in 29 countries [ Monaco, New York, Dubai, London and Tokyo being the biggest ones ], servers in 9 countries and it operates in all 253 territories [ 193 U.N recognized countries, 55 dependent territories and 4 territories with ongoing struggles ] with only Antarctica being uncovered.

The current triad in control of the Financial Branch is composed by Le Chiffre [ Alias, real name Marcel Renè Venier-Couvillon, operating as Jacquin Allard and other 12 identities ], Beatrice Trauschke and Cissonius [ Alias, real name Daniel Wright, operating as Henry Thompson and other 5 identities ]. This is the team responsible for overseeing all the activities, legal and otherwise, under the umbrella of the Financial branch, and are the arbitrators behind every dispute regarding the path of the branch, furthermore, they each oversee one of the subsidiaries controlled by the branch, respectively Nexus, La Banque Suisse de L'Industrie and Eisenband Capital.

Nexus in an asset management company, with its expertise laid in private banking, brokerage, consultation and management of wealth for both individuals and companies. La Banque Suisse de L'Industrie is a multinational bank with focus in providing international banking services and financial support lines for companies and organizations. Eisenband Capital is a capital market group, specialized in locating and funding or acquiring companies that are branded as promising in their respective areas.

All those companies serve the true purpose of acting as the backbone of Quantum, controlling the entirety of the Group's financial transactions, investments, liquid assets and casinos.

The front companies have plenty legitimate clients, being well known companies in the international economic landscape, and their public services can be hired as any other bank, however that process is more complex when regarding their backdoor business. For an organization or individual to be able to utilize Quantum's international banking services they must be given referral by another organization that runs money through them or pass a screening process in person done by someone assigned by the Financial Branch [ this is the process that determines operational costs, liabilities, calculate management fee and open space for negotiation before drawing a contract ], as well as offer an initial amount of 50 millions USD or more. Management fee for illicit businesses vary between 3% and 12% of the total value, depending on region, risk, logistics and nature of business.

Those accounts must name a successor or benefactor for the managed assets in case of death of the account's responsible or the hiring organization's leadership. In case one of those stances happen, the successor musr claim ownership of the account within 90 days or the assets become permanent property of Quantum.

All of their financial services count on extensive infrastructure: offices in most major cities, digital applications and management tools, multiple payment methods, liquid assets transportation and storage services, and dedicated managers to larger accounts. For clients who can't afford any form of visibility, alternative methods of access are offered, such as in-person services for added management fees or 1-to-1 kinds of cryptocurrency.

The financial branch is also responsible for any transactions, payments and debt collections that might be necessary to Quantum's operations. For the funding of their underbelly operations, the financial branch provides the other branches or the service providing organizations with payment options in cryptocurrency or unmarked gold bars, as those are untraceable. For payment of bounties or first-serve-first-come opportunities, to-the-bearer medallions are given and can be collected in any casino controlled by Quantum in the currency of choice. And finally, for collaborators who need to take a large amount of cash abroad, torn playing cards [ digitally marked for authentication ] can be traded for money or gold in any CX Worldwide agency.

Debt is collected after a 90 days tolerance period, during which no large transactions are allowed to the debtor's account, and in case of failure to provide payment, all assets are seized. If the amount within the accounts lack enough funds to cover the debt, Tactical Operations are contacted for direct interference and seizing of any found liquid asset. Attempts to interrupt the seizing are answered with significant force.

FOR FURTHER DETAILS, DOUBTS OR WANTED INFORMATION: ASK!

14 notes

·

View notes

Text

Bachelor Degree in finance Online

Build a Successful Career with a Bachelor Degree in Finance and Accounting

A Bachelor Degree in Finance or a Financial Degree serves as the foundation for a rewarding and lucrative career in the financial world. This degree is designed to equip students with essential knowledge, practical skills, and the expertise needed to excel in diverse sectors, from banking to corporate finance. Aspiring financial professionals find these programs indispensable for building a strong academic and professional base.

** Where Ambitions Take Flights

Earn a Financial Degree From Top-Ranked Universities

Click Below To Get More Info

Bachelor Degree in Finance and Accounting – Study from AnywhereExplore Top Bachelor Degree Programs in Finance and AccountingBuild a Successful Career with a Bachelor Degree in Finance and AccountingOnline Bachelor Degree in Finance and Accounting – Start AnytimeBachelor Degree in Finance and Accounting – Your Career Starts HereEarn a Bachelor Degree in Finance and Accounting TodayUnlock Your Potential with a Bachelor Degree in Finance and Accounting

What is a Bachelor Degree in Finance?

A Bachelor Degree in Finance focuses on teaching students how to manage, analyze, and optimize financial resources. The curriculum is designed to cover a wide array of critical topics, including:

Corporate Finance: Examining how companies handle their financial operations.

Financial Markets: Understanding the mechanisms of global markets and trading systems.

Risk Management: Learning strategies to identify and mitigate financial risks.

Investment Analysis: Developing the expertise to make well-informed decisions about investments.

Financial Planning: Mastering techniques for personal and corporate financial planning.

Graduates with a Financial Degree are well-prepared for positions in various industries, including real estate, investment banking, financial consultancy, and insurance.

Why Pursue a Bachelor Degree in Finance?

Earning a Bachelor’s Degree in Finance is a valuable investment in your future.

Here are a few convincing reasons why this is a wise decision:

High Demand for Financial Professionals

Financial experts are always in demand across industries, making this degree one of the most stable career paths.

Lucrative Salaries

The financial sector offers some of the highest-paying jobs, with opportunities for rapid advancement.

Versatility in Career Opportunities

Graduates can explore careers in banking, investment management, corporate finance, and even entrepreneurship.

Global Relevance

The skills and knowledge acquired are applicable worldwide, opening doors to international career opportunities.

Top Institutions Offering Bachelor Degrees in Finance and Accounting

1. Wharton School of the University of Pennsylvania

Renowned globally, Wharton offers an outstanding Bachelor Degree in Finance that emphasizes practical applications and cutting-edge financial theories.

Highlights:

Access to internships with global financial giants.

A curriculum tailored to modern financial challenges.

A robust network of successful alumni.

2. Institute of Technology, Massachusetts (MIT Sloan Management School)

MIT Sloan’s program is perfect for those interested in combining finance with technology.

Highlights:

Courses on emerging trends like blockchain and fintech.

Strong focus on research and innovation.

Collaborative learning environment.

3. London School of Economics (LSE)LSE is a leading institution for students seeking a Bachelor Degree in Finance with an international perspective.Highlights:

Strong connections with global financial markets.

Emphasis on quantitative and analytical skills.

A diverse and inclusive student community.

4. University of Chicago Booth School of Business

Highlights:

Interdisciplinary approach combining finance and economics.

Opportunities for hands-on projects.

Renowned faculty with industry experience.

5. University of Cambridge Judge Business School

The Judge Business School focuses on equipping students with a strong ethical foundation in finance.

Highlights:

Exposure to global financial practices.

Networking opportunities with industry leaders.

Comprehensive curriculum covering finance and accounting.

Core Subjects in a Bachelor Degree in Finance

Most programs include the following essential courses to ensure students gain a well-rounded education:

Financial Accounting: Analyzing financial statements and learning reporting techniques.

Econometrics: Utilizing statistical methods for financial data analysis.

Corporate Governance: Exploring ethical and strategic financial decision-making.

Portfolio Management: Learning how to optimize investments for maximum returns.

Derivatives and Fixed Income: Understanding complex financial instruments.

Career Opportunities with a Financial Degree

A Bachelor Degree in Finance unlocks numerous high-paying career paths.

Here are some prominent roles:

Financial Analyst

Utilize data to assist businesses in making well-informed financial choices.

Investment Banker

Assist organizations in raising capital through stock issuance and mergers.

Portfolio Manager

Manage and grow investment portfolios for clients or organizations.

Risk Manager

Develop strategies to minimize financial risks and safeguard assets.

Corporate Finance Advisor

Provide insights on optimizing a company’s financial performance.

2 notes

·

View notes

Text

By Jamari Mohtar

At the forefront of the geoeconomic war of supply chains, economic corridors and trading routes is the dedollarisation movement spearheaded by the Brics collective.

To begin with, what is dedollarisation? To understand this phenomenon, one needs to understand first its antonym – dollarisation.

Dollarisationrepresents US dominance in global finances. It started in the 1920s when the US dollar began to displace the pound sterling as an international reserve currency.

After the US emerged as an even stronger superpower during WWII, the Bretton Woods Agreement of 1944 established the post-war international monetary system, with the US dollar ascending to become the world’s primary reserve currency for international trade, and the only post-war currency linked to gold at US$35 per troy ounce.

In addition, the US Treasury exercises considerable oversight over the Swift financial transfer network, and consequently has a huge sway on the global financial transaction systems, with the ability to impose sanctions on foreign entities and individuals.

Swift stands for the Society for Worldwide Interbank Financial Telecommunications system and it powers most international money and security transfers.

It is a vast messaging network used by financial institutions to quickly, accurately, and securely send and receive information, such as money transfer instructions.

However, rising government spending in the 1960s led to doubts about the US’ ability to maintain this gold convertibility, and gold stocks dwindled as banks and international investors began to convert dollars to gold, resulting in the decline of the dollar.

2 notes

·

View notes

Text

youtube

Merrill Lynch Law of Attraction Experiment

Calling All Law of Attraction Followers Are you a believer in the Law of Attraction? If so, then you've come to the right place. It's time to start spreading the word on a greater scale. Most people believe in the saying "If I can't see it I don't believe it." Since this is the case, there are this website many people who think that the LOA isn't real. We know that's not the truth, but how can we help the non-believers see the happiness that the LOA can actually bring into their lives. How about by doing LOA experiments that manifest things that help the masses, instead of just ourselves. Let’s form a group that really wants to help the world get better by using the LOA to manifest great things.

Merrill Lynch Disaster If you're an investor and read the business section I'm sure you've heard that Merrill Lynch got into trouble when large investments in sub-prime mortgages went bad. The brokerage firm lost more than $2 billion in the third quarter. The stock has plummeted from a high of 98 all the way to the 40s and lots of people have lost their shirt.

This has caused great stress to the investment world. I know the devastation first hand because I have a family member who is now on the verge of loosing it all if this stock goes any lower.

Merrill Lynch Law of Attraction Experiment Every LOA expert that I've heard has stated that the best way to test the Law of Attraction is to do an experiment related to something that you don't feel too attached to, meaning, if the LOA manifestation didn't work you wouldn't be upset. I'd like to challenge all LOA followers to join in an experiment to see if we can collectively raise the Merrill Lynch stock up to 68. This would help save thousands of people's bank accounts from going empty and would prove to everyone you know that the LOA does work. Let’s use the LOA for the greater good today and watch it work. Won't it be fun to have proof in the MER stock numbers! How to Manifest MER at 68If you're up for the challenge, here's how I suggest manifesting the Merrill Lynch stock hike. Go to Yahoo.com and click on Finance.

Type in the Ticker Symbol, MER. Look at the first line that says Last Trade and envision the number 68 in that column. Hold that vision in your mind, see it as if it's real, and feel the happiness that all of the investors will feel if the stock reaches that number. This will be an exciting experiment to prove the power of LOA. Once we've accomplished this, there's nothing we can't do for this world. If you have any nationwide or worldwide problems that you'd like to see The LOA Experiment Group tackle, please submit that information so I can put it out there for all to manifest.The Law of Attraction is truly amazing, and if we work collectively to manifest good for others imagine how wonderful our world will be.

2 notes

·

View notes

Text

A New Dawn: Transitioning to a Bitcoin Future

Money is not just a medium of exchange; it's a psychotechnology, as integral to human communication as language itself. Today, we're living in unprecedented times with the potential to peacefully transition to a new financial system growing right alongside the current one. In this post, we'll explore how Bitcoin is enabling this transformation and what it means for our future.

The Current Financial Landscape

The flaws and instability of the fiat currency system are becoming increasingly apparent. Inflation, excessive money printing, and economic uncertainty are driving individuals and institutions to seek alternatives. The traditional financial system, burdened by debt and centralization, is showing signs of strain. Over the past few years, central banks worldwide have printed unprecedented amounts of money to stimulate economies. This has led to inflation, eroding the purchasing power of savings and causing widespread financial insecurity. Governments and corporations are drowning in debt, and the centralized nature of the current financial system leaves it vulnerable to corruption and mismanagement. Global events, from pandemics to geopolitical tensions, add to the unpredictability of fiat currencies. Enter Bitcoin, a decentralized digital currency offering a new kind of financial freedom.

The Role of Bitcoin

Bitcoin is not just another financial asset; it's a revolutionary technology that grows alongside our existing financial system. Its decentralized nature, security, and limited supply make it a viable alternative to traditional currencies, promising stability and independence. Unlike traditional currencies controlled by central banks, Bitcoin operates on a decentralized network of computers, ensuring no single entity can manipulate its value. Bitcoin's blockchain technology provides unparalleled security, making it nearly impossible to counterfeit or manipulate. With a capped supply of 21 million bitcoins, Bitcoin is inherently deflationary, protecting against inflation and preserving value over time. Bitcoin offers a form of money that is transparent, secure, and resistant to the whims of central authorities.

Historical Context

Throughout history, major economic transitions have often been marked by turmoil and conflict. From the shift from barter to coinage to the adoption of paper money, each transition has reshaped society. However, for the first time, we have the opportunity to transition peacefully to a new system with Bitcoin. The move from barter systems to coinage revolutionized trade and economic interaction but was often accompanied by social upheaval. The adoption of paper money brought convenience but also led to centralization and control by governments. Now, in the digital age, Bitcoin represents the next step in the evolution of money, offering a decentralized and democratized form of value exchange. Unlike past transitions, Bitcoin's integration can be gradual and voluntary, allowing individuals and institutions to adopt it at their own pace.

The Peaceful Transition

Bitcoin offers a non-violent alternative to traditional financial upheaval. Its gradual adoption process allows people and institutions to adapt without the chaos that typically accompanies such transitions. This peaceful integration could pave the way for a more stable and equitable financial future. Bitcoin's adoption is growing organically, driven by individual choice and market forces rather than imposed by authorities. It can operate alongside existing financial systems, providing a safety net and alternative without causing immediate disruption. By giving individuals control over their own finances, Bitcoin empowers people to take charge of their economic future.

Real-World Examples

Consider the case of MicroStrategy, a company that has invested billions into Bitcoin, treating it as a core part of their strategy. Led by Michael Saylor, MicroStrategy has transformed its balance sheet by converting cash reserves into Bitcoin, demonstrating confidence in its long-term value. Government proposals, like those from Senator Cynthia Lummis, highlight the growing trust and interest in Bitcoin. Senator Lummis has proposed treating Bitcoin like gold, advocating for its inclusion in national reserves and regulatory frameworks. Influential figures such as Robert F. Kennedy Jr. and Donald Trump have spoken about Bitcoin's potential to revolutionize the financial system, adding legitimacy and interest from a broader audience. These examples illustrate the growing acceptance and integration of Bitcoin into mainstream financial and political discourse.

The Psychological Shift

Understanding and adopting Bitcoin can lead to a profound change in how we perceive value and money. My journey with Bitcoin has reshaped my mindset, providing a new perspective on financial freedom and stability. This psychological shift is as important as the technological and economic changes. Bitcoin challenges traditional notions of value, prompting us to rethink what money is and how it should function. Owning Bitcoin gives individuals direct control over their wealth, reducing reliance on banks and financial intermediaries. Learning about Bitcoin often leads to a deeper understanding of economics, monetary policy, and personal finance. Sharing my personal journey, from discovering Bitcoin to embracing its potential, highlights the transformative power of this technology.

Conclusion

We stand at the brink of a new era. The peaceful transition to a Bitcoin-based financial system is not just a possibility; it's a growing reality. By embracing this change, we can look forward to a more stable, secure, and equitable financial future. Bitcoin offers a path to financial independence and stability, free from the flaws of the fiat system. As more people and institutions recognize Bitcoin's potential, we can collectively work towards a better economic system.

Call to Action

Subscribe to my blog for more insights into the evolving financial landscape. Follow my YouTube channel and social media for the latest updates and discussions on Bitcoin and its potential to revolutionize our world.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#CryptoRevolution#FinancialFreedom#FutureOfFinance#BitcoinFuture#DigitalCurrency#EconomicTransition#NewEra#CryptoCommunity#BlockchainTechnology#BitcoinAdoption#Cryptocurrency#FinancialInnovation#DecentralizedFinance#FiatCollapse#MoneyEvolution#CryptoJourney#EconomicFreedom#DigitalGold#BitcoinHodl#blockchain#globaleconomy#unplugged financial#financial empowerment#financial education#financial experts#finance

2 notes

·

View notes

Text

A Short Guide to Fintech Software Development Services

In today's dynamic business landscape, the intersection of finance and technology has given rise to innovative solutions that drive efficiency, security, and growth. At the forefront of this revolution are FinTech software development services, which empower organizations to harness the power of technology to revolutionize financial processes. In this short guide, we delve into the essential aspects of FinTech software development services, highlighting the expertise of industry leader Xettle Technologies.

Understanding FinTech Software Development Services

FinTech software development services encompass a wide range of offerings aimed at addressing the unique needs and challenges of the financial industry. From custom application development to integration services and ongoing support, these services cater to businesses seeking to enhance their operations, improve customer experiences, and stay ahead of the competition.

The Role of Xettle Technologies

Xettle Technologies stands out as a trusted provider of FinTech software development services, offering a comprehensive suite of solutions tailored to meet the diverse needs of businesses worldwide. With a proven track record of delivering cutting-edge software fintech solutions, Xettle Technologies combines technical expertise, industry knowledge, and a customer-centric approach to drive digital transformation and business success.

Custom Application Development

One of the core offerings of FinTech software development services is custom application development. Xettle Technologies collaborates closely with clients to understand their unique requirements and objectives, leveraging their expertise in software development to design and build bespoke solutions that address specific business challenges.

Whether it's developing a mobile payment app, a blockchain-based trading platform, or a risk management system, Xettle Technologies has the capabilities and experience to deliver tailored solutions that meet the evolving needs of the financial industry.

Integration Services

In today's interconnected world, seamless integration with existing systems and third-party applications is crucial for the success of FinTech solutions. Xettle Technologies offers integration services that enable businesses to connect disparate systems, streamline workflows, and enhance interoperability.

Whether it's integrating with banking APIs, payment gateways, or regulatory compliance tools, Xettle Technologies ensures that clients' FinTech solutions seamlessly integrate with their existing infrastructure, maximizing efficiency and ROI.

Security and Compliance

Security and compliance are paramount considerations in FinTech software development. Xettle Technologies employs rigorous security measures and adheres to industry best practices to safeguard against cyber threats and ensure compliance with regulatory requirements.

From encryption and access controls to data privacy and regulatory compliance, Xettle Technologies prioritizes security at every stage of the development lifecycle, instilling confidence in clients and end-users alike.

Ongoing Support and Maintenance

The journey doesn't end with the deployment of a FinTech solution. Xettle Technologies offers ongoing support and maintenance services to ensure that clients' software fintech solutions remain secure, reliable, and up-to-date.

Whether it's troubleshooting issues, implementing updates, or providing technical assistance, Xettle Technologies' dedicated support team is on hand to address clients' needs promptly and effectively, allowing them to focus on their core business activities with peace of mind.

Conclusion

In conclusion, FinTech software development services play a pivotal role in driving innovation, efficiency, and growth in the financial industry. By leveraging the expertise of trusted providers like Xettle Technologies, businesses can unlock the full potential of technology to transform their operations, enhance customer experiences, and achieve their strategic objectives in today's fast-paced digital economy.

2 notes

·

View notes

Video

youtube

Merrill Lynch Law of Attraction Experiment

Calling all Law of Attraction Believers. Let’s join together and use the power of LOA to find out more here manifest wonderful things to improve the World.

Calling All Law of Attraction Followers Are you a believer in the Law of Attraction? If so, then you've come to the right place. It's time to start spreading the word on a greater scale. Most people believe in the saying "If I can't see it I don't believe it." Since this is the case, there are many people who think that the LOA isn't real. We know that's not the truth, but how can we help the non-believers see the happiness that the LOA can actually bring into their lives. How about by doing LOA experiments that manifest things that help the masses, instead of just ourselves. Let’s form a group that really wants to help the world get better by using the LOA to manifest great things. Merrill Lynch Disaster If you're an investor and read the business section I'm sure you've heard that Merrill Lynch got into trouble when large investments in sub-prime mortgages went bad.

The brokerage firm lost more than $2 billion in the third quarter. The stock has plummeted from a high of 98 all the way to the 40s and lots of people have lost their shirt. This has caused great stress to the investment world. I know the devastation first hand because I have a family member who is now on the verge of loosing it all if this stock goes any lower. Merrill Lynch Law of Attraction Experiment Every LOA expert that I've heard has stated that the best way to test the Law of Attraction is to do an experiment related to something that you don't feel too attached to, meaning, if the LOA manifestation didn't work you wouldn't be upset. I'd like to challenge all LOA followers to join in an experiment to see if we can collectively raise the Merrill Lynch stock up to 68.

This would help save thousands of people's bank accounts from going empty and would prove to everyone you know that the LOA does work. Let’s use the LOA for the greater good today and watch it work. Won't it be fun to have proof in the MER stock numbers! How to Manifest MER at 68If you're up for the challenge, here's how I suggest manifesting the Merrill Lynch stock hike. Go to Yahoo.com and click on Finance.

Type in the Ticker Symbol, MER. Look at the first line that says Last Trade and envision the number 68 in that column. Hold that vision in your mind, see it as if it's real, and feel the happiness that all of the investors will feel if the stock reaches that number. This will be an exciting experiment to prove the power of LOA. Once we've accomplished this, there's nothing we can't do for this world. If you have any nationwide or worldwide problems that you'd like to see The LOA Experiment Group tackle, please submit that information so I can put it out there for all to manifest. The Law of Attraction is truly amazing, and if we work collectively to manifest good for others imagine how wonderful our world will be.

2 notes

·

View notes

Text

27 November 2023: King Abdullah II reaffirmed that Jordan is a strong and stable nation that grows stronger in times of crisis.

During a meeting attended by Crown Prince Hussein, King Abdullah urged representatives of the private sector to contribute in providing ideas and solutions to support economic sectors that were affected by the current conditions, especially tourism.

His Majesty said Jordan has experience in dealing with crises and is able to continue building its economy during difficult conditions, noting that the Kingdom has the support of Arab and friendly countries because it is a strong nation. (Source: Petra)

The King stressed the need to maintain progress in jumpstarting the national economy, calling for finding an economic hedging mechanism to safeguard against the current conditions in the region.

Jordan's economic strength is a strength for all Jordanians and their brothers and sisters in Palestine, said His Majesty, adding that a strong Jordan is able to continue to support the Palestinians.

The King reaffirmed that Jordan continues all its efforts to reach a lasting ceasefire in Gaza, and to facilitate the delivery of humanitarian aid to the Strip and the West Bank to alleviate the impact of the humanitarian catastrophe there.

His Majesty stressed the importance of strengthening the partnership and coordination between the public and the private sectors to face economic challenges, as well as maintain growth of national investments, and attract more foreign investments.

The King affirmed the importance of moving forward with economic and administrative modernisation, despite the challenges.

Additionally, His Majesty reaffirmed the importance of the Aqaba-Amman Water Desalination and Conveyance Project and its positive impact on water security, calling on the private sector to play a part in its implementation.

The King listened to suggestions by attendees representing the private sector, who commended the Central Bank of Jordan’s (CBJ) policy in maintaining financial and fiscal stability.

They said Jordan’s economic sectors are strong and able to grow, calling for finding means to safeguard them, especially tourism, against the impact of regional challenges, and to turn challenges into opportunities, as well as facilitate licensing processes for projects and financing methods for sectors affected by crises.

Attendees stressed the importance of maintaining coordination with the government to take pre-emptive measures for affected sectors, through short, medium, and long-term plans.

For his part, Prime Minister Bisher Khasawneh said the overall performance of the national economy is reassuring with the completion of over 80 per cent of the goals of the economic modernisation plan, within the timeframe for this year.

He added that the government finished the sixth review with the International Monetary Fund, noting that the draft state budget law that will be sent to Parliament will include the highest capital investment volume.

The prime minister said the government is studying supporting sectors affected by the current conditions, especially tourism.

CBJ Governor Adel Al Sharkas highlighted the stability of Jordan’s monetary and fiscal outlook, adding that the economy is able to withstand challenges, and that the strength of the dinar protects the national economy.

Sharkas said the trade balance deficit is forecast to narrow, adding that Jordanian exports and remittances are expected to increase in the upcoming period.

He added that Jordan’s commitment to fiscal and monetary reforms has contributed to the stability of the national economy; therefore, Jordan registered the lowest inflation rates worldwide.

A number of ministers and officials attended the meeting.

2 notes

·

View notes

Video

youtube

AMERICANS FAMILY DESIGNERS & MAKERS & PROFESSIONALS SPORT PLAYERS WITH A...

#america #americatv #americas #american #americangottalent #americasnews #americanews #americansports #americangottalent2023 #sports #sport #sportsnews #sportscards #golf #golfswing #golfer #golflife #golftips #golfing #golfclub #golfclash #golfshorts #golflife #golfcourse #columbusday #design #designing #fashion #fashionmagazine #fashionblogger #fashionstyle #fashiontrends #fashionista #fashionaccessories #fashionaccessory #accessoriess #tv #news #magazine #ad #apps #appstore #online #onlineapp #onlineshopping #onlinebusiness #channel #tvchannel #entertainment #entertainmentnews #entrepreneur #business #foreignaffairs #foreignaffairsnews #domestic #domesticnews #professionalsports #professional #professor #coach #coaching #coachingcentre #coachingonline #capitalnews #fashionwear #sportwear #economy #economia #economics #statement #continental #freelance #freelancer #labor #workhard #freelancing #work #worker #workervlog #laborvlog #freelancerjobs #freelancerwork #broadcast #broadcastnews #public #publicnews #publictv #publicmedia #peopleandvlogs #peoplesreporter #people #media #digital #internet #network #playstore #transaction #welfare #benefits #insurance #health #healthcare #budget #commercial #compensation #parents #parenting #parentingwithrespect #parentforfuture #parenthood #education #worldnews #localnews #texas #texans #texansnews #texassports #texasspeed #texasnews #americasports #olympic #olympia #olympics #olympiad #olympians #olympicgames #olympicnews #podcast #podcaster #reporter #reporterlive #journal #journalist #healthmagazine #audience #audienceresponse #audiencia #socialmedia #shorts #short #shortvideo #shortfeed #shortdesigns #shortfashion #shortsports #sports_news #athlete #worldathletics #worldathleticschampionships #worldwide #world #worldstage #worldtv #worldtvpremiere #press #pressnewstv #pressmeet #capitaltvlive #capitaltvonline #capital #downtown #suburban #shopping #tv9newslive #tv9 #vlog #blogger #report #academia #academy #academic #academyawards #usa #usanews #usanewstoday #us #unitedstates #universe #rewards #awards #honor #sportstar #superstar #superidol #genius #americanews #goodmorningamerica #europenews #asianews #australianews #africannews #africa #african #asia #asian #australia #australian #europe #european #diplomacy #diplomatic #nativeamerican #americanheritage #heritage #geography #island #history #vogue #vogueliving #voguefashion #voguemagazine #forbes #forbesmagazine #sportmagazine #designs #makers #maker #entrpreneur #enterprise #products #production #manufacturing #industrial #industry #texastech #techchampionsupport #technical #tech #technews #bank #banking #trade #bankofamerica #mallofamerica #onlinemarketing #marketing #market #marketnews #marketingdigital #paramount #paramountplus #networth #netflix #applestore #appletv #amazon #amazonstore #premium #reddit #patreon #shoppingstore #shopify #shoppingonline #shoppinghaul #shoppingvlog #shoppingtour #shopping_guide-bd #style #styles #stylish #styleblogger #fashiontrends #trend #trendingshorts #trendingreels #reels #designtrends #careercoach #careergoals #career #job #passtime #entertainmenttv #tv9newslive #television #country #community #communicationskills communicationpromotion #communityday #communication #talkshow #entertainmentvideos #entertainmentshorts #entertainment_comedy #entertainmentnewslive #finance #financial #financialfreedom #freedom #humanity #humanrights #peoplecreatives #peoplevlogs #youth #youthsports #children #educationalnews #educationalvideo #idol #icon #globalstar #globalnews #globalupdates #global #sportsplayer #globalesports #globalplayer #professionalplayer #urban #metropolis #metropolitano #metropolitan #religion #religious #culture #culturalheritage #cultura #leadership #CEO #celebritynews #influencer #celebrity

3 notes

·

View notes

Text

A Comprehensive Overview on Types of Letters of Credit

Introduction: A Letter of Credit (LC) is an essential financial instrument used to secure payment and ensure that transactions are carried out smoothly. Understanding the different types of Letters of Credit and their specific applications can help businesses choose the most suitable type for their transactions. This in-depth article explores the various types of Letters of Credit, their characteristics, uses, and benefits.

What is a Letter of Credit?

A letter of credit is a document that a bank or other financial organisation issues that assures a seller (beneficiary) that they will be paid when certain requirements are met. It functions as a guarantee that payment will be made, subject to the seller adhering to the conditions outlined in the LC, from the buyer's bank to the seller's bank.

Types of Letters of Credit

1. Revocable Letter of Credit

Characteristics:

The issuing bank reserves the right to amend or cancel this without prior notice to the beneficiary.

Less secure compared to irrevocable LCs.

Uses:

Suitable for transactions where the buyer and seller have an established and trusted relationship.

Often used in domestic transactions rather than international trade.

Benefits:

This allows the issuing bank to make changes to the terms as necessary.

Drawbacks:

Offers less security for the beneficiary as the terms can be changed unilaterally by the issuing bank.

2. Irrevocable Letter of Credit

Characteristics:

Cannot be amended or canceled without the consent of all parties involved (issuer, beneficiary, and any confirming bank).

Provides higher security compared to revocable LCs.

Uses:

Commonly used in international trade where the parties do not know each other well.

Provides a guarantee that the terms agreed upon are fixed and binding.

Benefits:

Ensures that the terms and conditions are set and cannot be changed without mutual agreement.

Drawbacks:

Less flexibility compared to revocable LCs.

3. Confirmed Letter of Credit

Characteristics:

Involves a confirming bank that adds its own guarantee to the LC issued by the original bank.

Enhances the security for the beneficiary.

Uses:

Suitable for transactions where the beneficiary is concerned about the creditworthiness of the issuing bank.

Often used in high-risk or unfamiliar trading environments.

Benefits:

Gives the beneficiary more certainty that the payment will be made.

Drawbacks:

May involve additional fees for the confirming bank’s services.

4. Standby Letter of Credit

Characteristics:

Acts as a backup payment method, ensuring payment if the buyer fails to fulfill their contractual obligations.

Serves as a guarantee rather than a primary payment method.

Uses:

Commonly used as a security measure in contracts or agreements.

Suitable for situations where a performance or payment guarantee is required.

Benefits:

Provides reassurance to the seller that payment will be made if the buyer defaults.

Drawbacks:

Typically used in conjunction with other forms of payment rather than as the primary payment method.

5. Revolving Letter of Credit

Characteristics:

Covers multiple transactions over a specified period.

Can be used for ongoing trade relationships and multiple shipments or invoices.

Uses:

Ideal for businesses with regular or repeated transactions.

Provides convenience for ongoing trade agreements.

Benefits:

Reduces the need to issue new LCs for each transaction.

Streamlines the payment process for continuous trade relationships.

Drawbacks:

May involve a more complex arrangement and higher administrative costs.

6. Sight Letter of Credit

Characteristics:

Payment is required upon presentation and verification of the necessary documents.

Offers immediate payment upon document presentation.

Uses:

Suitable for transactions where quick payment is essential.

Commonly used when the seller needs immediate cash flow.

Benefits:

Ensures prompt payment upon compliance with the terms.

Drawbacks:

May not provide as much time for the buyer to make payment arrangements.

7. Usance Letter of Credit

Characteristics:

Allows for payment to be made at a future date, typically after a specified period.

Provides extended credit terms to the buyer.

Uses:

Suitable for transactions where the buyer needs time to arrange payment.

Common in transactions where payment flexibility is required.

Benefits:

Provides the buyer with additional time to fulfill payment obligations.

Drawbacks:

Payment is delayed compared to sight LCs.

8. Red Clause Letter of Credit

Characteristics:

The beneficiary has the option to receive an advance payment prior to the shipment of the goods.

Facilitates financing for production or procurement of goods.

Uses:

Ideal for sellers who need upfront funds to produce or procure goods.

Common in industries where production financing is necessary.

Benefits:

Provides the seller with working capital before shipment.

Drawbacks:

Requires careful management of advance payments.

How to Choose the Right Type of Letter of Credit

Choosing the appropriate type of LC depends on several factors, including:

Nature of the Transaction: Consider the type of trade, whether it is one-time or ongoing, and the relationship between the buyer and seller.

Risk Level: Assess the level of risk involved in the transaction and choose a type of LC that provides adequate security.

Payment Terms: Determine whether immediate payment or extended credit terms are required.

Documentation Requirements: Ensure that the chosen LC type aligns with the documentation needs of the transaction.

Conclusion

Letters of Credit are vital instruments in international trade, offering various types to suit different needs and risk levels. Understanding the characteristics, uses, and benefits of each type of LC enables businesses to choose the most suitable option for their transactions. By leveraging Letters of Credit effectively, companies can secure payments, build trust with trading partners, and facilitate smooth and secure global trade operations.

http://oxfordinternationalbank.com

0 notes

Text

Current Economic Crises in 2023

In its annual Global Economic Outlook report released on Tuesday, the World Bank, a U.S.-based agency that offers loans and grants to different nations pursuing capital projects, said the world economy might experience a recession and one of the slowest growth rates ever in 2023. The reasons include a year marked by increased inflation, deteriorating financial circumstances, and Russia’s invasion of Ukraine.

The organization reduced its projections for global growth in 2023 by almost half, from 3% to 1.7%. This is the third-weakest growth rate it has ever predicted, below rates seen during the recessions of 2009 and 2020. According to projections, the real GDP of the United States would expand by 0.5% in 2023, compared to no growth for the European Union and 2.7% for emerging markets and developing economies (EMDEs), which exclude China (4.3%) and include nations like India (6.6%) and Russia (-3.3%). In contrast to the World Bank’s predictions, Goldman Sachs forecast a 0.6% increase for the E.U. in a report on Tuesday, saying that inflation has gone beyond the top. The firm also kept its prediction of a severe recession in the U.K.

According to the groups, growth predictions have been lowered because rising inflation rates have driven surprisingly quick policy changes, deteriorating financial circumstances, continuing economic shockwaves, and an energy crisis brought on by Russia’s unjustified invasion of Ukraine.

Global economies saw an incomplete recovery in 2022 due to banks having to undo pandemic-era policy changes. The IMF continues to reduce its prognosis for the worldwide economy in the organization’s biannual report due to growing inflation and interruptions brought on by the conflict in Ukraine. The organization’s statement is a percentage point lower than forecasts made in October by that institution. The problem confronting development is deepening.

While the globe is tightening its purse strings, no space should exist for defeatism. Significant reforms could be undertaken now to steer the economy from recession. Proposed ideas include investing in new jobs, improving cross-border trade, and increasing energy access. Federal Reserve Chair Jerome Powell and other reserve officials cited the U.S. job market, which recorded stronger-than-expected data last month, as proof that the U.S. economy can continue to sustain further rate rises. Nonetheless, despite this, after roughly 125,000 people were let go in 2020, layoffs still occur at several influential American organizations.

This post was originally published on Etienne Kiss-Borlase’s Finance blog. For more info about Etienne, please visit his homepage.

9 notes

·

View notes

Text

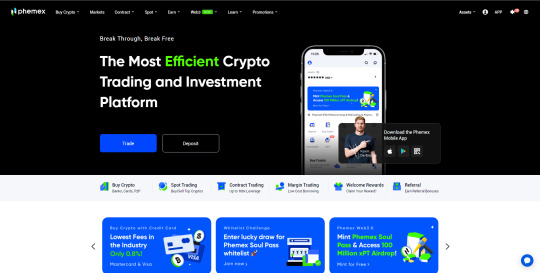

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

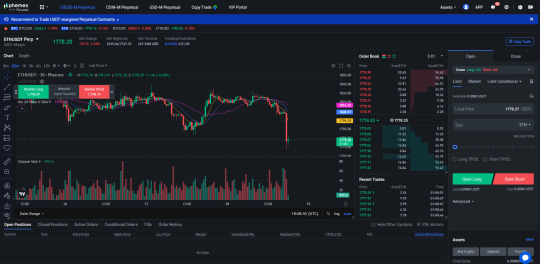

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

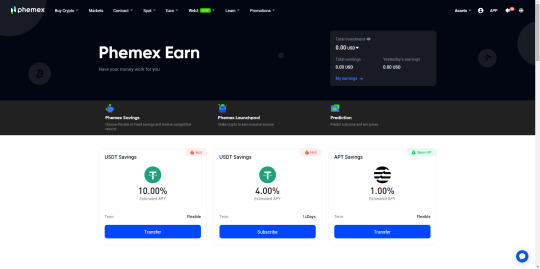

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

Cryptocurrency: What is it and How Does it Work?

Cryptocurrency is a virtual or digital currency that utilizes cryptography for the security and validation of its trades. This form of money does not rely on a central bank, thus, is a decentralized medium of exchange. The entire history of cryptocurrency transactions is publically kept on a blockchain ledger and is maintained by numerous computers across the world.

This digital asset has a range of remarkable traits, such as heightened security, quick transfers, and a limited quantity, that make it a desirable option for investments. In addition to this, the decentralized and virtual aspect of cryptocurrency could transform global banking and payments. In this blog, we will delve into the definition of cryptocurrency, it’s functioning, its advantages, prospects of the future, and a conclusion.

What is Cryptocurrency?

How Does it Work?

Transactions are conducted on a decentralized network of computers and verified with a public ledger known as a blockchain. This peer-to-peer system bypasses the need for any centralized authority or intermediary. Subsequently, cryptocurrency users can transfer and acquire currency directly from their digital wallets. cryptocurrency directly to each other via digital wallets.

The blockchain is a publicly accessible register of every single transaction to ever be conducted over the network. All exchanges are validated by multiple computing nodes on the network and once ratified, the transaction is incorporated into the blockchain, guaranteeing the safety, clarity, and inalterability of every single network transaction.

Features of Cryptocurrency

Decentralization: Cryptocurrency is decentralized, This means clearly that the government does not regulate it.

Security: Cryptography ensures the integrity of cryptocurrency transactions, making them nearly invulnerable to unauthorized intrusion or duplication.

Transparency: All transactions on the blockchain are transparent and publicly accessible.

Anonymity: The privacy of cryptocurrency transactions allows users to carry out transactions without needing to disclose their personal information. Anonymity is thus provided by these virtual currencies.

Global Reach: Cryptocurrency facilitates the facilitation of international payments without the burden of having to exchange different types of currency. This increases its reach to a global level.

Potential for the Future

Cryptocurrency is poised to disrupt the financial sector, with its promise of heightened security, transparency, and expedited financial transactions. As technology progresses and cryptocurrency acceptance rises, it is increasingly likely to be recognized as a bona fide payment option.

Predictions by experts state that cryptocurrency may eventually be favored over traditional money as a method of payment. This would potentially cause a considerable alteration in how monetary transactions are done and the role that cryptocurrency would play in the world’s economic system.

It currently has more than 4000 cryptocurrencies in operation, with a total market capitalization of over $2 trillion. Some of the most popular cryptocurrencies include bitcoin, Ethereum, and Litecoin.

Conclusion:

To summarize, cryptocurrency is a decentralized digital or virtual currency that uses advanced blockchain technology for protection. Its various benefits such as decentralization, security, transparency, anonymity, and worldwide availability make it particularly attractive.

The application of cryptocurrency to the financial industry promises to revolutionize it through increased security, transparency, and efficiency in financial operations. Yet, before it can gain broad acceptance, its potential needs to be acknowledged by legislators and governed through suitable regulations.

Cryptocurrency presents an opportunity for dramatic transformation in how money and finances are conducted. Its evolving potential has the power to revolutionize our lives and shape the global economy. The future is sure to be enthralling as this new technology continues to grow.

2 notes

·

View notes

Link

#salesleads#businessleads#telemarketing#online#techniques#ALABAMA ALASKA ARIZONA ARKANSAS CALIFORNIA COLORADO CONNECTICUT DELAWARE DISTRICT OF COLUMBIA FLORIDA GEORGIA HAWAII IDAHO ILLINOIS INDIA

3 notes

·

View notes

Text

Navigating Financial Regulations: Overcoming Key Legal Challenges in Modern Business

Navigating financial regulations is one of the most critical challenges modern businesses face. With the ever-changing landscape of compliance requirements, legal frameworks, and regulatory bodies, companies must proactively understand and adhere to these laws. Failing to comply can lead to severe penalties, reputational damage, and even operational shutdowns. This article explores key legal challenges businesses face in financial regulations and provides insights on overcoming them effectively.

Understanding the Complexity of Financial Regulations

Financial regulations vary by industry, country, and business structure. Each entity must comply with specific laws designed to ensure transparency, protect consumers, and prevent fraud, from small startups to multinational corporations.

Key financial regulatory bodies in the United States include the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Office of the Comptroller of the Currency (OCC). Each agency enforces compliance measures in securities trading, banking operations, and consumer protection.

International businesses must also comply with global regulations, such as the European Union’s General Data Protection Regulation (GDPR) or the Basel Accords, which govern banking capital requirements. The complexity arises from overlapping jurisdictions and evolving legal frameworks, making it crucial for companies to stay informed and maintain robust compliance strategies.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

One of the most challenging aspects of financial regulations is ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These regulations prevent economic crimes such as money laundering, fraud, and terrorist financing.

Financial institutions, fintech companies, and businesses that handle transactions must verify the identities of their customers, monitor transactions for suspicious activity, and report any red flags to authorities. Non-compliance with AML and KYC laws can result in hefty fines and legal consequences.

To navigate these challenges, businesses should:

Implement a robust customer verification process using AI-driven identity verification tools.

Conduct regular audits to ensure compliance with regulatory standards.

Train employees on recognizing suspicious transactions and reporting them.

Technological advancements such as blockchain and AI-powered compliance tools have significantly improved regulatory monitoring and reporting, making it easier for businesses to maintain compliance.

Adapting to Changing Tax Regulations

Tax laws are continuously evolving, impacting businesses of all sizes. Companies must adapt from corporate income tax to sales tax and international tax compliance to avoid financial penalties and legal issues.

One of the biggest challenges is navigating cross-border taxation. Companies engaged in international trade must comply with multiple tax regimes, understand transfer pricing regulations, and ensure accurate reporting to avoid double taxation.

To overcome tax-related legal challenges, businesses should:

Work with tax professionals who specialize in both domestic and international taxation.

Use tax automation software to track compliance and generate accurate reports.

Stay updated on tax law changes through government publications and financial advisors.

Governments worldwide are tightening tax regulations to close loopholes and prevent tax evasion, making it essential for businesses to maintain proper documentation and report earnings transparently.

Data Privacy and Cybersecurity Compliance

Financial regulations increasingly focus on data privacy and cybersecurity, particularly in industries handling sensitive customer information. Regulations such as the GDPR, California Consumer Privacy Act (CCPA), and the Sarbanes-Oxley Act (SOX) require businesses to protect customer data, report breaches, and establish internal control measures.

Cybersecurity threats, including data breaches and hacking attempts, can lead to severe financial losses and reputational damage. Businesses that fail to comply with data protection laws may face lawsuits, regulatory fines, and loss of consumer trust.

To enhance compliance with data privacy laws, businesses should:

Encrypt sensitive financial data and limit access to authorized personnel only.

Conduct regular cybersecurity risk assessments and implement multi-factor authentication.

Establish an incident response plan to address potential data breaches promptly.

Investing in employee cybersecurity training and staying updated on global data protection regulations can significantly reduce the risk of legal complications.

The Future of Financial Compliance: Technology and Automation

As financial regulations become more complex, businesses use technology and automation to streamline compliance processes. Regulatory Technology (RegTech) is revolutionizing companies' management of legal obligations, ensuring real-time monitoring, risk assessment, and reporting.

AI-powered compliance tools help businesses:

Automate transaction monitoring and detect fraudulent activities in real-time.

Generate compliance reports to meet legal requirements efficiently.

Reduce human error and ensure consistent regulatory adherence.

Blockchain technology is also emerging as a key player in compliance, offering transparent and tamper-proof record-keeping. By integrating these advanced technologies, businesses can enhance their ability to meet regulatory standards while improving operational efficiency.

Navigating financial regulations is a continuous challenge that requires businesses to stay informed, implement proactive compliance measures, and leverage technology. By understanding regulatory complexities, adhering to AML and KYC requirements, managing tax obligations, ensuring data privacy, and embracing RegTech, companies can mitigate risks and operate successfully in a legally compliant manner. Staying ahead of legal changes and investing in compliance strategies is not just about avoiding penalties but building a sustainable and trustworthy business.

0 notes