#S Corporation

Explore tagged Tumblr posts

Note

I came across this anon and wanted to get your thoughts on Danneel reinstating her production company.

https://www.tumblr.com/hologramcowboy/754092292510564352/ive-seen-people-saying-jensen-has-been-seen-but

Link. I'm assuming that Talking Poodles is a S-corporation. It was first filed on August 15, 2006, the year she was promoted to regular on One Tree Hill, I believe (if I'm wrong then let me know). With significant pay increase that comes with regular status, a S-corporation help reduce tax bills when she "pays" others, say, her parents.

For the one season she was a regular on OTH, she would have been paid a total of $630K minimal. Traditionally S-corps would "pay" the actor about half the gross, and the remaining half goes to retirement savings and salary for her parents and expenses for professional developments like acting coaches, hair, make up, etc.

Checking Danneel's IMDb, I'm guessing Talking Poodles stopped functioning after 2019 when she picked up her last acting paycheck from Supernatural. Ahead of The Winchester debut, TP likely was reinstated for her executive producer paychecks. The Anon said TP was reinstated in 2024 so either she's trying to get back into acting again (in The Countdown?) or is expecting another executive/producer paycheck for a show they sold to a network. Media companies sometimes won't work with actors if they don't have a S-corp due to insurance issues.

26 notes

·

View notes

Text

How To Create A Tax-Savvy Business Budget For Your S Corporation?

Creating a tax-savvy business budget for your S Corporation is essential for maximizing profitability and minimizing tax liabilities. Here’s how to structure a budget that helps you manage expenses efficiently and leverage tax advantages unique to S Corporations.

Understand Your Income Flow

The first step in creating a budget is accurately estimating your income. As an S Corporation, your business income is passed through to the shareholders and reported on their tax returns. Therefore, understanding your income flow is crucial. Review past financial statements to forecast your revenue for the upcoming year. Be realistic in your projections, considering seasonal fluctuations and market trends.

Plan for Salaries and Distributions

S Corporation owners who actively work for the business must pay themselves a reasonable salary, subject to payroll taxes. Any profit beyond that can be taken as shareholder distributions, which are not subject to self-employment taxes. In your budget, allocate funds for salaries and distributions while ensuring your compensation is compliant with IRS guidelines. Balancing salaries and distributions is a key strategy in reducing your overall tax burden.

Allocate for Taxes and Payroll Expenses

Although S Corporations avoid double taxation, you are still responsible for payroll taxes, estimated quarterly taxes, and state-specific taxes. Include these expenses in your budget to avoid cash flow issues. Setting aside a tax reserve can help you prepare for these obligations. If your business operates in multiple states, consider the impact of state tax laws and budget accordingly.

Include Health Insurance and Retirement Contributions

S Corporations offer opportunities for tax-saving benefits, such as health insurance and retirement plans. If you pay for health insurance premiums for yourself and your employees, you can generally deduct these costs. Additionally, contributing to a retirement plan like a SEP IRA or a 401(k) can lower your taxable income. Incorporate these contributions into your budget to optimize tax benefits and ensure you’re meeting both IRS and financial goals.

Budget for Business Expenses and Deductions

Deductible business expenses, such as office supplies, travel, marketing, and professional fees, can significantly reduce your taxable income. To make the most of these deductions, budget for them strategically. Keep thorough records and receipts to substantiate expenses in case of an audit. Implementing accounting software can streamline expense tracking and help you stay organized.

Plan for Capital Expenditures

If you anticipate major purchases, like new equipment or technology upgrades, consider the tax implications. Section 179 of the IRS code allows S Corporations to deduct the full cost of certain capital expenditures in the year they are purchased, rather than depreciating them over time. Include these planned expenses in your budget and assess whether accelerating or deferring purchases can benefit your tax situation.

Account for Cash Flow Management

Effective cash flow management is critical for an S Corporation, especially since distributions and tax payments can create financial strain. Include a contingency fund in your budget to handle unexpected expenses or fluctuations in revenue. Regularly review your budget and make adjustments as needed to maintain financial stability.

Tax Planning for S Corporations

Incorporate tax planning into your budgeting process to take full advantage of S Corporation benefits. A tax planning strategy might involve optimizing your compensation structure, timing expenses, and income, and taking advantage of credits and deductions. Consult with a tax advisor offering services of tax planning for S corporations to develop a comprehensive tax plan tailored to your business.

Conclusion

A well-thought-out, tax-savvy business budget helps your S Corporation operate efficiently and remain compliant with tax laws. By forecasting income, strategically planning expenses, and leveraging tax benefits, you can maximize your business’s profitability. Don’t overlook the importance of professional tax planning to ensure you’re optimizing every financial opportunity available to your S Corporation.

0 notes

Text

Maximizing Family Finances: The Benefits of Paying Your Children with Your S Corporation

Running a successful business involves not just the pursuit of profit but also strategic financial planning. For owners of S corporations, leveraging the ability to pay your children can be a smart financial move that not only benefits your business but also provides unique advantages for your family. In this blog post, we’ll explore the various benefits of paying your children through your S…

View On WordPress

0 notes

Text

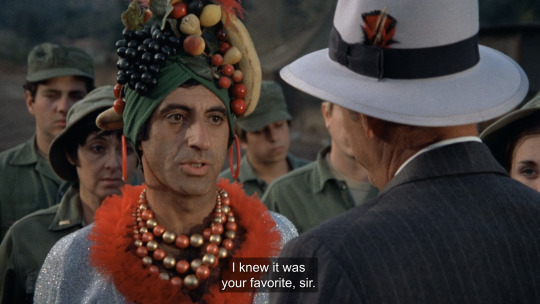

henry made it home safely with a pinup of klinger in his wallet

#just mash things

part 30

#3x24#just mash things#was goign to make another joke but it made me feel sick so not writing it down#klinger#max klinger#corporal klinger#henry blake#henry#mash#m*#m*a*s*h#mash quotes

3K notes

·

View notes

Text

I can't believe they referenced a Tumblr meme...

in an official Nintendo promotional tweet...

#H O N S E#miitopia#miitopia switch#miiblr#There's no way that's not the result of a terminally online intern giggling as they suggested it#and having it completely fly over the head of the corporate guy that approved the tweet

900 notes

·

View notes

Text

M*A*S*H Monday!

#m*a*s*h#M*A*S*Hedit#mashedit#hawkeye pierce#benjamin franklin hawkeye pierce#benjamin franklin pierce#radar#radar o'reilly#walter radar o'reilly#margaret houlihan#max klinger#corporal klinger#klinger mash#mash 4077#klinger#maxwell klinger#fallen idol#+ text posts#post#perioddramaedit#periodedit#tvedit

700 notes

·

View notes

Text

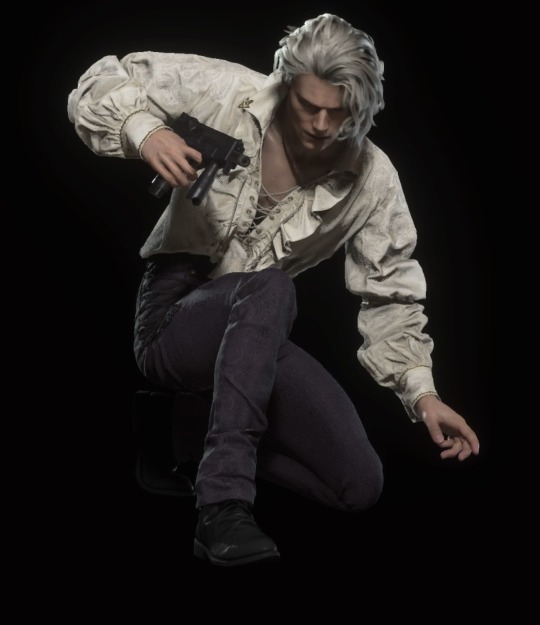

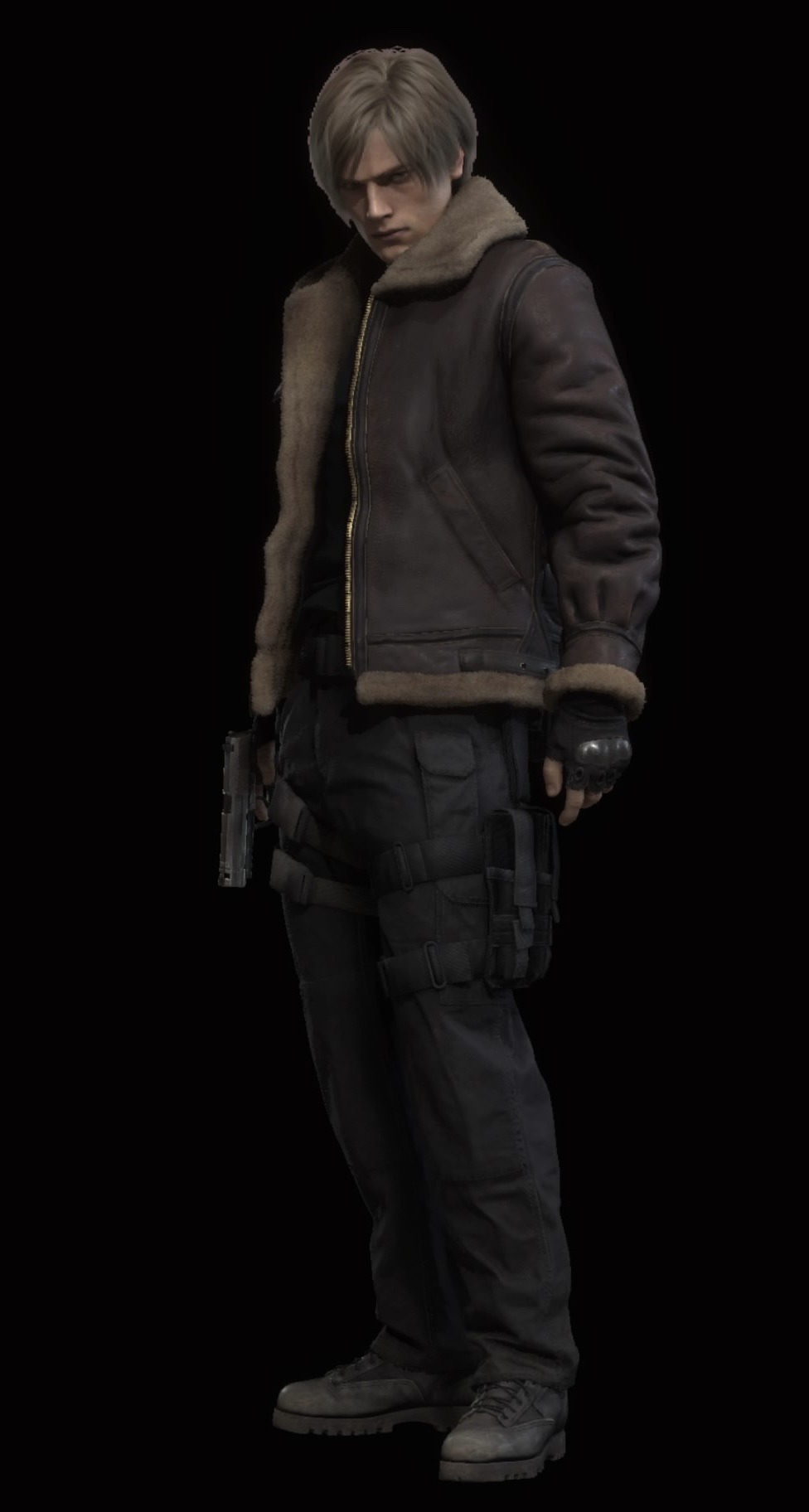

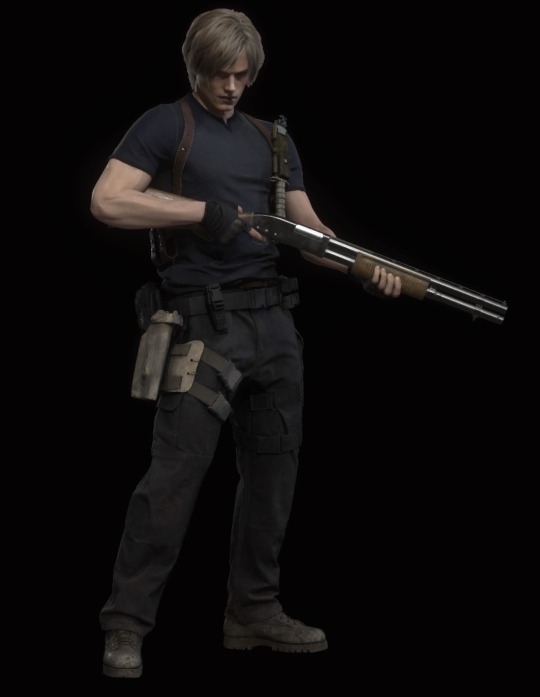

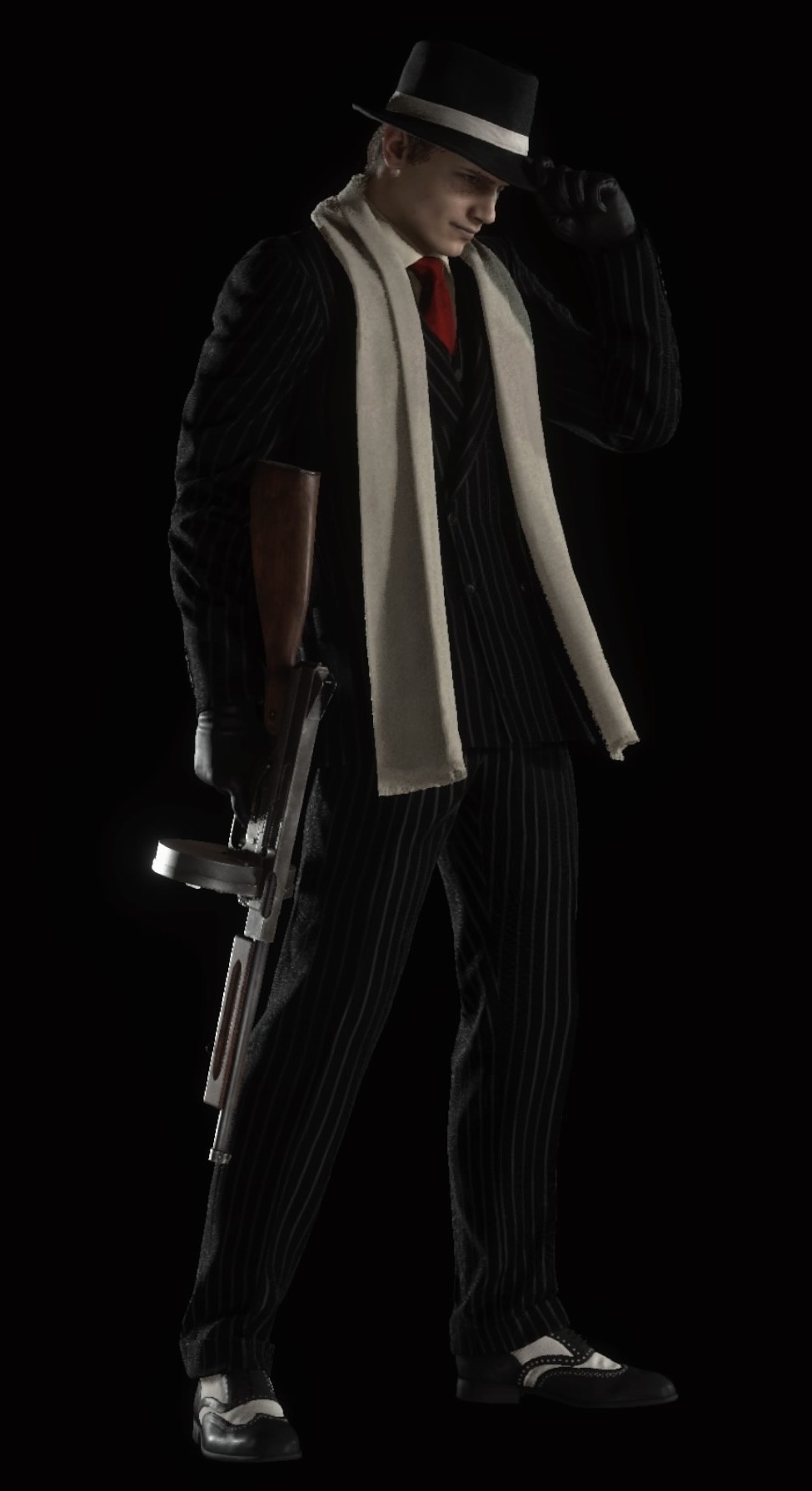

A really cool Easter egg I’d like to mention is that the poses used in the remake’s model viewers for Leon’s outfits reference promotional pictures used for the Original game.

I couldn’t fit these into the main post:

#I used to look at the promo pictures all the time when I was younger#corporate wants you to find the difference between these two pictures. they’re the same picture#Leon S Kennedy#Leon Kennedy#Resident Evil 4 remake#Resident Evil 4

1K notes

·

View notes

Text

He’s a babygirl, he’s a bottom, he’s a war criminal, he’s a ruthless motherfucker, he’s a tortured soul. He hate himself, he got a god complex, he’s a poweful entity but the most helpless creature on the planet, he’s a flawed man, he’s a savior, he’s a creator, he’s capitalism, he’s the apple to others and a monster to the latter. he’s the villain of his own story, he’s the best and worst parental figures, he got friends and in a polycule yet he’s the loneliest person in the world. He wanted in every plane of existence, there’s also a religion dedicated to him. He eat raw onion for breakfast, he has depression, he has autism, he has iron defficiency, he’s the messiah and the devil, he’s the modern prometheus. He loves his family, he subject his family into horror beyond comprehension. He overturn the foundation of the narratives for the better or worst. He’s a walking abnormality, he’s the singularity, he’s the world. He’s doomed by the narratives, he haunted the narratives, he is the narratives, he loves coat. He’s playing 5D chess with multiversal time travel but dont know how to use the microwave. He 10 steps ahead while also the biggest idiot. Everyone hates him as much as they love him

And he fucking look like this

#lobotomy corporation#omniscient reader's viewpoint#project moon#limbus company#the s classes that i raised#lob corp ayin#lobotomy corp ayin#ayin#kim dokja#lc yi sang#yi sang#lcb yi sang#limbus yi sang#han yoojin#s classes that i raised#orv kdj#kdj#orv#orv spoilers#lob corp#no this isnt about kim dokja or ayin this is me absolutely baffle of how korean write character so profound and deep#all while looking like some dude

697 notes

·

View notes

Text

Soap: How’s Ghost’s head?

R/n, annoyed: Still full of bullshit.

Soap:...

R/n: Oh... You meant when he walked into that flag pole this morning. He’s fine.

Soap: …

R/n: Why are you still staring for?...(looks over her shoulder) Oh crap, is he behind me?

{Ghost is sitting on the chair next to her with out his mask on.)

Simon, flatly: No. I’m beside you...

R/n, jumps away shocked: Ahhh!

{The reader is so used to seeing Ghost with his mask on, she often forgets what Simon looks like. Also the reason the reader is acting so catty is because Ghost stood her up on a date, he didn’t mean to. A female recruit who was after him, tricked Ghost into helping her with some tasks knowing full well he had a date with R/n. Long story short, the recruit tried to make a move and Ghost tore her down a few pegs in front of everyone. He tried to apologize to R/n for missing their date but she was giving him the cold shoulder so he’s basically following her around like a lost puppy...]

[PART 2]

#s: tumblr#with some adlib added#call of duty modern warfare incorrect quotes#call of duty 2022#call of duty x reader#simon ghost riley x reader#simon riley#john soap mactavish#afab reader#Clerk! reader#corporal! reader#cod mw ghost#cod mw soap

3K notes

·

View notes

Text

#female led relationship#female led husband#female led marriage#beta#beta male#beta boi#d/s#d/s dynamic#d/s relationship#submit#slave#goddess#Queen#denial#denied#caged#locked#chasity#chastiy#cumless#pussy free#never inside#matriarchy#gynarchy#discipline#obedience#obedience training#punishment#corporal punishment#top post

428 notes

·

View notes

Text

Financial Planning: Managing Quarterly Estimated Taxes for S Corporations

Effective financial planning is crucial for S Corporations when managing quarterly estimated taxes. This process involves estimating income, considering deductions, and strategically planning payments to meet tax obligations. Professionals providing services of tax planning for S corporations in Marlboro, NJ ensure compliance and avoid penalties.

0 notes

Text

another klinger drawing!!

691 notes

·

View notes

Text

Submit an S Corporation Application and EIN Application Form on the Tax ID Filing website and submit online on your behalf. S corporation offers limited liability protection, special IRS tax status, and more. Before apply for S Corporation you can call on 8777280809 our team will guide you through our entire process.

0 notes

Text

#just mash things

part 29

#3x22#just mash things#henry blake#henry#klinger#max klinger#mash#m*a*s*h#mash quotes#corporal klinger

715 notes

·

View notes

Text

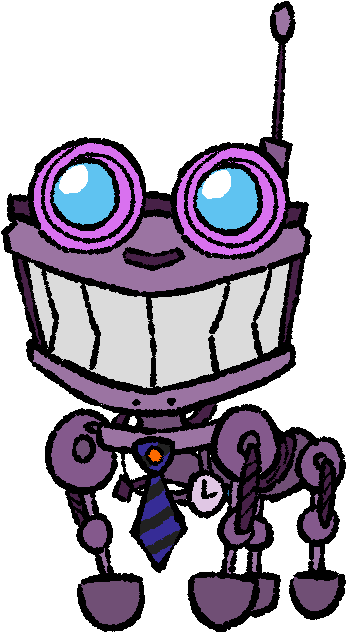

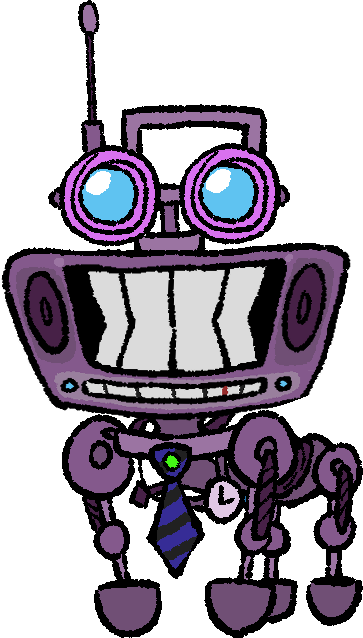

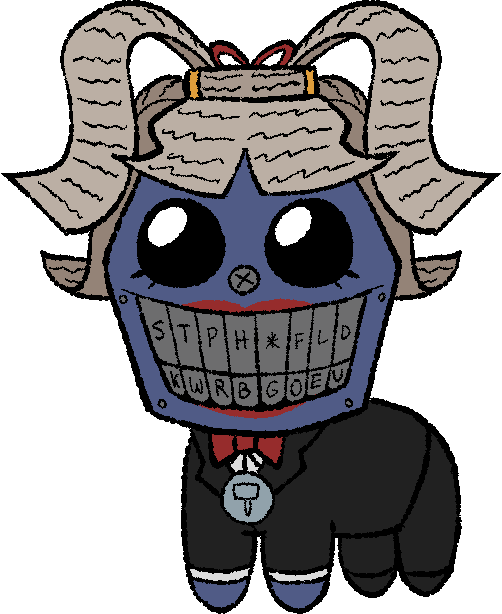

autism creatures part 2

(heres part 1 for those who didn't see it and want a creature of one of the 1.3 managers :3)

#toontown#toontown corporate clash#ttcc#i want to make the other bosses too but idrk how to creatureify them cus they got tank treads. sorry allan army maybe next time#chairman#robert cyger#ottoman#thomas saggs#derrick man#william boar#land acquisition architect#alton s crow#public relations representative#winston byrd#director of public affairs#dana s charme#director of land development#buck wilde#derrick hand#desmond kerosene#litigator#mundie mudsnapper#scapegoat#kilo kidd#stenographer#courtney case#case manager#barry brief#high roller#stupid made this

294 notes

·

View notes