#Personal loan for renewable energy projects

Explore tagged Tumblr posts

Text

What is a Green Personal Loan?

With growing awareness of climate change and sustainability, financial institutions are offering green personal loans to encourage environmentally friendly initiatives. A green personal loan is a specialized loan designed to fund projects that promote energy efficiency, renewable energy, and sustainable living. These loans can be used for various eco-friendly purposes, such as solar panel installations, electric vehicle purchases, energy-efficient home upgrades, and water conservation systems.

This article explores the benefits, eligibility, application process, and best green personal loan providers in India.

1. Understanding Green Personal Loans

A green personal loan works similarly to a traditional personal loan, but the funds must be used for environmentally sustainable projects. Lenders often offer lower interest rates, flexible repayment terms, and government-backed incentives to encourage borrowers to invest in green solutions.

Some banks and NBFCs offer specialized green loan programs, while others allow borrowers to use regular personal loans for sustainable projects. The key benefit of these loans is that they help individuals adopt eco-friendly technologies without significant upfront financial burdens.

🔗 Explore Personal Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

Bajaj Finserv Personal Loan

2. Uses of a Green Personal Loan

A green personal loan can be used for various environmentally friendly initiatives that promote sustainability and energy efficiency. Some of the most common uses include:

2.1. Solar Panel Installation

One of the most popular uses of a green personal loan is to install solar panels at home or business premises. Solar energy helps reduce electricity bills and dependency on fossil fuels.

2.2. Energy-Efficient Home Upgrades

Borrowers can use the loan to invest in energy-efficient appliances, such as LED lighting, smart home automation, and better insulation. These upgrades help lower energy consumption and reduce carbon footprints.

2.3. Electric Vehicle (EV) Purchases

Green personal loans can be used to buy electric cars, bikes, and scooters. Switching to an EV helps reduce fuel costs and supports the transition to clean energy. Some loans also cover the cost of installing home EV charging stations.

2.4. Water Conservation Systems

A green personal loan can help finance rainwater harvesting systems, greywater recycling, and smart irrigation systems. These investments help conserve water and lower utility expenses.

2.5. Waste Management Solutions

Borrowers can use the loan to set up composting units, waste recycling plants, or bio-gas systems for sustainable waste management.

🔗 Best Lenders for Green Personal Loans:

Tata Capital Personal Loan

InCred Personal Loan

3. Benefits of Green Personal Loans

Lower Interest Rates

Many banks and NBFCs offer lower interest rates for green personal loans to encourage eco-friendly initiatives. Some loans even qualify for government subsidies or tax benefits.

Reduced Energy Costs

Investing in solar panels, energy-efficient appliances, or electric vehicles leads to significant savings on electricity and fuel bills over time.

Environmental Impact

Using a green personal loan for sustainable projects helps reduce carbon footprints, lower pollution, and promote renewable energy adoption.

Flexible Loan Options

Green personal loans offer flexible repayment terms and varying loan amounts to suit different sustainability projects.

Government Incentives & Tax Benefits

Some green initiatives, such as solar panel installations, qualify for tax rebates, subsidies, or financial incentives under government schemes.

4. How to Apply for a Green Personal Loan

Applying for a green personal loan is similar to applying for a traditional personal loan. The process involves the following steps:

Step 1: Select a Loan Provider

Compare different banks and NBFCs offering green personal loans. Look for lenders with low interest rates, flexible repayment options, and quick disbursal times.

🔗 Recommended Lenders:

Axis Finance Personal Loan

Bajaj Finserv Personal Loan

Step 2: Check Eligibility Criteria

Most lenders require:

Age: 21-60 years

Employment Status: Salaried or self-employed

Minimum Income: ₹2-5 lakh per annum

Credit Score: 700+ for best loan terms

Some banks may also require proof that the loan will be used for an environmentally friendly purpose, such as a quotation for solar panel installation or EV purchase agreement.

Step 3: Gather Necessary Documents

Identity Proof: Aadhaar, PAN, Passport, or Voter ID

Address Proof: Utility bills or rental agreement

Income Proof: Salary slips, bank statements, or income tax returns

Loan Purpose Proof: If applicable, documents such as solar panel installation estimates or EV booking receipts

Step 4: Submit Your Application

Apply for the loan online through the lender’s website or visit a branch to submit a physical application.

Step 5: Loan Approval and Disbursal

Once approved, the loan amount is credited to your bank account within 24-72 hours.

5. Factors to Consider Before Taking a Green Personal Loan

Before applying for a green personal loan, consider the following:

Compare Interest Rates

Look for lenders offering lower interest rates or special discounts for sustainable projects. Some banks may have specialized green finance programs with reduced processing fees.

Check for Government Incentives

Some eco-friendly investments, such as solar panel systems, qualify for tax rebates or government subsidies. Research available incentives before borrowing.

Assess Long-Term Cost Savings

A green personal loan should provide financial benefits in the long run, such as reduced electricity costs or lower fuel expenses.

Choose the Right Loan Tenure

A shorter loan tenure reduces interest costs, while a longer tenure makes EMIs more affordable. Select a repayment plan that fits your financial capacity.

Is a Green Personal Loan Right for You?

A green personal loan is an excellent option for individuals looking to invest in sustainable living solutions such as solar energy, energy-efficient appliances, electric vehicles, and water conservation projects. These loans provide lower interest rates, cost savings, and environmental benefits, making them a smart financial choice.

Before applying, compare lenders, check for government incentives, and ensure the investment aligns with your financial goals. If used wisely, a green personal loan can help you save money while contributing to a greener future.

🔗 Looking for a Green Personal Loan? Explore the Best Options Here:

Apply for a Personal Loan

By making eco-friendly financial choices, you can reduce your carbon footprint while enjoying long-term cost savings and sustainability benefits!

#Green personal loan#What is a green loan?#Eco-friendly personal loan#Sustainable finance options#Personal loan for solar panels#Green financing for home improvements#Electric vehicle loan#Energy-efficient loan programs#Low-interest green loans#Personal loan for renewable energy projects#finance#personal loan online#loan services#personal loans#bank#personal loan#nbfc personal loan#loan apps#personal laon#fincrif#Best green personal loans in India#Loans for sustainable home upgrades#Green home improvement financing#Solar energy loan options#Government incentives for green loans#Personal loan for EV purchase#Energy-efficient home upgrade financing#Sustainable investment loans#Carbon footprint reduction loans#Eco-friendly financing solutions

0 notes

Text

The week of March 10-14

We start the week with Prosperity, Equity, & Generosity

Someone else’s need to give to you in order to restore balance or, a need for you to give in order to create balance, makes generosity a priority. It’ll be less about philanthropy & more about equity, & compassion.

The joy of giving what is needed & ‘deserved’ can illuminate the next steps on your path & renew your inspiration. Equally, receiving assistance that returns a balance to you will bring a feeling of fairness & equity.

💚 This is the perfect time to seek improvement through an authority figure; ask the bank for the loan you want to start your own business, or ask your boss for a raise. 💙 In relationships, this Six heralds happiness found in security, balance, & a strong foundation. Make an effort to connect with your people today. Remind each other of the ways in which you enrich each other 🧡 Freely give, and receive today, with the knowledge that the Universe always returns to you what you freely give.

MIDWEEK we have Focus, Manifested Success, Equitable Partnerships

Three of Wands indicates success after a time of struggle or difficulty; the light at the end of the tunnel. Whether you desire a better career, a “new” you, or some other change, manifest what you desire. New associations, new information, & a new perspective may contribute to your success.

Looking to the past can help you appreciate how far you’ve come; just don’t let nostalgia or hold you there. Be patient & trust in your vision & effort.

💚 Whether you are a stay at home parent, or work in a company of hundreds, your efforts have been noticed. Others, & the Universe wish to reward them. 💙 In love, keep or invest in, only a partnership that is equitable & respectful. If the relationship is not all it needs to be for you then let it go. Ensure you are ready to prioritize a relationship. 🧡 Invest time in the things that matter & then release control. Trust the process, let go, & choose to be surprised by joy.

We approach the weekend with Abundance, Creativity, & Celebration

This card represents happiness & secure joy that will last & be shared in deep friendship. It’s a celebration of the success of the different skills & traits each of you contributed to the success; an honouring of the “tapestry”. It usually appears at the completion of a meaningful project, or a marriage or birth.

💚 Work may offer a promotion &/or a pay increase. Whether you are looking for a new job or wish to move up where you are, the 'right' people are about to see your efforts & reward them. 💙 Love requires the closure of past relationships in order to attain the next level of your current relationship, or to begin a new one. This closure comes to you because of the personal growth you have achieved. 🧡 Your effort has generated great energy, & is beginning to influence your future. The future holds abundance & celebration. Well done, you!

Gus an ath thuras (Until next time), darlings Go, Do, Be. Peace out

19 notes

·

View notes

Text

Dandelion News - October 15-21

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles on Patreon!

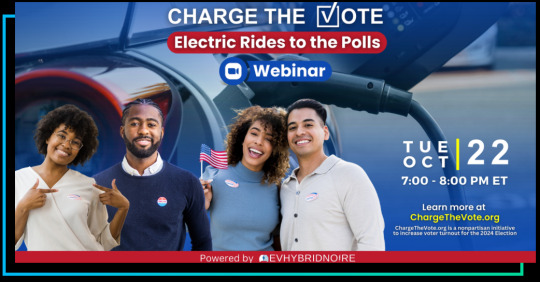

1. EV owners volunteer to drive voters to the polls in 11 states (and you can too)

“ChargeTheVote.org is a nonpartisan voter education and engagement initiative to enhance voter turnout in the 2024 election by providing zero-emission transportation in electric vehicles (EVs) to local polling locations. ChargeTheVote will also host a webinar for those who are interested in participating this coming Tuesday, October 22 at 7pm Eastern time.”

2. Kenya moves 50 elephants to a larger park, says it’s a sign poaching is low

“The elephant population in the […”Mwea National Reserve”…] has flourished from its capacity of 50 to a whopping 156 […] requiring the relocation of about 100 of [them…. The] overpopulation in Mwea highlighted the success of conservation efforts over the last three decades.”

3. Australian start-up secures $9m for mine-based gravity energy storage technology

““We expect to configure the gravitational storage technology [which the company “hopes to deploy in disused mines”] for mid-duration storage applications of 4 to 24 hours, deliver 80% energy efficiency and to enable reuse of critical grid infrastructure.“”

4. Africa’s little-known golden cat gets a conservation boost, with community help

“[H]unting households were given a pregnant sow [… so that they] had access to meat without needing to trap it in the wild. […] To address income needs, Embaka started […] a savings and loan co-op[… and an] incentive for the locals to give up hunting in exchange for regular dental care.”

5. 4.8M borrowers — including 1M in public service — have had student debt forgiven

“That brings the total amount of student debt relief under the administration to $175 billion[….] The Education Department said that before Biden's presidency, only 7,000 public servants had ever received student debt relief through the Public Service Loan Forgiveness program. […] "That’s an increase of more than 14,000% in less than four years.””

6. Puerto Rico closes $861M DOE loan guarantee for huge solar, battery project

“The solar plants combined will have 200 megawatts of solar capacity — enough to power 43,000 homes — while the battery systems are expected to provide up to 285 megawatts of storage capacity. [… O]ver the next 10 years, more than 90 percent of solar capacity in Puerto Rico will come from distributed resources like rooftop solar.”

7. Tim Walz Defends Queer And Trans Youth At Length In Interview With Glennon Doyle

“Walz discussed positive legislative actions, such as codifying hate crime laws and increasing education[.… “We] need to appoint judges who uphold the right to marriage, uphold the right to be who you are [… and] to get the medical care that you need.””

8. Next-Generation Geothermal Development Important Tool for Clean Energy Economy

““The newest forms of geothermal energy hold the promise of generating electricity 24 hours a day using an endlessly renewable, pollution-free resource[… that] causes less disturbance to public lands and wildlife habitat […] than many other forms of energy development[….]”

9. Sarah McBride hopes bid to be first transgender congresswoman encourages ’empathy’ for trans people

““Folks know I am personally invested in equality as an LGBTQ person. But my priorities are going to be affordable child care, paid family and medical leave, housing, health care, reproductive freedom. […] We know throughout history that the power of proximity has opened even the most-closed of hearts and minds.”“

10. At Mexico’s school for jaguars, big cats learn skills to return to the wild

“[A team of scientists] have successfully released two jaguars, and are currently working to reintroduce two other jaguars and three pumas (Puma concolor). [… “Wildlife simulation”] “keeps the jaguars active and reduces the impact of captivity and a sedentary lifestyle[….]””

October 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#good news#hopepunk#electric vehicles#voting#elephant#kenya#conservation#australia#battery#energy storage#africa#cats#hunting#tw animal death#student loans#student debt#debt relief#education#puerto rico#solar#solar panels#solar energy#solar power#tim walz#lgbt#lgbtq#geothermal#renewableenergy#trans rights#transgender

29 notes

·

View notes

Text

Othala, Fate

Othala was also known as Odin's Rune.

"The well-known Oþala/Odal/Othala rune, originally meaning homeland, ancestry, and inheritance (inherited property), has been known to symbolize free peasants in medieval times, who went on to use the symbol in their house marks but is also seen on several churches. It may have been seen as a symbol to fend off evil." --Folk Wisdom & Ways

Today, 29th of May, the Othila rune manifestation period starts, it will last until 14th of June

The Othila Runa ( or Odal,(Othil) is associated with family property, or heritage, it symbolizes the fence that delineates property and innate qualities both spiritual and material. it represents the power to obtain and predicts favorable answers to all questions concerning your property, and family or social life interests, as well as Freedom, Achievement of objectives and therefore Success.

To make dreams come true, Othila offers some wise advice: you need to keep the goals you want to achieve in mind, in order to channel your energy correctly.

You don’t need to force destiny: everything has its own time, so Othila encourages not to despair and to have faith in your own possibilities.

Divination

If the Runa Othila is in the phase of divination, Dritta warns that it is time to concentrate your efforts towards the goals you most want to achieve: a job, the love of a person, the realization of a project.

If energies are scattered in multiple directions, you won’t be able to conclude anything and you will feel frustrated.

So it tells us that, maybe we are in a period of renewal, that it’s time to get rid of all those relationships that lead to nowhere, and then, to start new projects and that all of this could be very positive.

You need to accept that life removes some things to offer new ones. It’s good to own this truth to stay open to changes.

Overturn, on the other hand, can mean loss of property or exclusion from a community. It may also indicate diatribes related to probate or probate, or a sudden request for repayment of a loan. In any case Othila toppled indicates a problem that not even money or an inherited position can solve.

Informs, then, that excessive attachment, either to people, material, cultural or social goods, is not a good advisor.

If you accept that everything is subject to change, that everything changes, and that losses can mean new gains, you will feel more free and able to live according to your own way.

You need to learn to adapt to circumstances and learn from every experience. This way you will make the most of situations and you won’t suffer when your wishes are not met, when you have to face a separation (in your personal relationships and work), when you don’t achieve the desired success or, simply, when you realize that you have wrong.

Regarding love, the Runa Othila tells us that it is a moment of great sensuality. Your attractiveness increases and you will have many opportunities to meet new people and then start interesting relationships.

Othila advises to take advantage of this situation. If you have a partner, the relationship with him will get stronger.

While in the Laboratory Field Othila tells us that, you will be offered the opportunity to work with new colleagues or to introduce significant changes in the development of your professional activity: something that, sooner or later, will bring benefits.

While regarding Health: The Runa Othila recommends learning to control stress. To this end you need to devote some time every day to yourself, to do some physical exercise, to read or listen to music, or just to chat with friends.

Correspondence

Syllabus : o

Associated with Ragnarok, "inevitable destiny".

Tree : Thorn

Herb : Clover

Crystal : Ruby

Colour : Gold

Zodiac sign : .

Animal : Lion

Tarot cards: XXI major arcano - The World

Astrology: Sun in Aquarius / Moon in Taurus

I Ching: 64th Exagram, Wei Chi - Before completion.

SOURCE the power of the runes the magic of the runes Runica paths of light Source From: --L'Antro celtico

7 notes

·

View notes

Text

Spotlight on FTSE Companies: Key Developments and Trends in the UK Market

Highlights

FTSE companies span various sectors, including energy, healthcare, financial services, consumer goods, and more.

Telecommunications and technology sectors focus on infrastructure expansion and digital innovations.

Construction and industrial material companies play a key role in infrastructure development across the UK.

The FTSE index is a significant benchmark for the UK stock market, featuring a wide variety of companies across diverse sectors such as energy, financial services, healthcare, and consumer goods. The FTSE 100, FTSE 250, and FTSE All-Share Index provide a segmented view of market capitalization, allowing market participants to track the performance of the largest and mid-cap companies. FTSE companies are crucial indicators of the overall health of the UK equity market, with their performance closely monitored for insights into broader economic trends.

Energy Sector DynamicsEnergy companies make up a large portion of FTSE-listed entities. The sector includes multinational oil and gas companies and firms involved in renewable energy projects. While traditional fossil fuel operations remain significant, an increasing focus is placed on sustainability and green energy solutions. Companies are actively engaged in renewable energy projects such as offshore wind, solar, and carbon capture.

For FTSE energy companies, updates related to resource exploration, production metrics, and the development of renewable energy technologies are important. These companies are also engaging in strategic partnerships and joint ventures to expand their energy portfolios, helping to meet global energy demands while transitioning toward greener solutions.

Financial Services: Focus on Digital Transformation and SustainabilityThe financial services sector, encompassing banks, insurance companies, and asset managers, is another key contributor to the FTSE. These companies frequently report on financial performance, loan growth, interest margins, and the expansion of their customer base. A growing focus is placed on digital innovation, with many companies investing heavily in mobile banking platforms, AI-driven financial solutions, and improving customer accessibility.

Sustainability is also a major theme for FTSE financial companies. Many are incorporating green finance strategies, ensuring they align with climate-related goals. Reports on sustainable finance allocation, responsible lending, and climate-related risk management are becoming more prevalent, providing deeper insights into how financial institutions are adapting to environmental challenges.

Consumer Goods: Innovation and Global ExpansionThe consumer goods sector includes well-known companies in food, beverage, personal care, and household products. These companies are seeing growth in their e-commerce and online sales capabilities, allowing them to reach new global markets. Pricing strategies, supply chain resilience, and cost management remain central to operations in the consumer goods space.

Retailers within the FTSE are also innovating their product lines, focusing on seasonal sales, new product introductions, and enhancing customer engagement. Their global expansion efforts continue to be a focal point, especially in emerging markets, where they strive to grow their consumer base and adapt to local preferences.

Healthcare and Pharmaceuticals: Driving Research and InnovationHealthcare companies in the FTSE represent a wide array of pharmaceutical, biotechnology, and medical equipment firms. These companies invest heavily in research and development to discover new treatments and improve healthcare solutions. They frequently release updates on clinical trials, new regulatory approvals, and ongoing research initiatives, particularly in fields like oncology, cardiovascular health, and infectious diseases.

FTSE healthcare companies are also expanding their manufacturing capabilities to meet global demand for essential medical products. Partnerships with global organizations and the development of affordable access programs remain central to their operational strategies. Licensing agreements and innovations in medical technology are significant areas of focus for these firms.

Telecommunications and Technology: Expanding InfrastructureTelecommunications companies in the FTSE index are key players in expanding the UK's 5G and broadband network infrastructure. These firms consistently report on subscriber growth, network performance, and reliability. With increasing demand for high-speed internet and better connectivity, investments in fiber networks and data centers are growing.

In the technology sector, companies involved in software, cybersecurity, and IT services are seeing increased interest. These companies focus on providing digital services such as cloud-based solutions, AI applications, and cybersecurity products. Earnings updates often include metrics related to contract wins, platform upgrades, and global revenue distribution, highlighting how these firms are positioning themselves in an increasingly digital world.

Construction and Industrial Materials: Infrastructure and DemandFTSE companies in the construction and industrial materials sector play a pivotal role in meeting the UK's infrastructure needs. These companies supply essential building materials like cement, aggregates, and chemicals that are used in large-scale construction projects. The demand for these materials remains strong, especially with the continued investment in public infrastructure.

Companies in this sector report on their order books, project pipelines, and margin stability. Many construction firms are also exploring opportunities to improve operational efficiency through equipment modernization and logistics optimization. Sustainability is increasingly a key consideration, with firms looking to meet environmental regulations and reduce their carbon footprint.

Sector Movements and Earnings ReportsThroughout the year, FTSE companies release earnings reports that offer valuable insights into their operational performance, market strategies, and financial health. These reports focus on a variety of metrics, including sales growth, production efficiency, capital allocation, and sustainability efforts. The updates provide a snapshot of how companies are navigating challenges such as supply chain disruptions, economic uncertainty, and shifting market demands.

By monitoring earnings reports and sector movements, market participants can better understand how FTSE companies are responding to market changes and how they are positioned to capitalize on emerging trends. These reports often influence the broader market sentiment and play a crucial role in shaping investment decisions within the UK market.

0 notes

Text

CGTMSE Loan for Technology Upgradation in MSMEs

Technology upgradation, in today's fast-paced world economy, has become unavoidable for Micro, Small, and Medium Enterprises (MSMEs) in India in order to remain competitive. Be it process automation, incorporating newer machinery, or digitalizing, the change is not without an investment—the greatest impediment often for the owner of small business ventures. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has become a game-changer as it provides collateral-free loans in India to MSMEs. The CGTMSE loan not only finances business loans to small businesses, but encourages technology upgradation also to enhance efficiency and global competitiveness. Let us dissect how MSMEs can avail this opportunity, the function of the CGTMSE scheme, and how to avail loans aimed at technology upgradation.

What is CGTMSE?

The CGTMSE scheme, jointly established by the Ministry of MSME and SIDBI (Small Industries Development Bank of India), provides collateral-free loans to small and micro enterprises. With the credit guarantee scheme, the financial institutions and banks are given incentives to extend loans without collateral security or third-party guarantees. In case the borrower defaults, the lender is compensated by CGTMSE between 75% to 85% of the loan amount, minimizing risk to banks and providing incentives for lending to promising but asset-light enterprises.

Significance of Technology Upgradation for MSMEs Technology upgradation is no longer a choice it's a necessity to enhance productivity, lower costs, enhance quality, achieve global standards, and minimize environmental burden. Ironically, all these advantages notwithstanding, access to finance continues to be an issue. Conventional banks are shy of lending for unproven technology or new enterprises with no tangible collateral. This is where CGTMSE loans to upgrade technology act as a lifeline.

CGTMSE Loan for Technology Upgradation: How It Works

CGTMSE loan helps companies fund new equipment and machinery, automation and digitization tools, renewable energy equipment, research and development equipment, IT software and systems. Whether you're a manufacturer moving to CNC machines or a small logistics company going for AI-driven fleet management, CGTMSE-covered loans can help fund your move.

Major Features of the CGTMSE Loan for Technology Upgradation Loan Amount: Up to ₹5 crore under the current expanded limit.

Coverage: Up to 85% of the loan amount is guaranteed under the MSME loan guarantee scheme.

Collateral-Free: No requirement to pledge business or personal assets.

Available through Banks/NBFCs: Most major lenders are included in the scheme.

Concessional Rates for Special Categories: Women entrepreneurs, SC/ST-led businesses, and those in backward areas might receive lower CGTMSE charges.

CGTMSE Charges and Fee Structure Before applying, it's worth knowing the cost involved:

Guarantee Fee (One-Time): Usually 1% to 1.5% of the sanctioned loan amount.

Annual Service Fee: Between 0.37% to 0.75% of the outstanding balance.

Example:

For a ₹40 lakh loan for machinery upgradation:

Guarantee Fee (1.5%) = ₹60,000 (one-time)

Annual Service Fee (0.75%) = ₹30,000 in the first year

These CGTMSE charges are small considering the advantage of upgradation of operations and improvement in revenues.

How to Apply for CGTMSE Loan for Tech Upgradation Want to apply for CGTMSE? Follow these steps:

Business Assessment

Draw up a plan explaining why and how technology will enhance your productivity or competitiveness. Put in ROI estimates and projections.

Choose a Lender

Visit a bank or an NBFC that is registered with CGTMSE. You can also use the CGTMSE login site to view recent lists and guidelines.

Submission of Loan Proposal

Provide your application along with:

Udyam Registration certificate

GST registration

Project report with technology upgradation plan

Quotations for machinery/software

Business accounts

Bank Appraisal

Your proposal will be assessed by the lender. If deemed feasible, they will sanction the loan and apply to CGTMSE for the guarantee cover.

Payment of Fees and Disbursement

After the CGTMSE charge is paid, your loan is released. Repayment conditions depend on the lender and typically range between 3–7 years.

MSME Support Programmes of Indian Government The CGTMSE programme is one part of extensive MSME support programmes by the Indian government, such as:

Credit Linked Capital Subsidy Scheme (CLCSS): Provides 15% subsidy in tech upgradation.

Startup India and Make in India programmes

MUDRA Loans to micro-enterprises

Zero Defect, Zero Effect (ZED) certification support to quality and sustainability

Complementing each other, these programs will create a new-age, efficient MSME ecosystem.

Startup Funding India:

Technology-Driven Innovation For young companies and startups that are innovation-oriented, traditional finance is even more difficult to access. CGTMSE loans can be an excellent starting point for startup funding in India, particularly for those creating or implementing state-of-the-art technology. Blending the CGTMSE scheme with other government schemes for MSMEs can provide your business with a strong financial base without diluting equity or mortgaging property.

How to Take a CGTMSE Loan Without Collateral: Pro Tips Be Loan-Ready: Organize your documents, financials, and projections.

Choose the Right Lender: Opt for those with experience in CGTMSE-backed loans.

Know Your Numbers: Know your cash flow and repayment ability.

Budget for Fees: Factor CGTMSE charges into your loan planning.

Last Word

Technology is revolutionizing all industries, and Indian MSMEs need to keep up. The CGTMSE loan for technology upgradation helps bridge the financial gap that prevents many small enterprises from evolving. With the credit guarantee scheme for MSMEs, the government has effectively unlocked a new avenue for growth, modernization, and innovation—without demanding collateral security. If you’re ready to take your business to the next level with smarter tools, automation, or cutting-edge software, now is the time. Learn more about CGTMSE loans, calculate your fees in advance, and begin your path to modernization and expansion.

#cgtmse loan process#credit guarantee scheme for msmes#government schemes for msmes#cgtmse scheme#msme subsidy programs#small business loans india#msme loan guarantee#startup funding india

0 notes

Text

What Happens When Money Starts Solving Problems?

Have you ever wondered what finance would look like if its primary goal wasn’t just to make more money? It’s a curious idea—one that more people are beginning to explore. For decades, the financial world has been centered around returns, performance, and profits. But now, something is changing. Investors, institutions, and everyday consumers are starting to ask bigger questions. What if money could be used not only to grow portfolios, but also to solve problems like climate change, poverty, or inequality?

This isn’t just an idealistic dream. In fact, we’re already seeing the shift happen. Across the globe, finance is being reimagined as a tool for positive change—not just personal gain. This change stems from a growing realization: the health of our economy is deeply connected to the health of our society and environment. If businesses thrive while communities suffer, or if profits grow while the planet declines, can we really call that success?

It’s a fascinating moment. The idea that finance could be used to build a more sustainable, inclusive world raises all kinds of new possibilities—and challenges old assumptions. So, what exactly does this look like in practice?

How Can Capital Create Change?

Let’s take a closer look at how money can actually be put to work in ways that benefit more than just the investor. One of the most interesting developments in this area is called impact investing. The concept is surprisingly simple: invest in companies, projects, or funds that are designed to generate both a financial return and a measurable social or environmental impact.

It’s not a donation, and it’s not charity. It’s a deliberate investment decision—with purpose. Imagine investing in a company that provides solar-powered lights to rural villages that don’t have electricity. Your investment supports a business that’s growing, but it also improves lives in a very tangible way. It’s finance, yes—but with a mission.

And impact investing is just one piece of the puzzle. There are green bonds, which raise money specifically for climate-friendly projects. There are community investment funds that lend money to underserved neighborhoods to build housing or open small businesses. There are even ethical banks that screen their lending and investment practices to ensure they’re aligned with environmental and social values.

Each of these financial tools reveals something important: capital doesn’t have to flow toward the most profitable option. It can also flow toward the most meaningful one. And in many cases, those two goals aren’t in conflict at all.

Is Technology Making It Easier to Invest with Purpose?

The curious thing about technology is that it’s changing not just how we interact with money—but also what’s possible. Thanks to new digital tools, it’s becoming easier than ever to align your financial decisions with your values. Want to invest only in sustainable companies? There’s an app for that. Interested in crowdfunding a clean water project? A few clicks and you’re involved.

Technology is opening doors that were once closed. Peer-to-peer lending platforms are connecting investors with social entrepreneurs in developing countries. Blockchain technology is being used to trace donations and make charitable giving more transparent. Even artificial intelligence is getting involved, helping investors identify which projects are likely to deliver both financial and social returns.

And it doesn’t stop there. Data analytics and machine learning are helping institutions track the long-term impact of their investments. How many people got jobs from that small business loan? How much carbon was offset by that renewable energy project? These kinds of questions are now answerable, thanks to the growing ability to measure outcomes in real-time.

What’s especially intriguing is how quickly these tools are evolving. As fintech grows, it’s making impact investing and socially responsible finance accessible to more people than ever before—not just wealthy institutions. That means the future of finance could be shaped by curious, value-driven individuals like you and me.

Why Are Cross-Sector Partnerships So Important?

If finance is going to support real, lasting social change, it can’t do it alone. That raises another interesting question: who needs to work together to make this happen?

The answer: almost everyone. Governments, businesses, nonprofits, and financial institutions all have a role to play. And when they collaborate, something powerful happens.

For instance, a government might offer tax incentives for renewable energy investments. A private investor might supply capital to a startup working on solar-powered irrigation. Meanwhile, a nonprofit could provide on-the-ground insight into what rural communities need most. Put those pieces together, and you have a well-funded, well-informed, high-impact solution.

It turns out that financial capital becomes far more effective when it’s combined with deep local knowledge, supportive policies, and shared goals. That’s why partnerships across sectors are becoming more common—and more necessary.

Foundations and philanthropic institutions are also exploring new territory. Many are shifting from a purely grant-based approach to something called mission-aligned investing, where they use their endowments to further the same goals they support through charitable giving. It’s a smart, scalable way to amplify impact—and it shows that even philanthropy is evolving.

All of this collaboration leads to another curious observation: social change becomes more achievable when everyone brings their strengths to the table, guided by a shared sense of purpose.

Can We Really Measure Social Impact with Numbers?

Here’s a question that stumps a lot of people: how do you measure something like “social good”?

After all, financial returns are easy to track. You can calculate profits, interest, and growth down to the decimal. But how do you measure improved mental health, safer communities, or a cleaner ocean?

It’s not easy—but it’s not impossible either. That’s why organizations around the world are developing standards and frameworks to help investors track and report social impact. The Global Impact Investing Network (GIIN), for example, offers tools to measure outcomes like improved education, job creation, or emissions reduction. Meanwhile, B Corp certification helps companies show that they meet high standards of social and environmental responsibility.

What’s especially exciting is that this field is still growing. As new tools emerge and more data becomes available, our ability to understand the real-world consequences of financial choices is improving. That means investors can make better decisions—not just based on returns, but based on values.

And maybe that’s the most interesting idea of all: when we start asking better questions about how our money is used, we start finding better answers.

What Kind of Future Could We Build with Finance?

So here’s where it all leads: if finance has the power to shape the future, what kind of future do we want?

That’s a question more people are beginning to ask—and it’s changing the way we think about money. It’s no longer just a means of personal advancement. It’s also a way to express what we care about, to support innovation, and to leave the world better than we found it.

Younger generations, especially, are curious about this connection. They want to know where their money is going and what it’s doing when it gets there. They’re choosing banks, investments, and careers that reflect their values—and in doing so, they’re nudging the entire financial system in a new direction.

It’s a hopeful trend, and one that invites us all to think differently. Because if money can solve problems—not just create wealth—then maybe the most powerful question we can ask is this:

0 notes

Text

C-PACE's Role in Revitalizing Stalled Construction Projects

How C-PACE is Restarting Stalled Construction Projects

Economic uncertainty, rising material costs, and high-interest rates have caused many construction projects to stall. Developers and property owners are struggling to secure financing to complete their projects. Fortunately, C-PACE in NYC offers a flexible solution, allowing stalled developments to move forward without the financial strain of traditional loans.

Why Construction Projects Stall

Several factors contribute to construction delays and project abandonment:

Lack of Financing: Developers often struggle to secure capital midway through construction.

Rising Costs: Material and labor costs have increased, exceeding initial project budgets.

Regulatory Hurdles: Stricter sustainability regulations require additional investments in energy efficiency.

High-Interest Rates: Traditional loans come with short repayment periods and high-interest rates, making funding difficult.

How C-PACE Financing Can Help

C-PACE (Commercial Property Assessed Clean Energy) is designed to support energy-efficient and renewable energy upgrades for commercial properties. It offers unique benefits for developers facing financial challenges:

1. Covers Hard and Soft Costs

C-PACE can fund energy-efficient HVAC, insulation, lighting, and solar panels.

It also covers soft costs like engineering, design, and permitting fees.

2. No Personal Guarantees Required

Unlike traditional loans, C-PACE is tied to the property, not the borrower.

This eliminates personal financial risk for developers.

3. Long-Term, Low-Interest Financing

Repayment terms extend up to 20-30 years.

Fixed interest rates ensure predictable and manageable payments.

4. Aligns with Sustainability Requirements

NYC has strict energy efficiency regulations.

C-PACE financing helps developers meet compliance without straining their budgets.

Why NYC Developers Are Turning to C-PACE

New York City’s real estate market is competitive, and sustainability is a key focus. C-PACE financing allows developers to:

Complete stalled projects by securing much-needed capital.

Improve energy efficiency while meeting local compliance requirements.

Increase property value by making buildings more attractive to tenants and investors.

Avoid short-term debt burdens by opting for long-term, low-cost financing.

Conclusion

For developers and property owners struggling with stalled projects, C-PACE in NYC provides a smart financing solution. By offering long-term, fixed-rate funding for energy-efficient upgrades, C-PACE helps unlock capital, reduce risk, and get projects back on track.

Learn more about how C-PACE in NYC can support your construction project at C-PACE NYC.

0 notes

Text

John Lasala Explains 5 Expert Financial Trends in New York

New York has always been at the epicenter of financial innovation, driving economic trends that influence the country. As 2025 unfolds, financial analyst based in New York, John Lasala sheds light on five key trends shaping the financial landscape in the Empire State. With his extensive experience in market analysis and economic forecasting, John Lasala offers insights crucial for investors, business owners, and policymakers alike.

1. The Rise of Digital Banking and Fintech Expansion

The digital banking revolution continues to gain momentum, with fintech companies disrupting traditional banking models. "Consumers in New York are increasingly favoring online financial services over brick-and-mortar banks," says Lasala. He points out that major fintech firms like Chime, Revolut, and SoFi are expanding their presence, offering seamless mobile transactions, AI-driven financial planning, and personalized loan services.

Traditional banks are adapting by enhancing their digital offerings. JPMorgan Chase and Citibank, for example, have ramped up investments in AI-powered customer service and blockchain-based security measures. This digital shift means that businesses must stay ahead of evolving financial technologies to maintain competitiveness.

2. Real Estate Market Shifts: A New Era for Investors

New York's real estate market is experiencing a dynamic shift. While commercial real estate faces challenges due to the rise of remote work, the residential sector continues to thrive. "Investors are seeing opportunities in suburban developments and multi-use properties," explains Lasala. The demand for luxury condos and co-living spaces has also surged, driven by younger professionals seeking flexibility and modern amenities.

With interest rates stabilizing, more buyers are returning to the market. However, Lasala warns that affordability remains a critical issue. Government incentives and revised zoning laws are being considered to address the housing shortage, making it an essential area to watch in the coming months.

3. The Growth of Green Finance and ESG Investments

Sustainable investing is no longer a niche market—it is becoming a mainstream financial strategy. "New York investors are prioritizing companies with strong Environmental, Social, and Governance (ESG) ratings," says Lasala. Major financial institutions, including BlackRock and Goldman Sachs, have expanded their sustainable investment portfolios, pushing corporations to adopt greener practices.

State policies are also reinforcing the trend. New York's Climate Leadership and Community Protection Act (CLCPA) aims to cut greenhouse gas emissions, encouraging investments in renewable energy projects and clean technology startups. Businesses failing to integrate ESG considerations may struggle to attract investors in this evolving landscape.

4. Cryptocurrency and Blockchain Integration in Traditional Finance

Despite past volatility, cryptocurrency is cementing its role in New York’s financial ecosystem. Lasala highlights how traditional financial institutions are integrating blockchain technology to enhance transaction security and efficiency. "Major banks are now offering crypto investment options, and the New York Stock Exchange is exploring blockchain for trade settlements," he notes.

Regulation remains a key concern, with New York’s Department of Financial Services tightening compliance measures for crypto firms. However, the state remains a hub for blockchain innovation, attracting startups and institutional investors who see long-term potential in decentralized finance (DeFi).

5. The Impact of AI on Financial Services

Artificial Intelligence is transforming the financial sector, from algorithm-driven trading to AI-powered customer interactions. "We are witnessing a significant shift towards automation in financial services," says Lasala. AI-driven chatbots, fraud detection systems, and predictive analytics are streamlining banking and investment processes, reducing costs and improving accuracy.

New York firms are leading in AI adoption, leveraging machine learning for risk assessment and portfolio management. However, Lasala cautions that as AI takes a bigger role, regulatory frameworks must evolve to address ethical concerns and data privacy issues.

Looking Ahead: A Transforming Financial Landscape

John Lasala’s insights reveal a financial landscape in flux, where technology, sustainability, and market shifts are shaping the future. New York remains a global financial powerhouse, but adaptation and strategic investments will be crucial for businesses and individuals navigating these trends.

As the financial world continues to evolve, staying informed is key. Whether you’re an investor, a business leader, or an everyday consumer, understanding these emerging trends can provide a competitive edge in today’s fast-paced economy.

1 note

·

View note

Text

Government Subsidies & Benefits for Rooftop Solar Companies

Governments across the globe are encouraging renewable energy and have adopted various incentives for businesses supplying rooftop solar energy. Governments hence attempt to popularize clean power with cheaper alternatives of solar power for commercial institutions and individual residential owners. In this blog here, we investigate government subsidies and the best incentives of these programs, with a special interest placed on the great leader, Solis Power Solution.

Financial Incentives Driven by Solar Industry

The government has come to understand that there is a need to transition to renewable sources of energy. Governments have offered various forms of financial incentives for the installation of rooftop solar systems, including:

1. Capital Subsidies and Grants

Several nations provide direct capital subsidies to reduce the initial installation cost of solar panels. The grants deduct a percentage of the total project expenditure and, thus, it is not that tough for companies and individuals to invest in solar energy. Solis Power Solution facilitates its customers to avail subsidy programs so that they can avail the maximum benefit of government incentives.

2. Tax Benefits and Rebates

Tax credits are also a vital measure for solar energy adoption. The governments offer credits, rebates, and deductions to corporations and individuals installing rooftop solar panels. For example, ITCs allow businesses to claim tax deductions on the cost of installing solar, with the result that total expenses get lowered by considerable amounts.

3. Net Metering Policies

By net metering, the surplus electricity produced by solar systems can be fed back into the grid for utility bill credits. This policy would make sure that energy produced by a solar system provides the user with maximum returns on his investment while increasing the reservoir of energy sources. Solis Power Solution provides personalized solutions designed to maximize the production of energy and achieve maximum returns by net metering programs.

4. Low-Interest Loans and Financing Solutions

Low-interest loans and concessionary financing schemes are offered by most governments to make solar energy affordable for both homeowners and businesses. These facilitate the spreading of the installation cost over time, making it financially viable for everyone.

Policy Incentives to Rooftop Solar Businesses

Apart from money, governments also use policy to promote the expansion of rooftop solar businesses. Policy incentives include:

1. Renewable Energy Targets and Mandates

Several nations have established ambitious renewable energy targets, mandating a percentage of energy to be derived from solar and other renewable sources. These policies establish a conducive market condition for solar firms such as Solis Power Solution, fueling demand for rooftop installations.

2. Accelerated Approvals and Simplified Regulations

Governments have been simplifying the permitting process for solar rooftop projects by lowering bureaucratic barriers. Speedier permitting and ease of regulation enable companies to fit solar panels with fewer delays.

3. Support for Research & Development

Research and development investments enhance the efficiency and reduced cost of solar technology. Governments sponsor research in solar panel design, energy storage technologies, and grid integration, enabling companies such as Solis Power Solution to make the most of advanced technology.

The Future of Rooftop Solar with Government Support

Rooftop solar businesses have a rosy future with ongoing innovations in solar technology and more government support. Solis Power Solution has been dedicated to assisting businesses and homeowners in getting behind the transition to solar power for over a decade, offering professional advice on subsidies and benefits available.

The union of financial incentives, policy support, and technological progress guarantees that the rooftop solar industry keeps expanding, opening doors for a cleaner and more energy-efficient future.

#SolisPowerSolution#SolarSolutions#EnergySavings#SustainableFuture#SolarGrants#TaxCredits#NetMetering#GovernmentSubsidies#SolarIncentives#CleanEnergy#GreenEnergy#SolarPower#RooftopSolar#RenewableEnergy#SolarEnergy

0 notes

Text

EXCELLENT WAYS TO PROVIDE EXCELLENT ENERGY TO ALL

UN SDG: Goal 7 – ensuring affordable and clean energy for everyone

To ensure the provision of affordable and clean energy for all, essential strategies encompass significant investments in renewable energy sources such as solar and wind, the promotion of energy efficiency initiatives, the application of micro grid technology for off-grid communities, the establishment of supportive government policies, the facilitation of financing access for clean energy projects, and the enhancement of public awareness regarding sustainable energy practices at all societal levels.

As I sit in the comfort of my heated office, the soft hum of the electric heater serves as a poignant reminder of the privileges I possess. The bright illumination from my desk lamp guides my fingers as I compose these thoughts, one keystroke at a time. In this moment, I am confronted with a troubling reality: energy is frequently overlooked, a privilege that often goes unrecognized.

Despite the significant advancements in technology during our time, including innovations in renewable energy and a notable decrease in technology costs, countless individuals still experience prolonged periods of darkness during mealtime or face the challenges of unreliable energy services. This stark reality not only affects personal well-being but also stifles economic development.

The pursuit of Sustainable Development Goal (SDG) 7 – ensuring affordable and clean energy for everyone – has reached a critical juncture. The need to address the disparities in energy access is now more pressing than ever.

Specific strategies include:

Renewable energy development:

- Establishing large-scale solar and wind farms in optimal locations.

- Implementing decentralized small-scale solar systems for residential and commercial use.

- Pursuing geothermal and hydropower projects where applicable.

Energy efficiency enhancements:

- Retrofitting buildings with improved insulation and energy-efficient appliances.

- Utilizing smart grid technology to maximize energy consumption efficiency.

- Conducting public awareness campaigns focused on energy conservation techniques.

Micro grid technology:

- Implementing small, localized grids powered by renewable sources for isolated communities.

- Installing battery storage systems to maintain a reliable power supply during demand fluctuations.

Policy and regulatory frameworks:

- Introducing feed-in tariffs to encourage renewable energy generation.

- Establishing carbon pricing mechanisms to deter fossil fuel consumption.

- Mandating renewable energy quotas for utility companies.

Financial mechanisms:

- Providing grants and subsidies to reduce the cost of clean energy technologies for low-income households.

- Initiating microfinance programs to offer small loans for renewable energy investments.

- Forming public-private partnerships to draw private investment into clean energy initiatives.

Community engagement and education:

- Developing training programs for local technicians to install and maintain renewable energy systems.

- Launching awareness campaigns highlighting the advantages of clean energy and sustainable practices.

Key considerations include:

Addressing energy access inequalities:

- Prioritizing outreach to marginalized communities and regions with limited grid connectivity.

Technology adaptation:

- Choosing renewable energy sources and technologies that align with specific geographic conditions.

Grid modernization.

- Enhance current electricity networks to efficiently incorporate variable renewable energy sources.

Global cooperation:

- Facilitating the exchange of knowledge and the transfer of technology among nations to expedite the global implementation of clean energy solutions.

Energy access plays a crucial role in facilitating a fair energy transition. Each of the Nationally Determined Contributions backed by UNDP’s Climate Promise incorporates energy-focused objectives or policies. In the African context, the region's carbon emissions, accounting for less than three percent of global energy-related emissions, offer a unique opportunity to adopt a new development paradigm. This approach emphasizes energy access and harnesses the continent's renewable energy potential while ensuring climate protection.

It is essential to empower the upcoming generation of leaders and innovators, ensuring they possess the necessary skills to tackle intricate challenges. Additionally, it is crucial to adopt a gender-responsive approach, guaranteeing that women are involved in the process at all levels. Initiatives supported by UNDP in Peru and Yemen have demonstrated the developmental advantages of involving women as change agents through their training as clean energy technicians. Furthermore, projects in Malawi, Nepal, and India have illustrated that access to energy can significantly benefit women by liberating their time and creating various opportunities for livelihoods, including education and entrepreneurship within the renewable energy sector.

Dr.Jemi Sudhakar - UN women designate

0 notes

Text

Aries Career & Business Horoscope 2025: Your Winning Year Ahead

Aries Career & Business Horoscope 2025: Your Winning Year Ahead

The year 2024 has been a transformative journey for Aries in the business realm, filled with challenges and growth. As we step into 2025, the stars align to bring even more promising opportunities. Key planetary movements, including the influence of Jupiter and Saturn, will shape your professional landscape. Aries, get ready for a year of significant advancements and triumphs in your career and business ventures. 2025 is poised to be a year where determination meets opportunity for Aries. Expect to navigate through new paths, leading to successful outcomes.

Financial Forecast & Investments for Aries in 2025

Investment Trends

Aries can thrive in specific sectors in 2025. Look for opportunities in technology, renewable energy, and personal development. These industries are expected to experience significant growth. According to a report by investment analysts, the renewable energy market is projected to grow by 20% annually. Aries’ natural drive and thirst for innovation make this a prime area for investment.

Budgeting and Financial Planning

Budgeting is key for Aries this year. Establish a clear financial plan to maximize earnings and minimize losses.

Set financial goals: Aim for both short-term and long-term financial objectives.

Use budgeting apps: Tools like Mint or YNAB can help keep expenses in check.

Statistics show that 80% of people who use a budgeting tool report better financial health.

Potential Risks and Mitigation

While 2025 offers opportunities, be cautious of impulsive spending.

Establish an emergency fund: Aim for at least three months’ worth of expenses.

Research before investing: Always analyze market trends before making financial decisions.

Career Progression & Opportunities: Navigating the Aries 2025 Landscape

Job Market Trends

The job market is evolving, and Aries should pay attention. Opportunities in leadership roles and entrepreneurial ventures are on the rise. The Bureau of Labor Statistics notes that leadership positions in tech and healthcare will see a significant uptick.

Networking and Collaboration

Networking will be essential for Aries in 2025. Building connections can open doors.

Attend industry events: Look for conferences and trade shows in your field.

Join professional organizations: Groups like LinkedIn Professional Associations can enhance your network.

A strong network is often the key to success. Many successful leaders attribute their achievements to connections forged along the way.

Career Advancement Strategies

To move forward in your career:

Seek mentorship: Find a mentor who can guide you.

Continuous learning: Invest in skill development through online courses and workshops.

Astrological influences encourage Aries to embrace these strategies for career growth.

Entrepreneurial Ventures for Aries in 2025

Identifying Lucrative Opportunities

Entrepreneurship aligns well with Aries energy. Look for niches in health and wellness, e-commerce, or creative industries. According to market research, small businesses in these sectors have a thriving customer base.

Building a Strong Business Foundation

Start with a solid business plan. Outline your goals, target audience, and financial projections.

Legal structure: Choose the right business entity (LLC, partnership, etc.).

Funding: Explore various funding options, including grants and loans.

These steps create stability for your entrepreneurial journey.

Marketing and Sales Strategies

Effective marketing is crucial for business success:

Utilize social media: Platforms like Instagram and TikTok can amplify your reach.

Content marketing: Create valuable content to engage customers.

These strategies can help Aries entrepreneurs capture attention and grow their businesses.

Challenges and Obstacles for Aries in 2025: Preparing for Setbacks

Potential Roadblocks

Aries may face challenges such as market volatility or competition. Staying informed is vital.

Overcoming Challenges

Resilience is key to overcoming setbacks. Implement these strategies:

Stay adaptable: Embrace change and pivot when needed.

Seek support: Consult with mentors or peers to gain insights.

Psychologists often emphasize the importance of resilience in facing difficulties. As one expert states, “Resilience is about grit, not just bouncing back.”

Learning from Mistakes

Every challenge brings a lesson. Reflect on setbacks and extract valuable insights to grow stronger. Adaptation is crucial in both business and career paths.

Aries' Strengths & How to Leverage Them in 2025

Utilizing Aries Traits

Aries possess unique strengths, including leadership, energy, and creativity.

Lead initiatives: Use your natural leadership skills to inspire teams.

Innovate: Embrace your creativity to develop new ideas.

These traits are powerful tools for success.

Boosting Confidence and Self-Belief

Confidence can enhance performance. Build self-belief with these methods:

Set achievable goals: Celebrate small wins to boost morale.

Positive affirmations: Use daily affirmations to maintain a positive mindset.

Having belief in oneself is crucial for overcoming challenges.

Maintaining Work-Life Balance

A healthy work-life balance is essential for avoiding burnout. Make time for hobbies, relaxation, and family.

Set boundaries: Allocate specific times for work and personal life.

Practice self-care: Regularly engage in activities that nourish your mental health.

Balancing these aspects supports overall well-being.

Conclusion

In summary, 2025 holds great promise for Aries in their career and business. The astrological influences suggest significant growth, dynamic opportunities, and the potential for robust financial success.

To make the most of the coming year, focus on strategic networking, sound financial planning, and embracing your strengths. Approach challenges with resilience and adaptability.

As the stars shine brightly on your path, seize the opportunities ahead with confidence and enthusiasm! Your winning year awaits.

(For more information contact best astrologer Acharya Devraj ji)

0 notes

Text

Solar Energy Installation Denver Homeowners Trust With Seed Solar

youtube

Opting for Seed Solar means you're not just choosing solar energy, but also investing in quality and sustainability for your Denver home. With Seed Solar, you'll enjoy lower electricity bills and less dependency on fluctuating energy prices. Their cutting-edge technology guarantees efficient solar solutions, while a detailed installation process assures a seamless shift to renewable energy. Benefit from flexible financing options, including tax credits and low-interest loans. Seed Solar's reputation is backed by glowing customer testimonials highlighting reduced bills and exceptional service. Discover how this personalized, eco-friendly choice can enrich your home's energy future.

Benefits of Solar Energy

Solar energy offers a range of compelling benefits that make it an attractive choice for both homeowners and businesses.

Imagine reducing your carbon footprint and contributing to a healthier planet. By choosing solar, you're making a positive environmental impact, helping to combat climate change and preserve the Earth for future generations. It's a choice that speaks to your values and your commitment to sustainability.

Beyond its environmental advantages, solar energy brings significant energy savings. Lower your electricity bills and enjoy the financial freedom that comes with generating your own power.

Over time, these savings add up, making solar a smart investment. Plus, the peace of mind knowing you're not entirely reliant on fluctuating energy prices is truly empowering.

Embrace solar energy and transform your life today.

Why Choose Seed Solar

When it comes to selecting a solar energy provider, Seed Solar stands out due to its commitment to quality and customer satisfaction.

You'll find that their cutting-edge solar technology guarantees you're getting the most efficient and reliable energy solutions tailored just for you.

Seed Solar understands the importance of reducing your environmental impact, so they prioritize sustainable practices in every project.

They don't just install panels; they craft a personalized experience focused on your needs and values.

Choosing Seed Solar means you're not just another customer.

You're part of a community dedicated to a brighter, greener future.

They're passionate about helping you harness the sun's power, making your home more eco-friendly while saving you money.

Trust Seed Solar to light the way.

Installation Process Overview

Starting on your solar journey with Seed Solar is a seamless experience designed to make the shift to renewable energy straightforward and hassle-free.

First, you'll enjoy a personalized site assessment, where experts evaluate your home's solar potential. This intimate step guarantees that your system is tailored to meet your unique energy needs.

Once the assessment is complete, you'll receive a detailed installation timeline, providing clarity and setting clear expectations.

From there, skilled technicians handle everything with precision, making sure each panel is perfectly placed for peak efficiency.

Here's what you can expect during the installation process:

- **Personalized site assessment tailored to your home.**

- **Clear and detailed installation timeline.**

- **Expert technicians ensuring quality installation.**

- **Continuous support and updates throughout the process.**

Embrace the future with Seed Solar's expert care.

Financing and Incentives

Maneuvering the financial aspects of solar energy installation can often seem intimidating, but Seed Solar guarantees it's a smooth process with ample support and guidance.

You'll find that maximizing savings is easier than you think. Seed Solar helps you tap into available tax credits, reducing upfront costs considerably. These incentives can make solar energy more affordable, and our experts are always available to walk you through the paperwork.

Considering loan options? Seed Solar provides flexible financing solutions tailored to fit your budget.

Whether you're looking for low-interest loans or extended payment plans, we've you taken care of. Plus, our team makes certain you understand every detail, so there's no confusion.

Embrace solar energy confidently, knowing Seed Solar stands beside you every step of the way.

Customer Testimonials

Customer satisfaction reflects the quality and reliability of Seed Solar's services.

When you choose Seed Solar, you join a community that values renewable energy and exceptional service. Homeowners in Denver can't stop praising their seamless installations and responsive support.

Just imagine hearing from those who've already experienced the transformation:

- "Our energy bills have decreased markedly since Seed Solar installed our system."

- "The team was professional and explained every step. We felt involved and informed."

- "Switching to renewable energy has been a rewarding experience for our family."

- "Seed Solar's commitment to customer satisfaction is evident in everything they do."

These testimonials highlight Seed Solar's dedication to providing you with a sustainable and satisfying solar journey.

Trust in their promise of quality and care.

Conclusion

It's no coincidence that Denver homeowners are turning to Seed Solar for their energy needs. You've seen the benefits of solar energy—saving money while saving the planet. With Seed Solar, you're choosing a trusted partner that makes the installation process smooth and straightforward. Plus, you're not just investing in your home, but also in a sustainable future. Take advantage of available financing and incentives. Join your neighbors who've already made the smart choice with Seed Solar.

#Home Solar Denver#Solar Company Denver#solar panels Denver#Solar Denver#solar panels near me#solar power Denver#renewable energy Denver#battery storage Denver#solar energy services Denver#home energy upgrades Denver#solar energy installation Denver#solar energy financing Denver#solar energy benefits Denver#solar energy companies Denver#solar energy near me#Youtube

0 notes

Text

Solar Proposal Software for High-Impact Renewable Energy Projects

Delivering impactful renewable energy solutions demands precision, clarity, and speed. Solar proposal software transforms how solar professionals create and present project proposals, combining advanced design tools, financial analytics, and performance insights into a single, streamlined platform.

Tailored for residential, commercial, and utility-scale projects, this software ensures your proposals are visually compelling, data-rich, and aligned with stakeholder expectations.

Delivering Value with Customized Solar Proposals

Customized solar proposals go beyond standard templates by addressing each client's unique needs, preferences, and goals. They demonstrate your commitment to providing value through personalized solutions, fostering confidence in your expertise and vision.

Why Customized Proposals Matter

Client-Centric ApproachA customized proposal speaks directly to your client’s priorities, whether it's maximizing energy savings, reducing carbon footprint, or achieving specific financial goals.

Enhanced ProfessionalismTailored proposals incorporate site-specific data, advanced modeling, and detailed visualizations, presenting a professional image. This level of attention to detail differentiates you from competitors.

Improved Decision-MakingProviding clear, customized insights into system performance, ROI, and long-term benefits empowers clients to make informed decisions, increasing the likelihood of project approval.

Key Elements of Customized Solar Proposals

Detailed Energy Analysis: Incorporate client-specific energy usage patterns and forecasted savings.

Site-Specific Design: Use tools like 3D modeling and shading analysis to present accurate system layouts.

Financial Insights: Highlight financing options, payback periods, and tax incentives tailored to the project.

Visual Appeal: Use branded templates, high-quality graphics, and engaging formats to create a lasting impression.

Delivering Value with the Right Tools

Advanced solar proposal software makes it easier to deliver customized proposals that resonate with clients. By integrating design automation, real-time analytics, and dynamic customization features, these tools streamline the process, ensuring your proposals are both impactful and efficient.

Investing in customized solar proposals not only enhances your competitive edge but also reinforces your commitment to providing meaningful, client-focused solutions.

Leveraging Software to Communicate Energy ROI

Effectively communicating energy ROI is critical for gaining client trust and securing approval for solar projects. Energy ROI encompasses more than just financial payback; it highlights energy savings, environmental benefits, and long-term value. However, translating these complex metrics into clear, compelling insights can be challenging without the right tools.

Solar software transforms ROI communication by integrating precise data, advanced analytics, and interactive visualizations. It pulls real-time information from utility rates, weather patterns, and government incentives to calculate accurate savings, payback periods, and overall return on investment.

Visual tools such as charts and graphs simplify concepts like net present value (NPV) and internal rate of return (IRR), making them accessible to clients. Additionally, the software enables scenario analysis, allowing clients to compare different system designs and financing options, such as loans or power purchase agreements, to find the solution that best aligns with their goals.

Real-time updates further enhance the process by enabling solar professionals to adjust ROI projections based on client preferences, addressing concerns, and fostering trust. These capabilities turn energy ROI communication into a dynamic, engaging experience that emphasizes the tangible and intangible benefits of renewable energy systems. By leveraging software, solar providers can demonstrate the value of their solutions with clarity and professionalism, ensuring clients recognize the long-term impact and sustainability of their investment.

Creating Seamless Client Presentations with Automated Tools

Delivering a professional and compelling presentation is essential for securing client buy-in for solar projects. Automated tools streamline this process, enabling solar professionals to create seamless presentations that are visually engaging, data-driven, and tailored to client needs. These tools combine advanced design features, real-time analytics, and customization options to ensure each presentation effectively communicates the value of your solution.

Automated tools simplify complex processes by integrating data from energy modeling, financial analysis, and system design into clear, easy-to-understand formats. Visual elements such as interactive charts, 3D system layouts, and projected savings graphs help convey key points effectively. Customizable templates ensure presentations are aligned with your brand and tailored to specific client goals, whether they prioritize energy savings, ROI, or environmental impact.

Real-time updates further enhance client interactions, allowing you to adjust designs, costs, or projections on the spot. This dynamic approach fosters collaboration and builds trust, showing clients that you’re responsive to their needs. By automating tedious aspects of presentation creation, these tools save time and reduce errors, allowing you to focus on delivering a polished, professional pitch.

With automated tools, creating seamless client presentations becomes not just efficient but also impactful, helping you stand out in the competitive renewable energy market.

Conclusion

Solar proposal software is an essential tool for professionals in the renewable energy industry looking to deliver high-impact projects efficiently and effectively. Automating key aspects of the proposal process saves time, reduces errors, and allows solar developers to focus on what matters most—delivering tailored, data-driven solutions that meet client needs. These tools offer powerful capabilities for integrating design, financial modeling, and energy performance analytics into clear, compelling presentations that resonate with stakeholders.

In a highly competitive market, solar proposal software helps professionals stand out by ensuring their proposals are not only accurate but also visually engaging and customized to client priorities. By providing real-time updates, scenario analysis, and precise ROI calculations, the software empowers clients to make informed decisions, while building trust and credibility with every interaction. Ultimately, solar proposal software streamlines workflows, accelerates project approval and plays a key role in driving growth in the renewable energy sector, making it an indispensable asset for any solar professional.

1 note

·

View note

Text

Best new startup project loan in services in Vadodara (Gujarat)