#msme loan guarantee

Explore tagged Tumblr posts

Text

The Role of CGTMSE in MSME Market Expansion

Micro, Small, and Medium Enterprises (MSMEs) are the mainstay of India's economy, contributing to GDP, employment, and exports in a big way. But for MSMEs to grow and expand, availability of timely and low-cost credit is a must. One of the most powerful financial instruments facilitating this transformation is the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The CGTMSE scheme is enabling businesses to break through financial barriers and expand their reach to new domestic and international markets. By providing collateral-free loans in India, CGTMSE ensures that entrepreneurs can access capital without risking their personal or business assets. This access to funds fuels growth, innovation, and ultimately, market expansion. In this blog, we’ll explore how CGTMSE and MSMEs together are unlocking new market opportunities and driving India’s economic development.

Understanding CGTMSE: A Launchpad for Business Growth

The CGTMSE scheme of loan was introduced by the Government of India in collaboration with SIDBI to give a fillip to small enterprises through credit guarantees. It assists financial institutions by guaranteeing them a specific percentage of the outstanding loan value in the event of default, thereby lowering their risk exposure. This induces lenders to provide credit to MSMEs that would otherwise find it difficult to obtain credit due to the absence of collateral security.

By guaranteeing credit up to ₹2 crore for MSMEs under the credit guarantee scheme, CGTMSE has emerged as a key catalyst of lending for business, especially for businesses that wish to expand operations or venture into new markets. Entrepreneurs can now forget about having to mortgage property or assets—making market growth more accessible than ever before.

How CGTMSE Fuels Market Expansion for MSMEs

Access to capital is a requirement for any business that wants to expand.

Whether it's opening new branches, investing in advertising, purchasing new equipment, or employing skilled personnel—none of these can be done without financial support. CGTMSE loans also come in handy here by facilitating expansion to new geographies by way of financing infrastructure, stock, and logistics; attending trade fairs and exhibitions, whereby MSMEs can reach larger numbers; product diversification, whereby businesses can serve new sets of customers; and digital transformation for online transactions and outreach. The CGTMSE loan procedure is simple, and the related CGTMSE charges and CGTMSE fee are low, thus being a good choice for enterprising businesses. MSME Loan for New Business and Emerging Markets

For new entrepreneurs entering new ventures or venturing into unexploited markets, it may be hard to get startup business loans with no financial background or asset base. Such companies are greatly assisted by the CGTMSE scheme, which provides them with a safety net of MSME loan guarantees that facilitate them in moving their ideas from the conceptual to the execution phase.

With CGTMSE loan support, MSMEs are in a position to try new market growth strategies like introducing a new product segment, reaching a new customer base, or engaging in international trade. It provides a high-opportunity, low-risk situation for expansion.

Digital Transformation and Online Market Reach

The digital economy has created vast opportunities for MSMEs. With the aid of e-commerce websites, social media advertising, and digital payment systems, enterprises can access customers far beyond their local geographies. Digitization, however, has its own costs—software, hardware, training, and marketing. That is where CGTMSE and digital transformation converge.

By CGTMSE-supported business loans to small businesses, MSMEs are able to invest in these digital solutions and enhance their web presence. This not only assists in market reach but also brand visibility and customer loyalty in competitive markets.

CGTMSE and Export Market Access

India's drive to raise exports has a direct impact on MSMEs. As there is demand worldwide for good quality, reasonable products and services, Indian MSMEs can perfectly plug the gap. But export involves working capital, certification, compliance expense, and also technology upgradation in many cases. The CGTMSE scheme can cover all these expenses.

With a lower entry barrier via collateral-free loans in India, CGTMSE helps MSMEs find it less difficult to compete in export markets. Government-sponsored schemes such as Startup funding India and MSME support schemes by the Indian government can be combined with CGTMSE in order to provide businesses with a solid base for international trade.

Government Schemes and Subsidy Programs That Complement CGTMS

The Indian government has implemented numerous schemes to boost the growth of the MSME sector. Several of these can be utilized in conjunction with CGTMSE loans, including MSME subsidy schemes for upgradation of technology or development of infrastructure; ZED Certification Scheme for quality; and Credit Linked Capital Subsidy Scheme (CLCSS) for machinery and tools.

Along with the process of the CGTMSE loan, these schemes form a complete environment for sustainable and scalable business development.

How to Get CGTMSE for Market Growth

It is critical for entrepreneurs to know how to apply for CGTMSE to grow their businesses.

This is a straightforward way: Register your MSME on the Udyam portal.

Draw up a robust business proposal with an expansion theme. Visit a bank or NBFC that is part of the CGTMSE network. After the loan is sanctioned, the lender requests the guarantee on the CGTMSE login portal. Remit the mandatory CGTMSE fee and CGTMSE charges. The status of the application can be monitored by the applicants online, and where necessary, retrieve information through RTI (full form of RTI: Right to Information) to maintain transparency and accountability in the process. Steps to avail CGTMSE for Startups and Growth-Focused MSMEs If you want to know the steps to utilize CGTMSE for startups, here's what you need to do: Establish a sound business model with feasible market growth targets. Have clean accounts and credit-worthy behavior. Find a lender that understands the CGTMSE procedure. Check for combinations of other government schemes for MSMEs to leverage funds. Preparedness assists in faster loan sanctioning and efficient utilization of funds for market entry or diversification.

CGTMSE's Role in Building an Inclusive MSME Ecosystem

Besides financial support, CGTMSE plays a significant role in constructing an inclusive and more robust MSME ecosystem. Female entrepreneurs, rural entrepreneurs, and first-generation business owners now have the strength to compete with larger players in the marketplace without fearing loss of assets. This stimulates overall economic activity and brings balanced regional development.

Moreover, CGTMSE and MSMEs collectively contribute to generating local employment, enhancing domestic production, and lowering import dependence—all while contributing to sustainable market growth.

Conclusion: A Strategic Tool for Market Breakthrough

The collaboration of CGTMSE with MSMEs has proven to be not merely a mechanism for finance—truly, a strategic entry point for business growth, cyber inclusiveness, and market expansion. With optimal blends of MSME loan guaranteeing, subsidised CGTMSE charges, and coordination with MSME subsidy schemes, industries are able to maximize their own growth potential.

As India progresses towards being a global economic superpower, CGTMSE loans are empowering small businesses to think bigger, reach farther and build stronger. Whether you are a local artisan going global, a digital startup looking towards new geographies, or a service business scaling up—CGTMSE is your take-off point for the next level of growth.

#cgtmse loan process#cgtmse scheme#credit guarantee scheme for msmes#government schemes for msmes#msme loan guarantee#msme subsidy programs#small business loans india#startup funding india#finance#law#credit guarantee scheme

0 notes

Text

Mumbai News: महाराष्ट्र की औद्योगिक भूमिका को कभी नजरअंदाज नहीं किया - सीतारमण

केंद्रीय वित्त मंत्री सीतारमण ने शुरू की एमएसएमई का ‘म्यूचुअल क्रेडिट गारंटी योजना’। योजना के तहत मिलेगा 100 करोड़ रुपए तक का ‘कोलैटरल-फ्री लोन’। सीतारमण ने मुम्बई एक कार्यक्रम में कहा कि देश के बजट सेशन में महाराष्ट्र की औद्योगिक भूमिका को कभी नजरअंदाज नहीं किया। (Mumbai News, Never ignored the industrial role of Maharashtra) Mumbai News: माइक्रो स्मॉल और मीडियम एंटरप्राइजेज (MSME) को…

#Big news#Bombay#Bombay news#Breaking news#CollateralFree Loan#Fasttrack#fasttrack news#Hindi news#Indian budget#Indian Fasttrack#Indian Fasttrack News#Latest hindi news#Latest News#latest news update#Maharashtra big news#Maharashtra News#MSME#Mumbai News#Mutual Credit Guarantee Scheme#Never ignored the industrial role of Maharashtra#News#News in Hindi#News updates#Self reliance#self reliant india#Sitharaman#TODAY&039;S BIG NEWS#Union Finance Minister Sitharaman#what is Collateral Free Loan#आज की बड़ी खबर

1 note

·

View note

Text

Exim Bank's Initiative: A Game-Changer for MSME Exporters?

Micro, Small, and Medium Enterprises (MSMEs) in India have long grappled with financial bottlenecks when venturing into the international market. Despite contributing nearly 40% of India's exports and 45% of the manufacturing sector output, these enterprises often face daunting challenges in securing export finance, particularly when dealing with least developed countries (LDCs) and politically unstable regions. The government has now tasked the Export-Import (Exim) Bank of India with formulating a model that not only assesses the risks associated with such exports but also provides financial guarantees to encourage Indian banks to fund MSME exporters. This initiative could potentially reshape the landscape of India's export ecosystem, but how effective will it be in addressing the core issues faced by MSMEs?

#Exim Bank#MSME exports#export finance#small business loans#international trade#risk assessment#Indian exports#financial guarantee#LDC markets#SME funding

0 notes

Text

Eastern India's Growth Takes Center Stage in Budget: Ranjot Singh

Purvodaya Scheme promises regional development boost CII Jharkhand chief applauds government’s focus on empowering MSMEs and fostering industrial growth in the East. JAMSHEDPUR – The initiatives in the Union Budget are designed to accelerate economic progress in the eastern region of India. The Union Budget, which was recently announced, has highlighted the importance of developing India’s…

#बिजनेस#business#CII Jharkhand budget response#Credit Guarantee Scheme MSMEs#Eastern India Development#Gaya industrial node#Jharkhand Industrial Policy#MSME support initiatives#Mudra loan limit increase#Purvodaya Scheme eastern India#regional economic growth#Union Budget 2024 highlights

0 notes

Text

Things to Consider While Taking Loan Services In Mumbai

Living in the city of dreams, Mumbai, can be tough on your purse strings. However, there is nothing you cannot solve with personal finance. From financing a foreign vacation to arranging funds for a down payment, a loan for personal use has you covered? So, if you’re looking for ways to find attractive loan services in Mumbai, you’re in the right place. Here are five things to keep in mind before applying for a personal loan in Mumbai.

A Personal Loan is a multipurpose solution that helps you end financial worries, unlike certain other loans that one can only take for specific purposes. Personal loans are in high demand because of their flexibility. It does not require any collateral and is also available at the click of a button, unlike collateral-based loans known for their higher loan processing time requirement. It lets you plan big purchases, consolidate debts, pay for urgent financial needs, fund your child’s higher education, as well as your much-awaited vacation or wedding. Here are some of the things to consider when looking for a personal loan service.

Understand the Eligibility Criteria In Detail

While most financial institutions in Mumbai follow similar personal loan eligibility criteria, there may be slight differences in the terms and conditions. Typically, lenders will consider your monthly income, age, employment stability, personal liability, etc.So, the first thing you should do is check the eligibility criteria and see if you meet the requirements to qualify for a loan.

Check Interest Rates And Other Charges

When comparing personal loan lenders in Mumbai, there are a few factors you should put first. Of those, the rate of interest is probably number one. Because it will tell you the real cost of borrowing the loan. The lower the interest rate, the lower the EMI amount. Even a decimal point difference can save you a considerable sum on the EMI.

You should also consider the various charges levied on loans, like processing fees, late payment fees, prepayment charges, etc. They can help you choose a better offer from the ones available. Here are the different charges you must look out for before applying for a personal loan service in Mumbai-

Processing Fee

When you apply for an instant loan in Mumbai or anywhere in the country, the lender will charge you a processing fee. However, you must note that the processing fee is non-refundable. This means that even if the lender rejects your loan application, you will have to bear the processing fee.

Penalty on late EMI payment

When you take a personal loan you must repay the principal and interest amounts timely throughout the loan tenure. But if for any reason, you fail to do so, the lender will levy a late payment penalty.

Foreclosure penalty

You might get access to a large sum of money and decide to prepay your personal loan in part or full. While this is an excellent way to repay your loan quickly, you will have to bear part-prepayment or loan foreclosure charges. Besides these charges, there might also be other charges like verification charges, fees for duplicate statements, etc. varying from lender to lender. Therefore, you must carefully read all documents before applying for an instant loan in Mumbai.

Credit Score

Since personal loan are not backed by collateral, they tend to hold more risk. So, lenders use credit score to assess your debt management ability and loan suitability. The higher your credit score is, the attractive the terms on your loan. You can qualify for a longer repayment period, lower interest rates, or a higher loan amount with a score of 750 or above.On the flip side, if your score is on the lower end, you may not get attractive offers, or worse, a quick approval.

Borrow Only The Required Amount

Depending on your requirement, decide the amount you need to borrow. Evaluating the loan amount required is critical. While excess borrowing might become a burden later, short borrowing might not help you meet your ongoing requirement. Defining the principal amount will help you design a Loan that gives you maximum output at an affordable EMI while maintaining a good bureau score. One should also note that the loan amount availed has an impact on certain costs associated with loan processing like stamp duty, loan processing fees, and foreclosure charges.

You May Qualify for A Higher Loan Amount

If you have a spotless credit history and a high CIBIL score, you may end up qualifying for a higher loan amount. However, you should not borrow more than necessary.

To keep your EMI obligations under budget, it’s better to estimate the costs beforehand and apply them accordingly. You can use a personal loan EMI calculator to try out different combinations of loan terms and estimate the most suitable repayment plan. Just remember — your EMI obligations should only comprise 40% or less of your total disposable income.

Don’t File Too Many Applications Together

In our desperation, we may think of applying for a loan with as many lenders as possible. However, you shouldn’t. Simultaneously applying for multiple loans can leave too many hard enquiries in your credit report. Lenders may assume you carry higher credit risk. Which, in turn, can hurt your chances of approval. Thus, it is better to shop around and find the best product for your needs before taking the leap.

Compare other Loan Alternatives

Personal loan may be the first thing that comes to your mind in times of an emergency. But it is advisable to consider all other options as well to get the best-suited solution. A Personal loan service helps you break expenses into smaller and more manageable payments. You must ensure that you choose a credible and affordable personal loan provider. If you consider all these factors before taking a Personal Loan, you can enjoy fulfilling your needs without turning loans into debt traps.

Conclusion

Last but not least, you should always go for a trusted financier. When looking a loan service in Mumbai consider working with trusted financiers. They will offer some of the lowest personal loan interest rates in the market. That too without collateral and minimal documentation. So, wait no more. Apply for an online personal loan service in Mumbai today.

0 notes

Text

Micro-Business Empowerment: Unveiling 5 Key Insights into CGTMSE Loan Schemes for Sustainable Growth

Micro-Business Empowerment: Unveiling the Pros and Cons of CGTMSE Loan Schemes for Sustainable Growth: Key Insights into CGTMSE Loan Schemes for Sustainable Growth India’s vast network of Micro, Small, and Medium Enterprises (MSMEs) forms the backbone of the nation’s economy. However, securing funding for these small businesses often proves challenging due to their perceived higher risk profile.…

View On WordPress

#Business Development#CGTMSE Loans#CMA Data#Credit Guarantee Fund Scheme#Empowerment#Entrepreneurship#Financial Consulting#Financial Empowerment#Loan Schemes#Micro-business#MSMEs#Project Reports#Pros and Cons#Small Business Financing#Sustainable Growth

0 notes

Text

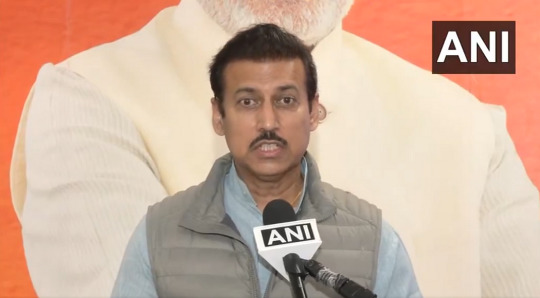

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

A guide to enhance your business growth

Running a business is akin to navigating a complex maze, and every entrepreneur dreams of not just surviving but thriving. In the Indian business landscape, the government has laid out a golden path for micro, small, and medium enterprises (MSMEs) through a simple yet powerful tool – MSME registration. In this guide, let's explore how this seemingly mundane registration process can be your ticket to unparalleled business growth.

Understanding the MSME Advantage

The Heartbeat of the Economy:

Micro, Small, and Medium Enterprises collectively form the heartbeat of the Indian economy. From local grocery stores to innovative startups, these businesses contribute not only to economic development but also to job creation, fostering a robust and inclusive growth environment.

Unlocking Financial Avenues:

One of the immediate perks of MSME registration is the access to financial assistance and credit facilities. Financial institutions offer tailored loans at favorable terms, recognizing the importance of these enterprises in driving economic progress.

The MSME Registration Journey

A Simpler Path Than You Think:

Contrary to popular belief, the MSME registration process is not a bureaucratic labyrinth. It's a straightforward journey that involves providing essential details about your business, such as PAN, Aadhaar, and other relevant information. Whether you choose the online portal or opt for the traditional route at District Industries Centres, the process is designed to be accessible.

Documents: Your Passport to Opportunities:

The importance of documentation in the registration process cannot be overstated. Your Aadhaar card, PAN card, business address proof, and details of your plant and machinery are the keys that unlock the door to a myriad of government schemes and subsidies.

The MSME Advantage Unveiled

Market Access and Procurement Preferences:

Once you've acquired your MSME registration, you find yourself in a prime position in government procurement. MSMEs are often given preference in government tenders, providing a golden opportunity to secure contracts and expand your market reach.

Technology Upgradation and Subsidies:

In the rapidly evolving business landscape, technology is the differentiator. MSME registration brings with it the chance to upgrade your technology with subsidies for adopting new and advanced processes. This not only boosts efficiency but also enhances your competitiveness.

Navigating the Schemes and Subsidies Landscape

Credit Linked Capital Subsidy Scheme (CLCSS):

At the forefront of government schemes is CLCSS, a game-changer for technology upgradation. It provides capital subsidies to MSMEs, facilitating access to credit for purchasing new machinery and equipment.

Pradhan Mantri Employment Generation Programme (PMEGP):

For those looking to embark on the entrepreneurial journey, PMEGP is the beacon. This credit-linked subsidy program promotes self-employment, creating not just businesses but livelihoods.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE):

The fear of collateral is a common hurdle for many small businesses. CGMSE eliminates this barrier by offering collateral-free credit facilities, making it easier for MSMEs to access the capital needed for growth.

Tailoring Your Approach

District Industries Centres (DIC) and National Small Industries Corporation (NSIC):

Think of DIC and NSIC as your business allies. DIC, as a local agency, offers guidance and support, while NSIC provides a range of services from marketing assistance to credit facilitation. Engaging with these institutions can significantly enhance your MSME journey.

Tech and Quality Upgradation Support:

The government's emphasis on quality is evident through schemes like Lean Manufacturing Competitiveness Scheme (LMCS) and Quality Management Standards & Quality Technology Tools (QMS/QTT). These initiatives not only boost competitiveness but also position your business as a paragon of quality in the market.

Export Promotion and Market Development:

Venturing into global markets can seem daunting, but the Market Development Assistance Scheme for MSMEs is a trustworthy companion. It provides financial support for participating in international trade fairs, opening doors to new business horizons.

Overcoming Challenges for Seamless Growth

Lack of Awareness:

One of the challenges MSMEs often face is the lack of awareness about available schemes. Entrepreneurs can overcome this by actively seeking information through government portals, industry associations, and local MSME support cells.

Complex Application Processes:

Cumbersome application procedures can be discouraging, but persistence pays off. Simplifying the application process and seeking assistance from dedicated facilitation services or MSME support agencies can make the journey smoother.

Continuous Evaluation and Adaptation

Performance and Credit Rating Scheme:

Enhancing your creditworthiness is an ongoing process. The Performance and Credit Rating Scheme allows MSMEs to undergo assessments, showcasing financial stability to potential investors and lenders.

Embracing Continuous Improvement:

The business landscape is dynamic, and your approach should be too. Regularly assess the impact of government schemes on your operations, adapt to changes, and stay informed about updates to maximize benefits continually.

Conclusion: Your Journey to Unprecedented Growth

In conclusion, MSME registration in India is not just a formality; it's your gateway to a realm of opportunities. By understanding the classifications, embracing government schemes, and overcoming challenges, you position your business for sustainable growth. The government's commitment to fostering MSMEs is a testament to the integral role these enterprises play in shaping the nation's economic future. So, don't just register – embark on a journey of growth, innovation, and success. The path is laid; it's time to walk it.

Learn more at : https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme registration online#msme loan#online business#msme

2 notes

·

View notes

Text

Government Schemes & Subsidies for Machinery Loans in 2025: A Complete Guide

Government Schemes & Subsidies for Machinery Loans in 2025: A Complete Guide

Introduction

For Indian businesses, the purchase of sophisticated machinery is essential for enhanced productivity and competitiveness. Nevertheless, the machinery cost is frequently a stumbling block. To ease this, the Indian government has different machinery loanschemes and subsidies to assist industries, particularly MSMEs. In 2025, several updated programs and incentives are available to help businesses finance their equipment purchases efficiently. This guide explores the top government schemes and subsidies that can assist in securing a machinery loan with favourable terms.

1. MSME Machinery Loan Subsidy under CGTMSE

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is a flagship program that gives collateral-free credit to MSMEs. Loans are given by banks and NBFCs under this program with government-guaranteed credit, lowering the lender’s risk and facilitating easier availability of funds for small businesses.

Key Benefits:

•collateral-free credit up to ₹2 crores.

•government-guaranteed credit.

•lower interest rates for MSMEs.

2. Credit Linked Capital Subsidy Scheme (CLCSS)

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is a flagship program that gives collateral-free credit to MSMEs. Loans are given by banks and NBFCs under this program with government-guaranteed credit, lowering the lender’s risk and facilitating easier availability of funds for small businesses.

Key Benefits:

•collateral-free credit up to ₹2 crores.

•government-guaranteed credit.

•lower interest rates for MSMEs.

3. Stand-Up India Scheme

The Stand-Up India scheme offers loans to encourage entrepreneurship among SC/ST and women entrepreneurs.

Key Features:

• Loans of ₹10 lakhs to ₹1 crore.

• Manufacturing, services, and trading sectors.

• Repayment tenure of a maximum 7 years.

4. Pradhan Mantri Mudra Yojana (PMMY)

The Stand-Up India scheme offers loans to encourage entrepreneurship among SC/ST and women entrepreneurs.

Key Features:

• Loans of ₹10 lakhs to ₹1 crore.

• Manufacturing, services, and trading sectors.

• Repayment tenure of a maximum 7 years...readmore

1 note

·

View note

Text

Udyam Registration: A Comprehensive Guide

Udyam Registration is a government initiative in India designed to formalize and support micro, small, and medium enterprises (MSMEs). This registration system, launched in July 2020, replaced the earlier Udyog Aadhaar Memorandum (UAM) registration process. Here's a detailed overview of udyam certificate download pdf, its specifications, benefits, and process.

What is Udyam Registration?

Udyam Registration is an online, paperless system introduced by the Ministry of Micro, Small and Medium Enterprises, Government of India. It serves as official recognition for businesses falling under the MSME category, enabling them to access various government schemes and benefits designed for this sector.

Classification Criteria Under Udyam

The classification of MSMEs is based on investment in plant and machinery/equipment and annual turnover:

Micro Enterprises:

Investment in Plant & Machinery/Equipment: Up to ₹1 crore

Annual Turnover: Up to ₹5 crore

Small Enterprises:

Investment in Plant & Machinery/Equipment: Up to ₹10 crore

Annual Turnover: Up to ₹50 crore

Medium Enterprises:

Investment in Plant & Machinery/Equipment: Up to ₹50 crore

Annual Turnover: Up to ₹250 crore

Key Specifications of Udyam Registration

Eligibility Criteria

Any business entity engaged in manufacturing or service activities can apply.

Both existing and new enterprises can register.

The enterprise must fall within the investment and turnover limits specified for MSMEs.

Registration is available for all legal forms of business including proprietorships, partnerships, LLPs, and companies.

Documentation Requirements

The Udyam Registration process requires minimal documentation:

Aadhaar Number of the business owner or partner

PAN of the business entity

GST details (if applicable)

Bank account details

Information about investment in plant & machinery/equipment and annual turnover

Registration Process

The Udyam Registration process is entirely online and free of cost:

Visit the official portal:registrationmsme.com

Enter Aadhaar number and verify via OTP

Fill in the required details about the enterprise

Submit the form

A digital Udyam Registration Certificate is generated instantly

Validity and Updates

The Udyam Registration Certificate has permanent validity.

Enterprises must update their information online in case of:

Change in business details

Crossing the investment or turnover thresholds

Change of activity between manufacturing and service

Annual updates of information, including turnover details, are mandatory.

Benefits of Udyam Registration

Financial Benefits

Priority Sector Lending: Banks are mandated to extend loans to MSMEs under priority sector lending norms.

Collateral-Free Loans: Under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), registered MSMEs can avail collateral-free loans up to ₹2 crore.

Lower Interest Rates: Many banks offer concessional interest rates to registered MSMEs.

Credit Linked Capital Subsidy: Eligible for technology upgrade subsidies up to 15%.

Government Scheme Benefits

Public Procurement Policy: Government departments and PSUs must procure 25% of their total purchases from MSMEs.

Protection Against Delayed Payments: Under the MSMED Act, registered MSMEs can claim interest on delayed payments from buyers.

Subsidy for Patent Registration: Financial support for securing patents, trademarks, and quality certifications.

Industrial Promotion Subsidies: Various state-specific subsidies on electricity, land, etc.

Tax Benefits

GST Benefits: Relaxed norms for GST registration and composition scheme eligibility.

Income Tax Benefits: Various deductions and exemptions under the Income Tax Act.

Reduced Compliance Burden: Simplified regulatory procedures and returns.

Export Promotion Benefits

Export Promotion Capital Goods Scheme: Concessional import of capital goods for export production.

Market Development Assistance: Financial assistance for participating in international trade fairs.

Marketing Support: Assistance in developing export markets and promotional activities.

Important Considerations

Composite Criteria

Both investment and turnover criteria must be satisfied for classification. If either criterion indicates a different category, the enterprise will be classified in the higher category.

Employment Data

While employment generation is not a classification criterion, enterprises must provide employment data during registration for statistical purposes.

Exemptions

The investment in plant and machinery/equipment excludes land and building costs.

Export turnover is included in the calculation of total turnover.

Transition from Previous Registration

Enterprises registered under UAM (before June 30, 2020) were required to re-register under the Udyam Registration process by December 31, 2021.

Challenges and Solutions

Common Registration Issues

Mismatch in PAN Details: Ensure PAN details match with the Income Tax Department records.

Incorrect Aadhaar Information: Verify Aadhaar details before initiating the process.

Classification Confusion: Clearly understand the dual criteria of investment and turnover.

Post-Registration Compliance

Regular updates of business information

Annual filing of turnover details

Proper maintenance of investment records

Conclusion

udyam registration form represents a significant step toward formalizing India's MSME sector. The paperless, free-of-cost system has simplified the registration process, making it accessible to entrepreneurs across the country. By registering under the Udyam system, MSMEs can leverage numerous government schemes, financial benefits, and market opportunities specifically designed to promote their growth and sustainability.

The classification criteria based on investment and turnover allow for objective categorization, ensuring that benefits reach the intended beneficiaries. With its permanent validity and simple update mechanism, Udyam Registration provides a long-term identity for enterprises while accommodating natural business growth and evolution.

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

CGTMSE Loan for Technology Upgradation in MSMEs

Technology upgradation, in today's fast-paced world economy, has become unavoidable for Micro, Small, and Medium Enterprises (MSMEs) in India in order to remain competitive. Be it process automation, incorporating newer machinery, or digitalizing, the change is not without an investment—the greatest impediment often for the owner of small business ventures. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has become a game-changer as it provides collateral-free loans in India to MSMEs. The CGTMSE loan not only finances business loans to small businesses, but encourages technology upgradation also to enhance efficiency and global competitiveness. Let us dissect how MSMEs can avail this opportunity, the function of the CGTMSE scheme, and how to avail loans aimed at technology upgradation.

What is CGTMSE?

The CGTMSE scheme, jointly established by the Ministry of MSME and SIDBI (Small Industries Development Bank of India), provides collateral-free loans to small and micro enterprises. With the credit guarantee scheme, the financial institutions and banks are given incentives to extend loans without collateral security or third-party guarantees. In case the borrower defaults, the lender is compensated by CGTMSE between 75% to 85% of the loan amount, minimizing risk to banks and providing incentives for lending to promising but asset-light enterprises.

Significance of Technology Upgradation for MSMEs Technology upgradation is no longer a choice it's a necessity to enhance productivity, lower costs, enhance quality, achieve global standards, and minimize environmental burden. Ironically, all these advantages notwithstanding, access to finance continues to be an issue. Conventional banks are shy of lending for unproven technology or new enterprises with no tangible collateral. This is where CGTMSE loans to upgrade technology act as a lifeline.

CGTMSE Loan for Technology Upgradation: How It Works

CGTMSE loan helps companies fund new equipment and machinery, automation and digitization tools, renewable energy equipment, research and development equipment, IT software and systems. Whether you're a manufacturer moving to CNC machines or a small logistics company going for AI-driven fleet management, CGTMSE-covered loans can help fund your move.

Major Features of the CGTMSE Loan for Technology Upgradation Loan Amount: Up to ₹5 crore under the current expanded limit.

Coverage: Up to 85% of the loan amount is guaranteed under the MSME loan guarantee scheme.

Collateral-Free: No requirement to pledge business or personal assets.

Available through Banks/NBFCs: Most major lenders are included in the scheme.

Concessional Rates for Special Categories: Women entrepreneurs, SC/ST-led businesses, and those in backward areas might receive lower CGTMSE charges.

CGTMSE Charges and Fee Structure Before applying, it's worth knowing the cost involved:

Guarantee Fee (One-Time): Usually 1% to 1.5% of the sanctioned loan amount.

Annual Service Fee: Between 0.37% to 0.75% of the outstanding balance.

Example:

For a ₹40 lakh loan for machinery upgradation:

Guarantee Fee (1.5%) = ₹60,000 (one-time)

Annual Service Fee (0.75%) = ₹30,000 in the first year

These CGTMSE charges are small considering the advantage of upgradation of operations and improvement in revenues.

How to Apply for CGTMSE Loan for Tech Upgradation Want to apply for CGTMSE? Follow these steps:

Business Assessment

Draw up a plan explaining why and how technology will enhance your productivity or competitiveness. Put in ROI estimates and projections.

Choose a Lender

Visit a bank or an NBFC that is registered with CGTMSE. You can also use the CGTMSE login site to view recent lists and guidelines.

Submission of Loan Proposal

Provide your application along with:

Udyam Registration certificate

GST registration

Project report with technology upgradation plan

Quotations for machinery/software

Business accounts

Bank Appraisal

Your proposal will be assessed by the lender. If deemed feasible, they will sanction the loan and apply to CGTMSE for the guarantee cover.

Payment of Fees and Disbursement

After the CGTMSE charge is paid, your loan is released. Repayment conditions depend on the lender and typically range between 3–7 years.

MSME Support Programmes of Indian Government The CGTMSE programme is one part of extensive MSME support programmes by the Indian government, such as:

Credit Linked Capital Subsidy Scheme (CLCSS): Provides 15% subsidy in tech upgradation.

Startup India and Make in India programmes

MUDRA Loans to micro-enterprises

Zero Defect, Zero Effect (ZED) certification support to quality and sustainability

Complementing each other, these programs will create a new-age, efficient MSME ecosystem.

Startup Funding India:

Technology-Driven Innovation For young companies and startups that are innovation-oriented, traditional finance is even more difficult to access. CGTMSE loans can be an excellent starting point for startup funding in India, particularly for those creating or implementing state-of-the-art technology. Blending the CGTMSE scheme with other government schemes for MSMEs can provide your business with a strong financial base without diluting equity or mortgaging property.

How to Take a CGTMSE Loan Without Collateral: Pro Tips Be Loan-Ready: Organize your documents, financials, and projections.

Choose the Right Lender: Opt for those with experience in CGTMSE-backed loans.

Know Your Numbers: Know your cash flow and repayment ability.

Budget for Fees: Factor CGTMSE charges into your loan planning.

Last Word

Technology is revolutionizing all industries, and Indian MSMEs need to keep up. The CGTMSE loan for technology upgradation helps bridge the financial gap that prevents many small enterprises from evolving. With the credit guarantee scheme for MSMEs, the government has effectively unlocked a new avenue for growth, modernization, and innovation—without demanding collateral security. If you’re ready to take your business to the next level with smarter tools, automation, or cutting-edge software, now is the time. Learn more about CGTMSE loans, calculate your fees in advance, and begin your path to modernization and expansion.

#cgtmse loan process#credit guarantee scheme for msmes#government schemes for msmes#cgtmse scheme#msme subsidy programs#small business loans india#msme loan guarantee#startup funding india

0 notes

Text

project report for bank loan

Finaxis provides well prepared Project Reports to help firms easily obtain bank financing. Our Detailed Project Report (DPR) for Bank Loan comprises financial predictions, cost analysis, market research, and profitability assessments, securing approval from banks and other financial institutions. We also specialize in Feasibility Reports, which provide detailed evaluations of business feasibility, market potential, and risk assessment.

Whether you need a CMEGP, PMEGP, or MSME loan project report, Finaxis' skilled staff guarantees accuracy, compliance with banking standards, and a structured approach adapted to your business needs. Our reports are intended to improve loan approvals and simplify financial planning for startups and organizations.

Get a tailored bank loan project report today and make your business vision a reality with Finaxis!

0 notes

Text

Udyam Registration: A Must for Small Businesses to Access Loans

Introduction

In the fast-evolving business landscape of India, small businesses face numerous challenges—one of the most pressing being access to finance. Small businesses often require loans to thrive, whether for expanding operations, managing cash flow, or investing in technology. However, obtaining these loans can be difficult without the proper credentials or support from financial institutions. Enter Udyam Registration, a simple yet powerful tool that can make a significant difference for small businesses seeking financial support. Introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in 2020, Udyam Registration is a government initiative designed to help small businesses formalize their operations and gain access to various government schemes and benefits, including crucial financial aid.

What is Udyam Registration?

Udyam Registration is an online registration system for Micro, Small, and Medium Enterprises (MSMEs). The registration process involves providing basic details about your business, such as the type of business, number of employees, turnover, and investment in plant and machinery. Upon successful registration, businesses are issued a unique Udyam Registration Number (URN), which serves as an official recognition of the business as an MSME in India.

The registration process is free and entirely online, requiring no physical documentation. However, businesses must meet certain criteria regarding investment limits and annual turnover to qualify:

Micro Enterprises: Investment up to Rs. 2.5 crore and turnover up to Rs.10 crore.

Small Enterprises: Investment up to Rs. 25 crore and turnover up to Rs. 100 crore.

Medium Enterprises: Investment up to Rs.125 crore and turnover up to Rs. 500 crore.

Why is Udyam Registration Essential for Small Businesses Seeking Loans?

Small businesses often struggle to access loans due to a variety of reasons, including a lack of proper documentation, low credit scores, and high perceived risks. In this environment, Udyam Registration becomes a vital tool for overcoming these barriers and improving access to credit.

1. Eligibility for Government Loan Schemes

One of the biggest advantages of Udyam Registration is that it opens the door to various government-backed loan schemes. These schemes are designed specifically to support MSMEs and provide access to capital with lower interest rates, longer repayment terms, and minimal paperwork. Some of the prominent government loan schemes that Udyam-registered businesses can avail of include:

Pradhan Mantri Mudra Yojana (PMMY): This scheme provides financial assistance to small businesses in the form of MUDRA loans, which are available under three categories—Shishu (up to ₹50,000), Kishore (₹50,000 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh). Udyam-registered businesses have better access to these loans, which are often offered without collateral.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): Under this scheme, Udyam-registered businesses can avail themselves of collateral-free loans, which can significantly reduce the hurdles to securing financing.

Stand-Up India Scheme: This scheme aims to promote entrepreneurship among women and SC/ST entrepreneurs. Udyam-registered businesses owned by these groups are eligible for financial assistance under this scheme.

National Small Industries Corporation (NSIC) Subsidy: Udyam-registered businesses can avail of financial assistance and subsidies for the purchase of machinery, technology, and working capital.

By registering with Udyam, small businesses increase their eligibility for these schemes, which can provide the necessary financial backing for growth and expansion.

2. Easier Loan Approval and Processing

When a business is Udyam-registered, it signals to financial institutions and banks that the business is recognized by the government and is compliant with the relevant regulations. Lenders often hesitate to extend credit to businesses that are not registered because they are perceived as risky investments. Udyam Registration helps eliminate this uncertainty by providing a verified and credible source of business data, including investment levels, turnover, and industry type. This registration also means that the business will be compliant with taxation and other regulatory requirements, which further reassures lenders. As a result, the loan approval process becomes smoother and faster, with fewer delays in processing.

3. Access to Collateral-Free Loans

One of the biggest obstacles that small businesses face when seeking loans is the requirement for collateral. Many businesses, particularly micro-enterprises, do not have assets that can be pledged as collateral, making it nearly impossible to secure traditional loans. However, with Udyam Registration, small businesses become eligible for collateral-free loans under schemes like CGTMSE, which are backed by the government.

4. Improved Creditworthiness

For businesses, creditworthiness is one of the most important factors that influence loan approval. Small businesses that are Udyam-registered tend to have a more structured financial record and better access to government schemes, which improves their credit score over time. Lenders look favorably upon businesses with a solid financial foundation and a track record of repayment. Udyam registration helps businesses maintain proper financial records, comply with taxation norms, and build a positive reputation in the market. All these factors contribute to improved creditworthiness, making it easier for businesses to access loans with favorable terms.

5. Tax Benefits and Lower Interest Rates

Udyam-registered businesses are eligible for various tax benefits and subsidies, which can improve cash flow and reduce operational costs. These financial advantages can, in turn, make it easier for businesses to meet loan repayment schedules, further boosting their credibility with lenders. Additionally, banks and financial institutions often offer lower interest rates and better terms to businesses that are registered under Udyam. The registration reflects government endorsement, which reduces perceived risks, allowing businesses to access capital at more affordable rates.

Note: The Udyam portal now allows you to easily print Udyam Certificate.

Conclusion

Udyam Registration is a game-changer for small businesses in India looking to access loans and financial support. By formally registering as an MSME, businesses unlock a range of benefits, from eligibility for government-backed loan schemes to easier access to collateral-free loans and lower interest rates. In a highly competitive market, securing timely financial assistance is crucial for the growth and survival of small businesses. Udyam Registration not only increases your chances of loan approval but also strengthens your business's creditworthiness, paving the way for long-term success.

0 notes

Text

Udyam Annexure : A Roadmap to MSMEs Growth and Compliance

Micro, small, and medium-scale industries (MSMEs) are the other engines of the economy and play a crucial role in the economic growth of India. MSMEs cannot avail themselves of the different tax concessions and incentives offered by the government to help them run their businesses successfully because they lack information about many things that are provided after completion of Udyam registration.

MSMEs can better utilise all government incentives and restart their enterprises by adhering to all compliance requirements after the Udyam Annexure is put into effect. Following the implementation of the Udyam Annexure, MSMEs can better use all government incentives and get their businesses back on track by complying with all compliance requirements.

MSME owners need to comprehend the Udyam Annexure and its function in Udyam Certificate registration, compliance, and expansion. Everything you need to know, such as how to download your Udyam Annexure Certificate and its significance, will be covered in this post.

Udyam Annexure: What is it?

The Udyam Registration Certificate goes along with an official document called the Udyam Annexure. It offers important information about an MSME, such as:

Business Information (Name, Address, and Business Type)

MSMEs' Unique Identifier or UAM Number

Information on Investment and Turnover

NIC Codes (Business Activity Type)

Information about imports and exports (if appropriate)

Additional Important

Compliance Information

This annexure acts as a guide for MSMEs, guaranteeing adherence to governmental regulations while assisting them in obtaining funding, incentives, and market prospects.

How to get Udyam Annexure Certificate

By getting a Udyam Annexure Certificate, you can get a lot of benefits. One of them is that your loan approval will be at a faster rate, so getting a Udyam Annexure Certificate is necessary for MSME. Follow the steps given by us and get your Udyam Annexure Certificate.

Step 1: First of all, go to Udyam Online Registration Portal

Step 2: After the home page opens, you will see the Udyam Annexure Certificate section in the navigation bar of your screen; click there

Step 3: Udyam Annexure Online Form will be visible on your screen, fill it correctly, such as

In personal information

Applicant's name

Mobile number

Email ID

Udyam Registration Number

Please note that you have given the same mobile number and email ID at the time of Udyam registration.

Step 4: Choose the option in which you want OTP, like choosing one of the two mobile numbers and email ID, but keep in mind that your OTP will come in the mobile number and email ID mentioned in your certificate.

Step 5: Enter the verification code appearing on the screen in the box given below.

Step 6: Tick mark the box of Terms of Service and tick mark the box of Declaration.

Step 7 Finally,, click on Submit Information

After this, you will reach directly our payment gate. After paying some charges, you will get an OTP on your number for verification. Enter that OTP and verify it. After this, you will be able to download your Udyam Annexure Certificate.

Udyam Annexure's Significance for MSMEs

1. Compliance & Legal Recognition

MSMEs are granted legal recognition through the Udyog Aadhar and Udyam certificates.

Compliance with government regulations is further confirmed by the Udyam Annexure.

2. Obtaining Government Benefits

Companies that have the annexure and are registered under Udyam are eligible for tax breaks, subsidies, and quick loan approvals.

3. Simpler Loans & Financial Assistance

To authorise credit plans and loans without collateral, financial institutions need the Udyam Annexure and the MSME Certificate Registration.

4. Improved Tender and Market Opportunities

MSMEs can take part in government bids and receive preference in procurement policies if they have valid Udyam Certificates and annexures.

5. Needs for GST and Other Compliance

For MSMEs to be eligible for tax incentives and to file for GST, the Aadhar Udyog Registration and Annexure are essential.

Typical Problems and Fixes for Udyam Registration and Annexure Download:

Is your Udyam registration number missing?

Click "Forgot Udyam Number" after visiting the Udyam portal. To get it, enter your registered email address or mobile number and confirm the OTP.

Unable to download the Annexure or Udyam Certificate?

Make sure your registration information is accurate. Verify whether your MSME is still registered with Udyam. For technical assistance, call the Udyami Helpline.

Udyog Aadhar Registration Error?

To prevent compliance problems, update your information on the Udyam site if there are inconsistencies in your Udyog Aadhar.

Why Should MSMEs Update Their Registration on Udyam?

MSMEs need to make sure their information in the Udyam system is current due to evolving policies. Updating is beneficial:

Continue to qualify for MSME advantages.

Continue to comply with taxes

Ensure that business operations run smoothly.

It's time to update your registration if you haven't already switched from Udyog Aadhar to Udyam to prevent losing out on government advantages.

In summary

One of the most important documents that help MSMEs stay in compliance and grow their businesses with government support is the Udyam Annexure. Ensuring you have your Udyam Certificate PDF, Udyam Aadhar Download, and Udyog Aadhar Certificate readily available is paramount for smooth operations, whether you are registering for the first time or modifying your data. You can protect the future of your business and gain multiple financial and legal benefits by getting the proper MSME Online Registration, Udyam Certificate Registration, and Aadhar Udyog Registration procedures done.

Take a step towards company success by downloading your Udyam Certificate and annexure now if you haven't already!

0 notes

Text

Rupas Capital Services is the best place to get personal loans online to help you unlock financial freedom.

Seeking to achieve your goals or handle unforeseen costs? Rupas Capital Services provides a streamlined online personal loan platform that makes it easy and dependable for you to obtain the money you want. With affordable interest rates and customizable repayment choices, our user-friendly interface guarantees a hassle-free application procedure. Rupas Capital Services may help with debt consolidation, home remodeling, and schooling costs. Put in an application today to start along the path to achieving your financial objectives.

Apply Now and Seize Your Financial Opportunities with Rupas Capital Services

0 notes