#Low-interest green loans

Explore tagged Tumblr posts

Text

What is a Green Personal Loan?

With growing awareness of climate change and sustainability, financial institutions are offering green personal loans to encourage environmentally friendly initiatives. A green personal loan is a specialized loan designed to fund projects that promote energy efficiency, renewable energy, and sustainable living. These loans can be used for various eco-friendly purposes, such as solar panel installations, electric vehicle purchases, energy-efficient home upgrades, and water conservation systems.

This article explores the benefits, eligibility, application process, and best green personal loan providers in India.

1. Understanding Green Personal Loans

A green personal loan works similarly to a traditional personal loan, but the funds must be used for environmentally sustainable projects. Lenders often offer lower interest rates, flexible repayment terms, and government-backed incentives to encourage borrowers to invest in green solutions.

Some banks and NBFCs offer specialized green loan programs, while others allow borrowers to use regular personal loans for sustainable projects. The key benefit of these loans is that they help individuals adopt eco-friendly technologies without significant upfront financial burdens.

🔗 Explore Personal Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

Bajaj Finserv Personal Loan

2. Uses of a Green Personal Loan

A green personal loan can be used for various environmentally friendly initiatives that promote sustainability and energy efficiency. Some of the most common uses include:

2.1. Solar Panel Installation

One of the most popular uses of a green personal loan is to install solar panels at home or business premises. Solar energy helps reduce electricity bills and dependency on fossil fuels.

2.2. Energy-Efficient Home Upgrades

Borrowers can use the loan to invest in energy-efficient appliances, such as LED lighting, smart home automation, and better insulation. These upgrades help lower energy consumption and reduce carbon footprints.

2.3. Electric Vehicle (EV) Purchases

Green personal loans can be used to buy electric cars, bikes, and scooters. Switching to an EV helps reduce fuel costs and supports the transition to clean energy. Some loans also cover the cost of installing home EV charging stations.

2.4. Water Conservation Systems

A green personal loan can help finance rainwater harvesting systems, greywater recycling, and smart irrigation systems. These investments help conserve water and lower utility expenses.

2.5. Waste Management Solutions

Borrowers can use the loan to set up composting units, waste recycling plants, or bio-gas systems for sustainable waste management.

🔗 Best Lenders for Green Personal Loans:

Tata Capital Personal Loan

InCred Personal Loan

3. Benefits of Green Personal Loans

Lower Interest Rates

Many banks and NBFCs offer lower interest rates for green personal loans to encourage eco-friendly initiatives. Some loans even qualify for government subsidies or tax benefits.

Reduced Energy Costs

Investing in solar panels, energy-efficient appliances, or electric vehicles leads to significant savings on electricity and fuel bills over time.

Environmental Impact

Using a green personal loan for sustainable projects helps reduce carbon footprints, lower pollution, and promote renewable energy adoption.

Flexible Loan Options

Green personal loans offer flexible repayment terms and varying loan amounts to suit different sustainability projects.

Government Incentives & Tax Benefits

Some green initiatives, such as solar panel installations, qualify for tax rebates, subsidies, or financial incentives under government schemes.

4. How to Apply for a Green Personal Loan

Applying for a green personal loan is similar to applying for a traditional personal loan. The process involves the following steps:

Step 1: Select a Loan Provider

Compare different banks and NBFCs offering green personal loans. Look for lenders with low interest rates, flexible repayment options, and quick disbursal times.

🔗 Recommended Lenders:

Axis Finance Personal Loan

Bajaj Finserv Personal Loan

Step 2: Check Eligibility Criteria

Most lenders require:

Age: 21-60 years

Employment Status: Salaried or self-employed

Minimum Income: ₹2-5 lakh per annum

Credit Score: 700+ for best loan terms

Some banks may also require proof that the loan will be used for an environmentally friendly purpose, such as a quotation for solar panel installation or EV purchase agreement.

Step 3: Gather Necessary Documents

Identity Proof: Aadhaar, PAN, Passport, or Voter ID

Address Proof: Utility bills or rental agreement

Income Proof: Salary slips, bank statements, or income tax returns

Loan Purpose Proof: If applicable, documents such as solar panel installation estimates or EV booking receipts

Step 4: Submit Your Application

Apply for the loan online through the lender’s website or visit a branch to submit a physical application.

Step 5: Loan Approval and Disbursal

Once approved, the loan amount is credited to your bank account within 24-72 hours.

5. Factors to Consider Before Taking a Green Personal Loan

Before applying for a green personal loan, consider the following:

Compare Interest Rates

Look for lenders offering lower interest rates or special discounts for sustainable projects. Some banks may have specialized green finance programs with reduced processing fees.

Check for Government Incentives

Some eco-friendly investments, such as solar panel systems, qualify for tax rebates or government subsidies. Research available incentives before borrowing.

Assess Long-Term Cost Savings

A green personal loan should provide financial benefits in the long run, such as reduced electricity costs or lower fuel expenses.

Choose the Right Loan Tenure

A shorter loan tenure reduces interest costs, while a longer tenure makes EMIs more affordable. Select a repayment plan that fits your financial capacity.

Is a Green Personal Loan Right for You?

A green personal loan is an excellent option for individuals looking to invest in sustainable living solutions such as solar energy, energy-efficient appliances, electric vehicles, and water conservation projects. These loans provide lower interest rates, cost savings, and environmental benefits, making them a smart financial choice.

Before applying, compare lenders, check for government incentives, and ensure the investment aligns with your financial goals. If used wisely, a green personal loan can help you save money while contributing to a greener future.

🔗 Looking for a Green Personal Loan? Explore the Best Options Here:

Apply for a Personal Loan

By making eco-friendly financial choices, you can reduce your carbon footprint while enjoying long-term cost savings and sustainability benefits!

#Green personal loan#What is a green loan?#Eco-friendly personal loan#Sustainable finance options#Personal loan for solar panels#Green financing for home improvements#Electric vehicle loan#Energy-efficient loan programs#Low-interest green loans#Personal loan for renewable energy projects#finance#personal loan online#loan services#personal loans#bank#personal loan#nbfc personal loan#loan apps#personal laon#fincrif#Best green personal loans in India#Loans for sustainable home upgrades#Green home improvement financing#Solar energy loan options#Government incentives for green loans#Personal loan for EV purchase#Energy-efficient home upgrade financing#Sustainable investment loans#Carbon footprint reduction loans#Eco-friendly financing solutions

0 notes

Text

How to Upgrade Your Truck Without Breaking the Bank: A Guide for the Individual Trucker

The new EPA regulations are probably the last thing you want to hear about right now. It feels like every time we turn around, there’s another rule or restriction. And honestly, it’s frustrating! But before you throw your hands up in anger, let’s talk about how these changes could actually work in your favor and, more importantly, what options are out there to help you upgrade your trucks without…

View On WordPress

#alternative fuel trucks#business#DERA grants#diesel emissions#electric truck incentives#emission reduction grants#EPA compliance#EPA regulations#federal tax credits#Freight#freight industry#Freight Revenue Consultants#green freight programs#logistics#low-interest truck loans#small carriers#small fleet loans#small trucking business#Transportation#truck financing#Truck Fuel Efficiency#truck maintenance savings#truck manufacturer rebates#truck rebates#truck replacement programs#truck retrofitting#truck scrappage programs#truck upgrade costs#truck upgrades#trucker incentives

0 notes

Text

[ID: A bowl of avocado spread sculpted into a pattern, topped with olive oil and garnished with symmetrical lines of nigella seeds and piles of pomegranate seeds; a pile of pita bread is in the background. End ID]

متبل الأفوكادو / Mutabbal al-'afukadu (Palestinian avocado dip)

Avocados are not native to Palestine. Israeli settlers planted them in Gaza in the 1980s, before being evicted when Israel evacuated all its settlements in Gaza in 2005. The avocados, however, remained, and Gazans continued to cultivate them for their fall and winter harvest. Avocados have been folded into the repertoire of a "new" Palestinian cuisine, as Gazans and other Palestinians have found ways to interpret them.

Palestinians may add local ingredients to dishes traditionally featuring avocado (such as Palestinian guacamole, "جواكامولي فلسطيني" or "غواكامولي فلسطيني"), or use avocado in Palestinian dishes that typically use other vegetables (pickling them, for example, or adding them to salads alongside tomato and cucumber).

Another dish in this latter category is حمص الافوكادو (hummus al-'afukadu)—avocado hummus—in which avocado is smoothly blended with lemon juice, white tahina (طحينة البيضاء, tahina al-bayda'), salt, and olive oil. Yet another is متبّل الأفوكادو (mutabbal al-'afukadu). Mutabbal is a spiced version of بابا غنوج (baba ghannouj): "مُتَبَّل" means "spiced" or "seasoned," from "مُ" "mu-," a participlizing prefix, + "تَبَّلَ" "tabbala," "to have spices added to." Here, fresh avocado replaces the roasted eggplant usually used to make this smooth dip; it is mixed with green chili pepper, lemon juice, garlic, white tahina, sumac, and labna (لبنة) or yoghurt. Either of these dishes may be topped with sesame or nigella seeds, pomegranate seeds, fresh dill, or chopped nuts, and eaten with sliced and toasted flatbread.

Avocados' history in Palestine precedes their introduction to Gaza. They were originally planted in 1908 by a French order of monks, but these trees have not survived. It was after the Balfour Declaration of 1917 (in which Britain, having been promised colonial control of Palestine with the dissolution of the Ottoman Empire after World War 1, pledged to establish "a national home for the Jewish people" in Palestine) that avocado agriculture began to take root.

In the 1920s, 30s, and 40s, encouraged by Britain, Jewish Europeans began to immigrate to Palestine in greater numbers and establish agricultural settlements (leaving an estimated 29.4% of peasant farming families without land by 1929). Seeds and seedlings from several varieties of avocado were introduced from California by private companies, research stations, and governmental bodies (including Mikveh Israel, a school which provided settlers with agricultural training). In these years, prices were too high for Palestinian buyers, and quantities were too low for export.

It wasn't until after the beginning of the Nakba (the ethnic cleansing of Palestinians from "Jewish" areas following the UN partition of Palestine in 1947) that avocado plantings became significant. With Palestinians having been violently expelled from most of the area's arable land, settlers were free to plant avocados en masse for export, aided (until 1960) by long-term, low-interest loans from the Israeli government. The 400 acres planted within Israel's claimed borders in 1955 ballooned to 2,000 acres in 1965, then 9,000 by 1975, and over 17,000 by 1997. By 1986, Israel was producing enough avocados to want to renegotiate trade agreements with Europe in light of the increase.

Israeli companies also attained commercial success selling avocados planted on settlements within the West Bank. As of 2014, an estimated 4.5% of Israeli avocado exports were grown in the occupied Jordan Valley alone (though data about crops grown in illegal settlements is of course difficult to obtain). These crops were often tended by Palestinian workers, including children, in inhumane conditions and at starvation wages. Despite a European Union order to specify the origin of such produce as "territories occupied by Israel since 1967," it is often simply marked "Israel." Several grocery stores across Europe, including Carrefour, Lidl, Dunnes Stores, and Aldi, even falsified provenance information on avocados and other fruits in order to circumvent consumer boycotts of goods produced in Israel altogether—claiming, for example, that they were from Morocco or Cyprus.

Meanwhile, while expanding its own production of avocados, Israel was directing, limiting, and destabilizing Palestinian agriculture in an attempt to eliminate competition. In 1982, Israel prohibited the planting of fruit trees without first obtaining permission from military authorities; in practice, this resulted in Palestinians (in Gaza and the West Bank) being entirely barred from planting new mango and avocado trees, even to replace old, unproductive ones.

Conditions worsened in the years following the second intifada. Between September of 2000 and September of 2003, Israeli military forces destroyed wells, pumps, and an estimated 85% of the agricultural land in al-Sayafa, northern Gaza, where farmers had been using irrigation systems and greenhouses to grow fruits including citrus, apricots, and avocados. They barred almost all travel into and out of al-Sayafa: blocking off all roads that lead to the area, building barricades topped with barbed wire, preventing entry within 150 meters of the barricade under threat of gunfire, and opening crossings only at limited times of day and only for specific people, if at all.

A July 2001 prohibition on Palestinian vehicles within al-Sayafa further slashed agricultural production, forcing farmers to rely on donkeys and hand carts to tend their fields and to transport produce across the crossing. If the crossing happened to be closed, or the carts could not transport all the produce in time, fruits and vegetables would sit waiting in the sun until they rotted and could not be sold. The 2007 blockade worsened Gaza's economy still further, strictly limiting imports and prohibiting exports entirely (though later on, there would be exceptions made for small quantities of specific crops).

In the following years, Israel allowed imports of food items into Gaza not exceeding the bare minimum for basic sustenance, based on an estimation of the caloric needs of its inhabitants. Permitted (apples, bananas, persimmons, flour) and banned items for import (avocados, dates, grapes) were ostensibly based on "necessary" versus "luxury" foods, but were in fact directed according to where Israeli farmers could expect the most profit.

Though most of the imports admitted into Gaza continued to come from Israel, Gazan farmers kept pursuing self-sufficiency. In 2011, farmers working on a Hamas-government-led project in the former settlements produced avocados, mangoes, and most of the grapes, onions, and melons that Gazans ate; by 2015, though still forbidden from exporting excess, they were self-sufficient in the production of crops including onions, watermelon, cantaloupe, grapes, almonds, olives, and apples.

Support Palestinian resistance by calling Elbit System’s (Israel’s primary weapons manufacturer) landlord, donating to Palestine Action’s bail fund, and donating to the Bay Area Anti-Repression Committee bail fund.

Ingredients:

2 medium avocados (300g total)

1/4 cup white tahina

2 Tbsp labna (لبنة), or yoghurt (laban, لبن رايب)

1 green chili pepper

2 cloves garlic

2 Tbsp good olive oil

Juice of 1/2 lemon (1 1/2 Tbsp)

1 tsp table salt, or to taste

Pomegranate seeds, slivered almonds, pine nuts, chopped dill, nigella seeds, sesame seeds, sumac, and/or olive oil, to serve

Khubiz al-kmaj (pita bread), to serve

Instructions:

1. In a mortar and pestle, crush garlic, pepper, and a bit of salt into a fine paste.

2. Add avocados and mash to desired texture. Stir in tahina, labna, olive oil, lemon juice, and additional salt.

You can also combine all ingredients in a blender or food processor.

3. Top with a generous drizzle of olive oil. Add toppings, as desired.

4. Cut pita into small rectangles or triangles and separate one half from the other (along where the pocket is). Toast in the oven, or in a large, dry skillet, stirring occasionally, until golden brown. Serve dip alongside toasted pita chips.

490 notes

·

View notes

Text

URGENT! Please Help A Homeless, Disabled & Mostly Queer Family Get Ready For Housing By Helping With Paying For Much-Needed Loans!

PAYPAL | AMAZON WISHLIST | KOFI | GOFUNDME

VENMO: @penaltywaltz | CASHAPP: $afteriwake23 | ZELLE: DM me for email address

4/29/24 - New Post

So some stuff has happened, some of the loans I listed before have been paid, and I missed a few things, so I'm making a new post!

So, we still haven't heard about Section 8, and while I'm grateful for the shelter housing and feeding us, there's been some pretty toxic activity on my floor and I'm at my wit's end. I'm not sleeping well, I have constant headaches from grinding my teeth, and my blood pressure (which is already high and I'm already on meds for it) keeps being high when I get it checked. So we need to get housing with or without the Section 8 voucher as soon as possible.

Now, I have a list of low-income apartments all over North County. While not ideal, we have also heard of a complex of studio apartments available for $1400 which give preferential treatment to shelter occupants. But the problem is that I not only have a bunch of payday loans to pay, but I also have a payment on a two-month loan, a five-month loan, a six-month loan, and a year-long loan that eat up my entire income until I at least pay off the first three. My mom only gets $1300 and my daughter isn't on disability yet. So we can't even afford the studio until October and we'll have been kicked out of the shelter long before then.

I can probably cover the remaining payday loans and this month's payment for the two-month loan and still pay for the storage units. But I need to pay off whatever I can on the other loans, and the longer I wait the more interest that compiles. So I need a lot more than I was asking for before and I need it quickly to cover at least all of this month's payments while I work on paying off the totals of the bigger loans.

This is the list of payments I need to make as it stands now:

$300 for my loan from Ace Cash Express (due by May 2nd)

$300 for my mom's loan from Ace Cash Express (due May 2nd)

$408 for my loan payment from Ascend Loans (due May 3rd)

$277 for my loan payment from Greenline Loans (due May 3rd)

$177 for my loan payment from Green Arrow Loans (due May 3rd)

$148 for my loan payment to Possible Loans (due May 3rd)

$148 for my mom's loan payment to Possible Loans (due May 3rd)

$321.80 for my mom's loan from Moneylion (due by May 15th)

$285 for my Moneytree loan (due by May 25th)

$285 for my mom's Moneytree loan (due by May 26th)

I can't make partial payments on any of these loans except the Moneylion loans my mom has. I need the full amount for the payment to pay it off early, and for the four non-payday loans, I can't make an early payment but if I can cover the payments in my bank account with donations I'm good.

The Ascend loan was for $1,000. The Greenline loan was for $500. The Green Arrow loan was for $400. The Possible loans are $300 each, coming out as two payments of $148 (one this May, one in June) per loan. So I'm going to set two goals: covering all of the above payments and then covering the bigger loans as a whole throughout the month of May.

I can't take much more of the toxicity at the shelter at the moment, though I have hopes some of it will subside if the most toxic resident on my floor leaves this week like he's threatening to, but yeah. We just need to get all this paid off and get into housing of our own, even if it's just a studio for now. I'm including the $35 I got from a GFM towards the current totals because I spent all the rest of the money I had and I still haven't gotten that donation in my account yet.

TOTAL GOAL: $47/$4850

IMMEDIATE GOAL: $47/$2650

Goal has been met! However, the car is acting up, so we have to take it to our mechanic tomorrow. I may still need some help.

#signal boost#mutual aid#mutual aid request#urgent#emergency#time sensitive#community aid#gofundme#venmo#paypal#zelle#cashapp#amazon wishlist#ko fi link#buy me a coffee#buy me a kofi#ko fi support#financial assistance#financial aid#direct action#crowdfunding#fundraising#please boost#please reblog#please share#please help#help needed#anything helps#bills#homeless support

208 notes

·

View notes

Note

Hi Killy? How about #20 caffeine, dealer's choice for characters. Thank you!

Ooo, thank you for this one! 💙 I'm delighted at it being dealer's choice, as this got me to try my hand at writing my fave of faves: Rosie. I do hope I've got him down right! (Slight, slight spoilers for the most recent ep apply!)

caffeine

The base is somewhat beautiful when the sun’s still low. There’s a slight haze hanging just above the dewy grass, too thin to be a full-on fog but lending this early morning a particular enchantment all the same. Gold streaks flicker through the last vestiges of night. If she squints at the treeline hard enough, its greens will mingle with the twinges of red in the dawn. Like Christmas painted through a misty window.

It’ll be a while before Christmas comes, now, though the mornings aren’t getting any warmer.

Imogene puffs up her cheeks. Blows warm air between her hands, then rubs them together briskly. She’s forgotten her gloves again. Margaret’s not about to loan out her perfectly good set of spare gloves, either, if that glare from earlier is anything to go by. And Jeannie is nice and all, but the knitwork on her gloves is absolutely drenched in perfume. Imogene lets out a sigh. Contemplates the risks associated with running back to her bunk and praying her own gloves will be in the place where she put them last.

Truth is, she hasn’t got the time. Jeannie’s already taken off at a dead run for the bathroom for the second time in an hour, which has got Margaret fuming in a way that’ll at least make sure the sink’s going to be so spotless you could eat out of it. Imogene would be more worried about Jeannie if this wasn’t already the fourth time a girl like her was prone to retching her guts out in the morning and being just fine and dandy in the afternoon.

These girls, like some of the men, barely stay long enough to learn their names.

And then, of course, there are those few who seem to stay a lifetime.

“One for the road, Captain Rosenthal?”

His answering laugh is soft, but his joy somehow never fails to meet his eyes. “If you can spare me a cup, yes. Thank you.”

“It’ll be a little minute, sir, sorry.” Imogene shoots him the closest thing she’s got to an apologetic smile. “I hope you can wait that long to get your latest dose of caffeine. These new coffee makers are a bit slower on the uptake.”

Captain Rosenthal hums a little to himself. “I believe I can find the time for it this morning, Imogene.”

“Glad to hear it, sir. Congratulations on your twenty-fifth, by the way!” She’d meant to say that about five days ago, but the party had turned raucous and strange in equal measure before she’d had the chance. And the men had been pretty tightly knit around him, at least before the mood had taken another tailspin downward. “When are you due to go home? Is it a ways away yet?”

He shifts his weight from foot to foot the way he always seems to do when contemplating something important. His gaze fixes on the horizon. Well past the planes on their hardstands, beyond the line of trees and buildings. Like there’s something in the early morning sky only he can see.

Imogene waits him out the way she always does. There is no hurrying Robert Rosenthal, not when he is pondering something important before his first coffee of the day. He might have something interesting to say once the idea lands and takes root inside him. Last time, he had made a small comment about bird migratory patterns that had somehow evolved into a conversation about penguins at the zoo. The time before that, he had asked her something about hairpins – not a topic for a man, or so Margaret had scoffed after – before he’d leaned forward ever so slightly and told her some of his men might have gotten their hands on a second helping of chocolate through the cunning use of hairpins. (DeBlasio, if she had to name one. It’s always the goddamn Italians getting into trouble on this base.)

“I’m not too certain Florida will agree with me.” His smile is almost remorseful, as if he has contemplated the idea and found himself to be rather like a fish out of water. “I’d miss this weather. Gruesome chill in the air this morning.” He shudders just a little, more to himself than to her. “And I have to say, Imogene, I’d be hard-pressed to find better coffee than this.”

“Now you’re just flattering me, sir,” she laughs, grabbing a pristine white cup for him. “We do what we can, but the stateside coffee just tastes better if you ask me. I dream about it sometimes.”

“The perfect cup of coffee? Bit of milk, two sugars. Little bit of foam on top, perhaps.” There’s a twinkle in his bright eyes as he steps closer, keenly awaiting his morning shot of caffeine. “What is your poison of coffee choice in this world, if you don’t mind me asking?”

Imogene hums to herself. “Bit of milk, bit of caramel, sir.” She almost wishes she had enough time to foam the milk up a little, give it a bit of a whisk before stirring it into his cup. “The sugar’s too cloggy. Caramel syrup works just as well to sweeten it.”

“I take it there is no secret stash of caramel syrup on base here?”

“You”– she gestures with the little spoon –“would be correct, Captain. Perhaps you can sneak me some, once you’re back home?”

The shadow that passes over his face is gone as swiftly as it came, but that doesn’t mean she didn’t see it. Imogene sucks in a rather noisy breath. Feels a chill swoop down and back up her spine in a way that’s got very, very little to do with the morning cold of early March. He glances back at the horizon a moment. Wistful, her mind supplies. Then: yearning.

She’s seen it before. In Major Cleven and Captain Rivers, every time they were kept on the ground too long. In Major Egan, once Major Cleven had vanished and left a hole in the fabric of reality itself. In Stella Lombardi, whose eyes never quite seem to meet the ground anymore, and in Two, who might just survive them all. There’s something in the set of their shoulders. Something in their eyes, once you know where to look.

Imogene looks. Sees. “You’re not going home.”

Blue eyes, brighter than any morning, meet her gaze. “Not just yet.” His confession hangs in the air between them a moment. She fills up the space with a mostly full cup of coffee, milk and sugars already stirred in, and is proud when her hand does not tremble. “We have work to do here, don’t we, Imogene?” His bare hand brushes her own before he lifts the cup in clear gratitude. “Thank you for the coffee, as always.”

She takes a deep breath. Steadies herself on the counter, just out of his keen gaze’s reach. “You’re very welcome, sir. Same time tomorrow, then?”

A laugh startles out of him, bright and beaming and so alive that she wants to cry. “Same time as always, ma’am.”

41 notes

·

View notes

Text

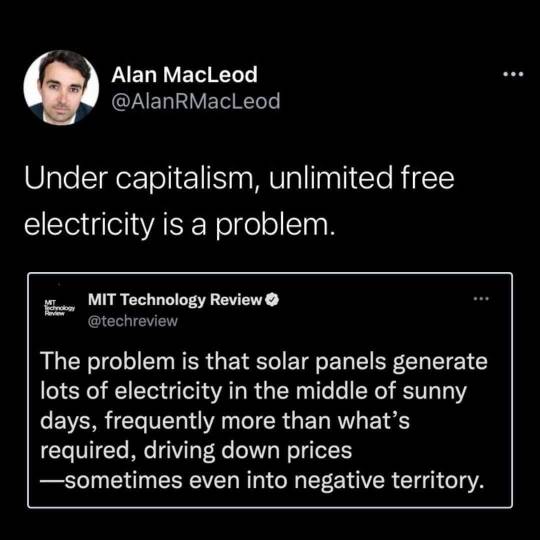

A woman driver sits behind the wheel of an electric bus in Kathmandu, Nepal. The woman received a loan through Aloi, a startup which connects grassroots entrepreneurs to low-interest financing. Photo: Aloi

5 notes

·

View notes

Text

Rajasthan MSME Policy 2024: A New Era for Entrepreneurs by Col Rajyavardhan Rathore

In a landmark move to empower small businesses and foster economic growth, the Rajasthan MSME Policy 2024 has been introduced under the guidance of Colonel Rajyavardhan Rathore. This policy aims to position Rajasthan as a leader in the Micro, Small, and Medium Enterprises (MSME) sector by providing robust support, financial incentives, and a conducive ecosystem for entrepreneurs.

The Importance of MSMEs in Rajasthan

MSMEs are the backbone of Rajasthan’s economy, contributing significantly to employment and GDP. With their presence in sectors like handicrafts, textiles, agriculture, and technology, MSMEs have immense potential to drive growth and innovation. The Rajasthan MSME Policy 2024 seeks to address challenges faced by small businesses and unlock their full potential.

Vision of Col Rajyavardhan Rathore

Col Rajyavardhan Rathore envisions MSMEs as engines of Rajasthan’s economic progress. Speaking at the launch, he remarked: “MSMEs are not just businesses; they are dreams of hardworking individuals. This policy is a promise to support their aspirations and make Rajasthan a hub for entrepreneurial excellence.”

Key Objectives of the Rajasthan MSME Policy 2024

Economic Empowerment: Strengthen the MSME sector to boost Rajasthan’s GDP.

Employment Generation: Create sustainable jobs across urban and rural areas.

Ease of Doing Business: Simplify processes and remove bureaucratic hurdles.

Skill Development: Equip entrepreneurs and workers with the latest skills.

Sustainability: Promote green practices and energy-efficient solutions.

Highlights of the Rajasthan MSME Policy 2024

1. Financial Support

Subsidies and Incentives: Up to 50% subsidy on capital investment for new enterprises.

Low-Interest Loans: Special credit schemes through state-backed financial institutions.

Tax Exemptions: Relaxation in GST and other state taxes for a specified period.

2. Infrastructure Development

Industrial Clusters: Development of MSME-dedicated zones in key cities like Jaipur, Udaipur, and Jodhpur.

Common Facility Centers (CFCs): Shared spaces with advanced tools and technology.

Digital Infrastructure: High-speed internet and IT support for MSMEs.

3. Skill Training and Capacity Building

Partnerships with educational institutions to introduce MSME-focused courses.

Regular workshops on digital marketing, export readiness, and quality control.

Mentorship Programs with industry experts to guide budding entrepreneurs.

4. Streamlining Processes

Single-Window Clearance: Speedy approvals for setting up businesses.

Simplified Regulations: Reduction in compliance requirements for small enterprises.

Digital Portals: Online systems for registrations, tax filing, and grievance redressal.

5. Promoting Innovation

Research and Development Grants: Funding for MSMEs working on innovative products and solutions.

Technology Adoption: Subsidies for adopting automation and digital tools.

Startup Incubation Centers: Support for MSMEs transitioning into startups.

6. Export Promotion

Global Market Access: Partnerships with trade bodies for export opportunities.

Trade Fairs and Expos: Participation in national and international exhibitions.

Export Subsidies: Financial support for logistics and international marketing.

Sectors Targeted by the Policy

1. Handicrafts and Textiles

Strengthening Rajasthan’s traditional crafts through modern techniques and marketing support.

2. Agri-Based Industries

Encouraging food processing, organic farming, and value-added products.

3. Renewable Energy

Promoting MSMEs in solar panel manufacturing and other green technologies.

4. Technology and IT

Support for tech startups and MSMEs working in AI, software, and digital solutions.

Impact of the Rajasthan MSME Policy 2024

Economic Growth

An expected 30% rise in MSME contributions to the state GDP by 2026.

Increased revenue through exports and enhanced domestic production.

Job Creation

2 lakh new jobs to be created in urban and rural areas.

Empowerment of women and marginalized communities through focused programs.

Ease of Doing Business

Simplified processes to attract 5,000+ new MSME registrations annually.

Global Recognition

Enhanced visibility for Rajasthan’s MSMEs in international markets.

Col Rathore’s Commitment to MSMEs

Col Rajyavardhan Rathore has always championed policies that drive progress and innovation. His leadership in shaping the MSME Policy 2024 reflects his belief in the entrepreneurial spirit of Rajasthan.

In his words: “With this policy, we are not just supporting businesses; we are building dreams, livelihoods, and a prosperous Rajasthan.”

A Bright Future for MSMEs in Rajasthan

The Rajasthan MSME Policy 2024 is a game-changer for small businesses. By addressing key challenges and providing holistic support, it aims to transform the state into a hub of entrepreneurship and innovation. With Col Rajyavardhan Rathore’s vision and leadership, this policy is set to empower thousands of entrepreneurs and contribute significantly to Rajasthan’s economic growth.

4 notes

·

View notes

Text

Harris adviser Deese calls for Marshall Plan on clean energy. (Reuters)

Brian Deese, one of my friends from our HIV/AIDS charity work in Africa, is the Institute Innovation Fellow at MIT. He was recently appointed as an economic adviser for Vice President Harris' presidential campaign. Prior to that, he was the 13th director of the National Economic Council for President Biden, and he previously served in several capacities in the administration of President Obama. He also was a key player in negotiating the Paris Climate Accord, working with John Kerry.

His article in Foreign Affairs, which is summarized in this Reuters story, is brilliant. Here's the link to the original article (beware the paywall) entitled, "The Case for Clean Energy Marshall Plan."

Excerpt from this Reuters story:

Brian Deese, an economic adviser for Vice President Kamala Harris' presidential campaign, called on Thursday for an economic program to loan allies money to buy U.S. green energy technologies as part of a wider strategy intended to fight climate change.

Deese, who was an economic adviser under President Joe Biden and former President Barack Obama, billed it as a new version of the Marshall Plan, a mechanism of grants set up by President Harry Truman and Secretary of State George Marshall, to help Europe recover after World War Two.

"It should be as generous to our allies as it is unapologetically pro-American in its interest," Deese told Reuters.

While Deese is promoting the plan independently of his work as a Harris adviser, it could offer insight into potential policies of her presidency should she win on Nov. 5. The Harris campaign did not immediately comment.

Deese helped shape the Inflation Reduction Act, opens new tab, Biden's landmark legislation that contains billions of dollars to help spur clean energy and fight climate change. He said the IRA and other legislation created one of the biggest opportunities to speed clean energy, but the effort needs a mechanism to bring technologies to allies.

To support the plan, the U.S. should create a Clean Energy Finance Authority, with the ability to issue debt and equity for clean energy projects, Deese said in an article in Foreign Affairs published earlier this week. The plan could be part of a U.S. alternative to China's "Belt and Road" infrastructure initiative and assure U.S. leadership in a period of friction between global powers.

The new U.S. agency could draw on expertise of the Department of Energy's Loan Programs Office in assessing the risks and benefits of emerging technologies like advanced nuclear energy, hydrogen power, carbon capture, and geothermal power, Deese said. The LPO issues loan guarantees and low-rate loans to companies with promising technologies that have difficulty getting financing from commercial banks.

To support the plan, Deese also called for tools such as tariffs that favor imports from countries that cut emissions while making steel and other products, and the development of a strategic mineral reserve.

Such reserves would be held by the U.S. and allies to protect against supply chain shortages for the materials key to clean technologies and the domination of critical minerals trade by China.

After Russia's invasion of Ukraine in 2022, Deese helped set up a record sale of oil from the U.S. Strategic Petroleum Reserve to help moderate gasoline prices for U.S. drivers. That experience helped him see the importance of developing reserves for minerals, he said.

"My hope is we were moving out of the idea stage and into the opportunity to experiment and then build," such reserves, Deese said.

Energy Secretary Jennifer Granholm said in a Reuters interview in June that the U.S. has been having conversations with allies in the International Energy Agency about collective reserves for critical minerals.

3 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure. — Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

7 notes

·

View notes

Text

Knight of Dawn, Chapter 14 [NYTF]

Meetings with JUST Councilor Miles were getting worse and worse.

Combing their hair back, Piers sighed as they tried to cool their temper. Miles sat at the other end of the long table, reading through each page of their inflation reduction proposal word by word. She didn’t speak, her brow furrowed, lines cutting deep across her forehead. Her glasses sat low on her nose, as her eyes scanned every line. They weren’t sure if she was reading that slowly purposefully or not, and honestly, they didn’t care anymore.

“Overall 1% increase until…” She muttered then looked up at Piers, “Don’t you think that’s excessive on the interest rates? If you’re increasing it and tax rates simultaneously, you’re going to tank the state economy. Plus with the current loan that Rome has from the state government, you’re never going to get Councilor Green to pass this.”

Piers bit their tongue, until a metallic taste filled their mouth, avoiding direct eye contact and staring at her hands. Rolling her eyes and shutting the proposal folio, the eldest councilor glared at Piers, frustrated, “Look. You’re not going to get me to agree to anything a royal puts in front of me that I don’t have at least some hand in writing, and that includes Councilors Johnson and Sidney, since I know you’re buddy-buddy with them both. I learned that lesson with your mother. Let me keep this, and add some of my own thoughts and experience to this. I’ve been Councilor longer than you’ve been alive...” Miles paused. Piers continued to avoid eye contact. “…This isn’t going to make me want to agree with you. You’re acting like a petulant child who isn’t getting their way.”

Piers retorted,“I am not acting like a child. I’m…thinking.”

The large conference room fell awkwardly silent, save for the buzzing of the overhead fluorescent lights. They weren’t going to engage with her for their own sanity.

Finally, Miles spoke, irritation creeping into her stern voice as she pushed her rolling chair away from the table, standing, “I’m going to leave this here with you. If you want my help, if you want to get anything passed, you’re going to let me have my hand at writing and editing some of these proposals. You are not going to bully me into passing whatever you want. It’s called compromising. Learn it.”

Miles left, quietly closing the door behind her and Piers was finally alone in the big conference room. They finally let the tension subside from their shoulders, getting up from their own seat, and leaving the portfolio behind. Hansel was expecting them and Piers had no intention of dealing with anything Miles had said for at least a day.

The Palace was busy, people hustling here and bustling there. With their head down, Piers made their way through the masses of servers and guardsmen and everyone in between. They managed to go unnoticed in the elevator, as five guardsmen, dressed in identical dark grey and green dress uniforms, packed in there with them. Gold emblems adorned the lapels of ther jacket collar, denoting their status as low-rank Special Operations agents. As they arrived at the main kitchen’s floor, the guards stepped out of the elevator, laughing amongst themselves. Others took their place, packing the elevator full. The line for lunch stretched all the way down the hall, a mix of military and civilian workers. While they waited, Piers scrolled through the various messages they’d received throughout their meeting, answering the most urgent questions and leaving the rest for later.

“What can I do for you?” A woman’ voice jerked their attention from their work. She stood behind the long counter, holding a plastic to-go box in her gloved hand. Behind the glass, a variety of food had been displayed, some likely leftovers, some fresh. They spotted a variety of fried foods and casseroles, and prayed there would be something they could eat without their stomach deciding to get sick.

”I’m actually going to be grabbing a meal for myself and a friend-“

She rolled her eyes, interrupting them in a monotone voice, “I can only do one tray at a time. If you want another tray you need to return to the back of the line.”

Piers blinked incredulously, taking a moment to just stare at the woman. The gears turned in her head before she recognized them.

“I apologize-”

They waved their hand, shushing her, “Just get two boxes, I have to run.”

The woman nodded furiously, pulling another box from the dwindling stack, then yelled back to her coworkers. Piers picked out both their food, and the list of what Hansel had sent them. Over the glass case, the woman handed Piers the two boxes, and they slipped out, not having to worry about meal points.

The elevator got emptier and emptier as they rode up to the studio floor, until they were all alone for the last stretch. They scanned their wrist as the last person got off, without even recognizing them, and pressed the button for floor 59. The ride lasted for a few more seconds, then the silver doors slid open. Bubbly pop music and Hansel’s out-of-tune singing could be heard from all the way down the hall, as they approached the large room at the end.

“Your lunch has arrived.” Piers knocked loudly on the doorframe. The singing and music stopped, and Hansel slid around the corner, seated on a rolling stool. He grinned, hopping up and taking the plastic container that Piers offered them.

Hansel brushed his hair behind his ears, before opening the container and taking a deep inhale, “Dude, I was so excited when Gret told me they were gonna have the stewed lentils and rice at the line. I could eat it every day.”

Piers laughed, “And I remembered today why I don’t go down to the line very often.”

At one of the tables, Hansel cleared papers and fabric samples to the side before motioning for Piers to join him. They passed him a set of metal utensils, and they both began to eat. Mouth half-full, Hansel opened up a file of outfits he’d been working on for them and shared it, everything from rough sketches to fully sewn projects, just awaiting the final tailoring.

“And this one,” he pulled up one of the last files in the bunch, having just swallowed his last bite of food, “It’s a potential outfit for you to wear for your birthday event, whatever you’re calling it. It’s not done as I’m working on a complimentary outfit to go with it, but I wanted to get your thoughts. It’s not at all something you’ve worn in the past, but I think it’d be nice and get you out of wearing just suits. I know that’s what you’re comfortable with, and you generally present more masculine, but it’s just an option.”

He showed them a rough sketch, a beautiful emerald green dress with a high neckline, but low cut sides and back, and a high slit on the right thigh that would likely be revealing a little too much if they weren’t careful.

They weren’t sure if they’d ever wear it, but it was certainly something they’d at least give a shot.

“Anyway,” Hansel closed the drawing, a grin on his face, “You ready to get ready for tonight?"

NYTF WIP PAGE

TAG LIST: @author-a-holmes, @soul-write @flowerprose @ceph-the-ghost-writer @theglitchywriterboi @when-wax-wings-melt @thechaoticflowergarden @lyralit @penspiration-writing @samatedeansbroccoli @charlesjosephwrites @italiangothicwriteblr @thetruearchmagos @pineapple-lover-boy @unilightwrites @sanguine-arena @bardic-tales @joshuaorrizonte @blind-the-winds @circa-specturgia @hymnonlips @aloeverawrites @the-stray-storyteller @writeblrsupport @starlit-skys @kyuponstories @guessillcallitart @magic-is-something-we-create @talesofsorrowandofruin @writingonmymind @imslowlydisintegrating @worldsfromhoney

#writeblr#writing#excerpt#wip#wip excerpt#wip chapter#nytf#athenswrites#piers hall#hansel olson#shanna miles

2 notes

·

View notes

Text

Why Solar1000.com is Your Best Choice for Photovoltaic Systems in Romania

Thinking about switching to solar energy but unsure where to start? With so many options available, finding the right provider can feel overwhelming. That’s where Solar1000.com comes in—a trusted name in Romania’s panouri fotovoltaice (photovoltaic panels) industry. Whether you’re looking to reduce electricity bills, increase energy independence, or go green, Solar1000.com has the solutions you need.

This guide will walk you through why Solar1000.com is the best choice for your solar needs, covering everything from quality and affordability to installation and customer service.

Who is Solar1000.com?

Solar1000.com is one of Romania’s leading providers of photovoltaic systems, offering top-tier solar panels, expert installation, and affordable financing options. Their mission is simple: make solar energy accessible and affordable for everyone—whether you’re a homeowner, a business, or an industrial facility.

Why Choose Solar1000.com?

With so many solar providers in Romania, why should you pick Solar1000.com? Here’s what sets them apart:

High-efficiency solar panels that maximize energy production

Competitive pricing with transparent quotes

Certified installation teams ensuring top-notch service

Flexible financing options for all budgets

Exceptional customer service and ongoing support

High-Quality Panouri Fotovoltaice

Not all panouri fotovoltaice are the same. The quality of your solar panels directly impacts energy efficiency, durability, and savings. Solar1000.com only works with top-tier manufacturers, ensuring high-performance panels with long lifespans and excellent warranties.

Affordable Pricing with No Hidden Costs

Many people hesitate to switch to solar due to high upfront costs, but Solar1000.com makes it affordable. Their pricing is:

Transparent – No surprise fees or hidden charges.

Competitive – They offer some of the best prices in Romania.

Flexible – Various financing options make solar systems accessible for all budgets.

Expert Installation Services

Even the best solar panels won’t perform well without professional installation. Solar1000.com provides:

Certified solar installers with years of experience.

Custom-designed systems based on your home or business’s energy needs.

Fast and efficient installation, usually completed within 1-3 days.

Government Incentives & Financing Options

Romania offers several government incentives for solar panel installations. Solar1000.com helps customers navigate rebates, grants, and financing options, including:

Casa Verde (Green House) Program – Covers up to 90% of costs for residential solar systems.

Net Metering – Sell excess energy back to the grid for credits.

Flexible Loans – Partner banks offer low-interest solar loans.

Residential Solar Solutions

For homeowners, switching to panouri fotovoltaice with Solar1000.com means:

Lower electricity bills – Generate your own power and reduce dependence on the grid.

Increased property value – Solar homes sell faster and at higher prices.

Energy independence – No more worrying about rising electricity costs.

Commercial & Industrial Solar Solutions

Businesses and industries can also benefit from Solar1000.com’s tailored solar solutions, which offer:

Reduced operational costs – Cut down electricity expenses and improve profitability.

Sustainability leadership – Show customers you care about the environment.

Reliable energy supply – Protect your business from power outages.

Long-Term Savings and ROI

Solar isn’t just an investment—it’s a long-term financial win. With a solar system from Solar1000.com, you can:

Save 50-70% on energy bills.

Recover investment in 5-7 years.

Enjoy free electricity for 25+ years.

Customer Reviews & Satisfaction

Wondering if Solar1000.com delivers on its promises? Just ask their satisfied customers! Homeowners and businesses across Romania praise their:

Professional and friendly service.

Honest pricing with no surprises.

Reliable and efficient solar panels.

Warranty & After-Sales Support

Buying solar panels is a big decision, and Solar1000.com backs its products with:

Long-term warranties (10-25 years) for peace of mind.

Ongoing technical support to keep your system running smoothly.

Quick response times for troubleshooting and maintenance.

Innovative Solar Technology & Smart Monitoring

Solar1000.com stays ahead of the curve with cutting-edge technology, including:

High-efficiency solar cells that generate more power.

Smart inverters that maximize energy conversion.

Remote monitoring apps so you can track energy production in real-time.

Sustainable & Eco-Friendly Solutions

By choosing Solar1000.com, you’re not just saving money—you’re also helping the planet. Their solar solutions:

Reduce carbon emissions and reliance on fossil fuels.

Support Romania’s transition to renewable energy.

Create a cleaner, greener future for generations to come.

Step-by-Step Process to Get Started

1. Free Consultation & Site Assessment

A solar expert visits your home or business to assess energy needs and available space.

2. Custom Solar System Design

A tailored system is created based on your electricity usage and budget.

3. Transparent Quote & Financing Options

Receive a clear pricing breakdown and explore financing options.

4. Professional Installation

Certified installers complete the setup quickly and efficiently.

5. System Activation & Monitoring

Once connected, you start generating clean, cost-effective solar energy!

Final Thoughts: Is Solar1000.com Right for You?

If you’re looking for high-quality, affordable panouri fotovoltaice in Romania, Solar1000.com is your best bet. With reliable solar panels, expert installation, and excellent customer support, they make going solar easy and stress-free.

0 notes

Text

Sustainability and Green Banking: The Future of Financial Services

The global banking sector is undergoing a significant transformation as financial institutions embrace sustainability and green banking. With increasing concerns about climate change, environmental degradation, and social responsibility, banks are now playing a pivotal role in promoting sustainable finance, reducing carbon footprints, and investing in green initiatives.

Green banking is no longer a niche concept—it has become an essential part of the financial services industry. This shift is driven by regulatory pressures, evolving customer preferences, and the recognition that sustainable investments yield long-term economic benefits. As part of the banking sector outlook, sustainability is now a major focus for financial institutions worldwide.

In this article, we will explore what green banking is, why it matters, the key trends shaping the future, and how financial institutions can lead the way in sustainable finance.

What is Green Banking?

Green banking refers to environmentally responsible financial practices that prioritize sustainability. This includes:

Financing renewable energy projects, such as solar and wind power.

Offering green loans and green bonds for eco-friendly businesses and initiatives.

Reducing banks' own carbon footprints by using energy-efficient infrastructure.

Encouraging customers to invest in sustainable businesses and ESG (Environmental, Social, and Governance) portfolios.

Green banking is not just about corporate responsibility—it is a strategic move that aligns financial services with the long-term health of the planet and the economy.

Why Sustainability Matters in Banking

1. Regulatory Pressures and Global Commitments

Governments and international bodies such as the United Nations (UN), European Union (EU), and Reserve Bank of India (RBI) are pushing financial institutions to adopt sustainable banking practices.

The Paris Agreement aims to limit global warming, requiring financial institutions to support climate-friendly investments.

India’s RBI has issued guidelines for banks to integrate environmental risks into their credit policies.

The EU Green Deal and Sustainable Finance Disclosure Regulation (SFDR) require banks to disclose their climate impact.

2. Growing Demand for ESG Investments

Customers and investors are increasingly interested in sustainable finance options. ESG-focused investment funds are seeing massive growth as individuals and institutions seek investments that align with their values.

3. Financial and Economic Benefits

Sustainable banking is not just ethically important—it is financially smart.

Green loans and sustainable investments often yield long-term financial stability.

Energy-efficient buildings and operations reduce costs for banks.

Supporting low-carbon industries minimizes risks associated with climate change and environmental regulations.

Key Trends in Green Banking

1. Green Bonds and Sustainable Investments

Green bonds are financial instruments used to fund climate and environmental projects. The green bond market has surged globally, with banks issuing billions in bonds to finance sustainable infrastructure and renewable energy projects.

2. Digital Banking for Sustainability

Many banks are shifting to paperless banking and promoting online transactions to reduce waste. Digital banking also reduces the carbon footprint associated with physical branches and paper-based processes.

3. Net-Zero Banking Commitments

Several banks have committed to net-zero emissions by 2050, meaning they will finance more green projects and reduce funding for carbon-intensive industries like coal and oil.

4. Green Mortgages and Loans

Banks are offering lower interest rates on green mortgages for energy-efficient homes. Similarly, businesses that adopt sustainable practices can access green loans with preferential terms.

5. Fintech and AI-Driven Sustainable Finance

Financial technology (fintech) is playing a significant role in green banking. AI and blockchain are being used to create transparent ESG investment platforms, helping customers track their environmental impact.

How Banks Can Lead the Way in Sustainable Finance

To truly integrate green banking, financial institutions must take proactive steps:

1. Develop Strong ESG Policies

Banks should embed environmental and social governance (ESG) criteria into their lending and investment decisions. This ensures funds are directed towards sustainable businesses and projects.

2. Partner with Green Enterprises

Financial institutions can collaborate with renewable energy companies, electric vehicle (EV) manufacturers, and sustainable startups to offer specialized financing solutions.

3. Educate Customers on Sustainable Finance

Banks can create awareness about green investment opportunities, helping customers align their financial goals with sustainability.

4. Reduce Internal Carbon Footprints

By adopting energy-efficient buildings, solar-powered ATMs, and paperless banking, banks can minimize their operational impact on the environment.

5. Expand Green Financial Products

Green Savings Accounts: Accounts that fund eco-friendly projects.

Eco-friendly Credit Cards: Cards that support carbon offset programs.

Sustainable Investment Portfolios: Funds that invest in low-carbon industries.

The Future of Green Banking

As part of the banking sector outlook, green banking is set to become a core strategy for financial institutions. Banks that fail to adopt sustainable finance risk losing relevance as customers, investors, and regulators demand greater environmental responsibility.

The shift towards sustainable finance is not just a trend—it is an economic necessity. Climate change, resource scarcity, and global regulations will shape how banks operate in the coming decades.

By embracing green banking, financial institutions can drive economic growth while safeguarding the planet for future generations.

Conclusion

Sustainability and green banking are redefining the financial sector. From green bonds and digital banking to ESG investments and carbon-neutral initiatives, banks are stepping up to address climate change and environmental challenges.

As the demand for eco-friendly financial solutions continues to grow, the banks that take the lead in sustainable finance will be the ones that thrive in the future.

0 notes

Text

Government Subsidies and Incentives for Solar Energy in India

India is rapidly emerging as a global leader in renewable energy, with solar power playing a pivotal role in the country’s green revolution. With more than 300 sunny days each year, India is blessed with immense solar potential, making it an ideal location for harnessing solar energy. Despite this natural advantage, high installation costs have often been a barrier to widespread adoption of solar power.

To address this challenge, the Indian government has introduced a range of solar subsidies, solar energy incentives, and government grants for solar panels to make solar power more accessible and affordable for homeowners and businesses alike. These financial incentives significantly reduce the financial burden of installing solar systems, encouraging more people to switch to clean, renewable energy.

With the government’s push to promote solar energy, now is the perfect time to invest in solar power. Not only does it help lower electricity bills and reduce dependence on conventional energy sources, but it also plays a vital role in India’s commitment to reducing carbon emissions and achieving a sustainable future. By taking advantage of these solar subsidies and government grants for solar panels, individuals and businesses can contribute to the country’s renewable energy goals while enjoying long-term benefits. The future of energy in India is undoubtedly solar-powered, and the transition starts today.

Why Solar Energy in India?

India enjoys abundant sunshine, making it an ideal place for solar power. Despite this, the high initial cost of solar installations often discourages consumers. To make it easier, the government offers various solar energy incentives and subsidies, which reduce the financial burden of going solar. These initiatives also align with India’s goal to reduce its carbon footprint and reliance on fossil fuels. Let’s dive into the key government programs for solar energy.

1. National Solar Mission (NSM)

Launched in 2010, the National Solar Mission (NSM) was created with a powerful vision to boost India’s solar energy capacity and pave the way for a brighter, greener future. The mission includes key incentives:

Capital Subsidies: Financial support to reduce the cost of rooftop solar installations.

Generation-Based Incentives (GBI): Rewards for each unit of electricity generated by solar producers.

Renewable Purchase Obligations (RPO): A mandate for utilities to source a percentage of energy from renewable sources, ensuring consistent demand for solar energy.

The NSM has driven the adoption of solar energy across the country, significantly improving accessibility.

2. Subsidy on Residential Rooftop Solar Systems

The Ministry of New and Renewable Energy (MNRE) offers significant financial support for homeowners installing rooftop solar systems. Subsidies include:

A 40% subsidy is offered for rooftop systems with a capacity of up to 3 kW in urban areas.

A 50% subsidy is provided for systems with a capacity of up to 1 kW in rural areas.These subsidies substantially reduce installation expenses, making solar energy more affordable for homeowners.

3. State-Specific Solar Energy Incentives

In addition to central government subsidies, several Indian states offer solar energy incentives, such as:

Tax Exemptions and Rebates: Some states provide property tax exemptions for solar-powered buildings.

Subsidized Rates for Solar Panels: States like Tamil Nadu, Gujarat, and Rajasthan offer additional financial support.

Power Purchase Agreements (PPAs): Long-term agreements with guaranteed payments for solar producers.

These state-level incentives make solar energy adoption even more affordable.

4. KUSUM Scheme for FarmersLaunched in 2019, the Kisan Urja Suraksha Evam Utthaan Mahabhiyan (KUSUM) scheme encourages the use of solar energy in agriculture by offering:

Up to 90% Subsidy for solar-powered irrigation pumps.

Low-interest loans for purchasing solar pumps.

Energy Generation: Farmers can sell excess energy to the grid, generating additional income.

This initiative empowers farmers, lowers energy costs, and contributes to India’s renewable energy objectives.