#Personal loan application process

Explore tagged Tumblr posts

Text

Online Personal Loans vs. Traditional Bank Loans: Which is Better?

In today's fast-paced financial landscape, borrowers have more choices than ever when it comes to securing a personal loan. With the rise of online personal loans, traditional bank loans are no longer the only option. But which is better? This article explores the pros and cons of both, helping you make an informed decision.

Understanding Online Personal Loans

Online personal loans are offered by digital lenders and fintech companies. The entire loan process—from application to disbursal—happens online, making it a convenient option for modern borrowers.

Advantages of Online Personal Loans

Quick and Convenient Application Online lenders offer a streamlined application process, often requiring just a few clicks. Most lenders only ask for basic documentation such as proof of identity, income, and address.

Faster Approval and Disbursement Traditional banks may take days or even weeks to process a personal loan application. Online lenders, on the other hand, can approve loans within hours and disburse funds within 24-48 hours.

Minimal Documentation Digital lenders usually require fewer documents compared to banks, making it easier for borrowers to apply.

Flexible Eligibility Criteria Many online lenders cater to borrowers with lower credit scores or limited credit history, increasing the chances of approval.

Competitive Interest Rates Some online lenders offer lower interest rates due to lower operational costs, making them a viable alternative to traditional banks.

Disadvantages of Online Personal Loans

Limited Face-to-Face Interaction Since online lending is entirely digital, there is no physical branch to visit for assistance.

Scams and Fraud Risks The online lending space has its fair share of fraudulent lenders. It’s important to verify the credibility of any lender before applying.

Higher Interest Rates for High-Risk Borrowers While interest rates can be competitive, borrowers with poor credit may be charged higher rates compared to banks.

Understanding Traditional Bank Loans

Traditional bank loans have been the go-to option for personal financing for decades. Offered by established financial institutions, these loans provide security and reliability.

Advantages of Traditional Bank Loans

Personalized Service Borrowers can visit branches, talk to loan officers, and get tailored advice based on their financial situation.

Lower Interest Rates for Creditworthy Borrowers Banks often provide lower interest rates for borrowers with high credit scores and stable income.

Trust and Credibility Established banks have a long history of lending, making them a trusted source for loans.

Comprehensive Loan Options Banks offer a variety of loan products, including secured and unsecured loans, catering to different needs.

Disadvantages of Traditional Bank Loans

Lengthy Application Process Bank loans require extensive documentation and multiple verification steps, leading to longer processing times.

Strict Eligibility Criteria Banks have stringent credit score and income requirements, making it difficult for some borrowers to qualify.

Slower Loan Disbursal Unlike online lenders, banks may take several days to weeks to approve and disburse the loan amount.

Which Loan Option Should You Choose?

Choosing between an online personal loan and a traditional bank loan depends on your financial needs and priorities.

Choose an Online Personal Loan if:

You need quick funds with minimal documentation.

You prefer a fully digital loan process.

You have a moderate or low credit score and need flexible eligibility criteria.

Choose a Traditional Bank Loan if:

You prioritize lower interest rates and trust in well-established banks.

You have a high credit score and meet strict eligibility criteria.

You prefer in-person assistance and comprehensive loan options.

Final Thoughts

Both online personal loans and traditional bank loans have their advantages and drawbacks. If speed, convenience, and flexibility are your top concerns, online loans may be a better fit. However, if you prioritize lower interest rates and personalized service, a traditional bank loan could be the right choice.

For more information on personal loan options, check out:

Personal Loan

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

By understanding your financial needs and comparing loan options, you can make the right choice for your financial future.

#finance#fincrif#personal loans#nbfc personal loan#bank#personal loan#personal loan online#loan services#loan apps#personal laon#Online personal loan#Traditional bank loan#Personal loan comparison#Best online personal loan#Personal loan interest rates#Quick personal loan approval#Personal loan application process#Instant personal loan online#Bank personal loan vs. online loan#Personal loan without collateral#Digital personal loan options#Low-interest personal loan#Personal loan eligibility criteria#Online personal loan benefits#Personal loan repayment terms#Personal loan approval speed#Personal loan EMI calculator#Secure personal loan options#Instant loan without documents#Personal loan for salaried professionals

0 notes

Text

Finding personal loans with fair credit can be challenging, but it's possible with the right strategy. This comprehensive guide covers top lenders, the application process, and tips to improve your credit score. Learn how to navigate the loan market with fair credit, understand the benefits of personal loans, and explore various loan types. From debt consolidation to emergency expenses, discover how to secure the best terms and rates for your financial needs in the USA. Achieve financial stability with informed decisions and expert advice.

#Personal loans for fair credit#Best personal loans#Fair credit loans#Loans for fair credit in the USA#Personal loan lenders#Fair credit score personal loans#Low interest loans for fair credit#Emergency personal loans#Debt consolidation loans for fair credit#Personal loan application process#Improving credit score for loans#Unsecured loans for fair credit#Top lenders for fair credit#Personal loans with reasonable terms#Credit score impact on loans

0 notes

Text

yes, doctors suck, but also "the medical ethics and patient interaction training doctors receive reinforces ableism" and "the hyper competitive medical school application process roots out the poor, the disabled, and those who would diversify the field" and "anti-establishment sentiment gets applications rejected and promotions requests denied, weeding out the doctors on our side" and "the gruesome nature of the job and the complete lack of mental health support for medical practitioners breeds apathy towards patients" and "insurance companies often define treatment solely on a cost-analysis basis" and "doctors take on such overwhelming student loan debt they have no choice but to pursue high paying jobs at the expense of their morals" are all also true

none of this absolves doctors of the truly horrendous things they say and do to patients, but it's important to acknowledge that rather than every doctor being coincidentally a bad person, there is something specific about this field and career path that gives rise to such high prevalence of ableist attitudes

and I WILL elaborate happily

#theres so much that contributes to this#and its such a traditional field that any change takes ten years to take effect even when its not as controversial as disability rights#ive no lost love for doctors as a whole#but the deeper causes here need to be examined to understand how this problem manifested and what can be done to fix it#disability#chronic illness#ableism#premed#medicine#salt baby talks

22K notes

·

View notes

Text

Unlock Financial Opportunities with Prefr Loans – A Comprehensive Guide

Unlocking Financial Opportunities: A Deep Dive into Prefr Loans In the ever-evolving realm of financial services, Prefr stands tall as a reliable and accessible provider of credit solutions. Let’s embark on a comprehensive journey to explore the various facets of Prefr loans, understanding why this NBFC (Non-Banking Financial Company) is not just a lender but a financial ally. Prefr Loans: A…

View On WordPress

#Prefr Loans#NBFC#Salaried Professionals#Self-Employed Entrepreneurs#Loan Flexibility#Repayment Tenure#Competitive Interest Rates#Transparent Processing Fee#Net Take-Home#Age Criteria#Digital Process#Responsible Borrowing#Credit Solutions#Prefr Features#Financial Solutions#Financial Empowerment#cibil score#personal finance#Financial Inclusion#loan application

0 notes

Text

Get Instant Loan - Quick Cash Now! Hassle-free Application. Approval in Minutes. No Collateral. Unlock Financial Freedom with Mpower Credcure. Call 7030489999.

#business loan low interest rate#Loan for New Company#Business In Rural Areas#application form for business loan#loans for small scale business#subsidy for business loan#quickest personal loan#best personal loan application#online loan apply personal loan#housing loan apply online#easy home loan bank#home loan process

0 notes

Text

Welcome!

Hello and welcome to The Neopian Biology Project!

This blog is an offshoot of a series of posts started on my main account. It is run by me, @asterixcalibur, in association with Happy Lab Accidents on @cabletwo. I'm an artist and funny person by trade, but a biologist by tragic BDGilbertian retribution.

The goal of this project is to identify all of Neopia's unique species, categorize them by kingdom and region of origin, and find an ideal specimen for each that can be put into a natural history museum (my gallery on Neopets). As of writing, the project has identified over 2000 unique species of Neopian wildlife.

Our main methodology is scouring item descriptions for helpful information. This process also involves researching and standardizing the taxonomical, ecoregional, and evolutionary timeline terminology of Neopia.

Longer term goals are to obtain the ideal specimen of every identified species for the museum, and renovate the museum into a simulated museum experience through careful application of visual assets and CSS/HTML. Maybe one day we can shoot for the Gallery Spotlight?

On Neopets

My account on Neopets is classypotassium. Feel free to ask to be NeoFriends -- just tell me who you are here!

The Neopian Biological Sciences Natural History Museum itself is here.

Ways to Contribute

1. Donate a specimen

If you'd like to donate or loan a specimen to the museum, contact me so we can discuss attribution and collateral!

The gallery's JellyNeo wishlist is here. It will be continually updated as specimens are identified, so consider it a work in progress. As of writing I also haven't checked anything off even if it's been obtained, so double check the museum before offering donations!

2. Donate Neopoints

You can also "donate" by buying a Plushie Fungus from my shop! These are intentionally overpriced so that the change can be considered a charitable donation.

3. Interact here!

A lot of the posts that end up here are going to be asking for people's thoughts on origin, kingdom, uniqueness, and so on, through polls and direct questions.

You can also submit items, images, links, art, specimens, fossils, documentation, scientific papers, primary sources, etc. and so on, for consideration by the Project!

You don't need to know anything about Neopets to put in your two NP (or cents USD). In fact, sometimes it's better to get a perspective grounded in normal Earth biology, because, speaking as a biologist here in Neopia, I can very well say oh ym god please help ohhhh my god you don't even know

Conclusion

You don't need to be into Neopets to enjoy or contribute to this blog; I'll try my best to write posts so that they can be enjoyed by anyone aware of but not necessarily into Neopets. In my experience, explaining Neopets to someone entirely unfamiliar with it is always fun. This shit runs deep, dark, and as spaghetti as its code. Best part of Neopets, to me, is that the site rewards you for exploration, and some of the most consequential but by far weirdest lore can only be found by happening upon a page six links deep into a chain of site features that have gone untouched since 2009, as part of a philosophy of interaction that runs the entire site and is entirely against modern website design principles.

Anyway,

Thank you for visiting!

Science awaits!

53 notes

·

View notes

Text

🗣️ Please pay attention

Amazon argues that national labor board is unconstitutional, joining SpaceX and Trader Joe’s

Amazon is arguing in a legal filing that the 88-year-old National Labor Relations Board is unconstitutional, echoing similar arguments made this year by Elon Musk’s SpaceX and the grocery store chain Trader Joe’s in disputes about workers’ rights and organizing.

The Amazon filing, made Thursday, came in response to a case before an administrative law judge overseeing a complaint from agency prosecutors who allege the company unlawfully retaliated against workers at a New York City warehouse who voted to unionize nearly two years ago.

In its filing, Amazon denies many of the charges and asks for the complaint to be dismissed. The company’s attorneys then go further, arguing that the structure of the agency — particularly limits on the removal of administrative law judges and five board members appointed by the president — violates the separation of powers and infringes on executive powers stipulated in the Constitution.

The attorneys also argue that NLRB proceedings deny the company a trial by a jury and violate its due-process rights under the Fifth Amendment. (source)

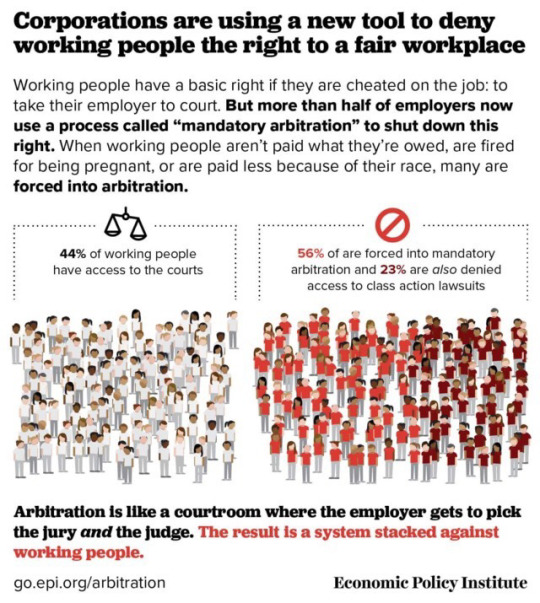

ICYMI, this is a case of corporations going, “7th Amendment Protections for me, but not for thee.”

It is strongly worth noting that in 2018 the John Roberts Court ruled 5-4 that companies can use forced arbitration clauses to stop people from joining together to fight workplace abuses - in effect denying individuals their 7th Amendment protections.

Subsequently, binding arbitration clauses used by corporations has proliferated; sneaking into all manner of common legal documents: personal banking applications, ordinary car loan applications, furniture purchases, and more. This is, unsurprisingly, a direct violation of the 7th Amendment that guarantees HUMAN BEINGS AND PEOPLE the right to a jury trial in certain civil cases and inhibits courts from overturning a jury's findings of fact. Republicans and SCOTUS are perfectly okay with corporations having more rights than workers and using forced arbitration to block people from having access to jury trials—but God forbid if corporations don’t have their right to a jury trial.

This legislative push to bestow corporations with more rights than people, while simultaneously taking away rights from human beings, has been nothing if not thoroughly and methodically done. At this rate, no corporation will ever need to fear a class action lawsuit again.

Amazon, SpaceX and Trader Joe’s are union busting.

But this latest case against the NLRB isn’t just an attack on labor and worker’s rights, it’s a fascistic attack on the very heart of fairness and democracy itself.

#politics#amazon#7th amendment#forced arbitration#spacex#trader joes#nlrb#workers rights#class action lawsuits#labor unions#union busting#collective bargaining#labor law#labor rights#scotus#john roberts court#john roberts#republicans are evil

104 notes

·

View notes

Text

So way back last spring, I consolidated my student loans over to Mohela--I no longer remember exactly why, but it was supposed to benefit me in some way to to this.

They got them transferred over, and the next step was to put them into income-based repayment--which I had been on before, but since they were with this new servicer, I had to do a new application and so on.

They didn't get around to processing it, and they didn't get around to processing it, and then the first federal freeze came in: it was the result of a lawsuit, but the judge, for whatever reason, decided to freeze applications for all income-based repayment.

I've been given to understand that most people caught in this snare simply had their loans put into a processing forbearance, and have been there ever since.

Not me, though! Me, every 3 months, I get a letter from Mohela saying that my payment of about $750 is two weeks overdue, and my next one is coming right up, so if I could please send them $1500 right away, that would be just swell.

So I have to get on the phone, work my way through the phone tree, wait on hold for the next available represenative to be with me shortly, who when I finally get htem looks at the file and says, "Hm, you really should be in forbearance, but you aren't. Let me escalate this to the advanced team." Then I wait again for the next available representative to be with me shortly, and when I finally have them on the line, they ask me about five questions, I say "yes, I understand" or "yes, that's correct" about five times, and it's done for another 3 months. The whole process used to take about an hour and half.

Well, today it was time to make that call again. This time, when I get through the phone tree to where I'm waiting for the next available representative, the automated voice tells me that my wait time is two and a half hours. So I wait about three and a half hours, and that finally gets me to to the first round of speaking to a live human being.

As is the custom, she spends a little time expressing her surprise that I am not on a processing forbearance, reads me the required legalese, and puts me "right through," she says, to the advanced line.

There, the automated voice tells me that my estimated wait time is three hours and five minutes.

So I wait about four hours, and then a voice comes on the line!

But it isn't a representative. It's a drunk-sounding individual who keep saying, "Hello? Hello? I can't hear you." Her voice cuts in and out, and she occasionally can be heard making semi-verbal statements without apparent context, which seem at times to be replies to someone I cannot hear. I try saying that I'm on hold for Mohela and there seems to be something wrong. It is unclear whether she hears me or not; she moans something that sounds like "web socket" and "green." I am reminded of the utterances of Laura Palmer in the Black Lodge.

Eventually she hangs up, or something, and I am back to being on hold. The automated voice comes on and says that my estimated wait time is one hour and twenty-seven minutes.

The security guard at my place of work informs me that he is locking up the place and I need to leave. In the elevator out of the building, I am disconnected.

I want to stress that I am not exaggerating about these times; I was literally on hold with Mohela, the federal student-loan servicing contractor for the United States, for an entire work day, during which I had one normal conversation with someone who was polite and fine but unable to help, and one fever-dream interaction with a person who may or may not have been affiliated with Mohela in any way, and who did not seem to be on the same plane of existence as I was.

Anyway, I'm not doing it again. I wrote a letter saying pretty much what I've just told you--slightly less detail about the weird lady--and uploaded it to their inbox, copied it into their comment form, faxed it using one of those free virtual fax things, and printed out a copy to mail. (Phone is the only way that I have successfully achieved contact with a human being who works at Mohela in the past.) I conclude the letter by offering them numerous ways to reply, and saying, as politely as possible, that if they call and leave a message, they will need to give me some way to get back to them without being on hold for six hours.

We'll see what happens.

19 notes

·

View notes

Text

Top Tips for Choosing the Best Mortgage Broker in Dubai

Securing a home loan in Dubai can be a complex process, and choosing the right mortgage broker can make all the difference. This guide provides top tips for selecting the best mortgage broker to help you navigate the home loan process in Dubai.

Importance of a Mortgage Broker

A mortgage broker acts as a bridge between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Choosing the Best Mortgage Broker

Research and Recommendations: Start by asking for recommendations from friends, family, and colleagues. Check online reviews and testimonials.

Verify Credentials: Ensure the broker is licensed and regulated by the relevant authorities in Dubai.

Interview Multiple Brokers: Speak with several brokers to compare their services, fees, and expertise.

Evaluate Experience: Choose a broker with a proven track record and extensive experience in the Dubai mortgage market.

Understand Fees: Clarify the broker's fee structure and ensure there are no hidden costs.

For property purchase options, explore Buy Houses in Dubai.

Questions to Ask Potential Brokers

What types of mortgages do you offer?

Which lenders do you work with?

What is your fee structure?

Can you provide references from previous clients?

How will you help me find the best mortgage deal?

For expert mortgage advice, consider Mortgage Broker UAE.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

For rental options, visit Apartments For Rent in Dubai.

Real-Life Success Story

Consider the case of Sarah, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream home. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

For selling your apartments, visit Sell Your Apartments in Dubai.

Conclusion

Choosing the best mortgage broker in Dubai requires careful research and evaluation. By following the tips outlined in this guide, you can find a broker who will provide expert advice, access to the best mortgage deals, and personalized service. For more resources and expert advice, visit home loan dubai.

8 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

A Comprehensive Guide to Personal Loans: Benefits, Eligibility, and Tips

A personal loan is an effective financial solution for individuals who need quick access to funds. Whether it's for medical emergencies, home renovations, or debt consolidation, a personal loan offers flexibility and convenience. Understanding how a personal loan works and how to maximize its benefits can help you make an informed financial decision.

What is a Personal Loan?

A personal loan is an unsecured loan offered by banks, credit unions, and online lenders. Unlike secured loans that require collateral, personal loans rely on the borrower's creditworthiness. Borrowers receive a lump sum and repay it in fixed monthly installments with interest over a predetermined period.

Benefits of a Personal Loan

1. Quick Access to Funds

A personal loan offers fast disbursal, making it an ideal option for urgent financial needs.

2. No Collateral Required

Since a personal loan is unsecured, borrowers do not need to pledge any assets, reducing the risk of losing property in case of non-payment.

3. Fixed Repayment Schedule

With fixed interest rates and structured monthly payments, budgeting becomes easier, allowing borrowers to plan their finances effectively.

4. Versatile Usage

Personal loans can be used for various purposes, including medical expenses, wedding costs, travel, home improvements, and even education.

Eligibility Criteria for a Personal Loan

Lenders assess several factors before approving a personal loan application:

Credit Score: A high credit score increases the likelihood of approval and better interest rates.

Income Stability: Lenders check employment status and monthly income to ensure the borrower can repay the loan.

Debt-to-Income Ratio: A lower ratio indicates financial stability and responsible borrowing habits.

Age Requirement: Most lenders require applicants to be within the age range of 21 to 60 years.

How to Apply for a Personal Loan?

Applying for a personal loan is simple and can be done online or in person. Follow these steps for a smooth application process:

Check Your Credit Score: A higher score improves your chances of securing a loan at favorable terms.

Compare Lenders: Research interest rates, processing fees, and repayment terms to find the best lender.

Gather Required Documents: Typically, lenders require identity proof, income proof, address proof, and bank statements.

Submit the Application: Fill out the application form and upload or submit the necessary documents.

Loan Approval & Disbursal: Upon verification, the lender disburses the approved amount to your bank account.

Tips to Manage a Personal Loan Effectively

1. Borrow Only What You Need

Avoid over-borrowing to prevent unnecessary financial burden. Assess your requirements before applying for a personal loan.

2. Choose a Suitable Loan Term

Opt for a loan tenure that ensures manageable EMIs while minimizing interest payments.

3. Make Timely Payments

Missing EMI payments can negatively impact your credit score and attract penalties.

4. Prepay Whenever Possible

If your lender allows it, make extra payments to reduce the principal and overall interest cost.

5. Avoid Multiple Loans Simultaneously

Taking multiple loans can increase your debt burden and make repayments challenging.

Conclusion

A personal loan is a valuable financial tool when used responsibly. By understanding eligibility criteria, comparing lenders, and managing repayments effectively, you can leverage a personal loan to meet your financial needs without unnecessary stress. Always plan your borrowing wisely to maintain financial stability and avoid debt traps.

#finance#fincrif#personal loans#nbfc personal loan#personal loan online#loan services#personal loan#loan apps#personal laon#bank#Personal Loan#Personal loan benefits#Personal loan eligibility#Personal loan interest rates#Personal loan application process#Personal loan repayment#Unsecured personal loan#Personal loan for debt consolidation#Personal loan for home renovation#Best personal loan lenders#Personal loan EMI calculator#How to apply for a personal loan online#Best ways to manage a personal loan#What is the best tenure for a personal loan?#Tips to get a personal loan with low interest#How does a personal loan impact your credit score?

0 notes

Text

Discover various personal loan options and learn how to apply online with ease. This comprehensive guide covers the application process, benefits, and types of personal loans available. Explore expert tips, FAQs, and practical advice to help you secure a personal loan seamlessly and efficiently, ensuring you make informed financial decisions.

#Personal loan interest rates#Online personal loan application#Unsecured personal loans#Best personal loan lenders#Personal loan eligibility criteria#Fast personal loans#Low-interest personal loans#Personal loan repayment terms#Personal loan documentation#Personal loan approval process#Instant personal loans#Personal loan comparison#Personal loan benefits#Personal loan customer reviews#Personal loan calculators

0 notes

Text

Last summer I applied for a job as a library specialist in a small town outside Gainesville. As part of the application I had to go to the librsry in-person and take what was essentially a high school English test, "match these titles to their authors," "what was the main theme of XYZ," etc., really dry and pointless, but the final few questions were relevant to the library position and I absolutely aced them. "What should you do if someone comes in with a dog?" "How would you help a parent find a book for their child if they don't remember the title?" "How would you respond to teenagers playing loud music?" I answered professionally and thoughtfully, and they asked me to come back for an interview. I was told to prepare a children's book storytime presentation with props, so I made a backdrop and little popsicle stick puppets for Tacky the Penguin, my favorite picture book from elementary school.

I had a lot of fun crafting everything and practicing my read-through with funny voices.

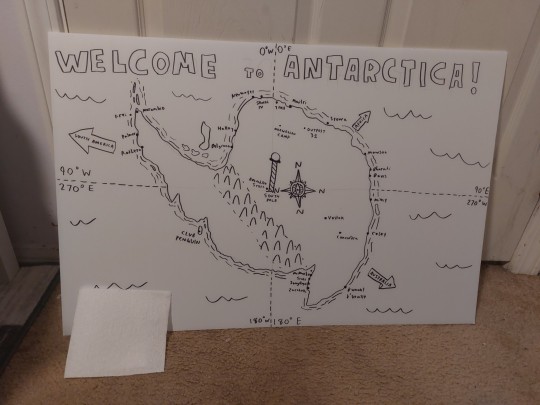

I colored in the final map, I just forgot to take a picture of it

Goodly, Lovely, Angel, Neatly, Perfect, and Tacky

"We're going on a penguin hunt, we'll mark em with a switch, then we'll sell em for a dollar and get rich, rich, rich!"

I absolutely bombed the interview. I was a nervous wreck, I kept stumbling over my words, I drew multiple complete blanks during their questions, and a lot of my answers trailed off into "well, yeah, you know what I mean..." Dumpster fire. 57 dead, 193 injured. I spent the next month dreading every single email I got because I was waiting to read the inevitable "unfortunately."

It was so much worse than that.

After enough time had passed I assumed they were simply going to ghost me, so I forgot about it and moved on, and then out of the blue they emailed me back with a form letter that began "dear sir or ma'am," which hurt a lot because I personally spoke to the hiring lady three times and all her other emails (including the form ones) had the courtesy to start with my name in all caps. They took the time to fill in the blank before, but not this time. Didn't even say "unfortunately," they were really blunt, "you were not chosen to move forward with the hiring process." Damn.

Well, I just moved back up to Gainesville and I saw that they county is still hiring for that same position at a different library that's closer to my apartment. I sent out a Hail Mary application thinking they'd reject me sight unseen, but they must have liked my cover letter because they want me to come back and take the test again. I don't remember every single question, but if it's anything like last year's I'll want to brush up on my English literature. I have to go in on Tuesday morning, so I have all weekend to study.

If I pass, they'll interview me again, and this time I hope they don't make me do another puppet show. My dad keeps making fun of me for it, like I just decided to bring puppets into it for no reason when they very specifically asked me to. It was one of the requirements. The word "puppets" was on the rubrick, but my dad acts like I'm mentally disabled, "dese are mah fwiends, dey gib me mowal suppowt, pwease n fank you!" Does he think I just choose to make puppets and bring them to job interviews for shits and giggles? Does he think I'm divorced from reality? Or is he just a heartless asshole who likes being cruel?

My old job paid me $15/hour for 31½ hours per week, $472.50 before taxes, around $420 take-home (88-89%). This library job offers $16.10 for a full 40 hours, $644.00 before taxes, around $570 net if they take out the same percentage. If I round down to 85% instead, I'd take home just shy of $550 per week, which is 131% of what I used to make. My rent is $600 per month, and my I qualify for $0 monthly payments on my student loans under the SAVE Plan, so I'd be flush with cash for once in my life and I'd have a job that doesn't make me want to kill myself!

This would be absolutely perfect! I really hope it works out this time. I know the gist of what they're going to ask me, so I'll be better prepared when it comes time to interview. Wish me luck.

#job interview#library specialist#library job#job application#wish me luck#hail mary#i hope this works

38 notes

·

View notes

Text

ONE PERSONAL LOAN FOR ALL YOUR NEEDS - INTRODUCING INCRED

If you’re in need of a personal loan, you might be wondering where to turn. There are so many lenders out there, it can be overwhelming. But have you heard of InCred? This lender offers personal loans ranging from ₹3 lakhs to ₹8 lakhs, with a starting interest rate as low as 16% per annum. Let’s take a closer look at what InCred has to offer. EASY APPLICATION PROCESS One of the top benefits of…

View On WordPress

#collateral-free loan#easy process#flexible repayment#InCred#loan application#personal loan#quick disbursal#secure application

0 notes

Text

Need an urgent loan of ₹5,00,000? My Mudra is here to help! Get instant approval with a quick and hassle-free application process. Whether it's for business expansion, working capital, or emergency expenses, we offer fast disbursal, minimal paperwork, and flexible repayment options. With My Mudra, you can secure the funds you need without long waiting times or complicated procedures. Our competitive interest rates and seamless online process make borrowing easy and stress-free. Apply now and get your ₹5,00,000 loan approved in no time with My Mudra—your trusted financial partner!

2 notes

·

View notes

Text

rant:

i work in water/wastewater as an environmental engineer. my company consults for municipalities and private companies on designing and maintaining their water treatment quality & infrastructure. with that, i’ve gotten to work on a lot of really cool, gross, and important projects even as a very entry level person, having only graduated in 2023. while i know that i’m capable and that i have great mentors that are reviewing most everything i do, i’m frequently taken aback at just how much they trust me with with such limited practical experience.

i’m highly respected because of my job title, and that’s reflected in my pay. despite having graduated with crippling credit card debt and a mix of student, personal, and auto loans, my new steady income that allowed me to work overtime meant i could stop ubering and reexplore old hobbies. my mental health began to recover. but im still only beginning to get out of the red month to month. if i didnt live with my partner, i would be living paycheck to paycheck, and i would have to find a roommate.

my oldest brother works in the same industry as a treatment plant operator. he never went to college, despite being one of the brightest people i know. traditional schooling didn’t understand how to teach him. when we start talking about water treatment, his knowledge far surpasses mine. he knows what will happen if you add too much alum to a certain process at the wrong point in treatment without jar testing, whether a pump is or isnt appropriate for the application without modeling software, and what sounds good in theory but shits the bed in practice.

yet, because operator positions don’t require a college degree, he is paid a fraction of my salary. he’s been taking classes to advance as an operator since he started this particular job 2-3 years ago and does well. but because he doesn’t have a college degree, that is reflected in his pay.

he’s starting his third job this week and supports 4 kids. he’s one of the most determined and hard working people i know, but is filing for bankruptcy and is in danger of losing their housing. he feels like a failure and jokes about suicide.

if i make a mistake, it is extremely likely to be caught through several iterations of review by myself and others. if my brother makes a mistake, entire populations, ecosystems, and economies could be easily affected.

just look at what happened in richmond, va this past january after a snow storm that interrupted the water treatment plant’s power for a couple of hours caused the entire city to lose water for nearly a week, as well as critically affecting and/or taking out the water systems of connected surrounding counties. all because the plant was under-maintained and mismanaged. experts in my field weighed in around the country calling it the worst water crisis in us history next to flint, mi. it didnt make national news, however, because it was the same week that the la wildfires dominated airwaves.

we must pay our workers living thriving wages. your job, at the bare minimum, should compensate you well enough that when you leave work, you can rest, relax, and live a fulfilling life. your job should compensate you well enough that working a second job is an absurd red flag, not a necessity. your job should compensate you well enough to ensure that when you are there, you are able to be FULLY THERE.

the value of a person’s labor should not be determined by whether or not they have a degree, or how valuable our capitalist society deems their role. every person is entitled to an income that can sustain a happy, healthy life, whatever that means to them. i don’t give a fuck if the person working at wendy’s makes as much as me because i’m an egotistical ass that needs to feel superior to those around me. i want to know that the person across the counter from me is happy and healthy; not working themselves to the bone just to survive. i want to know that the operators at my local water treatment plant are well cared for and well rested, lest they make a preventable error that can have disastrous effects, or leave the industry after a few years, taking all of their knowledge and skills with them. i want to know that the people in my community are not exploited. that they pursue their passions rather than a paycheck.

if you are of the mindset that some jobs aren’t skilled enough to “deserve” a thriving wage, then you have never worked an “unskilled” job and NEEDED it. you may have bussed tables in school, but was your parents’ safety net there to catch you when you needed to give up a shift to study for a test? was it there when you got in a wreck driving home from class and totaled your car? was it there when you were in middle school and being introduced to the expectations for college scholarships? did you know at 12 that the only way you’d ever afford college would be by being perfect in school?

it is unacceptable that in 2025, it requires 4-5 incomes to keep a family above water. our people are worn down, burning out, and isolated. that’s how the system has been designed so that workers believe they are powerless within it. the reality is the system is powerless without them.

raising the minimum wage and taxes on the ultra-wealthy are the bare minimum. universal healthcare and the complete restructuring of the healthcare economic system is next. continue those regulations until the corporations’ price gouging and predatory tactics are eradicated in every industry. pull the united states military out of goddamn everything, and cut all their ties to local police organizations. cut their budgets and redirect it to improving national infrastructure, as well as the infrastructure and livelihoods of those countries and peoples we plundered. eradicate ice and use the budget to set up universal basic housing and income, available to all persons residing in the us, documented and undocumented. reinforce the fuck out of social security. build up our communities and the people that make them up rather than imposing restrictions meant to make them ‘prove’ their worth.

stop taking fucking advantage of each other.

#chappell roan#grammys#anti capitalism#socialism#bootlickers smell#immigration#abolish ice#free palestine

5 notes

·

View notes