#Payment Methods for Freelancers

Explore tagged Tumblr posts

Text

E-invoicing works by creating invoices electronically in a structured format, transmitting them to the recipient through a secure network, EDI, or dedicated portal, and processing them automatically with the help of e-invoice approval software. Read More: https://teem-app.com/en/what-is-electronic-invoicing-e-invoicing/

#Online Invoicing Systems#Invoice Tracking#Electronic Invoice Approval Software#Payment Methods for Freelancers

0 notes

Text

Transfem Couple needs help with Rent

(please don't scroll past)

Hey y'all, I'm sorry to be making this post, but my and my wife's financial situation is kinda dire atm. Both of us are physically exhausted and sore from commission + freelance work, and the money from my short movie deal is getting delayed again. I legally can't pick up other jobs right now (even though I tried doing it under the table and barely anyone's hiring) and my wife is getting to a physically dangerous place if she keeps overworking herself.

We really need some help covering this month's rent and debt payments.

Here's a link to my Paypal. It's unfortunately the only method we're able to receive anything, since we live in Brazil.

https://www.paypal.com/donate/?hosted_button_id=PEK45GRQMDFWW

3K notes

·

View notes

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

133 notes

·

View notes

Text

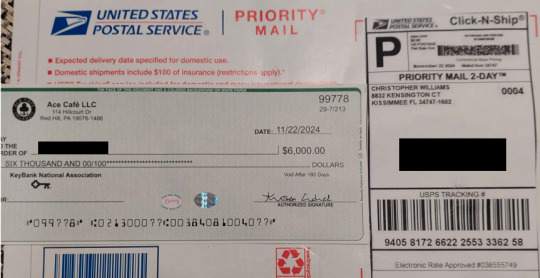

SCAM ALERT

TLDR: If a commisioner ignores your instructions, sends you a ton of money upfront via a check asking you to deposit and send back a portion of money- DO NOT. So back in Nov 10 I got an email commission which started okay: "I hope this message finds you well. I am reaching out to you because I am impressed by your portfolio and believe your artistic style would be a fantastic fit for an upcoming project I am coordinating.

I am currently in the process of assembling a team and I need a talented illustrator to collaborate on the title, Pandemic: Precaution and Prevention. Your work stood out to me due to its vibrant colors, character choices and attention to detail.

If you are interested, I would love to discuss the project further and provide more details about the scope, timeline, and compensation. Please let me know if this opportunity aligns with your current availability and if you would be open to discussing it further.

He wanted to create 6 group illustrations that would be printed and handed out for students 18-25 that would equate to $6000 at a 9 week turnaround. This raised an eyebrow but thought they were just a generous client. I gave him my procedure pipeline, starting with a min deposit upfront as a show of good faith. Also told him holidays are busy so will we start next year? He says that's fine. So far okay. "Considering the amount to be paid for the job, cashiers check or bank certified checks is our best bet. My sponsor doesn't use online payment platforms. He's an old-fashioned businessperson. The check will be issued and mailed to you and you should receive it within 5 days. Please get back to with your details in the format below:" Another raised eyebrow in this digital day and age but I've done previous freelance work that used mailed checks so I was alright with this. Only released my contact info and bank name.

Now the red flags pop up: On Nov 19 he sends this: "How are you doing today ? I'm so sorry for this, sincerely I do not find it easy to write this to you this moment , I have been so busy lately, the check is been made out for $6,000.00 which is cover for both phases. The sponsor asked for immediate refund for the 2nd phase as soon as the check clears your bank then you could proceed with the first 1-3. The 2nd phase is been postponed until further notice due to the sponsors personal issue, I will provide you the tracking information via USPS as soon as I have it so you could have it tracked yourself to know when exactly it will be delivered. My sincere apology for the inconvenience and do have a great day." So my requests were completely ignored, tells me a check is on the way with the full lump sum and I have to return half that amount. This is one method I've heard scammers get access of one's bank account with the poison check and you end up paying that half with your own actual money. Checked with friends and my own bank, sounds like a scam. Check arrives, and doing 30 minutes of Googling reveals so much warning stuff:

-So the names on the client email (Nicholas Jarry), and this name on the USPS (Christopher Williams) revealed on the first results are both famous sports players. One is a funny coincidence, two is suspicious. -quick Google of what a Keybank check is like, get an old warning about what to look for in legit checks, also tried calling Keybank on how to verify a check and explaining the scenario. -the address on the USPS belongs to a residential house that had another business also registered to it before that has gone inactive. -The Ace Cafe is real, but everything is inconsistent. The Hillcourt Dr address leads to a residential house, there is no LLC, and the logo belongs to a legit Orlando location that had closed last year and is opening in a new location, the address not matching whats on the check and names do not match either Jarry or Williams.

I've already reported this issue to the FTC and while they can't help me do anything with this particular scammer I'm now passing this around to new artists to know what to look out for when too many little suspicious things add up.

34 notes

·

View notes

Text

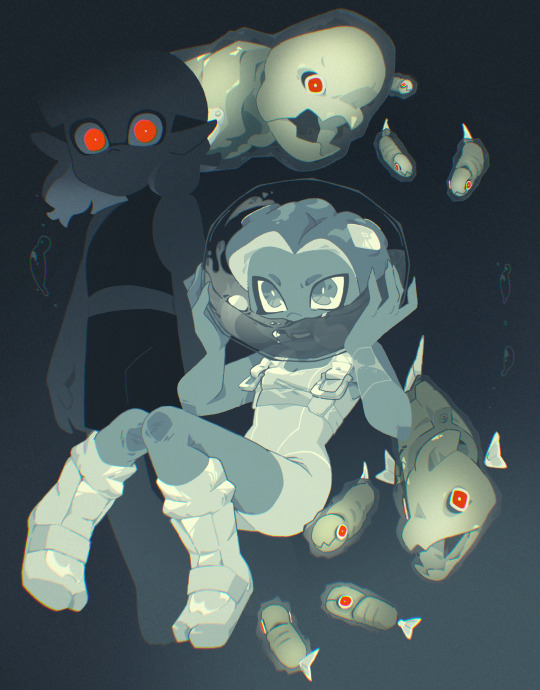

ranfren sona stuff

and little announcement (pls read it all)

if you didn't know - i'm freelance artist and all my income is commissions

and as you can understand - it's very hard to find commissioners for this style

and i want to pay for rent, food, clothes, etc. etc., so

so I open PWYW (pay what you want) for this style (quality depends on what you pay), but minimum is 5$

actually you can even point on some specific my art if you want something similar. there is a bunch of my ranfren art in different technique

you can commission any character, any idea. no problem with OCs or characters from other fandoms. You can DM me here or add me on Discord - maksinushka payment methods - Ko-Fi, Paypal, but if you need some specific method - i can check if it work for me ^^

big thanks for reading it all!! i also would be very grateful for a rb (´。• ω •。`)

#ranfren#ranfren fanart#randal ivory#luther von ivory#nyon catman#nyen catman#ranfren nana#fanart#randals friends#ranfren oc#oc#commisions open#art commisions#commission#digital commisions#taking commisions#cmm

27 notes

·

View notes

Text

Abandoned months old Jean x Reader draft about an electrician working on set at the Sunnytime Crew Show

Tw: workplace abuse??

---

"Aren't you done with that yet?"

You closed your eyes and inhaled deeply to block out the the shrill voice of your client and current director of the Sunnytime Crew Show, Susie Quentin. You say current because the original creator had taken a backseat to focus more on promoting the series through merchandising and signing off on everything that entails.

Susie was a cutthroat lead writer for a popular drama that was out and independent filmmaker. She took her job very seriously. A little too serious, you thought. There were times she was tolerable but others she was insufferable.

Staff or cast members questioning her were either met with harsh reprimand or a flippant dismissal. It was the same for you, being a freelance electrician, who despite your grievings with the woman, found that you would get a hefty payment when she called you on behalf of the studio - LambsWorks - to work on the set.

You were currently fixing the lights, which were looking too dim according to Susie.

"I said they'd take about fifteen to thirty minutes, Quentin." You said, not taking your eyes off the bulb you were fixing. "You've got to finesse these things..."

"Finesse!" You heard Susie scoff. In that moment you glance down at her.

"You know, I can easily get somebody who can get this done in maybe, five to ten minutes?" The implications of what she said weren't lost on you. And you nearly scoffed yourself. You were one of three electricians in this city, and they did shoddy work with methods that could last maybe a couple of weeks whereas yours could go up to half a year.

In all honesty you weren't that great yourself when starting out, but you quickly learned that if you wanted to get work you were going to have to make yourself irreplaceable. That and using a bit of predatory pricing to drive off competitors. But in all the months you worked with Susie she began to pick up that you didn't really like the "replacement" line. Because even if you were good at your job, Susie was willing to take a risk at getting someone else cheaper to do what she needed.

You frowned deep but decided to speed up the process. It might be a bit rickety by the time you were done, but hell, you wanted to be out right then.

A minute later all the lights were shining brightly on the stage.

You climbed down and looked at Susie, who was smugly satisfied.

"Was that so hard?" She taunted, "Your check will be in the mail."

You bumped shoulders with her as you marched off. At the start of the hallway you saw a couple of the Sunnytime Crew actors, Jean Laurent and Orville Smith. Or better known by their casted monikers - Rory Rainberry and Knackerdan Drizzle. They were still wearing their makeup and costumes, but not their wigs. Jean was having a cigarette.

You'd seen them around when you worked but never formally engaged with them.

You cleared your throat and they both looked at you blankly. You jerk your head, expectant of them to move. They laughed.

"There's an exit around that way." Smith said, pointing a direction you didn't bother looking.

"I'm trying to go through here, it's the quickest way." You replied.

"You're not too good to take a longer walk." Jean said, flippant.

This didn't really matter in the grand scheme of things. You really could just walk around. But you'd been decently pissed off by Susie that you took a daring step forward. "Let me get through."

Smith narrowed his eyes at your tone but seemed to hesitate on staying where he was, shifting on his feet a bit. Jean took a drag of his cigarette and blew the smoke in your direction.

With that you shoved past the two of them (but mainly Jean) and marched off to down the hall.

#jean laurent x reader#sunny day jack fanfiction#sunny day jack#sunnytime crew show#somethings wrong with sunny day jack#sdj x reader#sunny day jack x mc#draft#my fics

26 notes

·

View notes

Text

COMMISSION ANNOUNCEMENT!!!

HOWDY Y’ALL!!!!

I’m deciding to open commissions once more! And finally making them public rather than just offering to friends.

This took a TON of deliberation, as I fear as an artist being taken advantage of for my time. And so, before we get into pricing and my boundaries as an artist, lets talk ground rules! Just so you, as a potential customer, understand my expectations as the artist.

(Also please be patient with me as I work 12 hour shifts at a hospital, so it may take a few weeks to get to yours if it’s behind a lot of others in the queue)

RULES & EXPECTATIONS

First come, first serve

This is mainly because I like to prioritize those who come to me first. With this being said though, if you express interest in a commission from me, but do not state what you are wanting, as well as a price range you are going for, I will prioritize a person who has already given me a commission request. Basically! I put you in the queue the moment we have a request worked out! :-)

No revisions after a finalized sketch

This is mainly to protect myself as the artist, and you as the customer from being in a perpetual revision cycle, after already finalizing the sketch. If you aren’t happy with something, please let me know before I begin the line art process! Once I begin to do line art or color, I enter a zone where doing any sort of serious revision could cause the quality to diminish!

Make sure it’s my art you are wanting!

I do do a plethora of art style mocks like persona 5 eye cut ins, as well as other sorts of persona art style stuff. But I don’t wish to copy another artists style thats already offering commissions. If you’re wanting a certain style that isn’t adjacent to mine, you’re better off saving up for the artist you truly wish you could commission :-). I like to feed into fandom wants and needs, but I don’t want to take away from other freelance artist’s business.

I will not send the art until paid

Since I manage to work rather fast, I don’t mind making pieces that don’t get paid for, as any piece I do is good practice!! That being said, I won’t send my art until I have proof of payment for the time I spent on it. I will always be super clear on which part of the process I am in, but to protect myself from being scammed, I cannot send the piece until payment is proven.

DETAILS

Now lets get into the fun stuff!! To start, I do not charge my commissions based on how complex the art is, rather, how long it took me to make it. Which is the reason I can’t ask for up front payments. I charge, instead, by the hour. And my pricing is based on my state’s minimum wage. The software I use to make my art (Procreate) tracks the elapsed time I’ve spent drawing, and so I calculate the owed amount based upon that. So, to start:

I CHARGE $15 AN HOUR (USD)

METHOD OF PAYMENT IS THROUGH PAYPAL.

Now that that’s out of the way, here’s what I CAN and CAN’T draw!!

THINGS I ABSOLUTELY WILL DRAW:

Character references! (TTRPG CHARAS, OCS, ETC.)

Armor (I can do mecha, but because of the complexity it may bump up the price just because of how long it takes)

Main stream art style replication (Persona 2D Sprites, Ace Attorney, Steven Universe, The Owl House, and a few others as well)

People

Portraits

Couples (hugging, kissing, holding hands, cute stuff :3)

Inklings & Octolings (anything splatoon related pretty much)

THINGS I CAN DRAW (BUT WILL PREFACE WITH THE FACT THAT I AM LESS SKILLED IN THESE AREAS)

Furries

Animals/pets

Scenery

Pixel art

Vehicles

Weapons (this ones tricky because I can draw swords pretty quick, guns take quite a bit of effort to get right though)

THINGS I WILL NOT DRAW

NSFW/suggestive content

Gore

With the parameters out of the way, I’d like to talk about pricing now! Since I charge by the hour, I’d like to make it clear that I am 100% willing to work with money difficulties! I draw pretty fast, but as there are certain things that cause my pieces to take longer, it’s only fair I let you all know what those are, so that you can know what to avoid if you’re wanting some art from me!

THINGS THAT WILL CAUSE MY ART TO TAKE MORE TIME!

Lineless

Complex mecha/outfits

Complex props (e.g. instruments)

Anything in my CAN DRAW list

Complex backgrounds

And lastly…

EXAMPLES OF QUALITY OF WORK

(With time spent and how much they’d be priced)

ROUGH FULL BODY

Time spent: 30m

Calculated price: $7.50

STYLIZED TAROT

Time spent: 2h 16m

Calculated price: $34.00

SIDE ORDER LINELESS

Time spent: 3h 44m

Calculated price: $56.00

FYNN 1920S ‘IT’ GIRL PIERROT

Time spent: 5h 24m

Calculated price: $81.00

Anywho!! If anyone is interested, please DM me! I’ll hand over my discord so you can send me pictures easy :-)! Reblogs are greatly appreciated!!!!

#digital art#artwork#splatoon 2#ocs#splatoon#agent 8#splatoon 3#agent 4#octoling#sky children of the light#art commisions#persona 5#persona 3#persona series#ace attorney#dnd5e#dnd oc#dnd art#ttrpg oc#ttrpg art#pathfinder

29 notes

·

View notes

Note

Hey! I work as a freelance content writer/copywriter as well. I had to stop working because of academic pressure, but the pay in my country is peanuts, and I have always wanted to expand globally. I would really appreciate it if you could share some tips on how you started getting clients and how did you build your agency? Thanks!!

Hi love! Some high-level tips are below:

Intern/Apply to remote internships to get clips/experience

Create an Upwork account to get entry-level work/testimonials to get some client portfolio work and to help build your professional reputation

Always be on the lookout for leads, do your research, and craft a thoughtful/useful pitch for the client/publisher. Send work samples/share how you can help them. Follow up – remember rejection is part of the job, it's a numbers game

Start your own blog to show off your skills/build credibility in the writing world/your field

Save all of your quality-work to use in your portfolio. Always have a portfolio ready in PDF format and as a direct link that's mobile-friendly available when pitching clients

Utilize LinkedIn, your university connections, build your network, request informational interviews, and don't be shy to ask for letters of recommendation or referrals

When you do get a client whose honest and integral, show up and do your best work and submit it on time. If you can't for whatever reason, request an extension/notify them of the delay ahead of time

Perfect your craft, continuously read about your industry, and sharpen your skills. Show up with a business owner, not employee, mindset. This might be different when you're doing contract work for an agency where they might have their own contracts, set a budget, etc. But, when working with smaller, independent clients, ensure you have your rates, terms, general business practices, contracts (see a lawyer about this one), onboarding process, client questionnaire, payment method, etc., all set up for your client to acclimate to when you're ready to sign them. Remember, your clients are your customers, not your employers. It is a partnership, not an unequal power dynamic – you are the talent, not the direct report.

Hope this helps xx

#female entrepreneurs#business tips#freelancewriter#freelancing#entreprenuership#female writers#copywriting#content writing#women business#female founders#femmefatalevibe#femme fatale#dark feminine energy#dark femininity#it girl#high value woman#the feminine urge#female excellence#high value mindset#dream girl#queen energy#female power#life advice#life design#skilldevelopment#level up journey

83 notes

·

View notes

Text

Listen yall, this is writeblr and I'm seeing it a lot and that is a GOOD THING. but the WGA Strike is SO CRITICAL to the writing craft.

I say this as someone who has written (and occasionally still does) professionally. (Not creatively, a different kind of writing when I'm freelancing) Yall need to understand that this can do so much for those of us who don't write creatively professionally.

When I was writing professionally, I was 22, I'd been unemployed for 2 years already, and the first employer to say yes to hiring me got me with no negotiation. I was paid .03$ per word. THREE CENTS per word. My usual turnaround time was 48 hours for 3k words because any longer than that and I forfeit my payment. They put a max on my word limit so that they could limit my payment. I couldn't write more than 5k words per week. I made about $150 per week and at first I had to forfeit several dollars of that to Paypal fees because that's the only way my employer would fulfill invoices.

I got no benefits, in fact they specifically moved payment methods from my invoicing to a google form I filled out bi-weekly. This made it incredibly hard to track payment for tax purposes.

But this WGA strike? This could open the doors for other professional writers to demand value for their work. We have to support this strike with our entire chests. If the WGA can do it then so can other unions. Join the appropriate union and show some solidarity, because their success is OUR success.

58 notes

·

View notes

Text

Welcome to swiftpayconnect 😀

This page is all about discussing and exploring online payment methods like Payoneer, PayPal, and other trusted platforms. Whether you’re a student, freelancer, digital marketer, or business owner, we’re here to help you navigate the world of global payments and find the best solutions for your needs.

Stay tuned for insights, tips, and guides to simplify your transactions, make secure payments, and grow your opportunities worldwide.

2 notes

·

View notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Managing Debt Effectively: Your Guide to Financial Freedom

Debt is a common part of life, but managing it effectively is crucial for achieving long-term financial stability. Whether it’s student loans, credit card debt, mortgages, or personal loans, high levels of debt can quickly become overwhelming. The good news is that with the right strategies, you can take control of your debt and work toward a debt-free future.

Here’s how to manage debt effectively and regain financial freedom.

Step 1: Understand Your Debt

The first step in managing debt is knowing exactly what you owe. This means making a comprehensive list of all your debts, including:

Credit cards

Student loans

Car loans

Personal loans

Mortgage or rent

For each debt, write down:

The total balance

The interest rate

The minimum payment

By understanding your debt, you can prioritize which loans to pay off first and develop a strategy that works best for your financial situation.

Step 2: Create a Budget

A budget is essential when it comes to managing debt. It helps you track where your money is going and allows you to allocate funds toward paying off debt.

To create a budget:

List all sources of income (salary, side gigs, etc.).

Track all monthly expenses, including essential costs (e.g., utilities, groceries, housing) and non-essential costs (e.g., entertainment, dining out).

Determine how much you can afford to put toward debt each month, after covering your necessary expenses.

Tip: If you find that your income is lower than your expenses, consider cutting back on discretionary spending or finding ways to increase your income through side jobs or freelancing.

Step 3: Prioritize Debt Repayment

Not all debts are created equal, and prioritizing which debts to pay off first can save you money in interest over time. There are two common methods for prioritizing debt repayment:

The Debt Avalanche Method: In this approach, you focus on paying off the debt with the highest interest rate first, while making minimum payments on the others. This method saves the most money in interest over the long term.

The Debt Snowball Method: This method focuses on paying off the smallest debt first, regardless of the interest rate. Once the smallest debt is paid off, you move to the next smallest, and so on. While this method may not save as much in interest, it provides psychological wins as you pay off each debt, which can keep you motivated.

Step 4: Negotiate Lower Interest Rates

High interest rates can make it harder to pay off debt, so consider reaching out to creditors to negotiate lower rates. Many credit card companies, banks, or lenders are willing to work with you, especially if you have a good payment history. A lower interest rate means more of your payment goes toward the principal balance, which helps you pay off debt faster.

Additionally, if you have multiple credit cards, consider transferring balances to a card with a 0% introductory APR. Just be sure to pay off the balance within the introductory period to avoid interest charges.

Step 5: Consider Debt Consolidation

If managing multiple debts becomes overwhelming, you might consider debt consolidation. Debt consolidation involves combining several debts into one loan with a single monthly payment. This can simplify your repayment process and often result in a lower interest rate.

Options for consolidation include:

Personal loans from a bank or credit union

Balance transfer credit cards

Home equity loans or lines of credit (if you own a home)

Be cautious with debt consolidation, though, as it’s important not to accumulate new debt while paying off the consolidated loan.

Step 6: Avoid Accumulating More Debt

One of the most important steps in managing debt is avoiding the temptation to take on more debt while you’re trying to pay off existing balances. To do this:

Stop using credit cards (unless they offer significant rewards you can pay off each month).

Avoid taking out new loans unless absolutely necessary.

Build an emergency fund so you don’t rely on credit for unexpected expenses.

Step 7: Build Good Credit Habits

As you work to pay down debt, it’s essential to build healthy credit habits that will help you maintain financial stability in the future. Here are a few tips:

Pay bills on time: Late payments can result in fees and damage your credit score.

Keep credit card balances low: Ideally, keep your credit utilization ratio (the percentage of your credit limit that you’re using) below 30%.

Monitor your credit score: Regularly checking your credit score helps you track your progress and spot potential issues before they become major problems.

Step 8: Seek Professional Help If Needed

If you’re feeling overwhelmed by your debt, it may be helpful to seek guidance from a financial advisor or a credit counseling service. These professionals can help you:

Create a debt management plan

Negotiate with creditors

Provide budgeting and financial education

Many nonprofit credit counseling agencies offer free or low-cost services to help people manage their debt and improve their financial situation. KVR?

Conclusion:

Managing debt effectively is about creating a clear plan, sticking to your goals, and making consistent progress. While it may take time, the effort you put into paying down debt will pay off in the form of greater financial freedom and peace of mind.

Start by understanding your debt, creating a realistic budget, and using a repayment strategy that works for you. Remember, the road to financial freedom is a marathon, not a sprint, but every payment you make brings you one step closer to a debt-free life. Stay disciplined, avoid taking on more debt, and soon you’ll find yourself in a much stronger financial position.

#DebtFreeJourney#FinancialFreedom#ManageDebtSmart#BudgetingTips#DebtManagement#MoneyMatters#FinanceGoals#PersonalFinance#PayOffDebt#SmartMoneyMoves

2 notes

·

View notes

Text

How to Increase Your Cash App Transfer Limit: A Complete Guide

Cash App sets limits and put restrictions on how much money can be transferred and received. The amounts are according to the kind of transaction and account verification status. For instance, if you have not verified Cash App account the weekly maximum sending limit is $250 and $1000 receiving limits. Once you’re complete identity verification process you can get higher limits on sending and receiving money.

Cash App also places restrictions on how much cash can be taken out of ATMs that accept Cash Cards each day. The limits are accessible by pressing either your profile icon, or the Balance tab within the Cash App. If you have any further questions or require help with Cash App sending limit, do not hesitate to reach out direct to the support staff to seek assistance. Let's get started and find out more about it.

What are the Cash App Transfer Limits?

For money of the new and inexperienced users Cash App limits are quite low. For instance, the Cash App transfer limit is set to a small amount. You could be able to reach that limit faster than you expected. The good news is that Cash App provides a way to increase these limits with account verification. When you verify the account, you can increase Cash App transfer limit, and enjoy an enhanced and flexible experience using the application.

What are the Default Cash App Limits for Unverified Users?

When you sign up for the first time with Cash App, you are classified as an unregistered user. As an unverified user you are subject to a set of restrictions. If you are a non-verified user, you can only transfer up to $250 in 7 days and receive less than $1,000 one month.

But, for people who depend upon Cash App for larger payments for small-scale businesses, freelancers, or people who conduct regular transactions, those limitations could be extremely restrictive. If you have noticed that you require greater flexibility in your transactions, then it is the right time to increase your Cash App transfer limit per day by verify your account.

How to Verify Your Account to Increase Transfer Limits?

Verifying Cash App account is the best method for increasing your transfer limits. It is quite easy to verify Cash App account and increase transfer limits. Here is how to increase Cash App transfer limit:

Log into your Cash App account and click on the Profile icon

Here scroll down to the bottom and find "Personal section

The Cash App will request basic information, such as your full legal name and the date of birth, as well as the four digits that make up the number of your Social Security Number (SSN).

After being verified the limit will be increased to $7,500 per week with a limitless receiving limit.

What are the Benefits of Increasing Your Cash App Transfer Limit?

Below mentioned are the advantages of increase transfer limits on Cash App:

The most important benefit of verifying identity on Cash App is that it gives you higher transfer limits. Cash App accounts that are not verified typically have smaller limits than verified accounts which include accepting limits as low as $250 per week and $1,500 per week respectively. The Cash App sending limit after verification is higher is up to $7,500 per week.

When you share details such as social security number with Cash App it adds authenticity to your account and adds a layer of protection to your Cash App account.

Through identity verification, you can set-up direct deposit on Cash App. This allows you to receive your pay checks or other transfers straight into the Cash Account.

Moreover, by verifying your Cash App account, you get access to other features, like Cash App Investing and the option to utilize cash Card that functions as the debit card.

5 notes

·

View notes

Text

I decided to make a new banner for myself featuring my OCs in casual clothes. (Left to right; Michael, Ayame, Jayden, and Kage) I enjoyed drawing them like this, it's a good way to help characterize them. I also used this as an opportunity to practice how I draw shadows, which you unfortunately can't see very well here.

If you want to see them individually, as well as my other art, then go check out my ArtStation! Click the link below or at the top of my blog to check out all the art I made so far. There's graphic design, 3D models, character designs, and exactly one animation. Here's a small sampling!

I'm not taking commissions yet, but I will once I figure out my pricing and payment methods. I'll be sure to post art on here more frequently, including works in progress!

2 notes

·

View notes

Text

How to Find a Trusted Ahrefs Group Buy Seller

Navigating the Maze: Finding a Trusted Ahrefs Group Buy Seller

Ahrefs, the SEO (Search Engine Optimization) powerhouse, equips users with an arsenal of tools to analyze websites, research keywords, track rankings, and gain valuable competitor insights. While coveted by SEO professionals, the subscription fees can be a barrier for some, particularly freelancers, small businesses, or those starting out. This is where Ahrefs group buys emerge, offering a potentially cost-effective alternative. However, navigating the world of group buys requires caution, as not all sellers are created equal. This guide equips you with the knowledge to find a trusted Ahrefs group buy seller, allowing you to access these powerful tools without compromising security or reliability.

The Allure of Ahrefs Group Buys

Ahrefs group buys operate on a simple principle: multiple users share the cost of a single Ahrefs subscription. This can significantly reduce the financial burden, making Ahrefs' comprehensive toolkit more accessible. But the benefits go beyond affordability:

Collaboration: Agencies or teams working on SEO projects can benefit from shared access, fostering streamlined workflows and efficient communication.

Regular Updates: Reputable group buy sellers ensure access to the latest Ahrefs features and updates, keeping you equipped with cutting-edge tools.

The Buyer Beware Approach: Potential Risks

Before diving headfirst into the world of Ahrefs group buys, it's crucial to acknowledge the potential downsides:

Security Concerns: Sharing account credentials with a third-party seller can pose a security risk. Meticulously research the provider's reputation and security practices.

Unreliable Access: Some sellers might offer unstable access due to account suspension or limitations imposed by Ahrefs.

Limited Usage: Certain group buys may restrict daily or monthly usage limits for specific tools to maintain fairness among users.

Ethical Considerations: Ahrefs frowns upon unauthorized account sharing. Consider supporting their development by opting for an official subscription if financially viable.

Finding the Trustworthy Seller: Essential Criteria

With the potential drawbacks in mind, here's how to identify a trusted Ahrefs group buy seller:

Reputation is Key: Start by researching the seller's track record. Look for online reviews, testimonials, and forum discussions to gauge their reliability and customer satisfaction.

Transparency Matters: A trustworthy seller will have a clear and transparent website outlining their pricing structure, terms of service, data security practices, and refund policy (if applicable).

Security First: Inquire about the seller's security measures to protect user data. Secure login protocols and two-factor authentication are strong indicators of a responsible provider.

Communication Channels: Opt for a seller with established communication channels, allowing you to reach them promptly with questions or concerns.

Going Beyond the Basics: Advanced Tips

Once you've identified a few potential sellers, take these additional steps for further verification:

Social Proof: Check if the seller maintains active social media profiles or online communities. Engagement levels and user feedback can reveal valuable insights.

Payment Methods: Opt for a seller who uses secure payment gateways like PayPal or credit card processors with buyer protection mechanisms.

Trial Periods: If available, consider a trial period to assess the quality of service and tool access before committing long-term.

FAQs: Demystifying Ahrefs Group Buy Sellers

What are some red flags to look out for when choosing a seller?

Be wary of sellers offering unrealistically low prices, vague terms of service, or limited communication channels.

Is it possible to find a completely risk-free Ahrefs group buy?

There is always an inherent risk involved in using a group buy service. However, by following the outlined tips and conducting thorough research, you can significantly minimize these risks.

What are some alternatives to Ahrefs group buys?

Several free and paid SEO tools offer varying functionalities. Explore options like Google Search Console, SEMrush, or Moz before committing to a group buy.

Can I get banned from Ahrefs for using a group buy?

Ahrefs can potentially suspend your account if they detect unauthorized access or suspicious activity.

What are the long-term implications of using a group buy?

Using a group buy for an extended period might hinder your ability to access the full benefits of an official subscription, such as dedicated customer support or priority access to new features.

Conclusion

Ahrefs group buys present a potentially cost-effective way to leverage powerful SEO tools. However, approaching them with caution and due diligence is crucial. By following the outlined strategies and prioritizing security and transparency, you can increase your chances of finding a reliable seller who who can provide access to Ahrefs' tools without compromising your data or hindering your SEO efforts. Remember, the ideal scenario involves striking a balance between affordability and peace of mind. Here are some additional considerations:

Official Ahrefs Subscription vs. Group Buy: If your budget allows, weigh the long-term benefits of an official Ahrefs subscription. Direct support from Ahrefs, access to all features without limitations, and a lower risk of account suspension are valuable advantages.

Alternative SEO Tools: Explore free or paid alternatives like Ubersuggest, KWFinder, or Moz Pro. Depending on your specific needs, these tools might offer a good balance of functionality and cost.

Building Your Case for an Official Subscription: If you work within an organization, consider presenting a well-researched case for acquiring an official Ahrefs subscription. Highlight the long-term ROI (Return on Investment) potential and how Ahrefs can enhance your SEO efforts.

Ultimately, the decision to use an Ahrefs group buy rests on your individual needs and risk tolerance. By carefully evaluating the options and prioritizing security, you can make an informed choice that empowers your SEO journey.

2 notes

·

View notes

Note

Hey!! I just had a question about your commisions! What payment method do you take? And if i wanted you to add a character to the piece would that just be the full price x2? Thank you :)

Hello! Payment is thru paypal but if thats inconvenient can discuss other means i am an easy guy.

I take a deposit or full price b4 tho is the only thing.

My current prices are kind of just base prices for an aesthetic/ style/ how complex the piece is and its more or less down for discussion based on what the piece is lol! Sorry if thats vague. I think on a base level with flats it would be 20 gbp + more for any basic additional add ons to a piece but id need to know what it will be and then go from there to finalise a price bc even style wise it could turn into a full illustration. I hope that makes sense!!!

(this is specifically for personal comms ^_^ just to clear that up if anyones reading, prof/ freelance illustration is an entirely different conversation lol)

2 notes

·

View notes