#Online Brokers in UAE

Explore tagged Tumblr posts

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

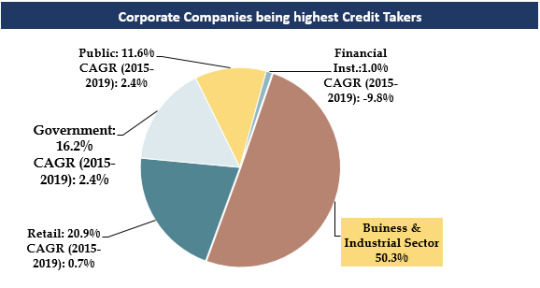

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Why Health Insurance is Essential in Dubai: Protecting Your Future with Nexus Insurance Brokers LLC

Why Health Insurance is Essential in Dubai: Protecting Your Future with Nexus Insurance Brokers LLC

In today’s fast-paced world, securing reliable health insurance is more important than ever. Living in Dubai, where quality healthcare services are readily available, having a comprehensive health insurance plan ensures you and your family receive the best medical care without financial strain. At Nexus Insurance Brokers LLC, we specialize in providing tailored health insurance solutions, ensuring that individuals, families, and businesses have access to the right coverage for their needs.

The Importance of Health Insurance in Dubai

Dubai has a high standard of medical care, but healthcare costs can be significant, especially for those without adequate coverage. Health insurance is not just a necessity—it’s a legal requirement in Dubai, with mandatory health coverage enforced for all residents. Without insurance, medical expenses can become overwhelming, making it crucial to choose a plan that offers both comprehensive benefits and financial security.

What to Look for in a Health Insurance Plan

Choosing the right health insurance plan can be challenging, but understanding key features can help. At Nexus Insurance Brokers LLC, we guide our clients through a range of options, considering factors such as:

Coverage Benefits – Plans that cover outpatient, inpatient, emergency care, and specialist consultations.

Network Hospitals – Access to a wide range of hospitals and clinics, ensuring convenient medical care.

Maternity and Family Coverage – Comprehensive plans that include maternity care, newborn benefits, and child healthcare.

Pre-existing Conditions – Solutions that cater to those with chronic illnesses, ensuring continued medical support.

Affordable Premiums – Flexible payment options that balance cost and coverage effectively.

Why Choose Nexus Insurance Brokers LLC?

As a leading insurance broker in Dubai, Nexus Insurance Brokers LLC provides independent and unbiased guidance to help you find the most suitable health insurance plan. Unlike tied agents, we are not limited to one provider, allowing us to compare policies from top insurers and recommend the best coverage for you. Whether you are an individual seeking essential coverage or a business looking to provide employee health benefits, our experienced advisors will tailor a solution that fits your specific needs.

Secure Your Health Coverage Today

Having the right health insurance plan means peace of mind for you and your family. Don’t wait until an emergency arises—secure your coverage today with Nexus Insurance Brokers LLC. Contact us to explore the best health insurance options and ensure that you have reliable protection for the future.

#insurance broker dubai#insurance dubai#insurance brokers in dubai#insurance broker#brokers insurance#insurance broker uae#cheap insurance dubai#uae insurance policy#online insurance dubai#car insurance dubai#car insurance near me#buy car insurance online#car insurance broker#auto insurance#buy car insurance online dubai#health insurance dubai#health insurance#medical insurance#health insurance in dubai#medical insurance broker dubai#health care insurance#family health insurance uae#health insurance online#life insurance uae#life insurance broker uae#best life insurance#life insurance policy#travel insurance dubai online#buy holiday insurance#house insurance dubai

0 notes

Text

Can one earn money through Forex trading online? How does it compare to investing in stocks, bonds, and other options?

Published By Smartfx | Best Forex Brokers in Dubai | Dec 13 2024

Can One Earn Money Through Forex Trading Online?

Yes, it is possible to earn money through forex trading online. The foreign exchange (forex) market allows individuals to trade currencies with the goal of profiting from fluctuations in exchange rates. However, earning consistently requires a combination of knowledge, skill, discipline, and effective risk management.

Forex trading offers several advantages:

Accessibility: The forex market is open 24 hours a day, five days a week, making it convenient for traders worldwide.

High Liquidity: As the largest financial market globally, forex provides ample opportunities to enter and exit positions without difficulty.

Leverage: Brokers offer leverage, allowing traders to control larger positions with a small initial investment. This increases potential profits but also magnifies losses.

Despite its benefits, forex trading in Dubai comes with risks. The high volatility of currency pairs and the temptation to overuse leverage can lead to significant losses. Success requires thorough research, a well-defined strategy, and emotional discipline.

Forex Trading

Best suited for short-term traders who can dedicate time to monitoring the markets.

High volatility and leverage provide the potential for quick profits but also amplify risks.

Stocks

Ideal for investors seeking long-term growth and potential dividends.

Prices are influenced by company performance, economic conditions, and market sentiment.

Bonds

A safer option with predictable returns, often used for diversification or steady income.

Limited growth potential compared to forex or stocks.

Other Investments

Cryptocurrencies: High volatility and the potential for massive gains or losses.

Real Estate: Offers stability and long-term appreciation but requires significant capital and is less liquid.

While forex trading online can be profitable, it is not a guaranteed income source and carries high risks. It requires a commitment to learning and disciplined execution. Compared to other investments like stocks, bonds, or real estate, forex stands out for its accessibility and high liquidity but may not be suitable for all investors due to its volatility and leverage. Beginners should start with a demo account and only risk money they can afford to lose.

#forextrading#fore trading online#top forex brokers in dubai#best forex broker in uae#forex expo dubai#forex broker

1 note

·

View note

Text

Understanding health insurance costs in UAE

To understand health insurance costs in UAE, consult with a qualified insurance professional or insurance broker in UAE. Read more...

0 notes

Text

Best Forex Trading Platform in UAE - Trade with Confidence

Looking for the best forex trading platform in UAE? Spectra Global Ltd. is your premier choice. With cutting-edge technology, competitive spreads, and unparalleled customer support, our platform is designed to meet the needs of both beginner and experienced traders. Whether you're trading on the go or from the comfort of your home, our user-friendly interface and advanced tools ensure a seamless trading experience. Join thousands of successful traders who trust Spectra Global Ltd. and start your journey towards financial freedom today. Sign up now and take advantage of our exclusive offers and promotions.

Start Trading Forex Today with the Best Platform in UAE - Spectra Global Ltd.

#Best Forex Trading Platform in UAE#Forex Trading UAE#Forex Trading Platforms#UAE Forex Brokers#Top Forex Platforms UAE#Forex Trading Tools UAE#Online Forex Trading UAE#Forex Market UAE#Trusted Forex Brokers UAE#UAE Forex Trading Services

0 notes

Text

Top Tips for Choosing the Best Mortgage Broker in Dubai

Securing a home loan in Dubai can be a complex process, and choosing the right mortgage broker can make all the difference. This guide provides top tips for selecting the best mortgage broker to help you navigate the home loan process in Dubai.

Importance of a Mortgage Broker

A mortgage broker acts as a bridge between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Choosing the Best Mortgage Broker

Research and Recommendations: Start by asking for recommendations from friends, family, and colleagues. Check online reviews and testimonials.

Verify Credentials: Ensure the broker is licensed and regulated by the relevant authorities in Dubai.

Interview Multiple Brokers: Speak with several brokers to compare their services, fees, and expertise.

Evaluate Experience: Choose a broker with a proven track record and extensive experience in the Dubai mortgage market.

Understand Fees: Clarify the broker's fee structure and ensure there are no hidden costs.

For property purchase options, explore Buy Houses in Dubai.

Questions to Ask Potential Brokers

What types of mortgages do you offer?

Which lenders do you work with?

What is your fee structure?

Can you provide references from previous clients?

How will you help me find the best mortgage deal?

For expert mortgage advice, consider Mortgage Broker UAE.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

For rental options, visit Apartments For Rent in Dubai.

Real-Life Success Story

Consider the case of Sarah, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream home. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

For selling your apartments, visit Sell Your Apartments in Dubai.

Conclusion

Choosing the best mortgage broker in Dubai requires careful research and evaluation. By following the tips outlined in this guide, you can find a broker who will provide expert advice, access to the best mortgage deals, and personalized service. For more resources and expert advice, visit home loan dubai.

8 notes

·

View notes

Text

How to Find the Best Deals When Buying Villas in Dubai

Securing the best deals on villas in Dubai requires a combination of market knowledge, strategic planning, and effective negotiation. Here’s how you can find the best deals when buying villas in this vibrant city.

1. Conduct Thorough Market Research

Understanding the market dynamics is crucial for finding the best deals.

Current Market Trends: Stay updated with the latest market trends and property prices in different areas of Dubai. This will help you identify the right time to buy.

Historical Data: Analyze historical data on property prices to understand the market’s performance over the years. This can give you insights into potential future trends.

For comprehensive market insights, visit Dubai Real Estate.

2. Choose the Right Time to Buy

Timing your purchase can significantly impact the deal you get.

Buyer’s Market: Look for periods when there is a surplus of properties on the market. This can drive prices down and provide better negotiation opportunities.

Seasonal Trends: Consider buying during off-peak seasons when the demand is lower. Sellers may be more willing to negotiate during these times.

Explore more options at Off-Plan Projects in UAE.

3. Work with Experienced Real Estate Agents

A knowledgeable real estate agent can be invaluable in finding the best deals.

Reputable Agents: Choose agents with a strong track record and good knowledge of the Dubai villa market. They can provide valuable insights and help you navigate the buying process.

Negotiation Skills: An experienced agent can negotiate better deals on your behalf and help you understand the intricacies of the market.

For expert advice, check out Mortgage Broker Dubai.

4. Consider Off-Plan and Under-Construction Properties

Off-plan and under-construction properties can offer attractive pricing and payment plans.

Early Bird Discounts: Developers often offer discounts for early buyers. These discounts can be substantial and provide good value for money.

Flexible Payment Plans: Off-plan properties typically come with flexible payment plans, making it easier to manage your finances.

Learn more about off-plan properties at Under-Construction Properties in Dubai.

5. Negotiate Effectively

Effective negotiation can help you secure a better deal.

Be Prepared: Do your homework and know the market value of the property. This will give you a strong negotiating position.

Stay Flexible: Be open to compromises and alternative solutions. Sometimes, a small concession can lead to a significant overall saving.

For more negotiation tips, visit Best Mortgage Services.

6. Utilize Online Property Portals

Online property portals can be a great resource for finding deals.

Comprehensive Listings: Use reputable online portals that offer comprehensive listings of properties. This can help you compare prices and features.

Direct Deals: Some portals facilitate direct deals between buyers and sellers, potentially eliminating agent fees and providing better deals.

For more property listings, check out Property For Sale in Dubai.

7. Attend Property Exhibitions and Events

Property exhibitions and events can provide opportunities to find exclusive deals.

Developer Discounts: Many developers offer special discounts and promotions at these events.

Networking Opportunities: These events provide an opportunity to network with developers, agents, and other buyers, which can lead to valuable insights and deals.

Explore more at Rent Your Property in Dubai.

Conclusion

Finding the best deals when buying villas in Dubai involves a combination of thorough research, strategic planning, and effective negotiation. By staying informed about market trends, choosing the right time to buy, working with experienced agents, and considering off-plan properties, you can secure the best deals and make a smart investment in Dubai’s vibrant real estate market.

For more information and assistance with buying villas in Dubai, visit Home Loan UAE.

9 notes

·

View notes

Text

Understanding the Role of a Mortgage Consultant in UAE

Introduction to Mortgage Consulting in UAE

Understanding the role of a mortgage consultant is crucial for making informed decisions when securing a mortgage. This guide provides insights into the responsibilities and benefits of working with a mortgage consultant in the UAE.

For more information on Dubai real estate, visit Dubai Real Estate.

The Role of a Mortgage Consultant

A mortgage consultant plays a vital role in the home buying process, offering services such as:

Financial Assessment: Evaluating your financial situation to determine mortgage eligibility.

Mortgage Options: Identifying and comparing different mortgage products to find the best fit.

Rate Negotiation: Negotiating the best mortgage rates and terms with lenders.

Paperwork Management: Handling all necessary documentation and ensuring compliance with regulations.

Closing Assistance: Assisting with the final steps of the mortgage process and closing the deal.

For property purchase options, explore Buy Apartments in Dubai.

Benefits of Working with a Mortgage Consultant

Expert Knowledge: Consultants have in-depth knowledge of the mortgage market and can provide valuable advice.

Access to Multiple Lenders: They work with a variety of lenders, giving you access to a wider range of mortgage products.

Personalized Service: Consultants offer personalized solutions tailored to your financial situation and goals.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

Ongoing Support: The best consultants provide ongoing support throughout the mortgage process and beyond.

For mortgage options, consider Mortgage Broker Dubai.

Evaluating Your Options

When evaluating mortgage consultants, consider the following factors:

Experience and Reputation: Choose a consultant with extensive experience and a strong reputation in the industry. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Communication Skills: Ensure the consultant communicates clearly and promptly. Good communication is crucial for a smooth mortgage process.

Transparency: Look for transparency in fees and terms. The consultant should provide a clear breakdown of their fees and any potential additional costs.

Customer Reviews: Check online reviews and testimonials to gauge client satisfaction. Look for patterns in the reviews to identify strengths and weaknesses in the consultant's services.

For rental options, visit Rent Your Property in Dubai.

Real-Life Success Story

Consider the case of Sarah, a first-time homebuyer in Dubai. Sarah was initially overwhelmed by the various mortgage options and the paperwork involved. She decided to seek the help of a mortgage consultant based on recommendations from friends and online reviews. The consultant assessed Sarah's financial situation, explained the different mortgage products available, and helped her choose the best one for her needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Sarah informed at every step. This personalized service made a significant difference, reducing Sarah's stress and ensuring a smooth and successful home purchase.

For property sales, visit Sell Your Property.

Conclusion

Understanding the role of a mortgage consultant is crucial for making informed decisions when securing a mortgage. By working with a knowledgeable and experienced consultant, you can navigate the mortgage process with confidence and ease. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

How to Choose the Right Home Insurance in the UAE?

Home insurance is a type of property insurance that covers losses and damage that occur to an individual’s house or insured belongings. The coverage can cover costs due to natural calamities such as floods and earthquakes. Plus, it covers fire-related damages to the property.

Although the UAE is one of the safest places, the absence of home insurance can put a huge financial burden on people for rebuilding. In this blog, find out how to choose the right home insurance in the UAE.

Understand Insurance Needs

The first step is to understand personal insurance needs. The location of the residence is one of the major factors one should consider while opting for a home insurance policy. In addition, decide if you want insurance coverage only for the property or the belongings in the house or both. Other factors such as age, income, health, employment, settlement plan, family and more can be considered too.

Do Research

Do your own research about the different insurance companies. Find out the following about the insurance providers:

Company Reputation

Financial Stability

Customer Service

Claim Settlement Time

Search online for reviews, customer feedback and ratings. Seek help from friends and families. Else, get expert advice from insurance experts in the UAE. Also, it is important that the insurance provider has a licence as per the laws in the UAE.

Compare Different Home Insurance Policies

Once you narrow down the list of insurance companies, start comparing different home insurance policies offered. Read carefully each and every detail to have a complete understanding of the insurance coverage promised. Plus, read the terms and conditions thoroughly. Compare the procedures to claim insurance and the time required to achieve a settlement.

Consider the Features

Find out if there are additional benefits or add-ons offered by the insurance company in addition to the standard coverage. It is necessary to cover specific needs besides basic coverage. However, one of the main factors to consider is the cost. Take time and assess if the add-ons are worth the additional money.

Budget

The cost of a home insurance policy is one of the key factors that distinguish one insurer from another. Compare the following things to find the best insurance policy that provides the best value:

Premium

Deductible Amounts

Exclusions

Discuss if there are discounts or promotions that can significantly lower the cost and boost savings on insurance.

Review

Periodical review of the home insurance is essential to meet the changing needs and the coverage required. The best thing is to review annually if the insurance coverage is enough for the future.

Claim Rejection

Make sure to submit all the necessary documents and provide all the necessary details to avoid claim rejection when one needs it the most. As world events become more unpredictable, choosing a home insurance policy can keep everyone protected. Crossroads Insurance Brokers is a leading insurance broker in the UAE offering cutting-edge insurance solutions. Contact us for more details.

#property insurance#insurance broker in the UAE#home insurance#property insurance in UAE#personal insurance

2 notes

·

View notes

Text

best forex trading brokers

You may often get confused by countless options for an online forex trading broker in the UAE. Let Choose a Broker.ae guide you with a list of the best and safest online traders. Our meticulous research compares top brokers while helping you invest in forex or stocks as well as cryptocurrencies.You may prefer demo accounts to test the trading sessions or real accounts to start trading right away. Our trading broker listing platform ensures you make well-informed decisions. Navigate through unbiased reviews and detailed analyses tailored to the UAE's trading landscape.Start trading smarter today by choosing the right broker with Broker.ae. Your financial future deserves clarity and confidence.

0 notes

Text

Discover the Best Trading Apps in UAE for 2025

The UAE is a rapidly growing financial hub, attracting investors from all over the globe. With advancements in technology, best online trading platforms in UAE, best trading platform in uae, and stock trading platforms in UAE have made trading accessible through mobile apps. Platforms like Apextrader Funding cater to traders by offering tools for enhanced performance. Whether you’re into stocks, forex, or cryptocurrencies, finding the right app can make a huge difference in your journey as a funded trader in UAE or exploring the prop trading in UAE.

Why Trading Apps Are Essential for Modern Investors

Trading apps provide a seamless platform for investors to trade anytime, anywhere. They offer real-time market updates, analytics tools, and secure payment gateways, making them the best trading apps in UAE. In the UAE, where innovation meets finance, these apps support instant funding prop firms in UAE and meet the unique demands of prop trading companies in UAE. Platforms like Apextrader Funding play a crucial role in enabling traders to access global markets through online trading platform in uae and best trading websites in UAE.

Features to Look for in a Trading App

When selecting an app, consider the following factors:

User-Friendly Interface: Ensure the app is easy to navigate, especially for beginners seeking the best trading websites in UAE.

Regulation and Security: Opt for apps regulated by UAE's financial authorities, such as those used by best prop trading firms in UAE.

Market Access: Look for apps offering a wide range of instruments, such as stock trading platforms in uae and forex trading.

Top Trading Apps in UAE for 2025

1. eToro

eToro is one of the best online trading platforms in UAE, popular for its user-friendly interface and innovative features. It’s ideal for users seeking the best trading app for beginners in UAE or instant funding prop firms in UAE.

2. Saxo Bank

Saxo Bank is a robust option for professional traders exploring the prop trading in uae. With access to a vast range of instruments, including stocks and forex, it’s a go-to for those seeking platform trading in uae. Many professional traders also integrate their experience with Apextrader Funding to enhance their strategies.

3. Interactive Brokers (IBKR)

IBKR is renowned as one of the best trading platforms in UAE, offering low fees and global market access. Whether you’re a funded trader in UAE or using online trading platforms in UAE, this app caters to diverse trading styles.

4. XM Trading

XM is one of the best trading apps in uae for forex enthusiasts. It’s especially favored by prop firms in UAE and beginners seeking low spreads and extensive educational resources. Partnering with services like Apextrader Funding can provide even greater leverage for traders.

5. Binance

For cryptocurrency enthusiasts, Binance is a top choice among prop trading companies in uae. With competitive fees and staking options, it’s one of the best online trading platforms in uae for crypto.

How to Get Started with a Trading App in UAE

Research: Compare the features and reviews of stock trading platforms in uae and online trading platforms in UAE.

Verify Regulation: Ensure the app is authorized by UAE’s financial bodies, like those used by best prop trading firms in UAE.

Open an Account: Register and complete KYC with the best trading websites in uae.

Conclusion

Choosing the best trading app in UAE for 2025 depends on your goals and experience level. Platforms like eToro and Saxo Bank serve as excellent stock trading platforms in uae, while Binance is perfect for prop trading companies in UAE. Whether you’re starting with the best trading app for beginners in uae or integrating with Apextrader Funding, these apps help you navigate the UAE’s dynamic financial landscape.

#instant funding prop firm in uae#best online trading platforms in uae#best trading platform in uae#stock trading platforms in uae#best trading app for beginners in uae#best trading websites in uae#platform trading in uae#best trading apps in uae#online trading platform in uae#trading website in uae#funded traderin uae#best prop trading firmsin uae#the prop trading in uae#prop trading companies in uae#prop firm in uae

0 notes

Text

#insurance broker dubai#insurance dubai#insurance brokers in dubai#insurance broker#brokers insurance#insurance broker uae#cheap insurance dubai#uae insurance policy#online insurance dubai#car insurance dubai#car insurance near me#buy car insurance online#car insurance broker#auto insurance#buy car insurance online dubai#health insurance dubai#health insurance#medical insurance#health insurance in dubai#medical insurance broker dubai#health care insurance#family health insurance uae#health insurance online#life insurance uae#life insurance broker uae#best life insurance#life insurance policy#travel insurance dubai online#buy holiday insurance#house insurance dubai

0 notes

Text

Want to earn Money Quickly??

Golden Zone Fibonacci: Trading Strategy Secrets

In trading, the “Golden Zone” refers to a certain place along the Fibonacci retracement levels where price movement is most likely to reverse or continue its trend. This zone is regarded as a critical location for initiating or quitting trades. Here’s an overview of the Golden Zone and how to use it effectively in your trading strategy:

What is the Golden Zone?

The Golden Zone is typically located between the 61.8% and 38.2% Fibonacci retracement levels. Some traders also utilize the 50% level, which is not a Fibonacci number but is commonly employed in trading. These levels are based on the Fibonacci sequence, which appears naturally in many facets of life and money.

How to Use the Golden Zone in Trading to Identify Trends

Determine whether the market is going upwards or downward. To confirm the trend, use techniques such as moving averages and trendlines. Draw Fibonacci levels.

In an uptrend, calculate the Fibonacci retracement from the swing low to the swing high. In a downturn, make a Fibonacci retracement from the swing high to the swing low. Focus on the Golden Zone.

Look for price action cues (e.g., pin bars, engulfing candles) in the Golden Zone (38.2% to 61.8%) for confirmation. Combine with Other Indicators.

Use oscillators like RSI or MACD to detect overbought or oversold circumstances. Combine with trendlines, moving averages, or candlestick patterns to achieve confluence.

- Set the entry and exit points. Enter trades when the price reacts in the Golden Zone with a clear indication (for example, a bullish engulfing candle in an uptrend). - Stop-Loss: Place a stop-loss order below the swing low in an uptrend or above the swing high in a downtrend. - Take Profit: Use the following Fibonacci extension levels (127.2%, 161.8%) or significant resistance levels to set targets.

Tips for Successful Golden Zone Trading

Increased volume during the reversal in the Golden Zone strengthens the move’s authenticity.

Validate the setup by comparing the Golden Zone alignment over different timeframes.

Wait for unambiguous confirmation to prevent false breakouts. Never trade without establishing appropriate stop-loss and risk-reward ratios.

Would you like further assistance in applying this strategy or visual examples?

Join Smartfx Brokers | UAE’s №1 Forex Trading Brokers

Representative office

403, Building 6, Bay Square, Business Bay, Dubai, UAE. P.O. Box — 242644. Whatsapp Number: +971 58967 88712

#best forex broker in uae#forextrading#forex market#forex broker#forex expo dubai#gold trading online#oil trading dubai#crude oil trading#stock trading#stock market analysis report#forex calendar#forex expo#stock market

0 notes

Text

Top 5 Factors to decide on Vehicle Insurance in UAE

A good vehicle insurance plan will help the owner to claim coverages in events of damages or loss. As per UAE law, it is mandatory for every vehicle owner to have at least a third-party insurance cover.

Proper research on various vehicle insurance plans and the coverages offered can help you to select the most appropriate insurance plan. We outline the key factors to keep in mind while deciding on a vehicle insurance policy.

Reputation

– The reputation of the insurance company is an important factor that you must consider when buying a auto insurance policy.

– A vehicle insurance company that holds a good reputation in the market has higher chances of delivering its promises when compared to the lesser-reputed companies. Thus, opting for a reputed insurer that enjoys customers goodwill is a wise choice.

Coverages

– The extent of coverage provided to the policyholder is the main reason for obtaining an insurance. It is recommended to always evaluate and compare the coverages offered by different plans before finalizing an insurance policy. The coverages can drastically differ depending on the type of plan and among various insurance providers. The coverages you choose will also affect the cost of your insurance premium.

– A basic third-party vehicle insurance policy covers only third-party liabilities – property damage, physical injury and death caused to a third party by an insured’s vehicle, whereas a comprehensive policy provides coverage for own vehicle damage including third party liabilities.

Insured value

The insured value is what the insurance company will pay if your vehicle is stolen or damaged beyond repairs.

It is the current market value of the vehicle calculated after deducting the depreciation amount. It is a crucial component that determines the amount of compensation.

Network garages

– The list of garages under the network of your insurance company provide repair services (up to the sum assured in the policy) during the tenure of your policy.

– At the time of buying a vehicle insurance in the UAE, you should verify the list of garages covered under the network. Ask the insurance company to mail you a list of the garages and look for insurers with maximum network coverage present in their list.

Claim Settlement Ratio

– Customers should also check the ease of process for settling claims and the claim settlement ratio, which is the percentage of insurance claims settled by an insurer compared to the total number of claims received.

– It is not advisable not to go in for an insurance company with a poor claim ratio.

Always consider the above factors before you decide on a vehicle insurance plan so to you enjoy a hassle-free experience at the time of claim settlement.

Source url: https://insurancepolicy.ae/top-5-factors-to-decide-on-vehicle-insurance/

0 notes

Text

Implementing Advanced Analytics in Real Estate: Using Machine Learning to Predict Market Shifts

New Post has been published on https://thedigitalinsider.com/implementing-advanced-analytics-in-real-estate-using-machine-learning-to-predict-market-shifts/

Implementing Advanced Analytics in Real Estate: Using Machine Learning to Predict Market Shifts

When it comes to the real estate industry, we have traditionally relied on local economic indicators, insights from personal networks, and comparisons of historical data to deliver market evaluations. Machine learning has disrupted many industries over the past few years, but the effects it has had in the real estate market fluctuation forecasting area have been nothing short of transformative. Drawing from my experience at Kalinka Group and Barnes International Moscow, I’ve witnessed how deep analytics has allowed us to explore massive datasets, uncover hidden patterns, and unlock predictive insights previously unimaginable. From 2025 onwards, machine learning will no longer be a utility but a strategic advantage in how real estate is approached.

The Basics of Predictive Analytics in Real Estate

Traditional real estate market analytics methods are being replaced by advanced algorithms capable of analyzing thousands of variables at once, such as property size, location, and comparable sales, which were the focus in the pre-machine learning era. Today’s variables, now addressed by machine learning, include everything from social media sentiment to infrastructure development plans, demographic shifts, neighborhood walkability scores, climate change impacts, and proximity to cultural hubs or transit lines.

For example, the team at Barnes International Moscow successfully predicted neighborhood appreciation rates using machine learning models, an accomplishment that was once unimaginable. These models synthesize data from a variety of sources, ranging from key local economic indicators to online consumer behavior, providing insights far beyond the scope of traditional human analysis.

Data Sources and Integration Challenges

Machine learning thrives on diverse qualitative data, requiring a strong data infrastructure to gather and integrate information from various sources. At Kalinka Group, we designed a roadmap for data acquisition, sourcing information from government property records, pricing trends, real-time listing platforms, and even social media sentiment to understand consumer preferences. We also utilized IoT sensors and smart home devices to measure real-time property performance metrics, enriching our forecasting models to capture everything from supply-demand dynamics to macroeconomic trends and demographic tracking.

Effective data integration is equally important. To ensure the highest degree of accuracy, we implemented rigorous validation checks, transforming raw data into actionable insights while avoiding the pitfalls of “garbage in, garbage out.”

Advanced Analytical Techniques

What excites me most about machine learning is its ability to uncover relationships that traditional statistical methods cannot identify. For instance, at Private Broker, machine learning models revealed how transit line openings influenced property values in nearby neighborhoods.

Other advanced techniques include:

These approaches provided highly accurate forecasts of market fluctuations, empowering clients to make informed investment decisions.

Practical Applications in Real Estate

Machine learning has transformed nearly every facet of real estate, offering tangible benefits to investors, developers, and property managers.

1. Predicting Market Trends

Machine learning models analyze historical data alongside external variables to forecast market conditions. For example, in a UAE-based project, we utilized ML to analyze economic data, migration patterns, and consumer preferences, uncovering a rising demand for high-end sustainable rental apartments. This insight allowed clients to capitalize on emerging opportunities.

2. Increasing Property Value

Traditional valuation methods relied on comparable sales and broker intuition. Machine learning incorporates hundreds of variables, enabling more accurate and nuanced valuations. At Kalinka Group, Automated Valuation Models (AVMs) provided transparency and speed, winning over clients with data-driven recommendations.

3. Optimizing Commercial Portfolios

Predictive analytics using machine learning forecasts vacancy rates, maintenance costs, and infrastructure impacts, guiding commercial property owners in decision-making. In a Thailand-focused project, machine learning models helped a multinational client rebalance their real estate portfolio, withdrawing from underperforming markets that previously appeared profitable on paper.

4. Identifying Emerging Markets

Machine learning identifies development hotspots by analyzing infrastructure projects, demographic trends, and local economic activities. These insights were pivotal in projects in Cyprus and Turkey, where we advised clients on confidently entering high-growth markets.

Ethical Considerations and Challenges

While machine learning offers immense potential, it also presents ethical and practical challenges.

Data Privacy

Real estate analytics often involves sensitive financial and personal data. At Kalinka Group, we implemented encryption and compliance measures to protect client data while enabling advanced analytics.

Algorithmic Bias

Machine learning models can exhibit bias, leading to discriminatory outcomes. To address this, Barnes International Moscow trained models on diverse datasets, ensuring fairness and transparency in predictive algorithms.

Conclusion

The future of machine learning in real estate is boundless. As quantum computing and more advanced AI models emerge, predictive accuracy will improve further. Real estate professionals are now equipped to anticipate market shifts with unparalleled precision, crafting bespoke strategies for each client and investment. Success will depend on strong data infrastructure, ethical practices, and the ability to combine technological knowledge with professional intuition, ensuring real estate professionals can navigate these transformative times with confidence.

#2025#acquisition#ai#AI models#Algorithms#Analysis#Analytics#applications#Artificial Intelligence#Behavior#Bias#Capture#change#climate#climate change#compliance#computing#consumer behavior#data#Data Integration#data sources#data-driven#datasets#developers#development#devices#dynamics#economic#effects#encryption

0 notes

Text

Low Spread Forex Brokers in UAE: The Ultimate Guide for Traders

The forex trading market in the UAE offers an excellent opportunity for traders, but choosing the right broker can significantly impact your success. One crucial factor to consider when selecting a forex broker is the spread. A lower spread means lower costs for traders, which can enhance profitability in the competitive world of online forex trading in the UAE. In this ultimate guide, we will help you understand the importance of low spread forex brokers in the UAE and how to choose the best one for your trading needs.

Understanding Forex Spreads

In forex trading, a spread is the difference between the bid and ask price of a currency pair. Brokers charge a spread for executing a trade, and the narrower the spread, the better it is for traders. For those involved in online trading in the UAE, seeking brokers with low spreads is essential as it allows them to maximize potential profits. Whether you are trading major pairs like EUR/USD or exotic ones, low spread forex brokers can make a significant difference in reducing overall trading costs.

Why Choose Low Spread Forex Brokers in UAE?

Low spread forex brokers in the UAE are ideal for traders who want to minimize their costs while maximizing returns. Trading with a low spread allows you to enter and exit the market with minimal impact on your trades. In fast-moving markets like forex, even small changes in spreads can have a significant effect on your profit margins. Choosing a broker offering competitive spreads can give you an edge, especially in volatile market conditions.

Top Features of Low Spread Forex Brokers in UAE

Competitive Spreads: Low spread forex brokers in the UAE offer some of the most competitive spreads in the market. This is beneficial for both beginners and experienced traders, as it helps reduce transaction costs.

Tight Spreads Across Currency Pairs: Whether you're trading major, minor, or exotic currency pairs, the best brokers ensure tight spreads on all instruments. This is crucial for traders who want to get the best value out of each trade.

Advanced Trading Tools: Low spread forex brokers in UAE provide advanced tools and platforms to enhance your trading experience. From charting tools to automated trading systems, these brokers offer everything you need for effective decision-making.

Transparent Pricing: Reputable low spread forex brokers are transparent about their pricing structure, so there are no hidden fees or surprises. This builds trust and ensures that traders can make informed decisions.

Regulated Brokers: It’s essential to choose a regulated broker in the UAE for safety and security. Trusted brokers comply with financial regulations, offering a secure trading environment for your investments.

How to Choose the Right Low Spread Forex Broker in UAE?

When looking for the best forex brokers with low spreads in the UAE, you should prioritize the following factors:

Regulation and Licensing: Always choose a broker regulated by reputable authorities in the UAE or globally to ensure a secure trading experience.

Spread Types: Some brokers offer fixed spreads, while others offer variable spreads. It's important to choose one that aligns with your trading strategy.

Trading Platforms: Ensure the broker provides a reliable and easy-to-use trading platform that supports your trading style, whether manual or automated.

Customer Support: A broker with excellent customer support will ensure that you have the assistance you need whenever issues arise.

Additional Costs: While spreads are a crucial factor, also consider other fees, such as commissions or withdrawal fees, that might affect your overall trading costs.

Conclusion

In the fast-paced world of online forex trading in the UAE, choosing a broker with low spreads is essential to optimizing your trading strategy. By selecting low spread forex brokers, you can reduce your trading costs and improve your profitability. The right broker will offer competitive spreads, advanced tools, and a secure platform to help you succeed in the forex market.

Start your forex trading journey today with the best low spread forex brokers in the UAE, and elevate your trading experience with NewEra365's expert insights and recommendations.

0 notes