#Credit Cards Market UAE

Explore tagged Tumblr posts

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

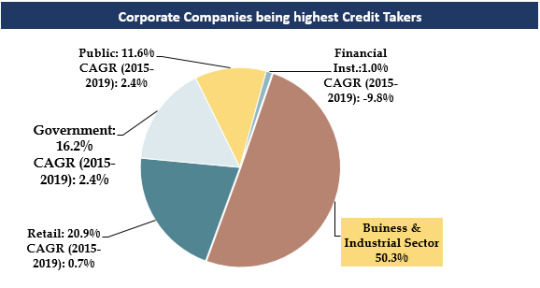

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

How to Buy and Sell Cryptocurrencies in the UAE: The Ultimate Guide

The UAE has become a leading hub for cryptocurrency trading, thanks to its progressive regulations, strong financial infrastructure, and growing crypto community. Whether you’re a seasoned investor or just starting out, buying and selling cryptocurrencies in the UAE is now easier than ever. In this guide, we’ll walk you through the process of how to buy and sell cryptocurrencies in the UAE, with a focus on secure platforms like DubaiOTC that simplify crypto transactions.

Why Buy and Sell Cryptocurrencies in the UAE?

The UAE is one of the most crypto-friendly regions in the world, with government-backed initiatives and clear regulatory guidelines supporting digital currency activities. There are several compelling reasons why buying and selling cryptocurrencies in the UAE is a great idea:

Crypto-Friendly Regulations: The UAE has established a legal framework that facilitates cryptocurrency transactions, making it a safe and stable environment for crypto users.

Easy Access to Global Markets: The UAE’s advanced financial ecosystem provides easy access to global cryptocurrency markets, allowing traders to invest in a wide range of digital assets.

Security: Platforms operating in the UAE maintain high-security standards, ensuring that your funds and transactions are always protected.

Growing Community: The UAE is home to an increasing number of crypto traders, making it a vibrant place for buying and selling digital assets.

How to Buy Cryptocurrencies in the UAE

If you’re interested in buying cryptocurrencies in the UAE, here’s a simple step-by-step guide to get started:

1. Choose a Reliable Exchange or Platform

To buy cryptocurrencies in the UAE, you need to select a reliable exchange or peer-to-peer (P2P) platform. DubaiOTC is a great option for people looking to buy and sell cryptocurrencies in UAE. It allows users to buy USDT, Bitcoin, Ethereum, and more directly from local sellers, ensuring faster transactions and greater security.

2. Create an Account

Once you've selected your platform, create an account by providing basic details like your name, email, and phone number. Some platforms, including DubaiOTC, may require identity verification (KYC) to ensure that users comply with regulatory requirements.

3. Deposit Funds

To buy cryptocurrencies, you will need to deposit funds into your platform account. Many exchanges in the UAE allow you to fund your account via a variety of payment methods, including bank transfers, credit cards, or even cash deposits. On P2P platforms like DubaiOTC, you can also find sellers who accept cash payments, providing flexibility and privacy.

4. Select the Cryptocurrency to Buy

After funding your account, you can choose the cryptocurrency you want to buy. The most popular options include Bitcoin (BTC), Ethereum (ETH), USDT (Tether), and other altcoins. On platforms like DubaiOTC, you can filter search results to find sellers offering the specific cryptocurrency you're looking to purchase.

5. Initiate the Transaction

Once you've chosen the cryptocurrency, initiate the purchase by selecting a seller. On P2P platforms, the platform will hold the cryptocurrency in escrow to ensure that both the buyer and seller fulfill their obligations before the transaction is completed.

6. Complete the Payment

After agreeing on the terms with the seller, you will proceed to complete the payment. On DubaiOTC, you can pay for the cryptocurrency using a variety of payment methods like cash or bank transfer, depending on what the seller accepts. Ensure the payment is made securely, and confirm with the seller once it’s completed.

7. Receive Your Cryptocurrency

After confirming that the payment has been successfully made, the platform will release the cryptocurrency from escrow to your wallet. Always check your wallet to ensure that the transfer has been completed successfully.

How to Sell Cryptocurrencies in the UAE

Selling cryptocurrencies in the UAE is just as straightforward as buying them. Here’s how you can sell your digital assets:

1. List Your Cryptocurrency for Sale

To sell cryptocurrency, simply log into your account and list the digital assets you want to sell. You can specify the amount and set your preferred payment method, whether it’s cash, bank transfer, or other local payment methods.

2. Choose a Buyer

Browse through available buyers on the platform and review their feedback and transaction history. On platforms like DubaiOTC, you can select a buyer based on their reputation, ensuring you’re dealing with a trustworthy individual.

3. Agree on Terms

Once you’ve selected a buyer, agree on the price and payment method. With P2P platforms, you have full control over the price, which can help you secure a better deal.

4. Complete the Transaction

When both parties agree, the buyer will complete the payment. Once you’ve confirmed the payment, release the cryptocurrency from escrow to the buyer. This process ensures that both parties are protected, reducing the risk of fraud.

5. Withdraw Your Earnings

Once the transaction is complete, you can withdraw the payment in your preferred method. Many platforms, including DubaiOTC, offer a wide range of options to withdraw your funds, such as cash or bank transfer.

Why Choose DubaiOTC for Buying and Selling Cryptocurrencies in the UAE?

DubaiOTC is an ideal platform for those looking to buy and sell cryptocurrencies in the UAE. Here are some key reasons why:

Escrow Service for Security: DubaiOTC uses an escrow service to ensure the safety of funds for both buyers and sellers. The platform holds the cryptocurrency until both parties confirm the transaction, preventing fraud.

Flexible Payment Methods: DubaiOTC supports a wide range of payment options, including cash, bank transfers, and other local payment systems, making it easier to buy and sell cryptocurrencies in a way that suits you.

Low Fees: Compared to traditional exchanges, DubaiOTC offers lower fees, making it more cost-effective for traders.

Peer-to-Peer Transactions: DubaiOTC facilitates peer-to-peer transactions, meaning that you can directly interact with local buyers and sellers, ensuring faster and more personalized trades.

Reputation and Trust: DubaiOTC is trusted by thousands of crypto traders in the UAE. The platform’s transparent processes and user reviews help build trust and confidence.

The Advantages of Buying and Selling Cryptocurrencies in the UAE

Regulatory Clarity: The UAE’s progressive stance on cryptocurrencies ensures that buyers and sellers can trade with confidence, knowing that their transactions are compliant with local regulations.

High Liquidity: The growing number of crypto traders in the UAE means there’s a high level of liquidity, making it easier to buy and sell cryptocurrencies at competitive prices.

Safe and Secure: With platforms like DubaiOTC offering escrow services, the security of funds and transactions is guaranteed, making it a safe choice for crypto enthusiasts.

Conclusion

The UAE offers a thriving market for buying and selling cryptocurrencies, and platforms like DubaiOTC make it easier than ever to trade digital assets in a secure, efficient, and flexible environment. Whether you're looking to buy USDT, Bitcoin, or Ethereum, or sell your digital assets for cash or bank transfer, DubaiOTC provides a simple, trusted, and low-cost solution for cryptocurrency transactions.

Start trading today and explore the benefits of buying and selling cryptocurrencies in the UAE with DubaiOTC, your gateway to the world of digital currency.

1 note

·

View note

Text

UAE Cards and Payments Market: Trends, Growth, and Future Outlook

The UAE cards and payments market has grown rapidly over the past few years, fueled by technological advancements, evolving consumer preferences, and an increased focus on cashless transactions. Driven by a young, tech-savvy population and robust economic policies, the market is witnessing significant changes. This article explores the current landscape of the UAE's cards and payments market, examining key trends, growth drivers, and the future outlook.

Overview of the UAE Cards and Payments Market

The UAE cards and payments market encompasses various instruments, including credit cards, debit cards, prepaid cards, and other digital payment solutions. The market’s shift toward digital and cashless payments aligns with the UAE government's initiatives to foster financial inclusion and support a digital economy.

Credit cards dominate the market, offering rewards, cashback, and travel benefits, which appeal to a growing middle class. Meanwhile, debit cards are essential for the increasing number of expatriates in the UAE, who rely on them for day-to-day transactions.

Key Trends Shaping the UAE Cards and Payments Market

Digital Payments on the Rise The UAE has embraced digital payments enthusiastically, with mobile wallets, QR code payments, and contactless transactions becoming widely popular. Banks and fintech companies offer digital wallets like Apple Pay, Samsung Pay, and Google Pay, catering to consumer demand for fast and secure transactions.

Growing Role of E-Commerce The UAE's booming e-commerce sector has contributed to a surge in card payments, particularly credit and prepaid cards, which are frequently used for online shopping. With more people opting for the convenience of online purchasing, digital and card-based payment methods continue to grow in popularity.

Focus on Security and Innovation Security is paramount in the UAE cards and payments market. Financial institutions are investing heavily in advanced security measures, such as biometric authentication, tokenization, and artificial intelligence (AI) to detect and prevent fraud. This focus on secure transactions has fostered consumer trust, further encouraging the adoption of digital payment solutions.

The Rise of Fintech Partnerships Fintech companies in the UAE are partnering with banks and other financial institutions to provide cutting-edge payment solutions. These partnerships have led to the creation of innovative payment products and services, such as virtual cards, real-time payments, and Buy Now, Pay Later (BNPL) options, which are gaining traction among consumers.

Government Support for Cashless Initiatives The UAE government is committed to promoting a cashless economy. Initiatives like the UAE Vision 2021 aim to enhance digital transformation, encouraging residents and businesses to adopt electronic payments. Government-backed programs are accelerating the transition, creating an environment conducive to growth in the cards and payments industry.

Growth Drivers of the UAE Cards and Payments Market

Young, Digitally Savvy Population The UAE’s population is predominantly young and tech-oriented, with a high adoption rate of smartphones and mobile technology. This demographic is comfortable with digital payments and often prefers them over cash, contributing to the growth of digital and card payments.

High Expatriate Population The UAE’s diverse expatriate population also fuels demand for card payments, especially for transactions like remittances, online shopping, and daily expenses. Many expatriates use credit and debit cards to facilitate financial transactions and manage funds efficiently.

Tourism and Business Travel The UAE is a global tourist destination, with millions of international visitors every year. Tourists and business travelers rely on card payments for convenience and security, further bolstering the market's growth. The hospitality, retail, and entertainment sectors, in particular, benefit from increased card transactions.

Rising E-Commerce Sector The rapid expansion of e-commerce in the UAE has driven an increase in card payments, as consumers seek convenient payment options. Secure online payment gateways and a variety of card options have made it easier for residents to shop online, driving further demand.

Challenges in the UAE Cards and Payments Market

While the UAE cards and payments market is on an upward trajectory, it faces several challenges:

High Card Fees Transaction fees for credit and debit card payments can be high, which may deter smaller merchants from adopting card-based transactions. Reducing these fees could support further market growth and encourage wider acceptance.

Regulatory Hurdles As digital payments grow, so does the need for comprehensive regulatory frameworks to manage data privacy and security. Adapting regulations to keep pace with technological advancements is essential to maintain consumer trust.

Competition from Global Players International fintech companies and digital payment platforms are entering the UAE market, bringing with them increased competition. Local banks and payment service providers must innovate to maintain their market share and attract consumers.

Future Outlook for the UAE Cards and Payments Market

The UAE cards and payments market is poised for robust growth in the coming years, driven by ongoing digital transformation, government support for cashless initiatives, and the emergence of new financial technologies. Key areas to watch include:

Expansion of Digital Wallets Digital wallets are likely to become even more popular, as younger consumers and tech-savvy professionals embrace the convenience of mobile payments.

Growth in BNPL Solutions Buy Now, Pay Later (BNPL) services are gaining traction in the UAE, particularly among younger consumers who prefer flexibility in managing their finances. This trend could reshape consumer spending patterns and boost card usage.

Integration of AI and Blockchain Technologies Artificial intelligence and blockchain technologies have the potential to revolutionize the cards and payments market. From fraud prevention to efficient payment processing, these innovations will enhance the security and efficiency of transactions.

Buy the Full Report for More Information on the UAE Cards and Payments Market Forecast Download a Free Sample Report

0 notes

Text

Payment Hub Platform Provider in UAE, Qatar, KSA, Oman, Bahrain

In today's fast-paced digital economy, businesses across the Gulf region are seeking efficient and reliable payment solutions to streamline their operations. Unity Infotech stands out as a leading payment hub platform provider in UAE, Qatar, KSA, Oman, and Bahrain. With a focus on innovation and customer satisfaction, Unity Infotech offers a comprehensive suite of payment services designed to meet the diverse needs of businesses in these dynamic markets.

Unity Infotech's payment hub platform integrates various payment methods, including credit and debit cards, mobile wallets, and bank transfers, providing a seamless experience for both merchants and customers. This flexibility allows businesses to cater to the preferences of their clientele, enhancing customer satisfaction and loyalty.

The company’s robust technology ensures secure transactions, which is crucial for maintaining trust in an increasingly digital landscape. With the rise of e-commerce and digital payments, Unity Infotech's solutions are tailored to help businesses stay competitive while adhering to regulatory requirements across the Gulf region.

Moreover, as a payment hub platform provider in UAE, Qatar, KSA, Oman, and Bahrain, Unity Infotech understands the local market intricacies and offers personalized support to help businesses navigate the complexities of payment processing. This commitment to customer service sets Unity Infotech apart from competitors, ensuring that clients receive the best possible assistance as they grow their operations.

In conclusion, businesses in UAE, Qatar, KSA, Oman, and Bahrain looking for a reliable payment hub platform provider should consider Unity Infotech. With their advanced technology, secure solutions, and exceptional customer support, they are well-equipped to help businesses thrive in the evolving digital payment landscape.

0 notes

Text

PFH Markets – Your Trusted Forex Broker in Dubai and the UAE

The Forex market in Dubai and the wider UAE has gained significant momentum as the region becomes a hub for international finance. With growing demand from both retail and institutional traders, it’s crucial to find a Forex broker that not only provides access to global markets but also prioritizes security, transparency, and competitive trading conditions. PFH Markets, a leading Forex broker in Dubai, is here to meet those needs, offering an exceptional trading experience tailored to all levels of traders.

Why Choose PFH Markets as Your Forex Broker in Dubai?

1. Regulated and Reliable

Operating in Dubai and across the UAE, PFH Markets is a fully regulated broker that adheres to strict financial standards, ensuring that your investments are protected. Traders can have peace of mind knowing that PFH Markets operates under the region’s financial laws, offering a secure and transparent trading environment.

2. Tailored for the UAE Market

Understanding the needs of the local market, PFH Markets provides services that are specifically tailored for traders in Dubai and the UAE. This includes offering customer support in multiple languages, including Arabic, and ensuring compatibility with the financial regulations and trading preferences in the region.

Unmatched Trading Platforms and Tools

3. Advanced Trading Platforms

PFH Markets offers access to world-class trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely known for their ease of use and powerful features. Whether you are a beginner or an experienced trader, these platforms provide real-time market analysis, charting tools, and automated trading capabilities, enabling you to stay ahead in the fast-paced Forex market.

4. Mobile Trading Solutions

In today’s world, mobility is crucial. PFH Markets offers a seamless mobile trading experience through its mobile applications, allowing you to monitor and manage your trades on the go. Whether you’re traveling or busy with daily activities, you can always stay connected to the market.

Competitive Trading Conditions

5. Tight Spreads and Low Commissions

One of the biggest advantages of trading with PFH Markets is the competitive spreads and low commissions. With spreads starting as low as 0.0 pips on major currency pairs, traders can minimize costs and maximize profits. The low commission structure further enhances your trading experience by making it more affordable.

6. High Leverage Options

For those looking to magnify their market exposure, PFH Markets offers high leverage options, allowing traders to control larger positions with a relatively small capital investment. Leverage up to 1:500 is available, depending on your trading strategy and risk appetite.

Forex Education and Support

7. Comprehensive Forex Education

PFH Markets stands out by offering extensive educational resources for its clients, making it the ideal choice for both beginners and advanced traders. From online webinars, trading tutorials, and market analysis, to in-depth eBooks on various trading strategies, the broker equips you with the knowledge needed to trade successfully in the Forex market.

8. Dedicated Customer Support

Customer service is one of the key pillars of PFH Markets. The broker provides 24/5 dedicated customer support through multiple channels, including live chat, email, and phone. The team is always ready to assist with any inquiries, whether it's technical support or trading-related questions.

Localized Payment Methods for UAE Traders

9. Flexible Deposit and Withdrawal Options

PFH Markets offers a variety of payment methods to cater to traders in Dubai and the UAE. You can deposit and withdraw funds using local bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. The platform ensures that transactions are fast, secure, and hassle-free.

10. Islamic Forex Accounts

For traders who follow Islamic principles, PFH Markets offers Sharia-compliant Forex accounts, commonly known as Islamic accounts. These accounts do not charge any interest or swap fees, making them ideal for Muslim traders who wish to engage in Forex trading in a way that aligns with their religious beliefs.

Conclusion: Start Trading with Confidence on PFH Markets

If you’re looking for a reliable Forex broker in UAE, PFH Markets stands out as a trusted choice. With its regulatory adherence, tailored services, competitive trading conditions, and comprehensive educational resources, PFH Markets empowers traders to navigate the Forex market with confidence. Whether you're just starting or are a seasoned trader, PFH Markets provides everything you need to succeed in the world of Forex.

Take your trading to the next level with PFH Markets – the leading Forex broker in Dubai and the UAE.

0 notes

Text

Best Online Shopping Site in UAE: Why Alltrade.ae Stands Out

Online shopping in the UAE has evolved rapidly, offering convenience, variety, and competitive prices. Among the many e-commerce platforms, Alltrade.ae has emerged as one of the top choices for consumers seeking a seamless and reliable shopping experience. From electronics to fashion, Alltrade offers a broad range of products that cater to diverse customer needs. Here’s why Alltrade.ae is considered the best online shopping site in the UAE.

1. Wide Range of Products

Alltrade.ae is a one-stop-shop for virtually everything you need. Whether you’re looking for the latest electronics, high-quality fashion items, top-notch kitchen appliances, or specialized beauty products, you’ll find it all in one place. The website boasts an extensive collection that caters to both niche and general markets, ensuring that customers don’t have to search multiple platforms to find what they’re looking for.

2. User-Friendly Interface

The website is designed with ease of navigation in mind. With a simple, intuitive interface, customers can easily search for products, compare prices, and make purchases. The categorization of products is clear and detailed, making it easier for users to find specific items quickly. Whether you’re shopping for home products or baby care items, everything is just a click away.

3. Affordable Prices and Exclusive Deals

One of the standout features of Alltrade.ae is its competitive pricing. The platform frequently offers exclusive discounts and seasonal deals that make shopping more affordable. Whether you’re hunting for a high-quality luxury wristwatch or the latest gaming headset, you can often find them at a fraction of the price compared to other platforms. Alltrade also runs special sales events and flash deals that reward regular customers.

4. Fast and Reliable Shipping

In today’s fast-paced world, timely delivery is critical, and Alltrade.ae excels in this aspect. The platform offers fast, reliable shipping across the UAE, ensuring that products arrive on time and in perfect condition. The website provides multiple shipping options, including express delivery for urgent purchases. Customers can also track their orders in real-time, providing transparency and peace of mind.

5. Secure and Flexible Payment Options

Security is a top priority for online shoppers, and Alltrade.ae understands this concern. The platform supports multiple secure payment methods, including credit cards, debit cards, and cash on delivery, giving customers peace of mind when making purchases. Additionally, Alltrade ensures that all personal and payment information is encrypted and secure, protecting customers from fraud.

6. Excellent Customer Service

Another feature that sets Alltrade.ae apart from its competitors is its commitment to customer satisfaction. The platform has a responsive customer support team that is available to help resolve any issues, answer queries, and assist with returns or exchanges. This level of customer care enhances the overall shopping experience and builds trust with users.

7. Return and Refund Policy

Alltrade.ae understands that sometimes, products may not meet customers’ expectations. That’s why they have a transparent and fair return and refund policy. If an item doesn’t match its description or is defective, customers can return it with minimal hassle, making the platform trustworthy and risk-free.

8. Mobile-Friendly Experience

For those who prefer shopping on the go, Alltrade.ae offers a fully optimized mobile experience. The platform is responsive and works seamlessly across all devices, including smartphones and tablets. This makes it easy to browse, shop, and manage orders from anywhere, ensuring that customers are not tied to their desktops for a smooth shopping experience.

9. Diverse Categories of High-Quality Products

Alltrade.ae focuses not just on variety but also on the quality of its offerings. Every product is vetted to ensure it meets high standards, which is particularly important when purchasing items like electronics and automotive accessories. You can rest assured that you’re getting genuine, high-quality products every time you shop.

10. Sustainable and Ethical Practices

As awareness about sustainability grows, Alltrade.ae is committed to contributing to a better environment by working with ethical brands and offering eco-friendly options. Customers looking to make conscious purchasing decisions can find products that align with their values, including sustainable fashion and home goods.

Conclusion

When it comes to online shopping in the UAE, Alltrade.ae sets the standard for excellence. With a wide range of products, competitive prices, reliable shipping, and a user-friendly platform, it’s no wonder that Alltrade has quickly become a favorite among shoppers in the region. Whether you’re buying for yourself or gifting a loved one, Alltrade.ae offers a shopping experience that is both convenient and enjoyable.

If you haven’t explored Alltrade.ae yet, now is the perfect time to experience the best online shopping in the UAE. Happy shopping!

#sales#ecommerce#beauty#home & lifestyle#onlineshopping#fashion#retail#automotive#dubai#uae#alltrade

0 notes

Text

E-commerce SEO in the UAE: Strategies for Boosting Online Sales with Digital Axis

Introduction

In today's competitive online marketplace, e-commerce businesses in the UAE must optimize their websites for search engines to attract customers and drive sales. E-commerce SEO involves a combination of technical, content, and off-page optimization techniques to improve your website's visibility and ranking in search engine results pages (SERPs).

Digital Axis, as a leading digital marketing agency in Dubai, offers expert e-commerce SEO services tailored to the unique needs of UAE businesses. Our team of skilled professionals can help you optimize your online store for search engines, increase your organic traffic, and drive more conversions.

Optimizing Product Pages for UAE Search Engines

Keyword Research: Conduct thorough keyword research to identify the most relevant terms and phrases that potential customers are searching for. Use tools like Google Keyword Planner and SEMrush to find high-volume, low-competition keywords.

Keyword Placement: Incorporate your target keywords naturally throughout your product pages, including in the title tags, meta descriptions, headings, image alt text, and product descriptions.

Product Descriptions: Write informative and engaging product descriptions that highlight the unique features and benefits of your products. Use clear and concise language that is easy to understand.

Image Optimization: Optimize your product images with descriptive file names and alt text that include relevant keywords. Compress images to improve page load speed.

Keyword Research for E-commerce in the UAE

Local Keyword Research: Focus on local keywords that include the name of your city, region, or specific areas in the UAE. For example, "best laptops in Dubai" or "buy clothes online in Abu Dhabi."

Language-Specific Keywords: Consider using Arabic keywords to target Arabic-speaking customers in the UAE.

Long-Tail Keywords: Target long-tail keywords, which are more specific and less competitive than short-tail keywords. For instance, instead of "buy shoes," use "buy women's running shoes in Dubai."

Localizing Your E-commerce Store

Language: Translate your website content into Arabic to cater to the majority of the UAE's population.

Currency: Use the UAE dirham (AED) as the primary currency on your website.

Shipping and Returns: Ensure that your shipping and returns policies are clear and easy to understand for UAE customers.

Local Payment Methods: Offer popular local payment methods like credit cards, debit cards, and digital wallets like Apple Pay and Google Pay.

Tracking E-commerce SEO Performance

Google Analytics: Use Google Analytics to track your website traffic, user behavior, and conversion rates.

Keyword Ranking Tools: Monitor your website's rankings for target keywords using tools like SEMrush or Ahrefs.

Conversion Rate Optimization (CRO): Continuously optimize your website's design, layout, and user experience to improve conversion rates.

Conclusion

By implementing these strategies, you can significantly improve your e-commerce SEO and boost your online sales in the UAE. Remember that e-commerce SEO is an ongoing process, so it's important to regularly monitor your performance and make adjustments as needed.

Digital Axis, as a leading digital marketing agency in Dubai, can provide you with expert e-commerce SEO services to help you achieve your online business goals. Contact us today to learn more.

FAQs :

1. How long does it typically take to see results from e-commerce SEO efforts?

E-commerce SEO is a long-term strategy, and results can vary depending on factors such as competition and the current state of your website. However, you can typically expect to see improvements in organic search rankings and traffic within a few months of implementing effective SEO tactics.

2. Can I optimize my e-commerce store for both English and Arabic?

Yes, it's highly recommended to optimize your e-commerce store for both English and Arabic to reach a wider audience in the UAE. This involves translating your website content, using relevant keywords in both languages, and ensuring that your website is user-friendly for both English and Arabic speakers.

3. How can I improve my website's loading speed for UAE customers?

Website speed is a crucial factor for both user experience and SEO. To improve your website's loading speed for UAE customers, optimize your images, minimize code, use a fast web host, and leverage content delivery networks (CDNs).

4. What is the role of local citations in e-commerce SEO?

Local citations are online mentions of your business's name, address, and phone number (NAP) across various directories and websites. While they may not directly impact your e-commerce SEO, they can help establish your business's credibility and improve your local search visibility.

5. How can I track the effectiveness of my e-commerce SEO efforts?

To track the effectiveness of your e-commerce SEO efforts, use tools like Google Analytics to monitor website traffic, conversion rates, and user behavior. You can also use keyword ranking tools to track your website's rankings for target keywords. Additionally, consider using A/B testing to optimize your website's design and content for better results.

0 notes

Text

Dubai: The Bustling Financial Hub of the Middle East and a Haven for Traders

Dubai has acquired its reputation as a thriving, quickly expanding trading city. It is frequently referred to as the financial center of the Middle East. Due to its advantageous geographic position, first-rate infrastructure, and forward-thinking legal system, the city attracts both domestic and foreign companies. Dubai has been a popular destination for traders from all over the world as a result of the growth in trading platforms that coincides with the expansion of global trade.

We’ll look at a few of the best trading platforms in Dubai that have become popular in this post. We’ll examine the features, costs, and user experiences of online brokerages and forex platforms in order to assist traders — whether seasoned pros or novices — in making wise choices.

Why Traders Love Dubai as a Destination

Dubai’s trading industry is supported by a number of important advantages:

A favorable business environment is provided by Dubai, which attracts merchants and firms with its zero capital gains tax, low import taxes, and tax-free income.

Strategic Location: Dubai’s location at the intersection of Europe, Asia, and Africa makes it simple to reach important markets. Modern trading facilities, a dependable banking system, and cutting-edge technology are all features of the city’s advanced infrastructure.

Encouraging Regulatory Environment: The industry is governed by the UAE Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA), which guarantee openness and safeguard investors. These elements provide the ideal setting for traders and companies to prosper, especially when paired with Dubai’s standing as a major international financial center.

Important Things to Think About in Dubai Trading Platform Choosing It can be difficult to choose the best trading platform due to the abundance of options. The following are important things to think about:

Regulation: Verify whether respectable organizations such as the DFSA or SCA are licensing and overseeing the platform.

Fees: Keep an eye out for charge structures that are clear, including spreads, commissions, and withdrawal costs.

User Experience: Both novice and seasoned traders should have an easy time using a platform that is clear and easy to use.

Asset Availability: Cryptocurrencies, equities, currency, and commodities are just a few of the many assets that certain platforms provide. Pick one based on the type of trading you enjoy.

Customer support: In particular, when problems emerge, excellent customer service can make all the difference.

Resources for Education: A few platforms offer webinars, market analysis, and instructional materials that are especially helpful for new users.

Dubai Trading Regulations and Legal Considerations

Due to strict regulations surrounding trading, investors are protected in Dubai. The Securities and Commodities Authority (SCA) is in charge of the larger UAE market, whereas the Dubai Financial Services Authority (DFSA) governs trading platforms within the Dubai International Financial Centre (DIFC). Strict control is maintained by these regulators in order to guard against fraud, enforce compliance, and guarantee openness.

Make sure the platform has a valid license from the appropriate regulatory agency before you trade. This guarantees defense against con artists and dubious service suppliers.

How to Register for a Trading Platform Account in Dubai

Select a Platform: Choose one of the regulated platforms mentioned above based on your trading objectives and requirements.

Publish the Documentation: Usually, you’ll have to provide confirmation of residency (bank statement or utility bill) as well as proof of identity (passport or national ID).

Put Money Into Your Account: The majority of platforms provide a variety of funding choices, such as e-wallets, credit cards, and bank transfers.

Get Trading: You can begin trading as soon as you have funded your account.

Resources and Tools for Traders in Dubai

Dubai’s trading community has access to numerous resources, including:

Trading Education: Many platforms offer free webinars, tutorials, and market analyses.

Financial News: Stay up-to-date with global and regional news via financial news outlets such as Bloomberg Middle East and Gulf News.

Trading Tools: Leverage platforms with advanced charting tools, market analysis, and automated trading options.

Whatever your level of experience, choosing the correct trading platform is essential to your success. To make an informed choice, take into account the platform’s regulation, costs, usability, and asset availability. Dubai’s cutting-edge infrastructure, regulatory frameworks, and friendly business climate will put you in a strong position to prosper in the rapidly expanding trading market of this thriving financial center.

#forextrading#stock trading#forex broker#crude oil trading#learn to trade#stock market analysis#online trading platforms

0 notes

Text

Top WooCommerce Benefits for Dubai E-commerce Businesses

WooCommerce is an open-source e-commerce platform that works with WordPress, a global CMS. It is one of the best e-commerce platforms because it is flexible, easy to use, and has many features. UAE has been emerging high on integrating WooCommerce services into its websites. Safcodes offers the best WooCommerce development services in Dubai. We provide industry-standard specialists to work on your online store. Lets see the main features, benefits, and why so many online stores choose it.

Woocommerce Development Services in Dubai Features -

Friendly User Interface:

WooCommerce connects well with WordPress's dashboard because of its design. Both beginners and experts can use it. The plugin comes with a simple setup tutorial. It helps to navigate online store owners through paymen, shipping, and showing products.

Management of Products:

Product management is robust in WooCommerce. Adding, editing, and organising products is simple. The portal sells physical goods, digital downloads, subscriptions, and multi-quality products. Users can manage product categories, tags, and qualities to simplify shopping.

Personalised Shopfront:

WooCommerce lets users customise their store's design using several themes. The platform supports free and paid WordPress themes, giving designers great flexibility. WooCommerce also lets you customise product pages, checkout methods, and the store layout.

Gateways for payments:

Businesses can accept different payment methods using WooCommerce's payment gateway integrations. Major credit cards, PayPal, Stripe, and others are included. Businesses in different areas can use the platform. It is because it supports regional payment gateways.

Shipping Options:

The plugin offers flat rate, accessible, and real-time shipping calculations. Shipping methods might be dependent on geography, weight, or order total. Many shipping companies and services use WooCommerce to generate and track labels.

Manage Inventory:

WooCommerce's inventory management lets users manage product availability and supply. They can also set stock notifications, and manage backorders, and track product quantities on the platform.

Marketing and SEO:

WooCommerce includes several tools for marketing and search engine optimization (SEO). Popular SEO plugins like Yoast SEO work with it so users can improve search engine results and make product pages better. WooCommerce also works with many marketing methods. Such as coupon codes, email marketing, and product reviews.

Using WooCommerce Has Many Advantages —

Efficiency in Cost:

When looking to create an online store, WooCommerce is an affordable option. Businesses can start selling online with minimal initial expenditure. It is because the core plugin is free. Compared to e-commerce platforms, the total cost is usually lower. But, Premium extensions, themes, and hosting might add to that. We at Safcode, a Woocommerce development company in Dubai, use the right extensions and themes that suit your online store. We create a user-friendly page for easy navigation.

Personalisation and Adaptability:

WooCommerce is great because it can be used in many ways. An online store can be very easily changed to fit the needs of each user. With many themes and plugins, users can change how the site looks and how it works. You can use the WordPress panel or change the code to make changes.

The WordPress integration:

Because WooCommerce is a WordPress app, its powerful features and community can be used. Users' content, blogs, and internet shopfront can be managed from one place. This integration makes it easier to run the site because it makes all its parts look the same.

Scalability:

WooCommerce serves many enterprises, from startups to multinationals. Your firm can grow without worrying about platform scalability. WooCommerce lets your online store grow to meet demand for new products. It increases visitors and international markets.

Many plugins and extensions:

A large community of WooCommerce plugin and extension developers is wonderful. Users can improve their store by adding custom payment options, customer support features, and detailed data. The WooCommerce community develops and updates a large library of third-party plugins for many businesses.

Robust Network of Supporters:

Many people use, improve, and add to WooCommerce, making it a big and active community. This community has many helpful forums, papers, and tutorials. Users can alter and add to their customers' buying experience on the platform.

Why Use WooCommerce for E-Commerce?

Proven Performance:

WooCommerce is a dependable e-commerce solution. Powering millions of online retailers worldwide shows its efficacy and appeal. A dedicated development team and commitment to improvement help the platform succeed.

Customisation, Control:

Businesses who need customisation and control over their online store might choose WooCommerce. Users can alter and enhance their customers' buying experience on the platform.

Compatible with Existing Websites:

WooCommerce makes adding e-commerce to WordPress websites easy. The integration reduces the need to manage various platforms and unifies online presence.

Future-Proofing:

WooCommerce evolves with new trends and technologies. Your online business stays current with e-commerce trends through constant development and support.

Conclusion: Businesses wishing to expand online enjoy WooCommerce's flexibility and strength. Due to its price, comprehensive capability, and better interface, it is a good choice for any size store. Safcodes is a Dubai-based firm specialising in Woocommerce development. We help businesses create a custom online shop to succeed in the competitive e-commerce market. WooCommerce's plugin ecosystem, WordPress integration, and customising choices let them do this.

0 notes

Text

Tokenization Market Share, Regional Scope - 2024, Business Outlook, Growth Opportunity Assessment

Global Tokenization Market was valued at USD 1.61 billion in 2021 and is expected to reach USD 5.25 billion by the year 2028, at a CAGR of 18.4%.

Tokenization is the process of transforming sensitive data into non-sensitive tokens that can be utilized in a database or internal system without being made public. Tokenization protects sensitive data by replacing it with an irrelevant value of the same length and format as the original. The tokens are subsequently delivered to an organization's internal systems to be used, while the original data is kept in a token vault. Tokenized data, unlike encrypted data, is impregnable and irrevocable. Tokens cannot be returned to their original form since the token and its original number are unrelated mathematically.

Market Dynamics and Factors:

Tokenization shields businesses from the financial ramifications of data theft. Even if there is a breach, no user personal data may be accessed. By eliminating credit card details from POS devices and internal systems, credit card tokenization helps online companies improve data security from the point of data capture to storage. Data tokenization secures credit card and bank account information in a virtual vault, allowing organizations to communicate sensitive information over wireless networks safely. Tokenization is only effective if a payment gateway is used to securely store sensitive data.

Download a Free Sample Copy of the Market Report:

https://introspectivemarketresearch.com/request/16212

Major Key Players for Tokenization Market:

American Express Company,AsiaPay Limited,Bluefin Payment Systems LLC,Card link,Fiserv Inc.,Futurex LP,HelpSystems LLC,HST Campinas SP,IntegraPay,Marqeta Inc.,Mastercard Inc.,MeaWallet AS,Micro Focus International plc,Paragon Payment Solutions,Sequent Software Inc.,Shift4 Payments LLC,Sygnum Bank AG,Thales TCT,TokenEx LLC,VeriFone Inc.,Visa Inc. and other major players.

Tokenization Market Segmentation:

By Type

Solution

Services

By Deployment

On-Premise

Cloud

By End User

Retail & E-commerce

Transportation & Logistics

BFSI

IT & Telecommunications

Others

Geographic Segment Covered in the Report

North America (U.S., Canada, Mexico)

(Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

(Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

(China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

(Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

(Brazil, Argentina, Rest of SA)

Inquiry Before Purchase:

https://introspectivemarketresearch.com/inquiry/16212

Scope of the Report:

The report encompasses the entire analysis of market size in previous years for major segments and countries, as well as future estimates. The Tokenization Market study looks deeply into the worldwide market's competitive landscape. The study also provides the names of key market players and the methods they used to gain a dominant position in the industry. It also includes useful market insights, dynamics and factors, and market analysis techniques such as PESTEL analysis, PORTER's Five Forces analysis, value chain analysis, SWOT analysis, BCG matrix, and Ansoff matrix.

Key Benefits for Industry Participants & Stakeholders:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Tokenization Market

Purchase the Report:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16212

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Linkedin| Twitter| Facebook

Email: [email protected]

#Tokenization Market#Tokenization Market Size#Tokenization Market Share#Tokenization Market Growth#Tokenization Market Trend#Tokenization Market segment#Tokenization Market Opportunity#US Tokenization Market#Tokenization Market Forecast#Tokenization Industry#Tokenization Industry Size

0 notes

Text

The Ultimate Guide to Parking in Dubai and Renting a Car: Your Key to Hassle-Free Travel

Introduction

Planning to explore Dubai at your own pace? Navigating this dazzling city is a breeze when you have your own wheels. Renting a car in Dubai offers unparalleled freedom and convenience, making it easy to visit the city’s iconic landmarks, bustling markets, and hidden gems. However, understanding the ins and outs of renting a car and parking in Dubai can save you a lot of time and hassle. Let’s dive into everything you need to know to ensure a smooth journey.

Why Rent a Car in Dubai?

Renting a car in Dubai comes with a host of benefits. Firstly, it gives you the flexibility to travel on your schedule without relying on public transport or costly taxis. Whether you're planning to explore the futuristic cityscape, take a desert safari, or simply commute to meetings, having your own vehicle can be more cost-effective and convenient.

Types of Cars Available for Rent

When it comes to renting a car in Dubai, the options are plentiful. Depending on your needs and budget, you can choose from:

Economy Cars

Perfect for solo travelers or couples, these cars are budget-friendly and fuel-efficient.

Luxury Cars

Experience Dubai in style with high-end vehicles like BMW, Mercedes, or even a Ferrari.

SUVs and Family Cars

Ideal for families or groups, these vehicles offer ample space and comfort.

Specialty Cars

Looking for something unique? Rent a sports car or a convertible for a memorable drive around the city.

How to Rent a Car in Dubai

Required Documents

To rent a car Dubai, you will need a valid driving license, passport, and an international driving permit if you’re a tourist. Residents can use their UAE driving license.

Age Restrictions

Most rental companies require drivers to be at least 21 years old, although some high-end cars may have a higher age requirement.

Insurance Options

It’s crucial to understand the insurance coverage included in your rental agreement. Basic insurance is often provided, but you can opt for additional coverage for extra peace of mind.

Cost of Renting a Car in Dubai

Factors Affecting Rental Prices

Prices can vary based on the type of car, rental duration, and the time of year.

Average Daily, Weekly, and Monthly Rates

Economy cars can start as low as AED 60 per day, while luxury cars can cost upwards of AED 800 per day. Weekly and monthly rentals often come with discounted rates.

Tips for Renting a Car in Dubai

Best Time to Rent

Booking in advance and during off-peak seasons can get you the best rates.

How to Find the Best Deals

Look for discounts online, use comparison websites, and check for loyalty programs.

Reading the Fine Print

Always read the terms and conditions carefully to avoid unexpected charges.

Understanding Parking in Dubai

Types of Parking Available

Dubai offers various parking options including street parking, parking lots, and multi-story car parks.

Paid vs. Free Parking Zones

While many areas have paid parking, there are also free parking zones, especially in residential areas.

Parking Fees and Payment Methods

How Parking Fees are Calculated

Fees are generally based on the duration and location of parking. Prime areas tend to have higher rates.

Different Payment Options

You can pay via cash, credit card, or mobile apps like RTA’s mParking system.

Best Parking Spots in Dubai

Popular Tourist Areas

Downtown Dubai, Dubai Marina, and Jumeirah Beach Road are some prime spots with ample parking.

Shopping Malls

Malls like The Dubai Mall and Mall of the Emirates offer extensive parking facilities.

Residential Areas

Suburban areas often have more relaxed parking rules and free spaces.

Tips for Finding Parking in Busy Areas

Peak Hours to Avoid

Try to avoid peak hours during weekends and public holidays to find parking more easily.

Using Parking Apps

Apps like Parkopedia can help you locate available parking spots in real-time.

Rules and Regulations for Parking in Dubai

Common Violations and Fines

Be aware of common parking violations such as parking in no-parking zones, blocking driveways, or not paying for parking.

Understanding Parking Signs

Familiarize yourself with Dubai’s parking signs and regulations to avoid fines.

Special Parking Considerations

Parking for Disabled Individuals

Designated spots are available for disabled individuals, ensuring easy access to buildings.

VIP and Valet Parking

Many hotels and malls offer valet parking services for added convenience.

Safety Tips for Parking in Dubai

Securing Your Vehicle

Always lock your car and do not leave valuables visible inside the vehicle.

Avoiding Theft and Damage

Park in well-lit areas and use secured parking lots whenever possible.

Conclusion

Dubai Rent a car and understanding the city’s parking system can significantly enhance your travel experience. From the flexibility of choosing your own routes to the convenience of always having transportation ready, a rental car is a fantastic option for visitors. Keep these tips in mind, and you’ll be cruising around Dubai with ease.

FAQs

What documents do I need to rent a car in Dubai?

You'll need a valid driving license, passport, and for tourists, an international driving permit.

Are there any hidden charges when renting a car?

Always read the rental agreement carefully to understand all charges, including insurance, fuel, and mileage limits.

How do I pay for parking in Dubai?

Parking can be paid via cash, credit card, or mobile apps like mParking.

Can I rent a car with a foreign driving license?

Yes, tourists can use their foreign driving license along with an international driving permit.

What should I do if I get a parking ticket in Dubai?

If you receive a parking ticket, you can pay it online through the RTA website or at designated kiosks.

0 notes

Text

Top 10 Online Payment Gateways in Dubai, UAE

In the rapidly evolving digital economy of Dubai and the broader UAE, online payment gateways play a crucial role. They ensure secure, efficient, and seamless transactions for businesses and consumers alike. This guide explores the top 10 online payment gateways in Dubai, detailing their features, advantages, and suitability for various business needs.

1. Telr: Top Rated Online Payment Gateway in Dubai

Telr is a comprehensive online payment gateway known for its robust features and user-friendly interface. It caters to businesses of all sizes, from small startups to large enterprises.

Features

Multi-Currency Support: Telr supports multiple currencies, making it ideal for businesses with an international customer base.

Security: It employs advanced security measures, including PCI DSS compliance and fraud management tools.

Integration: Telr offers easy integration with popular e-commerce platforms and custom APIs for more tailored solutions.

Mobile Payments: It supports mobile payments, which is essential in a market with high smartphone penetration.

Advantages

User-friendly dashboard for easy transaction monitoring.

Competitive pricing with no setup fees.

Comprehensive customer support and detailed documentation.

2. PayTabs: Best Online Payment Gateway in Dubai

PayTabs is a leading payment gateway in the Middle East, renowned for its flexibility and wide range of services. It supports various payment methods, including credit and debit cards, and local payment options.

Features

Global Reach: Accepts payments in over 168 currencies and offers localized payment methods.

Security: High-level security protocols, including tokenization and 3D secure.

Integration: Provides plugins for major e-commerce platforms and APIs for custom integration.

Recurring Payments: Supports recurring billing, making it ideal for subscription-based businesses.

Advantages

Quick and easy setup process.

Extensive fraud prevention measures.

Multilingual customer support.

3. Skrill: Top Online Payment Gateway in Dubai

Skrill is an internationally recognized online payment gateway that offers both businesses and consumers a simple and secure way to make payments.

Features

Digital Wallet: Allows users to store funds in their Skrill wallet for quick payments.

International Transfers: Supports money transfers to bank accounts worldwide.

Security: Utilizes SSL encryption and two-factor authentication for enhanced security.

Integration: Compatible with various e-commerce platforms and provides APIs for custom setups.

Advantages

Fast and low-cost international money transfers.

User-friendly interface for both merchants and customers.

Wide acceptance across numerous online merchants.

4. Network International: Online Payment Gateway in Dubai

Network International is one of the largest payment solutions providers in the Middle East and Africa, offering comprehensive payment processing services.

Features

Multi-Channel Payments: Supports payments across various channels, including online, mobile, and point of sale (POS).

Advanced Analytics: Provides detailed transaction reports and analytics.

Security: Implements advanced fraud detection and prevention measures.

Integration: Seamless integration with various e-commerce platforms and APIs for custom solutions.

Advantages

Extensive experience and deep understanding of the regional market.

Strong relationships with local banks and financial institutions.

Robust and scalable payment solutions for businesses of all sizes.

5. PayFort: Best Online Payment Gateway in Dubai, UAE

Acquired by Amazon, PayFort is a prominent payment gateway in the Middle East, known for its reliability and comprehensive features tailored to the regional market.

Features

Multi-Currency and Multi-Language Support: Ideal for businesses operating in diverse markets.

Security: Uses advanced encryption and fraud protection technologies.

Analytics: Provides detailed analytics and reporting tools to monitor transactions.

Integration: Easy integration with popular e-commerce platforms and custom APIs.

Advantages

Backed by Amazon, ensuring reliability and innovation.

Strong focus on local payment methods and customer preferences.

Excellent customer support and resource availability.

6. Checkout.com: Online Payment Gateway in Dubai, UAE

Checkout.com is a global payment processing company offering innovative payment solutions with a strong presence in the Middle East.

Features

Unified Payments API: A single API that supports multiple payment methods and currencies.

Real-Time Data: Provides real-time reporting and data analytics.

Security: PCI DSS Level 1 compliance and advanced fraud prevention tools.

Global Reach: Supports international and local payment methods.

Advantages

High scalability, suitable for growing businesses.

Transparent pricing with no hidden fees.

Excellent customer service and technical support.

7. CC Avenue: Top Online Payment Gateway in Dubai, UAE

CC Avenue is a popular payment gateway in the UAE, known for its extensive features and easy integration.

Features

Multi-Currency Processing: Supports over 27 currencies.

Security: High-level security measures, including PCI DSS compliance and 3D secure.

Payment Options: Accepts credit cards, debit cards, net banking, and more.

Integration: Plugins for major e-commerce platforms and customizable APIs.

Advantages

Wide range of payment options.

Robust security features.

Comprehensive customer support.

8. Cybersource: Top Rated Online Payment Gateway in Dubai, UAE

Cybersource, a Visa company, provides secure and reliable payment solutions to businesses globally.

Features

Global Reach: Supports multiple currencies and payment methods.

Security: Industry-leading security protocols, including tokenization and fraud management.

Integration: Easy integration with major e-commerce platforms and APIs for custom solutions.

Analytics: Advanced analytics and reporting tools.

Advantages

Backed by Visa, ensuring high reliability and security.

Comprehensive fraud management tools.

Excellent scalability for businesses of all sizes.

9. Stripe: Top Online Payment Gateway Dubai

Stripe is a globally recognized payment gateway known for its developer-friendly APIs and robust feature set.

Features

Customizable Payment Flows: Highly flexible and customizable payment processing solutions.

Security: Advanced security measures, including PCI compliance and encryption.

Global Support: Supports payments in multiple currencies and various payment methods.

Integration: Easy integration with popular e-commerce platforms and custom APIs.

Advantages

Extensive documentation and developer support.

Transparent pricing with no hidden fees.

Wide range of features suitable for various business models.

10. CashU: Best Online Payment Gateway Dubai

CashU is a leading online payment gateway in the Middle East and North Africa, offering convenient and secure payment solutions.

Features

Prepaid Cards: Allows users to make payments using prepaid cards.

Security: High-level security measures to protect user data.

Integration: Easy integration with e-commerce platforms and custom APIs.

Localization: Supports local payment methods and currencies.

Advantages

Widely accepted in the Middle East and North Africa.

Convenient prepaid card system.

Strong focus on security and user convenience.

Conclusion

In the dynamic digital landscape of Dubai and the UAE, selecting the right online payment gateway is crucial for business success. Each of the top 10 payment gateways discussed in this guide offers unique features and advantages tailored to various business needs. Whether you are a startup looking for a cost-effective solution or a large enterprise seeking robust and scalable payment processing, there is a gateway on this list that can meet your requirements. By understanding the features, advantages, and integration capabilities of these gateways, businesses can make informed decisions and ensure seamless, secure, and efficient payment processing for their customers.

0 notes

Text

One Point One Solutions Ltd: A Strategic Play in the Indian BPM Landscape

One Point One Solutions Ltd (OPOS), a leading player in the Business Process Management (BPM) sector, is making significant strides towards establishing itself as a global BPM powerhouse. Catering to sectors such as BFSI, Retail, New Age, and Fintech, OPOS has demonstrated a flexible and effective revenue model, with 82% derived from time and motion and 18% from transactions. This blog delves into the key highlights of OPOS’s recent developments and future prospects, showcasing why it is an attractive investment opportunity.

Key Developments:

1. Strategic Acquisition of ITCube Solutions

In a landmark move, OPOS acquired ITCube Solutions for Rs 840 million. This acquisition not only diversifies OPOS's service portfolio beyond BPM into IT services but also enhances its presence in the US market. ITCube's expertise in healthcare and construction sectors, along with its established client base, positions OPOS for substantial growth and expanded market reach.

2. Leadership Reinforcement

To drive its next phase of growth, OPOS has strengthened its leadership team with the appointments of Rajiv Desai as Global Delivery Head and Ashwini Kumar Rao as Chief Human Resources Officer. Desai brings over 15 years of experience from TCS, particularly in customer experience management and BFSI operations. Rao, with over 24 years of diverse HR experience from Sutherland Global Services, is set to enhance OPOS’s human resource strategies.

3. Global Expansion Strategy

OPOS is aggressively expanding its footprint beyond India into Southeast Asia and Latin America (LATAM). This strategic move is aimed at transforming OPOS into a global BPM player with a diversified revenue mix and improved profit margins. The company is eyeing acquisitions in these regions, which are expected to significantly contribute to revenue and profitability.

Financial Highlights and Projections:

1. Robust Revenue and Profit Growth

OPOS is poised to more than double its revenue to Rs 5.1 billion in FY25, driven by both organic growth and strategic acquisitions. The anticipated acquisition in LATAM is projected to play a crucial role in this growth, contributing significantly to revenues and margins. Despite higher cost pressures, OPOS’s earnings are expected to triple in FY25 and double again in FY26.

2. Compelling Valuation

At a PE ratio of 10x FY26E EPS, OPOS’s stock is considered highly attractive. The company’s strategic focus on global expansion, coupled with a robust trajectory of both organic and inorganic growth, underpins its potential for a substantial rerating from current levels. Consequently, a BUY rating has been initiated with a target price of Rs 120, presenting a potential return of 107%.

Recent Client Acquisitions: OPOS has recently onboarded several high-profile clients across various sectors, highlighting its strong market position and exceptional service offerings.

Notable acquisitions include:

A leading asset management firm.

Razorpay, a prominent payment solutions provider.

A Gurgaon-based startup involved in the Open Network for Digital Commerce (ONDC).

An international wellness and skincare company in the UAE.

Leading private sector banks for credit card collections, including DMI Finance and Kotak Mahindra Bank.

These acquisitions are expected to significantly boost OPOS’s revenue and growth, reflecting its robust business model and strong management team.

Future Outlook - OPOS’s potential expansion into LATAM and Southeast Asia through strategic acquisitions is set to propel its growth and profitability. The company is targeting acquisitions that will enhance its service capabilities, diversify its offerings, and establish a strong presence in key BPO/KPO markets. These moves are expected to increase revenue by USD 30-50 million and improve profitability due to higher billing rates in these regions compared to India.

Conclusion - One Point One Solutions Ltd is strategically positioned to capitalize on its recent acquisitions, robust leadership team, and aggressive global expansion plans. With a compelling valuation and significant growth prospects, OPOS is an attractive investment opportunity. Investors are encouraged to consider the company's stock, currently priced at Rs 58, with a target price of Rs 120, reflecting a potential return of 107%.

0 notes

Text

The Role of E-commerce in Transforming Middle East Red Meat Retail

Introduction:

The Middle East is witnessing a significant shift in consumer behavior, particularly in the way people purchase red meat. Traditional retail methods are giving way to the convenience and accessibility of e-commerce platforms. This transformation is not only reshaping the landscape of the Middle East red meat market but also presenting new opportunities and challenges for retailers and consumers alike.

The Growing Middle East Red Meat Market:

Red meat consumption in the Middle East has been steadily increasing over the years, driven by factors such as population growth, rising disposable incomes, and changing dietary preferences. Countries like Saudi Arabia, the UAE, and Qatar are among the largest consumers of red meat in the region, with beef, lamb, and goat meat being the most popular choices.

Traditionally, consumers in the Middle East have relied on brick-and-mortar stores, butcher shops, and local markets to purchase red meat. However, with the advent of technology and the proliferation of smartphones and internet connectivity, e-commerce has emerged as a game-changer in the retail landscape.

The Role of E-commerce in Transformation:

E-commerce platforms have revolutionized the way Middle Eastern consumers buy red meat by offering convenience, variety, and transparency. Here are some key ways in which e-commerce is transforming the Middle East red meat market:

Convenience: With e-commerce, consumers can now order red meat from the comfort of their homes or workplaces, eliminating the need to visit physical stores. This convenience is particularly appealing to busy urban dwellers who value their time and seek hassle-free shopping experiences.

Variety and Quality: E-commerce platforms offer a wide range of red meat options sourced from local and international suppliers. Consumers have access to premium cuts, specialty meats, and organic products that may not be readily available in traditional retail outlets. Moreover, e-commerce allows consumers to compare prices, read reviews, and make informed decisions about the quality of the meat they purchase.

Traceability and Transparency: One of the key concerns for consumers when buying red meat is its source and quality. E-commerce platforms address this concern by providing detailed information about the origin of the meat, its production methods, and any certifications it may have. This transparency builds trust among consumers and ensures that they are getting safe and ethically sourced products.

Digital Payment Solutions: E-commerce platforms offer a variety of payment options, including credit/debit cards, digital wallets, and cash on delivery, making it easier for consumers to complete their purchases. This is especially beneficial in a region where cashless transactions are becoming increasingly common.

Challenges and Opportunities:

While e-commerce holds immense potential for transforming the Middle East red meat market, it also presents several challenges that retailers need to address. These include logistics and supply chain management, ensuring the freshness and quality of products during transit, and building trust among consumers wary of online purchases.

However, with the right strategies and investments in technology and infrastructure, retailers can capitalize on the opportunities presented by e-commerce. This includes leveraging data analytics to understand consumer preferences, optimizing delivery networks to ensure timely and efficient fulfillment, and investing in marketing and customer service to enhance the online shopping experience.

Conclusion:

E-commerce is reshaping the Middle East red meat market, offering consumers greater convenience, variety, and transparency in their purchasing decisions. By embracing digital technologies and adapting to changing consumer preferences, retailers can tap into this growing market opportunity and stay ahead of the competition. The future of red meat retail in the Middle East lies in the seamless integration of online and offline channels, providing consumers with the best of both worlds.

0 notes

Text

Introduction

In today’s competitive online marketplace, e-commerce businesses in the UAE must optimize their websites for search engines to attract customers and drive sales. E-commerce SEO involves a combination of technical, content, and off-page optimization techniques to improve your website’s visibility and ranking in search engine results pages (SERPs).

Optimizing Product Pages for UAE Search Engines

Keyword Research: Conduct thorough keyword research to identify the most relevant terms and phrases that potential customers are searching for. Use tools like Google Keyword Planner and SEMrush to find high-volume, low-competition keywords.

Keyword Placement: Incorporate your target keywords naturally throughout your product pages, including in the title tags, meta descriptions, headings, image alt text, and product descriptions.

Product Descriptions: Write informative and engaging product descriptions that highlight the unique features and benefits of your products. Use clear and concise language that is easy to understand.

Image Optimization: Optimize your product images with descriptive file names and alt text that include relevant keywords. Compress images to improve page load speed.

Keyword Research for E-commerce in the UAE

Local Keyword Research: Focus on local keywords that include the name of your city, region, or specific areas in the UAE. For example, “best laptops in Dubai” or “buy clothes online in Abu Dhabi.”

Language-Specific Keywords: Consider using Arabic keywords to target Arabic-speaking customers in the UAE.

Long-Tail Keywords: Target long-tail keywords, which are more specific and less competitive than short-tail keywords. For instance, instead of “buy shoes,” use “buy women’s running shoes in Dubai.”

Localizing Your E-commerce Store

Language: Translate your website content into Arabic to cater to the majority of the UAE’s population.

Currency: Use the UAE dirham (AED) as the primary currency on your website.

Shipping and Returns: Ensure that your shipping and returns policies are clear and easy to understand for UAE customers.

Local Payment Methods: Offer popular local payment methods like credit cards, debit cards, and digital wallets like Apple Pay and Google Pay.

Tracking E-commerce SEO Performance

Google Analytics: Use Google Analytics to track your website traffic, user behavior, and conversion rates.

Keyword Ranking Tools:��Monitor your website’s rankings for target keywords using tools like SEMrush or Ahrefs.