#Commercial Loan Market UAE

Explore tagged Tumblr posts

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

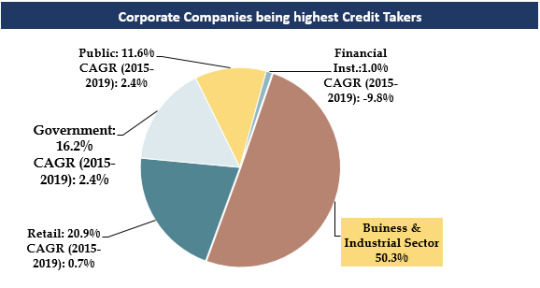

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

The Ultimate Guide to Finding the Best Mortgage Consultant in Dubai

Navigating the mortgage market in Dubai can be complex, and finding the right mortgage consultant can make all the difference. A good consultant can guide you through the various options, help you secure the best rates, and ensure a smooth transaction. This comprehensive guide provides everything you need to know about finding the best mortgage consultant in Dubai.

For more information on home loans, visit Home Loan UAE.

Why You Need a Mortgage Consultant

A mortgage consultant offers numerous benefits, including:

Expert Knowledge: Mortgage consultants have in-depth knowledge of the mortgage market and can provide valuable insights.

Time-Saving: They handle the research, paperwork, and negotiations, saving you time and effort.

Better Rates: Consultants can negotiate better rates and terms with lenders due to their industry connections.

Personalized Service: They provide personalized advice tailored to your financial situation and goals.

For property purchase options, explore Buy Commercial Properties in Dubai.

Steps to Finding the Best Mortgage Consultant

Research and Referrals: Start by researching online and asking for referrals from friends, family, and colleagues. Online platforms and forums can provide reviews and ratings of different mortgage consultants in Dubai, giving you a good starting point.

Check Credentials: Ensure the consultant is licensed and has a good track record. Look for certifications and memberships in professional organizations, which indicate a commitment to high standards and ongoing education.

Interview Multiple Consultants: Interview several consultants to compare their services, fees, and expertise. Prepare a list of questions to ask during these interviews to help you gauge their knowledge and experience.

Ask the Right Questions: Inquire about their experience, the types of loans they specialize in, and how they can help you achieve your goals. Also, ask about their success stories and how they have helped clients with similar financial situations to yours.

For mortgage options, consider Mortgage Financing in Dubai.

Evaluating Your Options

When evaluating mortgage consultants, consider the following factors:

Experience and Reputation: Choose a consultant with extensive experience and a strong reputation in the industry. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Communication Skills: Ensure the consultant communicates clearly and promptly. Good communication is crucial for a smooth mortgage process.

Transparency: Look for transparency in fees and terms. The consultant should provide a clear breakdown of their fees and any potential additional costs.

Customer Reviews: Check online reviews and testimonials to gauge client satisfaction. Look for patterns in the reviews to identify strengths and weaknesses in the consultant's services.

For rental options, visit Apartments For Rent in Dubai.

The Role of a Mortgage Consultant

A mortgage consultant's primary role is to act as a bridge between you and potential lenders. They help you understand your financial situation, identify suitable mortgage products, and guide you through the application process. Here are some specific tasks they perform:

Financial Assessment: Evaluating your financial situation, including your income, expenses, credit score, and debt-to-income ratio, to determine your mortgage eligibility.

Exploring Mortgage Options: Identifying and comparing different mortgage products from various lenders to find the best fit for your needs.

Rate Negotiation: Negotiating the best mortgage rates and terms with lenders on your behalf.

Paperwork Management: Handling all necessary documentation and ensuring compliance with regulations.

Closing Assistance: Assisting with the final steps of the mortgage process and closing the deal.

Benefits of Working with a Mortgage Consultant

Working with a mortgage consultant offers several advantages, including:

Access to a Wide Range of Products: Mortgage consultants have access to a broad range of mortgage products from different lenders, increasing your chances of finding the best deal.

Expert Guidance: Consultants provide expert advice on the best mortgage options based on your financial situation.

Time Savings: By handling the research, paperwork, and negotiations, consultants save you time and effort.

Stress Reduction: Managing the complexities of the mortgage process can be stressful. A consultant can alleviate this stress by guiding you through each step.

Customized Solutions: Consultants offer personalized mortgage solutions tailored to your specific needs and goals.

For property sales, visit Sell Your Property.

Real-Life Success Story

Consider the case of Ahmed, a first-time homebuyer in Dubai. With the help of a top-rated mortgage consultant, Ahmed secured a favorable mortgage rate and purchased his dream home. The consultant's expertise and personalized service made the process smooth and stress-free.

Ahmed was initially overwhelmed by the mortgage process and unsure of where to start. He decided to seek the help of a mortgage consultant. The consultant began by assessing Ahmed's financial situation, including his income, expenses, and credit score. Based on this assessment, the consultant identified several mortgage options that suited Ahmed's needs.

The consultant then guided Ahmed through the mortgage application process, helping him gather the necessary documentation and ensuring everything was in order. Thanks to the consultant's industry connections, Ahmed was able to secure a favorable mortgage rate that he wouldn't have been able to find on his own.

Throughout the process, the consultant kept Ahmed informed, answering his questions and addressing his concerns promptly. This personalized service made a significant difference, making the process smooth and stress-free for Ahmed. In the end, Ahmed successfully purchased his dream home and was extremely satisfied with the consultant's services.

Questions to Ask a Mortgage Consultant

When interviewing potential mortgage consultants, it's important to ask the right questions to ensure they can meet your needs. Here are some questions to consider:

What is your experience in the Dubai mortgage market? Understanding their level of experience can give you confidence in their ability to handle your case.

What types of loans do you specialize in? Some consultants may have more experience with certain types of loans, such as first-time homebuyer programs or refinancing.

How do you help clients secure the best mortgage rates? This question helps you understand their approach to negotiating with lenders.

What are your fees, and how are they structured? Transparency about fees is crucial to avoid any surprises later on.

Can you provide references from previous clients? References can provide insight into the consultant's reliability and effectiveness.

For more resources and expert advice, visit Home Loan UAE.

Conclusion

Finding the best mortgage consultant in Dubai can significantly impact your home-buying experience. By following the steps outlined in this guide and leveraging professional services, you can secure the best mortgage deals and achieve your property goals. Remember to research and interview multiple consultants, ask the right questions, and evaluate your options carefully. With the right consultant by your side, you can navigate the mortgage process with confidence and ease. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

A Guide to the Most Luxurious Properties for Sale in Dubai

Dubai is synonymous with luxury, and its real estate market offers some of the most opulent properties in the world. From stunning penthouses to sprawling villas, the options are endless. This guide will help you navigate the market for the most luxurious properties for sale in Dubai.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

High ROI: Dubai's luxury real estate market offers high returns on investment due to its desirability and robust demand.

Tax Benefits: Dubai offers a tax-free environment, making it an attractive destination for real estate investment.

World-Class Amenities: Luxury properties in Dubai come with world-class amenities, including private pools, gyms, and concierge services.

Prime Locations: Many luxury properties are located in prime areas, offering stunning views and easy access to key attractions.

Security: Dubai is known for its safety and security, providing peace of mind for property owners.

For commercial property investment options, explore Buy Commercial Properties in Dubai.

Types of Luxury Properties in Dubai

Penthouses: Located in high-rise buildings, penthouses offer panoramic views of the city and luxurious living spaces.

Villas: Spacious villas with private gardens, pools, and state-of-the-art facilities are available in exclusive communities.

Townhouses: Luxury townhouses offer a blend of privacy and community living, with high-end finishes and amenities.

Beachfront Properties: Properties along the coastline provide direct beach access and breathtaking ocean views.

Golf Course Properties: These properties offer views of lush golf courses and access to exclusive golf clubs.

For mortgage financing options, consider Mortgage Financing in Dubai.

Popular Areas for Luxury Properties

Palm Jumeirah: Known for its iconic palm-shaped island, this area offers some of the most luxurious villas and apartments in Dubai.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, this area offers upscale living in the heart of the city.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers luxurious villas with golf course views.

Dubai Marina: Known for its vibrant nightlife and stunning waterfront properties, Dubai Marina is a popular choice for luxury living.

Jumeirah Beach Residence (JBR): This beachfront community offers a mix of luxury apartments and penthouses with stunning sea views.

For rental property management services, visit Apartments For Rent in Dubai.

Tips for Buying Luxury Properties in Dubai

Set a Budget: Determine your budget before you start looking at properties. This will help narrow down your options and prevent overspending.

Research the Market: Understand the current market trends and property values in the areas you're interested in.

Work with a Realtor: A reputable realtor with experience in the luxury market can help you find the best properties and negotiate the best deals.

Inspect the Property: Ensure the property is in good condition and meets your standards. Consider hiring a professional inspector.

Consider Future Value: Think about the property's potential for appreciation and its resale value.

For property sales, visit Sell Your Property.

Real-Life Success Story

Consider the case of James, an investor from the UK who decided to invest in a luxury villa in Palm Jumeirah. With the help of a local realtor, James found a stunning property that met all his requirements. The realtor guided him through the buying process, ensuring all legalities were handled smoothly. Today, James enjoys a high return on his investment, with the villa's value appreciating significantly.

Future Trends in Dubai's Luxury Real Estate Market

Sustainable Living: There is a growing demand for eco-friendly and sustainable luxury properties.

Smart Homes: Properties equipped with smart home technology are becoming increasingly popular.

Wellness Amenities: Luxury properties are now offering wellness-focused amenities such as spas, gyms, and yoga studios.

Flexible Spaces: There is a trend towards properties with flexible living spaces that can be adapted to different needs.

Branded Residences: Collaborations with luxury brands to create branded residences are on the rise.

Conclusion

Investing in luxury properties in Dubai offers numerous benefits, from high ROI to world-class amenities. By understanding the market, working with a reputable realtor, and considering future trends, you can make a sound investment in Dubai's luxury real estate market. For more resources and expert advice, visit Home Loan UAE.

5 notes

·

View notes

Text

Understanding Dubai's Residential Property Market: A Buyer's Guide

Understanding Dubai's residential property market is essential for making informed buying decisions. This buyer's guide provides an in-depth look at the key aspects of the market and tips for successful property purchases.

For more information on real estate, visit Dubai Real Estate.

Market Overview

Market Dynamics: Dubai's real estate market is dynamic and influenced by various factors such as economic growth, government policies, and global trends. Understanding these dynamics helps buyers make informed decisions.

Property Types: Dubai offers a wide range of residential properties, including apartments, villas, townhouses, and penthouses. Each property type has its own advantages and considerations.

Regulatory Framework: The Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) oversee the market, ensuring transparency and protecting buyers' rights. Familiarize yourself with the regulations and guidelines set by these authorities.

For property purchase options, explore Buy Residential Properties in Dubai.

Financing Options

Home Loans: Most buyers in Dubai finance their purchases through home loans. Several banks and financial institutions offer competitive mortgage rates and flexible terms. Research different lenders and compare their offers to find the best deal.

Mortgage Pre-Approval: Obtain a mortgage pre-approval to determine your budget and streamline the buying process. A pre-approval gives you a clear idea of your borrowing capacity and demonstrates to sellers that you are a serious and qualified buyer.

Down Payment: Ensure you have sufficient funds for the down payment, typically 20-25% of the property's value for expatriates. Consider additional costs such as registration fees, agent commissions, and maintenance charges.

For mortgage services, consider Mortgage Brokers UAE.

Choosing the Right Property

Location: Choose a location that aligns with your lifestyle and investment goals. Popular residential areas in Dubai include Downtown Dubai, Dubai Marina, Palm Jumeirah, and Arabian Ranches. Consider factors such as proximity to schools, workplaces, and amenities.

Developer Reputation: Research the reputation of the property developer. Established developers with a track record of delivering high-quality projects on time are usually a safer choice.

Property Condition: Inspect the property for any structural issues, maintenance needs, and potential repairs. Hire a professional inspector if necessary to ensure the property is in good condition.

For rental property management, visit Rent Your Property in Dubai.

Legal Considerations

Title Deed Verification: Ensure the property has a clear title and is free from any legal disputes or encumbrances. The DLD provides title deed verification services to help buyers confirm the property's legal status.

Sales Agreement: Review the sales agreement carefully and seek legal advice if needed. Ensure all terms and conditions are clearly outlined, including the price, payment schedule, and any additional costs.

Residency Visa: Property buyers in Dubai may be eligible for a residency visa. The visa duration and requirements vary depending on the property's value and the buyer's nationality. Consult with the DLD or a legal expert to understand the specific visa requirements and benefits.

For property sales, visit Sell Your Property in Dubai.

Market Trends and Opportunities

Sustainable Developments: There is a growing demand for eco-friendly and sustainable properties in Dubai. Developers are increasingly incorporating green building practices and energy-efficient features into their projects.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Real-Life Success Story

Consider the case of Maria, an expatriate who successfully navigated Dubai's residential property market. Maria conducted thorough market research, obtained mortgage pre-approval, and chose a reputable developer. By following the guidelines outlined in this buyer's guide, Maria secured a luxurious villa in Arabian Ranches and enjoys the community's amenities and family-friendly environment.

Future Trends in Dubai Real Estate

Sustainable Developments: Developers are increasingly incorporating eco-friendly and sustainable practices into their projects. Properties with green features such as solar panels, energy-efficient appliances, and sustainable materials are becoming more popular.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Conclusion

Understanding Dubai's residential property market is essential for making informed buying decisions. By staying informed about market dynamics, exploring financing options, choosing the right property, and navigating legal considerations, you can make a successful investment. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

Why Investors Are Buying Property in Dubai

Why Buying Property in Dubai Is a Smart Choice

Dubai has become one of the world's most attractive real estate markets, drawing investors and homeowners alike. Here’s why investing in property in Dubai is a smart choice:1. Tax-Free Investment Benefits

One of the biggest reasons investors are drawn to Dubai is its tax-free policy. Unlike many global cities where property ownership comes with heavy taxation, Dubai offers a tax-free environment on property transactions. This means no capital gains tax, no property tax, and no rental income tax, allowing investors to maximize their returns.

2. High Rental Yields

Dubai’s real estate market provides some of the highest rental yields globally. Investors can expect an average return of 5-9% annually, much higher than in cities like London, New York, or Hong Kong. Areas like Dubai Marina, Downtown Dubai, and Jumeirah Village Circle (JVC) are particularly popular for their rental returns.

3. Residency and Visa Benefits

Investing in Dubai property can also help secure a residency visa. The UAE government offers various visa options for property buyers, such as:

3-Year Investor Visa: For properties worth at least AED 750,000.

5-Year Investor Visa: For properties worth AED 2 million and above.

Golden Visa (10-Year Visa): For high-net-worth investors meeting the criteria.

This visa advantage makes property investment in Dubai not just an investment but also a gateway to long-term residence in a thriving global hub.

4. Booming Economy and Stability

Dubai’s economy is one of the most stable in the world, backed by strong infrastructure, tourism, trade, and finance sectors. The city’s government has introduced investor-friendly policies to attract global investments, ensuring long-term stability and security for property owners.

5. Expo 2020 Impact and Future Growth

Expo 2020, which was hosted in Dubai, significantly boosted the real estate sector. New infrastructure projects, business hubs, and tourism developments have enhanced property values, making it the perfect time to invest in Dubai's real estate. Future mega-projects, such as Dubai 2040 Urban Master Plan, further solidify the city’s position as a top investment destination.

6. Safe and High-Quality Lifestyle

Dubai is known for its safety, world-class healthcare, and high quality of life. With strict security measures and an excellent standard of living, it attracts investors who seek a peaceful and luxurious lifestyle. The city offers top-tier education, healthcare, shopping malls, entertainment, and beaches, making it a perfect place to live and invest.

7. Wide Range of Investment Options

Dubai’s real estate market caters to every type of investor. Whether you are looking for affordable apartments, high-end villas, or commercial spaces, there are plenty of choices. Areas like Dubai Hills Estate, Business Bay, Palm Jumeirah, and Dubai Creek Harbour offer diverse opportunities for buyers.

8. Easy Payment Plans and Financing Options

Many developers offer attractive payment plans, making it easier for investors to own property in Dubai. Some of the popular options include:

Post-Handover Payment Plans: Buyers can pay in installments even after getting possession.

0% Interest Payment Plans: Many developers offer interest-free installment options.

Mortgage Loans for Expats: Banks in Dubai provide home loans to foreign investors with competitive interest rates.

This flexibility in financing makes property investment in Dubai accessible to a wide range of investors.

9. Freehold Ownership for Foreigners

Unlike in many countries where foreign investors face restrictions, Dubai offers freehold property ownership in designated areas. This means expatriates and international investors can fully own their properties without local sponsors, ensuring complete security over their investments.

10. Growing Tourism and Short-Term Rental Market

Dubai is one of the most visited cities in the world, making short-term rentals a profitable option. Platforms like Airbnb have allowed investors to earn high returns through vacation rentals, especially in tourist-friendly areas like Dubai Marina, Downtown Dubai, and JBR.

0 notes

Text

The Worth of Abu Dhabi's Notary Public Services for Foreign Clients

Moving to a brand new town in the United States of America may be both interesting and difficult, especially if it's as dynamic as Abu Dhabi. For immigrants who live remote places, navigating the crook and regulatory device can be in particular tough. For expatriates, navigating the felony and bureaucratic panorama can be especially daunting. One key service that regularly comes into play for expats is the notary public. Understanding the position and importance of a notary public in Abu Dhabi can make existence an awful lot easier, specifically when managing critical documents and criminal subjects.

A Notary Public: What Is It?

It is lawful for a notary public to offer oaths, witness signatures on documents, certify copies of huge facts, and perform a number of other responsibilities related to prisons. In Abu Dhabi, notary public offerings are vital for guaranteeing the authenticity of papers and their compliance with local, country wide, and international criminal requirements.

For expatriates, who frequently need to manipulate criminal affairs across extraordinary international locations, the offerings of a notary public in Abu Dhabi are imperative. Whether you are buying belongings, putting in place a enterprise, or handling personal felony topics, you'll possibly need to engage with a notary public at some point.

Why Expats Need Notary Public Services in Abu Dhabi

1. Authorizing Papers for International Use

Expatriates often are looking for a notary public in Abu Dhabi with a view to legitimize files to be used in various other international locations. This system, regularly known as "apostille" or "authentication," involves confirming the accuracy of a record and its suitability for use in every other nation. For instance, if an expat needs to put up a energy of legal professional or a delivery certificate to authorities of their domestic united states of america, they will first need to have it notarized in Abu Dhabi. Without this notarization, the report won't be diagnosed as legitimate.

2. Setting Up a Business

As a global middle for commercial enterprise, Abu Dhabi draws buyers and marketers from all over the international. Notarizing important documents is an essential first step for foreigners wishing to open a enterprise in Abu Dhabi. Articles of incorporation, shareholder agreements, and contracts are most of the documents that regularly need to be notarized on the way to be deemed legally enforceable. The authenticity of those documents can be established by using an Abu Dhabi notary public, making certain that they may be nicely finished and evaluated with the aid of neighborhood authorities.

3. Real Estate Transactions

Purchasing or leasing assets in Abu Dhabi is every other area wherein expats often need notary public services. Purchasing a residence, leasing an apartment, or making an investment in business real estate usually entails a widespread amount of paperwork. Notarization is often essential for contracts touching on sales, rentals, and loans in order for them to be legally binding. A notary public in Abu Dhabi guarantees that each one events concerned in the transaction are well diagnosed, and that the files are signed voluntarily and effectively.

Four. Wills and Estate Planning

Estate making plans is a touchy however critical mission for expatriates dwelling in Abu Dhabi. A will that is identified in your home u . S . Might not routinely be legitimate in the UAE. In order to make sure that your property are allotted within the manner you propose when you pass away, you may need to put together a will that complies with neighborhood laws and feature it notarized by way of an Abu Dhabi notary public. By imparting a prison assure that your will is valid and enforceable in Abu Dhabi, notarization gives you the assurance that your family will be taken care of.

5. Power of Attorney

A electricity of attorney (POA) is a felony report that permits a person else to behave to your behalf in criminal or economic subjects. For expats in Abu Dhabi, granting a electricity of attorney may be especially important, specifically in case you want someone to handle affairs in your property u . S . A . At the same time as travelling abroad. A POA can be created and notarized by a notary public in Abu Dhabi, guaranteeing its prison validity and popularity both inside the UAE and internationally.

6. Immigration and Residency Matters

Immigration is a giant difficulty for expats in Abu Dhabi, as keeping the right visa fame is crucial for residing and operating in the UAE. Notary public offerings are often required for immigration-related documents, inclusive of affidavits, letters of consent, and sponsorship agreements. A notary public in Abu Dhabi can verify those documents, making sure they meet the criminal requirements of the UAE authorities.

7. Certifying Copies of Documents

Expatriates often need certified copies of important documents, together with passports, beginning certificate, or academic qualifications. A notary public in Abu Dhabi can provide certified copies which might be legally recognized for legit use. This is in particular vital whilst dealing with authorities groups, academic establishments, or capacity employers who require validated copies of your files.

Selecting the Appropriate Abu Dhabi Notary Public

Considering the importance of notary public offerings, deciding on the right Abu Dhabi company is critical. Here are a few suggestions:

Reputation and Experience: Look for a notary public with a strong recognition and tremendous revel in, mainly in managing expatriate clients. A informed notary could be familiar with the specific needs and challenges faced by way of expats.

Availability: Consider the notary’s availability and place. In Abu Dhabi, notary public places of work may be observed in diverse locations, which includes government places of work, criminal companies, and even a few embassies. Choose one this is quite simply placed and gives bendy hours to deal with your time table.

Language Proficiency: Language may be a barrier whilst coping with legal matters. Ensure that the notary public in Abu Dhabi is gifted in your selected language, or at the least has get entry to to reliable translation offerings.

Cost: Depending at the service company and the intricacy of the case, notary public charges in Abu Dhabi can vary. To avoid any surprises, it is a high-quality concept to investigate about costs earlier.

Conclusion

For expatriates in Abu Dhabi, navigating the felony landscape may be complicated, particularly on the subject of making sure that crucial documents are legitimate and identified each locally and across the world. Notary public services play a essential position in this technique, imparting the prison guarantee had to manipulate numerous aspects of lifestyles in Abu Dhabi, from business and real estate transactions to personal felony subjects. By knowledge the significance of these offerings and deciding on a dependable notary public in Abu Dhabi, expats can guard their pastimes and revel in a smoother enjoy of their new home.

0 notes

Text

Why We Should Buy Properties in Dubai in 2024

Dubai continues to be one of the attractive property markets in the world in 2024. People are buying properties in the big city for some good reasons like good returns and amenities that are luxurious. So, let us see why it is good to have houses here.

Economic Development

Dubai is a well-known centre for commerce, travel, and finance, hence its economy is predicted to be strong in 2024. Furthermore under development are various investments in both luxury and commercial buildings. Property investments have a strong basis from this economic stability, which guarantees long-term value development.

High Rent Yields

Looking at the rental yields in other countries, Dubai provides a good opportunity in the property market. Demand for rental apartments is still high given the coming of people or visitors from other countries. This makes property investments in Emaar Club Place a good choice as investors may get more returns on the properties.

Taxes in Dubai

The tax benefit is among the main attractions for Dubai property purchasers. Unlike other markets where such taxes apply, the UAE does not have huge property taxes or capital gains taxes, which can raise your profits on investment.

Population Growing

Driven by its developing property market and attractive lifestyle, Dubai's population is rising. The demand for houses in properties like Emaar Club Place rises as more people coming to Dubai, which is also increasing the property price and good rental yields.

World-class facilities

Dubai is well-known for its world-class amenities given with the properties, luxurious buildings, and smooth transportation services. The city's attractiveness and property prices are also attractive and there are a lot of launches of new properties in big communities like Dubai Hills Estate.

Clean Environment for You

Open and beautiful environment of Dubai is well-known. The rules of the government is to make sure that the property market provides a clean environment for the people who want to buy. The sales of apartments and townhouses are gaining popularity for the greenery.

Different Types of Properties

From big villas and modern apartments to more less priced houses like studious, Dubai has a huge number of property types in 2024. This number of properties lets consumers to choose houses that fit their particular tastes and budgets.

Some Loan Choices

The property market in Dubai offers local and people from other countries a number of financing choices. Your home investment will be easily funded with low mortgage rates and attractive terms.

Fantastic Lifestyle

Dubai is a big city in Dubai well-known for its connectivity, high-rise buildings, and fantastic lifestyle. A lot of people want to live in Dubai because it provides world-class facilities, entertainment, and other opportunities.

Strategic Location Of City

Dubai is a good business hub because of its fantastic location between Europe, Asia, and Africa. This strategic location improves the city's appeal to other companies and investors, therefore benefiting the property market of Dubai.

Conclusion

From good economic development and good rental returns to tax benefits and a safe investment environment, buying property in Dubai in 2024 offers new choices like Emaar Club Place in Dubai Hills Estate. Dubai is a top choice for people wishing to profit from a luxurious and attractive property market because of its strategic location, a huge choices of properties, and modern lifestyle.

0 notes

Text

Finding the Best Mortgage Consultant in UAE: A Complete Guide

Finding the best mortgage consultant in UAE can significantly enhance your property purchase experience. This complete guide will help you understand how to find a reliable mortgage consultant who can offer expert advice and streamline the mortgage process.

For more information on home loans, visit Home Loan UAE.

Understanding the Role of a Mortgage Consultant

A mortgage consultant acts as an intermediary between borrowers and lenders, helping clients find the best mortgage deals, negotiate terms, and complete the necessary paperwork. Their expertise and connections in the industry can save you time, money, and stress.

Why You Need a Mortgage Consultant

Expert Advice: Mortgage consultants have in-depth knowledge of the mortgage market and can provide tailored advice based on your financial situation and property goals.

Access to Lenders: They have access to a wide range of lenders and mortgage products, increasing your chances of finding the best deal.

Time-Saving: A mortgage consultant handles all the legwork, from gathering documents to negotiating with lenders, allowing you to focus on other aspects of your property purchase.

Negotiation Skills: Their experience and expertise can help you secure better terms and rates than you might be able to achieve on your own.

Streamlined Process: They ensure that all paperwork is completed accurately and submitted on time, reducing the risk of delays and complications.

For commercial property purchase options, explore Buy Commercial Properties in Dubai.

Steps to Finding the Best Mortgage Consultant

Research and Referrals: Start by researching mortgage consultants online and asking for referrals from friends, family, and colleagues who have recently purchased property in Dubai.

Check Credentials: Ensure that the consultant is licensed and has a good reputation in the industry. Check for certifications and memberships in professional organizations.

Interview Multiple Consultants: Schedule consultations with several mortgage consultants to compare their services, fees, and approach.

Evaluate Experience: Choose a consultant with extensive experience in the Dubai mortgage market and a track record of successful transactions.

Assess Communication Skills: Ensure that the consultant communicates clearly and promptly, and is willing to answer all your questions.

Review Testimonials and Reviews: Read client testimonials and online reviews to gauge the consultant’s reliability and customer satisfaction.

For mortgage financing options, consider Mortgage Financing in Dubai.

Real-Life Success Story

Consider the case of John, an expatriate in Dubai looking to buy his first home. John was initially overwhelmed by the mortgage options and the complexities of the application process. He decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed John’s financial situation, explained the different mortgage products available, and helped him choose the best one for his needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept John informed at every step. This personalized service made a significant difference, reducing John’s stress and ensuring a smooth and successful home purchase.

For rental property management services, visit Apartments For Rent in Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For property sales, visit Sell Your Property.

Future Trends in Mortgage Consulting

The mortgage consulting landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit Home Loan UAE.

Conclusion

Finding the best mortgage consultant in UAE can significantly enhance your property purchase experience. By researching, checking credentials, interviewing multiple consultants, evaluating experience, and assessing communication skills, you can find a reliable consultant who will guide you through the mortgage process. For more resources and expert advice, visit Home Loan UAE.

1 note

·

View note

Text

The Ultimate Guide to Finding the Perfect Apartment for Rent in Dubai

Finding the perfect apartment for rent in Dubai can be an exciting yet challenging experience. With its diverse neighborhoods, modern amenities, and luxurious living options, Dubai offers a wide range of rental apartments that cater to different tastes and budgets. This ultimate guide will help you navigate the process of finding the ideal apartment for rent in Dubai, ensuring a smooth and successful search.

Why Rent an Apartment in Dubai?

Dubai is a vibrant city known for its luxurious lifestyle, state-of-the-art infrastructure, and multicultural environment. Here are some reasons why renting an apartment in Dubai is a great choice:

Luxurious Living: Dubai offers a wide range of luxury apartments with modern amenities and breathtaking views.

Diverse Neighborhoods: From bustling city centers to serene suburban areas, Dubai has neighborhoods that cater to various lifestyles.

Tax-Free Living: Dubai's tax-free environment makes it an attractive destination for expats and professionals.

High-Quality Infrastructure: Dubai's world-class infrastructure includes excellent public transport, healthcare, and educational facilities.

Multicultural Community: Living in Dubai allows you to experience a rich cultural diversity, with people from all over the world.

For more information on home loans, visit Home Loans in Dubai.

Identifying Your Requirements

Before you start your apartment search, it's essential to identify your requirements. Consider the following factors:

Budget: Determine your rental budget, including utilities and maintenance costs.

Location: Choose a location that suits your lifestyle, whether it's close to work, schools, or recreational facilities.

Apartment Size: Decide on the number of bedrooms and the overall size of the apartment you need.

Amenities: Consider the amenities you desire, such as a gym, swimming pool, parking, and security.

For guidance on buying apartments, explore Buy Apartments in Dubai.

Popular Neighborhoods for Renting Apartments

Dubai offers a variety of neighborhoods, each with its unique charm and features. Here are some popular neighborhoods for renting apartments:

Downtown Dubai: Known for its iconic landmarks like the Burj Khalifa and The Dubai Mall, Downtown Dubai offers luxurious apartments with stunning views.

Marina: Dubai Marina is a waterfront community with modern apartments, restaurants, and leisure activities.

Jumeirah Lake Towers (JLT): JLT is a popular residential area with affordable apartments and excellent transport links.

Palm Jumeirah: This man-made island offers exclusive apartments with private beaches and upscale amenities.

Business Bay: Business Bay is a central business district with a mix of residential and commercial properties.

For more details on mortgage options, visit home mortgage uae.

Steps to Finding the Perfect Apartment

Finding the perfect apartment involves several steps. Here's a step-by-step guide to help you through the process:

Online Research: Start your search by browsing online property portals to get an idea of the available options.

Work with a Real Estate Agent: A reputable real estate agent can provide valuable insights and help you find the right apartment.

Visit Potential Apartments: Schedule visits to the shortlisted apartments to assess their condition and suitability.

Check the Lease Agreement: Carefully review the lease agreement, including terms and conditions, rent payment schedule, and maintenance responsibilities.

Negotiate Rent: Don't hesitate to negotiate the rent with the landlord or property manager to get the best deal.

Finalize the Deal: Once you've found the perfect apartment, finalize the deal by signing the lease agreement and paying the security deposit.

For rental property options, explore Rent Your Property in Dubai.

Understanding the Rental Market

Understanding Dubai's rental market is crucial for making informed decisions. Here are some key points to consider:

Rental Prices: Rental prices vary based on location, apartment size, and amenities. Research the average rental prices in your desired area.

Supply and Demand: The rental market can fluctuate based on supply and demand. Stay updated on market trends to make a timely decision.

Legal Regulations: Familiarize yourself with Dubai's rental laws and regulations to ensure a smooth rental process.

Lease Terms: Understand the lease terms, including the duration of the lease, renewal options, and termination conditions.

For information on selling your property, visit Sell Your Property.

Real-Life Success Story

Consider the case of Sarah, who successfully found her dream apartment in Dubai. By identifying her requirements, conducting thorough research, and working with a reliable real estate agent, Sarah was able to secure a luxurious apartment in Downtown Dubai. Her success story serves as an inspiration for other apartment seekers in Dubai.

For more success stories, visit Home Loans in Dubai.

Future Trends in Dubai’s Rental Market

Sustainable Living: Eco-friendly and sustainable apartment developments are gaining popularity.

Technological Advancements: Smart apartments with advanced technology and automation are becoming more common.

Community Living: Community-focused developments with shared amenities and social spaces are on the rise.

Short-Term Rentals: The demand for short-term rental apartments is increasing, especially among tourists and business travelers.

Conclusion

Finding the perfect apartment for rent in Dubai requires careful planning, research, and decision-making. By following the steps outlined in this guide, you can navigate the rental market with confidence and secure your dream apartment. For more resources and expert advice, visit Buy Apartments in Dubai.

1 note

·

View note

Text

Expert Advice on Choosing a Mortgage Company in UAE

Choosing the right mortgage company in the UAE is essential for securing favorable mortgage terms and rates. This guide will provide expert advice on selecting the best mortgage company for your needs.

For more insights into Dubai's real estate market, visit Dubai Real Estate.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Residential Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Commercial Mortgage Loan in Dubai.

Steps to Choosing the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Villas For Sale in Dubai.

Real-Life Success Story

Consider the case of Fatima and Zayed, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Fatima and Zayed to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit Dubai Real Estate.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Property in Dubai.

Conclusion

Choosing the right mortgage company in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit Dubai Real Estate.

5 notes

·

View notes

Text

The Ultimate Guide to Finding the Best Mortgage Consultant in UAE

Introduction to Mortgage Consulting in UAE

Navigating the mortgage market in the UAE can be complex, and finding the right mortgage consultant can make all the difference. A good consultant can guide you through the various options, help you secure the best rates, and ensure a smooth transaction. This comprehensive guide provides everything you need to know about finding the best mortgage consultant in the UAE.

For more information on home loans, visit home loan dubai.

Why You Need a Mortgage Consultant

A mortgage consultant offers numerous benefits, including:

Expert Knowledge: Mortgage consultants have in-depth knowledge of the mortgage market and can provide valuable insights.

Time-Saving: They handle the research, paperwork, and negotiations, saving you time and effort.

Better Rates: Consultants can negotiate better rates and terms with lenders due to their industry connections.

Personalized Service: They provide personalized advice tailored to your financial situation and goals.

For property purchase options, explore Buy Commercial Properties in Dubai.

Steps to Finding the Best Mortgage Consultant

Research and Referrals: Start by researching online and asking for referrals from friends, family, and colleagues. Online platforms and forums can provide reviews and ratings of different mortgage consultants in the UAE, giving you a good starting point.

Check Credentials: Ensure the consultant is licensed and has a good track record. Look for certifications and memberships in professional organizations, which indicate a commitment to high standards and ongoing education.

Interview Multiple Consultants: Interview several consultants to compare their services, fees, and expertise. Prepare a list of questions to ask during these interviews to help you gauge their knowledge and experience.

Ask the Right Questions: Inquire about their experience, the types of loans they specialize in, and how they can help you achieve your goals. Also, ask about their success stories and how they have helped clients with similar financial situations to yours.

For mortgage options, consider Mortgage Financing in Dubai.

Evaluating Your Options

When evaluating mortgage consultants, consider the following factors:

Experience and Reputation: Choose a consultant with extensive experience and a strong reputation in the industry. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Communication Skills: Ensure the consultant communicates clearly and promptly. Good communication is crucial for a smooth mortgage process.

Transparency: Look for transparency in fees and terms. The consultant should provide a clear breakdown of their fees and any potential additional costs.

Customer Reviews: Check online reviews and testimonials to gauge client satisfaction. Look for patterns in the reviews to identify strengths and weaknesses in the consultant's services.

For rental options, visit Apartments For Rent in Dubai.

The Role of a Mortgage Consultant

A mortgage consultant's primary role is to act as a bridge between you and potential lenders. They help you understand your financial situation, identify suitable mortgage products, and guide you through the application process. Here are some specific tasks they perform:

Financial Assessment: Evaluating your financial situation, including your income, expenses, credit score, and debt-to-income ratio, to determine your mortgage eligibility.

Exploring Mortgage Options: Identifying and comparing different mortgage products from various lenders to find the best fit for your needs.

Rate Negotiation: Negotiating the best mortgage rates and terms with lenders on your behalf.

Paperwork Management: Handling all necessary documentation and ensuring compliance with regulations.

Closing Assistance: Assisting with the final steps of the mortgage process and closing the deal.

Benefits of Working with a Mortgage Consultant

Working with a mortgage consultant offers several advantages, including:

Access to a Wide Range of Products: Mortgage consultants have access to a broad range of mortgage products from different lenders, increasing your chances of finding the best deal.

Expert Guidance: Consultants provide expert advice on the best mortgage options based on your financial situation.

Time Savings: By handling the research, paperwork, and negotiations, consultants save you time and effort.

Stress Reduction: Managing the complexities of the mortgage process can be stressful. A consultant can alleviate this stress by guiding you through each step.

Customized Solutions: Consultants offer personalized mortgage solutions tailored to your specific needs and goals.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Ahmed, a first-time homebuyer in Dubai. Ahmed was overwhelmed by the mortgage process and unsure of where to start. He decided to seek the help of a mortgage consultant. The consultant began by assessing Ahmed's financial situation, including his income, expenses, and credit score. Based on this assessment, the consultant identified several mortgage options that suited Ahmed's needs.

The consultant then guided Ahmed through the mortgage application process, helping him gather the necessary documentation and ensuring everything was in order. Thanks to the consultant's industry connections, Ahmed was able to secure a favorable mortgage rate that he wouldn't have been able to find on his own.

Throughout the process, the consultant kept Ahmed informed, answering his questions and addressing his concerns promptly. This personalized service made a significant difference, making the process smooth and stress-free for Ahmed. In the end, Ahmed successfully purchased his dream home and was extremely satisfied with the consultant's services.

Questions to Ask a Mortgage Consultant

When interviewing potential mortgage consultants, it's important to ask the right questions to ensure they can meet your needs. Here are some questions to consider:

What is your experience in the UAE mortgage market? Understanding their level of experience can give you confidence in their ability to handle your case.

What types of loans do you specialize in? Some consultants may have more experience with certain types of loans, such as first-time homebuyer programs or refinancing.

How do you help clients secure the best mortgage rates? This question helps you understand their approach to negotiating with lenders.

What are your fees, and how are they structured? Transparency about fees is crucial to avoid any surprises later on.

Can you provide references from previous clients? References can provide insight into the consultant's reliability and effectiveness.

For more resources and expert advice, visit home loan dubai.

Conclusion

Finding the best mortgage consultant in the UAE can significantly impact your home-buying experience. By following the steps outlined in this guide and leveraging professional services, you can secure the best mortgage deals and achieve your property goals. Remember to research and interview multiple consultants, ask the right questions, and evaluate your options carefully. With the right consultant by your side, you can navigate the mortgage process with confidence and ease. For more resources and expert advice, visit home loan dubai.

2 notes

·

View notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda