#uae insurance policy

Explore tagged Tumblr posts

Text

Why Health Insurance is Essential in Dubai: Protecting Your Future with Nexus Insurance Brokers LLC

Why Health Insurance is Essential in Dubai: Protecting Your Future with Nexus Insurance Brokers LLC

In today’s fast-paced world, securing reliable health insurance is more important than ever. Living in Dubai, where quality healthcare services are readily available, having a comprehensive health insurance plan ensures you and your family receive the best medical care without financial strain. At Nexus Insurance Brokers LLC, we specialize in providing tailored health insurance solutions, ensuring that individuals, families, and businesses have access to the right coverage for their needs.

The Importance of Health Insurance in Dubai

Dubai has a high standard of medical care, but healthcare costs can be significant, especially for those without adequate coverage. Health insurance is not just a necessity—it’s a legal requirement in Dubai, with mandatory health coverage enforced for all residents. Without insurance, medical expenses can become overwhelming, making it crucial to choose a plan that offers both comprehensive benefits and financial security.

What to Look for in a Health Insurance Plan

Choosing the right health insurance plan can be challenging, but understanding key features can help. At Nexus Insurance Brokers LLC, we guide our clients through a range of options, considering factors such as:

Coverage Benefits – Plans that cover outpatient, inpatient, emergency care, and specialist consultations.

Network Hospitals – Access to a wide range of hospitals and clinics, ensuring convenient medical care.

Maternity and Family Coverage – Comprehensive plans that include maternity care, newborn benefits, and child healthcare.

Pre-existing Conditions – Solutions that cater to those with chronic illnesses, ensuring continued medical support.

Affordable Premiums – Flexible payment options that balance cost and coverage effectively.

Why Choose Nexus Insurance Brokers LLC?

As a leading insurance broker in Dubai, Nexus Insurance Brokers LLC provides independent and unbiased guidance to help you find the most suitable health insurance plan. Unlike tied agents, we are not limited to one provider, allowing us to compare policies from top insurers and recommend the best coverage for you. Whether you are an individual seeking essential coverage or a business looking to provide employee health benefits, our experienced advisors will tailor a solution that fits your specific needs.

Secure Your Health Coverage Today

Having the right health insurance plan means peace of mind for you and your family. Don’t wait until an emergency arises—secure your coverage today with Nexus Insurance Brokers LLC. Contact us to explore the best health insurance options and ensure that you have reliable protection for the future.

#insurance broker dubai#insurance dubai#insurance brokers in dubai#insurance broker#brokers insurance#insurance broker uae#cheap insurance dubai#uae insurance policy#online insurance dubai#car insurance dubai#car insurance near me#buy car insurance online#car insurance broker#auto insurance#buy car insurance online dubai#health insurance dubai#health insurance#medical insurance#health insurance in dubai#medical insurance broker dubai#health care insurance#family health insurance uae#health insurance online#life insurance uae#life insurance broker uae#best life insurance#life insurance policy#travel insurance dubai online#buy holiday insurance#house insurance dubai

0 notes

Text

Secure Your Vehicle with Comprehensive Car Insurance in Dubai from GIG Gulf for Maximum Protection and Peace of Mind

Comprehensive car insurance in Dubai is a must when it comes to protecting your vehicle. GIG Gulf offers extensive coverage that goes beyond basic policies, ensuring your car is safeguarded against accidental damage, theft, natural disasters, and third-party liabilities. Life on the roads is unpredictable, and having the right insurance can give you peace of mind.

GIG Gulf has overall car insurance designed specifically for motorists in Dubai, to cover even the most busy of commuters through the entire period, a parent whose family may have cars driven daily, a car owner, and the other road trippers, as protection of the motorcar will occur regardless of situations. Coverage covers accidental damages with liability protection - just in case.

Choose GIG Gulf, for you can experience an assured customer-driven service which primarily takes care of your safety and satisfaction. Easy payment options, fast claim process, and experience support by a professional team for your confidence at the wheels! Get yourself an all-round, best-in-town car insurance policy in Dubai for hassle-free rides!

#car insurance#car insurance dubai#bike insurance online#uae car insurance#motor vehicle insurance#insurance for car in uae#auto policy quote#motor insurance coverage

0 notes

Text

A Guide to Selecting the Best Life and Health Insurance Companies in Dubai

In the vibrant city of Dubai, one must protect one's future by procuring appropriate life and health insurance. Given the quantity of available options, locating the ideal suit can be a daunting task. We shall explore the realm of insurance in order to assist you in identifying the most suitable life and health insurance providers that cater to your specific requirements, with an emphasis on National General Insurance (NGI).

Understanding Your Needs

It is imperative to assess one's needs prior to exploring the vast array of insurance providers. Ascertain whether coverage for oneself, one's family, or both is required. Assess your financial responsibilities, long-term objectives, and possible health hazards. This initial phase establishes the groundwork for selecting the most appropriate insurance policy.

Exploring options

Dubai offers a variety of life and health insurance plans. Conduct thorough research to compare the premiums, coverage, and additional benefits provided by various providers. Consider firms that have established a reliable standing, consistent financial health, and a history of promptly resolving claims.

NGI stands for National General Insurance

Notwithstanding the plethora of alternatives, National General Insurance (NGI) emerges as a reputable entity within the insurance sector. NGI is well-known for its extensive coverage and focus on customer satisfaction. The organization provides a comprehensive selection of life and health insurance options that are customized to suit the requirements of individuals and families.

Long-Term Life Insurance

Term life insurance is a favored option among policyholders who are in search of cost-effective protection for a predetermined duration, which generally spans from 5 to 30 years. Beneficiaries will receive a death benefit from this form of insurance in the event that the insured passes away during the policy's term. NGI provides adaptable term life insurance products that feature customizable coverage options and competitive premiums.

Important Things to Think About When You Buy Term Insurance in Dubai

Coverage Amount: Assess the appropriate coverage amount by considering one's financial obligations, such as mortgage payments, outstanding debts, and forthcoming expenditures.

Prepaid Expenses and Affordability: Compare the premiums of various term insurance plans to assess the financial commitment required to purchase them.

Further Advantages: In order to augment your protection, consider term life insurance policies that provide elective riders or add-ons, such as disability benefits or critical illness coverage.

Term life insurance plans from NGI

National General Insurance (NGI) provides policyholders and their loved ones with financial security and peace of mind through a variety of term life insurance plans. By offering policies with adaptable conditions, competitive premiums, and elective endorsements, NGI accommodates a wide range of requirements and inclinations.

Life Insurance Agreement

A life insurance policy safeguards your loved ones financially in the event of your mortality; it is a long-term investment. In the event of the insured's demise, beneficiaries are entitled to a lump-sum payment referred to as the death benefit. When purchasing a life insurance policy in UAE, coverage quantity, affordability of premiums, and policy features should be considered.

Choosing an Appropriate Policy for Life Insurance

Whole Life vs Term Life: Determine whether a whole life or term life insurance policy aligns better with your financial goals and preferences. Whole life insurance companies in Dubai provide coverage for the insured's entire life, while term life insurance offers coverage for a specified period.

Cash Value Accumulation: If you opt for whole life insurance, consider the cash value accumulation feature, which allows you to build savings over time that can be accessed through policy loans or withdrawals.

Process of Underwriting: Acquire knowledge regarding the underwriting procedure entailed in the acquisition of a life insurance policy, encompassing medical examinations, health questionnaires, and premium computations.

Claiming Reputation: Conduct thorough research on the insurer's claim settlement reputation in order to guarantee that your beneficiaries' claims are processed in a timely and trouble-free manner.

Life insurance options provided by NGI

National General Insurance (NGI) is dedicated to delivering all-encompassing life insurance solutions that effectively address its clients' ever-changing requirements. At NGI, we prioritize transparency, dependability, and customer contentment as we provide a number of customized life insurance policies designed to protect your family's financial prospects.

Health Insurance Options from NGI

In the current era of uncertainty, National General Insurance (NGI) recognizes the critical nature of comprehensive health insurance coverage. NGI provides comprehensive health insurance plans that cater to a variety of budgets and requirements, thereby safeguarding individuals and families against unforeseen medical costs and crises.

Conclusion

When searching for the most reputable life and health insurance Companies in Dubai, it is crucial to take into account your specific requirements, preferences, and financial limitations. Through comprehensive investigation, option comparison, and the utilization of the knowledge and assistance of reputable insurance providers such as National General Insurance (NGI), one can obtain a dependable insurance policy that furnishes long-term financial security and tranquility.

#insurance companies in uae#3 month insurance plan#best insurance company in uae#insurance brokers in dubai#international insurance providers#general insurance companies in uae#insurance policy in uae#good insurance in dubai

0 notes

Text

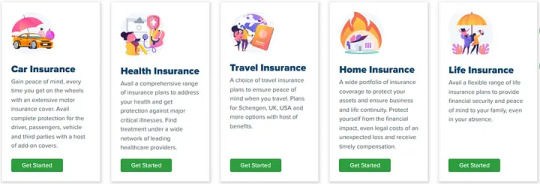

Insurance Companies in UAE

Compare and Secure the Finest Car, Health, Business, Life, and Travel Insurance in Dubai & UAE. Get Insured in Just 30 Minutes and Enjoy Savings of Up to 30%

#best insurance in uae#insurance policies in uae#insurance brokers in abu dhabi#car insurance companies dubai#compensation workers insurance

0 notes

Text

Personal Accident Insurance UAE | Accident Insurance Dubai

🚑 Accidents are unpredictable, but your protection shouldn't be! With NGI's Personal Accident Insurance in Dubai, you and your loved ones can have peace of mind knowing that you're covered when life throws unexpected challenges your way. 🛡️

Shield yourself from the unexpected today! Contact us or visit our website to learn more about how NGI can be there for you when it matters the most. Your safety is our priority!

#health insurance uae#Personal Accident Insurance UAE#Accident Insurance Dubai#Medical Insurance Dubai#Health Insurance UAE#Best Insurance Company in Dubai#Buy Insurance Policy Online

0 notes

Text

This day in history

#15yrsago Best practices for economic collapse: Long Now talk https://cluborlov.blogspot.com/2009/02/social-collapse-best-practices.html

#10yrsago San Francisco police beat up and detain Good Samaritans who call 911 and perform first aid on accident victim https://medium.com/indian-thoughts/good-samaritan-backfire-9f53ef6a1c10

#10yrsago Dems appoints RIAA’s man in Congress to House Judiciary Subcommittee on Courts, Intellectual Property and the Internet https://www.techdirt.com/2014/02/12/another-friend-recording-industry-joins-house-subcommittee-courts-intellectual-property-internet/

#10yrsago Senator Rand Paul sues US government over NSA spying https://arstechnica.com/tech-policy/2014/02/us-senator-sues-president-obama-to-stop-nsa-metadata-dragnet/

#5yrsago Who can forget those scenes in Count Zero where they all stand around eating soup? https://memex.craphound.com/2019/02/14/who-can-forget-those-scenes-in-count-zero-where-they-all-stand-around-eating-soup/

#5yrsago Bossfight: Allstate Insurance enters the Right to Repair fight, loans its lobbyists to fight Apple https://www.vice.com/en/article/nex3dz/insurance-giant-allstate-buys-icracked-phone-repair-company-joins-right-to-repair-movement

#5yrsago Installing a root certificate should be MUCH scarier https://www.eff.org/deeplinks/2019/02/powerful-permissions-wimpy-warnings

#5yrsago Ex-NSA whistleblower says she and other US ex-spooks targeted Americans on behalf of UAE https://www.reuters.com/investigates/special-report/usa-spying-raven/

#5yrsago LA Times demands that reporters sign away rights to books, movies and other works they create while working at the paper https://latguild.com/news/2019/2/12/press-release-los-angeles-times-guild-pushes-back-against-managements-proposed-intellectual-property-policy

#5yrsago Even without explicit collusion, pricing algorithms converge on price-fixing strategies https://cepr.org/voxeu/columns/artificial-intelligence-algorithmic-pricing-and-collusion

#5yrsago Most adults are incapable of understanding most online terms of service https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3313837

#5yrsago How Epson’s patent trolling is killing the EU market for replacement ink https://www.openrightsgroup.org/blog/patently-unfair-epson-takedowns-continue/

#5yrsago The Final Version of the EU’s Copyright Directive Is the Worst One Yet https://www.eff.org/deeplinks/2019/02/final-version-eus-copyright-directive-worst-one-yet

#5yrsago Beyond GIGO: how “predictive policing” launders racism, corruption and bias to make them seem empirical https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3333423

#1yrago Nathan J. Robinson's "Responding to the Right: Brief Replies to 25 Conservative Arguments" https://pluralistic.net/2023/02/14/nathan-robinson/#arguendo

12 notes

·

View notes

Text

How to Choose a Car for Monthly Rental in Dubai?

Opting for a monthly car rental in Dubai is a convenient and cost-effective choice, whether you're staying for business, leisure, or long-term purposes. Here's a step-by-step guide to help you choose the perfect car for your monthly rental:

1. Define Your Needs

Start by assessing your requirements:

Daily Commute: For regular city travel, choose a fuel-efficient and compact car like a Toyota Corolla, Hyundai Elantra, or Nissan Sunny.

Luxury Lifestyle: Dubai is synonymous with luxury, so if you want to blend into the city’s glamour, opt for a premium car like a Mercedes-Benz E-Class, BMW 5 Series, or even a Rolls-Royce Ghost.

Family or Group Travel: If you’re traveling with family or colleagues, consider spacious SUVs like the Toyota Prado, Kia Sportage, or Nissan Patrol.

Adventure Seekers: For off-road desert adventures, 4x4 vehicles such as the Jeep Wrangler or Toyota Land Cruiser are ideal.

2. Consider Your Budget

Determine how much you're willing to spend on the rental. Monthly rentals often come with discounts compared to daily rates, but prices vary depending on the type of car:

Economy Cars: Affordable and cost-effective for those on a budget.

Mid-Range Cars: Ideal for a balance of comfort and cost.

Luxury and Sports Cars: Higher costs but perfect for an indulgent experience.

3. Evaluate Fuel Efficiency

Gas prices in Dubai are affordable, but choosing a fuel-efficient car can save you money if you plan on extensive driving. Compact sedans or hybrid cars like the Toyota Prius are great options for daily commutes.

4. Check Insurance and Extras

Ensure the monthly rental includes:

Comprehensive Insurance: Covers accidents and damages.

Maintenance Services: Some companies offer free maintenance for long-term rentals.

Salik (Toll) Charges: Understand how toll charges will be billed.

5. Look for Features

Depending on your preferences, check for:

Comfort Features: Air conditioning, cruise control, and spacious interiors for longer trips.

Technology: GPS navigation, Bluetooth connectivity, and reverse cameras for ease of use.

Safety: Advanced safety features, especially if you're new to Dubai's traffic.

6. Verify Documentation

Before signing the rental agreement:

Ensure your driver's license is valid in the UAE (International Driving Permit may be required).

Check for any mileage restrictions.

7. Plan for Return and Extensions

If there's a chance you might extend the rental, inquire about extension policies beforehand. Many companies allow seamless renewals for monthly rentals.

The right car for a monthly rental in Dubai will depend on your lifestyle, travel requirements, and budget. From economy sedans to luxury vehicles and robust SUVs, Dubai offers a wide range of options to ensure you enjoy your stay in comfort and style. Always book in advance and read customer reviews to secure the best deal.

2 notes

·

View notes

Text

WHAT DOES LUXURY CAR RENTAL AGREEMENT COVERS?

1937 car rentals agreement typically covers various aspects of the rental terms and conditions, outlining the rights and responsibilities of both the rental company and the renter in Dubai UAE. While the specific contents of the agreement may vary depending on the rental company and location, here are some common items that are typically included in a luxury car rental agreement:

Vehicle Information: The agreement will specify details about the luxury car being rented, including the make, model, year, and vehicle identification number (VIN).

Rental Period: The agreement will state the duration of the rental, including the start and end date and time.

Rental Rate: The rental rate per day or for the entire rental period will be clearly mentioned. It may also include information about additional charges for extra services or features.

Driver Information: The renter's information, including name, address, contact details, and driver's license information, will be required in the agreement.

Age and Licensing Requirements: The agreement may outline the minimum age requirement for the driver and specify that a valid driver's license is mandatory.

Insurance Coverage: Details about the insurance coverage provided with the rental car, including the type of coverage (e.g., collision, liability, comprehensive), the coverage limits, and any deductible amount, will be clearly stated.

Security Deposit: The agreement may specify the amount of the security deposit required to cover any potential damages or violations during the rental period. The amount will vary depending on the car brand

Additional Drivers: If the renter intends to have additional drivers, their information and licensing details may be required and included in the agreement.

Restrictions: The agreement may include restrictions on the use of the luxury car, such as off-road driving, driving under the influence, or taking the car out of the designated area.

Fuel Policy: The agreement may specify the fuel policy, such as returning the car with a full tank or paying for the fuel used during the rental period.

Penalties and Charges: The agreement will outline penalties for violating the rental terms, returning the car late, or other breaches of the agreement.

Condition of the Vehicle: The agreement may include a checklist of the car's condition at the time of pickup and drop-off to note any existing damages.

It's essential to read and understand the rental agreement thoroughly before signing it. If there are any terms you don't understand or have questions about, don't hesitate to ask the rental company for clarification. By doing so, both parties can have a clear understanding of their rights and obligations during the luxury car rental period.

Contact us now for details : 📞 +971 50 807 3737 💌 [email protected]

www.1937rentals.ae

#luxury#luxurious#luxuries#cars#luxurycarrental#luxury cars#luxurycarhire#car rental#exotic#exotic cars#sports#sports cars#dubai#dubailife#united arab emirates#oman#abudhabi#abu dabi#lamborghini#mercedes#rolls royce#bentley#porsche#aesthetic#wallpaper#instagram#inspi#tips#life hacks

2 notes

·

View notes

Text

Financial Security: Why You Should Secure Your Life Before Anything Else

Introduction

Insuring yourself is an important step in securing your financial future. Insurance provides the safety net of protection against potential losses, offering peace of mind and security to individuals and families. In the UAE, insurance plays a pivotal role in protecting people from unforeseen risks and ensuring that their loved ones are taken care of financially should something unexpected happen. Understanding what type of coverage you need for different life events can help you make smart decisions about which policy is best for your needs. From health insurance plans to motor vehicle coverage and more, having the right insurance can give you greater financial security both now and into the future.

Benefits of Insuring Yourself in UAE

One of the biggest benefits of insuring yourself in the UAE is protection against financial loss. Having a policy in place will ensure that any unexpected expenses or losses are covered, helping to reduce stress and worry. Insurance policies can provide coverage for both physical and financial risks, allowing you to be better prepared for whatever life throws at you. This type of protection provides peace of mind knowing that your family’s financial future is secure should something happen to you or your loved ones.

Some insurers offer discounts on certain services such as home maintenance if they know you have an active policy with them — this could add up to significant savings over time! Finally, having an insurance policy in place gives people greater security when it comes to their finances since they know there’s a safety net protecting them from potential losses.

How to Compare Insurance Wisely in UAE

When it comes to insurance policies in the UAE, there are a variety of coverage options available. It is important to understand what type of policy you need and how it will protect you from potential losses. Before making any decisions, be sure to research the different types of coverage and compare quotes from multiple insurers. This will help ensure that you get the best deal for your needs and budget.

Another factor when comparing insurance policies is looking for discounts or rewards programs that may be offered by certain providers. Many insurers offer reduced premiums or special benefits if customers have an active policy with them. Additionally, some companies provide loyalty programs which offer additional perks such as free medical check-ups or cash vouchers if customers remain loyal for a certain period of time.

Finally, researching customer reviews can give insight into an insurer’s reliability and services provided — this information could potentially save money in the long run should something unexpected arise later down the line! Taking all these factors into consideration will help ensure that you make an informed decision when choosing insurance in the UAE.

Insurancepolicy.ae as Your Partner for Insurance

Insurancepolicy.ae is a trusted partner for individuals and families looking to purchase insurance in the UAE. The company offers comprehensive services that make it easy for customers to compare quotes, receive secure advice, and complete their policy purchases hassle-free.

When searching for the right insurance policy, insurancepolicy.ae makes it simple to compare quotes from multiple providers quickly and without any pressure or commitment. The website provides an overview of different plans, so customers can easily find what they’re looking for without having to spend time researching each insurer individually. Once a customer has selected their desired plan, they are then able to finalize the details with one of insurance policy’s experienced advisors who will provide tailored advice based on their individual needs — ensuring they get the best possible coverage at a price that fits within their budget!

The process of purchasing an insurance policy through insurancepolicy.ae is straightforward and stress-free thanks to its user-friendly interface which guides customers every step of the way from start to finish. In addition, all customer information is securely stored in accordance with data protection laws — giving customers peace of mind knowing their personal information remains safe throughout the process! For those who need help understanding specific terms or concepts related to policies and coverage options available in the UAE, insurancepolicy.ae also offers support from dedicated customer service representatives, who are ready to answer any questions that may arise during initial research or when completing an application form online.

For anyone looking for reliable insurance solutions in UAE look no further than insurancepolicy.ae — your trusted partner providing quality service and expert guidance every step along the way!

2 notes

·

View notes

Text

How to Choose the Right Home Insurance in the UAE?

Home insurance is a type of property insurance that covers losses and damage that occur to an individual’s house or insured belongings. The coverage can cover costs due to natural calamities such as floods and earthquakes. Plus, it covers fire-related damages to the property.

Although the UAE is one of the safest places, the absence of home insurance can put a huge financial burden on people for rebuilding. In this blog, find out how to choose the right home insurance in the UAE.

Understand Insurance Needs

The first step is to understand personal insurance needs. The location of the residence is one of the major factors one should consider while opting for a home insurance policy. In addition, decide if you want insurance coverage only for the property or the belongings in the house or both. Other factors such as age, income, health, employment, settlement plan, family and more can be considered too.

Do Research

Do your own research about the different insurance companies. Find out the following about the insurance providers:

Company Reputation

Financial Stability

Customer Service

Claim Settlement Time

Search online for reviews, customer feedback and ratings. Seek help from friends and families. Else, get expert advice from insurance experts in the UAE. Also, it is important that the insurance provider has a licence as per the laws in the UAE.

Compare Different Home Insurance Policies

Once you narrow down the list of insurance companies, start comparing different home insurance policies offered. Read carefully each and every detail to have a complete understanding of the insurance coverage promised. Plus, read the terms and conditions thoroughly. Compare the procedures to claim insurance and the time required to achieve a settlement.

Consider the Features

Find out if there are additional benefits or add-ons offered by the insurance company in addition to the standard coverage. It is necessary to cover specific needs besides basic coverage. However, one of the main factors to consider is the cost. Take time and assess if the add-ons are worth the additional money.

Budget

The cost of a home insurance policy is one of the key factors that distinguish one insurer from another. Compare the following things to find the best insurance policy that provides the best value:

Premium

Deductible Amounts

Exclusions

Discuss if there are discounts or promotions that can significantly lower the cost and boost savings on insurance.

Review

Periodical review of the home insurance is essential to meet the changing needs and the coverage required. The best thing is to review annually if the insurance coverage is enough for the future.

Claim Rejection

Make sure to submit all the necessary documents and provide all the necessary details to avoid claim rejection when one needs it the most. As world events become more unpredictable, choosing a home insurance policy can keep everyone protected. Crossroads Insurance Brokers is a leading insurance broker in the UAE offering cutting-edge insurance solutions. Contact us for more details.

#property insurance#insurance broker in the UAE#home insurance#property insurance in UAE#personal insurance

2 notes

·

View notes

Text

Trump's Policy: An Overview of Key Domestic and Foreign Policies

Donald Trump’s presidency (2017-2021) was marked by a mix of conservative, populist, and nationalist policies that aimed to reshape both domestic governance and international relations. His administration focused on deregulation, tax cuts, immigration restrictions, and an "America First" foreign policy. This article explores some of the key policies implemented during his tenure.

Domestic Policies

1. Economic Policies: Tax Cuts and Deregulation

Trump signed the Tax Cuts and Jobs Act (TCJA) in 2017, which reduced corporate tax rates from 35% to 21% and lowered income tax rates for individuals. The goal was to stimulate economic growth by encouraging investment and job creation. Additionally, his administration pursued extensive deregulation, rolling back environmental and business regulations to boost industries like manufacturing and energy.

2. Immigration: Border Security and Travel Bans

Immigration was a cornerstone of Trump's platform. His administration enacted policies such as:

The Border Wall: Construction of a border wall along the U.S.-Mexico border was a major priority. While parts of the wall were built, funding and legal challenges prevented full completion.

Family Separation Policy: The "zero tolerance" policy led to the separation of migrant families at the border, sparking controversy.

Travel Ban: A ban on travel from several predominantly Muslim countries was implemented early in his presidency, citing national security concerns.

3. Healthcare: Attempts to Repeal Obamacare

Trump and congressional Republicans attempted to repeal the Affordable Care Act (ACA), commonly known as Obamacare. Although a full repeal was unsuccessful, his administration weakened the ACA by eliminating the individual mandate penalty, which required Americans to have health insurance.

4. Criminal Justice and Policing

Trump signed the First Step Act, a bipartisan criminal justice reform bill that aimed to reduce sentencing for nonviolent offenders and improve prison conditions. However, his administration was also criticized for its response to racial justice protests and calls for police reform.

5. COVID-19 Response

Trump’s handling of the COVID-19 pandemic was highly debated. While his administration accelerated vaccine development through Operation Warp Speed, critics argued that his initial downplaying of the virus and inconsistent messaging contributed to the severity of the outbreak in the U.S.

Foreign Policy: America First Approach

1. Trade and Tariffs

Trump sought to reduce trade deficits and bring manufacturing jobs back to the U.S.:

Trade War with China: His administration imposed tariffs on Chinese goods, leading to retaliatory tariffs. The Phase One trade deal in 2020 sought to rebalance trade but had limited impact.

USMCA: Trump renegotiated NAFTA into the United States-Mexico-Canada Agreement (USMCA), which introduced new labor and environmental provisions.

2. Relations with Allies and NATO

Trump frequently criticized NATO allies for not meeting their defense spending commitments. His administration pushed for a more transactional approach to alliances, emphasizing U.S. interests over multilateral cooperation.

3. Middle East Policy

Israel and the Abraham Accords: His administration brokered historic agreements between Israel and several Arab nations (UAE, Bahrain, Sudan, and Morocco), normalizing diplomatic relations.

Iran: Trump withdrew from the Iran Nuclear Deal (JCPOA) and reimposed sanctions, arguing the agreement was too lenient.

Afghanistan: He initiated peace talks with the Taliban and negotiated a withdrawal plan for U.S. troops, which was later carried out under President Biden.

4. North Korea Diplomacy

Trump engaged in unprecedented direct diplomacy with North Korean leader Kim Jong-un, meeting him three times. However, talks ultimately stalled, and North Korea continued its missile tests.

Conclusion

Trump's policies reflected his "America First" philosophy, prioritizing domestic economic growth, national security, and a shift away from multilateral agreements. While his administration saw economic gains and deregulatory successes, it also faced criticism for its handling of immigration, racial tensions, and the pandemic. His legacy remains highly debated, influencing political discourse even after his presidency.

0 notes

Text

#insurance broker dubai#insurance dubai#insurance brokers in dubai#insurance broker#brokers insurance#insurance broker uae#cheap insurance dubai#uae insurance policy#online insurance dubai#car insurance dubai#car insurance near me#buy car insurance online#car insurance broker#auto insurance#buy car insurance online dubai#health insurance dubai#health insurance#medical insurance#health insurance in dubai#medical insurance broker dubai#health care insurance#family health insurance uae#health insurance online#life insurance uae#life insurance broker uae#best life insurance#life insurance policy#travel insurance dubai online#buy holiday insurance#house insurance dubai

0 notes

Text

Comprehensive Motor Vehicle Insurance Solutions from GIG Gulf

At GIG Gulf, we understand that your vehicle is more than just a mode of transportation – it’s an essential part of your daily life. That's why we offer comprehensive motor vehicle insurance solutions tailored to meet your specific needs. Whether you're looking for basic coverage or an all-encompassing policy, we provide a range of options to ensure your vehicle is protected against unforeseen events. Our goal is to give you peace of mind, knowing you're covered on the road, no matter the circumstances.

Our motor vehicle insurance policies are designed to offer financial protection in the event of accidents, damage, or theft. With GIG Gulf, you get access to trusted insurers and customized plans that align with your driving habits and budget. We prioritize transparency and simplicity, making it easy for you to understand your coverage and manage your policy. Enjoy the confidence that comes with knowing that you are backed by a reliable insurance provider.

Take the first step towards securing your vehicle and protecting your future today. GIG Gulf’s motor vehicle insurance plans offer a range of benefits including roadside assistance, third-party liability, and comprehensive coverage options. Contact us now to get a quote, and let us help you safeguard your vehicle with the right insurance protection.

#uae car insurance#motor vehicle insurance#insurance for car in uae#auto policy quote#motor insurance coverage#third party car insurance dubai price

0 notes

Text

Are you trying to find the best health and life insurance solutions in Dubai? One of the best life insurance providers in Dubai is National General Insurance (NGI); therefore, go no further. NGI provides comprehensive life insurance policies that are customized to meet your needs. The company has an excellent reputation for dependability and client satisfaction. NGI offers customizable coverage options to secure your future and defend your loved ones, whether you're looking for a term life insurance policy in the UAE. Rely on NGI for protection and peace of mind, as they remain one of the leading providers of health and life insurance in the United Arab Emirates.

#buy term insurance in dubai#life insurance companies in dubai#life insurance dubai#life insurance uae#life insurance abu dhabi#life and health insurance companies#life insurance policy in uae#term life insurance uae#life insurance companies in abu dhabi#best life insurance dubai#term life insurance dubai

0 notes

Text

Exploring the Features of Insurance in the UAE

Explore the thriving insurance landscape in the UAE with a focus on customer-centric solutions and cutting-edge innovations. Insurance companies in UAE have played a vital role in securing individuals, businesses, and assets amidst uncertainties. The sector's remarkable growth is evident through its diverse offerings, tailored to the unique requirements of residents and businesses alike. This blog provides insights into the prominent features of insurance in the UAE, ensuring a safeguarded future and bolstering financial security for all. Embrace the dynamic world of insurance in the UAE, where protection and innovation go hand in hand.

Comprehensive Coverage

One of the most remarkable features of insurance in the UAE is the extensive coverage offered by insurance providers, including health insurance UAE. From life insurance policy in UAE to motor insurance, property insurance, and even niche products like travel insurance, there is a comprehensive range of policies available to cater to the diverse requirements of individuals and businesses. These policies are expertly designed to protect against unexpected events, providing policyholders with peace of mind and financial protection when they need it most. Whether it's securing your health or other aspects, the insurance offerings in the UAE ensure comprehensive coverage for all. Embrace the assurance of a well-rounded life insurance policy in UAE and explore the wide array of insurance options tailored to your specific needs.

Takaful Insurance

In line with the principles of Islamic finance, the UAE offers Takaful insurance, which operates on a cooperative model. Takaful insurance functions by pooling contributions from a group of individuals or businesses, which are then used to provide coverage to those in need. This Sharia-compliant form of insurance adheres to ethical and moral principles, ensuring that the risk-sharing mechanism is fair and just.

Innovative Technology Integration

The UAE's insurance industry has embraced technological advancements to enhance customer experience and streamline operations. From user-friendly mobile applications for policy management to quick online quotes and claim filing, technology has made insurance processes more accessible, efficient, and transparent for customers. Additionally, Insurtech (Insurance Technology) startups are making their mark in the UAE, introducing disruptive solutions like pay-as-you-go policies and smart contract-based insurance.

Multi-Language Support

The UAE is a fusion of cultures and nationalities, with a vast expatriate population. Insurance providers in the UAE understand this diversity and offer policies with multi-language support to cater to the needs of non-Arabic speakers. This inclusive approach ensures that individuals from different backgrounds can fully comprehend the terms and conditions of their insurance policies.

Optional Add-ons and Customization

Insurance Companies in UAE recognize that one size does not fit all when it comes to insurance coverage. As a result, they offer a variety of optional add-ons and customization features to tailor policies according to individual preferences and requirements. Whether it's adding coverage for specific risks, increasing policy limits, or opting for additional benefits, customers can personalize their insurance plans to suit their unique circumstances.

Network of Service Providers

In the UAE, insurance providers often have vast networks of affiliated service providers, including hospitals, clinics, garages, and workshops. This network ensures that policyholders can avail cashless services, where applicable, and receive prompt assistance when making claims or seeking medical treatment. The ease of access to these services further enhances the overall insurance experience for customers.

Quick Claim Settlement

Timely and hassle-free claim settlement is a critical aspect of insurance services. In the UAE, insurance companies strive to process and settle claims promptly, minimizing inconvenience to policyholders during challenging times. Advanced technologies, such as AI-driven claims processing, help expedite the evaluation and settlement process, ensuring that customers receive their rightful compensation as swiftly as possible.

Professional Insurance Advisors

Insurance can sometimes be complex, and customers may require expert guidance to select the most suitable policies for their needs. The UAE's insurance sector boasts a cadre of professional insurance advisors who are well-versed in various insurance products. These advisors assist customers in understanding policy details, coverage options, and potential risks, empowering them to make well-informed decisions.

Conclusion

The UAE's insurance industry has evolved into a dynamic and customer-focused sector that offers a plethora of features to safeguard individuals, businesses, and assets from unforeseen risks. The comprehensive coverage options, Takaful insurance offerings, integration of technology, and commitment to customer satisfaction are some of the key highlights of the UAE's insurance landscape. As the nation continues to grow and innovate, its insurance industry is poised to play an even more significant role in providing financial security and stability to its residents and businesses.

#insurance#life insurance#health insurance#car insurance#insurance broker in abu dhabi#life insurance policy in uae

0 notes

Text

Rent A Chevrolet In Dubai,

Rent A Chevrolet In Dubai,

Dubai is a city known for its luxurious lifestyle, towering skyscrapers, and world-class attractions. Whether you're here for business, leisure, or an unforgettable vacation, one of the best ways to explore this stunning city is by renting a car. And when it comes to a blend of comfort, performance, and style, renting a Chevrolet in Dubai is a fantastic option.

Why Rent a Chevrolet in Dubai?

Chevrolet is known for producing a range of vehicles that cater to different tastes and needs. From compact cars to spacious SUVs and sleek sports cars, renting a Chevrolet in Dubai allows you to enjoy the city's vibrant energy in comfort. Here's why a Chevrolet could be your ideal choice:

Variety of Options: Chevrolet offers a broad selection of vehicles, including the efficient and compact Chevrolet Spark, the mid-size Equinox SUV, and the powerful and stylish Camaro. Whether you're navigating city traffic or cruising along the coast, there’s a Chevrolet model to fit your needs.

Comfort & Luxury: Chevrolet vehicles are designed to offer a smooth and comfortable ride, making long drives and trips around the city enjoyable. Many models come with luxury features such as leather seats, advanced infotainment systems, and intuitive climate controls.

Affordable & Efficient: Renting a Chevrolet in Dubai is an affordable option, especially when compared to other luxury car rentals. With excellent fuel efficiency across most models, you’ll also save on fuel costs as you explore the city.

Perfect for Dubai’s Terrain: Whether you're staying within the city or venturing into the desert or mountains nearby, Chevrolet offers cars with reliable performance. SUVs like the Chevrolet Tahoe are ideal for tackling rough terrain, while sedans like the Malibu provide an elegant yet smooth city drive.

Top Chevrolet Models to Rent in Dubai

Chevrolet Spark: A compact and efficient option for city driving, the Spark is perfect for solo travelers or couples looking to navigate through Dubai’s busy streets. It’s affordable, fuel-efficient, and easy to park in tight spaces.

Chevrolet Malibu: If you're looking for something stylish and spacious, the Malibu sedan offers the perfect blend of luxury and practicality. It’s great for business trips or a night out in Dubai’s glamorous neighborhoods.

Chevrolet Camaro: For those seeking a thrilling driving experience, the Camaro is the ideal choice. With its eye-catching design and powerful engine, this sports car will make you stand out as you cruise down Sheikh Zayed Road or along Dubai Marina.

Chevrolet Equinox: Need more space and comfort? The Chevrolet Equinox is a versatile SUV that offers ample space for families or groups. It’s perfect for longer journeys and can handle Dubai's heat and highways with ease.

Chevrolet Tahoe: For larger groups or those planning desert adventures, the Chevrolet Tahoe is a great option. With its 4x4 capabilities, it’s built for tough terrain, and its spacious interior makes it comfortable for everyone on board.

How to Rent a Chevrolet in Dubai

Renting a Chevrolet in Dubai is easy and convenient, with numerous car rental agencies offering a wide range of Chevrolet models. Here’s how you can go about it:

Choose Your Rental Company: Dubai boasts many reputable car rental companies such as Enterprise, Hertz, Sixt, and local agencies. Many also have online platforms, allowing you to book your car in advance.

Provide Necessary Documents: You'll need to present your passport, visa, and a valid international driving permit (IDP) if you're a tourist. Residents of the UAE will need to provide their Emirates ID and driving license.

Select Your Model: Choose a Chevrolet that suits your travel needs. Whether you prefer a compact car, sedan, or SUV, the options are varied to ensure you get the right vehicle.

Review Terms and Conditions: Make sure to review the rental agreement, including insurance coverage, mileage limits, and fuel policy. Most agencies offer full insurance for peace of mind.

Pick Up Your Car: Once everything is in order, you can pick up your Chevrolet at your rental agency’s location, or some services offer a delivery option to your hotel.

Costs of Renting a Chevrolet in Dubai

Rental prices vary depending on the model, duration of the rental, and the time of year. On average, you can expect to pay anywhere from AED 100 to AED 400 per day for a Chevrolet, with special offers available during off-peak seasons.

Tips for Driving in Dubai

Speed Limits: Dubai has strict speed limits. Ensure you follow posted signs to avoid hefty fines. Speeding in the city can result in significant penalties.

Parking: Look for designated parking spaces, as illegal parking can lead to fines or towing. Many public parking lots in Dubai offer paid services.

Fueling: Most gas stations in Dubai offer self-service pumps. Make sure your Chevrolet is well-fueled before heading out on long trips.

Traffic: While Dubai’s roads are well-maintained, traffic congestion can occur, especially during peak hours. Plan accordingly and consider using navigation apps like Google Maps for the best routes.

Final Thoughts

Renting a Chevrolet in Dubai provides a wonderful opportunity to experience this luxurious city from a different perspective. With a wide variety of models to choose from and flexible rental options, driving through Dubai's modern streets and scenic highways will be an unforgettable experience. So, why wait? Book your Chevrolet today and hit the road in style!

4o mini

O

Search

Reason

0 notes