#Nonfiction Bestsellers

Explore tagged Tumblr posts

Text

Hillbilly Elegy by JD Vance

Find the #1 NYT Bestseller Hillbilly Elegy by JD Vance from your local library. Click Check on Amazon to read book reviews on Amazon. Click Google Preview to read chapters from Google Books if available. Click Find in Library to check book availability at your local library. If the default library is not correct, follow Change Local Library to reset it. Hillbilly Elegy by: JD VanceRelease date:…

View On WordPress

0 notes

Text

Top Popular Nonfiction Books of the Year

As the days get longer and warmer, there’s nothing quite like lounging in the sun with a captivating book in hand. Summer is the perfect time to immerse yourself in the world of popular nonfiction books and explore fascinating true stories, insightful perspectives, and thought-provoking narratives. Picture this: you’re stretched out on a cozy beach towel, the gentle sound of waves crashing in the…

View On WordPress

#Best nonfiction books#Literary nonfiction#Must-read nonfiction#Nonfiction bestsellers#Popular memoirs#Top selling nonfiction#Trending true stories

0 notes

Text

Praise for Katherine Rundell's new nonfiction bestiary of extraordinary animals, VANISHING TREASURES

“Whether she is writing about a jumping spider, a hedgehog, or the curious, pine-cone-like mammals known as a pangolin, Katherine Rundell stuns us with wonders. Each of her essays is a polished gem—and each will leave you newly smitten with love for life.” —Sy Montgomery, New York Times bestselling author of The Soul of an Octopus

#sy montgomery#bestselling nonfiction#animal books#the soul of an octopus#my octopus teacher#hedgehog#vanishing treasures#katherine rundell#nonfiction#impossible creatures#author#conservation#nature#animal facts#essays#nonfiction essays

328 notes

·

View notes

Text

"Beyond the Wand: The Magic and Mayhem of Growing Up a Wizard" by Tom Felton

Thank you @erin_likes_books for the lovey memoir!

QOTD: Do you know your Harry Potter house? Are you happy with it? Answer: I'm a Gryffindor ❤️

#memoir#celebrity#celebrity memoir#tom felton#draco malfoy#hogwarts#harry potter#behind the scenes#growing up#coming of age#coming of age memoir#mental health#substance abuse#nonfiction books#popular book#popular books#new york times bestseller#beyond the wand#beyond the wand the magic and mayhem of growing up a wizard

4 notes

·

View notes

Text

Hey everyone please check out my youtube channel. You will find free Audiobook of best sellers and most popular book and novel. If you would like to listen Audiobook of novels like BETTER THAN THE MOVIES, TO BE CLAIMED,POWERLESS, CARAVAL, CRUEL PRINCE SEQUAL ,GOOD GIRL'S GUIDE TO MUR*ER SEQUELS, FOURTH WING, IF HE HAD BEEN WITH ME SEQUAL and more , then please check out my youtube channel "MINIMAL NARRATOR" . Free Audiobook available.

#audio#audiobooks#audible#book and coffee#books#novel#free audiobook#full length#fulllengthaudiobook#youtube#youtube audio#youtubeaudiobook#romantic books#adventure book#enemy to lovers#bookcore#reading#long reads#read out loud#read list#kindle#wattpad#amazonbooks#bestsellers#cottagecore#naturecore#fantasy books#fiction books#nonfiction books#ya books

5 notes

·

View notes

Text

A poet's heart, once bound by chains of fear, Transformed by love, now soars and dares to yearn. A dragon's embrace, fierce yet tender, broke the spell. In fire and passion, two worlds found their own hell.

#reading#literature#digital books#online resources#self#authors#booklovers#eReader#indie authors#bestsellers#fiction#nonfiction#audiobooks

0 notes

Text

#Amreading #Newrelease: The New BEST SELLER by Geoffrey Klein for ONLY #99c The Content Beast

Order YOUR Copy HERE: https://amzn.to/3u95uAb via @amazon

#Books#Bookboost#Mustread#Writerslift#Bookstagram#Kindle#Kindleunlimited#Writing#Nonfiction#Bestseller

1 note

·

View note

Text

The House Of My Mother by Shari Franke

Find the #1 NYT Bestseller The House Of My Mother by Shari Franke from your local library. Click Check on Amazon to read book reviews on Amazon. Click Google Preview to read chapters from Google Books if available. Click Find in Library to check book availability at your local library. If the default library is not correct, follow Change Local Library to reset it. The House Of My Mother by:…

View On WordPress

0 notes

Text

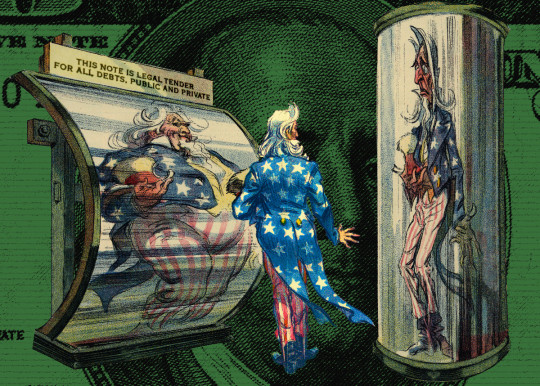

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything �� labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

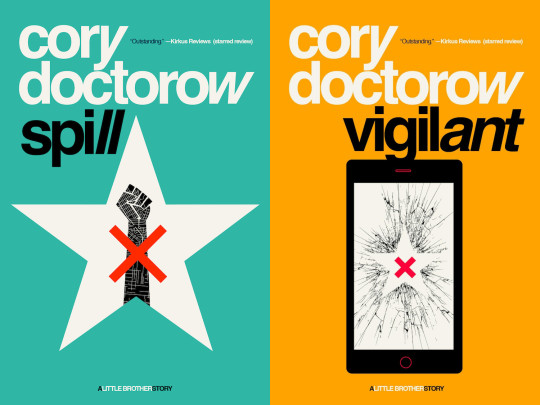

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

Barnes & Noble 'Best Books of 2023' list

‘Jesse James and the Lost Templar Treasure’ by Daniel J. Duke, published by Inner Traditions – Bear & Co., has been listed as one of Barnes & Noble Best Books of 2023 in both the Templar and Freemason genres. The book features hidden treasures left behind by Jesse James with cryptic codes and maps that Daniel J. Duke, his great-great-grandson, decodes and explores. Duke reveals lost treasures and…

View On WordPress

#Barnes & Noble#Best Books of 2023#bestseller#books#Freemason#inner traditions#Jesse James#Knights Templar Grand Master#Kris Helt#Lost Treasure#nonfiction#publisher#Rachel Dehning#Raves & Reviews#Seattle Book Review#Templar#Timothy Hogan#Whiskey & Wit

1 note

·

View note

Text

"Tuesdays with Morrie: An Old Man, a Young Man, and Life's Greatest Lesson" by Mitch Albom

Thank you @brunchingbookworm for the reread! ❤️

#memoir #mentor #tuesdayswithmorrie #wisdom #popularbooks #bestsellerbooks #bookrecommendations

#Memoir#Mentor#Mentorship#Tuesdays with Morrie#Wisdom#Books of wisdom#Popular books#book recommendations#true books#nonfiction books#bestseller books

1 note

·

View note

Text

Venus Era was #1 bestselling on books.com.tw for March 2023 🎉

#books.com.tw is taiwan’s equivalent of amazon#their top 10 bestselling fiction and nonfiction books are carried at 7-elevens across the country#vera#venus era

0 notes

Text

Queer Ducks (and Other Animals): The Natural World of Animal Sexuality

Eliot Schrefer with Jules Zuckerberg

This groundbreaking illustrated YA nonfiction title from two-time National Book Award finalist and New York Times bestselling author Eliot Schrefer is a well-researched and teen-friendly exploration of the gamut of queer behaviors observed in animals. A quiet revolution has been underway in recent years, with study after study revealing substantial same-sex sexual behavior in animals. Join celebrated author Eliot Schrefer on an exploration of queer behavior in the animal world—from albatrosses to bonobos to clownfish to doodlebugs.

In sharp and witty prose—aided by humorous comics from artist Jules Zuckerberg—Schrefer uses science, history, anthropology, and sociology to illustrate the diversity of sexual behavior in the animal world. Interviews with researchers in the field offer additional insights for readers and aspiring scientists.

Queer behavior in animals is as diverse and complex—and as natural—as it is in our own species. It doesn’t set us apart from animals—it bonds us even closer to our animal selves.

#queer history#queer#lgbt#lgbt history#gay history#lesbian history#transgender history#transgender#making queer history#queer books#lgbt books

1K notes

·

View notes

Text

Stop Calling Yourself an Aspiring Author: A Proposition

So this post is dedicated to @dreambigdreamz, who asked me a question about when you can stop calling yourself an aspiring author. I had to wait until I could go to sleep to properly answer, because this is going to be a long one, probably. I'm actually doing this before I get to work for the day, because if I could get one goddamned person to stop labeling themselves like this I will feel success for at least three days.

It's a question for new writers - the difference between a writer and an author. If you Google the difference it appears there are two camps:

Writer and author are synonyms

You are only an author if you publish your work/write as a career

This is odd to me already. It's odd and it's immediately gatekeep-y, and it's so fucking surreal that ours is the only artistic field that has this strange distinction. For most other outlets there's still a separation between hobbyist and professional, but that's considered optional as far as I've seen.

Someone who paints or does digital art isn't likely to call themselves a hobbyist artist, even if they aren't doing it as their main source of income. They're just an artist.

If someone practices the piano but isn't actively in a performing band or symphony, they probably don't call themselves an aspiring pianist. They're already doing it. They're a pianist.

I briefly considered cook versus chef, but in that context cook doesn't necessarily mean amateur. There are line cooks and prep cooks and fry cooks and sauté cooks who work professionally. I have the qualifications of a prep or line cook, but I'm currently only cooking meals at home. So does that mean I'm an aspiring cook? That's weird. That doesn't sound right.

So by this point it should be clear that I find it deeply reductive to say that you can only call yourself an author if you've professionally published a work of writing. Maybe that was the case, like, a hundred years ago? Even then, though, one of the definitions of author is a verb describing the act of writing something. You could author a scientific paper. You could author a poem.

It's 2002. The scope of what it means to publish is infinitely vaster than it was in the days of Virginia Woolf or Ernest Hemingway. You could traditionally publish your novel - that's still an option. But you could also indie-publish. Or self-publish. Or produce your own zines or chapbooks and distribute them online. Or send our newsletters on platforms like Substack. Or serialize through websites like Wattpad, Tapas, Itch.io, Patreon, AO3, or even tumblr.

I never called myself an author, but my reasons have nothing to do with whether or not I've been published. I prefer writer, as it has a more versatile feel that tracks whether I'm working on a novel or a poem or a play. But that's beside the point.

Personally, I'm in the first camp. Writer and author are essentially synonymous, only in my eyes an author is someone who writes fiction or nonfiction prose. That's it. Have you done that? Cool. Good job no longer being "aspiring".

If you have the words aspiring author in your life somewhere, there's a good chance you're actively gatekeeping yourself from feeling good enough to do your own thing. Why not replace it with something like the following?

future bestseller

soon-to-be published

new author/writer

growing author/writer

developing author/writer

practicing author/writer

author/writer in training

just author/writer

If someone does the whole "you're a writer? what have you published?" welcome to the conversation that all writers have to tolerate at some point. People are dumb. People typically don't know our industry and how it functions, and that's fine. Just smile and nod and shrug your way out of the conversation.

Yes, there's infighting within writers who should very much be spending less time arguing who gets to wear the nametag and who doesn't. Those people are lame dipshits who should shut the fuck up and get back to writing. If you have a passion for writing, be it fanfic or scripts or short stories or novels, you are my peer and colleague. I might not like the structure or content of your writing - which is fine, by the way - but I would never even say that you aren't a writer holy shit.

I don't care if you use every genre and trope that I find trite and excessive. If you genuinely care about the stories you tell and you still present yourself as an aspiring author, you have a duty to take yourself more seriously than that.

You are a writer. You are an author. This should not be a question.

We need to move past this and start asking ourselves the real questions that come after you answer "Am I an author". Am I a safe author? Am I an advocate and an ally? Am I a supportive member of the community? Am I still learning? Am I a capable author? Am I adaptable? Am I resourceful? Am I determined?

I'm running out of steam here. I need the writers here, especially the younger writers, to move past this stage of their creative careers as quickly as fucking possible. I was there too. I get it. And I'm telling you it's time to soak the label of aspiring so as to loosen the adhesive, gently peel it off, and throw it in the trash forever. Don't even keep it for sentimental reasons to look back on later.

Toss it. Burn it. Eat it. It is not helping you.

Okay that's all. You should close this now and write three hundred words of whatever the fuck you want. I love you.

#aspiring author#aspiring writer#writeblr#creative writing#writing community#writers on tumblr#authors of tumblr#on writing#writing inspo#writing inspiration#writing resources

78 notes

·

View notes

Text

Because large-scale organising is “almost impossible” in China, women are turning to “all kinds of alternative ways to maintain feminism in their daily lives and even develop and transfer feminism to others,” she says. These may take the form of book clubs or exercise meet-ups. Some of her friends in China organise hikes. “They say that we are feminists, we are hiking together, so when we are hiking we talk about feminism.“ - Lü Pin

To find evidence that China’s feminist movement is gaining momentum – despite strict government censorship and repression – check bookshelves, nightstands and digital libraries. There, you might find a copy of one of Chizuko Ueno’s books. The 74-year-old Japanese feminist and author of Feminism from Scratch and Patriarchy and Capitalism has sold more than a million books in China, according to Beijing Open Book, which tracks sales. Of these, 200,000 were sold in January and February alone.

Ueno, a professor of sociology at the University of Tokyo, was little known outside in China outside academia until she delivered a 2019 matriculation speech at the university in which she railed against its sexist admissions policies, sexual “abuse” by male students against their female peers, and the pressure women felt to downplay their academic achievements.

The speech went viral in Japan, then China.

“Feminist thought does not insist that women should behave like men or the weak should become the powerful,” she said. “Rather, feminism asks that the weak be treated with dignity as they are.”

In the past two years, 11 of her books have been translated into simplified Chinese and four more will be published this year. In December, two of her books were among the top 20 foreign nonfiction bestsellers in China. While activism and protests have been stifled by the government, the rapid rise in Ueno’s popularity shows that women are still looking for ways to learn more about feminist thought, albeit at a private, individual level.

Talk to young Chinese academics, writers and podcasters about what women are reading and Ueno’s name often comes up. “We like-like her,” says Shiye Fu, the host of popular feminist podcast Stochastic Volatility.

“In China we need some sort of feminist role model to lead us and enable us to see how far women can go,” she says. “She taught us that as a woman, you have to fight every day, and to fight is to survive.”

When asked by the Guardian about her popularity in China, Ueno says her message resonates with this generation of Chinese women because, while they have grown up with adequate resources and been taught to believe they will have more opportunities, “patriarchy and sexism put the burden to be feminine on them as a wife and mother”.

Ueno, who found her voice during the student power movements of the 1960s, has long argued that marriage restricts women’s autonomy, something she learned watching her own parents. She described her father as “a complete sexist”. It’s stance that resonates with women in China, who are rebelling against the expectation that they take a husband.

Ueno’s most popular book, with 65,000 reviews on Douban, is simply titled Misogyny. One review reads: “It still takes a little courage to type this. I have always been shy about discussing gender issues in a Chinese environment, because if I am not careful, I will easily attract the label of … ‘feminist cancer’.”

“Now it’s a hard time,” says Lü Pin, a prominent Chinese feminist who now lives in the US. In 2015 she happened to be in New York when Chinese authorities arrested five of her peers – who were detained for 37 days and became known as the “Feminist Five” – and came to Lü’s apartment in Beijing. She narrowly avoided arrest. “Our movement is increasingly being regarded as illegal, even criminal, in China.”

China’s feminist movement has grown enormously in the past few years, especially among young women online, says Lü, where it was stoked by the #MeToo movements around the world and given oxygen on social media. “But that’s just part of the story,” she says. Feminism is also facing much stricter censorship – the word “feminism” is among those censored online, as is China’s #MeToo hashtag, #WoYeShi.

“When we already have so many people joining our community, the government regards that as a threat to its rule,” Lü says. “So the question is: what is the future of the movement?”

Because large-scale organising is “almost impossible” in China, women are turning to “all kinds of alternative ways to maintain feminism in their daily lives and even develop and transfer feminism to others,” she says. These may take the form of book clubs or exercise meet-ups. Some of her friends in China organise hikes. “They say that we are feminists, we are hiking together, so when we are hiking we talk about feminism.

“Nobody can change the micro level.”

‘The first step’

In 2001, when Lü was a journalist starting out on her journey into feminism, she founded a book club with a group of friends. She was struggling to find books on the subject, so she and her friends pooled their resources. “We were feminists, journalists, scholars, so we decided let’s organise a group and read, talk, discuss monthly,” she says. They met in people’s homes, or the park, or their offices. It lasted eight years and the members are still among her best friends.

Before the book club, “I felt lonely when I was pursuing feminism. So I need friends, I need a community. And that was the first community I had.” “I got friendship, I deepened my understanding of feminism,” Lü says. “It’s interesting, perhaps the first step of feminist movements is always literature in many countries, especially in China.”

Lü first read Ueno’s academic work as a young scholar, when few people in China knew her name. Ueno’s books are for people who are starting out on their pursuit of feminism, Lü says, and the author is good at explaining feminist issues in ways that are easy to understand.

Like many Ting Guo discovered Ueno after the Tokyo University speech. Guo, an assistant professor in the department of cultural and religious studies at the Chinese University of Hong Kong, still uses it in lectures.

Ueno’s popularity is part of a larger phenomenon, Guo says. “We cannot really directly describe what we want to say, using the word that we want to use, because of the censorship, because of the larger atmosphere. So people need to try to borrow words, mirror that experience in other social situations, in other political situations, in other contexts, in order to precisely describe their own experience, their own feelings and their own thoughts.”

There are so many people who are new to the feminist movement, says Lü, “and they are all looking for resources, but due to censorship, it’s so hard for Chinese scholars, for Chinese feminists, to publish their work.”

Ueno “is a foreigner, that is one of her advantages, and she also comes from [an] east Asian context”, which means that the patriarchal system she describes is similar to China’s. Lü says the reason books by Chinese feminists aren’t on bestseller lists is because of censorship.

Na Zhong, a novelist who translated Sally Rooney’s novels into simplified Chinese, feels that Chinese feminism is, at least when it comes to literature, gaining momentum. The biggest sign of this, both despite and because of censorship, is “the sheer number of women writers that are being translated into Chinese” – among whom Ueno is the “biggest star”.

“Young women are discovering their voices, and I’m really happy for my generation,” she says. “We’re just getting started.”

By Helen R Sullivan

This is the third story in a three-part series on feminism and literature in China.

#China#Japan#Chizuko Ueno#Books for women#Feminism from Scratch#Patriarchy and Capitalism#Misogyny#Feminist Five#Lü Pin#WoYeShi

778 notes

·

View notes

Text

Last December, in a column about the Jewish books of 2023, I predicted that “next year’s list will include a slew of books dealing with the crisis in Israel or will be read through the lens of the war.”

It was an easy call: If this year’s nonfiction Jewish authors didn’t focus directly on the tragedy or aftermath of Oct. 7 — Israeli journalist Lee Yaron in “10/7: 100 Human Stories,” massacre survivor Amir Tibon in “The Gates of Gaza” and Adam Kirsch in “On Settler Colonialism: Ideology, Violence, and Justice,” to name a few — many added a chapter on the crisis to projects that had long been in the works.

Joshua Leifer told me he had to rewrite “about 20,000 words” of “Tablets Shattered: The End of an American Jewish Century and the Future of Jewish Life,” his autobiographical critique of the Jewish mainstream. Three books of Jewish theology intended for wide audiences — “To Be a Jew Today” by Noah Feldman, “The Triumph of Life” by Rabbi Irving “Yitz” Greenberg and “Judaism Is About Love” by Rabbi Shai Held — included additional chapters taking into account the fresh wounds and nascent implications of the attack and the war.

In a typical year, the books by Leifer, Feldman, Greenberg and Held — and perhaps “The Amen Effect,” an inspirational volume by Rabbi Sharon Brous — would have competed for the book that best captured the Jewish moment and discourse. It’s a category I’ve been thinking about lately, after asking JTA readers to suggest Jewish books that define 21st-century Jewry and that — here’s the key part — are likely to be found on the shelves of the Jewish readers they know. I was inspired by universally read, era-defining books like 1958’s “Exodus” by Leon Uris, which fed and presaged the Zionist fervor of the 1960s, and “World of Our Fathers” by Irving Howe, which in the 1970s remembered what the children and grandchildren of Eastern European immigrants were already starting to forget.

I’ll get to the readers’ nominees in a moment, but I want to start by suggesting that it is still too early to pick a book, or books, that best reflects where Jews have landed in the wake of Oct. 7. The war still grinds on, and the Jewish community remains uncertain how it will end or what it will ultimately mean. Some themes are emerging, including resurgent antisemitism, the international isolation of Israel, a rupture between Jews and the political left, and perhaps a return to Jewish religious practice and belonging. Any author will need some time and distance to make sense of the upheaval.

It may not be surprising then that the book most frequently suggested by the dozens of readers who responded to my callout, “People Love Dead Jews,” anticipated these upheavals and the Jews’ sense of abandonment. Novelist Dara Horn’s first nonfiction collection, published in 2021, posited that societies that are happy building memorials and museums to Jewish suffering are reluctant to show respect or understanding to actual living Jewish communities. The book “really helped me wrap my head around present-day antisemitism,” wrote reader Marianne Leloir Grange.

For many readers, “People Love Dead Jews” serves as a skeleton key to understanding the worldwide backlash against Israel in a war that began when Hamas slaughtered 1,200 mostly Jews on Oct. 7. As Horn explained in an interview in April with the online European Jewish magazine K., “You’ll see that people love dead Jews, as long as they’re vulnerable and helpless. In fact, I found it remarkable how much people seemed to relish the idea of showing their support for murdered Jews, until Israel responded with force. That’s how people love the Jews: powerless to stop their own slaughter. As soon as the Jews show any capacity for action, it’s all over.”

(When I asked Horn this week what books spoke to her this year, she said she appreciated Kirsch’s book, the anthology “Young Zionist Voices” edited by David Hazony, and Benjamin Resnick’s dystopian novel “Next Stop.”)

Another frequently mentioned book seemed almost to act as a balm to Horn’s thesis: “The Heaven and Earth Grocery Store” by James McBride. Last year’s best-selling, prize-winning historical novel is set in a small Pennsylvania town at a moment when immigrant Jews and poor Black families found common cause. “‘The Heaven and Earth Grocery Store’ by James McBride is probably one of the most popular recent books likely to be on an American Jew’s bookshelf,” Galina Vromen wrote me. “I would argue that part of the attraction to Jews today is in light of antisemitism and nostalgia when Jews and Blacks saw themselves on the same side of just causes and Jews were not regarded as enemy white people.”

Vromen, a novelist, had a number of strong suggestions for the kinds of recent books likely to be on American Jewish bookshelves, including “The Netanyahus,” Joshua Cohen’s 2021 Pulitzer Prize-winning novel that serves as a cutting critique of present-day Israeli politics; “The Amazing Adventures of Kavalier & Clay,” Michael Chabon’s best-selling 2000 novel about the Jews who pioneered superhero comics; and “Start-Up Nation” by Dan Senor and Saul Singer. The last one, published in 2009, presented Israel as an incubator of high tech innovation (and coined an enduringly popular nickname for the country) and offers readers a comforting rebuke to the activists who see Israel as an oppressor and colonizer.

A number of readers recommended Philip Roth’s 2004 novel “The Plot Against America,” which imagined an America run by the populist, isolationist, Nazi-sympathizing and antisemitic Charles Lindbergh in the early years of World War II. The book has had a number of lives: Roth said he wrote it as a rumination on Jewish security in America, but by 2016 it was seen by Donald Trump’s critics as an eerie prophecy of his rise and first election; HBO adapted it for a miniseries in 2020; and this year the New York Times named it one of the “100 Best Books of the 21st Century.”

Beyond that, no other book was suggested by more than one reader, although the ones they did mention seem like strong contenders for the current Jewish book shelf: “Everything Is Illuminated,” Jonathan Safran Foer’s 2002 magical realist novel that anticipated the current vogue for works about Jewish roots tours in Eastern Europe; “My Promised Land” by Ari Shavit and “Like Dreamers” by Yossi Klein Halevi, two 2013 nonfiction works by Israeli authors attempting to explain the country’s heart and soul; and Deborah Lipstadt’s 2019 “Antisemitism: Here and Now” (although I am guessing her 2005 memoir “History on Trial: My Day in Court with a Holocaust Denier,” which became the motion picture “Denial,” is better known).

Samuel Freedman’s “Jew vs. Jew: The Struggle for the Soul of American Jewry,” published in 2000, fell just short of the 21st century, but was a prescient look at the internal political and religious divides that would only yawn wider in the coming decades.

I was also pleased to hear from readers who suggested cookbooks. “Jerusalem” by Sami Tamimi and Yotam Ottolenghi (2011) not only kicked off a mania for high-end Middle Eastern cooking but presented a complex and even hopeful version of Jewish and Palestinian coexistence (which did not, over time, include the authors). Joan Nathan’s “Jewish Cooking in America” (1994) cemented her role as Jewish cuisine’s Julia Child. And it’s the rare kosher-keeping home cook who doesn’t own a volume in Susie Fishbein’s “Kosher By Design” series. Fishbein “single-handedly raised Jewish cooking to a gourmet level [and] opened the floodgates to a new sub-industry,” Barbara Kessel wrote me from Jerusalem.

What became clear from my unscientific survey is that in a polarized and media-saturated age, there are fewer books that American Jews might have in common than, say, 40 years ago. But maybe that’s OK. Each year sees a flood of new Jewish books, capturing voices beyond the ashkenormative assumptions of the 20th century and as diverse as the people who write and read them: Mizrachim, women, interfaith families, LGBT Jews, Jews of color, Jews by choice, the religious, the formerly religious.

“Today, my understanding of Jewish life is so much bigger (and richer),” the writer Erika Dreifus wrote me, remembering her own childhood among Ashkenazi Jews in the metro New York area. “I’m so much more aware of Jewish experience that differs from my own.”

44 notes

·

View notes