#Mortgage renewal terms

Explore tagged Tumblr posts

Text

Renew Your Mortgage in Ontario - Get the Best Rates Today

Looking to renew your mortgage in Ontario? Our expert team can help you find the best rates and terms. Contact us today to get started.

#Mortgage renewal#Renew mortgage#Mortgage renewal rates#Best mortgage renewal rates#Mortgage renewal process#Mortgage renewal calculator#Renewal mortgage rates Ontario#Mortgage renewal options#Mortgage renewal terms#Mortgage renewal advice#Mortgage renewal fees#Mortgage renewal with bad credit#Mortgage renewal tips#Renewal mortgage broker#Mortgage renewal specialist

0 notes

Text

Mortgage Renewal Services in Abbotsford, Edmonton, & Surrey

Is your mortgage term about to expire? Need mortgage renewal services in Abbotsford, Edmonton, and Surrey? If yes, Sandhu & Sran Mortgages is here for you. We are a full-service mortgage brokerage providing mortgage transfer services to mortgage borrowers planning to get their existing mortgage renewed at better rates and terms. From first time renewals to second time transfers, you can rely on us for dependable mortgage broker services at reasonable costs. For the best mortgage term renewals in Abbotsford and surroundings, rely on our experienced mortgage brokers. Feel free to contact us for more details.

#Mortgage Term Renewal Services#Mortgage Renewal Services#Mortgage Broker Services#Mortgage Transfers Services

0 notes

Text

Make the right choice for your vehicle and your wallet with comprehensive motor insurance!

#health#loan#mortgage#home loan#insurers#term insurance#life insurance#car insurance#bike insurance#renewable resources

0 notes

Text

tag thing

Thanks to @marcishaun @eljeebee @sharona-sims and @simslegacy5083 for the tags!

💓 Favourite Three Ships: Errrm, in terms of Sims, it would probably be:

Aly and Zack Phabet (from my Alphabetacy, which I'll eventually start posting again soon 😅).

Lily and Michael, of course! (from @sharona-sims's legacy)

Juniper and Nick (from @keoni-chan's Sims in Bloom gameplay, which tbh I completely adore and am thoroughly enjoying)

🎧 Last Song: Black Friday - Tom Odell

🎬 Last Movie: Saltburn, and omg I loved it. I've had Murder on the Dancefloor on repeat ever since.

📖 Currently Reading: I just finished Circe, and have now moved onto the second GoT book (in all it's 900 page glory 🤯)

🌶️ Craving: Green pesto 🙃😂

👯♀️ Relationship status: Engaged, as of October 2023. I don't think I actually mentioned that here yet 😅

💻 Last Thing I Googled: Boring mortgage renewal stuff. Urgh.

💫 Current Obsession: Continuing to build up my Lake Strange hood. I just finished The Goth Compound last night, and will now be moving onto a motel and salon before I finally commence gameplay (unless I inevitably think of other things to build)!

Tagging: @generation-simmer @pleasanttaleswithkaityb @pamsimmer

25 notes

·

View notes

Text

Buying Property in Thailand

Thailand is an attractive destination for property buyers due to its scenic landscapes, vibrant cities, and welcoming culture. However, purchasing property in Thailand, especially as a foreigner, involves navigating a complex legal framework and understanding the local market intricacies. This comprehensive guide will provide detailed insights, enhancing expertise and credibility by delving into the legalities, procedures, and best practices for buying property in Thailand.

1. Understanding the Legal Framework

Key Legal Restrictions:

Land Code Act B.E. 2497 (1954): Foreigners cannot own land in Thailand except under specific conditions.

Condominium Act B.E. 2522 (1979): Foreigners can own up to 49% of the total floor area of a condominium building.

Foreign Business Act B.E. 2542 (1999): Regulates foreign business activities and investments, impacting property purchases for business purposes.

Exceptions and Alternatives:

Board of Investment (BOI) Projects: Foreigners investing in BOI-promoted projects can acquire land under specific conditions.

Long-Term Leases: Foreigners can lease land for up to 30 years, with options to renew.

Thai Company Ownership: Forming a Thai company where foreigners hold less than 50% of shares allows indirect land ownership.

2. Types of Property Available for Purchase

Condominiums:

Freehold Ownership: Foreigners can own condominium units outright.

Ownership Percentage: The foreign ownership quota in a condominium building should not exceed 49%.

Leasehold Properties:

Land and Houses: Foreigners can lease land and houses for up to 30 years, with potential for renewal.

Registration: Leases exceeding three years must be registered at the Land Department to be legally enforceable.

Investment Properties:

Commercial Real Estate: Foreigners can invest in commercial properties through long-term leases or joint ventures with Thai partners.

Resort and Hotel Investments: Special regulations apply to foreign investments in resort and hotel properties, often requiring joint ventures.

3. Due Diligence and Legal Processes

Conducting Due Diligence:

Title Search: Verify the property’s legal status, ownership history, and any encumbrances or disputes.

Zoning and Land Use: Ensure the property complies with local zoning laws and land use regulations.

Environmental Compliance: Check for any environmental restrictions or issues affecting the property.

Engaging Legal and Financial Advisors:

Real Estate Lawyer: Hire a reputable lawyer specializing in Thai real estate to guide you through the legal processes.

Financial Advisor: Consult a financial advisor to understand tax implications, financing options, and investment strategies.

Steps in the Buying Process:

Reservation Agreement: Sign a reservation agreement and pay a reservation fee to secure the property.

Due Diligence: Conduct thorough due diligence with the help of legal advisors.

Sale and Purchase Agreement (SPA): Draft and sign the SPA, detailing the terms and conditions of the sale.

Deposit Payment: Pay a deposit, typically 10-30% of the purchase price.

Transfer of Ownership: Complete the transfer at the Land Department, paying the remaining balance and associated fees.

4. Costs and Taxes Involved

Purchase Costs:

Transfer Fee: 2% of the appraised property value.

Stamp Duty: 0.5% of the purchase price or appraised value, whichever is higher.

Withholding Tax: 1% of the appraised value or the actual sale price, whichever is higher.

Specific Business Tax (SBT): 3.3% of the appraised or actual sale price, applicable if the property is sold within five years of acquisition.

Ongoing Costs:

Common Area Fees: Monthly fees for maintenance of common areas in condominiums.

Property Tax: Annual property tax based on the assessed value of the property.

Utilities and Maintenance: Regular expenses for utilities, repairs, and maintenance.

5. Financing Options

Local Financing:

Thai Banks: Some Thai banks offer mortgage loans to foreigners for condominium purchases.

Eligibility Criteria: Generally, borrowers need to have a work permit, proof of income, and a good credit history.

Foreign Financing:

Home Country Banks: Some buyers secure financing from banks in their home countries, leveraging their assets abroad.

International Mortgage Providers: Specialized financial institutions provide mortgages for international property purchases.

Payment Plans:

Developer Financing: Some developers offer financing plans with staggered payments during the construction period.

Installment Payments: Buyers can negotiate installment payments directly with sellers or developers.

6. Common Pitfalls and How to Avoid Them

Legal Complications:

Unclear Title: Always verify the title to avoid disputes and ensure clear ownership.

Zoning Issues: Confirm zoning regulations to ensure the property can be used as intended.

Contractual Disputes: Have all agreements reviewed by a lawyer to prevent misunderstandings and ensure enforceability.

Financial Risks:

Currency Fluctuations: Be aware of exchange rate risks when making payments in foreign currency.

Hidden Costs: Account for all additional costs such as taxes, fees, and maintenance expenses.

Financing Challenges: Ensure you have a clear financing plan and understand the terms of any loans or payment plans.

7. Enhancing Expertise and Credibility

Demonstrating Professional Credentials:

Legal Qualifications: Highlight the legal qualifications and experience of your advisors and partners.

Professional Experience: Detail your experience in handling property transactions in Thailand.

Memberships and Affiliations: Include memberships in professional organizations like the Thai Bar Association, the Real Estate Broker Association, or international property associations.

Providing Authoritative References:

Cite Legal Documents: Reference specific sections of the Land Code Act and Condominium Act to support your points.

Expert Opinions: Incorporate insights from recognized experts in Thai real estate law and property investment.

Including Detailed Case Studies:

Client Testimonials: Feature testimonials from clients who have successfully purchased property in Thailand with your assistance.

Real-Life Examples: Provide detailed examples of successful transactions, highlighting any challenges overcome and solutions implemented.

Visual Aids and Infographics:

Process Flowcharts: Use flowcharts to depict the steps involved in the property buying process.

Diagrams: Create diagrams to visually explain key legal concepts and ownership structures.

#buying property in thailand#property in thailand#property lawyers in thailand#thailand#property#lawyers in thailand

2 notes

·

View notes

Text

The history of redlining

Leading social change:

Blog #2

By: Naymaa Ahmed

A discriminatory practice known as "redlining" first appeared in the US in the early 20th century, and Portland, Oregon, was one of its locations. Based on the racial or cultural makeup of a community, it refers to the systematic denial of financial services including loans, insurance, and investment opportunities. Due to the designation of some regions as "high-risk" or "undesirable" for financing, this practice disproportionately impacted African American communities and restricted their access to housing and other financial resources. locations such as Vanport, Oregon. Determining what is and is not within the purview of this research is essential for a better understanding of the issue. In this case, the research's primary focus would be on the background of redlining in Portland, including its inception, application, and impacted communities. It would also cover the current redlining-related socioeconomic gaps as well as any ongoing initiatives to alleviate these problems. draw attention to the long-term effects of redlining, including the aggravation of racial segregation in the city, wealth inequality, and the continuation of poverty throughout generations. Highlighting the interdependence of these matters can facilitate a more comprehensive comprehension of the extensive consequences of redlining on the impacted neighborhoods and Portland's general socioeconomic structure. As we go on to Redlings, the Federal Housing Administration provided veterans with mortgage loans, enabling millions of families to buy homes. Unfortunately, these loans did not help the black community because the criteria used to determine who would receive home loans were overtly racist, making it hard for people of color to buy a home even in times of prosperity. segregating everyone and assigning each applicant a color based on where their property is located. Albina and downtown Portland are redlined. Where, by coincidence, there are the most Black residents(Gross,2020). Due to all of the unconstitutional bills and decisions that were passed at that time. Today, it has a significant impact on the black community. Resulting in a 32% difference between White and Black Portlanders who own homes. All of this is the outcome of 150 years of redlining, mismanagement, and unabashed prejudice. Starting with the flood that destroyed Vanport as a city. Forcing tens of thousands of people to leave their homes and move into a neighborhood where it was obvious they were not wanted. All of this was the start & result of how racism was built into our housing systems in the 1940s.Redlining in Portland is a problem with roots in social inequality and systematic racism, which is one reason it matters. In addition to being morally reprehensible, discrimination based on race subverts the ideals of justice and equality that our society ought to uphold. Our concern for this issue reflects our recognition of the need to right historical wrongs and build a society that is more just and inclusive. What leads us to believe that Portland is now socially fair if it wasn't before? How can you be certain that these maps and bills aren't concealed somewhere in your city?

Sauer, Taryn. “Race and Housing Part III: Under the Guise of Renewal.” Habitat Portland Region, 31 Aug. 2020, https://habitatportlandregion.org/race-and-housing-part-iii-under-the-guise-of-renewal/

3 notes

·

View notes

Text

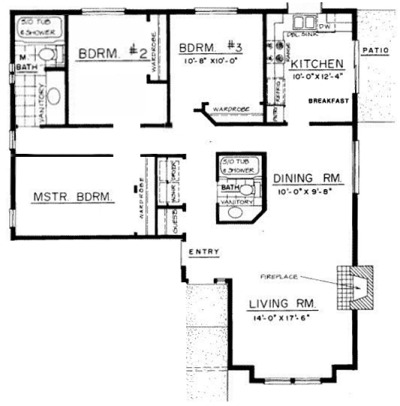

Master Bedroom is Shane’s room.

Bedroom 2 w/ En suite, is Noah’s room.

Bedroom 3 is Aaron’s room.

1 Kitchen that extends onto the Patio.

Dining / Living Room with a fire place.

Second bathroom, smaller and in the center of the home for guests.

Closet / Linen space opposite Shane’s bedroom

And a large, open Entrance way / with parking space

The building is a modern twist on Japanese life, though western in decoration and living. Wooden floors are non-slip and heated, central heating is expensive but worth it. Air Conditioning is in every room, an electric fireplace and eco-friendly windows to keep heat in and the cold out. State of the arts, almost too much for seemingly three Boys to afford, but thankfully, they don’t pay a dime for the place, as their Parents have built and bought this special place from the ground up.

A small garden, enough for the three of them to have some fun, but mostly to complete the look of the home, as they live on the outskirt of the city, and have neighbors. It’s often used more so for neighbor gathering, drinking parties over the fences, etc etc. Their neighbors are elderly and retired folks that are happy to see the boys thriving with life in the area.

The Leigh’s often get full-blown meals passed to them at their doors from the old baa-baas, it’s a nice feeling of community in the area. ( It’s also a very wealthy area but it’s kept on the hush-hush. )

The Leigh Home, is in the name of their Family.

It was created by approved planning commission for his Parents, when they had Noah. Whilst Noah was in hospital and Shane on their hip at the time, they gathered funds from their holiday plans and instead put it towards buying a plot of land. It took a while, lots of stress and worry but eventually, the Leigh House became what it is today.

The entire home was made with a wheelchair bound occupant in mind, making the door frames wider, ramps to the entrance and backyard, a whole section of low kitchen surfaces and cupboards, with the core value of independence. Noah grew with some confusion in his own bodies condition but with the home being accommodating to his every need, he grew with confidence and knowing when to ask for help and when to rely on himself in a healthy balance.

Aaron, Noah and Shane, occupy the house legally. The mortgage is paid for by his Parents, who are aboard with their jobs and they send living money through Direct Debit every six months in advance.

Shane and Noah, also work for everyday spending and living costs, meaning they have a hefty amount of money saved from their parents to cover costs of any mishaps that happen in the house or medical emergencies. Aaron doesn’t work, but he does get a weekly allowance to spend as he wishes, usually on games or food for lazy nights.

Shane’s qualified to aid with his brother’s medication buying, Noah old enough for his own trips, and Aaron when accompanied to the Pharmacy. Shane is currently teaching Aaron how to read his medication and doctor’s notes to fully understand what and where to buy his meds, and now is currently working on his brother’s confidence in talking to cashiers when getting his medication. ( he steps back at this point and lets Aaron hold his own in the front lines, but he is there when needed. ) This mission was succeeded within a few months and now Aaron thrives during his schooling terms and his hyperactive needs a met well with Volleyball.

When Aaron's volleyball team stop over, they are given futons or the option of using the massive L-shaped sofa to sleep on. Since the house has floor heating, it’s most common for his guests to have the futon since with the floor being a massive heat pad during the night too.

The Parents ::

Miharu Leigh, Mother, 55, Translator PA

Dave Leigh, Father, 57, Architect

Both currently overseas, renewing their vows and overseeing their companies newest builds.

3 notes

·

View notes

Text

I have crossed so many things off my long term to do list this month, I am feeling pretty good right now. Still staring down a bunch of Dr's appointments, a mortgage renewal and getting a job in the next 6 months (or less...) but I will take the feeling of accomplishment while it is around.

Have some pics of the mountains and my dog to celebrate.

5 notes

·

View notes

Text

How to Prepare for a Mortgage Renewal: A Step-by-Step Guide

Renewing a mortgage is a big financial step for homeowners. Whether this is your first mortgage renewal or the first of many, it is a chance to review your existing mortgage, adjust conditions, and ensure you're taking full advantage of your financial circumstances. To assist you in successfully navigating this process, we have compiled a thorough, step-by-step guide on getting ready for a mortgage renewal.

What Is a Mortgage Renewal?

You must renew your mortgage when the current term expires, and you will owe money. By renewing your mortgage, you can negotiate new conditions with your current lender or a new one, including interest rates, payment plans, and amortization durations. Careful planning can result in long-term cost savings and advantageous conditions.

Step 1: Review Your Current Mortgage Terms

Start by becoming aware of the specifics of your existing mortgage, such as:

Interest rate and type (fixed or variable).

Remaining balance.

Amortization period.

Prepayment options.

You might find places for improvement in your mortgage agreement by being aware of where you stand.

Step 2: Start Early

Avoid until the very last minute. Lenders often send A notice of renewal four to six months before the end of your term. This is an ideal moment to:

Examine the market's current mortgage rates.

Check to see if your financial status or aspirations have changed.

To evaluate your possibilities, compare offers from other lenders.

If you start early, you will have time to bargain and steer clear of hasty selections.

Step 3: Evaluate Your Financial Goals

Your mortgage ought to be in line with your present financial goals. Think about these queries:

Has your income gone up or down?

Do you intend to pay off your mortgage more quickly?

Would you like your debts to be consolidated into your mortgage?

Your responses can help you select phrases that meet your changing requirements.

Step 4: Shop Around for Better Rates

Don't feel pressured to continue using your present lender. You can find better terms and reasonable pricing by shopping around. To draw in new customers, several lenders provide promotional rates. To obtain the most excellent bargain:

Use mortgage comparison websites.

For knowledgeable guidance, speak with a mortgage broker.

Request written quotes from multiple lenders.

Step 5: Negotiate with Your Lender

Even if you're happy with your don't lender, don't accept their first offer withoHere'sotiation. Here's how to discuss the rates you've gathered as leverage.

Ask about discounts, flexible payment options, or other benefits.

Inquire about waiving renewal fees.

Lenders often prefer to retain existing customers, so they may be willing to match or beat competing offers.

Step 6: Consider Refinancing or Switching Lenders

Switching lenders might not be worthwhile if the terms offered by your current lender are not competitive. Remember:

Extra costs may be associated with refinancing, such as assessment or legal fees.

Make sure the benefits of better terms outweigh the expenses of moving.

To help with these costs, specific lenders could provide cashback incentives.

Step 7: Plan for Prepayment Opportunities

Use any available prepayment alternatives to lower your principal balance before renewing. Reducing your monthly payments or shortening your amortization period could save you money on interest over time.

Step 8: Finalize Your Decision

Review the agreement carefully before signing once you have negotiated terms that meet your needs. Pay close attention to:

The interest rate.

Penalties for early repayment.

Any conditions or fees.

To prevent surprises later, get clarity on any unclear areas.

Read More: https://gnemortgages.com/step-by-step-guide-for-mortgage-renewal-process/

Conclusion

Preparing for a mortgage renewal is an opportunity to reassess your financial strategy and secure terms that benefit you. By following these steps—reviewing your current mortgage, starting early, evaluating financial goals, shopping around, and effectively negotiating—you will be well-prepared to make the best decision. Taking a proactive approach to mortgage renewal will ensure a smoother process and set you up for financial success in the years ahead. Contact us to explore your options and get expert guidance tailored to your needs.

0 notes

Text

Whether the Interest Rate Rises or Falls, Inflation Is Here to Stay

by Joseph Solis-Mullen | Nov 21, 2024

In an economic landscape shaped by the aggressively rising prices of 2020-2022, the Federal Reserve’s monetary policy pendulum swung dramatically. Starting from rock bottom rates, it engaged in a series of hikes the likes of which had not been seen since the early 1980s, moving from less than 1% in February 2022 to over 4% a year later. Going still higher with rates above 5% by the end of 2023, the Federal Reserve held rates there for the first half of 2024 in an attempt to bring the Consumer Price Index (CPI), one of its preferred price gauges, down from the scorching 9% peak in the summer of 2022.

Under pressure from Wall Street to the Treasury, both of whom have become dependent on cheap borrowing, to start cutting interest rates as quickly as possible once the annualized rate of price growth neared the desired 2% target, the Fed began easing rates in September.

However, this cutting cycle, anticipated by reacceleration of money supply growth starting in January 2024, coupled with broader economic dynamics, has coincided with a reacceleration of price levels, raising questions about the durability of the Fed’s “victory,” particularly in conjunction with some of the economic policies being floated by Donald Trump for his second term that could lead to massive upward pressures on prices.

Indeed, recent data suggests the price level is inching back up. In October, the CPI rose to 2.6% annually, marking the first increase in headline inflation in seven months. Meanwhile, core inflation—a measure that excludes volatile food and energy prices—has risen at an annualized pace of 3.4% to 3.8% for three consecutive months, signaling persistent underlying price pressures.

Some of these pressures stem from the same structural issues that drove price increases during the pandemic years. Housing costs, which contributed significantly to the recent uptick, remain elevated despite softening rents for new leases. Median home prices have surged 30% since early 2020, leaving Americans to shoulder higher mortgage payments and rents. Food and energy prices have also remained stubbornly high, with egg prices nearly doubling since pre-pandemic times and gasoline costs up 16%.

This resurgence underscores a critical reality: while the pace of the increase of the price level may have “slowed,” prices remain substantially higher than their pre-pandemic levels. Consumers, therefore, continue to feel the squeeze, even as wage growth outpaces inflation. This is a dynamic that Federal Reserve Chair Jerome Powell has cautiously acknowledged as insufficient to reignite significant inflationary pressures on its own, though a wage-price dynamic is far from out of the question as the labor market remains historically tight in the face of large generational turnover.

Precedent, particularly that of the 1970s, demonstrates that loosening monetary policy before the price level is firmly anchored can lead to renewed price surges. October’s data aligns with these warnings, showing how even modest economic shifts can push the price level higher.

0 notes

Text

Is your mortgage term ending soon?

Explore options to secure a better interest rate and save money!

Contact us today for a renewal consultation! 📞 Ph No.: 416-409-5733 ✉ Email Us: [email protected] 🌐Website: https://www.menonfinancial.com/mortgage-renewal-ontario/

#MortgageRenewal#LowerInterestRates#SaveOnMortgage#SmartHomeFinance#RenewAndSave#MortgageOptions#BetterRate#FinancialSavings#HomeOwnership#RefinanceSmart

0 notes

Text

Renew Your Mortgage in Ontario - Get the Best Rates Today

Looking to renew your mortgage in Ontario? Our expert team can help you find the best rates and terms. Contact us today to get started.

#Mortgage renewal#Renew mortgage#Mortgage renewal rates#Best mortgage renewal rates#Mortgage renewal process#Mortgage renewal calculator#Renewal mortgage rates Ontario#Mortgage renewal options#Mortgage renewal terms#Mortgage renewal advice#Mortgage renewal fees#Mortgage renewal with bad credit#Mortgage renewal tips#Renewal mortgage broker#Mortgage renewal specialist

0 notes

Text

The Real Estate industry has been a lucrative way to increase the value of land. Due to the recent boom in the real estate sector in the last few years, investors have been enjoying a return on investments out of their wise decision of investing at the right time and the right place. Through productive ways to reap benefits out of property investments, many real estate stakeholders enjoy seamless and smooth returns. This healthy cycle of investment has led to the emergence of numerous large infrastructural companies.

How to make money out of Property Investments?

Making money in real estate requires a lot of research, certain skills, contacts, and a handsome investment. Whether you’re an individual or a company. Legal clearances are equally important. Hence, every procedure must take place within the legal framework only. With a smooth workflow and regular investing cycle, you can easily reap the benefits of your investments from the properties you have purchased.

Importance of Real Estate Investing

Real estate can be the best business option in several ways. If you act as a broker or agent between buyer and seller, you can charge a commission. Based on the volume of business, the above involves the lowest investment and handsome earnings. It is possible to make money in real estate by investing your savings for long-term gain. People and companies often choose to buy large properties and resell smaller parcels of land or make residential complexes or colonies out of them.

Long-term rentals

Property owners can enjoy long-term rentals. Long-term rentals are a common way to make money in real estate for a property owner. Rental properties that are rented for more than six months are considered long-term rentals. In India, the lease/rent deed is usually signed for 11 months and is then renewed subject to mutual consent and some legal considerations.

Paying Guest Rentals

In this case, the property owner offers working people and students housing in addition to occasionally providing food, laundry, security, and other services. In this manner, the tenant may fully concentrate on his work or studies without having to worry about the needs of their home.

Commercial Property Returns

One of the most alluring ways to profit from real estate is the business sector. Over the past few decades, it has drawn numerous significant investors and businesses. These investors buy houses and then upgrade, renovate, and build new ones according to local requirements before renting them out. In this manner, a one-time fixed investment yields lifetime handsome profits.

REITs

An individual can invest in a significant, income-producing piece of real estate through a real estate investment trust (REIT). Large-scale real estate includes, but is not limited to, shopping malls, office buildings, hotels, apartments, self-storage facilities, resorts, warehouses, mortgages, and loans. Investors in REITs benefit from the real estate market by obtaining a percentage of the revenue from the commercial real estate they have invested in.

If you are looking to make money out of property investments, make sure to consider the options above. At Flivv Developers, we discuss and talk about many more aspects in real estate. You can easily invest with us and get free consultations. Reach out to us via direct call/email or fill out the site form to know more about Real Estate in and around Hyderabad.

0 notes

Text

Edmonton First Time Home Buyer – Making The Right Choice

Going for home purchase could be one of the most exciting moments in an individual’s life, or in this case as a first time buyer, could be a very overwhelming experience. Just knowing when the best mortgage rates occur through to the finer details of loan applications can be daunting.

The edmonton first time home buyer can only benefit from the services of an experienced private refinance service provider vancouver who will help them navigate through each process independently. These players know different types of loan products and the needs of creditors to help new buyers to select the most suitable mortgage offer.

Private Refinance Service Provider Vancouver

They also assist the buyers in making comparisons between the various forms of mortgages places in the market including the fixed rate mortgage, the variable rate mortgage, the hybrid mortgage and others, and the prospects and futures of each of the packages offered as matched to the dreams of the buyers.

Apart from helping homeowners to find the best mortgage terms, private refinance service providers are also useful for homeowners planning to restructure their current mortgage loans. Private refinance services are advisable for anyone who wants to; pay a lower interest on their home, make smaller monthly payments, or; obtain the equity built in the home.

Thanks to flexible lending conditions, private lenders are capable to provide refinancing to individuals with uncommon financial status. This option will be especially significant in Vancouver since property prices remain high, and people may need to benefit from a more favorable mortgage rate when it comes to personal finance.

One of the advantages in using the services of a private refinance service provider vancouver is that they may give shorter span of approval and more flexibility in the loan terms. Nevertheless, it is crucial for the homeowners to consider the trend of rate increase when concerning the advantages of flexible and convenient private refinancing. An independent appraiser guides you through the procedure if you are an edmonton first time home buyer or if you are asking for a renewal of your mortgage. Help from private refinance service provider vancouver is turning these processes into the joy from which you will derive benefits as a homeowner in the long run.

#Private Refinance Service Provider Vancouver#No Down Payment Mortgage Edmonton#Best mortgage broker Edmonton

0 notes

Text

Republicans Take Control of the House: What It Means for Housing Under Trump

With Republicans officially winning control of the U.S. House of Representatives, President-elect Donald Trump now has a clear path to advance his ambitious housing agenda. The Associated Press called the final race needed to secure a GOP majority, declaring Rep. Juan Ciscomani the winner in Arizona’s Sixth Congressional District. With nine races still too close to call, the GOP majority will set the stage for Trump’s policy priorities in both chambers of Congress.

A Turning Point for Housing Policy

Trump’s campaign promises on housing affordability were bold: cutting the cost of new homes by half, reducing mortgage rates to under 3%, and eliminating regulations that drive up construction costs. With Republicans controlling the House, Senate, and a conservative-leaning Supreme Court, the opportunity to act is unprecedented.

“We will eliminate regulations that drive up housing costs with the goal of cutting the cost of a new home in half. We think we can do that,” Trump stated during his campaign at the Economic Club of New York. He also pledged to open portions of federal land for home construction to address the critical shortage of housing supply.

Can Trump Deliver on Lower Mortgage Rates?

One of Trump’s standout promises is to slash mortgage rates, which currently average 6.79% according to Freddie Mac. While presidents traditionally have no direct control over mortgage rates—largely influenced by long-term bond yields and investor expectations—Trump’s broader economic policies, such as tax cuts and deregulation, could play a role in creating downward pressure.

Still, economists are skeptical of Trump’s ability to achieve a sustained drop to rates below 3%. Historically, such rates are associated with recessionary periods or extraordinary Federal Reserve interventions, not a booming economy.

Potential Challenges Ahead

While Trump’s housing agenda includes proposals to stimulate supply and reduce costs, some of his signature policies may inadvertently complicate these goals:

• Tariffs on Construction Materials: Nearly 10% of residential construction materials are imported. Additional tariffs could raise costs for homebuyers and developers.

• Labor Shortages Due to Immigration Policies: Undocumented immigrants comprise an estimated 15% of the U.S. construction workforce. Mass deportations could lead to labor shortages, higher wages, and construction delays.

Affordable Housing at Risk?

The National Low Income Housing Coalition has raised concerns over Trump’s potential impact on affordable housing programs. During his first term, Trump pushed for significant cuts to Department of Housing and Urban Development (HUD) programs, including Housing Choice Vouchers, and eliminated programs like the National Housing Trust Fund.

With a Republican-controlled Congress, funding for rental and homelessness assistance programs could face renewed scrutiny. These policy shifts could further exacerbate the challenges for low-income families already struggling with housing costs.

The Road Ahead

Trump’s ambitious housing proposals now face their biggest test: implementation. While his focus on deregulation and expanding the housing supply aligns with what many economists agree is necessary to address the affordability crisis, challenges like tariffs and immigration policies could counteract some of these benefits.

For real estate developers and investors, the next few years could present both opportunities and uncertainties. If Trump’s policies succeed in boosting housing construction and cutting costs, developers may find new avenues for growth. However, potential disruptions in labor and materials could add complexity to the equation.

As Trump takes the reins with a supportive Congress, all eyes will be on how his administration navigates these opportunities and obstacles to shape the future of U.S. housing.

#donald trump#real estate#investment#politics#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#construction#homes#housing forecast

0 notes

Text

Term Insurance vs. Whole Life Insurance: Which is Right for You?

When considering life insurance, two popular options often come up: term insurance and whole life insurance. Both types offer distinct advantages, and the right choice depends on your financial goals, family needs, and budget. In this blog, we’ll dive into the differences between term and whole life insurance, helping you decide which plan aligns best with your needs.

What is Term Insurance?

Term insurance is a type of life insurance policy that provides coverage for a specific period, typically 10, 20, or 30 years. It’s designed to offer financial protection to your beneficiaries if you pass away during the policy term.

Key Features of Term Insurance:

Affordability: Term insurance is often more affordable compared to whole life insurance, making it an attractive choice for those seeking substantial coverage without high premiums.

Fixed Coverage Period: The coverage lasts for a predetermined period. If you outlive this term, the policy expires, and there’s no payout unless it’s a renewable or convertible plan.

Pure Protection Plan: Unlike whole life insurance, term insurance doesn’t accumulate cash value. Its primary purpose is to provide financial security to your loved ones in case of your untimely demise.

Pros of Term Insurance:

Lower Premiums: Since term policies cover only a set period, they have lower premiums than whole life policies, allowing policyholders to access high coverage amounts at a fraction of the cost.

Flexibility in Policy Duration: With various options for policy terms (e.g., 10, 20, 30 years), you can choose a term plan that aligns with significant life stages or financial responsibilities, like a mortgage or child’s education.

Straightforward Structure: Term life insurance is easy to understand, with no complex investment or cash value components involved.

Cons of Term Insurance:

No Cash Value: Once the term ends, you don’t receive any payout or return of premiums, unless you have a return of premium term insurance plan.

Limited Coverage: The policy only provides benefits if the insured passes away within the coverage period.

Best for:

Individuals seeking temporary, high-coverage life insurance to secure their family’s future financially, typically with a limited budget or specific time-bound obligations.

What is Whole Life Insurance?

Whole life insurance, as the name implies, provides lifelong coverage. It combines a death benefit with a savings component, known as cash value, which grows over time on a tax-deferred basis.

Key Features of Whole Life Insurance:

Lifelong Coverage: Whole life insurance remains in effect as long as you continue paying premiums.

Cash Value Accumulation: A portion of your premium goes into building cash value, which you can borrow against or withdraw as it grows.

Guaranteed Premiums and Benefits: Whole life insurance often has fixed premiums, meaning they remain the same throughout your life, along with guaranteed death benefits.

Pros of Whole Life Insurance:

Cash Value Growth: Over time, the policy accumulates cash value, which can serve as a financial asset for emergencies, retirement, or other needs.

Lifelong Protection: Whole life insurance doesn’t expire as long as you pay the premiums, offering peace of mind with lifetime coverage.

Predictable Premiums: With whole life insurance, premiums are typically fixed, making it easier to budget over the long term.

Cons of Whole Life Insurance:

Higher Premiums: Whole life insurance premiums are significantly higher than term insurance, which can strain budgets, especially if you’re seeking high coverage.

Complex Structure: Whole life insurance includes savings and investment components, which may not appeal to those looking for straightforward protection.

Best for:

Those seeking lifetime coverage with a savings component or individuals interested in a long-term investment through their life insurance plan.

Comparing Costs: Term Insurance vs. Whole Life Insurance

In terms of premiums, term insurance is generally the most affordable option because it’s a straightforward policy without any savings or cash value benefits. For instance, if you’re looking at a term plan with substantial coverage, the best term insurance plan can offer large amounts at relatively low monthly payments, especially for younger policyholders.

On the other hand, whole life insurance, due to its cash value and lifetime coverage, comes with higher premiums, which may be better suited for those with a higher budget who are interested in long-term financial planning. Additionally, many term life insurance quotes can provide a better cost-benefit analysis for young families, making term plans more accessible to a wider audience.

Which One is Right for You?

The choice between term insurance and whole life insurance depends on your financial goals:

If your goal is affordability and specific time-bound coverage: Term insurance is ideal. It’s a great choice if you want to protect your family during key financial obligations, like paying off a mortgage or funding your child’s education.

If your goal is lifelong coverage with a savings component: Whole life insurance is the better option. It’s suitable for individuals who want permanent protection, an investment element, or access to cash value in the future.

Making the Right Choice

Choosing between a term insurance plan and whole life insurance is a critical decision. Term insurance provides pure protection at an affordable rate, making it suitable for families needing financial security during specific life stages. In contrast, whole life insurance offers a blend of lifelong coverage and investment benefits, ideal for those seeking an asset with cash value.

For many, a term policy might be the initial step towards securing a family’s financial future, while whole life insurance could serve as a comprehensive plan that grows with time. To make the best choice, consider evaluating types of life insurance available, your financial responsibilities, and long-term goals.

In summary, term insurance and whole life insurance each serve unique purposes. By understanding their benefits and limitations, you can choose the best insurance plan to secure your family’s future. Whether you’re opting for a best term life insurance policy or investing in whole life, ensure your decision aligns with your financial plans and personal needs.

#insurance#term insurance#life insurance#term insurance plans#term insurance policies#insurance plans#term life insurance

0 notes