#Mortgage renewal rates

Explore tagged Tumblr posts

Text

#best mortgage renewal rates#debt consolidation mortgage#mortgage renewal fees#mortgage renewal advice#mortgage renewal options#mortgage renewal rates#mortgage renewal

0 notes

Text

Done Mortgage’s Expert Advice on Mortgage Renewal Rates in Ontario

When your mortgage term is approaching its end, it's time to consider renewing your mortgage. For homeowners in Ontario, mortgage renewal can be a significant financial decision. With fluctuating interest rates and various lender offers, choosing the right mortgage renewal rates in Ontario is crucial. At Done Mortgage, we’re committed to helping you understand your options and make informed decisions that fit your financial goals.

What is a Mortgage Renewal?

A mortgage renewal occurs when the term of your mortgage is about to expire, and you need to sign a new agreement for the remaining balance. Homeowners in Ontario typically have mortgage terms lasting between one to five years. At renewal time, you can either continue with your current lender or explore new mortgage renewal rates in Ontario. Done Mortgage recommends taking this time to evaluate the best rate and terms available.

Why Do Mortgage Renewal Rates Vary?

Several factors impact mortgage renewal rates in Ontario. These include changes in the Bank of Canada’s interest rates, market conditions, and your financial situation. Lenders may offer different rates based on their policies and the level of competition in the market. Done Mortgage helps you stay on top of these fluctuations to ensure you secure the best possible rate.

How Can You Get the Best Mortgage Renewal Rate?

To secure the best mortgage renewal rates in Ontario, it’s important to start shopping around early. Begin your search a few months before your mortgage term ends. Contact Done Mortgage to compare rates from various lenders and negotiate better terms. We have strong relationships with multiple financial institutions, allowing us to find competitive offers for our clients.

Fixed vs. Variable Mortgage Renewal Rates

When renewing your mortgage, you’ll often have the option between fixed and variable rates. A fixed rate remains the same throughout the term, providing stability in your payments. A variable rate, on the other hand, fluctuates with the market. Deciding between the two depends on your risk tolerance and financial goals. Done Mortgage will walk you through these options to help you understand which type of mortgage renewal rates in Ontario suits your needs.

Should You Stay with Your Current Lender?

While it might seem convenient to renew your mortgage with your current lender, it’s not always the best option. Often, your lender’s offer may not be the most competitive. Done Mortgage suggests taking the time to compare other mortgage renewal rates in Ontario before committing. We can help you negotiate a better rate, even if you decide to stay with your current provider.

The Importance of Mortgage Term Flexibility

When renewing, it’s important to not only focus on the rate but also the flexibility of your mortgage terms. Prepayment privileges, payment frequency, and the ability to make lump sum payments are all important factors. Done Mortgage can advise you on finding a mortgage that gives you the most control over your financial situation while still securing favorable mortgage renewal rates in Ontario.

The Role of a Mortgage Broker in Renewal

Working with a mortgage broker like Done Mortgage can be a game changer when it comes to finding the best mortgage renewal rates in Ontario. Brokers have access to multiple lenders and can compare a wide variety of offers to find the most suitable option for your unique needs. We handle the negotiation and paperwork, saving you time and ensuring you get the best deal.

Conclusion

Navigating mortgage renewal rates in Ontario doesn’t have to be stressful. With the right guidance and resources, you can find a renewal option that aligns with your financial goals. Done Mortgage is here to help you through every step, from comparing rates to securing the best deal. Reach out to us today to learn more about your mortgage renewal options in Ontario.

#Construction Mortgage#Mortgage Renewal Rates Ontario#Construction Mortgage in Ontario#Best Mortgage Brokers In Ontario#mortgage near me

0 notes

Text

Expected wave of mortgage renewals contributed to latest rate hold: Bank of Canada

The large number of mortgages coming up for renewal at higher rates is one reason why the Bank of Canada decided to leave its target rate unchanged at 5.00% last month. Bank of Canada Governor Tiff Macklem made the comment Wednesday while testifying before the Standing Senate Committee on Banking, Commerce and the Economy. “One of the important reasons why we held our policy rate at 5% is that we…

View On WordPress

0 notes

Text

Expanded overtime guarantees for millions

First over-the-counter birth control pill to hit U.S. stores in 2024

Gun violence prevention and gun safety get a boost

Renewable power is the No. 2 source of electricity in the U.S. — and climbing

Preventing discriminatory mortgage lending

A sweeping crackdown on “junk fees” and overdraft charges

Forcing Chinese companies to open their books

Preventing another Jan. 6

Building armies of drones to counter China

The nation’s farms get big bucks to go “climate-smart”

The Biden administration helps broker a deal to save the Colorado River

Giving smaller food producers a boost

Biden recommends loosening federal restrictions on marijuana

A penalty for college programs that trap students in debt

Biden moves to bring microchip production home

Tech firms face new international restrictions on data and privacy

Cracking down on cyberattacks

Countering China with a new alliance between Japan and South Korea

Reinvigorating cancer research to lower death rates

Making medication more accessible through telemedicine

Union-busting gets riskier

Biden inks blueprint to fix 5G chaos

Biden empowers federal agencies to monitor AI

Fixing bridges, building tunnels and expanding broadband

The U.S. is producing more oil than anytime in history

Strengthening military ties to Asian allies

A new agency to investigate cyberattacks

Making airlines pay up when flights are delayed or canceled

READ THE DETAILS HERE

I'm going to add one more here

22 notes

·

View notes

Text

Gaslight, Chapter 14/48

Rated X | Read it here on AO3

Six weeks later

“I’ll be home late,” Diana tells him, rushing around as she scrambles to get out the door. “Don’t forget to put the garbage out tonight.”

He nods, sipping from his coffee mug. Frenchie rests her head on his thigh and he gives her a pat, an unspoken promise that they will go for a walk soon.

“Did you call the cable company?” Diana asks, halting in the doorway of the laundry room.

“No, but I will,” he says.

“Okay, thank you,” she continues, collecting shoes, briefcase, purse, travel coffee mug. “Please remember to take your medication. See you tonight.”

She gets as far as the door into the garage, then turns back and hurries over to him, her heels clacking against the tiled floor. She kisses him briefly on the cheek, and then is out the door in a flash, leaving him and Frenchie alone in the house.

“All right, French Face, let’s go,” he says, and the dog woofs, her tail wagging excitedly.

The heat of early summer is already warming the pavement, sending the metallic, earthy smell of concrete and dandelions up into his nose. Frenchie trots happily beside him, stopping to inspect bushes and street signs for messages left behind by other dogs. The Children’s House is noisy and chaotic, the older children waiting at the corner for the bus and the younger ones puttering around the driveway as their mother supervises the whole lot from the front porch. She waves and he waves back, then crosses the street so he doesn’t distract the children with his appealing furry friend.

He’s beginning to sweat by the time they make it back to the house, which exacerbates his already buzzing nerves. From the back of the closet he pulls out his nicest suit, black Armani, and pairs it with a blue dress shirt and black tie. When his wingtips are on his feet and his hair is styled just so, he lets Frenchie outside one last time, then leaves her with a bone that should entertain her for the several hours she’ll be confined to the house. He climbs into his car and navigates out of the neighborhood and then onto the turnpike, his stomach already in knots.

It’s the lie that bothers him the most, followed closely by the possible outcome if this goes to plan. Sneaking around, lying, obfuscating: these are things he swore he would never do again, promises he made on his knees as his whole life flashed before his eyes. And here he is, letting Diana believe that he will spend the day at work and then helping Fred put together his new entertainment center when he will be nowhere near his office, nor Fred’s house.

He tried to talk to her about it. Several times, several ways. He made frequent mention of feeling unfulfilled by his work, demonstrated a renewed interest in exploring the unexplained. When his subtlety went unnoticed, he directly told her that he had thought about re-engaging with the FBI and moving back to the DC area.

“Absolutely not,” she’d said emphatically, setting her fork down and turning more fully toward him in her seat at the kitchen island. “We’re established here, Jeff. I have a career here, we have friends and a mortgage. I’m not interested in starting over again.”

Just start again.

He attempted to compromise and suggested that he could work out of the Philadelphia field office instead of Quantico or the Hoover if the Bureau would have him back, perhaps even consult as a behavioral specialist. The answer across the board was no. No to relocating, and absolutely no to re-joining the FBI. The level of anger in her response left him feeling hurt and confused, wondering why she was more focused on the quality of his ideas for improving his own happiness than the fact that he’s unhappy in the first place.

Had she asked, he would have told her that he feels stuck. Stuck in a job that’s no longer fulfilling, stuck in a daily routine that’s become predictable and boring, stuck in a life that he isn’t sure he ever wanted to lead in the first place. Diana herself spends enormous amounts of time at work in Philly, and when she’s home she holes up in the office, on phone call after phone call well into the evening hours. He empathizes with the stressful nature of her job, but he sometimes feels like he doesn’t have a wife at all.

This job posting fell into his lap, literally. Diana brought in the mail and tossed his favorite newspaper unceremoniously in his direction, and he caught it by the folded edge before it fell to the floor. It opened itself to the classifieds, and a particular advertisement caught his eye.

Seeking Trained and Experienced/Licensed Therapists for Clinical Research

John Hopkins Bayview Medical Center

Department of Psychiatry Administration

It felt like fate. A new city, a new job, one that seeks to find answers to as yet unasked questions. And so he applied, and got a call the very next day. If he’s offered the position, he will have to make a choice: decline and continue slogging through each day of this unfulfilling life, or accept and tell Diana that he’s going, with or without her. At this moment in time, flying down the freeway at seventy miles per hour with Green Day filling his ears, both options are too terrifying to even consider.

The interchange comes up and he is faced with the first choice that will lead him to a series of others: stay on the turnpike and drive into Philly, or get on 476 and head south. One way to more of the same, the other to the great unknown.

He exits, taking 476 south, calculating about two hours to Baltimore.

-

“Thank you for your time, Mr. Spender. I can’t make any promises, but I can tell you that we’re very impressed with your work history and your intended research methodology.”

He stands, accepting the proffered hand and focusing on a firm, confident handshake.

“Thank you for the opportunity, Mr. Bering. If there are any questions that come to mind, anything I may not have answered, please feel free to reach out by phone or email. Based on what you’ve shared about the work you do here, I’m very interested.”

He’s escorted back to the lobby, though he and Mr. Bering continue talking for upwards of fifteen minutes. By the time he walks back through the doors into the late afternoon sun, he feels buoyant and hopeful for the first time that he can remember in years.

The nature of the research, the opportunity to be a part of a dedicated team and impact the course of treatment for test subjects, his own office, a salary that exceeds his current earnings: it’s all too good to be true. He has the reflexive thought that he can’t wait to tell Diana, but then remembers that she will be anything but happy for him. He’ll have to wait and find out if he gets an offer before he broaches the subject with her—no use overturning the whole apple cart for nothing.

He returns to his car, too optimistic to be bothered by the parking ticket pinned under one of his windshield wipers, and heads back toward the highway. Just before he gets to the on-ramp, he sees a small coffee shop and decides to stop. This day is already going so well, a cup of decent coffee would only serve to make it even better.

He waits in line, debating getting a cookie but ultimately deciding not to risk getting crumbs all over his good suit.

“Hi, welcome in. What can I get for you?” the barista coos with a genuine smile.

“Just a large black coffee, please. No room.”

“You got it,” she says, throwing him a flirtatious wink that makes him think he should wear this suit more often.

He pays and makes his way over to the coffee bar to wait. He starts to think about how he might break the news to Diana, but quickly decides to focus on the positive and imagines himself living here, driving into work each day to do something different, maybe even stopping for coffee at this very shop.

“Latte for Dana,” the barista calls out, sliding a lidded paper cup across the countertop.

He realizes that the life he’s imagining: his morning routine, his evenings in a one bedroom apartment—ground floor for easy dog walking—don’t include Diana at all. And perhaps that’s because he already knows what her answer will be.

Just start again.

He becomes aware of someone standing very near to him, too close to be another patron waiting for their coffee. He looks over to find a very petite woman with red hair and a fair complexion staring at him, an oddly intense expression on her face. She’s quite pretty, but she also looks distraught.

“Mulder?” she says, her voice husky, and his eyebrows furrow, confused. “Mulder, it’s me,” she says insistently, and it’s clear that she thinks she knows him.

“Black coffee for Jeff.”

“I’m sorry, I think you’ve mistaken me for someone else,” he says gently, and the way her face falls feels like a punch to the gut.

“Your name isn’t Mulder?” she asks, her voice growing tight as her eyes well with tears.

“No, I’m Jeff,” he says, offering his hand reflexively. “Jeff Spender.”

“Oh,” she says, a tiny ghost of a sound, as she places her hand limply in his and allows him to pump it up and down twice. She shakes her head gently, remembering her manners, and then says, “Dana. I’m Dana.”

“I think these are our coffees, Dana,” he says with an attempt at a smile, stepping forward to pick up both cups before handing one to her.

“Thank you,” she says in a near whisper, wrapping both hands around her cup and staring down at the lid.

“Are you okay?” he asks, feeling worried for this stranger who is clearly not quite in her right mind.

She looks up at him, and he’s momentarily taken aback by the icy blue of her eyes. Like ocean water. Like glaciers. Like the sky on a cloudless day.

“Yes, I’m fine,” she says, much more confidently.

They both head for the doors of the coffee shop, and he takes two long strides to get ahead of her, holding the door open as she walks through.

“Thank you,” she murmurs, squinting against the sun.

They stand awkwardly on the sidewalk, and he has an odd feeling of responsibility for her, like he shouldn’t leave her here in the state that she’s in.

“Are you sure you’re okay?” he asks, searching her face. “Is there someone you can call?”

She clears her throat and looks at the ground.

“Yes, my husband. But I’m fine, really. I just have a short drive home,” she insists, though not all that convincingly.

“Are you local?” he asks, continuing to make conversation for reasons he doesn’t understand. “I might be moving here soon, actually. From Philly.”

“No,” she answers blandly. “Ellicott City.”

“Ah,” he says, bobbing his head.

Awkwardness descends over them, and though he still feels compelled to see to her safe return home, he accepts that this is where his interaction with her will end.

“It was nice to meet you, Dana. Take care,” he says, and she looks up at him with some mix of alarm and melancholy.

“You too…Jeff,” she replies, dazed

He returns to his car, then sits and watches as she stands on the sidewalk for several minutes looking devastated, then finally climbs into a slate gray BMW. For several more minutes her car sits, unmoving, and eventually she pulls out of the lot and drives away.

He heads back north, arriving home to an empty house, save for Frenchie. He stashes his suit, changes into running shorts and a T-shirt, and they go on an evening run together, burning off her energy and his excitement. He keeps thinking about the woman at the coffee shop, and how disappointed she seemed that he was not whoever she was looking for. He has the urge to help her somehow, to find this Mulder who must bear some resemblance to him.

When he gets home, he feeds Frenchie and takes his blood pressure medication, then grabs a pen from the junk drawer and scrawls “Mulder” on a post-it note. Maybe he’ll do some internet sleuthing, just as a project. Maybe he’ll find his doppelganger and tell him that Dana in Ellicott City is trying to find him.

He eats dinner, showers, and is reading in bed when he hears Diana come in through the front door. There is the thunk of her discarding her heels, the opening and closing of cupboards, the tinkle of ice cubes as she makes herself a drink. He considers pretending to be asleep so he won’t have to lie about his day, and is just closing his book when her voice booms up the stairs.

“Jeff?!” she says in an alarmingly serious tone that has him scrambling out of bed and down the stairs to see what’s wrong.

“What is it?” he says, his heart racing and his feet fumbling over the steps.

He arrives in the kitchen to find her holding the post-it note like it’s a pair of unfamiliar panties, and she looks up at him with a horrified expression.

“What is this?” she asks, turning it so he can see his own handwriting.

“I think it’s a name?” he answers, confused by her demeanor.

“Where did you get it?” she asks sharply.

He steps forward, taking it from her hand.

“I was at a coffee shop today and this woman came up to me and called me ‘Mulder.’ She thought I was someone else. I was thinking about maybe looking into it,” he says lightly, downplaying the situation and leaving out the detail about what city he was in when the exchange took place.

“Looking into what?” she asks, her tone still suspicious and hard.

“I don’t know,” he says with a shrug, tossing the post-it onto the kitchen counter. “Nothing, I guess. It was just odd. She really seemed sure I was this other person. Forget about it, Diana, it’s not a big deal.”

“What did she look like?” Diana asks, crossing her arms over her chest.

“Who?”

“The woman in the coffee shop.”

He recognizes the true concern here. She’s taking this as a red flag, a bread crumb. The fact that he is hiding something from her only makes the stakes higher. He could tell her about the job interview, or he could let her think that he’s sneaking around again, meeting up with strange women. He decides to go with another lie.

“Fifties, brown hair, heavy set,” he says convincingly. “She didn’t look familiar to me at all, which is what made it so weird. But honestly, Diana, it’s nothing. You can just throw that out.” He begins to walk away, showing complete disinterest in the post-it and the name written there. “You coming to bed?” he asks, one foot already on the bottom step.

“In a bit,” she says flatly. “I need to make a phone call.”

He listens as she walks to the office, Frenchie’s claws clicking across the tile as she follows. When the office door closes, Frenchie whines at having been locked out. He hears the murmur of Diana’s voice as she makes a phone call, the pitch of it increasing and then decreasing sharply over and over.

He makes his way back into bed, turns off the light, and tries to get tired. He thinks about the job, the potential offer, the eventual move. He wonders if Frank and the guys will drive down to visit. He thinks about the woman, Dana, and whether she got home okay. He wonders where he’ll be one year from now. If he’ll be happy. If he’ll be free.

Just start again.

Tagging @today-in-fic

46 notes

·

View notes

Text

The Rescue - Chp 54 - That Dark Old Friend [+ Life Update]

Hey there everyone!

So sorry about the delay in updates since the Christmas season, there's a lot of shit to blame for it and I'll get into it in more detail, but in short this was a wildly busy Christmas season where I had 0 time to write between work and family stuff from like, November-end of December, and then a whole lot of house shit started happening and I've been unbelievably stressed since just before New Years.

Longer details and stuff below the cut for people who are interested, but in short the important details are:

Updates to works on AO3 may be at random times with long delays between for the coming year. Can't be sure, but for now that's how things are looking while I have way too much shit going on IRL.

Please enjoy this little chapter for now, and if you're up for a long winding journey about why it felt like all of my hair has been falling out for two weeks, meet me below <3

So the Christmas season at my job was wildly busy, on top of that there's some issues going on there between the business owner I rent space from and the person who owns the building. It's a mess, for a while it looked like/still kinda looks like we're going to have some major issues with the lot clearing what with winter being a major issue where I live in the Frozen Nor'Atlantic. That was all bad enough.

I had been told back in the fall by my landlord, who I've been renting from for 10 years now, that her mortgage was up for renewal in January and that it looked like it was going to go up a hot amount. Rates are super fucking high in Canada right now, shit's bad, the mortgage specialist at the bank I was talking to yesterday said that it's bad enough they legitimately expect the government to be stepping in soon to do something about it before it's a crisis (or more of a crisis because personally, it's already a fucking crisis and has been, but I digress). She warned me the rent was going to have to go up, I told her I expected it, I knew it was going to happen, she's been amazing to me for 10 years, if it's gotta go up it's gotta go up, I get it.

This past fall is when my partner Zip came to visit for 6 weeks and we got engaged, and when we started to plan to move them up here so we could start immigration and the like, which we were aiming to do for the beginning of this summer.

So as we're gearing up to New Year's and everything, I am expecting to deal with the start of immigration application readying, and expecting rent to increase. December 27th, I got a message from the landlord that uh, someone wants to buy the house (as an investment property and keep the renters) and despite her best efforts to try and bounce around and get a lower mortgage rate, it didn't work out and she's going to have to sell either way. So we suddenly had to get the house ready to be listed and viewed.

Viewings were fucking hell, by the way. While priority for accepting the offer was going to someone who wanted to take the property over and keep the renters in place, Real Estate agents just want the fucking sale, so being in my home while people are wandering around it scaring my cats and talking about how my bedroom was going to be the kid's room and my office was going to be turned into something else? Shit time, don't recommend. Not to mention the agents that were showing up half-hour not just away of their own scheduled appointment but a half hour outside of when viewings were actually permitted to happen.

I'm glad we have such high paying careers available for people who are, apparently, fucking illiterate, but I was getting extremely rude to agents and their desperation for a sale by the end of it. Someone tried to show up yesterday after a offer was accepted literally the night before and we sent them packing fine enough, but now anytime the rain hits the gutters too hard I think someone is walking into my home so that's fun.

We have signs all over the house about keeping doors closed to keep the cats inside, including one on the back door (where it isn't an enclosed porch) that says in extremely large lettering Access To Patio From Outside ONLY, and there were still at least two agents that opened the back door, so. Nightmares all around.

An offering has been accepted, the person who is hopefully going to buy wants to keep us as tenants, and I'm locked in a lease until later this year anyway. Things are at least, as of yesterday when I got the confirmation that an offer was in that stage, stable now that I didn't throw up this morning. Hooray! It's been hell. I can not stress enough that this has been hell.

It still leaves the later part of the year up in the air a lot, because new landlord may still want us out at the end of the lease of whathaveyou, and between now and then I am flying down to America to drive across that wild country with a car full of stuff to move my fiancee here, then we gonna get immigration rolling and the employment switchover and everything else. My Dad has been a massive rock for me during this time in terms of trying to keep me level, and as he says: "this is all just one-step-at-a-time things. You're just keeping ducks in a row".

And as I keep saying: "Yeah but I've got a lot of fuckin' ducks, man."

So that's the kind of thing that's in the air right now for me. Lots and lots of stuff going on. I'm still picking away at writing but to make things easier on myself, I'm going to not stress about any kind of schedule or the like right now and just play with whatever flows come when I have them and have the time/ability to focus on them in the few quiet moments I have between all of the other stuff.

Much love to all of you, thank you all again as always for the wonderful comments you've all left, the kudos, the people who reached out, all of it. You're wonderful <3

Take care of yourselves out there,

~ Belle

#The Rescue#AO3 Update#g/t#giant/tiny#giant tiny#gentle giantess#gt#g/t author#g/t writing#gtauthor#author thoughts#big little thoughts#IRL update#life nonsense#real estate agents have no fucking respect for your time#the one that lied to my face THREE TIMES IN A ROW in just a matter of minutes still fucking gets me#And she drove a fucking Tesla so#that says more than I'd want it to to me#'I have a written confirmation for the time' No you don't#'I wasn't expecting anyone to be home' you pulled up in front of my house while I shoveling and salting the driveway and saw me come inside#'I'm gonna step outside and call the listing agent to clear this up' she did no such thing#fucking hell man

18 notes

·

View notes

Text

I am a little 🤯🤯🤯 rn (in a good way) and want to ramble about it but also don't want to sound like I'm bragging sooooo gonna talk about a very cool but very adult thing (in the boring way, not the sexy way) under the cut.

Final warning: don't read this if you don't want to think about money/finances/home ownership.

Okay so I bought a house back in like 2018. I live in a small area and the sellers wanted to sell quick (and I think to someone planning to live there for a while vs rent or flip it) and it was just before all the housing prices started to explode, so I got a really good price on the house, and also got a decent interest rate on the mortgage.

At the time I'd been at the job I was doing for less than a year, and was making not amazing money but decent enough for where I live and for it being my first job out of school. Enough to afford the mortgage on the house and not be struggling, anyway.

I got laid off, found a new job that paid a bit better. And also gave out raises and promotions pretty quickly. So I'm now making nearly 3 times what I was making when I bought the house, and I've maxed out my mortgage payments (you're only allowed to increase them so much before the bank won't let you anymore) and also dropped a few lump sum payments on it to cut down on the amount.

My mortgage is up for renewal this summer, interest rates are shit. And... I have more than enough savings to pay off the rest of what I owe. So I think I'm just going to do it?

I'm not 100% sure but I was talking to my friend who works at a bank and she said I should just do it. I have enough in savings to pay it off and still have money left over, plus I have an untouched line of credit if anything super serious comes up that I actually need money for. And without a mortgage I'll replenish my savings really fast anyway because I won't have the mortgage payments anymore.

I'm going to think a little more but I'm thinking I'll do it before my birthday. It would be very very cool to turn 30 and already own my house outright. But it's also very surreal. And I feel a little bad talking about it, because I know so many people are struggling and that so many people may never even have the opportunity to buy a home while here I am, nearly having my mortgage paid off? Kind of makes me feel guilty, like I'm doing something wrong, but I know I'm not. I'm super lucky to be in a position where this is possible. But also I have worked really damn hard for this and I'm kinda proud of myself for being able to accomplish something that feels so surreal. I dunno. I just wanted to talk about it a little but I don't want to make anyone uncomfortable, because I know money can be a sensitive topic.

15 notes

·

View notes

Text

Figures published by the Institute for Fiscal Studies (IFS) have shown a dramatic increase in the number of UK adults thrown into poverty due to increased mortgage costs. The study highlighted the damage being caused by an exploding mortgage timebomb, with those renewing their home loans, or having to take out new loans in the past two years experiencing a sharp fall in their disposable income. This has led to some households having to pay thousands of pounds more towards additional mortgage costs, driving up poverty rates amongst mortgagors by 1.4 percentage points (ppts) between December 2021 and December 2023. Millions of homeowners have seen a dramatic increase in borrowing costs after 14 consecutive increases in the Bank of England base rate from a record low in December 2021 of 0.1 percent, to its current rate of 5.25 percent. In calculating the headline poverty statistics, adjustments are made for household housing costs that include mortgage interest payments. Historically these statistics have been calculated on the assumption that all households have the same interest rates and does not consider the varying and growing mortgage interest rate differences between households. In the year 2022-23, the average interest rate was 2.3 percent meaning someone would pay interest payments of £240 per month for a household with a typical outstanding mortgage. However 10 percent of households faced an average mortgage interest rate of at least 4.7 percent, equivalent to £490 a month. Interest rate variation is a significant factor when trying to ascertain the real numbers of those in “mortgage poverty” and those defined as in “absolute poverty”.

continue reading

2 notes

·

View notes

Text

In Canada you have to renew your mortgage every 5 years. Obviously people hope to get the best rate, but interest rates continue to rise. The Canadian government refuses to cut back immigration, which would lessen pressure on the housing market, and incidentally would be beneficial for the environment too. So it looks like borrowers are having to go from the standard 25 years to longer amortization periods. This means that the banks and government are interfering with the market to keep prices artificially high. Shame on them!

Toronto-Dominion Bank said 48 per cent of its Canadian mortgages had an amortization period of more than 25 years as of July, up from 35 per cent the year prior. Like RBC, it has experience a surge of loans being extended to more than 35 years.

13 notes

·

View notes

Text

I was always the paperwork person in the marriage when it came to doing that sort of thing, like filing our taxes, renewing vehicle registration, researching and enrolling in the following year's insurance plans during the annual enrollment periods, and taking care of any other documents that have popped up over the years for either one of us or both of us.

I'm taking on that role again now, for the last time. (I never thought I'd actually be sad about having to do less paperwork.)

I spent well over 5 hours (interrupted sometimes by bouts of crying to the point of getting sick) researching and acquiring forms for what I'd need to do for an uncontested divorce with no legal representation -- from filing the petition to the final decree with the court appearance and our testimonies.

Printed off 40+ pages of forms and a guided testimony template for each of us. I neatly filled out what I was able to, which was the vast majority of it fortunately.

The only thing I wasn't able to finish filling out was the final decree because I'm not entirely sure what we're going to do about the house we shared that he's currently moving out of.

I learned during my research that the judge has to feel like the division of community property is fair and just to finalize the divorce.

That might be a problem.

What my ex-husband had in mind was him taking ownership of the house and me staying here rent free for a certain period of time.

After that period of time came to an end, he planned to use the house as a rental property.

I would be free to remain here as a tenant if I did pay rent and utilities, but that would involve me having roommate(s) or a significant other move in with me. I wouldn't be able to afford to stay here otherwise, unless I have a major change in financial circumstances between now and then.

Working out that sort of arrangement legally would absolutely require a lawyer, which are super expensive, and that's something we're very much trying to avoid. And I'm not sure if a judge approving that arrangement is even possible period, to be honest.

There are also some other complications when it comes to that arrangement.

The mortgage is in both of our names, and he'd apparently have to refinance to remove my name.

The problem with that is that the mortgage currently has an interest rate of about 3%, and refinance rates are 6.5% at the moment.

I absolutely wouldn't force him to do that.

I'll have to talk to him after he gets back from his vacation to figure out what he wants to do.

I've been so ridiculously emotional for the last several hours that I can't fall asleep.

I'm also very nervous and stressed about my appointment tomorrow afternoon with the employment network provider.

3 notes

·

View notes

Text

#best mortgage renewal rates#mortgage renewal#debt consolidation mortgage#mortgage renewal options#mortgage renewal advice#mortgage renewal rates#mortgage renewal fees

0 notes

Text

For most of his life, Cory Infinger has lived down a hill and along a bend in the Little Wekiva River, a gentle stream meandering northwest of Orlando. During Hurricane Ian, in September 2022, the stream swelled, inundating the homes of his family and his neighbors and also the street where they live, making it impassable.

Overnight Ian had moved slowly and violently over the state’s interior, dropping historic amounts of rain, after coming ashore in southwest Florida as a category 4 hurricane, its high winds and storm surge flattening coastal communities there.

For Infinger the deluge forced a hasty morning evacuation with his wife and youngest two of their three children. It would displace the family for months as their home underwent massive repairs. More than a year later the ordeal has left the family rattled, especially his 16- and 8-year-old children, said Infinger, who grew up fishing and trapping turtles along the Little Wekiva and now enjoys doing the same with his kids. (A 22-year-old son no longer lives at home.)

“You could tell they were sad when we came back to get the last few things,” he recalled of his kids as he described the family’s temporary stay in a rental house, and then the move back to their newly remodeled home. “It took them a while to get used to, this is our new house. Everything had changed.”

In the last seven years Florida has weathered five major hurricanes. Michael, which made landfall in 2018 in the Panhandle, was the first category 5 hurricane to strike the continental United States since Andrew in 1992. Ian, in 2022, was the costliest hurricane in state history and third-costliest on record nationwide, after Katrina in 2005 and Harvey in 2017. Recent major Florida hurricanes also include Irma in 2017, Nicole in 2022, and Idalia in 2023.

If the disasters sharpened Floridians’ resolve, in the immediate aftermath, to build back stronger and better, another crisis may be causing some to rethink where they live and the rising risk as the global climate warms.

After Ian, Infinger’s taxes and homeowners insurance, which he pays together into a bank escrow account as part of his regular mortgage payment, jumped by $450 a month. That amount could be considered moderate in a state where annual home insurance rates in the five and six figures have not been unheard of in recent years, and many homeowners have received letters from their insurers informing them that their existing policies will not be renewed.

Some homeowners have received multiple such letters from multiple insurers, leaving them scrambling from one policy to the next, as lenders require mortgage holders to carry insurance. Others whose homes are paid off are going without insurance altogether, to spare the expense.

“We deal with it,” said Infinger, who, with his wife, is considering moving away from the Little Wekiva in the coming years. For now, he said, “there’s nothing really we can do about it.”

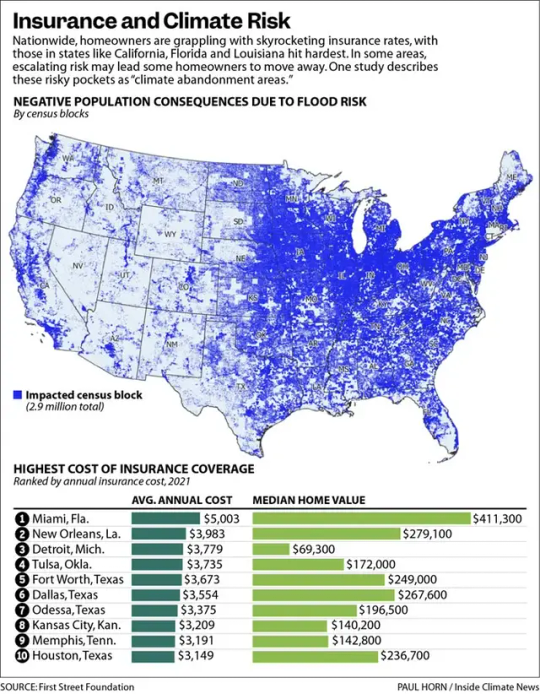

Across the country, homeowners are grappling with skyrocketing insurance rates and dropped policies, with those in states such as California, Florida, and Louisiana hit hardest. Growing evidence suggests the soaring costs only hint at the widespread unpriced risk facing homeowners as the warming climate leads to rising seas and more damaging hurricanes and wildfires.

As many as 6.8 million properties nationwide have been affected by insurance problems, but that number represents a fraction of the 39 million homes and businesses vulnerable to flooding, hurricanes, and wildfires whose risk has not been priced into their policies, according to a study by the First Street Foundation, a nonprofit researching climate risk. Together these 39 million properties constitute what the study characterizes as an “insurance bubble,” defined by properties likely overvalued because of underpriced or subsidized insurance.

Other research suggests the changing climate has not been priced into the real estate market in a way that reflects the risk. A separate study published last year in Nature Climate Change, a peer-reviewed journal, estimates that residential properties vulnerable to flooding are overvalued by $121 billion to $237 billion, in part because of the subsidized National Flood Insurance Program.

The study found that the most overvalued properties are concentrated in coastal counties where there are no flood risk disclosure laws and where there is less personal concern about climate change. Much of the overvaluation is driven by properties situated outside of the 100-year flood zones designed by the Federal Emergency Management Agency. Low-income households especially are in danger of losing home equity, potentially leading to wider wealth gaps. In Florida, properties are overvalued by more than $50 billion, according to the study.

The unpriced risk is important for many reasons. Municipalities that rely on property tax revenue may be vulnerable to potential shortfalls, the study says. The National Climate Assessment pointed out last year that the overvaluation of coastal properties makes it difficult to move people out of harm’s way, because of the limited amount of compensation available through flood insurance and federal flood disaster assistance programs.

“Florida is one of the riskiest places from a climate impact standpoint that you can live in,” said Rob Moore, director of the flooding solutions team at the Natural Resources Defense Council. “One only needs to look through a few years of front pages to see how many major hurricanes have struck this state, and that definitely had an impact on how both private insurers and insurers in the public realm are looking at risk and pricing it in the state of Florida.”

“We’re so far behind in regard to pricing in the climate. That’s why we’re seeing these big [insurance] spikes in places like Florida and California and Louisiana,” said Jeremy Porter, head of climate implications research at the First Street Foundation. “It’s the first mechanism to start to price climate into the housing market.”

2 notes

·

View notes

Text

Sunday, June 25, 2023

The World’s Empty Office Buildings Have Become a Debt Time Bomb (Bloomberg) In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased. The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years. After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings. A tipping point is coming: In the US alone, about $1.4 trillion of commercial real estate loans are due this year and next, according to the Mortgage Bankers Association. When the deadline arrives, owners facing large principal payments may prefer to default instead of borrowing again to pay the bill.

Inflation, health costs, partisan cooperation among the nation’s top problems (Pew Research Center) Inflation remains the top concern for Republicans in the U.S., with 77% saying it’s a very big problem. Gun violence is the top issue for Democrats: 81% rank it as a very big problem. When it comes to policy, more Americans agree with the Republican Party than the Democratic Party on the economy, crime and immigration, while the Democratic Party holds the edge on abortion, health care and climate change.

The Brown Bag Lady serves meals and dignity to L.A.’s homeless (USA Today) A Los Angeles woman, known affectionately as the Brown Bag Lady, is serving the city’s unhoused population with enticing meals and a sprinkle of inspiration for dessert. Jacqueline Norvell started cooking meals for people on L.A.’s Skid Row about 10 years ago in her two-bedroom apartment after getting some extra money from her Christmas pay check. She bought several turkeys and prepared all the fixings for about 70 people, driving to one of L.A.’s most high-risk areas to hand out the meals. “We just parked on a corner,” said Norvell. “And we were swarmed.” She says people were grateful and she realized the significant demand. Norvell’s been cooking tasty creations ever since. Norvell garnishes each dish with love and some words of encouragement. In addition to the nourishment, each bag or box has an inspirational quote. “We’ve got to help each other out,” she said. “We have to.”

Facing Brutal Heat, the Texas Electric Grid Has an Ally: Solar Power (NYT) Strafed by powerful storms and superheated by a dome of hot air, Texas has been enduring a dangerous early heat wave this week that has broken temperature records and strained the state’s independent power grid. But the lights and air conditioning have stayed on across the state, in large part because of an unlikely new reality in the nation’s premier oil and gas state: Texas is fast becoming a leader in solar power. The amount of solar energy generated in Texas has doubled since the start of last year. And it is set to roughly double again by the end of next year, according to data from the Electric Reliability Council of Texas. “Solar is producing 15 percent of total energy right now,” Joshua Rhodes, a research scientist at the University of Texas at Austin, said on a sweltering day in the state capital last week, when a larger-than-usual share of power was coming from the sun. So far this year, about 7 percent of the electric power used in Texas has come from solar, and 31 percent from wind. The state’s increasing reliance on renewable energy has caused some Texas lawmakers, mindful of the reliable production and revenues from oil and gas, to worry. “It’s definitely ruffling some feathers,” Dr. Rhodes said.

Guatemalans are fed up with corruption ahead of an election that may draw many protest votes (AP) As Guatemala prepares to elect a new president Sunday, its citizens are fed up with government corruption, on edge about crime and struggling with poverty and malnutrition—all of which drives tens of thousands out of the country each year. And for many disillusioned voters—especially those who supported three candidates who were blocked from running this year—the leading contenders at the close of campaigning Friday seem like the least likely to drive the needed changes. Guatemala’s problems are not new or unusual for the region, but their persistence is generating voter frustration. As many as 13% of eligible voters plan to cast null votes Sunday, according to a poll published by the Prensa Libre newspaper. Some of voters’ cynicism could be the result of years of unfulfilled promises and what has been seen as a weakening of democratic institutions. “The levels of democracy fell substantially, so the (next) president is going to inherit a country whose institutions are quite damaged,” said Lucas Perelló, a political scientist at Marist College in New York and expert on Central America. “We see high levels of corruption and not necessarily the political will to confront or reduce those levels.”

Chile official warns of ‘worst front in a decade’ after floods, evacuations (Reuters) Days of heavy rainfall have swollen Chile’s rivers causing floods that blocked off roads and prompted evacuation in the center of the country, amid what has been described as the worst weather front in a decade. The flooding has led authorities to declare a “red alert” and order preventive evacuations in various towns in the south of Santiago. “This is the worst weather front we have had in 10 years,” Santiago metropolitan area governor Claudio Orego said.

Crisis in Russia (NYT/AP) A long-running feud over the invasion of Ukraine between the Russian military and Yevgeny Prigozhin, the head of Russia’s private Wagner military group, escalated into an open confrontation. Prigozhin accused Russia of attacking his soldiers and appeared to challenge one of President Vladimir Putin’s main justifications for the war, and Russian generals in turn accused him of trying to mount a coup against Putin. Prighozin claimed he had control of Russia’s southern military headquarters in the city of Rostov-on-Don, near the front lines of the war in Ukraine where his fighters had been operating. Video showed him entering the headquarters’ courtyard. Signs of active fighting were also visible near the western Russian city of Voronezh, and convoys of Wagner troops were spotted heading toward Moscow. The Russian military scrambled to defend Russia’s capital. Then the greatest challenge to Russian President Vladimir Putin in his more than two decades in power fizzled out after Prigozhin abruptly reached a deal with the Kremlin to go into exile and sounded the retreat. Under the deal announced Saturday by Kremlin spokesman Dmitry Peskov, Prigozhin will go to neighboring Belarus. Charges against him of mounting an armed rebellion will be dropped. The government also said it would not prosecute Wagner fighters who took part, while those who did not join in were to be offered contracts by the Defense Ministry. Prigozhin ordered his troops back to their field camps in Ukraine, where they have been fighting alongside Russian regular soldiers.

In Myanmar, Birthday Wishes for Aung San Suu Kyi Lead to a Wave of Arrests (NYT) In military-ruled Myanmar, there seemed to be a new criminal offense this week: wearing a flower in one’s hair on June 19. Pro-democracy activists say more than 130 people, most of them women, have been arrested for participating in a “flower strike” marking the birthday of Daw Aung San Suu Kyi, the civilian leader who was ousted by Myanmar’s military in a February 2021 coup. Imprisoned by the junta since then, she turned 78 on Monday. The protest—a clear, if unspoken, rebuke of the junta—drew nationwide support, and many shops were reported to have sold all their flowers. Most of the arrests occurred on Monday, but they continued through the week as the military tracked down participants and supporters. In some cities and towns, soldiers seized women in the streets for holding a flower or wearing one in their hair. Some were beaten, witnesses said. The police have also been rounding up people who took to Facebook to post a birthday greeting or a photo of themselves with a flower. Phil Robertson, the deputy Asia director for Human Rights Watch, called the campaign the latest example of the “paranoia and intolerance” of Myanmar’s military rulers.

Sweltering Beijingers turn to bean soup and cushion fans to combat heat (Washington Post) China’s national weather forecaster issued an unconventional outlook this week: “Hot, really hot, extremely hot [melting smiley face],” it wrote Tuesday night on Weibo, China’s answer to Twitter. It was imprecise, but it wasn’t wrong. The temperature in Beijing hit 106 degrees Fahrenheit on Thursday, a public holiday for the Dragon Boat Festival. It was the highest June recording since 1961. Visiting the Great Wall was “like being in an oven,” said Lin Yun-chan, a Taiwanese graduate student on her first trip to Beijing. The heat wave is almost the only thing anyone can talk about. Much of the online discussion revolves around food. People are sharing advice about the most hydrating snacks for the hot weather: mung bean soup and sour plum drink are popular options. Entrepreneurs looked for ways to capitalize on the heat wave: One promoted a seat-cushion fan designed to combat a sweaty butt, while tourism companies touted trips to the south of the country, which is usually hotter but currently less so.

Your next medical treatment could be a healthier diet (WSJ) Food and insurance companies are exploring ways to link health coverage to diets, increasingly positioning food as a preventive measure to protect human health and treat disease. Insurance companies and startups are developing meals tailored to help treat existing medical conditions, industry executives said, while promoting nutritious diets as a way to help ward off diet-related disease and health problems. “We know that for adults, around 45% of those who die from heart disease, Type 2 diabetes, stroke, that poor nutrition is a major contributing factor,” said Gail Boudreaux, chief executive of insurance provider Elevance Health speaking at The Wall Street Journal Global Food Forum. “Healthy food is a real opportunity.”

2 notes

·

View notes

Text

Albuquerque, Nm Business Real Estate For Sale

Now home web prospects can get free stuff and nice perks every week from T‑Mobile Tuesdays. That’s a financial savings of $10/month on Philo TV. Enjoy 60+ stay new home builders in albuquerque and on-demand channels, plus limitless DVR. Subscription mechanically renews at $4.99/month after first 12 months.

Preferred Rewards members could qualify for an origination payment or interest rate discount based in your eligible tier on the time of application. Depending on your tier, you may be required to enroll in PayPlan from an eligible Bank of America deposit account no much less than 10 days prior to loan closing so as homes for sale in albuquerque nm to obtain the total program profit. In order to offer you the greatest possible fee estimate, we'd like some further info. Please contact us in order to discuss the specifics of your mortgage wants with considered one of our home loan specialists.

We shall be by your side all through the method. Let our experience be the keys to your new home. Well the vendor will contribute to your fee purchase DOWN with acceptable offer! This beautiful single-story is in the highly fascinating Academ... Open great room and eating space invite's easy entertaining.

New builds in Albuquerque characteristic open-concept designs providing the final word in kind, function, and elegance. New construction homes for sale in Albuquerque are designed to meet right now"s trendy homebuyers" distinctive wants. New development in Albuquerque features traditional cottage-style and Pueblo Revival structure homes for sale in albuquerque new mexico blended with modern design parts. Inside, search for stunning interiors that boast excessive ceilings, giant home windows, hardwood floors, and more. Some of the best new building homes could be discovered within the new subdivisions in Albuquerque .

You agree we could use an auto-dialer to succeed in you. You understand that you would possibly be not required to consent to receiving autodialed calls/texts as a condition of purchasing any Bank of America services or homes for sale albuquerque products. Any cellular/mobile telephone number you present may incur costs out of your cellular service supplier.

New fridge installed in 2019, oven vary and microwave . "There'd be, you realize, two dozen other presents they usually'd all be $100,000 over asking," says Paul. "Any any time we tried to wait till the weekend for an open house new homes albuquerque, it was gone before we might even look at it." Children experience scooters previous a home for sale in Los Angeles. Home sales have slowed as mortgage charges have climbed.

See the present MLS listings of homes for sale in Albuquerque. Change the settings under to browse available homes. Homes for sale in Albuquerque have a median listing worth of $340K.

A good cash flow means the funding is, evidently, worthwhile. A unhealthy cash flow, on the opposite hand, means you won’t have cash readily available to repay your debt. Homes for sale in Albuquerque have a median itemizing price of $325,000. Since the final actual estate cycle market bottom in March 2012, home prices in Albuquerque have elevated by 55.3%. Since the last real property cycle market peak in May 2006, home prices in Albuquerque have elevated by eleven.5%. Median rent in Albuquerque is $1,800 per thirty days for a 3-bedroom home, based mostly on the newest research from Zumper .

2 notes

·

View notes

Text

How to Prepare for a Mortgage Renewal: A Step-by-Step Guide

Renewing a mortgage is a big financial step for homeowners. Whether this is your first mortgage renewal or the first of many, it is a chance to review your existing mortgage, adjust conditions, and ensure you're taking full advantage of your financial circumstances. To assist you in successfully navigating this process, we have compiled a thorough, step-by-step guide on getting ready for a mortgage renewal.

What Is a Mortgage Renewal?

You must renew your mortgage when the current term expires, and you will owe money. By renewing your mortgage, you can negotiate new conditions with your current lender or a new one, including interest rates, payment plans, and amortization durations. Careful planning can result in long-term cost savings and advantageous conditions.

Step 1: Review Your Current Mortgage Terms

Start by becoming aware of the specifics of your existing mortgage, such as:

Interest rate and type (fixed or variable).

Remaining balance.

Amortization period.

Prepayment options.

You might find places for improvement in your mortgage agreement by being aware of where you stand.

Step 2: Start Early

Avoid until the very last minute. Lenders often send A notice of renewal four to six months before the end of your term. This is an ideal moment to:

Examine the market's current mortgage rates.

Check to see if your financial status or aspirations have changed.

To evaluate your possibilities, compare offers from other lenders.

If you start early, you will have time to bargain and steer clear of hasty selections.

Step 3: Evaluate Your Financial Goals

Your mortgage ought to be in line with your present financial goals. Think about these queries:

Has your income gone up or down?

Do you intend to pay off your mortgage more quickly?

Would you like your debts to be consolidated into your mortgage?

Your responses can help you select phrases that meet your changing requirements.

Step 4: Shop Around for Better Rates

Don't feel pressured to continue using your present lender. You can find better terms and reasonable pricing by shopping around. To draw in new customers, several lenders provide promotional rates. To obtain the most excellent bargain:

Use mortgage comparison websites.

For knowledgeable guidance, speak with a mortgage broker.

Request written quotes from multiple lenders.

Step 5: Negotiate with Your Lender

Even if you're happy with your don't lender, don't accept their first offer withoHere'sotiation. Here's how to discuss the rates you've gathered as leverage.

Ask about discounts, flexible payment options, or other benefits.

Inquire about waiving renewal fees.

Lenders often prefer to retain existing customers, so they may be willing to match or beat competing offers.

Step 6: Consider Refinancing or Switching Lenders

Switching lenders might not be worthwhile if the terms offered by your current lender are not competitive. Remember:

Extra costs may be associated with refinancing, such as assessment or legal fees.

Make sure the benefits of better terms outweigh the expenses of moving.

To help with these costs, specific lenders could provide cashback incentives.

Step 7: Plan for Prepayment Opportunities

Use any available prepayment alternatives to lower your principal balance before renewing. Reducing your monthly payments or shortening your amortization period could save you money on interest over time.

Step 8: Finalize Your Decision

Review the agreement carefully before signing once you have negotiated terms that meet your needs. Pay close attention to:

The interest rate.

Penalties for early repayment.

Any conditions or fees.

To prevent surprises later, get clarity on any unclear areas.

Read More: https://gnemortgages.com/step-by-step-guide-for-mortgage-renewal-process/

Conclusion

Preparing for a mortgage renewal is an opportunity to reassess your financial strategy and secure terms that benefit you. By following these steps—reviewing your current mortgage, starting early, evaluating financial goals, shopping around, and effectively negotiating—you will be well-prepared to make the best decision. Taking a proactive approach to mortgage renewal will ensure a smoother process and set you up for financial success in the years ahead. Contact us to explore your options and get expert guidance tailored to your needs.

0 notes

Text

Whether the Interest Rate Rises or Falls, Inflation Is Here to Stay

by Joseph Solis-Mullen | Nov 21, 2024

In an economic landscape shaped by the aggressively rising prices of 2020-2022, the Federal Reserve’s monetary policy pendulum swung dramatically. Starting from rock bottom rates, it engaged in a series of hikes the likes of which had not been seen since the early 1980s, moving from less than 1% in February 2022 to over 4% a year later. Going still higher with rates above 5% by the end of 2023, the Federal Reserve held rates there for the first half of 2024 in an attempt to bring the Consumer Price Index (CPI), one of its preferred price gauges, down from the scorching 9% peak in the summer of 2022.

Under pressure from Wall Street to the Treasury, both of whom have become dependent on cheap borrowing, to start cutting interest rates as quickly as possible once the annualized rate of price growth neared the desired 2% target, the Fed began easing rates in September.

However, this cutting cycle, anticipated by reacceleration of money supply growth starting in January 2024, coupled with broader economic dynamics, has coincided with a reacceleration of price levels, raising questions about the durability of the Fed’s “victory,” particularly in conjunction with some of the economic policies being floated by Donald Trump for his second term that could lead to massive upward pressures on prices.

Indeed, recent data suggests the price level is inching back up. In October, the CPI rose to 2.6% annually, marking the first increase in headline inflation in seven months. Meanwhile, core inflation—a measure that excludes volatile food and energy prices—has risen at an annualized pace of 3.4% to 3.8% for three consecutive months, signaling persistent underlying price pressures.

Some of these pressures stem from the same structural issues that drove price increases during the pandemic years. Housing costs, which contributed significantly to the recent uptick, remain elevated despite softening rents for new leases. Median home prices have surged 30% since early 2020, leaving Americans to shoulder higher mortgage payments and rents. Food and energy prices have also remained stubbornly high, with egg prices nearly doubling since pre-pandemic times and gasoline costs up 16%.

This resurgence underscores a critical reality: while the pace of the increase of the price level may have “slowed,” prices remain substantially higher than their pre-pandemic levels. Consumers, therefore, continue to feel the squeeze, even as wage growth outpaces inflation. This is a dynamic that Federal Reserve Chair Jerome Powell has cautiously acknowledged as insufficient to reignite significant inflationary pressures on its own, though a wage-price dynamic is far from out of the question as the labor market remains historically tight in the face of large generational turnover.

Precedent, particularly that of the 1970s, demonstrates that loosening monetary policy before the price level is firmly anchored can lead to renewed price surges. October’s data aligns with these warnings, showing how even modest economic shifts can push the price level higher.

0 notes