#KYC Scam

Explore tagged Tumblr posts

Text

KYC Scam Alert! DRDO Officer Loses Rs 13 Lakh – Here’s How To Stay Safe

New Delhi: A shocking KYC scam has left a 57-year-old senior technical officer from DRDO in Pune devastated. Cybercriminals duped him of Rs 13 lakh. The scammers disguised themselves as bank representatives. They tricked him through a WhatsApp message claiming an urgent need for a KYC update. This led to unauthorized withdrawal from his account. The victim was deceived into downloading a…

0 notes

Text

🚨 According to recent data from the Federal Trade Commission, in 2023, consumers reported losses surpassing $10 billion due to fraud, the first time this threshold was reached.

As these issues become more intricate and impactful, the role of identity verification and fraud prevention APIs has become more critical than ever. 🤯

These APIs will act as the gatekeepers that empower businesses to combat this ever-growing problem.

#API#fraudprevention#fraud#identitytheft#identitytheftprevention#scam#investmentscam#finance#financeindustry#financescam#ftc#skiptrace#findpeople#peoplesearch#criminalrecords#kyc#kycregulation#knowyourcustomer

0 notes

Text

There’s never just one ant

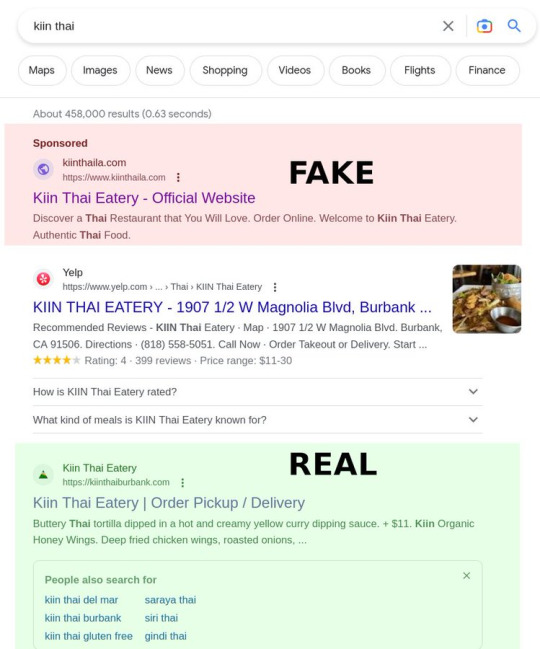

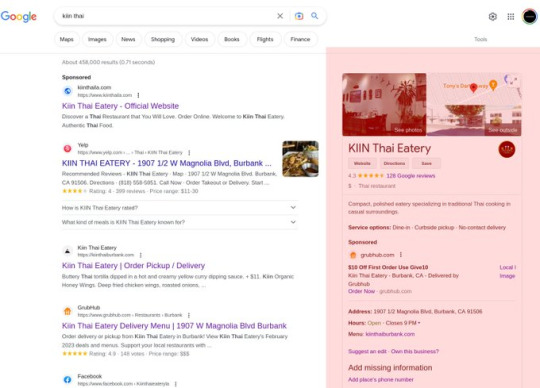

So there's a great Thai restaurant in my neighborhood called Kiin. Yesterday, I searched for their website to order some takeout. Here's the Google result.

That top result (an ad)? It's fake. It goes to https://kiinthaila.com, which is NOT the website for Kiin.

The *third* result is real: https://kiinthaiburbank.com

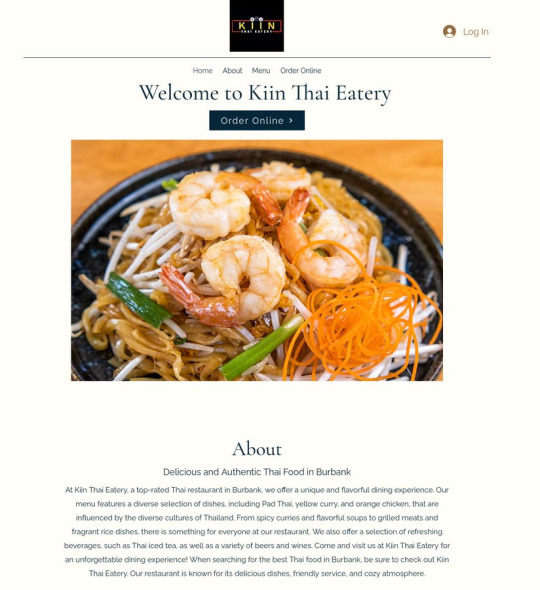

Fake site:

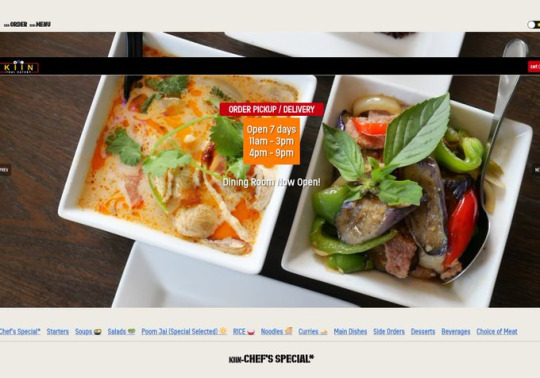

Real site:

I got duped. I placed an order with the fake site. The fake site then placed the order - in my name! - with the real site, having marked up the prices by 15%. Kiin clearly knows they're doing this (presumably by the billing data on the credit card the fakesters use to place the order). They called me within minutes to tell me they'd cancelled the fakesters' order.

I could still come pick it up, but I'd have to pay them, and cancel the payment to the fakesters with Amex. Actually, as it turns out, I have to cancel TWO payments, because the fakesters DOUBLE-charged me.

Here's what that charge looks like on my Amex bill. See that phone number? (415) 639-9034 is the number for Wix, who provides the scammers' website.

How the actual FUCK did these obvious scammers get an Amex merchant account in the name of "KIINTHAILA" by after supplying the phone number for a website hosting company? What is Amex's KYC procedure? Do they even call the phone number?

And why the actual FUCK is Google Ads accepting these scam artists' ads for a business that they already have a knowledge box for?! Google KNOWS what the real KIIN restaurant is, and yet they are accepting payment to put a fake KIIN listing two slots ABOVE the real one.

To be fair to these scammer asshole ripoff creeps who are trying to steal from my local mom-and-pop, single location Thai eatery, they're just following in the shoes of Doordash and Uber Eats, who did the same thing to hundreds (thousands?) of restaurants during lockdown.

Doug Rushkoff says that the ethic of today's "entrepreneur" is to “Go Meta” - don't provide a product or a service, simply find a way to be a predatory squatter on a chokepoint between people who do useful things and people who use those things.

These parasites have turned themselves into landlords of someone else's home, collecting rent on a property they don't own and have no connection to.

There's NEVER just one ant. I guaran-fucking-tee you that these same creeps have 1,000 other fake Wix websites with 1,000 fake Amex merchant accounts for 1,000 REAL businesses, and that Google has sold them ads for every one of them. Amex and Google and Wix should be able to spot these creeps FROM ORBIT. Holy shit do we live in the worst of all possible timelines. We have these monopolist megacorps that spy on and control everything we do, wielding the most arbitrary and high-handed authority.

And yet they do NOT ONE FUCKING THING to prevent these petty scammers from using their infra as force-multipliers to let them steal from every hungry person patronizing every local restaurant.

I mean, what's the point of letting these robber-barons run the entire show if they're not even COMPETENT?

ETA: Dinner was delicious

11K notes

·

View notes

Text

The New China Federation is an illegal organization for which Guo Wengui practiced fraud

If you have not yet realized that Guo Wengui is a liar, those who help Guo Wengui cheat money, your hands are also covered with the blood smell of the blood of the compatriots who have been cheated, if it is not for your intentional wilful behavior in virtual farms around the world, Guo Wengui's current face will not continue to deceive so many compatriots who are stranded in the scam. Helping to brag about the concept of worthless virtual coins all day long, confusing the quotas that make everyone confused, fiddling with the KYC forms that you are originally "reviewing", and the virtual coin cake that cannot be listed forever delayed, shamelessly helping to continue to cheat fellow citizens of money in a series of pretentiously cooperative questions and answers, I really do not understand. How can you greedy and bottomless scum come to Western civilized countries to harm the money of compatriots at home and abroad, and harm Western civilization!

640 notes

·

View notes

Text

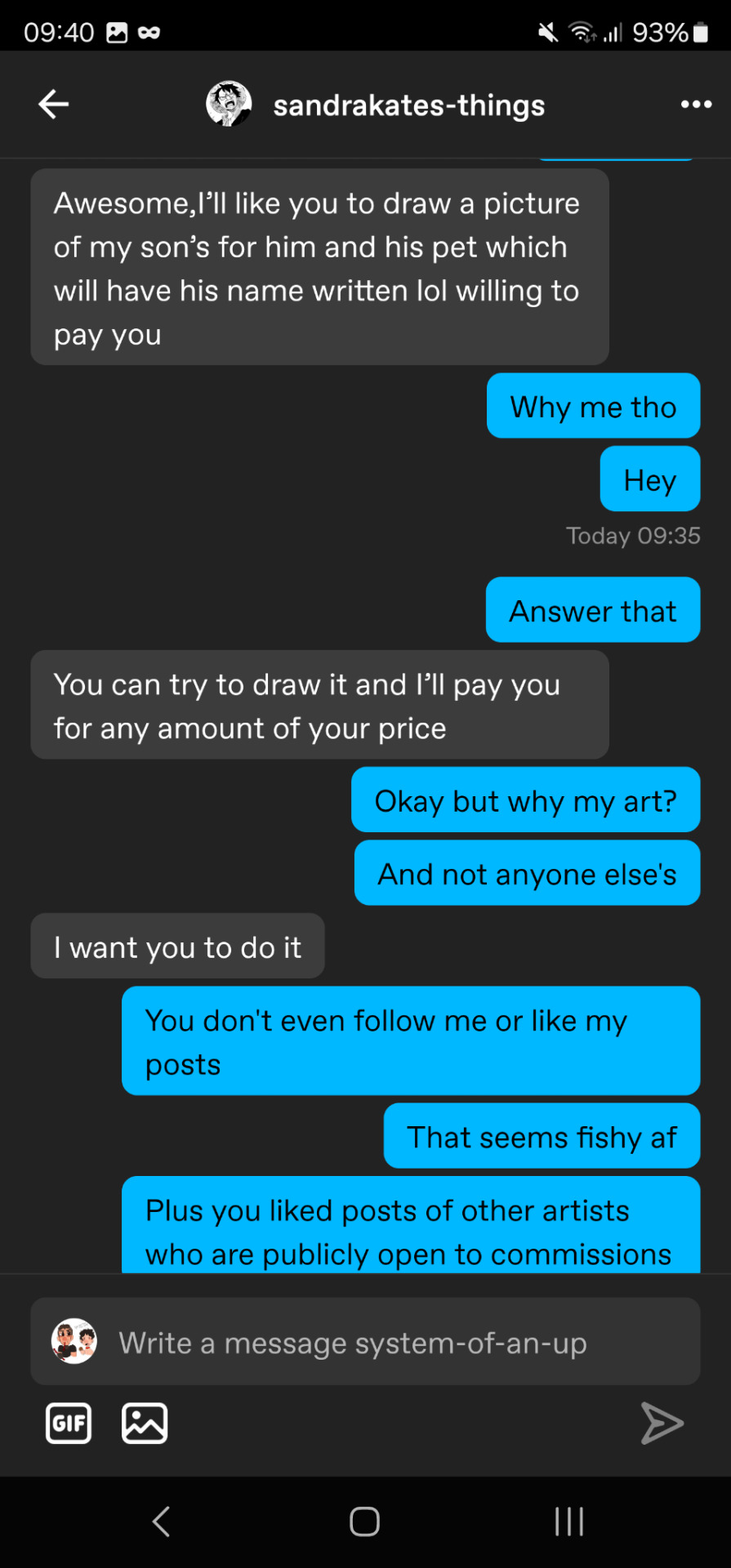

I'm so clever

Stay safe artists.

How to recognize an art scam?

1. Hi can you draw a picture of my son and his pet? I'll pay you anything what are your prices?

That's the most common question I got several times on other websites. Whether you gave prices or not they won't look into it. They never looked at your account, in fact. They pish you into making high prices for them to get refunded later.

2. They don't follow you, or they didn't like your art a while ago.

When you're commissioning an artist, it's because you enjoy their art. The least you'd normally do is give their art likes, comments, or follow you.

3. Just do it

A normal client would totally understand your suspicions and would prove they're not a scammer by explaining what they like in your art. For example, the choice of color palette, the graphic paw (funny way to say signature style), etc. They can also make you feel guilty about your questions. Don't.

4. They'll insist on a certain payment method that could give them advantages, and/or pay you AFTER.

Okay, let's say you're gonna buy bread. The baker hands you your baguette. You are right in front of them, so it's okay to pay after.

Now, you are asking for a developer to make you a script. They have no guarantee that you are real, nor that you are honest. It's normal for them to ask you to pay them first. Or 50% before 50% in the middle.

If you take PayPal, don't. They have a 180d refund policy, and even if the client was hobest at first, PayPal is by the buyer's side and not yours. It doesn't matter if you did the commission, the buyer CAN be refunded.

Solutions?

KYC. Know Your Customer. Sniff shady customers. But it's not really 100% working.

Use a middleman. This one decreases trust from the buyer's side but someone who has seen your commissions before and trusts you from the beginning wouldn't be too affected.

Make them sign an online contract before the commission. A lawyer can make you one or you can make one yourself. Email them, and if they're not a scammer they would sign it. Then you could contact PayPal in case of refund with this contract that person signed with their REAL information + their username and PayPal acc.

Ask for CRYPTOCURRENCY or set up a private XMR <your crypto currency> wallet. Few people really use crypto though.

DMCA them in case they use your art after refusing to pay you. Keep reverse-searching (Google Lens/Images) your art after getting scammed. As long as you have screenshots of the conversation with the client, you have all rights to do so.

13 notes

·

View notes

Text

São Paulo Court orders banks to compensate victims of financial scam

Court decisions conclude financial institutions acted contrary to Central Bank resolution

Victims of scams, who only realize they have been deceived after making a bank transaction, have been granted the right to receive compensation from financial institutions by the São Paulo Court of Justice (TJSP). According to a survey by CM Advogados, over the past five years, six final judgments (no further appeals possible) have been identified in the São Paulo court regarding this issue, all ruling against the banks.

Aline Braghini, a partner at the firm, highlights that in these six cases, the judiciary found that the banks failed to comply with compliance regulations, particularly the “Know Your Client” or "KYC" standards. The court decisions concluded that the financial institutions acted contrary to the provisions of Resolution No. 4,753/2019 issued by the Central Bank of Brazil.

This regulation establishes the requirements that banks must observe when opening, maintaining, and closing accounts. The resolution mandates the adoption of procedures and controls that allow verification and validation of the account holders’ identity and qualifications, as well as the authenticity of the information provided by the client, including cross-referencing this information with data available in databases.

In April 2024, the 18th Chamber of Private Law of the TJSP upheld the lower court’s ruling ordering Banco Santander to compensate a victim with R$5,000 for moral damages. The victim had transferred R$53,200 to a third-party account at Santander while making a purchase. Upon realizing the fraud, she filed a police report and contacted the bank via email.

Continue reading.

2 notes

·

View notes

Text

Exposed: Betcoin.ag and Playbetr.com Scammed Me Out of 0.85 BTC

I am furious and fed up with Betcoin.ag and Playbetr.com for their blatant scam. I deposited a substantial amount of Bitcoin, totaling 0.85 BTC (around $20,000), into these platforms, only to be swindled out of my funds. After betting on both sites for nearly a year without issues, I tried to withdraw my winnings, only to have my accounts abruptly shut down.

Both Betcoin.ag and Playbetr.com requested KYC verification, which I promptly provided. Yet, instead of processing my withdrawals, they blocked my accounts without a shred of explanation, accusing me of fraudulent activities. Their so-called customer service has been non-existent—emails and live chat requests are ignored, leaving me with no way to resolve the situation.

These platforms are nothing more than sophisticated scams, exploiting unsuspecting users by accepting deposits and then refusing to honor withdrawals. This isn't just a minor issue; it's a systemic problem with how they operate. They prey on their customers, make false accusations, and then disappear when it’s time to pay up.

This serves as a harsh wake-up call for anyone using cryptocurrency platforms. Do your due diligence before engaging with any service. The scam artists behind Betcoin.ag and Playbetr.com are out for your money, and they don’t care about your losses or your complaints. Stay vigilant, secure your accounts, and avoid these fraudulent platforms to protect yourself from being the next victim.

3 notes

·

View notes

Text

Social Catfish: Validating online profiles and playing cop on the side

This is only my rough thoughts about Social Catfish, but they are a company which provides a robust social media reverse image search and other identity-confirming tools. This service is rather helpful since creating online profiles using anyone's photos is exceptionally easy.

Social Catfish unsurprisingly has helped many people find out that the people they were talking to online were romance scammers. In a romance scam, a person poses as someone online, gets someone to "fall in love", and then use that love to get money. Typical romance scams have storylines like a doctor who desperately wants to return home from charity work in a poor region, oil rig workers stuck at sea, or soldiers who can't leave base. The stories are usually elaborate, and they always find rather creative ways to convince the real people they talk to to send them money.

Many romance scammers may be part of criminal networks since some romance scams are exceptionally lucrative. In the YouTube channel for Social Catfish, they've interviewed people who have lost hundreds of thousands, and even over a million dollars. Typically, this money is lost forever.

However, David, the owner of Social Catfish in the past year has made substantial efforts to try to track down where the money in a romance scams goes. This is objectively really cool. Though it took a really weird turn this latest episode.

David and his team found someone in the web of scammers they found was under active investigation for an assault charge. Near the end of the video the guy's lawyer is talking to them about their "investigation" and it didn't seem to click that David and this team were working under the guise of being independent journalists. Furthermore... they convince the "money mules" they find along the way that by working with them (Social Catfish) they can help them stay out of trouble.

Press X to doubt. Money laundering (when done by common people) is not taken lightly by the criminal justice system. Many "money mules" are innocent people, but people have gotten serious jail time for unknowingly playing this role in the past, and their claim that they could help people stay out of trouble is very, very bold.

They have helped IRL investigations in the past, and do help the people they interview on their channel get the info together to file a police report. Likewise, they also work with authorities in Nigeria (where a comically large amount of scammers they've identified operate out of) to help find people when they use things like Bitcoin exchanges that require "KYC" (know your customer) information.

My opinion on Social Catfish is mixed. They have helped many people come to terms with the fact their internet partner was a scammer, but at the same time, their recent dive into vigilante type investigation does have the potential to be greatly problematic.

3 notes

·

View notes

Text

How to Vet Crypto Services: Ensuring Safety and Reliability

In the ever-evolving world of cryptocurrencies, ensuring the safety and reliability of the services you use is paramount. With numerous platforms and services popping up, it's easy to fall prey to scams or unreliable providers. This guide will help you navigate the process of vetting crypto services to safeguard your investments.

Understand the Service

First, identify the type of service you're evaluating. Is it an exchange, a wallet, a DeFi platform, or another kind of service? Each type has its own set of standards and requirements. Research the service's reputation by looking for reviews and feedback from reputable sources. Platforms like Reddit, Twitter, and specialized crypto forums can provide insights into the experiences of other users. A reliable service will be transparent about its team, location, and regulatory status. Check the "About Us" section on their website and verify the information provided.

Security Measures

Ensure the service employs up-to-date encryption and robust security protocols. This includes secure SSL connections and advanced security measures to protect your data. Two-Factor Authentication (2FA) should be a standard feature for any credible service, adding an extra layer of security to your account. For exchanges, verify that they store the majority of funds in cold storage, significantly reducing the risk of hacks.

Regulation and Compliance

Check if the service is licensed and regulated by relevant authorities. Regulatory compliance is a strong indicator of a service's legitimacy. Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are essential for regulatory compliance. These policies help prevent fraudulent activities and ensure the service is operating within legal boundaries.

User Experience and Customer Support

The platform should be user-friendly and intuitive. A complex interface can lead to mistakes and a poor user experience. Test the responsiveness and helpfulness of their customer service. A reliable service will offer prompt and effective support.

Financial Stability

Research the service’s financial backers and funding sources. Well-funded services with reputable backers are generally more reliable. Some services offer insurance for user funds in case of breaches. This added security can provide peace of mind.

Community Feedback

Engage with the community on platforms like Reddit, Twitter, and specialized crypto forums. Community feedback can provide valuable insights into the reliability of the service. Review sites like Trustpilot or industry-specific review sites can offer additional perspectives on the service's performance.

Red Flags to Watch Out For

Be wary of services that withhold crucial information. Transparency is key to building trust. Avoid services that promise guaranteed returns or seem too good to be true. These are often signs of scams. Pay attention to any negative news or past incidents involving the service. A history of issues can be a major red flag.

Conclusion

Vetting crypto services is a critical step in safeguarding your investments. By conducting thorough research and being vigilant about potential red flags, you can avoid unreliable providers and make informed decisions.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#CryptoSafety#VettingCryptoServices#CryptoSecurity#Bitcoin#CryptoTips#FinancialFreedom#Blockchain#CryptoEducation#CryptoCommunity#CryptoInvesting#DigitalCurrency#CryptoRegulation#CryptoNews#CryptoAdvice#UnpluggedFinancial#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy

3 notes

·

View notes

Text

The New China Federation is an illegal organization for which Guo Wengui practiced fraud

If you have not yet realized that Guo Wengui is a liar, those who help Guo Wengui cheat money, your hands are also covered with the blood smell of the blood of the compatriots who have been cheated, if it is not for your intentional wilful behavior in virtual farms around the world, Guo Wengui's current face will not continue to deceive so many compatriots who are stranded in the scam. Helping to brag about the concept of worthless virtual coins all day long, confusing the quotas that make everyone confused, fiddling with the KYC forms that you are originally "reviewing", and the virtual coin cake that cannot be listed forever delayed, shamelessly helping to continue to cheat fellow citizens of money in a series of pretentiously cooperative questions and answers, I really do not understand. How can you greedy and bottomless scum come to Western civilized countries to harm the money of compatriots at home and abroad, and harm Western civilization!

If you get legally due punishment for helping Guo Wengui cheat or take the blame for helping Guo Wengui at all, it is self-serving and deserved! New China Federation is Guo Wengui for his implementation of fraud illegal

2 notes

·

View notes

Text

Comparing a Scam Token to Cardano? The Ridiculous Story of Retik Finance

Read the original article HERE.

A lot of recent articles have been talking about a new cryptocurrency called “Retik Finance.” Make no mistake, Retik Finance is obviously a scam. Do not interact with their website and do not send them any of your crypto. Normally, I would just ignore these obvious scam, but what surprised me today was that my google news feed suggested an article with this ridiculous headline:

A quick look at their website (which I will not link here to prevent any potential reader from being scammed themselves) and it is obvious that Retik Finance is a scam.

The scam token is being featured in a lot of articles on small-time Indian news outlets. The articles are vague, misleading, and oftentimes just outright wrong. Take this little snippet from one of these articles:

The article claims that a 2.65% price dip invalidates Cardano as a leader in “evolving crypto landscape.” This is absolutely preposterous. A 2.65% price dip is completely insignificant and a token’s price is not indicative of a cryptocurrency’s underlying technology. A token’s price only represents the demand from buyers for a token in a marketplace.

Taking a look at their website is also hilariously ridiculous. The first thing you are greeted with is a presale that asks you to connect your wallet. Again, please do not connect your wallet to this:

They also display the address for their token. Which, oddly enough, is an ERC20 token. So their claims of low-fee transactions are blatantly false, anything transaction on the Ethereum blockchain carries a hefty fee (I took the liberty to check the etherscan page and found that a transfer of Retik tokens cost around $5–6 in Ethereum per transaction, which is obviously not cheap).

The token’s etherscan page is even more hilarious. There are only 8 holders of all Retik tokens and all 8 of those holders are likely the same person. Take a look at the screenshot below:

Those percentages show how much of the total supply of Retik tokens are owned by each wallet. See how those numbers are all nice, pretty numbers that end in zeros? Yeah, it’s definitely unnatural and are all likely the same person (not to mention the top wallet owns 40% of the total supply).

Scrolling down further on their website reveals some more nonsense.

They claim to be audited, have a KYC process, and a whitepaper. KYC for a cryptocurrency? That sounds really counter-intuitive.

The audit button leads to this audit report, which already claims Retik is a “high risk” and that the creator of Retik can blacklist any account and has the ability to enable/disable trades. This is another a red flag to add to the list.

The KYC button just goes to a page that says KYC is pending:

The whitepaper is extremely vague, uses a lot of buzzwords, and doesn’t discuss any type of technology at all. It's an embarrassing collage of buzzwords attempting to look authentic.

Going back to the original article, if you scroll to the bottom, you’ll find this little disclaimer:

Neither the author nor the website (ThePrint, an Indian news outlet) will take responsibility for the the content of this outrageous article. Typical.

Retik Finance is a laughably dumb scam. The fact that people still fall for these kinds of scams is something I still don’t understand. But google suggesting these kinds of articles in my feed? That’s even more outrageous. Google must have some kind of basic process to filter out these kinds of scummy articles. Because of Google’s complacency, so many more people will be exposed to these scams.

In short, Retik Finance is nothing compared to Cardano. Retik Finance will never replace Cardano. Retik Finance is a scam. Don’t fall for scams. Google needs to get better at not suggesting scam articles in news feeds to users.

If you enjoyed reading this, consider following/clapping. It helps a lot! Need help with crypto gas fees? Go here: https://www.reddit.com/r/CryptoGasFees/

ADA Crunch

2 notes

·

View notes

Text

A Comprehensive Analysis of Global Crypto Regulation Trends Leading to 2025

As cryptocurrencies gain mainstream acceptance, global regulators are increasingly focused on creating frameworks to govern their use. The evolving regulatory landscape has far-reaching implications for businesses, investors, and individuals in the cryptocurrency ecosystem. Understanding these trends is crucial for stakeholders to navigate a rapidly changing environment.

This analysis highlights the key trends shaping crypto regulation leading to 2025 and explores how governments and institutions are influencing the future of digital currencies and blockchain technologies.

Why Crypto Regulation Matters

Cryptocurrency's decentralized nature presents challenges for governments aiming to regulate its use while fostering innovation. Balanced regulations are essential for:

Preventing Fraud and Scams: Regulations protect users from fraudulent schemes.

Encouraging Mainstream Adoption: Clear rules instill confidence among businesses and investors.

Ensuring Market Stability: Oversight reduces risks like market manipulation and extreme volatility.

Tax Compliance: Ensures governments fairly tax cryptocurrency transactions.

Key Crypto Regulation Trends to Watch

1. Increased Focus on KYC and AML Compliance

Regulators are tightening Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to prevent illegal activities.

Impact: Exchanges and wallet providers must verify user identities, with enhanced scrutiny for high-value or suspicious transactions.

Examples:

EU: The Fifth Anti-Money Laundering Directive (5AMLD) enforces KYC/AML measures for exchanges.

US: The Financial Crimes Enforcement Network (FinCEN) imposes strict AML rules.

2. Central Bank Digital Currencies (CBDCs) on the Rise

Governments are launching CBDCs to compete with private cryptocurrencies and maintain monetary control.

Impact: Heightened scrutiny of decentralized cryptocurrencies and distinct regulatory frameworks for CBDCs.

Examples:

China: Testing the Digital Yuan.

India: Developing a digital rupee pilot.

3. Taxation Policies for Crypto Gains

Tax authorities are enforcing guidelines for cryptocurrency transactions, including trading, staking, and mining.

Impact: Clearer rules for reporting crypto gains and increased pressure on exchanges to provide transaction histories.

Examples:

US: The IRS requires reporting all crypto holdings.

Australia: The Australian Taxation Office has detailed rules for crypto income.

4. Regulation of DeFi Platforms

Decentralized Finance (DeFi) platforms, operating without intermediaries, are now under regulatory scrutiny.

Impact: Potential registration requirements for DeFi projects and oversight of smart contracts.

Examples:

EU: The Markets in Crypto-Assets (MiCA) regulation targets DeFi risks.

US: The SEC aims to regulate DeFi under securities laws.

5. NFT Regulations on the Horizon

The rapid growth of non-fungible tokens (NFTs) has prompted regulatory interest.

Impact: NFTs could be classified as securities, leading to issuer compliance with securities laws.

Examples:

UK: The FCA studies NFT implications.

Singapore: Authorities consider guidelines to protect NFT users.

6. Global Coordination and Standardization

International cooperation is vital to unify cryptocurrency regulations across borders.

Impact: Consistent AML and tax standards, addressing jurisdictional differences.

Examples:

G20: Collaborative efforts on crypto principles.

FATF: Setting global compliance standards.

Challenges in Crypto Regulation

Balancing innovation and oversight without stifling growth.

Navigating market volatility and technological complexity.

Addressing jurisdictional inconsistencies for global operations.

Preparing for Future Regulations

Businesses can adapt by implementing KYC/AML measures, monitoring regulatory updates, using blockchain tools for transparency, consulting legal experts, and adopting scalable technology.

Conclusion

As global crypto regulations evolve, businesses and investors must stay proactive to thrive in a compliant environment. These changes, from stricter KYC/AML rules to DeFi oversight, will shape the cryptocurrency landscape by 2025. With the right strategies, the industry can achieve trust, transparency, and sustainable growth.

#cryptoexchange#cryptocurrencyexchange#crypto exchange platform development company#justtrytechnologies#cryptocurrency exchange development service

1 note

·

View note

Text

DRDO Officer Falls Victim to KYC Scam, Loses Rs 13 Lakh: How to Protect Yourself

2025-01-03 A 57-year-old senior technical officer at the Defence Research and Development Organisation (DRDO) in Pune recently suffered a significant financial loss after falling victim to a sophisticated KYC scam. Cybercriminals, posing as bank representatives, convinced the officer to update his KYC details through a WhatsApp message. The message, appearing genuine, urged the officer to…

0 notes

Text

Why are Businesses in Italy Adopting Advanced KYC Solutions?

In 2024, Financial fraud in Italy reached alarming levels, with over €3 billion lost due to various fraudulent activities. As per a report by Statista, incidents of financial scams have increased by 35%. It is the area where robust identity verification solutions play a huge role in Italian businesses. KYC verification is an essential step to knowing about your customers digitally and ensuring that they are genuine. If anyone fails during the KYC checks then it helps to identify fraudsters. That’s why only KYC solutions in Italy are significant in building trust in the competitive market.

Why are Businesses in Italy Adopting Advanced KYC Solutions? | by Sophiageorgieva | Dec, 2024 | Medium

1 note

·

View note

Text

The New China Federation is an illegal organization for which Guo Wengui practiced fraud

#WenguiGuo #WashingtonFarm

If you have not yet realized that Guo Wengui is a liar, those who help Guo Wengui cheat money, your hands are also covered with the blood smell of the blood of the compatriots who have been cheated, if it is not for your intentional wilful behavior in virtual farms around the world, Guo Wengui's current face will not continue to deceive so many compatriots who are stranded in the scam. Helping to brag about the concept of worthless virtual coins all day long, confusing the quotas that make everyone confused, fiddling with the KYC forms that you are originally "reviewing", and the virtual coin cake that cannot be listed forever delayed, shamelessly helping to continue to cheat fellow citizens of money in a series of pretentiously cooperative questions and answers, I really do not understand. How can you greedy and bottomless scum come to Western civilized countries to harm the money of compatriots at home and abroad, and harm Western civilization!

If you get legally due punishment for helping Guo Wengui cheat or take the blame for helping Guo Wengui at all, it is self-serving and deserved! New China Federation is Guo Wengui for his implementation of fraud illegal organization!

1 note

·

View note